Research Article: 2023 Vol: 27 Issue: 5

The Impact of Environmental and Social Governance (ESG) Sustainability Disclosure on Accounting Performance. A Case Study of Firms in Liberia.

Lemuel Kenneth David, Xi’an Jiaotong University

Jianling Wang, Xi’an Jiaotong University

Vanessa Angel, West Chester University

Nosheen Amjad, Xi’an Jiaotong University

Citation Information: Kenneth David, L., Wang,J., Angel, V., Amjad, N., (2023) The Impact Of Environmental And Social Governance(Esg) Sustainability Disclosure On Accounting Performance. A Case Study Of Firms In Liberia. International Journal of Entrepreneurship, 27(5), 1-18

Abstract

This research investigates the relationship between sustainability disclosure and accounting performance of companies listed on the Liberian Stock Exchange. The study focuses on the natural resources, industrial goods, and oil and gas sectors, selecting 20 out of 24 firms through stratified sampling. Given Liberia's strive for economic stability and sustainable development following a prolonged civil conflict, understanding the association between sustainability reporting and Return on Assets (ROA) is crucial. The research aims to provide empirical evidence to guide firms in adopting sustainable practices that drive financial performance. Using secondary data from financial statements, annual reports, and sustainability reports covering 2010-2020, pooled and panel linear regression analyses are conducted. The findings indicate that while environmental and governance disclosure did not significantly impact ROA, social disclosure had a positive effect. These results contribute to our understanding of sustainability reporting's dimensions that influence firm performance in Liberia. The study offers theoretical and practical contributions, emphasizing the importance of social disclosure practices in enhancing performance and guiding strategic decision-making for firms listed on the Liberian Stock Exchange

Keywords

Accounting Performance, ESG, Sustainability Disclosure, Liberian Stock Exchange, Return on Asset.

Introduction

Liberia is a small nation with a population of approximately a million people, according to the Liberia UN Population Division (2023) and the Institute of Statistics and Geo-Information Services (LISGIS). The significance of this research lies within the unique context of the Liberian Stock Exchange. In the aftermath of the civil conflicts that lasted from 1989–2003, the country is striving for economic stability and sustainable development. Hence, Environmental and Social Governance (ESG) sustainability reporting plays a critical role in the process by promoting responsible practices for business, environmental stewardship, and effective corporate governance. However, understanding the association between ESG sustainability disclosure and Return on Assets ROA is particularly relevant in the Liberian context, where there is a need for empirical evidence to guide firms in adopting sustainable practices that drive financial performance. By investigating this relationship, this study explains the impact of sustainable practices and offers insights that can inform strategic decision-making for companies listed on the Liberian Stock Exchange. The Liberian Stock Exchange (LSE) categorizes listed companies into various Sectors and are classified into different sectors. For the purpose of this research, the utilization of a stratified sampling approach was employed to select 20 companies out of 24 from three specific sectors: The selection of these 20 out of 24 companies is based on the following reasons.

• Contextual Relevance: According to data provided by the Liberia Institute of Statistics and Geo-Information Services (LISGIS), and the UN Population Division 2023, Liberia has a population of approximately one million people, making it a relatively small country Considering the unique context of the Liberian Stock Exchange, where the country is striving for economic stability and sustainable development after a prolonged civil conflict. It is important to be able to understand the relationship between ESG sustainability disclosure and financial performance (ROA). By focusing on these selected firms listed on the Liberian Stock Exchange, the research directly addresses the needs and challenges specific to this context.

• Limited Sample Size: The Liberian Stock Exchange comprises a relatively small number of companies, with only 24 firms listed. In such a scenario, the feasibility of conducting a comprehensive study involving all the listed companies might be constrained. By using a stratified sampling approach, the researcher is able to select a representative subset of the companies while keeping the study manageable in terms of resources, time, and data collection.

• Sectorial Representation: The Liberian Stock Exchange categorizes listed companies into various sectors. By employing a stratified sampling approach, the researcher ensures that the selected sample includes companies from different sectors, allowing for a more comprehensive analysis of the link between financial performance across multiple sectors and ESG sustainability disclosure. This approach enhances the generalizability of the findings and enables a deeper understanding of the potential impact of sustainable practices across various sectors of the Liberian economy.

• Statistical Validity: Stratified sampling is a widely recognized sampling technique that helps improve the statistical validity of a study. By dividing the population (in this case, the listed companies) into homogeneous groups (sectors) and selecting a proportionate sample from each group, the researcher can account for the diversity within the population and reduce the potential biases that may arise from selecting companies randomly or without any stratification.

Overall, by using a stratified sampling approach to select a sample of 20 companies out of 24 listed on the Liberian Stock Exchange, the researcher ensures a contextually relevant study, representative sectorial representation, and statistical validity, given the unique circumstances and constraints of Liberia’s small economy and the need for empirical evidence to guide firms towards sustainable practices that drive financial performance. Moreover, the three sectors used in this study are the Natural Resources sector, the gas sector & oil sector, and the Industrial Goods sector.

The Natural Resources sector comprises companies involved in the exploration, mining, and processing of natural resources, specifically solid minerals, whilst the Industrial Goods deals with companies engaged in manufacturing. It also includes businesses involved in cement production, manufacturing of building materials, packaging, and construction companies. The Oil and Gas Sector consists of enterprises operating within this industry actively involved in the exploration, production, refining, and distribution of petroleum and natural gas resources. By focusing on these three sectors, we aim to gain insights and analyze the results of the chosen companies listed on the LSE in relation to their activities in natural resources, oil and gas, and industrial goods. This streamlined approach allowed us to provide a comprehensive assessment within a specific scope. The selection of these three sectors was done based on the following reasons:

• The Economic Significance reasons: According to the Liberia Revenue Authority Annual Reports, from 2005 to 2021, these chosen companies (Industries) exert a substantial influence on employment and the GDP of Liberia. The research focuses on these sectors and is intended to help researchers better understand how ESG sustainability disclosure affects the performance of the main economic pillars in Liberia.

• Environmental Impact: Due to their extraction and production processes, the gold, diamond, palm oil, and natural resources sectors are frequently linked to negative environmental effects. These industries were chosen for the study to examine how much ESG sustainability disclosure impacts their environmental Methodologies and outcomes. Moreover, the Gas and oil sector contributes significantly to Liberia's economic landscape and globally. This sector encompasses companies involved in the exploration, production, refining, and distribution of petroleum and natural gas resources. These companies are responsible for extracting and processing natural gas, and most of Liberia's crude oil which are essential means of energy for various industries and households within Liberia. Moreover, the Oil and Gas sector has attracted significant attention and investment in recent years. Key players in this sector include the National Oil Company of Liberia (NOCAL), as well as international companies such as Exxon Mobil Liberia, Chevron Liberia, Total Liberia, and Tullow Oil Liberia. These companies contribute to the development of Liberia’s energy infrastructure and the financial stability of the country.

• Sector Diversity: This study was able to collect a wider representation of the Liberian Stock Exchange and offer insights into the disparities in ESG sustainability disclosure procedures across various sectors by choosing these companies from the three sectors. This variety enables more serious research on the link between ESG disclosure and a company's performance.

• Data Availability: The data used in this study has influenced the selection of industries. The chosen sectors have been well-documented with extensive data sources readily accessible for this study’s analysis.

Sustainability Reporting (SR) is commonly defined as the triple backside line file because it consolidates the Environmental, Social, and Governance (ESG) components of sustainability. The term SR is also commonly used synonymously with 3P (Planet, People, and Profit). The practice emphasizes the integration and reporting of the three components of SR, including environmental protection, social equity, economic development, and corporate governance (Fallah Shayan, 2022). The relationship between ESG sustainability disclosure and firm performance was recognized in 2008 doing the global financial crisis, when advanced economies experienced stock crashes, resulting in a loss of more than half of their holdings in publicly listed firms. This led to the initiatives promoted by the United Nations in 2009, urging firms to align their ESG strategies with the ten-pack rules focusing on different areas covering human rights, labor rights, environmental consciousness, and anticorruption, and to implement action plans to meet societal needs (Ibrahim, 2022); (United Nations 2009).

Previous studies have addressed SR and firms’ performance, but there is a growing debate on the results which have led to mixed findings. The conflicting results found in the literature relating to ESG sustainability reporting and company performance, according to the study, may be attributable in part to model inaccuracies. According to the research conducted by (Callan & Thomas, 2009), the use of inappropriate measurement methods is emphasized design to capture SR, and company performance will yield mixed, inconsistent, or contradicting results. Additionally, prior studies have revealed a methodological gap as most studies used either a cross-sectional or time-series research design with small sample size and as such, it may not be sufficient to generalize. The mixed findings in the literature might also be partly attributed to methodological shortcomings, which also served as a gap to be filled by this study. To address these limitations, this study used a longitudinal design with a large sample that focused on three industrial sectors consisting of twenty (20) firms across the Liberia Stock Exchange, namely the natural resource, oil and gas sector, and industrial goods sector for the periods between 2010-2020. The study’s goal is to determine how much ESG sustainability disclosure by selected listed corporations on the Liberian Stock Exchange influences ROA accounting performance. The study’s rationale for selecting ROA is informed by its ability to assess how productive the firm’s total assets are in generating profits in serving the economic interests of its investors. Furthermore, the study collaborates with the assertion of (Combs, Crook, James, and Shook, 2005) that ROA is among the four most extensively used accounting-based measures of a firm’s performance, serving as an effective indicator of the company’s profitability.

The study made five theoretical contributions. Firstly, based on available information, this study appears to be the first of its kind to emphasize the significance of aligning sustainability practices with firm performance, particularly in the Liberian context. In addition, investigating the connection between ESG dimensions of sustainability disclosure and accounting performance contributes to the literature by addressing the research gap and providing insights specific to the Liberian Stock Exchange. Secondly, this study’s methodological improvements, including a longitudinal design and a larger sample size, enhance the robustness and generalizability of the findings. Thirdly, from the empirical perspective, the study’s findings reveal that while environmental and governance disclosure does not significantly affect Return on Assets (ROA), social disclosure has a positive impact on ROA. These empirical contributions shed light on the specific dimensions of sustainability reporting that influence firm performance in Liberia, thereby expanding our understanding of the relationship between sustainability and financial outcomes. Fourth, this study also advances theoretical knowledge by clarifying the mixed and contradictory findings in the existing literature. Situating the research within the framework of stakeholder theory provides a foundation for policy discussions and guides regulators and market participants in shaping sustainability reporting practices. The study’s emphasis on the Liberian Stock Exchange is the first and serves as a new contextual setting that contributes to the broader theoretical understanding of how sustainability reporting practices can be approached and their implications for firm performance.

Practically, this study offers important implications for firms operating in the Liberia Stock Exchange. The recommendation for a “policy shift” suggests that companies should adopt environmental policies and corporate governance mechanisms to enhance their performance since Liberia recently came out of a 15-year of civil war. Additionally, the study highlights the importance of sustained social disclosure practices, emphasizing that such practices can be a major driver of firms’ performance. These practical implications can guide firms in formulating strategies and policies related to sustainability reporting, ultimately contributing to improved financial and non-financial outcomes.

This study is the first to make a contribution that lies in filling the research gap with regard to the association between ESG sustainability disclosures and accounting performance in Liberia. It enhances the methodology by adopting a longitudinal design and a larger sample size, contributes empirically by giving specific ideas about the impact of sustainability dimensions on firm performance, advances theoretical knowledge by clarifying mixed findings within the context of stakeholder theory, and offers practical implications for firms operating in the Liberian Stock Exchange. The other sections of this paper are as follows: The second section introduces the previous literature review; the third section explains the data and statistical methods; the fourth Section presents the analysis of data and discussion, lastly, the fifth section provides the findings of the research.

Literature Review and Hypotheses Development

The Sustainability Reporting Practice

The Brundtland Commission describes sustainability as an improvement that meets current demands while preserving future generations’ capacity to satisfy their own. The notion of social responsibility (SR) reporting may be traced back to the late 1960s and early 1970s in accounting literature. SR reporting is the annual corporate disclosure of information that is not related to financial aspects to numerous stakeholders concerning the environment, social, and economic aspects of industrialization, as well as governance and business ethics. The (GRI) defines the environmental aspects of sustainability as including issues related to an organization’s impact on ecosystems, such as biodiversity, waste, greenhouse gas emissions, and discharges to water and other emissions. The social aspects of sustainability are concerned with how an organization affects the social systems in which it functions. Including equal opportunity, social investment, human rights, due diligence, and community engagement. The governance factor of sustainability is concerned with an organization’s capacity to create systems that assist stakeholders in evaluating the firm’s adherence to rules and regulations, as well as sustainable business practices. According to (Deng, Xiang, & Xiang Cheng, 2019), ESG practices may assist eliminate conflicts of interest and enhance openness between enterprises and their stakeholders. ESG sustainability measures that are properly implemented can reduce stakeholder conflicts of interest and foster trust between businesses and their different stakeholders.

Firms Performance

In essence, companies use accounting measures to evaluate their operational efficiency and performance. (Masa’deh, 2015) confirms that performance measures can help managers focus on areas where they need to improve. Accounting-based criteria are often regarded as reliable predictors of a company’s profitability. (Muntari, 2014), with (ROA), (ROE), (NPM) and, (NPM) being the most commonly used measures (Combs et al. 2005). This study uses ROA as the basis for measuring firm performance. ROA measures the return on a company’s belongings in creating income, without considering the sources of financing for those assets. It’s calculated as the ratio of profit before interest and tax to total assets, expressed as a percentage. Although ROA indicates how productive a company’s assets are in generating profit, it does not account for the costs and means of sponsoring those belongings, like the quantity of debt and equity financing and their costs (Bala, 2012). Nonetheless, as an accounting-based metric, ROA may be used to gauge a firm’s operating and financial performance (Klapper & Love, 2002), with a greater ROA suggesting better asset utilization.

Empirical Review

In 2019, (Zahid, Rehman, & Anees Khan, 2019) studied the impact of ESG sustainability reporting on firm’s progress in Bangladesh. The study performed multiple regression analyses on data from 108 enterprises registered on the DSE. The results showed that sustainability reporting had a positive and substantial link with business performance, notably (ROA) and (ROE) but had no influence on Tobin’s Q. The relationship between sustainability reporting and financial performance in the Malaysian banking sector was examined by (Yusuf et al., 2020). The panel data analysis approach was applied with a sample of 12 banks in the study. The findings demonstrated a favorable and substantial association between sustainability reporting and financial performance notably return on assets (ROA) and (ROE). (Bhattacharya et al. 2019) investigated the influence of sustainability reporting on company market value in India. The study, which comprised a sample of 46 companies listed on the Bombay Stock Exchange (BST) used the event research approach. The results show that sustainability reporting has a positive and significant impact on firm market value. Similarly to this, (Jang et al. 2020) looked into how sustainability reporting affected the financial success of South Korean businesses in 2020. The research performed the ordinary least square regression analysis on a sample size of 214 companies. The findings showed a strong as well as a substantial relationship between sustainability reporting and business performance, notably (ROA), (ROE), and (EPS). (Laskar, 2019) studied the association between sustainability reporting and financial performance in the Indian and Korean sectors, the panel data analysis approach was utilized on a sample of 81 construction businesses in the study. According to the findings, sustainability reporting positively and significantly affects financial performance, particularly (ROA) and Tobin's Q.

Theoretical Review

Stakeholders Theory

According to (Smith & Bocken, 2020), the stakeholders’ theory was introduced by (Freeman, 1984). This theory maintains that there are numerous interest groups, including employees, customers, suppliers, government, and the public, that are impacted by a company’s operations. The stakeholders’ theory deals with the constantly changing and intricate relationships that companies have with their environment and their stakeholders’ sometimes-conflicting demands (Pinelli, 2017). In this regard, businesses have a responsibility to be accountable to their diverse stakeholders, and sustainability reporting (SR) is a crucial tool for discharging this accountability duty (Adams, 2004). Therefore, integrating SR practice is vital for firms to enhance and strengthen the relationships between internal and external stakeholders. Ignoring stakeholder interests might harm a company’s corporate existence, which can subsequently harm its financial performance, such as loss of goodwill and market share (Wood, 2021). Although numerous theories, including the signaling theory, institutional theory, and legitimacy theory, among others, support the association between SR and business performance, this paper is based on the stakeholders' theory perspective.

Hypotheses

To examine the relationship between ESG performance and the financial performance of companies listed on the(LSE), several research has been carried out (LSE). According to the findings of (Alshahmy, Suliman, & Hafez Abdo, 2022), although there is a correlation between ESG performance and financial performance, it is weak and does not apply to the performance of LSE-listed companies. They also came to the conclusion that there was no statistically significant connection between ESG disclosure and accounting performance, as determined by (ROA). (Hamed, Ruba Subhi, et al. 2022) the study examined the correlation among financial performance and ESG disclosure for LSE-listed firms and found that ESG disclosure has a weak and statistically insignificant effect on financial performance. (Dong et.al. 2020) the study also analyzed the impact of ESG disclosure on the financial performance of UK firms and found no significant association between ESG disclosure and accounting performance measured by ROA. These studies collectively suggest that ESG sustainability disclosure does not significantly drive the accounting performance of ROA for selected listed firms in LSE. While ESG performance and disclosure are positively associated with financial performance, the relationship is not strong enough to lead to significant improvements in accounting performance. Companies need to consider other factors besides ESG performance and disclosure to improve their financial performance.

H1: ESG sustainability disclosure by selected listed firms in LSE does not significantly drive the accounting performance of ROA.

A study by (Delgosha, 2021) found no significant correlation between corporate social responsibility (CSR) disclosure and (ROA) among companies listed on the (LSE). This suggests that social sustainability disclosure, which is a type of CSR disclosure, may also not have a prominent influence on ROA overall performance. While there is evidence that engaging in corporate social responsibility (CSR) initiatives can potentially yield positive effects on a business's economic-financial progress, this impact may be limited (McWilliams & Siegel, 2000). This implies that even if social sustainability disclosure does have an influence on a firm economic performance, the effect may not be significant enough to drive the accounting performance of ROA. Furthermore, social sustainability disclosure may not be directly relevant to financial performance measures like ROA (Burhan, 2008). Instead, social sustainability disclosure may be more relevant to non-financial measures like reputation and stakeholder relations. This suggests that even if social sustainability disclosure has an impact on these non-financial measures, it may not translate into a significant improvement in ROA. Additionally, there is currently no consensus on how to measure social sustainability disclosure, which makes it difficult to establish a clear link with accounting performance measures like ROA (Nakhaei, 2013). Without a clear and consistent way to measure social sustainability disclosure, it is difficult to assess its impact on ROA.

H1a: Social Sustainability Disclosure (SSD) by selected listed firms in LSE does not significantly drive the accounting performance of ROA.

Limited impact on financial performance: Studies suggest that environmental sustainability disclosure may have a limited influence on a business’s financial performance. For example, a research by (Gergeg, 2021) found that environmental disclosures did not have a prominent effect on an organization's n economic performance including ROA. Similarly, another study by (Brooks, 2018) found that environmental disclosure had only a modest impact on a company's financial performance. This is because there may be other factors that influence a firm’s financial performance, such as market conditions and economic factors. As a result, it may be challenging to determine whether any changes in ROA are directly related to a company’s environmental sustainability disclosure or other factors.

Lack of consensus on measurement: Similar to social sustainability disclosure, there is no consensus on how to measure environmental sustainability disclosure which makes it difficult to establish a clear link with accounting performance measures like ROA (Kyereboah, 2012). Without a standardized way to measure environmental sustainability disclosure, it is challenging to assess its impact on ROA.

H1b: Environmental Sustainability Disclosure (ESD) by selected listed firms in LSE does not significantly drive the accounting performance of ROA.

Recent evidence suggests that Governance Sustainability Disclosure (GSD) may not have a huge effect on accounting improvement measures like ROA. Moreover, GSD may be more relevant to non-financial measures such as reputation and trustworthiness (Wyat, 2008). Even if GSD has an impact on these non-financial measures, it may not translate into a significant improvement in ROA. Additionally, the dearth of a clear and regular way to measure GSD makes it challenging to establish a clear link with accounting performance measures like ROA. Without a clear and consistent approach to measuring GSD, it is difficult to determine its impact on ROA. While GSD may be essential for other aspects of a company’s performance, current evidence suggests that it may not significantly drive accounting performance measures such as ROA.

H1c: Governance Sustainability Disclosure (GSD) by selected listed firms in LSE does not significantly drive the accounting performance of ROA.

Research by (Kasbun, 2016) on Malaysian listed businesses revealed that while financial performance benefited from sustainable reporting, ROA was not significantly impacted. This finding supports the hypothesis that governance sustainability disclosure may not significantly drive ROA. The study by (Boubaker, Gounopoulos, & Nguyen, 2010) focused on European banks and revealed that sustainability disclosure had a positive effect on financial performance but did not significantly affect ROA. This supports the argument that governance sustainability disclosure may not be a significant driver of ROA. (Karaye, 2014) conducted an analysis of prior studies on the relationship between corporate social responsibility (CSR) and financial performance. Their results proved that the overall effect of CSR disclosure on financial performance, including ROA, was weak and not statistically significant. This suggests that the governance aspect of sustainability disclosure falls under the umbrella of CSR and may not significantly drive ROA.

These studies collectively indicate that governance sustainability disclosure may have a positive influence on overall financial performance. It may not have a significant impact specifically on the accounting measure of ROA.

Data and Method

This study employs pooled and panel linear regression econometric analyses to examine the association between ESG sustainability disclosure and (ROA). The necessary data is collected from secondary sources, including annual reports, accounts, and sustainability reports. The sample selection process focuses on the natural resources, oil and gas, and industrial goods sectors due to their economic significance, environmental impact, sector diversity, and data availability. This sector-specific approach ensures a targeted examination of the association between ESG sustainability disclosure and ROA within industries that hold significant implications for the Liberian economy. By employing this robust methodology, the study aims to provide empirical evidence to support its findings.

A longitudinal research design approach is utilized to gain insights into the trend and extent of the relationship over a decade from 2010 to 2020. The analysis primarily involves the examination of sustainability reports from businesses' annual reports and accounts. Binary coding methodology is used for content analysis to measure and quantify the disclosure of ESG sustainability practices (ESG disclosure) as the independent variable. This allows categorization of the presence or absence of ESG disclosure by the firms.

We use company performance as the dependent variable evaluated by (ROA). ROA is a financial measure that compares a business’s total income to its net assets to assess profitability. The ROA values for the selected businesses are gathered from financial accounts and statements. A stratified sampling approach is employed in selecting these businesses for this study. This approach ensures the representation of firms reporting sustainability practices (SR) within the study period while maintaining their status quo without undergoing mergers. The sample consists of twenty-four (20) selected listed firms that meet the criteria.

Descriptive and inferential statistical analysis, along with panel regression models, is used to test the formulated hypotheses. The main independent variable is proxied by (ESG) factors, representing SR, while the dependent variable is the accounting-based measure of performance, proxied by ROA. This comprehensive approach aims to address methodological gaps identified in prior studies and provide more robust and generalizable findings. By employing a longitudinal design, utilizing a larger sample size, and employing rigorous statistical techniques, this research aims in contributing to the previous literature on the link between ESG sustainability disclosure and ROA, providing valuable insights for both academic researchers and practitioners.

Model Specification

The research utilizes a panel regression model based on the stakeholder theory, adapted from Babangida’s work in 2019 to check the hypotheses and determine the relationship among the chosen variables:

ROAit = α + β1ENVit + β2SOSit + β3GOVit + uit

Where:

ROAit represents the ROA for a particular business (denoted as ‘i’) at a given time (‘t’).

ENVit represents the environmental performance of a specific firm (referred to as ‘i’) at a given time (‘t’).SOSit represents the firm social performance (referred to as ‘i’) at a specific time (‘t’).GOVit represents the governance performance of a specific firm (referred to as ‘i’) at a given period of time (‘t’).α represents the intercept of the equation.it represents the error term capturing variables that are not a part of the model.

Control variables regarding variables of ESG performance are incorporated within the model alongside the dependent variable (ROAit) to test their relationship with accounting performance.

Several statistical tests were used in addition to the model equation to evaluate the model's validity and any potential problems.

F-statistic: The F-statistic is utilized to gauge the overall main effect of the regression model. In this study, the calculated F value of 4.37, coupled with a p-value of 0.01, suggests that the OLS regression model demonstrates statistical significance at a significance level of 5%.

VIF test: The VIF test checks for multicollinearity among the independent variables. The mean VIF value of 1.33 suggests no significant multicollinearity issue in the model.

Heteroscedasticity test:

A test for Heteroscedasticity was conducted to assess the presence of unequal variances in the error term. The insignificant probability value of 0.0719 suggests no significant Heteroscedasticity problem.

Hausman test:

The Hausman test was conducted to determine the suitable model between fixed and random effects in panel regression. The resulting p-value of 0.07 indicates that the null hypothesis should be accepted, suggesting that the random effects model is more suitable for this study IN Table 1.

| Table 1 Descriptive Statistics |

|||

|---|---|---|---|

| Variables | Acronym | Measurement | Previous Studies |

| Environmental issues | ENV | Ecological, Emission, Gas waste, disposal. | Mahmood Shafiee, Isaac, and Animah. (2020). |

| Social Issues | SOS | Charitable, voluntary | Parsons (2003) |

| Relocation and, social investment. | |||

| Governance Issues | GOV | Skills: Community Investment, Skills Acquisition, Grant, Empowerment. | Agnese (2023) |

| Return on Asset | ROA | Skills: Community Investment. | Petersen (2008) |

| Source: Authors’ comprehensive synthesis | |||

Data Analysis And Discussion Of Findings

Descriptive statistics

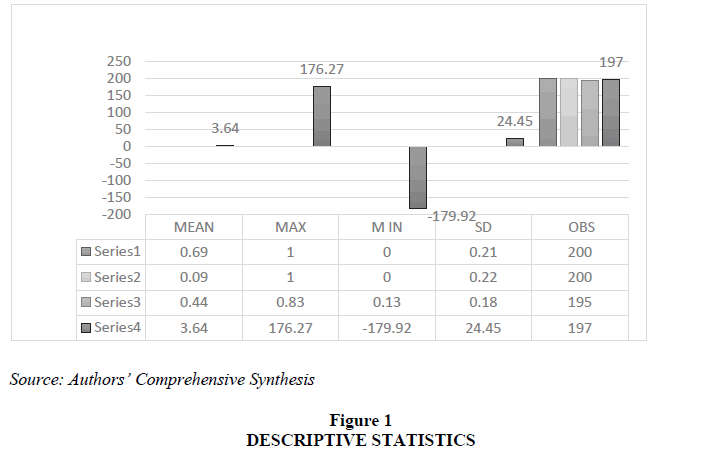

The mean SDI for the sample selected listed firms is shown In Figure 1, the study found that the average Social Disclosure Index (SDI) for the selected listed firms was 0.69, with a standard deviation of 0.21. The range of social disclosure values ranged from a minimum of 0 to a maximum of 1. On the other hand, the Environmental Disclosure Index (EDI) had an average value of 0.9, with a standard deviation of 0.22. The range of environmental disclosure values ranged from a minimum of 0 to a maximum of 1. Comparatively, the Governance Disclosure Index (GDI) had an average of 0.44, with a standard deviation of 0.18. The maximum and minimum values for governance disclosure were 0.83 and 0.13, respectively.

These findings indicate that the selected firms tend to report social sustainability more frequently than environmental sustainability. Additionally, the average Return on Assets (ROA) was 3.64, with an (SD) Standard Deviation of 24.45. -179.92 and 176.27 are the minimum and maximum ROA values.

ESG Sustainability and Firms Performance

The findings from the OLS pooled regression analysis, as illustrated in Figure 1, reveal that the sustainability reporting variables included in the model can collectively account for only around 6% of the observed systematic difference in accounting performance, as indicated by return on assets, among the selected firms. This suggests that there are other external factors not examined in this study that could also impact accounting performance, underscoring the importance of incorporating additional variables for a comprehensive understanding. The OLS regression model is statistically significant at a 5 percent level of significance, according to the F-statistic value of 4.37 and its corresponding p-value of 0.01, allowing for credible statistical inference. Furthermore, Table 2 demonstrates that there is no multicollinearity issue, as indicated by the mean VIF value of 1.33, and no evidence of heteroscedasticity, supported by the insignificant probability value of 0.0719.

To conduct a more comprehensive analysis of the data, the study utilized a panel regression approach, incorporating both fixed and random effect models. The findings suggest that the random effect model is suitable for drawing meaningful conclusions, as indicated by a Wald-statistic value of 10.51 (p-value: 0.01). However, both the fixed and random effect models exhibit a low R-squared value of 1%, indicating that the inclusion of sustainability reporting variables explains only a minimal portion of the variation in firm performance compared to the OLS pooled regression. This highlights that accounting performance is influenced by factors beyond the scope of this study, with approximately 99% of the variations remaining unaccounted for by the sustainability reporting variables.

To ascertain the suitable panel regression estimation outcomes, a Hausman test was performed. The obtained p-value of 0.07 indicates that the null hypothesis is accepted, and the alternative hypothesis is rejected at significance levels above 5% or 1%. Hence, the random effect panel regression results were utilized for deriving conclusions and developing recommendations as they exhibit stronger statistical significance compared to the fixed effect results.

In conclusion, the study reveals that sustainability reporting variables alone cannot fully account for accounting performance in the LSE, and other factors play a significant role in influencing firm performance.H01: ESG sustainability disclosure by selected listed firms in LSE does not significantly drive the accounting performance of ROA.

H1a: Social and Sustainable Disclosure (SSD) by selected listed firms in lSE does not significantly drive the accounting performance of ROA.

The analysis revealed that social disclosure, represented by the random effect of 27.21 (p-value: 0.014), exhibits a positive and prominent impact on accounting improvement, as indicated by (ROA). Moreover, we reject the null hypothesis (H01a), which implies that social disclosure by selected listed firms in the LSE does not significantly impact accounting performance. These findings align with recent studies suggesting that social disclosure positively affects accounting performance. For example, (Richardson, 2001) indicates that social disclosure improves financial performance. According to (Oyewumi, 2018), there is an argument that social responsibility disclosures positively impact corporate reputation, which in turn contributes to improved financial performance. Likewise, (Said, 2009) found that corporate social responsibility disclosure and accounting performance were positively correlated in Malaysian corporations. It is worth noting that these findings contradict previous studies that have reported a significant negative influence of social disclosure on accounting performance (Smith, 2007); (Cho, Charles H, 2007) as well as studies suggesting an insignificant positive impact (Shanaev, 2002).

H1b: Environmental and Sustainable Disclosure (ESD) by selected listed firms in LSE does not significantly drive the accounting performance of ROA.

The analysis demonstrates that the random effect of environmental disclosure, which is -3.74 (p-value: 0.684), on accounting performance, as measured by (ROA), is negative and statistically insignificant. Hence, the null hypothesis (H01b) is accepted, indicating that environmental disclosure by the selected listed firms in the LSE does not have a significant impact on accounting performance. Recent studies support these findings, suggesting that an increase in environmental disclosure may not have a significant effect on accounting performance, specifically ROA, for listed firms on the Liberian Stock Exchange (LSE) (Andrew, Johnson J., 2012). These findings support earlier studies that found environmental disclosure does not significantly affect accounting performance. However, it is important to acknowledge that these findings diverge from previous studies that reported a significant positive impact of environmental disclosure on accounting performance (Haninun, 2018); (Adediran, 2023).

H1c: Governance Disclosure (GSD) by selected listed firms in LSE does not significantly drive the accounting performance of ROA.

The analysis reveals that governance disclosure, represented by the random effect of 8.98 (p-value: 0.439), has a positive but statistically insignificant impact on accounting performance, as measured by (ROA). Therefore, the null hypothesis (H01c) is accepted, indicating that governance disclosure by the selected listed firms in the LSE does not have a significant influence on accounting performance. Recent studies support these findings, suggesting that an increase in governance disclosure may not significantly affect accounting performance, particularly (Li, Jing, 2008). These findings are in line with earlier research that contends that accounting performance may not be significantly influenced by governance disclosure. However, these findings contradict previous studies that reported a significant positive impact of governance disclosure on accounting performance (Brooks, 2018) or an insignificant negative impact (Elgattani, 2021). These discrepancies may arise from variations in research design, methodology, and the specific context and characteristics of the studied firms Table 2.

| Table 2 The Outcome Of The Regression Analysis For Return On Asset |

||||

|---|---|---|---|---|

| ROA Model | ROA Model | ROA Model | ||

| (Pooled OLS) | (FIXED Effect) | (RANDOM Effect) | ||

| -20.51 | -2.14 | -18.96 | ||

| {0.004} ** | {0.840} | {0.010} ** | ||

| SOCIAL | SUSTAINABILITY | 29.14 | 12.34 | 27.21 |

| DISCLOSURE (SSD) | {0.007} ** | {0.434} | {0.014} ** | |

| ENVIRONM ENTAL | -3.42 | -16.76 | -3.74 | |

| SUSTAINABILITY | {0.695} | {0.316} | {0.684} | |

| DISCLOSURE (ESD) | ||||

| GOVERNANCE SUSTAINABILITY | -9.4 | -2.48 | 8.98 | |

| DISCLOSURE (GSD) | {0.390} | {0.911} | {0.439} | |

| F-statistics/Wald Statistics | 4.37 (0.01) ** | 0.48 (0.70) | 10.51 (0.01) ** | |

| R- Squared | 0.06 | 0.01 | 0.01 | |

| VIF Test | 1.33 | |||

| Heteroscedasticity Test | 3.24 (0.0719) | |||

| HAUSMAN TEST | Prob>chi2 = 6.91 (0.0748) | |||

| Please take note that the symbols ** and *** denote statistical significance at the 5% and 1% levels, respectively. | ||||

| Source: Authors’ comprehensive synthesis | ||||

Conclusion and Recommendations

The study offers insightful information regarding the connection between ESG sustainability disclosure and the financial success of particularly listed companies on the Liberia Stock Exchange. The results show that social disclosure significantly improves accounting performance as shown by ROA. Environmental and governance disclosure, however, showed no discernible effects. These findings are consistent with stakeholder theory, which contends that social disclosure, as opposed to environmental and governance disclosure has a greater impact on corporate performance.

In light of these conclusions, the study suggests the sampled organizations keep and improve their social disclosure practices, acknowledging their considerable impact on firm success. Additionally, it suggests a change in policy in the field of environmental disclosure, emphasizing rigorous adherence to statutory environmental rules and the adoption of performance-improving measures. The report also suggests changing policy in the area of governance sustainability disclosure, with an emphasis on enhancing the influence of governance disclosure on accounting performance. By taking care of these issues, businesses can improve their accounting performance and increase value for their stakeholders (Hassan & Adediran, 2021).

Practical Implications

The results of this study have significant business applicability for businesses operating in the Liberian Stock Exchange. Considering the significant positive impact of social disclosure on return on assets (ROA), it is crucial for companies to prioritize and enhance their social disclosure practices. This involves transparently reporting on social initiatives, engaging with the community, and adopting responsible business practices. The study further suggests a policy change that encourages the implementation of strong corporate governance practices and environmental legislation. This can be accomplished by implementing sustainability reporting requirements and providing incentives for firms that demonstrate strong environmental and governance practices. By accepting these changes. Businesses can enhance their financial performance, acquire a competitive edge, and support the long-term growth of the Liberian economy.

Limitations

This study acknowledges several limitations that should be taken into consideration. Firstly, the sample selection is limited to the natural resource, oil and gas, and industrial goods sectors, which may not fully represent all sectors listed on the Liberian Stock Exchange. Therefore, caution is advised when generalizing the findings to other industries. Additionally, relying on the study's secondary data introduces the possibility of inherent biases or limitations.

To enhance the understanding of the association between ESG sustainability disclosure and firm performance in Liberia, future research should incorporate primary data collection methods and expand the sample to include a broader range of sectors. Moreover, the study focuses solely on the relationship between ESG sustainability disclosure and ROA as a measure of firm performance. Other performance indicators, such as ROE or market-based measures, have not been considered. Incorporating a wider range of financial performance measures, such as EPS, or CFROI, would provide additional insights into the financial implications of ESG disclosure. These measures can capture different aspects of profitability, efficiency, and investment returns, contributing to a more comprehensive understanding of the financial outcomes associated with ESG practices would provide a more comprehensive understanding of the effects of ESG disclosure. Lastly, it is important to note that this study specifically focuses on the Liberian Stock Exchange. The generalizability of the findings to other stock exchanges or countries may be limited due to variations in institutional frameworks, regulations, and business environments.

Acknowledgment

We would like to extend our deepest gratitude to the esteemed management of Excellent Entrepreneur Wester Chester United States and the exceptional team at the Liberia Revenue Authority for their unwavering support and invaluable contributions throughout the process of setting up and meticulously collecting data for this Study. Our sincere appreciation goes to Dr. Williams, Emmanuel Johnson, Billy Johnson, and Sara Dojo for their funding in the successful implementation of this endeavor. Their dedication and expertise have been instrumental in achieving our objectives. Furthermore, we would like to acknowledge and express our immense gratitude to Luo meiling and Dr. Victor David for their unwavering support and guidance. Their invaluable expertise has played a pivotal role in ensuring the smooth progress of this undertaking. Their commitment and assistance have been truly commendable, and we consider ourselves privileged to have had their involvement in this significant project.

Abbreviations

| ESG | Environmental Social Governance |

| ROA | Return On Assets |

| EV | Environmental Issues |

| LISGIS | Liberia Institute of Statistics and Geo-Information Services |

| ESD | Environmental Sustainability Disclosure |

| GSD | Governance Sustainability Disclosure |

| Return on Equity | ROE |

| Net Profit Margin | NPM |

| Return on Investment | ROI |

Appendix I

Selected Listed Firms across the Sectors on the Liberian Stock Exchange

| Sector | Reporting Firms | Not Reporting Firms |

|---|---|---|

| Natural Resources Sector | ||

| Liberia Coca-Cola Bottling Company Société Générale de Banques Liberia National Port Authority China Union |

2010-2020 2010-2020 2010-2020 2010-2020 |

|

| Industrial Goods Sector | ||

| Firestone Natural Rubber Company Total Liberia Lonestar Cell-MTN Finance Company Liberia Cement Corporation (CEMENCO) ArcelorMittal Liberia National Toiletries Company Liberia (NTC) Liberian Agricultural Company (LAC) Cavalla Resources Tropical Timber and Construction Company Liberia Glass Manufacturing (LGM) Liberia Ceramic Tiles Company (LCTC) Liberia Machinery & Equipment Corporation (LMEC) |

2010-2020 2010-2020 2010-2020 2010-2020 2010-2020 2010-2020 2010-2020 |

2010-2019 2010-2012 2010-2020 2010-2020 2010-2016 |

| Oil and Gas Sector | ||

| National Oil Company of Liberia (NOCAL) ExxonMobil Liberia Limited Chevron Liberia Limited Total Liberia Tullow Oil Liberia African Petroleum Liberia Limited Oranto Petroleum Liberia Universal Petroleum Liberia Limited |

2010-2020 2010-2020 2010-2020 2010-2020 2010-2020 2010-2020 2010-2020 2010-2020 |

References

Adams, C., & Zutshi, A. (2004). Corporate social responsibility: Why business should act responsibly and be accountable. Australian accounting review, 14(34), 31-39.

Adediran, S. A., & Alade, S. O. (2013). The impact of environmental accounting on corporate performance in Nigeria. European Journal of Business and Management, 5(23), 141-152.

Agnese, P., et al. (2023). ESG controversies and governance: Evidence from the banking industry. Finance Research Letters, 53, 103397.

Aifuwa, H. O. (2020). Sustainability reporting and firm performance in developing climes: A review of literature. Copernican Journal of Finance & Accounting, 9(1), 9-29.

Alabede, J. O. (2016). Effect of Board Diversity on Corporate Governance Structure and Operating Performance: Evidence from the UK Listed Firms. Asian Journal of Accounting & Governance, 7, 7.

Alshahmy, S., & Abdo, H. (2022). Impacts of reserve and decommissioning disclosures on value and performance of oil and gas firms listed in the UK. International Journal of Disclosure and Governance, 1-17.

Andrew, J. J. (2012). The relationship between corporate governance and insolvency risk among commercial banks in Liberia. Diss. 2012.

Animah, I., & Shafiee, M. (2020). Application of risk analysis in the liquefied natural gas (LNG) sector: An overview. Journal of Loss Prevention in the Process Industries, 63, 103980.

Bala, A. S., & Ibrahim, M. (n.d.). Does the Disclosure of ESG Sustainability Matter to Selected Listed Firms Performance in Nigeria?

Bhattacharya, Sonali, and Dipasha Sharma. "Do environment, social and governance performance impact credit ratings: a study from India." International Journal of Ethics and Systems 35.3 (2019): 466-484.

Boubaker, S., et al. (2020). Reaching for yield and the diabolic loop in a monetary union. Journal of International Money and Finance, 108, 102157.

Brooks, C., & Oikonomou, I. (2018). The effects of environmental, social and governance disclosures and performance on firm value: A review of the literature in accounting and finance. The British Accounting Review, 50(1), 1-15.

Burhan, A. H. N., & Rahmanti, W. (2012). The impact of sustainability reporting on company performance. Journal of Economics, Business, & Accountancy Ventura, 15(2), 257-272.

Cho, C. H., & Patten, D. M. (2007). The role of environmental disclosures as tools of legitimacy: A research note. Accounting, organizationSocietyociety, 32(7-8), 639-647.

Combs, J. G., Russell Crook, T., & Shook, C. L. (2005). The dimensionality of organizational performance and its implications for strategic management research. Research methodology in strategy and management (pp. 259-286).

Delgosha, M. S., et al. Modelingelling the asymmetrical relationships betwedigitalizationion and sustainable competitiveness: A cross-country configurational analysis. Information Systems Frontiers, 23, 1317-1337.

Deng, X., & Cheng, X. (2019). Can ESG indices improve the enterprises' stock market performance?—An empirical study from China. Sustainability, 11(17), 4765.

Elgattani, T., & Hussainey, K. (2021). The impact of AAOIFI governance disclosure on Islamic banks' performance. Journal of Financial Reporting and Accounting, 19(3), 434-454.

Elmagrhi, M. H., et al. (2020). Corporate governance disclosure index–executive pay nexus: The moderating effect of governance mechanisms. European Management Review, 17(1), 121-152.

Emami, M., et al. (2022). Quantitative risk assessment and risk reduction of integrated acid gas enrichment and amine regeneration process using Aspen Plus dynamic simulation. Results in Engineering, 15, 100566..Journal of Results in Engineering

Fallah Shayan, N., et al. (2022). Sustainable development goals (SDGs) as a framework for corporate social responsibility (CSR). Sustainability, 14(3), 1222.

Freeman, R. E., et al. (2010). Stakeholder theory: The state of the art.

Gerged, A. M., Beddewela, E., & Cowton, C. J. (2021). Is corporate environmental disclosure associated with firm value? A multicountry study of Gulf Cooperation Council firms. Business Strategy and the Environment, 30(1), 185-203.

Hajir, J. A., et al. (2015). The role of knowledge management infrastructure in enhancing innovation at mobile telecommunication companies in Jordan. European Journal of Social Sciences, 50(3), 313-330.

Hamed, R. S., et al. (2022). The impact of introducing new regulations on the quality of CSR reporting: Evidence from the UK. Journal of International Accounting, Auditing and Taxation, 46, 100444.

Haninun, H., Lindrianasari, L., & Denziana, A. (2018). The effect of environmental performance and disclosure on financial performance. International Journal of Trade and Global Markets, 11(1-2), 138-148.

Hull, C. E., & Rothenberg, S. (2008). Firm performance: The interactions of corporate social performance with innovation and industry differentiation. Strategic Management Journal, 29(7), 781-789.

Jang, Soebin, and Alexandre Ardichvili. The role of HRD in CSR and sustainability: a content analysis of corporate responsibility reports. European Journal of Training and Development, 44.6/7 (2020): 549-573.

Karaye, Y. I., Ishak, Z., & Adam, N. C. (2014). Corporate social disclosure quantity and quality as moderators between corporate social responsibility performance and corporate financial performance. Research Journal of Finance and Accounting, 5(14), 15-19.

Kasbun, N. F., Teh, B. H., & Ong, T. S. (2016). Sustainability reporting and financial performance of Malaysian public listed companies. Institutions and Economies, 8(2), 78-93.

Ke, B., Petroni, K., & Safieddine, A. (1999). Ownership concentration and sensitivity of executive pay to accounting performance measures: Evidence from publicly and privately-held insurance companies . Journal of Accounting and Economics, 28(2), 185-209.

Klapper, Leora F., and Inessa Love. Corporate governance, investor protection, and performance in emerging markets. Journal Corporate Finance, 10.5 (2004): 703-728.

Knizhnikov, A., et al. (2021). Environmental transparency of Russian mining and metal companies: Evidence frthe om independent ranking system. The Extractive Industries and Society, 8(3), 100937.

Kyereboah-Coleman, A. (2008). Corporate governance and firm performance in Africa: A dynamic panel data analysis. Studies in Economics and econometrics, 32(2), 1-24 Sabinet African journal

Laskar, N. (2019). Does sustainability reporting enhance firms' profitability? A study on select companies from India and South Korea. Indian Journal of Corporate Governance, 12(1), 2-20.

Li, J., Pike, R., & Haniffa, R. (2008). Intellectual capital disclosure and corporate governance structure in UK firms. Accounting and Business Research, 38(2), 137-159.

Nakhaei, H., et al. (2013). Evaluation of company performance with accounting and economic criteria in Bursa Malaysia. Journal of Global Business and Economics, 6(1), 49-63.

Oyewumi, O. R., Ogunmeru, O. A., & Oboh, C. S. (2018). Investment in corporate social responsibility, disclosure practices, and financial performance of banks in Nigeria. Future Business Journal, 4(2), 195-205.

Parsons, L. M. (2003). Is accounting information from nonprofit organizations useful to donors? A review of charitable giving and value-relevance. Journal of Accounting Literature, 22, 104.

Petersen, M. A., & Schoeman, I. (2008). Modeling of banking profit via return-on-assets and return-on-equity. Proceedings of the World Congress on Engineering, 2(1), 2008.

Pinelli, M., & Maiolini, R. (2017). Strategies for sustainable development: Organizational motivations, stakeholders' expect,ations and sustainability agendas. Sustainable Development, 25(4), 288-298.

Richardson, A. J., & Welker, M. (2001). Social disclosure, financial disclosure and the cost of equity capital. Accounting, organizations and society, 26(7-8), 597-616.

Said, R., Zainuddin, Y. H., & Haron, H. (2009). The relationship between corporate social responsibility disclosure and corporate governance characteristics in Malaysian public listed companies. Social responsibility journal, 5(2), 212-226.

Schaltegger, S., & Wagner, M. (2006). Managing sustainability performance measurement and reporting in an integrated manner. Sustainability accounting as the link between the sustainability balanced scorecard and sustainability reporting. Sustainability accounting and reporting, 681-697.

Shanaev, S., & Ghimire, B. (2022). When ESG meets AAA: The effect of ESG rating changes on stock returns. Finance Research Letters, 46, 102302.

Smith, M., Yahya, K., & Amiruddin, A. M. (2007). Environmental disclosure and performance reporting in Malaysia. Asian Review of Accounting, 15(2), 185-199.

Wood, D. J. (2010). Measuring corporate social performance: A review. International journal of management reviews, 12(1), 50-84.

Wyatt, A. (2008). What financial and non-financial information on intangibles is value-relevant? A review of the evidence. Accounting and Business Research, 38(3), 217-256.

Zahid, Muhammad, Haseeb Ur Rehman, and Muhammad Anees Khan. ESG in focus: the Malaysian evidence. City University Research Journal, 9.1 (2019): 72-84.

Received: 27-Jun-2023, Manuscript No. IJE-23-13796; Editor assigned: 29-Jun-2023, Pre QC No. IJE-23-13796(PQ); Reviewed: 13-Jul-2023, QC No. IJE-23-13796; Revised: 17-Jul-2023, Manuscript No. IJE-23-13796(R); Published: 24-Jul-2023