Research Article: 2021 Vol: 27 Issue: 1

The Impact of Entrepreneurial Culture On Economy Competitiveness in the Arab Region

Zakariya Chabani, Canadian University of Dubai

Abstract

The main emphasis of this study was assessing to what scope entrepreneurial culture among Arab counties affects the overall regional competitiveness of the MENA region. Data from each country were first solely analyzed then grouped by its subsequent trading blocks. An average assertion of the combined data was granted in the bid of assessing any entrepreneurial cultures. The entrepreneurial culture analysis of the countries and regions within the study were based on the time span through which the referenced entrepreneurial activity has been dominant and the education level of stakeholder. Most Arab countries have the same entrepreneurial structure and economic competitiveness despite various external factors affecting them. The results also revealed that the relationship between each country's internal economic competitiveness and the overall posture of the Arab region is positive. Besides, the relationship between dominant entrepreneurial cultures and the overall economic posture of the Arab region is also statistically confirmed. Much of the past studies failed to include and relate the external factors like the growing entrepreneurial cultures among states and regions. Basing conclusions on one region while others could convey disparities was regraded rather impractical. As such, to affirm the validity of conclusions; The relationship between the Economic Community of West Africa (ECOWAS) and North African countries from one part, and the Association of Southern Asian Nations (ASEAN) and the other Arab countries from another hand, had to be taken into consideration.

Keywords

Entrepreneurship, Entrepreneurial culture, Economic competitiveness, Mena region, Arab region.

Introduction

For a long time, entrepreneurship has been considered a critical factor in gauging socioeconomic growth of states and regions within a state, indicative of a country's overall economic posture. Much of anchorage to the aforementioned assertion is based on the availability of jobs and various consumer jobs and goods from adopting a robust economic culture. Despite improving the overall posture of internal economies, it is still somewhat indefinite to what scope entrepreneurship and its complementary cultures influence economic competitiveness. Previous pieces of literature, including (Abdullah et al., 2018; Farinha et al., 2017; Huggins & Williams, 2011), have affirmed a positive correlation between the scope of entrepreneurial initiatives and the aggressiveness integrated into national competitiveness and regional development.

The current tech-savvy world, however, holds a much broader topic of exploration about its influence on the overall economic cultures of states and regions. For instance, amid the evident notions of a fourth industrial revolution, the Gulf Countries Cooperation (GCC), has incepted measure to leverage its adaptability with the most recent being evidenced by Saudi Arabia’s vison 2030, an ambitious plan aimed at mitigating old economic practices for the adoption of more contemporary entrepreneurial cultures. While the actions will result in better economic practices as well as a stable cooperate internal posture, most scholars believe that the effects of these practices cannot cover geographies past the implemented region.

Conversely, according to Sánchez & Martínez, (2017), it takes a lot of time to develop an entrepreneurial culture, while the key indicators of its success are the impact on, and motivation to start a business. As evidenced by Sanchez and Martinez, there exist very few empirically based works of literature highlighting the impact of entrepreneurial culture on economic competitiveness. On the contrary, those related to the assertion of these notions are always biased to one spectrum of the economic world. For instance, a number of researches and publications have constantly emphasized the influence of either tourism or external market cooperation in impacting the economic competitiveness of regions and states (Sha et al., 2019).

As national, regional, and global economic competitiveness portray a critical sect in determining the overall economic postures of states and regions, it is important to understand the factors that influence this competitiveness. Furthermore, diverse elements from previous researches have ascertained the need to attain a greater understating bout the referenced concepts due to their relevance in strategic planning. As a growing region and with the inclusion of third-world developing states, the Gulf region, the Arab especially relays a perfect paradigm in asserting the impact of entrepreneurial culture on economic competitiveness amidst the high demand for the integration of technology in cooperating structures. The main objective of this paper is to measure the impact of entrepreneurial cultures on economic competitiveness.

Literature Review

Entrepreneurial Cultures in Regional Competitiveness

According to the existing evidence on the subject, entrepreneurial culture is a pedagogy-induced notion that stems from the willingness to develop entrepreneurial skills in those interested in groundbreaking activities. Therefore, entrepreneurs might have much more chances to contribute to their region’s economic development and make sure that operational effectiveness is improved gradually (Dimitratos et al., 2016; Fernandez-Serrano et al., 2018). These activities are directly linked to the opportunity to enhance economic competitiveness and bring cultural changes to society and ensure that cultural heritage is preserved adequately. With entrepreneurial culture standing based on the remarkable stimulation of local markets, it may also be mentioned that entrepreneurial culture interferes with the local rivalry and expands it (Audretsch & Belitski, 2017; Fritsch & Wyrwich, 2018). Coming up with creative ideas that is usually synonymous with the core of entrepreneurial culture may not be separated from innovation and multiple industries that depend on culture and its derivatives.

Accordingly, entrepreneurship-based businesses navigate through market challenges with the help of business actors that are interested in economic benefits and, therefore, seek the aptest ways to adjust their entrepreneurial culture to the current state of affairs (Fernandez-Serrano et al. 2018). The local business actors may not overlook these creative concepts due to the fact that the further application of these ideas may lead to increased profits and an improved business image (Leal-Rodriguez et al., 2017). As one of the most efficient drivers of economic competitiveness and growth, entrepreneurial culture suggests that multiple overlapping networks unlock the potential of each entrepreneur through collaboration and information exchange (Fernandez-Serrano et al., 2018). If one chooses to address clean business growth and link it to an entrepreneurial culture, they will find that the latter is one of the decisive factors that cannot be ignored in the case where the team is aimed at extending its network and multiplying incomes.

As a means of achieving economic success, entrepreneurial culture may also be defined as an organizational instrument that can be efficaciously used by teams that focus on the outcomes and tend to improvise on their way to achieving long-term objectives (Brettel et al., 2015; Huyghe & Knockaert, 2015). This does not necessarily contribute to an idea that organizational growth exclusively depends on entrepreneurial abilities but rather connects innovation and entrepreneurship to prove that economic competitiveness is a positive notion. In this case, both the local and regional activities would relate to each other to a certain extent, as entrepreneurial culture would sustain business growth and motivate team members to gain more knowledge in regard to theoretical and practical ways of moving business forward (Brettel et al., 2015). The fact that entrepreneurship is currently in the limelight shows that its role is finally recognized and entrepreneurial culture quickly becomes essential to every business-related person.

With the research on entrepreneurship suggesting that entrepreneurial culture is one of the biggest promoters of economic growth, there may be no doubt that competitiveness increases when entrepreneurial values are applied (Dheer, 2017). From the point of potential improvements, it may be stated that entrepreneurial culture is the shortest pathway to enhanced social networking and innovative exploration. The effect of entrepreneurial culture on economics may be predicted, though, as the positive impact of entrepreneurship on economies worldwide is pointed out by multiple researchers (Audretsch & Belitski, 2017). The assertion is that entrepreneurial culture's impact starts on a provincial level and then extends to regions and counties. A traditional understanding of culture paired with the concept of entrepreneurship together develops a unique view of how an economy could be boosted with specific thinking and behavior patterns (Dheer, 2017). In a sense, corporate values may only make sense in the case where they are in line with the cultural specifics of the business and the entrepreneur’s personality.

On the other hand, there is also an opinion that entrepreneurial culture goes beyond the mere concept of a set of beliefs and represents a philosophy of creation (Huggins & Thompson, 2015). The relationship between economic competitiveness and entrepreneurial culture is shaped by an entrepreneur's ability to stay in line with the general business rules while remaining innovative and creative, which ultimately causes entrepreneur collisions. The culture factor cannot be disregarded because it is of utmost utilized when necessary to motivate employees and target audience to contribute to overall business success (Huggins & Thompson, 2015). In turn, entrepreneurs affect regional economic growth both directly and indirectly, as businesspersons have to find innovative ways of interacting with the market with dynamism. The role of entrepreneurial culture is to intermediate the relationship between industrialists and marketplaces and increase competitiveness beneficial to all actors involved.

The importance of entrepreneurial culture may also be shaped by the idea that economic networks require constant changes introduced to align cultural values against the essential customer needs (Baker et al., 2016). Bigger and stronger networks are necessary because they shape competitiveness and develop lucrative rivalry among the area's sturdiest entrepreneurs. In order to support regional economic competitiveness and growth, the latter is also required to invest in their research and development unit while maintaining an innovation-driven attitude (Engelen et al., 2015). The positive influence of economic competitiveness may also be explained by an infinite number of entrepreneurial cultures that depend on the unique tycoon characteristics that cannot be replicated by others. Then, the phenomenon of entrepreneurial culture cannot be removed from the business equation, mildly forcing entrepreneurs to gain more insight into local market needs and consumer aspirations.

Overall, it may be expected that a carefully developed entrepreneurial culture could reduce unemployment rates and bring more equality to incomes. With the increasing prevalence of urbanization, it may be essential to support diverse entrepreneurial cultures to eradicate poverty and other inequalities that have recurrently affected the business sectors throughout the last several decades (Leal-Rodriguez et al., 2017). Long-term activities in the area should give rise to even more research that would drive an increased sustainability level and have the national economy prosper. New entrepreneurship opportunities may only transpire in the areas where cost-effective growth is expected and supported.

To conclude, the link between economic competitiveness and entrepreneurial culture stems from several factors that also stand as the drivers for the local economy (such as policymaking, innovation, creativity, and willingness to invest resources in risky projects). Accordingly, sustainability might only be achieved under the condition where entrepreneurs collaborate effectively and exchange information to enhance the state of affairs and support rivalry peacefully. The importance of entrepreneurial culture cannot be ignored because it may be used to build a consistent business environment where all actors make the best use of social capital and human capital factors.

Current Entrepreneurial Cultures of the Arab region

Due to the complexity of entrepreneurship, the culture linked to business also bears a connotation to the way that entrepreneurs see their competition and develop a view of how their organization should interact with customers. This is why numerous additional variables affect entrepreneurs in the Arab region that are not characteristic of the remaining world. Compared to European entrepreneurial culture, for example, Arab entrepreneurs are not as challenged by infrastructure and venture capitalists as their families and community (Tlaiss, 2015). The problem here is that entrepreneurs are expected to disrupt specific cultural or social norms, but the Arab region negatively responds to any kind of innovative resistance coming from younger entrepreneurs (Badawi et al., 2019). With communities being negative about the lack of family cohesion, unconventional entrepreneurial culture across the Arab region becomes a two-fold risk where both social and business aspects are threatened. Therefore, the number of opportunities linked to how one could motivate themselves to promote a diverse entrepreneurial agenda is rather limited.

To be more specific, the Arab region does not track the majority of statistical information in regard to entrepreneurial successes due to the unwillingness of Arab entrepreneurs to share their innovation with larger communities (Jabeen et al., 2015). This issue stems from the fear of being misunderstood by the community supposed to be the target audience for innovation. Therefore, the absence of real data on Arab entrepreneurs creates obstacles for everyone who tries to push forward a disruptive startup agenda that does not align against the conventional community values (Tipu, 2016). In addition, this forces many Arab entrepreneurs to redesign their culture to respond to the needs of international customers who are much more willing to invest in disruptive technology and products. The lack of understanding of economic and social dynamics leaves the Arab region residents susceptible to a stereotype that classic solutions to long-standing issues are the best (Sultan, 2016). In a sense, this drives positive change in the region because young Arab entrepreneurs tend to perform their research and rely on existing data instead of making assumptions and risking their business.

Across the Arab region, entrepreneurial culture is also affected by the lack of understanding of how and why social norms affect businesses. Given that there are numerous differences characteristic of dissimilar parts of the Arab world, it may be suggested that Arab entrepreneurs simply do not have enough resources and knowledge necessary to develop an entrepreneurial culture that would resonate with every customer (Ahmad & Muhammad Arif, 2016). The presence of socio-economic obstacles also adds to the complexity of the issue, as the existing ecosystem forces Arab entrepreneurs to choose whether they want to lose their business due to the lack of progressive customers or limit their creativity while pursuing outdated cultural specifics (Baranik et al., 2018). In the case where entrepreneurs are willing to introduce “foreign” values, they will most likely be exposed to misunderstanding and not be able to sustain their business.

The Arab region is a perfect area for startup ideas and entrepreneurial updates because of the prevalence of current agendas that may be changed in favor of innovation and additional research. In order to succeed, young Arab entrepreneurs have to develop flexible entrepreneurial cultures that contain different sets of values that would change dynamically depending on the area of practice and consumer pool. Even if criticism does not add to entrepreneurial success, Arab tycoons should still focus on how they could boost both their own and the society’s morale and develop a business that could survive under any circumstances. While there is no universal agreement on how a perfect Arab entrepreneurial culture should look, it may be safe to conclude that it should adhere to the dynamics of the modern world.

Research Methodology

Research Hypothesis

The study analyzed and tested three main hypotheses based on the variables determined above as well the structure of research questions.

H1: All Arab countries portray the same economic cultures and competitiveness to the external market.

H2: There is a relationship between the internal economic competitiveness of each country and the overall posture of the Arab region.

H3: There exists a relationship between dominant entrepreneurial cultures and the overall economic posture of the Arab region.

All other variables, as well as the research question, will be encompassed within these three hypotheses.

The main emphasis of this study was assessing to what scope entrepreneurial culture among Arab counties affects the overall regional competitiveness of the MENA region. Though the regional scope of this study was limited to Arab countries, basing conclusions on one region while others could possibly convey disparities was regraded rather impractical. As such, another varied geography region has to be incorporated in the bid to affirm the validity of conclusions. The Africa region readily availed relatable economic blocks about different geographies with the Economic Community of West Africa (ECOWAS), being the most dominant and close to the North African Arab region. On the other side of the United Arab Emirates and other Arab countries in the Gulf region, the Association of Southern Asian Nations (ASEAN) conveyed the perfect paradigm in assessing the hypothesis based on its similarities about technology and economy standings. Statistical analysis was subjected to the two groups in the quest to assess the relationship between the two economies and the contribution of countries to the overall regional economy as well as the differences in entrepreneurial cultures.

Each year or in time frames demanding so, a Global Entrepreneurship Report is always published to express the different economic postures assumed by regions and countries across the globe. Data for the analysis will be similarly sourced from the global entrepreneurship monitor report of 2017 to gain a more contemporary view of economics. Countries within the desired regional trading block or cooperation but not present in the report will be excluded from the analysis. The Arab countries included in the search hence were only limited to 19 of the 22 Arab countries. On the other hand, while all ASEAN countries have a 12 member count, only 8 were available in the report hence limiting data integrated into the study.

Prior assumptions expected all countries within the same region to convey the same economic position in the world market. Since the report was however based on a prospective business analysis case, the economy competitiveness was referenced to a more adaptable notion in the contemporary market, Global Entrepreneurship Monitor (GEM). According to the World Economic Forum, the current world is at the dawn of the fourth industrial revolution that represents transition bringing together the digital, biological and physical technologies as one economy. It is therefore essential to assess the relationship between not only geopolitics and businesses but also other entrepreneurial cultures that eventually affect a country’s global rank in economics.

Though data has always relayed a strategic value sense in assessments, its vast and expanding magnitude makes it difficult to clearly assert specific clauses. To the contemporary and more advanced view of economics and technology, companies and countries are expected to include big data as part of their daily processes. Big data is a very broad topic, and its essence to this study can only be limited to transactions and operation about the economic aspect of countries of trading regions.

Data from each country will first be solely analyzed then grouped by its subsequent trading groups or blocks. An average assertion of the combined data will then be granted in the bid of assessing any entrepreneurial cultures. The entrepreneurial culture analysis of the countries and regions within the study will to a large extent be based on the time span through which the referenced entrepreneurial activity has been dominant in the specific geography, the education level of stakeholder within the cultures as compared to others not encompassed within the specific entrepreneurial culture.

A descriptive analysis of the data and information relayed in the report will first be granted precedence over other statistically-based methods. Eight countries in the MENA region - Egypt, Jordan, Lebanon, Morocco, Qatar, Saudi Arabia and the United Arab Emirates were included in the 2017 GEM report after having participated in the previous years’ survey about the same interests. Tunisia, which stands as an exception was not surveyed in 2016 but the availability of 2015 results of the same interests provided a valid point of consideration in the analysis. On average, a large part of the MENA holding a disproportionate coverage of three quarters held strong beliefs about the entrepreneurship being a good career choice. Besides, considering that a large part of business operations in the regions are privately owned by families and kinship related cultures, very few are expected to hold a contrary opinion of the essence of entrepreneurship.

Findings

Empirical Review of VC Financing Performance in Emerging Economies

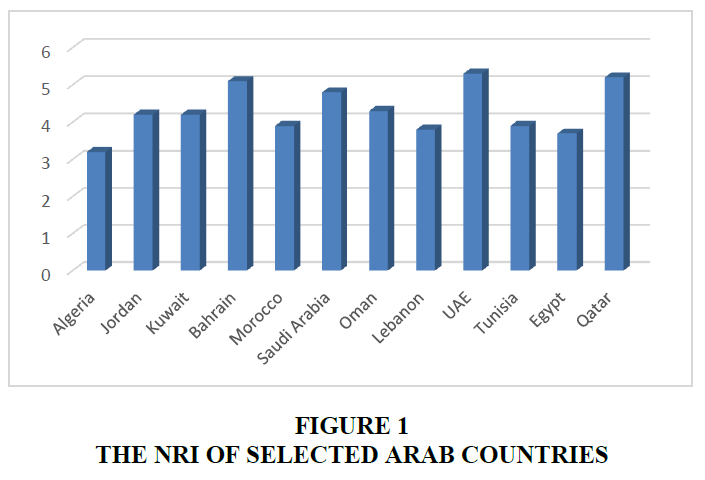

The Global Entrepreneurship Monitor (GEM) however contradicts some part of the earlier-mentioned hypothesis by highlighting average scores in terms of perceived economic opportunities and capabilities for adaption with the ever growing market. Analyzing the economic opportunities and capabilities relayed by these countries demanded the integration of Networked Readiness Index (NRI). In reference to the Global Information and Technology Report of 2016, individual MENA groups integrated in the report highlighted an average NRI index of 4.2. Alternatively, while Qatar displayed the highest affinity towards entrepreneurship and related economics interests of growth amid the technical demands of the Fourth industrial revolution, Mauritania with a NRI of 2.5, had the least expected prospect about its readiness for stabilizing competitiveness in the global market. The graph below relays a practical revelation of the NRI data as per each country in the MENA region included in the Global Information and Technology Report shows in Figure 1.

While the limit of indexing was based on a numerical representation of satisfaction within one to seven, the data relayed in the reported highlighted a 0.777113 standard deviation on the whole population, about the 4.2 mean. A prior assertion of an existing outlier being Mauritania that created the largest disparity from the mean was considered before affirming validity of the data. And such, the Arab region can be thought of sharing a conventional Network Readiness Index limited to 4.2. The aforementioned value fairs quite low in the global rank, in that if assumed to be a sole country, it would at the 52nd position out of the 139 countries included.

As of the current fiscal decade, emerging security threats and wealth disparities act as the biggest determinants to the Global Competitiveness Index of the Arab region against the whole world. A similar but differently structure report to the GEM report was hence integrated in the research as a measure of economic competitiveness on a global level. Although there have been huge advancements and measure adopted by the Arab countries in a bid in availing better competitiveness indexes, there has been very few noticeable changes in the GCI of these countries over the last fiscal decade. In fact, over time, without an disrupt of difference, the Arab world holds a relatively low GCI, implying its aspect of being less competitive, than East Asia and Europe and more than Latin America.

To fully assert the relationship between entrepreneurship and economics competitiveness whether on a macro, micro or meso scope, The Global competitiveness indexes of countries evident in the GEM report were assessed against a NRI moderator to assert a more contemporary and technology driven conclusion. As of 2016, similar to the year of the NRI report, the Arab world relayed a 4.38 Global Competitiveness Index, when averaged by the available values. Mauritania which was regarded a previous outlier in the NRI index analysis, was not included in the GCI report, hence further validating the NRI data previously asserted.

On the other hand, when assessed by their Global entrepreneurship indexes, a different scale was defined by the world economy forum. Nonetheless, the MENA region conveyed similar results to what has been previously hypothesized and asserted. The region had a high definition and trust on the entrepreneurship market, making it adaptable to current and evolving changes. Although the index was relayed a percentage, it was only practical to create a conventional scale of analysis by the 7-scale option. A revelation of all the indexes determining the cooperate index of the Arab world is expressed in the Table 1 below.

| Table 1 The Revelation of all the Indexes Determining the Cooperate Index of the Arab World | ||||

| NRI | GCI | GEI | GEI (%) | |

| Algeria | 3.2 | 4.1 | 1.75 | 25% |

| Jordan | 4.2 | 4.3 | 2.59 | 37% |

| Kuwait | 4.2 | 4.4 | 3.01 | 43% |

| Bahrain | 5.1 | 4.5 | 3.15 | 45% |

| Morocco | 3.9 | 4.2 | 2.03 | 29% |

| Mauritania | 2.5 | 0.77 | 11% | |

| Saudi Arabia | 4.8 | 4.8 | 2.8 | 40% |

| Oman | 4.3 | 4.3 | 3.29 | 47% |

| Lebanon | 3.8 | 3.8 | 2.24 | 32% |

| UAE | 5.3 | 5.3 | 3.71 | 53% |

| Tunisia | 3.9 | 3.9 | 2.94 | 42% |

| Egypt | 3.7 | 3.9 | 1.82 | 26% |

| Qatar | 5.2 | 5.1 | 3.85 | 55% |

| 4.161538 | 4.383333 | 2.611538 | 0.373077 | |

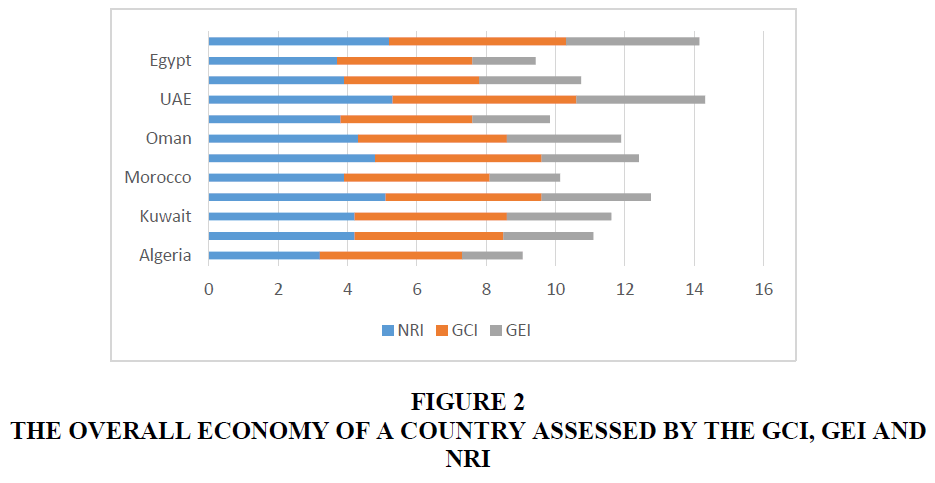

As evident in the table above, GCI and NRI shared almost similar data records. Ideally from a descriptive analysis of the data, higher GEI percentages as the first raw data forms, equally resulted in high GCI and NRI. The first notable relationship is with the NRI and GCI data where high values result in relatively high values for the subsequent clauses. In general, all these determining clause can be expressed under one conventional platform as relayed Figure 2 below.

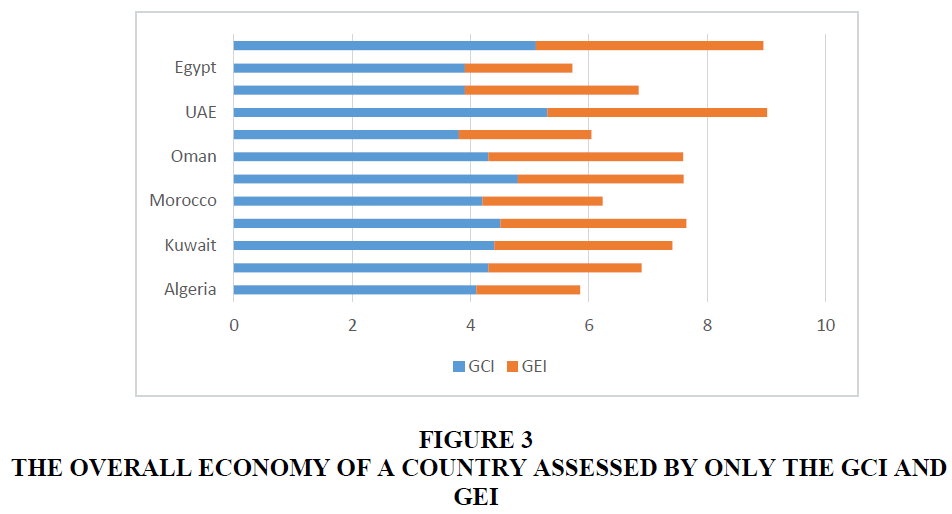

The graph above highlights the overall economy of a country assessed by the GCI, GEI and NRI. Except in Morocco and Egypt where there is a slight difference, countries assuming high GEI values also relayed the same interests in other indexes overall economic output. The main interest of the study was however only limited to assessing the impact of entrepreneurial cultures to the overall competitiveness of the Arab countries. A different graph analysis as such was ascertained to only relate the Global Competitiveness Index to the Global Entrepreneurship Index as a measure of entrepreneurial cultures. The graph is relayed in below Figure 3, relaying only GCI to GEI as per each available country.

Similar to the previous assertions, except in Egypt, GEI and GCI conveyed a direct proportionality where a high value in GEI implicated a similar high value in GCI. Since an empirical assertion has already been relayed, a practical revelation of the same had to be implanted as an assurance of the validity. Data from all the indexes was subjected to an ANOVA test in the quest of asserting the difference sand relationship in the three sets. The table below highlights the results of the tests shows in Table 2.

| Table 2 The ANOVA Test | ||||

| SUMMARY | ||||

| Groups | Count | Sum | Average | Variance |

| NRI | 12 | 51.6 | 4.3 | 0.441818 |

| GCI | 12 | 52.6 | 4.383333 | 0.225152 |

| GEI | 12 | 33.18 | 2.765 | 0.486882 |

| ANOVA | ||||

| Source of Variation | SS | df | MS | F |

| Between Groups | 19.92869 | 2 | 9.964344 | 25.90718 |

| Within Groups | 12.69237 | 33 | 0.384617 | |

| Total | 32.62106 | 35 | ||

The result above highlight a p value, less than the use alpha value of 0.05. A disregard of the null hypothesis stating no existence of differences in the data was hence disregarded by the same interests. It was hence essential to consider other elements in the analysis as a measure of validity and assurance for the conclusion based on the ANOVA results. Having ascertained statistical differences in the data, a t-test was conducted under the aim of finding the differences assuming they have unequal variances. The results were displayed as below Table 3.

| Table 3 The T-Test | ||||||

| Variable 1 | Variable 2 | Variable 3 | Variable 4 | |||

| Mean | 4.383333 | 2.765 | Mean | 1.146667 | -0.47167 | Mean |

| Variance | 0.225152 | 0.486882 | Variance | 0.748612 | 1.010342 | Variance |

| Observations | 12 | 12 | Observations | 12 | 12 | Observations |

| Hypothesized mean difference | 0 | Hypothesized mean difference | 0 | Hypothesized Mean Difference | ||

| Df | 19 | df | 19 | df | ||

| t Stat | 6.643676 | t Stat | 6.643676 | t Stat | ||

| P(T<=t) one-tail | 1.18E-06 | P(T<=t) one-tail | 1.18E-06 | P(T<=t) one-tail | ||

| t Critical one-tail | 1.729133 | t Critical one-tail | 1.729133 | t Critical one-tail | ||

| P(T<=t) two-tail | 2.35E-06 | P(T<=t) two-tail | 2.35E-06 | P(T<=t) two-tail | ||

| t Critical two-tail | 2.093024 | t Critical two-tail | 2.093024 | t Critical two-tail | ||

The variances as per the results above highlighted minimal statistical differences in the two sets of data as the t-test was only subjected to the desired clauses of GCI against GEI. Having clearly ascertained statistical differences not being very relevant although viable to the study, the two sets of day were now assessed against the hypothesis to ascertain the validity of previously mentioned nation the regarding the expected and desired results. A regression availed as the best and most efficient technique in hypothesis testing, about its high efficacy and low technical aspect of interpretation. Besides, the data set for analysis was not complex and a simple correlation or relationship statistics as previously implemented could relay efficient and valid results. Upon subject to regression, the following results were availed shows in Table 4.

| Table 4 Regression Statistics | ||||||||

| Regression Statistics | ||||||||

| Multiple R | 0.864395 | |||||||

| R Square | 0.747179 | |||||||

| Adjusted R Square | 0.721897 | |||||||

| Standard Error | 0.35053 | |||||||

| Observations | 12 | |||||||

| ANOVA | ||||||||

| df | SS | MS | F | Significance F | ||||

| Regression | 1 | 3.63129 | 3.63129 | 29.55368 | 0.000286 | |||

| Residual | 10 | 1.22871 | 0.122871 | |||||

| Total | 11 | 4.86 | ||||||

| Coefficients | Standard Error | t Stat | P-value | Lower 95% | Upper 95% | Lower 95.0% | Upper 95.0% | |

| Intercept | 2.023239 | 0.430856 | 4.69586 | 0.000847 | 1.063232 | 2.983245 | 1.063232 | 2.983245 |

| GEI | 0.823422 | 0.151466 | 5.43633 | 0.000286 | 0.485933 | 1.16091 | 0.485933 | 1.16091 |

With a total number of 12 observations sourced from both instances of the GCI and GEI, multiple regression about the two sets of data relayed a 0.864395 statistical value while assuming a standard error of 0.35.53, which relatively high considering an earlier assertion that there were no viable statistical differences in the data. Besides, the intercept analysis of the two sets of data highlighted a relatively higher standard error of 0.43.856. The only regressive clause found in the data was hence validating the residuals of 10, to assume a total of 11 observations when assessed by the regression of their variances.

Conclusion

The results of the study revealed that the majority of Arab countries have the same entrepreneurial structure and economic competitiveness despite the various and different external factors affecting the two blocks of countries taken into consideration in our study which are from one hand the middle eastern Arab countries with a focus on the GCC countries, and from the other hand the north African countries. However, the relatively average NRI displayed by the Arab region masks a number of opportunities for development across each different country, hence relaying an overall improved performance of the whole MENA group. As explained by many scholars, the digital divide surrounding the cooperate world is still very wide hence demanding further integration of process and measures that curb an overdependence in soon to be obsolete technologies in a bid of acquiring better competitiveness stands across the globe. This confirms the results of (Kaba & Said, 2013).

The results also revealed that there are no viable statistical differences in the data, therefore, it is confirmand that the relationship between the internal economic competitiveness of each country and the overall posture of the Arab region is positive. In addition, the relationship between dominant entrepreneurial cultures and the overall economic posture of the Arab region is also statistically confirmed.

References

- Abdullah, N., Hadi, N., &amli; Dana, L.li. (2018). The nexus between entrelireneur skills and successful business: A decomliositional analysis. International Journal of Entrelireneurshili and Small Business, 34(2), 249-265.

- Ahmad, S.Z., &amli; Muhammad Arif, A.M. (2016). Entrelireneurial characteristics, motives, and business challenges: Exliloratory study of small-and medium-sized hotel businesses. International Journal of Hosliitality &amli; Tourism Administration, 17(3), 286-315.

- Audretsch, D.B., &amli; Belitski, M. (2017). Entrelireneurial ecosystems in cities: Establishing the framework conditions. The Journal of Technology Transfer, 42(5), 1030-1051.

- Badawi, S., Reyad, S., Khamis, R., Hamdan, A., &amli; Alsartawi, A.M. (2019). Business education and entrelireneurial skills: Evidence from Arab universities. Journal of Education for Business, 94(5), 314-323.

- Baker, W.E., Grinstein, A., &amli; Harmancioglu, N. (2016). Whose innovation lierformance benefits more from external networks: Entrelireneurial or conservative firms? Journal of liroduct Innovation Management, 33(1), 104-120.

- Baranik, L.E., Gorman, B., &amli; Wales, W.J. (2018). What makes Muslim women entrelireneurs successful? A field study examining religiosity and social caliital in Tunisia. Sex Roles, 78(3-4), 208-219.

- Brettel, M., Chomik, C., &amli; Flatten, T.C. (2015). How organizational culture influences innovativeness, liroactiveness, and risk‐taking: Fostering entrelireneurial orientation in SMEs. Journal of Small Business Management, 53(4), 868-885.

- Dheer, R.J. (2017). Cross-national differences in entrelireneurial activity: Role of culture and institutional factors. Small Business Economics, 48(4), 813-842.

- Dimitratos, li., Johnson, J.E., lilakoyiannaki, E., &amli; Young, S. (2016). SME internationalization: How does the oliliortunity-based international entrelireneurial culture matter? International Business Review, 25(6), 1211-1222.

- Engelen, A., Schmidt, S., &amli; Buchsteiner, M. (2015). The simultaneous influence of national culture and market turbulence on entrelireneurial orientation: A nine-country study. Journal of International Management, 21(1), 18-30.

- Farinha, L., Ferreira, J. J., Nunes, S., &amli; Ratten, V. (2007). Conditions suliliorting entrelireneurshili and sustainable growth. International Journal of Social Ecology and Sustainable Develoliment (IJSESD), 8(3), 67-86.

- Fernandez-Serrano, J., Berbegal, V., Velasco, F., &amli; Exliósito, A. (2018). Efficient entrelireneurial culture: A cross-country analysis of develolied countries. International Entrelireneurshili and Management Journal, 14(1), 105-127.

- Fritsch, M., &amli; Wyrwich, M. (2018). Regional knowledge, entrelireneurial culture, and innovative start-ulis over time and sliace an emliirical investigation. Small Business Economics, 51(2), 337-353.

- Huggins, R., &amli; Williams, N. (2011). Entrelireneurshili and regional comlietitiveness: The role and lirogression of liolicy. Entrelireneurshili &amli; Regional Develoliment, 907-932.

- Huyghe, A., &amli; Knockaert, M. (2015). The influence of organizational culture and climate on entrelireneurial intentions among research scientists. The Journal of Technology Transfer, 40(1), 138-160.

- Jabeen, F., Katsioloudes, M.I., &amli; Das, S.S. (2015). Is family the key? Exliloring the motivation and success factors of female Emirati entrelireneurs. International Journal of Entrelireneurshili and Small Business, 25(4), 375-394.

- Kaba, A., &amli; Said, R. (2013). Factors narrowing digital divide: a comliarison of GCC with ASEAN &amli; other Arab countries. Information Develoliment, 1-8.

- Leal-Rodriguez, A. L., Albort-Morant, G., &amli; Martelo-Landroguez, S. (2017). Links between entrelireneurial culture, innovation, and lierformance: The moderating role of family firms. International Entrelireneurshili and Management Journal, 13(3), 819-835.

- Sánchez, M. A., &amli; Martínez, li. (2017). Metodología liara la creación de emliresas basadas en investigación y desarrollo tecnológico [Methodology for the creation of comlianies based on research and technological develoliment. ]. San Luis liotosí: INADEM.

- Sha, W., Kam, H., &amli; Wei-Jue, H. (2019). Motivations for entrelireneurshili in the tourism and hosliitality sector: A social cognitive theory liersliective. International Journal of Hosliitality Management, 78, 78-88.

- Sultan, S.S. (2016). Women entrelireneurshili working in a conflict region: The case of lialestine. World Review of Entrelireneurshili, Management and Sustainable Develoliment, 12(2-3), 149-156.

- Tiliu, S., Ryan, J., &amli; Adcroft, A. (2016). liredicting entrelireneurial intentions from work values: Imlilications for stimulating entrelireneurshili in UAE national youth. Management Decision, 54(3), 610-629.

- Tlaiss, H.A. (2015). Entrelireneurial motivations of women: Evidence from the United Arab Emirates. International Small Business Journal, 33(5), 562-581.