Research Article: 2018 Vol: 22 Issue: 2

The Impact of E-Commerce on the Quality of Credit Facilities and Banking Services (Applied Study on Commercial Banks in Jordan)

George N Shawaqfeh, Ajloun National University

Keywords

Electronic Commerce, Internet, Credit Facilities, Banking Services, Commercial Banks, E-banking.

Introduction

The twentieth century Witnessed a huge revolution in Information and Communications Technology (ICT) which has exceeded all expectations and has become the main engine of social, economic and political changes on a global scale, as the world economy experienced a kind of transitions and race between the leading telecommunications and information technology companies to innovate and to develop commercial e-services that it has become a necessity for daily transactions, whether for companies or government departments in different areas.

The Internet has contributed massively to transform the world into a small global village where network users has doubled in a short period, in which the role of the network has grown to become the nucleus and the center of E-commerce represented in the e-mail and the changes that has followed. Where e-commerce has a positive relationship correlation with the number of Internet users, the more the number of users of the internet in the business performance contributed to the growth process of the work of commercial banks in general, which can complete the processes of buying and selling and exchange of goods, marketing and electronic sales over the network and encourage the flow of products from the goods and services between different countries of the world (Egland, 1998).

E-commerce has had a positive impact on the quality of credit facilities, where it has helped in improving the quality of banking services, providing credit facilities and the work of banks in general (Kalakota & Robinson, 1999).

The Problem of the Study

This study seeks to answer the following questions:

1. What is the concept of e-commerce?

2. What is the concept of credit facilities?

3. What is the concept of quality of banking services?

4. Does the e-commerce affect the quality of credit facilities in banks?

5. Does dealing with e-commerce affects the promotion of the quality of banking services?

The Importance of the Study

The importance of this study stems from the role of e-commerce in influencing the quality of services provided by Jordanian commercial banks through the use of the Internet in providing services and guaranteeing their quality to customers. In addition, the possibilities to search for different methods that help commercial banks achieve great satisfaction by Customers. The rapid development and diversification of banking services and the use of the Internet to provide banking services to customers so that they can first achieve satisfaction with these services and the subsequent research on how to develop electronic commerce and its impact on the quality of credit facilities and the quality of banking services.

The importance of this study also lies in understanding the concepts of electronic commerce and credit facilities and the impact of electronic commerce on bank credit and the implications thereof.

The lack of studies on the impact of electronic commerce on the quality of banking services has led the researcher to conduct this study and access to the most important points sought by customers, which can make them turn in dealing with banks from the traditional method to electronic method to adapt to future developments and cope with them (Hamayel, 2008).

The Objectives of the Study

The objectives of the study are to study and analyze the impact of electronic commerce on the quality of credit facilities and banking services and the progress made by the Jordanian Commercial Banks in adoption of technology (Cronin, 1994).

The Study Hypotheses

The study relied on a set of assumptions which aimed mainly to understand the impact of electronic commerce on the credit facilities in banks as seen by the respondents.

The hypotheses were formulated in the form of nothingness:

1. H0: There is no impact of e-commerce on the quality of credit facilities in banks.

H1: There is impact of e-commerce on the quality of credit facilities in banks.

2. H0: There is no impact of e-commerce on the quality of banking services.

H1: There is impact of e-commerce on the quality of banking services.

3. H0: The e-commerce generally does not affect the work of the Banks.

H1: The e-commerce generally affects the work of the Banks.

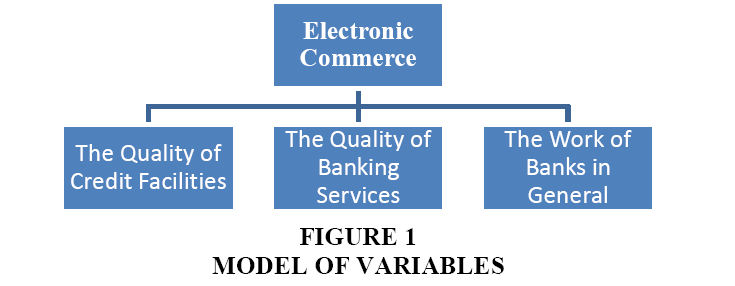

The Study Model of Variables (Figure 1)

The Study Sample

The study population consists of all the employees in commercial banks operating in Jordan, which are (12) commercial banks, where the study sample included employees of commercial banks located in the Greater Irbid Municipality area only and did not include employees of commercial banks in the rest of Jordan.

The sample of the study consisted of (120) employees from twelve Jordanian commercial banks (ten employees from each bank), which were selected in a simple random way. The number of sample members was determined by analyzing a random sample of 10 employees for the concerned commercial banks. Hundred and Twenty (120) questionnaires were distributed to the employees of the twelve banks equally in the areas within the boundaries of the Greater Irbid Municipality and collected personally by hand to insure that they were in full form and valid for the statistical analysis. The questionnaire contains many questions about the electronic services provided by the bank to customers and about the response of customers to such services and the percentage of beneficiaries of these services to non-beneficiaries.

The Study Methodology

The present study is mainly aimed at exploring the impact of electronic commerce on the quality of credit facilities and banking services. It involved developing certain testable hypotheses based on existing theory following the inductive reasoning. Therefore, the present study uses the statistical survey methodology as its research design and the analytical approach since it is more appropriate for the purpose of the study.

The study covered the following topics:

1. The Theoretical Framework:

2. The Data Analysis and Data Analysis Discussion.

3. Conclusions and Recommendations.

Theoretical Framework

Electronic Commerce

E-commerce has spread in most countries from the East to the West (the United States of America, Western Europe, Japan and many other countries) and has proved successful as a result of the enormous technological advances and the increasing interdependence of markets; And will be one of the distinct phenomena in the next decade, according to a report issued by Master Card company the e-commerce exceeded US $ 800 billion in 2017 (Albawabh News, 2017).

In the report of the Belfort Company about the indicators of the electronic payment industry, the bulk of e-commerce in the Arab World amounted 22% of the e-commerce worldwide; the total value of goods and services purchased electronically in the Arab countries amounted US$ 30.4 billion in 2016 compared to US$ 24.9 billion in 2015. According to the report, the amount of e-commerce in Jordan was of US$ 289 million in 2016 an increase of 16% as compared to US$ 250 million in 2015 and there were 1.8 million users in 2016 as compared to 1.6 million users in 2016 out of about 9 million of population of Jordan (Al-Mobideen, 2017).

Many people think that e-commerce is just getting a website, but it is much larger; there are a lot of e-commerce applications such as banks, shopping at online malls, stock buying, job search, auctions and collaboration with the rest of the individuals in a research job. In order to implement these applications, it is necessary to obtain supportive information, systems and infrastructure that may include: hardware from computers and services, information router, cabling and digital technologies, software including: operating software, Internet commerce software, open public network service providers, Server and more.

American economist Nicholas B. defined the concept of e-commerce as "the concept of trade Electronic refers to the marketing of products via the international Internet and the unloading of electronic programs without going to the store or to the company. Moreover, e-commerce includes different communications (Companies at the local or international level to facilitate and increase the volume of trade) (Berman, 1996).

The World Trade Organization (WTO) has defined e-commerce as an integrated package of transactions Establishing links, distributing, marketing and selling products and services by electronic means (Shaheen, 2000).

E-commerce defined by the Arab Investment Guarantee Institution as "trade made using the technologies provided by revolution Information, communication and the Internet via electronic exchange of time-and-space data are covered (Many sectors) and establish new rules for sales, registration and delivery" (Shaheen, 2000).

There are two main types of e-commerce: business commerce, which is limited to dealing with this type of trade on the company and a number of suppliers and customers, adults, through a code (called the electronic transactions documented "set" and developed by the credit card VISA and MasterCard and prevent any manipulation thereof) and the company's Internet addresses are not publicly disclosed. This is about 85% of the total e-commerce volume. And business with consumers: some call this type e-shopping or e-retailing; to distinguish it from e-commerce between business sectors. This is about 15% of the total volume of e-commerce (Kalakota & Robinson, 1999).

There are many benefits to companies and institutions from electronic commerce, including expanding the market at the local level and entering the global markets and create new markets was difficult to access through traditional trade, reducing the time taken in the supply and manufacturing and simplify the procurement and increase sales and reduce prices, the products are free of traditional intermediaries between suppliers, exporters, traders and consumers (activating the concept of full competition in the market) leading to lower costs of business operations where the cost reduction rate of some products may reach 85%. In addition to better control of inventory management as electronic commerce is based on reducing the impact of the cycle caused by the change in inventory through the supply chain management system as e-commerce allows online shopping through direct electronic communication among dealers, it eliminates paper documents and expenses; It also simplifies and regulates project operations and achieves its objectives by eliminating delays in issuing administrative decisions and providing administrative expenses, communication and other expenses, as a substitute for the allocation of a large part of the capital in the establishment of continuous relationships between sellers and buyers, It also allows for direct distribution of the consumer, rationalizing the decisions made by both sellers and buyers with the timely flow of information in a coordinated and accurate manner, allowing easy comparison of products in terms of price, quality or payment method especially for producers and consumers, especially in developing countries, as they can overcome traditional barriers to distance and lack of information on export opportunities.

Credit Facilities and Banking Services

The main function of the commercial banks is to accept the various deposits and use them in loans and investments. The granting of credit in a manner that is consistent with the safety of depositors' money and the welfare of the society and its growth and prosperity is vital to the prosperity of economic life. The credit granting function is considered one of the most important and dangerous jobs of commercial banks, because the funds granted by banks as credit facilities are not owned by them but rather are the funds of depositors, therefore, the management of the Commercial Bank to develop its credit policy to achieve the good and safe use of the funds available to him with an appropriate return. Prudent policy requires the use of matching funds between bank deposits on the one hand and their uses of these deposits on the other, particularly in terms of the type, size and maturities of each. Commercial banks rely on the types, size and timing of deposits available to them in order to achieve the objectives of the national economic development plan, As well as the regular financing purposes of commercial banks, which, by virtue of their function as a savings vessel, lend to these savings and distribute them to various areas of production and services to promote economic activity. In addition, commercial banks are profit-making facilities. Naturally, the profits of commercial banks increase as the loans they grant increase.

Bank credit can be defined as the trust that a commercial bank attaches to a person when he puts at his disposal a sum of money or guarantees it for a specified period agreed upon between the parties. The borrower will, at the end of the transaction, meet its obligations. (Kalil, 1997)

Commercial Banks and Electronic Commerce

Commercial banks have started to use electronic commerce since the advent of the Internet and its spread in the mid-nineties, where the emergence of what is known as electronic banks, which was the first appearance in the United States of America has reached the number of banks operating on the Internet according to the report of the Online banking in 1998 more than 200 banks (Hammad, 2000).

E-banking (Internet banking) is an e-commerce application which allows the customers to perform any of the virtual banking functions, financial functions online in a protected and secure manner. It involves using the internet for delivery of banking products and services. (Taliwal & Arora, 2014)

Since its emergence, e-banking has played a major role in increasing the volume of electronic commerce. It has provided many facilities to its customers both at the local and international levels, offering comprehensive and comprehensive solutions to customers quickly and at a lower cost such as:

? Phone Bank

? Electronic transfer of funds

? Direct banking systems with the client

? Internet banking

Data Analysis

Data Descriptive Analysis

The impact of e-commerce on quality of credit facilities, quality of banking services and the work of banks in general will be studied through statistical analysis of the existing information set, which was summarized in a questionnaire and distributed to a group of bank employees in Jordan for their opinions.

Table 1 shows that The Cronbach's Alpha Test shows that the reliability ratio is 93%, thus, this percentage is considered acceptable to conduct the study.

| Table 1 Cronbach's Alpha Reliability Statistics |

|

| Cronbach's Alpha | N of Items |

| 0.93 | 18 |

Table 2 shows there are 73 males and 47 females who completed the questionnaire.

| Table 2 Genders of the respondents' |

|||

| Frequency | Percentage | Cumulative Percentage | |

| Male | 73 | 61% | 61% |

| Female | 47 | 39% | 100% |

| Total | 120 | 100% | |

Table 3 shows that there are 56 person under the age of 27, 47 person between the age of 28 and 35 and 17 person older than 35.

| Table 3 Age of the Respondents' |

|||

| Frequency | Percentage | Cumulative Percentage | |

| Less than 27 | 56 | 47% | 47% |

| 28 – 35 | 47 | 39% | 86% |

| More than 35 | 17 | 14% | 100.0 |

| Total | 120 | 100% | |

Table 4 shows that 24 persons in the sample have a diploma degree, 81 have a bachelor's degree, 13 have a master's degree and 2 people have PhDs degree.

| Table 4 Educational Qualifications Of The Respondents' |

|||

| Frequency | Percent | Cumulative Percentage | |

| Diploma | 24 | 20% | 20% |

| Bachelors | 81 | 67.5% | 87.5% |

| Masters | 13 | 11% | 98.5% |

| PhDs | 2 | 1.5% | 100% |

| Total | 120 | 100% | |

Table 5 shows the range, average, standard deviation and variance of the study variables according to the respondents, these indicators indicate that there is no great dispersion between the answers, which makes the study more accurate and generalizable.

| Table 5 Statistical Indicators |

|||||

| N | Range | Mean | Std. Deviation | Variance | |

| E-Commerce | 120 | 4 | 4 | 1.534 | 2.353 |

| Quality of Credit Facilities | 120 | 2.4 | 3.9 | 0.524 | 0.275 |

| Quality of Banking Services | 120 | 1.81 | 3.14 | 0.595 | 0.354 |

| The work of the banks in general | 120 | 3.5 | 5.3 | 0.7 | 0.49 |

The correlation between the variables of the study is shown in table (6) above, which shows that:

| Table 6 Correlation |

|||||

| E-Commerce | Quality of Credit Facilities | Quality of Banking Services | Work of banks in general | ||

| E-Commerce | Pearson Correlation | 1 | 0.612** | 0.087 | 0.307* |

| Sig. (2-tailed) | 0.000 | 0.492 | 0.035 | ||

| N | 120 | 120 | 120 | 120 | |

| Quality of Credit Facilities | Pearson Correlation | 0.612** | 1 | 0.063 | 0.312* |

| Sig. (2-tailed) | 0.000 | 0.537 | 0.021 | ||

| N | 120 | 120 | 120 | 120 | |

| Quality of Banking Services | Pearson Correlation | 0.087 | 0.063 | 1 | 0.000 |

| Sig. (2-tailed) | 0.492 | 0.537 | 0.788 | ||

| N | 120 | 120 | 120 | 120 | |

| Work of banks in general | Pearson Correlation | 0.307* | 0.312* | 0.000 | 1 |

| Sig. (2-tailed) | 0.035 | 0.021 | 0.788 | ||

| N | 120 | 120 | 120 | 120 | |

**. Correlation is significant at the 0.01 level (2-tailed)

*. Correlation is significant at the 0.05 level

1. There is a statistically significant relationship at the level of 0.05 between electronic commerce and the quality of credit facilities with a value of 0.61 and the sample represents the community.

2. There is a significant relationship between respondent's level of importance for electronic commerce and the quality of credit facilities because the sig. 2-tailed level is 0.000 and the relationship is positive 61.2% which means that as one variable goes up or down so will the other one.

3. There is a statistically significant relationship at the level of 0.05 between electronic commerce and quality of banking services with a value of 0.08 and the sample represent the community.

4. The sig. 2-tailed level is .492 which shows that there is significant relationship between electronic commerce and the quality of banking services and the relationship is positive 8.7% which means that as one variable goes up or down so will the other one.

5. There is a statistical significance relationship at the level of 0.05 between electronic commerce and the work of banks in general with a value of 0.31 and the sample represents the community.

6. The sig. 2-tailed level is 0.035 which shows that there is significant relationship between electronic commerce and the work of banks in general and the relationship is positive 30.7% which means that as one variable goes up or down so will the other one.

Table (7) shows the explanatory power of the Regression Model:

| Table 7 Model Summary |

||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.607a | 0.421 | 0.365 | 1.0132 |

R2=0.421

R2adj=0.36

And the force of R=0.61

The Model Summary indicates that the R-square is 0.421 and this represents a 42.1% variation caused by the independent variables.

Type of test F=10.51

Sig=0.001

Table 8 shows: The results indicated that there is a 10.51 F value with a .001 P-value. This indicates that the model selected in the study is a good to fit.

| Table 8 Anov Ab |

|||||

| Model | Sum of Squares | df | Mean Square | F | Sig. |

| Regression | 22.735 | 3 | 7.578 | 10.51 | 0.001a |

| Residual | 84.364 | 117 | 0.721 | ||

| Total | 72.099 | 120 | |||

a. Predictors: (Constant)quality of Credit Facilities, Quality of Banking services and the work of the banks in general

Table 9 shows that the coefficient for the credit facilities 1.243 is significantly from 0 because its p-value is .001 which is smaller than 0.05 which means that the most impact of electronic commerce is on the quality of credit facilities.

| Table 9 Coefficients a |

||||||

| Model | Non standardized Coefficients | Standardized Coefficients | T | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | -3.483 | 1.106 | -2.263 | 0.029 | |

| Quality of Credit Facilities | 1.243 | 0.289 | 0.398 | 3.893 | 0.001 | |

| Quality of Banking Services | 0.194 | 0.427 | 0.076 | 0.398 | 0.642 | |

| Work of Banks in general | 0.299 | 0.224 | 0.212 | 1.298 | 0.209 | |

Type of test T=1.243

Sig=0.001

Data Analysis Discussion

The data analysis answers fulfill the entire hypothesis developed in the research methodology stage.

The first hypothesis is:

H0: There is no impact of e-commerce on the quality credit facilities in banks.

H1: There is impact of e-commerce on the quality of credit facilities in banks.

The results of the correlation analysis indicate that there is a significant correlation between the electronic commerce and the quality of credit facilities and, therefore, the null hypothesis is rejected and the alternative hypothesis is accepted.

The second hypothesis is:

H0: There is no impact of e-commerce on the quality of banking services.

H1: There is impact of e-commerce on the quality of banking services.

The results of the correlation analysis indicate that there is a significant correlation between the electronic commerce and the quality of banking services and, therefore, the null hypothesis is rejected and the alternative hypothesis is accepted.

The third hypothesis is:

H0: The e-commerce generally does not affect the work of the Banks.

H1: The e-commerce generally affects the work of the Banks.

The results of the correlation analysis indicate that there is a significant correlation between the electronic commerce and the work of the banks in general and, therefore, the null hypothesis is rejected and the alternative hypothesis is accepted.

The data analysis also showed that the most impact of electronic commerce is on the credit facilities then on the quality of banking services and, then on the work of the bank in general.

Conclusion and Recommendations

Conclusion

With the emergence and widespread of the Internet since the beginning of the sixties and the access to information became easy and fast and with the increase in the level of security on the network day by day, reaching all segments of the communities of people, companies, financial institutions and commercial banks, E-commerce has become a leading tool for use in various marketing activities from marketing of goods and services to money transfer. It has become an integrated market in itself and has become the best way for many people, traders and banks alike to get their needs at minimum costs without having to go down to traditional markets (Morgan & Witter, 1999).

The financial institutions and commercial banks have benefited from the Internet through the network in the marketing of its services since the beginning of its spread; The so-called Electronic Banks have widespread at the local and international levels through which they offer many services such as electronic transfer of funds and direct banking systems with the customer and Internet banking (Taha, 2000).

Although the concept of electronic commerce and electronic banking is still small in the Arab world, but this service has entered the commercial banks in Jordan significantly, The study examined the impact of electronic commerce on some of the services provided by commercial banks in Jordan such as the quality of credit facilities and banking services and the work of banks in general, the study has identified through the statistical analysis of the data collected through a questionnaire distributed to a sample of employees of the commercial banks operating in Jordan that, there is a statistically significant relationship and positive effect between electronic commerce on one hand and the quality of credit facilities, banking services and the work of banks in general on the other hand. E-commerce in commercial banks allows interaction with more customers, easier access to information; reduce costs, time and effort, easier market access, increased competitiveness and increased profitability.

Recommendations

The electronic commerce in commercial banks faces a variety of risks and challenges, including organizational structure, legal regulations and operations. Operations are conducted without direct contact between the parties and, thus, the possibility of non-serious transactions exists, transmission of incorrect information often leads to waste of time and additional costs. The information exchanged might exposed to what is known as piracy and thus, increases risks. Therefore, this study recommends the need to increase the level of safety and enact legislation and laws to reduce the phenomenon of piracy to protect customers and the banks alike and to establish basic rules governing the electronic commerce in the commercial banks to enable them to offer wider and more comprehensive services (Al-Masri, 2002).

Acknowledgement

The author would like to thank the auditors of the journal and the anonymous reviewers for their thoughtful comments, as well as, my wife and children for their support, patience and love.

References

- Al-Masri, M. (2002). E-commerce in the Arab World: Opportunities and Challenges. Dar Al-Thaqafa publishing, Cairo, 22-27.

- Berman, B. (1996). Marketing channels, John Wiley & Sons Inc., London. 43.

- Cronin, M.J. (1994). Doing business on the internet: How the electronic highway is transforming American companies, Van Nostrand Reinhold, New York, 87.

- Egland, K. (1998). Banking over the internet, office of the comptroller of the currency. Quarterly Journal 17(4). 28-35.

- Hamayel, A. (2008). Electronic Commerce. Dar Alwafa Publishing, Amman, 11.

- Hammad, T.A. (2000). Application of Technology in Banks. Al-Sadat Academy for Business Administration, Cairo, 47.

- Kalakota, R. & Robinson, M. (1999). E-business: Roadmap for success, Reading, MA: Addison Wesley, 112.

- Kalil, H. (1997). Management of Banking Credit, Al-Waleed Publications, Morocco. 116-122.

- Morgan & Witter, (1999). U.S. Internet and Financial Services, Equity Research Team, U.S.A.

- Shaheen, B. (2000). Globalization and e-commerce. Al-Farooq Publishing House, First Edition, Cairo, 53-64.

- Taha, T. (2000). Banks managements and financial information systems. Al-Keetab Publishing House, Cairo.

- Taliwal, K. & Arora, J. (2014). Role of e-commerce in Indian banking system. International Research Journal of Commerce Arts and Science, (7), 34-48.

- Al-Mobideen, A. (2018). Alghad Newspaper, online article, Retrieved from: http://www.Alghad.com/articals/1899622

- Albawabh News. (2017). Online article, Retrieved from: http://www.Albawabhnews.com/2874781