Research Article: 2022 Vol: 28 Issue: 3

The Impact of Digital Financial Inclusion On Household Consumption in Encouraging the Economic Growth in Indonesia

Husain Insawan, Institut Agama Islam Negeri Kendari

Alwahidin, Institut Agama Islam Negeri Kendari

Beti Mulu, Institut Agama Islam Negeri Kendari

Kiki Novita Sari, Institut Agama Islam Negeri Kendari

Citation Information: Insawan, H., Alwahidin, Mulu, B., & Sari, K.N. (2022). The Impact Of Digital Financial Inclusion On Household Consumption In Encouraging The Economic Growth In Indonesia. Academy of Entrepreneurship Journal, 28(3), 1-16.

Abstract

Household consumption is one of the essential foundations of a country's economic growth. Encouraging household consumption through technology is a necessity. On the other hand, for regulators and even academics, digital financial inclusion is not familiar with shifts in consumption patterns in society. This study examines the impact of digital inclusion on household consumption in Indonesia. The research model based on previous research uses the OLS (Ordinary Least Square) econometric basis. In addition to testing the direct relationship between variables, this model will also examine the indirect relationship with technology variables. The per capita consumption database will be collected through IFLS and BPS data sources, while digital financial data will be through a digital financial inclusion index developed using the extensive database provided by IFLS and the level of development of information technology. The test results show that digital financial inclusion can encourage household consumption. In the consumption category, digital finance is positively correlated with spending on food, clothing, housing needs, health, and education and recreation spending. An analysis of the mediating model variables found that online shopping, digital payments, online credit, online purchase of financial services, and insurance business become the primary mediating variable of the impact between digital finance variables and household consumption.

Keywords

Financial Inclusion, Digital Finance, Household Consumption, Digital Financial Inclusion, Mediating Effect.

Introduction

Indonesia is a country with a very high level of household consumption. Even the national economic growth is driven by consumption, increasing every year (Badan Pusat Statistik, 2017). Household consumption is still a supporter of national economic development. BPS data (2019) reached IDR 8,296.8 trillion, or 55.7% of Indonesia's Gross Domestic Product (GDP). Therefore, the household consumption component is the main controlling factor in transforming and sustainable economic growth or becoming a national strategic program in encouraging economic growth. Promoting the development of household consumption is an important and exciting subject for policymakers and academics.

Research on controlling the level of inadequate consumption is positively related to the level of liquidity of a country has been carried out by (Kuijs, 2006), the relationship between unemployment, consumption, and household savings levels (Meng, 2003), and research on income inequality studied by (Schmidt-Hebbel & Servén, 2000). These studies show how important it is to encourage and improve the factors that influence adequate consumption. Meanwhile, financial inclusion can relieve households from liquidity constraints through rationalization and efficient allocation of resources to increase household consumption demand (Levchenko, 2005) by encouraging financial inclusion through digital financial inclusion and digital financial data inclusion.

The Global Partnership for Financial Inclusion, GPFI (2011) from the G-20 countries, increased financial inclusion in developing countries. This initiative was taken to assist developing countries in reducing poverty levels in developing countries. The growth of digital finance and awareness of financial inclusion in promoting poverty reduction and increasing economic development have attracted policymakers and academics to this issue. This issue happens because many of these issues show that if the governance and implementation of digital financial policies are carried out properly, the benefits can be felt by every household, business world, government, and even the economy in general (Ozili, 2018a).

Digital finance and financial inclusion have several benefits for users of financial services, financial service providers, government, and the economy, such as increasing access to finance for the poor reducing the cost of financial intermediation by bank financial institutions and non-financial institutions. Banks, as well as increasing aggregate spending or spending from the government. However, (G20 Development Working Group, 2015) stated that the use of digital finance and financial inclusion is not sufficient to absorb segments with a broader population, which shows that there is a problem of inequality between the availability of financial services, access to finance itself, and how users use it. The service.

Digital financial service providers experience different deep understandings of digital financial inclusion, financial data inclusion, and digital finance. The relationship between these three terms and the issue of how they can support financial inclusion has not received an adequate place and attention in the study of literature and even science. Also, how can financial service providers such as financial technology (fintech) increase economic growth as long as the economy is good by increasing the volume of financial transactions in the financial system? However, research on digital finance is about the impact of its activities on economic conditions that are in crisis. Or whether it can be an instrument that can control the financial crisis or even worsen the problem, not many academics and practitioners have studied it and proven it empirically.

In the last few years, the development and integration of internet network technology and the financial world in Indonesia have progressed very well. A new business model in the financial world by utilizing digital information system technology has become a new trend for the needs of the Indonesian people in meeting the needs of financial services in the economic system in Indonesia. This issue helps reduce information asymmetry, lower transaction costs, increase the availability of financial services, and increase data resource allocation in financial markets. Unfortunately, Indonesia does not yet have instruments that can measure the level of digital financial inclusion in society in recent years. However, according to BPS data, household consumption is constantly increasing, which shows that digital financial inclusion plays a role in driving consumption growth.

The idea of compiling this research proposal is to examine the Ozili (2018b) model in understanding the relationship between digital finance, financial inclusion, and digital financial inclusion and their relationship to economic and financial system stability risk. The model will be modified to accommodate the level of consumption factors influenced by digital financial inclusion developed by (Li et al., 2020). This study will also create an index to measure digital financial inclusion in Indonesia. This research will specifically examine the impact of inclusive digital finance on the level of household consumption in Indonesia and its relationship to the growth and stability of the economic system in Indonesia to encourage the achievement of an economy that prospers the ummah.

Literatur Review

The level of household consumption in Indonesia is the central pillar supporting national economic growth. There is a lot of debate about priority strategies for long-term economic development. Some academics argue that consumption as a support for economic growth is unhealthy in the long term. Still, it is undeniable that some academics also encourage consumption based on the theory of constraints. Liquidity (Kuijs, 2006; Aziz & Cui, 2007), households always face liquidity constraints caused by unequal financial inclusion, thus encouraging confinement in consumption, which impacts the economic slowdown.

Many studies have examined the factors that can influence consumption growth about financial development. Based on theoretical analysis, many academics believe the development of consumer credit services can reduce households in terms of liquidity constraints, facilitating them to increase their consumption (Cochrane, 1991). However, developing financial markets can promote consumption growth (Bayoumi, 1993; Levchenko, 2005). Empirical research finds that people or households living in areas where financial markets are not well developed will face severe liquidity constraints. On the other hand, people living in areas with well-developed financial market infrastructure will facilitate their liquidity capacity and smooth consumption levels through consumer credit service providers (Jappelli & Pagano, 1989). Furthermore, Ludvigson (1999) indicates that household consumption positively correlates with credit services when qualifications or requirements for consumer credit services are relaxed.

Research conducted by (Karlan & Zinman, 2010) and (Dupas & Robinson, 2013) shows that the income and consumption of each person with low income will increase if he has an account with a financial service provider institution that uses it frequently. Different types of investments impact household consumption patterns about assets and wealth, and the mechanism is always other (Carroll et al., 2011). According to the life cycle hypothesis of Ando & Modigliani (1963), the higher the level of a person's assets or wealth, the group or class of consumption will also increase. Commercial insurance can reduce households in future variable expenditures about consumption insurance. Purchasing insurance can help families regulate health at the level of consumption patterns and improve the average consumption trend in society as a whole (Arrow, 1964). Engen & Gruber (2001) proved that insurance could reduce the deposit ratio based on variations in insurance coverage caused by policy changes. Zhao (2019) also found that health insurance can increase daily household consumption. In addition, Kang (2019) found that social media can support household consumption.

Past research in digital finance has focused on their impact on the economy, traditional financial markets, business finance, and household and financial economies. About the economy, researchers show that digital financial inclusion can help increase household income, reduce poverty levels, reduce income inequality, and narrow the ratio of welfare differences between urban and rural areas (Sarma & Pais, 2011; Anand & Chhikara, 2013). For traditional financial markets, the development and growth of digital finance will transform conventional financial institutions, improve the quality and diversity of banking services and increase the efficiency of financial services (Berger, 2003). Concerning finance, academics indicate that risk evaluation based on big data can help secure transaction costs and reduce the degree of information asymmetry. This finding will help small and medium-sized businesses secure against financing (Moenninghoff & Wieandt, 2013). With the household economy and finance, research by Beck et al. (2018) found that payments with smartphones can help improve the entrepreneurial world in executing business ideas and reduce the degree of information asymmetry, thereby increasing entrepreneurial performance. Grossman and Tarazi (2014) also found that digital finance can help households in farming households in Kenya through ease of service and payment channels and ease of consumption. In addition, several researchers have tried to discuss or discuss digital financial inclusion. Ozili (2018a) argues that digital finance positively relates to financial inclusion and financial system stability. Ren et al. (2018) examined the existence of financial inclusion and its degree to households in rural areas or regions during the development and development of digital finance. They found that families in the room did not include consumers or users of payment services using smartphones and online loan services. The degree of exclusion depends on personal characteristics, infrastructure, social environment, and others.

From some of the previous studies above, it can be concluded that digital finance has become an enormous influence in all aspects of everyday life as an essential component in modern financial markets. Digital economic development innovations, such as online credit services, internet finance, digital insurance services via the internet, payments using smartphones, credit investigations, can be helpful. They can help increase financial service penetration, increase the availability of financial services for households, and help ease households in terms of financial services. Availability of liquidity can encourage income growth, facilitating household life consumption, such as encouraging household consumption itself. However, there are very few studies currently examining the impact of digital finance on household consumption, especially in Indonesia. Therefore, this study will examine the potential impact of digital financial inclusion on Indonesia's consumption, economic growth, and financial stability.

Research Method

Data

The data in this study comes from data from the Indonesian Family Life Survey (IFLS) wave 5 in 2014 issued by RAND. IFLS data started in 1993 and is updated every five years or seven years. IFLS data in 2014 consisted of 34,462 samples from 33 provinces in Indonesia. IFLS provides household data information ranging from demographic characteristics, assets and debt, income and consumption, and comprehensive insurance reflected in household consumption as the database in this research. In addition to IFLS data, household consumption data in this study also uses data provided by the Indonesian Central Statistics Agency (BPS). Panel data on per capita household consumption will be constructed from 2007 to 2019. The data will be divided into classifications of consumption data per province and even per district and city in Indonesia. In the process of analyzing consumption data, to reduce the possibility of heteroscedasticity in consumption data patterns, households under 18 years of age and over 65 years of age will be excluded from the data. This study uses regression analysis with cross-sectional data. At the same time, the descriptive analysis covers the time range from 2007 to 2019. This study did not perform a panel data regression analysis due to the limitations of the latest IFLS data after 2014. The data available at BPS has a different data structure from IFLS data.

Variable

This study uses per capita household expenditure and household consumption level as dependent variables. This variable is done to measure household consumption levels. Household per capita expenditure is the value or parameter obtained by dividing aggregate household expenditure by the number of family members. The level of household consumption is defined as the ratio obtained by dividing aggregate household expenditure by household consumption in the year calculated. Fortunately, BPS has detailed data on household consumption, including spending on food, clothing, household needs and services, household maintenance costs, transportation and communication, insurance, entertainment, education, and other consumer information. By considering the possibility of abnormality in the per capita household expenditure data.

The digital financial inclusion index data was developed using available IFLS and BPS data and is relevant to the approach developed by Li et al. (2020); Guo et al. (2020). The digital finance index was developed independently using big data provided by IFLS and BPS through relevant survey data at both the household and institutional levels. The index system includes three dimensions of digital financial service providers, namely (1) The scope of the inclusiveness of digital financial service providers. (2) The depth of the user's use of digital financial services, and (3) the available digital service support. In addition to the total index, this study also reduces its level in Province, Regency, and Rural. For regression data, this study uses local data, while the other groups only check the validity of the previous analysis results. In addition to index development, this research also uses data from digital financial service providers or providers in Indonesia, such as fintech companies, digital wallets, e-commerce platforms, and other adequate sources.

Previous studies have explained various factors influencing household consumption (Attanasio & Weber, 1995; Carroll et al., 2006; Zhao, 2019). Therefore, several control variables such as household demographic characteristics, age, and age squared were used in this study. To consider the possible non-linear influence, gender, marital status, education, health condition, and attitude on risk. Household characteristics such as family size, the ratio of children, and the ratio of parents. Household resources, including household assets and income, to consider the non-linear effect on assets and income are transformed in the natural logarithm. Economic growth variables such as GDP per capita and level of financial development are measured using debt ratio in financial institutions to the GRDP of the province where the household lives. Details of the description variables can be seen in Table 1.

| Table 1 Operational Definition |

|

|---|---|

| Variable | Definitions |

| Household Consumption Per capita | The value derived from the aggregate household expenditure of the number of family members |

| Household consumption rate | Ratio derived from the comparison of aggregate household expenditure to household income |

| Total household assets | Total assets owned by the household |

| Total household income | Total income of all household members |

| Age_Head of the Family | Age of head of household |

| Gender | Gender of the head of the household, male:1; Female:0 |

| Education_Head of the Family | Age of Head of household, uneducated: 0; SD:6; SMP:9; SMA:12; D3:15; S1:16; postgraduate:19 |

| Marital | Marital Status of Head of Family, married:1, other:0 |

| Size | Family Size-Number of Family Members |

| Child_Ratio | The total population aged 1-15 years to the working population is aged 16-65 years in the household. |

| Parent_Ratio | The total population is aged over 65 years compared to the working population aged 16-65 years in the household. |

| Risk_prefer | The attitude of the head of the household towards risk, at risk:1; other:0 |

| Risk-Aver | The attitude of the head of the family towards risk, stay away from risk:1, others:0 |

| family_sick | Number of family members in an unhealthy condition |

| Rural | Village:1; city:0 |

| GDP_PerCapita | GDP Per capita |

| Financial_level | Debt to GDP ratio Province |

| internet | Using the internet:1; not use:0 |

| Mobile_banking | Using:1; not use:0 |

| Online_shoping | Yes:1; No:0 |

| Indeks_internet | Internet usage index by province |

| Insurance | Have insurance:1 don't have:0 |

Several factors have been found that can affect household consumption levels (Carroll et al., 2011; Attanasio & Weber, 1995). This research model includes them as control variables, for example, household demographic characteristics such as age-relevant to the research issue, gender, marital status, education, health condition. Data for household characteristics categories contains family size, the ratio of some children, the percentage of parents. Meanwhile, for the type of household resources, including assets and household income, the variables include assets and income, transformed into a natural logarithm form. Other control variables related to macroeconomics, such as GDP per capita and loan data will also be considered as the main supporting variables. Descriptive statistics of the main variables in this study can be seen in Table 2. As presented in the table, on average, household consumption expenditures per month amount to Rp. 2550.000,-. The total index of digital finance development in Indonesia is 1,327.

| Table 2 Descriptive Statistics |

|||

|---|---|---|---|

| 2014 | |||

| Observasi | Mean | Standard Deviation | |

| Household Consumption Per capita (in thousands of rupiah) | 34,462 | 2,055 | 2.458 |

| Household consumption rate | 34,462 | 0.538 | 0.232 |

| Digital finance index | 34,462 | 1.871 | 0.242 |

| Access breadth index | 34,462 | 1.865 | 0.337 |

| Usage depth index | 34,462 | 1.584 | 0.270 |

| Total household assets (in thousands of rupiah) | 34,462 | 224,373 | 227.760 |

| Total household income (in thousands of rupiah) | 34,462 | 58.325 | 13.957 |

| Age_Head of the Family | 34,462 | 48.325 | 10.389 |

| Gender | 34,462 | 0.792 | 0.406 |

| Education_Head of the Family | 34,462 | 10.181 | 3.797 |

| Marital | 34,462 | 0.838 | 0.369 |

| Size | 34,462 | 3.896 | 1.757 |

| Child_Ratio | 34,462 | 0.235 | 0.348 |

| Parent_Ratio | 34,462 | 0.157 | 0.364 |

| Risk_prefer | 34,462 | 0.122 | 0.327 |

| Risk-Aver | 34,462 | 0.645 | 0.478 |

| family_sick | 34,462 | 0.254 | 0.549 |

| Rural | 34,462 | 0.290 | 0.454 |

| GDP_PerCapita | 34,462 | 6.644 | 2.712 |

| Financial_level | 34,462 | 1.458 | 0.414 |

| internet | 34,462 | 0.583 | 0.453 |

| Mobile_banking | 34,462 | 0.406 | 0.491 |

| Online_shoping | 34,462 | 0.538 | 0.499 |

| Indeks_internet | 34,462 | 0.831 | 0.312 |

| Insurance | 34,462 | 0.192 | 0.392 |

Model

This research will use simple regression with the OLS model and Eviews test tool. The dependent and independent variables are modeled as follows:

The model above shows the linear relationship between the independent and dependent variables. The variable  Represents the dependent variable, where the per capita consumption expenditure of household i in year t. In addition, the level of household consumption is used as an alternative dependent variable in a more in-depth and consistent test of the model.

Represents the dependent variable, where the per capita consumption expenditure of household i in year t. In addition, the level of household consumption is used as an alternative dependent variable in a more in-depth and consistent test of the model.

represents the digital financial development index in year t-2 in the area where household i resides and is also used to measure digital finance growth.

represents the digital financial development index in year t-2 in the area where household i resides and is also used to measure digital finance growth.  is the corresponding regression coefficient, which shows the marginal effect of the development and growth of digital finance on household expenditure per capita consumption. While the variable

is the corresponding regression coefficient, which shows the marginal effect of the development and growth of digital finance on household expenditure per capita consumption. While the variable  represents a series of control variables, including household characteristics, welfare, regional economic growth, and others.

represents a series of control variables, including household characteristics, welfare, regional economic growth, and others.  represents the fixed effect of time, while

represents the fixed effect of time, while  is a random variable from the residual model.

is a random variable from the residual model.

Several previous studies have shown that financial market growth (Levchenko, 2005) increases the level of security and convenience in payments (McCallum & Goodfriend, 1986) and can support household consumption. In addition, the changing culture of online shopping has led to very significant growth in the development of the world of e-commerce. This issue reduces the degree of information asymmetry and expands consumer offerings in both retail and financial markets. This issue shows how digital financial inclusion affects consumer spending decisions in households. Digital finance has entered every joint and many aspects of daily life activities. This study will also explore how the mechanism by which digital financial inclusion impacts household consumption from aspects of online shopping, online payments, online credit, internet finance, and commercial insurance, with a mediation model approach in later testing. The mediation model adopts the research conducted by Baron & Kenny (1986) as follows:

The initial step taken in the test is to perform regression on model 2. The coefficient  measures the total effect of digital financial inclusion on household consumption expenditure per capita. The second stage is regression testing in model 3, where the coefficient

measures the total effect of digital financial inclusion on household consumption expenditure per capita. The second stage is regression testing in model 3, where the coefficient  measures the impact of the digital financial inclusion index on the mediating variable. If the results are significant, it shows that digital financial inclusion explains the variation in the mediating variable. The third step is to test the final model. The coefficient

measures the impact of the digital financial inclusion index on the mediating variable. If the results are significant, it shows that digital financial inclusion explains the variation in the mediating variable. The third step is to test the final model. The coefficient will measure the effect of the mediating variable on household consumption after controlling for the independent variable, namely the digital financial inclusion variable. If the regression results show the results of the coefficients

will measure the effect of the mediating variable on household consumption after controlling for the independent variable, namely the digital financial inclusion variable. If the regression results show the results of the coefficients  and

and  are significant and have a coefficient value of

are significant and have a coefficient value of  lower than the coefficient

lower than the coefficient it means that there is a mediating effect in a specific value or degree, then if the coefficient

it means that there is a mediating effect in a specific value or degree, then if the coefficient  is not significant, but the coefficient

is not significant, but the coefficient  is still significant. This result shows that the mediating variable acts as the primary mediating variable.

is still significant. This result shows that the mediating variable acts as the primary mediating variable.

Based on the Hausman test results, the P-Value is 0.000. which shows that it significantly rejects the null hypothesis, so in this study, we adopt a fixed-effect model to examine the impact of the digital financial growth index on household consumption expenditure. Table 3 shows the results of the basic regression in the data analysis of this study. The first column shows the regression results of the total digital financial index. The Table 4 shows that the regression coefficient of the digital finance index on household consumption expenditure is significantly positive at a magnitude of 0.108. This data indicates that digital finance significantly affects household consumption can be seen in Table 5.

| Table 3 Impact Of Digital Finance On Household Consumption |

|||||||

|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| Total digital financial index | 0.108*** (0.033) |

0.139*** (0.038) |

|||||

| Internet usage index | 0.216*** (0.055) |

||||||

| Internet user deepening index | 0.060*** (0.019) |

||||||

| Insurance index | 0.016*** (0.005) |

||||||

| Investment index | 0.328*** (0.071) |

||||||

| Credit index | 0.357*** (0.042) |

||||||

| Ln(asset) | 0.079*** (0.005) |

0.080*** (0.003) |

0.079*** (0.005) |

0.079*** (0.005) |

0.080*** (0.005) |

0.122*** (0.007) |

0.119*** (0.006) |

| Ln(Income) | 0.028*** (0.002) |

0.028*** (0.002) |

0.028*** (0.002 |

0.028*** (0.002) |

0.028*** (0.002) |

0.076*** (0.005) |

0.075*** (0.005) |

| Age_Head of the Family | -0.059*** (0.015) |

-0.069*** (0.016) |

-0.086*** (0.017) |

-0.042*** (0.013) |

-0.035*** (0.012) |

-0.030*** (0.005) |

-0.028*** (0.005) |

| Aggregation_age | 0.022** (0.010) |

0.022** (0.009) |

0.022** (0.010) |

0.022** (0.010) |

0.022*** (0.010) |

0.022*** (0.005) |

0.020*** (0.005) |

| Gender | 0.336*** (0.170) |

0.310 (0.313) |

0.265 (0.238) |

0.383** (0.151) |

0.399*** (0.151) |

-0.050*** (0.010) |

-0.047*** (0.010) |

| Education | -0.186** (0.079) |

-0.224*** (0.116) |

-0.308*** (0.099) |

-0.109 (0.072) |

-0.079 (0.073) |

0.020*** (0.002) |

0.020*** (0.002) |

| Marital | 0.356 (0.771) |

0.371 (1.045) |

0.397 (0.760) |

0.333 (0.805) |

0.300 (0.822) |

-0.010 (0.014) |

-0.005 (0.014) |

| Family_Size | -0.147*** (0.007) |

-0.147*** (0.005) |

-0.148*** (0.007) |

-0.147*** (0.007) |

-0.147*** (0.007) |

-0.190*** (0.005) |

-0.188*** (0.005) |

| Child_Ratio | 0.177 (0.844) |

0.136 (0.748) |

0.050 (0.956) |

0.268 (0.790) |

0.291 (0.773) |

0.031*** (0.013) |

0.034*** (0.013) |

| Parent_Ratio | -0.139 (0.481) |

0.020 (1.020) |

0.401 (0.527) |

-0.473 (0.577) |

-0.587 (0.637) |

-0.043*** (0.013) |

-0.048*** (0.013) |

| Risk_Prever | 0.001 (0.018) |

0.001 (0.016) |

0.001 (0.018) |

0.001 (0.018) |

0.002 (0.018) |

0.038** (0.016) |

0.038** (0.016) |

| Risk_Averse | -0.041*** (0.012) |

-0.041*** (0.011) |

-0.041*** (0.012) |

-0.041*** (0.012) |

-0.041*** (0.012) |

-0.111*** (0.011) |

-0.109*** (0.010) |

| Unhealthy_Family | -0.134 (0.841) |

-0.093 (1.057) |

-0.004 (0.953) |

-0.229 (0.788) |

-0.250 (0.770) |

-0.035*** (0.008) |

-0.034*** (0.008) |

| Rular | 0.008 (0.037) |

0.008 (0.026) |

0.005 (0.037) |

0.009 (0.037) |

0.011 (0.037) |

-0.251*** (0.016) |

-0.245*** (0.016) |

| Ln_per_PDRB | 0.376*** (0.085) |

0.369*** (0.065) |

0.328*** (0.088) |

0.392*** (0.087) |

0.379*** (0.087) |

-0.015 (0.040) |

-0.034 (0.031) |

| Finance_Level | 0.269*** (0.052) |

0.260*** (0.041) |

0.261*** (0.053) |

0.277*** (0.053) |

0.264*** (0.054) |

0.000 (0.036 |

0.131*** (0.032) |

| Observations | 34,462 | 34,462 | 34,462 | 34,462 | 34,462 | 34,462 | 34,462 |

| R-squared | 0.069 | 0.069 | 0.069 | 0.069 | 0.069 | 0.537 | 0.539 |

| F value of the First stage | 56,268.28 | ||||||

| t value of IV | 142.94 | ||||||

| Wald test | 2.12e+07(0.000) | ||||||

| Table 4 Eight Categories Of Household Consumption |

||||||||

|---|---|---|---|---|---|---|---|---|

| Food | Clothes | Home-Repair | Daily-Needs | Transportation and Communication | Kesehatan | Pendidikan dan Hiburan | Lainnya | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Digital finance index | 0.098* (0.051) |

0.663*** (0.121) |

0.140** (0.063) |

-1.239*** (0.140) |

-0.021 (0.069) |

0.454** (0.197) |

2.618*** (0.257) |

-0.602*** (0.133) |

| Control | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 34,462 | 34,462 | 34,462 | 34,462 | 34,462 | 34,462 | 34,462 | 34,462 |

| R-square | 0.055 | 0.033 | 0.020 | 0.037 | 0.050 | 0.005 | 0.041 | 0.011 |

| Table 5 Consumption Structure |

||||

|---|---|---|---|---|

| Repeated Household Consumption | Household Consumption is not repeated | The proportion of recurring household needs | The proportion of household needs is not repeated | |

| (1) | (2) | (3) | (4) | |

| Digital finance index | 0.157*** (0.039) |

-1.030** (0.160) |

0.047*** (0.018) |

-0.047*** (0.015) |

| Control | Yes | Yes | Yes | Yes |

| Observations | 34,462 | 34,462 | 34,462 | 34,462 |

| R-square | 0.085 | 0.018 | 0.010 | 0.010 |

Unfortunately, in this analysis, there is a possibility that causality problems cause endogenous problems. To overcome this problem, the study of the data then using the mobile number data of each person per province as a digital financial variable instrument. On the other hand, mobile number data variables can facilitate using financial services for each household. They can also be correlated with digital finance development in a regional location. In addition, the average mobile phone number for each province strongly influences household consumption expenditure. Also, this study conducted several tests to verify the validity of the instrument variables. As shown in the second column in Table 6, in the first stage of regression, the t-value on the instrument variable is 142.94. The results show a positive significance at the 1% level, so it can be considered that the instrument is an important variable that fulfills the correlation relationship. The value of the F statistic at the first level estimation is 56,268.28, indicating that there is no instrument weakness in the variable problem. The endogeneity test rejects the null hypothesis, suggesting an endogeneity problem in digital finance. The digital finance coefficient remains significantly positive. To control the variables, the coefficient of total household assets and total household income shows a significant coefficient value, which indicates that the higher the assets and the level of household income, the higher the level of household consumption. This finding is consistent with the permanent income and inter-temporal consumption hypotheses. Regional financial development also has a positive impact on household consumption levels. This result shows that regional financial development impacts household consumption in Indonesia can be seen in Table 7.

| Table 6 Online Shopping |

|||

|---|---|---|---|

| Household consumption expenditure per capita | Online Shopping | Household consumption expenditure per capita | |

| (1) | (2) | (3) | |

| Digital finance index | 0.451*** (0.054) |

0.108*** (0.021) |

0.420*** (0.054) |

| Online Shopping | 0.289*** (0.010) |

||

| Control | Yes | Yes | Yes |

| Observations | 34,462 | 34,462 | 34,462 |

| R-square | 0.540 | 0.318 | 0.557 |

| Sobel Test | 7.779(0.000)/8.37% | ||

| Table 7 Digital Payment |

|||

|---|---|---|---|

| Household consumption expenditure per capita | Digital Payment | Household consumption expenditure per capita | |

| (1) | (2) | (3) | |

| Digital finance index | 0.451*** (0.054) |

0.166*** (0.030) |

0.410*** (0.051) |

| Digital Payment | 0.245*** (0.011) |

||

| Control | Yes | Yes | Yes |

| Observations | 34,462 | 34,462 | 34,462 |

| R-square | 0.540 | 0.327 | 0.552 |

| Sobel Test | 10.860(0.000)/10.58% | ||

Indonesia's Central Statistics Agency (BPS) regularly conducts a household consumption survey every year. BPS provides consumption data at the household level through its database channel to aggregate data per province. BPS can also distinguish consumption level data in urban and rural areas. Unfortunately, due to time constraints in this study, the data used are aggregation data for each province only and internet usage index data in 2019. This data is expected to represent the condition of internet development and its impact on household consumption levels in Indonesia can be seen in Table 8 & Table 9.

| Table 8 Kredit Online |

|||

|---|---|---|---|

| Household consumption expenditure per capita | Digital Kredit Online | Household consumption expenditure per capita | |

| (1) | (2) | (3) | |

| Digital finance index | 0.451*** (0.054) |

0.033*** (0.010) |

0.445*** (0.054) |

| Kredit Online | 0.170*** (0.015) |

||

| Control | Yes | Yes | Yes |

| Observations | 34,462 | 34,462 | 34,462 |

| R-square | 0.540 | 0.120 | 0.542 |

| Sobel Test | 4.659(0.000)/1.91% | ||

| Table 9 Keuangan Internet |

|||

|---|---|---|---|

| Household consumption expenditure per capita | Finance_internet | Household consumption expenditure per capita | |

| (1) | (2) | (3) | |

| Digital finance index | 0.451*** (0.054) |

0.028** (0.013) |

0.447*** (0.054) |

| Finance_Internet | 0.140*** (0.013) |

||

| Control | Yes | Yes | Yes |

| Observations | 34,462 | 34,462 | 34,462 |

| R-square | 0.540 | 0.152 | 0.542 |

| Sobel Test | 5.305(0.000)/2.22% | ||

BPS developed the internet usage index in Indonesia in 2009. The measure used by BPS is the percentage of internet use per household to the number of households in each region in Indonesia. BPS 2019 data shows the internet usage index in Indonesia in aggregation is 73.75 percent. The number of internet users in Indonesia reaches 196.7 million, while globally, internet users in Indonesia rank 4th in the world (APJII, 2020). Even though Indonesia is in a good position in terms of quantity, quality, and ability to penetrate the internet, Indonesia is still far below countries in Asia. Internet penetration in Indonesia only ranks 15th in Asia (Katadata, 2020), while the quality of the internet in Indonesia is ranked 108th out of 138 countries globally (Ookla, 2021). According to Freedom House (2018), Freedom of the internet in Indonesia is at the half-free level with a score range of 40-69.

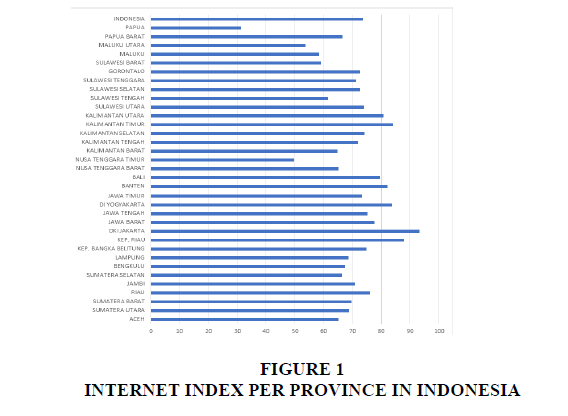

The highest internet user index in Indonesia is occupied by DKI Jakarta with 93.33 percent, followed by the Provinces of Riau Islands and East Kalimantan, respectively, at 87.96 percent and 84.17 percent. While the lowest user index is in Papua Province at 31.31 percent, then East Nusa Tenggara 49.83 percent and North Maluku 53.61 percent.

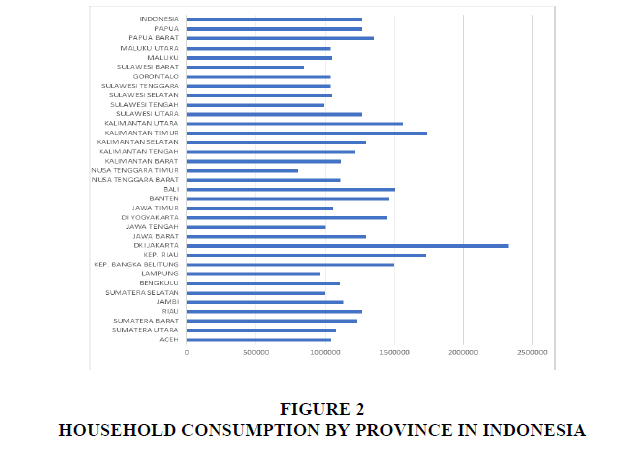

In 2019 Indonesia was occupied by DKI Jakarta in aggregate with an average per capita of Rp2,322,246,-. East Kalimantan Province occupies the second position with per capita consumption of Rp. 1,734,303, while the third place in Riau Islands Province of Rp. 1,729,824, -. Descriptively, when analyzing two graphic images of the internet index per province and household consumption per province in Indonesia, it shows a linear relationship. Internet usage penetration affects the level of household consumption in Indonesia shows in Figure 1.

The lowest household consumption per capita per province in Indonesia is East Nusa Tenggara Province at Rp800,619,-, followed by West Sulawesi Province at Rp847,375, and Lampung Province at Rp962,213. East Nusa Tenggara Province has the lowest group index of internet users and has the lowest per capita consumption level in Indonesia. Although the other two provinces that occupy the lowest index of internet users are not included in the lowest per capita household consumption group, North Maluku and Papua are also not included in the provinces with a high average per capita household consumption in Indonesia. Even the per capita household consumption of North Maluku Province did not reach Rp1.1 million, compared to other provinces with a better internet user index shows in Figure 2.

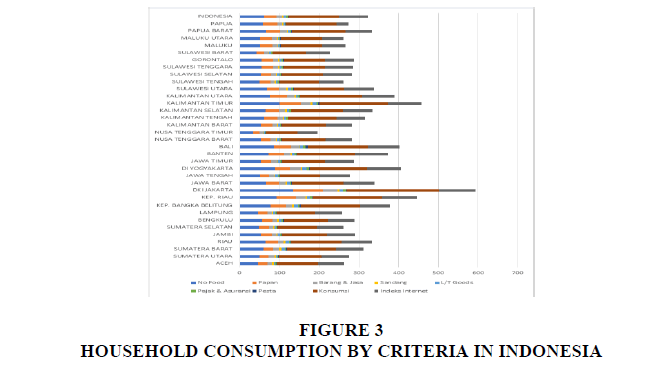

In theory, limited liquidity is the main factor limiting household consumption (Aziz & Cui, 2007)). Limited access to household finances, such as access to banking products and access to non-bank financial institutions, will weaken the liquidity capacity of households to increase their consumption. The development and growth of internet facility penetration in Indonesia provide many opportunities for the financial sector, both established and still in the form of start-ups, to become a new catalyst for household consumption levels in Indonesia. The development of peer-to-peer lending companies, digital-based microfinance businesses, digital wallet market share growth, and ease of access to marketplaces are promotions for household consumption. Research by Li et al. (2020) shows that the online credit variable is a variable that mediates the relationship between digital financial development variables that can affect household consumption. In addition, this variable also affects the digital financial index variable. Statistically, it has a significant positive effect on household online credit access in China. Likewise, other variables become a proxy for the internet utilization index shows in Figure 3.

In this case, the value-added effect by the growth of internet penetration, represented by digital finance on household consumption, is usually achieved through the impact of wealth and income and is realized through internet finance (Yu et al., 2021). Digital finance has expanded through efficient investment far beyond the expansion of conventional finance, which can touch villages and villages to households. Internet financial products have advantages in terms of good profitability and liquidity.

Conclusion

The development of the internet and information technology allows the development of digital finance based on big data, cloud computing, and other types of digital technology. This study hopes to combine household consumption and digital financial indexes data through an internet use index in Indonesia. It is hoped that this research will provide empirical results on the impact of digital financial inclusion on household consumption through various levels of mechanisms. Through a descriptive analysis approach, the initial analysis of this study found that the internet use index has a positive linear relationship to the level of household consumption in Indonesia. Data indicates that the higher the internet use index in Indonesia, the higher the household consumption expenditure in that region.

References

Anand, S., & Chhikara, K. S. (2013). A theoretical and quantitative analysis of financial inclusion and economic growth.Management and Labour Studies,38(1-2), 103-133.

Indexed at, Google Scholar, Cross Ref

Ando, A., & Modigliani, F. (1963). The" life cycle" hypothesis of saving: Aggregate implications and tests.The American Economic Review,53(1), 55-84.

APJII. (2020). Survei Pengguna Internet. Asosiasi Penyelenggara Jasa Internet Indonesia.

Arrow, K. J. (1964). The role of securities in the optimal allocation of risk-bearing.The Review of Economic Studies,31(2), 91-96.

Attanasio, O. P., & Weber, G. (1995). Is consumption growth consistent with intertemporal optimization? Evidence from the consumer expenditure survey. Journal of political Economy,103(6), 1121-1157.

Indexed at, Google Scholar, Cross Ref

Aziz, J., & Cui, L. (2007). Explaining China's low consumption: the neglected role of household income.

Indexed at, Google Scholar, Cross Ref

Badan Pusat Statistik. (2017). Pertumbuhan Ekonomi Indonesia Tahun 2016. Berita Resmi Statistik.

Baron, R. M., & Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology,51(6), 1173.

Indexed at, Google Scholar, Cross Ref

Bayoumi, T. (1993). Financial deregulation and household saving.The Economic Journal, 103(421), 1432-1443.

Beck, T., Pamuk, H., Ramrattan, R., & Uras, B. R. (2018). Payment instruments, finance and development.Journal of Development Economics,133, 162-186.

Indexed at, Google Scholar, Cross Ref

Berger, A. N. (2003). The economic effects of technological progress: Evidence from the banking industry.Journal of Money, credit and Banking, 141-176.

Indexed at, Google Scholar, Cross Ref

Carroll, C.D., Otsuka, M., & Slacalek, J. (2006). How Large Is the Housing Wealth Effect? A New Approach. NBER Working Paper.

Carroll, C. D., Otsuka, M., & Slacalek, J. (2011). How large are housing and financial wealth effects? A new approach.Journal of Money, Credit and Banking,43(1), 55-79.

Indexed at, Google Scholar, Cross Ref

Cochrane, J. H. (1991). A simple test of consumption insurance.Journal of Political Economy, 99(5), 957-976.

Dupas, P., & Robinson, J. (2013). Why don't the poor save more? Evidence from health savings experiments.American Economic Review,103(4), 1138-71.

Indexed at, Google Scholar, Cross Ref

Engen, E. M., & Gruber, J. (2001). Unemployment insurance and precautionary saving.Journal of Monetary Economics,47(3), 545-579.

Indexed at, Google Scholar, Cross Ref

Freedom House. (2018). Freedom on the Net 2018 | Freedom House. Freedom House.

G20 Development Working Group. (2015).G20 Inclusive Business Framework. United Nations Development Programme Istanbul International Center for Private Sector in Development (UNDP IICPSD).

GPFI. (2011). G20 Financial Inclusion Action Plan. Global Partnership for Financial Inclusion.

Grossman, J., & Tarazi, M. (2014). Serving smallholder farmers: Recent developments in digital finance.

Guo, M., Kuai, Y., & Liu, X. (2020). Stock market response to environmental policies: Evidence from heavily polluting firms in China.Economic Modelling,86, 306-316.

Indexed at, Google Scholar, Cross Ref

Jappelli, T., & Pagano, M. (1989). Consumption and capital market imperfections: An international comparison.The American Economic Review, 1088-1105.

Karlan, D., & Zinman, J. (2010). Expanding credit access: Using randomized supply decisions to estimate the impacts.The Review of Financial Studies,23(1), 433-464.

Indexed at, Google Scholar, Cross Ref

Katadata. (2020). Jumlah Pengguna Internet di Indonesia Capai 196,7 Juta. Katadata.Co.Id.

Kuijs, L. (2006). How will China's saving-investment balance evolve?.World Bank policy research working paper, (3958).

Levchenko, A. A. (2005). Financial liberalization and consumption volatility in developing countries.IMF Staff Papers,52(2), 237-259.

Li, J., Wu, Y., & Xiao, J. J. (2020). The impact of digital finance on household consumption: Evidence from China.Economic Modelling,86, 317-326.

Indexed at, Google Scholar, Cross Ref

Ludvigson, S. (1999). Consumption and credit: a model of time-varying liquidity constraints.Review of Economics and Statistics,81(3), 434-447.

Indexed at, Google Scholar, Cross Ref

McCallum, B. T., & Goodfriend, M. (1986). Theoretical analysis of the demand for money.Federal Reserve Bank of Richmond Working Paper, (86-3).

Indexed at, Google Scholar, Cross Ref

Meng, X. (2003). Unemployment, consumption smoothing, and precautionary saving in urban China.Journal of Comparative Economics,31(3), 465-485.

Indexed at, Google Scholar, Cross Ref

Moenninghoff, S. C., & Wieandt, A. (2013). The future of peer-to-peer finance.Schmalenbachs Zeitschrift für betriebswirtschaftliche Forschung,65(5), 466-487.

Ookla, L. L. C. (2019). Speedtest by Ookla—The Global Broadband Speed Test.

Ozili, P. K. (2018). Impact of digital finance on financial inclusion and stability.Borsa Istanbul Review,18(4), 329-340.

Indexed at, Google Scholar, Cross Ref

Ozili, P. K. (2018b). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review.

Indexed at, Google Scholar, Cross Ref

Ren, B., Li, L., Zhao, H., & Zhou, Y. (2018). The financial exclusion in the development of digital finance—a study based on survey data in the Jingjinji rural area. The Singapore Economic Review, 63(01), 65-82.

Indexed at, Google Scholar, Cross Ref

Sarma, M., & Pais, J. (2011). Financial inclusion and development.Journal of international development,23(5), 613-628.

Schmidt-Hebbel, K., & Serven, L. (2000). Does income inequality raise aggregate saving?. Journal of Development Economics, 61(2), 417-446.

Indexed at, Google Scholar, Cross Ref

Yu, C., Jia, N., Li, W., & Wu, R. (2021). Digital inclusive finance and rural consumption structure–evidence from Peking University digital inclusive financial index and China household finance survey. China Agricultural Economic Review.

Indexed at, Google Scholar, Cross Ref

Zhao, W. (2019). Does health insurance promote people's consumption? New evidence from China. China Economic Review, 53, 65-86.

Indexed at, Google Scholar, Cross Ref

Received: 29-Jan-2022, Manuscript No. AEJ-22-11032; Editor assigned: 31-Jan-2022, PreQC No. AEJ-22-11032(PQ); Reviewed: 15-Feb-2022, QC No. AEJ-22-11032; Revised: 23-Feb-2022, Manuscript No. AEJ-22-11032(R); Published: 28-Feb-2022