Research Article: 2019 Vol: 18 Issue: 2

The Impact of Designing Accounting Information Systems on the Level of Accounting Conservatism-A Field Study

Nabil Bashir Al-Halabi, Zarqa University

Abstract

The purpose of this research is to examine the impact of designing Accounting Information Systems (AISs) on the Accounting Conservatism Level (ACL) for Jordanian commercial banks listed in Amman stock exchange. It adopted an analytical and descriptive approach using dual research tools on a sample of 13 banks during the year 2016. Data were based on a questionnaire to measure the independent variable (AISs). A content analysis were also used to measure the dependent variable (ACL) based on Beaver and Ryan's model, 2005, while the bank size, as a moderating variable, was measured based on the logarithm of total assets. The main results of the study are: (1) the design of accounting information systems has a positive impact on the level of accounting conservatism in commercial banks listed at Amman stock exchange. This is explained by the existence of many formal accounting procedures and processes in limiting the level of accounting conservatism; (2) the design of inputs of accounting information systems has a positive impact on the level of accounting conservatism in commercial banks listed at Amman stock exchange. It is justified by the adoption of formal internal control system in linking the AISs of listed banks; (3) the design of processes of accounting information systems has a positive impact on the level of accounting conservatism in commercial banks listed at Amman stock exchange. The flexibility of the IFRS motivated management and accountants to practice the accounting conservatism; (4) The design of outputs of accounting information systems has a positive impact on the level of accounting conservatism in listed commercial banks. Several accounting adjustments at the end of the physical year were considered as an indication of the accounting conservatism level in listed banks; and (5) the bank's size has a negative impact on the level of the accounting conservatism, where the management of banks is controlled by formal processes and elements included in AISs, thus, an increase in the size of the bank led to a lower level of the accounting conservatism. The research recommended increase awareness on the importance of designing AISs in planning and decision-making processes.

Keywords

Designing Accounting Information Systems, Accounting Conservatism, Jordanian Commercial Banks.

Introduction

The last century witnessed rapid economic and technological developments which affected the accounting thinking that led to the existence of a comprehensive view for system design processes with the primary aim of achieving integrated informative systems (Jong-Min 1996). This is developed by a selection of various coordinated sub-systems to reach the final goal of corporations, to which users can get relevant, reliable and timely information to make sound decisions (Al-Hiayari et al., 2013). Following such developments enhanced the level of financial performance of companies through an integrated relationship of accounting information systems and increased the quality of outputs represented by the financial reports of corporations (Wang, et al., 2015).

The concept of accounting information systems was addressed by many specialists and researchers to denote theory of agency, human behavior and decision theory that indicated the interaction between systems and sub-systems for three main phases of data collection, recoding and storing processes within and outside corporations (Appiah et al., 2014; Romney & Steinbart, 2014; and Kronbauer et al., 2017). Other researchers concluded the integration requirement of elements of AISs with other information systems and the focus was on: (i) accounting information systems that are based on the collection, processing and conversion of data into useful information to assist in the decision-making process; (ii) processing data using software to provide appropriate financial information; (iii) accounting information systems that are one of the sub-components of MIS; and (iv) instructions, regulations, laws and risk inherent (Al-Amri et al., 2015; Gill & Obradovich, 2012; Alali & Yeh, 2012; and Jong-Min, 1996).

The use of modern technologies, on the other hand, have contributed in keeping abreast the enormous developments of information systems and providing information with necessary specifications to facilitate decision-making processes (Appiah et al., 2013; Debreceny, 2011; and Jongkyum et al., 2013). In line with similar studies, the technological environment of information can be characterized by: (i) the speed and the timely delivery of information that can lead to sufficient results for decision-making processes; (ii) the accuracy and reliability to deliver outputs and help preventing any errors that may adversely affect information systems; (iii) the ability to store information through devices and equipment that have the ability to store data in a manner that accommodated all sizes for a long period of time, in addition to its contribution in retrieving any information in a timely manner to meet the need for decision makers; (iv) the use of expert programs that deal with different type of data processing; and (v) internal audit and security measures that protect data in accounting systems and monitor them continuously (Kronbauer et al., 2017; Alali & Yeh, 2012; Rapp, 2010 ; and Wang et al., 2015).

The designs of Accounting Information Systems (AISs) were relied on management in analyzing data and providing information about the economic environment and the actual performance evaluation of corporations (Gill & Obradovich, 2012; and Zhang, 2014). Thus, IASs considered as a basic element of information production for major and famous corporations to foresee better future events in accordance with management plans (Debreceny, 2011). The importance of IASs can be seen as: (i) supplying information for current and future plans; (ii) improving the economic position of corporations; (iii) providing important information to management in preparing different policies and developing many procedures within different activities of corporations; and (iv) obtaining knowledgeable and cultural transformation between main systems, subsystems and employees within the corporation (Zhang, 2014; Appiah et al., 2014; Obaid, 2017; and Al-Hiayari et al., 2013 ). It is said that getting financial information became crucial for many commercial and industrial communities where all business sectors and the banking sector in particular, relied on the outputs of AISs (Wang et al., 2015; and Rapp, 2010). There are, also, many sub-goals associated with the main objective of AISs, such as getting information on each activity and sub-activity within the bank for performance evaluation and limiting the occurrence of unexpected threats and losses; and protecting the bank's assets (Romney & Steinbart, 2014; and Al-Hiayari et al., 2013).

Accordingly, Designing Accounting Information Systems (DAISs) is based on three integrated elements that should determine specifications required and knowledge of each component of the information system (Appiah et al., 2014). First, the inputs design phase should adopt both a corporation's strategy and its occupational culture to reduce wrong input data by users where data is free of errors through advanced techniques and programs such as a logical model of the database to obtain unquestionable outputs and value added to the whole design phases of the accounting information systems (Kronbauer et al., 2017; and Nybuti et al., 2016). Second, the process design phase, in terms of the coding system of the chart of accounts and the entry authority of users to the systems and subsystems of AISs, should determine: (i) specifications of each of the physical components (such as equipment) and software components (such as communication networks) taking into account the amount and number of transactions and events as well as the limited number of human resources, and (ii) determination of the degree of flexibility, duplication avoidance, and ability to cope with changes and developments available within the system (Alali & Yeh, 2012; Appiah et al., 2014; and Al-Hiyari et al., 2013). Third, the output design phase should have the possibility of: (i) getting access, specifications of output, the screen format, and the display for all models to be taken from outputs (Beshtawi & Bakamy 2015; and Obaid, 2017).

In fact, knowing the strengths and weaknesses of systems being used in corporations, designers should consider the following: (i) full knowledge of the needs of system users; (ii) the efficiency of the designed systems, to improve the performance of the personnel in those systems; (iii) keeping abreast of technological developments and future forecasting; (iv) designing systems that are easily handled by users; and identifying adequate alternatives to address any threats to systems (Widyatama & Wirama, 2018; Kronbauer et al., 2017; and Al- Hiyari et al., 2013). Further, the design of an accounting information system provides technical documents and reflects occupational culture by providing detailed data and information about inputs, processes, and outputs (Bushman & Piotroski, 2006). Data-designed inputs indicated storing and gathering information and routine and non-routine decisions within system and subsystems among different activities of corporations (Beaver & Rayan, 2005). Furthermore, datadesigned processes helped in processing data such as authority of entering data into programs and detailed chart of accounts for general and subsidiary ledger accounts within different activities of corporations (Neage & Masca, 2015). Finally, data-designed outputs showed integrated efforts of using different programs, business cycles, and the management behavior to use reasonable and unreasonable accounting conservatism in line with the application of current legislations and the IFRS (Beshtawi & Bakamy 2015; Wang et al., 2015; and Nyabuti, et al., 2016).

Getting a balance between the flexibility of applying the IFRS and the accounting conservatism level is crucial in achieving many advantages for corporations, such as: (i) identifying expected risks in applying accounting policies when there are unrealistic earnings and the use of big bath accounting; (ii) providing benefits to stakeholders when there is asymmetric information; (iii) obtaining tax benefits by recognizing losses and derecognizing revenues; and (iv) helping accountants to provide accurate accounting information (Widyatma et al., 2018; and Neage & Masca, 2015). Moreover, researchers explored conditional and unconditional levels of the accounting conservatism (Neage & Masca, 2015). The conditional level of accounting conservatism referred to timing at which losses and profits are recognized, where the recognition of the losses considered before its realization regardless of the evidence, and the recognition of the profits occurred only when they are realized and the future estimates of profits are not recognized even if there is an evidence of its existence (Kronbauer et al., 2017). The unconditional level of accounting conservatism focused on the management’s application of accounting policies that may show profits at the lowest value and reduce the net carrying amount of assets using legitimate depreciation methods such as the double declining method (Widyatama et al., 2018; and Wang et al., 2015).

On the other hand, other studies showed conflicting results among researchers with regard to the effect of company's size on the level of accounting conservatism (Basu, 1997). Contrary to Basu's study large-scale companies preferred to apply various conservative accounting policies, such as forwarding profits and losses and reducing the income tax due to greater pressures resulted from current economic policies, than small-scale ones (Bushman & Piotroski, 2006). In the Jordanian context large-size banks apply the accounting conservatism more than the small-size ones as driven by achieving the financial market efficiency which led to the reduction of the degree of asymmetry in accounting information; reducing debts of the company to avoid financial difficulties, and avoiding the weakness of the current accounting policies (Obaid, 2017). Moreover, although fewer studies focused on the importance of AISs, no attempts were made on designing accounting information systems and their effects on discovering self-management practices when using the accounting conservatism as justified by the existence of flexibility in applying the IFRS (Appiah et al., 2014; and Beshtawi & Bakamy 2015). In fact, the level of accounting conservatism encouraged management and accountants of banks to manipulate their financial statements and reports leading to dysfunctional behavior in applying wrong administrative and accounting policies and practicing earnings management (Al- Hiyari et al., 2013; and Widyatama et al., 2018).

Based upon the aforementioned discussion, most studies, and some studies in Jordan, focused either on the accounting conservatism variable or the AISs, and even when applying the AISs they were used with other variables such as financial performance, client’s satisfaction, and internal or external auditing. The current research focused on identifying the impact of designing AISs on the level of accounting conservatism in Jordanian banks listed at Amman Stock Exchange (ASE).

Materials and Methods

Commercial banks design accounting information systems in order to improve their performance, develop their financial outputs, and provide relevant and reliable financial data to meet the needs of users of such data, and to use the reasonable accounting conservatism that improves the quality of financial data. It is not known whether there is an impact of designing AISs on different levels of the accounting conservatism in the Jordanian environment in general and in listed banks in particular since Jordanian banks have more governance and formal internal control and auditing systems than other sectors; and the current study is the first to explore designing AISs in the banking sector in Jordan. This study attempted to measure the impact of designing accounting information systems on the level of accounting conservatism in Jordanian commercial banks that can be useful for decision-making at macro and micro levels. The research problem was set out to answer the following questions:

Is there an impact of designing accounting information systems (inputs, processes, and outputs) on the level of accounting conservatism (reasonable and unreasonable practices) in Jordanian commercial banks listed at Amman Stock Exchange?

The following sub-questions extracted from the above-mentioned main question:

1. Is there an impact of designing inputs of accounting information systems on the level of the accounting conservatism (reasonable and unreasonable practices) in listed Jordanian commercial banks?

2. Is there an impact of designing processes of accounting information systems on the level of the accounting conservatism (reasonable and unreasonable practices) in listed Jordanian commercial banks?

3. Is there an impact of designing outputs of the accounting information systems on the level of the accounting conservatism (reasonable and unreasonable practices) in listed Jordanian commercial banks?

Is there an impact of designing the accounting information systems on the level of accounting conservatism in listed Jordanian commercial banks attributed to the bank’s size?

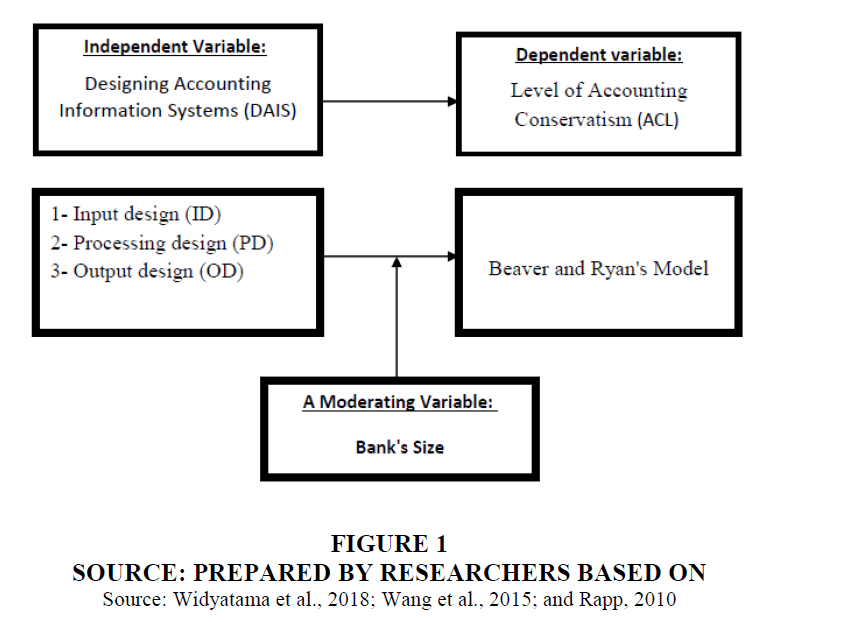

The research relied on a descriptive and analytical approach, and accordingly, the research was divided into two parts: the first part was theoretical by presenting prior literature on the impact of designing Accounting Information Systems (AISs) on the level of Accounting Conservatism (ACL) of Jordanian commercial banks listed in Amman stock exchange. The second part was practical through the use of two research tools: (i) the questionnaire analysis approach to measure the independent variable (AISs); and (ii) the content analysis based on listed financial statements of 13 listed commercial banks for the year 2016 to measure the dependent variable (ACL) and the moderating variable (bank's size). The research variables were demonstrated in Figure 1.

Figure 1.Source: Prepared By Researchers Based On

Source: Widyatama et al., 2018; Wang et al., 2015; and Rapp, 2010

The following hypotheses were formulated to answer the research questions:

H01: There is no statistically significant impact (α ≤ 0.05) of designing accounting information systems (inputs, processes, and outputs) on the level of accounting conservatism (reasonable and unreasonable practices) in Jordanian commercial banks listed in Amman stock exchange.

The following sub-hypotheses extracted from the aforementioned main hypothesis:

H01a: There is no statistically significant impact (α ≤ 0.05) of designing inputs of accounting information systems on the level of accounting conservatism (reasonable and unreasonable practices) in listed Jordanian commercial banks.

H01b: There is no statistically significant impact (α ≤ 0.05) of designing processes of accounting information systems on the level of accounting conservatism (reasonable and unreasonable practices) in listed Jordanian commercial banks.

H01c: There is no statistically significant impact (α ≤ 0.05) of designing outputs of the accounting information systems on the level of accounting conservatism (reasonable and unreasonable practices) in listed Jordanian commercial banks.

H02: There is no statistically significant impact (α ≤ 0.05) of designing accounting information systems on the level of accounting conservatism (reasonable and unreasonable practices) in listed Jordanian commercial banks attributed to the bank's size.

The study population consisted of 16 Jordanian commercial banks by the end of year 2016 to which financial statements were ready and completed in compatibility with the same year of collecting the questionnaire data for analysis purposes. The study sample consisted of 13 Jordanian commercial banks listed in Amman stock exchange based on the following criteria:

1. The bank should be listed in Amman stock exchange during 2016, the period in which financial statements were completed.

2. The fiscal year for the bank should be ended at 31-12.

3. The bank should not face abnormal events (such as consolidation) and should publish annual financial statements regularly.

The research was based upon two tools: the first tool represented by the questionnaire form that were designed and analyzed to measure the independent variable, consisted of (33) questionnaires items, and representing (85%) of the total questionnaires. The questionnaires distributed to sampling units of general managers, financial managers, branch managers, auditors, and accountants based on the research sample. The second tool was based upon the content analysis to measure the dependent and moderating variables.

The study adopted a descriptive and analytical approach based on the available data extracted from the questionnaire technique and published data from the financial statements of 13 Jordanian commercial banks listed in Amman stock exchange and the Amman stock exchange website for the year 2016. The Statistical Packages for Social Science program (SPSS) were used to test the independent variable (through questionnaires with a five-point scale ranging from point 5 to represent strongly agree and point 1 to represent strongly disagree with regard to the design of inputs, processes and outputs of AISs) and the dependent variable (applying Beaver and Ryan's model, 2005, in respect of the accounting conservatism level that is calculated by the book value of the bank to the market value of the bank) while the moderating variable (the bank size) were measured by the logarithm of total assets.

There were difficulties in collecting the research data:

1. More efforts were required to follow the sampling units to ensure the completeness of the questionnaire forms, particularly when some forms were not located in the right position.

2. The content analysis for the survey study were based on all 16 Jordanian commercial banks but difficulties faced researchers to limit the number of banks to 13 banks instead because of some banks that did not meet certain criteria.

Results And Discussion

The Cronbach Alpha test was used to measure the stability of measuring the first instrument (the questionnaire data used to measure the independent variable). The following Table 1 showed the results of the Cronbach Alpha test, Table 1.

| Table 1: Results Of The Test (Cronbach Alpha) | |

| Variables | Alpha Value |

|---|---|

| Design of input of accounting information systems. | 0.922 |

| Designing the processing of accounting Information systems | 0.894 |

| Designing the outputs of accounting Information systems. | 0.874 |

| Design of accounting information systems | 0.968 |

Table 1 showed that the value of the Cronbach alpha coefficient for all variables is good, and being higher than the acceptable of 60%.

The study consisted of two main hypotheses. The first hypothesis is divided into three sub-hypotheses. The following is a statement of each main and sub-hypotheses and their tests using the appropriate statistical technique.

The First Main Hypothesis

H01: There is no statistically significant impact of designing Accounting Information Systems (AISs) on the level of Accounting Conservatism (ACL) in Jordanian commercial banks listed in Amman stock exchange.

The design of the accounting information systems was measured by the questions (1-31) of the survey questionnaire, where point 5 was given if the answer was strongly agreed, and point 1 was given if the answer was not strongly agreed, while the average response to the IASs design variable was 3.49. The level of the accounting conservatism was measured using the Beaver and Ryan's model of 2005 by calculating the ratio of the book value of the bank to the market value of the bank for the research sample. Results showed in Table 2.

| Table 2: Results Of The Regression Analsyis Of The First Hypothsis | |||

| Variables | Accounting Conservatism Level (ACL) | ||

|---|---|---|---|

| T Sig | T | B | |

| Fixed | 0.001 | 3.59 | 0.79 |

| Designing Accounting Information Systems (AISs) |

0.000 | 7.49 | 0.46 |

| R | 0.80 | ||

| Adjusted R Square | 0.63 | ||

The hypothesis model test was as follows:

H01: ACL = 0.79 + 0.46 AISs

The aforementioned hypothesis was tested using the simple regression test. Table 2 presents the test results of the impact of designing accounting information systems at the level of the accounting conservatism in commercial banks listed at Amman stock exchange. The value of P-value sig=0.000, when compared to the level of significance α=0.05, was lower than P-value, thus, the null hypothesis is rejected and the acceptance of the alternative one. This means that designing accounting information systems affected the level of accounting conservatism in commercial banks listed at Amman stock exchange, and when the correlation coefficient (R)=0.80, and the Adjusted R Square=0.63, which means that designing accounting information systems interpreted of 63% of the level of accounting conservatism in commercial banks listed in Amman Stock Exchange. This result is in line with (Al-Hiyari et al., 2013; and Obaid, 2017).

H01a: There is no statistically significant impact of designing inputs of accounting information systems on the level of accounting conservatism in Jordanian commercial banks listed in Amman stock exchange.

The design of inputs in the IASs was measured by questions (1-13) of the questionnaire, where point 5 were given if the answer was strongly agreed, and point 1 was given if the answer was not strongly agreed, and the average response was 3.51, and the level of accounting conservatism is measured using the Beaver & Ryan's model, 2005, where the accounting conservatism is calculated by the book value of the bank to the market value of the bank. Results showed in Table 3.

| Table 3: Results Of The Regression Nalysis Of The First Sub-Hypothsis | |||

| Variables | Accounting Conservatism Level (ACL) | ||

|---|---|---|---|

| T Sig | T | B | |

| Fixed | 0.002 | 3.42 | 0.78 |

| Designing Accounting Information Systems (AISs) |

0.000 | 7.15 | 0.46 |

| R | 0.80 | ||

| Adjusted R Square | 0.61 | ||

Model of Sub-hypothesis Test

H01a: ACL=0.78+0.46 IAISs

This sub-hypothesis was tested using the simple regression test. Table 3 presented the test results of the impact of designing inputs of accounting information systems on the accounting conservatism level of commercial banks listed at Amman stock exchange. The value of P-value sig=0.000 (designing inputs of accounting information systems affected the level of accounting conservatism in listed Jordanian commercial banks). The correlation coefficient (R)=0.80 and the adjusted R Square=0.61. This means that the design of inputs in the IASs interpreted of 61% of the accounting conservatism level for Jordanian commercial banks listed on Amman stock exchange. This result is in line with Alnajar’s study (Alnajar, 2014).

| Table 4: Results Of The Regression Analsyis Of The Second Sub-Hypothsis | |||

| Variables | Accounting Conservatism Level (ACL) | ||

|---|---|---|---|

| T Sig | T | B | |

| Fixed | 0.002 | 3.31 | 0.73 |

| Designing Process of Accounting Information Systems (PAISs) |

0.000 | 7.21 | 0.45 |

| R | 0.79 | ||

| Adjusted R Square | 0.62 | ||

H01b: There is no statistically significant impact of designing processes of accounting information systems on the level of accounting conservatism in Jordanian commercial banks listed in Amman stock exchange.

The design of processes in the IASs was measured by questions (14-24) of the questionnaire form, where point 5 was given if the answer was strongly agreed, and point 1 was given if the answer was not strongly agreed, and the average response was 3.48, while the level of accounting conservatism was measured using the Beaver & Ryan's model, 2005, where the accounting conservatism was calculated by the book value of the bank to the market value of the bank. Results showed in Table 4.

Model Sub-hypothesis Test

H01b: ACL=0.73+0.45 PIASs

This sub-hypothesis was tested using the simple regression test. Table 4 presented the test results of the impact of designing processes on the accounting conservatism level of the commercial banks listed in Amman stock exchange. The value of P-value sig=0.000, comparing to the level of significance α=0.05, was lower than the P-value. Thus, the above-mentioned results rejected the null hypothesis and accept the alternative one. This means that designing processes of accounting information systems affected the level of accounting reservation in commercial banks listed in Amman stock exchange. This result is in line with (Zhang, 2014; and Obaid, 2017).

H01c: There is no statistically significant impact of designing outputs of accounting information systems on the level of accounting conservatism in Jordanian commercial banks listed in Amman stock exchange.

The design of outputs in the AISs was measured by questions (25-31) of the questionnaire of the study. Where the number 5 was given if the answer was strongly agreed, the number 1 was given if the answer was not strongly agreed, and the average response to the output design variable was 3.47. The level of accounting conservatism was measured using the Beaver & Ryan model, 2005, and the calculation of the accounting conservatism was done by the book value of the bank to the market value of the bank. Results showed in Table 5.

| Table 5: Results Of The Regression Analysis Of The Third Sub-Hypothsis | |||

| Variables | Accounting Conservatism Level (ACL) | ||

|---|---|---|---|

| T Sig | T | B | |

| Fixed | 0.001 | 3.81 | 0.80 |

| Designing Outputs of Accounting Information Systems (OAISs) |

0.000 | 7.90 | 0.47 |

| R | 0.82 | ||

| Adjusted R Square | 0.66 | ||

Model Hypothesis Test

H01c: ACL=0.80+0.47 OAISs

This sub-hypothesis was tested using the simple regression test. Table 5 presented the results of the test of the impact of designing outputs of the accounting information systems at the level of accounting conservatism in commercial banks listed in Amman stock exchange. The value of P-value sig=0.00. The correlation coefficient (R) was at the lowest of the nominal value of α=0.05, and therefore the null hypothesis was rejected and the alternative hypothesis was accepted. Thus, designing outputs of the accounting information systems affected the level of accounting conservatism in commercial banks listed at Amman stock exchange with R=0.82, while the Adjusted R Square=0.66, which means that designing accounting information systems interpreted of 66% of the level of accounting conservatism in commercial banks listed in Amman stock exchange. This result is in line with (Beshtawi & Bakamy 2015; and Widyatama et al., 2018).

H02: There is no statistically significant impact of IASs in the level of accounting conservatism in listed Jordanian commercial banks attributed to -the moderating variable- the bank's size.

The size of the bank was measured by the natural logarithm of the total assets of the bank. The level of the accounting conservatism was measured using the Beaver & Ryan's model. The accounting conservatism was calculated by the book value of the bank to the market value of the bank. Results showed in Table 6.

| Table 6: Results Of The Regression Analysis Of The Second Main Hypothsis |

|||

| Variables | Accounting Conservatism Level (ACL) | ||

|---|---|---|---|

| T Sig | T | B | |

| Fixed | 0.001 | 3.84 | 4.33 |

| Bank Size (BS) | 0.002 | -3.36 | -4.01 |

| R | 0.52 | ||

| Adjusted R Square | 0.42 | ||

This second main hypothesis was tested using the simple regression test. Table 6 showed the results of the impact of the bank's size on the level of accounting conservatism in commercial banks listed at Amman stock exchange. The value of P-value sig=0.002, comparing with the level of significance α=0.05, was lower than 0.05. Thus, the null hypothesis was rejected and the alternative hypothesis was accepted, which means that the size of the bank affected the level of accounting conservatism in commercial banks listed at the Amman stock exchange, because the beta signal is negative (-4.01). The correlation coefficient (R) was 0.52, while the Adjusted R Square=0.24, that means the size of the bank accounted for 42% of the level of the accounting conservatism in commercial banks listed at the Amman stock exchange. This indicated that the bank's size, as a moderating variable, has a negative relationship with the use of the accounting conservatism by management and accountants of listed banks. This result is in line with the study of Widyatama et al., 2018, but it is not in line with the study of Obaid, 2017.

Conclusions

The main findings of this research are as follows:

1. The design of accounting information systems has a positive impact (P-value sig=0.000, when compared to the level of significance α=0.05) on the level of accounting conservatism in commercial banks listed at Amman stock exchange. This implied that management and accountants of listed banks attempted to apply the accounting conservatism in order to reduce the tax income and changing accounting policies.

2. The design of inputs of accounting information systems has a positive impact (P-value sig=0.000, compared to α=0.05) on the level of accounting conservatism in commercial banks listed at Amman stock exchange. This implied that management and accountants of listed banks attempted to reduce debts and cost of borrowing to avoid financial difficulties and sudden losses.

3. The design of processes of accounting information systems has a positive impact (P-value sig=0.000, compared with the level of significance α=0.05) on the level of accounting conservatism in commercial banks listed at Amman stock exchange. This implied that the management and accountants of listed banks attempted to exploit flexibility of IFRS and irrelevance of accounting policies to achieve administrative and finance decisions.

4. The design of outputs of accounting information systems has a positive impact (P-value sig=0.000, compared to α=0.05) on the level of accounting conservatism in commercial banks listed at Amman stock exchange. This implied that management and accountants of listed banks attempted to apply different accounting adjustments at the end of the physical year to avoid sudden losses and credit loans risks.

5. The size of the bank has a negative impact (the value of P-value sig=0.002, comparing with the level of significance α=0.05, was lower than 0.05, knowing the negative B of -0.401 for the bank's size) on the level of the accounting conservatism. Thus, an increase in the size of the bank led to a lower level of the accounting conservatism. This implied that commercial banks adopted formal internal control procedures, international internal auditing (that is IIA), and updating governance systems that limited, to some extent, the level of the unreasonable accounting conservatism practiced by the management and accountants of listed banks.

According to the findings of the research, the researchers extracted and suggested some recommendations, which are as follows:

1. Increase the awareness of banks and other sectors of the importance of designing the three elements of Accounting Information Systems (AISs), and the concept of reasonable and unreasonable accounting conservatism in listed corporations, where AISs can help in increasing the quality and confidence of accounting information for different decisions makers.

2. Increase the role of AISs to penetrate all plans, procedures and detailed decision making processes in different activities of banks and other corporations.

3. Conducting further research and future studies to measure the impact of accounting information systems on other variables such as earnings management and accounting disclosures.

References

- Alali, F.A., & Yeh, C.L. (2012). Cloud computing: Overview and risk analysis.Journal of Information Systems,26(2), 13-33.

- Al-Amri, K., Al-Busaidi, M., & Akguc, S. (2015). Conservatism and corporate cash holdings: A risk prospective.Investment Management and Financial Innovations,12(1), 101-113.

- Al-Hiyari, A., Al-Mashregy, M.H.H., Mat, N.K.N., & Alekam, J.M. (2013). Factors that affect accounting information system implementation and accounting information quality: A survey in University Utara Malaysia.American Journal of Economics,3(1), 27-31.

- Alnajar, J. (2014). Measurement of the level of accounting conservatism in financial accounting and its impact on the market value of share: An empirical study on listed corporations in Palestine stock exchange. El-Balka Journal, 17(2).

- Appiah, K.O., Agyemang, F., Agyei, Y.F.R., Nketiah, S., & Mensah, B.J. (2014). Computerised accounting information systems: Lessons in state-owned enterprise in developing economies.Journal of Finance and Management in Public Services,12(1).

- Basu, S. (1997). The conservatism principle and the asymmetric timeliness of earnings.Journal of Accounting and Economics,24(1), 3-37.

- Beaver, W.H., & Ryan, S.G. (2005). Conditional and unconditional conservatism: Concepts and modeling.Review of Accounting Studies,10(2-3), 269-309.

- Beshtawi, S., & Bakamy, M. (2015). The effect of applying expert systems in commercial banks on electronic audit procedures from the view of certified external auditors on Jordan and Saudi Arabia. Jordanian Journal in Business Administration, 11(1).

- Bushman, R.M., & Piotroski, J.D. (2006). Financial reporting incentives for conservative accounting: The influence of legal and political institutions.Journal of Accounting and Economics,42(1-2), 107-148.

- Choe, J.M. (1996). The relationships among performance of accounting information systems, influence factors, and evolution level of information systems.Journal of Management Information Systems,12(4), 215-239.

- Debreceny, R.S. (2011). Betwixt and between? Bringing information systems and accounting systems research together.Journal of Information Systems,25(2), 1-9.

- Gill, A., & Obradovich, J.D. (2012). The impact of corporate management control and accounting systems and financial leverage on the value of American firm. International Research Journal of Finance and Economics, 91, 1-14.

- Kim, J., Nicolaou, A.I., & Vasarhelyi, M.A. (2013). The impact of enterprise resource planning (ERP) systems on the audit report lag.Journal of Emerging Technologies in Accounting,10(1), 63-88.

- Kronbauer, C.A., Marquezan, L.H.F., Barbosa, M.A.G., & Diehl, C.A. (2017). Analysis of the effects of conservatism in accounting information after the 2011 change in the basic conceptual pronouncement. Brazilian Business Management Journal,19(65), 453-468.

- Neag, R., & Masca, E. (2015). Identifying accounting conservatism-A literature review.Procedia Economics and Finance,32, 1114-1121.

- Nyabuti, V., Memba, F., & Chege, C. (2016). Influence of creative accounting practices on the financial performance of company listed in the Nairobi securities exchange in Kenya. International Journal of Management and Commerce Innovation, 3(2), 45-59.

- Obaid, E. (2017). Effect of accounting conservatism in financial reports on the market value of Jordanian public shareholding companies listed on the ASE. Zarqa University.

- OECD, (2004). Corporate management control and accounting systemsprinciples. Center for International Private Enterprise, 38-46.

- Rapp, M.S. (2010). Information asymmetries and the value-relevance of cash flow and accounting figure-empirical analysis and implications for managerial accounting.

- Romney, M., & Steinbart, P. (2014). Accounting information system, (13th Ed.). Pearson Prentice-hall, New Jersey, USA.

- Wang, J., Bloomberg, X.Y.R., Zhang, P., & Zhang, J. (2015). The effectiveness of internal control and the quality of accounting information-the introduction of western internal control research literature and the prospect in the background of China?s system (I). Accounting Review, 6, 87-95.

- Widyatama, W., & Wirama, D. (2018). The effect of accounting conservatism on the value relevance of accounting information: Evidence from Indonesia. European Journal of Business and Social Sciences, 6(12), 34-46.

- Zhang, X. (2014). Analysis on the influence of the current situation of enterprise internal control on accounting information quality. Financial Marketing, 21, 123-124.