Research Article: 2018 Vol: 22 Issue: 4

The Impact of CSR on the Asymmetric Pay-for-Performance Sensitivity of CEO Compensation

Kyoungwon Mo, Chung-Ang University

Kyung Jin Park, Myongji University

YoungJin Kim, Korea Advanced Institute of Science and Technology

Abstract

t was examine whether the Corporate Social Responsibility (CSR) activities affect the asymmetric P ay - for - Performance Sensitivity (PPS) of the compensation of a firm’s Chief Executive Offic er (CEO). Recent studies find that while a CEO’s compensation increases by a large amount when the firm’s performance is good, it dec r eases only by a small amount when the performance is poor. This study shows that such downward CEO compensation stickiness is mitigated by the firm’s CSR performance. Using various regression analyses, we find that CSR not only decreases the excessively high PPS for positive performance firms, but also increases the excessively low PPS for negative performance firms. This result can be evidence consistent with the theory that the CSR benefits the shareholders .

Keywords

Corporate Social Responsibility, CEO Pay-For-Performance Sensitivity, CEO Compensation Stickiness, Agency Problem, CEO Power.

JEL Classification: M14, M41, M52

Introduction

Compensation of Chief Executive Officer (CEO) and other top executives has drawn large attentions from both academic scholars and policy makers. Indeed, the amount of executive compensation has substantially increased since the 1980s (Hall & Liebman, 1998). As top executives’ compensation has shown a tremendous rise, many people have begun to question whether their compensation is adequate, as their huge compensation would be justified if it is a result of firm’s exceptionally excellent performance and rapid growth. Concerning this question, Hall & Liebman (1998) show that not only the amount but also the stock-price sensitivity of the compensation has increased excessively. This means that for equal one dollar of firm’s net income, current CEO is paid more than s/he was paid before. As such, compensation-related literature has observed a positive relation between firm’s earnings and managerial compensation, or Pay-for-Performance Sensitivity (PPS), and this PPS has continued rising significantly.

Related literature has also reported that the Pay-for-Performance Sensitivity (PPS) differs depending on whether the performance of the firm is good or bad (Gaver & Gaver, 1998; Matsunaga & Park, 2001; Jackson et al., 2008). Specifically, Gaver & Gaver (1998) regress CEO cash compensation on positive earnings (gains) and negative earnings (losses), and find that the coefficient of gains is significantly greater than that of losses. This result indicates that one dollar of gain affects more the manager’s compensation than one dollar of loss does. This asymmetry in Related literature has also reported that the Pay-for-Performance Sensitivity (PPS) differs depending on whether the performance of the firm is good or bad (Gaver & Gaver, 1998; Matsunaga & Park, 2001; Jackson et al., 2008). Specifically, Gaver & Gaver (1998) regress CEO cash compensation on positive earnings (gains) and negative earnings (losses), and find that the coefficient of gains is significantly greater than that of losses. This result indicates that one dollar of gain affects more the manager’s compensation than one dollar of loss does. This asymmetry in

Related literature has also reported that the Pay-for-Performance Sensitivity (PPS) differs depending on whether the performance of the firm is good or bad (Gaver & Gaver, 1998; Matsunaga & Park, 2001; Jackson et al., 2008). Specifically, Gaver & Gaver (1998) regress CEO cash compensation on positive earnings (gains) and negative earnings (losses), and find that the coefficient of gains is significantly greater than that of losses. This result indicates that one dollar of gain affects more the manager’s compensation than one dollar of loss does. This asymmetry in

Combining these two streams of literature, it was documented the association between CSR and asymmetric PPS of CEO compensation. If the CSR is to benefit shareholders, then the more important result is CSR’s effect on the PPS of CEO compensation, rather than the effect on the overall compensation value. The CEO of a more socially responsible firm is known to receive less compensation (Cai et al., 2011). If a decrease in the pay is not related to the firm’s performance, the link between CEO compensation and firm performance is weakened, and thus, the CEO has less incentive to serve better the shareholders. Henceforth, the CSR performance is expected to diminish the PPS when the firm’s performance is good, which is found to be excessive compared with the PPS after poor performance. It is also expected to raise the PPS during declining firm’s performance.

To demonstrate this, it was first perform PPS analysis on two separate subsamples-a positive Return on Asset (ROA) sample and a negative ROA sample. In this subsample analysis, it was finding that the CSR lessens the already very high PPS for positive ROA firms, while increasing the very low PPS for negative ROA firms. Further analysis with more interaction terms for the entire sample also confirms that CSR reduces downward stickiness in CEO compensation, or the asymmetric PPS of CEO compensation, according to whether the earnings are positive or negative. These results are robust to using an alternative corporate performance measure, an alternative CEO compensation measure, and an alternative compensation stickiness model of Jackson et al. (2008).

Our results provide supporting evidence for CSR’s positive aspects, especially for CSR’s positive effect on CEO compensation, which has not been examined so far, as well as on shareholders. Prior literature has already found that the CSR decreases the level of CEO’s compensation, but the change irrelevant to the change in firm’s performance does not guarantee that the decrease would be beneficial to the shareholders. Our study contributes to both CSR and compensation literatures. The negative association between the CSR and the compensation stickiness can be counted as additional evidence supporting CSR’s positive impact on the shareholders. It is also show that the CSR can be one of the tools for mitigating the asymmetry in CEO compensation, thereby placing the manager closer to the shareholders’ interest and leading the manager to serve better the shareholders.

Theory And Hypothesis

Corporate Social Responsibilities and Managerial Compensation

Researches on Corporate Social Responsibility (CSR) have investigated whether the CSR activities benefit or harm shareholders. A stream of literature has found evidence that CSR improves firm value by enhancing firms’ operating effectiveness (Porter & Kramer, 2002; Saiia et al., 2003; Brammer & Millington, 2005), employees’ productivity (Tuzzolino & Armandi, 1981; Valentine & Fleischman, 2008), profits in product markets (Menon & Kahn, 2003; Bloom et al., 2006), benefits in capital markets (Godfrey, 2005; Dhaliwal et al., 2012), more effective risk management policies (Richardson & Welker, 2001; Husted, 2005; Dhaliwal et al., 2011; Cheng et al., 2014), and earnings quality (Chih et al., 2008; Kim et al., 2012). These positive empirical results are based on stakeholder value maximization theory. According to Coase’s theory of the firm (1937), a corporation has responsibilities to serve not only shareholders, but also non-investing stakeholders related to the firm, such as employees, communities, consumers, environment, government, etc. In this perspective, higher CSR performance is viewed as an investment to increase firm value by resolving the conflicts among various stakeholders and raising their willingness to support the firm (Wood, 1991; Donaldson & Preston, 1995; Jensen, 2002; Calton & Payne, 2003; Scherer et al., 2006; Freeman, 2010; Harjoto & Jo, 2011). Based on this view, many researchers have theoretically and/or empirically shown that CSR activities enhance firms' long-term performance and efficiency (Alchian & Demsetz, 1972; Cornell & Shapiro, 1987; Hill & Jones, 1992; Orlitzky et al., 2003).

In contrast, the other stream of CSR studies argue that CSR activities can worsen firm value as the benefit stakeholders enjoy may stem from the shareholders' expense. Based on Jensen & Meckling, (1976), the agency theory predicts that the managers have incentives to overinvest in CSR activities as doing so can improve their reputation at the costs to shareholders (Vance, 1975; Aupperle et al., 1985; Pagano & Volpin, 2005; Surroca & Tribo, 2008; Cronqvist et al., 2009; Barnea & Rubin, 2010). From this aspect, the CSR investments are expected to exceed the level optimal or beneficial to shareholders, and thus adversely affect the firm value. Indeed, some scholars have found negative or unclear association between CSR and firm value (Griffin & Mahon, 1997; Waddock & Graves, 1997; Harrison & Freeman, 1999; Brammer et al., 2006; Becchetti & Ciciretti, 2009).

The stakeholder value maximization theory predicts negative association between CSR and manager’s compensation. Under this theory, as the firm aims to reduce potential conflicts among the stakeholders by investing in CSR activities, the manager is expected to be more responsible for firm’s morality and ethics, especially the equality and fairness issues (Jensen, 2002; Aguilera et al., 2007). Furthermore, the firm with higher investments in socially responsible activities would face less firm risks arising from outside stakeholders, such as labor strikes, activist groups’ accusations, etc. These overall factors anticipate lower CEO compensations for firms with more CSR activities. Mahoney & Thorne (2005) and Cai et al., (2011) have empirically found the negative association between CSR and the CEO compensation, supporting the stakeholder value maximization theory. With their results, the CSR activities are interpreted as the firm’s intention of being socially responsible and serving outside stakeholders as well, as doing so helps enhancing the firm value.

Asymmetry in Pay-for-Performance Sensitivity

Managerial compensation literature has long documented a positive relation between the firm’s financial performance, based primarily on accounting earnings, and CEO’s compensation (Lambert & Larcker, 1987; Sloan, 1993; Baber et al., 1999). This positive sensitivity between performance and CEO pay, or Pay-for-Performance Sensitivity (PPS), has been challenged, however, by more recent studies, which have found that this association between earnings and managerial compensation differs according to whether the performance is good or bad. Gaver & Gaver (1998) show that the managers are rewarded with higher compensation for positive earnings, while for negative earnings, they do not suffer losses in compensation commensurate with the gain in their compensation for good results. Matsunaga & Park (2001) finds similar results with losses weakening the relation between earnings and manager’s bonus compensation. The positive pay-for-performance sensitivity long supported by prior compensation literature is shown to be apparent only in the presence of positive earnings, and to disappear when the firm reports negative earnings. Jackson et al. (2008) also present consistent results, arguing that compensation committee places more weight on accounting fundamentals other than return on assets (ROA) when the earnings decrease, while it puts more weight on ROA when it increases. Additional researches support that the managerial cash compensation is partially or more protected from falling in the presence of certain transactions which likely damage firm’s financial results (Dechow et al., 1994; Duru et al., 2002; Adut et al., 2003).

Related studies overall confirm the existence of asymmetry in the PPS, or downward stickiness in CEO compensation, consistent with Jensen & Murphy (1990) and Bebchuk & Fried, (2004)’s criticism of a weak relation between earnings and CEO compensation, and of insufficient penalization of managers for poor financial results. It is evident that this asymmetry in PPS adversely impacts shareholders, as the manager is less incentivized to protect the shareholders from losses. Indeed, Jensen & Murphy (1990) and Abowd (1990), among others, have already shown the positive association between the change in PPS and the change in shareholder wealth (Aggarwal & Samwick, 1999; Iyengar et al., 2005; Matolcsy & Wright, 2011). Accordingly, a greater degree of CEO compensation stickiness may provide for managers environments more susceptible of opportunistic behaviors at the expense of shareholders (Yang & Mo, 2018).

Hypothesis

In this study, it was examined that relation between the CSR and the asymmetric PPS. As it was observed two contradictory views on the effect of CSR on shareholders and firm value, It was expected both positive and negative associations between the CSR and the compensation stickiness. Under stakeholder value maximization theory, the CSR activities reflect the manager and firm’s commitments to firm value maximization for shareholders’ benefits, by investing in the relationships with various outside stakeholders. As the CSR is a representation of firm’s endeavors to serve better the shareholders, it expects the CSR to be related with reducing the asymmetry in PPS. In other words, the CSR performance is expected to diminish the PPS when firm’s performance is good, which is found to be excessive when compared with the PPS after poor performance. It is also expected to increase the PPS during declining firm’s performance, in which case the PPS is found to be very low. In sum, a negative relation between CSR and compensation stickiness is interpreted as supporting the CSR as benefiting the shareholders. On the contrary, the negative view on CSR based on agency theory predicts a positive relation between the CSR and the asymmetry in PPS. From this perspective, the CSR is viewed as manager’s opportunistic behavior to raise his/her reputation using shareholders’ resources. As the CSR is associated with the manager’s self-interest-seeking behavior, it expects the CSR to be related with worsening the asymmetric PPS. That is, the CSR is expected to be related with higher PPS under good firm performance, whereas it is expected to be associated with lower PPS under poor firm performance. In a nutshell, if the CSR is to benefit the shareholders, a negative association is expected between the CSR and the compensation stickiness, while a positive association between them would support that CSR adversely affects shareholders.

Research Methodology

Research Design

The downward CEO compensation stickiness refers to the difference between the effect of positive and negative performance on CEO compensation. A downward CEO compensation stickiness implies that when the firm is doing well, the CEO compensation increases to a greater degree than the decrease witnessed in the case of poor firm performance.

It was intended to show that the CSR activities reduce the downward CEO compensation stickiness. To display this, it has first divide our sample into good performers and poor performers, based on the change in annual performance. It was then estimate the following regression coefficients for each group, following the cost stickiness model of Anderson et al. (2003).

ΔBonus = β0 + β1ΔROA + β2CSR + β3ΔROA × CSR + Controls + ε

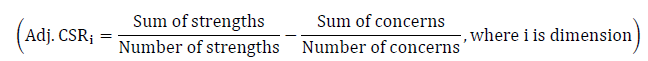

ΔBonus refers to the natural logarithm of current year’s CEO bonus divided by previous year’s CEO bonus. ΔROA is the natural logarithm of current year’s Return on Assets (ROA) divided by previous year’s ROA. The Return on Assets (ROA) is measured here using two earnings measures, Net Income (NI) and Income Before extraordinary items (IB). The ROA is calculated as the earnings divided by total assets. Two earnings measures generate two ROA figures, ROA-NI and ROA-IB, respectively. CSR is a dummy variable which equals one if adjusted CSR score is above median value, and zero otherwise. The adjusted CSR score is extracted from the KLD database, which provides each firm-year’s CSR activity score in various areas. These activities can be categorized into seven dimensions: environmental, community, employee, diversity, human rights, product, and corporate governance followed by Deng et al., (2013). It was first computed the adjusted CSR score in each dimension by: (i) dividing the sum of “strengths” in that dimension by the number of “strengths criteria” in it; (ii) dividing the sum of “concerns” in that dimension by the number of “concerns criteria” and finally (iii) subtracting the latter quotient from the former.

These seven CSR scores, one for each dimension, are summed to generate the adjusted CSR score. This CSR performance measure gives an equal weight to each dimension, regardless of how many criteria each dimension includes in the KLD database.

The controls used include change in total assets, change in sales, change in mean industry earnings, and industry and year fixed effects, following prior literature related to CEO compensation, PPS, and downward stickiness (Cai et al., 2011; Kane, 2002; Sun & Cui, 2014).

In equation (1), β1 captures the partial correlation between the change in corporate financial performance and the change in CEO bonus. For good performers, β1 is expected to have a positive value, as better (poorer) corporate performance will lead to an increase (decrease) in CEO compensation. The existence of downward CEO compensation stickiness can be implicitly shown through the difference of β1 for good and poor performers. The estimate of β1 for good performers is expected to be significantly higher than that for bad performers, which implies that the CEO compensation increases by a large amount with good corporate performance, while such compensation does not decrease as much with poor corporate performance as it increases with positive financial results. It has even consider a negative value of β1 for negative earnings subsample, as this may indicate that the CEO receives bonus in spite of bad performance, which can be an example of a severe lack of control over CEO by shareholders.

Our hypothesis on the effect of CSR on downward compensation stickiness can be tested more directly by comparing the β3 estimates of the two groups. If CSR reduces the downward stickiness for the sample of well-performing observations, then β3 is expected to have a sign opposite to that of β1. For the good performers sample, if β1, as expected, is positive, then β3 is expected to be negative, implying that the CSR mitigates the PPS, or that CSR suppresses the upward thrust of CEO compensation after good performance. As regards the poor performers subsample, the sign of β3 is expected to be positive. If β3 is negative, the decrease in CEO compensation for poor performance is reversed, so that the CEO receives an even higher pay for high CSR performance, despite the poor financial performance. This can be interpreted as making the CEO compensation less sensitive to firm’s performance, and lowering the overall PPS. On the contrary, positive β3 demonstrates that high CSR activity firms increase PPS for poor performers by punishing them more harshly than low CSR firms do. In other words, without CSR, the PPS is very high for good performers while the PPS is very low for poor performers, but with CSR, the high PPS for good performers decreases, and the low PPS for bad performers increases. To sum up, CSR’s anticipated effect of narrowing the gap between the PPS of good performers and that of poor performers predicts negative β3 for good performers and positive β3 for poor performers.

In addition to the subsample analysis, it has also added interaction terms in the regression equation and apply this regression to the entire sample for a more robust analysis. The equation is as follows:

ΔBonus = β0 + β1ΔROA + β2CSR + β3ΔROA × CSR + β4DD + β5ΔROA × DD + β6CSR × DD + β7ΔROA × CSR × DD + Controls + ε

Compared with previous equation, a new term, DD, along with its interactions with other variables, was added. DD equals one if the change in ROA is negative, and zero otherwise. This term is included to capture the difference in the outcome depending on the sign of the change in performance. In this equation, β1 is expected to be positive for the existence of PPS, β5 is expected to be negative for the existence of downward CEO compensation stickiness, and β7 is expected to be positive because CSR reduces the asymmetry in the PPS of CEO compensation. For all regression analyses in this study, It was clustered the standard errors by both firm and year.

Sample and Data

Our sample covers U.S. firm-year observations ranging from 1995 to 2015 and exclude financial and utilities industries (SIC codes 4900-4999 and 6000-6999). CEO compensation data are obtained from ExecuComp database and the CSR activity data are from the KLD Socrates database. Other accounting variables, such as Income Before extraordinary items (IB), Net Income (NI), total assets, and sales, are from the Compustat database

Results

Summary Statistics

The summary statistics are shown in Table 1. Out of the 2,948 observations, 45.3% (44.4%) reported poorer net income (income before extraordinary items) than in the previous year, according to DD -NI and DD -IB figures. The median adjusted CSR score is -0.087, the upper 25th percentile CSR score is 0.077, and lower 25th percentile CSR score is -0.242. Considering that, theoretically, the arithmetic CSR score range is from -7 to 7, the observations within the 1st and 3rd quartiles show little variation.

| Table 1 Summary Statistics |

||||||

| Variable | N | Mean | 1Q | Median | 3Q | Std. Dev. |

| Fiscal Year | 2,948 | 2004.830 | 2002 | 2004 | 2008 | 4.860 |

| Firm Characteristics | ||||||

| Total Assets | 2,948 | 7014.540 | 666.932 | 1690.310 | 4873.830 | 22873.080 |

| ROA-NI (Net income/Total assets) | 2,948 | 0.074 | 0.034 | 0.071 | 0.114 | 0.072 |

| ROA-IB (Income before extraordinary items/Total assets) | 2,948 | 0.074 | 0.034 | 0.070 | 0.113 | 0.069 |

| DD-NI (=1 if change in ROA -NI<0) | 2,948 | 0.453 | 0.000 | 0.000 | 1.000 | 0.498 |

| DD-IB (=1 if change in ROA -IB<0) | 2,948 | 0.444 | 0.000 | 0.000 | 1.000 | 0.497 |

| Bonus | 2,948 | 897.761 | 210.000 | 475.000 | 960.700 | 1881.070 |

| CSR performance | ||||||

| Adj. Environmental Strengths-Concerns | 2,948 | 0.012 | 0.000 | 0.000 | 0.000 | 0.065 |

| Adj. Community Strengths-Concerns | 2,948 | 0.001 | 0.000 | 0.000 | 0.000 | 0.093 |

| Adj. Employee Strengths-Concerns | 2,948 | -0.025 | -0.066 | 0.000 | 0.000 | 0.105 |

| Adj. Diversity Strengths-Concerns | 2,948 | -0.013 | -0.200 | 0.000 | 0.111 | 0.167 |

| Adj. Human Rights Strengths-Concerns | 2,948 | -0.004 | 0.000 | 0.000 | 0.000 | 0.046 |

| Adj. Product Strengths-Concerns | 2,948 | -0.030 | 0.000 | 0.000 | 0.000 | 0.097 |

| Adj. Corporate Governance Strengths-Concerns | 2,948 | -0.028 | -0.100 | 0.000 | 0.000 | 0.070 |

| Adj. CSR Strengths-Concerns (CSR score) | 2,948 | -0.087 | -0.242 | -0.075 | 0.077 | 0.262 |

Note: This table summarizes the descriptive statistics of the dependent/independent variables in the final sample of 2,948 firm-year observations. It presents the mean, median, 25th percentile, 75th percentile and standard deviation values. This study uses the Execucomp, COMPUSTAT and KLD databases for 1995-2015.

Univariate Analysis

Tables 2a &b presents the Pearson (upper-right triangle) and Spearman (lower-left triangle) correlation coefficients among the dependent and independent variables in the final sample of 2,948 firm-year observations.

| Table 2a Correlation Matrix |

||||||

| Bonus | ROA-NI | ROA-IB | Adj. CSR | Adj. Env | Adj. Com | |

| Bonus | 0.019 | 0.012 | -0.089 | 0.031 | -0.021 | |

| (0.272) | (0.474) | (0.000) | (0.078) | (0.230) | ||

| ROA-NI | 0.039 | 0.974 | 0.057 | -0.035 | 0.031 | |

| (0.026) | (0.000) | (0.001) | (0.046) | (0.070) | ||

| ROA-IB | 0.034 | 0.977 | 0.058 | -0.040 | 0.042 | |

| (0.053) | (0.000) | (0.001) | (0.022) | (0.015) | ||

| Adj. CSR | -0.022 | 0.057 | 0.059 | -0.006 | 0.436 | |

| (0.199) | (0.001) | (0.001) | (0.743) | (0.000) | ||

| Adj. Env | 0.094 | -0.051 | -0.052 | 0.012 | -0.303 | |

| (0.000) | (0.004) | (0.003) | (0.502) | (0.000) | ||

| Adj. Com | 0.061 | 0.038 | 0.044 | 0.370 | -0.163 | |

| (0.001) | (0.030) | (0.011) | (0.000) | (0.000) | ||

| Adv. Emp | -0.024 | 0.080 | 0.080 | 0.463 | -0.055 | 0.080 |

| (0.166) | (0.000) | (0.000) | (0.000) | (0.001) | (0.000) | |

| Adj. Div | 0.133 | 0.004 | 0.009 | 0.630 | 0.002 | 0.127 |

| (0.000) | (0.812) | (0.621) | (0.000) | (0.904) | (0.000) | |

| Adj. Hum | -0.071 | -0.010 | -0.019 | 0.177 | -0.077 | 0.092 |

| (0.000) | (0.546) | (0.271) | (0.000) | (0.000) | (0.000) | |

| Adj. Pro | -0.162 | 0.055 | 0.052 | 0.332 | -0.205 | 0.051 |

| (0.000) | (0.002) | (0.003) | (0.000) | (0.000) | (0.003) | |

| Adj. CG | -0.217 | 0.008 | 0.009 | 0.278 | -0.026 | 0.006 |

| (0.000) | (0.664) | (0.598) | (0.000) | (0.140) | (0.751) | |

| Total Assets | 0.412 | -0.174 | -0.177 | 0.041 | 0.161 | 0.056 |

| (0.000) | (0.000) | (0.000) | (0.018) | (0.000) | (0.001) | |

| Table 2b Correlation Matrix |

||||||

| Bonus | ROA-NI | ROA -IB | Adj. CSR | Adj. Env | Adj. Com | |

| Adj. Emp | Adj. Div | Adj. Hum | Adj. Pro | Adj. CG | Total Assets | |

| Bonus | -0.110 | 0.046 | 0.023 | -0.102 | -0.153 | 0.187 |

| (0.000) | (0.008) | (0.181) | (0.000) | (0.000) | (0.000) | |

| ROA -NI | 0.086 | 0.012 | -0.039 | 0.048 | 0.008 | -0.013 |

| (0.000) | (0.495) | (0.029) | (0.006) | (0.658) | (0.457) | |

| ROA -IB | 0.086 | 0.016 | -0.047 | 0.040 | 0.008 | -0.016 |

| (0.000) | (0.365) | (0.007) | (0.022) | (0.664) | (0.362) | |

| Adj. CSR | 0.496 | 0.602 | 0.242 | 0.365 | 0.327 | 0.002 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.891) | |

| Adj. Env | -0.101 | 0.034 | -0.146 | -0.247 | -0.039 | 0.253 |

| (0.000) | (0.048) | (0.000) | (0.000) | (0.023) | (0.000) | |

| Adj. Com | 0.066 | 0.094 | 0.138 | 0.089 | 0.053 | -0.069 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.002) | (0.000) | |

| Adv. Emp | 0.024 | 0.068 | 0.124 | 0.087 | -0.065 | |

| (0.171) | (0.000) | (0.000) | (0.000) | (0.000) | ||

| Adj. Div | 0.043 | -0.085 | -0.130 | -0.086 | 0.176 | |

| (0.012) | (0.000) | (0.000) | (0.000) | (0.000) | ||

| Adj. Hum | 0.089 | -0.111 | 0.124 | 0.128 | 0.040 | |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.021) | ||

| Adj. Pro | 0.087 | -0.064 | 0.110 | 0.135 | -0.277 | |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | ||

| Adj. CG | 0.062 | -0.091 | 0.081 | 0.082 | -0.098 | |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | ||

| Total Assets | 0.041 | 0.271 | -0.125 | -0.227 | -0.253 | |

| (0.017) | (0.000) | (0.000) | (0.000) | (0.000) | ||

Note: This table presents the Pearson (upper-right triangle) and Spearman (down-left triangle) correlations among the dependent/independent variables in the final sample of 2,948 firm-year observations. Adj. Env, Adj. Com, Adj. Emp, Adj. Div, Adj. Hum, Adj. Pro and Adj. CG refer to adjusted performance measures for environment, community, employee, diversity, human rights, product and corporate governance dimensions, respectively. Adj. CSR, or CSR score, is the sum of these seven CSR performance scores. The numbers in parentheses represent p-values.

In this Table 2, it has witness positive correlation coefficients between both ROAs and Bonus, of which Spearman coefficients are statistically significant at 10 percent level . The adjusted CSR score is shown to be negatively associated with CEO bonus, whose significance is especially strong in terms of Pearson’s method. The correlation between C SR and both ROA measures are significantly positive in terms of both Pearson’s and Sp earman’s methods.

Regression Analysis

Tables 3a & b shows the regression results. Models 1 through 3 display analysis using Net Income (NI) as earnings. Models 1 and 2 show results for positive and negative NI subsamples, respectively. For both subsamples, It was observe positive coefficients of ΔROA. Especially, the positive subsample analysis shows significant coefficient at 1 percent level with a greater value (0.1759) than that for negative earnings subsample (0.0452). This result confirms the downward CEO compensation stickiness as it indicates that when the firm performs well, the CEO compensation is strongly tied to the firm’s performance, compared with when the firm performs poorly. Further, a negative estimate of ΔROA × CSR (β3) for good performers and a positive estimate of ΔROA × CSR for poor performers support our prediction that CSR reduces high PPS for good performers while it increases low PPS for bad performers. Model 3 shows entire sample analysis. In this model, a dummy variable (DD), which indicates whether the current year’s corporate performance is worse than the previous year’s performance, is included. The estimate of the ΔROA×CSR×DD coefficient (β7) is significantly positive, as expected, implying that CSR increases the low PPS for bad performers and thereby reduces the asymmetric PPS of CEO Compensation.

| Table 3a The Impact Of Csr On Asymmetric Pps Of Ceo Compensation |

||||||

| Independent variable |

Dependent Variable: Change in CEO Bonus | |||||

| 1 | 2 | 3 | ||||

| ROA using net income (NI) | ||||||

| Positive Earnings | Negative Earnings | Entire Sample | ||||

| Intercept | 0.0655 | (0.628) | -0.0980 | (0.506) | 0.0285 | (0.775) |

| ΔROA | 0.1759 | (0.000)*** | 0.0452 | (0.444) | 0.1682 | (0.000)*** |

| CSR | 0.0149 | (0.741) | -0.0004 | (0.994) | 0.0255 | (0.563) |

| ΔROA×CSR | -0.0885 | (0.223) | 0.0938 | (0.306) | -0.0919 | (0.215) |

| DD | -0.1223 | (0.005)*** | ||||

| ΔROA×DD | -0.1444 | (0.052)* | ||||

| CSR×DD | -0.0204 | (0.762) | ||||

| ΔROA×CSR×DD | 0.2053 | (0.077)* | ||||

| ΔTotal asset | 0.0194 | (0.884) | 0.1492 | (0.242) | 0.0951 | (0.293) |

| ΔSales | 0.3412 | (0.020)** | 0.5304 | (0.000)*** | 0.4023 | (0.000)*** |

| Δ Industry mean Earnings | -0.0058 | (0.416) | -0.0058 | (0.429) | -0.0050 | (0.322) |

| Industry Dummies | Yes | Yes | Yes | |||

| Year Dummies | Yes | Yes | Yes | |||

| R2 | 0.0863 | 0.0866 | 0.0956 | |||

| Adjusted R2 | 0.0473 | 0.0390 | 0.0732 | |||

| N | 1,613 | 1,335 | 2,948 | |||

Note: The p-values are reported in parentheses, *** & * indicate statistical significance at the 1% and 10% level, respectively.

| Table 3b The Impact Of Csr On Asymmetric Pps Of Ceo Compensation |

||||||

| Dependent Variable: Change in CEO Bonus | ||||||

| Independent variables | 4 | 5 | 6 | |||

| ROA using income before extraordinary items (IB) | ||||||

| Positive Earnings | Negative Earnings | Entire Sample | ||||

| Intercept | 0.1107 | (0.425) | -0.1323 | (0.363) | 0.0645 | (0.521) |

| ΔROA | 0.1127 | (0.003)*** | -0.0312 | (0.446) | 0.1124 | (0.003)*** |

| CSR | 0.0061 | (0.885) | 0.0238 | (0.625) | 0.0243 | (0.554) |

| ΔROA × CSR | -0.0759 | (0.199) | 0.1224 | (0.093)* | -0.0767 | (0.192) |

| DD | -0.1970 | (0.000)*** | ||||

| ΔROA × DD | -0.1614 | (0.004)*** | ||||

| CSR × DD | 0.0077 | (0.901) | ||||

| ΔROA × CSR × DD | 0.2313 | (0.012)** | ||||

| Δ Total asset | 0.0903 | (0.489) | 0.1599 | (0.207) | 0.1231 | (0.169) |

| Δ Sales | 0.2997 | (0.041)** | 0.5690 | (0.000)*** | 0.3893 | (0.000)*** |

| Δ Industry mean Earnings | -0.0060 | (0.385) | -0.0047 | (0.526) | -0.0045 | (0.367) |

| Industry Dummies | Yes | Yes | Yes | |||

| Year Dummies | Yes | Yes | Yes | |||

| R2 | 0.0912 | 0.0875 | 0.0993 | |||

| Adjusted R2 | 0.0530 | 0.0390 | 0.0771 | |||

| N | 1,638 | 1,310 | 2,948 | |||

Note: The p-values are reported in parentheses, *** & ** indicate statistical significance at the 1% and 5% level, respectively.

Models 4 through 6, with Income Before extraordinary items (IB) as earnings, also demonstrate qualitatively similar results. For positive IB subsample, the coefficients of ΔROA and ΔROA × CSR show positive and negative values, respectively, as expected. For negative IB subsample, it has find a negative coefficient of ΔROA, which implies that even though the firm performed poorly, the CEO received more bonus than the previous year. This represents a severe lack of monitoring and discipline of CEO. However, the coefficient of ΔROA × CSR is positively positive, which suggests that the CSR can mitigate this problem by increasing the low PPS. Model 6 with entire sample also corroborates our expectations and previous results with a significantly positive coefficient of ΔROA, a significantly negative coefficient of ΔROA × CSR for downward CEO compensation stickiness, and a significantly positive coefficient of ΔROA×CSR×DD, indicating again that the CSR mitigates the asymmetry in CEO compensation.

Robustness Tests

To make our results more robust, it was performed an additional test with another model to estimate compensation stickiness, following Jackson et al. (2008).

ΔPay = β0 + β1ΔPROA + β2ΔNROA + β3CSR + β4ΔPROA × CSR + β5ΔNROA × CSR + Controls + ε

In this equation, ΔPROA is ΔROA if ΔROA > 0 and zero otherwise. Likewise, ΔNROA is ΔROA if ΔROA < 0 and zero otherwise. As per the construction of this research, the significant difference between the estimates of β1 and β2 imply downward CEO compensation stickiness. If CSR decreases PPS for good performers and increases PPS for bad performers, as it was anticipated, then it is expected that β4 < 0 and β5 > 0. Table 4 shows the regression results of the model of Jackson et al., (2008), using both the net income (NI) and Income Before extraordinary items (IB) as earnings. Both models show different estimates for coefficients of ΔPROA and ΔNROA, even though both of them are positive. In more detail, when ROA is measured using NI, the positive ROA increases the CEO bonus by 22.25%, whereas the negative ROA decreases the CEO bonus merely by 9.42%. Moreover, as expected, the estimate of β4 (ΔPROA × CSR) is negative in both models, which implies that for good performers, CSR reduces PPS. The estimate of β5 (ΔNOA × CSR), however, is significantly negative. Thus, it can interpret that CSR has a different effect on the PPS for bad and good performers, which is consistent with previous regression results.

| Table 4 Jackson Et Al.’S (2008) Model |

||||

| Independent variables | Dependent variable: Change in CEO Bonus | |||

| 1 | 2 | |||

| ROA using NI | ROA using IB | |||

| Intercept | -0.0247 | (0.800) | -0.0316 | (0.748) |

| ΔPROA | 0.2225 | (0.000)*** | 0.1750 | (0.000)*** |

| ΔNROA | 0.0942 | (0.056)* | 0.0175 | (0.665) |

| CSR | 0.0187 | (0.584) | 0.0284 | (0.384) |

| ΔPROA × CSR | -0.0838 | (0.209) | -0.0780 | (0.160) |

| ΔNROA × CSR | 0.1322 | (0.080)* | 0.1582 | (0.022)** |

| Δ Total asset | 0.0818 | (0.366) | 0.0907 | (0.313) |

| Δ Sales | 0.4190 | (0.000)*** | 0.4552 | (0.000)*** |

| Δ Industry mean Earnings | -0.0052 | (0.302) | -0.0045 | (0.372) |

| Industry Dummies | Yes | Yes | ||

| Year Dummies | Yes | Yes | ||

| R2 | 0.0911 | 0.0868 | ||

| Adjusted R2 | 0.0693 | 0.0650 | ||

| N | 2,948 | 2,948 | ||

Note: This table reports the regression results of the impact of CSR on CEO compensation stickiness by using Jackson et al.’s (2008) regression model. The p-values are reported in parentheses. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively.

Discussion

Unlike the prior literature that support CSR decreases CEO's compensation in any circumstance, our empirical results show that CSR helps CEOs receive more compensation when their company's performance is not good. In other words, our results provide supporting evidence for CSR’s positive effect on CEO compensation, which has not been examined so far. Although prior studies focus that CSR have negative effect on CEO compensation, our empirical results imply that it is only applicable when a firm's performance is good. It shows that if a firm is not performing well, CEOs can receive more compensation by doing more CSR activities and CSR can be a tool for mitigating the asymmetry in CEO compensation.

Conclusion

The studies about whether CSR improves corporate value are inconclusive. It was attempt to add new empirical evidence by examining the effect of CSR on CEOs’ compensation system. Particularly, it was focus on the association between CSR and asymmetric PPS of CEO bonus compensation. The results address that CSR reduces the high PPS for good performers but not for poor performers. Our results remain robust with using an alternative research model. Overall, our results imply that CSR helps firms mitigate the downward stickiness in CEO compensation, which benefits the shareholders and the firm value.

Acknowledgement

This work was supported by the Ministry of Education of the Republic of Korea and the National Research Foundation of Korea (NRF-2018S1A5A8027012). The corresponding author is Kyung Jin Park.

References

- Abowd, J.M. (1990). Does performance-based managerial compensation affect corporate performance?ILR Review,43(3), 52-S.

- Adut, D., Cready, W.H., & Lopez, T.J. (2003). Restructuring charges and CEO cash compensation: A reexamination.The Accounting Review,78(1), 169-192.

- Aggarwal, R.K., & Samwick, A.A. (1999). Executive compensation, strategic competition, and relative performance evaluation: Theory and evidence.The Journal of Finance,54(6), 1999-2043.

- Aguilera, R.V., Rupp, D.E., Williams, C.A., & Ganapathi, J. (2007). Putting the S back in corporate social responsibility: A multilevel theory of social change in organizations.Academy of Management Review,32(3), 836-863.

- Alchian, A.A., & Demsetz, H. (1972). Production, information costs, and economic organization.The American Economic Review,62(5), 777-795.

- Anderson, M.C., Banker, R.D., & Janakiraman, S.N. (2003). Are selling, general, and administrative costs sticky?Journal of Accounting Research,41(1), 47-63.

- Aupperle, K.E., Carroll, A.B., & Hatfield, J.D. (1985). An empirical examination of the relationship between corporate social responsibility and profitability.Academy of Management Journal,28(2), 446-463.

- Baber, W.R., Kang, S.H., & Kumar, K.R. (1999). The explanatory power of earnings levels vs. earnings changes in the context of executive compensation.The Accounting Review,74(4), 459-472.

- Barnea, A., & Rubin, A. (2010). Corporate social responsibility as a conflict between shareholders.Journal of Business Ethics,97(1), 71-86.

- Bebchuk, L., & Fried, J. (2004).Pay without performance. Cambridge, MA: Harvard University Press.

- Becchetti, L., & Ciciretti, R. (2009). Corporate social responsibility and stock market performance.Applied Financial Economics,19(16), 1283-1293.

- Bloom, P.N., Hoeffler, S., Keller, K.L., & Meza, C.E.B. (2006). How social-cause marketing affects consumer perceptions. MIT Sloan Management Review, 47(2), 49.

- Brammer, S., & Millington, A. (2005). Corporate reputation and philanthropy: An empirical analysis. Journal of Business Ethics, 61(1), 29-44.

- Brammer, S., Brooks, C., & Pavelin, S. (2006). Corporate social performance and stock returns: UK evidence from disaggregate measures.Financial Management,35(3), 97-116.

- Cai, Y., Jo, H., & Pan, C. (2011). Vice or virtue? The impact of corporate social responsibility on executive compensation.Journal of Business Ethics,104(2), 159-173.

- Calton, J.M., & Payne, S.L. (2003). Coping with paradox: Multistakeholder learning dialogue as a pluralist sensemaking process for addressing messy problems.Business & Society,42(1), 7-42.

- Cheng, B., Ioannou, I., & Serafeim, G. (2014). Corporate social responsibility and access to finance. Strategic Management Journal, 35(1), 1-23.

- Chih, H.L., Shen, C.H., & Kang, F.C. (2008). Corporate social responsibility, investor protection, and earnings management: Some international evidence.Journal of Business Ethics,79(2), 179-198.

- Coase, R.H. (1937). The nature of the firm. Economica, 4(16), 386-405.

- Cornell, B., & Shapiro, A. C. (1987). Corporate stakeholders and corporate finance. Financial Management, 5-14.

- Cronqvist, H., Heyman, F., Nilsson, M., Svaleryd, H., & Vlachos, J. (2009). Do entrenched managers pay their workers more? The Journal of Finance, 64(1), 309-339.

- Dechow, P.M., Huson, M.R., & Sloan, R.G. (1994). The effect of restructuring charges on executives' cash compensation. Accounting Review, 138-156.

- Deng, X., Kang, J.K., & Low, B.S. (2013). Corporate social responsibility and stakeholder value maximization: Evidence from mergers.Journal of Financial Economics,110(1), 87-109.

- Dhaliwal, D.S., Li, O.Z., Tsang, A., & Yang, Y.G. (2011). Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting.The Accounting Review,86(1), 59-100.

- Dhaliwal, D.S., Radhakrishnan, S., Tsang, A., & Yang, Y.G. (2012). Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility disclosure. The Accounting Review, 87(3), 723-759.

- Donaldson, T., & Preston, L.E. (1995). The stakeholder theory of the corporation: Concepts, evidence, and implications.Academy of Management Review,20(1), 65-91.

- Duru, A., Iyengar, R.J., & Thevaranjan, A. (2002). The shielding of CEO compensation from the effects of strategic expenditures.Contemporary Accounting Research,19(2), 175-193.

- Freeman, R.E. (2010).Strategic management: A stakeholder approach. Cambridge university press.

- Gaver, J.J., & Gaver, K.M. (1998). The relation between nonrecurring accounting transactions and CEO cash compensation.Accounting Review, 235-253.

- Godfrey, P.C. (2005). The relationship between corporate philanthropy and shareholder wealth: A risk management perspective.Academy of Management Review,30(4), 777-798.

- Griffin, J.J., & Mahon, J.F. (1997). The corporate social performance and corporate financial performance debate: Twenty-five years of incomparable research.Business & Society,36(1), 5-31.

- Hall, B.J., & Liebman, J.B. (1998). Are CEOs really paid like bureaucrats?The Quarterly Journal of Economics,113(3), 653-691.

- Harjoto, M.A., & Jo, H. (2011). Corporate governance and CSR nexus.Journal of Business Ethics,100(1), 45-67.

- Harrison, J.S., & Freeman, R.E. (1999). Stakeholders, social responsibility, and performance: Empirical evidence and theoretical perspectives. Academy of Management Journal, 42(5), 479-485.

- Hill, C.W., & Jones, T.M. (1992). Stakeholder‐agency theory. Journal of Management Studies, 29(2), 131-154.

- Husted, B.W. (2005). Risk management, real options, corporate social responsibility.Journal of Business Ethics,60(2), 175-183.

- Iyengar, V.R., Heaston, B.A., Hoying, J.F., Shal, D.A., Dellinger, D.D., Jundi, K.M., & Lukuc, M.R. (2005).U.S. Patent No. 6,892,864. Washington, DC: U.S. Patent and Trademark Office.

- Jackson, S.B., Lopez, T.J., & Reitenga, A.L. (2008). Accounting fundamentals and CEO bonus compensation.Journal of Accounting and Public Policy,27(5), 374-393.

- Jensen, M.C. (2002). Value maximization, stakeholder theory, and the corporate objective function.Business Ethics Quarterly, 235-256.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure.Journal of Financial Economics,3(4), 305-360.

- Jensen, M.C., & Murphy, K.J. (1990). Performance pay and top-management incentives.Journal of Political Economy,98(2), 225-264.

- Kane, E.J. (2002). Using deferred compensation to strengthen the ethics of financial regulation.Journal of Banking & Finance,26(9), 1919-1933.

- Kim, Y., Park, M.S., & Wier, B. (2012). Is earnings quality associated with corporate social responsibility? The Accounting Review, 87(3), 761-796.

- Lambert, R.A., & Larcker, D.F. (1987). An analysis of the use of accounting and market measures of performance in executive compensation contracts.Journal of Accounting Research, 85-125.

- Mahoney, L.S., & Thorne, L. (2005). Corporate social responsibility and long-term compensation: Evidence from Canada.Journal of Business Ethics,57(3), 241-253.

- Matolcsy, Z., & Wright, A. (2011). CEO compensation structure and firm performance.Accounting & Finance,51(3), 745-763.

- Matsunaga, S.R., & Park, C.W. (2001). The effect of missing a quarterly earnings benchmark on the CEO's annual bonus.The Accounting Review,76(3), 313-332.

- Menon, S., & Kahn, B.E. (2003). Corporate sponsorships of philanthropic activities: when do they impact perception of sponsor brand?Journal of Consumer Psychology,13(3), 316-327.

- Orlitzky, M., Schmidt, F.L., & Rynes, S.L. (2003). Corporate social and financial performance: A meta-analysis.Organization Studies,24(3), 403-441.

- Pagano, M., & Volpin, P.F. (2005). Managers, workers and corporate control.The Journal of Finance,60(2), 841-868.

- Porter, M.E., & Kramer, M.R. (2002). The competitive advantage of corporate philanthropy. Harvard Business Review, 80(12), 56-68.

- Richardson, A.J., & Welker, M. (2001). Social disclosure, financial disclosure and the cost of equity capital.Accounting, Organizations and Society,26(7-8), 597-616.

- Saiia, D.H., Carroll, A.B., & Buchholtz, A.K. (2003). Philanthropy as strategy: When corporate charity begins at home.Business & Society,42(2), 169-201.

- Scherer, A.G., Palazzo, G., & Baumann, D. (2006). Global rules and private actors: Toward a new role of the transnational corporation in global governance.Business Ethics Quarterly,16(4), 505-532.

- Sloan, R.G. (1993). Accounting earnings and top executive compensation.Journal of Accounting and Economics,16(1-3), 55-100.

- Sun, W., & Cui, K. (2014). Linking corporate social responsibility to firm default risk.European Management Journal,32(2), 275-287.

- Surroca, J., & Tribó, J.A. (2008). Managerial entrenchment and corporate social performance. Journal of Business Finance & Accounting, 35(6), 748-789.

- Tuzzolino, F., & Armandi, B.R. (1981). A need-hierarchy framework for assessing corporate social responsibility.Academy of Management Review,6(1), 21-28.

- Valentine, S., & Fleischman, G. (2008). Ethics programs, perceived corporate social responsibility and job satisfaction. Journal of Business Ethics, 77(2), 159-172.

- Vance, S.C. (1975). Are socially responsible corporations good investment risks.Management Review,64(8), 19-24.

- Waddock, S.A., & Graves, S.B. (1997). The corporate social performance–financial performance link.Strategic Management Journal,18(4), 303-319.

- Wood, D.J. (1991). Corporate social performance revisited.Academy of Management Review,16(4), 691-718.

- Yang, D., & Mo, K. (2018). Institutional monitoring of sticky CEO compensation. Journal of Applied Business Research, 34(2), 309-324.