Research Article: 2023 Vol: 29 Issue: 2S

The Impact of Covid-19 Virus on Banking Performance

Ammar Imad Khalaf Halboosh, University of Basrah-Iraq

Ali Sh. Abdeol. Wahab, University of Basrah-Iraq

Citation Information: Khalaf Halboosh, A.I., & Wahab, A.S.A. (2022). The impact of covid-19 virus on banking performance. Academy of Entrepreneurship Journal, 28(S2), 1-15.

Abstract

This paper evaluates the consequences of the Covid-19 pandemic on Europe, Asian banks and countries with oil as well it reviews bank stock bills from all around the world in order to assess the impact of the Pandemic on the banking industry. In addition, it studies the influence of finance sector strategical announcements on the performance of bank stocks. Generally, the outcomes indicate that the crisis and the countercyclical lending role that banks are anticipated to play have put banking systems under substantial strain, with bank stocks underachieving their local markets and other non-banking financial companies. Policy initiatives have had varying degrees of success. Recently, the banking system has adjusted constantly – it has been reinvented to keep up with remotsuc prospects and the requisite for cost reductions. The Pandemic has hastened digitalization in the banking system although, the need for innovation and digital strategies have been an important factor in banking even euotcu the Pandemic.

Keywords

Banking Performance, Banking Systems, Impact of Covid-19.

Introduction

The coronavirus pandemic differs from previous pandemics in that globalization and interconnectedness between countries play a crucial role in this outbreak. Nevertheless, the infection is spreading at a much quicker ratio at the moment. While globalization has a beneficial impact on employment and economic growth, a large number of confirmed COVID-19 cases has a detrimental impact may manifest itself during a pandemic disease. Almost every country in the world has been affected by the pandemic, which has spread fast and put strain on health and economic systems. The impact of this Pandemic might be bigger than that of the previous calamity, but it is still too early to tell. It has disrupted many financial and doouroua firms and families, as well as the related vagueness. In March 2020, the United States Treasury market likewise revealed anxiety. Corporate bond markets and money market capitals were also severely stressed. Most importantly, financial markets quickly recovered.

Banks are a vital economic llpp dc , and the management practices they employ have an impact on the economy's recovery amid the Pandemic. Banks have a substantial part in ohu

economy since they support local and foreign trade. Any major disturbance in this system would

eaaucpdu bad consequences on the entire society. Trust is essential to the smooth running of the financial system and the economy in this sector.

The banking system has always been at the heart of crises. Yet, Because we are dealing with a crisis involving universal health concerns, the crisis has a distinct impact. In previous crises, banks were seen as part of the issue, but this time they are seen as part of the solution. This approach raises banks' importance in the Covid-19 crisis, and bank initiatives affect the whole economy. The epidemic has completely altered the global economy and has had a significant impact on the majority of enterprises. The banking system is critical in this situation because it is a critical component from an economic standpoint. The banking system has consistently altered in recent years It has been rebuilt to meet client requirements as well as cost-cutting demands. The Pandemic has pushed the banking industry's digitalization, uoua ohte hh the need for innovation and digital policies was an aspect in banking afore the Pandemic (Berger & Humphrey, 1997).

Moreover, Banks are a crucial economic leader, and their management strategies have an influence on the economy's recovery after the Pandemic. Banks play a significant role in the economy since they facilitate both internal and international trade. The global banking system is expected to be strained as a result of the crisis and banks' countercyclical advancing role., having various impacts dependent on their features and pre-crisis vulnerabilities. Henceforth, the current study set forward the following questions:

• How has the world economy was affected by the Covid-19 pandemic?

• What are the fruitful methods that banks have taken to confront the Pandemic?

• How hdou the banks' performance changed before and after COVID-19?

Besides, the descriptive study is used in this research paper. Descriptive research is one in which information is gathered without causing any changes to the environment.

Study Objective

The purpose of this article is to explore banking strategies used during complicated crises in oil-producing countries, as well as in Europe and Asia, with an emphasis on the current Pandemic. It compiles the available information and correlates public materials on the banking sector's response to COVID-19. The purpose is to determine how the banking sector can deal with complex crises and how complex crises put banking management practices to the test. Furthermore, this paper will look at how the banking system was before and after COVID-19. The study examines whether the banking system was stronger and better constituted before the Pandemic, as well as recapping the lessons learnt from the last crises.

In the present study, the database was built by doing a thorough search for all relevant material on the financial system implications of the COVID-19 pandemic. Information was gathered via reading scientific journals, company audit reports, and expert opinions in order to address the expected questions. A literature search was conducted using the following keywords to classify these articles: Pandemic of COVID-19, banking methods, crisis, and financial catastrophe, performance.

This page provides readers with the latest recent information about the Pandemic's economic impact, notably the banking system. Articles were chosen, and then a decision was made on which ones to include in the analysis based on the abstracts, articles, and notes taken. A set of - olou otuaou articles is collected and only relevant articles were selected for the study. We selected articles for this paper based on our aims and research questions, and then created an overview of the most noteworthy works on the topic, as shown in Figure 1:

Literature Review

Regarding the notion of banking performance, the achievement of the firm's objectives within the agreed-upon time period and at the lowest feasible cost while employing current finances is referred to as results. For example, a director's performance may be stated as “profitability” or “competitiveness” for the firm or the employee, the work environment, or the client's satisfaction with the services provided. The variety of alternative methods stemmed from the concept dictated by the multiplicity of groups that comprise an organization. Profitability Ratios as a Tool for Measuring Bank Performance Several writers defined corporate financial performance using the ROA and ROE metrics.

While for Asset’s Return, this inconstancy indicates funds rent-ability used and expresses these funds' ability to provide a particular degree of working profits. As many authors, including Adams and Santos (2005) as well as Eisenberg et al., have employed this measurement (Eisenberg, 1998). The measurement for calculating ROA that will be used throughout this investigation is as follows:

ROA=net income / total assets

Return on Equity

The financial profitability coefficient is another name for this ratio. It is recognized as one of the most widely utilized financial indicators for evaluating bank performance. It demonstrates the role of equality in the achievement of the desired goal. It quantifies, in certain ways, return level of the investor; that is, the higher it is, the more efficiently the money allocated lm employed to generate a good outcome. Numerous writers, including Bouri and Bouaziz, have employed this performance metric (2007).

Efficiency as a tool for measuring bank performance

Efficiency is defined as an inner evaluation of corporate performance; it is typically evaluated by cost, production, income and it is measured by the aeseuc of funds required to generate an entity of products or services. In other words, it is the capacity to utilize as out

resources as feasible to attain a certain degree of efficiency. It evaluates the lack of waste in resource utilization. Therefore, efficiency assesses banks' productive performance as well as their financial performance.

Yet, the character of what is operative determines its efficacy. It is the ability to achieve the desired or expected outcome in order to achieve the objective. Goals can be broken down into one or more categories, such as time, number, cost, quality, and profitability. Effectiveness is also a characteristic of someone who completes a task successfully and meets the objectives set out. Efficacy is one of the attributes used by managers to assess employees in the workplace. two non-parametric approaches Bourke (1989) investigated the performance of banks in twelve European, North American, and Australian nations from 1972 to 1981. He discovered that concentration, liquidity, inflation, and size all had a favorable impact on bank performance and profitability. Molyneux and Thornton's (1992) study replicates Bourke's methods (1989). Between 1986 and 1989, they investigated the factors of banking performance in eighteen European nations. Bourke's observations were validated by the outcomes.

So far, an investigated profitability of 584 commercial domestic and international banks working in the fifteen European Union countries from 1995 to 2001 using return on average assets (ROAA). The findings reveal that the profitability of both local and foreign banks in the European Union is influenced by the bank's unique features (volume, capital adequacy, administrative efficiency), monetary market organization, and macroeconomic conditions (inflation and the real gross domestic product [GDP] growth).

Furthermore, From 1985 to 2001, investigated the impact of bank-specific, industry-specific, and macroeconomic variables on Greek bank profitability. Except for bank size, all bank-specific determinants had a significant influence on bank profitability, according to the estimation findings, bank profitability is unaffected by concentration and ownership.

Covid-19 Impact on Banking System

As it is displayed in the below Figure 2:

This disease has the same worldwide economic impact as a significant banking crisis, producing uncertainty, increasing poverty, and halting most commercial operations. Banking crises are frequently linked to temporary but severe reductions in economic development and prosperity. It is crucial to emphasize that the year after a financial crisis sees a considerable drop in economic growth, with the negative impact on the economy lasting for years, meaning that earlier banking crises have major economic consequences today. Furthermore, Europe is on the risk of collapsing.The COVID-19 crisis increased the sense of urgency, reiterating Jean Monnet's warning that Europe would be put to the test during a crisis.

The banking industry is undergoing a transformation important part of the economy since it provides services that affect people's daily lives. Banks provide financial stability and security to individuals and families. Savings are encouraged and invested in ways that assist the economy expand when the banking sector is robust. It's a trying moment that has ramifications not simply financially but also psychologically. The fact that the job offer now outnumbers the need is one of the most fundamental developments brought about by the COVID-19 outbreak. However, in this situation, firms must operate with prudence., taking into account the problematic social climate as well as the tight psychological ones. Furthermore, the pandemic is having an effect on stock market indices in general.

During this time of predicament, banks play an important role in helping the population cope with the pandemic by aiding the government, small and big businesses, and individuals. Banks must adapt to the difficulties provided by the COVID-19 pandemic in order to contribute to the resilience of enterprises, individuals, and other organizations.. However, the effectiveness of a bank-supported economic recovery is dependent on banks' resilience and financial soundness. Loan default losses and increases in risk-weighted assets will reduce banks' capital.

The COVID-19 outbreak is affecting many aspects of the banking industry, including how they operate, new activities, and procedures. Due to the vital significance of banking services, they were unable to close all of their branches and ensure people's access to financial resources. Approximately a quarter of bank branches in numerous countries and territories have closed due to employee safety, personnel shortages, and lower general commerce during the outbreak.. Many of the remaining 75% work shorter hours and with fewer staff. (KPMG, 2020b). They must concentrate on the plan that will define their destiny despite all of the concerns swirling around them. As a result, they must prioritise survival concerns in their business continuity planning, Adjusting branch hours, personnel mix, and times, moving in-branch visits to appointment-only, and temporarily shutting some branches are just some of the options available (PwC, 2020b). All of these changes in how they function will surely affect the financial sector's future.

Banks with significant loan publicity, Specifically, export-oriented industries and small businesses may see considerable increases in regulatory rates during or after the epidemic. (Barua, 2021). Another factor to evaluate is borrowers' performance and capacity to meet their credit commitments (Disemadi & Shaleh, 2020). Many people have had financial difficulties as a result of the COVID-19 epidemic, which rda undermine the banking system's performance.

The COVID-19 pandemic could be the most significant financial sector threat in recent history. It has caused the world to shift toward banking ot continue normal transactions such as paying bills, buying groceries, and shopping for goods. The banking industry has adjusted some of its old practices and is now looking for new ways to make life easier for clients.

In addition, the internet and banking applications have played an important role in the development of new payment methods. Online banking and payments are a quick and easy way to conduct business. This speedier digitalization will continue to grow, especially because uncertainty is strong right now, and traditional or conventional banks are more vulnerable to a big decline in loan volume, whereas major banks are better equipped. Because technology advancement and digitization make financial services more available to customers, customers respect a need-based sales strategy. The willingness of a bank to innovate has a positive impact on purchasing intentions. Banks must emphasise digital transformation and transfer of traditional banking services under these circumstances, as this does not happen on its own.

According to Capgemini's World Retail Banking Report 2020, digital banking services are now preferred by 57% of clients, up from 49% prior to the epidemic. The financial industry, on the other hand, will take time to modify and reform. Some people feel that new trends and technology will eventually replace current banks, while others believe that technology will help and improve existing financial institutions. The entire banking sector, on the other hand, will make the shift to a more integrated and digital organization. Banks must continue to develop these techniques, as the trend toward digitization has reached previously unreceptive demographics, such as the elderly or people living in remote areas. Asian banks are a fantastic illustration because of this since they have hastened the launch and growth of digital consumer services while avoiding severe customer communication issues.

Furthermore, liquidity risk assessments appear to be reduced when liquidity assistance measures are implemented. When liquidity support measures were announced, smaller banks and governmental entities also reported huge anomalous profits. As seen by bank stock outperformance surrounding these events, access to central bank refinancing and initiatives to address bank funding constraints appear to have had a calming effect on markets throughout the crisis. Negative abnormal returns in bank equities, on the other hand, are linked to countercyclical prudential actions. Banks can drain some of their reserves according to prudential measures. They also send a strong message about policymakers' determination to reduce the pandemic's economic impact. However, the fact that bank stock values drop when these actions are proposed suggests that they will be implemented (Claessens, 2005).

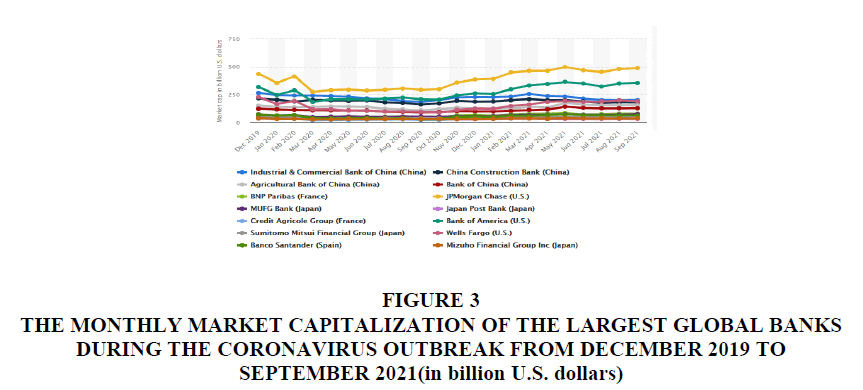

At the end, the outcomes of financial policy pronouncements are vaguer. While such statements haven't been related to a rise in bank stock prices as a whole, they have been associated to a rise in individual bank stock prices, both policy rate reduction and corporate purchases appeared to diminish the liquidity premium. That is, banks with weaker fluidity experienced better stock returns during the announcement period. The assumption suggests that profit rate policy, as well as quantitative easing, remained important tools at the start of the crisis, as markets became more comfortable with these measures following the 2008 global financial crisis (GFC) (Reinhart, 2009). This is illustrated by the Figure 3.

Figure 3:The Monthly Market Capitalization Of The Largest Global Banks During The Coronavirus Outbreak From December 2019 to September 2021(in billion u.s. Dollars).

Measures taken by banks

We can't deny that the economic stop was a huge surprise to the business, which had to ascent for cash to pay operational costs due to the revenue gap. The financial sector, and particularly banks, are expected to play a critical role in absorbing the shock by providing much-needed funding. Central banks and governments implemented a wide range of policy actions under these unprecedented conditions.

While some policies tried to prevent the rapid tightening of financial conditions in the short term, others aimed to increase the flow of credit to enterprises, either directly or through credit market intervention shows in Figure 3.

Whereas credit organizations are asked to have a significant countercyclical part in supporting the actual sector, their actions have muoucdp repercussions for the banking industry's future resilience. For instance, as lenders deplete their prevailing buffers, asset quality may decline, compromising the system's capability. The net effect of these policy actions on the banking sector is largely unknown because the crisis is projected to last even after the lockdowns are removed and economies begin to reopen.

The lack of liquidity in the early stages of the emergency was obvious, which was exacerbated by volatility in the securities and foreign exchange markets. We show that banks with lesser liquidity buffers suffered bigger price reductions than usual (especially in March), indicating an increase in the interbank liquidity premium. Furthermore, the combined shock arising from the price war between Russia and Saudi Arabia worsened bank stock price reductions, especially for lenders with significant exposure to the oil sector.

The epidemic will cut global GDP by 3.2 percent in 2020, according to economists at the International Monetary Fund (IMF). Advanced economies (AE) saw the biggest drop in GDP (4.6 percent), while it fell the least in emerging market (EM) countries (2.1%), including Emerging and Developing Europe (EDE) countries (2%). 2021) (International Monetary Fund). In the second quarter of 2020, the hospitality and tourism industry, retail, and commercial real estate markets all suffered the largest losses, with worldwide sales decreasing by 80%, 60%, and 50% year on year, respectively. (International Monetary Fund. 2020). According to different central banks, these negative processes spread to the financial sector, notably banks, resulting in a considerable tightening of lending policies as well as a worsening of the financial situation (European Central Bank, 2020). Customers' fear about the magnitude of the pandemic's spread contributed to a reduction in demand for financing, ohu current capital, and consumer goods and services. However, the weakening of the COVID-19 impact in the first half of 2021, along with improved economic activity, did not eliminate the high risk to which the banking industry is exposed (European Central Bank, 2021). Faced with thousands of new infections every day, many major world economies, such as the United Kingdom, have been forced to adopt harsh sanitary standards, which are likely to reduce the economic sustainability of enterprises and household incomes.

Uncertainty about how enterprises and, as a result, banks will react to potential changes in public aid regulations, the need to end credit holidays, and the spread of the pandemic prompts some to ask: What amount of credit losses will reduce banks' profits and equity to the point where they will fail to meet capital regulatory requirements? Furthermore, when studying the banking sector, it is vital to establish how banks of varied sizes, legal status, or locations of business operations are prepared for a shock reduction in loan portfolio quality.

Banks Performance

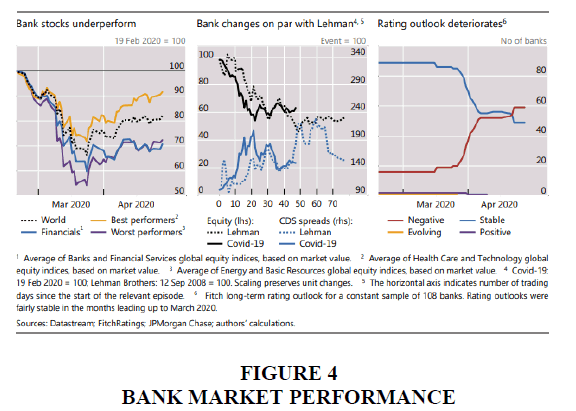

Over the first three months of the year, we compare the stock price returns of banks to those of their various home markets. As a result of the pandemic, bank and non-bank corporate performance began to worsen by mid-February, with declining trajectories that closely tracked each other. Business and bank stock values had fallen to less than 70% and 60% of their beginning-of-year levels, respectively, by late March. Non-bank firms proceeded to progressively improve their performance after that, achieving over 90% of their previous year's levels by the beginning of May. Banks, on the other hand, did not make such a recovery, with stock returns being 70% lower than they were at the start of the year. Markets expect this bank risk premium to rise.

This research further demonstrates that the reduction in stock prices is unique to banks and not to all financial firms, as investors appear to price in the excess pressure that the banking industry is feeling. The market's pricing of bank risk appears to differ across bank characteristics. Banks having larger exposure to the oil industry (i.e., those over the 75th percentile distribution of oil exposure) experienced lower returns following the COVID-19 crisis than banks with less exposure. Surprisingly, after the big decrease in stock prices in late March, the returns of smaller banks (i.e., institutions with less than the 2019 median mean assets) exceeded those of larger banks. Investors did not appear to price the extra risks more severely in poorly capitalized banks in terms of capital shows in Figure 4.

Not only in comparison to other firms, but also in comparison to prior crises, banks have suffered the most. Specifically, despite the recent partial recovery, the decline in bank stock prices is now on par with that experienced during the same luclta following the failure of Lehman Brothers in 2008 (Graph 1, above). The same can be said for the rise in CDS spreads. Banks' long-term rating outlooks have begun to deteriorate in line with these developments, reflecting concerns about the impact of Covid-19 on bank earnings.

The impact of COVID-19 on Arab Financial Systems

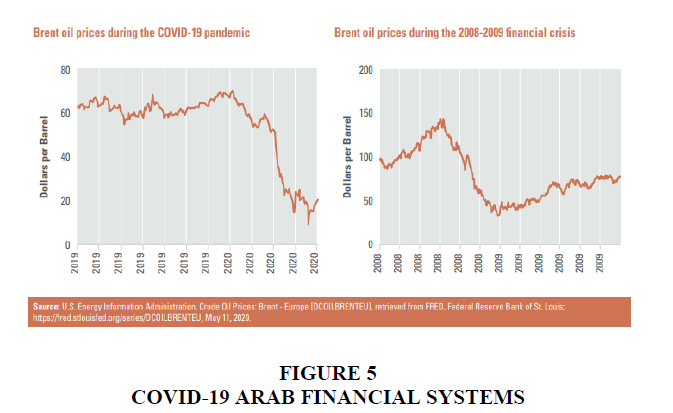

The cumulative effect of COVID-19 and an unprecedented decline in oil prices has put the financial systems of certain Arab countries on the verge of collapse. The Arab area is witnessing a historic reduction in demand for stocks and commodities, as well as tightening financial conditions, greater risk premiums, and weak banking sector resilience. This necessitates quick action by Arab governments and central banks to maintain financial sector liquidity and allow essential credit at whatever cost during the relief period, followed by additional financial measures throughout the recovery period shows in Figure 5.

Increased volatility in oil markets is predicted to diminish risk appetite and change capital market investments, particularly in oil-rich nations. When generated uncertainty during the first three weeks of post-peak is compared for both the period 2008-2009 and the present crisis, the variability in the current downturn is over ten times greater than that of the Great Recession. This high level of uncertainty is projected to produce an adverse investment climate, particularly in Gulf Cooperation Council (GCC) economies. Low oil prices will have an indirect impact on oil-poor economies through fewer-than-expected remittances and decreased tourism and investment from GCC countries.

Furthermore, as a result of the simultaneous danger of COVID-19 and rising oil prices, the Saudi economy and financial sector have been encountering challenges. The pandemic has caused severe asset quality degradation in Saudi banks, large losses in savings accounts, and increased demand for loans with little genuine desire to save. As a result, Saudi banking aggregate income in September 2020 declined by 28%, from SAR 34.77 billion in September 2019 to SAR 25.07 billion in September 2020 shows in Figure 6.

By the conclusion of the first quarter of 2020, major Arab stock markets had suffered a 23% average loss due to the collapse in oil prices and the COVID-19 epidemic. The COVID-19 epidemic and the drop in oil prices have devastated the stock market in Arab nations, bringing financial market performance below that of the 2008-2009 crash, particularly in oil-dependent economies. The GCC countries have suffered their worst capital market losses in decades, with the United Arab Emirates bearing the brunt of the burden. Non-GCC nations like Egypt, Morocco, and Tunisia are also in a dangerous position. Interruptions to vital economic activity, such as a drop in investment, tourism, and remittance inflows, as well as limited future development expectations, have resulted in an equally harsh stock market shock in these countries.

The efforts of the Global Central Bank

Many global central banks have reduced cash interest rates to maintain aggregate demand, including the Federal Reserve Board of The United States and the Central Bank of Canada, which reduced the cash exchange rate by half a percentage point on March 3, 2020, and the Bank of England in response to the virus's growing risk of money. In the same spirit, the Central Bank of Canada announced a 0.5 percentage point cash rate drop to strengthen Canada's economic immunity to COV just one day after the Federal Reserve of the United States lowered its interest rate. In addition, the People's Bank of China announced a stimulus package for commercial banks by 5.0 to 1 percentage points, allowing the equivalent of $79 billion to stimulate the national economy.

While the majority of global central banks have announced interest rate cuts, the ECB has been hesitant to respond to the COV outbreak with the same approach as the Federal Reserve, keeping interest rates unchanged at negative 0.5 per cent while the buyback rate has reached zero by relying on quantitative easing while keeping interest rates unchanged by pumping money through buy-back expansion. Government bonds and the purchase of €120 billion in private sector bonds by the end of 2020 have increased European banks' liquidity. Furthermore, the ECB has extended a package of loan facilities to European banks while encouraging SMEs to borrow at ptt - laoucumo rates. On March 18, 2020, the Bank additionally strengthened a credit facility in response to THE CORONA virus by giving 750 billion euros through an emergency financing program set up for this reason “Programme Purchase Emergency Pandemic” (PEPP) (European Central Bank, 2020).

Later, the US Federal Reserve noted the need to strengthen its response to the virus by lowering interest rates by half a percentage point and launching a $700 billion quantitative easing program that included the purchase of $500 billion in US Treasury bonds as well as securities as collateral for mortgages worth $200 billion. (Federal Reserve System 2020).

Monetary and Banking Sector

When the Central Bank publishes its monetary policy quantitative indicators, the channels for the transfer of ohu stauodcu policy to the real sector (interest rates, domestic credit, and asset prices) are launched, This has an effect on the growth of the economy and the rate of inflation. In this regard, In reaction to Virus Corona, the majority of governments throughout the globe have utilized monetary policy instruments, with some employing interest rates and the organization of open market operations, while others have used the legal monetary reserve ratio to improve merchant banks' capacity to award cash.

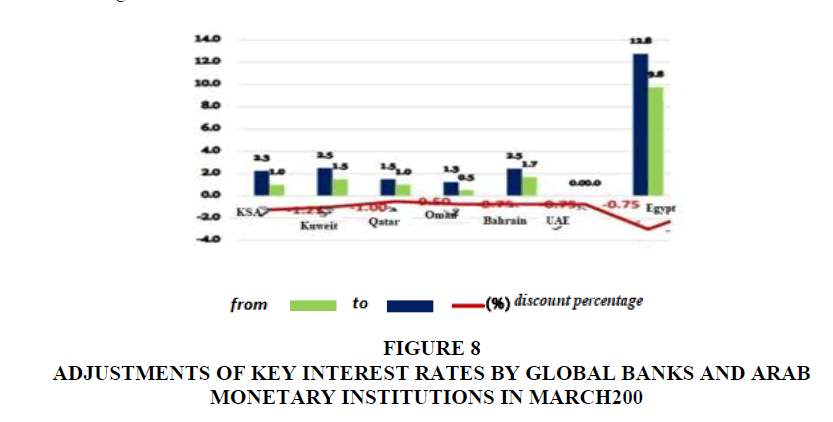

In this context, the majority of concentrated banks and Arab monetary institutions reduced monetary interest rates at the same time, with all rounds taking place in March 2020 and in similar proportions, bolstering liquidity levels that were impacted in 2019 by slowing economic activity in several Arab countries. Arab states, on the other hand, have adopted a monetary policy of saving to support domestic demand in the economy as well as banking sector liquidity, encouraging merchant banks to finance the private sector, small and medium-sized health-care projects, and businesses operating in sectors affected by the Virus Corona collapse, such as the services sector.

Central banks and Arab monetary organizations have also moved ahead ?supplied merchant banks with a package of incentives to lessen the impact of virus propagation on their clients, which will be detailed in the Arab nations study's next part. The influence of incentives on the financial safety indicators of the banking sector, as they relate to the quality of capital, the quality of assets, and profitability, as well as the scale of the hiccup in bank finance, as displayed by banks and differs between banks with a sovereign deficit and banks with a sovereign surplus, must be taken into account.

In comparison to those that had a deficit before to the Coronavirus pandemic, large banks with a sovereign surplus are required to give financial concessions and rewards to their consumers. For example, large banks (capital, asset quality, and liquidity) might give their consumers a luclta to repay easy-to-pay loan repayments. Longer periods cdahu from three to six months, but small and medium-sized banks will only pay out loan instalments to their consumers for a month to three months.

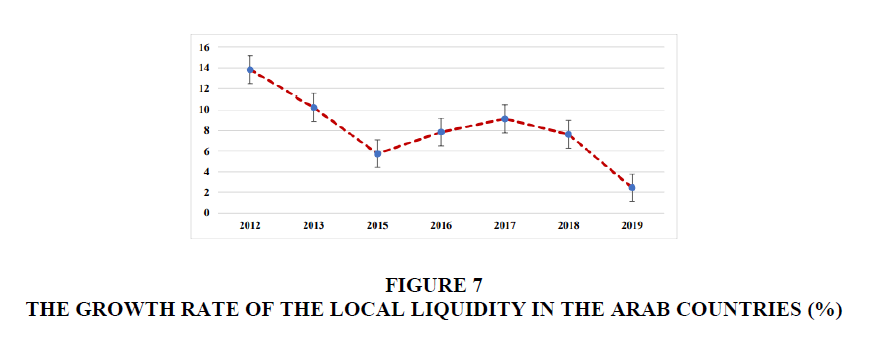

Stimulus Packages in Arab Countries

Coronavirus has been successfully combated by Arab central banks and monetary institutions. In response to the Corona crisis, Saudi Arabia adopted a $34.4 billion (16.5 percent of GDP) stimulus package in the first quarter of 2020 to support credit, liquidity, The authorities declared that they will pay 60% of the salary of Saudi private-sector employees, totalling 9 billion Saudi riyals, due to a lack of cash and the private sector shows in Figure 7.

In mid-April 2020, a package of further initiatives costing SAR 97.5 billion, or $26 billion, was approved, bringing the Kingdom's total packages to $4.60 billion, when the UAE announced a total stimulus package worth $76 billion (AED 238 billion, equivalent to about 19 per cent of GDP). 4.23 billion DW 75 billion Qatari riyals (equal to around 12% of GDP), and the Kuwaiti government has introduced legislation in parliament allowing for the employment of KD 500 million (equivalent to 6.1 billion USD) (4.1 per cent of GDP), Kuwait has also initiated an initiative with commercial banks to establish a financing fund of KD 10 million to address the issues of the CO-19 epidemic and reduce its spread, as well as support the Kuwaiti government's emergency and urgent finance needs in the face of the crisis. To combat the consequences of the virus on Bahrain's economy, the government issued incentive packages totalling BD 560 million, or 5.1 billion dollars. The measures, which span three months, include the payment of salaries to Bahrainis working in the private sector and the exemption of shops and small and medium-sized companies from government fees, and the Bahraini government plans to launch a $4.11 billion package equivalent to 3.4 billion dinars mhtcopu as a top priority to support the economy (IMF, 2020).

Egypt has also announced a series of actions worth EGP 100 billion, including the postponement of credit benefits for 6 months and the provision of credit facilities in this regard, as well as the exclusion of any support for temporary employment due to the spread of a virus of fines imposed as a result of non-payment, including corona. On April 3, 2020, the Egyptian government received $9.7 million from the World Bank to bolster the country's efforts to battle the Corona epidemic. The funds will be used to support Egypt's healthcare system development initiative, which aims to improve healthcare quality while also increasing demand. (World Bank, 2020).

Central Banks and Arab Monetary Institutions Efforts

Furthermore, the majority of central banks and Arab financial organizations have implemented expanding financial strategies by dropping profit rates, taking advantage of the Federal Reserve's two rounds of rate cuts. In this aspect, the Saudi Arabia Monetary Agency (SAMA) announced a 75 basis point decrease in the interest rate on purchase agreements (Saudi Arabian Monetary Agency, 2020), as well as a 75 basis point drop in the interest rate from 1.25 per cent to 0.50 per cent. In the face of the CORONA virus outbreak, SAMA sought financial stability.

The Central Bank of the United Arab Emirates has likewise made regulations to its several cash profit rates (United Arab Emirates Central Bank, 2020). It cuts the interest rate on his one-week deposit certificates by around 0.75 percentage ltlaom, uoua ohtehh his deposit certificates are the principal means through which changes in the banking system's monetary policy interest rates are transmitted. It also lowered the interest rate on coalition loans by around 50 basis points.. Furthermore, the Board of Directors of the Central Bank of the United Arab Emirates recommended a 50% reduction in the statutory reserve of on-demand deposits for all banks, from 14% to 7%. The United Arab Emirates' Central Bank contributed a total of 256 billion dirhams ($69.2 billion) in aid. A cash flow of up to AED 50 billion from central bank reserves would be used to offer loans and advances to banks operating in the country at no cost, backed by a guarantee. It is free of bank additional capital in addition to 50 billion dirhams. the bank's decision to reduce reserve requirements for all banks' on-demand deposits from 14% to 7% can be utilized to assist banks in lending to the UAE economy and managing liquidity. The Central Bank will continue to monitor the economic and financial situation and will be prepared to assist if necessary to help alleviate the situation crisis' impact (Arab Monetary Fund, 2020) shows in Figure 8.

Figure 8:Adjustments Of Key Interest Rates By Global Banks And Arab Monetary Institutions In March200 .

Conclusion

The COVID-19 crisis puts banks management approaches to the test, pushing managers to master new skills and develop courageous team members. Banks handled the mass move to remote working exceptionally effectively during this time, while maintaining a presence in offices for important functions. On a practical level, banks faced a number of difficulties, one of which was the deferral of lending rates for business clients after many requests to do so. The banking industry's digitalization operations have been accelerated, putting its durability and agility to the strain. Banks, according to the data, try to match customer expectations by launching new products and services. Furthermore, while no one can foretell the future, it is unquestionably necessary for organizations to modernize their IT infrastructure.

Apart from COVID-19's immediate and long-term implications, the financial sector has effectively completed the lockdown period. The banking business has a significant impact on the overall health of the economy. Infrastructure, education, technology, quality of life, and innovation are all improved by banks. The growth process's stability and long-term viability are critical. We live in a time where the rate at which things change is the only constant, and since banks are such an important part of economic progress, they have always been and will continue to be visible to the general population.

Recommendations

• As banks are at the heart of modern economies, bank restructuring strategies can have far-reaching political and economic consequences. This is especially crucial in these times when so many economies are failing and financial systems are under attack as a result of COVID-19.

• Bank restructuring is one of the most challenging challenges that policymakers face. Measures may be taken rapidly, and sometimes in the heat of a crisis, based on incomplete knowledge.

• Arab central banks should strive to provide appropriate liquidity to the financial sector at all costs during the relief and recovery periods. This approach will help banks to remain viable while also facilitating corporate financing, particularly to small and medium-sized businesses, ot avert major bankruptcies. Because of the lengthy uncertainty surrounding the COVID-19 epidemic, nations with flexible exchange rate regimes must accommodate low long-term interest rates. It is also critical that central banks' facilitation of extra liquidity outweighs substantial credit withdrawals by major enterprises and investors as a result of the widespread pandemic.

References

Arab Monetary Fund (2020). Arab Economic Outlook Report.

Barua, B., & Barua, S. (2021). COVID-19 implications for banks: Evidence from an emerging economy. SN Business & Economics, 1(1), 1-28.

Indexed at, Google Scholar, Cross Ref

Berger, A. & Humphrey, D.B..(1997)Efficiency of financial institutions: International survey and directions for future research. European Journal of Operational Research, 175–212.

Bourke, P. (1989). Concentration and other determinants of bank profitability in Europe, North America, and Australia. Journal of Banking & Finance, 13(1), 65-79.

Disemadi, H.S., & Shaleh, A.I. (2020). Banking credit restructuring policy amid COVID-19 pandemic in Indonesia. Journal Inovasi Ekonomi, 5(2), 63-70.

European Central Bank (2020). Our response to the coronavirus emergency. Available at: https://www.ecb.europa.eu/home/html/index.en.html

Federal Reserve System (2020). Available at: https://www.federalreserve.gov/newsevents/pressreleases/monetary20200323b.htm

Claessens, S., Klingebiel, D., & Laeven, L. (2005). Chris resolution, policies, and institutions: empirical evidence. In Systemic Financial Distress: Containment and Resolution. Cambridge: Cambridge University Press

European Central Bank. The Euro Area Bank Lending Survey. Fourth Quarter of 2020; European Central Bank: Frankfurt, Germany, 2020. Available online: https://www.ecb.europa.eu/stats/ecb_surveys/bank_lending_survey/html/ecb.blssurvey2020q4~{}e8 9c77d212.en.html (accessed on 15 August 2021)

European Central Bank. Financial Stability Review May 2021; European Central Bank: Frankfurt, Germany, 2021. Available online: https://www.ecb.europa.eu/pub/pdf/fsr/ecb.fsr202105~{}757f727fe4.en.pdf (accessed on 15 August 2021).

IMF (2020). https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19

International Monetary Fund. Global Financial Stability Report 2020; International Monetary Fund: Washington, DC, USA, 2020. Available online: https://www.imf.org/en/Publications/GFSR/Issues/2020/10/13/global-financial-stability-report-october2020 (accessed on 15 August 2021)

KPMG (2020b). A catalyst for change for bank branches https://home.kpmg/xx/en/blogs/home/posts/2020/04/a-catalyst-for-changefor-bank-branches.html

KPMG (2020b). A catalyst for change for bank branches https://home.kpmg/xx/en/blogs/home/posts/2020/04/a-catalyst-for-changefor-bank-branches.html

Molyneux, P., & Thornton, J. (1992). Determinants of European bank profitability: A note. Journal of Banking & Finance, 16(6), 1173-1178.

PwC (2020b). How retail banks can keep the lights on during the COVID-19 crisis- and recalibrate for the future. https://www.pwc.com/us/en/library/COVID19/coronavirus-impacts-retail-banking.html#content-free-1-afa8

Reinhart, C. M., & Rogoff, K. S. (2009). This time is different: Eight centuries of financial folly. Princeton University Press.

Saudi Arabian Monetary Agency (2020)," the bank's press release on the repercussions of the CORONA virus, and the policies it has taken in this regard. Available at: http://www.sama.gov.sa/ar-sa/News/Pages/allnews.aspx

United Arab Emirates Central Bank (2020)," the bank's press release on the repercussions of the CORONA virus, and the policies it has takenin this regard. Available at: https://centralbank.ae/ar/about-us

World Bank (2020), “Egypt: World Bank Provides US$7.9 Million in Support of Coronavirus Emergency Response”, April 2020. Available at: https://www.worldbank.org/en/news/press-release/2020/04/02/egyptworld-bank-provides-us79-million-in-support-of-coronavirus-covid-19-emergency-response

Received: 03-Dec-2022, Manuscript No. AEJ-22-12955; Editor assigned: 05-Dec-2022, PreQC No. AEJ-22-12955(PQ); Reviewed: 19-Dec-2022, QC No. AEJ-22-12955; Revised: 22-Dec-2022, Manuscript No. AEJ-22-12955(R); Published: 26-Dec-2022