Research Article: 2019 Vol: 23 Issue: 1

The Impact of Corporate Governance on Risk Disclosure: Jordanian Evidence

Amneh Alkurdi, Aqaba University for Technology, Jordan

Khaled Hussainey, University of Portsmouth, UK

Yasean Tahat, Gulf University for Science and Technology, Kuwait

Mohammad Aladwan, University of Jordan, Jordan

Abstract

This study explores the impact of Corporate Governance (CG) attributes on risk disclosure for a sample of Jordanian listed firms. The study employs two types of disclosure (voluntary and mandatory) and analyzed the firms’ annual reports for the period of 2008-2015 to extract risk-related disclosure information and CG variables. The study utilizes the Ordinary Least Squares (OLS) regression to carry out the current investigation. The findings indicate that CG attributes (including board size and independent board (non-executive directors), the separation of duties and audit committee meetings) have a statistically positive impact on Voluntary Risk Disclosure (VRD), while this was not the case with the managerial ownership attribute. Further, the results reveal that independent directors have had a significantly positive influence on Mandatory Risk Disclosure (MRD), and audit committee size has had a positive significant, effect on MRD. Finally, the findings show that leverage and profitability are among the determining factors of RD. The results suggest that firms’ managers, which exhibit greater compliance with mandatory regulations, have a greater propensity to publish RD.

Keywords

Corporate Governance, Risk Disclosure, Voluntary Disclosure, Mandatory Disclosure, IFRS 7, Jordan.

Introduction

Corporate Governance (CG) can protect stakeholders’ interest by introducing and strengthening business regulations which enhance accountability, integrity and transparency, ultimately, this can rationalize the decision-making process as well as mitigating the agency problem between the management and the shareholders. The Board of directors is one of the most powerful CG mechanisms to oversee a firm’s progress, enhance the quality of disclosure by monitoring and controlling the management’s activities and increasing a company’s alignment with its stakeholders (Beekes et al., 2004). From a macro level perspective, the boards of directors are to perform multiple functions by several means of its decisions and control system (Fama and Jensen, 1983) as to safeguard the public interest; guarantee stakeholders’ protection; and ensure transparency and compliance with business laws. Moreover, the board of directors is to manage the risk by sending good signals about a company’s financial performance and, thereby, increasing its legitimacy (Oliveira et al., 2011). Thus, the reliance on the existence of an efficient board of directors can balance between a company’s returns and risks. Consequently, facilitating the process of an effective supervision for the board of directors can benefit entities from their resources that are being managed efficiently (Al Attar, 2016).

The composition of board of directors can enhance the public confidence, reduce the information asymmetry between market participants, mitigate risks and enhance investment decision making (Al-Maghzom, 2016; Alsawalqa, 2014; Linsley and Shrives, 2006; Alkurdi et al., 2017). Further, prior research stressed the importance of RD for both corporations and investors. For corporations, RD provides great benefits in managing and reducing the cost of capital and, hence, increasing capital market activities and reducing the possibility of financial failure. These advantages can reduce the cost of external finance, generate trust and gain social legitimacy and improve a company’s stewardship (Linsley and Shrives, 2006; Kothari et al., 2009). On the other hand, RD can benefit investors by meeting their needs in assessing a company's financial performance, reducing their uncertainty about its future cash flows and improving the accuracy of security price forecasts (Hung & Subramanyam, 2007), hence, capital investment decisions is enhanced (Cabedo and Tirado, 2004; Miihkinen, 2013).

The current study examines the role of CG mechanisms in corporate RD for the Jordanian banks. This work is motivated by Al-Maghzom et al. (2016) recent review which suggested that the relationship between CG and RD is determined by some CG techniques including, the audit committee, board size, firm size and profitability. The choice of the banking sector as the sample is based on some rationales. First, Linsley & Shrives (2006) indicated that banks played a crucial role in a country’s business and economy; it is a high risk bearing sector that heavily relies on trust, hence, prior to the decision-making, investors, depositors, and business partners necessitate detailed information about risk measurement and management. Therefore, transparency and disclosure are important ingredients of the banking sector stability. The study is conducted in Jordan as a developing country with an emerging capital market that not only has a good potential for economic growth but, also, deals with serious political and economic risks.

The rest of the paper is structured as follows. Section 2 outlines the theoretical framework and discusses the literature review underpinning the current study. Section 3 discusses the research methodology and Section 4 summarizes the results of the empirical investigation. Finally, Section 5 concludes the paper, discusses the limitations and provides avenues for future research.

Theoretical Framework And Hypotheses Development

Risk Disclosure

Risk Disclosure (RD) has been defined as the communication of information concerning a firm’s strategies, operations and other external factors that do have the potential to affect its expected results, the disclosure of the firm specific variances of future cash flows (Jorgensen and Kirschenheiter, 2003) and the information that describes a firm’s major risks and their expected economic impacts on future performance (Miihkinen, 2013; Linsley and Shrives, 2006). More specifically, Hassan (2009) implied that RD is set of information communicated in financial statements dealing with managers’ estimates, judgments, reliance on market-based accounting policies such as impairment, derivative hedging, financial instruments, and fair value as well as the disclosure of concentrated operations, non-financial information about a firm’s plan, recruiting strategy, and other operational, economic, political and financial risks. In terms of classification, Popova et al. (2013) indicated that RD can be divided into Mandatory Risk Disclosure (MRD) which refers to the information that is required by the accounting and business regulations and Voluntary Risk Disclosure (VRD) which refer to the information that offers more explanation over and above the minimum requirements specified within RD-related regulations and accounting standards. In this regard, Miller (2004) argued that companies offer VRD for information users as to increase their global competitiveness.

Literature Review And Hypothesis Development

Previous literature argues that CG attributes can mitigate risk exposure by enhancing transparency and disclosure quality, protecting shareholders’ interest and monitoring management (Allini et al., 2016; Elshandidy and Neri, 2015; Al-Maghzom et al., 2016; Taylor et al., 2010). Elshandidy and Neri (2015) investigated risk disclosure and CG and found that strongly governed firms were more likely to provide more meaningful risk information to their investors as compared to weakly governed firms. This implies the importance of directors and encourages rather than mandates RD. Consistently; Allini et al. (2016) found that the effectiveness of CG within RD depends on the composition of the board of directors. In particular, there is a need for diversity within the board to mitigate the complexity of interests involved in the company's CG; as the board of directors is responsible for safeguarding the public interest in order to guarantee protection to stakeholders and to ensure transparency and compliance with the law. Prior studies investigated the relationship between the board characteristics and RD.

Elshandidy et al. (2013) and Oliveira et al. (2011) argued that greater disclosure by the board of directors signaled a greater ability to manage risk. Thus, the board of directors may use RD to signal their company’s good performance and to increase their legitimacy. Al-Maghzom et al. (2016) showed that banks with high outsider ownership, high regularity of audit committee meetings and mixed gender on the top management board of directors were more likely to demonstrate higher levels of VRD practices. Some studies pointed out those independent directors might help the board of directors to reduce information asymmetry and improve the quality of financial reporting (Abraham and Cox, 2007). In the Jordan environment (Mardini, 2015) investigated the impact of corporate governance mechanisms and company’s characteristics on level of voluntary disclosure provided by Jordanian banking within it period from 2007 to 2010 and concluded that there is no relationship between voluntary disclosure and corporate governance, but from the current study researchers point of view, it is believed that chose different period and used voluntary risk disclosure rather than mandatory area within period 2008-2015 may differed.

Board Size and Risk Disclosure

The board size is one of the CG mechanisms examined in prior research which underscored the importance of an effective CG for a proper function of businesses. In terms of the board size and RD, previous research pointed out that large boards are associated with greater amount of RD (Elshandidy and Neri, 2015; Gul and Leung, 2004). However, larger boards’ size does have negative impact on the effectiveness of the board of directors. In particular, Cheng & Courtenay (2006) and Allegrini and Greco (2013) pointed out that the more directors on the board the less efficient it would be at monitoring management resulting in less RD. Chen and Jaggi (2000) argued that a large number of directors on the board could mitigate the information asymmetry problem leading to more corporate disclosure. By contrast, some researches failed to find a significant association between the board size and RD (Cheng & Courtenay, 2006) and Coles et al. (2008) documented a negative relationship between board size and RD. Based on this argument, the first hypothesis is proposed:

H1: There is a positive relationship between the board size and both of VRD and MRD.

Independent Board (Non-Executive Directors)

The inclusion of independent directors on the board of directors is expected to have a significant influence on the board’s ability and effectiveness resulting in an enhanced RD as information asymmetry is reduced and the quality of financial reporting improved. However, there are various groups of insiders and outsiders within the board who affect the extent of corporate disclosure. For instance, independent directors represent the outsiders who are more likely to minimize agency problems and lower the demands for regulatory intervention in corporate disclosure (Abraham and Cox, 2007). In addition, independent directors can put pressure on management to release more information which enhances corporate disclosure by publishing more private information (Lopes and Rodrigues, 2007). In particular, the extant literature confirmed a statistically positive association between the proportion of independent directors and RD (Abraham and Cox, 2007; Elshandidy et al., 2013; Cheng & Courtenay, 2006; Li (2013). In keeping with this view, other empirical studies indicated that independence of the board was not related to RD (Lopes & Rodrigues, 2007; Eng and Mak, 2003; Gul & Leung, 2004). Accordingly, based on these arguments, we formulated the second hypothesis of the study as follows:

H2: There is a positive relationship between the independent (non-executive directors) and both of VRD and MRD.

Managerial Ownership

Management is deemed to be an independent professional party that operates the entity and maintains the owners’ interests. However, managers are presumed to have the incentive to provide more information to the public in order to achieve their own interests (Leung & Horwitz, 2004). Further, corporate managers may voluntarily disclose information at different levels of internal control for according to the cost-benefit analysis (Deumes and Knechel, 2008; Al- Maghzom et al., 2016). Prior research provided mixed findings about the impact of management ownership on RD. Konishi and Ali (2007) indicated that RD could not be published without the involvement of top management. Consistently, Oliveira et al. (2011) and Nagar et al. (2003) reported a strong positive relationship between managerial ownership and RD when the proportion of top management compensation is related to the company’s stock price used in compensation contracts. However, Akhtaruddin and Haron (2010) indicated a negative association between higher management shareholdings and RD; this suggests that less information would be disclosed in firms that were constituted with more share owning managers. By contrast, some studies indicated that higher insider ownership weakened the effect of disclosing more information as managers can decide on which and how much information to publish and/or hold (Baek et al., 2009). Based on previous argument the third hypothesis of the study is:

H3: There is a positive relationship between the managerial ownership and both of VRD and MRD.

Separation of Duties

The dual role occurs when the Chief Executive Officer (CEO) and the Chairman of the Board of directors are combined in the same position. Agency theory suggests the separation between the CEO and chairman positions in order to increase the effectiveness of the respective processes (Bolbol, 2012). The dual role Chairman of the Board may have an adverse effect on the effectiveness of the Board’s supervisory function by acting in favor of his/her own interest instead of shareholders’ ones (Firth et al., 2007). Fama and Jensen (1983) argued that the separation of the roles of CEO and the Chairman functions within a firm can reduce agency costs; enhance the firm’s performance; and provide the Board with strong powers that can improve the quality of information disclosed (Al-Janadi et al., 2013). Prior research suggested that such duality is associated with lower levels of VRD (Gul and Leung, 2004). The duality may have some advantages such as facilitating the transmission of information, reducing coordination costs; and avoiding the emergence of potential conflicts of interest between the two roles. Some studies reported a negative relationship between the duality and VRD (Cooke, 2002), while others found an insignificant association between (Ho and Wong, 2001). Hence, the fourth hypothesis is designed:

H4: There is a positive relationship between the non-duality and both of VRD and MRD.

Audit Committee Meeting

Regular meetings do have a fundamental impact on the audit committee’s function including the level of compliance, the achievement of responsibilities and the monitoring of financial reporting (Karamanou and Vafeas, 2005). In addition, Cheng & Courtenay (2006) affirmed that more meetings can reduce the risk of fraud. Allegrini and Greco (2013) reported a positive link between the regularity of audit committee meetings and corporate disclosure. Greco (2011) argued that the audit committee’s meeting frequency allowed members to express judgments about the firm’s accounting choice. The audit committee’s regular meetings can result in more informed decisions about accounting and auditing issues (Allegrini & Greco, 2013). Consequently, the present paper formulates the final hypothesis as follows:

H5: There is a positive relationship between the audit committee meetings and both of VRD and MRD.

Research Design

Sample and Data Collection

The final sample of the current study consists of all listed Jordanian banks (15 banks) over the period of 2008-2015. This period witnessed some developments in terms of CG and RD such as the introduction of CG code in Jordan in 2007, the adoption of both Basel II and IFRS 7 which organize firms’ risk disclosure. All banks’ annual reports were reviewed and analyzed in the current investigation. Annual reports are the main source of information that provides a historical record of the management in terms of risk management.

Method

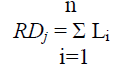

For MRD measurement, the researchers constructed an unweighted disclosure index based on IFRS 7 requirements. Thus, the number of items, included in this study’s index, was determined by the standard itself and subsequently assessed by the researchers (Bischof, 2009; Naser et al., 2006; Bamber and Mc-Meeking, 2010). Also unweighted index is adopted to measure the level of VRD items. This approach was adopted by many empirical studies examined voluntary risk reporting (Al-Maghzom et al., 2016; Deumes and Knechel, 2008; Abraham and Cox, 2007). According to the unweighted RD approach, a firm is scored (1) for an item disclosed in the annual report and (0) if it is not disclosed. Then, the total risk disclosure index is computed for each bank as a ratio of the total RD score to the bank’s maximum possible disclosure. Then, the RD index for each firm is expressed as a percentage. The index included a total of 28 items; 18 mandatory items and 10 voluntary items of RD respectively. Hence, we measured the level of RD using the following equation:

Where, L is one if the item i is disclosed and zero otherwise; n is number of items which has an upper limit of total RD*. Hence, the Percentage of Overall Risk Disclosure level (PORD) for each bank is measured as follows:

N is the total number of applicable to each firm.

(*) total disclosure score to the maximum possible disclosure by the bank.

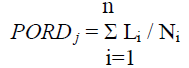

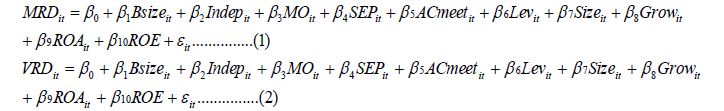

In terms of the independent variables, for CG variables measurement (Table 1). Following the previous literature of (Elshandidy et al., 2013; Elshandidy and Neri, 2015), we employed some control variables (Table 1). In order to test the association between RD and CG variables, the Ordinary Least Squares (OLS) regression model is designed as follows:

| Table 1 Variables Measurement |

||||

| Panel A: Board characteristics variables | ||||

| BSIZE | Board size | Number of board members | + | Annual report |

| INDEP | Independent directors | Number of non-executive directors on the board of directors | + | Annual report |

| MO | Managerial ownership | The percentage of shares held by board members | + | Annual report |

| SEP | separation | Dummy variable value of 1 if there is a separation between CEO and Chairman and zero otherwise | +/− | Annual report |

| ACMEET | Audit committee meetings | Number of audit committee meetings | + | Annual report |

| Panel B: Firm-specific characteristics | ||||

| LEV | leverage | Total liabilities to total assets ratio | + | Annual report |

| SIZE | Bank size | Natural logarithm of total assets | + | Annual report |

| GROW | Growth | The percentage of total assets for current year to previous year. | + | Annual report |

| ROA | Profitability ) | ROA (Return On Assets) | + | Annual report |

| ROE | Profitability ) | ROE (Return On Equity) | + | Annual report |

Where,

MRD: Mandatory risk disclosure score.

VRD: Voluntary risk disclosure score.

β0 : The intercept.

β1 to β10 : Regression coefficients for independent variables (Table 1 for explanation).

i: Bank.

t: Year.

To insure the reliability and validity of the disclosure index Cronbach’s Alpha is used to test the internal consistency for both the items and the categories included in the index. The results indicated that the coefficient for Cronbach’s Alpha was 0.76. We performed a construct validity test to assess the validity of this study’s disclosure index. This was done by examining the correlation between the percentage of the overall risk disclosure and a number of firm characteristics: namely, bank size, profitability and leverage. The correlation test results showed a positive and significant correlation between the level of RD and profitability p-values of less than 1%. On the other hand, there was a negative association between RD and leverage with a p-value of less than 5%.

Results

Descriptive Statistics

Table 2 provides a descriptive analysis for the variables examined in this study. A visual inspection of Table 2 reveals the MRD ranged from a minimum of 0.72 to maximum of 0.94 with a mean of 0.85; the VRD ranged from 0.30 to 0.80 with a mean of 0.57. Further; the average of board size is ranged between 7 and 15 directors with an average of 10 directors. This percentage shows banks’ commitment to the Central Bank of Jordan’s main requirements which state that the number of directors not fewer than 5 and not greater than 15. This conclusion is consisted with Al-Sraheen (2014) who stated that board size was better when it was around 9 to 11 members. Furthermore, Table 2 shows that the independent directors mean is 0.85 with a minimum of 0.45 and a maximum of 1. This shows bank's commitment about CG which states that there should be at least four independent members on the Board. A further inspection of Table 2 shows that the mean of managerial ownership was 0.35 with a minimum of 0.20 and a maximum of 0.98. This indicates that, through the high rates of ownership, the percentages of managerial ownership attempt to control the bank’s decisions; the separation of duties variable had a mean of 0.88. Finally, most of Jordanian listed banks indicated that the organizational structure of their Audit Committees met the requirements of Audit Committee effectiveness. Moreover, Table 2 outlines the control variables used in this study including bank size, profitability, leverage and growth Table 2 also shows Skewness and Kurtosis results which indicate that data were normally distributed. In this regard, Hair et al. (1998) argued that an appropriate range of Skewness illustrated was normal when values were between -1 and +1 while an appropriate range of Kurtosis ought to be between -3 and +3.

| Table 2 Descriptive Statistics |

|||||||

| Variables | Obs. | Minimum | Maximum | Mean | Std. Deviation | Skewness | Kurtosis |

| MRD | 120 | 0.72 | 0.94 | 0.85 | 0.051 | -0.302 | -0.606 |

| VRD | 120 | 0.3 | 0.8 | 0.57 | 0.096 | 0.296 | 0.107 |

| BSIZE | 120 | 7 | 15 | 10 | 1.818 | -0.475 | -0.201 |

| INDEP (%) | 120 | 0.45 | 1 | 0.85 | 0.129 | -1.03 | 0.896 |

| MO (%) | 120 | 0.2 | 0.98 | 0.35 | 31.21 | 0.471 | -0.988 |

| SEP | 120 | 0 | 1 | 0.88 | 0.322 | -2.419 | 3.914 |

| ACMEET | 120 | 2 | 16 | 5.95 | 3.022 | 1.807 | 2.876 |

| LEV | 120 | 0.151 | 0.92 | 0.82 | 0.135 | -3.916 | 15.615 |

| SIZE | 120 | 8.056 | 10.41 | 9.22 | 0.46 | 0.661 | 1.117 |

| GROWTH | 120 | 0.153 | 3.65 | 1.1 | 0.376 | 3.464 | 21.988 |

| ROA | 120 | 0 | 2.75 | 1.28 | 0.524 | -0.388 | 0.429 |

| ROE | 120 | 0 | 21.8 | 9.48 | 4.497 | 0.139 | 0.193 |

Correlation

Prior to multivariate tests, we investigate the correlation between variables examined in the current study to measure the strength and the direction of the linear relationships. Tables 3 (MRD) and 4 (VRD) report the Pearson correlation matrix between dependent variables and independent variables over eight years. The results of the correlation test reveals that MRD index has had significant and positive correlation with the proportion of independent directors and bank size at 0.203 and 0.393 respectively. On the other hand, there was a significant and negative correlation between managerial ownership and MRD at -0.275.

| Table 3 Pearson Correlation Matrix |

|||||||||||

| MRD | BSIZE | INDEP | MO | SEP | ACMEET | LEV | FSIZE | G | ROA | ROE | |

| MRD | 1 | ||||||||||

| BSIZE | 0.093 | 1 | |||||||||

| INDEP | 0.203* | 0.028 | 1 | ||||||||

| MO | -0.275** | -0.216** | -0.252** | 1 | |||||||

| SEP | -0.054 | -0.129 | 0.233** | 0.086 | 1 | ||||||

| ACMEET | -0.006 | 0.054 | -0.091 | -0.095 | -0.255** | 1 | |||||

| LEV | 0.061 | -0.076 | -0.07 | 0.202* | -0.079 | -0.115 | 1 | ||||

| SIZE | 0.393** | 0.272** | 0.184* | -0.169- | -0.248** | 0 | 0.246** | 1 | |||

| GROWTH | 0.003 | 0.164 | 0.09 | -0.112- | 0.01 | -0.141 | -0.075 | 0.14 | 1 | ||

| ROA | -0.019 | 0.027 | -0.067 | 0.181* | -0.154 | 0.05 | 0.155 | 0.038 | -0.021 | 1 | |

| ROE | 0.177 | 0.123 | 0.025 | -0.023 | -0.157 | 0.004 | 0.287** | 0.236** | -0.006 | 0.765** | 1 |

| Note: *significant at the 0.10% level; **Significant at the 0.05% level. | |||||||||||

| Table 4 Pearson Correlation Matrix (Vrd And Board Characteristics And Control Variables) |

|||||||||||

| VRD | BSIZE | INDEP | MO | SEP | ACMEET | LEV | FSIZE | G | ROA | ROE | |

| VRD | 1 | ||||||||||

| BSIZE | 0.321** | 1 | |||||||||

| INDEP | 0.298** | 0.028 | 1 | ||||||||

| MO | -0.233* | -0.216* | -0.252** | 1 | |||||||

| SEP | 0.129 | -0.129 | 0.233* | 0.086 | 1 | ||||||

| ACMEET | 0.111 | 0.054 | -0.091 | -0.095 | -0.255** | 1 | |||||

| LEV | -0.167 | -0.076 | -0.07 | 0.202* | -0.079 | -0.115 | 1 | ||||

| FSIZE | 0.185* | .272** | 0.184* | -0.169 | -0.248** | 0 | 0.246** | 1 | |||

| G | 0.11 | 0.164 | 0.09 | -0.112 | 0.01 | -0.141 | -0.075 | 0.14 | 1 | ||

| ROA | -0.114 | 0.027 | -0.067 | 0.181* | -0.154 | 0.05 | 0.155 | 0.038 | -0.021 | 1 | |

| ROE | 0.11 | 0.123 | 0.025 | -0.023 | -0.157 | 0.004 | 0.287** | 0.236** | -0.006 | 0.765** | 1 |

| Note: *significant at the 0.10% level; **Significant at the 0.05% level. | |||||||||||

The Association between Voluntary Risk Disclosure (VRD) and CG Attributes

Table 5 reports the results of testing the relationship between MRD and CG aspects. When doing regression analysis, the study controls for the possibility of multicollinearity, the Variance Inflation Factor (VIF) is computed to detect any noises in model examined; the result of this test confirms that there is no linear correlation problem among all independent variables as all values of VIF below 1. For more robustness, the study used the Durbin-Watson Test; the value of this test ranges between two numbers (0 and 4) which indicate the result is close to zero; this refers to the existence of a strong and positive correlation. The nearer the number to 4 refers to the existence of a strong and negative correlation while the optimum result ranges between 1.5 and 2.5. This refers to the lack of correlation between the values. Table 5 shows that the D-W is 1.779 which is within the appropriate range and, thus, it is clear that an autocorrelation problem is not present.

| Table 5 Regression Results For The Board Characteristics And Voluntary Risk Disclosure (VRD) |

||||||

| Variables | Unstandardized Coefficients | t | Sig. | Collinearity Statistics | ||

| B | Std. Error | Tolerance | VIF | |||

| (Constant) | 0.185 | 0.18 | 1.032 | 0.304 | ||

| BSIZE | 0.013 | 0.005 | 2.864 | 0.005 | 0.857 | 1.167 |

| INDEP | 0.15 | 0.065 | 2.3 | 0.023 | 0.818 | 1.223 |

| MO | 2.9 | 0 | 0.103 | 0.918 | 0.754 | 1.326 |

| SEP | 0.05 | 0.027 | 1.857 | 0.052 | 0.779 | 1.283 |

| ACMEET | 0.005 | 0.003 | 1.936 | 0.054 | 0.884 | 1.132 |

| LEV | -0.131 | 0.064 | -2.048 | 0.043 | 0.775 | 1.291 |

| FSIZE | 0.016 | 0.02 | 0.794 | 0.429 | 0.714 | 1.4 |

| GROWTH | 0.011 | 0.021 | 0.54 | 0.59 | 0.923 | 1.084 |

| ROA | 0.075 | 0.025 | 3.026 | 0.003 | 0.347 | 2.881 |

| ROE | 0.01 | 0.003 | 3.227 | 0.002 | 0.327 | 3.06 |

| Model summary: Adjusted R2 : 0.26; F-value : 5.131; sig : 0 .000; Durbin-Watson :1.779 | ||||||

Table 5 shows that the model to test the association between VRD and CG attributes is quite revealing with an adjusted-R2 of 0.26; this suggests that the board practices matters and can explain for VRD. Moreover, the model summary below indicates that the model is significant, with an F-value of 5.131. This confirms the fitness of the model used for the purpose of this study. In addition, Table 5 provides the analysis of this examination; it reports mixed results. It indicates statistically positive relationships between VRD and each of board size, independent (non-executive directors), separation and audit committee meetings with coefficients (t-values) of .013 (2.864), 0.150 (2.300), 0.050 (1.857), 0.005 (1.936) respectively and p-values of less than 5%. On the other hand, Table 5 reveals insignificant associations between VRD and managerial ownership. A further analysis shows some significant relationships between VRD and some control variables including, leverage and profitability measured by (ROA, ROE) respectively.

The Association between Mandatory Risk Disclosure (MRD) and CG Attributes

This part examines the relationship between MRD and CG attributes. An analysis of Table 6 shows an adjusted-R2 of 0.20. This suggests that the board characteristics can enhance MRD. Moreover, Table 5 indicates that the model is significant, with an F-value of 3.143 confirming the fitness of the model.

| Table 6 Regression Results For The Board Characteristics And Mandatory Risk Disclosure |

||||||

| Variables | Unstandardized Coefficients | t | Sig. | Collinearity Statistics | ||

| B | Std. Error | Tolerance | VIF | |||

| (Constant) | 0.454 | 0.2 | 2.265 | 0.026 | ||

| BSIZE | 0.002 | 0.003 | 0.492 | 0.624 | 0.807 | 1.24 |

| INDEP | 0.086 | 0.045 | 1.922 | 0.054 | 0.717 | 1.394 |

| MO | 0 | 0 | 0.653 | 0.516 | 0.626 | 1.596 |

| SEP | .026- | 0.018 | 1.457 | 0.149 | 0.57 | 1.754 |

| ACMEET | 0.005 | 0.002 | 2.236 | 0.028 | 0.62 | 1.612 |

| LEV | 0.255 | 0.107 | 2.393 | 0.019 | 0.846 | 1.182 |

| FSIZE | 0.02 | 0.015 | 1.388 | 0.169 | 0.604 | 1.655 |

| GROWTH | 0.04 | 0.072 | 0.562 | 0.576 | 0.73 | 1.37 |

| ROA | 0.001 | 0.012 | 0.123 | 0.903 | 0.737 | 1.357 |

| ROE | 0.002 | 0.001 | 1.442 | 0.153 | 0.811 | 1.232 |

| Model summary : Adjusted R2 : 0.20 F-value : 3.143 sig : 0 .002 Durbin-Watson :2.134 | ||||||

Table 6 also indicates statistically positive relationships between MRD and independent (non-executive directors) with a coefficient (t-value) of .086 (1.922) and a p-value of less than 5%. On the other hand, the results reveals significant and negative associations between MRD and Audit Committee meetings with a coefficient (t-value) of -0.005 (-2.236). However, board size, managerial ownership and separation do not show a significant relationship with MRD. The same table also shows insignificant relationships between MRD and control variables including, bank size and growth, profitability (Table 6).

Discussion

The result of the current study reveals a statistically strong significant relationship between VRD and CG attributes suggesting that diverse and experienced board characteristics enhance VRD as a part of the risk management approach. This finding is consistent with prior researches’ findings (Allini et al., 2016; Maghzom et al., 2016; Elshandidy and Neri, 2015; Al- Shammari and Al-Sultan, 2010). Findings show that banks with large size, high independent (non excutive directors), increasing in separation of duties and audit committee meetings are more likely to demonstrate higher levels of voluntary risk disclosure practices. The results show that there is a positive significant association between board size and VRD at significance level of 0.005. This result is consistent with the findings of Elshandidy and Neri (2015) ,this means that the size of the board of directors increase monitoring and enhancing transparency by reducing the likelihood of information asymmetry, this conclusion isn’t consistent with (Mardini, 2015) . Further, the current study provides strong evidence on the association between the independent board and VRD suggesting that a balanced board composition is important to improving the board’s decision-making capacity and the willing of independent members to improve corporate RD and reduce the information asymmetry. These results are supported by prior research (Miihkinen, 2013; Campbell et al., 2013; Elshandidy et al., 2013; Sayogo, 2006) which showed independent board tends to have higher fairness and transparency. As a result larger number of independent board will presumably enhance disclosure level. (Mardini, 2015; Barako et al., 2006b) not agreed with this finding and explained that establishment of non-executive directors on the board is significantly and negatively associated with the extent of voluntary disclosure and argued the outsider “agent” has a negative effect on the shareholders “principals” task of providing corporate governance disclosures

Moreover, the results point out that managerial ownership had no significant impact on VRD indicating that managers do not use the strength of their positions to influence and monitor RD. This suggests that banks with lower managerial ownership are not inclined to provide more VRD and management compensation is not related to the company’s stock price used in compensation contracts, this conclusion not consistent with (Bolbol, 2012; Al-Janadi et al., 2013; Mohobbot, 2005). Findings show a statistically positive association between the separation (CEO and chairman positions functions) and VRD suggesting that non-duality enhances VRD. And increase effectiveness of the Board’s supervisory function, reduce agency costs, reducing coordination costs; and avoiding the emergence of potential conflicts of interest between the two roles, this study not agreed with (Mardini, 2015) who indicate that the board of directors’ leadership structure did not appear to have a significant influence on the level of corporate governance voluntary disclosures and because executive director (CEO) have power to make decisions by occupying the board of directors leadership.

Finally, the frequency of the audit committee meetings shows the positive and significant impact on VRD. This means that audit committee meetings is related to an effective risk management. Audit committee can act as an efficient monitoring mechanism that can minimize agency costs and augment disclosure. This conclusion agreed with Ho and Wong, 2001; Chen and Jaggi, 2000) that indicated the presence of an audit committee significantly affects the extent of disclosure and large number of directors on the committee could lessen the information asymmetry issue and lead to more disclosure. Prior empirical research like Karamanou and Vafeas (2005), Maghzom et al. (2016) and Allegrini and Greco (2013) arrived at similar findings

This paper also examines the extent of MRD provided by Jordanian listed banks under IFRS 7. Three types of risk disclosure were investigated, namely: credit; market; and liquidity risk. In general, evidence is provided about the positive and significant effect of CG attributes MRD. In particular, a number of findings emerge from this study. First, the study finds that a larger number of Jordanian listed banks provided a greater level of MRD-related information after IFRS 7 became effective. The results also illustrate positive and significant association between board independent (non-executive directors) and MRD suggesting that independent directors put pressure on management to increase the chances of disclosing more private information. In addition, the frequency of audit committee meetings shows positive impacts on MRD. Consequently, the audit committee meeting is more likely to effectively accomplish its monitoring role. On other hand active audit committee meeting regularly are more likely to comply with their duties and enforce the monitoring of financial reporting, this agreed with Elshandidy and Neri, 2015)

Further, the evidence shows that board size and newcomers’ difficulties in understanding the firm’s strategy and disclosure culture failed to find a significant association with MRD. Moreover, the separation attribute did not show any effect on MRD since CEO duality existed in a majority of firms. Such a leadership structure was blamed for poor firm performance and the failure to adapt to a changing environment (Brown et al., 2011). Finally, there was no relationship between managerial ownership and MRD. This means that the proportion of a firm’s managerial ownership doesn't affect the MRD. Our results are consistent with the assumption that higher insider ownership weakens the effect of disclosure because of the low managerial ownership’s role in the selection in what kind of information should be disclosed (Baek et al., 2009; Eng and Mak, 2003; Gorton and Rosen, 1995). This outcome is inconsistent with some previous studies including Albitar (2015) and Nagar et al. (2003) who found a positive relationship between managerial ownership and RD. from this conclusion related to MRD we find board characteristics especially size, ownership, and separation of duties didn’t increase MRD and its composition, diversity and expertise cant affect its ability to carry out its duties

In terms of the control variables used in the current paper, they provide some insights to the findings. For instance, this study predicts that there is a significant relationship between the level of financial leverage and each of VRD and MRD; these results are consistent with prior research (Hassan, 2009; Rajab et al., 2009; Mardini, 2015). This can be explained by high levels of leverage disclose more financial information and banks attempted to avoid the negative impact of risk disclosure in order to avoid the problems of adverse informative disclosure. In addition, ROE and ROA had positive relationships with VRD. This is expected as the signaling theory illustrates those companies, which are better at risk management, have higher levels of profitability and are more willing to disclose risk-related information. And high profitability bank has a tendency to have a higher level of disclosure. This, in turn, is to attract more investors and stockholders. This result is consistent with previous literature (Maghzom et al., 2016; Deumes and Knechel, 2008) and not agreed with (Mardini, 2015). Bank size is one of the most important factors to affect the level of RD (Maghzom et al., 2016; Abraham and Cox, 2007). However, this study did not find an association between bank size and both each of MRD and VRD as larger banks did not lean towards reporting more risk information. This is consistent with Rajab’s (2009) finding.

Our findings have some policy implications for stockholders, risk regulators and other interested groups to ensure information adequacy, increased market efficiency, and providing specific guidelines to enhance accountability and to promote risk disclosure in companies listed in ASE. In addition, this study opens the door to future studies to explore more extensively the Jordanian listed banks’ VRD practices to determine the usefulness of risk disclosure practices. Further, the findings should be useful to accounting firms by providing information about the inadequacies of RD so auditing practices can be enhanced to overcome any setbacks.

Conclusion

This study suggests a number of other venues for future research. Firstly, research could extend over a longer period of time. Secondly, this study could be extended by conducting comparative studies with other countries, preferably in the Middle Eastern countries due to similarities in the settings in order to explore any differences in the determinants of risk disclosure across such countries. Further work could proceed applied to investigate the economic consequences resulted from risk disclosure practices in annual reports and investigates the effect of political connections, in the form of the family member on board composition, and its reflection on risk disclosures. Another area may investigate the impact of Intellectual Capital, voting coalitions, product-market competition on disclosure environment.

Limitations And Direction For Further Research

There are a number of limitations of the current paper related to use of the annual report as this was regarded as the most important means of information. Limitation was concerned with availability of other sources of information such as interim reports; press releases or the Internet. These Limitations could provide significant data for future research on risk disclosure. Such information could be used as a mean of comparison across different data sources. Another limitation for our study is that only focused on one setting, Jordan. An extension of this study may be to include or compare risk disclosure with other markets in the region. Other limitation should be considered before interpreting the results and finding of this study is that it uses a relatively small sample (Jordanian listed banks only). However, our target sample is well justified because it focuses on a specific group of Jordanian listed banks and excluded Islamic banks that represent the most followed companies in the market. Thus, the results cannot be generalized across all sectors that listed in ASE (industrial, services and insurance sectors) and needed to extend this examination to include more companies over more periods

Appendices

Appendix 1

Mandatory Risk Disclosure is updated depend on (Tahat, 2014; Bischof, 2013; Hossain, 2008; Htay & Salman, 2015; Martikainen et al., 2015).

Mandatory Risk Disclosure Index

Qualitative risk

1. Disclosure of Specific definition for each type of risk.

2. Objectives, policies and processes for managing the risks.

3. Methods used to measure the risk.

4. Disclosure of each type of risk separately.

5. Using graphs and illustrations along with descriptive narrative information.

Quantitative risk: credit risk

1. Maximum exposure to credit risk.

2. Concentration of credit risk.

3. Geographic distribution of credit exposures Table.

4. Distribution of credit exposure by industry Table.

5. Distribution of credit exposure by counterparty type (corporate/retail) Table.

6. Credit quality of FI that are neither past due nor impaired.

7. Collateral held as security and other credit enhancements.

Quantitative risk: market risk

1. Maximum exposure to market risk.

2. Concentration of market risk.

3. Maturity dates.

4. Sensitivity analysis of market risk.

Liquidity risk

1. Maximum exposure to liquidity risk.

2. Maturity analysis.

Note: This appendix represents risk disclosure items required by the accounting standards examined by IFRS 7.

| Appendix 2 Voluntary Risk Disclosure |

|

| general risks/Voluntary risk disclosure | References |

| Compliance Risk | Kutum, 2014. |

| Operation Risk | Al-Maghzom et al., 2016; Abdullah et al., 2015; ICAEW, 2000; Lipunga, 2014; Linsley and Shrives, 2006. |

| Reputation Risk | Kutum, 2014. |

| Strategic Risk | Linsley and Shrives, 2006. |

| Information processing and technology risk | Linsley and Shrives, 2006. |

| Pricing Risk | Alshammari, 2014, ICAEW, 1997:2000; Abdullah et al., 2015; Lipunga, 2014. |

| Commodity risk | Abdullah et al., 2015; Alshammari, 2014. |

| Insurance Risk | Abdullah et al., 2015; Alshammari, 2014; Al-Maghzom et al., 2016. |

| Sustainability Risk | Al-Maghzom et al., 2016. |

| Integrity risk | Linsley and Shrives, 2006. |

References

- Abraham, S., & Cox, P. (2007). Analysing the determinants of narrative risk information in UK FTSE 100 annual reports. The British Accounting Review, 39(3), 227-248.

- Akhtaruddin, M., & Haron, H. (2010). Board ownership, audit committees’ effectiveness, and corporate voluntary disclosures. Asian Review of Accounting, 18(3), 245-259.

- Al-Attar, M. (2016). Corporate governance and financial statement disclosure quality in Jordanian commercial banks. International Journal of Economics and Finance, 8(10), 192-205.

- Albitar, K. (2015). Firm characteristics, governance attributes and corporate voluntary disclosure: A study of Jordanian listed companies. International Business Research, 8(3).

- Al-Janadi, Y., Rahman, R.A., & Omar, N.H. (2013). Corporate governance mechanisms and voluntary disclosure in Saudi Arabia. Research Journal of Finance and Accounting, 4, 25-36.

- Alkurdi, A., Al-Nimer, M., & Dabaghia, M. (2017). Accounting conservatism and ownership structure effect: evidence from industrial and financial Jordanian listed companies. International Journal of Economics and Financial Issues, 7(2), 608-619.

- Alkurdi, A., Tahat,Y., & Al-mawali, H. (2017). The effect of governance attributes on corporate dividend payouts policy: Evidence from Jordan. International Journal of Corporate Governance, 8(3/4).

- Allegrini, M., & Greco, G. (2013). Corporate boards, audit committees and voluntary disclosure: Evidence from Italian Listed Companies. Journal of Management & Governance, 17(1), 187-216.

- Al-Sawalqa, F.A. (2014). Corporate governance mechanisms and voluntary disclosure compliance: The case of banks in Jordan. International Journal of Academic Research in Accounting, Finance, and Management Sciences, 4(2), 369-384.

- AL-Deen Omar Al-Sraheen, D., Hanim Bt Fadzil, F., & Bin Syed Ismail, S.S. (2014).The influence of corporate ownership structure and board members’ skills on the accounting conservatism: Evidence from non-financial listed firms in Amman stock exchange. International Journal of Accounting and Financial Reporting, 4, 1 -177.

- Baek, H.Y., Johnson, D.R., & Kim, J.W. (2009). Managerial ownership, corporate governance, and voluntary disclosure. Journal of Business and Economic Studies, 15(2), 44-61.

- Bamber, M., & McMeeking, K. (2010). An examination of voluntary financial instruments disclosures in excess of mandatory requirements by UK FTSE 100 non-financial firms. Journal of Applied Accounting Research, 11(2), 133-153.

- Barako, D.G., Hancock, P., & Izan, H.Y. (2006b) Relationship between corporate governance attributes and voluntary disclosures in annual reports: The Kenyan experience. Financial Reporting, Regulation and Governance, 5(1), 5-7.

- Beekes, W., Pope, P., & Young, S. (2004). The link between earnings and timeliness, earnings conservatism and board composition: Evidence from the UK. Corporate Governance: An International Review, 12, 14-59.

- Bischof, J. (2009). The effects of IFRS 7 adoption on bank disclosure, Europe. Accounting in Europe, 6(2), 167-194.

- Bolbol, I.I. (2012). Board characteristics and dividend payout of Malaysian companies. Unpublished Master Dissertation, University Utara Malaysia.

- Brown, P., Beekes, W., & Verhoeven, P. (2011). Corporate governance, accounting and finance: A review. Accounting and Finance, 51(1), 96-172.

- Cabedo, J.D., & Tirado, J.M. (2004). The disclosure of risk in financial statements. Accounting Forum, 28(2), 181-200.

- Campbell, J.L., Chen, H., Dhaliwal, D.S., Lu, H.M., & Steele, L.B. (2013). The information content of mandatory risk factor disclosures in corporate filings. Review of Accounting Studies, 19(1), 396-455.

- Chen, C., & Jaggi, B. (2000). Association between independent non-executive directors, family control and financial disclosures in Hong Kong. Journal of Accounting and Public Policy, 19(4). 285-310.

- Cheng, E.C., & Courtenay, S.M. (2006). Board composition, regulatory regime and voluntary disclosure. The International Journal of Accounting, 41(3), 262-289.

- Coles, J.L., Daniel, N.D., & Naveen, L. (2008). Boards: Does one size fit at all? Journal of Financial Economics, 87, 329-356.

- Davis, J.H., Schoorman, F.D., & Donaldson, L. (1997). Toward a stewardship theory of management. The Academy of Management Review, 22(1), 20-47.

- Deumes, R., & Knechel, R.W. (2008). Economic incentives for voluntary reporting on internal risk management and control systems. Auditing: A Journal of Practice & Theory, 27(1), 35-66.

- Elshandidy, T., & Neri, L. (2015). Corporate governance, risk disclosure practices, and market liquidity: Comparative evidence from the UK and Italy. Corporate Governance: An International Review, 23(4), 331-356.

- Eng, L.L., & Mak, Y.T. (2003). Corporate governance and voluntary disclosure. Journal of Accounting and Public Policy, 22, 325-345.

- Fama, E.F., & Jensen, M.C. (1983). Agency problems and residual claims. Journal of Law and Economics, 26(2), 327-349.

- Firth, M., Fung, P., & Rui, O. (2007). Ownership, two-tier board structure, and the informativeness of earnings-Evidence from China. Journal of Accounting and Public Policy, 26(4), 463-496.

- Gorton, G., & Rosen, R. (1995). Corporate control, portfolio choice and the decline of banking. Journal of Finance, 50, 1377-420.

- Greco, G. (2011). The management’s reaction to new mandatory risk disclosure: A longitudinal study on Italian listed companies. Corporate Communications: An International Journal, 17(2), 113-137.

- Gul, F.A., & Leung, S. (2004). Board leadership, outside directors’ expertise and voluntary corporate disclosures. Journal of Accounting and Public Policy, 23(5), 351-379.

- Hair, J.F. Jr., Anderson, R.E., Tatham, R.L., & Black, W.C. (1998). Multivariate data analysis, (Fifth Edition). Upper Saddle River, NJ: Prentice Hall.

- Hassan, M.K. (2009). UAE corporations-specific characteristics and level of risk disclosure. Managerial Auditing Journal, 24(7), 668-687.

- Ho, S., & Wong, K.S (2001). A study of the relationship between corporate governance structures and the extent of voluntary disclosure. Journal of International Accounting, Auditing & Taxation, 10(1), 139-15.

- Hung, M., & Subramanyam, K.R. (2007). Financial statement effects of adopting international accounting standards: The case of Germany. Review of Accounting Studies, 12, 623-657.

- Jorgensen, B.N., & Kirschenheiter, M.T. (2003). Discretionary risk disclosures. The Accounting Review, 78, 449-469.

- Karamanou, I., & Vafeas, N. (2005). The association between corporate boards, audit committees, and management earnings forecasts: An empirical analysis. Journal of Accounting Research, 43(3), 453-486.

- Konishi, N., & Ali, M. (2007). Risk reporting of Japanese companies and its association with corporate characteristics. International Journal of Accounting and Performance Evaluation, 4(3), 263-285.

- Kothari, P., Li, X., & Short, E. (2009). The effect of disclosures by management, analysts, and business press on cost of capital, return volatility, and analyst forecasts: a study using content analysis. Accounting Review, 84(5), 1639-1670

- Leung, S., & Horwitz, B. (2004). Director ownership and voluntary segment disclosure: Hong Kong Evidence. Journal of International Financial Management and Accounting, 15(3), 235-260.

- Li, H. (2013). Corporate risk and corporate governance: Another view. Managerial Finance, 39(3), 204-227.

- Linsley, P.M., & Shrives, P.J. (2006). Risk reporting: A study of risk disclosures in the annual reports of UK companies. The British Accounting Review, 38(4), 387-404.

- Lopes, P.T., & Rodrigues, L.L. (2007). Accounting for financial instruments: An analysis of the determinants of disclosure in the Portuguese stock exchange. International Journal of Accounting, 42(1), 25-56.

- Mardini, G.H., (2015). Corporate governance voluntary disclosures in developing countries: Evidence from Jordanian banks. International Journal of Business and Emerging Markets, 7(1), 101-129.

- Miihkinen, A. (2013). The usefulness of firm risk disclosures under different firm-riskiness, investor interest, and market conditions. Advances in International Accounting, 29(2), 312–331.

- Miller, G.S. (2004). Discussion of what determines corporate transparency. Journal of Accounting Research, 42(2), 253-268.

- Nagar, V., Nanda, D., & Wysocki, P. (2003). Discretionary disclosure and stock-based incentives. Journal of Accounting and Economics, 34(1-3), 283-309.

- Naser, K., Al-Hussaini, A., Al-Kwari, D., & Nuseibeh, R. (2006). Determinants of corporate social disclosure in developing countries: The case of Qatar. Advances in International Accounting, 19, 1-23.

- Oliveira, J.S., Rodrigues, L.L., & Craig, R. (2011). Voluntary risk reporting to enhance institutional and organizational legitimacy: Evidence from Portuguese banks. Journal of Financial Regulation and Compliance, 19(3), 271-288.

- Popova, V. (2013). Exploration of scepticism, client-specific experiences, and audit judgments. Managerial Auditing Journal, 28(2), 140-160.

- Rajab, B., Handley-Schachler, M. (2009). Corporate risk disclosure by UK firms: Trends and determinants. World Review of Entrepreneurship, Management and Sustainable Development, 5(3), 224-243

- Taylor, G., Tower, G., & Neilson, J. (2010). Corporate communication of financial risk. Accounting and Finance 50(2), 417-446.