Research Article: 2018 Vol: 22 Issue: 5

The Impact of Audit Committee Characteristics on Firm Performance: Evidence From Jordan

Ahmed Maqsad Mohammed, College of Administration and Economics, University of Babylon

Abstract

The prime objective of the current study is to explore the impact of audit committee characteristics on firm performance. The Breusch-Pagan Lagrangian Multiplier (LM) and Hausman test were used to verify the assumptions of the most appropriate test for this dataset. The study employed panel data methodology and fixed effect model on a sample of seventy-four non-financial firms listed on the Jordanian stock exchange for the period of 2010 to 2016 is used to investigate the said relationship. The result of this study supported the assumptions of agency theory. This study will be helpful for policymakers and researchers in assessing about the most useful characteristics of audit committee which can enhance the performance of firms.

Keywords

Audit Characteristics, Jordan, Non-financial Firms.

Introduction

The role of the audit committee in corporate governance is the subject of increasing public and regulatory interest, particularly after dot.com bubble. The audit committee is a sub-group of the full board. The audit committee plays a correspondent role between the full board, internal auditor, external auditor, executive officers, and the fund executives. Jensen and Mackling (1976) claimed that separation of ownership from management creates many problems and agency conflict is one of the worst when managers start acting against the interests of owners. Authors suggested that this situation can be controlled and/or corrected through an independent audit committee. It serves as trustees in a governance system that helps to decrease information asymmetry and mitigates agency issues. Beasley et al. (2009) identified few characteristics of an independent audit committee such as qualified individuals with authority, independent and honesty which ensure true and fair financial reporting so that stakeholders could make prudent, intelligent, and informed business decisions. An independent audit committee is important because it helps to maintain transparency, assist the board of directors, prevent and control inadequate business practices, and oversight process of financial reporting.

Financial sector plays a vital role in the economy of the country by stimulating entrepreneurial activities, promoting savings, diversification of risk, ensuring economic and financial stability, and efficient allocation of scarce resources (Mohy-ul-din et al., 2017). However, fair business practices and stringent regulatory measures are very important to build and maintain investor’s confidence in stock-market and to enjoy higher economy growth (Catalan et al., 2000; Zietlow et al., 2013; Alnajjar, 2013; Opara, 2014; Smirat and Sharif, 2014; Mahmoud, 2016; Foong & Lim, 2016; Ouattara, 2017; Mukherjee, 2017; Ali and Anis, 2018; Njiku and Nyamsogoro, 2018). Whereas, the business environment in Jordanian in last few decades is not very helpful for investors. Frauds, scams, malpractices in earnings management, and window dressing significantly breach the trust of Jordanian investors. Stringent regulations, independent external audit coupled with qualified and independent audit committee may help to reinstate the confidence of Jordanian investors in stock-market. Audit committee serves the premiums of stakeholders and investors through their autonomous oversight of the yearly corporate reporting process, incorporating the organization's correlation with the outside auditor. Therefore, the present study was being carried out in Jordan where audit committee implementation was in the early stage and provided an interesting insight for researchers. Previous studies such as Bananuka et al. (2017); Bradbury et al. (2006); Hamdan et al. (2013); Oussii and Taktak (2018) invested the impact of audit committee either on earnings management or on performance but these studies focused on financial sector companies and non-financial sector remained ignored. Therefore, the intent of this study is to investigate the impact of the audit committee on firm performance for non-financial companies listed in the Jordanian stock exchange.

Literature Review

The separation of ownership from management highlights the need for a high-quality audit. Since managers are bound to act to protect and promote the interests of shareholders and deviation from this behaviour is the agency problem (Jensen & Meckling, 1976). The nature of the agency problem faced by the individual firm is closely linked with its ownership structure. For instance, in the USA and UK ownership is disperse, though, with strong investor’s protection, the manager tends to behave in an opportunistic manner that put the shareholders at risk of losing the return on their investment and in extreme cases the whole investment (Basheer, 2014). On the other hand, in developing countries like Jordan, concentrated ownership structure prevails which to some extent mitigates agency conflict, however, minority shareholder’s protection is a serious challenge there. For example, the study of Agrawal and Knoeber (2017) posit that managerial ownership and concentrated ownership, either institutional and/or block holder, serves as an effective monitoring mechanism that improves a firm’s performance. In addition, the role of the various internal and external corporate governance mechanism cannot be ignored, because it reconciles, the conflicting interest of stakeholders (Basheer, 2014; Aimran et al., 2016; Swenson, 2016; Farnicka, 2017; Khan et al., 2017; Manaf and Ibrahim, 2017; Bhavan, 2017; Widhiastuti, et al., 2018).

The board of directors is an important component in corporate governance that reconciles the interest of all stakeholders. They set the company strategic direction and ensure compliance with laws and regulations. Further, the board of director are also required to make sure the independence, professional scepticism and ethical consideration of the external auditor. Salawu (2017) concludes that there is a positive relationship between audit quality and reporting and disclosure practices. Audit quality is reliable evidence amongst the most basic issues in audit practice today. Audit quality has been characterized as the joint likelihood that a current material blunder is identified and reported by an auditor (Jordan et al., 2017). The big accounting firms, normally, are considered as competent, independence, reliable, and experienced to deliver higher audit quality (Lokatt, 2018).

Firms with greater natural instability (greater information asymmetry between the firm and outcasts) have a motivation to talk their characteristic quality by enlisting an extra solid, top-notch auditor. This contention has primarily been made inside the connection of Initial Public Offerings (IPOs) and hence the evidence shows there is diminished proof spatial property (i.e. less underpricing) once opening up to the world about large brand auditor (Salehi et al., 2018). Big four firms are sued nearly less as a rule when overwhelming for business size, and massive big four firms authorized less as a rule by the Securities and Exchange Commission (SEC).

Auditors spend a significant amount of time and energy to acknowledge item separation and supply higher quality audit (Suryanto, 2014). A high-quality audit by industry specialist audit firm may increase the acceptability and creditability of a firm’s financial reports because they have better competencies to figure out industry anomalies and distortions (Sirois et al., 2016). Their capacity to supply high-quality audit originates from their ability in serving numerous customers inside the same learning, industry and sharing the best practices over the business. Previous studies prove that audit quality will improve organizations' performance (Mandzila et al., 2016). Based on literature, following hypotheses are developed:

H1: The ratio of non-executive director member in audit committee significantly impacting on firm’s performance.

H2: The financial experts of a non-executive director significantly impacting on firm’s performance.

H3: The number of audit committee members significantly impacting on firm’s performance.

Methodology

The data is collected from the annual reports of 74 non-financial firms listed on the Jordanian Stock Exchange for the years 2010 to 2016. The current study employed the panel data methodology, panel data involves the pooling of observation into time-series and cross-sections (Asteriou & Hall, 2015). Panel data analysis allows greater variability, less collinearity, higher speed of adjustment, larger sample size, considers the heterogeneity of cross-sections, a higher degree of freedom, and better efficiency compared to time-series (Din et al., 2017). The current study employed Breusch and Pagan Lagrangian Multiplier (LM) to decide between pooled OLS or fixed and random effect. The results of Breusch and Pagan Lagrangian Multiplier (LM) test shows that the probability value of Breusch and Pagan Lagrangian multiplier test (0.0000) is not significant. This leads to rejection of the null hypothesis, which means that there is an entity effect in the model. Thus, the test perfectly suggests that pooled OLS is not most efficient and appropriate. Lastly, Hausman test is applied to check the suitably of fixed or random effect for this dataset.

b=consistent under Ho and H1; obtained from xtreg.

B=inconsistent under H1, efficient under Ho; obtained from xtreg.

Test: Ho: difference in coefficients not systematic.

Chi Square (9)=(b-B)'[(V_b-V_B)^(-1)](b-B)=111.95

Prob>chi Square=0.0000***

Ho (Null Hypothesis): For RE.

H1 (Alternative Hypothesis): For FE.

Through Hausman Fixed Random test the value of probability comes out to be 0.0000 which is below 0.05, so as a result we accept Fixed Effect (FE) and reject Random Effect (RE) and finally conclude that fixed effect findings are good for the decision making. The value of R2 for the Fixed Effect model is 58% which explains total variation in DV; firm performance by all the explanatory variables of the study.

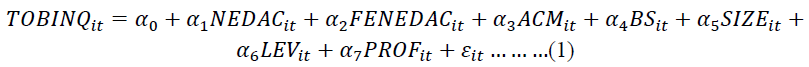

To measure the impact of corporate governance on Audit quality we have used the models, which are given below

Where,

Tobin’s Q is used to measure the firm performance for each company.

NEDAC=ratio of non-executive director member in audit committee by total member of audit committee.

FENEDAC=a dummy variable (1=qualified non-executive director, 0=not qualified nonexecutive director.

ACM=number of audit committee meetings.

BS=board size.

Results And Discussion

Multicollinearity in the panel data may raise certain issues. Hence, correlation analysis is used to check for the possibility of multicollinearity, Table 1 Shows the result on the bivariate correlation.

| Table1 CORRELATION ANALYSIS |

||||||||

| TOBIN’S Q | NEDAC | FENEDAC | ACM | BSIZE | SIZE | PROF | LEV | |

| TOBIN’S Q | 1 | |||||||

| NEDAC | 0.4079* | 1 | ||||||

| FENEDAC | 0.3764** | 0.4354* | 1 | |||||

| ACM | -0.2327 | -0.2127 | 0..2906 | 1 | ||||

| BSIZE | -0.1037** | 0.2056** | -0.2148* | -0.4328* | 1 | |||

| SIZE | -0.2433** | 0.4313* | -0.1711* | -0.2492* | 0.1982 | 1 | ||

| PROF | 0.4391*** | 0.2452** | -0.5741* | -0.2101* | 0.2101 | -0.1205 | 1 | |

| LEV | -0.1343** | 0.1342* | -0.2331* | 0.0213** | 0.1120* | -0.3120 | 0.3451* | 1 |

*,**,*** denote statistical significance at 0.1%, 0.05% and 0.01% level respectively.

The correlation table shows that firm performance is positively correlated with audit committee independence and financial expertise whereas negatively correlated with audit committee meetings. Further, none of the correlation coefficient value is greater than 0.8, hence, we may assume that multicollinearity is not an issue in this dataset.

The Table 2 shows the outcomes of panel data analysis for a dependent variable which is Tobin’s Q. The results in the above table demonstrate the outcomes for FGLS, FEM, REM, and OLS. FGLS is applied to account for the possible heterogeneity among cross-sections. The results of LSDVM and FEM analysis are same, so we interpret them collectively. The only difference between FGLS and FEM is that LSDVM not just controls the individual heterogeneous effect of the firms and years but show them also. For the simplicity of analysis, no such fixed effects for individual states or years are presented.

| Table2 REGRESSION RESULTS |

||||||||

| FGLS | FEM | REM | OLS | |||||

| TOBIN’S Q | Coef. | P>t | Coef. | P>T | Coef. | P>T | Coef. | P>T |

| NEDAC | 0.077 | 0.205 | -0.077 | 0.005*** | 0.176 | 0.114 | 0.176 | 0.005*** |

| FENEDAC | 0.009 | 0.816 | -0.009 | 0.060** | 0.008 | 0.845 | 0.008 | 0.845 |

| ACM | -0.032 | 0.808 | -0.032 | 0.008*** | -0.228 | 0.224 | -0.228 | 0.027** |

| BSIZE | 0.198 | 0.245 | 0.198 | 0.245 | 0.177 | 0.271 | 0.177 | 0.275 |

| SIZE | -0.238 | 0.426 | -0.238 | 0.426 | -0.712 | 0.004*** | -0.712 | 0.005*** |

| PROF | 9.58e-10 | 0.009*** | 9.58e-10 | 0.009*** | 1.28e-09 | 0.001*** | 1.28e-09 | 0.001*** |

| LEV | 0.243 | 0.007*** | 0.243 | 0.007*** | 0.171 | 0.019** | 0.171 | 0.022** |

| _cons | 0.774 | 0.557 | 0.774 | 0.557 | 1.073 | 0.384 | 1.073 | 0.387 |

| Model Summary | F (11, 68)=8.66 | F (11, 68)=8.66 | within=0.3456 | F (7, 72)=8.87*** | ||||

| Prob>F=0.0000 | Prob>F=0.0000 | between=0.7411 | Prob>F=0.0000 | |||||

| R2=0.5834 | R2=0.5834 | overall=0.4628 | R2=0.4630 | |||||

| Adj. R2=0.5160 | Adj. R2=0.5160 | Adj. R2=0.4108 | ||||||

*, **, *** denote statistical significance the 0.10%, 0.05% and 0.01% level respectively.

Based on FEM, the results of hypotheses showed a significant and negative relationship between Non-Executive Directors of the Audit Committee (NEDAC), FENEDAC, ACM and firm performance for Jordan. However, this relation remains insignificantly positive when the size of the board increases. The relationship between audit committee meeting and firm performance is positive and significant.

Audit committee independence is in negative relation to the firm’s performance. The findings of the study are consistent with the findings of Leung et al. (2014), which found that audit committee independence is negatively associated with audit quality that in terms will affect firm performance. It is also supporting the view that the audit committee independence director is significant in guaranteeing the respectability of the financial reporting process.

There is a positive relationship between the Financial Expertise of a Non-Executive Director’s Audit Committee (FENEDAC) and firm performance. However, as found in the study, the relationship is positive but not significant in this study with indicator p>10. The financial expertise of non-executive director is measured as the actual number of audit committee members who have the financial expertise or as a dichotomy. The regressions results of the current study have provided support with the agency theory which argues that internal audit helps in mitigating the risk arising from managerial entrenchment issue.

Conclusion

This study addresses the problem that arises on the poor and fraudulent financial reporting in the Federal Republic of Jordan that revealed the role of responsibilities of board audit committee has to play in the organization and to provide openness information or results either directly or indirectly as they are charged with overseeing financial reporting. Meanwhile, this is also placing significant impact on firm performance. The issues of corporate scandal have a negative effect on accounting manipulations, regulators, practitioners, researchers, and organizations in the world. Due to the fact of this, there is a need to review the code of corporate that governed the corporations of many countries. As such the new regulations and practices in developed countries, Jordan was not lacked behind. Audit committees assume imperative parts in financial parts of corporate governance as they guarantee audit quality while in the meantime securing the enthusiasm of investors. The audit committee and accounting firms plays a significant role in ascertaining the validity, acceptability, and reliability of high quality. The study has employed panel data methodology and a range of pre-test estimations are carried out to select the most appropriate model. The Table 2 above shows the outcomes of panel data analysis for a dependent variable which is (firm performance). The results in the above table demonstrate the outcomes for LSDVM, FEM, REM, and PRM. The results of LSDVM and FEM analysis are same, so we interpret them collectively. The only difference between LSDVM and FEM is that LSDVM not just controls the individual heterogeneous effect of the firms and years but show them also. For the simplicity of analysis, no such fixed effects for individual states or years are presented. Based on Hypotheses 1 stated the relationship between Non-Executive Directors of the Audit Committee (NEDAC) with firm performance is negative and significant. Similarly, the coefficient for NEDAC is negative and statistically significant p-values of NEDAC are 0.001 which implies that the variable is significant at 1% of the level of significance. However, this relation remains insignificantly positive when the size of the board increases. The relationship between audit committee meeting and firm performance is positive and significant.

References

- Agrawal, A., & Cooper, T. (2017). Corporate governance consequences of accounting scandals: Evidence from top management, CFO and auditor turnover. Quarterly Journal of Finance, 7(1), 1-41.

- Aimran, A.N., Ahmad, S., & Afthanorhan, A. (2016). Confirming the mediation effect of a structural model by using bootstrap approach: A case study of Malaysian 8th grade students’ mathematics achievement. International Journal of Business, Economics and Management, 3(4), 44-51.

- Ali, A.M., & Anis, J. (2018). CEO’s Emotional commitment level and its firm capital structure choice: Decision tree analysis. Asian Journal of Economics and Empirical Research, 5(1), 65-78.

- Alnajjar, M.I.M. (2013). Behavioural inferences of stock market participants. European Journal of Social Sciences, 39(3), 384-390.

- Bananuka, J., Nkundabanyanga, K.S., Nalukenge, I., & Kaawaase, T. (2017). Internal audit function, audit committee effectiveness and accountability in the Ugandan statutory corporations. Journal of Financial Reporting and Accounting, 16(1), 138-157.

- Basheer, M.F. (2014). Impact of corporate governance on corporate cash holdings: An empirical study of firms in manufacturing industry of Pakistan. International Journal of Innovation and Applied Studies, 7(4), 1371-1383.

- Beasley, M.S., Carcello, J.V., Hermanson, D.R., & Neal, T.L. (2009). The audit committee oversight process. Contemporary Accounting Research, 26(1), 65-122.

- Bhavan, T. (2017). Human capital as a pushing factor of export: The case of four south asian economies. Asian Development Policy Review, 5(4), 299-306.

- Bradbury, M., Mak, Y.T., & Tan, S.M. (2006). Board characteristics, audit committee characteristics and abnormal accruals. Pacific Accounting Review, 18(2), 47-68.

- Catalan, M., Impavido, G., & Musalem, A.R. (2000). Contractual Savings or Stock Markets Development?: Which Leads?? Los Angeles.

- DeFond, M.L., & Francis, J.R. (2005). Audit research after Sarbanes-Oxley. Auditing: A Journal of Practice & Theory, 24(1), 5-30.

- Din, S. M.U., Abu-bakar, A., & Regupathi, A. (2017). Does insurance promotes economic growth: A comparative study of developed and emerging/developing economies. Cogent Economics & Finance, 5(1), 1390029.

- Farnicka, M. (2017). The impact of cyber-activity on human development. Humanities and Social Sciences Letters, 5(2), 43-53.

- Foong, S.S., & Lim, K.P. (2016). Stock market liberalisation and cost of equity: Firm-level evidence from malaysia. Asian Academy of Management Journal of Accounting and Finance, 12(1), 19-42.

- Hamdan, A.M., Sarea, A.M., & Reyad, S.M.R. (2013). The impact of audit committee characteristics on the performance: Evidence from jordan. International Management Review, 9(1), 32-41.

- Jensen, M., & Mackling, W.H. (1976). Theory of the firm: Managerial behavior, agency cost and ownership structure. Journal of Financial and Quantitative Analysis. Retrieved from http://papers.ssrn.com/abstract=94043

- Jordan, C.E., Clark, C.S.J., & Thomas, P.B. (2017). Audit quality differentials for constraining cosmetic earnings management in the pre-sox era: An analysis of audit firm size and brand. Global Journal of Accounting and Finance, 1(1), 13.

- Khan, H., Hassan, R., & Marimuthu, M. (2017). Diversity on corporate boards and firm performance: An empirical evidence from malaysia. American Journal of Social Sciences and Humanities, 2(1), 1-8.

- Lee, T., & Stone, M. (1995). Competence and independence: The congenial twins of auditing? Journal of business finance & accounting, 22(8), 1169-1177.

- Leung, S., Richardson, G., & Jaggi, B. (2014). Corporate board and board committee independence, firm performance, and family ownership concentration: An analysis based on Hong Kong firms. Journal of Contemporary Accounting & Economics, 10(1), 16-31.

- Lokatt, C. (2018). Auditors’ Constitution of Performance: a study on the duality of performance in the auditing profession (Doctoral dissertation, Stockholm Business School, Stockholm University).

- Mahmoud, O. (2016). Managerial Judgement versus Financial Techniques in Strategic Investment Decisions: An Empirical Study on the Syrian Coastal Region Firms. International Journal of Business, Economics and Management, 3(3), 31-43.

- Manaf, N.A., & Ibrahim, K. (2017). Poverty reduction for sustainable development: Malaysia’s evidence-based solutions. Global Journal of Social Sciences Studies, 3(1), 29-42.

- Mandzila, E.E.W., & Zéghal, D. (2016). Content analysis of board reports on corporate governance, internal controls and risk management: evidence from France. Journal of Applied Business Research, 32(3), 637.

- Mohy-ul-din, S., Regupathi, A., & Abu-Bakar, A. (2017). Insurance effect on economic growth among economies in various phases of development. Review of International Business and Strategy, 27(4), 501-519.

- Mukherjee, S. (2017). The role of services in total productivity growth of indian manufacturing firms: A firm level analysis since 2000. Asian Journal of Economics and Empirical Research, 4(2), 121-131.

- Njiku, A.R., & Nyamsogoro, G.D (2018). Determinants of technical efficiency of small scale sunflower oil processing firms in Tanzania: One stage stochastic frontier approach. Asian Journal of Economics and Empirical Research, 5(1), 79-86.

- Opara, B.C. (2014). Analysis of Nigeria firms, export marketing configuration in the global market. International Journal of Management and Sustainability, 3(7), 448-456.

- Ouattara, B.S. (2017). Re-examining stock market integration among brics countries. Eurasian Journal of Economics and Finance, 5(3), 109-132.

- Oussii, A.A., & Taktak, N.B. (2018). Audit committee effectiveness and financial reporting timeliness: The case of Tunisian listed companies. African Journal of Economic and Management Studies, 1, 34–55.

- Salawu, M.K. (2017). Factors influencing auditor independence among listed companies in Nigeria: Generalized method of moments (GMM) approach. International Journal of Economics and Finance, 9(8), 191.

- Salehi, M., Tarighi, H., & Safdari, S. (2018). The relation between corporate governance mechanisms, executive compensation and audit fees: Evidence from Iran. Management Research Review, 41(8),939-967.

- Sirois, L.P., Marmousez, S., & Simunic, D.A. (2016). Auditor size and audit quality revisited: The importance of audit technology. Comptabilité-Contrôle-Audit, 22(3), 111-144.

- Smirat, I.M., & Sharif, M.N.M. (2014). Strategic determinants of family firm performance: A proposed research framework. International Journal of Management and Sustainability, 3(9), 580-595.

- Suryanto, T. (2014). Determinants of audit fee based on client attribute, auditor attribute, and engagement attribute to control risks and prevent fraud: A study on public accounting firms in Sumatra-Indonesia. International Journal in Economics and Business Administration, 2(3), 27-39.

- Swenson, C. (2016). Empirical evidence on municipal tax policy and firm growth. International Journal of Public Policy and Administration Research, 3(1), 1-13.

- Widhiastuti, S., Murwaningsari, E., & Mayangsari, S. (2018). The effect of business intelligence and intellectuals capital of company value moderated by management of profit riil. Journal of Accounting, Business and Finance Research, 2(2), 64-78.

- Zietlow, J., Hankin, J.A., & Seidner, A.G. (2013). Financial Management for Non-profit Organization: Policies and Practices. New Jersey: John Wiley & Sons.