Research Article: 2019 Vol: 23 Issue: 4

The Impact of Asymmetric Cost Behavior on the Audit Report Lag

Jin Ho Kim, Sungkyunkwan University

Abstract

This study examines the impact of the cost stickiness on the audit report lag. The author finds that company’s asymmetric cost behavior, cost stickiness, is one of the important determinants of the audit report lag. The test results show that firm’s cost stickiness induced by empire building incentives is positively associated with the audit report lag. Interestingly, in the “future expectation” group, stickiness is also positively related with the audit report lag but not significant. It implicates that even if the firm has an inefficient cost behavior, auditors do not consider it as an audit risk compared to the suspected group of “empire building”.

Keywords

Audit Report Lag, Cost Stickiness, Asymmetric Cost Behavior.

Introduction

Audit report lag (hereafter referred as an ARL) has been an important topic of audit research, because ARL is closely related with timeliness judgement and decision making by financial statement users. However, related research is not enough. All we know that timeliness is one of the important factors to determine the informativeness of the financial information. Although the managers have vital impact on the firm’s financial reporting process and in doing so, it affects to the auditing progress, they do not take much consideration from the researchers. In this paper, the author suggests that manager’s private incentives proxied by cost behavior can delay the audit report time, as a result it hinders timeliness judgement and decision making by stakeholders.

According to PCAOB Auditing Standards, when auditors assess of company’s risk, they should understand management's philosophy, operating style, and company environments. Because it can affect financial reporting. As part of obtaining an understanding of the company, it examples an analyst report. Interestingly, its accuracy and coverage are related with cost stickiness. Weiss (2010) shows that firms with stickier cost behavior have less accurate analysts' earnings forecasts than firms with less sticky cost behavior, and it affects analyst coverage. Inaccuracy of analyst forecasts and its smaller coverage would affect to auditor perceptions. Because auditors should spend more time to assess client’s risk compared to firms with less stickier cost behavior due to relatively small and inaccurate information. In addition, Jung (2015) exhibits that cost stickiness driven by the agency problem is positively associated with discretionary revenue. Underlying notion of this paper is managers may attempt to conceal the inefficiency by managing earnings through discretionary revenues. If Sticky cost behavior driven by the agency problem increases discretionary revenues, it also affects auditor’s risk assessment procedure. Therefore, auditors could regard cost stickiness as higher audit risk. Collectively, the author conjectures that there is a positive relation between cost stickiness induced by private incentives and the audit report lag.

For that reasons, this study examines the impact of the cost stickiness to the ARL. The author finds that company’s asymmetric cost behavior, cost stickiness, is one of the important determinants of the ARL. The test results show that firm’s cost stickiness induced by empire building incentives could be perceived as an audit risk to the auditors. Generally, firms asymmetric cost behavior is caused by two aspects of manager’s incentives. The one is from manager’s optimistic future forecasts. When managers expect bright future of the company or economy, they do not want to reduce the cost directly proportional to the increasing ratio of costs. The other one is from manager’s personal incentives, “empires building” theory. Sometimes managers aspire to attain personal benefits from the company by expending the company’s external size. In this context, company’s perceived audit risk would be increased, and it could affect to the ARL.

The author tries to distinguish the motivation of the cost stickiness using firm’s growth opportunity measured by market to book ratios. The author assumes that if a firm has a lower growth opportunity compared to a median value of all sample firms or a median value of industry, that firm’s stickiness is from manager’s private incentives, “empire building” (tabulated results are from the latter one. The test results are same to the former one).

At first, the author tests the relation between the stickiness and the ARL with all samples. After that, the author examines the same regression for a suspected firm sample, “empire building group” and a future expectation group. As the author predicted, stickiness is positively related with longer ARL in the suspected group of “empire building”. Interestingly, in the “future expectation” group, stickiness is also positively related with the ARL but not significant. It implicates that even if the firm has an inefficient cost behavior, auditors do not consider that is as an audit risk compared to the suspected group of “empire building”.

This paper has some contributions to the literature. Firstly, this research extends the scope of ARL researches to the manager aspects of ARL. Although the ARL is closely related with timeliness judgement and decision making by financial statement users, related research is not enough. Especially, according to PCAOB Auditing Standards managers are important factor of risk assessment procedure. In this context, this study complements existing researches. Secondly, this study extends the literature on the effects of cost stickiness. There is much evidence on the causes of cost stickiness. However, the understanding is far from complete regarding how cost stickiness affects the auditing environment. The findings of this research suggest that cost stickiness induced by manager’s private incentives negatively affects the audit report lag. When the firm has a sticky cost behavior, it delays audit report time, and as a result it hinders timeliness judgement and decision making by stakeholders.

The rest of the paper is structured as follows: the next section discusses the prior literature and presents the research hypotheses. In this section, the author discusses several scenarios underlying the expectation of both a negative association and a positive association. After that, the author discusses the data and research methods, present the results, and provide a conclusion for the paper.

Literature Review and Hypothesis Development

Audit Report lag and Cost Stickiness

Timely release of financial statement is an important aspect of financial reporting. Because it is closely related with timeliness judgement and decision making by stakeholders. However, it does not mean faster is always better. Because auditing time is related with audit efforts, and it is also associated with audit quality.

There are both theoretical reasons and empirical evidence suggesting that additional auditor effort should enhance audit quality. O'Keefe et al. (1994) initially developed a theoretical model liking audit quality (level of assurance) with audit effort (the various levels of labor hours) and client characteristics, and liked aggregate labor utilization with the desired level of assurance. Knechel et al. (2009) modified the audit production model by considering labor cost as inputs, and evidence-gathering activities that determine the level of assurance as outputs. One of the model’s key underlying assumptions suggests that as audit effort increases, the likelihood of a future restatement decreases because the auditor is more likely to detect a material misstatement (2009). There is also empirical evidence supporting the effort-effectiveness assumption. Bedard & Johnstone (2004) find that auditors plan increased hours for clients with higher perceived risk of earnings manipulation, and suggest that actual earnings management is likely to be less extensive than attempted earnings management due to the intervention of auditors. Blankley et al. (2014) find that auditors responded to high level of short-term accruals by increasing audit effort, even if they were unable to recover their related costs. In a more direct examination of audit effort and quality, Lee & Son (2009) evidence that auditors who lengthened their audit work permitted less earnings management. Caramanis & Lennox (2008) suggest that audit effort is negatively associated with abnormal accruals, as well.

However, it is possible that a long audit reveals information with respect to audit risk related with audit. For instance, researchers evidence that the market reaction to late filings is negative (Alford et al. 1994; Bartov et al. 2011). Kutcher (2007) suggest that a delayed filing is driven by audit completion time. Thus, a long ARL may be related with bad news. The fact that the market reacts negatively to late filings, which are associated with longer ARLs, suggests that the market interprets a lengthy ARL as a signal of a problem audit.

For that reasons, ARL has been explored by many researchers. Prior studies have determined that delays in the timely release of financial reports can adversely impact firm value (Givoly & Palmon 1982; Blankley et al. 2014). Specifically, Givoly & Palmon(1982) determined that the share price reaction to early earnings announcements was more significant than the reaction to late announcements, it suggests that the early release of financial performance data was viewed more favorably.

Prior ARL determinant researches (Davies & Whittred 1980; Wright & Ashton 1989; Ettredge et al. 2006; Munsif et al. 2012; Blankley et al. 2014) have focused on the client firmlevel characteristics (e.g., firm size, leverage, leverage, and restatements). Another major research stream is corporate governance such as ownership structure (Ettredge et al. 2005) and internal controls (Ashton et al. 1987; Ettredge et al. 2006; Munsif et al. 2012) have received the greatest attention. In addition, external auditor features, such as auditor size, auditor tenure and auditor change (Bamber et al. 1993; Lee et al. 2009; Tanyi et al. 2010; Knechel & Sharma 2012) have been explored.

Collectively, ARL is closely related with audit risk perceived by auditors. Since the ARL reflects audit effort (Knechel & Payne 2001; Knechel et al. 2009; Tanyi et al. 2010), a longer (shorter) ARL may reflect a more (less) thorough audit, which should be more (less) likely to uncover a material misstatement, leading to a negative association between the ARL and a future restatement. Bedard & Johnstone (2004) evidence that audit risk is associated with the audit hours empirically, and what factors are considered importantly by auditors. They surveyed some questions to the auditors with respect to the audit risks. It shows that auditors mainly concerned about two affairs. At first, they care the potential risk of earnings manipulations. Their primary finding is that heightened earnings manipulation risk is associated with an increase in planned audit effort, and with increased billing rates. So, if the potential risk of earnings manipulations is high, it could affect the audit report lag. Secondly, they focus on the BOD’s independence from the managers. Because of weak BOD’s independence induces agency problems.

In terms of agency problems, managers are important factor as much as BOD’s independence to the audit risk. According to PCAOB Auditing Standards, auditors should consider manager’s philosophy and operating style. Because it can affect to internal control and financial reporting. However, it is not easy to measure someone’s philosophy and operating style. So, recent studies have tried to do interdisciplinary collaboration between social and psychological fields to help explain corporate actions using psychological methods (e.g., manager’s overconfidence). However, in this paper, the author focuses more on accounting topic, asymmetric cost behavior. Because the author believes that we could estimate the agency problem from the firm’s cost behavior. According to Chen et al. (2012), they find the evidence that weak BOD’s independence, high FCF, longer CEO tenure, and lower ratio of fixed CEO compensation are associated with firm’s cost stickiness induced by manager’s private incentives. These factors and test results are closely related with agency problem in the cost stickiness.

Traditionally, cost behavior model describes a mechanistic relation between activity and costs. However, recent literatures on the cost behavior find that costs are sticky. For instance, costs decrease less with sales reduction than costs increase with sales rise. This alternative view recognizes the primitives of cost behavior-resource adjustment costs and managerial decisions. By following Anderson & Banker (2003), researchers examine the determinants, consequences and different angle of the cost stickiness.

Generally, the cost stickiness is caused by two incentives of managers. The one is private incentives, making an “empire building”. Even the firm’s performance is bad and growth opportunity is low, managers pursue the personal benefits by extending or maintaining level of cost spends. The other one is from manager’s “optimistic future forecast”.

In this manner, if sticky cost is caused by manager’s private incentives such as a making “empire building”, it will cause bad signals to the auditors. Because although the firm has a bad performance and low growth opportunity compared with competitors, they do not reduce the cost fair enough. This phenomenon will increase the audit risk perceived by auditors. In doing so, auditors need to or have to spend more time to shape an audit opinion. Weiss (2010) shows that firms with stickier cost behavior have less accurate analysts' earnings forecasts than firms with less sticky cost behavior, and it affects analyst coverage. Inaccuracy of analyst forecasts and its smaller coverage would affect to auditor perceptions. Because auditors should spend more time to assess client’s risk compared to firms with less stickier cost behavior due to relatively small and inaccurate information. In addition, Jung (2015) exhibits that cost stickiness driven by the agency problem is positively associated with discretionary revenue. Underlying notion of this paper is managers may attempt to conceal the inefficiency by managing earnings through discretionary revenues. If Sticky cost behavior driven by the agency problem increases discretionary revenues, it also affects auditor’s risk assessment procedure. Therefore, auditors could regard cost stickiness as higher audit risk. Collectively, the author conjectures that there is a positive relation between cost stickiness induced by manager’s private incentives and the audit report lag.

Hypotheses

H1: The cost stickiness is positively related with the audit report lag (ARL) in the “Empire Building” group.

H2: The cost stickiness is not related with the audit report lag (ARL) in the “Future Expectation” group.

Research Design and Sample Selection

Sample Selection

Sample was taken from the COMPUSTAT and Audit Analytics database. Sample set includes all firms in industrial field (COMPUSTAT code INDL) basically. The author studies the period 1999 - 2015. It starts from COMPUSTAT’s all fundamental data set, and the author deletes the firms’ data which do not have stickiness. After that, the author calculates the ARL and delete the minus and over 6 months ARL data. Collectively 25,586 firm years are included.

Research Design

To measure the CEO’s agency problem, the author employs the cost stickiness decomposed by growth opportunity. To estimate growth opportunities, the author uses marketto- book ratio following the studies (Myers 1977; Smith & Watts 1992; Skinner 1993; Jennifer J Gaver and Kenneth M Gaver 1993; Baber et al. 1996). Specifically, to measure the stickiness, the author uses the method of Weiss (2010). After that the author decomposed the sample by the median value of the MTB (I use yearly industry and all sample’s median value). If firm has lower MTB value, the author assumes that firm’s stickiness is from manager’s private incentives not preparing the future business.

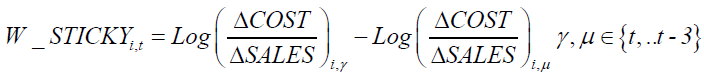

To capture the firm’s cost stickiness, the author uses the Weiss (2010) model.

where gamma is the most recent of the last four quarters with a decrease in sales and mu is the most recent of the last four quarters with an increase in sales, SALEi,t = SALEi,t- SALEi,t-1 (Compustat #2), COSTi,t = (SALEi,t - EARNINGSi,t) - (SALEi,t-1 - EARNINGSi,t-1), and earnings is income before extraordinary items (Compustat #8). Sticky is defined as the difference in the cost function slope between the two most recent quarters from quarter t-3 through quarter t, such that sales decrease in one quarter and increase in the other. If costs are sticky, meaning that they increase more when activity rises than they decrease when activity falls by an equivalent amount, then the proposed measure has a negative value. A lower value of sticky expresses more sticky cost behavior. That is, a negative (positive) value of sticky indicates that managers are less (more) inclined to respond to sales drops by reducing costs than they are to increase costs when sales rise (Weiss 2010).

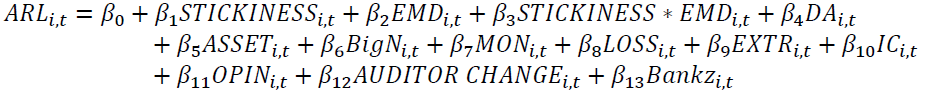

Model 1:

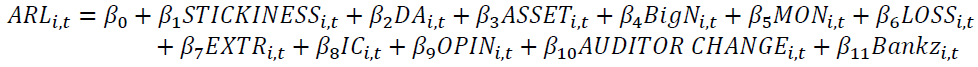

Model 2:

Where :

ARL : Logarithm of audit report lag;

STICKINESS : Absolute values of Weiss(2010) stickiness;1

EMD: If firm’s MTB is under industry median, then 1 and 0 otherwise;

DA : Discretionary accruals measured by modified Jones 1991;

ASSET : Logarithm of total assets;

BigN : COMPUSTAT CODE au, if au=4 to 7, then 1 and 0 otherwise;

MON : If fiscal year-end is DEC or JAN, then 1 and 0 otherwise;

LOSS : Negative income, then 1 and 0 otherwise;

EXTR : If firm has extra ordinary items, then 1 and 0 otherwise;

IC : No Material Weakness (auopic=1), then 1 and 0 otherwise;

OPIN : If firm takes unqualified opinion, then 1 and 0 otherwise;

AUDITOR CHANGE: If auditor is changed, then 1 and 0 otherwise;

Bankz: Bankruptcy risk of Zmijewski(1984), -4.803-3.599*(ni/at)+5.406*(lt/at)-0.1*(act/lct).

The author makes two sample sets using MTB ratio (If firms have lower growth opportunity compared with yearly industry median, the author assumes that their stickiness is from “empire building” incentives with more probability than “future expectation”. The author admits that my decomposing method is imperfect. Maybe there are more things that the author needs to consider to separate private incentives from the samples).

The one is suspected group as an “empire building”. The other one is “future expectation” group oriented from the manager’s rational future judgement. After decomposing the group, the author tests the relation between the firm’s stickiness and the ARL. The author predicts that if firm’s asymmetric cost behavior is oriented from manager’s private incentives, “empire building”, it is positively related with the ARL. However, if firm’s asymmetric cost behavior is from a rational judgment by the managers, there is no relation between the stickiness and the ARL or positively weak relation compared to the “empire building” group.

Following (Ashton et al. 1987), the author employs several variables such as ASSET, BigN, MON, LOSS, EXTR, and OPIN to control the effects to the ARL. They investigate that the determinants of the ARL. Ashton et al. (1987) and Ashton et al. (1989) evidence that ARL is associated with company size, industry classification, existence of extraordinary items, and sign of net income. In addition to this, the author adds IC (no material weakness), DA (discretionary accruals measured by modified Jones model, which is proposed by Dechow et al. (1995)), AUDITOR CHANGE, and Bankz (likelihood of bankruptcy based on Zmijewski (1984)) variables. Because if firm has a material weakness, auditor change, and higher bankruptcy risk, it might cause the ARL. Lee & Son (2009) evidence that auditors who lengthened their audit work permitted less earnings management. Caramanis & Lennox (2008) suggest that audit effort is negatively associated with abnormal accruals, as well. BigN auditors and unqualified opinions will be negatively related with audit report lag. That is, BigN auditors are more capable to the efficient auditing, thus they do work faster than other audit firms. The unqualified opinion means that firm’s financial reporting quality is fair enough to do work quickly compared to the other cases such as qualified, unqualified with additional language, and adverse opinion. MON (DEC and JAN. It means “busy seasons”) and LOSS (negative net income) will be positively connected to the ARL. Ashton et al. (1989) suggest that busy season has some possibility to delay the ARL. Because auditors are limited in the market, thus busy season means more workloads to the auditors. Therefore, it will cause the ARL. On the other hand, every auditor in the market already knows that, so it can have no effect on the ARL. In this manner, the author also does not predict the effect of MON on the ARL. The same notion goes for a LOSS variable.

Results and Discussion

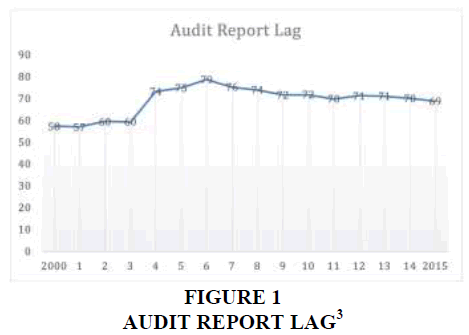

Table 1 provides descriptive statistics for the variables used in the model. All variables have 25,586 observations. The mean value of the ARL (Logarithm of audit report lag) is 4.241 in the suspect firm years, “empire building” group.2 Rest of the sample, “future expectation” group, has a 4.049 mean value. There is a difference between the two groups. The mean value of the ARL is longer in the “empire building” group. With total accruals, there is no difference between two groups. “future expectation” group takes more BigN auditors. The “empire building” group has more LOSS compared to the “future expectation” group. Figure 1 shows that since the 1995, the ARL has been longer.

| Table 1 Descriptive Statistics | ||||||

| Variables | “Empire Building” group | “Future Expectation” group | Difference in | |||

| (n=12,505) | (n=13,081) | |||||

| Mean | Median | Mean | Median | Means | Medians | |

| ARL | 4.241 | 4.29 | 4.049 | 4.078 | 0.192*** | 0.212*** |

| Stickiness | 0.969 | 0.549 | 0.927 | 0.508 | 0.042*** | 0.041*** |

| DA | 0.072 | 0.007 | 0.082 | 0.008 | -0.01 | -0.001 |

| ASSET | 3.64 | 3.851 | 5.683 | 5.873 | -2.043*** | -2.022*** |

| BigN | 0.518 | 1 | 0.802 | 1 | -0.284*** | 0*** |

| MON | 0.669 | 1 | 0.743 | 1 | -0.074*** | 0*** |

| LOSS | 0.444 | 0 | 0.28 | 0 | 0.164*** | 0*** |

| EXTR | 0.015 | 0 | 0.016 | 0 | -0.001 | 0 |

| IC | 0.31 | 0 | 0.548 | 1 | -0.238*** | -1*** |

| OPIN | 0.665 | 1 | 0.634 | 1 | 0.031*** | 0*** |

| AUDITOR CHANGE | 0.101 | 0 | 0.061 | 0 | 0.04*** | 0*** |

| Bankz | 9.046 | -2.243 | -2.314 | -2.178 | 11.36*** | -0.065*** |

Table 2 shows the Pearson correlation coefficients for the variables used in Model 2. The ARL is positively related with STICKINESS, LOSS, AUDITOR CHANGE and BANKZ. MON is positive but it is insignificant. On the other hand, IC is negative. It implicates that cost stickiness, negative net income; auditor change, material weakness, and possibility of bankruptcy affect the ARL potentially. The author predicted busy season, MON, is positively related with the ARL. However, its signal is positive but insignificant. Maybe almost all of audit firms know that is busy season, so they prepare that before. The ARL is negatively related with ASSET, BigN, IC, and OPIN. The author tests the collinearity among the independent variables.4

| Table 2 Correlation Table | ||||||||||||

| ARL | STICKINESS | DA | ASSET | BigN | MON | LOSS | EXTR | IC | OPIN | AUDITOR CHANGE | Bankz | |

| ARL | 1.00 | |||||||||||

| STICKINESS | 0.09*** | 1.00 | ||||||||||

| DA | 0.00 | 0.01 | 1.00 | |||||||||

| ASSET | -0.31*** | -0.15*** | -0.00 | 1.00 | ||||||||

| BigN | -0.25*** | -0.07*** | -0.00 | 0.56*** | 1.00 | |||||||

| MON | 0.00 | 0.03*** | 0.00 | 0.10*** | 0.09*** | 1.00 | ||||||

| LOSS | 0.23*** | 0.27*** | -0.00 | -0.39*** | -0.21*** | 0.01 | 1.00 | |||||

| EXTR | 0.00 | 0.01 | 0.00 | 0.00 | -0.00 | 0.02*** | 0.00 | 1.00 | ||||

| IC | -0.05*** | -0.07*** | 0.01 | 0.51*** | 0.35*** | 0.09*** | -0.26*** | -0.06*** | 1.00 | |||

| OPIN | -0.10*** | -0.05*** | 0.00 | 0.02*** | -0.06*** | -0.03*** | -0.11*** | -0.06*** | 0.03*** | 1.00 | ||

| AUDITOR CHANGE | 0.06*** | 0.02*** | -0.01 | -0.09*** | -0.13*** | -0.01* | 0.07*** | 0.01** | -0.11*** | -0.01 | 1.00 | |

| Bankz | 0.04*** | 0.01 | 0.03*** | -0.07*** | -0.02*** | 0.00 | 0.02*** | 0.00 | -0.02** | -0.02*** | 0.00 | 1.00 |

* p < 0.1, ** p < 0.05, *** p < 0.01 ARL : Logarithm of audit report lag; STICKINESS : Absolute values of Weiss(2010) stickiness; EMD: If firm’s MTB is under industry median, then 1 and 0 otherwise; DA : Discretionary accruals measured by modified Jones 1991; ASSET : Logarithm of total assets; BigN : COMPUSTAT CODE au, if au=4 to 7, then 1 and 0 otherwise; MON : If fiscal year-end is DEC or JAN, then 1 and 0 otherwise; LOSS : Negative income, then 1 and 0 otherwise; EXTR : If firm has extra ordinary items, then 1 and 0 otherwise; IC : No Material Weakness(auopic=1), then 1 and 0 otherwise; OPIN : If firm takes unqualified opinion, then 1 and 0 otherwise; AUDITOR CHANGE: If auditor is changed, then 1 and 0 otherwise; Bankz: Bankruptcy risk of Zmijewski(1984), -4.803-3.599*(ni/at)+5.406*(lt/at)- 0.1*(act/lct).

Table 3 column (1) exhibits that the results of model 1 with a full sample. In the column (1), Stickiness is negatively associated with the ARL insignificantly. STICKINESS *EMD is a positively related with an ARL, it appears positive relation between stickiness and ARL in the empire building group. It implicates that auditors spend more time to audit in the sticky firm. It supports H1. As the author predicted above, there are two possibilities that cause the cost stickiness and each has totally opposite incentives. For this reason, the author separates the group by yearly industry median value of MTB.

| Table 3 Audit Lag Model Regression Results5 | |||

| (1) | (2) | (3) | |

| ARL (Total) | ARL (EB group) | ARL (FE group) | |

| STICKINESS | -0.001 | 0.012*** | 0.000 |

| (-0.23) | (3.95) | (0.10) | |

| EMD | 0.066*** | ||

| (10.82) | |||

| STICKINESS *EMD | 0.012*** | ||

| (3.17) | |||

| DA | -0.000 | -0.001 | 0.002 |

| (-0.36) | (-0.97) | (1.43) | |

| ASSET | -0.038*** | -0.026*** | -0.043*** |

| (-26.30) | (-11.47) | (-23.00) | |

| BigN | -0.018*** | -0.020** | -0.026*** |

| (-3.00) | (-2.47) | (-2.96) | |

| MON | 0.023*** | 0.023*** | 0.024*** |

| (4.65) | (3.20) | (3.47) | |

| LOSS | 0.102*** | 0.100*** | 0.088*** |

| (19.53) | (13.61) | (11.90) | |

| EXTR | 0.110*** | 0.109*** | 0.110*** |

| (6.12) | (3.89) | (4.81) | |

| IC | -0.108*** | -0.136*** | -0.127*** |

| (-16.01) | (-13.86) | (-13.02) | |

| OPIN | -0.082*** | -0.110*** | -0.061*** |

| (-16.04) | (-14.16) | (-9.00) | |

| AUDITOR CHANGE | 0.066*** | 0.059*** | 0.072*** |

| (8.02) | (5.28) | (5.91) | |

| Bankz | 0.000** | 0.000*** | 0.001*** |

| (2.36) | (2.65) | (2.69) | |

| Constant | 4.301*** | 4.380*** | 4.298*** |

| (120.45) | (76.51) | (97.27) | |

| Observations | 25586 | 12505 | 13081 |

| Year&Ind Dummy | Included | ||

| Adjusted R2 | 0.285 | 0.205 | 0.305 |

Low value group represents suspected group, “empire building” group. The author assumes that this group’s stickiness is from manager’s private incentives. In the context, it is related with higher audit risk perceived by auditors. Discretionary accruals (DA) is negatively related with the ARL. Asset, BigN, IC, and OPIN are negatively associated with the ARL. Big firms are connected to BigN auditor and it may reduce the ARL. As the author predicted EXTR is positively related with the ARL. If firm has extra ordinary items, it makes ARL longer. Coefficient of IC is significantly negative, it means that no material weakness reduces the audit report lag. If firm takes OPIN, unqualified opinion, it is negatively related with the ARL. Maybe other not proper opinion causes more workloads to the auditors. MON, busy season, is positively related with the ARL. It could be possible, because this season is very busy, so it causes the audit delay. LOSS is connected to audit risk. If firm has a negative income, auditors need to spend more time to shape an audit opinion. Both AUDITOR CHANGE and Bankz are positively associated with ARL. If firm changes auditor, they will need more time to adopt audit environment. In addition, if the firm is exposed high bankruptcy risk, auditors have to pay more attention. As a result, it will delay audit report time.

Table 3 column (2) exhibits that the results of the model 2 with the suspected group. In this case, the STICKINESS is significantly positively associated with the ARL. Except this variable, all other results are very similar to column (1). Author predicted, if firm’s stickiness is from manager’s private incentives, it would affect audit risk perceived by auditors. For this reason, the ARL is positively related with the stickiness. This result supports H1.

Table 3 column (3) shows that future expectation group’s results. Interestingly the stickiness is no more significant in this case. It is quite interesting result. As per Authors assumption if firm’s stickiness is from the good incentives, manager’s proper forecast by growth rate, auditors do not consider the inefficient cost behavior is an audit risk factor. It supports H2.

Robustness Test

Next, the author uses a Tobin’s Q of alternative variable to explore the idea that cost stickiness induced by manager’s private incentives is a risk factor for auditors. If the firm has a smaller Tobin’s Q compared to industry median, there is a higher possibility that those firms’ stickiness is from manager’s private incentives. Therefore, as the author expected earlier, those firm’s stickiness will have a positive association with ARL.

Table 4 column (1) exhibits that the results of model 1 with a full sample. In the column (1), Stickiness is negatively associated with the ARL. It is different from previous result, but not significant. STICKINESS *EMD is significantly positive. It also supports H1. In the column (2), there is a positive relation between stickiness and ARL in the empire building group decomposing by Tobin’s Q. It implicates that auditors perceive stickiness differently depending on the cause of the stickiness. Other results are same to previous tests.

| Table 4 Audit Lag Model Regression Results6 | |||

| (1) | (2) | (3) | |

| ARL (Total) |

ARL (EB group) |

ARL (FE group) |

|

| STICKINESS | -0.009*** | 0.005* | 0.002 |

| (-3.50) | (1.67) | (0.60) | |

| EMD | 0.058*** | ||

| (10.97) | |||

| STICKINESS *EMD | 0.024*** | ||

| (7.53) | |||

| DA | 0.001 | 0.001 | 0.002 |

| (1.11) | (0.64) | (1.02) | |

| ASSET | -0.041*** | -0.042*** | -0.054*** |

| (-25.87) | (-18.64) | (-26.61) | |

| BigN | -0.017*** | -0.016* | -0.018** |

| (-2.78) | (-1.93) | (-2.11) | |

| MON | 0.027*** | 0.015** | 0.030*** |

| (5.17) | (2.00) | (4.32) | |

| LOSS | 0.090*** | 0.059*** | 0.084*** |

| (16.62) | (7.90) | (9.97) | |

| EXTR | 0.103*** | 0.090*** | 0.093*** |

| (5.41) | (3.62) | (3.06) | |

| IC | -0.108*** | -0.140*** | -0.073*** |

| (-15.70) | (-14.52) | (-7.32) | |

| OPIN | -0.075*** | -0.084*** | -0.047*** |

| (-13.86) | (-10.72) | (-6.35) | |

| AUDITOR CHANGE | 0.060*** | 0.058*** | 0.063*** |

| (7.15) | (5.11) | (4.98) | |

| Bankz | 0.001*** | 0.019*** | 0.001** |

| (4.13) | (9.46) | (2.47) | |

| Constant | 4.304*** | 4.413*** | 4.347*** |

| (119.41) | (78.95) | (94.36) | |

| Observations | 23719 | 12486 | 11233 |

| Year&Ind Dummy | Included | ||

| Adjusted R2 | 0.274 | 0.228 | 0.319 |

Conclusion

The author investigates the relation between the cost stickiness and the ARL. The author finds that firm’s asymmetric cost behavior is positively related with the ARL. Especially, when the stickiness is from manager’s private incentives, “empire building”, this phenomenon appears strongly. From this result, the author suggests that firm’s asymmetric cost behavior is closely related with audit risk perceived by auditors. The level of discretionary accruals is positively associated with the ARL. This result is correspondent with prior research, higher possibility of the earnings management affects to audit efforts. BigN auditors do their work efficiently, LOSS is positively associated with the ARL. It might be perceived as an audit risk. In the same context, if there is a higher bankruptcy risk in the firm, auditors should spend more time to audit, and it increases audit report lag. Overall, test results suggest that firm’s cost stickiness induced by manager’s private incentives, “empire building”, increases audit report lag and as a result it hinders timeliness judgement and decision making by stakeholders.

End Notes

1. The stickiness has a negative sign, to easier interpreting the author uses the absolute value of the stickiness.

2. I divide the group by yearly industry MTB ratio.

3. Mean value of ARL (2000~2015).

4. I calculated variance inflation factors (VIF) for the variables used in the regression model. All variables used in the model have VIFs under 2.

5. Grouping by MTB. EB group:Empire Building group, FE group: Future Expactation group.

6. Grouping by Tobin’s Q. EB group:Empire Building group, FE group: Future Expactation group

References

- Alford, A.W., Jones, J.J., & Zmijewski, M.E. (1994). Extensions and violations of the statutory SEC Form 10-K filing requirements. Journal of Accounting and Economics, 17(1-2), 229-254.

- Anderson, M.C., Banker, R.D., & Janakiraman, S.N. (2003). Are selling, general, and administrative costs "Sticky"? Journal of accounting research, 41(1), 47-63.

- Ashton, R.H., Willingham, J.J., & Elliott, R.K. (1987). An empirical analysis of audit delay. Journal of accounting research, 25(2), 275-292.

- Ashton, R.H., Graul, P.R., & Newton, J.D. (1989). Audit delay and the timeliness of corporate reporting*. Contemporary accounting research, 5(2), 657-673.

- Baber, W.R., Janakiraman, S.N., & Kang, S.H. (1996). Investment opportunities and the structure of executive compensation. Journal of Accounting and Economics, 21(3), 297-318.

- Bamber, E.M., Bamber, L.S., & Schoderbek, M.P. (1993). Audit structure and other determinants of audit report lag: An empirical analysis. Auditing: A Journal of Practice & Theory, 12(1),1.

- Bartov, E., DeFond, M.L., & Konchitchki, Y. (2011). Capital market consequences of filing late 10-Qs and 10-Ks. New York University Law and Economics Working Papers. Paper 254.

- Bedard, J.C., & Johnstone, K.M. (2004). Earnings manipulation risk, corporate governance risk, and auditors' planning and pricing decisions. The Accounting Review, 79(2), 277-304.

- Blankley, A.I., Hurtt, D.N., & MacGregor, J.E. (2014). The relationship between audit report lags and future restatements. Auditing: A Journal of Practice & Theory, 33(2), 27-57.

- Caramanis, C., & Lennox, C. (2008). Audit effort and earnings management. Journal of Accounting and Economics. 45(1), 116-138

- Chen, C.X., Lu, H., & Sougiannis, T. (2012). The agency problem, corporate governance, and the asymmetrical behavior of selling, general, and administrative costs. Contemporary accounting research, 29(1), 252-282.

- Davies, B., & Whittred, G.P. (1980). The association between selected corporate: attributes and timeliness in corporate: reporting: further analysis. Abacus, 16(1), 48-60.

- Dechow, P.M., Sloan, R.G., & Sweeney, A.P. (1995). Detecting earnings management. The Accounting Review, 70(2), 193-225.

- Ettredge, M.L., Li, C., & Sun, L. (2006). The impact of SOX Section 404 internal control quality assessment on audit delay in the SOX era. Auditing: A Journal of Practice & Theory, 25(2), 1-23.

- Ettredge, M.L., Kwon, S.Y., Smith, D.B., & Zarowin, P.A. (2005). The impact of SFAS No. 131 business segment data on the market's ability to anticipate future earnings. The Accounting Review, 80(3), 773-804.

- Gaver, J.J., & Gaver, K.M. (1993). Additional evidence on the association between the investment opportunity set and corporate financing, dividend, and compensation policies. Journal of Accounting and Economics, 16 (1-3), 125-160.

- Givoly, D., & Palmon, D. (1982). Timeliness of annual earnings announcements: Some empirical evidence. The Accounting Review, 5(3), 486–508.

- Jung, S.H. (2015). Cost stickiness and discretionary revenues. Korean Management Review, 44(4), 1183–27.

- Knechel, W.R., & Sharma, D.S. (2012). Auditor-provided nonaudit services and audit effectiveness and efficiency: Evidence from pre-and post-SOX audit report lags. Auditing: A Journal of Practice & Theory, 31(4), 85-114.

- Knechel, W.R., & Payne, J.L. (2001). Additional evidence on audit report lag. Auditing: A Journal of Practice & Theory, 20(1), 137-146.

- Knechel, W.R., Rouse, P., & Schelleman, C. (2009). A modified audit production framework: Evaluating the relative efficiency of audit engagements. The Accounting Review, 84(5), 1607-1638.

- Lee, H.Y., & Son, M. (2009). Earnings announcement timing and earnings management. Applied Financial Economics, 19(4), 319-326.

- Lee, H.Y., Mande, V., & Son, M. (2009). Do lengthy auditor tenure and the provision of non-audit services by the external auditor reduce audit report lags? International Journal of Editing, 13(2), 87-104.

- Munsif, V., Raghunandan, K., & Rama, D.V. (2012). Internal control reporting and audit report lags: Further evidence. Auditing: A Journal of Practice & Theory, 31(3), 203-218.

- Myers, S.C. (1977). Determinants of corporate borrowing. Journal of financial economics, 5(2), 147-175.

- O'Keefe, T.B., Simunic, D.A., & Stein, M.T. (1994). The production of audit services: Evidence from a major public accounting firm. Journal of accounting research, 32(2), 241-261.

- Skinner, D.J. (1993). The investment opportunity set and accounting procedure choice: Preliminary evidence. Journal of Accounting and Economics, 16(4), 407-445.

- Smith, C.W.Jr., & Watts, R.L. (1992). The investment opportunity set and corporate financing, dividend, and compensation policies. Journal of financial economics, 32(3), 263-292.

- Tanyi, P., Raghunandan, K., & Barua, A. (2010). Audit report lags after voluntary and involuntary auditor changes. Accounting horizons, 24(4), 671-688.

- Weiss, D. (2010). Cost behavior and analysts’ earnings forecasts. The Accounting Review, 85(4), 1441-1471.

- Wright, A., & Ashton, R.H. (1989). Identifying audit adjustments with attention-directing procedure. The Accounting Review, 64(4), 710-728.

- Zmijewski, M.E. (1984). Methodological issues related to the estimation of financial distress prediction models. Journal of accounting research, 22, 59–82.