Research Article: 2017 Vol: 16 Issue: 3

The Impact of Absorptive Capacity, Organizational Inertia on Alliance Ambidexterity and Innovation for Sustained Performance

Komang Budi Aryasa, University of Indonesia

Sari Wahyuni, University of Indonesia

Lily Sudhartio, University of Indonesia

Setyo H Wyanto, University of Indonesia

Keywords

Absorptive Capacity, Alliance Ambidexterity, Indonesia, Innovation, Organizational Inertia, Telkom Group.

Introduction

Strategic alliances have been known as an important strategy to build competitive advantage and keep the company's position in the market (Golonka, 2013; Hamel et al., 1989). An alliance is seen as an initiative to acquire external resources while keep leveraging internal capabilities (Gulati, Lavie & Singh, 2008). This is important in the industries which have a high growth, dynamically changing and technology-intensive. The key to success in those industries is the speed of entry into market in the form of providing services with a lower level of complexity and faster than competitors.

The ICT industry is one of the industries experiencing disruption. This industry is characterized by rapid technological developments and increasingly complex customer needs, no company provides the same exact services and always needs complex resources to meet those needs (Golonka, 2013). The industry also requires intensive technology and knowledge, dynamic technological change and industry growth. Activities such as the creation of new knowledge are more important than improving existing knowledge, building long-term relationships and trusting among corporations is also important. Therefore, inter-company alliances are the primary concern in this industry. This phenomenon is also experienced by telecommunication operators such as Telkom Group. In developing ICT portfolio, Telkom Group like other telecommunication companies, also collaborate with different organizations. This collaboration is necessary to acquire new knowledge as well as develop the knowledge and capabilities already possessed. Therefore, Telkom Group requires an alliance ambidexterity to explore new knowledge from partners and simultaneously requires leveraging current knowledge. This capability is also important to drive innovation for sustained performance. (March, 1991; Tushman & O'Reilly, 1996; Rivkin & Siggelkow, 2007) explained that the company's competitive advantage can be achieved by the balance between explorative alliance and exploitative alliance.

As a state owned enterprise (SOE), Telkom Group has internal organizational factors that influence new competency exploration initiatives. Absorptive capacity is needed to explore new capabilities from partners. However, past success history as a monopolist will lead to the emergence of organizational inertia (Liao et al., 2008; Carillo & Gromb, 1998). The highly structured organizational of the corporate, divisional, subsidiary levels and the vast range of product portfolios indicate that the company is a large corporation. Inertia will increment with increasing size and age of the organization (Hannan & Freeman, 1984; Kelly & Amburgey, 1991; Liao et al., 2008).

In this study, we will investigate the influence of absorptive capacity and organizational inertia on achieving alliance ambidexterity. Few studies concerning on internal factors of organizational learning affecting the success of alliance. Previous studies are dominated by the investigations of external factors such as environmental dynamism and competitiveness (Jansen et al., 2005). Unlike absorptive capacity that produces alternatives and innovations as a result of organizational external exploration, inertia leads to the use of the old ways of achieving organizational goals (Liao, Fei & Liu, 2008). These two internal factors will be able to affect alliance ambidexterities which subsequently result in innovation and organizational performance (He & Wong, 2004).

It would be interesting to investigate the impact of alliance ambidexterity on innovation (Leung et al., 2013). Most studies focusing on analysing the consequences of alliance ambidexterity to performance. From previous researches, there are different results of ambidexterity to performance. Firstly, they express the supporting relation of ambidexterity and sales growth rate (Gibson & Birkinshaw, 2004; He & Wong, 2004; Lubatkin et al., 2006). Second, the relation of competence exploration and competence exploitation on performance implies that exploration will be more important to the firm when it is coordinated with a lower level of exploitation and vice versa (Atuaheme-Gima, 2005; Atuaheme-Gima & Murray, 2007). Too much both exploration and exploitation may have undesirable expenses for the firm.

The alliances that are common models to acquire knowledge from external organizations will lead to innovation (He & Wong, 2004). How innovation as mediation between alliance ambidexterity and performance is still rare. (Leung et al., 2013; He & Wong, 2004) conclude that there are different influences of ambidexterity on product innovation and process innovation, thus they also produce different outcomes.

Thus, we are interested to answer of the following research question: Do absorptive capacity, organizational inertia; alliance ambidexterity can influence innovation and performance?

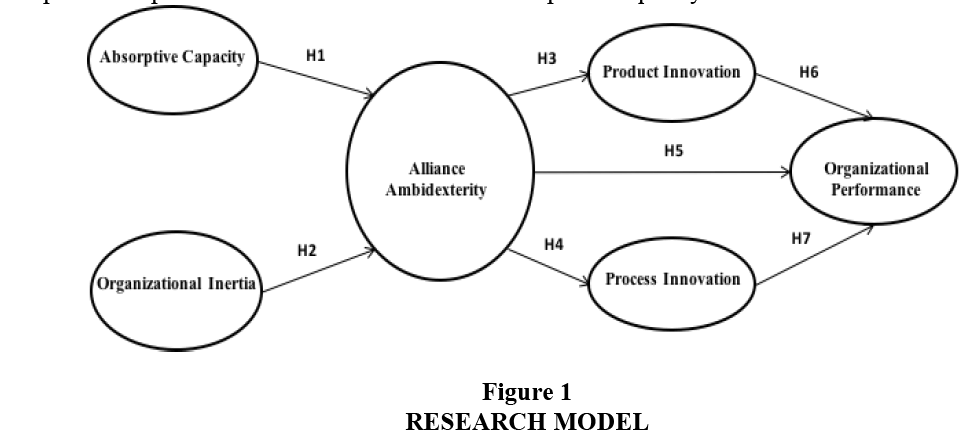

To answer above research question, a model is developed (Figure 1) to describe absorptive capacity and organizational inertia in incumbent previously monopoly company which in this case is Telkom Group. The model also depicts alliance ambidexterity activities in the form of explorative and exploitative (Lavie & Rosenkopt, 2006). Those alliances contribute to bundle of both new and complementary resources for the business units within Telkom Group which responsible for the innovation. Finally, the developed model explores product innovation and process innovation as consequences of ambidexterity alliance.

Research Model

Our literature review shows that there are two internal factors which influence alliance ambidexterity, namely absorptive capacity and organizational inertia. Absorptive capacity shows the company's ability to make acquisitions, assimilation, integration and transformation of knowledge gained from external organizations (Zahra & George, 2002; Cohen & Levinthal, 1990; Lavie & Rosenkopf, 2006). Organizational inertia is the organization inability to change rapidly and effectively. A big organization normally has resistance to change (Kinear & Roodt, 1998). These two internal factors that affect alliance ambidexterity influence the achievement of superior organizational performance. Ambidexterous organizations is an organization that constantly innovating (Yamakawa, Yang & Lin, 2011). Innovation can be product innovation or process innovation. Product innovation is also intended to produce new products whereas process innovation is intended to be development a new process. Alliance ambidexterity, product innovation and process innovation have also a direct influence on the performance of the organization (Lavie & Rosenkopf, 2006; March, 1991; Levinthal & March, 1993; Tushman & O'Reilly, 1996). Organizational performance is the main goal and part of organizational effectiveness. According to Venkatraman & Ramanujam (1986), organization's performance reflects the financial performance. Financial performance includes sales growth and profitability. Furthermore, the broader domain of financial performance is the business performance includes operational performance such as market share and product quality.

Literature Review and Hypotheses

The long-term sustainability of an organization depends greatly on ability to exploit their own capabilities and simultaneously explore new competencies (Levinthal & March, 1993; March, 1991). A company utilizes an alliance ambidexterity to find a proper means to explore its external possibilities and continue innovating internally. To achieve ambidextrous in alliance, the organization engages in both explorative alliance and exploitative alliance. The first is to acquire new knowledge, partnering with new partners from different industry and organizational culture. Thus, explorative alliance involves finding new routines in the organization and the discovery of new approaches in technology, new products and new processes (McGrath, 2001; Lavie & Rosenkopf, 2006). Conversely, through exploitative alliance, organizations partner with companies who have previous cooperation to leverage their existing knowledge, learn how to improve their ability and focus on existing domains. This alliance is created based on the similar industry and cultural background (Levie & Rosenkopf, 2006).

Lavie & Rosenkoft (2006) convey three dimensions of ambidextrous in strategic alliances: function-based, structure-based and attribute-based. The function-based dimension is focused on objective of the alliance whether it is created to generate new knowledge or leverage existing knowledge. The structure-based dimension is focused on whether the alliance partners with a new partner or a partner who has a history of previous cooperation. Finally, the attribute-based dimension refers to the alliance that is formed either with companies with similar organizational attribute or clearly different characteristics.

To maintain alliance ambidexterity, the company should not only consider external factors such as environmental dynamism and competition (Tushman & O’Reilly, 1996; Jansen et al., 2005), but also focus on internal factors. Furthermore, internal factors that much influence are absorptive capacity and organizational inertia. The absorptive capacity will support the company in exploring the external element; otherwise, organizational inertia is another internal factor that encourages a company to exploit internal resources (Cohen & Levinthal, 1990). Absorptive capacity is the ability to recognize the value of new information, to assimilate and to finally commercialize this information (Cohen & Levinthal, 1990). Four dimensions of absorptive capacity are acquisition, assimilation, transformation and implementation (Zahra & George, 2002; Daspit & D’Souza, 2013). Acquisition is the company's ability to perform the identification and acquisition of useful knowledge. Assimilation is to analyze and understand the knowledge gained externally (Jansen, Van Den Bosch & Volberda, 2005). Transformation is to enable the combination of knowledge acquired from the external with the internal knowledge. Finally, implementation refers to the company's ability to implement the incremental changes or improvements to create value for the company (March, 1991; Benner & Tushman, 2003).

In certain circumstances, the organization is very difficult to change (Kinear & Roodt, 1998). This phenomenon is called organizational inertia; it is the resistance of the organizations to transition and the inability to react to the change rapidly and effectively. Gilbert (2005) expresses organizational inertia in two categories: resources rigidity and routine rigidity. Sydow et al. (2009) discusses path dependence, which is also known as inertia. Resource rigidity is the organization’s difficulty to change the pattern of resource investment, while routine rigidity is the organization’s difficulties in making changes in organizational processes for managing the resources. Path dependence is the position of the organization that is shaped by its long-term journey. Thus, the organization's history is the factor that determines the current and future position of the organization.

Besides the pressure of alliance ambidexterity from internal organization, the balance of explorative alliance and exploitative alliance is an important capability to drive both product innovation and process innovation. Innovation as a source of competitive advantage should be closely linked with organization performance. We apply the theory of disruptive innovation as introduced by (Christensen, Raynor & McDonald, 2015) and process innovation by (Utterback & Abernathy, 1975; Wong et al., 2008; Fontana, 2011). Product innovation that has a disruptive characteristic begins in two types of markets that incumbent ignore: low-end footholds and new-market footholds. The first refers to products and services that pay more attention to less-demanding customers. The second creates a new market where none existed. A disruptive innovation begins from one of those two footholds. Process innovation develops process improvement or systems and methods. Process innovation includes new and more effective internal operations, business process reengineering (Li, Liu & Ren, 2007), using new tools and knowledge in the field of technology to reduce the cost of production (Freeman, 1987). Cost reductions will help the company improve its competitive position and produce better performance.

Absorptive Capacity and Alliance Ambidexterity

A turbulent business environment has caused organizations to focus on knowledge as a source of competitive advantage (Jansen, Van Den Bosch & Volberda, 2005). The organization needs to recognize new knowledge that originates from external sources; eventually the organization must assimilate and then apply these to commercial purposes to survive. Cohen & Levinthal (1990) and Van den Bosch, Volberda & De Boer (1999) state that inward-looking and outward-looking absorptive capacity is required for effective organizational learning. However, a disproportion of inward-looking and outward-looking absorptive capacity will generate reductions in an organization’s benefits. Organizations that are highly concerned with efficiency will create imbalance in the absorption of knowledge from another organization. This imbalance will affect how the organization explores and exploits the alliance strategy.

Particularly, absorptive capacity contributes to the organization's alliance ambidexterity by internalizing and adapting the alliance companies’ skills and capabilities into the internal organization. In the situation where the new knowledge that has been received is in accordance with the knowledge that has been previously agreed upon, the organization will be able to better understand the new knowledge. Organizations with a higher absorptive capacity level tend to be better in saturating new knowledge. Organizations must have the capacity to absorb inputs and turn them into outputs (Tsai, 2001). Without this absorptive capacity, the company will not be able to receive knowledge from other companies. Szulanski (1996) finds that the lack of absorptive capacity is the main obstacle in transferring knowledge in the company.

Researchers from different research areas have been varying the challenge of acquiring knowledge externally while integrating that knowledge into internal organization (Raisch, Probst & Tushman, 2009). For example, the absorptive capacity research area indicates that internal and external knowledge are needed; however, the dominance of one will cause dysfunction in the organization (Cohen & Levinthal, 1990; Zahra & George, 2002). Ambidexterity is a managerial challenge not only to achieve a balance between exploration and exploitation but also to integrate external knowledge with the internal knowledge of the company.

Organizations that have relevant knowledge with external knowledge tend to have a better understanding of new technologies that will generate ideas and develop products (Tsai, 2001). An organization that has a high level of absorptive capacity appears to take advantage of new knowledge from others to increase its innovation. The organization should thus have the capacity to absorb inputs to make outputs. Without such capacity, the organization will not be able to acquire or transfer knowledge among its units. As Cohen & Levinthal (1990) state, the ability to leverage external knowledge is often the result of investment in R&D.

According to Cohen & Levinthal (1990), absorptive capacity involves not only the ability to assimilate new knowledge of the external but also the ability to adjust this for commercial purposes and thus create opportunities to eventually obtain benefits for the organization. A suitable level of absorptive capacity is likely more successful in developing a new product. In addition, these units appear to apply new knowledge to improve their business operations thus enhancing their performance.

Based on the above explanations, the following hypothesis is developed:

Hypothesis 1: Absorptive capacity positively affects the alliance ambidexterity.

Organizational Inertia and Alliance Ambidexterity

Regarding resource rigidity, companies tend to invest in their core businesses rather than new businesses. The companies tend to invest in existing technology, not on new technology. Resource rigidity is associated with greater risks that will be encountered by the company by entering new business (Gilbert, 2005). This inertia inhibits companies to learn and acquire knowledge about new technology, products, expertise through alliances. An explorative alliance is undertaken to build new competencies such as cooperation in research and development. It is also to find new opportunities or new markets with new products (Koza & Lewin, 1998).

In routine rigidity, the length of operation of the organization also leads to the tendency for organizations to continue maintaining routines as well as the previously successful practices that are used as reference (Yamakawa, Yang & Lin, 2011). These routines will cause a competence trap; organizations become inflexible (Levitt & March, 1988). This inertia limits the company from absorbing the knowledge that originates from external organizations (Hannan & Freeman, 1984); thus, it will inhibit the exploration and exploitation activities. For example, the study resulted by Collinson & Wilson (2006) states that Japanese companies have weaknesses in integrating knowledge, particularly research and development (R & D) functions. Companies experience barriers of inertia. The internal relationships of organizations and routine knowledge sharing between R&D unit and other units are very strict; this causes difficulties in improvements. The relations with external parties such as suppliers and customers in the keiretsu structure have decreased the flexibility of the companies. Routines and procedures in organizations that have been run for years have led the organizations to encounter difficulties in making changes. Thus, the organization experiences the path dependency trap, conducting something successfully in the short-term (exploitation) and unable to envision the long-term (exploration).

Sydow et al. (2009) express the formation of path dependence in three phases: pre-formation, formation and lock-in. In the formation phase, a self-reinforcing process that makes the whole process more intense and stronger (irreversible) begins to appear. These intense processes have implicated narrower choices; it becomes increasingly difficult to change the initial choices. Finally, during the phase lock-in, the behaviour becomes inflexible where the action has been patterned well. Organizations become potentially less efficient because of the inability to adopt better solution options. This inability will negatively implicate the exploration initiatives and tends to exploit the internal organization. Furthermore, this exploitation will override the exploration and make it increasingly difficult for companies to build new competencies (March, 1991). Thus, inertia not only has a negative effect on the needs of the new knowledge in the organization but will also enable the competitor to easily know the organization's strategies (Liao, Fei & Liu, 2008).

Thus, it can be concluded in the following hypothesis:

Hypothesis 2: Organizational inertia negatively affects the alliance ambidexterity.

Alliance Ambidexterity and Product Innovation

A prior study by Lin, Yang & Demirkam (2010) confirmed that the explorative alliance and exploitative alliance directly affect the performance of the company; in this paper, product innovation is identified as the output of alliance ambidexterity. (Benner & Tushman, 2003; Danneels, 2002) find that the terms, exploration and exploitation, are two different results. The result of an explorative initiative is a disruptive innovation (Chistensen & Bower, 1996) or a radical innovation (Benner & Tushman, 2003). These innovations are designed to meet the needs of new customer segments (new market). These types of innovations offer new designs, create new markets and develop new distribution channels (Abernathy & Clark, 1985). Therefore, innovation is the result of an exploratory search for new routines in the organization and the discovery of new approaches for technology, business, processes and products (McGrath, 2001). The product innovation as an exploratory result requires new knowledge (Levinthal & March, 1993; McGrath, 2001). This is characterized by search, variety, experimentation, flexibility and risk-taking (March, 1991).

Koza & Lewin (1998) state that the exploration of strategic alliances is included in the scope of the 'R' (research) within the framework of the R and D (Research and Development). If we examine the development of new products as part of the knowledge management process, the output of the exploration process is knowledge learned through exploration. This knowledge then becomes a product prototype that will be tested by additional processes. Moreover, the process of exploration through strategic alliances can also be codified as new knowledge by means of a patent process. Exploitative alliance focus on the ‘D’ scope within the R & D process and the meaningful alliance competence of each company within the synergy framework where the capability and competence is shared with each company in the alliance (Koza & Lewin, 1998). Exploitative alliances as mergers of the assets among companies are complementary (Teece, 1986).

An explorative alliance and exploitative alliance carries its own value (Leung, Lau & Zhang, 2013). An explorative alliance provides value to the innovation of new products. Conversely, the exploitative alliance delivers value to the sustaining and incremental product innovation. Isobe, Makino & Montgomery (2008) state that the explorative alliance positively influences product innovation. He & Wong (2004) show that the explorative alliance also supports product innovation. Explorative alliance and exploitative alliances encourage the creation of product innovation. These alliances have also been investigated empirically by Leung, Lau & Zang (2013) by using samples of the glass industry in China.

Furthermore, the relationship between the stability of explorative alliance activity and exploitative alliance (ambidexterity alliance) with product innovation must be considered. Tushman et al. (2002) convey that the ambidextrous organization produces useful innovations for the competitive advantages of the company. Their research was conducted on 15 business units and 36 innovations and a positive relationship between ambidexterity and innovation was found. Therefore, the following hypothesis is delivered:

Hypothesis 3: Alliance ambidexterity positively affects products innovation.

Alliance Ambidexterity and Process Innovation

As noted earlier, March (1991) expresses that the exploitation encompasses the achievement of short-term objectives, refinement, efficiency and implementation. Refinement activities are included in process innovation (Isobe, Makino & Montgomery, 2008). Process innovation involves the process of production, services to customers and human resources.

An alliance ambidexterity stimulates process innovation (He & Wong, 2004). Conceptually, both exploration and exploitation will encourage process innovation. Exploitation influences process innovation by reducing costs to become more efficient. Explorative alliance and exploitative alliance affect process innovation through the discovery of new processes. Rothaermal (2001) illustrates that a company which has marketing capability requires alliances with companies that have technology or new products. Capable marketing companies need to properly improve their processes in accordance with the presence of a new product or technology. In this case, an explorative alliance will empower process innovation. Tushman et al. (2002) find a positive relationship between ambidexterity with innovation. Benner & Tushman (2002) examine the effect of ambidexterity with improvements in process management and find a mutual supportive relationship. Hence, following hypothesis is developed:

Hypothesis 4: Ambidexterity alliances positively affect the process innovation.

Alliance Ambidexterity and Organizational Performance

Maintaining a balance between explorative alliance and exploitative alliance is the main factor that will determine a company’s success (March, 1991). Tushman & O'Reilly (1996), who presented the theory of an ambidextrous organization for the first time, state that an ambidextrous organization will have superior performance. Ambidexterity in a strategic alliance is clearly conveyed by Lavie & Rosenkopf (2006) through the dimensions of function, structure and attributes. A company that commits to alliances by operating in these three domains simultaneously will positively affect its performance.

Several studies convey the importance of continuous efforts in applying exploration and exploitation in organizations (Gibson & Birkinshaw, 2004; He & Wong, 2004). Gibson & Birkinshaw state that the ability of business units to simultaneously achieve alignment and adaptation will ultimately impact their organizational performance. Moreover, the organizations that combine strategic exploitative and explorative innovation attain a higher sales growth rate. In addition to sales growth, an ambidextrous company can improve financial performance, especially the profitability or the return on investment. He & Wong (2004) examine the relationship of an organization’s ambidexterity level and financial performance by two means. First, an ambidextrous organization can be considered an organization that has continuous exploration and exploitation innovation. Second, the impact of organization ambidexterity on the company's financial performance has also been demonstrated by the different empirical results between exploration innovation and exploitation innovation.

O'Reilly & Tushman (2004) find that ninety percent of ambidextrous organizations can achieve their goals. Ambidextrous organizations can implement evolutionary and revolutionary changes. The results of the study show that the interaction between exploration and exploitation positively affects sales growth. Therefore, a concise explanation of the above can be delivered with the following hypothesis:

Hypothesis 5: An ambidexterity alliance has a positive influence on organization performance.

Product Innovation, Process Innovation and Organizational Performance

Stuart (2000) states that the alliance’ performance is measured through the number of innovations and the revenue growth of the alliances’ product. Furthermore, the performance of the alliance is also measured by the quality of the resulting innovations. This quality relates to the quality of companies joint in an alliance. The higher the company quality, the higher the product quality will be. This finding is more likely caused by the market perceptions that are associated with the quality of the companies that are joined in those alliances.

Previous research has conveyed that product innovation and process innovation have a positive influence on the performance, particularly on the increase in sales (He & Wong, 2004). Companies that consistently explore new knowledge and expertise through product innovation will be able to affect organization performance (Yang & Li, 2011). Conversely, innovation also has a positive influence on the performance of the organization through the process of learning. For example, innovation can influence a strategy that will be used to familiarize the companies with the operational processes to achieve higher cost efficiency.

An organization must constantly develop products to be able to compete and to meet customer expectations (Leung, Lau & Zhang, 2013). When a company implements product innovations, it is expected that these products will meet the company's product performance expectations, increase market share, increase sales or increase customers' perception of the company’s product (Fontana, 2011). A superior result of product innovation over the existing products typically generates a better return on investment and has higher quality such that sales will eventually increase.

When a company implements process innovation, they normally expect cost reductions by enhancing the quality of products and services. For example, companies invest in IT to improve customer service by making the production process more efficient. This type of process innovation will present the company with a competitive advantage and will positively influence the company’s performance.

He & Wong (2004) state that product innovation and process innovation may encourage a sales increase. The researchers use sales as an indicator of the performance because it is an easy and valid tool. Leung, Lau & Zhang (2013) conducted a study on how product innovation and process innovation increase the market performance and the efficiency in the glass industry in China. Isobe, Makino & Montgomery (2008) prove that refining a company’s capability is positively related to operational performance. The presence of the new capabilities of the organization because of the exploration is positively related to market performance. Market performance, including sales and profitability, is the parameter used in the assessment of organizational performance (Venkatraman, 1990; Christensen & Kagerman, 2008). Thus, the hypotheses developed from the statements above are as follows:

Hypothesis 6: The higher the product innovation, the higher the performance of an organization.

Hypothesis 7: The higher the process innovation, the higher the performance of an organization.

Research Method

This study collected the data from business units in Telkom Group. These business units are given the authority to do alliance and innovation. Since all business units are located in Jakarta, the location of the research is conducted in Jakarta. There are 314 business units headed by two-tier officials under General Manager or Senior Manager spread across both the parent company and subsidiaries. The contract alliances were conducted from 2012 to 2015. 2012 is marked as Telkom's investment year in the ICT business. In addition, the company's strategic initiative is emphasized on investment in IT, Media and Education businesses by building digital communities in Indonesia (Telkom, 2012). In this year, Telkom Group began to invite players in the IT and digital industries to join their business and build alliances together. A list of all contracts was downloaded from TELIS (Telkom Legal Information System) application and from partnership’ database.

The main respondents in this study are head of business unit in Telkom Group. To gain more understanding about the operational of alliance, this study also uses additional respondents, i.e. managers in each business units. Managers are direct subordinate of head of business units. Numbers of alliances within the time range 2012 until 2015 is 211 contracts. As leaders, head of business units and their managers must continue to strengthen teamwork, initiative, accountability and innovation (Tushman & O'Reilly, 1996). They ensure in building the corporate culture so that the organization continues to learn in order to strengthen its capabilities. One of the most important learning is the ambidextrous organization requires a senior manager team of ambidextrous as well.

The six variables in this study, as shown in Figure 1, are measured as follows. First, absorptive capacity is defined as the ability to acquire new knowledge and the ability to implement new knowledge in organization. Based on Zahra & George (2002); Jansel et al. (2005); Daspit dan D’Souza (2013), the variable of absorptive capacity is represented by four dimensions, i.e., acquisition, assimilation, transformation and implementation. Second, organizational inertia, in this study refers to structural inertia (Gilbert, 2005; Sydow et al., 2009; Nedzinskas et al., 2013) covering three dimensions, i.e., resource rigidity, routines rigidity and path dependence. Third, alliance ambidexterity is the ability of doing explorative alliance and exploitative alliance simultaneously. Lavie & Rosenkopt (2006) explained three dimensions represent explorative and exploitative in alliance: function, structure and attribute of organization.

Fourth, product innovation is measured using items as presented by Christensen, Raynor & McDonald (2015); Christensen, Anthony & Roth (2004); Christensen & Reynor (2003); Christensen & Bower (1996). It uses the dimensions of profit margin, customer segment and product pricing. Fifth, process innovation uses measurement items as used by previous researchers (Fontana, 2011; He & Wong, 2004; Murovec & Prodan, 2008; Leung, Lau & Zhang, 2013). Process innovation emphasizes on the adoption of the latest technologies to improve the quality of existing products, increasing flexibility and quantity in service delivery. The dimensions of process innovation are input, process and output. Finally, organization performance is represented based on perceived organizational performance on sales, market share, profitability and product quality (Delaney & Huselid, 1996; Ar & Baki, 2011). Overall, there are 89 items to operationalize the six variables (Appendices).

The data is collected primarily through questionnaire. Each questionnaire is written in Bahasa Indonesia, which is measured on a 6-point Likert-type scale. Following preliminary pre-test, the questionnaire was improved and refined to ensure the questions were well understood by respondents. This research employs SPSS and LISREL in data processing.

The measurement of alliance ambidexterity referred the combination concept of exploration and exploitation explained by Cao, Gedajlovic & Zhang (2009). In accordance with the concept of combine, ambidexterity can be operated as a sum of exploration and exploitation (Gibson & Birkinshaw, 2004; He & Wong, 2004; Lubatkin et al., 2006). The value of explorative alliance summed up with exploitative alliance for each dimension is the dimensions of functions, structures and attributes.

Results

There were 336 of complete and valid questionnaires (55%) out of 611 questionnaires distributed. It came from 175 out of 314 business units based on their responsibilities to manage partnership and innovation streams. The validity of measurement model can be considered as good. All of the 85 items have standardized factor loading (SFL) ≥ 0.50 (Appendix 1). The reliability of group of items and dimensions can be also considered as good. All group of items have construct reliability (CR) ≥ 0.70 and variance extracted (VE) ≥ 0.50 (Hair et al., 1988) (Appendix 1).

| Appendix 1 The Result of Measurement Model Analysis |

||

| Absorptive Capacity (CE=0.96; VE=0.55; P-Value=1.00; RMSEA=0.00; NNFI=1.06; CFI=1.00; IFI=1.05; RFI=1.00; GFI=0.91) |

||

| Dimensions | Measurement Items | SFL |

| Acquisition | Interactions with other firms | 0.72 |

| Regularly visit other firms | 0.65 | |

| Collect industry information | 0.70 | |

| Meet with employees peer firms | 0.91 | |

| Periodically meets customers | 0.78 | |

| Assimilation | Recognize shifts in market shift | 0.70 |

| Recognize change in regulation | 0.67 | |

| Recognize change in demography | 0.77 | |

| Identify new opportunities | 0.69 | |

| Analyse market demand | 0.84 | |

| Transformation | Considers changing market demands | 0.61 |

| Record and store knowledge | 0.66 | |

| Share practical experiences | 0.65 | |

| Grasp opportunities from knowledge | 0.82 | |

| Discuss of market trends | 0.70 | |

| Exploitation | Understanding each role in firm | 0.61 |

| Exploit new knowledge | 0.70 | |

| Easy introducing new products | 0.85 | |

| Similar understanding in products | 0.94 | |

| Organizational Inertia (CE=0.96; VE=0.61; P-Value=1.00; RMSEA=0.00; NNFI=1.11; CFI=1.00; IFI=1.10; RFI=1.00; GFI=0.76) |

||

| Dimensions | Measurement Items | SFL |

| Resource Rigidity | New product investments | 0.58 |

| Focus on core business | 0.90 | |

| New hired employees | 0.83 | |

| Investment in uncertain business | 0.93 | |

| Routines Rigidity | Firm controlled more strictly | 0.56 |

| Centralized decision making | 0.63 | |

| Tighter budget control | 0.86 | |

| Unit autonomy reduced | 0.73 | |

| Experiments is limited | 0.83 | |

| Difficult to change business direction | 0.87 | |

| Utilizing existing infrastructure | 0.52 | |

| Path Dependency | Legacy internal procedures and rules | 0.83 |

| Existing knowledge for new business | 0.59 | |

| Proud of former success story | 0.75 | |

| Different behaviour for new business | 0.92 | |

| Former best practices accepted | 0.93 | |

| Alliance Ambidexterity (CE=0.94; VE=0.56; P-Value=1.00; RMSEA=0.00; NNFI=1.07; CFI=1.00; IFI=1.06; RFI=1.00; GFI=0.87) |

||

| Dimensions | Measurement Items | SFL |

| Exploration (Function) |

New knowledge of technology | 0.64 |

| New competences (R&D) | 0.56 | |

| New opportunities & market | 0.76 | |

| New market coverage | 0.82 | |

| Synergy for similar objectives | 0.80 | |

| Exploration (Structure) |

New partner form cross industries | 0.86 |

| New partner not tied with before | 0.88 | |

| Partners outside of existing network | 0.90 | |

| Partnership for new competencies | 0.77 | |

| Partner reputation is not priority | 0.78 | |

| Exploration (Attribute) |

Partner who different from other partners | 0.67 |

| Partner who different from our company | 0.66 | |

| Partners who different in culture with us | 0.55 | |

| Partners who different in management | 0.79 | |

| Partners who different in organization | 0.50 | |

| Exploitation (Function) |

Leverage existing knowledge | 0.78 |

| Combine capabilities with partners | 0.74 | |

| Complement asset with partners | 0.65 | |

| Complement marketing channel | 0.74 | |

| Reduce competitor threat | 0.85 | |

| Exploitation (Structure) |

Partners that familiar with | 0.74 |

| Partners that have alliance experience | 0.90 | |

| Partners within our existing network | 0.97 | |

| Well-known partner experience | 0.51 | |

| Partner reputation is the priority | 0.97 | |

| Exploitation (Attribute) |

Partner who same as other partners | 0.64 |

| Partner who same as our company | 0.60 | |

| Partners who same in culture with us | 0.75 | |

| Partners who same in management with us | 0.68 | |

| Partners who same in organization structure | 0.62 | |

| Product Innovation (CE=0.88; VE=0.51; P-Value=1.00; RMSEA=0.00; NNFI=1.08; CFI=1.00; IFI=1.07; RFI=1.00; GFI=0.80) |

||

| Dimensions | Measurement Items | SFL |

| Product Profitability | Product Profit | 0.80 |

| Product Margin | 0.57 | |

| Segment Market | Market segment | 0.55 |

| Product perception | 0.59 | |

| Product Features | Product capability | 0.90 |

| Product type | 0.64 | |

| Product new-ness | 0.87 | |

| Process Innovation (CE=0.89; VE=0.52; P-Value=1.00; RMSEA=0.00; NNFI=1.02; CFI=1.00; IFI=1.01; RFI=1.00; GFI=0.93) |

||

| Dimensions | Measurement Items | SFL |

| Input Process | Efficiency and affectivity | 0.84 |

| Profit/revenue share scheme | 0.80 | |

| Administrative managerial process | 0.68 | |

| Process | Supply chain partnering management | 0.77 |

| New business process | 0.85 | |

To test the fitness of the measurement model with the collected data, we use several indicators, such as p-value, RMSEA, NNFI, CFI, IFI, RFI, GFI (Appendix 1). Some models have GFI that are slightly below the threshold, for example, Organizational Inertia (GFI=0.76), Alliance Ambidexterity (GFI=0.87) and Product Innovation (GFI=0.80). However, the measurement model is considered acceptable, given the other supportive indicators (Anderson & Gerbing, 1988). At the overall measurement models, each latent variable is represented by a single indicator. These models, show p-value=1.0 and RMSEA=0.0 and can be considered as having good fitness.

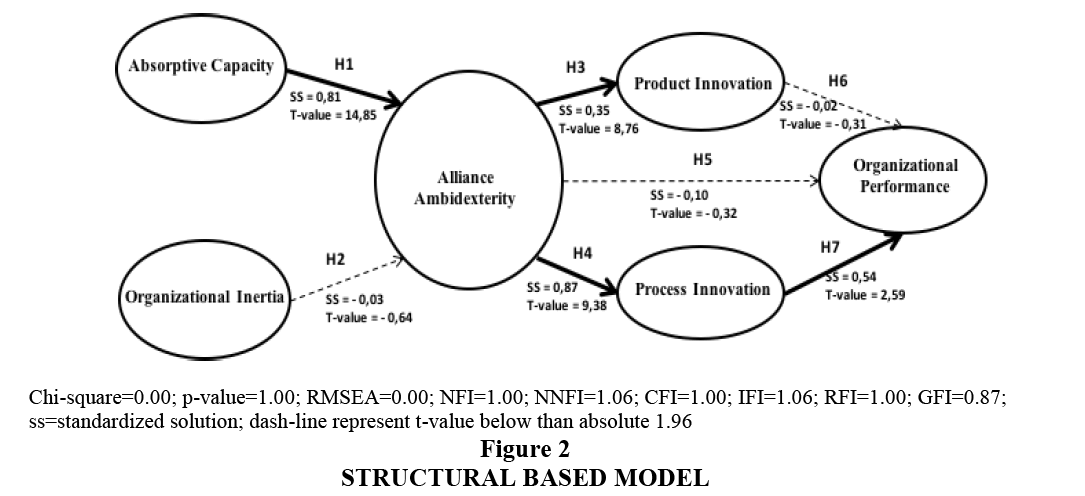

The structural models of this research are displayed in Figure 2. All goodness of fit index has met the thresholds. Structural model analysis shows a causal relationship among latent variables that exist in the research model. The dash line indicates an insignificant relationship or data does not support the research model whereas the solid line indicates a significant relationship (accepted hypothesis).

The calculated t-values and structural coefficients are shown in Figure 2. It shows absorptive capacity has positive effect to alliance ambidexterity. The alliance ambidexterity positively affects product innovation and process innovation. Process innovations have a positive effect on organizational performance. The result also shows the positive effect of alliance ambidexterity on organizational performance is only indirectly (i.e., mediated by process innovation). Overall, the research hypothesis H1, H3, H4 and H7 are accepted. While H2, H5 and H6 rejected (data does not support the research model).

Discussion

The aim of this study is to investigate the impacts of absorptive capacity and organizational inertia to alliance ambidexterity to maximize performance in Telkom Group’s context. This study also examined how the balance of explorative alliance and exploitative alliance results in product innovation and process innovation. Based on statistical analysis results, this study finds six major findings which can be summarized as follows.

First, this study finds that absorptive capacity is a critical factor in exploring and simultaneously exploiting strategic alliance. Thus, the acquisition of new knowledge, assimilation, transformation and implementation of knowledge are the most important factors in the alliance ambidexterity. It demonstrates that alliance ambidexterity is developed more effectively through adopting new knowledge from partners and leveraging existing knowledge. It is also formed through cooperating with parties from various industries background. This finding supports the concept of dynamic organizational capability of Zahra & George (2002).

Second, one of the interesting findings of our study is that there was no support from organizational inertia to alliance ambidexterity. Although there is organizational inertia in Telkom Group but they are also very active in conducting alliances. Unit business are found to be inertia because of their heavy investments getting locked in existing technologies rather than investing in new business, difficulty in implementing changes because of existing processes and procedures and employee pride in the company's success story that cause less awareness of environment change. Inertia and resistance generate mental model for valuable organizational learning. Through strategic alliance, business unit synergizes with partners to complement the capabilities. This combination of complementary capabilities perceived by respondents can reduce the threat of competition. This is in line with Wong & Millete (2002) that inertia within the organization can be a top management trigger for deciding to cooperate with others. Alliance with other companies is a solution if there are obstacles in allocating internal resources.

Third, ambidexterity is always expressed as a balance of exploration and exploitation. However, exploration and exploitation have limitations (March, 1991). Levinthal & March (1993) and March (1991) also point out that when a firm overemphasizes exploration or exploitation, it increases its risk of failing to appropriate returns from its costly search and experimentation activities. Aggressive exploration will cost too much without considering the lessons learned or feedback. Similarly, the high exploitation is also because high costs. Exploration will be more valuable in organizational performance whenever combined with exploitation at a certain level. Similarly, exploitation will be valuable when combined with the proper level of exploration alliance (Atuahene-Gima, 2005).

Fourth, the alliance ambidexterity positively affects product innovation and process innovation. This result is consistent with the concepts introduced by Benner & Tushman (2002) that product innovation and improvement in management processes are driven by ambidexterity.

Thus, in Telkom context, to innovate, company cooperates with other firms from various industry backgrounds. For example, partnership between Telkom Group and Banking is intended to explore new knowledge in the field of financial technology. Financial is a non-core industry of Telkom, so it is necessary for Telkom Group to develop partnership with other companies that have competencies in the field of financial technology. Telkom also cooperates with online company through bundling of data package and give the right for its customers to access mobile application without credit charged.

Fifth, the result shows that organizational performance influenced through process innovation. Large companies are expected to allocate a higher proportion of their expenditures in process innovation than smaller companies (Vaona & Pianta, 2006; Fritsch & Monika, 2001; Cohen & Klepper, 1996). Small companies tend to be more creative than large companies. Fritsch and Monika also found that process innovation may be much better suited for incumbent companies. Meanwhile, the companies that entry into a market more in line with product innovation. This result also supports research conducted by Yang & Li (2011) who state that the implementation cost is more efficient in the operational process has the positive effect on the performance. The investment for improving customer service process is conducted by making processes more efficient. The internal coordination process and administration is arranged by IT systems that make the company efficient (Yang & Li, 2011). Process innovation will give the company a competitive advancement and impact positively to the company's performance. The company expects to reduce cost, improve product and service quality through process innovation.

Sixth, this study also finds that every single product of company can be considered as product improvement. In addition, new products are always assumed more expensive than similar products owned by competitors. Customer segments that mostly targeted are the upper-middle segments that have been served by similar products from competitors. Product development is also targeting the mainstream customer that has the higher profitability. According to Berthon et al. (1999), in order to achieve high performance, the company not only serves existing customers with existing products (serve), but also creates new segments that have never been served before by similar products or new market (create).

Conclusion

This paper adds new insights of how Telkom as an incumbent Telco company in Indonesia, doing strategic alliance to drive innovation and performance. The need for adopting new knowledge from external organization and combining with internal knowledge is very important to balance exploration and exploitation in strategic alliance. We found there are two internal factors of organizational learning (absorptive capacity and organizational inertia) that may influence on alliance ambidexterity. It confirms previous research suggesting the importance of absorptive capacity to balance exploration and exploitation in strategic alliance. However, this study challenges previous research that discloses organizational inertia as an opposing construct for absorptive capacity. Strengthening alliance ambidexterity will increase both product innovation and process innovation. This study show that it indirectly impacts organizational performance but through process innovation.

The results reported here give several contributions to the current theories. The first contribution goes to organizational learning, especially in absorptive capacity and organizational inertia. This finding enriched previous study that mention the opposite construct between these two constructs (Nedzinskas, 2013). The results of this study indicate that unit organizational inertia provides opportunities in the context of the alliance ambidexterity to collaborate with other companies to obtain resources. Through alliances, un-owned capabilities and process rigidity can be solved.

Second, the results of this study enrich the debate about the influence of organizational ambidexterity on organizational performance since there are different results of ambidexterity to performance from previous researches. To manage undesirable cost of both high exploration and high exploitation is through process innovation by making processes more efficient, reducing cost, improving product and service quality.

This study also proposes some managerial implications. First, relates to absorptive capacity in organizations. It enables organizations to partner with other companies in generating new knowledge and simultaneously leveraging existing knowledge. Absorptive capacity also causes an understanding of new knowledge and analyses whether the knowledge is in accordance with the needs of the company and can be combined with existing knowledge. In addition, absorptive capacity in unit organization also leads to a transformation of knowledge by combining new knowledge acquired, modifying and implement in organization.

Second, the results of this study have implications for manager in organizational units on exploitation and exploration management in strategic alliance portfolios. They need to manage exploration and exploitation in strategic alliance to achieve equilibrium (Tushman & O'Reilly, 2006). This allows the organization to better understand resources; especially what knowledge is needed in the alliance and what can be learned from the alliance (Leung, Lau & Zhang, 2013). Organizations must effectively design and organize alliances to facilitate effective learning knowledge from alliance partners. Thus, the complexity in the alliance does not always create difficulties; if managed well, it will result in greater benefits to the organization.

Third, product innovation and its effect to organizational performance. As an incumbent, Telkom certainly has many challenges from the presence of new players (Christensen, 2015). To produce product innovation Christensen believes that the incumbent must create products that not only target premium segments. In some cases, failure to respond to new comer because the organization is focused on short-term targets with no regard to long-term goals (Christensen, 2015). Disruption according to Christensen also occurs within a certain time frame, so the manager in organization should always anticipate the emergence of unidentified disruptor.

Limitations and Future Research

This study has several limitations and suggestion for future research. The first limitation in this research is the fact that this study only conducted in Telkom Group. This research is built based on assumptions that are adjusted to the conditions in Telkom Group concerned. As a state-owned company may have different results when this model is used to test other telecommunication operators in Indonesia who are all foreign ownership companies. Different organizational attributes will produce different results. Further research is suggested to test this model on other telecommunication companies or companies in other industries.

Second, the period of study in the timeframe from 2012 to 2015 can lead to bias when measuring the construct of product innovation. According to Christensen & Antony (2004), the result of product innovation cannot be seen in short period of time. Therefore, future research may be conducted on a wider time horizon.

References

- Abernathy, W. & Clark, K. (1985). Innovation: Mapping the winds of creative destruction. Elsevier Science Publisher, 14, 3-22.

- Akdoan, S., Akdoan, A. & Cngoz, A. (2009). Organizational ambidexterity: An empirical examination of organizational factors as antecedents of organizational ambidexterity. Journal of Global Strategic Management, 6, 17-27.

- Anderson, J.C. & Gerbing, D.W. (1988). Structural equation modelling in practice: A review and recommended two-step approach. Psychological Bulletin, 103(3), 411-423.

- Ar, I. & Baki, B. (2011). Antecedents and performance impacts of product versus process innovation: Empirical evidence from SMEs located in Turkish science and technology parks. European Journal of Innovation Management, 14(2), 172-206.

- Atuahene-Gima, K. & Murray, J.Y. (2007). Exploratory and exploitative learning in new product development: A social capital perspective on new technology venture in China. Journal of International Marketing, 15(2), 1-29.

- Atuahene-Gima, K. (2005). Resolving the capability-rigidity paradox in new product innovation. Journal of Marketing, 69(4), 61-86.

- Benner, M.J. & Tushman, M. (2002). Process management and technological innovation: A longitudinal study of the photography and paint industries. Administrative Science Quarterly, 47(4), 676-707.

- Benner, M. & Tushman, M. (2003). Exploitation, exploration and process management: The productivity dilemma revisited. Academy of Management Review, 28, 238-256.

- Berthon, P., Hulbert, J. & Pitt, L.F. (1999). To serve or create? Strategic orientations toward customers and innovation. California Management Review, 42(1), 37-58.

- Carillo, J. & Gromb, D. (1998). Culture in organizations: Inertia and uniformity. Journal of Law, Economics and Organization Advance Access, 1-29.

- Cao, Q., Gedajlovic, E. & Zhang, H. (2009). Unpacking organizational ambidexterity: Dimensions, contingencies and synergistic effects. Organizational Science, 20, 781-796.

- Christensen, C., Anthony, S. & Roth, E. (2004). Seeing what's next: Using the theories of innovation to predict industry change. Cambridge: Harvard Business Scholl Press.

- Christensen, C. & Bower, J. (1996). Customer power, strategic investment and the failure of leading firms. Strategic Management Journal, 17(3), 197-218.

- Christensen, C. & Kagermann, H. (2008). Reinventing your business model. Harvard business review.

- Christensen, C. & Raynor, M. (2003). Why hard-nosed executives should care about management theory. Cambridge: Harvard Business Review.

- Christensen, C., Raynor, M. & McDonald, R. (2015). What is Disruptive Innovation? Cambridge: Harvard Business Review.

- Cohen, W. & Klepper, S. Firm size and the nature of innovation within industries: The case of process and product R&D. The Review of Economics and Statistics, 78(2), 232-243.

- Cohen, W. & Levinthal, D. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128-152.

- Collinson, S. & Wilson, D. (2006). Inertia in Japanese organizations: Knowledge management routines and failure to innovate. Organization Studies, 27(9), 1359- 1378.

- Danneels, E. (2002). The dynamics of product innovation and firm competences. Strategic Management Journal, 23(12), 1095-1121.

- Delaney, J. & Huselid, M. (1996). The impact of human resource management practices on perceptions of organizational performance. Academy of Management Journal, 39(4), 949-969.

- Daspit, J. & D’Souza, D. (2013). Understanding the multidimensional nature of absorptive capacity. Journal of Management Issues, 25(3), 299-316.

- Fontana, A. (2011). Innovate we can: How to create value through innovation in your organization and society. Cipta Innovasi Sejahtera, 107-116.

- Freeman, D. (1987). Applied categorical data analysis. New York: Marcel Dekker, Inc.

- Fritsch, M. & Meschede, M. (2001). Product innovation, process innovation and size. Review of Industrial Organization, 19(3), 335-350.

- Gibson, C. & Birkinshaw, J. (2004). The antecedents, consequences and mediating role of organizational ambidexterity. Academy of Management, 47(2), 209-226.

- Gilbert, C. (2005). Unbundling the structure of inertia: Resource versus routine rigidity. Academy of Management Journal, 48(3), 741-763.

- Golonka, M. (2013). The alliance strategy and firms’ performance: Insights from research on the ICT industry. Journal of International Business Research, 12, 67-77.

- Gulati, R., Lavie, D. & Singh, H. (2008). The nature of partnering experience and the gains from alliances. Strategic Management Journal.

- Hair, J., Anderson, R., Tatham, L. & William, C. (1988). Multivariate Data Analysis (7th edition). Pearson.

- Hamel, G., Doz, Y. & Prahalad, C. (1989). Collaborate with your competitor and win. Harvard business Review, 71, 75-84.

- Hannan, M. & Freeman, J. (1984). Structural inertia and organizational change. American Sociological Review, 49(2), 149-164.

- He, Z. & Wong, P. (2004). Exploration vs. exploitation: An empirical test of the ambidexterityhypothesis. Organization Science, 15(4), 481-494.

- Isobe, T., Makino, S. & Montgomery, D. (2008). Technological capabilities and firm performance: The case of small manufacturing firms in Japan. Asia Pacific Journal of Management, 25(3), 413-426.

- Jansen, J. (2005). Ambidextrous organizations: A multiple-level study of Absorptive Capacity, exploratory and exploitative innovation and performance. Ph.D. dissertation.

- Jansen, J., George, G., Van Den Bosch, J. & Volberda, H. (2008). Senior team attributes and organizational ambidexterity: The moderating role of transformational leadership. Journal of Management Studies, 45(5), 982-1007.

- Jansen, J., Van Den Bosch, F. & Volberda, H. (2005). Managing potential and realized absorptive capacity: How do organizational antecedents matter? Academy of Management Journal, 48(6), 999-1015.

- Kelly, D. & Amburgey, T. (1991). Organizational inertia and momentum: A dynamic model of strategic change. Academy of Management Journal, 34(3), 591-612.

- Kinear, C. & Roodt, G. (1998). The development of an instrument for measuring organizational inertia. Journal of Industrial Psychology, 24(2), 44-54.

- Koza, M.P. & Lewin, A. (1998). The coevolution of strategic alliances. Organization Science, 9, 255-264.

- Lavie, D. & Rosenkopf, L. (2006). Balancing exploration and exploitation in alliance formation. Academy of Management Journal, 49(4), 797-818.

- Leung, V., Lau, C.M. & Zhang, Z. (2013). Explorative versus exploitative alliances: Evidence from the glass industry in China. China: MPRA: Munich Personal RePEc Archive.

- Levinthal, D. & March, J. (1993). The myopia of learning. Strategic Management Journal, 12, 95-112.

- Levitt, B. & March, J. (1988). Organizational learning. Annual Review of Sociology, 14, 319-340.

- Li, Y., Liu, Y. & Ren, F. (2007). Product innovation and process innovation in SOEs: Evidence from the Chinese transition. Journal Technology Transfer, 32, 63-85.

- Liao, S., Fei, W. & Liu, C. (2008). Relationship between knowledge inertia, organizational learning and organization innovation. Technovation, 28, 183-195.

- Lin, Z., Yang, H. & Demirkam, I. (2010). The performance consequences of ambidexterityin strategic alliance formations: Empirical investigation and computational theorizing. Management Science, 53(10), 1645-1658.

- Lubatkin, M.H., Simsek, Z., Ling, Y. & Veiga, J. (2006). Ambidexterityand performance in small to medium-sized firms: The pivotal role of TMT behavioural integration. Journal of Management, 32, 1-17.

- March, J. (1991). Exploration and exploitation in organizational learning. Organization Science, 2, 71-78.

- McGrath, R. (2001). Exploratory learning, innovative capacity and managerial oversight. Academy of Management Journal, 44, 118-131.

- Murovec, N. & Prodan, I. (2009). Absorptive capacity, its determinants and influence on innovation output: Cross cultural validation of the structural model. Technovation, 29(12), 859-872.

- Nedzinskas, S., Asta, P., Solveiga, B. & Margarita, P. (2013). The impact of dynamic capabilities on SME performance in a volatile environment as moderated by organizational inertia. Baltic Journal of Management, 8(4), 376-396.

- O'Reilly, C. & Tushman, M. (2004). The ambidextrous organization. Harvard business review.

- Raisch, S., Probst, G. & Tushman, M. (2009). Organizational ambidexterity: Balancing exploitation and exploration for sustained performance. Organization Science, 20(4).

- Rivkan, J. & Sigglekow, N. (2007). Patterned interactions in complex systems: Implications for exploration. Management Science, 53(7), 1068-1085.

- Rothaermel, F. (2001). Incumbent’s advantage through exploiting complementary assets via inter-firm cooperation. Strategic Management Journal, 22, 687-699.

- Stuart, T. (2000). Inter-organizational alliances and the performance of firms: A study of growth and innovation rates in a high-technology industry. Strategic Management Journal, 21, 791-811.

- Sydow, J., Schreyogg, G. & Koch, J. (2009). Organizational path dependence: Opening the black box. Academy of Management Review, 689-709.

- Szulanski, G. (1996). Exploring internal stickiness: Impediments to the transfer of best practice within the firm. Strategic Management Journal, 17(2), 27-43.

- Teece, D. (1986). Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy. Research Policy, 15(6), 285-305.

- Telkom. (2012). Keputusan Direksi TELKOM. Tentang Kerjasama (Partnership).

- Tsai, W. (2001). Knowledge transfer in intra-organizational networks: Effects of network position and absorptive capacity on business unit innovation and performance. Academy of Management Journal, 44(5), 996-1004.

- Tushman, M. & O’Reilly, C. (2006). Ambidextrous organizations: Managing evolutionary and revolutionary change. Sage: Managing Innovation and Change, 170-184.

- Tushman, M. & O'Reilly, C. (1996). Evolution and revolution: Mastering the dynamics of innovation and change. California Management Review.

- Tushman, M., Smith, W., Wood, R. & Westerman, G. (2002). Innovation streams and ambidextrous organizational forms. Unpublished Manuscript.

- Utterback, J. & Abernathy, W. (1975). A dynamic model of process and product innovation. Journal of Management Science, 3(6), 639-656.

- Van den Bosch, F., Volberda, H. & De Boer, M. (1999). Coevolution of firm absorptive capacity and knowledge environment: Organizational forms and combinative capabilities. Organization Science, 10, 551-568.

- Vaona, A. & Mario, P. (2006). Firm size and innovation in European manufacturing. The Kiel Institute for the World Economy.

- Venkatraman, N. (1990). Performance implications of strategic co-alignment: A methodological perspective. Journal of Management Studies, 27(1), 19-41.

- Venkatraman, N. & Ramanujam, V. (1986). Measurement of business performance in strategy research: A comparison of approaches author. The Academy of Management Review, 11(4), 801-814.

- Venkatraman, N.L.C. & Iyer, B. (2007). Strategic ambidexterity and sales growth: Longitudinal test in the software sector. Boston: Boston University.

- Wijanto, S. (2008). Structural equation modelling (SEM) dengan LISREL 8.8 Konsep & Tutorial. Yogyakarta: Graha Ilmu Yogyakarta.

- Wong, D.J. & Millete, W.R. (2002). Dealing with the dynamic duo of innovation and inertia: The in-theory of organization change. Organization Development Journal, 20(1), 36-52.

- Wong, P., Lee, L. & Foo, M. (2008). Occupational choice: The influence product vs. process innovation. Small Business Economics, 30, 267-281.

- Yamakawa, Y., Yang, H. & Lin, Z. (2011). Exploration versus exploitation in alliance portfolio: Performance implications of organizational, strategic and environmental fit. Research Policy, 40, 287-296.

- Yang, T.T. & Li, C.R. (2011). Competence exploration and exploitation in new product development: The moderating effects of environmental dynamism and competitiveness. Management Decision, 49(9), 1444-1470.

- Zahra, S. & George, G. (2002). Absorptive capacity: A review reconceptualization and extension. Academy of Management Review, 27(2), 185-203.