Research Article: 2023 Vol: 27 Issue: 1

The Imapct of Mobile Wallet Services in Cash-Less Economy through the Digital Revolution

Sreeram Kumar, KLEF Deemed to be University

Venu Madhav, KLEF Deemed to be University

Citation Information: Kumar, S. & Madhav, V. (2023). The impact of mobile wallet services in cash-less economy through the digital revolution. Academy of Marketing Studies Journal, 27(1), 1-19.

Abstract

Payments and settlements are critical components of the financial system. In recent years, significant progress has been made in infrastructure development, FinTech adoption, digital fund transfer, security, regulatory sandboxes, and other financial sector areas. The modern Indian economy relies heavily on digital payments. Digital wallets are an example of an innovative digital payment platform that has been in use, particularly since demonetization. Mobile wallets have made banking services more accessible. Mobile wallet transactions in India have increased 40 times in the last five years. The study's goal is to examine user satisfaction with mobile wallet services and identify the factors that contribute to dissatisfaction. The objective of the study is to analyze the impact of mobile wallet services in cashless economy with the digital revolution. Descriptive type of research is used for the study. Secondary as well as primary data has been gathered for the study. The study looks at user satisfaction with digital wallet services and briefly explains how digital wallet service delivery affects user satisfaction. The study goes into detail about the various factors that influence the use of Digital Wallets. The study analysis the industry, objectives of research, hypothesis formulated definition of the basic terms, analysis and limitations are discussed.

Keywords

Digital Economy, Digital Payments, Mobile Wallet, E-Wallet, Usage Satisfaction.

Introduction

Digital payments are extremely important in today's Indian economy. In digital payments, both the payer and the payee use digital modes to send and receive money. As a result of demonetization and active GDP growth, physical cash circulation was reduced to an unprecedented level. (RBI, 2020a) In October 2019, notes in circulation (NIC) would have been 26.04,953 crore, but it was only 22.31,090 crore. The actual growth rate of NIC in India in October 2019 was clearly lower than the expected rate. This means that digitization and reduced cash usage contributed to a reduction in NIC of more than 3.5 lakh crore. In 2019-20, the Reserve Bank's various initiatives Jack & Suri (2014) in the payments ecosystem were designed to promote healthy competition, improve customer convenience at a low cost, and boost customer trust in payment systems (RBI, 2020b). Online payments and face-to-face/proximity payments are the two types of electronic payment transactions. Online payments do not necessitate the user's presence at the point of sale, whereas face-to-face payments do. Digital wallets, internet banking, and other online payment methods are examples. A face-to-face payment transaction is an example of a point of sale. The Reserve Bank's overarching goal in the payments ecosystem is to ensure the adoption and penetration of digital payments across the country, supported by customer-centric measures to improve payment system safety and security (RBI, 2020b). One of the most effective platforms for settling cashless transactions is digital wallets. It is innovations that will help the Indian government achieve its goal of expanding digital payments across the country Karlan et al. (2016).

Review of Literature

(Azhagaiah, 2002) This article depends on customer credit card usage issues. It displays the latest developments, analyses the current situation, and forecasts the prospect of consumer debt as a result of credit card debt. It also assesses India's banking sector's financial position. Without a doubt, banks will benefit when they prioritize credit cards, which results in increased credit creation. (K, 2019) The customer satisfaction of cashless banking has a favorable impact on online payment adaptation. Online purchases of goods and services, mobile payments at point-of-sale (POS) via Smartphone apps, and peer-to-peer transfers between private users are examples of digital payments. (VISHWAKARMA, 2020) The study was carried out to investigate respondents' attitudes toward the use of plastic money Lake (2013). The findings demonstrated that no statistically significant difference was found among socioeconomic demographic factors and cardholders' preference for plastic money. The majority of respondents were hesitant to respond to the statement "Plastic money leads to debt trap." The suggestions are properly implemented in order to improve customer service. (Kumar, 2004) According to the study "Credit cards: on a growth trajectory," The perception of having a bank account has shifted, and they are now seen as a suitable substitute for carrying cash and also utilizing credit for a limited time. However, when it comes to credit card usage in the home country, India ranks last, trailing only China, Taiwan, and Malaysia. (Jeanne M. Hogarth, 2004) Using data from a consumer survey, this study focuses on consumers' efforts to resolve credit card troubles and their possibility of "exiting" that is, ceasing to use a specific credit card or the financial institutions connected with the card (Chakravorthi, 2003) demonstrates that credit cards provide advantages to consumers and business that other convenient payment do not, as evidenced by their volatile growth and transaction value over the last 20 years. (Morgan, 1998) This paper investigates how the proliferation of credit cards made credit card lenders more difficult. The paper investigates how credit card lenders are becoming extremely risky, as well as the economic consequences. (Singh, 2021) A digital payment is one which is made electronically. To send and receive money in digital payments, both the payer and the payee use digital methods. The findings of this study can help decision makers implement and develop in the digital payment mode, as well as understand how it affects user perception and intention Manikandan & Jayakodi (2017).

Aside from the above, the following key observations about online payment systems can be made after having studied various research papers and articles:

Research Gap

According to a review of the literature, a number of studies have been conducted to investigate the impact of digital wallets on usage satisfaction. The factors used in this study differ from those used in previous studies. The sample for the study was collected in Hyderabad, India. Earlier studies included mobile payments and digital payments as dependent variables, whereas the current study focuses solely on digital wallets.

Objectives of the Study

1. To investigate the impact of selected factors that contributes to Digital Wallet usage satisfaction.

2. To evaluate the effect of selected factors towards the Usage satisfaction of Digital Wallets.

Hypothesis of the Study

H1: There is no significant influence of factors that contribute to the Usage satisfaction of Digital Wallets.

H2: There is no significant effect of factors that contribute to the Usage satisfaction of Digital Wallets.

Research Methodology

Many studies on digital payments have already been conducted around the world. A variety of factors influence the use of Digital Wallets. The current study focuses on the cost and convenience of consumers when using e-Wallets.

Sources of Data

Primary data Primary data was gathered from general public of south Indian metropolitan cities from different sectors through the distribution of well-structured questionnaires and the use of Google forms.

Secondary data Secondary data was gathered through journals, theses, magazines, and yearly reports, among other sources.

The study relies on both primary and secondary data gathered via questionnaires, RBI publications, journal articles, and research papers. An online questionnaire (Google form) with multiple-choice and open-ended questions is used to collect primary data. The study will collect a sample of 235 respondents Table 1.

| Table 1 Tabular Representation Of Demographic Factors Of The Respondents |

||

|---|---|---|

| Gender | Number of responders | Percentage |

| Male | 109 | 46 |

| Female | 126 | 54 |

| Total | 235 | 100 |

| Age | Number of responders | Percentage |

| Up to 25 years | 103 | 44 |

| 26-35 years | 74 | 31 |

| 36-45 years | 17 | 7 |

| 46-55 years | 0 | 0 |

| 56-65 years | 21 | 9 |

| Above 66 years | 20 | 9 |

| Total | 235 | 100 |

| Education | Number of responders | Percentage |

| Primary Education | 75 | 32 |

| Secondary Education | 95 | 41 |

| Graduation | 36 | 15 |

| Post Graduation | 29 | 12 |

| Total | 235 | 100 |

| Occupation | Number of responders | Percentage |

| Student | 72 | 31 |

| Housewife | 16 | 7 |

| Public Sector | 32 | 14 |

| Private Sector | 89 | 38 |

| Self-Employed | 26 | 10 |

| Total | 235 | 100 |

| Monthly Income | Number of responders | Percentage |

| Below 25000 | 54 | 23 |

| 25001-35000 | 86 | 37 |

| 35001-45000 | 20 | 8 |

| 45001-55000 | 29 | 12 |

| Above 55000 | 46 | 20 |

| Total | 235 | 100 |

| Marital Status | Number of responders | Percentage |

| Married | 107 | 45 |

| Unmarried | 128 | 55 |

| Total | 235 | 100 |

| “Source: Authors calculated value” | ||

Results and Discussions

Representing Demographic Factors Using Frequency Tables

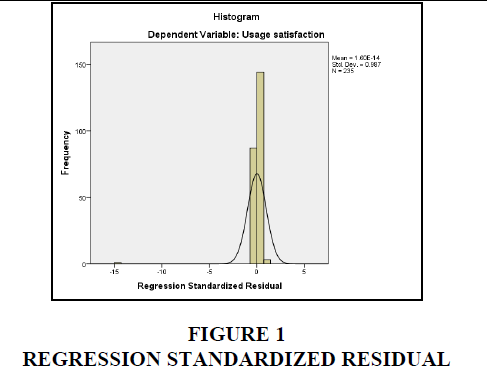

From the Table, the information was gathered from 235 users of mobile wallets; the respondent’s information is described in detail here. Considering the gender (109)46% of them were Males and the remaining were females Figure 1. Out of the total respondents, the majorities respondents are (103) 44% were up to the 25 years of age and (74) 31% were 26-35 years of age. Majority of the respondents have done their secondary education (95)41% followed by (75)32% have completed their primary education. Maximum respondents were from private sector 89(38%) and (72) 31% were students Mallat (2007). This implies that digital wallets are also popular among students. (86) 37% earn a monthly income of 25001-35000 and (54) 23% were earning below 25000. Unmarried respondents were (128) 55% and married respondents were (107) 45% Table 2 - 5.

| Table 2 Tabular Representation Of Model Summary Of Factors That Contribute To Digital Wallet Usage Satisfaction |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | Durbin-Watson | ||||

| R Square Change | F Change | df1 | df2 | Sig. F Change | ||||||

| 1 | 0.963a | 0.928 | 0.926 | 0.10190 | 0.928 | 489.507 | 6 | 228 | 0.000 | 2.024 |

| “a. Predictors: (Constant), Quickness, Usefulness, Ease of Use , Security, Customer support service , Cost | ||||||||||

| b. Dependent Variable: Usage satisfaction | ||||||||||

| Source: Authors calculated value” | ||||||||||

| Table 3 Tabular Representation Of Anova Of Factors That Contribute To Digital Wallet Usage Satisfaction |

||||||

|---|---|---|---|---|---|---|

| Model | Sum of Squares | df | Mean Square | F value | Sig. value | |

| 1 | Regression | 30.500 | 6 | 5.083 | 489.507 | 0.000b |

| Residual | 2.368 | 228 | 0.010 | |||

| Total | 32.867 | 234 | ||||

| “a. Dependent Variable: Usage satisfaction | ||||||

| b. Predictors: (Constant), Quickness, Usefulness, Ease of Use , Security, Customer support service , Cost | ||||||

| Source: Authors calculated value” | ||||||

| Table 4 Tabular Representation Of Coefficients Of Factors That Contribute To Digital Wallet Usage Satisfaction |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Correlations | Collinearity Statistics | |||||

| B | Std. Error | Beta | Zero-order | Partial | Part | Tolerance | VIF | ||||

| 1 | (Constant) | -0.045 | 0.086 | -0.524 | 0.601 | ||||||

| Cost | 0.176 | 0.013 | 0.275 | 13.092 | 0.000 | 0.609 | 0.655 | 0.233 | 0.716 | 1.397 | |

| Ease of Use | 0.206 | 0.012 | 0.315 | 16.833 | 0.000 | 0.410 | 0.744 | 0.299 | 0.902 | 1.108 | |

| Customer support service | 0.231 | 0.011 | 0.420 | 21.457 | 0.000 | 0.631 | 0.818 | 0.381 | 0.826 | 1.210 | |

| Security | 0.180 | 0.012 | 0.278 | 14.936 | 0.000 | 0.468 | 0.703 | 0.265 | 0.910 | 1.098 | |

| Usefulness | 0.190 | 0.011 | 0.339 | 16.909 | 0.000 | 0.659 | 0.746 | 0.301 | 0.786 | 1.272 | |

| Quickness | 0.026 | 0.011 | 0.045 | 2.364 | 0.019 | 0.294 | 0.155 | 0.042 | 0.863 | 1.159 | |

| “a. Dependent Variable: Usage satisfaction | |||||||||||

| Source: Authors calculated value” | |||||||||||

| Table 5 Tabular Representation Of Residual Statistics Of Factors That Contribute To Digital Wallet Usage Satisfaction |

|||||

|---|---|---|---|---|---|

| Minimum | Maximum | Mean | Std. Deviation | N | |

| Predicted Value | 3.0088 | 5.0011 | 4.3506 | 0.36103 | 235 |

| Residual | -1.47979 | 0.09011 | 0.00000 | 0.10059 | 235 |

| Std. Predicted Value | -3.717 | 1.802 | 0.000 | 1.000 | 235 |

| Std. Residual | -14.521 | 0.884 | 0.000 | 0.987 | 235 |

| “a. Dependent Variable: Usage satisfaction | |||||

| Source: Authors calculated value” | |||||

Analysis Representing The Influence of Factors That Contributes to The Usage Satisfaction of Digital Wallets Using Multiple Regression

The Output represents that out of all the factors “Customer support service” has a greater impact on Usage satisfaction of digital wallets. This represents that for every one unit increase in Customer support service, Usage satisfaction of digital wallets increases by 0.231 units. The residual value is stated as the vertical distance between a data point and the regression line in table Each data point contains one residual, which can be positive or negative. Positive indicates that you are above the regression line. Negative values indicate that the point is below the regression line, while zero values indicate that the regression line actually passes through the point. The values in this analysis are negative, indicating that they are below the regression line.

Regression assumptions: The Durbin-Watson all the time generates a test digit between 0 and 4. Here the value was 2.024. (No autocorrelation). VIFs between 1 and 5 suggest that there is a moderate correlation, which represents multicollinearity. Here the values are greater than 1. Homoscedasticity: Residual values should be constant, and then the Homoscedasticity is met. Here it is 48 Table 6 – 9 and Figure 2.

| Table 6 Table Representing The Descriptives That Effects The Cost On Usage Satisfaction Of Digital Wallets |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Usage satisfaction | |||||||||||||

| N | Mean | Std. Deviation | Std. Error | 95% Confidence Interval for Mean | Minimum | Maximum | Between- Component Variance | ||||||

| Lower Bound | Upper Bound | ||||||||||||

| Neutral | 11 | 3.5636 | 0.34430 | 0.10381 | 3.3323 | 3.7949 | 3.00 | 4.00 | |||||

| Agree | 92 | 4.1978 | 0.32002 | 0.03336 | 4.1316 | 4.2641 | 3.00 | 4.80 | |||||

| Strongly Agree | 132 | 4.5227 | 0.26918 | 0.02343 | 4.4764 | 4.5691 | 2.80 | 5.00 | |||||

| Total | 235 | 4.3506 | 0.37478 | 0.02445 | 4.3025 | 4.3988 | 2.80 | 5.00 | |||||

| Model | Fixed Effects | 0.29359 | 0.01915 | 4.3129 | 4.3884 | ||||||||

| Random Effects | 0.22016 | 3.4034 | 5.2979 | 0.10214 | |||||||||

| “Source: Authors calculated value” | |||||||||||||

| Table 7 Table Representing The Test Of Homogeneity Of Variances That Effects The Cost On Usage Satisfaction Of Digital Wallets |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Usage satisfaction | |||||||||||||

| Levene Statistic | df1 | df2 | Sig. | ||||||||||

| 3.676 | 2 | 232 | 0.027 | ||||||||||

| “Source: Authors calculated value” | |||||||||||||

| Table 8 Table Representing Anova That Effects The Cost On Usage Satisfaction Of Digital Wallets |

|||||

|---|---|---|---|---|---|

| Usage satisfaction | |||||

| Sum of Squares | df | Mean Square | F | Sig. | |

| Between Groups | 12.871 | 2 | 6.435 | 74.661 | 0.000 |

| Within Groups | 19.997 | 232 | 0.086 | ||

| Total | 32.867 | 234 | |||

| “Source: Authors calculated value” | |||||

| Table 9 Table Representing The Multiple Comparisons That Effects The Cost On Usage Satisfaction Of Digital Wallets |

||||||

|---|---|---|---|---|---|---|

| Dependent Variable: Usage satisfaction Games-Howell |

||||||

| (I) Cost | (J) Cost | Mean Difference (I-J) | Std. Error | Sig. | 95% Confidence Interval | |

| Lower Bound | Upper Bound | |||||

| Neutral | Agree | -0.63419* | 0.10904 | 0.000 | -0.9246 | -0.3438 |

| Strongly Agree | -0.95909* | 0.10642 | 0.000 | -1.2464 | -0.6718 | |

| Agree | Neutral | 0.63419* | 0.10904 | 0.000 | 0.3438 | 0.9246 |

| Strongly Agree | -0.32490* | 0.04077 | 0.000 | -0.4213 | -0.2285 | |

| Strongly Agree | Neutral | 0.95909* | 0.10642 | 0.000 | 0.6718 | 1.2464 |

| Agree | 0.32490* | 0.04077 | 0.000 | 0.2285 | 0.4213 | |

| “*. The mean difference is significant at the 0.05 level. | ||||||

| Source: Authors calculated value” | ||||||

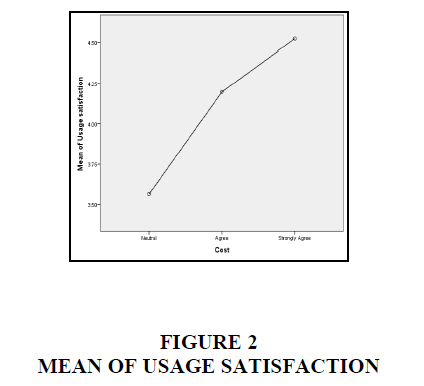

Tabular Representation of Effects of Cost on Usage Satisfaction Using ANOVA

ANOVA helps to find out whether there exits any difference among the means. Table represents those maximum respondents 132 were strongly agreeing about the affects of cost on Usage Satisfaction of Digital Wallets. From the table, Levene test explained the homogeneity of variance. As the value of “P” in the analysis was less than 0.05, this represents that equal variance not assumed. The result is significant. The table discusses about ANOVA. The value of “P” at the 5% threshold of significance was 0.000, which was less than 0.05. This demonstrated that there was a large disparity among opinions of the respondents towards cost on Usage Satisfaction of Digital Wallets. To estimate the significant difference Games Howell method from table was used. It represents multiple comparisons of respondent’s perceptions. The 0.000 P values indicate that there is a disparity in the opinions of different respondents towards cost on Usage Satisfaction of Digital Wallets. The output represents that maximum respondents were strongly agreeing to the point Table 10-13 Figure 3 Nithyanada & Fouillet (2015).

| Table 10 Table Representing The Descriptives That Effects The Ease Of Use On Usage Satisfaction Of Digital Wallets |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Usage satisfaction | ||||||||||

| N | Mean | Std. Deviation | Std. Error | 95% Confidence Interval for Mean | Minimum | Maximum | Between- Component Variance | |||

| Lower Bound | Upper Bound | |||||||||

| Neutral | 17 | 3.7882 | 0.41515 | 0.10069 | 3.5748 | 4.0017 | 3.00 | 4.40 | ||

| Agree | 145 | 4.3407 | 0.33344 | 0.02769 | 4.2860 | 4.3954 | 2.80 | 4.80 | ||

| Strongly Agree | 73 | 4.5014 | 0.31291 | 0.03662 | 4.4284 | 4.5744 | 3.80 | 5.00 | ||

| Total | 235 | 4.3506 | 0.37478 | 0.02445 | 4.3025 | 4.3988 | 2.80 | 5.00 | ||

| Model | Fixed Effects | 0.33359 | 0.02176 | 4.3078 | 4.3935 | |||||

| Random Effects | 0.16600 | 3.6364 | 5.0649 | 0.05613 | ||||||

| “Source: Authors calculated value” | ||||||||||

| Table 11 Table Representing The Test Of Homogeneity Of Variances That Effects The Ease Of Use On Usage Satisfaction Of Digital Wallets |

|||

|---|---|---|---|

| Usage satisfaction | |||

| Levene Statistic | df1 | df2 | Sig. |

| 0.922 | 2 | 232 | 0.399 |

| “Source: Authors calculated value” | |||

| Table 12 Table Representing The Anova That Effects The Ease Of Use On Usage Satisfaction Of Digital Wallets |

|||||

|---|---|---|---|---|---|

| Usage satisfaction | |||||

| Sum of Squares | df | Mean Square | F | Sig. | |

| Between Groups | 7.050 | 2 | 3.525 | 31.676 | 0.000 |

| Within Groups | 25.817 | 232 | 0.111 | ||

| Total | 32.867 | 234 | |||

| “Source: Authors calculated value” | |||||

| Table 13 Table Representing The Scheffe That Effects The Ease Of Use On Usage Satisfaction Of Digital Wallets |

|||

|---|---|---|---|

| Scheffe | |||

| Ease of Use | N | Subset for alpha = 0.05 | |

| 1 | 2 | ||

| Neutral | 17 | 3.7882 | |

| Agree | 145 | 4.3407 | |

| Strongly Agree | 73 | 4.5014 | |

| Sig. | 1.000 | 0.114 | |

| “Means for groups in homogeneous subsets are displayed. | |||

| “a. Uses Harmonic Mean Sample Size = 37.774. | |||

| b. The group sizes are unequal. The harmonic mean of the group sizes is used. Type I error levels are not guaranteed. | |||

| Source: Authors calculated value” | |||

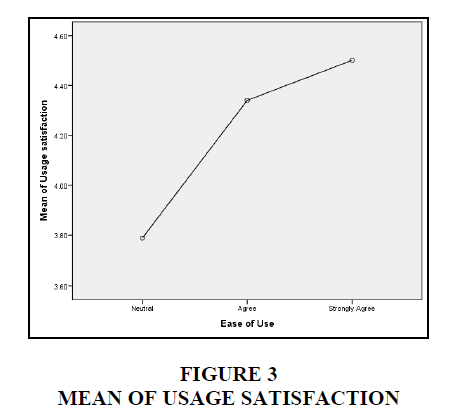

Tabular Representation of Significant Effect of Ease of Use Towards Usage Satisfaction of Digital Wallets Using ANOVA

Table represents those maximum respondents 145 were agreeing about the affects of ease of use on Usage Satisfaction of Digital Wallets Wright et al. (2013). From the table Levene test explained the homogeneity of variance. As the value of “P” in the analysis was greater than 0.05, this represents that equal variance assumed Onyima & Egbunike (2017). The result is insignificant. The table discusses about ANOVA. The value of “P” at the 5% threshold of significance was 0.000, which was less than 0.05. This demonstrated that there was a large disparity among opinions of the respondents towards ease of use on Usage Satisfaction of Digital Wallets. To estimate the significant difference Scheffe method from table was used. It represents multiple comparisons of respondent’s perceptions. This represents that there is a difference in the opinions of respondents. Majority respondents were strongly agreeing and few were neutral towards ease of use on Usage Satisfaction of Digital Wallets Table 14-17 Figure 4.

| Table 14 Table Representing The Descriptives That Effects Of Consumer Support On Usage Satisfaction Of Digital Wallets |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Usage satisfaction | ||||||||||

| N | Mean | Std. Deviation | Std. Error | 95% Confidence Interval for Mean | Minimum | Maximum | Between- Component Variance | |||

| Lower Bound | Upper Bound | |||||||||

| Disagree | 2 | 3.3000 | 0.14142 | 0.10000 | 2.0294 | 4.5706 | 3.20 | 3.40 | ||

| Neutral | 19 | 3.7263 | 0.38993 | 0.08946 | 3.5384 | 3.9143 | 2.80 | 4.20 | ||

| Agree | 86 | 4.2628 | 0.30719 | 0.03312 | 4.1969 | 4.3287 | 3.00 | 4.80 | ||

| Strongly Agree | 128 | 4.5188 | 0.25402 | 0.02245 | 4.4743 | 4.5632 | 3.60 | 5.00 | ||

| Total | 235 | 4.3506 | 0.37478 | 0.02445 | 4.3025 | 4.3988 | 2.80 | 5.00 | ||

| Model | Fixed Effects | 0.28659 | 0.01870 | 4.3138 | 4.3875 | |||||

| Random Effects | 0.21323 | 3.6720 | 5.0292 | 0.10320 | ||||||

| “Source: Authors calculated value” | ||||||||||

| Table 15 Table Representing The Test Of Homogeneity Of Variances Of Consumer Support On Usage Satisfaction Of Digital Wallets |

|||

|---|---|---|---|

| Usage satisfaction | |||

| Levene Statistic | df1 | df2 | Sig. |

| 2.650 | 3 | 231 | 0.050 |

| “Source: Authors calculated value” | |||

| Table 16 Table Representing The Anova Of Consumer Support On Usage Satisfaction Of Digital Wallets |

|||||

|---|---|---|---|---|---|

| Usage satisfaction | |||||

| Sum of Squares | df | Mean Square | F | Sig. | |

| Between Groups | 13.895 | 3 | 4.632 | 56.391 | 0.000 |

| Within Groups | 18.973 | 231 | 0.082 | ||

| Total | 32.867 | 234 | |||

| “Source: Authors calculated value” | |||||

| Table 17 Table Representing The Scheffe Of Consumer Support On Usage Satisfaction Of Digital Wallets |

|||

|---|---|---|---|

| Scheffe | |||

| Customer support service | N | Subset for alpha = 0.05 | |

| 1 | 2 | ||

| Disagree | 2 | 3.3000 | |

| Neutral | 19 | 3.7263 | |

| Agree | 86 | 4.2628 | |

| Strongly Agree | 128 | 4.5188 | |

| Sig. | 0.054 | 0.427 | |

| “Means for groups in homogeneous subsets are displayed. | |||

| a. Uses Harmonic Mean Sample Size = 6.992. | |||

| b. The group sizes are unequal. The harmonic mean of the group sizes is used. Type I error levels are not guaranteed. | |||

| Source: Authors calculated value” | |||

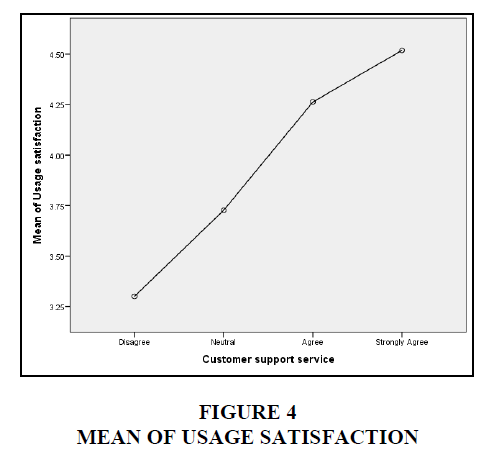

Tabular Representation of Significant Effect of Consumer Support Towards Usage Satisfaction of Digital Wallets using ANOVA

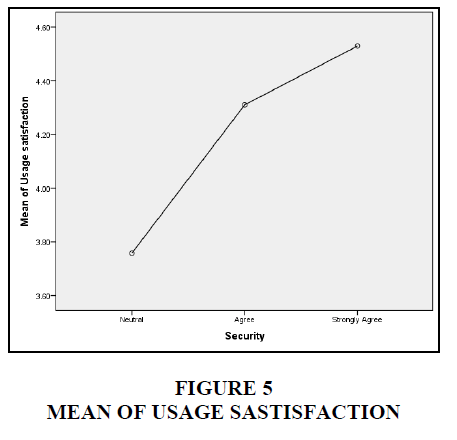

From the table represents those maximum respondents 128 were strongly agreeing about the affects of consumer support on Usage Satisfaction of Digital Wallets. From the table Levene test explained the homogeneity of variance. As the value of “P” in the analysis was equal to 0.05, this represents that equal variance are neither assumed nor not assumed. The result may be significant or insignificant. The table discusses about ANOVA. The value of “P” at the 5% threshold of significance was 0.000, which was less than 0.05. This demonstrated that there was a large disparity among opinions of the respondents towards consumer support on Usage Satisfaction of Digital Wallets Vidya Shree et al. (2015). To estimate the significant difference Scheffe method from table was used. It represents multiple comparisons of respondent’s perceptions. This represents that there is a difference in the opinions of respondents. Majority respondents were strongly agreeing and few were disagreeing towards consumer support on Usage Satisfaction of Digital Wallets Table 18-21 Figure 5 Sujith & Julie (2017).

| Table 18 Table Representing The Descriptives Of Security On Usage Satisfaction Of Digital Wallets |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Usage satisfaction | ||||||||||

| Number of responders | Mean Value | Std. Deviation value | Std. Error | 95% Confidence Interval for Mean | Minimum | Maximum | Between- Component Variance | |||

| Lower Bound | Upper Bound | |||||||||

| Neutral | 14 | 3.7571 | 0.40897 | 0.10930 | 3.5210 | 3.9933 | 3.00 | 4.20 | ||

| Agree | 142 | 4.3099 | 0.31472 | 0.02641 | 4.2576 | 4.3621 | 3.20 | 4.80 | ||

| Strongly Agree | 79 | 4.5291 | 0.34049 | 0.03831 | 4.4528 | 4.6054 | 2.80 | 5.00 | ||

| Total | 235 | 4.3506 | 0.37478 | 0.02445 | 4.3025 | 4.3988 | 2.80 | 5.00 | ||

| Model | Fixed Effects | 0.32947 | 0.02149 | 4.3083 | 4.3930 | |||||

| Random Effects | 0.17318 | 3.6055 | 5.0958 | 0.06130 | ||||||

| “Source: Authors calculated value” | ||||||||||

| Table 19 Table Representing The Test Of Homogeneity Of Variances Of Security On Usage Satisfaction Of Digital Wallets |

|||

|---|---|---|---|

| Usage satisfaction | |||

| Levene Statistic | df1 | df2 | Sig. |

| 1.030 | 2 | 232 | 0.359 |

| “Source: Authors calculated value” | |||

| Table 20 Table Representing The Anova Of Security On Usage Satisfaction Of Digital Wallets |

|||||

|---|---|---|---|---|---|

| Usage satisfaction | |||||

| Sum of Squares | df | Mean Square | F | Sig. | |

| Between Groups | 7.684 | 2 | 3.842 | 35.393 | 0.000 |

| Within Groups | 25.184 | 232 | 0.109 | ||

| Total | 32.867 | 234 | |||

| “Source: Authors calculated value” | |||||

| Table 21 Table Representing The Scheffe Of Security On Usage Satisfaction Of Digital Wallets |

||||

|---|---|---|---|---|

| Scheffe | ||||

| Security | N | Subset for alpha = 0.05 | ||

| 1 | 2 | 3 | ||

| Neutral | 14 | 3.7571 | ||

| Agree | 142 | 4.3099 | ||

| Strongly Agree | 79 | 4.5291 | ||

| Sig. | 1.000 | 1.000 | 1.000 | |

| “Means for groups in homogeneous subsets are displayed. | ||||

| a. Uses Harmonic Mean Sample Size = 32.920. | ||||

| b. The group sizes are unequal. The harmonic mean of the group sizes is used. Type I error levels are not guaranteed. | ||||

| Source: Authors calculated value” | ||||

Tabular Representation of Significant Effect of Security Towards the Usage Satisfaction of Digital Wallets Using Anova.

From the table represents those maximum respondents 142 were agreeing about the affects of Security on Usage Satisfaction of Digital Wallets. From the table Levene test explained the homogeneity of variance. As the value of “P” in the analysis was greater than 0.05, this represents that equal variance assumed. The result is insignificant. The table discusses about ANOVA. The value of “P” at the 5% threshold of significance was 0.000, which was less than 0.05. This demonstrated that there was a large disparity among opinions of the respondents towards Security on Usage Satisfaction of Digital Wallets. To estimate the significant difference Scheffe method from table was used. It represents multiple comparisons of respondent’s perceptions. This represents that there is a difference in the opinions of respondents. Greater part of respondents was strongly agreeing and few were neutral towards Security on Usage Satisfaction of Digital Wallets Table 22-25 Figure 6.

| Table 22 Table Representing The Descriptives Of Usefulness On Usage Satisfaction Of Digital Wallets |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Usage satisfaction | ||||||||||

| N | Mean | Std. Deviation | Std. Error | 95% Confidence Interval for Mean | Minimum | Maximum | Between- Component Variance | |||

| Lower Bound | Upper Bound | |||||||||

| Disagree | 2 | 3.4000 | 0.56569 | 0.40000 | -1.6825 | 8.4825 | 3.00 | 3.80 | ||

| Neutral | 21 | 3.7238 | 0.31290 | 0.06828 | 3.5814 | 3.8662 | 3.00 | 4.20 | ||

| Agree | 113 | 4.2920 | 0.26327 | 0.02477 | 4.2430 | 4.3411 | 3.20 | 4.80 | ||

| Strongly Agree | 99 | 4.5697 | 0.27901 | 0.02804 | 4.5140 | 4.6253 | 2.80 | 5.00 | ||

| Total | 235 | 4.3506 | 0.37478 | 0.02445 | 4.3025 | 4.3988 | 2.80 | 5.00 | ||

| Model | Fixed Effects | 0.27657 | 0.01804 | 4.3151 | 4.3862 | |||||

| Random Effects | 0.21409 | 3.6693 | 5.0320 | 0.10920 | ||||||

| “Source: Authors calculated value” | ||||||||||

| Table 23 Table Representing The Test Of Homogeneity Of Variances For Usefulness On Usage Satisfaction Of Digital Wallets |

|||

|---|---|---|---|

| Usage satisfaction | |||

| Levene Statistic | df1 | df2 | Sig. |

| 2.298 | 3 | 231 | 0.078 |

| “Source: Authors calculated value” | |||

| Table 24 Table Representing The Anova For Usefulness On Usage Satisfaction Of Digital Wallets |

|||||

|---|---|---|---|---|---|

| Usage satisfaction | |||||

| Sum of Squares | df | Mean Square | F | Sig. | |

| Between Groups | 15.197 | 3 | 5.066 | 66.225 | 0.000 |

| Within Groups | 17.670 | 231 | 0.076 | ||

| Total | 32.867 | 234 | |||

| “Source: Authors calculated value” | |||||

| Table 25 Table Representing The Scheffe For Usefulness On Usage Satisfaction Of Digital Wallets |

|||

|---|---|---|---|

| Scheffe | |||

| Usefulness | N | Subset for alpha = 0.05 | |

| 1 | 2 | ||

| Disagree | 2 | 3.4000 | |

| Neutral | 21 | 3.7238 | |

| Agree | 113 | 4.2920 | |

| Strongly Agree | 99 | 4.5697 | |

| Sig. | 0.187 | 0.316 | |

| “Means for groups in homogeneous subsets are displayed. | |||

| a. Uses Harmonic Mean Sample Size = 7.060. | |||

| b. The group sizes are unequal. The harmonic mean of the group sizes is used. Type I error levels are not guaranteed. | |||

| Source: Authors calculated value” | |||

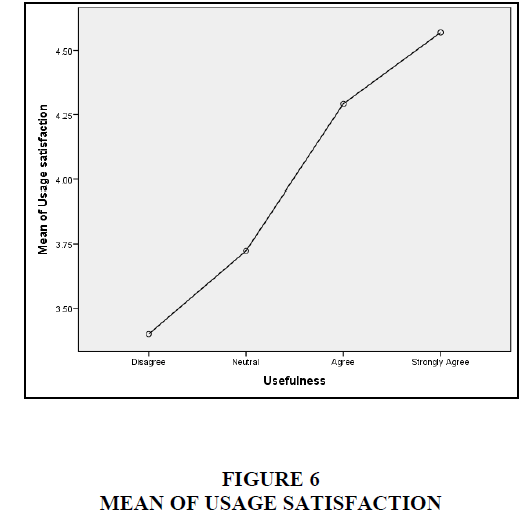

Tabular Representation of Significant Effect of Usefulness Towards the Usage Satisfaction of Digital Wallets Using ANOVA.

Table represents those maximum respondents 113 were agreeing about the affects of usefulness on Usage Satisfaction of Digital Wallets. From the table Levene test explained the homogeneity of variance. As the value of “P” in the analysis was greater than 0.05, this represents that equal variance assumed. The result is insignificant. The table discusses about ANOVA. The value of “P” at the 5% threshold of significance was 0.000, which was less than 0.05. This demonstrated that there was a large disparity among opinions of the respondents towards usefulness on Usage Satisfaction of Digital Wallets. To estimate the significant difference Scheffe method from table was used. It represents multiple comparisons of respondent’s perceptions. This represents that there is a difference in the opinions of respondents. Maximum respondents were strongly agreeing and few were disagreeing towards usefulness on Usage Satisfaction of Digital Wallets Table 26-29 Figure 7.

| Table 26 Table Representing The Descriptives Of Quickness On Usage Satisfaction Of Digital Wallets |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Usage satisfaction | ||||||||||

| Number of respondents | Mean value | Std. Deviation value | Std. Error | 95% Confidence Interval for Mean | Minimum | Maximum | Between- Component Variance | |||

| Lower Bound | Upper Bound | |||||||||

| Neutral | 24 | 3.9333 | 0.44396 | 0.09062 | 3.7459 | 4.1208 | 2.80 | 4.80 | ||

| Agree | 123 | 4.3837 | 0.36087 | 0.03254 | 4.3193 | 4.4482 | 3.00 | 5.00 | ||

| Strongly Agree | 88 | 4.4182 | 0.29810 | 0.03178 | 4.3550 | 4.4813 | 3.80 | 5.00 | ||

| Total | 235 | 4.3506 | 0.37478 | 0.02445 | 4.3025 | 4.3988 | 2.80 | 5.00 | ||

| Model | Fixed Effects | 0.34834 | 0.02272 | 4.3059 | 4.3954 | |||||

| Random Effects | 0.12067 | 3.8314 | 4.8699 | 0.03308 | ||||||

| “Source: Authors calculated value” | ||||||||||

| Table 27 Table Representing The Test Of Homogeneity Of Variances For Quickness On Usage Satisfaction Of Digital Wallets |

|||

|---|---|---|---|

| Usage satisfaction | |||

| Levene Statistic | df1 | df2 | Sig. |

| 2.990 | 2 | 232 | 0.052 |

| “Source: Authors calculated value” | |||

| Table 28 Table Representing The Anova Of Quickness On Usage Satisfaction Of Digital Wallets |

|||||

|---|---|---|---|---|---|

| Usage satisfaction | |||||

| Sum of Squares | df | Mean Square | F | Sig. | |

| Between Groups | 4.716 | 2 | 2.358 | 19.431 | 0.000 |

| Within Groups | 28.152 | 232 | 0.121 | ||

| Total | 32.867 | 234 | |||

| “Source: Authors calculated value” | |||||

| Table 29 Table Representing The Scheffe For Quickness On Usage Satisfaction Of Digital Wallets |

|||

|---|---|---|---|

| Scheffe | |||

| Quickness | N | Subset for alpha = 0.05 | |

| 1 | 2 | ||

| Neutral | 24 | 3.9333 | |

| Agree | 123 | 4.3837 | |

| Strongly Agree | 88 | 4.4182 | |

| Sig. | 1.000 | .887 | |

| “Means for groups in homogeneous subsets are displayed. | |||

| a. Uses Harmonic Mean Sample Size = 49.051. | |||

| b. The group sizes are unequal. The harmonic mean of the group sizes is used. Type I error levels are not guaranteed. | |||

| Source: Authors calculated value” | |||

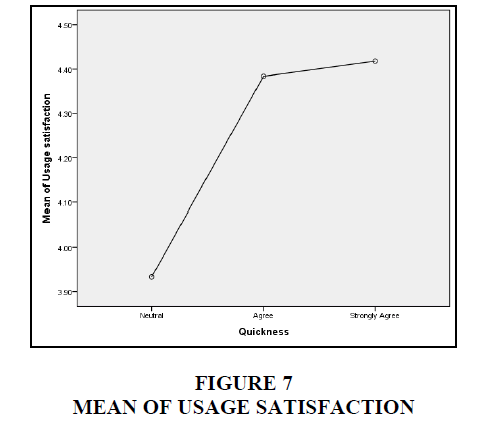

Tabular representation of significant effect of quickness towards the Usage satisfaction of Digital Wallets using ANOVA

Table represents those maximum respondents 123 were agreeing about the affects of quickness on Usage Satisfaction of Digital Wallets. From the table Levene test explained the homogeneity of variance. As the value of “P” in the analysis was greater than 0.05, this represents that equal variance assumed. The result is insignificant. The table discusses about ANOVA. The value of “P” at the 5% threshold of significance was 0.000, which was less than 0.05. This demonstrated that there was a large disparity among opinions of the respondents towards quickness on Usage Satisfaction of Digital Wallets. To estimate the significant difference Scheffe method from table was used. It represents multiple comparisons of respondent’s perceptions. This represents that there is a difference in the opinions of respondents. Larger part of the respondents was strongly agreeing and few were neutral towards quickness on Usage Satisfaction of Digital Wallets.

Findings

1. Demographic factors explain that Male respondents are 46% and Females are 54%, the data was gathered more from female respondents.

2. Age of the respondents represents that majority of them (103) 44% were from the category of below 25years and respondents between 46-55 years were nil.

3. Respondent’s education represents that majority of them have done their secondary education (95) 41%, and (75) 32% of the respondents have done their primary education.

4. The study evaluated that (89) 38% were private employees and (72) 31% were students. Very less responses from housewife’s.

5. Annual income represents that (86) 37% of the total respondents earn 25001-35000 and (54) 23% earn Below 25000.

6. Majority of the respondents were unmarried (128) 55% and (107) 45% were married.

7. Out of all the factors “Customer support service” has a greater impact on Usage satisfaction of digital wallets. This represents that for every one unit increase in Customer support service, Usage satisfaction of digital wallet increases by 0.231 units.

8. There is a disparity in the opinions of different respondents towards cost on Usage Satisfaction of Digital Wallets. The output represents that maximum respondents were strongly agreeing to the point.

9. Majority respondents were strongly agreeing and few were neutral towards ease of use on Usage Satisfaction of Digital Wallets.

10. Majority respondents were strongly agreeing and few were disagreeing towards consumer support on Usage Satisfaction of Digital Wallets.

11. Greater part of respondents was strongly agreeing and few were neutral towards Security on Usage Satisfaction of Digital Wallets.

12. Maximum respondents were strongly agreeing and few were disagreeing towards usefulness on Usage Satisfaction of Digital Wallets.

13. Larger part of the respondents was strongly agreeing and few were neutral towards quickness on Usage Satisfaction of Digital Wallets.

Suggestions

1. As “Customer support service” has a greater impact on Usage satisfaction of digital wallets. The issuers need to concentrate on services which are to be provided to the customers.

2. Every individual must have access to banking services, including a bank account with a debit/credit card and online banking.

3. Digital and mobile wallet issuers need to protect platform users with a variety of access management and cyber security.

4. It is recommended to improve Digital financial services as they lower the cost and increase the security of sending, paying and receiving money.

5. It is suggested to enable passwords on user devices and use secure network connections.

6. It is suggested to install apps from sources users trust and create a unique password for the digital wallet and keep login credential secure.

The Study’s Limitations

Only 235 people took part in the study. The sample results may not be generalizable to the entire population. The study was scheduled for the summer and fall of 2022, but attitudes may shift in the future. Furthermore, because the study was restricted to the Hyderabad area, the findings may not be applicable to customers in other parts of the country. The data gathered is based on the respondents' perceptions. The truthfulness of the responses from digital payment users would determine the data's validity and trustworthiness. The sample size is very small in comparison to the population, and thus does not represent the entire population. The data was collected using a structured questionnaire, which has the usual flaws associated with this data collection technique.

Conclusion

The study's goal was to collect information about the impact of digital wallet use on user satisfaction. Cost, ease of use, customer support, security, usefulness, and time savings are all independent variables that have a significant impact on digital wallet user satisfaction. The digital wallet is a FinTech revolution innovation, and according to the study, users are pleased with its use. Maintaining the level of satisfaction will thus encourage users to make digital payments rather than traditional payment methods, which could play a significant role in achieving the government's 'Digital India' goal.

References

Jack, W., & Suri, T. (2014). Risk sharing and transactions costs: Evidence from Kenya's mobile money revolution.American Economic Review,104(1), 183-223.

Indexed at, Google Scholar, Cross Ref

Karlan, D., Kendall, J., Mann, R., Pande, R., Suri, T., & Zinman, J. (2016).Research and impacts of digital financial services(No. w22633). National Bureau of Economic Research.

Lake, A.J. (2013). Risk management in Mobile Money.

Indexed at, Google Scholar, Cross Ref

Mallat, N. (2007). Exploring consumer adoption of mobile payments–A qualitative study.The Journal of Strategic Information Systems,16(4), 413-432.

Indexed at, Google Scholar, Cross Ref

Manikandan, S., & Jayakodi, J.M. (2017). An empirical study on consumer adoption of mobile wallet with special reference to Chennai city.International Journal of Research-Granthalaya,5(5), 107-115.

Nithyanada, K.V., & Fouillet, C. (2015). Spatial Complementarity of Mobile Financial Services, Business Correspondents and Banking Infrastructures: Accounting for Mobile Financial Services Ecosystems in India.IMTFI Final Report.

Onyima, J.K., & Egbunike, F.C.(2017) Generational Tensions in the Uptake of Digital Financial Services: Adolescent Girls and Adults in Nigeria.

Sujith, T.S., & Julie, C.D. (2017). Opportunities and Challenges of E-payment System in India.International Journal of Scientific Research and Management (IJSRM),5(09), 6935-6943.

Vidya Shree, D.V., Yamuna, N., & Nitua Shree, G. (2015). A Study on new Dynamics in Digital Payment System-with special reference to Paytm and Pay U Money.International Journal of Applied Research,1(10), 1002-1005.

Wright, G.A., Chopra, P., Mehta, S., & Shukla, V. (2013). Financial Inclusion Through Digital Financial Services.A Guided Tour… Linked To Resources.

Received: 27-Sep-2022, Manuscript No. AMSJ-22-12738; Editor assigned: 30-Sep-2022, PreQC No. AMSJ-22-12738(PQ); Reviewed: 14-Oct-2022, QC No. AMSJ-22-12738; Revised: 30-Nov-2022, Manuscript No. AMSJ-22-12738(R); Published: 20-Nov-2022