Research Article: 2023 Vol: 27 Issue: 6

The Green Financing Innovation Development Model Based For Micro Small Medium Enterprises

Teti Chandrayanti, Fakultas Ekonomi Universitas Ekasakti

Rice Haryati, Fakultas Ekonomi Universitas Ekasakti

Rina Asmeri, Fakultas Ekonomi Universitas Ekasakti

Citation Information: Chandrayanti. Y., Haryati. R., Asmeri. R., (2023). The Green Financing Innovation Development Model Based For Micro Small Medium Enterprises. International Journal of Entrepreneurship, 27(6),1-10

Abstract

The study aimed to develop the strategy of banks in giving green financing for Micro, Small, Medium Enterprises (MSMEs), by considering condition of parties involved and supporting of ecosystem. Some alternatives possible practical’s are proposed. The research method used is qualitative descriptive research. The purpose of this study is to make a systematic, factual and accurate picture of the facts, properties and relationships between the phenomena under study. The green financing strategy that was used as a framework for achieving goals is adjusted to the green business carried out by MSMEs, both related to the amount, interest rate and loan allocation for environmentally friendly activities or activities that minimize environmental damage. The level of concern of banks and also the level of concern of MSMEs for environmental sustainability related to their business activities will be a competitive advantage. By considering environmental elements in every business decision will be an important element to do business.. Banks and MSMEs activities are in line with the environment will get benefits financially and operationally. The study explored the role of the awareness about environmental is becoming part of the business, therefore all decision, all activities will consider the balance of profits and environmental due to the increase in the level of awareness of environmental sustainability.

Keywords

Green financing, Green business, Bank, MSMEs, Competitive advantage.

Introduction

The society awareness about environmental preservation increase significantly in this decade. is an important need at this time in society. Global warming, the destruction of the ozone layer, the greenhouse effect, is the impact of environmental damage that can be caused by human activities. Due to the increasing in environmental problems, companies are required to use balanced natural resources through responsible behaviour (Candrianto, Aimon & Sentosa, 2023). Therefore, the world community should concern for the environment which is manifested its activities also for business sector such as banks and other business in variety scale.

Banks have an important role for the economy in every country. Banks play more roles in environmentally friendly activities. The term green banking is becoming popular today. According to (Handajani, Rifai & Husnan, 2019) green banking is a bank that in its overall activities is environmentally friendly, has environmental responsibilities and work, and considers aspects of environmental protection in running its business. Guided by this, business decisions can be taken by considering environmental aspects into business so that the negative impact of bank activities can be reduced and banks play an even greater role in maintaining environmental sustainability. According to (Gupta, 2015) there are various ways to implement the adoption of green banking such as online banking, internet banking, green checking accounts, green loans, mobile banking, electronic banking outlets and energy use savings that contribute to environmental sustainability programs.

The core of banking business activities are collecting funds from communities and giving credit to communities. In the activity of distributing funds to the business world, the term green financing has become popular at this time. Green financing is financing provided by financial institutions including banks whose businesses are all intended for environmentally friendly business activities. For example, in China, The government wants to be a pioneer in Green Finance by ordering all banks in China to participate in developing Green Finance in order to realize China's ideals as a leading country in the affairs of world ecological civilization. While in Indonesia, The state is very concerned about sustainable development, where the Government has developed various policy frameworks so that Indonesia can contribute more to saving the earth. Although environmental-based investment instruments are still very limited, but Indonesia seeks to encourage environmentally friendly economic growth to attract investors into the Indonesian financial market

Business obtains the flow of funds from banks can be categorized into large businesses, medium enterprises, small businesses and micro enterprises. The definition of the business will be very diverse in many countries. The role of MSMEs in each country is also different. MSMEs have an important role for the economy of a country. In Indonesia, the number reaches 99% of all business units. The contribution of MSMEs to GDP also reached 60.5%, and the absorption of labor was 96.9% of the total national employment. Commercial banks based on applicable regulations are required to provide loans to MSMEs of at least 20% (twenty percent) which is calculated based on the ratio of MSME Credit or Financing to the total Credit or Financing.

The level of awareness of the importance of protecting the environment for MSMEs is associated with their business activities is very limited. The existence of loans from banks for MSMEs whose businesses are environmentally friendly provides a very large opportunity to create a sustainable environment that is conducive not only to business continuity but also to sustainable community life. Therefore, an appropriate and targeted strategy is needed for banks, to design an innovative model of providing green loans for MSMEs with limited understanding and application of environmentally sound activities for the parties involved.

In the era of globalization, every business must have a competitive advantage. One of the competitive advantages possessed by corporate companies in developed countries is oriented towards environmentally friendly enterprises. Awareness of the importance of the role of the environment for human life and the sustainability of the universe is increasingly being carried out in the world This happens because the world community is increasingly aware of the importance of protecting the environment and its sustainability As well as banking institutions. A developed and developing bank is one that always harmonizes the balance of its environment and economic activities, as this will be a competitive advantage.

Based on this, this article created a model for developing innovations in green lending by banks to micro, small and medium enterprises. Banks and MSMEs in synergy must jointly increase knowledge, understanding and sustainable development which is the integration of 3 important components, namely the economy, environment and society. In addition, in this article, we will discuss implementations that can be applied in green financing for green business. It is said that the banking mind set in designing sustainable economic activities must integrate with increasing the knowledge and readiness of business actors carried out side by side, and must be supported by a strong ecosystem. The problem that arises is the limited number of banks that are committed to environmental sustainability in carrying out their activities; on the other hand, MSMEs that receive financing from banks have limitations in managing their business with an environmental perspective. Serious efforts must be made to increase awareness of all parties about the importance of sustainable businesses that are environmentally friendly.

Literature Review

Bank

Bank is a business entity that collects funds from the public in the form of deposits and then distributes them to the public in the form of credit and in order to improve the standard of living of many people (Wisliyatni & Maqsudi, 2023: Parenrengi & Hendratni, 2018 and Law No.10 of 1998). So it can be said that banks, in addition to distributing funds in the form of credit, also provide other financial services, namely raising funds. Meanwhile, the definition in Financial Accounting Standards (SAK) No.31 of 2007 states that, "A bank is a business entity that collects funds from the public in the form of credit and or other forms in order to improve the living standards of many people. Added by (Wisliyatni & Maqsudi ,2023 that the main function of banking is as a financial intermediary institution, namely the process of purchasing surplus funds from the business sector, government and households, to be distributed to economic units

Micro Small Medium Enterprises (MSMEs)

MSMEs have different definitions in each country. Based on Indonesian Government Regulation Number 7 of 2021 concerning the Ease, Protection, and Empowerment of Cooperatives and Micro, Small and Medium Enterprises (hereinafter abbreviated as PP No. 7 of 2021) MSMEs are productive business units that stand alone, which are carried out by individuals or business entities in all sectors of the economy. In principle, the distinction between micro-enterprises, small businesses, medium-sized enterprises, large enterprises is generally based on the value of initial assets (excluding land and buildings), the average turnover per year, or the number of permanent workers (Chalim, Listyowati, Hanim, & Noorman, 2022). The definitation of MSMEs in Indonesia is as follow: A micro-enterprise is a business that has an annual sales turn over up to IDR 2 billion and a maximum turnover of 1 billion outside the land and business buildings. A small enterprise is a business that has an annual sales turnover of IDR 2 - 15 billion billion and a turnover of IDR 1-5 billion, outside the land and business buildings. Medium Enterprise: A medium enterprise is a business that has an annual sales turnover of 15-50 billion and a turnover of IDR 5 – 10 billion outside the land and business buildings.

Green Financing

Green financing concept aims to create and distribute financial products and services that encourage environmentally friendly investment and sustainable development. This means that loans provided by financial institutions or banks are used for environmentally friendly businesses. Banking activities should harmony with maintaining environmental sustainability. Unfortunately, the number of banks that contribute to this environmentally friendly activity is still very limited. According to data (2021) in Indonesia there are 90 banks operating, but only 9 banks already have ISO 14001 certification, namely BNI, Bank Mandiri, Bank Muamalat, Bank OCBC NISP, BRI, BTN, CIMB Niaga, and HSBC Indonesia. On the other hand, banks are required to provide business funds to small businesses. Although the nominal value of loans is small for each small business, because the amount is quite large in each country, this will have an impact on the country's economy

Research Methodology

The research method used was qualitative descriptive research. The purpose of this study ways makes a systematic, factual and accurate picture of the facts, properties and relationships between the phenomena under study. The results of the expected research are in the form of policy strategies from banks, as well as strengthening green businesses from MSMEs so that collaboration produces mutual benefits for both parties, and also for the environment. Qualitative descriptive research can be carried out whose results are in the form of strategies. This study aims to formulate the right strategy for banks in providing loan flows for MSMEs that carry out green business activities. The steps in this research are: identifying and analysing related parties such as banks, MSMEs and ecosystems in their activities related to environmental sustainability

Results and Discussion

The State of Green Banks 2020 report showcases trends among both operational and emerging green banks. The report highlights successes, trends, and lessons learned from existing green banks and presents trends in countries seeking to set up new green banks. These trends include the technologies they will invest in, types of financial instruments they will deploy, capitalization strategies, and obstacles green bank champions face during the establishment process.

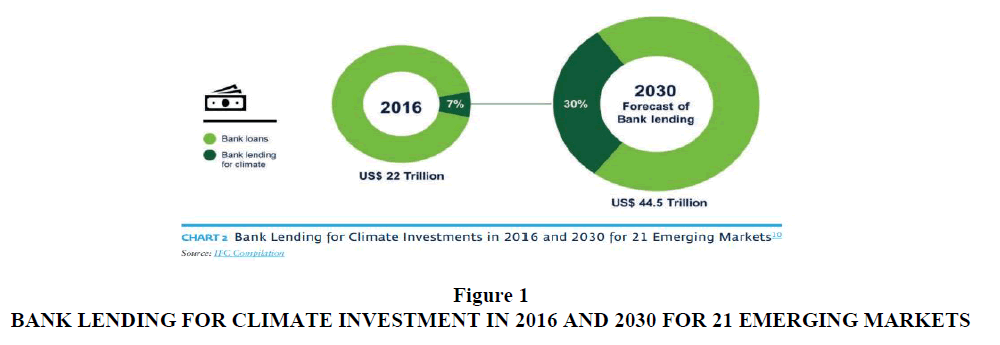

Based on the figure 1 above, it can be predicted that there will be an increase in loans provided by banks. Loans for environmentally sound activities in 2016 which was only 7% increased to 30% in 2030. This suggests that the trend of banking activity in the future includes the concept of environmental activity in its business decisions. Therefore, the concept of green banking by prioritizing green financing innovations for MSMEs business will be a complementary advantage for banks.

Micro, Small and Medium Enterprises have an important role for the economy, both in developed and developing countries. According to (Keskġn, Ġentürk, Sungur & Kġrġġ, 2010), SME's contribute to over 55% of GDP and over 65% of total employment in high-income countries. SME's and informal enterprises, account for over 60% of GDP and over 70% of total employment in low-income countries, while they contribute over 95% of total employment and about 70% of GDP in middle-income countries. In the European Union countries, for example, there are some 25 million small businesses, constituting 99% of all businesses; they employ almost 95 million people, providing 55% of total jobs in the private sector. The existence of small and medium enterprises in the future the activities carried out must also be oriented towards environmentally friendly which is called green business

The concept of green financing from banks to small businesses has an effect on the level of public awareness, because financial institutions and small businesses are required to apply the concept of balance between the economy and the environment so as to have a greater influence on the safety and preservation of the natural environment. The application of green financing to MSMEs help increase awareness of the importance of environmental sustainability and help MSMEs to contribute to sustainable development, so that they can have a positive impact on the environment and society. According to Hou & Fang (2023), green finance is a catalyst to increase economic recovery and the business climate due to new ideas and commitments to the environment.

The following are several ways to implement green financing for MSMEs: (1) Encouraging the use of renewable energy: Banks can provide credit to finance the installation of solar panels or other energy-saving technologies for MSMEs, thereby reducing the use of fossil energy and reducing operational costs. (2) Financing for waste treatment: Banks can provide loans to help MSMEs finance environmentally friendly waste treatment plants, thereby helping to reduce the environmental impact of their business activities. (3) Financing for business conversion: Banks can provide financing for MSMEs who want to switch to environmentally friendly businesses such as waste processing businesses, organic plantations, or waste water management businesses. (4) Funding for energy-saving programs: Banks can provide credit or financing for energy-saving programs carried out by MSMEs, such as replacing energy-saving lamps or installing energy management systems. (5) Financing for environmental certification: Banks can provide credit to help MSMEs obtain environmental certification such as ISO 14001 certification or other certifications, which can help MSMEs improve the quality of their products and services and increase customer confidence. Broadly speaking, the loans provided are used by small and medium enterprises for activities that are environmentally friendly according to the characteristics of the business being carried out.

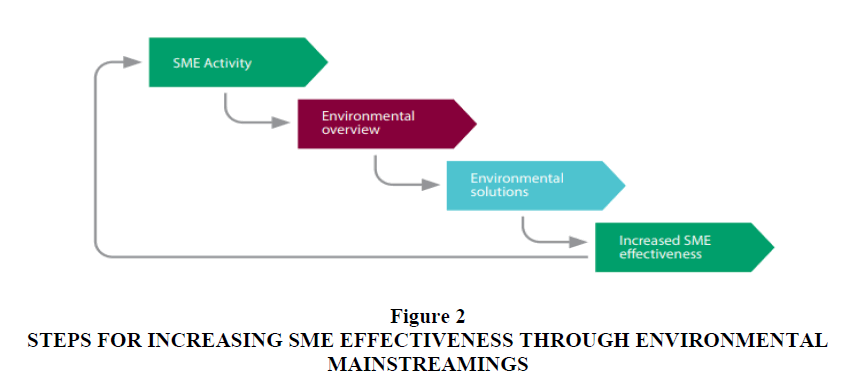

Based on the figure 2 it can be stated that SMEs activities will increase their effectiveness and it becomes their competitiveness. The importance of considering the elements of environmental sustainability for business actors in carrying out their business is an important part of small business activities at this time and in the future. This happens because small businesses gain financial and operational benefits. Small businesses that market their products to the public will get additional benefits, because the products or services produced are environmentally friendly and are chosen by consumers. Especially with the increasing level of public awareness of environmentally friendly products and activities. Likewise in terms of bank financing to small businesses. On green financing apart from banks having limited implementation, small businesses also have many limitations related to green financing.

Several small business problems in obtaining loans from banks are usually related to: (1) lack of information and education about financing. Many MSMEs do not understand how to obtain financing and manage their finances, (2) Strict requirements: Many financing institutions have strict requirements for financing, which makes it impossible for MSMEs to fulfill these requirements, (3) There is a negative perception of small businesses that considered unstable and lack good prospects' ,lack of guarantees. Many MSMEs do not have adequate collateral to obtain financing from financial institutions. There are 2 main factors that affect the ability of MSMEs to access loans from financial institutions, namely internal aspects and external aspects. Internal aspects are aspects that come from within SMEs such as the characteristics of business actors, business characteristics. While external aspects are aspects that come from outside the MSMEs such as cultural factors, environmental factors, quantity and quality factors from financial institutions.

According to (Handajani, Rifai & Husnan, 2019), there are 4 (four) reporting domains and indicators of green banking activities, especially at state-owned banks, namely green product, green operational, green customer and green policy. Green product relates to the creation of banking products or services that can encourage and guarantee the implementation of the green banking concept in banking business practices. Second, green bank operational activities (green operations) are related to the bank's efforts to make bank operational activities better from time to time with increasing awareness of the environment as an environmentally-friendly bank. Furthermore, the green banking domain related to customers (green customers) allows customers to contribute to green banking and not be involved in business activities that have a negative impact on the environment. Finally, bank practices related to green policy are systems, policies, principles and business decision making to become an increasingly environmentally friendly bank.

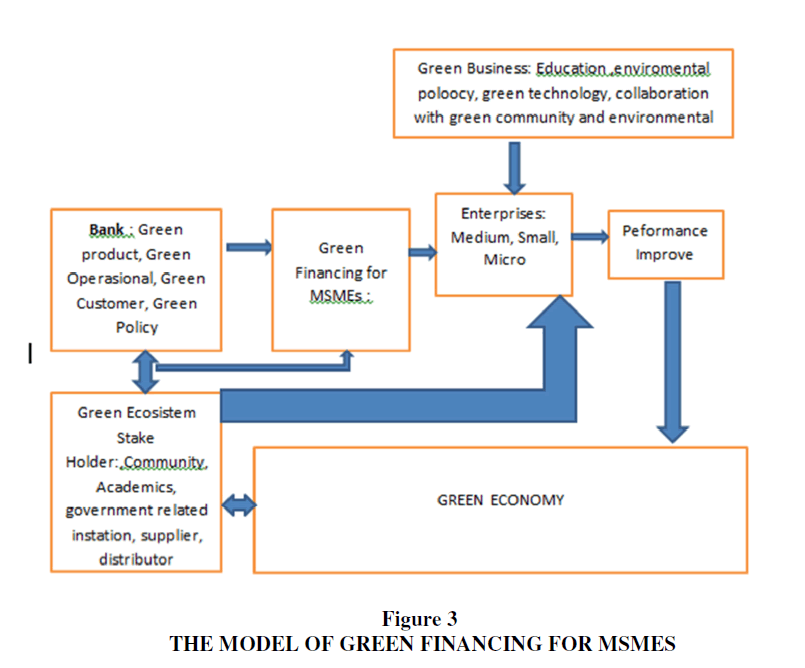

(Candrianto, Aimon & Sentosa, 2023) stated that the more companies are integrating the environmental concerns in their business operations and in their interactions with stakeholders, it will improve environmental sustainability that is applied into business strategies. They are adopting green practices, and it becomes the increasing in competitiveness and social responsibility of business. Making a corporate strategy must include pro-environment business activities supported by a green ecosystem that will ultimately improve the performance of MSMEs. Broadly speaking, the strategy carried out by financial institutions must look at environmental conditions and also the characteristics of MSMEs to be given loans. The strategy for developing green financing innovations carried out by banks can be seen in figure 3.

Banks can provide services to customers through 4 components, namely green products, green operations, green customers and green policies. The Bank collaborates with other stakeholders such as the Government, related agencies, business suppliers and business distributors to provide education, outreach and assistance to MSMEs. On the other hand, because MSMEs have different characteristics, banks provide optimal service at each scale based on their characteristics.

Banks should be able to have innovation in the way of delivering loans. Increasing in the number of loan given, minimize the credit risks and support environment preservation. Due to MSMEs as targets of green loans, and they have a variety different characteristics, financial institution should apply the right strategies. There are some strategies that can be applied by banks to MSMEs such as: (1) Green loans are loans given to MSMEs that have sustainable businesses and minimize environmental impacts. Therefore financial institution have to design and implement green financing programs that is suitable to the MSMEs characteristics,(2) Green Business, Banks give many benefits to green business such as in simple procedure, the interest rate, and others, (3) joint funding several banks with other investors to environmentally friendly projects, (4) Specialized green financing such as financing model to provide loans for MSMEs which adopt business practices sustainable and minimize greenhouse gas emissions. Interest rates can be adjusted based on the level of energy efficiency and green business applied by MSMEs and (5) Certification-based financial. Financial institutions provide loans to MSMEs that have environmental or social certification, and the interest rate is based on the level of certification owned by small businesses.

The choice of strategies will depend on many factors such as capacity and characteristics of business. According to (Jinru, Changbiao, Ahmad, Irfan, & Nazir, R., 2022). The green financing is a strategic tactic to include the financial industry in the transition to resource-efficient and low-carbon economies and climate change adaptation. It also contributes to the achievement of the green development strategy. The previous study has highlighted several benefits of general financing such , encourages technological diffusion for eco-efficient infrastructure, aids in the creation of competitive advantage, provides corporate value, and improves economic prospects.

Conclusion

Banks activities which are harmony with the environment will receive added value, while MSMEs that are environmentally oriented will receive benefits both financially and operationally. The green financing strategy of banks is used as a framework for achieving their goals that is balanced between profit oriented and environmental sustainability. Both banks and MSMEs will take benefits in entering environmental sustainability in their activities, and it is a right strategy. It becomes competitive strategy. By implementing green financing policies, financial institutions will increase their role in a sustainable economy. It will force many MSMEs to do the same practices in doing their business. The prediction of awareness community in relating to the earth increase rapidly, due people will choose products from business that concern about environment. Furthermore, socialization, education and proper implementation are needed for the success of the green financing model. Wider and integrated efforts from related parties are needed so that the contribution is more significant.

Acknowledgement

The authors would like to express gratitude to the Ministry of Finance through Ministry of Research, Technology and Higher Education (Kementrian Riset, Teknologi dan Pendidikan Tinggi) for providing the funds of this research.

References

Candrianto, C., Aimon, H., & Sentosa, S. U. (2023). The role of knowledge, awareness and environmental attitudes in green product management. Global Journal of Environmental Science and Management, 9(1), 101-112.

Chalim, M. A., Listyowati, P. R., Hanim, L., & Noorman, M. S. (2022). Peran Pemerintah dalam Pengembangan Koperasi Modern dan UMKM Berdasarkan PP No. 7 tahun 2021. Audi Et AP: Jurnal Penelitian Hukum, 1(01), 21-29.

Chandrayanti, 2022. The Business Strategy of Small Enterprises in The Digital Period in West Sumatera. KnE Social Sciences The Second Economics, Law, Education and Humanities International Conference (ELEHIC-2021) / Pages 339–354.

Fasa, Muhammad Iqbal, and Adib Fachri (2022). "A Analisis penerapan green banking dalam pengembangan E-business usaha mikro kecil dan menengah (UMKM) (Studi UMKM Bandar Lampung): Analisis penerapan green banking dalam pengembangan E-business usaha mikro kecil dan menengah (UMKM)(Studi UMKM Bandar Lampung)." Kalianda Halok Gagas 4.2 (2022): 158-171.

Gupta, J. (2015). Role of Green Banking in Environment Sustainability: A study of selected commercial banks in Himachal Pradesh. International Journal of Multidisciplinary Research and Development, 2(8), 349-353.

Handayani, L. Rifai, A., & Husnan, L.H. 2019. Kajian Tentang Inovasi Praktek Green Banking Pada Bank BUMN. Jurnal Ekonomia: Kajian Ilmiah Ekonomi Bisnis, 15 (1); 1-16.

Hou, Y., & Fang, Z. (2023). Unleashing the mechanism between small and medium enterprises, and green financing in China: A pathway toward environmental sustainability and green economic recovery. Environmental Science and Pollution Research, 30(1), 1672-1685.

I.Nyoman Ayu Suryandari, 16 Oktober 2019. UMKM Ramah Lingkungan

Jinru, L., Changbiao, Z., Ahmad, B., Irfan, M., & Nazir, R. (2022). How do green financing and green logistics affect the circular economy in the pandemic situation: key mediating role of sustainable production. Economic Research-Ekonomska Istraživanja, 35(1), 3836-3856.

Keskġn, H., Ġentürk, C., Sungur, O., & Kġrġġ, H. M. (2010, June). The importance of SMEs in developing economies. In 2nd international symposium on sustainable development (pp. 183-192).

Lisa Fitriyanti Akbar.21 Juni 2022. Taksonomi Hijau Indonesia dan Peran Perbankan dalam Mendukung Green Economy.

Parenrengi, S., & Hendratni, T. W. (2018). Pengaruh dana pihak ketiga, kecukupan modal dan penyaluran kredit terhadap profitabilitas bank. Jurnal Manajemen Strategi Dan Aplikasi Bisnis, 1(1), 9-18.

Peer, S, Gursimran, R; Tibor, K, (2018). Raising Us$23 Trillion Greening Banks and Capital Markets for Growth G20 Input Paper on Emerging Markets. International Finance Corporation,

Wisliyatni, S., & Maqsudi, A. (2023). Analisis Perbandingan Tingkat Kesehatan PT Bank Rakyat Indonesia Tbk dan PT Bank Negara Indonesia Tbk Menggunakan Metode RGEC (Risk Profile, Good Corporate Governance, Earning, Capital) PERIODE 2017-2021. Jurnal Ekonomi dan Manajemen, 3(1), 269-287.

Received: 24-Aug-2023, Manuscript No. IJE-23-13935; Editor assigned: 28-Aug-2023, Pre QC No. IJE-23-13935(PQ); Reviewed: 11-Sep-2023, QC No. IJE-23-13935; Revised: 16-Sep-2023, Manuscript No. IJE-23-13935(R); Published: 22-Sep-2023