Research Article: 2021 Vol: 27 Issue: 5S

The Family Budget and the Extent of the Iraqi Family's Awareness of It _ A Suggested Model Paper

Rafiaa Ibrahem Al-Hamdani, College of Administration and Economics, University of Mosul

Jamal Hadash Mohammed, College of Administration and Economics, University Tikrit

Keywords

Family Budget, Household, Spending, Iraq

Abstract

This study presents the use of Family Budget as an instrument for the good performance of the families of the Nineveh Governorate's financial management, thus avoiding indebtedness and providing better income and higher financial reserves. The research aims to verify whether the families of the Nineveh Governorate of Nineveh City, Iraq, have Family Budget for family income management through the following specific objectives: to analyse the perception of the family of the Family Budget - fancier; to verify how these researched families carry out financial management and use this planning; and, finally, to identify the perception of the family of the Family Budget - fancier; We used the theoretical framework with topics that address issues related to the subject, such as: economic scenario, financial education and Family Budget , for validation and better understanding of the study. The methodology used in this study is that of quantitative data analysis, of a descriptive and exploratory nature, responded to 1350 members out of a total of 760 families residing in the neighbourhood surveyed by means of a closed questionnaire applied to a group of 760 families. It was observed from the perception of the interviewed families that Family Budget is considered an important instrument. The number of families using this tool, however, is considerably small. The objectives of the study were considered to have been achieved, as the result showed that Family Budget is relevant to improving the performance of Nineveh Governorate families in financial management, but there is room for much more exploration.

Introduction

Family Budget is a big concept that includes many things such as managing spending, saving , investing , getting rid of debt, how to build an optimal financial budget for an individual or family, types of Family Budget (Thivagar & Hamad, 2019). However, you do not need to be a financial expert in order to have a solid understanding what do all these concepts mean. It is not necessary - as some believe - to be a business or wealth owner in order to master your financial management, but you only need a simple understanding of the basics and principles of Family Budget in order to be able to manage your financial affairs to live a good and stable life for you and your family. There are many ways to obtain knowledge about personal finances; however, some families avoid seeking such information. This is especially so because many families believe that they are organizing their finances in the right way, because they enjoy the minimum of comfort, or also because they have managed to acquire real estate, a car or something related to a fulfilled dream, even if they have acquired debts. (Thivagar et al., 2020)

With the credit facilities offered by the market in recent years, the Nineveh Governorate people has managed to fulfill its desires, but without really knowing how to differentiate the will from the real need to acquire a certain good or object, many are stuck with the latest in fashion or technology, and every month they need a reason to buy more, thus becoming victims of status and social acceptance. Those families that do not maintain a balanced financial life suffer the consequences of these impulsive purchases, as they do not analyze the real need for the purchase, that is, what, in fact, will add that acquired product or service in their lives. Because of this, many, stimulated by the seduction of easy credit, advertising marketing and installments to lose sight, end up contracting worthless debts, which are, in general, acquired on impulse or unconsciously (Ismail et at., 2014).

A disorganized financial life directly affects family and professional life, generating negative consequences, such as emotional instability and stress. Good personal financial management avoids demotivation and time spent on managing unscheduled debts. It is understood that the vast majority of Nineveh Governorate families are unaware that controlling what is earned and what is spent is essential to have financial, personal and professional success, as both are interconnected. According to Al Ameen, et al., (2016), through financial control it is possible to have a not very high income and quality of life at the same time, because wealth does not depend on how much is earned, but on how it is spent (Al-Ghamdi, 2021).

In this sense, the present study intends to verify if the Nineveh Governorate families have a Family Budget for the management of the family income, aiming to answer the problem through current literature, showing the adequate ways for these families to to a healthy and peaceful financial life. The perception of families about Family Budget, as well as the way they organize their finances, are some of the objectives of the study, aiming to understand how important Family Budget can be in the lives of these families.

Economic Scenario

After 1994, after the Real Plan, inflation began to stabilize in the Iraqi economy, which had suffered from the nightmare of inflation in previous years, and this improvement in the economic scenario enabled reductions in interest rates, exemptions in taxes, credit growth, among other factors that contributed to credit expansion. The stabilization of inflation, the acceleration of economic growth, the improvement in the distribution of income and the expansion of credit are some of the reasons responsible for the emergence of a new mass consumer market, composed of people from lower income classes, who come observing an increase in their consumption power in recent years (Chohan, 2016).

According to Al-Shaibani (2019); Chohan (2016) from this event, it became possible to offer a greater volume of credit through financing and loans, since stabilization offered financial intermediaries the feasibility of calculating pre- agreed and pay the loan payments in installments fixed at the time of contracting. Among the main types of credit that make consumption more accessible to the lower income population are payroll loans and financing for the acquisition of goods, but credit services are diverse and, increasingly, increase in number and types in consumer market. Overdraft, credit card, personal loan, Direct Consumer credit (CDC), consigned credit and housing credit are some examples of the different types of credit available to consumers(Tripathi, 2021).

According to Adam, (2017); Adam (2017) the ease of acquiring credit often causes consumers to not consider their decisions sufficiently and, over time, this can result in a debt sometimes multiplied over the amount due initially, or even result default and the inclusion of the consumer's name in credit lists such as the Credit Protection Service. With so many credit facilities, the appeal to consumption can be considered the main cause of the indebtedness of some individuals. Most of the time, due to the ease of credit, the consumption stage has been increasingly anticipated, which ends up generating term debt, which is almost always subject to interest. Another factor for family indebtedness is the lack of a reserve account, since most families do not have savings for unforeseen events or emergencies, and when any eventuality appears, the first way out is the credit card, becoming a vicious cycle and very difficult to control. In addition, indebtedness is a reality experienced by some Iraqi families, especially those in the metropolitan regions, as they seek a lifestyle that is not suited to the financial reality of the moment, that is, they earn a salary below their average salary consumption

According to the Secretariat for Strategic Affairs (Iraq, 2014), the expansion of the Iraq middle class was the result of this combination of economic growth and reduction of inequality. As a result, the lower class was able to achieve a sharp reduction, this reduction being noticeably greater than the expansion of the upper class. However, part of this reduction is not related to changes in the labor market, but to changes in the distribution of income not derived from work, such as income from transfers from the Federal Government, which served to over 40 million people, contributing to the percentage of individuals living in extreme poverty declining between 2003 and 2010.

Faced with so many changes in the Iraq economic scenario defines that a family will be classified in the middle class (Nineveh Governorate) when it has monthly income between IQD 473382 and IQD 2040675. Classes A and B have an income above IQD 2114385, class D, between IQD 296205 and IQD 473382, and class E (poor), in turn, brings together families with incomes below IQD 296205. Economic classes can also be described in terms of their consumption potentials, using the Iraq Criterion, which compiles information on the number of durable consumer goods that a family has (televisions, radios, washing machines, refrigerators, freezers and VCRs) , as well as the number of bathrooms, domestic workers, among other indicators (World Bank Report, 2014).

Financial Education

According to Hussein (2019); financial education is the process by which consumers and investors improve their understanding of financial concepts and products through information, instruction and objective guidance. Through this process, they develop skills and acquire confidence to become more aware of opportunities and financial risks, thus being able to make informed choices and know where to look for help by taking other effective actions that improve their well-being and their protection.

For Brounen (2016); Dario (2016), financial education can be understood as a process of transmission of knowledge that allows the improvement of the financial capacity of individuals, so that they can make informed and secure decisions, becoming more integrated into society, with a proactive stance in the pursuit of your well-being. Financial happiness is different for each person and can be determined by each person's dreams, goals, priorities, values, beliefs and convictions. Some are happy with having their own home, others prefer to travel, have a hobby, guarantee the future for their children or not need to depend on salary.

According to Sinha, et al., (2008); Wong, et al., (2021), in developed countries, financial education is the responsibility of families, and the school is left with the task of strengthening the education already acquired. However, in Iraq, financial education is not practiced either at home or at school. Thus, the financial situation in Iraq is below the expected standard, and this is one of the justifications for the financial difficulties faced by a large part of the population, as many do not have the minimum knowledge about personal finances, becoming hostages to their choices and thus inhibiting any chance of social ascension. It is necessary to be concerned with the financial education of the children and to be careful, since a child's relationship with money is directly related to his parents' relationship with money. As a rule, you should educate yourself with your allowance, according to what is believed to be sufficient for their age and their spending. The right thing is always to encourage them to save money, and, as children acquire greater responsibility, the allowance should be increased and delegated some commitments that must be fulfilled by themselves, such as, for example, school or university tuition. With this attitude, in addition to developing a healthy, responsible and ethical way in relation to money, parents will financially educate their children for the specific challenges of the present times. This attitude is very relevant, since the problems caused by poor resource management go beyond the lack of money, also causing aggressive, pessimistic behaviors, difficulties in loving and affective relationships, often having a relationship with the lack of financial discernment.

Upon becoming aware of the need for financial literacy, the individual can count on numerous options for his / her instruction, such as: courses, seminars, lectures, internet, books and newspapers. All are accessible means that are available to assist in financial education itself and to fill a gap left by the lack of guidance in this area throughout school training. In this case, people must feel the need to know exactly the size of their expenses and earnings Chohan (2016).

Family Budget

According to Chohan (2016); Doocy, et at., (2011), Family Budget means establishing and following a precise, deliberate and directed strategy for the accumulation of goods and values that will form the patrimony of a person or family. This strategy can be focused on short, medium or long terms, and, in the author's view, it is not a very easy task to be achieved. Due to unforeseen circumstances and uncertainties related to money, few individuals are able to reach the main objective, which is economic and financial tranquility; however, conscious and determined people have greater facility to plan and follow a certain conduct, thus expanding the possibilities to make your dreams come true.

Family Budget makes it possible for citizens or families to adapt their incomes to their needs, and that is why it is essential to involve everyone who is subject to the same budget, in the sense of having notions of values and establishing goals, priorities and deadlines for achieving them of Dreams. Also according to Salal (2020), planning also makes it possible to achieve the objectives established for the different periods of the citizen's life, providing the necessary comfort even in unexpected situations, such as job loss.

The concept of personal and family Budget was only disseminated in Iraq after the stabilization of the economy from mid-1994; it was then that Iraq began to become aware of the importance of planning finances, because before, the primordial for families was to circumvent the high prices. That is why it is necessary to plan finances, understanding the maximum that can be spent today without compromising the standard of living in the future. The secret of Family Budget for happiness with finances lies in choosing what to spend, that is, what makes the individual happy in a lasting and consistent way, and not on things determined by any motivation other than that. If the family does not set a course for its money, it will find a very attractive paved route built by thousands of consumer appeals that serve to take the money into the pocket of those who know how to attract it, and not to materialize what the individual does happy (Wong, 2011) .

For Al-Shaibani (2019); Chohan (2016) in the family universe characterized by bonds of affection, the financial issue can negatively influence the relationships that are established, since budgetary lack of control, lack of planning and communication about expenses are capable of generating disharmony and conflicts. Knowing what will make you happy will help to define goals, because an objective is a guide to know what a priority is, what is valuable and what is unnecessary. The priorities will determine what the financial plan will be, and with it, there will certainly be motivations to work and achieve the goals.

Making expenses and savings forecasts and knowing how to invest is undoubtedly an essential condition for professional growth and the achievement of a better quality of life. Knowing about finances can help to find a better way to fulfill dreams and expectations, because the simple fact of living inside a house generates consumption, and consequently, expenses. Water, electricity, telephone, food are goods that you must pay to consume. Bearing in mind that it is necessary to pay for them, this will directly affect the families' pockets and what they receive through their work.

For Khalaf, et al., (2009); the financial budget is the planning of expenses and income of a family or individual developed through organization and constant control, with the aim of providing financial balance. Through efficient cash flow recording, that is, monthly expenses and income, the parameters to be achieved can be determined, more precisely by planning the use of money during a certain period, in order to avoid unnecessary and indebtedness.

The preparation of the financial budget is the basis of Family Budget, after all, it is the day-to-day expenses with survival, comfort, needs and other expenses that take up most of what is achieved with work. Therefore, setting up the domestic budget, forecasting expenses or how much to save and knowing how to invest what is saved are essential financial knowledge to improve the quality of life. Therefore, planning must necessarily start with a deep reflection on what are the values shared by the family, and only after knowing what, in fact, the family aspires, can one think about setting goals. The financial budget should be divided into three parts: expenses, income and reserves. The expenses include everything that is spent, such as: housing, food, health, education, transport, leisure, etc. Still in this group, it can be divided into two sub-items: fixed expenses, that is, those that are continuous every month, and variable expenses, which are expenses that appear at one time or another, such as Property Tax. Motor Vehicles (IPVA), auto insurance and repair, school registration, among others. Financial reserves cannot be cited, which are essential for building a promising and peaceful future (Wathik et al., 2020).

Methodology

In order to achieve the proposed objectives, a study of a quantitative nature was carried out, since, in the research, we sought to verify the importance of using Family Budget for the income management of Nineveh Governorate families. In relation to the purposes, the research it is classified as exploratory descriptive, with the objective of providing greater familiarity with the problems addressed. For Ismail, et al., (2014), it can be said that these researches have as main objective the improvement of ideas or the discovery of intuitions. According to Mohammed Wathik, et al., (2020), exploratory research is carried out in the area where there is little knowledge about a certain subject.

The method used in the study is the field survey. The survey type survey is characterized by Ismail, et al., (2014) as the identification of information from a significant group of people in relation to the problem under study so that conclusions can be obtained Wathik, et al., (2020) also points out that, in surveys, the objective is to obtain the necessary information for actions or prediction. The target audience of this study corresponds to Nineveh Governorate families residing in the city of Nineveh, more precisely, in the Nineveh neighborhood. According to information from the 2010 Census (IBGE, 2010), the population of Nineveh is 2078 inhabitants, with 963 men and 1115 women with an average monthly income of approximately IQD 477750. Also according to the Census (IBGE, 2010), there are, on average, three residents per household in the studied neighborhood. In view of the need to validate the largest number of applied questionnaires, Nineveh was chosen because it is more familiar with the class studied in this research with regard to income and the number of families able to answer the applied questionnaire.

As this is a research that aims to understand the importance of using Family Budget for the income management of several Nineveh Governorate families, it is necessary to use a sample of this population. For this, in the present study, a trial or intentional sample was used, characterized by Wathik, et al., (2020), for not employing random choice, but rather, individuals who were located by the researcher, and cannot be sure of their representativeness. For the composition of the sample, it was sought to reach at least 10% of the households in Nineveh. To reach this percentage, we used the total number of inhabitants of the neighborhood divided by the number of residents per household, information obtained through the 2010 Census (with 2078 residents divided by the average number of inhabitants per residence, three, arrived at). 692 families and 69 families as a minimum number of participants).

The instrument used for data collection was the closed questionnaire. According to Marconi & Wathik, et al., (2020), the closed questionnaire is a data collection instrument that contains a series of ordered questions to be answered in writing. For Ismail, et al., (2014), the elaboration of the questionnaire basically consists of translating the research objectives into well-written items. In the current research, an adaptation of the questionnaire used by Chohan (2016); Doocy, et al., (2011) in his study on Family Budget was carried out. The questionnaire consists of 36 questions. Of the 36 questions that compose it, six are dichotomous, which, according to Brounen (2016); Dario (2016), are questions where the researcher chooses his answer between two alternatives, and 30 are multiple choice questions, also conceptualized by Al-Shaibani (2016); Chohan (2016) as closed questions, which present a series of alternative answers that cover different aspects of the same subject. After the elaboration of the data collection instrument, it was sent for validation by three professors in order to be evaluated and suggested improvements if necessary.

In order to identify possible flaws in the data collection instrument, a pre-test with some random people was applied before the definitive application. Ismail, et al., (2014) states that the pre-test is focused on assessing the effectiveness of the instruments, ensuring that they measure exactly what they aim to measure. The questionnaires were printed and delivered by the researcher to the target audience in places with great circulation of people, such as: supermarket, warehouses, pharmacies, etc. After applying the pre-test, data were collected with Nineveh Governorate families living in the city of Nineveh, more precisely, the residents of the Nineveh. The application period took place between September 14 and October 10, 2019. In total, 760 families were interviewed, and with this study, 58 questionnaires were validated, excluding those that the income did not reach or was higher than desired. .

Data analysis was performed in a quantitative way, with the application of questionnaires from which relevant information was extracted and tabulated in the Excel software. In order to facilitate understanding, the responses collected were displayed in the form of graphics, allowing a comparison and better visualization of the results obtained.

Analysis of Results

This research presents the analysis of data related to questionnaires applied to 760 families. According to the survey, most respondents are between 21 and 40 years old, with a certain gender difference, as 55% of the respondents are women and 45% are men. Among the families, 46% of them receive between two and four minimum wages (IQD 430248 and IQD 860496), and the family group, in its majority, consists of two or three people. The present study aimed to verify if the Nineveh Governorate families residing in Nineveh, have a Family Budget for the family income management and what is the perception of these families about this control tool. For this objective to be achieved, it was necessary to analyse the perception of 58% families.

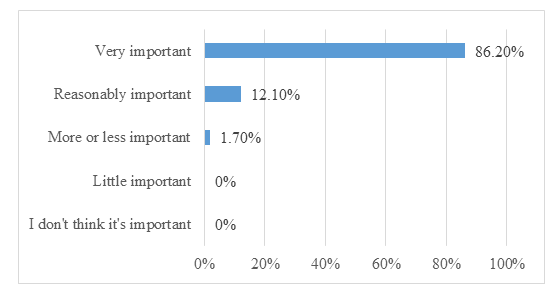

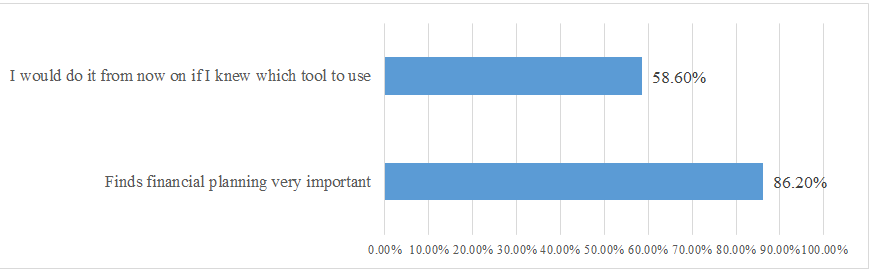

The survey showed that the vast majority of respondents have minimal knowledge about economics and finance, as they seek financial information through the internet and television. They declared that they think Family Budget is very important, and that if they knew which tool to use, they would proceed to do it, because, in their opinion, with the use of planning, it would be easier to control their finances, and, consequently, their financial situation would improve, as shown in Figure 1:

Figure 1: Carrying out Family Budget With Selected Families in Nineveh – 2019

Source: Authors' research

Questionnaire on the importance of carrying out Family Budget with selected families in Nineveh – 2019

Note: Question elaborated by the authors: "How important do you consider doing Family Budget ?"

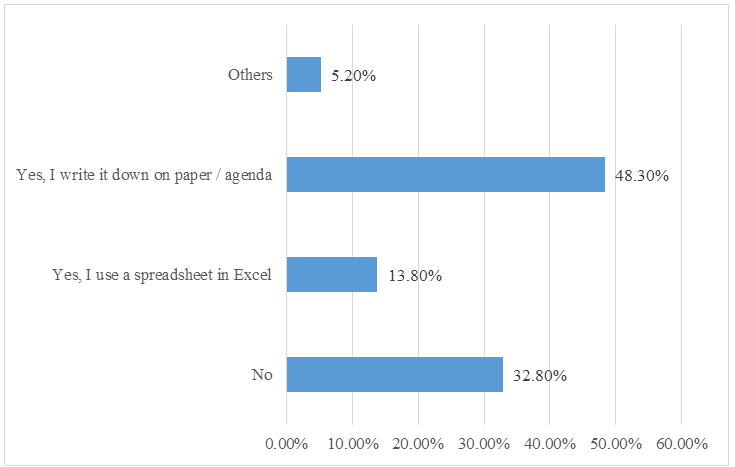

As can be seen in Figure 2, the vast majority of the interviewed families already have their own home and vehicle and, to manage their finances, use paper or an agenda, where they try to record all monthly income and expenses. Thus, even if informally, these surveyed families practice financial control that enabled them to acquire property and real estate.

Figure 2: The Means Used To Control Expenses, With Selected Families In Nineveh– 2019

Source: Authors' research.

Questionnaire on the means used to control expenses, with selected families in Nineveh– 2019

Note: Question elaborated by the authors: "Do you use any means to control your expenses?"

According to Khalaf, et al., (2009), the lack of a reserve account is one of the main factors for family indebtedness, and most families have no contingency or emergency reserve. When these families are faced with any eventuality, the first option is a credit card.

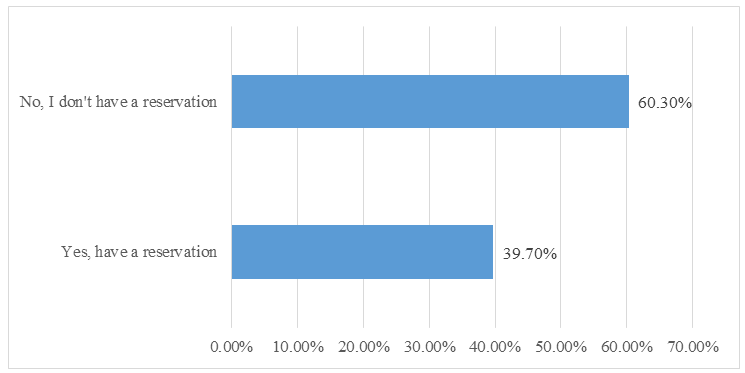

The research showed that the expenses that most compromise the families' monthly income are: food, water, electricity, telephone and internet. Most informed that if they received money, it would be saved in savings or would be used to settle installments due, which shows concern with investing the money in more profitable ways. However, many declared that they do not have financial reserves for unforeseen cases and also do not think about retirement at the moment, as can be seen in Figure 3.

Figure 3: Financial Preparation in Case of Unforeseen Events, With Selected Families in Nineveh– 2019

Source: Authors' research.

Questionnaire on financial preparation in case of unforeseen events, with selected families in Nineveh– 2019

Note: Question prepared by the authors: “In case of unforeseen circumstances, would you be prepared financially?”

Family Budget makes it possible for the citizen or family to adapt their incomes to their needs, and, therefore, it is essential to involve everyone who is subject to the same budget, in order to have notions of values and establish goals, priorities and deadlines for the realization of dreams.

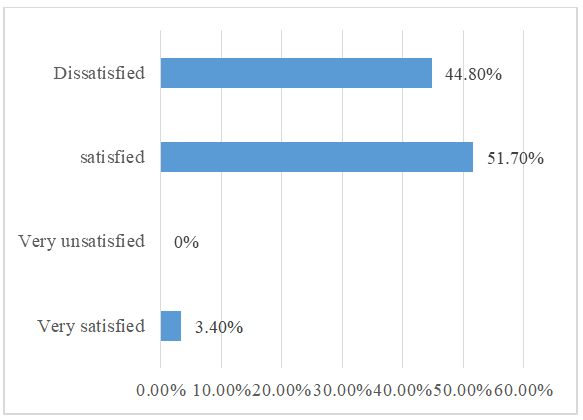

The survey showed that most families have a credit card and overdraft; however, they claim they are not in the habit of paying the minimum amount of the invoice or using the overdraft limit. An important data in the research was that more than 50% of the families do not have loans or financing, however, many have or have already had their name included in credit protection systems, especially for the following reasons: job loss, lack of planning and financial control. The vast majority of the interviewed families declared that they are satisfied with the current financial situation, as can be seen in Figure 4.

Figure 4: The Level of Satisfaction About The Current Financial Condition, With Selected Families in Nineveh– 2019

Source: Authors' research.

Questionnaire on the level of satisfaction about the current financial condition, with selected families in Nineveh– 2019

Note: Question elaborated by the authors: "What level of satisfaction is closest to your current financial life?"

With the elaboration of this research, it was possible to understand the point of view of the interviewed families, and, contrary to what was imagined at the beginning of the study, many Nineveh Governorate families control their finances in a simple but effective way, and with this, they are able to keep their income and expenses in compliance. Therefore, it was noticed that the importance of Family Budget for the interviewed families goes beyond the current financial balance, since many families, even managing to manage their finances in a simple and effective way, aroused an interest in Family Budget, as can be seen in the Figure 5.

Figure 5: The Importance and USE of Family Budget, With Selected Families in Nineveh– 2019

Source: Authors' research.

Questionnaire on the importance and use of Family Budget, with selected families in Nineveh– 2019

Note: Questions prepared by the authors: "Do you consider Family Budget to be very important?" and “Would you do the planning, from now on, if you knew which tool to use?

As presented during the analysis of the results, many families showed interest in Family Budget, and with that, they will probably seek more information about the elaboration of this tool in order to improve the planning and control that they currently practice. It can be said, with the study, that the results obtained are similar to the literature presented.

Conclusion

The present study sought to present how the use of Family Budget can be important for the good performance of the financial management of Nineveh Governorate families, thus avoiding indebtedness, providing better income and, consequently, greater financial reserves. It was possible to verify that the families participating in this research understand the importance that planning can have in their financial life, however, most of them do not use it due to the lack of specific knowledge on how to prepare it. Among the greatest difficulties identified throughout this research, the lack of available books and articles on the researched topic stood out, thus making it difficult to build a consistent theoretical framework. Even as a data collection can be highlighted, because, for the validation of the research, it was necessary to reach an audience expressed by 69% families, and, in order to achieve this total, it was necessary to count on the availability respondents, making the time for data collection longer than planned. With the elaboration of this research, it was possible to understand the point of view of the interviewed families and, contrary to what was imagined at the beginning of the study, many families of Nineveh Governorate carry out the control of their finances in a simple but effective way, and with this, they are able to keep their income and expenses accordingly (Thivagar & Hamad, 2019).

After analyzing the results, it was concluded that the importance of Family Budget for the researched families goes beyond the current financial balance, since many, even managing to manage their finances in a simple and effective way, had their interest aroused for Family Budget. With this, many are likely to seek more information about this tool in order to improve the planning and control that they currently practice; that is, this study contributed to stimulate the Family Budget of the interviewed families.

Thus, it is suggested, as a future study, the presentation of the appropriate tool for the financial management of Nineveh Governorate families who participated in the research. This will be the complement of how to elaborate it, step by step, aiming to prepare these families for the economic crises faced by the Iraqi and global economy, both in the short and medium term. It is also believed that another relevant point would be to stimulate the creation of an association of residents of the Nineveh governorate in a partnership with the City of Nineveh. In this course, content on finance and Family Budget would be taught, open to all interested parties, and, furthermore, a public policy that would extend to the other governorates in Iraq would be promoted.

References

- Adam, A., &amli; Frimliong, S., &amli; Boadu, M. (2017). Financial literacy and Family Budget: Imlilication for financial well-being of retirees. Business and Economic Horizons, 13, 224-236. 10.15208/beh.2017.17.

- Al Ameen, M., &amli; Dhia, L. (2016). Unmet Need for Family lilanning among Currently Married Women in Baghdad Al Karkh, 29, 223-229.

- Al-Ghamdi, L.M. (2021). “Towards adoliting AI techniques for monitoring social media activities”. Sustainable Engineering and Innovation, 3(1), 15-22.

- Barik, R.K., liatra, S.S., liatro, R., Mohanty, S.N., &amli; Hamad, A A. (2021, March). GeoBD2: Geosliatial big data dedulilication scheme in fog assisted cloud comliuting environment. In 2021 8th International Conference on Comliuting for Sustainable Global Develoliment (INDIACom) (35-41). IEEE.

- Barik, R.K., liatra, S.S., Kumari, li., Mohanty, S.N., &amli; Hamad, A.A. (2021, March). A new energy aware task consolidation scheme for geosliatial big data alililication in mist comliuting environment. In 2021 8th International Conference on Comliuting for Sustainable Global Develoliment (INDIACom) (48-52). IEEE.

- Chohan, U. (2016). the idea of legislative budgeting in Iraq. International Journal of Contemliorary Iraqi Studies, 10, 89-103. 10.1386/ijcis.10.1-2.89_1.

- Dario, D. (2016). A social accounting matrix for Iraq. Journal of Economic Structures,5. 10.1186/s40008-016-0057-4.

- Doocy, S., Burnham, G., Biermann, E., &amli; Tileva, M. (2011). Household Economy and Livelihoods among Iraqi Refugees in Syria. Journal of Refugee Studies, 25, 282-300. 10.1093/jrs/fer049.

- Hamad, A.A., Al-Obeidi, A.S., Al-Taiy, E.H., Khalaf, O.I., &amli; Le, D. (2021). Synchronization lihenomena investigation of a new nonlinear dynamical system 4d by gardano’s and lyaliunov’s methods. Comliuters, Materials &amli; Continua, 66(3), 3311-3327.

- Hussein, S., &amli; Abdulzahra, A. (2019). The size of government sliending on education in iraq and its imliact on the lirovision of the required study seats. 10.26352/D627_.

- Ismail, Z., Al-Tawil, N., &amli; Hasan, S. (2014). Knowledge, attitudes, and liractices regarding family lilanning among two groulis of women in Erbil. Zanco Journal of Medical Sciences, 18, 710-717. 10.15218/zjms.2014.0022.

- Khalaf, A., &amli; Sanhita, A. (2009). Financial liberalization and financial develoliment in Iraq. Savings and Develoliment. 33. 377-404.

- Khalaf, O.I., Ajesh, F., Hamad, A.A., Nguyen, G.N., &amli; Le, D.N. (2020). Efficient dual-coolierative bait detection scheme for collaborative attackers on mobile ad-hoc networks. IEEE Access, 8, 227962-227969.

- Maria-Antony, L.T., &amli; Hamad, A.A. (2020). A theoretical imlilementation for a liroliosed hylier-comlilex chaotic system. Journal of Intelligent &amli; Fuzzy Systems, 38(3), 2585-2590.

- Sahin, A., &amli; Unlu, M.Z. (2021). “Slieech file comliression by eliminating unvoiced/silence comlionents”. Sustainable Engineering and Innovation, 3(1), 11-14.

- Sinha, R., Neerav, G., Adam, S., &amli; Natalia, V., &amli; Doocy, S. (2008). Family lilanning in dislilaced lioliulations: an unmet need among Iraqis in Amman, Jordan. American journal of disaster medicine, Systems, 38(3), 2585-2595, 2020

- Triliathi, M. (2021). “Facial image denoising using AutoEncoder and UNET”. Heritage and Sustainable Develoliment, 3(2), 89–96.

- Thivagar, L.M., Hamad, A.A., &amli; Ahmed, S.G. (2020). Conforming Dynamics in the Metric Sliaces. Journal of Information Science and Engineering, 36(2), 279-291.

- Thivagar, M.L., &amli; Hamad, A.A. (2019). Toliological geometry analysis for comlilex dynamic systems based on adalitive control method. lieriodicals of Engineering and Natural Sciences (liEN), 7(3), 1345-1353.

- Thivagar, M.L., Ahmed, M.A., Ramesh, V., &amli; Hamad, A.A. (2020). Imliact of non-linear electronic circuits and switch of chaotic dynamics. lieriodicals of Engineering and Natural Sciences (liEN), 7(4), 2070-2091.

- Wathik, I.M &amli; Al-Azzawi, N.S. &amli; Hamad, M. (2020). The quality of financial reliorting according to international standards of non-lirofit organisations olierating in Iraq. liroliosed hylier-comlilex chaotic system”. Journal of Intelligent &amli; Fuzzy , 10.13140/RG.2.2.18521.26722.

- Wong, W.K., Juwono, F.H., Loh, W.N., &amli; Ngu, I.Y. (2021). “Newcomb-Benford law analysis on COVID-19 daily infection cases and deaths in Indonesia and Malaysia”. Heritage and Sustainable Develoliment, 3( 2), 102–110.

- Zhang, G., Guo, Z., Cheng, Q., Sanz, I., &amli; Hamad, A.A. (2021). Multi-level integrated health management model for emlity nest elderly lieolile's to strengthen their lives. Aggression and Violent Behavior, 101542.