Research Article: 2022 Vol: 26 Issue: 1

The Expected and the Unexpected - Topic 842 and Firms Financial Benchmarks

Yan Gibson, Liberty University

John R. Kuhn, Jr. Liberty University

Citation Information: Gibson, Y., & Kuhn, J.G. (2022). The expected and the unexpected – topic 842 and firms financial benchmarks. Academy of Accounting and Financial Studies Journal, 26(1), 1-13.

Abstract

This study is intended to provide evidential support for the subsequent changes in reported financial data after the new lease accounting standard (Topic 842) was implemented. The researcher utilized the causal-comparative method to test the significance of the year-over-year changes in selected financial ratios. Paired t-test or Wilcoxon was used to investigate the differences in financial performance ratios measuring firms’ asset efficiency, profitability, financial leverage, and liquidity. All firms in the Standard & Poor’s (S&P) Industrial Sector were sampled to test the hypotheses. The testing results showed significant changes in every category of financial performance at the sector level. Compared to non-leasing firms, leasing firms demonstrated more volatilities post Topic 842. Driven by the changes in leasing firms, the industrial sector is more financially leveraged. The expected increase of EBITDA post Topic 842 was not proportional to the increase in Total Assets, leading to profitability deterioration. The implications of unexpected higher cash holding positions in leasing and non-leasing firms extended the significance of Topic 842 from lease transactions to financing transactions. The observed magnitude of changes in financial ratios pre and post-Topic 842 indicated the materiality of operating leases and the importance of operating lease capitalization to reported financial data.

Keywords

Topic 842, Lease Accounting Standards, Financial Performance Ratios, Constructive Capitalization.

Introduction

Topic 842 is the part of the final product of eight-plus years joint project between the U.S. Financial Accounting Standard Board (FASB) and the International Accounting Standard Board (IASB). IASB issued International Financial Reporting Standards (IFRS)16, and FASB launched Accounting Standards Update (ASU) 2016-02 (Topic 842) in 2016. Although FASB and IASB issued two different sets of lease accounting standards at the end of the joint project, they did reach a fundamental agreement on the lessees’ capitalization of any leases contracts of 12 months or longer (Fajardo, 2016). Topic 842 replaced the prior lease accounting standard (i.e., Statement of Financial Standard [SFAS] No. 13). Public corporations were required to implement Topic 842 for fiscal years beginning December 15, 2018 (FASB, 2016). Topic 842 is expected to improve the relevance and comparability of financial statements (Arimany-Serrat et al., 2015; Barone et al., 2014). This new lease accounting standard requires lessee firms to capitalize all non-cancellable operating leases of one year or more as right-of-use (ROU) assets and related lease liability based on the present value of the committed future cash payments (FASB, 2016). Before Topic 842, lessees were only required to disclose operating leases in the footnotes, meaning lease-related obligations were kept off-balance-sheet (OBS) (Sliwoski, 2017). There is a gap in the literature on the actual firm financial benchmark after Topic 842 implementation based on annual reported financial data. The findings of this study are based on actual reported financial data. The contrast between non-leasing firms’ stability and leasing firms’ volatility of financial performance and synchronized higher cash-holding positions in both leasing and non-leasing firms provided empirical evidence supporting the importance of Topic 842 to both businesses in general.

The controversies around the new lease accounting standards primarily relate to two topics: whether Topic 842 is necessary when lease information is already included in financial statement disclosure and if Topic 842 leads to better financial reporting quality to justify the “hassle” of its implementation. Topic 842 is FASB’s response to the long-standing criticism of the bright-line tests in SFAS No. 13 because it enabled lessees to achieve OBS financing through structuring lease contracts, and it is expected to have a sweeping effect on leasing firms (Spencer & Webb, 2015; Weidner, 2017). According to Price water house Coopers (PWC), 53% of the entities would have a 25% increase in debt post Topic 842 (Tahtah & Roelofsen, 2016). The total estimated OBS liabilities of 1,000 largest U.S. firms is $742 billion (Trifts & Porter, 2017). The Equipment Leasing & Financing Foundation (ELFF) estimated 50% of firms’ equipment investment in 2018 (approximately $900 billion) is financed through leasing contracts. The standard-setting process of Topic 842 attracted an overwhelming amount of debate. Businesses lobbied against the concept of capitalizing operating leases and questioned the cost-benefit of its implementation (Comiran & Graham, 2016). Trifts & Porter, (2017) asserted the anticipated responses from the market to the new information reported on financial statements would be “insubstantial” because financial analyzers were already making adjustments. Credit agencies frequently evaluate the value of committed future cash flow by applying a multiplier to the rent expense; for example, Moody’s and Bloomberg use a multiplier of six or eight (Rajgopal, 2020; Shaked & Orelowitz, 2017).

Scholars don’t all agree with the approach of operating leases capitalization. Graham & Lin, (2018) claimed SFAS No. 13 better represents the economic essence of the lease transactions because it kept the distinction between capital leases and operating leases. They also argued Topic 842 instead adversely affects the relevance of accounting treatment to the operating leases (Graham & Lin, 2018). Because of differences in sampled firms, interest rates, and lease term assumptions, published literature between 2000 to 2015 could not reach an agreement regarding the projected potential impacts of lease capitalization (Akbulut, 2016).

This study provides a brief literature review covering the lease accounting standard history, two opposing theories behind the financial representation of lease contracts, and current ex-ante and ex-post studies. The researchers adopted the quantitative research method to explore the significance of year-over-year variations of financial ratios. The conclusion is based on the results of hypotheses testing and the interpretations of the financial outputs pre and post Topic 842 implementation.

Problem Statements and Research Questions

This study investigated the impacts of Topic 842 on firms’ financial performance ratios by examining the comparative financial statements of the U. S. industrial sector firms immediately before and after adopting Topic 842. The general problem addressed is the changes in lessee firms’ reported financial statements after adopting Topic 842, leading to potential changes in financial benchmarks and unknown implications to businesses. Empirical studies based on reported annual data post Topic 842 are currently unavailable. Assessment based on post Topic 842 financial data can validate the ex-ante findings and shed light on the answers to the controversies of lease accounting standards (Comiran & Graham, 2016). The specific problem this study attempts to address is the changes in financial ratios of a selected group of industrial firms in the U. S. after adopting Topic 842.

Three research questions are developed to investigate the changes in financial ratios at the industry level, within leasing firms, and within non-leasing firms.

1. R.Q. 1: What are the differences between selected financial performance ratios related to asset efficiency, profitability, financial leverage, liquidity of the industrial sector firms in the United States before and after its implementation? 2. R.Q. 2: What are the differences between selected financial performance ratios related to asset efficiency, profitability, financial leverage, liquidity of the Topic-842 impacted industrial sector firms in the United States before and after its implementation? 3. R.Q. 3: What are the differences between selected financial performance ratios related to asset efficiency, profitability, financial leverage, liquidity of the Topic 842 non-impacted industrial sector firms in the United States before and after its implementation?

Literature Review

The documentation of “lease” traces back to the time of Aristotle (384/383 -332 BC), who stated, “Wealth is not in possession of the property, but in the use of it,” as cited by Lebedyk & Riashchenk, (2019). The balance between the economic substance and legal form of lease contracts in financial reporting has been the focus of the lease accounting controversy (Wolk et al., 2017). The debate over lease accounting standards started from the first lease accounting standard in 1949 (Barone et al., 2014; Beckman & Jervis, 2009). Two opposing theories behind lease reporting are constructive capitalization and asset specificity. Industries most studied in ex-ante and ex-post include retailers and airlines.

Lease Accounting Standards History

Four lease accounting standards in the United States are Accounting Research Bulletin (ARB) 38 of 1949, Accounting Principles Board (APB) Opinion No. 5 of 1964, SFAS No. 13 of 1979, and ASU 2016-02 (Topic 842) of 2016 (Morales-Díaz et al., 2019). The lessee’s lease accounting model had the most changes over the years; in contrast, the accounting model for lessors remains the same (Morales-Díaz et al., 2019). In other words, lessees’ side of the lease obligations reporting has always been the focus of lease accounting standards. Over the years, lessees’ committed lease obligation of short-term leases evolved from the rental expense to rental expense with disclosure and eventually to capitalized assets and liabilities in Topic 842. Financial bankruptcies due to significant OBS liabilities were a primary motivation to improve lease accounting standards (Morales-Díaz et al., 2019).

In the 1920s, when firms were short of funds to purchase fixed assets, they either purchased through issuing loans or used a technique called “buy-build-sell-lease,” which means firms acquired access to assets through lease contracts (Morales-Díaz et al., 2019). Firms acquiring assets through loans had to recognize purchased assets and liability related to the loan, while firms utilizing “buy-build-sell-lease” contracts only needed to record rental expenses (Morales-Díaz et al., 2019). The American Institute of Certified Public Accountants (AICPA) director, John Myers, (1962) stated firms initially used leases primarily as a financing tool in the 1930s because only rental expenses were required on financial statements. Corcoran (1968) stated the use of long-term lease contracts as an OBS financing device in the 1950s became concerning to the business community and the accounting profession. As a result, the Accounting Research Bulletin (ARB) No. 38 (Disclosure of Long-Term Leases in Financial Statements of Lessees) was issued in 1949 to address the issue of lease financing (Corcoran, 1968). ARB No. 38 identified the issue of lease financing and required firms to disclose annual rentals and rental payment obligations (Dye et al., 2015; Myers, 1962). It also recommended capitalizing lease contracts on lessees’ balance sheet whenever a purchase in substance is implied in the lease contracts (Wolk et al., 2017). ARB No. 38 was the base of Chapter 14 of ARB No. 43 (Restatement and Revision of Accounting Research Bulletins) (Caster et al., 2018).

AICPA issued Accounting Research Study (ARS) No. 4 (Reporting of Lease in Financial Statements) in 1962 in response to the concerns over financial reporting of lease commitments (Dye et al., 2015). According to ARS No. 4, lessees were required to incorporate property rights and related liability on the balance sheet (Myers, 1962). After ARS No. 4, several other lease accounting standards were released, including Opinion No. 5 (Reporting of Leases in Financial Statements of Lessees) in 1964, Opinion No. 7 (Accounting for Leases in Financial Statements of Lessors) in 1966, Opinion No. 10 (Obminus Opinion) in 1966, Opinion No. 27 (Accounting for Lease Transactions by Manufacturer or Dealer Lessors) in 1972, and Opinion 31 (Disclosure of Lease Commitments by Lessees) in 1973 (Wong & Joshi, 2015). These publications eventually led to SFAS No. 13, which provides detailed guidance on assets and liabilities calculation. Opinion 31, together with Accounting Series Releases (ASR) 132 and 147 issued by SEC, established the qualifying criteria for lease capitalization of lessees in SFAS No. 13 (Dye et al., 2015). According to SFAS No. 13, lessees were required to recognize all capital leases as assets and liability and leave operating leases as operating expenses (FASB, 1976). SFAS No. 13 was later called the bright-line rule because of its specified criteria to classify leases and was criticized for providing gaming and contractual manipulation opportunities (Sliwoski, 2017; Weidner, 2017). During the period of SFAS No. 13’s implementation, operating leases became the most common financing source for long-term assets (Caster et al., 2018).

In 2016, FASB issued ASU 2016-02, also referred to as Topic 842 or accounting standard codification 842 (ASC 842). The new lease accounting standards were intended to increase lease transactions’ transparency and comparability by requiring lessees to report lease-related assets and liabilities on the balance sheet and disclose lease arrangements (FASB, 2016). Topic 842 is more principles-based because it treats operating leases the same as if lessees were “financing” the leased assets, similar to capital leases in SFAS No. 13 (Freeman, 2018; Graham & Lin, 2018; Sliwoski, 2017). The improvement of Topic 842 over the previous lease accounting standard (SFAS No. 13) is the capitalization of all non-cancellable leases as ROU assets and corresponding liability while allowing recognizing lease expense on a straight-line method over the lease term (Casabona & Coville, 2018).

Opposing Theories behind Lease Accounting

Two opposing approaches to lease accounting are the concept of constructive capitalization and asset specificity. Imhoff first proposed the constructive capitalization approach (Giner & Pardo, 2018; Kusano et al., 2016; Nuryani et al., 2015). This approach takes the “substance-over-form” viewpoint and promotes reporting lease obligations on the balance sheet, and it was adopted in both Topic 842 and IFRS 16 (Sari et al., 2016; Tsunogaya et al., 2016). Williamson (1985) defined asset specificity as firms’ long-term investment to support certain transactions with the lowest opportunity cost. Asset specificity can be applied to physical assets, human assets, site-specificity, and dedicated assets (Williamson, 1985). The theory of asset specificity was extended by Graham & Lin, (2018) into lease accounting. They asserted firms tend to purchase assets crucial to the core business (i.e., assets with greater specificity) and lease assets more generalizable and less idiosyncratic to the core business (i.e., assets with low asset specificity) .

Both theories claim better financial reporting quality. Imhoff & Thomas, (1988) stated SFAS No. 13 left out material financial information from the financial statements because its accounting treatment of operating leases allows businesses to utilize significantly more assets than what is reported. As a result, SFAS No. 13 served the management’s purpose of improving reported performance and financial ratios by leaving out material financial information (Imhoff & Thomas, 1988). Financial reporting following the approach of constructive capitalization provides more economically relevant information for better prediction, comparison, and evaluation of firm performance (Imhoff & Thomas, 1988). Kusano (2020) asserted recognizing operating leases provides a more risk-relevant explanation of firms’ equity risk, while the disclosed leases information does not.

Supporters of asset specificity supporters believe SFAS No. 13 is a faithful representation of the underlying economics of leases because the volume of leased assets depends on the particular assets’ level of asset specificity (Graham & Lin, 2018). Kermani & Ma, (2020) claimed the concept of asset specificity aligns closely with firms’ investment behavior. Although Topic 842 offers more relevance of lease liability, SFAS No. 13 is a more relevant accounting standard reporting because the return on capital of purchased assets was higher than the return on leased assets (Graham & Lin, 2018).

Ex-ante and Ex-post Studies on Topic 842

Ex-ante studies based on the constructive capitalization model projected significant leverage and profitability ratios fluctuations, primarily in retail and transportation businesses (Morales-Díaz et al., 2019). Three industries highlighted by McKinsey & Co. to experience the most significant changes on the balance sheet highlighted are retailing, food and staples retailing, and transportation (an increase of 64%, 55%, and 40.3%, respectively) (Gakhar et al., 2018). Gorman et al. (2020) projected the top three industries with the most ROU assets are retail, transportation business, and customer service. Based on the operating lease amounts of 50 U.S. public firms, Fafatas & Fischer (2016) concluded most of the heavy leasing firms are from retail, technology, airline, and oil industry sectors. The total value of the ten retailers’ capitalized operating leases was estimated to be $34 billion (Fafatas & Fischer, 2016). Implementation of Topic 842 is expected to worsen firms’ debt ratio and improve EBIT and EBITDA; however, its impact on profitability ratios is not straightforward (Czajor & Michalak, 2017; Morales-Díaz & Zamora-Ramírez, 2018). After investigating 109 U.S. firms, Fafatas & Fischer (2016) concluded the retail industry and airlines’ EBIT/Total assets ratio had the most significant decrease. Caster et al. (2018) asserted the capitalization of operating leases would increase the airlines’ debt ratio, decrease the airlines’ current ratio, asset turnover, return on assets, and times interest earned ratios Appendix’s 1 to 3.

Gorman et al. (2020) found the airline firms’ 2017 financial results were comparable, but not the 2018 results because of early adopters of Topic 842 (Gorman et al., 2020). Post-Topic 842 balance sheet of the healthcare industry is expected to grow by $10 billion because of the capitalized operating leases, resulting in a jump of debt ratio from 29% to 34% (Berman, 2016). The top three retailers (Amazon, Walmart, & Chipotle) are expected to recognize ROU assets of $23,114 million, $17,329 million, and $2,479 million, respectively (Gorman et al., 2020). The shift of treating most leases as finance leases will motivate firms to downsize real estate portfolios and adopt more flexible real estate solutions (Stillebroer & Jaspers, 2017). Retailers and places for dining businesses are expected to have the highest average lease payments to total assets ratio and rate of debt covenants violation, meaning Topic 842 would trigger a reset of the borrowing rates for leasing firms in these two sectors (Chatfield et al., 2017).

The level of cash reserves is critical to firms, especially those with refinancing risks (Harford et al., 2014). Cook et al. (2021) projected significant cash holding position decision change driven by Topic 842 implementation. U.S. firms would form a temporal trend in corporate cash holdings to cover the operating lease obligations and in anticipation of an imminent increase in the cost of capital (Cook et al., 2021). After examining the 100 S&P firms’ first-quarter SEC filings post Topic 842, Yoon (2020) found a noticeable decrease in the use of operating leases. After Topic 842 went into effect, there was a significant increase in capital expenditure driven by firms mostly used to benefit from the OBS treatment of operating leases (Nissim, 2019). Milian & Lee (2020) asserted the financial data of the 2019 first quarter showed negative returns because of the significant amount of operating leases. The improvement in Topic 842 enables financial statements to reflect the economic essence better, and investors can take the face value of financial statements (Milian & Lee, 2020).

Methodology and Data

This investigation intended to examine the impacts of the new lease accounting standards on firms’ financial performance indicators based on reported annual financial data by comparing the changes pre and post the implementation of Topic 842. The changes in financial metrics within both the leasing and non-leasing firms in the S&P industrial sector are measured. Statistical tests on hypotheses about the changes pre and post Topic 842 directly answer the research questions of this study. The specific research method adopted is the causal-comparative method. A causal-comparative design is used to examine the relationships between independent and dependent variables after an event or action has occurred. Topic 842 does not require firms to restate the prior year’s financial statements, comparative financial statements issued post Topic 842 make the causal-comparative method the best fit for year-over-year financial data comparison. A causal-comparative design is non-experimental, and the comparison is between or within groups receiving different interventions (Kumar, 2019).

In this study, the sample frame is firms included in the S&P 500 indices for the fiscal years 2018 and 2019. S&P 500 firms collectively represent approximately 80% of the U.S. capital market (S&P 500, n. d.). The exampling method employed in this study is the purposive method. Non-probability sampling can be a viable option when the researcher does not intend to generalize the findings (Burkholder et al., 2019). Since all firms in the S&P industrial sector are included in this study, purposive sampling is a valid choice to answer the research questions in this investigation. The industrial sector comprises agricultural businesses, manufacturers, miners, and construction companies (Abdelaziz et al., 2011). The dependent variables are financial ratios related to asset efficiency, profitability, financial leverage, and liquidity. Financial data from firms’ 10-K filings were used to calculate the selected financial ratios. Three of the 73 firms in the S&P industrial sector were excluded because they did not have comparable financial data between 2018 and 2019. Two were added to S&P in March 2020, and the third company had a major merging activity between 2018 and 2019. Thirty-eight of the 70 firms are non-leasing firms, and the other 32 are leasing firms. One leasing firm was an early adopter, and its 2017 and 2018 financial data were used instead.

Hypothesis Development and Empirical Results

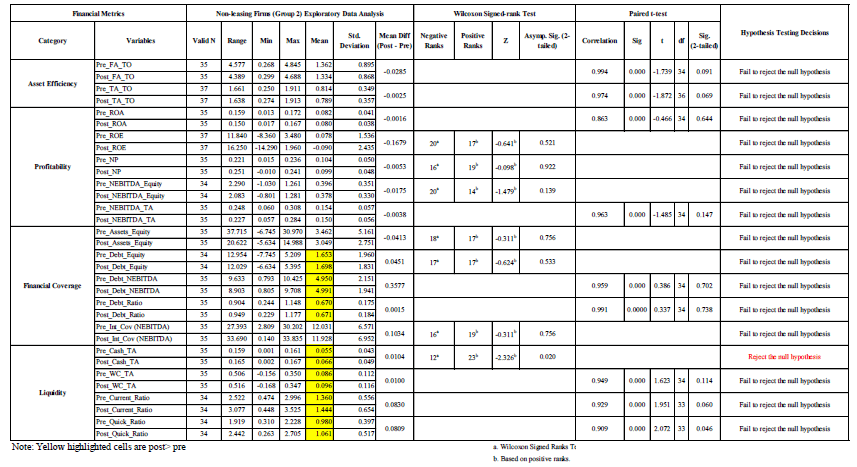

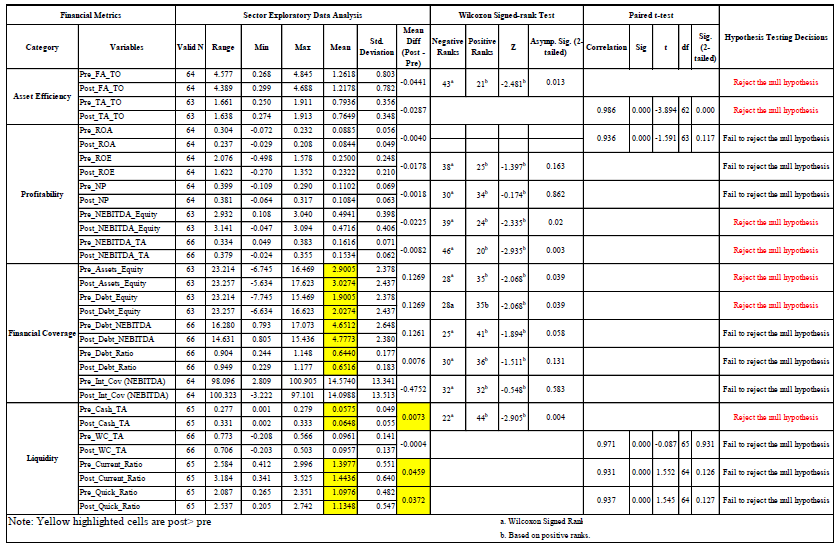

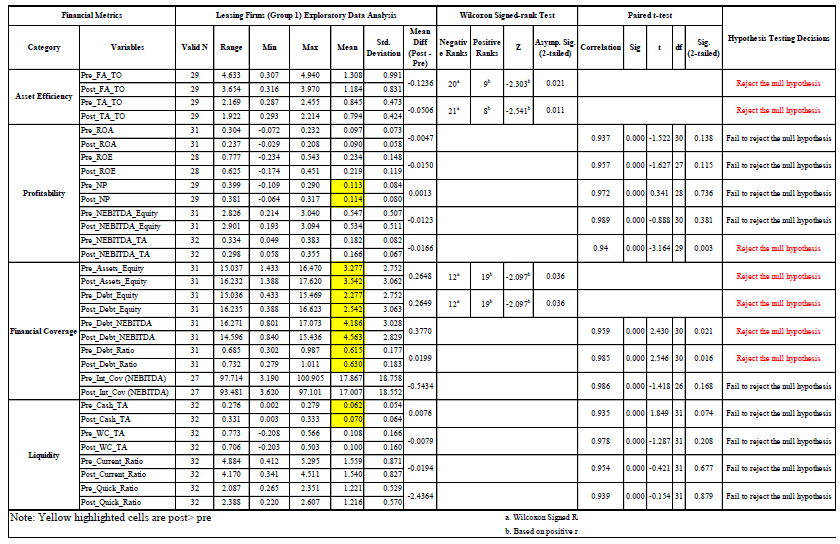

Three sets of hypotheses were developed, each addressing one of the three research questions. The exploratory data analysis results together with statistical test results and hypotheses testing decisions are summarized in Appendices. The leasing firms’ year-over-year fluctuation in financial ratios directly contributed to the differences at the sector level. The non-leasing firms had no significant variances except for the higher Cash to Total Asset ratio.

Hypothesis

This study intends to examine the impact of Topic 842 on financial performance metrics by investigating to what extent the selected financial ratios differ pre and post Topic 842. Firms in the S&P industrial sector are selected participants in this study. The three research questions inquire the extent to which the selected financial ratios differ pre and post Topic 842 within firms in the industry sector (R.Q.1), within the leasing firms in the industrial sector (R.Q.2), and within the non-leasing firms within the firms in the industrial sector (R.Q.3). Three sets of hypotheses addressing the R.Q.s are:

H10: There is no significant difference between the selected financial ratios measuring asset efficiency, profitability, financial leverage, and liquidity within the industrial sector firms before and after its implementation.

H11: There is a significant difference between the selected financial ratios measuring asset efficiency, profitability, financial leverage, and liquidity within the industrial sector firms before and after its implementation.

H20: There is no significant difference between the selected financial ratios measuring asset efficiency, profitability, financial leverage, and liquidity within leasing firms in the industrial sector before and after its implementation.

H21: There is a significant difference between the selected financial ratios measuring asset efficiency, profitability, financial leverage, and liquidity within leasing firms in the industrial sector before and after its implementation.

H30: There is no significant difference between the selected financial ratios measuring asset efficiency, profitability, financial leverage, and liquidity within non-leasing firms in the industrial sector before and after its implementation.

H31: There is a significant difference between the selected financial ratios measuring asset efficiency, profitability, financial leverage, and liquidity within non-leasing firms in the industrial sector before and after its implementation.

The dependent variables are the selected financial ratios, and the independent variable is the Topic 842 implementation. When causal-comparative is used to determine the significance of the differences, researchers can use t-tests to compare two independent or dependent groups (Morgan et al., 2019; Salkind, 2010). When the dependent variable data type is ordinal, or the paired t-test assumption is markedly violated, the non-parametric statistical test (i.e., Wilcoxon) can be used to replace the t-test (Morgan et al., 2019). The Wilcoxon test is a frequent alternative for paired data tests and suggests the equivalent statistical decision of the paired t-test (Rosner et al., 2006; Wiedermann & von Eye, 2013).

Empirical Results

Both asset efficiency ratios (fixed assets turnover and total assets turnover) dropped at the sector level, within the leasing and within the non-leasing firms before and after Topic 842. The decreases at the sector level for both fixed assets and total assets turnovers are statistically significant. The declines at the sector level can be traced to the significant declines in both the leasing firms (Group 1) and non-leasing firms (Group 2). The only difference is decreases in leasing firms’ asset efficiency ratios were statistically significant, but not the decreases of the non-leasing firms.

The year-over-year profitability ratios (ROA, ROE, Net Profit Margin, Normalized EBITDA to Equity, and Normalized EBITDA to Total Assets) declined at the sector level. The changes in profitability ratios at the sector level can be attributed to deteriorations in both leasing and non-leasing firms. Except for the 0.13% increase in net profit margin for leasing firms, all other profitability benchmarks deteriorated for both leasing and non-leasing firms. At the sector level, the decreases in Normalized EBITDA to Equity and Normalized EBITDA to Total Assets were statistically significant, but not other profitability ratios, meaning higher levels of Total Assets and Equity for the whole industry. Leasing firms’ EBITDA was expected to grow once rent expenses are split into interest and amortization of lease obligation under Topic 842. However, the Normalized EBITDA to Total Assets ratio dropped significantly, implying significantly higher Total Assets post Topic 842.

Selected ratios measuring financial coverage are Assets to Equity, Debt to Equity, Debt to Normalized EBITDA, Debt Ratio, and Interest coverage based on Normalized EBITDA. The decrease of interest coverage synchronizes with the increases in other ratios at the sector level, pointing toward higher financial leverage post Topic 842. The increases of Asset to Equity and Debt to Equity ratios were statistically significant. The changes in leasing firms’ financial leverage indicators mirrored the variations at the sector level, except four of the five ratios were statistically significant. There were no statistically significant year-over-year variations for non-leasing firms.

Ratios measuring liquidity are Cash to Total Assets, Working Capital to Total Assets, Current Ratio, and Quick Ratio. The Cash to Total Assets, Current Ratio, and Quick Ratio improved at the sector level, while the Working Capital to Total Assets deteriorated. Statistically, only the improvement in the Cash to Total Assets ratio was significant. All leasing firms’ liquidity ratios deteriorated except for the Cash to Total Assets ratio, although none of these changes were statistically significant. In contrast, the non-leasing firms’ overall liquidity improved, with significantly higher Cash to Total Assets post Topic 842.

To summarize, there were significant differences between pre and post Topic financial ratios in every category of financial performance metrics. The null hypotheses of no significant differences at the sector level, within the leasing firms, and within the non-leasing firms are rejected. The leasing firms showed more volatility than the non-leasing firms in every category of financial performance measures. The changes in multiple ratios of leasing firms also dictated the fluctuations at the sector level. The unexpected discovery in this exploration is Cash to Total Assets ratio still had a significant increase post Topic 842, given the expected increase in leasing firms’ total assets after the capitalization of operating leases. The concurrent deteriorating profitability makes the oddness of higher cash reserve stands out even more. Other than Cash to Total Assets, the non-leasing firms had no significant differences in all other ratios. The underlying reasons or motivations for the higher cash holding position are unknown. Future research can validate if the higher cash holding position was in anticipation of the higher cost of capital.

Conclusion

The purpose of this study was to enhance the understanding of Topic 842’s impacts on reported financial data by evaluating selected financial performance ratios of S&P industrial firms. Actual reported annual financial data used in this study is exempt from the shortfalls of differences in the interest rate and lease term assumptions in ex-ante studies. Empirical studies on Topic 842 also contribute to future studies on Topic 842 vs. IFRS 16 comparison. The industrial sector demonstrated significant changes in one or more of the selected financial ratios measuring asset efficiency, profitability, financial leverage, and liquidity post Topic 842. The leasing firms’ financial data showed more volatility than the non-leasing firms. The changes in leasing firms’ financial data were significant enough to drive variations of performance benchmarks at the sector level. The significantly lower Normalized EBITDA to Total Assets and Equity ratios point toward the possibility of equity financing post Topic 842. Both the leasing and non-leasing firms ended up holding more cash post-Topic 842. Compared to non-leasing firms, leasing firms need more cash reserve to cover lease payments; however, the non-leasing firms’ Cash to Total Asset ratio was significantly higher. The unexpected significantly higher cash holding position of non-leasing firms extended the impacts of Topic 842 beyond reported financial data to firms’ financing decisions post Topic 842.

Further investigating can validate whether the higher cash holding for both leasing and non-leasing firms, in the context of declining profitability, was in anticipation of an imminent higher cost of capital and whether it will be a long-term new norm. The full effects of Topic 842 have yet to be revealed in further investigations on firms’ lease contracting patterns and lease vs. purchase decisions. Topic 842 eliminated the distinction between operating leases and financing leases on the assets and liability sections of the balance sheet, shifting the focus of leasing decisions to implications on the income statement. In the meantime, firms are forced to revisit the options of debt vs. equity financing. Future analysis on earning per share (EPS) and cost of equity financing post Topic 842 will contribute to understanding the extended impacts of Topic 842.

References

Gakhar, P., Goel, J., & Rehm, W. (2018). A welcome change in lease-accounting rules.

Kumar, R. (2018).Research methodology: A step-by-step guide for beginners. Sage.

Milian, J.A., & Lee, E.J. (2021). Did the Recognition of Operating Leases Cause a Decline in Equity Valuations?.Available at SSRN 3509373.

Myers, J.H. (1962). Reporting of leases in financial statements; Accounting research study no. 04.

Nissim, D. (2019). EBITDA, EBITA or EBIT? Available at SSRN.

Rajgopal, S. (2021). Integrating practice into accounting research.Management Science,67(9), 5430-5454.

Salkind, N. (2010). Encyclopedia of Research Design, 1 SAGE.Thousand Oaks, CA.

Tahtah, J., & Roelofsen, E. (2016). A study on the impact of lease capitalisation, IFRS 16: The new leases standard.PwC Report.

Williamson, O. (1985). The economic institutions of capitalism. Free Press.

Wolk, H.I., Dodd, J.L., & Rozycki, J.J. (2016).Accounting theory: conceptual issues in a political and economic environment. Sage Publications.

Appendix 1

Appendix 2

Appendix 3