Research Article: 2023 Vol: 27 Issue: 1S

The Effects of Corporate Governance on Jordanian Companies Capital Structure

Mohammad Yousef Alghadi, Irbid National University

Ayed Ahmad Khalifah Alzyadat, Irbid National University

Citation Information: Alghadi, M.Y., & Alzyadat, A.A.K. (2023). The effects of corporate governance on Jordanian companies’ capital structure. Academy of Accounting and Financial Studies Journal, 27(S1), 1-09.

Abstract

The main purpose of this study is to examine whether board of directors and CEO characteristics affects the leverage. A data set comprising 783 observations of Jordanian firms listed on the Amman Stock Exchange (ASE) was selected, from 2011 to 2019. The empirical analysis was based on random-effect generalized least square (GLS) regression model. The empirical results show that the managerial ownership, CEO education and CEO experience positively influences leverage, while board independent and profitability negative association with leverage. Further, board independent have no a direct effect on leverage in Jordan. This study also paves the way for further investigations on leverage in the context of other nations that are also facing a dearth of research in this study area. Additionally, there is a prevailing need for developing countries to demonstrate improved compliance with international governance standards.

Keywords

Managerial Ownership, Board Independent, CEO Education, CEO Experience, Leverage.

Introduction

Capital structure suggests the combination of funding methods maintained by a certain company (Niu, 2008). Gomez et al. (2014) assert that the financing method of a company has to be fitting to the investors, directors and stakeholders. Financing decisions also directly affect the value of a company. Past literatures on financial leverage indicate that capital structure is affected by various factors. In the field of research on corporate finance decision, capital structure represents one of the most prominent topics.

The fundamental goals of companies are the maximization of the wealth of shareholders. According to Black (2000); Rouf (2015) argue that corporate governance mechanisms and firm leverage play a pivotal role in maximizing the wealth of shareholders. Strong corporate governance leads to the enhancement of firm value. Salehi et al. (2020) stated that firms can minimize equity cost by having solid corporate governance in place. Accordingly, Jantadej and Wattanatorn (2020) asserted the crucial role of corporate governance in safeguarding shareholder wealth and reducing asymmetric information between the corporate and external investors inclusive of the debt holder, thus resulting in a decrease in debt financing costs. According to Chatterjee (2020), corporate governance refers to the management of business in an accountable, fair, transparent, and responsible manner. A solid corporate governance safeguards stakeholder interest. Establishing effective governance policies and creating shareholder value corporate governance is designed to minimize agency conflict.

Boards of directors have enormous authority over internal control to monitor the top management of firm including the chief executive officer (CEO) (Fama & Jensen, 1983). Under agency theory, the board of directors is one of the most important corporate governance mechanisms for ensuring that managers work in the best interests of shareholders (Allen, 2005). Board of directors plays their significant role to increase the business performance, through the development of strategic objectives and working for the mission and vision statements (Johnson et al., 2013; Chouaibi et al., 2018). According to Alam et al. (2014) argues that elected by a company’s shareholders, the board of directors are responsible for the financial and strategic decisions in the business firms. The top managers will confront stiffer supervisors when the board of directors is governed by an independent director or an outside director, (Wen et al., 2002). Wen et al. (2002) explained that when the board of directors is controlled by an independent director or an outside director, the top managers will face stricter supervisors. The presence of an independent board, managers' monitoring becomes more active in order to ensure that their activities do not hurt the company. As a result, it is expected that the existence of an independent director will minimize the CEO's risk-taking when making debt-related decisions. Hambrick (2007) argue that a corporation with a poor board of directors will have a weak monitoring. In this respect, the company's strategy will be increasingly influenced by the demographic characteristics of managers.

Theoretical Background and Hypothesis Development

Managerial ownership and leverage: According to agency theory, debt can play a significant role in supervising managerial conduct in order to preserve shareholders' interests and decrease the agency problem (Grossman & Hart, 1980). While the information asymmetry theory argues that debt can be a positive signal for companies. The study by Friend and Hasbrouck (1988) explained that higher managerial ownership leads to a reduction in leverage as managers attempt to reduce the risk of default. Hasan and Butt (2009) investigated Pakistan non-financial firms in 2002 to 2005 and reported a negative and significant link between managerial ownership and leverage. The study by Uwuigbe (2014) showed a significant and negative connection between managerial ownership and leverage. In a recent study on listed companies in Indonesia, Muharam and Putri (2020) found a significantly negative association between the managerial ownership and leverage.

In contrast, increased managerial ownership may result in more agency problem between managers and other shareholders. Leverage could be employed in this case to keep track of managerial actions (Friend and Lang, 1988). Le and Tannous (2016) investigated Vietnamese industrial and service firms in 2007 to 2012 and reported a positive and significant link between managerial ownership and leverage. Moreover, Vijayakumaran and Vijayakumaran (2019) explored the effect of corporate governance on leverage among the firms listed on the Shanghai and Shenzhen stock exchanges from 2003 to 2010. The study found a positive and significant link between managerial ownership and leverage. In a recent study by Thakolwiroj and Sithipolvanichgul (2021) found that the larger the percentage of managerial ownership, the more the leverage and debt financing. Due to the mixed results on managerial ownership, the following hypothesis is proposed:

H1: There exists a positive and significant relationship between managerial ownership and leverage

Board independent and leverage: According to the agency theory, top managers are subjected to increased scrutiny because independent directors, who are generally worried about their reputations and social position, have incentives to monitor management (Fama & Jenson, 1983; Weisbach, 1988). Many studies show that when board independence is combined with board structure, the board's monitoring level increases (Bettinelli, 2011; Adeymi & Udofia, 2015; Jizi & Nehme, 2018). As a result, corporate governance indicates that outside directors' knowledge, experience, and independence from management are critical for monitoring (Fama & Jensen, 1983; Khalil & Ozkan, 2016; Raheja, 2004); Adams & Ferreira (2007) discovered that independent directors enhance monitoring and minimize agency problems by safeguarding the wealth of minority shareholders. Meanwhile, companies with high managerial influence or poor institutional investor ownership, have less board independence (Boon et al., 2007). Abor (2007); Berger et al. (1997); Kajananthan (2012) who claim that Firms with more external directors are more likely to take on debt supports the resource dependence theory.

The relationship between board independence and leverage has a mixed impact. Berger et al. (1997) find that board independent affect leverage positively. This research suggests that when independent directors control the board, managers are faced to more monitoring, limiting their personal benefit. In line with this, Abor (2007); Abor & Biekpe (2007); Kajananthan (2012) who also found positive association between board independence and leverage. In contrast, Wen et al. (2002) used Chinese listed companies to investigate the association between board independence and leverage from 1996 - 1998. The results showed that there is a statistically significant negative effect of board independent and leverage. Their findings show that outside directors actively oversee management, and that outside directors may thus serve as a substitute for debt's disciplinary role in the capital structure. In addition, Al-Najjar & Hussainey (2011); Memon et al. (2019), revealed a negative relationship between board independence and leverage. However, Hasan & Butt (2009); Vijayakumaran & Vijayakumaran (2019) find that leverage are not related to board independent. Thus, the second hypothesis is developed as follows:

H2: Board independent positively affects leverage decisions

CEO education and leverage: According to Anderson et al. (2011), diverse educational backgrounds (education levels, such as postgraduate degrees) might contribute distinct opinions, perspectives, cognitive paradigms, and professional development to the board. Beber and Fabbri (2012) argue that overconfident directors with an MBA degree may be willing to take more risk. CEOs with an MBA are more aggressive and have a higher level of capital expenditures and debt (Bertrand & Schoar, 2003). According to Wang et al. (2016) formal education can effectively enhance a CEO's capacity to implement new, more complicated strategies.

Sitthipongpanich & Polisri (2015) examined the relationship between CEO education and leverage utilizing Thailand (SET) listed companies from 2001-2005. The findings revealed that CEO education and leverage have a statistically significant positive effect. Their findings revealed that CEOs with a high level of education have a higher level of confidence, making them more likely to take risks. In the same line, Frank & Goyal (2007) examined the relationship between CEO postgraduate education (MBA) and leverage using 2,702 executives in Execucomp databases over the period, 1993-2004. The results showed that CEOs with a postgraduate education (MBA) are more likely to choose a higher level of financial leverage. However, Custódio & Metzger (2014); Nilmawati et al. (2021) finds that CEO education is not associated with leverage. Therefore, the third hypothesis is developed as follows:

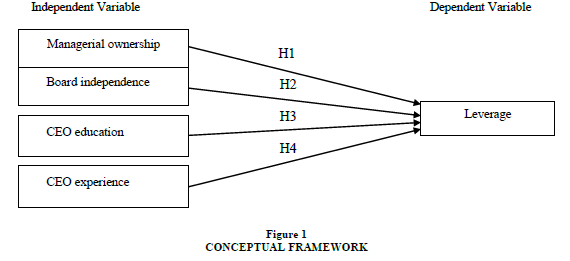

H3: There is a positive relationship between CEO education and leverage

CEO functional experience and leverage: Fahlenbrach et al. (2011) claim that previous CEOs with industry experience are more likely to be reappointed to boards because firms can benefit from their experience. Huang (2014) finds that a better fit between CEO industry experience and assets improves business value. According to (Jensen & Jazac, 2004) managers with a strong functional experience in finance usually perceive a company as a collection of assets. The firm is viewed as a collection of businesses. It increases the likelihood of companies led by functional finance managers focusing on growth. Custodio & Metzger (2014) examined the relationship between CEO functional experience and leverage using 17,716 observations over the period, 1993-2007. The findings revealed that CEO functional experience and leverage have a statistically significant positive influence. Their findings revealed that finance-experienced CEOs increase the company's leverage. CEOs with financial experience are more likely to have a better understanding of financial theory, which can help them become more sophisticated. Sitthipongpanich & Polsiri (2015); Nilmawati et al. (2021) finds that CEO functional experience is not associated with leverage. Therefore, the fourth hypothesis is developed as follows Figure 1:

H4: There is a positive relationship between CEO functional experience and leverage

Methodology

Population and Sampling

This research focuses on the effects corporate governance mechanisms (managerial ownership, board independence, CEO education and CEO functional experience) on the leverage of the public-listed companies of Amman Stock Exchange (ASE) from 2011 to 2019. This period is selected because the establishment of corporate governance in Jordan first started in 2009.

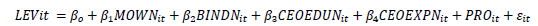

Model Specification

The following regression model is used to investigate the effects of corporate governance on leverage Table 1.

| Table 1 Measurement Of Variables |

||

|---|---|---|

| Variables | Variable name | Measurement |

| LEV | Leverage | Total debt divided by total assets (Osma, 2008; Belkhir et al., 2014; Anagnostopoulou & Tsekrekos, 2017). |

| MOW | Managerial Ownership | Percentage of shares held by the board disclosed in the annual financial report |

| BIND | Board Independence | Percentage of independent directors to total board of directors. Lee and Lee (2009) |

| CEOEDU | CEO Education | If the CEO has a postgraduate degree, they will be given a score of 1, and if they do not, they will be given a score of 0. (Altuwaijri & Kalyanaraman, 2020). |

| CEOEXP | CEO Functional Experience | A large audit company or a CEO with experience in a financial-related function (accountant, chief financial officer, treasurer, or vice president of finance). If the CEO has functional experience, they will be given a 1 and if they do not, they will be given a 0. |

| PRO | Profitability | EBIT/Total assets |

Empirical Results

Descriptive Statistics

Table 2 shows that a level of significant variation exists among companies included as a sample in this study. The leverage ranges from 0.00399 to 0.98984, with an average of 0.33067 and a standard deviation of 0.21078, as shown in Table 2. The values for MOW range between 0 and 0.9545309, averaging at 0.1805512 with a standard deviation of 0.2199146. The range of (BIND) is 0 to 0.66666, with an average of 0.33171 and a standard deviation of 0.09473. As for the (CEOEX) variable has a maximum value of 1 and a minimum value of 0, as it is a dummy variable that is measured by 1 if the CEO have functional experience and 0 if they do not. The average value for this variable is 0.8825, indicating, that 88% of the sample companies CEO have functional experience. Finally, the (CEOEDU) variable is a dummy variable that is measured as 1 if the CEO has a postgraduate level of education and 0 if they do not. These variable maximum and minimum values are 1 and 0, respectively, with a mean of 0.70242. Lastly, with respect to the control variables, the mean of PRO is 0.0260956 with a maximum of 0.68344 and a minimum of -0.47623 and a standard deviation of 0.10929 Table 3.

| Table 2 Summary Statistics |

||||||||

|---|---|---|---|---|---|---|---|---|

| variable | Obs. | Min | Max | Mean | Std.D | Prob. | Skewnes | Kurtos |

| LEV | 783 | 0.0039982 | 0.9898424 | 0.3306777 | 0.2107847 | 0.2927928 | 0.900898 | 3.403937 |

| MOW | 783 | 0.0000 | 0.9545309 | 0.1805512 | 0.2368563 | 0.085513 | 1.805156 | 5.658195 |

| BIND | 783 | 0.0000 | 0.666666 | 0.3317136 | 0.0947381 | 0.3333333 | 0.236473 | 5.187586 |

| CEOEXP | 783 | 0.0000 | 1 | 0.8825032 | 0.3222172 | 1 | -2.375713 | 6.64401 |

| CEOEDU | 783 | 0.0000 | 1 | 0.7024266 | 0.4574831 | 1 | -.8855232 | 1.784151 |

| PRO | 783 | -0.4762397 | 0.6834401 | 0.0260956 | 0.1075369 | 0.0340546 | -.4750026 | 9.340928 |

| Table 3 Correlation Matrix Results |

||||||

|---|---|---|---|---|---|---|

| Variable | LEV | MOW | BIND | CEOEXP | CEOEDU | PRO |

| LEV | 1 | |||||

| MOW | 0.2579 | 1 | ||||

| BIND | 0.0495 | 0.0495 | 1 | |||

| CEOEXP | 0.4385 | 0.0815 | 0.0477 | 1 | ||

| CEO EDU | 0.6669 | 0.1149 | 0.0745 | 0.5172 | 1 | |

| PRO | -0.2835 | -0.0752 | -0.0086 | -0.1832 | -0.1979 | 1 |

The correlation matrix measures the strength and direction of the variables’ linear relationships. Practically, the correlation coefficient ranges between -1 and +1, whereby -1 indicates a perfect negative correlation, +1 indicates a perfect positive correlation and 0 a non-correlation.

Multicollinearity Test

The multicollinearity test determines whether a correlation issue exists. A VIF value of 10 and below indicates an acceptable level of multicollinearity (Hair et al., 2013; Pallant, 2013). The VIF values in Table 4 show that there is no significant multicollinearity problem in the model.

| Table 4 Multicollinearity Test |

||

| Variable | VIF | 1/VIF |

| MOW | 1.02 | 0.981795 |

| BIND | 1.01 | 0.992569 |

| CEOEDU | 1.40 | 0.714820 |

| CEOEXP | 1.38 | 0.725269 |

| PRO | 1.05 | 0.949275 |

| Mean VIF | 1.21 | |

Managerial ownership and leverage were expected to have a positive relation in this study. Managerial ownership has a significantly positive connection with leverage (β =0.0955565, p=0.000), as seen in Table 5. This finding implies that managerial ownership has a positive impact on leverage. This finding is in line with that of Le and Tannous (2016); Vijayakumaran and Vijayakumaran (2019) who found that leverage positively influences managerial ownership.

The higher the percentage of managerial ownership, the higher the level of leverage and debt finance (Thakolwiroj & Sithipolvanichgul, 2021). Hence, hypothesis first (H1) is accepted. This research assumes that board independence and leverage have a negative connection. The direction of the association between board independence and leverage is positive and insignificant (β = -0.0134281, p=0.366), as shown in Table 5. The findings are in line with our expectations and an empirical study by Al-Najjar and Hussainey (2011), as well as Memon et al. (2019), who discovered a negative and insignificant link between board independence and leverage. Hence, hypothesis second (H2) is not accepted.

CEO education is expected to be positively associated with leverage. Table 5, shows that there is significant positive relationship between CEO education and leverage (β =0.249493, p=0.000). The result is in-line with Sitthipongpanich and Polisri (2015); Frank and Goyal (2007) who found that CEO education was significantly related with leverage. Their findings suggest that CEOs with a high level of education have a higher level of confidence, making them more taking risks. As a result, H3 is accepted as the third hypothesis.

| Table 5 Gls Regression Results Of Lev Model |

||||||

| Fixed-effect | Round-effect | Gls | ||||

| Variable | Coefficient | Prob. | Coefficient | Prob. | Coefficient | Prob. |

| MOW | 0.0861016 | 0.000 | 0.0913409 | 0.000 | 0.0955565 | 0.000 |

| BIND | 0.0517217 | 0.082 | 0.0473918 | 0.113 | -0.0134281 | 0.366 |

| CEOEDU | 0.1665424 | 0.000 | 0.1750655 | 0.000 | 0.249493 | 0.000 |

| CEOEXP | 0.0456378 | 0.002 | 0.0529429 | 0.001 | 0.070207 | 0.000 |

| PRO | -0.2253404 | 0.000 | -0.2308293 | 0.000 | -0.1444158 | 0.000 |

| VIF | 1.17 | |||||

| F - Stat | Prob-f | 0.0000 | ||||

| Hausman | chi2 = | 0.0000 | ||||

| Homo | No Hetero | |||||

Note: LEV = Leverage, MOW = Managerial ownership, BIND = Board independence, CEOEDU = CEO education, CEOEX = CEO experience, PRO = Profitability.

This study expected a positive relationship between CEO functional experience and leverage. As shown in Table 5, CEO functional experience has a positive and significant relationship with leverage (β = 0.070207, p=0.000). This result suggests that CEO functional experience contributes positively to the leverage. This result is consistent with Custodio and Metzger (2014) who found that leverage positively influences CEO functional experience. According to Custodio and Metzger (2014), CEOs with financial experience increase the company's leverage. CEOs with financial experience are more likely to comprehend financial theory, which can help them become more sophisticated. Hence, hypothesis fourth (H4) is accepted.

Conclusion

Optimal level leverage and good corporate governance strength are crucial for increasing the value of the firm and maximizing the wealth of shareholders. However, prior literature suggests that the governance characteristics and leverage structures change at various life cycles of the firm. Therefore, in this study has addressed 87 companies in the non-financial firms (industrial and service) at Amman stock exchange for the period of 9 years 2011 to 2019, using generalized least square random-effect (GLS) regression model to study the effect (managerial ownership and board independent) and CEO characteristics (CEO education and CEO functional experience) on the leverage of a firm.

The findings of this study show that there are various variables that determine level leverage. The study showed that board independence has a strong negative relationship with profitability, whereas CEO education and functional experience have a positive and significant relationship with leverage in Jordan. The findings also show that board independence and firm complexity, as well as leverage, have no statistically significant association.

Regulators and policymakers should be very interested in the findings of this study. The findings, which hold up to a variety of other proxies and further tests, offer new insights into the factors that influence leverage. Furthermore, the findings of this study may serve as a warning to JSC to adopt a Jordanian corporate governance code and stiffen the penalties for companies that fail to comply with the code's provisions.

However, this study is limited to the Jordanian region, with a small sample size. Future research should examine the reasons and results of this study in diverse circumstances, as our understanding of the interplay of different board of directors and CEO characteristics is still restricted. Better research and literature on the implications of various boards of director and CEO characteristics on leverage are desperately needed, especially in developing markets.

References

Abor, J. (2007). Corporate governance and financing decisions of Ghanaian listed firms. Corporate Governance, 7(1), 83-92.

Indexed at, Google Scholar, Cross Ref

Abor, J., & Biekpe, N. (2007). Corporate governance, ownership structure and performance of SMEs in Ghana: Implications for financing opportunities. Corporate Governance, 7(3), 288-300.

Indexed at, Google Scholar, Cross Ref

Adams, R., & Ferreira, D. (2007). A theory of friendly boards. Journal of Finance, 62, 217-250.

Indexed at, Google Scholar, Cross Ref

Adeymi, S.B., Akinteye, S.A., & Udofia, I.E. (2015). Corporate governance: Board of directors’ independence in emerging economies. European Journal of Applied Business and Management, 1(2).

Alam, Z.S., Chen, M.A., Ciccotello, C.S., & Ryan, H.E. (2014). Does the location of directors matter? Information acquisition and board decisions. Journal of Financial and Quantitative Analysis, 49(1), 131-164.

Indexed at, Google Scholar, Cross Ref

Allen, F. (2005). Corporate governance in emerging economies. Oxford Review of Economic Policy, 21(2), 164-177.

Indexed at, Google Scholar, Cross Ref

Al-Najjar, B., & Hussainey, K. (2011). Revisiting the capital-structure puzzle: UK evidence. Journal of Risk Finance, 12(4), 329-338.

Indexed at, Google Scholar, Cross Ref

Anderson, R.C., Reeb, D.M., Upadhyay, A., & Zhao, W. (2011). The economics of director heterogeneity. Financial Management, 40, 5-38.

Indexed at, Google Scholar, Cross Ref

Beber, A., & Fabbri, D. (2012). Who times the foreign exchange market? Corporate speculation and CEO characteristics. Journal of Corporate Finance, 18(5), 1065-1087.

Indexed at, Google Scholar, Cross Ref

Berger, G.P., Ofek, E., & Yermack, L.D. (1997). Managerial entrenchment and capital structure decisions. The Journal of Finance, 52(4), 1411-1438.

Indexed at, Google Scholar, Cross Ref

Bertrand, M., & Schoar, A., (2003). Managing with style: The effect of managers on firm policies. Quarterly Journal of Economics, 118, 1169-1208.

Indexed at, Google Scholar, Cross Ref

Bettinelli, C. (2011). Boards of directors in family firms: An exploratory study of structure and group process. Family Business Review, 24(2), 151-169.

Indexed at, Google Scholar, Cross Ref

Boon, A.L., Field, L.C., Karpoff, J.M., & Raheja, C.G. (2007). The determinants of corporate board size and composition: An empirical analysis. Journal of Financial Economics, 85(1), 66-101.

Indexed at, Google Scholar, Cross Ref

Chatterjee, C. (2020). Board quality and earnings management: evidence from India. Global Business Review, 21(5), 1-23.

Chouaibi, J., Harres, M., & Brahim, N.B. (2018). The Effect of board director’s characteristics on real earnings management: Tunisian-listed firms. Journal of the Knowledge Economy, 9(3), 999-1013.

Indexed at, Google Scholar, Cross Ref

Custódio, C., & Metzger, D. (2014). Financial expert CEOs: CEO’s work experience and firm’s financial policies. Journal of Financial Economics, 114(1), 125-154.

Indexed at, Google Scholar, Cross Ref

Fahlenbrach, R., Minton, B.A., & Pan, C.H. (2011). Former CEO Directors: Lingering CEOs or valuable resources. Review of Financial Studies, 24, 3486-3518.

Fama, E.F., & Jensen, M.C. (1983). Agency problems and residual claims. The Journal of Law Economics, 26(2), 327-349.

Indexed at, Google Scholar, Cross Ref

Fama, E.F., & Jensen, M.C. (1983). Separation of ownership and control. The Journal of Law and Economics, 26(2), 301-325.

Indexed at, Google Scholar, Cross Ref

Frank, M.Z., & Goyal, V.K. (2007). Corporate leverage: how much do managers really matter? In: SSRN Electronic Journal.

Friend, I., & Hasbrouck, J. (1988). Determinants of capital structure. Research in Finance, 7, 1-20.

Indexed at, Google Scholar, Cross Ref

Grossman, S., & Hart, O. (1980). Takeover bids, the free-rider problem, and the theory of the corporation. Bell Journal of Economics, 11, 42-64.

Indexed at, Google Scholar, Cross Ref

Hambrick, C.D. (2007). Upper echelons theory: an update. Academy of Management Review, 32(2), 334-343.

Indexed at, Google Scholar, Cross Ref

Hasan, A., & Butt, S.A. (2009). Impact of ownership structure and corporate governance on capital structure of Pakistani listed companies. International Journal of Business and Management, 4(2), 50-57.

Indexed at, Google Scholar, Cross Ref

Huang, S. (2014). Managerial expertise, corporate decisions and firm value: Evidence from corporate refocusing. Journal of Financial Intermediation, 23, 348-375.

Indexed at, Google Scholar, Cross Ref

Jantadej, K., & Wattanatorn, W. (2020). The effect of corporate governance on the cost of debt: evidence from Thailand. The Journal of Asian Finance, Economics, and Business, 7(9), 283-291. ?

Indexed at, Google Scholar, Cross Ref

Jensen, M. (1993). The modern industrial revolution, exit and the failure of internal control systems. Journal of Finance, 48(3), 831-880.

Indexed at, Google Scholar, Cross Ref

Jensen, M., & Zajac, E.J. (2004). Corporate elites and corporate strategy: How demographic preferences and structural position shape the scope of the firm. Strategic Management Journal, 25(6), 507-524.

Indexed at, Google Scholar, Cross Ref

Jizi, M., & Nehme, R. (2018). Board monitoring and audit fees: The moderating role of CEO/chair dual roles. Managerial Auditing Journal, 33(2), 217.

Indexed at, Google Scholar, Cross Ref

Johnson, S.G., Schnatterly, K., & Hill, A.D. (2013). Board composition beyond independence: Social capital, human capital, and demographics. Journal of Management, 39(1), 232-262.

Indexed at, Google Scholar, Cross Ref

Kajananthan, R. (2012). Effect of Corporate Governance on Capital Structure: Case of the Srilankan Listed Manufacturing Companies. Journal of Arts, Science and Commerce, 3(4), 63-71.

Khalil, M., & Ozkan, A. (2016). Board independence, audit quality and earnings management: Evidence from Egypt. Journal of Emerging Market Finance, 15(1), 84-118.

Indexed at, Google Scholar, Cross Ref

Le, T.P.V., & Tannous, K. (2016). Ownership structure and capital structure: A study of Vietnamese listed firms. Australian Economic Papers, 55(4), 319-344. ?

Indexed at, Google Scholar, Cross Ref

Memon, Z.A., & Samo, Y.C.A.A. (2019). Corporate governance, firm age, and leverage: Empirical evidence from China. Corporate Governance, 10(2). ?

Indexed at, Google Scholar, Cross Ref

Muharam, H., & Putri, G.K. (2020). The effect of ownership structure on leverage with credit rating as a moderating variable. Diponegoro International Journal of Business, 3(2), 80-87. ?

Nilmawati, N., Untoro, W., Hadinugroho, B., & Atmaji, A. (2021). The relationship between CEO characteristics and leverage: the role of independent commissioners. The Journal of Asian Finance, Economics and Business, 8(4), 787-796. ?

Indexed at, Google Scholar, Cross Ref

Niu, X. (2008). Theoretical and practical review of capital structure and its determinants. International Journal of Business and Management, 3(3), 133-139.

Indexed at, Google Scholar, Cross Ref

Raheja, C. (2004). Determinant of board size and composition: a theory of corporate boards. Journal of Financial and Quantitative Analysis, 40(2), 283-306.

Indexed at, Google Scholar, Cross Ref

Rouf, D., & Abdur, M. (2015). Capital structure and firm performance of listed non-financial companies in Bangladesh. The International Journal of Applied Economics and Finance, 9(1), 25-32. ?

Indexed at, Google Scholar, Cross Ref

Salehi, M., Arianpoor, A., & Dalwai, T. (2020). Corporate governance and cost of equity: Evidence from Tehran stock exchange. The Journal of Asian Finance, Economics, and Business, 7(7), 149-158. ?

Indexed at, Google Scholar, Cross Ref

Sitthipongpanich, T., & Polsiri, P. (2015). CEO characteristics and corporate financing in Thailand. International Research Journal of Finance and Economics, 102, 56-69.

Thakolwiroj, C., & Sithipolvanichgul, J. (2021). Board Characteristics and Capital Structure: Evidence from Thai Listed Companies. The Journal of Asian Finance, Economics and Business, 8(2), 861-872.

Indexed at, Google Scholar, Cross Ref

Uwuigbe, U. (2014). Corporate governance and capital structure: evidence from listed firms in Nigeria stock exchange. Journal of Accounting and Management, 4(1), 5-14.

Vijayakumaran, R., & Vijayakumaran, S. (2019). Corporate governance and capital structure decisions: Evidence from Chinese listed companies. Journal of Asian Finance, Economics and Business, 6(3), 67-79. ?

Indexed at, Google Scholar, Cross Ref

Wang, G., Holmes, R.M., Oh, I.S., & Zhu, W. (2016). Do CEOs matter to firm strategic actions and firm performance? A meta-analytic investigation based on upper echelons theory. Personnel Psychology, 69(4), 775-862. ?

Indexed at, Google Scholar, Cross Ref

Weisbach, M. (1988). Outside directors, monitoring, and the turnover of chief executive officers, An empirical analysis. Journal of Financial Economics, 20, 431-460.

Wen, Y., Rwegasira, K., & Bilderbeek, J. (2002). Corporate governance and capital structure decisions of Chinese listed firms. Corporate Governance: An International Review, 10(2), 75-83.

Indexed at, Google Scholar, Cross Ref

Received: 25-Dec-2021, Manuscript No. AAFSJ-22-10622; Editor assigned: 28-Dec-2021, PreQC No. AAFSJ-22-10622(PQ); Reviewed: 12-Jan-2022, QC No. AAFSJ-22-10622; Revised: 22-Nov-2022, Manuscript No. AAFSJ-22-10622(R); Published: 29-Nov-2022