Research Article: 2017 Vol: 21 Issue: 3

The Effect of Profit and Cash Indices and the Financial Increase on the Distribution of Cash Profits in the Industrial Companies Listed in Amman Stock Exchange

Ajloun National University

Abstract

This study aims to investigate the effect of profit and cash indices as well as financial leverage on the distribution of cash profits in the industrial companies listed in Amman Stock Exchange during the period (2009-2016). A simple stepwise regression analysis was used to test the hypotheses of the study. The outcomes were the lack of the impact of financial leverage indices on the distribution of cash profits, and the presence of an impact of profitability and cash indices on the proportion of cash dividends. The study also found a model that can be used to predict the distribution of cash dividends based on the monetary and profitability indices of Jordanian industrial companies. Finally, the study recommends that cash and profitability indices can be used to predict cash dividends and further studies.

Keywords

Financial Indices, Dividends, Financial Accounting, Cash Dividends.

Introduction

The growth and recovery of any country's economy is connected to its ability to deal with various types of investments, whether internal or external as well as create appropriate and safe conditions and means. The financial market is one of these important means of investment, which seeks to attract and collect savings from different sectors of society, and direct them to various fields of investment, in a way that is beneficial to all saved and invested parties which lead to the provision of additional jobs and the need of the community of goods and services, in addition to export to other country. The goal of savers in obtaining safe additional funds is the main driver that makes them invest their money in joint stock companies listed in the financial market because the registration gives them the feeling of confidence and security on a hand, and provides them with profits on the other hand; the loss of security or profit makes many savers away from investment. In other words, profit represents the blood of investment, and security is the air it breathes.

The interest in the financial market has increased, especially after the discovery of some manipulation cases by fake administrations, companies and stock exchanges. As a result, the control of companies’ registration has increased, and many restrictions were put on their performance to ensure professionalism and integrity, in addition to imposing a set of conditions and requirements to be provided and disclosed to enhance transparency and governance in companies. In Jordan, the financial market provides many information and indices based on data provided by companies or collected from the financial market. The presentation of information is made in paper or electronic form to the public who seek benefits in order to enable them to assess the reality of current companies, predict their future and build their decisions accordingly.

The indices of profitability, cash and financial leverage are the main indices presented in the Jordanian financial market; they enable investors and various information users to assess the reality of companies and reduce the degree of uncertainty and guide them to make useful decisions to develop their benefits and wealth. These indices can be used either independently or by linking them together with other variables to construct useful predictive models. This study was conducted to determine the impact of profit and cash indices and financial leverage on the distribution of cash profits, either individually or in a group to develop a beneficial model that helps decision makers at the level of Jordanian industrial companies.

The cash profits distributed by industrial companies are an important source of income, and many investors, especially the young ones, depend on them to finance their expenses and secure their various needs. Share prices can also be affected by cash dividends (Zoarab & Sharab, 2007), which gives investors an indication of ownership of a company's shares or divestment of another company’s shares. Forecasting cash dividends and identifying the impact of financial indices is therefore important for investment decision makers. So this study came to answer the following question: Is there an impact of the indicators of profitability (EPS), cash ratio and financial leverage (debt ratio) on the percentage of cash dividends distributed by the industrial companies listed in Amman Stock Exchange? The disclosure of accounting information of listed companies is a fundamental requirement of disclosure issued by the Jordan Securities Commission and a prerequisite for listing in the stock exchange. The financial market presents a set of key indices that are calculated based on the financial and accounting information provided by the companies clearly and transparently in order to enable different users of information to benefit from them in achieving their diverse goals. This study has come out with the following objective: Recognition of the impact of profit indices (EPS), cash ratio and financial leverage (debt ratio) on the percentage of cash dividends distributed in the industrial companies listed in Amman Stock Exchange.

This study is a continuation of many studies conducted by many researchers on the policies of profits distribution in public shareholding companies and their affecting factors. This study dealt with an important aspect which is the distribution of cash dividends per share as well as the impact of indices of profitability and financial leverage on them. This study is important for several reasons, namely: (1) enable current investors to predict the distribution of cash profits in Jordanian industrial companies to direct their decisions to retain shares of existing companies or replace them with shares of other companies; (2) reduce the frequency and uncertainty of prospective investors and direct them to invest in shares of industrial companies to suit their investment objectives; (3) the service of credit decisions and loans-granting because the distribution of cash profits is an indication of the continuity of the company and the integrity of its financial position; (4) evaluating the efficiency of industrial companies' managements and their ability to achieve profits and distribute cash on investors; (5) giving feedback to the Jordanian financial market administrations on the information or financial indices related to the industrial companies in order to improve indices and replace them or keep presenting them as they are; and, (6) provide a scientific addition that can be used by various researchers in the field of accounting and finance to conduct their future studies.

Previous Studies

Several studies have dealt with the subject of the policies of profits distribution in shareholding companies and the factors related to them and the effect thereof as well as the degree of this effect through several addresses related to different means and methods of measurement.

Some local and Arab studies have dealt with the policies of profit distribution and the factors influencing them (Al-Shubiri et al., 2012), which aims to identify the effect of the capital structure on the policy of distributing profits in the Jordanian companies listed in Amman Stock Exchange during the period (2005-2009). The results revealed a negative relationship between the structure of ownership and the distribution of cash profits, the study also showed that the largest companies are the most able to distribute cash profits. As for the study of (Khalil, 2011), he showed that there isn’t a significant relationship between the structure of funding and dividends in the Jordanian companies listed in Amman Stock Exchange during the period (2007-2009). Al-Barajneh study examined the effect of dividends distribution on the market value and shares of listed companies in Palestine Securities Exchange. The study included 36 companies during the period (2000-2008) which found that there is a relationship between the ratio of dividends and market value of shares whereas there isn’t a relationship with book value.

Salama et al. (2012) examined the effect of some factors on the policy of distributing dividends in 27 companies listed in Saudi Stock Exchange during the period (2004-2009). The study has come up with results such as profits distribution is negatively affected by financial leverage, monetary risk, positive profitability factors, volume and growth and it is not affected by tangible assets and liquidity. The study of (Juhmani, 2006) aimed to identify the directors views of public shareholding companies listed in Bahrain Stock Exchange on the factors influencing the decision to distribute cash profits by applying on 36 listed Bahraini companies. In Hussein's study (2008), the factors affecting the profit distribution policy were identified through a field study based on a questionnaire with 53 forms distributed to financial and administrative officials in Iraqi joint stock companies.

One of the most important results of the study is the factors of liquidity and indebtedness affect the distribution of profits and there are many shareholders who rely on profits as a source of income. The study of (Bot & Pirtea, 2014) aimed at verifying the motives of the profit distribution policy by linking them to several variables, mainly cash flows and agency costs. The study was conducted on a sample of companies from 13 developing countries, including Saudi Arabia. One of the most important results of the study is that liquid cash is the most relevant to the distribution of cash profits. At the international level, some studies have examined the determinants of profit distribution policies by selecting a set of factors to study their impact. Farman & Nawaz (2017) examined the impact of profitability, growth opportunities, risk, liquidity, size of the company, leverage, taxation and type of audit on dividends over the period (2009-2014) on pharmaceutical companies listed in Karachi Stock Exchange. The results showed that the type of audit, liquidity, growth and profitability opportunities are the main determinants of dividends in companies, and that taxes, risks, company size and leverage significantly affect the profit distribution decisions of these companies.

Balagobei (2017) aimed to identify the impact of the ownership structure on the dividend policy of the companies listed in Sri Lanka Stock Exchange. Fifteen companies were selected during the period 2010-2014. Sindhu et al. (2016) discussed the impact of the ownership structure on the distribution of cash profits during the period (2011-2015). The study was conducted on 100 non-financial companies in Pakistan, and the results of the study showed that the lower the leverage, the more cash dividends because the high percentage of equity makes it preferable for companies to keep money and reinvest it. In the Forti et al. (2015) study, governance, profitability, financial leverage, liquidity, investment, risk, profit growth and information asymmetries were examined to reveal their impact on the cash dividend distribution policies of public shareholding companies listed in Brazil Stock Exchange during the period (1995-2001); and, linear regression analysis was used to measure the company's size, profitability, liquidity, market value, financial leverage and risk which are the most influential factors in the distribution of cash profits.

In the study by Kumar & ESQ (2014), the determinants of distribution profits in listed Indian companies during the period (2002-2013) were addressed by linking them to the indices of return on equity, economic value added and liquidity, and determining whether the profits generate a value to shareholders in the long term. The correlation analysis showed that there is a positive correlation between dividends and the economic value added of most companies and as for the results of the multiple regression, they show that the economic value added explains the profit distribution decisions and that profits do not add any value to shareholders in the long term. Another study for Li et al. (2014), he revealed the importance of cash profits distribution theoretically and practically by studying the relationship between the distribution of cash profits and liquidity of the market. The study was conducted on a sample of Chinese companies listed in the stock exchange during the period (1992-2011). The study found that the value of shares of companies that distribute cash profits is higher than those which are not distributed, and that there is a positive relationship between the distribution of cash profits and market liquidity.

Singhania & Akshay, 2012 which was conducted in India during the period (1999-2010), on 50 companies listed in the stock exchange showed that the size of the company and the rate of growth are determinants of dividend distribution whereas the structure of debt and profitability are not determinants of cash profits distribution. The study of (Napompech 2010), which was conducted on Thai shareholding companies during the period (1997-2008), found that the companies that make the most profits are the more distributed cash profits and the size of the companies and the rate of growth affect the distribution of cash profits as well. The study of Wang & Chang (2011) examined the profit distribution policies used by listed Taiwanese companies during the period (1994-2008), it showed that the increase in tax credit is not related to long-term dividends; moreover, the cash flow affects cash dividends. While, the study of Petra et al. (2012) examined the determinants of cash profits distribution, the study was applied on non-financial companies listed in the Greek Stock Exchange during the period (1993-2007). The study found a positive relationship between the cash dividends, the size of the company, liquidity and profitability, whereas there is a negative relationship between leverage and business risk.

In the study of Gupta & Banga (2010), the factors influencing the distribution of profits in the Indian companies listed in Bombay Stock Exchange were examined during the period (2001-2007). The study found that liquidity, profitability, growth of the company and structure of ownership are the main factors affecting the dividends. On the other hand, some studies have dealt with the relationship between the profit distribution policy and some other factors. In Susak & Soric (2015), a model for cash dividends was developed based on a set of financial indices, namely earnings per share, debt-to-assets ratio, sales-to-operating expenses ratio and their impact on cash dividends, based on a sample of non-financial companies listed in Zagreb stock exchange during the period 2013-2014. The study found that the selected indices explain the distribution of cash dividends is at a high rate. Al-Najjar & Belghitar (2011) showed that the policy of distributing cash profits is positively affected by profits, governance, the size of company, risk, profitability and the working capital, and this was by studying the relationship between monetary assets and cash dividends in the British joint stock companies and non-financial ones during the period (1991-2008).

Ramachandran & Packkirisamy, 2010 examined the relationship between the leverage and the dividend distribution policy for a sample of Indian companies listed in the stock exchange during the period (1996-2007). The study found that investors are interested in dividends and some companies rely on debt to distribute profits. The study of Swanson & Krishnan (2014) outlines profit distribution policies by developing a model based on the residual income index of a sample of US companies during the period (2000-2012), passing by the global financial crisis. The results showed a moderate support for the model and there is no difference during the pre and post global financial crisis. In the study of Ince & Owers (2012), a model combining capital structure and profit distribution policies was developed through a model that includes tax rate, profit, capital gains and linking the capital structure with profit distribution policies in order to produce a model for evaluating companies. The study was conducted on a sample of US companies listed during the period 1979-2002. The study found that the increase in dividends would increase the value of the company and there is a relationship between the profit distribution policy and the financial structure.

Baker & Powell, 2000 showed that current and future profits, sustainability and economic conditions are the most important determinants of profit distribution by applying it on companies listed in New York Stock Exchange during the period (1983-1997). As for the comparative study of Braouezec (2010), it aimed at assessing corporate financial policy through profit-sharing policy based on cash flow, and the fiscal policy has been linked to the risk of non-payment of taxes. The study found that there is a relationship between the distribution of profits and the value of the company; moreover, the decline in cash affects the policy of dividend distribution, and the distribution of profits is a catalyst for shareholders.

It is clear from the above that there are many previous studies that dealt with the factors influencing the policies of profits distribution and their determinants and some of them came out with suitable models that are consistent with the environment they depend on to collect data. This study is distinguished not only for being related to the Jordanian environment and the industrial companies listed in the ASE during the period (2009-2016), but also to the financial indices chosen to measure the impact and come out with the model. These indicators are represented by the percentage of earnings per share to represent profitability, the ratio of ready cash to represent cash, and the ratio of indebtedness to represent the financial leverage.

Hypotheses of the Study

In light of the previous studies, and in line with the objectives of the study, the hypothesis of the study can be presented as follows:

H0: There is no effect on the percentage of cash dividends distributed by industrial companies listed in Amman Stock Exchange.

The main hypothesis of the study can be divided into the following sub-hypotheses:

H01: There is no effect of the profitability index (EPS) on the percentage of cash dividends distributed by the industrial companies listed in Amman Stock Exchange.

H02: There is no effect of the monetary index (ready cash) on the percentage of cash profits distribution in the industrial companies listed in Amman Stock Exchange.

H03: There is no effect of the leverage index on the percentage of cash dividends distributed by the industrial companies listed in Amman Stock Exchange.

The Theoretical Framework

The profit distribution mechanisms differ from a joint stock company to another. Some companies that make profits prefer to retain and reinvest them either by maximizing property rights by creating optional reserves or capitalizing these profits and distributing free shares to investors. Other companies may prefer to distribute available cash dividends to investors in order to provide them with a stable income and encourage others to own the company's shares. Companies may distribute part of the available profits and retain another part. Profit distribution is usually related to policies and trends of each company, and this is called (profit distribution policies).

Many of the theoreticians studied the profit distribution policies in order to guide the managements of the joint stock companies to choose the appropriate policy for the company and its shareholders. Perhaps two of the most important theories were Sorour (2009) and Al-Naimi & Al-Tamimi (2009).

First

The theory of neutralizing the policy of profits distribution: The value of the company is related to its ability to exploit the available resources, and this value is related to the profitability of the company and its operational risks, also the value of the company's current shares are not affected by dividends.

Second

The theory of sparrow in hand: it believes that the distribution of cash profits would reduce the risk of ownership of shares and the cash provided as dividends would increase the desire of shareholders to acquire shares under the pretext of sparrow in hand.

Third

The theory of agency: it is the separation of management from ownership to make the management the agent of shareholders or owners in the management of the shareholding company to conduct its work and take all necessary decisions in order to carry out all tasks and it has a measure of information that is not available to the public in order to take decisions that benefit the general interest of the investors which is not in favor of a specific group. The management is the most familiar with the company's current circumstances, financial position and future plans, so the decision to distribute profits may or may not be made. On the other hand, senior shareholders may exert pressure on the management to distribute profits and the administration will usually respond to these pressures in the event of a cash surplus and lack of suitable investment opportunities.

Fourth

The theory of contracts: it considers that the shareholder contracts with the company to buy shares and this would arrange a financial commitment, and the company is committed to the shareholder to maintain his money and to make profits. The distribution of cash profits may become an annual commitment to the management in favor of shareholders, even at the expense of recourse to external sources of financing to cover their costs, but this may adversely affect the market value of shares.

Fifth

The theory of signal: and is illustrated by the goal of accounting in providing useful information to different decision makers. The International Financial Reporting Standards (IFRS) has sought to adjust the characteristics, measurement and disclosure of financial information so that they can rationalize decisions and maximize benefits. This theory holds that information possessed by individuals with a financial deficit is different from that of individuals with financial surpluses. Individuals with disabilities are looking for sources of finance, sending signals indicating their good financial standing and their ability to pay in the future. The surpluses look for the best methods and places to invest their financial surpluses. The distribution of cash profits and the increase in annual rates will be accompanied by an increase in the value of shares and vice versa and a greater response rate, that the decline in distributions will reflect a decline in share prices and lower percentage compared to the increase.

Previous theories have shown that the distribution of profits in joint stock companies can be affected by several variables, such as profits. The existence and availability of profits or positive income is a prerequisite for some joint stock companies to make a decision to distribute cash dividends or it may be a fair and good financial centre that does not expose the company to pressure from lenders or creditors. The distribution decision may relate to the company's future direction and position in the market for expansion and opening up activities. The following factors may affect the distribution of cash profits and their proportion:

First

Profitability indices which measure the efficiency of management in the utilization of available resources to generate additional wealth for shareholders and investors in joint stock companies. Earnings per Share (EPS) are one of the most important indices which have a special International Accounting Standard (IAS 33) to define its types, components and how to calculate them. The dividend distribution policy may be affected by profitability. The cash dividend distribution ratio may be a percentage of the accounting profits achieved in these companies. Most non-profit companies may not decide to distribute cash dividends for ordinary shares. Earnings per share are calculated simply by dividing the net income of the company by the number of ordinary shares (Matar, 2009).

Second

Cash or Liquidity Indices: The distribution of cash profits in joint stock companies may require the existence of sufficient liquid cash to ensure distribution without any monetary hardship. The increase in cash in the industrial companies may be an incentive to increase the distribution ratio, especially if the corporate departments are not able to invest their liquid cash efficiently. Related Cash (RC) is one of the most widely used cash indices to measure the monetary capacity of industrial companies; it is calculated through the ratio of cash assets and the current liabilities (Ramadan, 2007).

Third

Financial leverage is one of financing sources in companies with the form of loans or short, long-term liabilities. One of indices used in the measurement of leverage is the debt (D) ratio; it is calculated in shareholding companies by dividing the total short and long term debt into total liabilities. This indicator is used to measure the financing proportion of debt that companies rely on compared to their relative complement, which represents equity financing. The increase in the indices of leverage in industrial companies means that these companies are subject to pressures and risks related to debt repayment. This means that companies direct available cash to pay their liabilities at the expense of distributing cash dividends. In other words, an increase in financial leverage may negatively affect the distribution of cash profits and their proportion (Lotfi, 2007).

The Study Model and Methodology

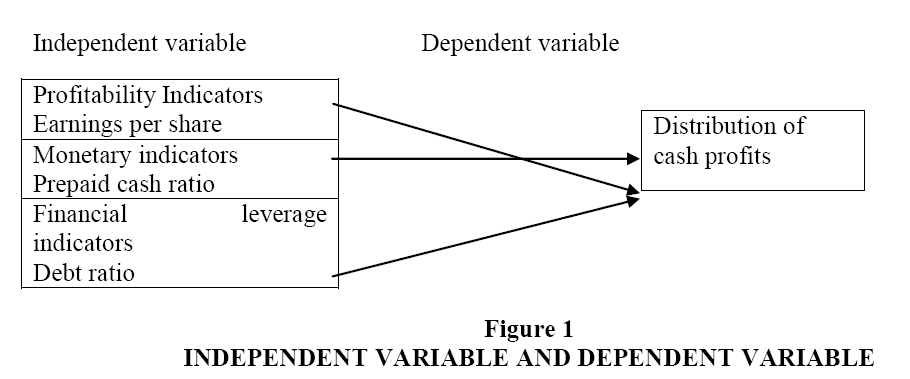

The study model can be expressed mathematically as follows:

DPS=b0+b1EPS+b2RC+b3D

(EPS): per share, (RC): ratio of ready cash, (D): debt ratio, (DPS): ratio of cash dividends distributed per share (Figure 1).

The study population consists of all industrial companies listed in ASE during the period (2009-2016), which distributed cash dividends during the study period. Table 1 represents the number of these companies.

| Table 1 Represents the Number of Companies that Distribute Profits |

|

| Year | Companies Distributing Profits |

| 2009 | 32 |

| 2010 | 44 |

| 2011 | 33 |

| 2012 | 30 |

| 2013 | 32 |

| 2014 | 32 |

| 2015 | 36 |

| 2016 | 31 |

| Distribution total | 270 |

Data Source: http://www.ase.com.jo

The table above shows that the number of distributions by industrial companies during the study period reached 270 and all of them were taken for the purpose of conducting the study.

The sources of data are divided into: firstly, Primary sources: including books, references, studies, articles and university letters in paper and electronic. Secondly, Secondary sources: including all data and indices related to the study variables. It was collected through the financial reports of industrial joint stock companies listed in ASE during the period (2009-2016) in addition to the published financial indices on the website of Amman Stock Exchange.

Discussion and Results

This part of the study presents descriptive statistics as well as the results of main and sub-hypotheses using the Statistical Analysis Program (SPSS) as follows:

First

Descriptive Statistics: Table 2 presents the arithmetic mean of the financial indices during the period (2009-2016), which shows that the average of per share of the distributed dividends was the highest in 2010 by 0.270, but in 2014, it was the lowest average by 0.194. As for the return of per share, it was the highest in 2010 by 0.390 and the lowest in 2014 by 0.234. The highest rate of indebtedness in 2010 was 0.271, but the lowest rate was in 2012 by 0.222. In 2009, the percentage of ready cash was the highest by 0.680 and the lowest was in 2014 by 0.600.

| Table 2 The Arithmetic Mean of the Study Variables |

||||||||

| Statement | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| Distributed profit per share | 0.264 | 0.270 | 0.255 | 0.237 | 0.212 | 0.197 | 0.266 | 0.221 |

| Return of per share | 0.386 | 0.390 | 0.373 | 0.334 | 0.248 | 0.234 | 0.381 | 0.305 |

| Debt | 0.259 | 0.271 | 0.230 | 0.222 | 0.248 | 0.267 | 0.260 | 0.264 |

| Ready cash | 0.680 | 0.669 | 0.665 | 0.653 | 0.634 | 0.600 | 0.672 | 0.631 |

Second

Testing the hypotheses of the study, here are the results of testing the main and sub- hypotheses, as follows:

Test the sub-hypothesis: The study used the simple linear regression at the significant level (0.05) to test the sub-hypotheses of the study and the rule of decision states if the level of the (Sig) is less than or equal to 0.05, there is an effect of rejecting the nihilistic hypothesis and accepting the alternative one. The following is the hypothesis test:

Testing the first sub-hypothesis of the study which states that "there is no effect of the profitability index (EPS) on the proportion of cash profits distribution in the industrial companies listed in Amman Stock Exchange." The following Table 3 shows that the level of the (Sig) is equal to (000), i.e., it is less than 0.05. This means rejecting the first nihilistic hypothesis and stating there is an effect of the profitability index (EPS) on the distribution of cash profits in Jordanian industrial companies listed in ASE. It is also noted from the table that the R=0.808 is higher, meaning that the profitability index can be used to interpret the ratio of cash dividend distribution to a large extent.

| Table 3 Result of the First Sub-Hypothesis Test |

|||

| Determinants coefficient | Coefficient of influence and significance | ||

| R Square | Sig | B | |

| 0.808 | 0.000 | 0.821 | EPS |

To test the second nihilistic hypothesis of the study which states that "there is no effect of the cash index (ready cash) on the percentage of cash profits distribution in the industrial companies listed in Amman Stock Exchange." Table 4 shows that the level of (Sig) is equal to (000), i.e., it is less than (0.05). This means rejecting the second nihilistic hypothesis stating that there is an effect of cash index on the percentage of cash dividends distributed by the listed Jordanian industrial companies in Amman Stock Exchange. It is also noted from the table that R=0.486, which is an acceptable value, meaning that the cash-ready indicator can be used to explain the ratio of cash dividend distribution with an acceptable level.

| Table 4 Result of the Second Sub-Hypothesis Test |

|||

| Determinants coefficient | Coefficient of influence and significance | ||

| R Square | Sig | B | |

| 0.486 | 0.000 | 0.347 | RC |

To test the third nihilistic hypothesis of the study, that states that "there is no effect of the leverage index on the percentage of cash dividends distributed by the industrial companies listed in Amman Stock Exchange." The following Table 5 shows that the level of significance is equal to 0.167, i.e., it is greater than 0.05. This means accepting the third nihilistic hypothesis which says that there is no effect of the leverage index on the distribution of cash profits in the Jordanian industrial companies listed in the ASE.

| Table 5 Result of Third Hypothesis Test |

|||

| Determinants coefficient | Coefficient of influence and significance | ||

| R Square | Sig | B | |

| 0.013 | 0.167 | -0.402 | D |

Testing the hypothesis of the main study: This hypothesis states that, “there is no effect of profit indices (EPS), (ready cash ratio) and financial leverage (percentage of indebtedness) on the distribution of cash profits in industrial companies listed in Amman Stock Exchange.” The main hypothesis combines all the indices in the sub-hypotheses in order to work on producing a model that is combined together to be used in predicting and interpreting the distributed dividends of per share. Since the main hypothesis test is based on the stepwise regression approach, a set of basic conditions must be verified to ensure the credibility of the results:

Natural distribution: The following figure shows that the distribution of study data is closest to normal distribution (Figure 2).

Test of the correlation of independent variables: The existence of high correlation between the independent variables generates a problem called Multicollinearity. This affects the interpretation of the relationship between independent and dependent variables. Tolerance can be used to test the correlation between independent variables with the rule of decision that states if the tolerance coefficient is less than 0.1, this means that there is a correlation problem and if it is less than 0.2, this means that the correlation problem exists.

Self-interference test between independent variables:

The presence of such interference would negatively affect the results of the proposed model. In order to conduct the self-interference test between the data of variables, Durbin Watson test was used with the value (2.38), which is closer to (2), meaning that there is no self-interference (Table 6).

| Table 6 Presents the Result Indicating that There Is No Problem of Self-Correlation between Independent Variables or a Problem Probability |

|||

| Statement | ERP | RC | D |

| ERP | 0.665 | -0.753 | |

| RC | 0.665 | -0.547 | |

| D | -0.753 | -0.547 | |

Significance of regression test: The ANOVA is used to measure this significance with the rule of decision stating that if the significance level is less than or equal to 0.05, this means that the regression is significant and therefore there is a relationship between the independent variables and the dependent ones.

The following table shows the result of the significance of regression test for the variables of the study. The table shows that the level of significance is equal to 000 and less than 0.05, i.e., the linear regression model is a significant one and has a good explanatory power as shown in R Square with the value (0.845).

From the above (Table 7), it is clear that the basic conditions for ensuring the integrity of results of multiple linear regression analysis are available. Thus, the results of the linear regression analysis of the study can be presented in a stepwise approach, i.e., excluding the independent variables that do not affect the dependent variable. The following table shows the results of the main hypothesis, which is in line with the results of the sub-hypotheses of the study, i.e., there is a statistical significance of the effect of profit indices (EPS) and (ready cash) excluding the financial leverage index (indebtedness) of the model because it is not statistically significant (Table 8).

| Table 7 Result of Variance Test |

||||

| Statement | Value of P | Level of significance (Sig) | D-W | R Square |

| Study model | 188.08 | 0.000 | 2.38 | 0.845 |

| Table 8 Result of the Main Hypothesis (Study Model) |

||||

| Level of significance (Sig) | T | Correlation coefficient | Model | |

| Standard error | B | |||

| 0.073 | -1.821 | 0.024 | -0.043 | Fixed |

| 0.000 | 12.521 | 0.055 | 0.686 | EPS |

| 0.000 | 4.031 | 0.030 | 0.119 | RC |

Dependent Variable: DPS

Accordingly, the model of the study can be presented to predict the distribution of cash dividends per share in the industrial joint stock companies listed in Amman Stock Exchange based on the indices of earnings per share and the percentage of ready cash as follows:

DPS=-0.043+0.686EPS+0.119RC

Conclusion

This study examined the effect of profit, cash indices and the financial leverage on the distribution of cash profits in the industrial companies listed in Amman Stock Exchange during the period (2009-2016) in order to serve various decision makers and achieve the objectives of accounting. The study included all industrial companies that distributed cash profits during the study period. The method of simple linear regression analysis was used to study the effect, after confirming the linearity of the relationship and the absence of self-correlation between the independent variables as well as the absence of self-interference in the variables data from the significance of regression.

The study found that there is no effect of the financial leverage indices on the distribution of cash dividends. This result is consistent with the study of (Khalil, 2011), which stated there is no relationship between the financing structure and the profit distribution in the Jordanian companies. Whereas the results of Al-Shubiri et al. (2012) and Salama et al. (2012) showed a negative relationship between financial leverage, profit distribution and percentage of cash dividends. In Hussein’ study (2008), there was a direct effect of debt factors on the distribution of cash profits. The results of the study also showed an effect of the profit and cash indices on cash dividends, and this is consistent with the results of several studies, including the study of Forti et al. (2015), Juhmani (2006) and Petra et al. The study also found a model that can be used to predict the distribution of cash dividends based on monetary indices and profitability in industrial companies.

The study recommends that decision makers in Jordan can depend on the indices of cash and profitability in forecasting cash dividends and the possibility of using the study model. The study also recommends that further studies be conducted on the indices affecting the rate of distribution of cash profits and the inclusion of other sectors of companies listed in the stock exchange.

References

- Khalil, A. & Faisal, I.A. (2011). The impact of the financing structure on the profitability of Jordanian Joint Stock companies and their policies in distributing profits. Unpublished Master Thesis, Middle East University, Jordan.

- Al-Najjar, B. & Belghitar, Y. (2011). Corporate cash holdings and dividend payments: Evidence from simultaneous analysis, managerial and decision economics.

- Kent, B.H. & Gary, P.E., (2000). Determinants of corporate dividend policy: A survey of NYSE firms, financial practice and education spring or summer.

- Saseela, B. (2017). Impact of institutional ownership and individual ownership on dividend policy of listed plantation companies in Sri Lanka: Advanced Business and Social Studies. Asia Pacific Journal, 3(1).

- Barajneh, A.I. (2009). Test of the relationship between the distribution of profits and the market and book value of shares traded in the Palestine Securities Exchange, unpublished Master thesis, Islamic University, Gaza.

- Claudiu, B. & Marilen, P. (2014). Dividend payout-policy drivers: Evidence from emerging countries. Emerging Markets Finance & Trade, 50(4).

- Yann, B. (2010). corporate liquidity, dividend policy and default risk: Optimal financial policy and agency costs. International Journal of Theoretical and Applied Finance, 13(4).

- Al-Shubiri, F.N., Al-Taleb, G. & Al-Zoued, A.A. (2012). The relationship between ownership structure and dividend policy: An empirical investigation. Review of International Comparative Management, 13(4).

- Khan, F.A. & Nawaz, A. (2017). Determinants of dividend pay-out: An empirical study of pharmaceutical companies of Pakistan stock exchange (PSX). Journal of Financial Studies & Research.

- Borges, F.C., Maciel, P.F. & Alves, D.L. (2015). Determinant factors of dividend payments in Brazil, R. Cont. Fin-USP, Sao Paulo, 26(68).

- Amitabh, G. & Charu. B. (2010). The determinants of corporate dividend policy. Decision, 37(2).

- Hassan, H.H. (2008). Factors affecting the policy of dividend distribution in joint stock companies. Journal of Baghdad Faculty of Economic Sciences.

- Ufuk, I. & Owers, J.E. (2012). The interaction of corporate dispute policy and capital structure decisions under differential tax regimes. Journal of Economics & Finance, 36.

- Juhmani, O. (2006). Determinants of corporate dividend policy: A survey of Bahraini Firms, Abhath AL-Yarmouk. Humanities and Social Sciences Series, 23(1).

- Kumar, D.N.S. & Chandrasekar, E.S. (2014). Financial management analysis of dividend policy pursued by selected indian manufacturing companies. Journal of Financial Management and Analysis, 27(1).

- Chui, L.M.L., Chin, M. & Qing, L.C. (2014). Dividend, liquidity and firm valuation: Evidence from China AB share markets. Applied Financial Economics, 24(19).

- Ahmed, L.A. (2012). Financial analysis for performance evaluation, auditing and investment in the stock exchange, University House, Egypt, 2007.

- Mohammed, M. (2009). Investment management, Dar Wael for Publishing, Amman, Jordan.

- Tayeh, N.A. & Al-Tamimi, R.F. (2009). Advanced financial management, Dar Al Yazouri for Scientific Publishing and Distribution, Jordan.

- Kulkanya, N. (2010). Corporate pay-out in Thailand, accounting and finance. International Journal of Business, 4(1).

- Theophano, P., Sunil, P. & Kean, O.Y. (2012). Determinants of corporate dispute policy in Greece. Applied Financial Economics, 22.

- Azhagaiah, R. & Veeramuthu, P. (2010). The impact of firm size on dividend behavior: A study with reference to corporate firms across industries in India. Managing Global Transitions, 8(1).

- Ziad, R. (2007). Principles of financial and real investment, Dar Wael for Publishing, Amman, Jordan.

- Mohammed, S.H., Al-Zoubi, B.A.R. & Tawirish, A.O. (2012). Determinants of dividend policy in the Saudi financial market. Arab Journal of Administrative Sciences, 19(2).

- Ilyas, S.M., Haider, H.S. & Ehtasham, U.H. (2016). Impact of ownership structure on dividend pay-out in Pakistan non-financial sector. Cogent Business & Management, 3(1).

- Monica, S. & Gupta, A. (2012). Determinants of corporate dividend policy: A Tobit model approach. Vision, 16(3).

- Sorour. A.I. (2009). Financial management: Theory and practice, Saudi Arabia.

- Toni, S. & Branko, S. (2015). Development of dividend pay-out model using logistic regression: The case of Croatian non-financial companies. Economy Trans Disciplinarily Cognition, 18(1).

- Zane, S. & Sivarama, K.V. (2014). Determinants of dividend pay-out, accounting and finance. International Journal of Business, 8(2).

- Fung, W.S. & Hao, C.H. (2011). Evolution of dividend policy: Tax reform and share repurchase-evidence from Taiwan. The International Journal of Finance, 23(1).