Research Article: 2020 Vol: 24 Issue: 3

The Effect of Managerial Ability on the Association Between CEO Tenure and Downward Pay Rigidity

Daecheon Yang, Chung-Ang University

Sung Hwan Jung, The University of Suwon

Junghee Lee, IESEG School of Management

Abstract

This paper explores the phenomenon of downward pay rigidity by employing a regime-switching model that distinguishes between rigid and flexible regimes in U.S. companies during the 1993-2013 period. Downward pay rigidity refers to the asymmetric patterns that reflect positive pay-performance sensitivity when firms perform well, but less positive sensitivity when performance worsens. Depending on managerial power theory, we postulate that downward pay rigidity intensifies with CEO tenure. In addition, we investigate the effects of managerial ability on downward pay rigidity in relation to the effect of CEO tenure. The results suggest that CEO compensation is downwardly rigid for long-tenured CEOs. However, the results of the null hypothesis testing the incremental impact of CEO managerial ability on the association between CEO tenure and downward rigidity shows that talented CEOs with longer tenures are less likely to experience downward pay rigidity. The findings imply that long tenure of CEOs enables them to extract greater levels of rents. However, the incremental effect of CEO ability is consistent with the confidence hypothesis, suggesting that talented CEOs with long tenure are less likely to seek opportunities to extract rents than their less-talented counterparts.

Keywords

Managerial Ability, CEO Tenure, Downward Pay Rigidity, CEO Compensation, Managerial Power Theory.

Introduction

Pay-without-performance, or excessive CEO compensation in cases of declining firm performance, has attracted significant criticism largely because CEO compensation arrangements do not serve stakeholders’ best interests. Bebchuk & Fried (2004) argue that ‘pay-without-performance’ is a widespread and persistent pay arrangement as being deviated from arm’s-length contracts. The literature on CEO compensation documents that CEOs with captive boards exhibit less sensitivity of pay to firm’s poor performance, implying an asymmetry in CEO compensation changes relative to firm performance changes (Gaver & Gaver, 1998; Adut et al., 2003; Garvey & Milbourn, 2006; Jackson et al., 2008; Kim et al., 2017).

This paper provide evidence that downward pay rigidity is more common among longtenured CEOs than short-tenured CEOs in U.S. companies between 1993 and 2013. Furthermore, we find that talented CEOs with long tenure are less likely to experience downward pay rigidity when they have stronger management skills. In other words, CEO ability weakens the positive relationship between CEO tenure and downward pay rigidity. Managerial power theory often uses the length of CEO tenure as a proxy for CEOs’ entrenchment. The results of the empirical test imply that long-tenured CEOs demand more consistent pay where performance worsened than their short-tenured counterparts. However, CEO tenure, our proxy for rent extraction, should not be understood as suggesting that all longtenured CEOs are interested in extracting rents since some talented and long-tenured CEOs do have good intentions. Further tests of the impact of managerial ability suggest that undesirable downward pay rigidity is less likely to be found among more talented CEOs with longer tenures.

This paper contributes to the literature on managerial power theory/rent extraction and CEO compensation. First, though the literature on CEO compensation addresses the problem of excess pay-without-performance (Perel, 2003), there are still disagreements concerning downward pay rigidity. Some view these concerns as insignificant and limited to a small number of firms, suggesting that downward pay rigidity is neither persistent nor systematic. However, challenging the common assumption that most firms set their CEO pay arrangements independent of the CEO’s influence, we provide evidence that downward pay rigidity is pervasive in the U.S. companies. Second, there is a lack of empirical research responding to shareholders’ concerns about undesirable pay arrangements, such as pay-without-performance. We approach this issue by developing a full account of CEO rent extraction in cases of worsening firm performance. Using the length of CEO tenure as a proxy for CEO rent extraction, we shed light on a significant distortion in entrenched CEOs’ pay, which may eventually have substantial costs for shareholders. However, one problem with using CEO tenure as a proxy for rent extraction is that all CEOs with long-term tenures are viewed as comprising a homogenous group that seeks to extract rents. We consider the heterogeneity of long-tenured CEOs, thereby further testing the effect of CEO ability on downward pay rigidity, which controls talented and long-tenured CEOs who seek to maximize shareholder value. Finally, in order to incorporate the pay-without-performance problem into our empirical specification, we directly estimate the probability of compensation being rigid using an econometric regime-switching model, which serves as our dependent variable in the regression model that tests the hypotheses. The approach is expected to meticulously estimate the degree of downward pay rigidities.

Theory and Hypotheses

According to the optimal contract approach, performance-based pay is regarded as being optimal for principals in order to alleviate the agency problem between shareholders and executives (e.g., Jensen & Meckling, 1976; Holmström, 1979; Grossman & Hart, 1983; Jensen & Murphy, 1990; Haubrich, 1994; Core et al., 1999). The optimal contract approach generally assumes that pay-for-performance arrangements sit a platform of fair trade between a board and its executives (Baixauli-Soler et al., 2016).

However, the managerial power approach argues that executives tends to influence boards’ decisions via compensation-setting. Bebchuk et al. (2002) and Bebchuk & Fried (2004) note that when CEOs have power over boards, they are expected to receive higher pay, irrespective of their performance; this is referred to as ‘pay-without-payment’. The literature on managerial power investigates the factors that intensify CEOs’ influence over boards’ decisions, particularly concerning the issue of CEO compensation (Hill & Phan, 1991; Hermalin & Weisbach, 1998; Allgood & Farrell, 2000; Bebchuk et al., 2002, Almazan & Suarez, 2003; Boone et al., 2007; Brookman & Thistle, 2009; Zheng, 2010; Cook & Burress, 2013; Dikolli et al., 2014).

Given that compensation contracts often go far beyond the justifiable, the Securities and Exchange Commission (SEC) compels publicly held companies to run compensation committees which consist of independent directors. Compensation committees are accountable for justifying CEO compensation amounts they approve and for linking these amounts to shareholder interests. However, merely replacing compensation board members with independent people has been found not to ultimately solve conventional problems as long as CEOs have incentive and power to influence boards in compensation-setting. There are mixed findings concerning the effects of compensation committees on pay–performance sensitivity.

Bebchuk et al. (2002) suggest several reasons independent compensation committees are limited and distanced from their executives. One explanation is that CEOs intervene in nominating incoming compensation committee members (Murphy, 1985; Bebchuk et al., 2002). Sun & Cahan (2009) argue that compensation committee independence is not the only source of existing problems in executive compensation-setting procedures. Belliveau, O'Reilly & Wade (1996) document that the actions of compensation committees can be affected by subtle status differences between their members and the managers they are appointed to oversee.

The lack of strong evidence concerning the role of independent compensation committees in CEO pay arrangements implies a potential confounding impact on the relationship between CEO pay and performance. Many studies on executive compensation might have neglected CEO heterogeneity; therefore, we expect CEO tenure and CEO managerial ability to have confounding impacts on the pay-performance link. Specifically, we explore the asymmetric patterns in the sensitivity of CEO pay to the firm performance for firms that experience worse performance.

The literature on CEO tenure emphasizes the association between CEO tenure and entrenchment (Hill & Phan, 1991; Hermalin & Weisbach, 1998; Allgood & Farrell, 2000; Almazan & Suarez, 2003; Boone et al., 2007; Brookman & Thistle, 2009; Zheng, 2010; Cook & Burress, 2013; Dikolli et al., 2014; Kim et al., 2017). Hill & Phan (1991) posit that longtenured CEOs are likely to influence on the board through pay-setting. Bebchuck & Fried (2004) also emphasize unobserved social and physiological attributes. For example, even members of a compensation committee appointed as ‘independent’ cannot avoid having personal or professional ties to the CEO, since both the board and the CEO must collaborate as one team. Consequently, initially independent compensation committee members may, over time, become less independent from the CEO and become incapable of enforcing pay arrangements unfavourable to the CEO. A stream of studies provide evidence that long-tenured CEOs receive higher pay than short-tenured CEOs regardless of firm performance (Chung & Pruitt, 1994; Lee & Chen, 2011; Abed et al., 2014; Van Essen et al., 2015). Similarly, another stream of research (Bebchuk & Fried, 2004; Zheng, 2010) suggests that as CEOs grow older and wealthier, total compensation package structures, including grants of equity-based compensation, change, just as the CEOs’ views on wealth change.

Here, as excessive pay in firms with worsening performance can severely damage shareholder wealth, our first hypothetical setting focuses on downward pay rigidities in longtenured CEOs. When rent-seeking CEOs keep their pay where performance worsened, they are more likely to have rigid pay. Based on the managerial power approach, CEOs which is entrenched by long tenure tend to negotiate with the board to maintain their pay levels under worsened firm performance. Thus, executives’ power to influence the board’s pay-setting process produce allows them to secure their pay, particularly when their firms perform badly. Following Hill & Phan (1991) in using CEO tenure which measures CEO power, we expect that longer tenure of CEOs induces their pay to be more rigid where performance is worsened. We thus hypothesize the following:

H1: Downward pay rigidity is greater for long-tenured CEOs than for short-tenured CEOs.

The literature has studied the role of managerial ability in explaining CEO pay. Previous studies provide evidence that more talented CEOs are paid a premium because of firms’ demands for higher quality executives (Malmendier & Tate, 2009; Kaplan & Rauh, 2010). To predict the association between downward pay rigidity and managerial ability, as measured by Demerjian et al. (2012), it is necessary to consider unobserved personal attributes (e.g. confidence, optimism and risk aversion) (Bertrand & Schoar, 2003; Graham, Li, & Qiu, 2011; Coles & Li, 2013). Going further, we attempt to investigate the incremental effects of CEO talent on the linkage between CEO tenure and downward pay rigidity.

With viewing a CEO’s managerial ability as his/her managerial confidence, one can expect talented CEOs to have more confidence in firm performance—and, thus, to demand equity-based compensation in anticipation of favourable news likely to increase share prices. Prior studies consistent with the confidence hypothesis find that CEO ability, as illustrated by both current and past-year firm performance, increases the stock-based component of compensation (Rose & Shepard, 1997; Core et al., 1999). Since their pay is more closely tied to equity-based compensation, talented CEOs have more incentive to maximize shareholder value than to influence their boards’ pay-setting to entrench themselves for bad days. Accordingly, the sensitivity of the pay of these talented CEOs to negative firm performance is stronger than that of the pay of less-talented CEOs, who need protection, particularity when their firms experience negative returns. Therefore, one can predict that the more talented a CEO is, the less downward pay rigidity his or her compensation will have (i.e. the more flexible it will be) when the firm underperforms.

Conversely, downward pay rigidity is more likely to be found among talented CEOs because such CEOs’ compensation is less likely to be affected by firm performance, due to the premium added for the high-quality of managerial ability in the form of a fixed base salary. Consistent with this premise, Murphy (1985) used the learning hypothesis to show that CEO pay is more equity-based when a CEO’s managerial ability is unknown, but shifts to include more fixed pay once the board carefully considers managerial ability. As a result, the association between CEO pay rigidity and CEO managerial ability is predicted to be positive. It is also possible that firms with long-tenured & high-quality CEOs may wish to maintain their employment relationships, despite current poor performance. Collectively, downward pay rigidity may increase for talented CEOs with long tenure.

These two competing scenarios lead to our second hypothesis (in the null form):

H2: The relationship between downward pay rigidity and CEO tenure is invariant to CEO managerial ability.

Research Design and Data

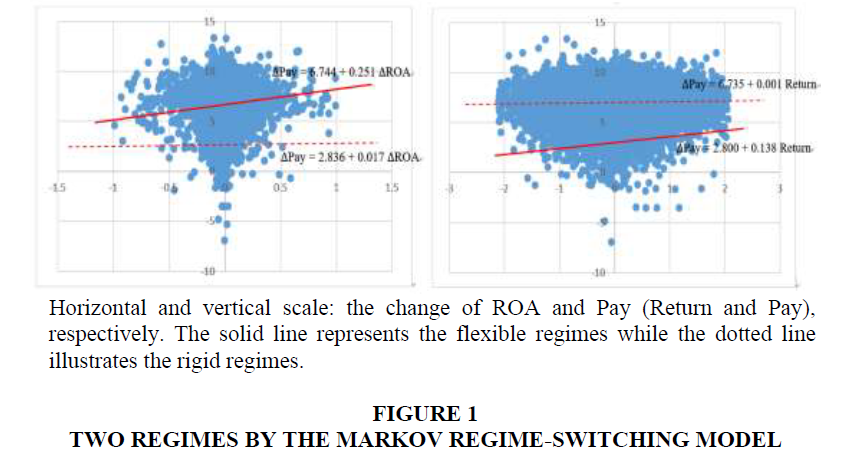

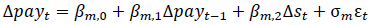

Consistent with the studies of Altonji & Devereux (2000) and Bauer et al. (2007), we adopt a regime-switching estimation that distinguishes between rigid and flexible regimes. We set our dependent variable of pay rigidity following Kwon et al. (2017) and Yang and Song (2018). Here, we employ Eq. (1) to estimate the one-step-ahead probability of an observation and use this probability as our dependent variable in Eq. (2).1

(1)

(1)

where two pay-dependent regimes are denoted as m: flexible pay (m=f ) and rigid pay (m=r); Δpayt is conditional probabilities of future pay changes; Δpayt-1 is prior pay-change information; βm is the estimate for the slope parameter; ΔSt is  ROA (return on assets) or

ROA (return on assets) or  stock returns. Here, we intervene heterogeneous variances through the two regimes’ error terms in Eq. (1) by adding σm , a (m × 1) vector, in σm εt .

stock returns. Here, we intervene heterogeneous variances through the two regimes’ error terms in Eq. (1) by adding σm , a (m × 1) vector, in σm εt .

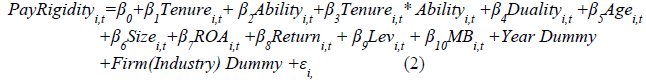

To test our hypotheses, we proceed with the multivariate analysis by estimating the following regression2:

where PayRigidity is the natural logarithm of the one-step-ahead probabilities of an observation being in the rigid regime, as estimated by the regime-switching model following Kwon et al. (2017) and Yang and Song (2018); Tenure is the number of years since becoming CEO; Ability is the measure of CEO ability developed by Demerjian et al. (2012);3 Duality is a dummy variable that is equal to 1 if the CEO is also the chairman of the board, and 0 otherwise; Age is the CEO age; Size is the log of total assets; ROA is return on assets; Return is stock returns; Lev is debt divided by equity; and MB is the sum of the market value of equity and the book value of debt divided by the book value of assets.

PayRigidity captures the extent of the downward pay rigidity. To the extent that the downward pay rigidity increases with CEO tenure, the coefficient on Tenure (β1) will be positive. A positive β1 will support the H1 testing that the entrenchment of long-tenured CEOs may facilitate ‘pay-without-performance’ scheme.

We have no expectations concerning the major effect of CEO ability (the sign for the coefficient on β2). If the coefficient on CEO ability (β2) is positive, it supports the learning hypothesis (Murphy, 1985) that CEO compensation includes more fixed pay once boards learn more about CEOs’ abilities. However, it is also possible that competent CEOs are less likely to attempt to influence their boards regarding executive compensation practices, which could lead to the negative association between CEO ability and downward pay rigidity (i.e. flexible pay).

Holding β1 (the coefficient on Tenure) constant, under the confidence theory, we expect CEO ability to mitigate the association between downward pay rigidity and CEO tenure, since long-tenured CEOs with higher abilities are typically more competent and better able to manage their firms for better performance than their counterparts with lower ability, making them less likely to extract rents (i.e., negative β3).

We control for potentially confounding factors. Our model includes a measure of CEO duality (Duality; binary variable, taking value 1 if the CEO is also the chairman of the board, and 0 otherwise) that is found to elevate CEO entrenchment by negatively affecting board monitoring (Finkelstein & D'aveni, 1994). As such, the control of CEO duality in our model may produce an underestimation of the effect of CEO tenure on downward pay rigidity. However, we use this conservative model specification to exclude the alternative explanation that our results are driven by general CEO power effects, rather than CEO tenure. In addition, we include CEO age (Age) to show that the effects of CEO tenure on downward pay rigidity do not merely capture CEO age effects. We also include firm-specific characteristics: firm size (Size; natural logarithm of total assets), return on assets (ROA), stock returns (Return), leverage (Lev; ratio of book value of total debt to total assets), and market-to-book ratio (MB; the market value of equity deflated by the book value of equity). In addition, we include Year Dummy and Industry Dummy based on two-digit SIC codes to control for year fixed effects and industry fixed effects, respectively. Also, we estimate Eq. (2) using firm fixed-effects. Firm fixedeffects regressions control for unobservable time-invariant firm-specific attributes, which might affect both downward pay rigidity and CEO tenure.

Data

Executive compensation data are obtained from the S&P ExecuComp database, financial statement data from the COMPUSTAT Industrial File, and stock return data from the Center for Research in Security Prices (CRSP).4 Data on CEO ability are obtained from the dataset providing the MA Score, the measure of managerial ability developed by Demerjian, (2012). Firms with SIC codes 6000 to 6999 (i.e. financial institutions) are excluded from our study. We also require firm-year observations to compute the control variables in the regressions.

This sample selection procedure leaves 12,455 firm-year observations between 1993 and 2013. Table 1 reports our sample selection procedure.

| Table 1: Sample Selection | ||

| Selection step | Reduction | Sample |

|---|---|---|

| All observations available on Compustat for Less: Less: 1993–2013 |

269,116 | |

| Financial institutions and insurance companies | -88,894 | |

| Firm-years without compensation data | -150,227 | |

| Data not available to estimate control variables | -17,540 | 12,455 |

| Total observations | ||

Descriptive Statistics

Descriptive statistics for all variables used in our sample are shown in Table 2. Table 2, Panel A shows that the dependent variables PayRigidity based on ROA and PayRigidity based on Return have means of -2.086 and -2.114, respectively. The probability of CEO paychange being in a rigid state is higher in response to ROA changes than in response to stock return changes. The average (median) Tenure is 8.368 years (6 years) and its standard deviation is 7.176 years. Managerial ability (Ability) ranges from -0.304 to 0.390, with an average of 0.017. The mean (median) of Duality as a dummy variable is 0.396 (0). In Table 1, Panel B, we report the result of the t-tests (Wilcoxon–Mann–Whitney tests) to examine whether the levels of PayRigidity and other measures differ across the subsamples partitioned by the median value of CEO tenure in our sample. Consistent with the view that the pay of long-tenured CEOs is more downwardly rigid than that of short-tenured CEOs, PayRigidity-ROA and PayRigidity- Return are significantly higher for the long-tenured CEO sample. Long-tenured CEOs have significantly higher managerial ability than short-tenured CEOs. The differences in control variables between the subsamples are significant (except for Return): long-tenured CEOs, on average, are more likely to be older (Age) and to serve as chairman of the board (Duality). CEOs are likely to work longer for firms that are smaller (Size), have higher ROAs (ROA), are less leveraged (Lev) and have higher market-to-book ratios (MB).

| Table 2: Descriptive Statistics | ||||||||||||||||

| Panel A: Descriptive statistics | ||||||||||||||||

| Variables | N | mean | sd | Min | p25 | p50 | p75 | Max | ||||||||

| PayRigidity-ROA | 12,455 | -2.086 | 0.772 | -2.808 | -2.704 | -2.431 | -1.622 | -0.308 | ||||||||

| PayRigidity-Return | 12,455 | -2.114 | 0.763 | -2.811 | -2.717 | -2.463 | -1.680 | -0.320 | ||||||||

| Tenure | 12,455 | 8.368 | 7.176 | 1.000 | 3.000 | 6.000 | 11.000 | 36.000 | ||||||||

| Ability | 12,455 | 0.017 | 0.130 | -0.304 | -0.066 | 0.008 | 0.089 | 0.390 | ||||||||

| Duality | 12,455 | 0.396 | 0.489 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 | ||||||||

| Age | 12,455 | 55.433 | 7.130 | 39.000 | 51.000 | 55.000 | 60.000 | 75.000 | ||||||||

| Size | 12,455 | 7.340 | 1.554 | 4.042 | 6.220 | 7.210 | 8.369 | 11.406 | ||||||||

| ROA | 12,455 | 0.062 | 0.102 | -0.381 | 0.027 | 0.064 | 0.108 | 0.347 | ||||||||

| Return | 12,455 | 0.157 | 0.556 | -0.769 | -0.164 | 0.086 | 0.348 | 3.024 | ||||||||

| Lev | 12,455 | 1.400 | 2.359 | -8.798 | 0.523 | 1.032 | 1.763 | 14.431 | ||||||||

| MB | 12,455 | 2.065 | 1.315 | 0.759 | 1.256 | 1.641 | 2.350 | 8.236 | ||||||||

| Panel B: Descriptive statistics by CEO tenure | ||||||||||||||||

| Variables | Long-tenured CEOs | Short-tenured CEOs | Test of Diff. p-value | |||||||||||||

| N | Mean | Median | N | Mean | Median | t-test | Wilcoxon-Mann-Whitney test/ Chi-square test |

|||||||||

| PayRigidity-ROA | 5,897 | -2.032 | -2.382 | 6,558 | -2.135 | -2.466 | <0.001 | <0.001 | ||||||||

| PayRigidity-Return | 5,897 | -2.063 | -2.422 | 6,558 | -2.159 | -2.492 | <0.001 | <0.001 | ||||||||

| Ability | 5,897 | 0.015 | 6,558 | 0.010 | 0.002 | <0.001 | <0.001 | |||||||||

| Duality | 5,897 | 0.487 | 0.000 | 6,558 | 0.314 | 0.000 | <0.001 | <0.001 | ||||||||

| Age | 5,897 | 57.500 | 58.000 | 6,558 | 53.575 | 54.000 | <0.001 | <0.001 | ||||||||

| Size | 5,897 | 7.231 | 7.091 | 6,558 | 7.438 | 7.332 | <0.001 | <0.001 | ||||||||

| ROA | 5,897 | 0.069 | 0.069 | 6,558 | 0.055 | 0.060 | <0.001 | <0.001 | ||||||||

| Return | 5,897 | 0.152 | 0.090 | 6,558 | 0.161 | 0.081 | 0.409 | 0.528 | ||||||||

| Lev | 5,897 | 1.277 | 0.968 | 6,558 | 1.509 | 1.100 | <0.001 | <0.001 <0.001 |

||||||||

| MB | 5897.000 | 2.131 | 1.688 | 6,558 | 2.007 | 1.600 | <0.001 | <0.001 <0.001 |

||||||||

Empirical Results

Estimates of Downward Pay Rigidity

Table 3 presents the preliminary test results of the regime-switching regression in Eq. (1). The results in Table 3 suggest that downward pay rigidity is pervasive in the U.S. Panel A shows the association between Δpay and ΔROA, while Panel B shows the association between Δpay and ΔReturns . Δpay, the probability of future pay changes, is based on total compensation (as reported in ExecuComp item TDC1). To avoid capturing the spurious relationship between the compensation levels of two different CEOs, we restrict the sample to firm-years in which the CEO was in office for two consecutive years. In both Panel A and Panel B, one βm is insignificant, and the other ??m is significantly positive, indicating that the former (the latter) represents a rigid (flexible) regime. Meanwhile, the common slope estimate for the lagged pay-change rate, Δpayt−1, in both Panels of Table 3 is significantly positive, showing the existence of autocorrelation in Δpayt. Thus, the results indicate the substantial existence of downwardly rigid pay.

| Table 3: Regime-Switching Regression | ||||||

| Panel A: ?St = ?ROAt | ||||||

| Specification | Independent variables |

Coefficient estimates |

t-statistics | |||

| Rigid slope | Intercept | 2.836*** | 29.23 | |||

| ?ROAt (?St ) | 0.017 | 0.05 | ||||

| Flexible slope | Intercept | 6.744*** | 308.47 | |||

| ?ROAt (?St ) | 0.251*** | 4.24 | ||||

| Common slope | 0.424*** | 39.28 | ||||

| Panel B: = ?Returnt | ||||||

| Specification | Independent variables |

Coefficient estimates |

t-statistics | |||

| Rigid slope | Intercept | 6.735*** | 307.97 | |||

| ?Returnt (?St ) | 0.001 | 0.23 | ||||

| Flexible slope | Intercept | 2.800*** | 29.05 | |||

| ?Returnt (?St ) | 0.138*** | 4.23 | ||||

| Common slope | ?payt-1 | 0.421*** | 37.55 | |||

***, ** and * indicate statistical significance at the 1%, 5% and 10% levels, respectively. This table presents the estimates for the Markov-switching auto-regression in Eq. (1). We restrict the sample to firm-years in which the CEO was in office for two consecutive years to avoid capturing the spurious relationship between the compensation levels of two different CEOs. Variables used in this model are defined as follows: is the probability of future pay changes; ?payt-1 is prior pay-change information; ?St is ROA (Panel A) or

ROA (Panel A) or stock returns (Panel B) respectively. Two pay-dependent regimes are denoted as m: flexible pay (m=f ) and rigid pay (m=r).

stock returns (Panel B) respectively. Two pay-dependent regimes are denoted as m: flexible pay (m=f ) and rigid pay (m=r).

The degree of downward pay rigidity between 1993 and 2013, as estimated by the twostate Markov regime-switching model, is also presented in Figure 1. In Panels A and B, the change of ROA and Return are applied as proxies of corporate performance, respectively. The line with the lower (higher) slope represents the rigid (flexible) regime, and the two slopes are significantly separate from each other. As shown in a low slope line, under the managerial power approach, a low sensitivity of pay to firm performance when firm performance worsens indicates rent extraction behaviors on the part of the CEO: in other words, CEO pay does not drop to a reasonable level when firm performance declines.

Panel A. Association between Δpay and ΔROA vs Panel B. Association between Δpay and ΔReturn

Effects of CEO Tenure and Ability on Downward Pay Rigidity

Using downward pay rigidity as the dependent variable, as estimated by the regimeswitching regression Eq. (1), Table 4 exhibits the panel regression results of estimating Eq. (2). We use as the dependent variable the downward pay rigidity in response to ROA (ΔROA) in Panel A, and in response to stock returns (ΔReturn) in Panel B. The standard errors are adjusted for possible correlations within a firm cluster. Not tabulated, the results from the baseline regression (without controlling for other independent variables and after controlling for industry and firm fixed effects) show that the coefficients for Tenure are significantly positive, suggesting that long-tenured CEOs are more reluctant to pay reductions than shorttenured counterparts. Panels A and B, Model 1 reports the results of testing Equation (2) without the interaction of Tenure and Ability, and the Model 2 reports the results of Equation (2). All the models show that CEO pay is more likely to be rigid for long-tenured CEOs than their short-tenured counterparts when firm performance worsens (p<0.01). This result remains the same for sensitivity to ROA and stock returns. This evidence supports the rent extraction hypothesis (H1) that downward pay rigidity increases with tenure. Under the managerial power approach, this result implies that CEOs have the power to influence their boards’ decisions over time and to use that power to extract rent through compensation-setting, allowing them to at least keep their previous pay levels even with worsening performance.

| Table 4: The impact of CEO Tenure and Ability on Pay Rigidity | ||||

| Panel A: Sensitivity to ROA | ||||

| Dependent variable = PayRigidity ( ?St= ?ROAt ) | ||||

| Model 1 | Model 2 | |||

| Constant | -1.060***(t=-8.03) | - 1.057***(t=-7.98) | ||

| Tenure | 0.004***(2.68) | 0.004***(2.64) | ||

| Ability | -0.038(-0.41) | |||

| Tenure*ability | -0.001***(-3.13) | |||

| Duality | -0.034*(-1.80) | -0.033(-0.78) | ||

| Age | 0.001(0.43) | 0.001(0.43) | ||

| Size | -0.137***(-9.75) | -0.137***(-9.75) | ||

| ROA | 0.029(0.37) | 0.020(0.24) | ||

| Return | 0.040***(3.48) | 0.040***(3.50) | ||

| Lev | 0.002(0.59) | 0.002(0.60) | ||

| MB | -0.034***(-4.53) | -0.035***(-4.54) | ||

| Adjusted R2 | 0.448 | 0.448 | ||

| n | 12,455 | 12,455 | ||

| Panel B: Sensitivity to stock returns | ||||

| Dependent variable = PayRigidity (?St = ?Returnt) | ||||

| Model 1 | Model 2 | |||

| Constant | -1.086***(t=-8.25) | -1.084***(t=-8.21) | ||

| Tenure | 0.004***(2.95) | 0.004***(2.93) | ||

| Ability | -0.032(-0.34) | |||

| Tenure*ability | -0.001***(-3.21) | |||

| Duality | -0.040 (-0.14) | -0.040(-0.13) | ||

| Age | -0.000(-0.07) | -0.000(-0.07) | ||

| Size | -0.132***(-9.45) | -0.132***(-9.43) | ||

| ROA | 0.029(0.37) | 0.023(0.28) | ||

| Return | 0.034***(2.97) | 0.034***(2.98) | ||

| Lev | 0.001(0.37) | 0.001(0.37) | ||

| MB | -0.033***(-4.41) | -0.033***(-4.41) | ||

| Adjusted R2 | 0.433 | 0.439 | ||

| n | 12,455 | 12,455 | ||

***, ** and * indicate statistical significance at the 1%, 5% and 10% levels, respectively. This table reports the regression results from estimating Eq. (2). The standard errors are adjusted for possible correlations within a firm cluster. Year, firm, and industry dummies are included but not shown. Dependent variable, PayRigidity, is measured as a natural logarithm of the one-step-ahead probabilities of an observation being in the rigid regime, as estimated by our regime-switching model (1): Δpayt = βm,0 + βm,1 Δpayt-1 + βm,2 ΔSt + σm εt , whereis the probability of future pay changes, Δpayt-1 is prior pay-change information, m=r(rigid) and f(flexible) and ΔSt =  ROA (Panel A) or

ROA (Panel A) or stock returns (Panel B). Panel A reports the result of downward pay rigidity in response to ROA and Panel B in response to stock returns. In Panels A and B, Model 1 reports the results of testing Equation (2) without the interaction of Tenure and Ability, and Model 2 reports the results of Equation (2).

stock returns (Panel B). Panel A reports the result of downward pay rigidity in response to ROA and Panel B in response to stock returns. In Panels A and B, Model 1 reports the results of testing Equation (2) without the interaction of Tenure and Ability, and Model 2 reports the results of Equation (2).

In relation to the role of managerial ability in CEO’s rigid pay (H2), we test two competing hypotheses (the confidence vs. learning hypothesis) manifested in the null form.

Essentially, the coefficients on Ability are insignificant, suggesting that managerial ability alone is not necessarily related to downward pay rigidity. However, the coefficients on the interaction terms between Tenure and Ability are significantly negative (p < 0.01), suggesting that when firms experience negative performance, talented CEOs’ pay is more sensitive to firm performance (i.e., less rigid) than that of less-talented CEOs with long tenure. This result supports the confidence hypothesis that talented CEOs who prove their managerial ability over time are less likely to seek opportunities to extract rents than their less-talented counterparts, leading to a greater consideration of performance in compensation in anticipation of good future performance. Meanwhile, the coefficients on controls show that Firm size (Size) and Market-to-book ratio (MB) are negatively associated with downward pay rigidity (Rigidity). However, the coefficients on Duality and Age are insignificant.

Conclusions

Using ExecuComp firms and data from 1993 to 2013, our study investigates downward pay rigidity in executive compensation in cases of worsening firm performance. Under the managerial power approach, CEO tenure is used as a proxy for managerial power and, more specifically, rent extraction. Consistent with CEOs having influence over their boards’ executive compensation practices, the results of testing the first hypothesis show that the compensation packages of long-tenured CEOs are more likely to reflect downward pay rigidity than those of their short-tenured counterparts. Going further, we provide a powerful account of rent extraction when firm performance worsens by considering talented CEOs who may not be interested in extracting rents. We find that more talented CEOs with longer tenures show less downward pay rigidity, consistent with the confidence hypothesis that CEOs who have confidence in their managerial skills anticipate good performance and, thus, demand more flexible pay. However, this result is subject to the notion that even after controlling for CEO talent, longer-tenured CEOs are more likely to induce downward pay rigidity regardless of their managerial ability. It may be possible that even talented CEOs develop risk aversion over time, as the degree of managerial risk aversion may increase according to the manager’s wealth (Sebora, 1996; Allgood & Farrell, 2000; Bebchuck et al., 2002). Overall, we confirm that downward pay rigidity is pervasive among the compensation packages of long-tenured CEOs. Our findings also imply that pay–performance sensitivity cannot be explained without separating underperforming firms from outperforming firms.

Although the SEC’s 2012 enforcement of independent compensation committees did not change our results, an important result of this research is a set of new questions that can spark further research on the role of independent compensation committees in shaping pay arrangements.

Endnote

1.We use Eviews to estimate the probability of an observation being rigid.

2.This paper estimates fixed-effects regression, based on Yang and Song (2018).

3.Demerjian et al. (2012) set a measure of managerial ability as managers’ efficiency in converting firm’s resources into sales revenues. This dataset is available at: https://community.bus.emory.edu/personal/PDEMERJ/Pages/Download-Data.aspx.

4.Our measure of CEO pay captures all compensation, including salary, bonuses, other annual pay, total value of restricted stock granted that year, Black–Scholes value of stock options granted that year, long-term incentive payouts and all other compensation (as reported in ExecuComp item #TDC1).

References

- Abed, S., Suwaidan, M. & Slimani, S. (2014). The determinants of chief executive officer compensation in Jordanian industrial corporations. International Journal of Economics and Finance, 6(12), 110-118.

- Adut, D., Cready, W.H., & Lopez, T.J. (2003). Restructuring charges and CEO cash compensation: A re-examination. The Accounting Review, 78(1), 169-192.

- Allgood, S., & Farrell, K.A. (2000). The effect of CEO tenure on the relation between firm performance and turnover, Journal of Financial Research. 23(3), 373-390.

- Almazan, A., & Suarez, J. (2003). Entrenchment and severance pay in optimal governance structures. Journal of Finance, 58, 519-547.

- Altonji, J., & Devereux, P. (2000). Is there nominal wage rigidity? Evidence from panel data. Research in Labor Economics, 19, 383-431.

- Baixauli-Soler, J.S., Lucas-Perez, M.E., Martin-Ugedo, J.F., Minguez-Vera, A., & Sanchez-Marin, G. (2016). Executive directors' compensation and monitoring: The influence of gender diversity on spanish boards. Journal of Business Economics & Management, 17(6), 1133-1154.

- Bauer, T., Bonin, H., Goette, L., & Sunde, U. (2007). Real and nominal wage rigidities and the rate of inflation: Evidence from West German micro data. The Economic Journal, 117(524), 508-529.

- Bebchuk, L.A., Fried, J.M., & Walker, D.J. (2002). Managerial power and rent extraction in the design of executive compensation, University of Chicago Law Review, 69(3), 751-846.

- Bebchuk, L.A., & Fried, J.M. (2004). Pay without performance: The unfulfilled promise of executive compensation. Cambridge, MA: Harvard University Press.

- Belliveau, M.A., O Reilly, C.A., & Wade, J.B. (1996). Social capital at the top: Effects of social similarity and status on CEO compensation. Academy of management Journal, 39(6), pp.1568-1593.

- Bertrand, M., & Schoar, A. (2003). Managing with style: The effect of managers on firm policies. The Quarterly Journal of Economics, 118(4),1169-1208.

- Boone, A., Field, L., Karpoff, J., & Raheja, C. (2007). The determinants of board size and composition: An empirical analysis. Journal of Financial Economics, 85(1), 66-101.

- Brookman, J. & Thistle, P.D. (2009). CEO tenure, the risk of termination and firm value. Journal of Corporate Finance, 15(3), 331-344.

- Chung, K.H., & Pruitt, S.W. (1994). A simple approximation of Tobin’s q. Financial Management, 23(3), 70-74.

- Coles, J.L. & Li, Z.F. (2013). Managerial attributes, incentives, and performance. Retrieved from http://dx.doi. org/10.2139/ssrn.1680484.

- Cook, M.L., & Burress, M.J. (2013). The impact of CEO tenure on cooperative governance. Managerial and Decision Economics, 34, 218-229.

- Core, J.E., Holthausen, R.W., & Larcker, D.F. (1999). Corporate governance, chief executive officer compensation, and firm performance. Journal of Financial Economics, 51(3), 371-406.

- Dikolli, S.S., Mayew, W.J., & Nanda, D. (2014). CEO tenure and the performance-turnover relation. Review of Accounting Studies, 19(1), 281-327.

- Demerjian, P., Lev, B., & McVay, S. (2012), Quantifying managerial ability: A new measure and validity tests, Management Science, 58(7), 1229-1248.

- Finkelstein, S., & Daveni, R.A. (1994), CEO duality as a double-edged sword: How boards of directors balance entrenchment avoidance and unity of command. Academy of Management journal, 37(5), 1079-1108.

- Garvey, G.M., & Milbourn, T.T. (2006). Asymmetric benchmarking in compensation: Executives are rewarded for good luck but not penalized for bad. Journal of Financial Economics, 82, 197-225.

- Gaver, J.G. & Gaver, K.M. (1998). The relation between nonrecurring accounting transactions and CEO cash compensation, The Accounting Review, 73(2), 235-253.

- Graham, J.R., Li, S., & Qiu, J. (2011), Managerial attributes and executive compensation. Review of Financial Studies, 25(1), 144–186.

- Grossman, S.J., & Hart, O.D. (1983). An analysis of the principal–agent problem, Econometrica, 51, 7-45.

- Haubrich, J.G. (1994). Risk aversion, performance pay, and the principal agent problem. Journal of Political Economy, 102, 258-276.

- Hermalin, B.E., & Weisbach, M.S. (1998). Endogenously chosen boards of directors and their monitoring of the CEO, American Economic Review, 88(1), 96-118.

- Hill, C.W., & Phan, P. (1991). CEO tenure as a determinant of CEO pay. Academy of Management Journal, 34(3), 701-717.

- Holmström, B. (1979). Moral hazard and observability. Bell Journal of Economics, 10, 74-91.

- Jackson, S.B., Lopez, T.J., & Reitenga, A.L. (2008). Accounting fundamentals and CEO bonus compensation, Journal of Accounting and Public Policy, 27(5), 374-393.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3, 305-360.

- Jensen, M.C., & Murphy, K.J. (1990). Performance pay and top-management incentives. Journal of Political Economy, 98, 225-264.

- Kaplan, S.N., & Rauh, J. (2010). Wall street and main street: What contributes to the rise in the highest incomes? Review of Financial Studies, 23, 1004-1050.

- Kim, J., Yang, D., & Minyoung, L. (2017). CEO tenure, market competition, and sticky pay-without-performance as the extraction of rents. Asia-Pacific Journal of Financial Studies, 46(2), 248-277.

- Kwon, S., Yang, D., Song, J., & SH, J. (2017). CEO gender and downward pay rigidities as rent-extractions. Asian Women, 33(4), 1-26.

- Lee, S.P., & Chen, H.J. (2011). Corporate governance and firm value as determinants of CEO compensation in Taiwan, Management Research Review, 34(3), 252-265.

- Leone, A.J., Wu, J.S., & Zimmerman, J.L. (2006). Asymmetric sensitivity of CEO cash compensation to stock returns, Journal of Accounting and Economics, 42, 167-192.

- Malmendier, U., & Tate, G. (2009). Superstar CEOs. The Quarterly Journal of Economics, 124 (4), 1593-1638.

- Murphy, K.J. (1985). Corporate performance and managerial remuneration: An empirical analysis. Journal of Accounting and Economics, 7(1-3), 3-36.

- Perel, M. (2003). An ethical perspective on CEO compensation, Journal of Business Ethics, 48(4), 381-391.

- Rose, N.L., & Shepard, A. (1997). Firm diversification and CEO compensation: Managerial ability or executive entrenchment? Rand Journal of Economics, 28(3), 489-514.

- Sebora, T.C. (1996). CEO board relationship evaluation: An exploratory investigation of the influence of base rate factors, Journal of Managerial Issues, 8(Spring), 54-77.

- Song, J., Yang, D., & Kwon, S. (2017). FDI consequences of downward wage-cost rigidities, Forthcoming in Singapore Economic Review.

- Sun, J., & Cahan, S. (2009). The effect of compensation committee quality on the association between CEO cash compensation and accounting performance. Corporate Governance: An International Review, 17(2), 193-207.

- Van Essen, M., Otten, J., & Carberry, E.J. (2015). Assessing managerial power theory: A meta-analytic approach to understanding the determinants of CEO compensation. Journal of Management, 41(1), 164-202.

- Yang, D., & Song, J. (2018). Impact of wage rigidity on sovereign credit rating. Emerging Markets Review, 34, 25-41.

- Zheng, Y. (2010). The effect of CEO tenure on CEO compensation, Managerial Finance, 36, 832-859.