Research Article: 2021 Vol: 25 Issue: 2

The Effect of Learning Orientation on Innovative Service Development and Insurance Firm Performance

Winston Asiedu Inkumsah, Marketing Department, University of Professional Studies

Ibn Kailan Abdul-Hamid, Marketing Department, University of Professional Studies

Benjamin Baroson Angenu, Marketing Department, University of Professional Studies

Abstract

This research assessed the effect of learning orientation on innovative service development, business growth and profitability in the insurance sector. The study relied on the resource-based view (RBV) and the dynamic capabilities of a firm. Three hundred and five (305) top and middle managers of insurance firms, brokers and reinsurance within the Ghanaian setting were surveyed. The findings indicated that commitment to learning and shared-vision that define learning orientation indicate a positive and significant effect on innovative service development activities. Similarly, the results also showed that innovative service development has a significant and positive effect on business performance. The indirect effect was significantly positive, which buttresses the essence of ISD in the insurance sector. The study re-echoed that commitment to learning and shared vision necessitate insurance firms, brokers and reinsurance players to be more proactive in introducing innovative service development activities.

Keywords

Learning Orientation, Innovative Service Development, Insurance Industry, Ghana.

Introduction

There is a growing interest in organisational learning due to its contribution to business success (Vij & Farooq, 2015; Tajeddini, 2011). This is also due to the unpredictable market environment characterised by a competitive landscape (Wilden & Gudergan, 2015). For firms to be successful, they must be industry innovators, adapting to the changing market demands, agile and must be cost-efficient (Vanpoucke et al., 2014). On the other hand, firms must also learn how to match resources to their market situation (Wilden & Gudergan, 2015). Firms with dynamic capability can tackle the evolving environment by introducing innovative strategies (Lin & Wu, 2014). These dynamic capabilities include a firm’s ability to “innovate, adapt to change and create change that is favourable to customer and competitors” (Teece et al., 2016). The service sector is one of the fastest-growing industries worldwide. As a result, it attracted researchers' growing attention with little studies in learning orientation and innovative research (Hollenstein, 2019). Some existing contributions focused on the hospitality industry (Ottenbacher & Gnoth, 2005) and hotels (Tajeddini, 2009). With little or none in other sub-sectors of the service sector such as the insurance sector (cf. Huy, 2019). For instance, studies by Deloitte (2018) indicate that “sustained economic growth, rising interest rates, and higher investment income are among the positive factors that appear to be bolstering the insurance sub-sector”. Some studies on the United States of America’s insurance sector saw organisational learning processes and innovations as part of a firm's value management system. But the benefits from innovation (IT investments) are marginal unless integrated and dynamic processes exist to actively manage and adapt these investments (Henderson & Lentz, 1995). Also learning orientation and innovation play a critical role in business success (Tajeddini, 2009).

Ghana’s insurance sector is a growing industry. Also, there is increased interest from multinational firms in the sector (Africa Business, 2017). The industry has experienced an appreciable rise on the insurer’s front with other financial players such as banks taking advantage of partner insurers to deliver superior value to prospective and existing clients. Based on the above, insurance can represent a focal market in understanding how learning orientation and innovative service developments can play a critical role in business success. The essential activities to transform the insurance sector is remarkable with new challenges. Consequently, insurance players must be revolutionary and innovative (Rajapathirana & Hui, 2018). There are 24 life insurance companies, 28 non-life insurance companies, 3 reinsurance companies, 81 broking companies, and 3 insurance loss adjusters (NIC, 2017). As technology evolves, the industry has been apprising with it. With the introduction of policies such as “Mobile Insurance Market Conduct Rule to regulate the sale and distribution of insurance through the mobile phone”, micro-insurance product sales have experienced a boom. Bancassurance collaborations increased from 36 in 2016 to 41 in 2017 (NIC, 2017).

Competition is keen among the top five life and non-life insurance players. The industry operates under the “Insurance Act 2006, ACT 724. This Act complies ominously with the International Association of Insurance Supervisors (IAIS) core principles” (NIC, 2017). It provides legal backing to the regulator who is responsible for the soundness of the insurance landscape. Among other things, the insurance Act “Act 2006, ACT 724 also prohibited composite insurance companies. All composite insurance companies per the Act were to separate their life and non-life activities into independent companies. This Act thus offers a robust structure for the sector in Ghana” (NIC, 2017).

The extant literature on innovations or new service development thrives on information originating from physical goods-producing institutions (Tajeddini, 2009). However, “applying innovation theory to service sectors, it must be taken into account the inter-sector heterogeneity which makes it important to study innovation in one specific sector at a time” (Randhawa & Scerri, 2015). Yet extreme care should be exhibited while extrapolating the findings of the theory of innovation from a physical good production arena into the non-product sector. A thorough consideration about the above must be given within the insurance sector because of its heterogeneity and the fact that “the penetration of insurance varies dramatically across regions and within countries, as does the exposure and vulnerability of human populations and property to unforeseen events” (De Masi & Porrini, 2018). This study assessed learning orientation and innovative service development on insurance business growth.

This paper is organised as follows. An introduction, theoretical background and hypothesis development, methods, data management and analysis approach, discussion and implications, study limitations and future studies.

Theoretical Background and Hypothesis Development

This study is dependent upon the “resource-based view” of the firm, which has gain prominence in marketing and management literature (Fahy & Smithee, 1999; Newbert, 2007). The conversation surrounding “RBV” is that the firm's disposal resources play a critical role in its achievement of sustained competitive advantage (Barney, 1991). “RBV’s emphasis is on internal analysis instead of an external focus”. The assertion surrounding RBV posit the fact that two assumptions hold sway. Primarily, heterogeneity exists amongst resources of firms within an industry. In other words, the resource portfolio of one firm stands distinct from those of others within the same sector (Kull et al., 2016). Secondly, there exist “imperfect resource mobility” (Barney, 1991). Resources are formally explained as an activity or offering which reflect “strength or weakness” (Wernerflet, 1984) and capabilities that results in the buildup of “core competence” (Day, 1994).

Dynamic capabilities are the firm’s ability to integrate, build and reconfigure internal and external competences to tackle rapidly changing environments and achieve congruence with these changes (Teece, 2007). Responses that create superior value is needed when “time-to-market” is of the essence, when the evolution of the tech platform is on the rise and when the intensity of rivalry as well as overall conditions within the market is not easy to determine (Beltran & Ramesh, 2017). Also, dynamic capabilities have three key emphases, namely, “sense-seize-transform”, which provides a thorough perspective of how firm transformation happen and how it leads to better accomplishments (Teece, 2007; Torres et al., 2018). The above approach management’s influence is critical in sensing profitable activities and challenges, seizing the opportunities that the activities present for the firm’s evolution, and changing the firm (Torres et al., 2018). It is worth stating that although dynamic capability finds root with the firm’s top management, it is also affected by the firm’s “processes, systems, and structures that the business has developed to manage its activities” (Beltran & Ramesh, 2017). In particular, the influence that “RBV and dynamic capabilities” plays in accomplishing and augmenting a firm’s growth has become the preoccupation of scholars and practitioner within the marketing and management arena (Lin & Wu, 2014).

Learning Orientation (LO) among Service Firms

Learning orientation (LO) is an internal process involving the development and utilising of expertise to improve the edge that a firm has over its rivals (Wolff et al., 2015). Also, LO is made up of beliefs, ideals and values, which influence the predilection to actively seek fresh understanding and challenge the current knowledge (Sinkula et al., 1997). A firm’s LO directly affects its performance (Hakala, 2013; Frank et al., 2012; Baker & Sinkula, 1999). This relationship has gained support, with LO having a more significant relative impact on performance aspects such as a change in relative market share, overall performance, and new product success (Celuch et al., 2002; Farrell & Oczkowski, 2002). Also, firms with an embedded learning culture allow their acquired values to be converted into knowledge that can be moved through the firm, combined with other fields of expertise and set out via several firm systems and processes (Crossan et al., 1999; Ellinger et al., 2002). Such a culture will thrive only through such capabilities as a commitment to learning, open-mindedness and shared vision (Sinkula et al., 1997; Calantone et al., 2002).

Commitment to Learning (CL) and Innovative Service Development (ISD)

A dimension of LO is explained as a value of a firm that is usually not only nurtured and enhanced to create culture but as well an investment that is essential for the firm to enjoy an edge over its rivals (Sinkula et al.,1997). Firms can appreciate and forecast customer needs and design innovative activities of value that delight customers. In that vein, they do not lose sight of opportunities existing within the sector (Seng et al., 2016). Instinctively, service firms within the insurance sectors who are cognizant of the market's competitive nature must continuously partake in innovative know-how to pursue their objectives. With such a commitment to learning, it offers the platform for them to be seen differently than other industry players (Damanpour, 1991).

Some empirical studies have indicated that firms committed to learning tend to have the platform to innovate (Jimenez-Jimenez & Sanz-Valle, 2011; Calantone et al., 2002). A study by Yli-Renko et al. (2001), for example, looked at only knowledge acquisition and innovation and found the relationship to be positive. Despite the above research looking at other aspects of CL and innovation's relationship, most show a positive relationship. Hence this study hypothesises that:

H1. Commitment to learning is related positively to Innovative service development

Open-Mindedness and Innovative service development

Open-mindedness (OM) is an approach that encourages the review of a firm’s beliefs, routines, and habits (Nguyen & Barrett, 2006). Also, open-mindedness is linked with the arena of unlearning, through which top executives encourage employees to question the status quo, thereby resulting in existing beliefs, values and processes being jettisoned (Sinkula et al., 1997; Hernandez-Mogollon et al., 2010). Studies have postulated that OM facilitates innovative service development in the sense that efficient introduction of new services thrives on how the structures and processes of the firm react to the innovations (Sinkula, 2002; Keskin, 2006). Also, open-mindedness and innovative service development relationship are strengthened by knowledge management initiatives from internal and external stakeholders (Darroch & McNaugton, 2002). Hence the study suggest:

H2. The degree to which an insurance firm realises open-mindedness is positively related to the extent of innovative service development.

Shared Vision and Innovative Service Development

Shared vision (SV) is the traditional idea of goal-oriented implementation and consensus-building (Exposito-Langa et al., 2015). Also, shared vision (SV) is described as the organisational principles that encourage the overall effective participation of all staff members towards the growth, promotion, spreading and execution, contrary to the existing top-down strategy (Wang & Rafiq, 2009). At the organizational level have indicated that shared vision can bring together a loosely linked system and encourage the whole firm's inclusion to achieve its objectives (Orton & Weick, 1990). Similarly, shared vision as a relationship-building system that assists varied sections of the firm to effectively and efficiently utilise scarce resources to introduce new products and services of value (Tsai & Ghoshal, 1998). Similarly, Exposito-Langa et al. (2015) assert that SV can also be regarded as a relational device that assists the firm's staff to take part, exchange resources, and acquire appropriate expertise, thereby enhancing innovation. Hence the following hypothesis:

H3. A shared vision of insurance firms would positively influence innovative service development.

Innovative Service Development and Business Performance

A crucial factor for organisational performance is innovation (Atitumpong & Badir, 2018). Innovation is “the adoption of an idea or behaviour, whether a system, policy, program, device, process, product or service, that is new to the adopting organisation” (Damanpour, 1991). Organisations innovate because of pressure from the external environment, such as competition, deregulation, isomorphism, resource scarcity, and customer demands, or because of an internal organisational choice, such as gaining distinctive competencies, reaching a higher level of aspiration, and increasing the extent and quality of services. Innovation thrives in an organisation where leadership appreciates innovative work behaviour among employees (Atitumpong & Badir, 2018). Innovation in this study is skewed to innovative service development. This is because service innovation under which innovative service development thrives is seen “as a research priority in the science of service” (Anderson & Ostrom, 2015).

Innovative service development (ISD) research is ongoing. There seems to be uncertainty concerning the activities that form criteria for new service creation activities and are peculiar to new physical goods (Atuahene-Gima, 1996). Notwithstanding the heightened attention to service and innovation, little has been done to innovative process for service firms. Dolfsma (2004) argues that this may be due to the absence because of the lack of applicability of methods measuring innovation for products to the heterogeneous group of sectors such as the service sector. ISD represents the integrated method of creating ultra-modern intangible offerings from commercialisation (Goldstein, Johnston, Duffy & Rao, 2002). ISDs may not fulfil financial performance or consumer satisfaction standards (Cooper & Edgett, 1996). Nevertheless, some scholars claim that the association between ISD and business growth and performance must be recognised (Johne & Storey, 1998). Managers usually appraise development efforts based entirely on either a financial or perceptual measurement (Griffin & Page, 1993). Hence, the study hypothesises that:

H4: ISD in the insurance sector positively influence business performance.

Learning Orientation (LO) and Business Performance

The impact of learning orientation on business performance has been researched extensively across diverse sectors (Taheri et al., 2019; Mahmoud et al., 2016). For example, Kharabsheh et al. (2017) and Mahto et al. (2018) confirmed a positive relationship between learning orientation and firm performance. Most of the study findings suggest the association prevailed across varied sectors (Kharabsheh et al., 2017). Hence, the study hypothesises that:

H5: Learning orientation (commitment to learning) positively influence insurance business performance

Methods

Data and Sampling Methods

This research focused on top managers and middle line decision-makers actively engaged in innovative service development and delivery within their firms. A survey instrument was drafted which asked the top and middle manager for their viewpoint of items that define sub-constructs which explains learning orientation; innovative service development, and the relationship with insurance company growth and outlook in Ghana's context. A five-point- Likert scale (with five representing-disagreed and one representing-agreed) was employed to collect the information. Administering of the survey was carried by visiting the insurance companies, brokers as well as reinsurance players and asking for their consent to administer the survey. This study’s choice of appropriate sample size was based on the requirement for performing confirmatory factor analysis (Tabachnick & Fidell, 2014). Researchers suggest that a sample size between 200 and 400 is appropriate for conducting SEM analysis. Hair et al. (2010) indicate that a sample size of more than 400 makes the SEM analysis too sensitive. Based on the above, a sample size of at least 305 was used for confirmatory analysis.

Measures

The scales used for this research was adapted from earlier studies. For instance, three-item scales were extracted from Hurt et al. (1977); Hollenstein, (1996); Hurt & Teigen (1977) to measure firm new innovative services. It was used because many subsequent studies well validate it. Also, insurance performance was measured by extracting three items from Voss (1992). Scales proposed by Baker & Sinkula (1999), Hult & Ferrell (1997); Sinkula et al., (1997) was used to measure Learning Orientation. LO is made up of three sub-dimensions, namely, commitment to learning Sinkula et al., (1997), open-mindedness Sinkula (1994) and shared vision (Verona,1999). Subsequent studies which have adopted and tested the measures have found them to be valid and reliable (Calantone et al. 2002). Hence its usage by this study. A five-point Likert-type scale, ranging from 1 (strongly disagree) to 5 (strongly agree), was used to measure the variable.

Data Management and Analysis Approach

The data analysis involved reducing the collected raw data into a manageable size to generate the desired result. As a result, the questionnaire's collected data was edited, classified, coded using IBM SPSS Statistics Version 20. Also, the responses with missing data were removed after using excel to perform count blank. Using Stdev in excel, standard deviation values below 0.3 for construct and its items were removed. Skewness and kurtosis were calculated to gauge for univariate normality of the data. Results (see Appendix A for Skewness and kurtosis values) indicated that none of the items had absolute values of Skewness > 3.0 and kurtosis > 8.0 (Kline, 2011).

Descriptive statistics relating to the characteristics of respondents are indicated below. Out of the 305 responses used for the analysis, 67.9% were male, with 31.8% representing females. In terms of age, a more significant percentage of 95.1% was found between the age range of 40 and above and 30-39, with 40 and above recording the highest age percentage of 50.8%. Because the study was focused on top managers as well as middle line managers of insurance companies within Greater, respondents varied in terms of their education levels, with a more significant number of respondents indicating they had their master’s degree (53.4%), doctorate (24.9%), diploma (11.1), undergraduate degree(10.5%).

For the type of business (TOB), 55.4% of the respondents indicated that they were in the life insurance business, followed by 25.6%, indicating they are in the non-life insurance business. Reinsurance business respondents also accounted for 2.6%, while brokers who responded accounted for 16.4%. Also, for the number of years in operation, 45.2% of the respondents indicated that they have been in operation for more than ten years, followed by 35.5% indicating they have been in operation between 5-10years.

Those who have been in operation for less than five years accounted for 19.3%. Further, for the position held, 57% of the respondents indicated they were in top management roles while 43% indicated they were middle-level managers. Because this study focused on construct associations and not descriptive insights, the study did not consider weighting the sampling elements.

Data Analysis and Results

Measurement approach

The constructs and their items were loaded in a factorial confirmatory model (CFA). The robust maximum-likelihood method (MLR) used in Mplus 8 software package was applied for estimating the CFA model. In measuring the goodness-of-fit (GOF) of the CFA model, indexes such as chi-square test statistic, comparative fit index (CFI), Tucker-Lewis index (TLI) and root mean square error of approximation (RMSEA) were used. GOF for the data model is arrived at once values were above the threshold of 0.90 for CFI and TLI, and below 0.08 for RMSEA (Hair et al., 2013). The results indicated that the CFA model had a good fit for the data. The GOF values were: MLR?2 (94) = 233.850, CFI = 0.933, TLI = 0.915, and RMSEA = 0.070; 90% confidence interval (C.I.) of 0.059–0.081.

In establishing the reliability of each of the scales, Cronbach’s alpha (α) composite reliability (CR) and factor determinacy (FD) were used for such assessment (Appendix B). Both Cronbach’s alpha (α) and composite reliability (CR) values for the latent variables ranged from 0.72 to 0.85. The above values exceed the threshold of 0.7 proposed by (Bagozzi and Yi, 1988). The factor determinacy (FD) values for all the latent variables were above 0.88, exceeding the proposed threshold of 0.80 (Muthen & Asparouhov, 2012). Besides, loading estimates were greater than 0.565 and statistically significant. As well, t-values for the items ranged from 8.923 to 30.866 (p < 0.000). Convergent validity was established as there was no cross-loading evidence (Hair et al., 2013). For discriminant validity, the study accessed it based on Fornell and Larcker’s (1981) criterion by testing if the square root of the Average variance extracted is greater than its correlation with each of the remaining constructs. Initially, the AVE for each construct was calculated. The average variance extracted of the constructs ranged from 0.50 to 0.65 (Appendix A). The values 24 calculated were in agreement or exceeded the acceptable threshold of 0.5 (Fornell and Larcker, 1981). It is also evident from Table 1 that the square root of the AVEs for each construct is greater than the cross-correlation with other constructs.

| Table 1 Construct Standardised Loadings, FD, CR, Reliabilities, and Intercorrelations | |||||||||

| FACTOR | ALPHA | FD | CR | AVE | LOCL | LOOM | LOSV | ISD | BPFM |

| LOCL | 0.82 | 0.948 | 0.834 | 0.635 | 0.79686* | ||||

| LOOM | 0.83 | 0.928 | 0.828 | 0.55 | 0.559 | 0.74162* | |||

| LOSV | 0.72 | 0.926 | 0.745 | 0.511 | 0.136 | 0.356 | 0.714843* | ||

| ISD | 0.85 | 0.939 | 0.848 | 0.651 | 0.329 | 0.413 | 0.79 | 0.8068* | |

| BPFM | 0.74 | 0.897 | 0.754 | 0.51 | 0.242 | 0.333 | 0.59 | 0.63 | 0.714* |

Note: LOCL= Learning Orientation Commitment to learning, LOOM= Learning Orientation open mindedness, LOSV= Learning orientation shared vision, ISD= Innovative service development, and BPFM= Business performance financial measurement. MLR?2(94)= 233.850, CFI = 0.933, TLI = 0.915, and RMSEA = 0.070; 90% confidence interval (C.I.) of 0.059–0.081

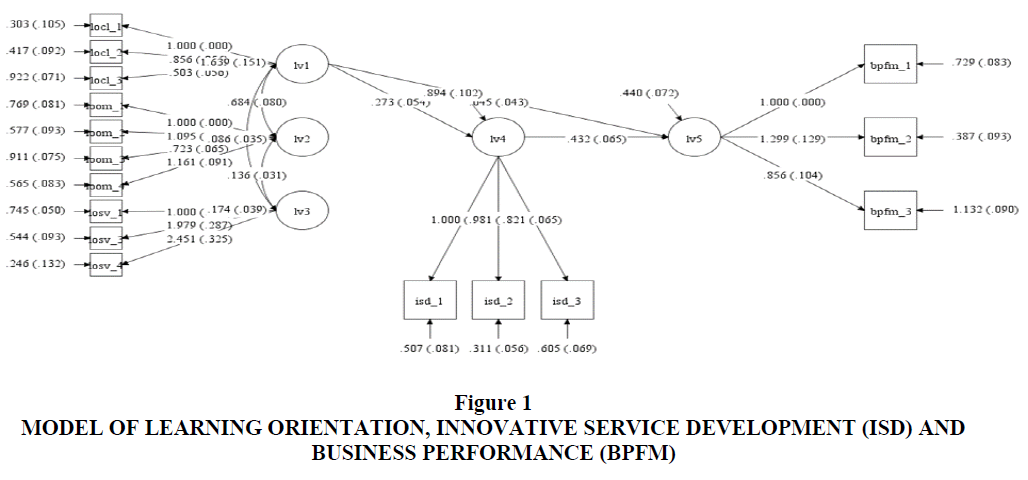

Path and Mediation Analysis for LO On Innovative Service Development and Business Performance in the Ghanaian Insurance Context (H1-H5)

The effect of learning orientation items on innovative service development activities and performance was assessed using path analysis with structural equation modeling in Mplus 8. MLR was the estimator method used. Also, the GOF values for the model were MLR2 (96)= 243.548, CFI = 0.929, TLI = 0.912, and RMSEA = 0.071; 90% confidence interval (C.I.) of 0.060–0.082.

As shown in Table 2, the regression results used the parameters based upon the independent variables to test the earlier framework in Figure 1 above. For hypothesis 1-4, 4-5 and 1and 5, the study hypothesised that the degree to which the three constructs that define learning orientation in the insurance industry is positively related to the degree of innovative service development activities. However, per the results shown in Table 2 below only commitment to learning (β= 0.211, t= 3.241 p =0.001) and shared vision (β= 0.768, t= 17.625 p =0.000) within the insurance sector significantly influences innovative service development activities.

| Table 2 Hypotheses and Path Analysis | ||||

| STRUCTURAL PATH | Beta | t-value | p-value | Acceptance/Rejection |

| Main Effect | ||||

| H1. LOCL→ISD | 0.211 | 3.421 | 0.001 | A |

| H2. LOOM→ISD | 0.03 | 0.658 | 0.658 | R |

| H3. LOSV→ISD | 0.768 | 17.625 | 0 | A |

| H4. ISD→BPFM | 0.581 | 9.372 | 0 | A |

| H5. LOCL→BPFM | 0.051 | 0.744 | 0.457 | R |

| Indirect Effect | ||||

| LOCL→ISD→BPFM | 0.122 | 3.041 | 0.002 | A |

Note: LOCL= Learning Orientation Commitment to learning, LOOM= Learning Orientation open mindedness, LOSV= Learning orientation shared vision, ISD= Innovative service development, and BPFM= Business performance financial measurement. MLR2(96)= 243. 548, CFI = 0.929, TLI = 0.912, and RMSEA = 0.071; 90% confidence interval (C.I.) of 0.060–0.082.

Top managers and middle managers of insurance companies who prioritise commitment to learning and shared vision within their sector tend to be proactive in their innovative service development activities. As well, the fourth direct hypothesis (ISD and BPFM) expected a positive effect. The results confirmed the positive relationship (β= 0.581, t= 9.372 p =0.000). However, the final directional hypothesis, which expected a positive effect, was detected not to be statistically significant (β= 0.051, t= 0.744 p =0.457). Therefore, it is instinctive from the result to take cognizance that in general terms, top managers and middle managers of insurance companies agree that insurance companies that develop innovative service development activities will be able to improve their performance. The outcomes of the paths are as shown in Figure 1 and Table 2, respectively.

For the indirect effect analysis, while the study did not hypothesise for it, further analysis of the indirect effect of LOCL and BPFM via ISD was calculated. The calculation outcome suggests a significantly positive effect of LOCL on BPFM (β=0.122, t=3.041 p=0.002) via ISD. Instructively, it desires much saying that the direct effect of LOCL on BPFM is not statistically significant when there is a partial mediation. However, the indirect effect of the model is significantly positive, which buttresses the essence of ISD in the insurance sector. The outcome of the indirect effect is shown in Figure 1 and Table 2.

Discussion and Implications

This paper examined the effect of learning orientation on innovative service development and performance in the insurance industry. The results indicate that commitment to learning and shared vision necessitates insurance firms to be more proactive in introducing innovative service development activities. Further, the findings suggest that only two of the above factors that define learning orientation indicate a positive effect on innovative service development activities and support hypothesis 1 and hypothesis 3.

Also, the findings reveal that the players within the insurance sector are committed to learning about values and the need to comprehend the causal outcome of their actions (Nguyen & Barrett, 2006; Tajeddini, 2009). The study found that commitment to learning encourages a learning culture that makes new ideas thrive (Sinkula et al., 1997; Tajeddini, 2009) studies support Calantone et al. (2002); Tajeddini (2009), supports the findings in the service industry.

Also, the findings revealed that the effect of open-mindedness on innovative service development was not significant and had no relationship with ISD. Further, the results concerning innovative service development and BPFM was significantly positive and revealed that top managers and middle managers of insurance companies agree that insurance companies that develop innovative service development activities will be able to improve their performance. This is supported by Grawe et al. (2009), whose work found a positive relationship between service innovation and performance. The empirical test reveals an indirect effect of one of the formative constructs of learning orientation (commitment to learning) on BPFM via innovative service development, although it was not hypothesised. The indirect effect was significantly positive, which buttresses the essence of ISD in the insurance sector (Lestari, et al., 2018).

Study Limitation and Future Studies

This paper provides relevant information about the effect of learning orientation on innovative service development and business performance in the insurance industry in the context of Ghana. But, the findings should be seen as preliminary because the paper used data from top managers and middle managers from the insurance industry in Ghana alone, generalising the results to other industries such healthcare, public and civil service, banking industry, among others, may not befitting. However, comparisons could be made by adapting the above service industries' model and comparing the findings. Finally, because the study used cross-sectional data, which is fraught with its problems (Rong & Wilkinson, 2011), it is advised that to get a more generalisable result, future studies should envisage the use of a longitudinal dataset.

References

- Anderson, L., & Ostrom, A.L. (2015). Transformative service research: advancing our knowledge about service and well-being.

- Atitumpong, A., & Badir, Y.F. (2018). Leader-member exchange, learning orientation and innovative work behavior. Journal of Workplace Learning.

- Atuahene-Gima, K. (1996). Market orientation and innovation, Journal of business research, 35(2), 93-103.

- Bagozzi, R.P., & Yi, Y. (1988). On the evaluation of structural equation models. Journal of the academy of marketing science, 16(1), 74-94.

- Baker, W.E., & Sinkula, J.M. (1999). The synergistic effect of market orientation and learning

- Barney, J. (1991). Firm resources and sustained competitive advantage, Journal of management, 17(1), 99-120.

- Beltran, G., & Ramesh, B. (2017), “Dynamic Capabilities in Small Service Firms”, Engaged Management Review, 1(3), 2.

- Calantone, R.J., Cavusgil, S.T., & Zhao, Y. (2002), “Learning orientation, firm innovation capability, and firm performance”, Industrial marketing management, 31(6), 515-524.

- Celuch, K.G., Kasouf, C.J., & Peruvemba, V. (2002), “The effects of perceived market and learning orientation on assessed organizational capabilities”, Industrial marketing management, 31(6), 545-554.

- Cooper, R.G., & Kleinschmidt, E.J. (1987), “New products: what separates winners from losers”, Journal of product innovation management, 4(3), 169-184.

- Crossan, M.M., Lane, H.W., & White, R.E. (1999). An organizational learning framework: From intuition to institution. Academy of management review, 24(3), 522-537.

- Damanpour, F. (1991). Organizational innovation: A meta-analysis of effects of determinants and moderators. Academy of management journal, 34(3), 555-590.

- Darroch, J., & McNaughton, R. (2002). Examining the link between knowledge management practices and types of innovation. Journal of intellectual capital.

- Day, G.S. (1994). The capabilities of market-driven organizations. Journal of marketing, 58(4), 37-52.

- Day, G.S. (1991), “Learning about markets”, Marketing Science Institute Report Number 91-117, Marketing Science Institute, Cambridge.

- De Masi, F., & Porrini, D. (2018), “Vulnerability to natural disasters and insurance: Insights from the Italian case”, International Journal of Financial Studies, 6(2), 56.

- Deloitte (2018), “The services economy's importance to world economic growth”, available at

- Dolfsma, W. (2004), “Paradoxes of Modernist Consumption–Reading Fashions”, Review of social Economy, 62(3), 351-364.

- Expósito-Langa, M., Tomás-Miquel, J.V., & Molina-Morales, F.X. (2015). Innovation in clusters: exploration capacity, networking intensity and external resources. Journal of Organizational Change Management.

- Fahy, J., & Smithee, A. (1999), “Strategic marketing and the resource based view of the firm”, Academy of marketing science review, 10(1), 1-21.

- Farrell, M.A., & Oczkowski, E. (2002), “Are market orientation and learning orientation necessary for superior organizational performance”, Journal of market-focused management, 5(3), 197-217.

- Fornell, C., & Larcker, D.F. (1981), “Evaluating structural equation models with unobservable variables and measurement error”, Journal of marketing research, 18(1), 39-50.

- Frank, H., Kessler, A., Mitterer, G., & Weismeier-Sammer, D. (2012), “Learning orientation of SMEs and its impact on firm performance”, Journal of Marketing Development and Competitiveness, 6(3), 29-41.

- Goldstein, S.M., Johnston, R., Duffy, J., & Rao, J. (2002), “The service concept: the missing link in service design research”, Journal of Operations management, 20(2), 121-134.

- Grawe, S.J., Chen, H., & Daugherty, P.J. (2009), “The relationship between strategic orientation, service innovation, and performance”, International Journal of Physical Distribution & Logistics Management, 39(4), 282-300.

- Griffin, A., & Page, A.L. (1993), “An interim report on measuring product development success and failure”, Journal of product innovation management, 10(4), 291-308.

- Hair, J.F., Black, W.C., Babin, B.J., & Anderson, R.E. (2013), Multivariate data analysis: Pearson new international edition, Pearson Higher Ed.

- Hair, J.F., Black, W.C., Rabin, B.J., & Anderson, R.E. (2010), Multivariate data analysis: A global perspective, New Jersey: Pearson Prentice Hall.

- Hakala, H. (2013), “Entrepreneurial and learning orientation: effects on growth and profitability in the software sector”, Baltic Journal of Management, 8(1), 102-118.

- Henderson, J.C., & Lentz, C.M. (1995, January), “Learning, working and innovation: a case study in insurance,” In Proceedings of the Twenty-Eighth Annual Hawaii International Conference on System Sciences (Vol. 4, pp. 546-555). IEEE.

- Hernández-Mogollon, R., Cepeda-Carrión, G., Cegarra-Navarro, J.G., & Leal-Millán, A. (2010). The role of cultural barriers in the relationship between open-mindedness and organizational innovation. Journal of Organizational Change Management, 23(4), 360-376.

- Hollenstein, H. (1996), “A composite indicator of a firm's innovativeness. An empirical analysis based on survey data for Swiss manufacturing”, Research Policy, 25(4), 633-645.

- Hollenstein, H. (2019), “Innovation strategies of Swiss firms: identification, dynamics and intraindustry heterogeneity”, Economics: The Open-Access, Open-Assessment E-Journal, 13(2019-18), 1-61.

- https://www2.deloitte.com/insights/us/en/.../trade-in-services-economy-growth.html (accessed on

- Hult, G.T.M., & Ferrell, O.C. (1997). Global organizational learning capacity in purchasing: Construct and measurement. Journal of business research, 40(2), 97-111.

- Hurt, H.T. & Teigen, C.W. (1977), “The development of a measure of perceived organizational innovativeness”, Annals of the International Communication Association, 1(1), 377-385.

- Hurt, H.T., Joseph, K., & Cook, C.D. (1977), “Scales for the measurement of innovativeness”, Human Communication Research, 4(1), 58-65.

- Huy, D.T.N. (2019). The Measurement of the Volatility of Market Risk of Viet Nam Insurance Industry after the Low Inflation Period 2015-2017. Journal of Entrepreneurship, Business and Economics, 7(1), 153-173.

- Jiménez-Jiménez, D., & Sanz-Valle, R. (2011). Innovation, organizational learning, and performance. Journal of business research, 64(4), 408-417.

- Johne, A., & Storey, C. (1998), “New service development: a review of the literature and annotated bibliography”, European journal of Marketing, 32(3/4), 184-251.

- Keskin, H. (2006). Market orientation, learning orientation, and innovation capabilities in SMEs: An extended model. European Journal of innovation management.

- Kharabsheh, R., Ensour, W., & Bogolybov, P. (2017), “Learning orientation, market orientation and organizational performance: The mediating effect of absorptive capacity”, Business and Economic Research, 7(1), 114-127.

- Kull, A.J., Mena, J.A., & Korschun, D. (2016), “A resource-based view of stakeholder marketing”, Journal of Business Research, 69(12), 5553-5560.

- Lestari, E.R., Ardianti, F.L., & Rachmawati, L. (2018, March). Firm performance model in small and medium enterprises (SMEs) based on learning orientation and innovation. In IOP Conference Series: Earth and Environmental Science (Vol. 131, No. 1, p. 012027). IOP Publishing.

- Lin, Y., & Wu, L.Y. (2014), “Exploring the role of dynamic capabilities in firm performance under the resource-based view framework”, Journal of business research, 67(3), 407-413.

- Mahmoud, M.A., Blankson, C., Owusu-Frimpong, N., Nwankwo, S., & Trang, T.P. (2016). “Market orientation, learning orientation and business performance: The mediating role of innovation”, International Journal of Bank Marketing, 34(5), 623-648.

- Mahto, R.V., McDowell, W.C., Kudlats, J., & Dunne, T.C. (2018), “Learning orientation and performance satisfaction as predictors of small firm innovation: the moderating role of gender”, Group Decision and Negotiation, 27(3), 375-391.

- Muthén, B., & Asparouhov, T. (2012). Bayesian structural equation modeling: a more flexible representation of substantive theory. Psychological methods, 17(3), 313.

- Newbert, S.L. (2007), “Empirical research on the resource?based view of the firm: an assessment and suggestions for future research”, Strategic management journal, 28(2), 121-146.

- Nguyen, T.D., & Barrett, N.J. (2006), “The adoption of the internet by export firms in transitional markets”, Asia Pacific Journal of Marketing and Logistics, 18(1), 29-42.

- NIC (2017), Annual Report. National Insurance Commission, available at: www.nic.gh.org (accessed 10 May 2019).

- orientation on organisational performance, Journal of the academy of marketing science, 27(4), 411-427.

- Orton, J.D., & Weick, K.E. (1990). Loosely coupled systems: A reconceptualization. Academy of management review, 15(2), 203-223.

- Ottenbacher, M., & Gnoth, J. (2005), “How to develop successful hospitality innovation”, Cornell Hotel and Restaurant Administration Quarterly, 46(2), 205-222.

- Rajapathirana, R.J., & Hui, Y. (2018), “Relationship between innovation capability, innovation type, and firm performance”, Journal of Innovation & Knowledge, 3(1), 44-55.

- Randhawa, K., & Scerri, M. (2015), “Service innovation: A review of the literature”, In The handbook of service innovation(pp. 27-51), Springer, London.

- Rong, B., & Wilkinson, I.F. (2011), “What do managers’ survey responses mean and what affects them? The case of market orientation and firm performance”, Australasian Marketing Journal (AMJ), 19(3), 137-147.

- Seng, E.L. K.S.K., & Wai, C.C. (2016). An empirical study of academic and non-academic staff’s job satisfaction and organizational commitment in an institute of higher learning. Journal of Entrepreneurship, Business and Economics, 4(1), 45-72.

- Sinkula, J.M. (1994), “Market information processing and organizational learning”, Journal of marketing, 58(1), 35-45.

- Sinkula, J.M. (2002). Market?based success, organizational routines, and unlearning. Journal of Business & Industrial Marketing.

- Sinkula, J.M., Baker, W.E., & Noordewier, T. (1997), “A framework for market-based organizational learning: Linking values, knowledge, and behavior”, Journal of the academy of Marketing Science, 25(4), 305.

- Tabachnick, B.G., & Fidell, L.S. (2014), Using multivariate statistics, Harlow.

- Taheri, B., Bititci, U., Gannon, M.J., & Cordina, R. (2019), “Investigating the influence of performance measurement on learning, entrepreneurial orientation and performance in turbulent markets”, International Journal of Contemporary Hospitality Management, 31(3), 1224-1246.

- Tajeddini, K. (2009), “The impact of learning orientation on NSD and hotel performance: Evidence from the hotel industry in Iran”, Education, Business and Society: Contemporary Middle Eastern Issues, 2(4), 262-275.

- Tajeddini, K. (2011), “Customer orientation, learning orientation, and new service development: an empirical investigation of the Swiss hotel industry”, Journal of Hospitality & Tourism Research, 35(4), 437-468.

- Teece, D.J. (2007), “Explicating dynamic capabilities: the nature and microfoundations of (sustainable) enterprise performance”, Strategic management journal, 28(13), 1319-1350.

- Teece, D.J. (2014), “The foundations of enterprise performance: Dynamic and ordinary capabilities in an (economic) theory of firms”, Academy of management perspectives, 28(4), 328-352.

- Teece, D., Peteraf, M., & Leih, S. (2016), “Dynamic capabilities and organizational agility: Risk, uncertainty, and strategy in the innovation economy”, California Management Review, 58(4), 13-35.

- Torres, R., Sidorova, A., & Jones, M.C. (2018), “Enabling firm performance through business intelligence and analytics: A dynamic capabilities perspective”, Information & Management, 55(7), 822-839.

- Tsai, W., & Ghoshal, S. (1998). Social capital and value creation: The role of intrafirm networks. Academy of management Journal, 41(4), 464-476.

- Vanpoucke, E., Vereecke, A., & Wetzels, M. (2014), “Developing supplier integration capabilities for sustainable competitive advantage: A dynamic capabilities approach”, Journal of operations management, 32(7-8), 446-461.

- Verona, G. (1999), “A resource-based view of product development”, Academy of management review, 24(1), 132-142.

- Vij, S., & Farooq, R. (2015), “The relationship between learning orientation and business performance: do smaller firms gain more from learning orientation”, IUP Journal of Knowledge Management, 13(4).

- Voss, C.A. (1992), Manufacturing strategy. Process and Content, Chapman and Hall. London.

- Wang, C.L., & Rafiq, M. (2009). Organizational diversity and shared vision. European Journal of Innovation Management.

- Wernerflet, B. (1984). A resource-based view of the ?rm. Strategic Management Journal, 5, 171-180.

- Wilden, R., & Gudergan, S.P. (2015), “The impact of dynamic capabilities on operational marketing and technological capabilities: investigating the role of environmental turbulence”, Journal of the Academy of Marketing Science, 43(2), 181-199.

- Wolff, J.A., Pett, T.L., & Ring, J.K. (2015), “Small firm growth as a function of both learning orientation and entrepreneurial orientation: An empirical analysis”, International Journal of Entrepreneurial Behavior & Research, 21(5), 709-730.

- Yli?Renko, H., Autio, E., & Sapienza, H.J. (2001). Social capital, knowledge acquisition, and knowledge exploitation in young technology?based firms. Strategic Management Journal, 22(6?7), 587-613.