Research Article: 2022 Vol: 21 Issue: 2S

The Effect of Information Technology on raising the Efficiency of Tax Collection/an exploratory study in the branches of the General Commission of Tax in Bagdad

Basima Abood Majeed, Middle Technical University

Sahar Khaleel Ismail, Middle Technical University

Keywords

Information Technology, Dimensions of IT, Efficiency of Tax Collection, Tax Evasion, Tax Avoidance

Citation Information

Majeed, B.A., & Ismail, S.K. (2022). The Effect of Information Technology on raising the Efficiency of Tax Collection/an exploratory study in the branches of the General Commission of Tax in Bagdad. Academy of Strategic Management Journal, 21(S2), 1-16.

Abstract

The research focused on studying the impact of information technology in raising the efficiency of tax collection by reducing tax evasion and tax avoidance. A questionnaire was used and distributed to the study sample of (70) tax auditors in the branches General Commission of Tax. My work is analytical for the opinions of a sample of senior and middle-ranking departments of the General Tax Authority branches, and the independent variable represents information technology in the following dimensions. (hardware, software, human resources, databases and communication networks) and the adopted variable is raising the efficiency of tax collection with its dimensions (tax evasion and tax avoidance), The results of the research show that all dimensions of information technology variables have a statistically significant effect on the efficiency of tax collection by reducing tax evasion and tax avoidance. The program (Amos V.23) was used to test the hypotheses, and in light of the conclusions, the research presented a number of recommendations, the most important of which was replacing the traditional means of payment and payment by electronic means, expanding dealing with the electronic declaration system, and urging tax administrations to increase interest in electronic procedures because of their importance in raising the efficiency of tax collection.

Introduction

Information technology is one of the contemporary administrative topics that have taken a prominent part of the attention of writers and researchers as well as managers at all levels because of its essential role in achieving the goals that their organizations aspire to survive and grow. Because of the technical progress to improve the work of organizations in various fields, and the interest in information in today's world is an indispensable necessity for the organization with the available opportunities it offers to achieve a competitive advantage that we advance, This situation is reinforced as long as these organizations deal with the external environment, which is a huge source of data and information, until the process of controlling it is no longer an easy matter, and it requires the existence of techniques to provide information based on the criteria of quantity, type, cost and appropriate timing (El-ebady, 2007).

Tax revenue is one of the important tax sources that contribute significantly to the state's general budget. The real estate tax collection system is of great importance all over the world, especially with regard to developing countries, including Iraq, because the tax system in Iraq suffers from significant shortcomings due to the use of traditional manual systems, and the limited use of modern technologies in them. Tax systems in Arab countries are characterized by low the tax contribution rates in financing the general budget, despite the efforts made to develop tax systems in the Arab countries, it still constitutes a challenge that requires more efforts and reform. To reach at least similar levels in emerging economies and other developing countries, despite the positive development of levels of economic development, tax revenues in Arab countries have remained stable at their low level over the past two decades, while they continued their upward trend in emerging economies and other developing countries, (Esmael, 2019) The Arab countries need to increase public financial resources by raising the proceeds of tax revenues in light of the increasing financial needs and the growing requirements for development on the one hand, and the decline of external grants and uncertainty about future trends in oil prices on the other hand. The GDP is due to the limited tax capacity of the Arab economies, or because of the low efficiency of the actual collection of possible tax revenues, in view of the role of taxes in achieving economic and social goals as the main source of public revenues for the state and the role of information technology in improving the tax collection process, this study came to measure the effect of the dimensions of information technology in raising the efficiency of tax collection.

Previous Studies

There are many previous studies that dealt with the study variables (information technology, tax collection efficiency) separately by measuring the level of relationship between each of them with another variable, and they did not combine the two variables, including:

Study (Shakhatra, 2019) -"Impact of the Income and Sales Tax System on Raising the Efficiency of Tax Collection in Jordan

The research aimed to identify the impact of the income tax system with its dimensions (tax legislation, electronic procedures, tax audit procedures) on raising the efficiency of tax collection with its dimensions (tax evasion, tax avoidance). As a tax auditor, the research proved that there is an effect of the income and sales tax system on raising the efficiency of tax collection by reducing tax evasion and tax avoidance.

Study (Matlab, 2017) -"The Role of Information Technology in Increasing the Real Estate Tax Proceeds

The most important results of the study of the role of information technology in increasing the real estate tax proceeds was that the process of optimally using electronic systems in tax work is one of the most important strategic options that countries take to develop tax work by using information technology to increase the real estate tax proceeds that contribute to increasing public revenues. The reasons for the weakness of tax accounting procedures and the collection of real estate taxes is the lack of reliance on modern electronic systems in tax work, The lack of a capable tax cadre who is fluent in working with modern techniques related to real estate taxes and the lack of necessary accounting information about the taxpayers (whether they are natural or legal persons) for the correct collection purposes, all of this weakens the tax collection process. on information technology, computer technologies, software, and communication networks, as well as changing legislation and laws in a way that ensures the optimal application of the proposed electronic model for real estate taxes, Improving tax accounting procedures and collection of real estate taxes using modern electronic systems and the preparation of qualified tax cadres to work on modern technologies in the field of tax work.

Study (Olaoye & Kehinde, 2017) - "Impact of Information Technology on Tax Administration in Southwest, Nigeria"

The research aims study the effect of IT on tax administration in southwestern Nigeria. questionnaire is the research tool , and descriptive analysis was used to achieve the objectives of the study. The results of the research were the presence of a significant impact of information technology on productivity taxes and the existence of a relationship between information technology and the application of taxes, and Online Tax Filing, Online Tax Registration- and affect the dimensions of tax administration, and the most important recommendations were to spread a culture of use Ways and means of electronic tax management for taxpayers, activating the information technology infrastructure to ensure the implementation of business electronically in the tax administration.

Study (Shahroodi, 2010) - "Investigation of the Effective Factors in the Efficiency of Tax System"

The research focuses measuring their effective six factors efficiency of the tax system, including information technology, tax law, administrative procedures, the private sector, services, encouragement, tax fraud and education, questionnaire is the research tool and the study sample (70) tax auditors, the most important findings of which were that factors such as tax laws, use of private sector services, tax fines, judicial fines and official procedures cannot be considered effective factors in the efficiency of the tax system, on the contrary, The use of information technology and training of tax system personnel and taxpayers can be effective factors for the efficiency of the tax system. However, other factors can also affect the tax system and improve taxation methods in light of the conclusions, the most important research recommendations: transparency presenting information on tax collection to the public through the media, taking advantage of the successful tax patterns of other countries with regard to tax collection and employee recruitment In tax institutions who have academic degrees related to financial affairs and taxation.

What Distinguishes the Current Study from Previous Studies?

Current research test the effect of IT on the efficiency of tax collection by reducing tax evasion and tax avoidance in the branches of the General Commission of Tax in the province of Baghdad, from the point of view of tax auditors, previous studies dealt with the study variables, both separately, did not combine the two variables in a holistic way, as the study included the information technology variable as an independent variable and the tax collection efficiency variable by reducing tax evasion and avoidance.

Research Methodology

Problem of Research

Research came to highlight the role of information technology in the efficiency of tax collection represented in reducing tax evasion and avoidance. The study problem was summarized by answering the following main question:

Is there a direct impact of information technology on the efficiency of tax collection?

From the main question, the following sub-questions can be asked:

1. How does the use of information technology affect the reduction of tax evasion?

2. What are the dimensions of information technology and is it applied in the branches of the General Authority for Taxes?

3. Is it possible to reduce the dimensions of tax collection efficiency through the use of information technology?

Importance of Research

Research is important from:

1. Test the direct impact relationship between the independent variable information technology on the adopted variable, the efficiency of tax collection?

2. Benefiting from the results and recommendations of the research in determining the role of information technology in reducing the dimensions of the efficiency of tax collection.

3. Putting proposals to decision-makers in the face of the difficulties of applying the dimensions of information technology and contributing to reducing tax evasion and avoidance that provide tax revenues in support of the state.

Research Objectives

The research aims to achieve the following objectives:

1. Recognizing the possibilities available to adopt the dimensions of information technology.

2. Determining the level of information technology interest of the surveyed sample.

3. Provides an integrative model between the research variables through a quantitative design.

4. Determining weak and strengths about the level of information technology dimensions in raising the level of tax collection efficiency in the branches of General Commission of Tax under study.

5. Determining the nature and type of the relationship between information technology and the efficiency of tax collection.

Hypothesis of the Research

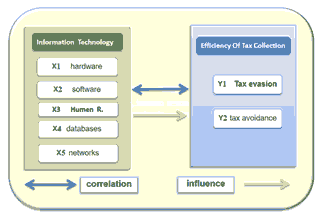

Based on the research problem and its objectives, and in order for the research to complete the requirements in its application, a hypothetical model was designed to show the logicality of the relationship between the independent variable. Information Technology (IT), the dependent variable Tax collection efficiency, the Independent variable Information technology consists of five dimensions:

Hardware (pc), Software (SO), Human Resources (HR), Databases (DB), and networking (N) as shown in Figure 1, which gives preliminary answers to the research, hypotheses:

Statistical Methods Used

Used number of statistical methods and employed for the purpose of describing and analyzing the data for the study variables and testing its hypotheses, through the help of the computer to extract the results, and based on the ready-made application software package (SPSS V.23) and the (AMOS V.23), was used to measure the stability of the study tool and the extent to which similar results were reached under similar conditions and at all times used Cranach’s Alpha, use of Path Analysis in order to determine the direct and indirect effect of the variables. For the purpose of testing the study model consisting of an independent variable and a dependent variable and used test Pearson's Correlation for hypotheses.

Society and Sample Research

A sample was selected from the study population, which is represented by the branches of the General Commission of Tax, which numbered (70) tax auditors distributed over the branches as shown in Table 1.

| Table 1 Society and Sample Research |

|||

|---|---|---|---|

| Branch of the general tax | N | ||

| 1 | General Commission of Tax/Dora Branch | 15 | |

| 2 | General Commission of Tax/Rusafa Branch | 12 | |

| 3 | General Commission of Tax/Habibyah Branch | 15 | |

| 4 | General Commission of Tax/Karrada Branch | 14 | |

| 5 | General Commission of Tax/Bayaa branch | 14 | |

| Total | 70 | ||

Source: The authors

Research Hypotheses

There is a statistically significant effect between IT with its dimensions (hardware, software, human resources, databases and communication networks) together and the efficiency of tax collection (tax evasion and tax avoidance), from which the following hypotheses are derived:

- There is a statistically significant effect of Hardware on the efficiency of tax collection.

- There is a statistically significant effect of t Software on the efficiency of tax collection.

- There is a statistically significant effect of HR on the efficiency of tax collection.

- There is a statistically significant effect of Databases on the efficiency of tax collection.

- There is a statistically significant effect of Networks on the efficiency of tax collection.

Theoretical Framework for Research

Information Technology

IT Concept

Information technology has many definitions, including:

Boukafa described Information technology as a concept that has tools and methods used to process data and make it useful information that can be retrieved as quickly and with the most accurate results (Boukafa, 2008), and Alkinzawi believes that it is the optimal investment of knowledge to access information as quickly as possible (Alkinzawi, 2019). And more accurate, as (Morrar et al., 2019) that the concept is limited to the study, design, development, support and management of computer information systems and programmers’ applications. Accordingly, the authors further stated that that information technology is a computer tool used by individuals to complete work accurately and quickly.

IT Measurement

According to (Laudon & Laudon, 2002) the components of an information system are (hardware, software, data resources, communications and networks in addition to personnel).

These components are an approach to the writings of the researcher (O'Brien, 2001). He finds that the components of the information system are all information systems that use the resources of individuals, hardware, software, data resources, and network resources (Jabbouri, et al., 2016; Utami et al., 2020; Al-Tabtabae & Abed, 2021) Information technology is measured in the following dimensions:

1- Hardware: It includes the equipment used for entering information, storing, transmitting, circulating, retrieval, receiving and broadcasting it to the beneficiaries, the main board, the screen, etc. of modern technology (El-ebady, 2006).

2- Software: means computer programs that operate and manage hardware components and carry out various applications. Because of its importance, it has become a basic technology for operating a computer as in software. The latter contributes to information processing, recording, and presentation as useful outputs to perform work and manage operations. Therefore, software includes final operating systems such as word processors and application software. Associated with specialized business tasks, software is generally divided into three types: authoring software, system software, and application software.

3- Human resources: according to (Davis & Olsin, 2000) There are two types of human resources that the system needs and they are classified into the system developer, who develops data processing applications and other system technologies, and the end-user who benefits from the system’s outputs.

4- Databases: A group of data linked together or information stored on devices and means of data storage such as computer hard disk drives, floppy disks and tapes, and it is a repository of organized and processed data (Laudon & Laudon, 2002).

5- Networks: Include the communication networks that connect technology devices to each other locally and internationally, and provide the opportunity to penetrate systems, and the network is defined as a group of computers linked among themselves to one of the well-known means of communication as seen (Daft, 2004) as multiple interconnected minds that help In expanding the strength of the organization and communication networks.

Efficiency of Tax Collection

Efficiency Concept

The concept of competence is a multifaceted concept in terms of the areas and purposes of measurement and evaluation, one of the most appropriate dimensions of the concept of efficiency, which is related to how the inputs are used compared to the outputs, or to achieve the maximum output from limited inputs, or to achieve the lowest level of inputs for limited outputs, in terms of the theoretical point of view, the concept of efficiency in this sense does not differ from that in the context of efficiency that is related to the tax system in terms of The ability to generate tax revenue, taking into account the level and structure of the economy (Jorgenson, 2012).

Efficiency of the Tax System

To assess the efficiency of the tax system, there are a number of characteristics, most notably the adequacy of tax revenue (the ability of the tax system to generate tax revenues, (Langford & Ohlenburg, 2015), in addition to efficiency standards (reducing the distortion effects of the tax system on economic decisions and the relative positions of economic elements). Administrative simplicity (related to the characteristics of simplicity, clarity and transparency, which is reflected in the costs of system management and compliance costs), and flexibility (the ability of the system to adapt to economic changes and achieve economic and social goals (Jorgenson, 2012).

Efficiency of Tax Collection

The ability of the tax system to generate tax revenue commensurate with the level of tax capacity of the economy, in theory, the concept of tax collection efficiency is linked to three basic aspects that overlap with each other to determine the optimal size of tax deduction, (Bassey & Efiong, 2018) and as follows:

1- The factors that determine the desired level of tax withholding.

2- The legal, administrative and technical frameworks that govern the tax withholding process.

3- The economy's ability to generate desirable tax revenues.

There is no normative theory applicable to all countries for determining the desired level of tax withholding, because the amount of tax revenue to be collected for each economy is essentially the result of a collective choice decision about the desirable level of public expenditures, determined by collective preferences for public goods and services, and the desired level of public spending. Social protection and insurance, economic wealth, as well as the level of the economic development gap. Therefore, building the tax capacity of the state in terms of transparency and accountability pushes society to accept the tax burden and fulfill its tax obligations.

Measuring the Efficiency of Tax Collection

The efficiency of tax collection is measured by reducing its dimensions of tax evasion and tax avoidance (Al-Ali, 2019).

Tax Evasion

There are many opinions about the concept of tax evasion. He defined it (Al-Tarawneh, 1993) as a complete evasion of the taxpayer from the tax and the loss of revenue from the tax. The law, in another definition, is that the tax is not paid in whole or in part by the taxpayer, following methods or methods that violate the law and carry the nature of fraud (Al-Maharmah, 2005). Violation of the law that would result in non-payment of the tax due, in whole or in part.

Tax Avoidance

Tax avoidance is achieved when a person is able to alter the texts of the law and use them to his advantage when the wording is inaccurate in its provisions. Thus, it is not considered a crime punishable by law, and the non-payer is not prosecuted. This differs from tax evasion that evasion is a tax punishable by law (Ma’ali, 2015). Some taxpayers resort to it when transferring the headquarters of the activity to other foreign countries to reduce the burden of payment. Lower taxes are imposed or not included in paying the tax instead of the countries they are affiliated with (Abu Sneina, 2008), Accordingly, The authors despite the difference in receiving the penalty for both of them, tax avoidance and evasion leads to a reduction in the state’s revenues resulting from reducing the tax amount to the lowest amount or even non-payment, which leads to the state’s inability to implement community service projects and thus constitute a crime against society.

The Relationship of Information Technology to the Efficiency of Tax Collection

Overcoming obstacles related to the basic infrastructure of information technology and increasing the effectiveness of the electronic system for filing tax returns on a comprehensive scale that leads to achieving progress and collecting the largest possible amount of tax revenues (Ma’ali, 2015), using the revenues to implement projects that focus on community service and achieving prosperity through information technology through The way to combine tax digitization with other methods such as the digital identification system, digital finance, electronic tracking of invoices and sales, and the self-report form that citizens have to confirm. And pay their taxes electronically through this platform. Accordingly, it is necessary to reduce the gap between the actual collection of tax revenues through the use of modern technology. Therefore, the Arab countries need to direct tax reform efforts towards enhancing their flexibility electronically, in order to support their efficiency, and increase their ability to collect the largest possible amount of tax revenues.

Methodology of the Field Research

The Research Tool

The tool adopted in the research is the questionnaire consisting of three parts, the first part to identify personal variables (gender, years of service, academic achievement), the second part consists of (20) paragraphs for the information technology variable, and the third part of (10) paragraphs for the variable The efficiency of tax collection, and the answer was based on the questionnaire’s paragraphs on a five-point Likert scale within the graded weights of (1,2,3,4,5) with the terms (totally agree, agree, neutral, disagree, completely disagree) and as shown in the table 2:

| Table 2 Reliability of the Constructs |

|||

|---|---|---|---|

| Variables | Construct | paragraphs | Scale |

| Information Technology | Hardware | 1-Apr | Jabbouri, et al., (2016); Utami, et al., (2020); Al-Tabtabae & Abed (2021) |

| Software | 5-Aug | ||

| HR | 12-Sep | ||

| Database | 15-13 | ||

| Networks | 20-16 | ||

| Tax Collection Efficiency | Tax evasion | 25-21 | (Shakhatra, 2019) |

| tax avoidance | 30-26 | ||

Validity and Reliability Test of the Research Tool

Internal Validity

To determine the stability of the measurement tool, the researchers used (Item-to-Total Correlation), which measures the effect of each paragraph of the questionnaire on the main variable, whereby canceling each paragraph whose correlation is less than (0.40) and keeping the rest of the paragraphs whose correlation is greater than (Pallant, 2011). (0.40), the test results showed that no items were excluded from the tool and (30) items were used in the final questionnaire to measure both the independent and dependent variable. Table (3) shows the internal validity coefficients of the research tool.

| Table 3 Internal Validity Values |

|

|---|---|

| Variables | Item–Total Correlation |

| Information Technology | 0.61 |

| Tax Collection Efficiency | 0.72 |

Reliability Measurement

Table 4 reflects that the Cronbach’s Alpha values for all variables are greater than 0.70, values of ranged Cronbach's Alpha coefficient is between (0.85-0.81), it is statistically acceptable in administrative and behavioral research (Pallant, 2011; Sekaran & Bougie, 2010), which shows that there is internal consistency among variables, and scales have been designed based on the five-point Likert scale.

| Table 4 Cronbach's Alpha Values |

|

|---|---|

| Scale | Cronbach's Alpha Value |

| Information Technology | 0.81 |

| Tax Collection Efficiency | 0.85 |

Analysis and Discussion of the Research Results

The Descriptive Analysis

1- Describe the Responses of the Independent Variable (Information Technology)

Table 5 describes the level of answers of individuals working in the branches of General Commission of Tax using the means and standard deviations for paragraphs related to information technology, which consists of (20) paragraphs distributed over five dimensions. The results of descriptive statistics were the mean and S.D for (information technology) as follows:

| Table 5 Descriptive Statistics for the Independent Variable (Information Technology) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| DIM. | seq | Rank | MEAN | S.D | DIM. | seq | Rank | MEAN | S.D |

| Hardware | X1 | 15 | 2.75 | 1.36 | Database | X13 | 5 | 3.32 | 1.37 |

| X2 | 14 | 2.86 | 1.4 | X14 | 3 | 3.36 | 1.38 | ||

| X3 | 16 | 2.73 | 1.28 | X15 | 4 | 3.33 | 1.34 | ||

| X4 | 9 | 3.26 | 1.33 | X16 | 2 | 3.38 | 1.33 | ||

| Software | X5 | 17 | 2.57 | 1.33 | Networks | X17 | 7 | 3.28 | 1.36 |

| X6 | 6 | 3.29 | 1.4 | X18 | 1 | 3.41 | 1.38 | ||

| X7 | 13 | 3.13 | 1.33 | X19 | 12 | 3.23 | 1.37 | ||

| X8 | 8 | 3.27 | 1.38 | X20 | 11 | 3.24 | 1.36 | ||

| Human R. | X9 | 7 | 3.28 | 1.36 | |||||

| X10 | 5 | 3.32 | 1.4 | ||||||

| X11 | 10 | 3.25 | 1.35 | ||||||

| X12 | 8 | 3.27 | 1.41 | ||||||

| The overall average of Information Technology | 3.18 | 1.36 | |||||||

Source: Prepared by the authors based on program SPSS

It is clear from Table 5 standard deviation and mean of the variable paragraphs range between (3.41-2.57), paragraph X18, obtained the highest mean which states" Computerization of all tax operations and the development of modern communication channels with taxpayers based on communication network technology, obtained mean at (3.41) with standard deviation (1.38), followed in second rank paragraph X16, which states that the responsibility for compulsory collection rests with the tax collector obtained mean (3.38) indicating the responsibility of compulsory collection on the responsibility of the tax collector and a standard deviation (1.33) that shows the consistency of the answers of the sample of the study regarding this paragraph while paragraph X5, which states, “The center relies on databases to avoid the problem of information conflict, obtained the lowest mean at (2.57) with standard deviation of (1.33), indicates a weak interest in using modern hardware and software, these results indicate a discrepancy in the identification of information technology items by the sample members within the variable, in general, the overall mean of the information technology variable as a whole amounted to (3.18) and a standard deviation (1.36).

Describe the Responses to the Independent Variable (Efficiency of Tax Collection)

Table 6 describes the level of answers of individuals working in the branches of General Commission of Tax using the means and standard deviations for paragraphs related to Efficiency of tax collection, which consists of (10) paragraphs distributed over two dimensions. The results of descriptive statistics were the mean and S.D for (Efficiency of tax collection) as follows:

| Table 6 Descriptive Statistics for the Independent Variable (Efficiency of tax Collection) |

||||

|---|---|---|---|---|

| DIM. | seq | Rank | MEAN | S.D |

| Tax evasion | y1 | 2 | 3.37 | 1.39 |

| y2 | 7 | 3.17 | 1.43 | |

| y3 | 1 | 3.47 | 1.4 | |

| y4 | 4 | 3.28 | 1.5 | |

| y5 | 9 | 2.89 | 1.43 | |

| Tax avoidance | y6 | 8 | 3.12 | 1.31 |

| y7 | 10 | 2.88 | 1.3 | |

| y8 | 3 | 3.34 | 1.31 | |

| y9 | 5 | 3.23 | 1.36 | |

| y10 | 6 | 3.21 | 1.34 | |

| The overall average | 3.19 | 1.38 | ||

Source: The authors based on program SPSS 1

Table 6 shows the standard deviation and mean of the variable paragraphs range between (2.88-3.47), paragraph y3, obtained the highest mean which states "In the control of tax collection from those charged with paying the tax depends on the tax declarations written by the taxpayer. "obtained mean at (3.41) with standard deviation (1.38), followed by the second rank, paragraph y1, which states that " Training all collection staff on how to use information technology "obtained mean at (3.38) indicates the responsibility of compulsory collection on the shoulders of the tax collector and a standard deviation (1.33) shows the consistency of the answers of the study sample regarding this paragraph The last rank was occupied by paragraph y7, which states " Provides systems for collecting information and penalties to reduce tax evasion and avoidance " obtained mean at (2.88), with standard deviation (1.30), which indicates a weak interest to the use of tax administration hardware and software for taxpayers, In general, the overall mean of the Efficiency of tax collection as a whole was (3.19) and a standard deviation (1.38).

Normal Distribution Test

The "Kolmogorov-Smirnov" test is the most appropriate method because the research data is data for one sample, according to this method, the data are distributed normally if the calculated value of the test is greater than the standard D level and because the sample size exceeds 35 participants and the level of significance used in this study is 0.05 Table 7 shows the "Kolmogorov-Smirnov" normal distribution test for the research variables, which confirms that the data are distributed normally and gives an indication of the possibility of using parametric statistical tests. (Cooper & Schindler, 2014).

| Table 7 Kolmogorov-Smirnov TES |

|||

|---|---|---|---|

| Variables | Kolmogorov-Smirnov | Asymp. Sig. (1-tailed) | Conclusion |

| Information Technology | 0.816 | 0.328 | natural |

| Tax Collection Efficiency | 0.695 | 0.58 | natural |

Source: The authors based on program SPSS V.23

Total Mean & Standard Deviations, and the Correlation between the Variables

Table 8 shows overall mean and standard deviation of the study variables, The authors used "Pearson correlation" because it is appropriate to test the variables of the current study that were measured using categorical measures and the data are distributed with a normal distribution, (Cooper & Schindler, 2014; Brace et al., 2006).

| Table 8 Descriptive Statistics & Correlation |

||||

|---|---|---|---|---|

| Variables | Mean | S.D | 1 | 2 |

| Information Technology | 3.18 | 1.36 | 1 | |

| Tax Collection Efficiency | 3.19 | 1.38 | 0.633** | 1 |

| **. Correlation is significant at the 0.01 level (2-tailed). | ||||

| Note: N=70. Alpha reliabilities appear in parentheses. | ||||

Source: The author's based on program SPSS V.23

It is clear from Table (8) correlation significant and positive correlation between Information Technology and Tax Collection Efficiency (p<0.01), The value of the relationship was (0.633**) almost one at the level of significance (0.01), which means that the change in the dependent variable is due to the change in the independent change. Normative (1.36) We note high agreement on the paragraphs of the independent variable dimensions, which means that the branches of the General Tax Authority contain an information system that is reliable in collecting and analyzing tax information, and there is interest from the branches of General Commission of Tax for the development of tax collection procedures in reducing tax evasion and avoidance , As for the total average of mean to efficiency of tax collection is (3.19) with a standard deviation of (1.38). We note a high agreement with the paragraphs of the variable dimensions. The results indicate that the tax collection process depends on information technology in the conduct of tax operations and procedures and helps individuals working in tax collection to process requests and declarations in an instantaneous manner, a mechanism at the same time, which facilitates the tax collection process.

Testing the Influence Relationship between Variables

The effect test between research variables was conducted using Path Analyze in Amos V.23 program, it includes regression weights whose outputs include the Estimate path coefficients, and includes the Critical Ratio (CR) Critical Ratio whose value should be (+)(-)1.96 at the level of significance (0.05) in order for the hypothesis to be acceptable(Hair & et al., 2009) as follows:

Testing the Influence Relationship between the Main Variables and the Effect of each Dimension of the Independent Variable Information Technology (IT) on the Dependent Variable Tax Collection Efficiency (TCE)

For the purpose of confirming the influence relationship, the results of the impact test were conducted between the research variables using path analysis (Path Analyze); Table 9 shows the influence relationship between the variables.

| Table 9 The Direct Effect Relationship Between the Variables |

|||||||

|---|---|---|---|---|---|---|---|

| Path | Total Effect | Estimate | S.E | C.R. | Result | ||

| PC | à | TCE | direct | 0.143 | 0.014 | 5.9 | Accept |

| SO | à | TCE | direct | 0.161 | 0.022 | 4.082 | Accept |

| HR | à | TCE | direct | 0.317 | 0.025 | 8.337 | Accept |

| DB | à | TCE | direct | 0.124 | 0.016 | 2.614 | Accept |

| N | à | TCE | direct | 0.231 | 0.028 | 3.301 | Accept |

Source: The author's based on program Amos v.23

Table 9 shows the path coefficients in the Amos V.23 program, which indicates the presence of a direct and positive impact with statistical significance for the dimensions of information technology as independent variables. The efficiency of tax collection as a dependent variable, as it is clear that there is a direct and positive effect with a strong στaτ?στ?χaλ significance of less than 0.001. The CR values extracted from the Estimate value divided by the Standard Error (SR) amounted to (>1.964 CR) and thus the model is strong, the research hypothesis that states that there is an impact of information technology in its dimensions (hardware, software, human resources, databases) was accepted networks) on the efficiency of tax collection, as follows:

1- Acceptance of the first sub-hypothesis: There is a significant effect between the physical components and the efficiency of tax collection, where the value of the direct effect was (0.143) at a significant level *** (α ≤ 0.05).

2- Acceptance of the second sub-hypothesis: There is a significant effect between the software and the efficiency of tax collection, where the value of the direct effect was (0.161) at a significant level *** (α ≤ 0.05).

3- Acceptance of the third sub-hypothesis: There is a significant effect between human resources and tax collection efficiency, where the value of the direct effect was (0.317) at a significant level *** (α ≤ 0.05).

4- Acceptance of the fourth sub-hypothesis: There is a significant effect between the databases and the efficiency of tax collection, where the value of the direct effect was (0.124) at a significant level *** (α ≤ 0.05).

5- Acceptance of the fifth sub-hypothesis: There is a significant effect between the networks and the efficiency of tax collection, where the value of the direct effect was (0.231) at a significant level *** (α ≤ 0.05).

Conclusion and Recommendations

Conclusion

1- Descriptive analysis of the IT dimensions items as follows:

A- Paragraph X18, which states, “Computerization of all tax operations and the development of modern communication channels with taxpayers based on communication network technology” came in first place, which indicates the availability of information technology infrastructure in the branches of the General Commission of Tax.

B- Paragraph X5 ranked last, which states “The Center relies on databases to avoid the problem of information conflict,” which indicates the weakness of databases as a mechanism to reduce tax evasion and avoidance used in the branches of the General Commission of Tax.

2- Descriptive analysis of tax collection efficiency dimensions as follows:

A- The paragraph that states “In the control of tax collection from those charged with paying the tax depends on the tax declarations written by the taxpayer” came in first place, which indicates poor tax collection and increased cases of tax evasion and avoidance.

B- The paragraph that states “Provides systems for collecting information and penalties to reduce tax evasion and avoidance” ranked last. There are no systems to detect defaulters and enact laws to punish them.

3- There is a significant correlation relationship between the main research variables (information technology and tax collection efficiency), and this indicates that increased attention to the dimensions of information technology will contribute to the efficiency of tax collection represented in reducing tax evasion and avoidance.

4- There is a direct and positive effect with statistical significance between each dimensions of information technology (hardware, software, HR, database, Networks) on efficiency of tax collection. In the branches of the General Commission of Tax.

Recommendations

1- Interest in developing databases in the branches of the General Commission of Tax in a modern way with the aim of protecting data from manipulation and thus increasing tax revenue.

2- Interesting that individuals responsible for tax collection have scientific degrees related to financial affairs and taxes, enhancing the skills of innovators working in the field of information technology and increasing their incentives to transfer their scientific ideas to the field of work, and applying ideas to reduce tax evasion and avoidance.

3- Continuous updating of tax laws, in a way that supports the simplification and clarification of the procedures and provisions related to taxpayers and the consequences of failure to pay the tax to face rapid changes in the external environment to ensure the reduction of tax evasion and avoidance

4- The use of advanced information technology and a good communication system that supports communication with taxpayers and the adoption of advanced software such as the SGF tax information program to develop tax collection.

5- There is a need to develop institutional capacities in terms of networking of tax units, computerizing all tax operations and creating modern communication channels with taxpayers that rely on communication network technology, represented in the website of the branches of General Commission of Tax.

6- Expanding the base of tax compliance and activating the tools to combat tax evasion by documenting the payment process and providing services with a fundamental invoice, simplifying procedures and improving the quality of administrative services provided to taxpayers, in a way that enhances tax compliance and reduces electronic financial costs.

References

Abu, S., & Tariq Hamdi, H. (2008). Factors affecting tax evasion and avoidance and its relationship to the legal form of the audit and accounting office and the legal form of the industrial company/An applied study on industrial companies in King Abdullah Industrial City. A Master’s Thesis in Accounting Published, Middle East University For Postgraduate Studies, College of Administrative and Financial Sciences.

Al-Ali, S. (2019). The degree of effectiveness of the tax administration in combating tax evasion in the work of electronic commerce companies in Palestine. Master's Thesis, Department of Tax Disputes, Faculty of Graduate Studies at An-Najah National University in Nablus, Palestine.

Alkinzawi, G.A.R. (2019). The relationship between marketing knowledge and information technology and its impact on the development of the administrative structure of the company: An analytical study in a sample of Iraqi industrial companies listed in the Iraq stock exchange. Muthanna Journal of Administrative and Economic Sciences, 9(3), 8-19.

Al-Maharmah, W. (2003). The reasons for income tax evasion in the Hashemite kingdom of Jordan and its economic effects. An unpublished Master’s thesis, Sudan University of Science and Technology, Khartoum.

AL-Tabtabae, F., Abed, A.A., & Rusul, K. (2021). Impact of information technology on lean production system: Analytical study at the state electric power transmission company/Middle Euphrates project implementation branch. Palarch's Journal of Archaeology of Egypt, PJAEE, 18(4).

Al-Tarawneh, S. (1993). The crime of income tax evasion in Jordan/Analytical study. Al-Shams Press.

Al-Tarman, Z. (2004). Factors affecting income tax evasion in the hotel sector in Jordan. Unpublished Master’s Thesis, Aal al-Bayt University, Mafraq.

Bassey, E., & Efiong, E. (2018). Determinants of taxable capacity in Nigeria. International Journal of Management Science and Business Administration, 4(6).

Boukafa, H. (2008). The impact of the use of information and communication technology on the performance of small and medium enterprises. A note presented within the requirements for obtaining a master's degree, Larbi Ben M'hidi University, Oum El Bouaghi, Algeria, 103-104.

Daft, Richard, L. (2004). Organization theory and design, (8th Edition). South western, New York.

El-ebady Basema, A.M. (2006). The impact of information system to support decision making/Case study in the national center for consultancy &management development. A Thesis of Master of Technology in Operations Technology, Technical College of management.

Esmael, T. (2019). The efficiency of tax collection in the Arab countries. Economic Studies No. 5226.

Cooper, D.R., & Schindler, P.S. (2014). Business research methods, (12th edition). McGraw-Hill education.

Hair, J.F., Black, W.C., Babin, B.J., & Anderson, R.E. (2010). Multivariate data analysis, (7th edition). Pearson prentice Hall.

Jabbouri, N.I., Siron, R., Zahari, I., & Khalid, M. (2016). Impact of information technology infrastructure on innovation performance: An empirical study on private universities in Iraq. Procedia economics and finance, 39, 861-869.

Jorgenson, D. (2012). Taxation, efficiency, and economic growth. Harvard University and Kun-Young, Yonsei University.

Langford, B., & Ohlenburg, T. (2015). Tax revenue potential and effort: An empirical investigation. International Growth Centre (IGC) Working Paper,Tanzania.

Laudon, K., & Laudon, J. (2002). Management information system, (7th Edition). Prentice–hall, New Jersey.

Maali, S. (2015). Accomplishment obstacles to the tax administration in Palestine from the point of view of tax officers. Master’s Thesis (unpublished) in Tax Disputes, Faculty of Graduate Studies at An-Najah National University, Nablus, Palestine.

Matlab, M.W. (2017). The role of information technology in increasing real estate tax returns. Master’s Thesis at the Higher Institute/University of Baghdad/Department of Financial Studies, specializing in taxes.

Morrar, R., Abdeljawad, I., Jabr, S., Kisa, A., &Younis, M.Z. (2019). The role of Information and Communications Technology (ICT) in enhancing service sector productivity in Palestine: An international perspective. Journal of Global Information Management (JGIM), 27(1), 13-18.

Naghsh, S., & Farajolahi, M. (2018). Relationship of self-directed learning, ICT, and educational motivation with entrepreneur curriculum in distant education. Iranian Distance Education Journal, 1(1), 1-8.

O’Brien James A. (2001). Introduction to Information systems, (10th Edition). McGraw-Hill, Singapore.

Pallant, J. (2011). SPSS survival manual, (4th edition). Open university press, McGraw-Hill education.

Shahroodi, S., & Mousavi, M. (2010). Investigation of the effective factors in the efficiency of tax system. Journal of Accounting and Taxation, 2(3), 42-45.

Shaker, A.G., & Al-Khafaji, O.K. (2019). The impact of information systems on increasing tax revenues. Journal of Accounting and Financial Studies, 12(38).

Shakhatra, M.Y. (2020). The impact of the income and sales tax system in raising the efficiency of tax collection in Jordan. Journal of the Islamic University of Economic and Administrative Studies, 28(1), 186-203.

Utami, S., Ramdani, M., Junadi, B., & Masshitah, S. (2020). The implementation of patient information system technology on employee effectiveness in Chasbullah Abdulmadjid hospital. Journal of Reseacrh in Business, Economics, and Education, 2(3).

Zikmund, W.G., Babin, B.J., Carr, J.C., & Griffin, M. (2010). Business research methods, (8th edition). Mason, HO: Cengage Learning.

Received: 16-Oct-2021, Manuscript No. ASMJ-21-8131; Editor assigned: 19-Oct-2021, PreQC No. ASMJ-21-8131 (PQ); Reviewed: 03-Nov-2021, QC No. ASMJ-21-8131; Revised: 10-Nov-2021, Manuscript No. ASMJ-21-8131; (R); Published: 16-Nov-2021