Research Article: 2023 Vol: 27 Issue: 4

The effect of IFRS adoption on information overload: Evidence from Egyptian Firms

Salma Samir, Cairo University

Medhat Abdel Rasheed, Cairo University

Eman Abdel Wanis, Cairo University

Citation Information: Samir, S., Rasheed, M.A., & Wanis, E.A. (2023). The effect of ifrs adoption on information overload: evidence from egyptian firms. Academy of Accounting and Financial Studies Journal, 27(4), 1-09.

Abstract

This paper explores whether the adoption of IFRS impacts the information overload of corporate reports using 48 Egyptian firms listed in EGX100 from 2013 to 2021. Our findings suggest that there is a negative association between IFRS adoption and information overload. Results show that IFRS adoption results in a less readable report in Egyptian firms. The readability of the corporate reports is at a low level when IFRS adoption over our sample period. Our results are of interest to regulators, investors, management, and academics.

Keywords

IFRS; information overload; corporate reports; Readability; Egypt.

Introduction

The main sources of information for stakeholders to learn more about the company and its value system are corporate reports (Jensen & Berg, 2012). The ability to easily communicate relevant information to a large audience is a key component of a high-quality corporate report (du Toit, 2017).

Stakeholders utilize the information given in corporate reports to assist their decisions, the information clarity is important to them because clarity is one of the enhancing qualitative aspects of the valuable information provided in the reports. Information should be provided such that users with a reasonable understanding of business and economics may understand it (Nilsson, 1997; Su et al., 2022).

The International Financial Reporting Standards (IFRS) created by the International Accounting Standards Board (IASB) and the US Generally Accepted Accounting Principles (GAAP) created by the FASB are two of the most widely used accounting standards in the world. They both concur that the information presented in corporate reports is useless if the report users are unable to understand it (Jang & Rho, 2016).

Some analysts believe that contemporary corporate reporting is difficult to grasp (du Toit, 2017). This reduces the effectiveness of information transmission, which has a detrimental effect on report users' motivation and capacity to comprehend important information in its entirety (Katsikas et al., 2017; Xu et al., 2019). As a result, investors, regulators, academics, and others have been interested in the readability and conciseness of company reports (Luo et al., 2018; Cavicchi et al., 2019; Xu et al., 2019).

Readability is defined as the ease with which a text may be read by a particular group of persons with comparable abilities, background knowledge, and motivation (McLaughlin, 1969). It is believed that readability is the foundation of understandability, strengthening the qualitative characteristics outlined in the conceptual accounting framework (Sattari et al., 2011). Without appropriate readability, the value of the data in a corporate report cannot be fully communicated to report users (Tan et al., 2015; Luo et al., 2018).

Numerous academics have found that the complexity of corporate reports makes them challenging to read in many different countries (Hrasky & Smith, 2008; du Toit, 2017). Due to this high level of complexity, many investors and even accounting professionals find the information in firm reports to be beyond their comprehension (Courtis & Hassan, 2002). Prior research has demonstrated that a lower level of readability has major repercussions, such as greater agency costs (Luo et al., 2018).

It is important to investigate if IFRS-compliant corporate reports are connected with growing disclosure complexity and information overload. Also, there is disagreement regarding how the adoption of IFRS will affect the comprehension of corporate reports. Additionally, no research has yet looked into how IFRS affects the information overload of corporate reports in the Egyptian environment. To close these gaps in the literature, this paper aims to determine whether IFRS adoption has an impact on information overload in Egyptian listed firms.

Literature Review

Some of the literature argued that the adoption of international financial reporting standards led to the easier reading of financial statements compared to the pre-adoption period (Cheung and Leu, 2016), while other studies argued that the adoption of international financial reporting standards led to the difficulty of reading the statements (Jang & Rho, 2016: Henderson, 2020: Efretuei, 2020).

Also, some of the literature dealt with the impact of adopting international financial reporting standards on the readability of financial statements, such as (Schrödl et al., 2010), studies agreed that the adoption of standards led to the difficulty of reading financial reports compared to the period before adopting the standards.

The adoption of IFRS has led to an improve the quality of financial reports because of the additional information they provide that is relevant, reliable, and comparable, and also contributes to reducing the differences between financial reports in different countries, which supports the comparability of information and reduce accounting information asymmetry, and improves its explanatory ability as an indicator of the firm performance, which leads to an improvement in the relationship between future information and stock returns (Duarte et al., 2015; Li, 2019).

On the other hand, the adoption of IFRS is one of the most important factors causing information overload, which occurs when financial reports include a huge amount of information and cause confusion among users instead of helping them to understand the financial condition of the enterprise.

Also, complaints are increasing by firms that apply these standards as a result of the increasing volume and costs of disclosure, in addition to users of financial statements struggling to reach appropriate information to understand the firm financial performance (Loughran & McDonald, 2014: Kholga & Jerry, 2016; Saha & Moris, 2019).

The impact of IFRS adoption on the comprehension of firm reports is a contentious issue. While many practitioners argue that firm reports created using the IFRS reporting framework are too complex to interpret, some practitioners believe that IFRS encourages improved communication among reporting users (Cheung & Lau, 2016).

According to several experts, IFRS' high level of complexity causes corporate reports to be difficult to read (Cheung and Lau, 2016). Many analysts claim that the rigorous disclosure requirements imposed by IFRS have resulted in the lengthening of business reports (Ding et al., 2007).

Prior research empirical findings are not conclusive. According to Melloni et al. (2017), there is no proof that the implementation of IFRS has an impact on the clarity and readability of integrated reports issued by IIRC Pilot Programme companies in 2013 and 2014.

According to Roman et al. (2019), firms that use IFRS tend to produce "foggier" corporate reports. Morunga & Bradbury (2012) argued that the adoption of IFRS in New Zealand led to disclosure overload, which lengthened corporate reports. Richards & van Staden (2015) show that the adoption of IFRS hurts the readability and concision of annual reports of NZX50-listed companies.

Jang & Rho (2016) observe that Korean-listed corporate report readability is lower if it adopts IFRS compared to a non-IFRS adopter. Cheung & Lau (2016) claim that Australian enterprises' corporate reports are noticeably longer but are easier to read after implementing IFRS in the Australian context.

Overall, there are contradictory theoretical justifications and empirical data. Overall, however, previous research is consistent with the notion that IFRS adoption does affect the clarity and readability of company reports. Overall, we consequently anticipate a considerable correlation between IFRS adoption and readability. The main hypothesis is as follows:

H1: There is a significant relationship between IFRS adoption and information overload in Egyptian firms.

Data and Methodology

Data

With a total of 432 observations, the sample consists of 58 non-financial Egyptian companies listed on the EGX100 within the period between 2013 -2021. This paper uses financial reports and statements to analyze panel data using OLS and PCSE. Table 1 presents all EGX100 sample sectors. The majority of the sample operates in the real estate sector (25%), followed by the materials sector approximately (21%), the consumer staples sector with a percentage of (18.75%), both consumer discretionary and Industrials sectors with a percentage of (12.5%), and the minority sample was the paper sector with a percentage of (2.08%), followed by communication services, and communication services sectors with a percentage of (4.17%) for each sector.

| Table 1 Sectors Relevant to the Sample | ||

| Sector | Freq. | Percent |

| Communication Services | 18 | 4.17 |

| Consumer Discretionary | 54 | 12.50 |

| Consumer Staples | 81 | 18.75 |

| Energy | 9 | 2.08 |

| Health Care | 9 | 2.08 |

| Industrials | 54 | 12.50 |

| Information Technology | 9 | 2.08 |

| Materials | 90 | 20.83 |

| Real Estate | 108 | 25.00 |

| Total | 432 | 100.00 |

Methodology

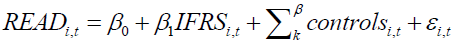

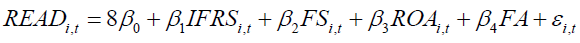

This paper aims to explore the relationship between IFRS and information overload in Egyptian firms listed on EGX100 using ordinary least squares (OLS), panel corrected the standard error (PCSE), and praise Winston models. The proposed model is as follows:

(1)

(1)

(2)

(2)

Where READ is the information overload of the firm (i) in period (t) measured by the natural logarithm of the fog index, which is measured as follows

Log fog = 100* (B/W) + (W/S) (3)

Whereas:

B = the total number of words consisting of seven or more letters.

W = the total number of words included in the notes to the financial statements.

S = the total number of sentences included in the notes to the financial statements.

IFRS is measured as a dummy variable that takes the value "one" if the firm applies the international financial reporting standards since 2016, and "zero" otherwise. Three main factors serve as controls: firm size (FS), return on assets (ROA), and firm age (FA). FS is determined by the natural logarithm of total assets, ROA is determined by dividing net income by total assets, and FA is determined by the natural logarithm of the number of years since the firm was founded Table 2.

| Table 2 Variables Measurements | ||||||

| Variables | Predicted sig | Proxies | ||||

| Name | Abb | Measure | References | |||

| Dependent Variable | Information overload | +/- | Readability | READ | Natural logarithm of the Fog readability index | (Cheung & Leu, 2016: Efretuei, 2020: Sun et al.,2022) |

| Independent Variable | International financial reporting standards | +/- | IFRS | IFRS | a dummy variable takesthe value "one" if the firmapplies the internationalfinancial reportingstandards since 2016,"zero" otherwise | (Cheung & Leu,2016: Richard &Staden, 2015:Efretuei, 2020: Sunet al., 2022) |

| Control Variables | Firm Size | +/- | Firm size | FS | Natural logarithm of total assets | (Cheung & Leu,2016: Richard & Staden, 2015: Efretuei, 2020: Sunet al.,2022) |

| eturn onAssets | +/- | Return onassets | ROA | Net income scaled bytotalassets | (Jang & 2016:Sunal., 2022) | |

| Firm Age | +/- | Firm Age | FA | The natural logarithm ofthe number of years since the firm was founded. | (Cheung & Leu,2016) | |

Empirical Results

Table 3 displays the descriptive summary of this study's variables of 48 Egyptian firms listed on EGX100. The mean value of RED is 1.641 and typically positive and ranges between 1.55 and 1.70. Throughout the study period, the average IFRS is 0.67. Due to decreased standard deviation, firms are distinguished by the stability of READ during the study period. The average FS, ROA, and FA based on the control variables are 21.3, 0.07, and 1.51, respectively. In the Egyptian market, all control variables are consistent and identical within the period between 2013- 2021 without ROA.

| Table 3 Descriptive Statistics | |||||

| Variable | Obs | Mean | Std. Dev. | Min | Max |

| READ | 432 | 1.641 | 0.0408 | 1.55 | 1.70 |

| IFRS | 432 | 0.667 | 0.472 | 0 | 1 |

| FS | 432 | 21.3 | 1.873 | 16.99 | 25.68 |

| FA | 432 | 1.515 | 0.234 | 1.079 | 1.94 |

| ROA | 428 | 0.067 | 0.089 | -0.13 | 0.24 |

Table 4 displays the correlation matrix for each study variable. The findings refer to the negative correlation between IFRS and information overload (r = -0.326). Also, there is a positive correlation between firm size (FS) and information overload (r = 0.116).

| Table 4 Correlation Matrix | ||||||

| Variables | (1) | (2) | (3) | (4) | (5) | VIF |

| (1) READ | 1.000 | |||||

| (2) IFRS | -0.326* | 1.000 | 1.01 | |||

| (0.000) | ||||||

| (3) FS | 0.116* | 0.077 | 1.000 | 1.10 | ||

| (0.016) | (0.112) | |||||

| (4) FA | 0.095* | 0.038 | 0.015 | 1.000 | 1.00 | |

| (0.049) | (0.428) | (0.749) | ||||

| (5) ROA | 0.060 | -0.002 | 0.295* | -0.022 | 1.000 | 1.10 |

| (0.218) | (0.963) | (0.000) | (0.650) | |||

| *** p<0.01, ** p<0.05, * p<0.1 | ||||||

Moreover, firm age (FA) has a positive correlation with information overload (RED), but not with return on assets (ROA). For all variables, the variance inflation factors (VIF) are all smaller than 10. Because all values are less than 10, there is a free multicollinearity issue.

According to Table 5, there is homoscedasticity because the Chi2 value for LEV1 is 0.06 and the probability value is more than 0.05. As the probability value is greater than 0.05 and the f-value for RED is 0.36, there is no cause for concern over omitted variables. There is a stationary time series because the likelihood value is less than 0.05 and the unit root test for RED is -14.763. There is autocorrelation, as indicated by the Durbin-Watson value of 1.119.

| Table 5 Diagnostics Tests | ||

| Diagnostics Tests | Coef. | |

| Heteroskedasticity Test | chi2(1) | 0.06 |

| Prob > chi2 | 0.802 | |

| Omitted VariablesTest | F (3, 404) | 0.36 |

| Prob > F | 0.780 | |

| Unit-Root Test | Adjusted t | –14.763 |

| Prob | 0.000 | |

| Autocorrelation | Durbin Watson (5.428) | 1.119 |

Table 6 shows IFRS explains information overload in 48 Egyptian firms in EGX100 by 26% (Adj R2 = 0.258 & 0.150). According to OLS, PCSE, and Praise Winston regression models, there is a negative impact of IFRS on information overload at the 1% level. Also, both firm size (FS) and firm age (FA) are a positive impact on information overload at 5% level in both OLS and PCSE, but the prais winsten model isn’t significant. Return on assets (ROA) isn’t affected by information overload in all models.

| Table 6 Regression Analysis | |||

| Variable | OLS | PCSE | Prais winsten |

| IFRS | -0.845*** | -0.865*** | -0.847*** |

| FS | 0.088** | 0.087** | 0.084 |

| FA | 0.7144** | 0.7136** | 0.507 |

| ROA | 0.533 | 0.512 | 0.350 |

| _cons | 9.52*** | 9.34*** | 9.85*** |

| Year Dummy | Yes | Yes | Yes |

| Industry Dummy | Yes | Yes | Yes |

| N | 428 | 428 | 424 |

| R2 | 0.293 | 0.289 | 0.239 |

| Adj R2 | 0.258 | 0.201 | |

| F-Test | 8.44 | 5.19 | |

| Prob > F | 0.000 | 0.000 | |

| Wald chi2(3) | 4234.94 | ||

| Prob > chi2 | 000 | ||

| legend: * p<0.05; ** p<0.01; *** p<0.001 | |||

Discussion

According to the main objectives, this paper explores the impact of the adoption of IFRS on information overload in the Egyptian stock market using a panel of 48 non- financial Egyptian firms within the period from 2013 to 2021 via OLS, PCSE, and prais winsten models. Results show that there is a negative impact of the adoption of IFRS on information overload of corporate reports. The main hypothesis (H1) is accepted, and this result is consistent with other earlier studies that back up the claim that IFRS adoption leads to less readable reports in Egyptian firms (Jang & Rho 2016: Henderson, 2020: Efretuei, 2021).

Table 6 shows that both firm size (FS) and firm age (FA) are a positive impact on information overload at 5% level in both OLS and PCSE, but the prais winsten model isn’t significant. Return on assets (ROA) isn’t affected by information overload in all models.

In practice, the management of a corporation in an emerging market country like Egypt is more likely to make corporate reporting less readable to influence reporting users' perceptions of the firm's actual financial status (Cheng et al., 2015; Lo et al., 2017). Another issue that lowers the quality of corporate reporting is information overload, thus businesses, professionals, and academics have taken notice of how concise corporate reports are (Monterio, 2015; Dumitru & Guse, 2017).

Corporate reports that are overly lengthy are referred to as information overload. Numerous report users have expressed grave worries about information overload (Chaidali & Jones, 2017; de Villiers et al., 2017). An excessively long report could make the information more difficult to interpret since reporting users must digest a large amount of data as a result of disclosure overload (van Staden, 2015).

IFRS are principle-based disclosure regimes that give businesses the freedom to disclose financial and non-financial information while also requiring them to justify their accounting decisions (Jang & Rho, 2016). Since IFRS has been adopted, corporate reports' content has expanded significantly, raising worries about complexity and extreme information overload (Lim et al., 2018).

According to our findings, IFRS-based corporate reports that are based on Egyptian Accounting Standards (EAS) are noticeably harder to read. To our knowledge, this is the first study to look at how IFRS adoption has affected how information overload of corporate reports in Egyptian firms.

Due to the rapidly expanding number of report users in Egypt, the relevance of corporate reporting's understandability has increased more than before. IFRS is thought to benefit companies since it makes information more comprehensible and beneficial to report users (Kuzey & Uyar, 2017). It is unclear, nevertheless, if this viewpoint is valid in the context of Egypt.

This paper primarily aims to improve the comprehension of corporate reporting in Egypt by exploring the implications of IFRS adoption on corporate reporting. This paper might be a crucial resource for changing IFRS standards. This paper also responds to the call for research on whether the IFRS framework has impacted how easily corporate reporting is understood in environments where English is not the primary language (Jang & Rho, 2016). Also, this paper has some social and practical ramifications that will help stakeholders including accountants and finance practitioners, the user who read corporate reports, legislators, regulators, and organizations that develop accounting standards.

Conclusion

This study assesses the readability of corporate reports issued by Egyptian companies and investigates the impact of the adoption of IFRS on the information overload using 48 non-financial Egyptian firms with a total of 432 firm-year observations within the period between 2013-2021. Our findings indicate that the readability level of corporate reports by Egyptian corporations is both unsatisfactory and is trending to decrease. We discover that the adoption of IFRS causes a less readable.

Many stakeholder groups are interested in this investigation. This study offers fresh information about the potential effects of IFRS adoption on the textual characteristics of company reports. This study demonstrates to Egyptian policymakers and regulators that Egyptian corporate reports are poorly comprehensible due to their length and low readability (which restricts their accessibility to knowledgeable users with considerable education).

This study provides information on the role of IFRS adoption in enhancing the comprehension of Egyptian corporate reports to policymakers and regulators in Egypt, which is especially helpful in light of the probable future broad adoption of IFRS among Egyptian enterprises.

Although great care has been taken, this study contains certain limitations. The first limitation is that it can only generalize its results to the Egyptian environment, which limits its applicability. In other instances, confirmatory research might be conducted in the future. Second, the chosen sample excludes small and medium-sized firms because this study primarily examines large Egyptian corporations. Such Egyptian companies will have a variety of complex topics to disclose, which may influence the readability and conciseness of their reports.

Future research could be expanded to discuss other latent components of the understandability of corporate reports or analyze the market response to the understandability of corporate reports, given that the primary goal of this paper is to examine the adoption of IFRS on information overload.

References

Cavicchi, C., Oppi, C., & Vagnoni, E. (2019). On the feasibility of integrated reporting in healthcare: a context analysis starting from a management commentary. Journal of Management and Governance, 23, 345-371.

Indexed at, Google Scholar, Cross Ref

Chaidali, P. P., & Jones, M. J. (2017). It’sa matter of trust: Exploring the perceptions of Integrated Reporting preparers. Critical Perspectives on Accounting, 48, 1-20.

Indexed at, Google Scholar, Cross Ref

Cheung, E., & Lau, J. (2016). Readability of notes to the financial statements and the adoption of IFRS. Australian Accounting Review, 26(2), 162-176.

Indexed at, Google Scholar, Cross Ref

Courtis, J.K., & Hassan, S. (2002). Reading ease of bilingual annual reports. The Journal of Business Communication, 39(4), 394-413.

Indexed at, Google Scholar, Cross Ref

Du Toit, E. (2017). The readability of integrated reports. Meditari Accountancy Research, 25(4), 629-653.

Indexed at, Google Scholar, Cross Ref

Duarte, A.M., Saur-Amaral, I., & do Carmo Azevedo, G.M. (2015). IFRS Adoption and Accounting Quality: A Review. Journal of Business & Economic Policy, 2(2), 104-123.

Dumitru, M., & Guşe, R.G. (2017). The legitimacy of the international integrated reporting council. Accounting and Management Information Systems, 16(1), 30-58.

Indexed at, Google Scholar, Cross Ref

Efretuei, E. (2021). Year and industry-level accounting narrative analysis: Readability and tone variation. Journal of Emerging Technologies in Accounting, 18(2), 53-76.

Indexed at, Google Scholar, Cross Ref

Henderson, E. (2020). Is Low Readability Resulting in Information Overload in Financial Statement Note Disclosures. International Journal of Business, Accounting and Finance, 14(1), 114-130.

Hrasky, S., & Smith, B. (2008). Concise corporate reporting: communication or symbolism?. Corporate Communications: An International Journal, 13(4), 418-432.

Indexed at, Google Scholar, Cross Ref

Jang, M. H., & Rho, J. H. (2016). IFRS adoption and financial statement readability: Korean evidence. Asia-Pacific Journal of Accounting & Economics, 23(1), 22-42.

Indexed at, Google Scholar, Cross Ref

Jensen, J. C., & Berg, N. (2012). Determinants of traditional sustainability reporting versus integrated reporting. An institutionalist approach. Business Strategy and the Environment, 21(5), 299-316.

Indexed at, Google Scholar, Cross Ref

Katsikas, E., Manes Rossi, F., Orelli, R. L., Katsikas, E., Manes Rossi, F., & Orelli, R. L. (2017). Principles, concepts, and elements of integrated reporting. Towards integrated reporting: Accounting change in the public sector, 65-94.

Indexed at, Google Scholar, Cross Ref

Koholga, O., & Jerry, M. (2016). International financial reporting standards adoption and financial reporting information overload: Evidence from Nigerian banks. GSTF Journal on Business Review (GBR), 4(4).

Indexed at, Google Scholar, Cross Ref

Li, H. (2019). Repetitive Disclosures in the MD&A. Journal of Business Finance & Accounting, 46(9-10), 1063-1096.

Indexed at, Google Scholar, Cross Ref

Lim, E. K., Chalmers, K., & Hanlon, D. (2018). The influence of business strategy on annual report readability. Journal of Accounting and Public Policy, 37(1), 65-81.

Indexed at, Google Scholar, Cross Ref

Loughran, T., & McDonald, B. (2014). Measuring readability in financial disclosures. The Journal of Finance, 69(4), 1643-1671.

Indexed at, Google Scholar, Cross Ref

Luo, J. H., Li, X., & Chen, H. (2018). Annual report readability and corporate agency costs. China Journal of Accounting Research, 11(3), 187-212.

Indexed at, Google Scholar, Cross Ref

McLaughlin, G. H. (1969). Reading at" impossible" speeds. Journal of Reading, 12(6), 449-510.

Melloni, G., Caglio, A., & Perego, P. (2017). Saying more with less? Disclosure conciseness, completeness, and balance in Integrated Reports. Journal of Accounting and Public Policy, 36(3), 220-238.

Indexed at, Google Scholar, Cross Ref

Monterio, B. J. (2015). Integrated reporting: a chat with the experts. Strategic Finance, 96(8), 35.

Morunga, M., & Bradbury, M.E. (2012). The impact of IFRS on annual report length. Australasian Accounting, Business and Finance Journal, 6(5), 47-62.

Nilsson, S. (1997). Understandability of narratives in annual reports. Journal of Technical Writing and Communication, 27(4), 361-384.

Indexed at, Google Scholar, Cross Ref

Richards, G., & Van Staden, C. (2015). The readability impact of international financial reporting standards. Pacific Accounting Review.

Indexed at, Google Scholar, Cross Ref

Roman, A. G., Mocanu, M., & Hoinaru, R. (2019). Disclosure style and its determinants in integrated reports. Sustainability, 11(7), 1960.

Indexed at, Google Scholar, Cross Ref

Saha, A., Morris, R. D., & Kang, H. (2019). Disclosure overload? An empirical analysis of International Financial Reporting Standards disclosure requirements. Abacus, 55(1), 205-236.

Indexed at, Google Scholar, Cross Ref

Sattari, S., Pitt, L. F., & Caruana, A. (2011). How readable are mission statements? An exploratory study. Corporate Communications: An International Journal, 16(4), 282-292.

Indexed at, Google Scholar, Cross Ref

Sun, Y., Wang, J. J., & Huang, K. T. (2022). Does IFRS and GRI adoption impact the understandability of corporate reports by Chinese listed companies?. Accounting & Finance, 62(2), 2879-2904.

Tan, H. T., Wang, E. Y., & Zhou, B. (2015). How does readability influence investors' judgments? Consistency of benchmark performance matters. The Accounting Review, 90(1), 371-393.

Indexed at, Google Scholar, Cross Ref

Xu, W., Yao, Z., & Chen, D. (2019). Chinese annual report readability: measurement and test. China Journal of Accounting Studies, 7(3), 407-437.

Indexed at, Google Scholar, Cross Ref

Received: 14-Apr-2023, Manuscript No. AAFSJ-23-13480; Editor assigned: 17-Apr-2023, PreQC No. AAFSJ-23-13480(PQ); Reviewed: 01- May-2023, QC No. AAFSJ-23-13480; Revised: 18-May-2023, Manuscript No. AAFSJ-23-13480(R); Published: 25-May-2023