Research Article: 2022 Vol: 21 Issue: 4S

The Effect of Financial Development on Economic Growth in Nigeria

Alexander Ehimare Omankhanlen, Covenant University Ota

Divine Chinyere Samuel-Hope, Covenant University Ota

Benjamin Ehikioya, Covenant University Ota

Citation Information: Omankhanlen, A.E., Samuel-Hope, D.C., & Ehikioya, B. (2022). The Effect of Financial Development on Economic Growth in Nigeria. Academy of Strategic Management Journal, 21(S4), 1-13.

Abstract

The growth of the financial sector allows financial intermediaries to conduct functionalities of distributing, aggregating and steering the resources of a country into an investment that leads to domestic development. The analysis of the manufacturing sector found that the industry was operating below estimates and contributing around 4 per cent to Nigeria's Gross Domestic Product (GDP). It has resulted in reduced productivity in the industry. Although the decline in the productivity of the sector was linked to the deterioration of the financial sector, this indicates that earlier efforts to grow financial markets may result in resource misuse that would have been disbursed in prior development phases to higher priority intentions. This research explores the effect of financial development economic growth in Nigeria covering 1990-2019. The main research goals were to investigate the linkages among market capitalization, money supply and credit to private sector on the economy’s growth. Data was obtained from CBN Bulletin different issues and analyzed using Autoregressive Distributed Lag. The result showed that the market capitalization and ratio of money supply to GDP of the financial development have a bigger impact on the economic growth in Nigeria. However Ratio of credit to the private sector to GDP of financial development is inversely not significant to economic growth in Nigeria. The study recommended that there is an urgent need to sustain a higher level of macro-economic stability in Nigeria, reduce the high incidence of non performing credits to ensure that private sector credits are channeled to the real sector of the economy, enhance the level of corporate governance in the financial system and strengthen risk management in the financial system.

Keywords

Financial Development, Economic Growth, Economy, Institutions, Instruments

Introduction

A well-functioning financial system is considered to be one of the main pillars on which sustainable economic growth can be established. The growth of the economy includes the development of its financial sector. And the development of the financial sector is taking place in the process of developing and increasing institutions, instruments and markets that support massive investments and growth that help to reduce poverty. Financial development thus offers better knowledge on future productive investments and facilitates the efficient allocation of resources. In other words, the advent of financial institutions tends to minimize the expense of knowledge acquisition and efficiently implements contracts and transactions. In addition, expanding financial access instills complex productivity in the sector by introducing systemic reform through creativity and welfare benefits to the economy as a whole. The development of the financial system can be described as the development of the size, efficiency and stability of financial markets, along with increased access to financial markets that may have multiple economic advantages (Guru & Yadav, 2019). Furthermore, (Udeme, Chinelo & Georgina, 2020), states that financial development can be seen, as the ability of a financial institution to channel savings efficiently and effectively and allocate them to households, entrepreneurs, business and government for investment opportunities and beyond investment purposes with a view of return on investment, which enhance economic growth. However, considerable attention has begun to be paid to the significant role of financial development in the growth process. In his thesis, Schumpeter (1911) argues that a well-functioning financial system would promote technological progress by efficient redistribution of resources from the unproductive sector to the productive sector. This concept was seen as the first paradigm for the study of the finance-led growth hypothesis. On the other hand, Robison (1952) argues that the relationship should start from growth to finance. According to this view, a high rate of economic growth leads to a high demand for a particular financial agreement or arrangement, and the well-developed financial sector will naturally respond to this form of demand. This view has recently been described as a growth-led finance hypothesis.

Nigeria's financial system needs to improve so that exports of natural resources will have a significant impact on economic development (Seyfettin, Durmus & Ayefer, 2020). The Nigerian financial system has undergone various changes in recent decades, starting with the introduction of several reforms, such as the Structural Adjustment Programme, in 1986. Prior to 1986, the economy was characterized by stringent taxation, stifling trade, capital misappropriation, weak banking system, lack of sufficient risk management framework, interest rate control, direct credit plan, lack of transparency in transactions, and other variables. This reform aimed to loosen up the financial sector with the general anticipation of an increase in activities. Nigeria has undergone development in the financial sector, and as a result of financial deepening, money market development has increased over time, equity and capital market activities have increased, bank branches have increased, debit and credit card use has increased high. Improved use of payment systems such as POS (Point of Sale), ATM (Automatic Teller Machine), Electronic Deposit Transfer, increased online banking services, automated banking and an overall increase in banking deposits. Financial-sector growth should translate into economic growth because financial-sector growth will make investment funds available. Throughout the industrial sector, private sector financing is the most commonly used measure in the estimation of the importance of the manufacturing industry to an economy.

Statement of Problem

A recent review of the manufacturing sector indicated that the sector has been performing below expectation, contributing only about 4% of the Gross Domestic Product (GDP) in Nigeria. This has resulted in a decline in industrial productivity. Financial sector growth should, conventionally, translate into economic growth, by making funds available for investment which in turn will trigger productivity in the manufacturing sector but the reverse is the case as the total loans granted by Nigeria banks to the private sector declined by N600.60 billion from N16 trillion in the first quarter of 2017 to N15.34 trillion, in the second quarter of 2018. More so, financial deepening has triggered massive focus from developmental finance professionals and has been argued substantially. This argument could be categorized into two key postulations: the supply and the demand leading hypothesis. Supply leading highlights financial deepening as important fundamentals for growth. Supply leading hypotheses infers that financial deepness fosters progressiveness. This theory is contrary to the fact that financial market activity creates and raises liquidity, mobilizes investments and results in domestic development (Pascal, Dorothy & Amalachukwu, 2019). Karimo & Ogbonna (2017) claims that the demand-leading theory underlines financial growth in response to shifts in the actual economy that arise as a result of increased government spending. These, suggests that earlier attempts to expand financial markets may result in the exploitation of capital that should have been disbursed, at prior growth stages to higher priority purposes. Local developments contribute to expanded competition for financial services, causing major monetary growth (Robinson, 1952; Lucas, 1988; Olufemi & Stephen, 2015).

There are various studies in the field of financial deepening and economic growth. Still, most studies focused on financial measures that do not capture the process by which financial deepening can affect economic growth. They simply analyzed the causality and impact of deepening finance on economic growth. This serves as a gap because, as alternate sources of expansion, none of them distinguished between the size of the financial sector and the level of activity within this sector. In addition, quite a lot of steps have been taken by the monetary authorities in Nigeria since 1986 to deepen financial bodies and reduce the amount of associated financial constraints. Reformations of financial systems emanated in adaptations of Nigeria’s financial structure in attempts to promote competitiveness, reinforce managerial responsibilities of administrative authorities, improve public-financial system relationship and reduce distortion in investment decisions. Many new financial instruments and methods were created and current ones altered, the financial markets have been adjusted to meet new requirements and conditions. These have been designed to deepen the financial system. But how have these impacted on Nigeria’s growth?

Finally, some of the studies such as Jagadish (2018) used data of 16 selected countries and Nahla, in this literature, 52 middle-income countries used by Jan & Sugata (2015) used cross-country data sets that are inherent in the omitted variable bias problem. To address this question of missing variable bias, this analysis will be country-specific and seeks to assess the effect of financial development on Nigeria's economic growth from 1990 to 2019.

Research Questions

In assessing this study’s topic, these research inquisitions were projected:

- What is the magnitude of money supply impact on economic growth?

- What is the level of credit to private sector impacted economic growth?

- To what extent has the market capitalization impacted economic growth in Nigeria?

Objective of the Study

The study's main objective is to empirically analyze the magnitude of Nigeria's financial deepening and its effect on the Nigerian economy. This research aims primarily to:

- To investigate the influence of the money supply on economic growth.

- To evaluate the impact of credit to the private sector on economic growth.

- To analyze the impact of market capitalization on Nigeria's economic growth.

Research Hypotheses

This study will examine the relationship between financial deepening and Nigerian economic growth. Some past investigations deduce that financial deepening affect economic growth, while others conclude that they are negatively associated. These supporting studies provide a foundation for exploring the relationship between financial deepening and economic development in Nigeria.

And the hypothesis of this research is as follows:

Hypothesis One

H0: Money supply to GDP does not have significant impact on economic growth in Nigeria.

H1: Money supply to GDP has a significant impact on economic growth in Nigeria.

Hypothesis Two

H0: Credit to the private sector does not have a significant effect on Economic growth in Nigeria.

H1: Credit to private sector has a significant effect on economic growth in Nigeria.

Hypothesis Three

H0: Market capitalization does not have a significant impact on economic growth in Nigeria.

H1: market capitalization has a significant impact on economic growth in Nigeria.

Review of Related Literature

Conceptual Framework

Financial Development

Experts in economic development frequently use the concept of financial development which is the capacity of a financial institution to efficiently and effectually allocate savings for investment reasons. Financial deepening has been described as one of those approaches that can accelerate the speed of growth. According to (Udeme, Chinelo & Georgina, 2020) Financial development may be defined as increasing the introduction and supply of financial sector (financial market) assets or securities within the economy (Guru & Yadav, 2019). Also opined that the development of the financial system can be described as the development of the size, efficiency and stability of financial markets, along with increased access to financial markets that may have multiple economic advantages. Kisaka (2015) sees financial development as an increased in the ratio of the money supply to Gross Domestic Product (GDP) or some price index. It refers to liquidity of money. The more liquid money is available in an economy, the more opportunities exist for continued growth. Money is available in an economy, the more opportunities exist for continued growth.

Two fundamental measurable quantifiers are usually adopted to gauge the size of financial markets: intermediation ratio and monetary ratio. While the latter contains liquid liabilities or pecuniary-related measures such as broad money supply to GDP ratio. The intermediation ratio comprises of bank-dependent barometers such as credit to the private sector and savings to time deposit. The interpretation of the literature on financial deepening represents the share of the money supply in GDP. Accordingly, financial deepening is measured by, the relation of monetary and financial aggregates such as M1, M2 and M3 to the GDP. M1: Technically described, is the total of the tender held outside banks, checks on passengers, checking accounts (but not demand deposits), minus the amount of money in the Federal Reserve float. M2: Total of M1, savings deposits (including money market accounts from which no checks can be made), and small-denomination time deposits M3: M2 plus big-time deposits.

M1, M2, M3 are all money supply indicators, that is to say, the sum of money in circulation at a given time. Typically speaking, the types of commercial bank money that appear to be priced at lower amounts are categorized, into the narrow group of M1. In contrast, the types of commercial bank money that seem to exist in more significant quantities are classified, into M2 and M3, with M3 being the highest. For the monetary aggregates, the expressions M1, M2, M3 apply. For quite some time, it has been assumed that the relationship between these figures and inflation rates was perfect deal one to one. This relationship seems to have broken down recently, and the numbers of money supplies have lost some of their appeal to market participants.

Measures of Financial Deepening

- Broad Money Supply (M2)

According to (Omodero, 2019) Money supply is a monetary policy instrument that is extremely important to improve a nation's economic development. All M2 components are very liquid, and the non-cash components can very easily be converted into cash. Broad money includes notes & coins, with saving accounts & deposits also included. Treasury Bills & gilts can also be included. These securities are considered to be 'near money.'

Broad money (M2) in economics is a measure of the money supply that involves more than just physical money, including currency and coins (also known as narrow money). It usually includes commercial bank demand deposits, and any money kept in easily accessible accounts. Broad money may have different meanings depending on the user situation, and typically it is designed as required to be the most useful indicator in the situation.

- Credit to the Private Sector (CPS)

The task of the financial intermediation is generally carried out by the financial sector, channeling capital to profitable investment. In particular, deposit-taking institutions are well-recognized for fulfilling the crucial role of sourcing finance in supporting Nigeria's private sector consumption and investment. According to (Olowofeso, Adeleke & Udoji, 2015) Private sector credit applies to financial capital made available to the private sector. Financial enterprise, such as loans and advances, sales of non-equity securities, transaction credits and other receivable accounts, which compensate for claims for repayments.

- Economic Growth

Economic growth is understood, as a dynamic mechanism in which each economy creates relationships between the different production factors that, following economic policies, allow the production of a greater quantity of goods and services produced, thereby improving the well-being of the population (Gallardo et al., 2019). Economic development requires more demand which implies an increase in output per unit of input, not inputs but also greater efficiency. Economic growth from Wikipedia is the rise in the volume of the products and services that a country creates over time. It is conventionally calculated, as the percentage rate of actual gross domestic product growth.

Theoretical Review

Three theories are used as hypothetical basis to explain the connection between financial deepening and economic growth. These theories include; Theory of Financial Intermediation, supply leading theory and demand leading theory, which are discussed below.

Theory of Financial Intermediation

This theory suggests that financial intermediaries are very important in growth processes via transference of finances from net savers (surplus units) to net borrowers (deficit units), which influences investment and propels growth. Here, market failure of information asymmetry can be conquered through transformation of risk features of assets. Such credit market asymmetry is due to the fact that borrowers typically have more knowledge about their investment schemes (moral integrity, industriousness and collateral) than the lenders (Shaw, 1973). Advocates that sufficiently functional financial intermediaries can enhance general economic efficacy via allocating and pooling finances to advance innovation and entrepreneurship which are essential for developing an economy. Financial intermediaries are also chances to boost financial capacity (investment and savings) of a lender. Therefore, higher intermediation aids greater savings mobilisation, consequently enhancing investment and growth levels (Bakang, 2015).

Supply - Leading Hypothesis

This hypothesis contends that well-functioning financial institutions can promote overall economic efficiency, create and expand liquidity, mobilize savings, enhance capital accumulation, transfer resources from traditional (non-growth) sectors to the more modern growth-inducing industries, and also promote a competent entrepreneur response in these new sectors of the economy. Economists such as Schumpeter (1911) supported the Finance-led causal relationship between finance and development. In a systematic analysis of the different methodological approaches used in the finance literature, Karimo & Ogbonna’s recent research (2017) found clear evidence that financial progress is essential to growth.

Demand - Following Hypothesis or Growth-Led Finance Theory

Robinson (1952) believed economic activity propelled banks to finance businesses. Thus, finance follows where enterprises lead. They contend that financial depth is simply a by-product of development decision. According to Patrick, Oladapo, Olufemi & Stephen (2015), the growing demand for financial services is boosting the finance market as the real sector grows.

Review of Empirical Literature

Ohiomu & Oligbi (2020) analyzed the impact of development of the financial sector, financial deepening on economic growth: Nigerian empirical evidence (1981-2018). For the research, the study used ARDL model for rigorous policy recommendations. The results showed that the metrics for the development of the financial sector have a long-term relation to economic growth. Indicator of the stock market has a direct association with the pace of economic growth. There are common characteristics in the ratio of net savings to gross domestic product and an insurance measure. The study recommends that the government re-engineer the insurance sub-sector and reinvigorate the money and capital markets to boost financial stability and economic growth for optimum development. Yahaya & Kolapo (2020) looked at the effects of financial development on Nigerian economic development. It is using secondary data from the 2015 Nigeria Central Bank Bulletin. Model for error correction and study of regression was used. The findings revealed that financial deepening variables linked to the banking sector and the stock market are important determinants of economic growth in Nigeria with a coefficient value of 4,6015 and 3,28E-09 at a significant level of 5 per cent respectively. The study concluded that financial deepening is stimulating Nigeria's economic growth. The study suggested that policyholders adopt policies that increase the flow of investment funds and enhance financial inclusion.

Alexander & klemm (2019) examined impact of financial deepening in Mexico from 2007 to 2015 using disequilibrium regression approach the study found that factors of supply are particularly significant as determinants of Mexico's credit. Recent financial reforms address many of the supply constraints but will depend on implementation for their success. The biggest challenge ahead would be to promote financial deepening while reducing financial stability risks. Chung-hua, et al., (2018) used 48 countries from 1988 -2014 to investigate the impact of the outliers on the causal relationship between financial development and economic growth. Levine, Loayza, & Beck's dynamic panel model (2000) is used to examine the problem. They proposed a novel approach by incorporating the least square dummy variable correction method (LSDVC) for eliminating the bias assumptions in the dynamic panel model and the Least Trimmed Squares (LTS) for monitoring outlier effect. The synthesis of both methods is known as LSDVC+LTS. Their findings revealed a counter-intuitive proof that when the outer effect is neglected, the production of the banks adversely affects economic growth. This contra-intuitive evidence holds even when the outliers are controlled, using the conventional winsorization method. Bank development, however, exhibits a positive impact on economic growth once the proposed LSDVC+LTS approach is adopted. Equally, the development of the stock market has a positive effect on economic growth regardless of outliers.

Dilek, Serdar & Hakan (2017) theoretically &empirically, studied the role of financial development in economic growth. They show, in the theoretical part of the study, that debt from credit markets and equity from stock markets are two long-term determinants of GDP per capita by developing a Solow – Swan growth model augmented with financial markets in the tradition of Wu, Hou, & Cheng (2010). They showed that debt from the financial markets and capital market equities are two long-term determinants of GDP per capita. In the empirical portion, the long-run relationship is calculated utilizing the Augmented Mean Group (AMG) and Common-Correlated Effects (CCE) for a panel of forty countries over the period 1989 to 2011 which allow for cross-sectional dependencies. Although the cross-sectional results differ across countries, the panel data analyzes show that both networks have positive long-run impacts on per capita GDP stable-state rates, &the credit markets' impact is considerably more significant. The study recommendation was that policymakers put particular focus on enforcing policies that result in capital markets being deepened, including structural & legal steps to improve borrower &investor rights and regulation of contracts. Thus, economic growth will be stimulated by promoting the creation of the financial sector of a nation.

Adeusi & Aluko (2015) evaluated the importance of the growth of the financial sector in the 21st century to real-market profitability. Annual time series details from the 2013 edition of the Central bank of Nigeria (CBN) Statistical Bulletin are retrieved. The period under review is 2000-2013. The Ordinary Least Square (OLS) approach was used &the analysis showed that a positive linear relationship exists between the financial sector &the real sector as the coefficient of multiple determinations is relatively high; thereby indicating that the growth of the financial sector is critical for the competitiveness of the real sector.

Methodology

The data used in this research are yearly time-series data of relevant variables and the data are primarily secondary data retrieved from Central Bank of Nigeria publications (CBN) from year 1990-2019. The variables included in the model are financial deepening indicators such as Real Gross Domestic Product Growth Rate, Ratio of money supply, Ratio of credit to private sector and market capitalization.

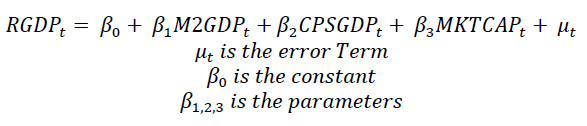

Where,

RGDP=Real Gross Domestic Product,

M2GDP=Ratio of Money Supply to GDP,

CPSGDP=Ratio of credit to private sector,

MKTCAP= market capitalization.

In Econometric Form:

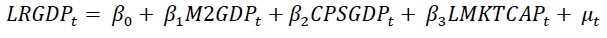

The model following a semi-log linear model due to high higher series of RGDP and MKTCAPO. The structured model is presented below:

Were L is the Logarithm,

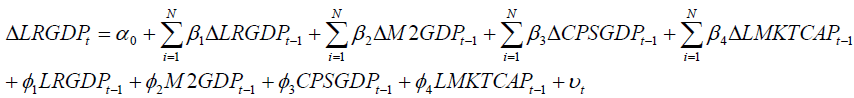

The Autoregressive Distributed Lag (ARDL) model for the study is modelled below:

Where Δ is the first difference of operator.

Estimation of Results and Discussion

Unit Root Test

| Table 1 Augmented Dickey–Fuller (ADF) unit root |

|||||

|---|---|---|---|---|---|

| Variable | Level | First Difference | Critical Value | Lag | Order of Integration |

| LRGDP | -4.598887 | -2.967767 | 2 | I (0) | |

| CPSGDP | -1.001815 | -4.348315*** | -2.967767 | 2 | I (1) |

| LMKTC | -2.428151 | -3.934879*** | -2.967767 | 2 | I (1) |

| M2GDP | -0.908760 | -5.083263*** | -2.967767 | 2 | I (1) |

Where:*, **, & *** implies 10%, 5% & 1% significance level.

Table 1 presents the ADF unit root test using the intercept model to deduce the order of integration of the variables at 5% level of significant. The results indicate that except LRGDP, which deduced order of zero in the intercept model, all other series (CPSGDP, M2GDP, LMKT) reveal a first order of integration. That is CPSGDP, M2GDP and LMKTCAP have a first order of integration. This is consistence with the assumption of ARDL as the series has a mixed order of integration.

Bound Test for Cointegration

Before we proceed to the estimation proper for the Autoregressive Distributed Lag (ARDL) regression model, it is important that we verify if they are jointly co-integrated or not. That is, if there exist a long relationship between the series in the model. In other to verify this, a bound co-integration by Pesaran & Shin (1999); Pesaran, et al., (2001) is applied.

| Table 2 Bound test for co-integration test |

||||

|---|---|---|---|---|

| F-statistic | K | Lower Bound | Upper bound | |

| 7.427408*** | 3 | 10% | 2.72 | 3.77 |

| 5% | 3.23 | 4.35 | ||

| 2.5% | 3.69 | 4.89 | ||

| 1% | 4.29 | 5.61 | ||

Where:*, **, & *** implies 10%, 5% & 1% significance level.

The results of the bound testing for co-integration of financial development and economic growth is presented in table 2. The bound test compares the F-value of a model at 5% level with the lower bound test and upper bound test at 5% significant level. The model F-statistics value of 7.4274 showed that the value is greater than both the lower and upper bound value of 3.23 and 4.35 respectively at 5% significant level. The result showed that there exists a long run relationship among the financial development and economic growth. This implies that the null hypothesis of no co-integration among the financial development and economic growth in Nigeria cannot be accepted. This means that the alternative hypotheses of co-integration among the variables in question are supported.

| Table 3 Estimated coefficients of the short run and error correction model |

||||

|---|---|---|---|---|

| Variables | Coefficient | Stand. Error | T-Statistics | P–Value |

| Method: Autoregressive Distributed Lag Model (ARDL) | ||||

| D(CPSGDP) | -0.015671 | 0.007976 | -1.964796 | 0.0616 |

| D(LMKTC) | 0.129689 | 0.040032 | 3.239647 | 0.0036 |

| D(M2GDP) | -0.010646 | 0.009250 | -1.150985 | 0.2616 |

| CointEq(-1) | -0.201167 | 0.050863 | -3.955047 | 0.0006 |

| R-Squared | 0.631897 | |||

| Adjusted R-Squared | 0.551874 | |||

| F-Statistics | 7.896491*** (0.000188) | |||

| Durbin Watson | 1.743240 | |||

Notes: ***, ** and * means the rejection of the null hypothesis at 1%, 5% and 10% respectively.

The table 3 presents the short run and error correction model of financial development and economic growth in Nigeria. The negative and significance of the coefficient of error correction term [-0.20116 (P–value=0.0006)] at 5% significant level indicates that the study conforms with theoretical exposition of the Error correction modelling with the negative value of the Error Correction term and corresponding significant Probability Value. The speed of adjustment from economic growth disequilibrium as warranted by the ECT(-1) is corrected at the speed of 20.1% yearly. Specifically, this shows that the disequilibrium in economic growth in the long run is corrected at the speed of 20.1% back to equilibrium from the short run of ratio of credit to the private sector to GDP (CPSGDP), market capitalization (MKTCAP), and Ratio of Money Supply to GDP (M2GDP).

Short run CPSGDP is not statistically significant at 5% level as the t-statistics denotes 1.9648 and the p-values of 0.0616 is greater than 0.05. A percent increase in the short run of CPSGDP will yield about 0.0156 percent decrease in LRGDP. This is negative and does not conform to the theoretical signs as higher CPSGDP is expected to increase the economic growth in Nigeria.

Short run MSGDP is not statistically significant at 5% level as the t-statistics denotes -1.1509 and the p-values of 0.2616 is greater than 0.05. A percent increase in the short run of M2GDP will yield about -0.1064 percent decrease in LRGDP. This negative relationship does not conform to the theoretical signs as higher M2GDP is expected to increase the economic growth in Nigeria.

Short run LMKTCAP is not statistically significant at 5% level as the t-statistics denotes 3.239 and the p-values of 0.0036 is less than 0.05. A percent increase in the short run of LMKTCAP will yield about 0.0106 percent decrease in LRGDP. This negative relationship does not conform to the theoretical signs as higher LMKTCAP is expected to increase the economic growth in Nigeria

The value of the adjusted R-squared of 0.5518 is an indication that about 55.18% variation in Log of real gross domestic product is explained by the explanatory variables in the model (Ratio of credit to the private sector to GDP, Log of Market Capitalization, and Ratio of Money Supply to GDP (M2GDP) while the remaining 44.82% are explained by other factors. The F-Test which is the test of overall significance of the model indicates that by its value of 7.8964 (P-value=0.0001), it is statistically significant at 5% level. Therefore, the result of the individual independent variables regressed against the dependent variables as shown above is reliable and is a true representation of the data used in the analysis.

| Table 4 Long run effect of financial development and economic growth in Nigeria |

||||

|---|---|---|---|---|

| Dependent Variable: LRGDP | ||||

| Long Run Coefficients | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| CPSGDP | -0.077901 | 0.042673 | -1.825508* | 0.0809 |

| LMKTC | 0.644685 | 0.060026 | 10.740079*** | 0.0000 |

| M2GDP | 0.099107 | 0.044558 | 2.224237** | 0.0362 |

| C | 3.610511 | 0.660132 | 5.469378*** | 0.0000 |

Where:*, **, & *** implies 10%, 5% & 1% significance level.

Table 4 presents the long run estimates of the effect of financial development on economic growth in Nigeria. The constant coefficient of 3.6105 indicates that economic growth equal to 3.6105 if all explanatory variables are held constant. In more specific, economic growth will assume a value of 3.6105 if market capitalization (MKTCAP), Ratio of credit to private sector (CPSGDP) and Ratio of Money Supply to GDP (M2GDP) does not exist in the model. The T-statistic of 5.4693 with the probability value of 0.0000 indicates that the coefficient of the constant is statistically significant at 5% significant level.

Hypothesis One

H0: Ratio of Money supply to RGDP has no significant impact on economic growth in Nigeria.

The results indicates that M2GDPS is positively and significant to determine the economic growth in Nigeria with the coefficient value of β=0.09910, the t-statistics of t=2.22423 and the corresponding probability value of P=0.0362). This shows that a unit increase in M2GDP brings about an increase of 0.09% in LRGDP in Nigeria. The positivity of M2GDP on LRGDP is statistically significance to explain the LRGDP in Nigeria. This study was premised on the level of money supply that has been shurned out of Nigeria in recent times. Hence the study reject the null hypothesis of no significant effect of ratio of money supply to GDP on economic growth in Nigeria. Hence the study concluded that M2GDP have statistically significant effect on economic growth in Nigeria.

Hypothesis Two

H0: Ratio of Credit to private sector to GDP has no significant effect on Economic growth in Nigeria.

Contrary to the objective of evaluating the impact of Ratio of Credit to private sector to GDP on economic growth. The results indicates that Ratio of Credit to private sector to GDPis negatively and insignificant to determine the economic growth in Nigeria with the coefficient value of β=-0.077900532, the t-statistics of t=-1.825508, and the corresponding probability value of P=0.0809). The study indicates that a unit increase in Ratio of Credit to private sector to GDP brings about an increase of 0.0779% in LRGDP. This study insignificant of ratio of credit to private sector to GDP on economic growth ravel around the basic problem of interest, interest rate problem is that credit purveyance may lead to sub-optimal outcomes and poor resource allocation decisions if local conditions are unfavourable, which may eventually cascade into a huge stock of non-performing credit facilities. Hence the study failed to reject the null hypothesis of no significant effect of Ratio of Credit to private sector to GDP on economic growth in Nigeria. Hence the study concluded that Ratio of Credit to private sector to GDP does not have any significant positive effect on economic growth in Nigeria.

Hypothesis Three

H0: Market capitalization has no a significant impact on economic growth in Nigeria.

The results indicates that MKTCAP is positively and significant to determine the economic growth in Nigeria with the coefficient value of β=0.644685, the t-statistics of t=10.7400, and the corresponding probability value of P= 0.0000). The result explains that for any unit increase in MKTCAP brings about an increase of 0.644% in LRGDP. More so, the estimate is statistically significant to influence economic growth in Nigeria within the observed years. Hence the study concluded that market capitalization have statistically significant effect on economic growth in Nigeria.

Diagnostic Tests

The ARDL models assess the effect of financial development on economic growth in Nigeriaare validated by applying Jarque-Bera normality test with the null hypothesis of normality, Breusch-Godfrey Serial Correlation LM Tests for Autocorrelations with the null hypothesis of no serial correlation, and ARCH Heteroskedasticity Tests with the null hypothesis of no Heteroskedasticity in the error term and the results as presented in Table 5.

| Table 5 Diagnostic test |

|

|---|---|

| Post Estimation Test | |

| Breusch-Godfrey Serial Correlation LM Test: | 2.06428 (0.1519) |

| Heteroskedasticity Test: Breusch-Pagan-Godfrey | 0.69513 (0.6324) |

| Jarque-Bera Statistics | 1.10426 (0.5757) |

Where:*, **, & *** implies 10%, 5% & 1% significance level.

Breusch Godfrey serial correlation LM test give a value of 2.0643 and the probability value of 0.1519. The results reveal that the test statistics is not statistically significant which implies that there is no serial correlation in the model. The heteroscedasticity test result shows that there exist noheteroscedasticity in the model. This implies that there is constant variance of the residual with the F-statistics value of 0.695 and probability value of 0.6324. Hence, it is safe to conclude that the model possess homoscedasticity. J-B statistical value of 1.1043 and the corresponding probability value of 0.5757 indicate that residual of the model is normally distributed. Hence the model is desirable and good for forecasting.

Summary and Conclusion

This study investigated effect of financial development on economic growth in Nigeria between 1990 and 2019. The empirical results for this study produces two important results especially relevant for developing Nigeria. The first result is that the market capitalization and ratio of money supply to GDP of the financial development have a bigger impact on the economic growth in Nigeria. However Ratio of credit to the private sector to GDP of financial development is inversely not significant to economic growth in Nigeria. This specifies that money supply and market capitalization in financial development matters more for the economic growth in Nigeria. The empirical analysis yields evidence that is strongly supportive of a positive influence of financial development (M2GDP and MKT) on economic growth in the long run. The results are very much in line with existing empirical literature, most of which uncover positive relationship between finance development and economic growth. The evidence is also consistent with economic theory, which throws up a number of intuitively plausible rationales for why well-functioning financial systems matter for growth.

The study recommended that there is an urgent need to sustain a higher level of macro-economic stability in Nigeria, reduce the high incidence of non performing credits to ensure that private sector credits are channelled to the real sector of the economy, enhance the level of corporate governance in the financial system and also strengthen risk management in the financial system. Another policy implication of the findings that emerges from the results is that, it is critical for the government to carry out subsequent efforts at developing the financial sector through credit creation to the public in such a way as to conform to the global development trend. This will tally with the global development pattern which has shifted from transformation of production and consumption pattern to aggregate societal empowerment.

Recommendation

The Authors appreciate Covenant University Centre for Research and Innovation (CUCRID) for sponsoring the publication of this paper.

References

Adeusi, S.O., & Aluko, O.A. (2015). Relevance of financial sector development on real sector productivity: 21st century evidence from Nigerian industrial sector. International Journal of Academic Research in Business and Social Sciences, 5(6), 118-132.

Crossref, GoogleScholar, Indexed at

Bakang, M.L.N. (2015). Effects of financial deepening on economic growth in Kenya. International Journal of Business and Commerce, 4(7), 1-50.

Chung-Hua, S., Xingyu, F., Dengshi H., Hongquan, Z., & Meng-wen, W. (2018). Financial development and economic growth: Do outliers matter?Journal of emerging markets finance and trade, 54(13), 2725-2947.

Crossref, GoogleScholar, Indexed at

Dilek, D.C., Serdar, I., & Hakan, Y. (2017). Financial development and economic growth: Some theory and more evidence. Journal of issue modelling, 39(2), 290-306. .

Crossref, GoogleScholar, Indexed at

Guru, B.K., & Yadav, I.S. (2019). Financial development and economic growth: Panel evidence from BRICS. Journal of Economics, Finance and Administrative Science, 24(47), 113-126.

Crossref, GoogleScholar, Indexed at

Gallardo, H.J.P., Vergel, M.O., & Cordero, M.C.D. (2019). Economic growth model in developing economies. Journal of physics: Conference series, 1388.

Crossref, GoogleScholar, Indexed at

Jagadish, P.B. (2018). Financial development and economic growth: Evidence from a panel of 16 African and non-African low-income countries. Cogent economics and finance, 6(1), 2018.

Crossref, GoogleScholar, Indexed at

Karimo, T.M., & Ogbonna, O.E. (2017). Financial deepening and economic growth nexus in Nigeria: supply-leading or demand-following?MDPI journal of economies, 5(4), 1-18.

Crossref, GoogleScholar, Indexed at

Kisaka, S.E. (2015). The effect of financial deepening on the performance of small holder formers in home bag country, Kenya. Research Journal of finance and Accounting, 6(10).

Lucas, R.E. (1988). On the mechanics of economic development. Journal of Monetary Economics, 22, 3-42.

Crossref, GoogleScholar, Indexed at

Nahla, S., Jan, F., & Sugata, G. (2015). Is the relationship between financial development and economic growth monotonic? Evidence from a sample of middle-income countries. World development, 68, 2015, 66-81.

Crossref, GoogleScholar, Indexed at

Ndako, U.B. (2017). Financial development, investment and economic growth: Evidence from Nigeria. Journal of Reviews on Global Economics, 6, 33-41.

Crossref, GoogleScholar, Indexed at

Ohiomu, S., & Oligbi, B.O. (2020).The influence of financial sector development and financial deepening on economic growth: Empirical evidence from Nigeria. Journalof Economic and Financial (IOSR-JEF) 11(1), 58-67.

Olowofeso, E.O., Adeleke, A.O., & Udoji, A.O. (2015). Impact of private sector credit on economic growth in Nigeria. CBN Journal of Applied Statistics, 6(2), 81-101.

Omodero, C. (2019). Effect of money supply on economic growth: A comparative study of Nigeria and Ghana. International Journal of Social Science Studies, 7(3), 1-8.

Crossref, GoogleScholar, Indexed at

Pascal, C.N., Dorothy, C.O., & Amalachukwu, C.A. (2019). Effect of financial deepening on economic growth in Nigeria: A time series appraisal (1986-2018). Asian Journal of Advanced Research and reports, 7(3), 1-9.

Crossref, GoogleScholar, Indexed at

Patrick, O.A., Oladapo, F., Olufemi A.A., & Stephen, O.M. (2015). Does supply-leading hypothesis hold in a developing economy? A Nigerian Focus. 3rd Economics & Finance Conference, Rome, Italy, April 14-17, 2015 and 4th Economics & Finance Conference: London, UK.

Robinson, J. (1952). The generalization of the general theory in the rate of interest and other essays. London: Macmillan.

Shaw, E. (1973). Financial deepening in economic development. London: Oxford University Press.

Crossref, GoogleScholar, Indexed at

Schumpeter, J.A. (1911). The theory of economic development. Harvard University Press: Cambridge, MA, USA.

Crossref, GoogleScholar, Indexedat

Seyfettin, E., Durmus, C.Y., & Ayefer, G. (2020). Natural resource abundance, financial development and economic growth: An investigation on Next-11 countries. Resources Policy, 65, 101559.

Crossref, GoogleScholar, Indexed at

Udeme, O., Chinelo, O.O., & Georgina, O.U. (2020).The impact of financial deepening on the economy of Nigeria. Asian Journal of Economics, Business and Accounting, 15(1), 12-21. .

Crossref, GoogleScholar, Indexedat

Yahaya, K.A., & Kolapo, M.B. (2020). The impact of financial deepening on economic growth of Nigeria. Center point journal, 21(1), 135-151.

Received: 21-Dec-2021, Manuscript No. ASMJ-21-10387; Editor assigned: 23-Dec-2021, PreQC No. ASMJ-21-10387 (PQ); Reviewed: 04-Jan-2022, QC No. ASMJ-21-10387; Revised: 14-Jan-2022, Manuscript No. ASMJ-21-10387 (R); Published: 21-Jan-2022