Research Article: 2021 Vol: 25 Issue: 1S

The Effect of Family-Owned Enterprises on the Quality of Auditing Systems

Badi Alrawashdeh, Arab Open University, Saudi Arabia Kingdom

Keywords:

Family Owned Corporates, Auditing Experience, Auditing Output

Abstract

Auditing quality affects the financial position of the corporate in the short and long run. The objective of this research is to investigate the effect of corporate ownership and the auditing experience on the quality of auditing. The questionnaire was used to collect data. The questionnaire is composed of three parts. The first part concerned with demographic characteristics of the auditors, while the second part concerned with the collection of data about the type of corporate ownership and its effect on auditing quality, and the last part concerned with the collection of data about the auditors' experience and its effect on auditing quality. A simple random sample was selected included 400 auditors. The collected data was entered into SPSS and analyzed using descriptive and inferential statistics. The results showed that auditing quality is highly affected by the type of corporate ownership. Also, the results showed that the experience of the auditor will determine the price and the type of corporate ownership that they may work with. The study recommended that the auditing work should be controlled through a third governing agent with authority to revise the financial statements of the corporates.

Introduction

The auditing role became a basic complementary part of the corporates' work. The position and importance of the auditing are determined through the quality of auditing and the attitudes of corporate management to reflect the real financial position. This will create a conflict between the auditing work and the benefits of the corporates owners or managers (Odudu et al., 2019). The outputs of the auditing process will be the concern of individuals related to business such as stock owners or participants outside the board of directors (Alkilani et al., 2019). This makes the auditing work a very sensitive process that should reach high credibility and reliability (Shahzad et al., 2017). The constraints that affect the output of auditing are numerous. One of the major determinants is the ownership of the corporate (Iswadi et al., 2016). The ownership of the corporates has been divided into different ownerships according to the source of management or board of directors of the corporate (Odudu et al., 2019). Alkilani et al., (2019) classified the ownership of the corporates to major parts as national which is represented in family and intuitional ownership and foreign ownership corporates. Alqatamin (2018) has shown whatever the classifications used for ownership classification, it affects the performance of auditing and quality of auditing outputs. The other constraint of the auditing process is the auditors' experience. High-quality auditors will work to produce high-quality auditing and vice versa. The classification of auditing bodies may range from poor or low experience to very high experience (Suprianto & Setiawan, 2020). This leads to the conclusion that the experience of the auditing body will play a vital role in the outputs. Moreover, the corporate may prefer or search for the level of auditing quality it needs to avoid any high auditing quality that affects its business or future position. On the other hand, the corporates’ management may find an auditing body that can be directed to reach specific financial positions that represent the owners’ attitudes (Odudu et al., 2019). Consequently, different external and internal factors may affect auditing quality. The external factors related to auditing bodies and the internal factors related to the ownership and the extent of auditing dependency. This paper will discuss the effect on auditing outputs in the case of family-owned corporates as well as the effect of auditor experience on the output of the auditing process.

Literature Review

Different authors showed that the effect of family-owned corporates on the auditing process (Aljaaidi & Bagais, 2021; Widani & Bernawati, 2020; Yustina & Santosa, 2020; Yustina & Valerina, 2018). Different authors classified the family-owned corporates into different classes to facilitate the understanding of the effect of these corporates on the quality of auditing in these corporates (Alkilani et al., 2019; Alqatamin, 2018; Odudu et al., 2019). Odudu, et al., (2019) classified the ownership as a family-owned business and managed by the family or family-owned business with external ownerships and the majority of the ownership is for family owners, or the third group is the family-owned but managed by external staff. The results of the authors were divided into two groups. The first group found that there is an effect of the family-owned corporates on the quality of auditing, while the other group found negative effects. Al-Okaily & Naueihed (2019) showed that the type, size, and experience of management of corporates affect the financial performance of the corporates. These characteristics affect positively the non-family corporates, while in family-owned corporates the effect was negatively related to the decisions related to family management. Charbel, et al., (2013) showed that in Lebanese, the financial performance of family-owned businesses is less effective compared to businesses managed by a variety of board members outside families. Beck, et al., (2015) showed that the audit fees did not affect the quality of financial auditing in family-owned corporates. Glaum (2020), also, has shown that the financial reporting in the family-owned businesses was of a high quality due to the commitment to law according to German regulations in family and non-family businesses. Yudha & Singapurwoko (2017) showed that the families-owned corporates are affected through financial performance but these corporates did not have an effect auditing quality of these corporates.

Methodology

The objective of this research is to investigate the effect of corporate ownership and auditors’ experience on the auditing quality of corporates. A questionnaire was used to collect data. The questionnaire is composed of three parts. The first part concerned with the collection of demographic characteristics of auditors. The second part is designed to collect information about the view of business owners of auditing, while the third part is designed to collect information about the effect of auditors' experience in the quality of auditing output. A simple random sample was selected using 400 auditors. A pilot survey was conducted to measure the validity and reliability of the questionnaire. The pilot sample included 30 auditors outside the original sample. The collected notes and feedback was reflected in the questionnaire before the distribution of the last form. The reliability analysis was performed using Cronbach’s alpha. The results of the reliability analysis showed that Cronbach’s alpha value exceeds the acceptable limit 0.6 (Hair et al., 2007) (Table 1).

| Table 1 Reliability Analysis Using Cronbach’s Alpha |

|

|---|---|

| Variable | Alpha value |

| Ownership | 0.92 |

| Selection of auditors’ criteria | 0.89 |

| Interference with the auditing team | 0.76 |

| Interference with financial statement output | 0.81 |

| Independency concepts awareness | 0.82 |

| Auditors’ intendency | 0.92 |

| Independency evaluation | 0.65 |

| Corporate type of ownership | 0.74 |

| Size of corporate | 0.83 |

| Procedures to approve final financial statements | |

The collected data were entered into SPSS (Version 21) for analysis. Frequencies and percentages were used to find the demographic characteristics of the sample. Mean and standard deviations were used to measure the trends of auditors for the effect of family ownership on the quality of auditing in family corporates. The inferential statistics were used to test the effect of demographic statistics on the attitudes of auditors for the effect of family ownership and auditors' independence on auditing quality.

Results and Discussion

Demographic Characteristics of the Sample

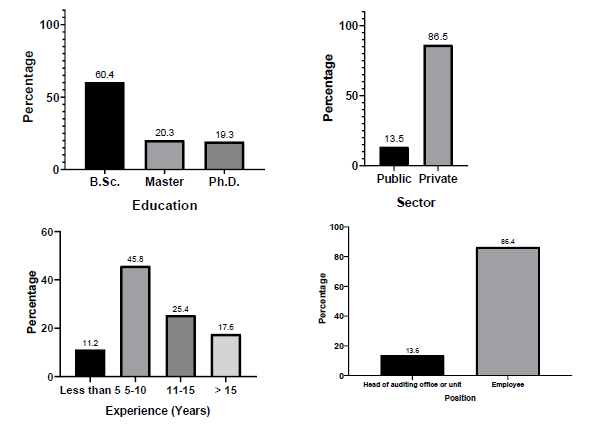

The results showed that the highest percentage of the sample has a bachelor's degree (60.4%), while the second education level was for the master's degrees (20.3%) and the least for the Ph.D. degree (19.3%). Concerning the sector of work, the results showed that both the private sector (80.5%) and public sector (13.5%).

The results showed that the experience category was for the experience 5 years-10 years (45.9%), followed by the experience category 11 years-15 years (25.4%) followed by the experience more than 15 years (17.5%), and the least was recorded for the experience category less than 5 years (11.2%). The sample included both head of auditing units or audit offices (13.6%) and employees of auditing 86.4%). The variety among the sample will give a good

impression of the effect of family-owned businesses on auditing quality.

Evaluation of Family-Owned Corporates on Auditing Quality

Selection of Auditors’ Criteria

The results showed that the family owners' corporates interfere with the selection of auditors’ criteria (m=3.38, st. dev.=0.81). This reflects that the family-owned corporates care for finding the required criteria for the auditors they need to avoid any auditing conflicts in the future. The highest interference for family owners corporates to assign or refuse any auditors for their company accounting system (m=3.63, st. dev.=1.07). Family owners corporates search for auditors that satisfy their needs (m=3.55, st. dev.=1.05). This indicates that the family-owned companies seek the use of auditors that satisfy their needs in reflecting the financial position of the company. This will facilitate tax evasion or the introduction of unreal information about the financial position of the corporate for the external concerned bodies. The results showed that the family owners corporate for the cost of auditing services was less (m=3.29, st. dev.=0.96). This indicates that the corporates prefer finding auditors that serve their needs moreover the cost of auditing cost. Also, the results showed that family owner corporates introduce some information about their needs which may give some direction for the auditors of the corporate needs (m=3.29, st. dev.=0.90). The least agreement was for the preference of auditors that meet the complete needs of corporate (m=3.15, st. dev.=0.96). The positive mean of that indicates that some respondents agreed that some corporates may introduce such interference.

Interference with the Auditing Team

The response for the interference with the auditing team was positive (m=3.76, st. dev.=0.81). The results showed that family owners give guidance about their position they to show (m=3.89, st. dev.=095). This indicates that family owners’ corporates try to interfere with auditors' work by raising some financial points. The results showed that the family owners’ corporates may supervise each stage of financial auditing (m=3.85, st. dev.=0.99). The results showed that the family-owned corporates interfere with a different stage of auditing (m=3.77, st. dev.=0.98). Also, in the family-owned corporates, their accounting employees interfere with the auditing process according to their managers' guidance (m=3.65, st. dev.=0.96). The least positive agreement was for the permissions gave to the accountants of the family-owned corporates before they cooperated with auditing teams (m=3.62, st. dev.=0.93).

Interference with Financial Statements Outputs

The results showed positive attitudes of family-owned corporates interfere with the financial statements outputs (m=3.73, st. dev.=0.95). The highest behavior is concerned with their agreement for the final financial statements (m=4.06, st. dev.=1). The final statements were revised by the financial staff at the corporates before its issue and approval (m=3.86, st. dev.=1.04). The positive agreement decreased for the ask for modifications in financial statements (m=3.65, st. dev.=1.01). The family owners’ corporates take into consideration the tax payments (m=3.55, st. dev.=0.95). The owners prefer the raise of some financial business position to show their success (m=3.52, st. dev.=0.97).

Independency Concepts Awareness

The results showed that the evaluation of independence concepts awareness positive (m=3.47, st. dev.=0.81). The highest agreement was for the realization of limitations between the auditors and the corporates (m=3.89, st. dev.=0.95) and family owners’ corporates believe that financial auditing is a sharing effort (m=3.85, st. dev.=0.99). The least positive agreement was for the realization of the complete independence of the auditors (m=3.37, st. dev.=1.07). The previous results agreed with Odudu, et al., (2019) who found that family-owned corporates affect the quality of auditing. These results were approved in Nigeria (Odudu et al., 2019), Lebanon (Charbel et al., 2013), and Jordan (Alkilani et al., 2019; Alqatamin, 2018). Although the results of this research agreed with these findings, still the auditors showed that they tried to resist this interference to reach their independence.

| Table 2 Auditors’ Attitudes for The Effect of Family Ownership on Auditing Quality |

||

|---|---|---|

| Item | Mean | St. Dev. |

| Selection of auditors’ criteria | 3.38 | 0.81 |

| The family owners’ corporates have the right to assign or refuse the auditors for their financial accounts |

3.63 | 1.07 |

| The family owners search for auditors that satisfy their needs | 3.55 | 1.05 |

| The family owners search for the cheapest prices for their auditing needs | 3.29 | 0.96 |

| The family owners corporates prefer the auditors that meet their needs to raise their financial positions |

3.15 | 0.96 |

| Family owners give their conditions for the auditors before hiring them | 3.29 | 0.90 |

| Interference with auditing team | 3.76 | 0.81 |

| Family owners give guidance about their financial position they need to show | 3.89 | 0.95 |

| The family owners supervise every stage of financial auditing | 3.85 | 0.99 |

| The family owners revise the results of each stage of auditing | 3.77 | 0.98 |

| Family owners guide their accountants in the way they need them to cooperate with auditors |

3.65 | 0.96 |

| Accountants take permissions before they provide auditors with any financial data | 3.62 | 0.93 |

| Interference with financial statements output | 3.73 | 0.95 |

| The family owners should agree about the final financial statements of the corporate | 4.06 | 1.00 |

| Family owners ask their accountants to revise the components of financial statement | 3.86 | 1.04 |

| Family owners ask for modifications on final financial statements before finalizing | 3.65 | 1.01 |

| Family owners ask the auditor to take into consideration the taxes amounts in the financial statements |

3.55 | 0.95 |

| Financial statements are the road for family owners to approve their success | 3.52 | 0.97 |

| Intendency concepts awareness | 3.47 | 0.81 |

| Family owners realize the complete independence of auditors | 3.37 | 1.07 |

| Family owners realized that any interference with auditors is a break of law | 3.26 | 0.97 |

| Family owners care for their benefits over the tendency of auditors | 3.00 | 0.95 |

| The independency limitation is that both corporate and auditor from different bodies and have the same mutual benefits |

3.89 | 0.95 |

| Family owners believe that financial auditing is a sharing effort | 3.85 | 0.99 |

Auditors Evaluation of Auditors’ Independence in Case of Family-Owned Corporates

Independency Evaluation in Family-Owned Corporates

The results showed that auditors seek their independence in family-owned corporates (m=3.73, st. dev.=0.91). Auditors believe that the job of corporate is to provide the required information only (m=4.06, st. dev.=1.00). Also, the auditors' concern for the customers more than the independency (m=3.86, st. dev.=1.04). The auditors believe that independence is something rational to achieve (m=3.65, st. dev.=1.01). The auditors prefer their independence over the reserving customers (m=3.55, st. dev.=0.95). and the least was for the independency and benefits are two faces of one coin (m=3.52, st. dev.=0.97).

The Effect of Corporate Ownership on Auditor Independence

The results showed that corporate ownership affects the extent of auditors' independence (m=3.30, st. dev.=0.91). The results showed that auditors care for the type of ownership of the corporate (m=3.51, st. dev.=0.95). Also, auditors deal differently according to the corporate type of ownership (m=3.38, st. dev.=0.91). The selection of auditors to follow up family ownership corporate meets the needs of these corporates (m=3.22, st. dev.=0.98). Also, auditors insist on the application of fit procedures despite the type of ownership of corporate (m=3.22, st. dev.=1.05. The least agreement was for auditors care for the disclosure and clear financial statement despite the type of ownership (m=3.18, st. dev.=0.86).

The Effect of Size of the Family-Owned Corporate on Independency

The family-owned corporate size affects the extent of independence of auditors (m=3.26, st. dev.=0.91). The results showed that the size of a corporation is the auditor decision (m=3.89, st. dev.=0.95). The auditors showed that they care for the ethics more than the size of the corporate (m=3.14, st. dev.=0.98). The auditors showed that in large size corporates the auditors have more independence compared to medium and small ones (m=3.12, st. dev.=0.99). The auditors care for the charges over any other considerations (m=3.11, st. dev.=0.90). The auditors refuse any interference of family owners despite the size of the corporate (m=3.06, st. dev.=0.88).

Procedures to Approve Final Financial Statements

The results showed that auditors care for the procedures to approve the final financial statements (m=3.60, st. dev.=0.93). The auditors approve that the final financial statements should be approved according to their findings (m=3.85, st. dev.=0.99). In case of any external interference, the auditor insists on reporting the right information (m=3.77, st. dev.=0.98). Also, auditors showed that they approve financial statements away from any external interference (m=3.65, st. dev.=0.96) and their role is to satisfy the customers’ expectations in family-owned business (m=3.62, st. dev.=0.93). The least agreement was that the auditor receives interference from other audition owners to make changes to final financial statements (m=3.12, st. dev.=1.11).

These results agreed with Yudha & Sigapurwoko (2017) who showed that the auditors seek their independence and they seek commitment to career ethics and local laws. Although the results showed the insist of independence, still auditors face problems to reach complete independence in family-owned corporates.

| Table 3 AUDITORS’ ATTITUDES FOR THE EFFECT OF AUDITORS’ INDEPENDENCY ON AUDITING QUALITY |

||

|---|---|---|

| Item | Mean | St. Dev. |

| Independency evaluation in family owning corporates | 3.73 | 0.91 |

| Auditors believe that the job of corporate is to provide the required information only | 4.06 | 1.00 |

| Auditors concern for the customers more than the independency | 3.86 | 1.04 |

| Auditors believe that independency is something rational to achieve | 3.65 | 1.01 |

| Auditors prefer independency over the reserving customers | 3.55 | 0.95 |

| The independency and benefits are two faces of one coin | 3.52 | 0.97 |

| Corporate type of ownership | 3.30 | 0.91 |

| Auditors care for the type of ownership of the corporate | 3.51 | 0.95 |

| Auditors deal differently according to the corporate type of ownership | 3.38 | 0.91 |

| The selection of auditors to follow up family ownership corporate meets the needs of these corporates |

3.22 | 0.98 |

| Auditors insist on the application of fit procedures despite the type of ownership of corporate |

3.22 | 1.05 |

| Auditors care for the disclosure and clear financial statement despite the type of ownership |

3.18 | 0.86 |

| Size of corporate | 3.26 | 0.91 |

| The auditors care to apply the right procedures away of the corporate size | 3.14 | 0.98 |

| In large size corporates, the auditors have more independency compared to medium and small ones |

3.12 | 0.99 |

| Auditors care for the expenses over any other considerations | 3.11 | 0.90 |

| Auditors refuse any interference of family owners despite the size of corporate | 3.06 | 0.88 |

| Auditors determine the size of corporates they will deal with | 3.89 | 0.95 |

| Procedures to approve final financial statements | 3.60 | 0.93 |

| Auditors approve the final financial statements according to their findings | 3.85 | 0.99 |

| In case of any external interference, the auditor insists on reporting the right information | 3.77 | 0.98 |

| Auditors approve financial statements away of any external interference | 3.65 | 0.96 |

| Auditors role is to satisfy the customers' expectations in the family-owned business | 3.62 | 0.93 |

| Auditor receive interference from other audition owners to make changes to final financial statements |

3.12 | 1.11 |

The Effect of Education and Experience on Evaluating Family Owners Effect on Auditing Quality

The results showed that the views of the auditors for the evaluation of the quality of auditing in family-owned corporates were affected by the education level of auditors (prob=0.001). The highest effect was for the bachelor educational level (m=4.01), while the least was for the master level (m=3.21). Also, the results showed that the evaluation was affected by the experience of the auditors (prob=0.001). The highest agreement was for the experience that exceeded the 15 years in auditing career, while the least agreement was for the least experience less than five years. These results may reflect that the high educational levels and the high experience level have more experience with the deal with family-owned corporates and face more conditions of interference of the low experienced auditors.

| Table 4 | ||||

|---|---|---|---|---|

| The Effect of Education and Experience on The Evaluation of Family Owners Effect on Auditing Quality |

||||

| Character | Mean | St. Dev | t-value | Prob. |

| Education | ||||

| B.Sc. | 4.01 | 1.01 | 5.61 | 0.001 |

| Master | 3.21 | |||

| Ph.D. | 3.53 | |||

| Experience | ||||

| Less than 5 years | 3.21 | 01.06 | 4.31 | 0.001 |

| 5-10 years | 3.56 | |||

| 11-15 years | 3.68 | |||

| > 15 years | 3.91 | |||

The Effect of Education and Experience on Evaluating the Auditors' Tendency on Auditing Quality The results showed that the educational level and the experience did not affect the evaluation of the independence of the auditors. This indicates that whatever the education or the experience the auditor role should be practiced without any external interference or changing of facts as it affects the auditors negatively and the auditing office in general.

| Table 5 The Effect of Education and Experience on The Evaluation of The Auditors' Independence on Auditing Quality |

||||

|---|---|---|---|---|

| Character | Mean | St. Dev | t-value | Prob. |

| Education | ||||

| B.Sc. | 3.71 | 0.62 | 2.10 | 0.56 |

| Master | 3.31 | |||

| Ph.D. | 3.42 | |||

| Experience | ||||

| Less than 5 years | 3.61 | 0.71 | 1.98 | 0.86 |

| 5-10 years | 3.41 | |||

| 11-15 years | 3.42 | |||

| > 15 years | 3.46 | |||

Conclusions and Recommendations

The objective of this research is to investigate the effect of family-owned corporates on the quality of auditing in these corporates according to the views of auditors. The questionnaire was used to collect data. The study is concerned with the evaluation of auditors of the interferences of family-owned corporates in the output of the auditing process as well as the extent of independence the auditors have in family-owned businesses. The results showed that family-owned corporates care for the type of outputs of the auditing processes and they prefer those that meet their needs internally and externally. The results showed that family owners corporates care for the cooperative auditors more than the costs of auditing to reach their objective. Moreover, the results showed that in family-owned businesses the management interferes with the final financial statements as well as the cooperation between the auditors and their internal accounting systems. The results also showed that auditors care for their independence. They showed that the size of the family-owned corporates affects the extent of independence the auditors have. In the large family-owned corporates the interference is higher than in small and medium corporates. The interference of the final financial output is one of the targets of management of family-owned corporates, but the results showed that the auditors refuse any interferences of the final outputs.

Future Research

The study recommended the study of auditing ethics and its application in the auditing of family-owned corporates. The study should consider the view of both the auditors and family business owners. The study of both parties will facilitate reaching the contradictions existed between the two points of view and facilitates reaching conclusions about the optimal procedures of auditing performance in such type of corporates.

References

- Al-Okaily, J., & Naueihed, S. (2019). Audit committee effectiveness and family firms: Impact on performance.

- Management Decision, 58(6), 1021–1034.

- Aljaaidi, K.S., & Bagais, O.A. (2021). The effect of company performance on audit committee diligence: The case of manufacturing companies in Saudi Arabia. Accounting, 7(2), 391–394.

- Alkilani, S., Hussin, W.N.W., & Salim, B. (2019). Impact of ownership characteristics on modified audit opinion in jordan. International Journal of Accounting, Finance and Risk Management, 4(3), 71-74

- Alqatamin, R.M. (2018). Audit Committee Effectiveness and Company Performance: Evidence from Jordan.

- Accounting and Finance Research, 7(2), 48-52.

- Beck, F., Roberto, P., Beck, F., & Roberto, P. (2015). Audit fees: an analysis of the and nonfamily and family business listed on BM&FBovespa. Revista Brasileira de Gestão De Negócios, 17(54), 719–735..

- Charbel, S., Elie, B., & Georges, S. (2013). Impact of family involvement in ownership management and direction on the financial performance of the Lebanese firms. International Strategic Management Review, 1(1–2), 30– 41.

- Glaum, M. (2020). Financial Reporting in Non-listed Family Firms: Insights from Interviews with CFOs.

- Schmalenbach Business Review, 72(2), 225–270.

- Hair, J., Celsi, M., Money, A., & Samouel, P. (2007). The essentials of Business Numeracy. John Wiley & Sons. Iswadi, Musnadi, S., & Faisal. (2016). The family firm’s performance: a literature review. Proceedings of The 6

- Annual International Conference Syiah Kuala University (AIC Unsyiah) in Conjunction with The 12 International Conference on Mathematics, Statistics and Its Application (ICMSA) 2016, 274–278.

- Odudu, A.S., Okpanachi, J., & Yahaya, A.O. (2019). Family and foreign ownership and audit quality of listed manufacturing firms in nigeria. Global Journal of Management And Business Research, 19(1), 68–79.

- Shahzad, F., Rauf, S., & Javid, A. (2017). An investigation of economic consequences of family control and audit quality of firms: A case study of pakistan. Pakistan Journal of Applied Economics, 27(2).

- Suprianto, E., & Setiawan, D. (2020). Accrual earning management and future performance: Evidence from family firm in Indonesia. Jurnal Akuntansi & Auditing Indonesia, 24(1), 33–42.

- Widani, N.A., & Bernawati, Y. (2020). Effectiveness of corporate governance and audit quality: the role of ownership concentration as moderation. Etikonomi, 19(1), 131–140.

- Yudha, D.P., & Singapurwoko, A. (2017). The effect of family and internal control on family firm performance: Evidence from Indonesia Stock Exchange (IDX). Journal of Business and Retail Management Research, 11(4), 68–75.

- Yustina, A.I., & Santosa, S. (2020). How work family conflict, work-life balance, and job performance connect: