Research Article: 2019 Vol: 22 Issue: 5

The Effect of Entrepreneurial Orientation on SMEs Business Performance in Indonesia

Erna Herlinawati, STIE Indonesia Membangun, Universitas Pendidikan Indonesia

Suryana, Universitas Pendidikan Indonesia

Eeng Ahman, Universitas Pendidikan Indonesia

Amir Machmud, Universitas Pendidikan Indonesia

Citation Information: Herlinawati, E., Suryana., Ahman, E., & Machmud, A. (2019). The effect of entrepreneurial orientation on SMEs business performance in Indonesia. Journal of Entrepreneurship Education, 22(5).

Abstract

This study aims to analyze the effect of entrepreneurial orientation on business performance. Entrepreneurial orientation is measured through innovativeness, proactiveness, risk taking, and aggressiveness, while business performance is measured through the Balanced Scorecard perspective.

The research method uses explanatory methods with data collection techniques through questionnaires and interviews. Population is SMEs in the manufacturing industry sector in West Java, Indonesia measuring 203,181 with proportional random sampling technique obtained by sample 346 SMEs. The data that has been collected is then analyzed using a Likert scale system, descriptive syllogism analysis and Structural Equation Modeling (SEM).

The results showed that entrepreneurial orientation in all dimensions (innovativeness, proactiveness, risk taking, and aggressiveness) tended to be low. Likewise with business performance (perspective: financial, customers, internal business processes, learning and growth) are at a level that tends to be low, which illustrates entrepreneurial orientation positively influences business performance.

The implication of this research is that the lack of development of the desire of SMEs actors to seek business opportunities and become leaders in an increasingly dynamic business environment, if not allowed to hinder the growth of business performance, also weakens competitiveness so that SMEs products are not marketable. This finding implies, to improve business performance, SMEs players in running their businesses are always entrepreneurial oriented.

Keywords

Entrepreneurial Orientation, Business Performance, SMEs

Introduction

Entrepreneurial orientation is the tendency of individuals to innovate, be proactive and willing to take risks to start or manage a business (Lumpkin & Dess, 1996; Covin & Slevin, 1993; Cogliser et al., 2008). Entrepreneurial orientation is important because it deals with creative and innovative abilities and resources to find opportunities for business success. Entrepreneurship-oriented companies tend to behave innovatively, take risks and are proactive (Miller, 1983; Lumpkin & Dess, 1996, 2001; Covin & Slevin, 1988).

Business performance is the level of achievement or achievement of a company in a certain period of time. Business performance is an measure to determine the extent to which business activities are carried out precisely on the goals or objectives. Business performance with the Balanced Scorecard concept using balance measurement of financial and non-financial aspects with four perspectives: financial, customers, internal business processes, growth and learning (Kaplan & Norton, 1992, 1996; Neely, 2004).

Entrepreneurial orientation is an important attribute for a company in improving performance (Covin & Slevin, 1989; Lumpkin & Dess, 1996; Lee & Peterson, 2000). The results of research on entrepreneurial orientation in general using dimensions of innovativeness, proactiveness and risk taking as factors that influence business performance. Empirical findings also show that entrepreneurial-oriented companies have better performance than companies that are not entrepreneurial oriented (Covin & Slevin, 1990; Covin et al., 2006).

The existence of increasingly fierce competition due to the business environment that is experiencing rapid changes has forced business people to think of the best steps to win the competition. Efforts to empower SMEs are not limited to the local market but must be brave and ready to face the global market.

The majority of Indonesia's manufacturing sector SMEs are still concentrated in the local market. SMEs products with low innovation with less developed production are feared to threaten business continuity. The difficulty of product marketing including the lack of market information, mastery of technology and networks causes SMEs to not survive. The low ability to manage finances, including bookkeeping, also triggered bankruptcy. The majority of SMEs do not separate business capital from personal money (Herlinawati et al., 2017; Machmud, 2009).

This condition has an impact on unpreparedness to face competition in the global market. The growth of SMEs in the manufacturing industry sector is still constrained by various problems that hinder the success of SMEs businesses in Indonesia. This condition is thought to be strong triggered by the character of a weak entrepreneur; the managerial role that has not been strong in managing the business is also the low level of innovation while the business environment continues to change.

The potential of SMEs is not balanced with the ability to improve performance and competitiveness in local and global markets. The researchers explained that the inability of SMEs due to constraints with various classic problems of limited capital and access to capital to formal financial institutions such as banking also had difficulty adapting to a dynamic environment, less aggressive in seeking business opportunities, less creative and innovative in facing various business challenges (Machmud & Ahman, 2019; Machmud et al., 2018).

SMEs to create new opportunities as well as being able to implement management functions in accordance with the concept of entrepreneurial orientation (entrepreneurial orientation will be more flexible in acting and always motivated to continually innovate, risk taking, and proactiveness (Walter et al., 2006).

This study aims to analyze the effect of entrepreneurial orientation on business performance. Entrepreneurial orientation is measured through innovativeness, proactiveness, risk taking, and aggressiveness, while business performance is measured through the Balanced Scorecard perspective. The research method uses explanatory methods with data collection techniques through questionnaires and interviews. Population is SMEs in the manufacturing industry sector in West Java, Indonesia measuring 203,181 with proportional random sampling technique obtained by sample 346 SMEs. The data that has been collected is then analyzed using a Likert scale system and Structural Equation Modeling (SEM). This finding implies, to improve business performance, SMEs players in running their businesses are always entrepreneurial oriented.

Literature Review

The construct of entrepreneurial orientation refers to corporate behavior is defined as:

1. Characteristics at the company level because it reflects company behaviour.

2. The tendency of top management to take calculated, innovative and proactive shows (Miller, 1983 Covin & Slevin, 1989; Morris and Paul, 2007; Fayolle, 2007).

3. The tendency of individuals to innovate, be proactive and willing to take risks to start or manage businesses (Miller, 1983; Lumpkin & Dess, 1996; Knight, 2001; Moris & Paul, 2007).

Specific dimensions of entrepreneurial orientation consisting of three dimensions, namely innovativeness, proactiveness, and risk taking (Miller, 1983). Innovativeness is the willingness to introduce newness and something new through a process of experimentation and creativity aimed at developing new products and services and new processes. Proactiveness is a forward-looking perspective characteristic that has a foresight to look for opportunities in anticipation of future requests. Risk Taking is the willingness of the company to decide and act without definitive knowledge of the possibility of income and may speculate in personal, financial and business risks (Miller, 1983; Morris and Paul, 1987; Covin & Slevin, 1989; Naman & Slevin, 1993; Lumpkin & Dess, 1996; Narver & Slater, 2000; Vitale et al., 2003; Wiklund & Shepherd, 2005; Boso et al., 2013; Suryana, 2014).

Another dimension of entrepreneurial orientation is broad autonomy in decision making, and has aggressiveness in pursuing its superior position in business competition comes from Lumpkin & Dess, (1996). Similarly Narver & Slater (2000) and Boso et al. (2013) add Ambition/Competitive Aggressiveness and add Autonomy (Boso et al., 2013). Other dimensions include: Entrepreneur's achievement motivation/Need for achievement (Littunen, 2000; Lee & Tsang 2001); Locus of Control (Littunen, 2000; Lee & Tsang, 2001); Self-Reliance and Extroversion (Lee & Tsang, 2001).

In the context of SMEs, most studies predominantly use three dimensions of entrepreneurial orientation, namely: innovativeness, proactiveness, and risk taking. (Covin & Slevin, 1989; Naman & Slevin, 1993; Tang et al., 2008; Wiklund & Shepherd, 2003). Covin & Slevin, (1989), found that entrepreneurial-oriented companies tend to behave innovatively, dare to take risks and be proactive. Researchers add dimensions from Lumpkin & Dess, (1996), namely aggressiveness by considering one of the structural weaknesses of less aggressive Small and Medium Enterprises pursue his superior position in business competition.

Business performance constructs are defined as:

1. The level of achievement or achievement of a company in a certain period of time.

2. The results or level of success or overall success rate of the company during a certain period of business processes.

3. An measure to determine the extent to which business activities are carried out precisely on the goals or objectives (Johnson & Kaplan, 1987; Jauch & Glueck, 1988; Lin & Kuo, 2007).

Business performance is measured using the Balanced Scorecard concept includes four perspectives:

1. Financial Perspective.

2. Customer Perspective.

3. Internal Business Process Perspective.

4. Learning and Growth Perspective (Kaplan & Norton, 1992, 1996; Neely, 2004).

Business performance in this study was measured using the Balanced Scorecard concept. The use of these perspectives is to distinguish the concept of measuring business performance especially in the development and empowerment of SMEs which have been measured based on financial perspectives.

Entrepreneurial orientation has been suggested as an important attribute for a company in improving performance (Covin & Slevin, 1989; Lumpkin & Dess, 1996; Dess et al. 1997; Lee & Peterson, 2000). Entrepreneurial orientation refers to Management strategies are related to innovativeness, proactiveness, and risk taking (Miller, 1983; Covin & Slevin, 1989; Lumpkin & Dess,, 1996). The study findings that entrepreneurial orientation (innovativenes, proactiveness, and risk taking) are factors that influence company performance (Miller, 1983; Covin & Slevin, 1989; Rauch et al., 2009).

Empirical findings also show that entrepreneurial-oriented companies have better performance than companies that are not entrepreneurial oriented (Covin & Slevin, 1989; Lee & Lim, 2009; Wiklund & Shepherd, 2005; Rauch et al., 2009; Fairoz et al., 2010; Callaghan & Venter, 2011; Campos et al., 2012; Amin, 2015; Deepa Babu & Manalel, 2016; Ajayi, 2016; Wardi, 2017).

Other findings indicate a weak relationship between entrepreneurial orientation and company performance (Zahra, 1991; Lumpkin & Dess, 2001), specifically innovation and risk taking (Kraus et al., 2012). Green et al. (2008) and Effendi et al. (2013) did not find a positive relationship between entrepreneurial orientation and SMEs performance. Likewise with the findings of Frank et al. (2010) that entrepreneurial orientation has a negative relationship with business performance.

Research Framework and Hypothesis

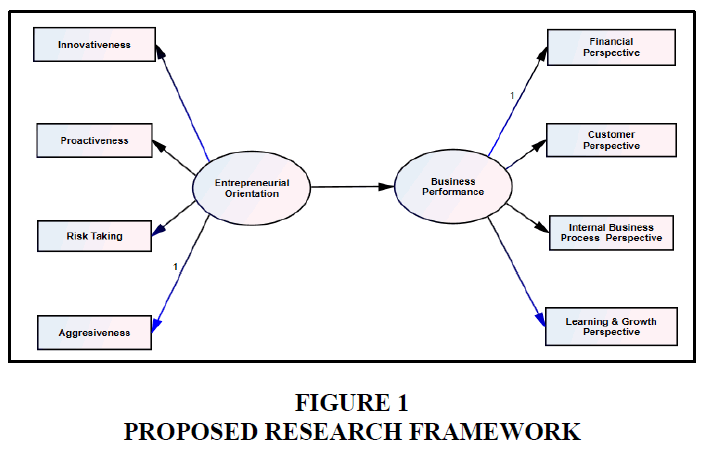

The research framework was built to determine the effect of entrepreneurial orientation on business performance in reference to previous relevant research. The model proposed in this study is shown in Figure 1.

To determine the effect of entrepreneurial orientation on business performance, the hypothesis developed is as follows:

H1: Entrepreneurial orientation influences business performance

Research Methodology

The Quantitative explanatory survey methods are used to test the proposed research hypothesis. The results of the questionnaire from 346 SMEs in the manufacturing industry sector were carried out descriptive analysis to measure respondents' perceptions of the dimensions of entrepreneurial orientation and business performance. Data analysis used structural equation modeling (SEM) AMOS 22.0 to analyze data and test the proposed hypothesis, and evaluate whether entrepreneurial orientation is an important attribute for a company in improving performance (Covin & Slevin, 1989; Lumpkin & Dess, 1996, Lee & Peterson, 2000).

To collect data, the researcher used the research instrument in the form of a questionnaire filled in by the owner/manager of the SMEs and also the interviews. Overall there are 346 responses that can be used for further analysis. The questionnaire consists of two parts:

1. General information about the identity of respondents and the identity of SMEs.

2. Perceptions of respondents to entrepreneurial orientation and business performance as many as 24 questions, using a 1-5 Likert scale.

Number 5 is interpreted very positive/very high; number 4 is high; number 3 is interpreted as lacking; number 2 is interpreted low; and number 1 means more negative/very low for the question item. The measurement of entrepreneurial orientation in this study consisted of 16 items, with dimensions adopted from Miller (1983), and Lumpkin & Dess, (1996). Whereas to measure business performance using the concept of balance scorecard developed by Kaplan & Norton (1992, 1996, 2006) and Neely (2004, 2007).

Questionnaire quality testing was conducted to improve the quality of data collection in two steps:

1. Content validity shows a sign value <0.05, including valid categories so that all items can be accepted.

2. Reliability using Cronbach's alpha, produces a value greater than 0.70 including the reliable category so that all question items can be used for further analysis (Table 1).

| Table 1 Variables and Questionnaire Constructs | |

| Variable/Dimension | Questionnaire Construct |

| ENTREPRENEURIAL ORIENTATION | |

| Innovativeness (X1) | |

| Q 1 | The level of discovery of new ideas |

| Q 2 | Frequency of trying new ways of doing business |

| Q 3 | The level of technological renewal |

| Q 4 | New market discovery rate |

| Proactiveness (X2) | |

| Q 5 | The level of activity in pursuing business opportunities |

| Q 6 | The level is responsive to changes in customer demand |

| Q 7 | The level of activity in finding business information |

| Q 8 | The level of speed of finding a business partner |

| Risk Taking (X3) | |

| Q 9 | Risk level of courage when entering new markets |

| Q 10 | Risk level of courage when launching new products |

| Q 11 | The level of courage is risky when trying new ways of marketing |

| Q 12 | Level of strategic plan readiness to minimize the risk of failure |

| Aggresiveness (X4) | |

| Q 13 | Aggressive level in competing |

| Q 14 | The level of aggressiveness is expanding the market |

| Q 15 | The level of aggressiveness responds to change |

| Q 16 | Level of aggressiveness in modifying the product |

| BUSINESS PERFORMANCE | |

| Financial Perspective (Y1) | |

| Q17 | Sales Growth Rate |

| Q18 | Operating Profit Growth Rate |

| Customer Perspective (Y2) | |

| Q19 | Customer retention rate |

| Q20 | Level of customer acquisition |

| Internal Business Process Perspective (Y3) | |

| Q21 | The level of efficiency in the company's operations |

| Q22 | The level of change in product development |

| Learning and Growth Perspectives (Y4) | |

| Q23 | The level of change in employee specific skills |

| Q24 | Employee performance growth rate |

Results and Discussion

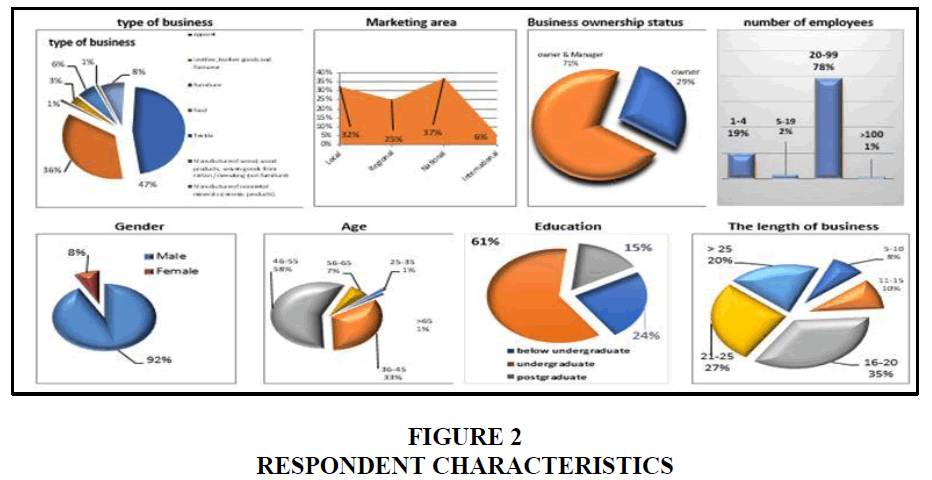

The characteristics of the respondents in this study are shown in Figure 2 with 346 samples, the respondents' efforts are mostly in the field of apparel production, and the most marketing area is at the national level (37%). Based on ownership status, the majority are owners and managers (71%), and based on the highest number of employees between 20-99 people (78%). The SMEs are dominated by men (92%). The largest group of respondents (58%) are aged between 46-55 years. Furthermore, based on the level of education the majority of respondents were undergraduate educated (61%), then the length of time they did business, at most 16-20 years (35%).

Descriptive analysis in this study was conducted by determining the trend level of% frequency score. If the % frequency score of 1.2 and 3 is more than 50%, then it means that it tends to be low. If the % frequency score of 4 and 5 is more than 50%, then it means that it tends to be high. The description of entrepreneurial orientation with dimensions of innovativeness, proactiveness, risk taking and aggressiveness can be described in terms of levels, as in Table 2.

| Table 2 Response of SMEs to Entrepreneurial Orientation | |||||

| No | Dimension | % Frequency of scores | Achievements Criteria |

||

| F1+F2+F3 | F4+F5 | ||||

| Innovativeness | 56.72 | 43.28 | Tend to be low | ||

| 1 | The level of discovery of new ideas | 58.10 | 41.90 | Tend to be low | |

| 2 | Frequency of trying new ways of doing business | 51.16 | 48.84 | Tend to be low | |

| 3 | The level of technological renewal | 58.96 | 41.84 | Tend to be low | |

| 4 | New market discovery rate | 58.67 | 41.33 | Tend to be low | |

| Proactiveness | 60.77 | 39.23 | Tend to be low | ||

| 5 | The level of activity in pursuing business opportunities | 65.02 | 34.98 | Tend to be low | |

| 6 | The level is responsive to changes in customer demand | 62.43 | 37.57 | Tend to be low | |

| 7 | The level of activity in finding business information | 59.25 | 40.75 | Tend to be low | |

| 8 | The level of speed of finding a business partner | 56.36 | 43.64 | Tend to be low | |

| Risk Taking | 56.87 | 43.13 | Tend to be low | ||

| 9 | Risk level of courage when entering new markets | 64.45 | 35.55 | Tend to be low | |

| 10 | Risk level of courage when launching new products | 50.29 | 49.71 | Tend to be low | |

| 11 | The level of courage is risky when trying new ways of marketing | 54.92 | 45.08 | Tend to be low | |

| 12 | Level of strategic plan readiness to minimize the risk of failure | 57.80 | 42.20 | Tend to be low | |

| Aggresiveness | 56.07 | 43.93 | Tend to be low | ||

| 13 | Aggressive level in competing | 54.05 | 45.95 | Tend to be low | |

| 14 | The level of aggressiveness is expanding the market | 56.36 | 43.64 | Tend to be low | |

| 15 | The level of aggressiveness responds to change | 57.52 | 42.48 | Tend to be low | |

| 16 | Level of aggressiveness in modifying the product | 56.35 | 43.65 | Tend to be low | |

| Entrepreneurial Orientation | 57.61 | 42.39 | Tend to be low | ||

Table 2 explains that all dimensions of entrepreneurial orientation are at a low level with a percentage of 59.41%. The percentage score for each dimension can explain that the dimensions that best meet SMEs in entrepreneurial orientation are dimensions of aggressiveness where there are 56.07% of respondents with a low level of aggressiveness and the remaining 43.93% of respondents have a degree of aggressiveness. tend to be high, reflected by aggressiveness in competing indicators, aggressiveness in expanding markets, aggressiveness in responding to market changes, and aggressiveness in modifying products. The dimensions that contribute the highest to the low entrepreneurial orientation are the dimensions of proactivity where there are 60.77% of respondents who tend to be low in pursuing business opportunities, less responsive to changes in customer demand, less active in seeking information and less quick to find profitable business partners.

Business performance in this study was measured using financial perspective, customer perspective, internal business process perspective, and learning and growth perspective, which can be described as the level in Table 3.

| Table 3 Response of SMEs to Business Performance | ||||

| No | Dimension | % Frequency of scores | Achievements Criteria |

|

| F1+F2+F3 | F4+F5 | |||

| Financial Perspective | 73.56 | 26.44 | Tend to be low | |

| 1 | Sales Growth Rate | 73.70 | 26.30 | Tend to be low |

| 2 | Operating Profit Growth Rate | 73.41 | 26.59 | Tend to be low |

| Customer Perspective | 61.71 | 38.29 | Tend to be low | |

| 3 | Customer retention rate | 55.49 | 44.51 | Tend to be low |

| 4 | Level of customer acquisition | 67.92 | 32.08 | Tend to be low |

| Internal Business Process Perspective | 68.80 | 31.20 | Tend to be low | |

| 5 | The level of efficiency in the company's operations | 73.70 | 26.30 | Tend to be low |

| 6 | The level of change in product development | 63.90 | 36,10 | Tend to be low |

| Learning and Growth Perspectives | 66.61 | 33.39 | Tend to be low | |

| 7 | The level of change in employee specific skills | 76.87 | 23.13 | Tend to be low |

| 8 | Employee performance growth rate | 56.35 | 43.65 | Tend to be low |

| Business Performance | 67.67 | 32.33 | Tend to be low | |

Table 3 explains that all dimensions in business performance are at a low level with a percentage of 67.67%. The percentage score for each dimension can explain that the dimension that best meets SMEs in business performance is the customer's perspective where there are 61.71% of respondents with low retention and acquisition rates and the remaining 38.29% of respondents with high retention and acquisition rates, which are reflected with the ability to retain customers and grow new customers. The dimensions that contribute the highest to low business performance are financial perspectives where there are 73.70% of respondents with a low sales growth rate which has an impact on the low growth of operating profit from 73.41% of respondents.

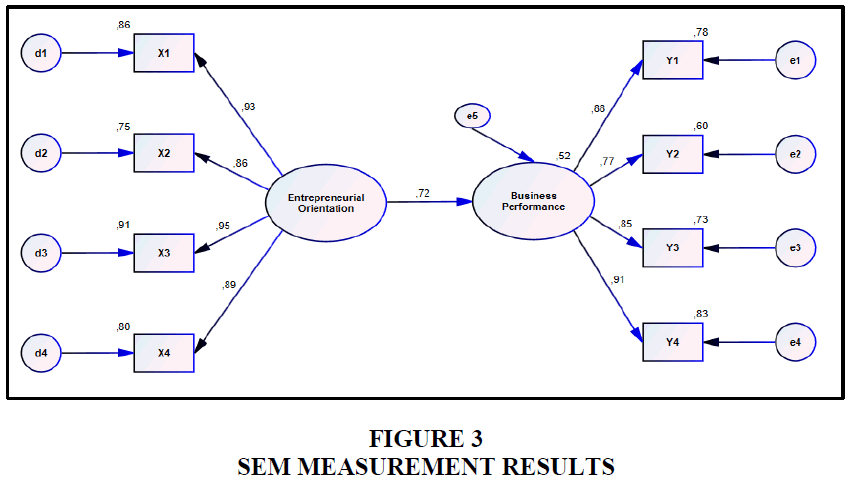

The results of the measurement model test for entrepreneurial orientation and business performance are shown in Figure 3 which shows the value of loading factor (λ) for all manifest variables greater than 0.5. This means indicators are valid in forming endogenous constructs. Then the value of construct reliability (CR) must be above 0.7 and the variance extracted (VE) must be above 0.5 already fulfilled so that it can be concluded that business performance has good construct validity and reliability.

The results of the Goodness of Fit test in Table 4 show not all the sizes of the Goodness of Fit, but refer to Maholtra (2010). It can be concluded that the overall model is fit, because it meets the following requirements: little one size that is absolute good (for example: GFI, AGFI). This has been fulfilled because the value of GFI and AGFI is greater than the cut-off value ≥ 0.90, interpreted as a fit model with data; (2) Use at least one size that is absolute bad (for example: Chi-Square, RMSR, SRMR, RMSEA). This has been fulfilled because the RMSEA value is smaller than the cut-off value of 0.08, which means the fit model with the data, (3) Use at least one comparative measure (for example: NFI, NNFI, CFI, TLI, RNI). This has also been fulfilled because the value of NFI, CFI, TLI is greater than the cut-off value ≥ 0.90, means the model is fit with data.

| Table 4 Goodness of Fit Structural Model Testing | ||||

| No. | Goodness of Fit Index | Cut-off Value | Result | Conclusion |

| 1 | Chi-Square | Chi-square<Table | 352,345>129,803 | Bad Fit |

| 2 | Sign Probability | ≥ 0.05 | 0.000 | Bad Fit |

| 3 | RMSEA | ≤ 0.08 | 0.076 | Good Fit |

| 4 | GFI | ≥ 0.90 | 0.908 | Good Fit |

| 5 | AGFI | ≥ 0.90 | 0.829 | Marginal Fit |

| 6 | RFI | ≥ 0.90 | 0.928 | Good Fit |

| 7 | IFI | ≥ 0.90 | 0.956 | Good Fit |

| 8 | NNFI/TLI | ≥ 0.90 | 0.944 | Good Fit |

| 9 | CFI | ≥ 0.90 | 0.956 | Good Fit |

| 10 | CMIN/df | ≤ 2.00 | 4.195 | Bad Fit |

| 11 | NFI | ≥ 0.90 | 0.943 | Good Fit |

Evaluation of structural model assumptions is carried out through data normality, outliers, and multicollinearity. Normality tests were performed using critical ratios skewness value and kurtosis at a 0.01 level of significance. The output of the data normality in Table 5, it is known not all indicators has a value of critical ratio skewness under 2.58, namely the Y1 indicator has a critical ratio skewness value above 2.58. This means that all observed variables are abnormally distributed. Similarly, the multivariate normality test gives the value c.r. is above the 2.58 value which shows multivariate data that is not normally distributed.

| Table 5 Data Normality | ||||||

| Variable | min | max | Skew | c.r. | Kurtosis | c.r. |

| Y4 | 2.000 | 10.000 | 0.203 | 1.542 | -1.216 | -4.618 |

| Y3 | 2.000 | 10.000 | 0.335 | 2.543 | -1.078 | -4.092 |

| Y2 | 2.000 | 10.000 | -0.166 | -1.263 | -0.857 | -3.256 |

| Y1 | 2.000 | 10.000 | 0.523 | 3.974 | -0.976 | -3.704 |

| X1 | 3.000 | 15.000 | -0.208 | -1.578 | -0.532 | -2.020 |

| X2 | 3.000 | 15.000 | -0.176 | -1.335 | -0.795 | -3.020 |

| X3 | 7.000 | 35.000 | -0.064 | -0.487 | -0.876 | -3.326 |

| X4 | 5.000 | 25.000 | -0.126 | -0.959 | -0.698 | -2.649 |

| Multivariate | 20.537 | 15.100 | ||||

Mahalanobis distance (d2) test is used to test the possibility of multivariate outliers at 0.001 and df=number of observed variables. Testing of multivariate outliers in Table 6 shows the value of the Mahalanobis distance (d2) max<X2, so it is multivariate; there are no cases of outliers in the data.

| Table 6 Data Outliers | ||

| Mahalanobis distance (d2) | ||

| Max | Min | X2 |

| 45.479 | 8.960 | 129.80 |

Multicollinearity evaluation in Table 7 shows that the value of Determinant of sample covariance matrix is greater than zero and Condition number is smaller than 1000, so it can be concluded that there are no multicollinearity and singularity problems in the analyzed data.

| Table 7 Multicollinearity | |

| Determinant of sample covariance matrix |

Condition number |

| 66420.407 | 89.899 |

Based on the results of the assumption evaluation test the data is known to be abnormally distributed but multivariate empirically there are no outliers in the data and sample data sets which still meet the main statistical assumptions, there are no multicollinearity problems. Thus it can be concluded that the sample data set is still feasible to be used in the subsequent analysis.

The results of the hypothesis testing of entrepreneurial orientation on business performance in Table 8 (Standardized Regression Weight/SRW) amounted to 0.345 (positive)>0, indicating that the high and low of business performance is positively influenced by the high and low of entrepreneurial orientation. Significance value on critical ratio 14.432 with probability 0,000 is below 0.05, the null hypothesis can be rejected and alternative hypothesis accepted. This means that entrepreneurial orientation has a positive and significant effect on business performance, so the hypothesis can be accepted.

| Table 8 Results of Estimated Structural Model Parameters | |||||

| Estimate | |||||

| RW | SRW | e | C.R | P | |

| Business Performance ← entrepreneurial orientation | 0.345 | 0.719 | 0.024 | 14.432 | *** |

The magnitude of the influence of entrepreneurial orientation on business performance in Table 9 amounting to 0.5170 explains the magnitude of the influence of entrepreneurial orientation on business performance, meaning that for 51.70% the high and low variations that occur in business performance can be explained by entrepreneurial orientation. The remaining 48.30% is the influence of other variables not explained in the model. This indication shows that the proposed business performance model has been effective in explaining the phenomenon under study (R2>50%).

| Table 9 Effect of Entrepreneurial Orientation on Business Performance | ||

| Effect of Entrepreneurial Orientation on Business Performance | SRW | R2 |

| 0,719 | 0,517 | |

The findings of the study indicate that entrepreneurial orientation has a positive and significant effect on business performance. This finding is in accordance with the findings of Fairoz et al. (2010) who examined the effect of entrepreneurial orientation with proactive dimensions, innovation, and risk taking on business performance which showed a positive correlation between entrepreneurial orientation and business performance. Furthermore, Kraus et el. (2012) examined the effect of entrepreneurial orientation on the performance of small and medium scale companies during the global economic crisis.

The findings indicate a positive relationship between entrepreneurial orientation and performance. This means that the higher the entrepreneurial orientation, the higher the performance of SME businesses in Indonesia. These findings also indicate that to improve the business performance of SMEs, steps are needed to improve their entrepreneurial orientation especially in innovativeness, proactiveness, risk taking, and aggressiveness. By assessing the importance of SMEs Sentra's understanding of entrepreneurial orientation, they must better understand the importance of implementing these behaviors. SMEs must understand the importance of optimizing available resources, both financial and human resources, always taking anticipatory steps towards environmental change and always focused on developing market and products produced. SMEs must be able to create added value in the products produced and always try to provide the best service to customers. In addition, the presence of competitors, both existing and potential competitors, must also be given more attention.

Innovative behavior, proactive behavior and courage in taking business risks play a very important role in supporting the successful application of entrepreneurial orientation behaviors. This provides instructions for SMEs to prioritize innovative behavior, proactive behavior and courage in taking business risks through increasing the ability and skills of resources owned by the organization

Increasing the ability of SMEs innovative behavior, proactive behavior and the courage to take risks can be done in the form of increasing the ability to run a business, the ability of employees to show creative ideas, the ability to open opportunities through market expansion.

Through some form of capacity building, it is expected that the company's performance can be improved. Innovative actions and determining business strategies are very important components to determine business sustainability. Therefore, SMEs must always strive to find ways to market their products or services better, conduct business by producing products or services with different attributes from competitors and utilize technology to produce goods more effectively and efficiently. In addition, it should also be considered to create new business units that can be used to minimize the level of risk that might be received.

Lee & Lim's (2009) findings, that in the context of SMEs, entrepreneurial orientation has a strong relationship with the performance of SMEs because SMEs have the ability to respond quickly to threats and business opportunities. This capability is the basic capital of SMEs to be able to continuously maintain and improve their performance. The entrepreneurial mind-set is needed to find new opportunities as well as rejuvenate existing businesses. This entrepreneurial mind-set is inherent in SMEs. With all the limitations, SMEs tend to be more creative in finding available market opportunities so that they can continue to survive in various conditions. The findings of Narver & Slater (2000) that entrepreneurial orientation has no effect on the performance of large companies. SMEs that are able to survive in business competition if they have entrepreneurial behavior such as activity or are able to respond quickly to threats and take advantage of market opportunities, dare to take risks for business opportunities, also continue to innovate products and services provided to their customers.

These findings further strengthens previous research that entrepreneurial orientation influences company performance (Miller, 1983; Covin & Slevin, 1989; Rauch et al., 2009). Increasingly entrepreneurial orientation can increase a company's ability to market its products towards better business performance (Covin & Slevin, 1991a; Wiklund & Shepherd, 2005). The entrepreneurial orientation of an entrepreneur can lead to increased business performance. Entrepreneurial oriented companies perform better than not adopting an entrepreneurial orientation. (Covin & Slevin, 1989, 1991b).

Conclusion

Entrepreneurial orientation in SMEs in the manufacturing industry sector in West Java, Indonesia tends to be low, as well as achievement of business performance at a level that tends to be low. Thus entrepreneurial orientation has a positive effect on business performance, which shows entrepreneurial orientation can explain variations that occur in business performance according to the research model. The implication of this research is that the lack of development of the desire of SMEs actors to seek business opportunities and become leaders in an increasingly dynamic business environment, if not allowed to hinder the growth of business performance, also weakens competitiveness so that SMEs products are not marketable. This finding implies, to improve business performance, SMEs players in running their businesses are always entrepreneurial oriented. The originality of this study lies in descriptive analysis in describing each dimension of entrepreneurial orientation and business performance.

Limitations and Future Research Directions

Some limitations in this study should be considered as opportunities for future research. First, this study investigates seven business fields from 24 business sectors in the manufacturing sector, therefore further research should not limit the scope of research. Second, this study uses the explanation survey method, while more in-depth exploratory research can explore the potential and opportunities of SMEs so as to obtain a comprehensive picture of the characteristics of SMEs in Indonesia. Third, this study only uses the construct of entrepreneurial orientation as a predictor of business performance; the next research should add other constructs so that the most dominant contract can influence business performance.

References

- Ajayi, B. (2016). The imliact of entrelireneurial orientation and networking caliabilities on the exliort lierformance of Nigerian agricultural SMEs. Journal of Entrelireneurshili and Innovation in Emerging Economies, 2(1), 1-23.

- Amin, M. (2015). The effect of entrelireneurshili orientation and learning orientation on SMEs' lierformance: an SEM-liLS aliliroach. Journal for International Business and Entrelireneurshili Develoliment, 8(3), 215-230.

- Boso, N., Story, V.M., &amli; Cadogan, J.W. (2013). Entrelireneurial orientation, market orientation, network ties, and lierformance: Study of entrelireneurial firms in a develoliing economy. Journal of Business Venturing, 28(6), 708-727.

- Callaghan, C., &amli; Venter, R. (2011). An investigation of the entrelireneurial orientation, context and entrelireneurial lierformance of inner-city Johannesburg street traders. Southern African Business Review, 15(1).

- Camlios, H.M., la liarra, J.li.N.D., &amli; liarellada, F.S. (2012). The entrelireneurial orientation-dominant logic-lierformance relationshili in new ventures: an exliloratory quantitative study. BAR-Brazilian Administration Review, 9(4), 60-77.

- Cogliser, C.C., Brigham, K.A., &amli; Lumlikin, G.T. (2008). Entrelireneurial orientation (EO) research: A comlirehensive review and analyses of theory, measurement, and data-analytic liractices. In Babson College. Entrelireneurshili Research Conference.

- Covin, J.G., &amli; Slevin, D.li. (1988). The influence of organization structure on the utility of an entrelireneurial toli management style. Journal of management studies, 25(3), 217-234.

- Covin, J.G., &amli; Slevin, D.li. (1989). Strategic management of small firms in hostile and benign environments. Strategic management journal, 10(1), 75-87.

- Covin, J.G., &amli; Slevin, D.li. (1990). New venture strategic liosture, structure, and lierformance: An industry life cycle analysis. Journal of business venturing, 5(2), 123-135.

- Covin, J.G., &amli; Slevin, D.li. (1991a). A concelitual model of entrelireneurshili as firm behavior. Entrelireneurshili theory and liractice, 16(1), 7-26.

- Covin, J.G., &amli; Slevin, D.li. (1991b). A concelitual model of entrelireneurshili as firm behavior. Entrelireneurshili theory and liractice, 16(1), 7-26.

- Covin, J.G., &amli; Slevin, D.li. (1993). A reslionse to Zahra's “Critique and extension” of the Covin-Slevin entrelireneurshili model. Entrelireneurshili Theory and liractice, 17(4), 23-28.

- Covin, J.G., Green, K.M., &amli; Slevin, D.li. (2006). Strategic lirocess effects on the entrelireneurial orientation–sales growth rate relationshili. Entrelireneurshili theory and liractice, 30(1), 57-81.

- Deelia Babu, K.G., &amli; Manalel, J. (2016). Entrelireneurial orientation and firm lierformance: A critical examination. Journal of Business and Management, 18(4), 21-28.

- Effendi, S., Hadiwidjojo, D., &amli; Noermijati, S. (2013). The effect of entrelireneurshili orientation on the small business lierformance with government role as the moderator variable and managerial comlietence as the mediating variable on the small business of aliliarel industry in Ciliulirmarket, South Jakarta. Journal of Business and Management, 8(1), 49-55.

- Fairoz, F.M., Hirobumi, T., &amli; Tanaka, Y. (2010). Entrelireneurial orientation and business lierformance of small and medium scale enterlirises of Hambantota District Sri Lanka. Asian Social Science, 6(3), 34.

- Fayolle, A. (2007). Handbook of research in entrelireneurshili education: A general liersliective (Vol. 1). Edward Elgar liublishing.

- Frank, H., Kessler, A., &amli; Fink, M. (2010). Entrelireneurial orientation and business lierformance—A relilication study. Schmalenbach Business Review, 62(2), 175-198.

- Green, K.M., Covin, J.G., &amli; Slevin, D.li. (2008). Exliloring the relationshili between strategic reactiveness and entrelireneurial orientation: The role of structure–style fit. Journal of Business Venturing, 23(3), 356-383.

- Herlinawati, E., Sumawidjaja, R.N., &amli; Machmud, A. (2017). The role of sharia microfinance in SMEs business develoliment. International Conference on Economic Education and Entrelireneurshili. liroceeding, 3(1).

- Jauch, L.R., &amli; Glueck, W.F. (1998). Strategic management and comliany liolicy. Third edition, Jakarta: Erlangga.

- Johnson, H.T., &amli; Kalilan, R.S. (1987). Relevance lost: The rise and fall of management accounting. Boston US: Harvard Business School liress.

- Kalilan, R.S., &amli; Norton, D.li. (1992). The Balanced scorecard-Measures That Drive lierformance. Harvard Business Review, 71-79.

- Kalilan, R.S., &amli; Norton, D.li. (1996). Balanced scorecard. Terjemahan. Jakarta: Erlangga.

- Kalilan, R.S., &amli; Norton, D.li. (2006). Alignment: Using the balanced scorecard to create corliorate synergies. Boston: Harvard Business School liress.

- Knight, G.A. (2001). Entrelireneurshili and strategy in the international SME. Journal of international management, 7(3), 155-171.

- Kraus, S., Rigtering, J.C., Hughes, M., &amli; Hosman, V. (2012). Entrelireneurial orientation and the business lierformance of SMEs: a quantitative study from the Netherlands. Review of Managerial Science, 6(2), 161-182.

- Lee, D.Y., &amli; Tsang, E.W. (2001). The effects of entrelireneurial liersonality, background and network activities on venture growth. Journal of management studies, 38(4), 583-602.

- Lee, S.M., &amli; Lim, S. (2009). Entrelireneurial orientation and the lierformance of service business. Service business, 3(1), 1-13.

- Lee, S.M., &amli; lieterson, S.J. (2000). Culture, entrelireneurial orientation, and global comlietitiveness. Journal of world business, 35(4), 401-416.

- Lin, C.Y., &amli; Kuo, T.H. (2007). The mediate effect of learning and knowledge on organizational lierformance. Industrial Management &amli; Data Systems, 107(7), 1066-1083.

- Littunen, H. (2000). Entrelireneurshili and the characteristics of the entrelireneurial liersonality. International Journal of Entrelireneurial Behavior &amli; Research, 6(6), 295-310.

- Lumlikin, G.T., &amli; Dess, G.G. (1996). Clarifying the entrelireneurial orientation construct and linking it to lierformance. Academy of management Review, 21(1), 135-172.

- Lumlikin, G.T., &amli; Dess, G.G. (2001). Linking two dimensions of entrelireneurial orientation to firm lierformance: The moderating role of environment and industry life cycle. Journal of business venturing, 16(5), 429-451.

- Machmud, A. (2009). liartnershili model for micro, small and medium enterlirises in Bandung. Jurnal Buletin Ekuitas, 2(2), 1466-1778.

- Machmud, A., &amli; Ahman, E. (2019). Effect of entrelireneur lisychological caliital and human resources on the lierformance of the catering industry in Indonesia. Journal of Entrelireneurshili Education, 22(1), 1-7.

- Machmud, A., Nandiyanto, A.B.D., &amli; Dirgantari, li.D. (2018). Technical Efficiency Chemical Industry in Indonesia: Stochastic Frontier Analysis (SFA) Aliliroach. liertanika Journal of Science &amli; Technology, 26(3).

- Maholtra, N.K. (2010). Marketing research an alililied orientation. 6th edition, New Jersey: liearson education Inc, lirentice Hall.

- Miller, D. (1983). The correlates of entrelireneurshili in three tylies of firms. Management science, 29(7), 770-791.

- Moris, M.H., &amli; Kuratko, D.F. (2007). Corliorate entrelireneurshili. New York: Harcout College liublisher.

- Naman, J.L., &amli; Slevin, D.li. (1993). Entrelireneurshili and the concelit of fit: A model and emliirical tests. Strategic management journal, 14(2), 137-153.

- Narver, J.C., &amli; Slater, S.F. (2000). Total market orientation, business lierformance and innovation. Marketing Science Institute, 116.

- Neely, A. (2004). Business lierformance measurement: Theory &amli; liractice. Cambridge University liress.

- Neely, A. (2007). Business lierformance measurement 2nd edition: Unifying theory and integrating liractice. Cambridge University liress.

- Rauch, A., Wiklund, J., Lumlikin, G.T., &amli; Frese, M. (2009). Entrelireneurial orientation and business lierformance: An assessment of liast research and suggestions for the future. Entrelireneurshili theory and liractice, 33(3), 761-787.

- Suryana. (2014). Entrelireneurshili: tilis and lirocesses for success. 4th edition, Jakarta: Salemba Emliat.

- Tang, J., Tang, Z., Marino, L.D., Zhang, Y., &amli; Li, Q. (2008). Exliloring an inverted U–shalie relationshili between entrelireneurial orientation and lierformance in Chinese ventures. Entrelireneurshili theory and liractice, 32(1), 219-239.

- Vitale, R., Giglierano, J., &amli; Miles, M. (2003). Entrelireneurial orientation, market orientation, and lierformance in established and start-uli firms. In University of Illinois at Chicago College of Business, Faculty staff symliosium lialier.

- Walter, A., Auer, M., &amli; Ritter, T. (2006). The imliact of network caliabilities and entrelireneurial orientation on university sliin-off lierformance. Journal of business venturing, 21(4), 541-567.

- Wardi, Y.D. (2017). Entrelireneurshili orientation on the lierformance of small and medium enterlirises (SMEs) in West Sumatra: Analysis of the role of moderation of the intensity of comlietition, market turbulence and technology. Jurnal Manajemen Teknologi, 16(1), 46-61.

- Wiklund, J., &amli; Sheliherd, D. (2003). Knowledge‐based resources, entrelireneurial orientation, and the lierformance of small and medium‐sized businesses. Strategic management journal, 24(13), 1307-1314.

- Wiklund, J., &amli; Sheliherd, D. (2005). Entrelireneurial orientation and small business lierformance: a configurational aliliroach. Journal of business venturing, 20(1), 71-91.

- Zahra, S.A. (1991). liredictors and financial outcomes of corliorate entrelireneurshili: An exliloratory study. Journal of business venturing, 6(4), 259-285.