Research Article: 2018 Vol: 17 Issue: 6

The Effect of Corporate Governance Attributes on Earnings Management: A Study of Listed Companies in Nigeria

Ikumapayi Tolulope, Covenant University

Uwalomwa Uwuigbe, Covenant University

Olubukola Ranti Uwuigbe, Covenant University

Ozordi Emmanuel, Covenant University

Sylvester Oriabie, Covenant University

Osariemen Asiriuwa, Covenant University

Abstract

Earnings are a fundamental item on the financial statement which also serves as a yardstick for investors and other stakeholders in making an informed decision. It is very important for close attention to be paid to it as regards its management. Hence, the study examined the relationship corporate governance attributes have on earnings management using earnings persistence as a proxy for measuring earning management. The corporate governance attributes are in accordance with CBN code of governances which include ownership structure, audit committee independence and board size. This study made use of Eviews 2017 software to compute the data obtained from the annual reports and financial statement using 44 firms as the sample size of the study. The sample size, however, was derived using random sampling technique across the eleven (11) sectors listed on Nigerian Stock Exchange Market. Based on the findings, corporate governance attributes influences the level of earnings management practised in Nigeria.

Keywords

Earnings Management, Corporate Governance, Audit Committee, Ownership Structure, Board Size.

JEL CODE: M41, M42

Introduction

The importance of corporate governance in the administration of companies cannot be over-emphasized especially as it relates to earnings management. Earnings to stakeholders of any organization serve as the faith of the firm upon which the stakeholders depend on to make returns on investment. Thus, making it one of the most significant accounting items on the financial statements. According to Abata & Migiro (2016), Mohammady (2010), earnings are described as a fundamental component in the decisive process of dividend policy. It serves as a guide for making investment decisions, poses a significant tool for measuring firm’s performance. More so, it can serve as a competent yardstick for stock pricing and also a mechanism employed to derive predictions. Cheng & Warfield (2005) have described earning management from two dimensions. First, as a manager, it is seen as an opportunity to efficiently handle debt contracts, political cost and effectively manage resources in dealing with compensation contracts (opportunistic earnings management). Secondly, it is described as a tool used by managers to protect themselves and the organization in anticipation of unexpected events that could negatively affect the gains in the contract especially in the aspect of efficient contracting. To further buttress the subject matter, Healy & Wahlen (1999) averred that earnings management arises when agents of organisations use their subjective opinion in financial reporting and shaping transactions to adjust financial reports to either misinform or hoodwink some stakeholders about the original pecuniary performance of the organisation or to sway predetermined outcomes that depend on reported accounting figures. The reality of managing earnings is that it is likely to induce companies performance to be unreal thereby defeating the purpose of relevance and reliability of the financial statements. It is therefore important for scholars in the accounting profession to continually observe earnings management as it helps to maintain the relevance of financial statements to users especially in the area of decision-making. However, better governance is likely to bring about exceptional performance in organizations (Uwuigbe et al., 2017). Hence, corporate governance has a high level of impact on firms’ performance and the practice of earnings management. This interrelationship, however, has become a contemporary issue among various scholars especially accounting and financial management scholars.

Over the years, financial reporting quality has become topmost importance to the regulatory agencies and the academic world not only in Nigeria but also globally (Abata & Migiro, 2016; Olubukola et al., 2016). In 2003, the Corporate Governance Code in Nigerian was issued with the notion that it would be adhered to by Nigerian companies so as to increase the economy’s level of confidence (Adegbite, 2012a:2012b); this would, in turn, boost the level of confidence attached to financial reports of organizations and also translate to an increase in the investment rate in the economy. Gabrielsen et al. (2002) described corporate governance as allinclusive which implies that it’s concerned with the means and technique that organizations are being regulated and controlled. It entitles popular stewardship, trust, accountability and honesty and it also encapsulates managerial features such as monitoring, supervision and inspection of the quality of financial statement reported. Earnings management practice entitles revamping the figures of earnings to be reported as a result of judgmental discretion usage the Generally Accepted Accounting Principles (GAAP) allowed. That is taking advantage of the loopholes in the system. However, on October 2014, the CBN revised “the code” of corporate governance to include crucial parameters that confirms the size of the board, formation of the board of directors, chairman and Chief Executive Officer (CEO) eligibility, board composition, structure of ownership, the reporting disclosure mandatory requirements and external auditors’ compliance report. This law was targeted at promoting accountability and transparency amid managers and investors functions. Currently, Nigeria as a developing country has recently revised its code Oct 2014 in anticipation to improve the quality of report issued to the public and increasing the level of confidence and reliability placed by the stakeholders.

In recent times, quite a number of the studies conducted in Nigeria have explored the practices of corporate governance on earning management (Uwuigbe et al., 2014; Hassan & Ahmed, 2012). More so, due to the revised code conduct, more studies have been accomplished on the individual variables of corporate governance (audit committee, board size, board characterizes ownership structure) and how it affects earnings management (Abata & Migiro, 2016; Uwuigbe et al., 2016). However, these studies were conducted using the accruals approach as a basis for the evaluation of earnings management regardless of other proxies available to measure earnings management. Thus, after a critical examination of the other proxies, this study seeks to evaluate the significance of corporate governance attributes on earnings management using earnings persistence as earnings management proxy. This is based on the fact that persistence uses current earnings to determine future earnings which invariably help to validate earnings usefulness in the prediction of expected cash flows and helps promote better planning. In addition, this study ascertained the existence of an individual relationship between corporate governance attributes (organizational ownership structure, board size and audit committee independence) and earning management.

To achieve this objective, organizations annual reports and financial statements for the financial period 2012-2016 were analysed. Also, premised on the size and accessibility of the annual report, a total of 44 listed companies were selected for this study using the judgmental sampling technique from a population of 176 listed companies on Nigerian Stock Exchange Market. The other outstanding sections of this paper have been structured to include reviews related literature and development of hypotheses. While section three presents the methodology employed in the study, section four and five provides insight on the findings and conclusions drawn from the study.

Literature Review

The argument in respect to the effect of corporate governance attributes on earnings management ought to be reviewed from the aspect of the agency problem which is as a result of control separation and ownership, generating interest irregularity between shareholders and managers (Jensen and Meckling, 1979). Where ownership stakes are not owned by managers of an organization, their attitude is influenced by self-interest goals which are not in accordance with the goal of maximizing shareholders and stakeholder’s wealth and increasing the organization value (Chen & Liu, 2010; Fama, 1980; Fama & Jensen, 1983; Uwuigbe et al., 2017). To this end, the agency theory states that there should be a distinct separation between control and ownership (Jensen & Meckling, 1976). Based on this goal conflict of goal congruence the agency problem has become more obvious as managers would act in their own interest rather than the interest of shareholders.

Concept of Earnings Management

Earnings management is a classical issue that has been extensively evaluated and reviewed from various perspectives and dimensions in the accounting literature. Healy & Wahlen (1999) opined that the management of earnings occurs whenever managers make use of their intuition when financial statement are being prepared by formulating financial transactions that would modify the financial statement which may delude financial users regarding the economic performance of the entity. Leuz et al. (2003) described earnings management as the modification in entities reported underlying economic performance by management for the purpose of obtaining undue advantage for a contractual event. According to Roodposhti & Chashmi (2011) management of earnings takes place in three ways namely:

1. By restructuring numerous transactions (expenses or revenue).

2. By taking advantage of modification in accounting procedures.

3. Lastly through management accruals’ approach.

From the itemized dimensions, the first two can be measured if the researcher has access to information from within the organization which is also referred to as insider information.

However, the third approach (management accruals method) can be externally evaluated through the financial statements of the selected entities and this study would be making use of this approach. Iturriaga & Hoffmann (2005) opined that earnings management may emerge as an aftermath of agency problem. Managers could engage in creative accounting while preparing the financial report with the aspiration of elaborating their position, without considering the facts that stakeholders rely on the information provided in the financial reports. This has however received great attention both internationally and locally. Studies carried out on corporate governance in developed countries appears that it helps reduce the earnings management practices executed by management in their respective organizations thereby providing greater credence to their financial reports.

Organizational Ownership Structure

Organizational ownership structure has the capacity to influence the monitoring techniques put in place to oversee both agency costs and earnings management activities (Siregar & Utama, 2008). This is because entity’s management and organizational ownership are to be detached. Thus, it creates conflict which is described as agency problem (Jensen & Meckling, 1976). This concept states that managers are not always interested in maximizing the shareholder’s wealth and suggests that it could be because they do not have any or a significant amount of shares or stake in the business. Therefore, one of the substantial stimuli to inspire managers is to bestow unto them a significant amount of stake of the business. In a related study, by Claessens et al. (2000) and La Porta et al. (1999) opined that this conflict can be reduced by providing managers with a significant amount of stock or shares in the organization so as to create interest alignment and alteration to earnings should reduce. Stulz (1988) entrenchment hypothesis states that managers owning a substantial amount of stake in the organization may exploit earnings management to boost their own personal goals and objectives. Therefore, it’s imperative to observe closely every decision made by managers to ensure shareholders’ values appreciate and are disclosed accurately in the financial statements.

The diverse degree of disclosure is tandem to organization’s ownership structure. However, it is expected that information rise as high ownership levels are diffused ensuring that majority shareholder does not chaos non-controlling shareholders access to genuine information on a high level (Raffournier, 1995). Consequently, the dispersal of shareholder control is based on the number of shareholders. Agency theory underlies that firms widely own would most likely disclose sufficient information as this would enable managers to prove their worth to the entity. Similarly, García-Meca & Ballesta (2011) identified various proxies that can be used to gauge ownership structure. For instance, the evaluation of ownership structure using ownership concentration, institutional (financial institutions) ownership and managerial (management) ownership as well as its relationship with earnings management. Ownership structure was represented by institutional and managerial ownership according to Cornett et al. (2008).

Institutional investors (financial institutions) have very strong enticement to assemble information concerning the companies in which they have investment or are interested in investing. Mitra (2002) suggested that large structure of ownership is inclined to prompt institutions in terms of actively monitoring any form of earnings manipulation and ensuring relevant policy decisions are made. Kamran & Shah (2014) state that there are two beliefs as regards the role institutional ownership plays in discouraging earnings management. The first ideology states that institutional investors (financial institutions) have the capacity and stimulus to curb opportunistic behaviour by executives in the form of earnings management practices. The second belief states that financial institutions investors are often more interested in short-term returns and are not overly concerned in controlling managers: rather than monitoring or removal of incompetent management, they would prefer to sell their investments. Agency theory points that the use of institutional ownership can be relevant to governance tool (effective monitoring assumptions). More so, the contribution of effective supervision and monitoring by institutional investors can managers’ confidence in the manipulation of earnings.

Board Size

Board size is the amount of (executive and non- executive) directors on firm structure. In conformity with agency theory, the size of an organization’s board is organized based on the scope and complexity of the firms’ production process; this implies that for larger and complex processes would lead to the larger board size (Fama & Jensen, 1983). Various studies have tried to establish an interrelationship between the board size and the effectiveness of the board. Jensen (1993) & Yermack (1996) averred that a smaller board would more effective due to fewer difficulties in coordination of efforts and the smaller board may be less burdened with political problems and might be able to provide quality financial reporting oversight. Likewise, there were opposing views that suggests that a large board is more effective as they have information and expertise leverage over boards with a few members (Dalton, 1999) and a board with more members would be able to have access to a broader and wider range of experienced members (Xie et al., 2003). Campos et al. (2002) maintains that the board size should be neither big nor small and recommends that the appropriate board size should be between five and nine members. Kouki et al. (2011) reviewed corporate governance attributes influences on earnings management and concludes that board size should not be too large neither should it be too small so as to prevent business decisions that are solely beneficial to the managers. The evidence regarding financial statement reliability is mixed. He also discovered that the size of the board is significantly and positively correlated with earnings management. Matoussi & Mahfoudh (2006) were of a different view as they provided findings that show that a large board size is not enough to increase financial statements reliability. Xie et al. (2003) also established an unfavourable connection between the size of the board and earnings management. However, they declare that larger numbers of directors have the relevant knowledge and are more equipped to hinder earnings management than smaller board sizes. The board of directors are majorly responsible for ensuring that other stakeholders have access to high-quality financial reports with adequate disclosures on both operating and financial results of the entity.

Audit Committee

Some of the financial crisis experienced by organizations over the years has been associated with a shortcoming in the duties of the internal audit department. This realization arose the need for a company’s board of directors to be more actively involved in enhancing control and monitoring of managerial activities; the members of the board are delegated with the obligation of overseeing the financial reports to the audit committee. This committee needs to be independent and as a sub-section consist of minimum three non-executive directors who are experienced in their respective field and enjoying neutrality. This implies that they are solely responsible for the protection of shareholders’ interests. They are also joined with a minimum of three representatives of the shareholders.

The Nigerian code of best governance practice expects the members of the committee to be independent to a great extends, should be highly competent and have a high degree of integrity (Uwuigbe et al., 2017). Klein (2002) recognized independence as a major characteristic of the audit committee effectiveness. Thus, the committee without waiting for the approval from management or the board have the resource capability and the necessary authority to carry out its responsibilities and duties. Nevertheless, this committee been a sub unit of the board may suffer certain bottlenecks in its operations as a result of its jurisdiction. Prior studies have reviewed the correlation among the audit committee as well as earnings management adopting diverse deductions of audit committee efficiency some of which include the composition of members of the board, size of the board, audit committee meetings and financial motivation of independent directors and financial expertise of committee members. Studies like, Al-Ajmi (2009) who discovered that clients appreciate or identify a good audit exercise (report) when an independent auditor champions this exercise whereas the quality of the audit work reduced when independent auditors engaged in a non-audit service. In Nigeria, Uadiale (2012) and Dabor & Adeyemi (2009) detected that autonomous members of the audit committee would have a considerable amount of financial expertise’s so as significantly reduce earnings management practices tendencies. Babalola (2013) reviewed the effectiveness of audit committees by making use of ten manufacturing organisations by taking into cognisance the year 2000 to 2009. The study however observed that the size of an organisation’s board and managerial ownership substantially impact on the performance of audit committees in Nigeria. The study also discovered that leverage, composition of the board, profitability and shareholding positively have a partial effect on the audit committees’ capacity. This study, however, made use of the independence of audit committee to evaluate the audit committee effectiveness so as to create an interrelationship between the audit committee and earnings management.

Hypotheses Development

All hypotheses to be tested in this study are presented in their null form as follows:

H01: Ownership structure has no significant influence on the level of earnings management practised in Nigeria.

H02: There is no significant relationship between board size and the level of earnings management practised in Nigeria.

H03: Audit committee independence does not have a significant impact on the level of earnings management practised in Nigeria.

Materials And Methods

This research is empirical in nature. It basically evaluates the subject matter over a period of time to draw inference for decision making and conclusion. In other to achieve the objective of this study, the annual reports for the period 2012-2016 were evaluated. This is based on the availability and accessibility of annual reports. However, the use of simple random sampling method is to eliminate biases in the choice of any company selected to constitute the sample and to give the same opportunity to every component of the population selected (Oaikhenan & Udegbunan, 2004 cited in Ibadin & Afensimi, 2015). A total sample size of 44 listed companies was analysed. This constitutes 25% of the entire population. However, this is coherent with the premises of Krejcie & Morgan (1970) that states it is appropriate to use a minimum of 5% sample size to represent the entire population when a generalization is to be done. The ordinary least square regression approach with the use of Eviews was used to analyse the data.

Model Specification

Earnings management represents the explained construct in this study and earnings persistence approach would be engaged to measure it. Earning persistence is described as the steadiness and robustness of the current earnings approach (Atashband et al., 2014). The attributes of corporate governance represent the independent variable in this study. These attributes include board size, audit committee independence and organizational ownership structure. For the control variable firm size was employed and was analysed as the natural log of total assets. This paper adopted the model used by Supana (2014) on earnings persistence. The model attempts to capture both the dependent variable (earnings persistence) scaled by operating income and independent variables in one equation. In summary, the models to be tested in this study as expressed in econometric form as given in equations below.

This is represented in functional form as follows:

EAR=f (BOARD SIZE, AUDIT COMMITTEE, OWNER STRUCTURE, FIRM SIZE) (1)

This further express in econometric form as:

EARPit=β0+β1BORDSIZEit+β2AUDITCOMit+β3OWNERSTRit+log4FSIZEit+Et+1 (2)

Where,

EARPer=Earnings Persistence is derived by scaling operating income to total asset.

BORDSIZE=Board size.

β2AUDITCOM=Audit committee.

β3OWNERSTR=Ownership structure.

LogFSize=Natural log of Total asset.

Results Ad Discussion

In this study, the achievement of the research objectives involved the application of statistical approaches which include; correlation analysis, descriptive statistics as well as regression technique to evaluate the data.

Table 1 represent the statistical description of the variables used in the analysis which provides explanation for the spread, maximum, minimum, range, mid values and normality of the variables. The board size mean value (BOARD_SIZE) is 10.95, audit committee independence (AUDIND) is 0.500455, and ownership structure (OWNSTR) is 0.69058. However, the maximum value of 20 was associated with board size and the minimum value of 6. This reveals quite a large variation and it’s reflected in companies’ board size degree of variability. Board size (BOARD_SIZE) was tilted to the right with a value of 0.413107 and is commonly distributed at 9.030864. The positive kurtosis represents a data-set with high peak close to the mean. This implies that the data used for the computation of the mean are heavilytailed to the sample size used for this study making the distribution results reliable. The mean values of all the explanatory variables are positive which means the increase in mean could affirm the positive effect the collective corporate governance variables tested have on earning management.

| Table 1 Descriptive Statistics |

|||||

| BOARD_SIZE | AUDIND | OWNSTR | EARN_PER | FSIZE | |

| Mean | 10.95 | 0.500455 | 0.690583 | 0.25041 | 8.02014 |

| Median | 11 | 0.5 | 0.6894 | 0.067558 | 7.911561 |

| Maximum | 20 | 0.6 | 0.992 | 37.85442 | 9.675762 |

| Minimum | 6 | 0.5 | 0.2263 | -0.39636 | 6.415725 |

| Std. Dev. | 3.126299 | 0.006742 | 0.160275 | 2.548995 | 0.887504 |

| Skewness | 0.413107 | 14.73107 | -0.1769 | 14.69343 | 0.163957 |

| Kurtosis | 2.44995 | 218.0046 | 2.645549 | 217.2679 | 1.890651 |

| Jarque-Bera | 9.030864 | 431704 | 2.299096 | 428764.7 | 12.26667 |

| Probability | 0.010939 | 0.000000 | 0.316780 | 0.000000 | 0.002169 |

| Sum | 2409 | 110.1 | 151.9283 | 55.09025 | 1764.431 |

| Sum Sq. Dev. | 2140.45 | 0.009955 | 5.625713 | 1422.925 | 172.4981 |

| Observations | 220 | 220 | 220 | 220 | 220 |

Source: Researchers computation (E-VIEWS 7) 2018.

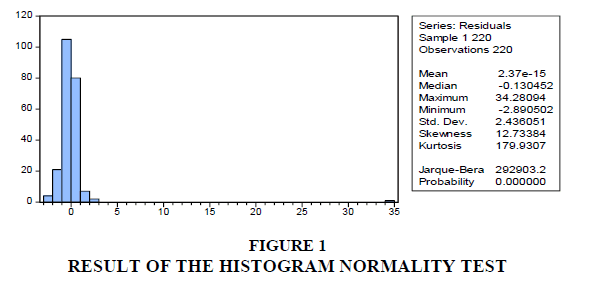

Figure (1) represents the bell-shaped histogram regression variables. It is a test that that indicates the normality of the data which helps to strengthen the rest of the descriptive statistics. The JB statistics is (292903.2) with a significant probability of (0.0000) the main kurtosis of (179.9) is above the benchmark of 3 and indicative of leptokurtic residual. The mean skewness depicts a value of (12.73). This indicates a positive histogram and is rightward skewed as visible.

The co-efficient of correlation displayed in Table 2 for each of the variables with respect to itself is 1.000. The model adopted for correlation tests in Table 2 reveals that explanatory variables of BOARD_SIZE had a positive relationship with EARN_PER and FSIZE with a value of 0.039451 and 0.566651. While AUDIND, and OWNSTR had a negative relationship with BOARD_SIZE with a value of -0.020581 and -0.183307 respectively. This result shows high relative probability values with no form of indication of collinearity problem. The board size and earnings persistence demonstrate a relationship with a correlation value of 0.039451 revealed to be the strongest as compared with the other relationships.

| Table 2 Covariance Analysis: Correlation |

|||||

| Variables | BOARD_SIZE | AUDIND | OWNSTR | EARN_PER | FSIZE |

| BOARD_SIZE | 1.000000 | ||||

| AUDIND | -0.020581 -0.303935 0.7615 |

1.000000 | |||

| OWNSTR | -0.183307 -2.753141 0.0064 |

0.074464 1.102513 0.2715 |

1.000000 | ||

| EARN_PER | 0.039451 0.582935 0.5605 |

-0.004263 -0.062945 0.9499 |

-0.158307 -2.367228 0.0188 |

1.000000 | |

| FSIZE | 0.566651 10.15405 0.0000 |

-0.083366 -1.235178 0.2181 |

-0.387419 -6.204731 0.0000 |

-0.124575 -1.853764 0.0651 |

1.000000 |

Source: E-views Output (2018).

Table 3 reveals the interrelationship that exists between the independent variables and earnings persistence using the Ordinary Least Square (OLS) approach. 0.086655 being the Rsquare value shows about 9% of systematic differences in the explained variable are described by the explanatory variables causing a disconnect of 91%. Shown in the table is both ownership structure (OWNSTR) and audit committee independence (AUDIND) which revealed a negative relationship with earnings persistence with values of -3.530062 and -0.135103 respectively, board size (BOARD_SIZE) exhibited a positive relationship with earnings persistence with a value of 2.218589. The total significance of the cumulative independent variables revealed a substantial connection with the dependent variable with a probability (F-statistic) of 0.000605.

| Table 3 Regression Analysis |

||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| OWNSTR | -3.977595 | 1.126777 | -3.530062 | 0.0005 |

| BOARD_SIZE | 0.143319 | 0.064599 | 2.218589 | 0.0276 |

| AUDIND | -3.345917 | 24.76572 | -0.135103 | 0.8927 |

| FSIZE | -0.924274 | 0.243071 | -3.802485 | 0.0002 |

| C | 10.51521 | 12.64308 | 0.831697 | 0.4065 |

| Weighted Statistics | ||||

| R-squared | 0.086655 | Mean dependent var | 0.250410 | |

| Adjusted R-squared | 0.069662 | S.D. dependent var | 2.548995 | |

| S.E. of regression | 2.458608 | Akaike info criterion | 4.659533 | |

| Sum squared resid | 1299.622 | Schwarz criterion | 4.736660 | |

| Log likelihood | -507.5486 | Hannan-Quinn criter. | 4.690679 | |

| F-statistic | 5.099607 | Durbin-Watson stat | 1.888141 | |

| Prob (F-statistic) | 0.000605 | |||

Source: E-views Output (2018).

The interrelationship that exists between the attributes of corporate governance and earnings persistence were evaluated using the variance inflation factors in Table 4. Myers (1990) states that a there is a call for concern when Variance Inflation Factor (VIF) value is greater than 10 calls. However, based on the findings of this study there is no course for concern as the VIF values are less than 10.

| Table 4 Diagnostic Analysis: Variance Inflation Factors |

|||

| Variable | Coefficient Variance | Uncentered VIF | Centered VIF |

| OWNSTR | 1.269627 | 23.21861 | 1.181613 |

| BOARD_SIZE | 0.004173 | 19.68830 | 1.477675 |

| AUDIND | 613.3408 | 5591.827 | 1.010054 |

| FSIZE | 0.059084 | 140.0027 | 1.686057 |

| C | 159.8476 | 5817.685 | NA |

Source: Researchers computation (E-VIEWS 7) 2018.

Based on the findings, it was established that there is a significant negative relationship between ownership structure and earnings persistence. This outcome is evident in the computed t-value of -3.530062 and p-value to 0.0005. This result implies an increase in the majority shareholding percentage would lead to a forward decrease in earnings management. Therefore, the null hypothesis H01 which states there is no significant relationship to the level of earnings management practiced in Nigeria is rejected. This outcome supports the findings of Abata & Migiro (2017) and Bao & Lewellyn (2017).

The second hypothesis which states that (board size does not have a significant association to the level of earnings management practiced in Nigeria) shows that there is a significant positive relationship between board size and earnings persistence. This is evident in the computed t-value and p-value of 2.218589 and p-value to 0.0276 respectively. Thus it can be deduced from the statistical outcome that a large board size would lead to a decrease in practice of earnings management. Thus, organisations with large board size are less prone to engage in opportunistic behaviour of earnings management that may affect the quality of earnings numbers to interested parties. Also, this outcome further suggests that larger tends to reduce the incidence of earning management. Hence, the null hypothesis H02 which states board size has no significant influence on the level of earnings management practiced in Nigeria is rejected while the alternative hypothesis is accepted. This summation is in line with the findings of Abata & Migiro, (2017) and Abdul Rahman & Ali (2006). It however, differs from the findings provided in Xie et al. (2003) and Bala & Kumai (2015).

From the result, it was also observed that the relationship between audit committee independence and earnings persistence was negative and not significant. This was clearly observed in the computed t-value and p-value of -0.135103 and 0.8927 respectively. This outcome suggests that an increase in the number of independent audit committee members would not necessarily lead to a decrease in the earnings management practices. Therefore, the null hypothesis H03 which states audit committee independence has no significant influence on the level of earnings management would be accepted. This outcome is in tandem with the findings of Ibadin & Afensimi (2015). However, it contradicts the submission provided in Abata & Migiro (2016).

Conclusion And Recommendations

The paper reviewed the impact and roles of corporate governance attributes on the practices of managers taken advantage of the loopholes in the regulation in form of earnings management. Thereby, using earning persistence as a proxy to evaluate this relationship in selected listed quoted organizations on Nigerian Stock Exchange (NSE). From the analyses carried out, there is a co-existing relationship between earnings management practices and corporate governance attributes in Nigeria. This study, however, concludes that board size and ownership structure can significantly reduce the practice of earnings management in Nigeria.

Therefore, this study recommends based on its findings that organizations should avoid having a smaller number of board of directors so as to reduce effectively the earnings management practice in the organization. This study is also of the opinion that the independence of the audit committee is also an important factor to be considered for the efficient reduction of earnings management in Nigeria. Lastly, for organizations to attain and retain a sound level of confidence from the economy they must adhere to the codes and practices of corporate governance.

Further Studies

Considering only a period of 2012-2016 is a major limitation. Hence, this study suggests that future research in this area could consider the current 2018 accounting period as soon as data becomes available at the end of the current financial year.

Acknowledgements

Authors acknowledge Covenant University who has solely provided the plate form for this research and has also fully sponsored the research cluster search for data across the country.

References

- Abata, M., & Migiro, S. (2016). Corporate governance and management of earnings: empirical evidence from selected Nigerian-listed companies.Investment Management and Financial Innovations (Open-Access),13(2-1).

- Abdul Rahman, R., & Haneem Mohamed Ali, F. (2006). Board, audit committee, culture and earnings management: Malaysian evidence. Managerial Auditing Journal, 21(7), 783-804.

- Adegbite, E. (2012a). Corporate governance in the Nigerian banking industry: Towards governmental engagement. International Journal of Business Governance and Ethics, 7(3), 209-231.

- Adegbite, E. (2012b). Corporate governance regulation in Nigeria. Corporate Governance: The International Journal of Business in Society, 12(2), 257-276.

- Adiguzel, H. (2013). Corporate governance, family ownership and earnings management: Emerging market evidence. Accounting and Finance Research, 2(4), 17-33.

- Al-Ajmi, J. (2009). Audit firm, corporate governance, and audit quality: Evidence from Bahrain. Advances in Accounting, 25(1), 64-74.

- Atashband, A., Moienadin, M., & Tabatabaenasab, Z. (2014). Examining the earnings persistence and its components in explaining the future profitability.Interdisciplinary Journal of Contemporary Research in Business,5(10) 10-19.

- Aygun, M., Ic, S., & Sayim, M. (2014). The effects of corporate ownership structure and board size on earnings management: Evidence from Turkey. International Journal of Business and Management, 9(12), 123.

- Babalola, Y. A. (2013). Corporate audit committees and risk controlling in Nigeria. European Journal of Business and Management, 5(12), 111-120.

- Bala, H., & Kumai, G. (2015). Board characteristics and earnings management of listed food and beverages firms in Nigeria.European Journal of Accounting, Auditing and Finance Research,3(8), 25-41.

- Bao, S.R., & Lewellyn, K.B. (2017). Ownership structure and earnings management in emerging markets-an institutionalized agency perspective. International Business Review, 26(5), 828-838.

- Campos, C.E., Newell, R.E., & Wilson, G. (2002). Corporate governance develops in emerging markets. McKinsey on Finance, 3, 15-18.

- Chen, J.J., & Zhang, H. (2014). The impact of the corporate governance code on earnings management-evidence from Chinese listed companies. European Financial Management, 20(3), 596-632.

- Chen, K., & Liu, J.L. (2010). Earnings management, CEO domination, and growth opportunities: Evidence from Taiwan. International Journal of Public Information Systems, 6(1), 43-69.

- Cheng, Q., & Warfield, T.D. (2005). Equity incentives and earnings management. The Accounting Review, 80(2), 441-476.

- Claessens, S., Djankov, S., & Lang, L.H. (2000). The separation of ownership and control in East Asian corporations. Journal of Financial Economics, 58(1-2), 81-112.

- Cornett, M.M., Marcus, A.J., & Tehranian, H. (2008). Corporate governance and pay-for-performance: The impact of earnings management. Journal of Financial Economics, 87(2), 357-373.

- Dabor, E.L., & Adeyemi, S.B. (2009). Corporate governance and the credibility of financial statements in Nigeria. Journal of Business Systems, Governance and Ethics, 4(1), 13-24.

- Dalton, R.J. (1999). Political support in advanced industrial democracies. Critical citizens: Global support for democratic government. Oxford Scholarship.

- Dechow, P., Ge, W., & Schrand, C. (2010). Understanding earnings quality: A review of the proxies, their determinants and their consequences.Journal of Accounting and Economics,50(2-3), 344-401.

- Emeni, F.K., & Ugbogbo, S.N. (2016). Accounting frameworks and cross-cultural effects on accounting disclosure practices in Nigeria. Covenant Journal of Business and Social Sciences, 6(2).

- Fama, E.F. (1980). Agency problems and the theory of the firm. Journal of Political Economy, 88(2), 288-307.

- Fama, E.F., & Jensen, M.C. (1983). Separation of ownership and control. The Journal of Law and Economics, 26(2), 301-325.

- Freeman, R.N., Ohlson, J.A., & Penman, S.H. (1982). Book rate-of-return and prediction of earnings changes: An empirical investigation.Journal of Accounting Research, 639-653.

- Gabrielsen, G., Gramlich, J.D., & Plenborg, T. (2002). Managerial ownership, information content of earnings, and discretionary accruals in a non-US setting. Journal of Business Finance & Accounting, 29(7?8), 967-988.

- García-Meca, E., & Sánchez-Ballesta, J.P. (2011). Ownership structure and forecast accuracy in Spain. Journal of International Accounting, Auditing and Taxation, 20(2), 73-82.

- Gulzar, M., & Zongjun, W. (2017).Corporate governance characteristics and earnings management: Empirical evidence from Chinese listed firms. International Journal of Accounting and Financial Reporting, 1(1), 133-151.

- Han, S., Kang, T., Salter, S., & Yoo, Y.K. (2010). A cross-country study on the effects of national culture on earnings management. Journal of International Business Studies, 41(1), 123-141.

- Hassan, S.U., & Ahmed, A. (2012). Corporate governance, earnings management and financial performance: A case of Nigerian manufacturing firms. American International Journal of Contemporary Research, 2(7), 214-226.

- Healy, P.M., & Wahlen, J.M. (1999). A review of the earnings management literature and its implications for standard setting. Accounting Horizons, 13(4), 365-383.

- Ibadin, A., & Afensimi, E. (2015). Audit committee attributes and earnings management: Evidence from Nigeria.International Journal of Business and Social Research,5(4), 14-23.

- Inah, E., Tapang, A., & Uket, E. (2014). Organizational culture and financial reporting practices in Nigeria.Research Journal of Finance and Accounting,5(13), 190-198.

- Iturriaga, F.J.L., & Hoffmann, P.S. (2005). Earnings management and internal mechanisms of corporate governance: Empirical evidence from Chilean firms. Corporate Ownership & Control, 3(1), 17-29.

- Jensen, M.C. (1993). The modern industrial revolution, exit, and the failure of internal control systems. The Journal of Finance, 48(3), 831-880.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure.Journal of Financial Economics, 3(4), 305-360.

- Kamran, K., & Shah, A. (2014). The impact of corporate governance and ownership structure on earnings management practices: Evidence from listed companies in Pakistan.The Lahore Journal of Economics,19(2), 27-70.

- Kao, L., & Chen, A. (2004). The effects of board characteristics on earnings management. Corporate Ownership & Control, 1(3), 96-107.

- Kazemian, S., & Sanusi, Z. M. (2015). Earnings management and ownership Structure. Procedia Economics and Finance, 31, 618-624.

- Klein, A. (2002). Audit committee, board of director characteristics, and earnings management. Journal of Accounting and Economics, 33(3), 375-400.

- Kothari, S.P., Leone, A.J., & Wasley, C.E. (2005). Performance matched discretionary accrual measures. Journal of Accounting and Economics, 39(1), 163-197.

- Kouki, M., Elkhaldi, A., Atri, H., & Souid, S. (2011). Does corporate governance constrain earnings management? Evidence from US firms. European Journal of Economics, Finance and Administrative Sciences, 35, 58-71.

- Krejcie, R.V., & Morgan, D.W. (1970). Determining sample size for research activities. Educational and Psychological Measurement, 30(3), 607-610.

- La Porta, R., Lopez?de?Silanes, F., & Shleifer, A. (1999). Corporate ownership around the world. The Journal of Finance, 54(2), 471-517.

- Leuz, C., Nanda, D., & Wysocki, P. D. (2003). Earnings management and investor protection: an international comparison. Journal of Financial Economics, 69(3), 505-527.

- Matoussi, H., & Mahfoudh, I. (2006). Composition of the board of directors and opportunistic management of the results. In Accounting, Audit, Audit and Institution (S).

- Mitra, R. (2002). The growth pattern of women-run enterprises: An empirical study in India. Journal of Developmental Entrepreneurship, 7(2), 217.

- Mohammady, A. (2010). Earnings quality constructs and measures.SSRN Electronic Journal, 1-7.

- Raffournier, B. (1995). The determinants of voluntary financial disclosure by Swiss listed companies. European Accounting Review, 4(2), 261-280.

- Roodposhti, F.R., & Chashmi, S.N. (2011). The impact of corporate governance mechanisms on earnings management. African Journal of Business Management, 5(11), 4143-4151.

- Siregar, S.V., & Utama, S. (2008). Type of earnings management and the effect of ownership structure, firm size, and corporate-governance practices: Evidence from Indonesia. The International Journal of Accounting, 43(1), 1-27.

- Sloan, R.G. (1996). Do stock prices fully reflect information in accruals and cash flows about future earnings?Accounting Review, 289-315.

- Stulz, R. (1988). Managerial control of voting rights: Financing policies and the market for corporate control. Journal of Financial Economics, 20, 25-54.

- Sukanantasak, S. (2014). The Effect of Corporate Governance Mechanisms on Earnings Informativeness through Earnings Persistence: Empirical Evidence from Thailand.Journal of Accounting, 10(29).

- Supana, S. (2014). A study of the rational relationship between corporate governance mechanisms and the quality of earnings of listed companies in the stock exchange of Thailand. Journal of Accounting Professional,27, 17-43.

- Uadiale, O.M. (2012). Earnings management and corporate governance in Nigeria. Research Journal of Finance and Accounting, 3(3), 1-10.

- Uwalomwa, U., Francis, K.E., Uwuigbe, O.R., & Ataiwrehe, C.M. (2016). International financial reporting standards adoption and Accounting Quality: Evidence from the Nigerian Banking Sector. Corporate Ownership and Control, 14, 287-294.

- Uwuigbe, O.R., Uwuigbe, U., Jafaru, J., Igbinoba, E.E., Oladipo, O., & Oni-Ojo, E.E. (2016). Value relevance of financial statements and share price: a study of listed banks in Nigeria. Banks and Bank Systems, 11(4), 135-143.

- Uwuigbe, U., Agba, L.U., Jimoh, J., Olubukunola, R.U., & Rehimetu, J. (2017). IFRS adoption and earnings predictability: evidence from listed banks in Nigeria. Banks and Bank Systems, 12(1), 166-174.

- Uwuigbe, U., Peter, D.S., & Oyeniyi, A. (2014). The effects of corporate governance mechanisms on earnings management of listed firms in Nigeria. Accounting and Management Information Systems, 13(1), 159-174.

- Uwuigbe, U., Uwuigbe, O.R., Igbinoba, E., Olugbenga, J., & Adegbola, O. (2016). The effect of financial performance and board size on corporate executive compensation: a study of selected listed banks in Nigeria. The Journal of Internet Banking and Commerce, 21(3).

- Xie, B., Davidson III, W.N., & DaDalt, P.J. (2003). Earnings management and corporate governance: The role of the board and the audit committee. Journal of Corporate Finance, 9(3), 295-316.

- Yermack, D. (1996). Higher market valuation of companies with a small board of directors. Journal of Financial Economics, 40(2), 185-211.