Research Article: 2022 Vol: 26 Issue: 1S

The Effect of CFO Management on Stock Price Crash Risk

Giman Nam, Sungkyunkwan University

Citation Information: Nam, G. (2021). The effect of cfo management on stock price crash risk. Academy of Accounting and Financial Studies Journal, 25(7), 1-11.

Abstract

I examine whether CFO management affects stock price crash risk. CFO management, which is known as a tool used to inflate reported CFO, can cause stock price crash risk by promoting the accumulation of bad news. I find that CFO management has no effect on stock price crash risk. But there are some firm characteristics that associated with incentive to inflate reported CFO. I find that the effect of CFO management on stock price crash risk is greater for under the specific firm characteristics. The results highlight the bad side of CFO management by providing evidence that under specific firm characteristics, CFO management can cause stock price crash risk.

Keywords

CFO Management, Firm Characteristics, S tock Price Crash Risk.

Introduction

Earnings and c ash from operations (CFO) are complementary measures of firm performance. But, earnings and CFO have different meaning for future earnings and for investors dep ending on the firm characteristics . For example, managers , in value earnings, but when the firm is near distress, managers consider CFO more important than earnings (Graham et al. 2005). Similarly, DeFond & Hung (2003) provide evidence that a lot of firm’s analysts and managers issue cash flow forecasts. It means that not only managers but also investors are interested in CFO. Unlike earnings, it is believed that managers do not exercise discretion over CFO so far. However , many examples of cash f low misreporting have raised concerns that to inflate reported CFO, managers are exercising discretion on financial reporting and in the timing of transactions as well as earnings.

Since the 2008 financial crisis, interest in investors’ perceptions of stoc k price crash risk has been increasing. Prior studies on stock price crash risk often attribute stock price crash risk to man agerial ability to hid bad news (Bleck Liu 2007; Hutton et al., 2009 ; Kim et al., 2011). When the bad news hidden by the manager s accumulate to a certain threshold, the stock price will plummet (Kim et al., 2016). For example, Hutton e t al. (2009) provide evidence that opaque financial reporting is associated with stock price crash risk Like earnings management, CFO management als o can facilitate bad news hoarding activities by exercising discretion in the timing of transactions . Therefore, I believe that it is meaningful to empirically examine the relationship between CFO management and stock price crash risk rather than earnings management. In this studies, I investigate the two questions: ( Is there a n association between CFO management and crash risk? (2) What firm characteristics influence these relationships?

Using 19,376 firm year observations of firms listed in U.S. stock market for the period of 2002 to 2017 , I find that stock price crash risk is not associated with CFO management. However, I find a significant positive relationship between CFO management and stock price crash risk in the four firm characteristics that kno wn to be associated with incentives to inflate reported CFO (Lee, 2012). These results suggested that in general, there is no relationship between CFO management and stock price crash risk. But, under specific circumstances such as higher associations betw een stock return and CFO, financial distressed firm credit rating grade cutoff , whether firms meet or beat the analyst cash flow managers can hoard bad news from investors through CFO management. After all, it is followed by a continuous sharp decrease in stock price.

Section 1: reviews relevant literature and develops the hypothesis development. Section 2: describes sample, data and research design. Section 3: reports primary empirical results. Finally, Section 4: offers some concluding remarks

Prior Literature and Hypothesis Development

Generally, earnings are better than CFO as a summary measure of firm performance (Dechow, 1994). R ecent studies show that analyst’s cash flow forecasts are helpful in alleviating earnings management (DeFond & Hung, 2003; McInnis Collins, 2011). Although, there is a trend that investors’ request for information about cash flow (Wasley & Wu, 2006), cases of misreporting in cash flow have raised concern that managers also exercise discretion on CFO. For example, to masque a loan as a cash inflow from operations, Dynegy made a complex transaction using a special purpose entity This allowed Dynegy to record a $300 million increase in CFO for the year 2001 without any effect on earnings (Lee, 2012). This anecdote su ggest that firms also can manage reported CFO.

Since the 2008 financial crisis, investors regard stock price crash risk as a significant risk factors. For example, Hutton et al. (2009) find that accruals management is one of the determinants of stock price crash risk. Similarly, Kothari et al. (2009) insist that career concerns drive managers to withhold bad news and inflate financial performance.

Like the accruals management, manager s can manipulate reported CFO using timing of transactions. However, it be comes too expensive for manager to hoard the bad news using CFO management when it reaches a certain point. Therefore, if CFO management facilitate bad news hoarding and then it is likely to be followed by stock price crash risk. Based on the discussion, I state my first hypothesis as follows:

H1: There is a relationship between CFO management and stock price crash risk

Lee (2012) identifies four firm characteristics related to incentives to i nflate reported CFO: (1) high relevance of stock returns and CFO, (2) whether the firms are in financial distress, (3) credit rating grade cutoff , (4) whether firms meet or beat the analyst cash flow benchmarks.

First, Earnings and CFO are two complementary summary measure of firm performance , they have different meanings for future earnings and, depending on the firm characteristics. For example, if firms have analyst cash flow forecasts, the ability of current CFO to predict future CFO is higher (Call 2007). Dechow & Weili (2006) find that, on average, CF O is less useful than earnings with respect to predict future earnings B ut CFO can be more useful than earnings when firms have a lot of negative accruals.

Therefore, when investors place more meaning on CFO, CFO is additional metric to evaluate managers. Using the association between stock returns and CFO, I expect the relationship between crash risk and CFO management is more pronounced in this measure.

H2a: The association between CFO management and stock price crash risk is more pronounced for firm w ith higher associations between stock returns and CFO.

Second, prior research provides mixed results of whether information of cash flow is related to financial distressed firm. Casey & Norman (1985) provide evidence that cash flows do not plays a role in distinguishing between bankrupt and non bankrupt firms But Sharma (2001) finds that cash flows provide additional information in distinctive between bankrupt and non bankrupt firms Furthermore, Gombola et al. (1987) and Gentry et al. (1985).

provide ev idence that cash flows do not have ability to predict firm failure. However, Graham et al. (2005) find that managers consider cash flow information more important to evaluate firms that are near financial distress or highly leveraged. This is consistent with the view that information of cash flow is a measure of evaluating credit and bankruptcy risk (DeFond & Hung, 2003). Thus, I expect the relationship between CFO management and stock price crash risk is stronger when the firm is near financial distress.

H2b The positive association between crash risk and CFO management is stronger when firm is near financial distress.

When rating agencies give credit rating to firms, information about the cash flow is important (Standard & Poor’s 2008). For example, Ba cker Gosman (1980) find that CFO to long term debt ratio is an important variable when senior executives at bond rating agencies make a decision about the credit rating Also, the grade boundary of investment/non investment is important point in the dist ribution of ratings (Beaver et al., 2006). Thus, there are incentives to inflate reported CFO to avoid downgrades, especially when firms are in grade boundary of investment and non investment. Therefore, I expect the relationship between CFO management and stock price crash risk to be stronger when firm are in this boundary.

H2c The positive association between crash risk and CFO management is stronger when firm is near the investment/non investment grade cutoff.

Several studies related to earnings manag ement interpret a discontinuity in earnings distribution around the zero as evidence of earnings management. For example, Zhang (2008) suggest that firms manipulate CFO to meet/beat cash flow forecast by documenting a discontinuity in cash flow distributio n . Following this stream of literature, I argue that the relationship between crash risk and CFO management is more pronounced for firms that just meet or beat the analyst cash flow forecast.

H1d: The positive association between crash risk and CFO management is more pronounced for firms that just meet beat analyst cash flow forecasts.

Sample, Data, and Research Design

Sample

I obtain annual financial data a nd quarterly data from Compustat, equity return data from Center for Research in Security Prices (C RSP). The sample spans 2002 to 2014. The sample period begins in 2002 because of th e Sarbanes Oxley Act (SOX) I exclude regulated industries (SIC codes 4400 to 5000) and banks and financial institutions (SIC codes 6000 to 6500) because the financial infor mation differs from that in other industries. And I exclude firm year observations that have non positive book values, fiscal year end stock prices of less than $1, and o bservations that have fewer than 26 weeks of stock return data. To mitigate the effect s of outliers, all variables are winsorized at the extreme 1st and 99th percentiles. Finally, I use 19,376 firm year observations.

Design

Unexpected cash flow from operation

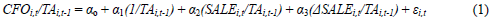

I calculate predicted CFO using the equation (1) over the prior 10 years based on (Dechow et al. al., 1998). The interest variable is the absolute value of unexpected CFO( ABSUCFO). To obtain the ABSUCFO, I deduct the actual CFO from predicted CFO.

Where C FOi,t is the operating cash flows(annual Compustat data item “ oancf annual Compustat data item “ xidoc ”. TA is total assets ( annual Compustat data item “ at ”. SALES is total saels (annual Compustat data item “ sales ”). ΔSALE i is change in s ales from the preceding year.

Measuring firm specific crash risk

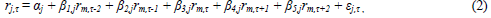

To calculate the measures stock price crash risk, I use equation (2) for each firm and year. Specifically, the firm specific weekly stock return is defined as the natural log of one plus the residual return from the equation (2)

Where  is the return on stock j in week and

is the return on stock j in week and is the return on the CRSP value weighted market index in week ??. I include the lead lag terms for the m arket index return to allow for nonsynchronous trading (Dimson 1979).

is the return on the CRSP value weighted market index in week ??. I include the lead lag terms for the m arket index return to allow for nonsynchronous trading (Dimson 1979).

B ased on prior studies, the first measure of stock price crash risk is an indicator variable( CRASH ) that equals one if there are one or more crash weeks during the fiscal year. Note th at I define crash weeks as those weeks during which firm specific weekly returns 3.2 standard deviations below the mean firm specific weekly return over the fiscal year.

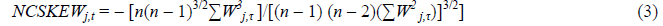

S econd measure of stock price crash risk is the negative stock return skewness NCSKE W ). Specifically, I calculate NCSKEW by taking the negative of the third moment of firm specific weekly returns for each year and dividing it by the standard deviation of firm specific weekly returns raised to the third power. A higher value of NCSKEW indi cates that it is more likely to experience stock price crash risk.

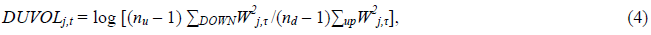

Third measure of stock price crash risk is the down to up volatility ( DUVOL ), which is computed as equation (4). I divide all the weeks by firm specific weekly returns below the annual mean (“ down ” weeks) and t hose firm specific returns above the annual mean (“ up ” weeks) and calculate the standard deviation for each of these subsamples separately. Then, the DUVOL measure is the log of the ratio of the standard deviation on the down weeks to the standard deviatio n on the up week.

Research M odel

To test whether CFO management is associated with stock price crash risk, I use the following model proposed by (Kim et al., 2009).

Where, for firm i in year t, Crash Risk i,t+1 are dependent variables that discussed above. I impose a one year lag between dependent variables and independent variables. A positive coefficient on ABSUCFO would indicate that CFO management increase the likelihood of stock price crash risk. Following Kim et al.(2009), I control for the effect of past return( RET ), stock SIGMA ), firm SIZE ), market to book ratio( MB ), leverage( LEV ), lag value of stock price crash NCSKEW ), change i n trading volume( DTRUN ), and abnormal DA

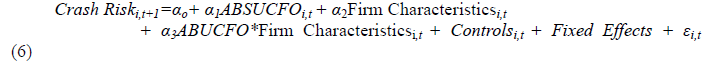

T o test the effect of firm characteristics on the relationship between CFO management and stock price crash risk, I estimate the following regression.

Where, for firm i in year t, Firm Characteristics i,t are (1) high relevance of stock returns and CFO, (2) whether the firms are in financial distress, (3) credit rat ing grade cutoff , (4) whether firms meet or beat the analyst cash flow benchmarks. Other variables are same as defined above. A positive coefficient on ABUCFO* Firm C haracteristics in equation (6) would indicate that the relationship between CFO management and stock price crash risk is more pronounce in firms that have this kind of characteristics.

Descriptive Statistics

Table 1 presents the descriptive statistics of the variables used for the regression analysis, based on the sample of firm years with non missing data. T he mean value of CRASH is 0.241, indicating that about 24 % of firm years have experience at least one stock price crash risk. And the mean values of NCSKEW and DUVOL are 0.014 and, 0.049, respectively. The mean value of ABS UCFO is 0.039 . The descriptive statistics of other variables are similar to the previous studies.

| Table 1 Descriptive Statistics |

||||||

| Variables | N | Mean | Std | Min | Median | Max |

|---|---|---|---|---|---|---|

| CRASHi,t | 19,376 | 0.241 | 0.428 | 0.000 | 0.00 | 1.000 |

| NCSKEWi,t | 19,376 | 0.014 | 0.822 | -2.404 | -0.015 | 2.990 |

| DUVOLi,t | 19,376 | -0.049 | 0.373 | -0.990 | -0.058 | 1.088 |

| ABSUCFOi,t | 19,376 | 0.039 | 0.051 | 0.000 | 0.022 | 0.357 |

| RETi,t | 19,376 | -0.002 | 0.003 | -0.027 | -0.001 | 0.000 |

| SIGMAi,t | 19,376 | 0.055 | 0.030 | 0.013 | 0.047 | 0.225 |

| SIZEi,t | 19,376 | 6.326 | 2.203 | 1.029 | 6.300 | 11.840 |

| MBi,t | 19,376 | 2.730 | 3.719 | -18.129 | 1.968 | 33.270 |

| LEVi,t | 19,376 | 0.189 | 0.192 | 0.00 | 0.154 | 0.968 |

| NCSKEWi,t | 19,376 | 0.027 | 0.804 | -2.306 | -0.005 | 2.926 |

| TURNOVERi,t | 19,376 | 1.751 | 1.622 | 0.035 | 1.303 | 10.425 |

| DAi,t | 19,376 | 0.178 | 3.127 | -30.199 | 0.040 | 32.506 |

| CFO_WEIGHTi,t | 19,376 | 1.189 | 5.169 | -19.828 | 0.838 | 24.785 |

| DISTRESSi,t | 19,376 | 0.110 | 0.189 | 0.000 | 0.031 | 0.960 |

| NON_IGRADEi,t | 19,376 | 0.487 | 0.499 | 0 | 0 | 1 |

| MEET_BEAT_CFOi,t | 19,376 | 0.022 | 0.149 | 0 | 0 | 1 |

Table 2 shows the Pearson correlation metrics for the variables used in the regression analysis. The three mea sures of stock price crash risk ( CRASH , NCSKEW , DUVOL ) are highly correlated each other. More importantly, the correlation between two of three measures of stock price crash risk and ABSUCFO is positive, suggesting that CFO management is likely to lead sto ck price crash risk.

| Table 2 Correlations |

|||||||||||||||||

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CRASHi,t | 1 | 1 | 0.6 | 0.535 | 0.004 | 0.012 | -0.01 | -0 | 0 | -0.02 | 0.04 | -0 | 0.02 | 0.02 | 0.01 | -0.01 | 0.01 |

| <.0001 | <.0001 | 0.827 | 0.519 | 0.47 | 0.81 | 0.9 | 0.22 | 0.03 | 0.45 | 0.23 | 0.4 | 0.58 | 0.76 | 0.572 | |||

| NCSKEWi,t | 2 | 1 | 0.956 | 0.033 | 0.034 | -0.03 | 0.04 | 0 | -0.03 | 0.03 | 0 | 0.02 | 0 | -0 | -0 | 0.006 | |

| <.0001 | 0.068 | 0.056 | 0.165 | 0.02 | 0 | 0.1 | 0.17 | 0.85 | 0.18 | 0.89 | 0.24 | 0.91 | 0.75 | ||||

| DUVOLi,t | 3 | 1 | 0.029 | 0.068 | -0.06 | 0.07 | 0 | -0.05 | 0.02 | -0 | 0.02 | -0 | -0.1 | 0 | 0.004 | ||

| 0.1 | 0 | 0.001 | 0 | 0 | 0.01 | 0.28 | 0.74 | 0.36 | 0.83 | 0.01 | 0.91 | 0.826 | |||||

| ABSUCFOi,t | 4 | 1 | -0.113 | 0.163 | -0.2 | 0 | 0.01 | 0.01 | 0.16 | 0.02 | -0 | 0.1 | 0.04 | -0.01 | |||

| <.0001 | <.0001 | <.0001 | 0.3 | 0.43 | 0.6 | <.0001 | 0.37 | 0.16 | <.0001 | 0.04 | 0.565 | ||||||

| RETi,t | 5 | 1 | -0.93 | 0.43 | 0.1 | -0.25 | -0.1 | -0.4 | -0 | -0 | -0.4 | 0.03 | 0.041 | ||||

| <.0001 | <.0001 | <.0001 | <.0001 | <.0001 | <.0001 | 0.68 | 0.02 | <.0001 | 0.12 | 0.024 | |||||||

| SIGMAi,t | 6 | 1 | -0.5 | -0.2 | 0.25 | 0.11 | 0.51 | 0.02 | 0.03 | 0.45 | 0.03 | -0.044 | |||||

| <.0001 | <.0001 | <.0001 | <.0001 | <.0001 | 0.41 | 0.07 | <.0001 | 0.06 | 0.014 | ||||||||

| SIZEi,t | 7 | 1 | 0.2 | -0.35 | -0 | -0.2 | 0.03 | -0 | -0.5 | -0.28 | 0.057 | ||||||

| <.0001 | <.0001 | 0.02 | <.0001 | 0.17 | 0.21 | <.0001 | <.0001 | 0.002 | |||||||||

| MBi,t | 8 | 1 | -0.03 | -0 | -0.1 | -0 | 0.02 | -0.1 | -0.11 | 0.031 | |||||||

| 0.07 | 0.01 | <.0001 | 0.23 | 0.26 | <.0001 | <.0001 | 0.084 | ||||||||||

| LEVi,t | 9 | 1 | -0 | 0.06 | -0 | 0.01 | 0.42 | 0 | -0.026 | ||||||||

| 0.71 | 0 | 0.72 | 0.72 | <.0001 | 0.87 | 0.149 | |||||||||||

| NCSKEWi,t | 10 | 1 | 0.04 | 0.01 | 0.02 | 0.08 | 0.02 | 0.024 | |||||||||

| 0.03 | 0.66 | 0.35 | <.0001 | 0.29 | 0.179 | ||||||||||||

| TURNOVERi,t | 11 | 1 | 0 | 0 | 0.2 | 0.09 | -0.018 | ||||||||||

| 0.91 | 0.98 | <.0001 | <.0001 | 0.324 | |||||||||||||

| DAi,t | 12 | 1 | -0 | -0 | -0.02 | 0.011 | |||||||||||

| 0.08 | 0.23 | 0.29 | 0.542 | ||||||||||||||

| CFO_WEIGHTi,t | 13 | 1 | 0.01 | -0.01 | -0.012 | ||||||||||||

| 0.43 | 0.75 | 0.496 | |||||||||||||||

| DISTRESSi,t | 14 | 1 | -0.04 | -0.031 | |||||||||||||

| 0.01 | 0.084 | ||||||||||||||||

| NON_IGRADEi,t | 15 | 1 | -0.034 | ||||||||||||||

| 0.058 | |||||||||||||||||

| MEET_BEAT_CFOi,t | 16 | 1 | |||||||||||||||

Variable Definitions

CRASH /NCSKEW/DUVOL proxies for stoc k price crash risk calculated by equation (2), (3), (4); ABSUCFO : absolute value of unexpected cash from operation, calculated by equation (1); SIZE the log value of the market value of equity; MB : the market value of equity divided by the book value of e quity; LEV the ratio of total liabilities to total assets; SIGMA : the standard deviation of the firm specific weekly returns; TURNOVER : the difference of the average monthly share turnover and the average monthly share turnover in previous year; RET : the mean of the firm specific weekly returns; DA : prior three years’ moving sum of absolute value of discretionary accruals, where disc retionary accruals are calculated from the modified Jones model ; W_CFO : weight on CFO given by ??2 from the following regr ession over 10 years :

: natural log of the probability of bankruptcy measure based on Shumway (2001) in t ; NON_IGRADE : indicator variable equal 1 if the Standard & Poor’s long term domestic issuer credit rating are BBB+, BBB, BBB --, B B+, BB, or BB --, and 0 otherwise; MEAT_BEAT_CFO : indicator variable equal 1 if the firm meet or beats analyst cash flow forecast by zero or one cent, and 0 otherwise.

: natural log of the probability of bankruptcy measure based on Shumway (2001) in t ; NON_IGRADE : indicator variable equal 1 if the Standard & Poor’s long term domestic issuer credit rating are BBB+, BBB, BBB --, B B+, BB, or BB --, and 0 otherwise; MEAT_BEAT_CFO : indicator variable equal 1 if the firm meet or beats analyst cash flow forecast by zero or one cent, and 0 otherwise.

Empirical Analysis

Table 3 presents the empirical results of estimation equation (5) to test the first hypothesis. Note that the first hypothesis is that there is a relationship between CFO management and stock price crash risk. I report t values based on stan dard errors clustered at the firm levels to control for cro ss sectional correlations (Petersen, 20009). Column (1) shows the results of using CRASH as the dependent variable. And Column (2), (3) show the results of using NCSKEW and DUVOL as the dependent v ariables. The coefficient on ABSUCFO, which indicate the effect of CFO management on stock price crash risk, are positive (0.485, 0.134, 0.043) but insignificant in column (1), (2), (3). This results indicates that in general, CFO management has no effect on stock price crash risk.

| Table 3 Cfo Management And Stock Price Crash Risk |

|||

| Crash Riski,t+1=αo+ α1ABSUCFOi,t + Controlsi,t + Fixed Effects + εi,t | |||

| Dependent variables | CRASHi,t+1 | NCSKEW i,t+1 | DUVOL i,t+1 |

|---|---|---|---|

| Intercept | -1.543*** (-10.04) |

-0.209*** (-3.17) |

-0.121*** (-4.010) |

| ABSUCFOi,t | 0.485 (1.21) |

0.134 (1.18) |

0.043 (0.66) |

| RETi,t | 42.094 (1.38) |

14.874* (1.74) |

5.048 (1.30) |

| SIGMAi,t | -0.920 (-0.34) |

0.444 (0.55) |

-0.387 (-1.05) |

| SIZEi,t | 0.027** (2.00) |

0.036*** (8.31) |

0.019*** (9.78) |

| MBi,t | 0.005* (1.65) |

0.005*** (2.59) |

0.002*** (2.76) |

| LEVi,t | 0.082 (0.79) |

-0.013 (-0.36) |

-0.022 (-1.39) |

| NCSKEWi,t | 0.045* (1.94) |

0.021*** (2.56) |

0.010*** (2.58) |

| TURNOVERi,t | 0.087*** (6.45) |

0.026*** (5.63) |

0.012*** (5.732) |

| DAi,t | 0.002 (0.40) |

0.002 (0.77) |

0.001 (0.59) |

| Industry/year fixed effects | Included | Included | Included |

| Adj R2 | 0.043 | 0.045 | 0.044 |

| N | 19,376 | 19,376 | 19,376 |

The coefficients of control variables are generally consistent with prior studies. The coefficients of SIZE, MB, NCSKEW, TURNOVER are positive and significant.

This table 3 presents regression results of equation ( 5 ). The sample consists of 19,376 firm year observations for the 2002 2014 period. All T statistics in parentheses are based on standard errors clustered by firm. *, **, and *** indicat e statistical significance at the 10%, 5%, and 1% levels, respectively.

| Table 4 The Effects Of Cfo Management On Stock Price Crash Risk Under The Four Firmcharacteristics |

||||

| Panel A: OLS regression of CRASH on ABSUCFO and FIRM CHARACTERISTIC CRASHi,t+1=αo+ α1ABSUCFOi,t + α2Firm Characteristicsi,t + α3ABUCFO*Firm Characteristicsi,t + Controlsi,t + Fixed Effects + εi,t |

||||

| CFO_WEIGHT | DISTRESS | NON_IGRADE | MEAT/BEAT_CFO | |

|---|---|---|---|---|

| Intercept | -1.471*** (8.92) |

-1.771*** (10.01) |

-0.485 (1.36) |

-0.988*** (3.29) |

| ABSUCFOi,t | 0.436 (1.23) |

0.156 (0.96) |

-1.805 (1.07) |

2.342** (1.02) |

| Firm Chari,t | -0.004 (0.005) |

-0.206 (0.205) |

-0.100 (0.093) |

-0.126 (0.269) |

| ABSUCFOi,t*Firm Char | 0.214** (2.12) |

0.841* (1.74) |

6.556*** (2.63) |

2.582** (2.22) |

| RETi,t | 29.846 (0.84) |

39.043 (1.08) |

39.704 (0.72) |

-33.541 (0.54) |

| SIGMAi,t | -2.683 (0.89) |

-2.010 (0.65) |

-1.080 (0.23) |

-6.523 (1.29) |

| SIZEi,t | 0.023* (1.64) |

0.002 (0.125) |

0.086*** (2.86) |

0.033 (1.32) |

| MBi,t | 0.005 (1.05) |

0.007 (1.06) |

0.017** (2.43) |

0.013* (1.62) |

| LEVi,t | 0.140 (1.21) |

0.127 (0.94) |

-0.161 (0.71) |

0.111 (0.62) |

| NCSKEWi,t | 0.062** (2.38) |

0.056** (2.07) |

0.011 (0.25) |

0.056 (1.40) |

| TURNOVERi,t | 0.085*** (5.67) |

0.103*** (6.86) |

0.032 (1.39) |

0.036* (1.89) |

| DAi,t | 0.000 (0.67) |

-0.004 (0.71) |

-0.002 (0.12) |

0.007 (0.91) |

| Industry/year fixed effects |

Included | Included | Included | Included |

| Adj R2 | 0.047 | 0.065 | 0.057 | 0.054 |

| N | 19,376 | 19,376 | 19,376 | 19,376 |

| Panel B: OLS regression of NCSKEW on ABSUCFO and FIRM CHARACTERISTIC NCSKEWI,T+1=ΑO+ Α1ABSUCFOI,T + Α2FIRM CHARACTERISTICSI,T + Α3ABUCFO*FIRM CHARACTERISTICSI,T + CONTROLSI,T + FIXED EFFECTS + Εi,t |

||||

| CFO_WEIGHT | DISTRESS | NON_IGRADE | MEAT/BEAT_CFO | |

| Intercept | -0.379*** (5.19) |

-0.408*** (4.91) |

0.001 (0.12) |

-0.184* (1.64) |

| ABSUCFOi,t | 0.089 (1.17) |

0.486 (1.27) |

1.105* (1.65) |

1.137 (1.38) |

| Firm Chari,t | -0.002 (0.78) |

-0.163 (0.62) |

-0.003 (0.27) |

-0.154 (1.83) |

| ABSUCFOi,t*Firm Char | 0.101*** (3.15) |

1.086* (1.95) |

0.237** (2.12) |

0.432** (2.23) |

| RETi,t | 12.680 (1.31) |

23.128** (2.40) |

10.121 (0.65) |

1.278 (0.06) |

| SIGMAi,t | 0.139 (0.15) |

1.131 (1.26) |

-0.511 (0.35) |

-1.608 (0.99) |

| SIZEi,t | 0.035*** (7.01) |

0.030*** (6.05) |

0.002* (1.67) |

0.009* (1.75) |

| MBi,t | 0.003 (1.50) |

0.003* (1.67) |

0.006** (2.003) |

0.009*** (0.003) |

| LEVi,t | 0.016 (0.41) |

0.048 (1.09) |

-0.022 (0.29) |

-0.025 (0.41) |

| NCSKEWi,t | 0.017* (1.89) |

0.025*** (2.77) |

0.002 (0.14) |

0.012 (0.85 |

| TURNOVERi,t | 0.027*** (5.40) |

0.030*** (6.00) |

0.006 (0.85) |

0.018*** (3.06) |

| DAi,t | 0.001 (0.50) |

0.003 (1.03) |

0.006 (1.54) |

0.003 (0.75) |

| Industry/year fixed effects |

Included | Included | Included | Included |

| Adj R2 | 0.047 | 0.055 | 0.034 | 0.037 |

| N | 19,376 | 19,376 | 19,376 | 19,376 |

| Panel C: OLS regression of DUVOL on ABSUCFO and FIRM CHARACTERISTIC DUVOLi,t+1=αo+ α1ABSUCFOi,t + α2Firm Characteristicsi,t + α3ABUCFO*Firm Characteristicsi,t + Controlsi,t + Fixed Effects + εi,t |

||||

| CFO_WEIGHT | DISTRESS | NON_IGRADE | MEAT/BEAT_CFO | |

| Intercept | -0.197*** (6.35) |

-0.204*** (5.67) |

-0.038 (0.69) |

-0.118** (2.36) |

| ABSUCFOi,t | 0.032 (0.41) |

0.240 (1.35) |

0.616 (1.27) |

0.552 (0.96) |

| Firm Chari,t | -0.001 (1.01) |

0.083 (0.28) |

0.006 (0.82) |

0.068 (1.35) |

| ABSUCFOi,t*Firm Char | 0.044*** (2.98) |

0.525** (2.24) |

0.213** (2.38) |

0.184* (1.85) |

| RETi,t | 4.637 (1.10) |

9.422** (2.20) |

2.549** (2.16) |

2.508* (1.76) |

| SIGMAi,t | -0.461 (1.16) |

-0.060 (0.15) |

-0.827 (1.19) |

-1.350* (1.81) |

| SIZEi,t | 0.018*** (9.02) |

0.016*** (8.03) |

0.002 (0.54) |

0.008** (2.66) |

| MBi,t | 0.002** (2.01) |

0.002** (2.21) |

0.002* (1.92) |

0.004*** (2.78) |

| LEVi,t | -0.011 (0.61) |

0.008 (0.02) |

-0.039 (0.35) |

-0.037 (0.28) |

| NCSKEWi,t | 0.008** (2.04) |

0.012*** (3.04) |

0.002 (0.33) |

0.002 (0.036) |

| TURNOVERi,t | 0.012*** (6.02) |

0.014*** (8.82) |

0.002 (1.03) |

0.010*** (5.33) |

| DAi,t | 0.001 (0.79) |

0.001 (0.90) |

0.002 (0.02) |

0.001 (0.94) |

| Industry/year fixed effects |

Included | Included | Included | Included |

| Adj R2 | 0.023 | 0.040 | 0.041 | 0.037 |

| N | 19,376 | 19,376 | 19,376 | 19,376 |

According to Lee (2012), specific firm characteristics are associated with managerial incentive to inflate reported CFO. This means that CFO management is likely to happen under such firm characteristics. Therefore, it needs to examine the relationship between crash risk and ABSUCFO under the four firm characteristics mentioned by (Lee, 2012). That is, I examine how the association between CFO management and stock price crash risk var ies conditional on firm characteristics. As empirical proxies for firm characteristics, I use four variables: ( 1 ) CFO_WEIGHT , 2) DISTRESS , 3 NON_IGRADE and (4) MEET/BEAT_CFO

Table 4 Panel A , Panel B, Panel C), shows the results of the effects of ABS UCFO on the crash risk under the four firm characteristics. Panel A of Table 4 shows the result when CRASH is used as the dependent variable. The coefficient on ABSUCFO is still positive but insignificant, suggesting that CFO management do not significantl y affect the stock price crash risk. However, the coefficients on ABSUCFO i,t *Firm Char is positive and significant under four firm characteristics. Panel B and C also report similar results to Panel A. To summarize, the impact of ABSUCF on stock price cras h risk is statistically highly significant under specific firm characteristics that associated with managerial incentive to inflate reported CFO.

This table presents regression results of equation ( 6 ). The sample consists of 19,376 firm year observations for the 2 002 2014 period. All T statistics in parentheses are based on standard errors clustered by firm and year. *, **, and *** indicate statistical significance at the 10%, 5%, and 1% levels, respe ctively.

Conclusion

Earnings and cash from operations (CFO) are complementary measures of firm performance. But, earnings and CFO have different meaning for future earnings and for investors depending on the firm characteristics. Also, cases of misreporting in cash flow have raised concern that managers also exercise d iscretion on CFO. Therefore, I investigate whether CFO management is associated with stock price crash risk because managers can hide bad news from investors through CFO management. The r esults are not supports h ypothesis that there is a relationship betwe en CFO management and stock price crash risk. But according to prior studies, there are hour firm characteristics that associated with incentive to inflate reported CFO. Therefore, I examine the relationship between CFO management and stock price crash ris k under the four firm characteristics. I find th at the effect of CFO management on stock price crash risk is greater for under the four firm characteristics.

This study contributes to the literature on CFO management by providing evidence that CFO manageme nt can cause stock price crash risk under specific firm characteristics by being used by opportunistic managers. Thus, r esults of this studies are relevant to standard setters and regulators who underscore the importance of understanding CFO management.

References

Call, A. C. (2007). The implications of cash flow forecasts for investors' pricing and managers' reporting of earnings (Doctoral dissertation, University of Washington).

Dechow, P.M., Kothari, S.P., & Watts, R.L. (1998). The relation between earnings and cash flows. Journal of Accounting and Economics, 25(2), 133-168.

Gentry, J., Newbold, P., & Whitford, D. (1985). Classifying bankrupt firms with funds flow components. Journal of Accounting Research, 23(1), 146-161.

Hutton, A.P., Marcus, A.J., & Tehranian, H. (2009). Opaque financial reports, R2, and crash risk. Journal of financial Economics, 94(1), 67-86.

Kim, J.B., Li, L., Lu, L.Y., & Yu, Y. (2016). Financial statement comparability and expected crash risk. Journal of Accounting and Economics, 61(2-3), 294-312.

Kim, J.B., Li, Y., & Zhang, L. (2011). CFOs versus CEOs: Equity incentives and crashes. Journal of Financial Economics, 101(3), 713-730.

Lee, L.F. (2012). Incentives to inflate reported cash from operations using classification and timing. The Accounting Review, 87(1), 1-33.

Zhang, W. (2008). “Real activity manipulation to meet analyst cash flow forecasts”. Working paper, National University of Singapore.