Research Article: 2022 Vol: 26 Issue: 4S

The Effect of Business and Investment Procedure, Taxation, and Infrastructure on the Investment Attractiveness: The Moderating Role of Embeddedness

Fadi Abdel Muniem Abdel Fattah, College of Business Administration (COBA) A’Sharqiyah University

Hussam Al Halbusi, Ahmed Bin Mohammed Military College (ABMMC)

Saleh Al Sinawi, College of Business Administration (COBA) A’Sharqiyah University

Abrar Al Alawi, University of Nizwa

Ghdeer Al Wahibi, College of Business Administration (COBA) A’Sharqiyah University

Citation Information: Fattah, F.A.M.A., Al-Halbusi, H., Al-Sinawi, S., Al-Alawi, A., & Al Wahibi, G. (2022). The effect of business and investment procedure, taxation, and infrastructure on the investment attractiveness: the moderating role of embeddedness. International Journal of Entrepreneurship, 26(S4), 1-19.

Abstract

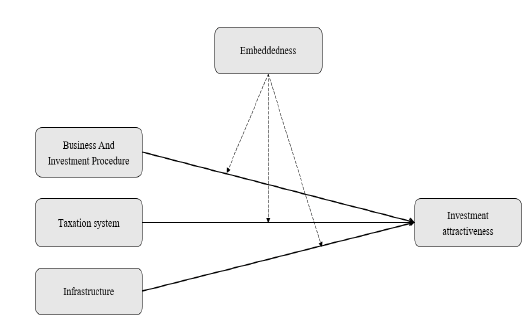

Due to rising rivalry among emerging nations, a better understanding of investment incentives has emerged. As a result, one of Oman’s government’s priorities is to attract investment, as mentioned in the country’s 2040 vision. Therefore, the purpose of this study is to examine the effect of business and investment procedure, taxation system, and infrastructure on the investment attractiveness in the Sultanate of Oman within the Duqm Special Economic Zone. In addition, this study investigated the moderating role of embeddedness between the proposed relationships. This study is a cross-sectional study that adopted a quantitative approach to investigate the proposed research model. An online questionnaire (google form) was used to collect data from the investor in the Sultanate of Oman (Duqm Zoon. Three hundred and five (305) completed and usable responses were received and considered for further analysis. The data was analyzed using Smart-PLS 3.3.3 software, Structural Equation Modeling (SEM) was used to analyze the collected data. The two models were supported empirically, and the results showed a significant relationship between that infrastructure and taxation systems significantly affect investment attractiveness. Interestingly, the result showed that embeddedness as moderating variable strengthens the relationship between business and investment procedure and investment attractiveness and between infrastructure and investment attractiveness. The current research outcomes will be helpful for policymakers to foster the attractiveness of power generation investment in the region. This study would not give only a foretaste for scholars; it would also be a reference for the policymakers and practitioners to facilitate and improve the investment procedures. In addition, this research can drive the development and implementation of facilitating and improving the investment procedures in the Duqm Special Economic Zone in Oman. The originality of the current research empirically tests two models within the Omani Special Economic Zone context while considering the proposed and studied variables. Therefore, this study scrutinized how (business and investment procedures). Moreover, the present study explored that embeddedness is a vital moderator of the association among independent variables (i.e., business and investment procedure, taxation system, and infrastructure) and dependent variables (i.e., investment attractiveness). A mixed-method design or qualitative research methodology may be used in future investigations. The research was carried out in the Sultanate of Oman, but the findings could be applied to other developing countries with similar settings.

Keywords

Investment Attractiveness, Business and Investment Procedure, Taxation System and Infrastructure, Embeddedness, Oman, Duqm Zone, Gulf Cooperation Council, Developing Countries

Introduction

Investment policy study is widespread, particularly in constructing institutional frameworks in emerging and developing economies. Emphasis has been placed on variables such as the function of the regions in terms of the country’s economic development (Hassan et al., 2021). In addition, sophisticated local measures, environment for economic growth, and institutional frameworks are all necessary for productivity. It also results in a substantial boost in budget revenues. The increase in income causes an increase in growth in the economy. Economists compare how econometric analyses directly depend on economic development based on income earned in areas in their study (De Clercq et al., 2012; Ershova, 2017; Tseng et al., 2019). Thus, the government has recognized the strengthening of Oman’s investment climate and its positive impact on the inflow of foreign direct investment into the country’s economy as a major requirement for its future economic development. One of the essential instruments for developing foreign investors’ ideas and reactions to the most pressing and crucial issues that obstruct their investment activities in the Sultanate (Martínez-Martínez et al., 2018; Ibrahim et al., 2020).

In particular, Sultanate Oman emphasizes Duqm Zone (Special Economic Zone Authority at Duqm). However, Duqm is a state located in the Al-wasta area. The Duqm area is 550 kilometers south of the capital, Muscat. It is the largest single economic project in Oman. The efforts aim to stop the country’s dependence on crude oil and gas exports and diversify its resources to other industries. The country’s resources will be depleted from the oil reserves. The Decree was issued by establishing the Special Economic Zone Authority Duqm SEZAD to manage, organize, and develop all economic activities in the Duqm area. The region seeks to attract investments expand re-exports, encourage the involvement of national manpower in the economic activities expected, activate the urban expansion of the modern city of Duqm, as well as protect the environment in the region and the region is one of the best places in the Middle East whether for tourism or living (Khalid et al., 2021; Hamudy, & Rifki, 2021; Al Halbusi et al., 2020). The most debatable issue of manpower and their visa processing to be faster without many glitches is making the permits for licenses and approvals easier for investors under the SEZAD framed policies. Single point of services for all required facilities for investors and their business; in addition to that, the Duqm is an area where there is not much Oman living (Al-Fazari, & Teng, 2019; Hamudy & Rifki, 2021; Uzir et al., 2021).

Based on the country’s economic development, special importance should be given to factors that attract or motivate investors. Thus, there are main issues that the Sultanate faces in getting more people to work in this new area. Investors would often ask about the essential elements before acting in that area (e.g., Business and Investment Procedure, Taxation system, and Infrastructure). Thus, this research investigates the availability of these factors in the Duqm zone. Importantly, culture such as embeddedness is crucial as it acknowledges that social networks between people are essential, where people make decisions based on previous contacts with others and stick with those they trust (Meuleman et al., 2017). Nevertheless, we considered these factors for several reasons are as follows:

First, business and investment procedure, the most debatable issue of manpower and their visa processing to be faster without many glitches, makes licenses and approvals easier for investors under the SEZAD framed policies. Special offices for issuance of visas to be made quicker and more comfortable for the expatriate families and staff. Single point of services for all required facilities for investors and their businesses. In the last ten years, companies have given significant provisions, making Duqm the next place to forward to drive the nation’s economy away from the exclusively dominated oil business (Dejuan-Bitria & Mora-Sanguinetti, 2021). Second, the taxation system is one feature that attracts investors towards Duqm in taxation system such as tax-free business for initial 30 years from the beginning, provision of 100% foreign ownership without need of a local, trade-in any currency no stipulation on minimum investment. No restriction on remittance of profit and investment, import of all items except for illegal materials permitted, import of parts, and assembling to make the finished goods with local branding permitted—free movement of goods and items imported inside the Sultanate free zones (Hamudy & Rifki, 2021). Third, to do the same, excellent infrastructure and surroundings have to be developed so that workforce can be relocated and moved to perform the development activities of electricity, resources, and human capital (Khalid et al., 2021). Forth, most importantly, embeddedness is the degree to which a country’s culture is entrenched shows how important it is for its citizens to create and maintain intimate relationships with each other; very rooted relations are manifest by lower matter costs and are informal, such that the growth the capability of conversation partners to share an extensive set of information. Compared to countries with low degrees of embeddedness, commercial ties are more legally governed by severe deterrent instruments (e.g., specific contract covenants) rather than extensive cultural links (Schwartz, 1994; Ciabuschi et al., 2017). Therefore, this research tries to get a better solution to attract investment in the Duqm zone, so a survey study depends on quantitative research.

Literature review and hypotheses

Business and Investment Procedure and Investment AttractivenessThe successful execution of investment policy in a region’s area ensures the region’s long-term economic growth. In this respect, one of the essential jobs is developing and assessing investment-relevant indicators, which impact the dynamics of the investment process and operational decision-making in the zone (Dejuan-Bitria & Mora-Sanguinetti, 2021). The state of a central subject’s potential value, whose practical use will raise the volume of investment resources incoming in the region’s economy, is a significant determinant of the growth of equity investments in that issue. The importance of forming (mobilizing all sources of investment) and efficiently employing the investment possibilities of this area can be seen when looking at the underlying instrument of each state issue (Tsepelev & Serikov, 2016; Tehseen et al., 2021).

In this regard, Oman has given special regulations and visa rules for working professionals and investors to find that moving to Duqm and settling for long-term work is feasible and convenient for ex-pats. Thus, there are different points of view in the economic literature concerning the main factors contributing to the advancement of investment attractiveness of the region and territorial development. In another approach of distinguishing the main factors of territorial development, the regional marketing tools highlighting the advantages of a particular region are the critical elements of territorial development (Glebova et al., 2013; Hamudy & Rifki, 2021). A special center is made available for all the people invested and doing business in Duqm for having faster processing of permits, licenses, visas, and approvals for any new implementation or anything which ‘Public Authority again monitors for Special Economic Zones and Free Zones’ (SEZAD). There is so much offered to make a business flourish and establish regulations to get the required approvals and licenses quickly so that the business does not have any shortfalls and hindrances while running. Government procedures and regulations often act as barriers to performing business smoothly (Abdul-Wahab et al., 2020; Uzir et al., 2020). Providing and supporting capital inflow and attracting potential investors are necessary for investments. The conditions in which there are all the prerequisites for creating a new business of the ideas and investment programs, the environment capable of minimizing the expenses arising at implementing investment activities, also act as essential. Protecting the rights of the investors and their interests is also necessary. (Zheltenkov et al., 2017). In addition, SEZAD and Oman have even eased the minimum capital stipulation for new businesses to increase. Adopting this strategy will give new investors the guts to enter new markets and domains as they are not forced to invest heavily in new business. This reduces the investor’s risk and helps them be more confident about the business venture. Currency restriction and free remittance of money incurred from capital profits for secure trading are also removed. Investors can roll their business from their native currency, making the Oman economy more substantial and independent from the US dollar. Relaxation on commercial laws helps to faster approval and work done for the necessary processing (Abdul-Wahab et al., 2020; Hamudy & Rifki, 2021). Hence, we theorize as follows.

H.1: The Assurance of Business and Investment Procedure is positively increasing the Investment attractiveness Duqm special economic zone.

Taxation System and Investment AttractivenessThe standing of tax law relates to the relevance of tax legislation must be regulated with a state’s strengths and legislative restrictions. First, though tax law is precious to society, the tax attorney must remember that absolute and flawless taxes can never be established due to its lack of exact release. Instead, it is a perpetual trial and error procedure (Waris, 2007; Popkova et al., 2019). Any taxation system is a product of history, people’s experiences, politics, economics, and law. Studies have tried to grasp the difficulty of taxation over time by developing rules and standards based on retroactive examination of taxation implementation. As a result, any endeavor to analyze any tax system or expenditures without considering the following five crucial variables is inadequate and impractical. Taxation is merely a tiny percentage of the government’s total budget. Charges, fees, licenses, and official business interests are other sources of income (Vasanthagopal, 2011; Popkova et al., 2019).

Furthermore, although tax relaxation does not apply to any business, some businesses will still be taxed, like the banking domain, including insurance, financial institutions, and related businesses. Telecommunication and land transportation also do not come under this exemption except if they are listed with Special Economic Zone Authority Duqm (SEZAD) and follow their regulations set for business in the area (Abdul-Wahab et al., 2020). These sectors are not given this exemption as they would severely affect the banking and telecommunication sector business in Oman, which is presently dominated and well supported by the government itself. Moreover, these two sectors are doing their business at excellent standards without much requirement to improve them further, while many other business domains are yet to be improved and focused on. The government does not give 100% foreign ownership in Oman to any business, but now they have given this exemption for attracting more investment in the Duqm. SEZAD has ensured to pass many such unconventional regulations to the traditional way of performing business in Oman (Pauceanu, 2016; Eudelle & Shrestha, 2017). Hence, 100% foreign ownership gives them the freedom to experiment and try all the things they want to in new business and apply techniques that they would find more lucrative for their business as they are main risk-takers. Thus, tax-exemption for new business development and starting so that new business gets time to set themselves without tax burden for the next 30 years from the beginning of a business. This itself stands as a significant relief to new investors and business people. Most countries outside the Middle East, even some GCC countries, have begun taxing nowadays. In such an era, if some region or nation offers a tax-free business for the next 30 years is a big positive step. Investors from Qatar and other nations are very keen on investing in a new business where there is proper scope for the future, and hence, we can see that many Qatari investors have stepped up in the Duqm projects (Yenigun et al., 2021; Hamudy & Rifki, 2021). So, we hypothesized that.

H.2: The taxation system positively increases the Investment attractiveness in the Duqm special economic zone.

Infrastructure Facilities and Investment attractivenessInfrastructure facilities comprise transportation systems, port facilities, utilities, energy. The infrastructures of a host state enhance a country’s investment environment. Investors are encouraged to invest because of solid and productive infrastructures (Asiedu, 2002; Mohamad et al., 2017). For example, more comprehensive transport and communications networks have motivated investors to invest in a country because physical infrastructure has a beneficial impact on productivity (Lall et al., 2000; Hammood et al., 2021b).

Relating to this case, Duqm has a lot of ambitious strategies in 2018 and after that. Sultanate has initiated two major projects: China-Oman Industrial Park, an overall $10.7 billion investment in many different projects. The second one is the manufacturing of buses that Qatari and Omani investors finance. In 2017, about 87 leased rental lands and about Omani Rail 610.2 million expansion projects. Some exciting projects are Al Wusta Cement and Little India, a tourism complex integrated for OMR 288 million. Port Duqm will be a competitor to Jebel Ali in Dubai due to its presence being active for the gulf region only, and Duqm being in the Indian Ocean will have more opportunity and easy access to trade. It is just about having good infrastructure, proper warehousing, handling containers, a strategically located port. It will undoubtedly impact the Sultanate’s economy considering maritime development, logistics, and the instability of the oil market. Hence, focusing on investment other than the oil domain is essential for Oman (Ramanuj Venkatesh, 2018; Ong, 2019; Hamudy & Rifki, 2021). So, all assets and projects implemented within its construction can be safely referred to as investment infrastructure components. In most, it is transport objects (from port to logistic hubs); creating the infrastructure to achieve the region’s target value of investment attractiveness is one of the central methodological moments of managing investment attractiveness (Zheltenkov et al., 2017).

All the applications are ensured to be responded to and resolved within five working days. Properties and any transaction are handled at lesser turn-around time as Duqm has customized, modernized systems as they follow visible and transparent methods for valuation, procedures for goods movement, and transaction processing quickly without compromising efficiency (Hammood et al., 2020). Presently, we can see that Sultanate is accustomed to lethargic working in all sectors. This affects lines of business that require faster turn-around time without which their products and goods will be tarnished and spoiled. Foreign investors especially would love to work in such environments and perform business as they are used to faster business processes in their native lands. All the trials are also passed and verified in the same arena so that people can quickly push products and goods into the market after a successful trial and error troubleshooting (Yahya Bin Said Bin Abdullah Al-Jabri, 2017; Abdul-Wahab et al., 2020). Thus, the following hypothesis was formulated.

H.3: Infrastructure facilities positively increase the Investment attractiveness in the Duqm special economic zone.

Moderation Role of EmbeddednessEmbeddedness refers to the idea that a company’s business success can be aided by the social bonds they build with such a variety of individuals in their social environment (Granovetter, 1985). Such interactions, which are typically overlooked by essentialist perspectives to organizations, are built on the logic of trustable cooperation, which can serve as a foundation for the transfer of knowledge and development from across the firm’s boundary (Uzzi & Lancaster, 2003; Al Halbusi et al., 2020). The social or interpersonal embeddedness method, in particular, stresses that companies can gain a competitive edge through acquiring ownership advantages via infrastructure that enables connections inherent in social ties and systems (Uzzi & Lancaster, 2003).

The level of embeddedness moderates the relationship between (business and investment procedure, taxation system, and infrastructure) toward investment attractiveness. When parties in an economic exchange cannot depend on their stronger family links with everyone, the occurrence of an extensive governing framework becomes much more vital (i.e., more “needed”) (Powell, 1990). This logic implies that formal and informal institutions are substituting for each other. Likewise, we believe that excellent legal protections are significant for micro-angel investment movement in countries with low levels of embeddedness. In contrast, a regulatory system that seeks to promote legal protections in companies with a significant propensity toward greater embeddedness may be less essential to enable micro-angel investment (Batjargal, 2003; Hassan et al., 2021). Whenever a country’s developing policies and procedures are ineffective, and safety measures toward opportunism are insufficient, salient, deeply embedded connections can deliver an alternative approach for enhancing performance to engage in economic exchanges (e.g., micro-angel investing) and optimism that these transfers will not be hindered by self-interested behavior (Wright et al., 2005). As a result, countries with high levels of embeddedness should have a less crucial role in influencing people’s willingness to invest personal capital in new firms (De Clercq et al., 2012; Kopyciński, 2020). Thus, we suggested the following hypotheses.

H.4: Embeddedness level of the culture positively moderates the relationship between assurance of business and investment procedure and investment attractiveness in Duqm special economic zone. The relationship is greater when the embeddedness level of the culture high than low.

H.5: Embeddedness level of the culture positively moderates the relationship between taxation system and investment attractiveness in Duqm special economic zone such as the relationship is greater when embeddedness level of the culture is high than low.

H.6: Embeddedness level of the culture positively moderates the relationship between Infrastructure facilities and investment attractiveness in Duqm special economic zone such as the relationship is greater when embeddedness level of the culture is high than low.

Method

Sample ProceduresThis research adopted a quantitative approach to test the proposed research framework. The data was collected from the 305 investors at Sultanate of Oman (Duqm Zoon). Nevertheless, before conducting the survey, senior human resources were approached in each organization to ask permission for the study: once permission was granted, the survey was distributed using a Google Form. The survey began with the cover letter explaining the purpose of the survey, assured the confidentiality of their responses, and requested respondents. Importantly, we ensure that this study is solely for academic purposes. We gathered gender, age, education level, and business type information. Regarding gender, males (60.3%) gained higher than females (36.1%). In terms of age, individuals between 30-35 received the highest (30.4%), followed by others (see Tables 1). People who hold a bachelor’s degree gained the highest (43.0%) education level, regarding the business types, people who operate in insurances obtained (18.4%) as higher. In addition, we asked if the people have visited Duqm Zoon (71.5%) have visited the place and (28.5%) not. Finally, we found that (59.4% were Omani) and (42.2% non-Omani) for nationality. All the results are displayed in Table 1.

| Table 1 Demographic profile |

|||

|---|---|---|---|

| Demographic Item | Categories | Frequency | Percentage |

| Gender | Male | 197 | 60.3 |

| Female | 108 | 36.1 | |

| Age | 18-23 | 69 | 22.6 |

| 24-29 | 71 | 23.3 | |

| 30-35 | 93 | 30.5 | |

| 36-41 | 67 | 22.0 | |

| 42-50 | 5 | 1.6 | |

| Education Level | High School | 61 | 20.0 |

| Diploma | 46 | 15.1 | |

| Bachelor | 131 | 43.0 | |

| Postgraduate | 67 | 22.0 | |

| Business Types | Manufacturing | 38 | 12.5 |

| Technology | 40 | 13.1 | |

| Medical Organizations | 32 | 10.5 | |

| Insurances | 56 | 18.4 | |

| Retails | 39 | 12.8 | |

| Legal | 29 | 9.5 | |

| Finance | 36 | 11.8 | |

| Telecommunication | 35 | 11.5 | |

| Did you visit Duqm | Yes | 218 | 71.5 |

| No | 87 | 28.5 | |

| Nationality | Omani | 171 | 59.4 |

| Non-Omani | 134 | 42.2 | |

Instrumental Measurement

All the instruments of this study were taken from prior valid studies. We checked the items to ensure that the content was accurate, understandable, and appropriate. However, all measures relied on five-point Likert response formats (1= Strongly Disagree; 5= Strongly Agree).

Business and investment procedure was assessed with 6-items taken from (Logunova et al., 2021). The items were slightly modified; an example of the item “There is significant organizational and institutional support. To measure the taxation system, 5-items borrowed from (Night & Bananuka, 2020), an example of item “The tax system is safe and convenient to use.” The infrastructure facilities were measured by 7-items adapted from (Zheltenkov et al., 2017). Items’ example “Harmonization of service prices for housing, public utilities, and electric energy.” 8-items were adapted from (Clinton et al., 2012) to assess the embeddedness level of the culture, the example of items “In general, I have strong relationships with people all over the zone.” We measured the investment attractiveness with 10-items taken from (Ershova 2017). Example of the item “Logistics and infrastructure partners are distinguished in the Duqm region.

Data analysis and results

We used Smart-PLS 3.3.3 software to perform Structural Equation Modeling (SEM) using Partial Least Squares (PLS) to evaluate the hypotheses (Ringle et al., 2015). This sophisticated, rigorous analytical approach is ideal for complicated causal analyses using both first- and second-order variables and does not require stringent assumptions regarding the parameters. Also, the PLS analysis employed 5,000 subsamples to create bootstrap t-statistics with n – 1 degree of freedom to examine the statistical significance of the path coefficients (where n is the number of subsamples) (Hair et al., 2017; Hair et al., 2019).

Common Method VarianceWe used various strategies to limit the likelihood of common method bias because our data came from the same single source (Podsakoff et al., 2003); (MacKenzie & Podsakoff, 2012; Afthanorhan et al., 2021). First, to avoid any confusion, the subjects were provided definitions of each concept and explicit instructions on how to complete the evaluations. The participants were also guaranteed the study’s scientific nature and the anonymity of their names.

We did various post hoc tests to assess the likelihood of CMV biasing the results in addition to these ex-ante procedural remedies. Even though CMV cannot exaggerate our interaction terms (MacKenzie & Podsakoff 2012), which are the focus of our investigation, we decided to examine them. This study employed Harman’s (1976) single-factor test technique to assess CMV bias, which yielded no issues; we then performed exploratory factor analysis to see if a single factor could describe the bulk of the covariance amongst the research items. The test revealed eight factors with eigenvalues greater than 1, which accounted for 68% of the total variance, and the variance in the first factor accounted for only 19% of the total variance, far from 50%. Therefore, this assessment advises that CMV is not a serious concern (Podsakoff et al., 2003). Second, we used Variance Inflation Factors (VIFs) to perform a thorough collinearity test (Kock, 2015). Kock & Lynn (2012) advocated doing such a test to evaluate vertical and lateral collinearity, and we adopted their instructions. A VIF higher than 3.3 shows pathological collinearity, implying that the model is affected by CMV (Kock and Lynn, 2012). Nevertheless, in Table 2, there is no CMV in the current research.

| Table 2 Common method variance assessment via full collinearity estimate criteria |

|||||

|---|---|---|---|---|---|

| Variable | Business and Investment Procedure | Taxation System | Infrastructure | Embeddedness Investment Attractiveness |

|

| VIF | 2.118 | 1.254 | 1.247 | 1.879 | 2.126 |

| Note: VIF = Variance inflation factor | |||||

Measurement Model Assessment

According to Hair, et al., (2017), before using a structural model, its characteristics (item reliability, internal consistency reliability, convergent validity, and discriminant validity) should be confirmed. All of these aspects were evaluated, starting with the item’s reliability. As shown in Table 3, most items were above the cutoff value of 0.5 or 0.707 (Hulland, 1999; Hair et al., 2017). Except for (TXS2=0.398 and EMBED1=0.269) were low; thus, these two items were dropped. Moreover, Cronbach’s alpha and composite reliability were employed to assess the constructs’ internal consistency. Table 3 showed that both procedures produced acceptable results, with values ranging from (0.747-0.882) Cronbach’s Alpha and (0.844-0.897) Composite Reliability, higher than the cutoff of 0.70 (Hair et al., 2017; Hair et al., 2019). In terms of convergent validity, the Average Variance Extracted (AVE) yielded results that ranged from (0.556-0.687), which exceeded the threshold of 0.5 (Hair et al., 2017; Hair et al., 2019) (see Table 3).

| Table 3 Measurement model, item loadings, construct reliability, and convergent validity |

|||||

|---|---|---|---|---|---|

| Constructs | Labeled | Factor Loading (> 0.5) |

Cronbach’s Alpha (> 0.7) |

Composite Reliability (> 0.7) |

Average Variance Extracted (> 0.5) |

| Business and Investment Procedure | BIP1 | 0.697 | 0.778 | 0.844 | 0.678 |

| BIP2 | 0.746 | ||||

| BIP3 | 0.738 | ||||

| BIP4 | 0.524 | ||||

| BIP5 | 0.761 | ||||

| BIP6 | 0.654 | ||||

| Taxation System | TXS1 | 0.517 | 0.747 | 0.855 | 0.664 |

| TXS2 | Dropped | ||||

| TXS3 | 0.833 | ||||

| TXS4 | 0.807 | ||||

| TXS5 | 0.758 | ||||

| Infrastructure | INFST1 | 0.675 | 0.829 | 0.867 | 0.687 |

| INFST2 | 0.794 | ||||

| INFST3 | 0.796 | ||||

| INFST4 | 0.752 | ||||

| INFST5 | 0.596 | ||||

| INFST6 | 0.618 | ||||

| INFST7 | 0.623 | ||||

| Embeddedness | EMBED1 | Dropped | 0.866 | 0.897 | 0.556 |

| EMBED2 | 0.707 | ||||

| EMBED3 | 0.800 | ||||

| EMBED4 | 0.643 | ||||

| EMBED5 | 0.771 | ||||

| EMBED6 | 0.763 | ||||

| EMBED7 | 0.718 | ||||

| EMBED8 | 0.796 | ||||

| Investment Attractiveness | IVEATT1 | 0.664 | 0.882 | 0.874 | 0.612 |

| IVEATT2 | 0.648 | ||||

| INEATT3 | 0.637 | ||||

| INEATT4 | 0.504 | ||||

| INEATT5 | 0.534 | ||||

| INEATT6 | 0.533 | ||||

| INEATT7 | 0.629 | ||||

| INEATT8 | 0.648 | ||||

| INEATT9 | 0.626 | ||||

| INEATT10 | 0.599 | ||||

| Notes: TXS2=0.398 and EMBED1=0.269) were dropped due to the low loading. | |||||

In addition, two approaches were used to test discriminant validity: (i) Fornell-Larcker and (ii) Heterotrait-Monotrait Ratio (HTMT). Nevertheless, there were no issues with Fornell-technique, Larcker’s, as shown in Table 4; the AVE for each construct was higher than the variation explained by each construct with the other latent constructs (Hair et al., 2017). Henseler et al., (2015) proposed the Heterotrait-Monotrait Ratio (HTMT) as a more trustworthy technique. As a result, the correlations found on the Multitrait-Multimethod Matrix are displayed. The criterion displays no problem with the discriminant validity when the HTMT value is more significant than the HTMT 0.85 value, 0.85. Therefore, the HTMT values are below the threshold of 0.85, thus confirming discriminant validity for each pair of constructs (Henseler et al., 2015; Hair et al., 2017) (see Table 5).

| Table 4 Discriminant validity via Fornell and Larcher |

|||||

|---|---|---|---|---|---|

| Business and Investment Procedure | Embeddedness | Infrastructure | Investment Attractiveness | Taxation System | |

| Business and Investment Procedure | 0.69 | ||||

| Embeddedness | 0.65 | 0.70 | |||

| Infrastructure | 0.61 | 0.67 | 0.77 | ||

| Investment Attractiveness | 0.41 | 0.48 | 0.57 | 0.64 | |

| Taxation System | 0.47 | 0.51 | 0.55 | 0.46 | 0.68 |

| Notes: Bold values on the diagonal in the correlation matrix are square roots of AVE (variance shared between the constructs and their respective measures). | |||||

| Table 5 Discriminant validity via HTMT |

|||||

|---|---|---|---|---|---|

| Business and Investment Procedure | Embeddedness | Infrastructure | Investment Attractiveness | Taxation System | |

| Business and Investment Procedure | |||||

| Embeddedness | 0.78 | ||||

| Infrastructure | 0.7 | 0.64 | |||

| Investment Attractiveness | 0.33 | 0.36 | 0.40 | ||

| Taxation System | 0.7 | 0.71 | 0.78 | 0.35 | |

| Notes: HTMT should be lower than 0.85. | |||||

Hypothesis Testing

This section goes on our primary hypothesis from H1 to H3. The hypothesis testing provided the first indication of the direct effect (H1), namely, business and investment procedure insignificantly related to investment attractiveness as per (β= 0.004, t = 0.061 and p < 0.952). Hence, H1 was not accepted as predicted. The second direct effect (H2) of the association between infrastructure and investment attractiveness was positively significant with values (β= 0.411, t = 5.321, and p < 0.000). Thus, H2 is supported. Likewise, for H3, the taxation system was significantly related to investment attractiveness (β= 0.396, t = 1.859, and p < 0.002). Hence, H3 is also supported. The mentioned results are shown in Table 6.

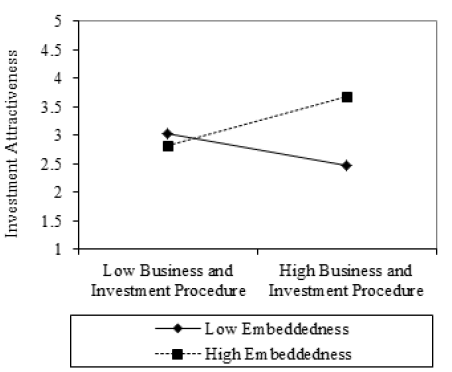

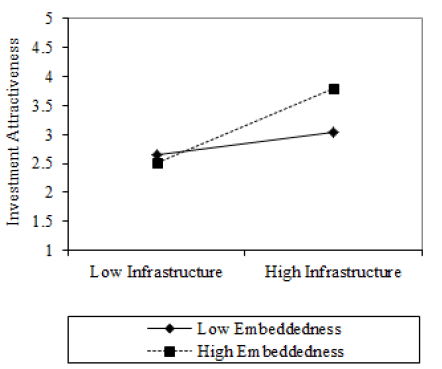

The moderation test was crucial in identifying whether embeddedness as a cultural aspect moderates the link between the independent elements, one of the study’s primary goals (i.e., business and investment procedure, infrastructure and taxation system), and the dependent variable (i.e., investment attractiveness). To produce the t-values, the structural model was subjected to the PLS bootstrapping procedure, which included 5,000 re-samples. In conclusion, the following were the findings of the moderation analysis for the 3-interactions: The first interaction between business and investment procedure and embeddedness toward investment attractiveness revealed a significant interaction, such that (β= 0.058, t= 1.670, and p < 0.004). Hence, H4 is supported. The second interaction presents the relationship between the taxation system and embeddedness toward investment attractiveness, and the statistical analysis showed insignificant interaction with values of (β= 0.048, t= 0.679, and p < 0.679). So, H5 was not supported as predicted. The third interaction between infrastructure and embeddedness toward the investment attractiveness revealed a significant interaction, with values of (β= 0.222, t= 3.197, and p < 0.001). Thus, H6 was accepted.

| Table 6 Structural path analysis: direct effect and interaction effect |

||||||||

|---|---|---|---|---|---|---|---|---|

| Bias and Corrected Bootstrap 95% CI | ||||||||

| Hypotheses | Paths | Std Beta | Std Error | t-value | p-value | Lower Level | Upper Level | Decision |

| H-1 | Business and Investment Procedure -> Investment Attractiveness | 0.004 | 0.066 | 0.061 | 0.952 | -0.129 | 0.133 | Non-Sig |

| H-2 | Infrastructure -> Investment Attractiveness | 0.411 | 0.077 | 5.321 | 0.000 | 0.251 | 0.548 | Sig |

| H-3 | Taxation System -> Investment Attractiveness | 0.396 | 0.081 | 1.859 | 0.002 | 0.075 | 0.233 | Sig |

| Bias and Corrected Bootstrap 95% CI | ||||||||

| Interaction Effect | Std Beta | Std Error | t-value | p-value | Lower Level | Upper Level | Decision | |

| H-4 | Business and Investment Procedure*Embeddedness-> Investment Attractiveness | 0.058 | 0.035 | 1.670 | 0.004 | 0.012 | 0.112 | Sig |

| H-5 | Taxation System*Embeddedness -> Investment Attractiveness | 0.048 | 0.071 | 0.679 | 0.249 | -0.173 | 0.063 | Non-Sig |

| H-6 | Infrastructure*Embeddedness-> Investment Attractiveness | 0.222 | 0.069 | 3.197 | 0.001 | 0.102 | 0.330 | Sig |

Generally, it is unclear how a moderation analysis varies when there is high or low interaction. In other words, determining the amount and precise nature of this influence from a coefficient analysis is difficult (Dawson, 2014). Thus, this study used an interaction plot to look at the strength of the slopes for two interactions. As displayed in Figure 2, the line labeled ‘embeddedness’ for the first interaction has a steeper gradient than ‘low embeddedness,’ indicating that the positive relationship between business and investment procedure and investment attractiveness is higher when embeddedness is higher is stronger. Thus, this is clear support of the first interaction. The second interaction is when the relationship is not significant. Thus the plotting is unimportant (Dawson, 2014). The third interaction between infrastructure and embeddedness toward investment attractiveness strengthens the relationship between infrastructure and investment attractiveness as long as the embeddedness is higher than low (see Figure 3).

Figure 2 Interaction plot of business and investment procedures and embeddedness on investment attractiveness

Discussion and Implications

Increased competition among developing countries in attracting investments has resulted in a better understanding of investment drive. As stated earlier, past research has focused on the determinants of investment attractiveness to identify elements that increase investment incentives (Asiedu, 2002; Dejuan-Bitria, & Mora-Sanguinetti, 2021). Therefore, this study scrutinized how (business and investment procedures). Moreover, the present study explored that embeddedness is a vital moderator of the association among independent variables (i.e., business and investment procedure, taxation system, and infrastructure) and dependent variables (i.e., investment attractiveness). Hence, this study revealed that infrastructure and taxation are significantly related to investment attractiveness, whereas business and investment procedure was not.

Interestingly, we discovered that embedding as a moderator reinforces the relationship between business and investment procedure attractiveness and the relationship between infrastructure and investment attractiveness, with these relationships being stronger when embeddedness is higher than low. However, the interaction between the taxation system and embeddedness was non-significant.

Implications of this StudyThis study adds to the growing literature by extending the variety of significant consequences predicted when factors attract investments. Nevertheless, relatively few studies, like this one, have combined dimensions like (business and investment procedures, taxation system, and infrastructure) into a single study. As a result, these three dimensions of investment attractiveness were included in our research, which may influence investment attractiveness.

Most significantly, in this study, we introduced embeddedness as a cultural aspect. Thus, embeddedness deals with the extent to which a country’s culture is deeply embedded and highlights how important it is for its citizens to form and maintain close relationships. Deeply rooted relationships are characterized by lower matter costs and are informal, allowing conversation partners to share a wide range of information. Business ties are more legally managed in nations with low degrees of embeddedness through severe deterring mechanisms (e.g., specific contract covenants) rather than critical cultural links in countries with high levels of embeddedness (Clinton et al., 2012; Ciabuschi et al., 2017). Thus, this study attempted to better respond to the literature for essential elements attracting investment.

Regarding the practical implications, the study shows that each country in the region faces some challenges of its own. To foster the attractiveness for power generation investment in the region, under the defined policies, business and investment procedures, including the most contentious problem of the workforce and their visa processing, should be speedier with fewer mistakes, making permits, licenses, and permits easier for stakeholders (Hassan et al., 2020). Special offices for issuing visas should be set up to make the process faster and more comfortable for expatriate families and employees. A single point of contact for all essential services is sanative and important (Abdul-Wahab et al., 2020). Also, well-planned infrastructure development would assist fill the gap that these countries currently have. Government cooperation could be beneficial in tackling critical issues, including ease of doing business and the legal environment and setting uniform principles for governments.

Furthermore, the economic environment could be enhanced by combining more mature and less mature markets through transmission lines (Mohamad et al., 2017). Moreover, the taxation system and financial process, thus, financial services can be more varied in an established economy with less regulated money movement in the zone. The structure and chosen indicators, obtained from credible and frequently updated sources, can overview each country’s strengths and weaknesses regarding energy-generating investments. Nevertheless, financial regulators must boost the use of computerized tax systems while also ensuring that taxpayers receive additional instruction on the necessity of tax compliance. Investors may need to assure compliance with tax regulations; attainable provided the appropriate infrastructure, such as technology and competent employees, is in existence. Thus, the taxation system is one of the most crucial components (Popkova et al., 2019).

Finally, when partners in a commercial transaction cannot rely on their more significant relationships with everyone, it becomes significantly more vital to have a sizeable governing organization (embeddedness) (Meuleman et al., 2017). By this logic, official and informal institutions are substitutes for one another. Similarly, people know that successful legal protections are more critical for micro-angel investor movement in countries with low levels of embeddedness. In contrast, a regulatory system that aims to promote legal protections may be less critical in companies with a high propensity forward into larger embeddedness (Batjargal, 2003).

Limitations and Future SuggestionsThis investigation, like many other studies, has limitations. Because this was cross-sectional research, it could not track changes in behavior throughout time. The survey took a quantitative approach, preventing participants from expressing their views and feelings (Sudman & Bradburn, 1982). Thus, a mixed-method design or qualitative research methodology may be used in future investigations to understand comprehensively. The research was carried out in the Sultanate of Oman, but the findings could be applied to other developing countries with similar settings. So, additional research could be carried out in other countries. Nevertheless, the research findings are relevant and applied to all small firms in developing countries with similar conditions to Sultanate of Oman, particularly Duqm Special Economic Zone Oman.

Acknowledgment

The authors would like to thank the Ministry of Higher Education, Research, and Innovation (MoHERI). Thus, the research leading to these results has received funding from the Ministry of Higher Education, Research and Innovation (MoHERI) of the Sultanate of Oman under the Block Funding Program with agreement no. MoHERI/BFP/ASU/01/2020.

References

AHammood, W., Abdullah, A.R., Asmara, M.S., Al-Halbusi, H., Hammood, A.O., & Al-Abri, S. (2021b). A systematic review on Flood Early Warning and Response System (FEWRS): A deep review and analysis. Sustainability, 13(1), 440.

Crossref, GoogleScholar, Indexed at

Abdul-Wahab, S., Charabi, Y., Al-Mahruqi, A.M., & Osman, I. (2020). Is it the right time now to replace the diesel system with the natural gas system at Al Duqm in the Sultanate of Oman?.International Journal of Ambient Energy, 1-9.

Afthanorhan, A., Awang, Z., Abd Majid, N., Foziah, H., Ismail, I., Al Halbusi, H., & Tehseen, S. (2021). Gain more insight from common latent factor in structural equation modeling. In Journal of Physics: Conference Series, 1793(1), 012030). IOP Publishing.

Crossref] GoogleScholar, Indexed at

Al Halbusi, H., Jimenez Estevez, P., Eleen, T., Ramayah, T., & Hossain Uzir, M.U. (2020). The roles of the physical environment, social services cape, Co-created value, and customer satisfaction in determining tourists. Citizenship behavior: Malaysian cultural and creative industries. Sustainability, 12(8), 3229.

Crossref, GoogleScholar, Indexed at

Al Halbusi, H., Williams, K.A., Mansoor, H.O., Hassan, M.S., & Hamid, F.A.H. (2020). Examining the impact of ethical leadership and organizational justice on employees’ ethical behavior: Does person-organization fit play a role?.Ethics & Behavior, 30(7), 514-532.

Al-Fazari, H., & Teng, J. (2019). Adoption of one belt and one road initiative by Oman: lessons from the East.Journal for Global Business Advancement, 12(1), 145-166.

Asiedu, E. (2002). On the determinants of foreign direct investment to developing countries: Is Africa different?.World Development, 30(1), 107-119.

Crossref, GoogleScholar, Indexed at

Batjargal, B. (2003). Social capital and entrepreneurial performance in Russia: A longitudinal study.Organization Studies, 24(4), 535-556.

Crossref, GoogleScholar, Indexed at

Ciabuschi, F., Kong, L., & Su, C. (2017). Knowledge sourcing from advanced markets subsidiaries: Political embeddedness and reverse knowledge transfer barriers in emerging-market multinationals. Industrial and Corporate Change, 26(2), 311-332.

Crossref, GoogleScholar, Indexed at

Clinton, M., Knight, T., & Guest, D.E. (2012). Job embeddedness: A new attitudinal measure.International Journal of Selection and Assessment, 20(1), 111-117.

Crossref, GoogleScholar, Indexed at

Dawson, J.F. (2014). Moderation in management research: What, why, when, and how.Journal of Business and Psychology, 29(1), 1-19.

Crossref, GoogleScholar, Indexed at

De Clercq, D., Meuleman, M., & Wright, M. (2012). A cross-country investigation of micro-angel investment activity: The roles of new business opportunities and institutions.International Business Review, 21(2), 117-129.

Dejuan-Bitria, D., & Mora-Sanguinetti, J.S. (2021). Which legal procedure affects business investment most, and which companies are most sensitive? Evidence from microdata.Economic Modelling, 94, 201-220.

Ershova, N. (2017). Investment climate in Russia and challenges for foreign business: The case of Japanese companies.Journal of Eurasian Studies, 8(2), 151-160.

Eudelle, P., & Shrestha, A. (2017). Foreign direct investment and economic growth: The cases of Singapore and Oman.Global Policy, 8(3), 402-405.

Crossref, GoogleScholar, Indexed at

Glebova, I.S., Sadyrtdinov, R., & Rodnyansky, D. (2013). Impact analysis of investment attractiveness of the Republic of Tatarstan on fixed investments of its leading companies.World Applied Sciences Journal, 26(7), 911-916.

Granovetter, M. (1985). Economic action and social structure: The problem of embeddedness.American Journal of Sociology, 91, 481–510.

Yahya Bin Said Bin Abdullah Al-Jabri, H.E. (2017). Welcome to Duqm SEZAD. Chairman SEZAD.

Hair, J.F., Sarstedt, M., & Ringle, C.M. (2019). Rethinking some of the rethinkings of partial least squares. European Journal of Marketing, 53(4), 566-584.

Crossref, GoogleScholar, Indexed at

Hair, J.F., Hult, G.T.M., Ringle, C., Sarstedt, M., (2017). A primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), (2nd edition). London and Thousand Oaks, CA: Sage.

Crossref, GoogleScholar, Indexed at

Hammood, W.A., Asmara, S.M., Arshah, R.A., Hammood, O.A., Al Halbusi, H., Al-Sharafi, M.A., & Khaleefah, S.H. (2020a). Factors influencing the success of information systems in flood early warning and response systems context.Telkomnika, 18(6), 2956-2961.

Hamudy, M.I.A., & Rifki, M.S. (2021). Tanjung Lesung special economic zone: Expectation and reality.Policy & Governance Review, 5(1), 50-65.

Crossref, GoogleScholar, Indexed at

Harman, H.H. (1976). Modern factor analysis, (3rd edition). Chicago, IL: University of Chicago Press.

Hassan, M.M., Jambulingam, M., Alagas, E.N., Uzir, M.U.H., & Halbusi, H.A. (2020). Necessities and ways of combating dissatisfactions at workplaces against the Job-Hopping Generation Y employees.Global Business Review, 0972150920926966.

Hassan, M.S., Ariffin, R.N.R., Mansor, N., & Al Halbusi, H. (2021). Rebelliousness and street-level bureaucrats’ discretion: Evidence from Malaysia.Journal of Administrative Science, 18(1).

Hassan, M.S., Raja Ariffin, R.N., Mansor, N., & Al Halbusi, H. (2021). An examination of street-level bureaucrats’ discretion and the moderating role of supervisory support: Evidence from the field. Administrative Sciences, 11(3), 65.

Henseler, J., Ringle, C.M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling.Journal of the Academy of Marketing Science, 43(1), 115-135.

Crossref, GoogleScholar, Indexed at

Hulland, J. (1999). Use of Partial Least Squares (PLS) in strategic management research: A review of four recent studies.Strategic Management Journal, 20(2), 195-204.

Ibrahim, O.A., Devesh, S., & Shaukat, M. (2020). Institutional determinants of FDI in Oman: Causality analysis framework. International Journal of Finance & Economics.

Khalid, A.H., Hock, O.Y., & Asif, M.K. (2021). Investigating the factors influencing on the development of leaders for smart city in Duqm: A special economic zone in Oman.Solid State Technology, 64(2), 345-375.

Kock, N. (2015). Common method bias in PLS-SEM: A full collinearity assessment approach. International Journal of e-Collaboration (ijec), 11(4), 1-10.

Crossref, GoogleScholar, Indexed at

Kock, N., & Lynn, G. (2012). Lateral collinearity and misleading results in variance-based SEM: An illustration and recommendations.Journal of the Association for Information Systems, 13(7).

Kopycinski, P. (2020). The embeddedness of firms and employees in Central Europe: Krakow as an offshoring and outsourcing centre.In Outsourcing in European Emerging Economies, 155-165. Routledge.

Lall, S. (2000). The technological structure and performance of developing country manufactured exports, 1985‐98.Oxford Development Studies, 28(3), 337-369.

Crossref, GoogleScholar, Indexed at

Logunova, N., Glechikova, T., & Kotenev, A. (2021). Investment attractiveness of the area for marine farming and marine aquaculture target species.Transportation Research Procedia, 54, 76-83.

MacKenzie, S.B., & Podsakoff, P.M. (2012). Common method bias in marketing: causes, mechanisms, and procedural remedies. Journal of retailing, 88(4), 542-555.

Crossref, GoogleScholar, Indexed at

Martínez-Martínez, A., Suárez, L.M.C., Montero, R.S., & Del Arco, E.A. (2018). Knowledge management as a tool for improving business processes: An action research approach.Journal of Industrial Engineering and Management, 11(2), 276-289.

Meuleman, M., Jääskeläinen, M., Maula, M.V., & Wright, M. (2017). Venturing into the unknown with strangers: Substitutes of relational embeddedness in cross-border partner selection in venture capital syndicates.Journal of Business Venturing, 32(2), 131-144.

Crossref, GoogleScholar, Indexed at

Mohamad, A., Zainuddin, Y., Alam, N., & Kendall, G. (2017). Does decentralized decision-making increase company performance through its Information Technology infrastructure investment?.International Journal of Accounting Information Systems, 27, 1-15.

Crossref, GoogleScholar, Indexed at

Night, S., & Bananuka, J. (2020). The mediating role of an electronic tax system in the relationship between attitude towards electronic tax system and tax compliance.Journal of Economics, Finance and Administrative Science, 25(49), 73-88.

Ong, D.M. (2019). Prospects for the integration of environmental, social, and cultural sustainability within the Belt and Road Initiative: 215Case study of the Duqm Port Development Project in Oman. In The 21st Century Maritime Silk Road, 215-242. Routledge.

Pauceanu, A.M. (2016). Foreign investment promotion analysis in Sultanate of Oman: The case of Dhofar Governorate.International Journal of Economics and Financial Issues, 6(2).

Crossref, GoogleScholar, Indexed at

Podsakoff, P.M., MacKenzie, S.B., Lee, J.Y., & Podsakoff, N.P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879.

Crossref, GoogleScholar, Indexed at

Popkova, E.G., Zhuravleva, I.A., Abramov, S.A., Fetisova, O.V., & Popova, E.V. (2019). Digitization of taxes as a top-priority direction of optimizing the taxation system in modern Russia.In Optimization of the Taxation System: Preconditions, Tendencies, and Perspectives, 169-175. Springer, Cham.

Powell, W.W. (1990). Neither market nor hierarchy: Network forms of organization. In Staw, B. M., & Cummings, L. L. (Eds.).Research in Organizational Behavior, 12, 295–336. Greenwich, CT: JAI Press

Venkatesh, R. (2018). Duqm is Strategically Located.

Ringle, C.M., Wende, S., Becker, J.M., (2015). SmartPLS 3. Bonningstedt: SmartPLS.

Schwartz, S.H. (1994). Beyond individualism/collectivism: New cultural dimensions of values. In U. Kim, H.C. Triandis, C. Kagitcibasi, S.C. Choi, & G. Yoon (Eds.).Individualism and collectivism: Theory, Methods, and Applications, 85–119. Thousand Oaks, CA: Sage.

Tehseen, S., Johara, F., Halbusi, H.A., Islam, M.A., & Fattah, F.A.M.A. (2021). Measuring dimensions of perceived business success among Malaysian and Bangladeshi SME owners.Rajagiri Management Journal, ahead-of-print No. ahead-of-print.

Crossref, GoogleScholar, Indexed at

Tseng, M.L., Tan, P.A., Jeng, S.Y., Lin, C.W.R., Negash, Y.T., & Darsono, S.N.A.C. (2019). Sustainable investment: Interrelated among corporate governance, economic performance, and market risks using investor preference approach.Sustainability, 11(7), 2108.

Crossref, GoogleScholar, Indexed at,

Tsepelev, O.A., & Serikov, S.G. (2016). Procedure for regional investment potential assessment by institutional sectors of economy.Indian Journal of Science and Technology, 9(14), 91523.

Crossref, GoogleScholar, Indexed at

Uzir, M.U.H., Al Halbusi, H., Thurasamy, R., Hock, R.L.T., Aljaberi, M.A., Hasan, N., & Hamid, M. (2021). The effects of service quality, perceived value and trust in home delivery service personnel on customer satisfaction: Evidence from a developing country. Journal of Retailing and Consumer Services, 63, 102721.

Crossref, GoogleScholar, Indexed at

Uzir, M.U.H., Jerin, I., Al Halbusi, H., Hamid, A.B.A., & Latiff, A.S.A. (2020). Does quality stimulate customer satisfaction where perceived value mediates and the usage of social media moderates?.Heliyon, 6(12), e05710.

Crossref, GoogleScholar, Indexed at

Uzzi, B., & Lancaster, R. (2003). Relational embeddedness and learning: The case of bank loan managers and their clients.Management Science, 49(4), 383-399.

Crossref, GoogleScholar, Indexed at

Vasanthagopal, R. (2011). GST in India: A big leap in the indirect taxation system.International Journal of Trade, Economics and Finance, 2(2), 144.

Crossref, GoogleScholar, Indexed at

Waris, A. (2007). Taxation without principles: A historical analysis of the Kenyan taxation system.Kenya Law Review, 1(272), 274-304.

Crossref, GoogleScholar, Indexed at

Wright, M., Pruthi, S., & Lockett, A. (2005). International venture capital research: From cross‐country comparisons to crossing borders.International Journal of Management Reviews, 7(3), 135-165.

Crossref, GoogleScholar, Indexed at

Yenigun, C., Albasoos, H., & Al-Zadjali, S. (2021). The impact of the Qatar crisis on the Omani relations.Psychology and Education Journal, 58(5), 654-665.

Zheltenkov, A., Syuzeva, O., Vasilyeva, E., & Sapozhnikova, E. (2017). Development of investment infrastructure as the factor of the increase in investment attractiveness of the region. IOP Conference Series: Earth and Environmental Science, 90(1), 012122). IOP Publishing.

Received: 28-Dec-2021, Manuscript No. IJE-21-10130; Editor assigned: 30-Dec-2021, PreQC No. IJE-21-10130(PQ); Reviewed: 07-Jan-2022, QC No. IJE-21-10130; Revised: 19-Jan-2022, Manuscript No. IJE-21-10130(R); Published: 28-Jan-2022