Research Article: 2022 Vol: 26 Issue: 2S

The effect of bank credit facilities granted by banks operating in Jordan on income

Shireen Mahmoud Alali, Ajloun National University

Mahmoud Ali Alrousan, Ajloun Natonal University

Ali A ALzoubi, Ajloun National University

Citation Information: Alali, S.M., Alrousan, M.A., & ALzoubi, A.A. (2022). The effect of bank credit facilities granted by banks operating in Jordan on income. Academy of Accounting and Financial Studies Journal, 26(S2), 1-9.

Abstract

The study discusses the extent of the contribution of banking credit facilities granted by banks operating in Jordan to income, using the (EViews) program, the study includes (15) banks operating in Jordan, where the study found that banking credit facilities granted by operating banks in Jordan, it contributes to income for the time period (2010-2018), by testing two main hypotheses, which indicate that there is a statistically significant effect of the bank credit facilities granted by banks operating in Jordan on net income and net operating income. The study recommended that commercial banks operating in Jordan expand the granting of bank credit facilities and not focus on a specific type because of their impact on net operating income and income, and commercial banks operating in Jordan must mitigate on customers in terms of terms and requirements for granting credit facilities for the arrival of the largest possible segment of clients to cover their needs, this is from the premise that the interest of both parties (the bank and the customer) must be realized to achieve their goals.

Keywords

Bank Credit Facilities, Operating Income, Net Income

Introduction

Commercial banks play a vital and important role through their prominent role in terms of collecting funds from surplus bodies and accepting them in the form of deposits of various types (current deposits and term deposits, deposits under notice, savings deposits) and employing them to those that suffer from deficits in the form of credit facilities in several Forms (direct facilities or indirect facilities), where the bank (Al-Halim, 2012) defined the bank as a financial intermediary between two parties who are the owners of the deficit and the owners of the surplus and through what the public provides from deposits and savings that he re-provides in the form of loans, where he was considered Loans are one of the most important means on which commercial banks depend to follow their activity and increase their profits. In order to protect the bank from risks, non-payment from borrowers, he must resort to adopting backup policies represented in a financial analysis that precedes the decision-making process in addition to obtaining various guarantees to cover the risk in In the event of its occurrence, i.e. granting bank credit facilities is one of the main functions of the commercial banks on which it rests in obtaining revenue, which banks strive to employ their deposits and not maintain a high liquidity ratio to achieve revenues Through interest rates and commissions, in addition to striving to provide the necessary liquidity in order to achieve a balance between profitability, liquidity and safety. Othman (2013) knew banking facilities as services provided by the bank to its customers, whether they are natural or juristic persons where they are allowed to use them during A specific period, within specific conditions and guarantees to be agreed in advance between the two parties (the bank and the customer) where these facilities are documented by contracts and documents signed by both parties, to ensure the bank’s right to recover the money that was provided to its customers.

In spite of the revenue earned by bank credit facilities, but in return it poses a risk to the banks that provide banking credit facilities in its various forms because the bank may not collect the borrowed money as a result of the borrower defaulting on the amount borrowed in addition to the interest it entails, resulting in risks borne by the donor banks for the facilities Payment, therefore, the banks granting these credit facilities must take strict and robust measures to recover their money, as this service is considered the main nerve of the banks ’work and the main tributary to achieve income.

Therefore, the study came to answer the following questions:

What is the extent of the contribution of the bank credit facilities granted by banks operating in Jordan to the net income?

What is the extent of the contribution of banking credit facilities granted by banks operating in Jordan to operating income?

Study Problem

Commercial banks provide banking services of various kinds, the most important of which are the two credit facilities: direct credit facilities, and indirect credit facilities provided by the banks to customers with various guarantees to guarantee its right. It is expected that the bank credit facilities will contribute to achieving income for the commercial banks that verify the commissions and the interest accrued On this service, therefore, the research problem is to identify the extent to which the banking credit facilities granted by banks operating in Jordan contribute to the income.

The First Main Question: What is the extent of the contribution of the banking credit facilities granted by banks operating in Jordan to the net income?

The Second Main Question: What is the extent of the contribution of banking credit facilities granted by banks operating in Jordan to operating income?

Importance of the Study

One of the common traditional banking services is the use of cash loans. It has become a very rare use, which has been replaced by bank credit facilities to include different types. These types change according to the changes that accompany the banks ’activity in the economy. Therefore, commercial banks must provide different types of these facilities in their modern forms to keep up with economic needs. Bank credit facilities provided by banks can be classified into direct bank credit facilities, and indirect bank credit facilities.

The increase in the percentage of bank credit facilities of all kinds (loans and advances, current receivables, bills and bonds discounted, Islamic bank receivables, credit cards) in the balance sheet of banks operating in Jordan contributes to the high amount of interest and commissions as a source of primary revenue with banks, through which Commercial banks are able to pay the interest owed to depositors (holders of deposits of various shapes) in line with the bank's ability to maintain a portion of the liquidity needed to meet customer needs from withdrawals. Therefore, commercial banks strive to achieve a balance between liquidity, profitability and risk.

Objectives of the Study:

First: A statement of the extent of the contribution of the bank credit facilities granted by banks operating in Jordan to the net income.

Second: Clarifying the extent of the contribution of the bank credit facilities granted by banks operating in Jordan to operating income.

Previous Studies

Habis (2011); Hijazi (2008) indicated that the credit facilities provided by banks to their clients are of two types: the first type: direct credit facilities which are granted to customers in a cash manner for use in financing agreed and pre-determined operations with a credit contract such as loans and advances, Accounts receivable current and discounted bills, which are among the most common types in the activity of commercial banks, the second type: indirect credit facilities: does not give the right to a student to use the facilities directly attached to him, and does not represent a direct debt to the customer towards the bank unless the customer does not By fulfilling its obligations according to specific ceilings, such as documentary credits, letters of guarantee, and credit cards.

Bank loans are considered the main resource that the bank depends on in order to obtain its revenues, as it represents the largest part of its uses. Therefore, commercial banks attach special importance to loans as they are one of the most important factors for creating credit and from which an increase in deposits and circulating cash arises, so it must be realized that the high percentage of loans It leads to higher interest rates and commissions, which are considered as a source of revenue (Zmit, 2006), meaning that loans are a major source of income for commercial banks through which they work to achieve their goals and that it is important to achieve profitability with appropriate consideration in mind among the objectives of liquidity Safety and profitability (Abdel-Muttalib, 2000), meaning that a balance must be struck between liquidity on one hand and profitability and risk on the other hand.

In the study of (Al-Mousawi, 70), he conducted on Iraqi commercial banks that concluded that there is an effect of bank credit with indicators of profitability (negative), i.e., by increasing the granting of credit, weakening financial performance and banking investment in them, and this is because these banks are not efficient in granting credit, i.e., customers Stumbling on debt performance and that the bank grants credit to untrustworthy people or does not put adequate guarantees for them or that the bank is not serious in studying lending requests and other reasons, with the exception of Bank Al-Ittihad indicated that granting credit in it is efficient because it affected the financial performance positively (directly That is, by increasing the credit in the Union Bank, the efficiency of the bank’s financial performance increases, and efficient financial investments increase in it, if the negative result reached between bank credit and profitability indicators results from the risk of non-payment by customers because the customer has not paid the installment due to it in addition to the benefits Which reflected negatively on profitability indicators considered among the determinants of lending, and was supported by a study (Rabab'ah, 2015) that took the determinants of lending commercial banks in Jordan for the time period of 2005-2013, thus, I concluded that the ratio of bad loans has a significant negative impact on the ratio of bank credit facilities, and (Neaime & Hakim, 2001) investigated about the effect of liquidity, bank credit and capital on the profitability of the bank in Egypt and Lebanon banks and found that the variable of bank credit has good impact on the profitability of banks.

The banking facilities granted by commercial banks contribute to the positive impact on the profitability of the bank and this effect can extend to the national economy, this is what was reached (Sweis, 2017) through studying the impact of credit facilities on the Palestinian economy, which the study showed that banks use promising laws Related to granting credit facilities. I also found that these banks have flexible facilities that play an important role in achieving the bank's economic growth and development, which in turn affects the national economy.

It must be realized that commercial banks are heavily relied upon to perform their primary function of granting credit facilities for various types of deposits that constitute the side of the source of funds in the commercial banks budget, where (Al-Ma’aitah, 2018) stated that there is an effect of term deposits and savings deposits on the banking performance of Jordanian commercial banks represented The rate of return on property rights, and indicated that this indicates the ability of banks to direct this type of deposit towards income-generating investments without the need to maintain liquidity in return for them, as it has proven that there is a negative impact of current deposits on the banking performance of Jordanian commercial banks, where banks cannot direct These deposits are income-generating investments, in addition to the bank maintaining high liquidity to meet sudden and recurring withdrawals, in addition to a study (Al-Lami, 2016) that sought to measure the relationship between deposits (current, savings, and for time) and the net income of the Middle East Bank of Iraq, where it concluded that there A direct relationship between savings accounts, time deposits and net income of the bank, which confirmed the most influential type of bank income is time deposits, and indicated that no Find a relationship between current deposits accounts and the bank’s net income, as these deposits are invested (savings, for a term) by granting bank credit facilities of various kinds, and (Sharma & Gounder, 2012) emphasized that the size of bank deposits has a positive impact on the growth of bank credit granted by Before banks, i.e., this indicates that term deposits and notification and savings deposits are used by the bank and often the main function that commercial banks depend on is banking facilities in its various forms and obtaining a return for this investment represented by interest and commission, a study (Muhammad & Kanaan, 2014) highlighted the extent of the contribution of the net interest margin to the profitability of the commercial bank, because the credit and debit interests constitute a large percentage of the income and expenses of the commercial bank, and the study concluded that the profitability of commercial banks consists of the net interest margin that expresses the difference between the credit interest collected from the facilities Granted and among the interest paid on deposits of all kinds. Therefore, we must realize that one of the most important factors affecting the granting of bank credit facilities is the size and type of deposits, as they have an effective role in granting commercial banks to dispose of them in the appropriate and most secure way in achieving high profit with less risk by investing various deposits of the most important aspects of investment for banks It is the bank credit facilities of all kinds and the resulting benefits, in addition to providing a guarantee by customers against these facilities.

As for the interest rates on the size of the bank credit facilities, he indicated (Al-Rugaibat & Fawaz, 2016) there is no effect of the interest rate on the volume of credit facilities with Jordanian commercial banks, indicating that the credit facilities did not respond to the size of the change in interest rates, meaning that high interest rates Credit facilities do not preclude investors from borrowing and obtaining the necessary funds for investment. Therefore, there are factors other than the interest rate that affect the volume of credit facilities with Jordanian commercial banks. I recommend that the bank must consider the balance between the interests of the bank and the customer with regard to prices Interest, in contrast to the findings of a study (Sharma & Gounder, 2012) that an increase in the average interest on bank loans of all kinds may have negative effects on the rate of growth in bank credit, and the study also indicated that good economic growth leads to growth in credit Also

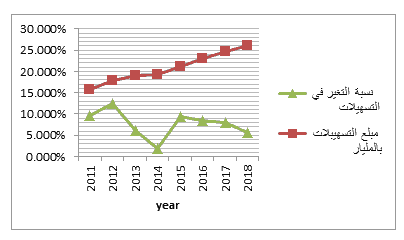

Banking credit facilities granted by banks operating in Jordan 2011-2018 (www.abj.org.jo):

The total balance of credit facilities granted by licensed banks is 15,851 billion dinars at the end of 2011, an increase of 9.7% compared to the previous year, and the balance of total credit facilities increased by 19.27 billion dinars at the end of 2014, an increase of 1.8% compared to the previous year by (6.20%) We note that the percentage of gaps in bank credit facilities decreased very, but the banks operating in Jordan witness the end of 2015 the balance of the bank credit facilities granted to 21.10 billion dinars, an increase of 9.5% and the balance of bank credit facilities granted by banks operating in Jordan with a continuous increase and a rate of a significant change in the facilities. The reason for the increase is due to the inclusion of the Islamic bank receivables item under the item of loans and advances within a separate item, in addition to the credit cards that were shown under the current debtor item under a separate item. Figure (1) shows the development of banking credit facilities granted by banks operating in Jordan (2011-2018).

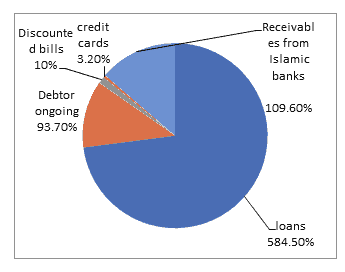

We note the bank credit facilities granted by banks operating in Jordan during 2011-2018, where loans and advances formed the most part of the facilities, about 584.50%, while the Islamic bank accounts receivable came, which accounted for 109.60%, while the debtor current accounted for 93.70%, and credit cards formed 3.20%, while the share of discounted bills and bonds amounted to about 10.0%, and Figure (2) shows the distribution of banking credit facilities granted by banks operating in Jordan by type during the period 2011-2018.

Figure 2: Distribution of Bank Credit Facilities Granted by Banks Operating in Jordan by Type During 2011-2018

The Hypotheses of the Study

The first main hypothesis: There is no statistically significant effect at the level of significance (α≤0.05) for bank credit facilities granted by banks operating in Jordan on net income.

The second main hypothesis: There is no statistically significant effect at the level of significance (α≤0.05) for bank credit facilities granted by banks operating in Jordan in net operating income.

Study Methodology

The current study adopts the Descriptive Analytical Approach, which aims to describe specific phenomena or events and collect information about them, and the statistical methods necessary to analyze the study data and test hypotheses will be used.

Study Method

Through reviewing the previous studies, it became clear that the appropriate approach to the study is the descriptive and analytical approach in order to capture various theoretical and practical aspects of the topic depending on the various sources and references such as books, scientific articles and magazines, etc., in addition to statistical and standard tools in order to facilitate the measurement of the financial variables used in the model.

In order to estimate "the extent of the contribution of bank credit facilities granted by banks operating in Jordan to income" the study used the EViews program, and the researcher relied on the Random Effect model based on the Hausman test, including an independent variable (the bank credit facilities granted By banks operating in Jordan), and its dependent variables (net income, operating income).

The Study Population and its Sample

The study population and sample include the financial statements of all (15) banks operating in Jordan during the time period (2010-2018).

Study Model

Net income

Net operating income

Banking credit facilities

As shows in Figure 3.

Hypotheses Testing

This part of the study will present the hypothesis test, where all the main hypotheses were subjected to a single-slope analysis, as follows:

The first main hypothesis: There is no statistically significant effect at the significance level (α≤0.05) of the bank credit facilities granted by banks operating in Jordan on net income.

To verify the validity of this hypothesis, a single regression analysis was applied to study the effect of bank credit facilities granted by banks operating in Jordan on net income, and Table (1) illustrates this.

| Table 1 The Results Of Applying The Unary Regression Analysis To Study The Effect Of Bank Credit Facilities Granted By Banks Operating In Jordan On Net Income |

|||||

|---|---|---|---|---|---|

| Dependent variable | Coefficients table | ||||

| Statement | B | Standard Mistake | T calculated |

Sig t* Level of significance |

|

| net income | Fixed | 6813803 | 2864502 | 2.38 | 0.02 |

| Banking credit facilities | 0.02 | 0 | 23.94 | 0 | |

| R2 coefficient of determination | 0.812 | ||||

| AdjR2 correction factor | 0.81 | ||||

| Calculated F value | 573.329 | ||||

| Sig. F | 0 | ||||

| D-W | 1.85 | ||||

The results of Table (1) indicate that the value of the determination coefficient (r2=0.812), which means that the independent variable has interpreted (81.2%) of the variance in (net income), with other factors remaining constant. It also turns out that the value of (F) has reached (573.329) at the confidence level (Sig=0.000) and this confirms the significance of the regression at the level of (α ≤ 0.05).

From the above, the first major hypothesis is accepted by the alternative formulation, which states, there is a statistically significant effect at the level of significance (α≤0.05) for bank credit facilities granted by banks operating in Jordan in net income.

The second main hypothesis: There is no statistically significant effect at the significance level (α≤0.05) of the bank credit facilities granted by banks operating in Jordan on net operating income.

To verify the validity of this hypothesis, a single regression analysis was applied to study the effect of bank credit facilities granted by banks operating in Jordan on net operating income, and Table (2) shows that.

| Table 2 Results Of Applying The Regression Analysis For Studying The Effect Of Bank Credit Facilities Granted By Banks Operating In Jordan On Net Operating Income |

|||||

|---|---|---|---|---|---|

| Dependent variable | Table of Coefficients | ||||

| Statement | B | Standard Mistake | T calculated |

Sig t* Level of significance |

|

| net income | Fixed | 9512449.00 | 3389966.00 | 2.81 | 0.01 |

| Banking credit facilities | *0.03 | 0.00 | 23.83 | 0.00 | |

| R2 coefficient of determination | 0.812 | ||||

| AdjR2 correction factor | 0.861 | ||||

| Calculated F value | 831.267 | ||||

| Sig. F | 0.000 | ||||

| D-W | 1.88 | ||||

The results of Table (2) indicate that the value of the determination coefficient (r2=0.862), and this means that the independent variable has interpreted an amount (86.2%) of the variance in (net operating income), with the other factors remaining constant. It also turns out that the value of (F) has reached (831.267) at the confidence level (Sig=0.000) and this confirms the significance of the regression at the level of (α≤0.05).

From the above, the second main hypothesis is accepted by the alternative formulation, which states, there is a statistically significant effect at the level of significance (α≤0.05) of the bank credit facilities granted by banks operating in Jordan in net operating income.

Results and Recommendations

The study showed that the bank credit facilities granted by banks operating in Jordan contribute to the income for the period of time (2010-2018), by testing two main hypotheses which showed that there is a statistically significant effect of the bank credit facilities granted by banks operating in Jordan in net income and Net operating income, as confirmed by a study (Neaime & Hakim, 2001; Sweis, 2017).

The study recommends commercial banks operating in Jordan to expand the granting of bank credit facilities and not focus on a particular type because of their impact on net operating income and income, and commercial banks operating in Jordan must mitigate on customers in terms of terms and requirements for granting credit facilities for greater access a possible segment of clients to cover their needs, this is from the point of view that the interest of both parties (the bank and the customer) must be realized to achieve their goals.

References

Ali, K.M. (2014). The interest rate and its impact on the profitability of commercial banks (Case Study of a Syrian and Diaspora Bank LLC) Damascus University. Journal of Economic and Legal Sciences, 30(1), 531-559.

Al-Lami., & Ali, H.N. (2016). The effect of deposits on net income of banks. Journal of Baghdad College for Economic Sciences University, 5(48), Iraq.

Al-Musawi, S. (2015). The philosophical dimension of credit and its reflection in banking investment: An analytical study of a sample of Iraqi commercial banks. Journal of the College of Administration and Economics for Economic, Administrative and Financial Studies, 7(2), 51-74.

Al-Rugaibat, G., Al-Fawaz, T. (2016). The effect of the interest rate on the size of credit facilities and deposits with Jordanian commercial banks (1985-2014), Studies, Administrative Sciences, 43(2), 801-8012.

Dawood, O.M. (2013). Credit management and analysis and its risks (First Edition). Dar Al-Fikr for Publishing and Distribution, Amman - Jordan.

Hakim, S., & Neaime, S. (2001). Performance and credit risk in banking: A comparative study for Egypt and Lebanon, Working Paper Published by The Economic Research Forum (ERF), No. 0137.

Hussein, Walid, Mahmoud, Ali, & Hafez. (2012). The effect of long-term financing on net profit: an analytical study of a sample of Iraqi banks. Journal of Accounting and Financial Studies, 7(20), 215-233.

Iman, H. (2011). The role of financial analysis in granting loans: A case study of the National Bank of Algeria. Ouargla Agency, Master Thesis in Management Sciences, University of Kassadi Merbah and Ouargla, Algeria.

Juwaida, A. (2018). Discount of commercial paper. MA, Thesis, Mohamed Boudiaf University - Al-Messila - College of Law and Political Science.

Khalid, S. (2017). The effect of Palestinian banking credit facilities on the Palestinian economy. International Journal of Economics and Financial Issues, 7(4), 677-684.

Muttalib, A., & Hamid, A. (2000). Comprehensive banks operations and management. The University House for printing, publishing and distribution, Alexandria, 1.

Rabab?ah, M. (2015). Factors affecting the bank credit: An empirical study on the Jordanian commercial banks. International Journal of Economics and Finance, 7(5), 166-178.

Sarah, A. (2012). The role of bank loans in achieving profitability of commercial banks: A case study of the Algerian popular loan agency in Ain Mellila. Master Thesis, University of Arabi Ben Mehdi Oum El Bouaghi, People's Democratic Republic of Algeria.

Sharma, P., & Gounder, N. (2012). Determinants of bank credit in small open economies: The case of six Pacific Island Countries. Discussion Paper Finance, Griffith Business School, Griffith University, No. 2012-13..

Wafaa, H. (2008). Accounting for loans and credit, open education center, bank and stock accounting program.

Wissam, A. (2018). The effect of the degree of stability of bank deposits of customers on the banking performance of Jordanian commercial banks for the period (2007-2016).Al-Hussein Bin Talal University Journal for Research, 4(1).

Zemit, M. (2006). The Algerian banking system in facing the challenges of financial globalization. Master Thesis in Economic Sciences, Youssef Ben Khadda University, Algeria.

Received: 20-Nov-2021, Manuscript No. AAFSJ-21-9875; Editor assigned: 23- Nov -2021, PreQC No. AAFSJ-21-9875 (PQ); Reviewed: 08-Dec-2021, QC No. AAFSJ-21-9875; Revised: 15-Dec-2021, Manuscript No. AAFSJ-21-9875 (R); Published: 03-Jan-2022