Research Article: 2020 Vol: 24 Issue: 6

The Effect of Audit Quality on Earnings Management Using Classification Shifting: Evidence from South Korea Before IFRS Adoption

Kiwi Chung, Yeungnam University

Soojoon Chae, Kangwon National University

Abstract

Classification shifting is an earnings management tool whereby managers shift operating income up the income statement by discretionarily classifying operating expenses as non-operating expenses. Since classification shifting does not change current-period net income, managers have an incentive to undertake shifting. Most previous studies have focused on earnings management methods in which managers adjust current-period net income. This study, therefore, examines the incentives to apply a different earnings management tool, that is, the arbitrary classification of expenses, in relation to audit quality sampling of companies listed on the South Korean stock market before the introduction of the International Financial Reporting Standards (IFRS). Starting in 2009, some South Korean companies adopted IFRS voluntarily, while all listed companies have been required to adopt IFRS since 2011. IFRS grants significant discretion to managers and thus, does not require the disclosure of operation earnings, making samples from the post-IFRS adoption period inapplicable to this investigation. This study, therefore, conducts a regression analysis on samples from 2002 to 2008. For audit quality, this study treats cases audited by any of the Big Four accounting firms as representative of a high-quality audit. When a Big Four auditor conducts an audit, managers are incentivized to opt for classification shifting as an alternative to an earnings management tool that increases current-period net income. However, an auditor providing a high-quality audit and properly fulfilling its role of monitoring the managers’ earnings management can decrease classification shifting. The empirical analysis reveals that companies audited by a Big Four auditor with high audit quality have a higher rate of classification shifting than other companies do. This outcome suggests that when audited by such a firm, managers are likely to choose classification shifting over an earnings management tool that adjusts current-period net income.

Keywords

Earnings Management, Classification Shifting, Audit Quality, Big4 Auditors, Before IFRS Adoption.

Introduction

This study examines companies listed on the South Korean stock market before the adoption of the International Financial Reporting Standards (IFRS), to reveal how the tendency to undertake earnings management through the arbitrary classification of expenses differs with the audit quality of an external auditor. Stock market participants pay more attention to operating income than to net income because firms earn this income through repeated and consistent operating activities. Analysts also stress the importance of operating income in evaluating enterprise value and predicting share prices. Previous studies have also reported that repeated and consistent operating income has greater explanatory power for the share price than nonoperating income.

Hayn (1995) suggested that operating income with no temporary items involved has higher power in explaining the stock value. Therefore, it is possible that managers with earnings management incentives may overstate the operating income by classification shifting, thus distorting market assessments.

In addition, earnings management through the arbitrary classification of expenses may be subject to less monitoring by a regulatory authority or auditor than accrual-based earnings management, in that it only shifts operating income upward without changing current-period net income. Moreover, this earnings management tool is associated with relatively low opportunity costs because it does not damage company value in the long run the way real earnings management does, thus making it an important research topic. Using an unexpected operating margin model, McVay (2006) presented evidence that managers arbitrarily classify expenses to maximize core earnings without affecting reported earnings. Such earnings management through the classification of expenses in an earnings statement is most prominent among listed companies, and for the purpose of reporting rather than analyst-forecasted operating income. Using a sample of companies listed on the South Korean stock market before the adoption of IFRS, this study examines the incentives for earnings management through the arbitrary classification of expenses in relation to audit quality. Starting in 2009, some South Korean companies adopted IFRS voluntarily, though all listed companies have been required to adopt IFRS since 2011. Since IFRS does not require companies to disclose operating income, samples from the post-IFRS adoption period are inapplicable to this investigation; therefore, this study selects its samples from the period before the introduction of IFRS.

The role of external auditors is to ensure that companies provide reliable accounting information and to improve the effectiveness of the capital market by letting average market participants evaluate corporate value objectively and fairly based on the provided accounting information. From this perspective, research on how audit quality affects financial statement quality is essential. Most research on the association between audit quality and financial statement reliability shows that when high-quality auditors perform an audit, the reliability of financial information increases. Becker et al. (1998) found that firms audited by a Big6 auditor show smaller discretionary accruals than do firms audited by a non-Big6 auditor. Nah & Choi (2003) also found that when the auditor is one of the Big Four, firms in the Korean market report smaller discretionary accruals. We examine how high-quality audits by a Big Four auditor affect earnings management by classification shifting. This study can be helpful for regulatory agencies supervising the quality of firms’ financial reporting. For investors, this study emphasizes the importance of carefully reviewing and considering firms in the capital market when making investment decisions.

This rest of this paper is organized as follows. Section II discusses the previous research and presents the research hypothesis. Section III describes the research methodology and samples. Section IV reports the results of the empirical analysis. Finally, Section V summarizes and concludes the study and describes its limitations.

Theoretical Background

Many previous studies have focused on earnings management in which managers adjust current-period net income. Since current-period net income consists of accruals and cash flow, previous studies have focused on accrual-based and real earnings management. However, the former is followed by a reverse in which future-period reported earnings decrease (increase) to the extent that the managers increase (decrease) the current-period reported earnings. The latter temporarily increases earnings by increasing sales via discount policies or through expense reduction by cutting advertisement costs, research, and development costs, and so on, thus potentially damaging brand value and increasing opportunity cost in the long run. Therefore, instead of these two earnings management tools, this study examines a third tool: earnings management through the arbitrary classification of expenses in an income statement. Since McVay’s (2006) study, research on earnings management by classification shifting via the income statement has become an urgent issue. McVay (2006) reported that managers misclassify expenses by classifying operating expenses as non-operating expenses to increase operating income while leaving net income unchanged. Classification shifting inflates operating income without increasing net income by classifying operating expenses such as cost of goods sold or selling and administrative expenses as non-operating expenses, which is the lower area of the income statement. In other words, shifting manipulates earnings by intentionally treating repetitive above-the-line operating expense items as non-operating expenses.

Literature Review

McVay (2006) found that managers use classification shifting to beat analyst forecasts of earnings, and is more frequent among growth firms. In addition, she reported that investors fail to realize the shifting activity, which increases the stock price. Fan, Abhijit, William, and Wayne (2010) used McVay’s (2006) unexpected operating income model and demonstrated that earnings management by classification shifting occurs more frequently during the fourth quarter. Lee, Cho, and Cho (2008) proved the existence of earnings management by classification shifting in the Korean stock market, especially for growth firms. They presented the same results as McVay (2006), namely, that investors fail to realize the shifting activity for earnings management to increase the stock price. To ensure the reliability of financial information, it is essential for firms to provide reliable accounting information to ensure an effective capital market and so that normal market participants can evaluate a firm’s value objectively and fairly based on the information available. Thus, studies on audit quality are important in terms of developing meaningful accounting information, which is associated with the auditor’s independence. Most studies on the association between audit quality and accounting information reliability focus on whether audits by a high-quality auditor increase the reliability of financial information. Becker et al. (1998) found that firms audited by a Big6 auditor show smaller discretionary accruals compared to firms audited by a non-Big6 auditor. The authors concluded that high-quality auditors provide more reliable accounting information. Nah and Choi (2003) analyzed whether the size of discretionary accruals differs when firms on the Korean stock market use one of the Big Four auditors. They reported that discretionary accruals are small when the auditor is one of the Big Four.

If an auditor provides a low-quality audit, then it may fail to expose earnings management, or even overlook such activities. In other words, high-quality auditors have more opportunities to uncover earnings management and are more eager to report such discovery; thus, high audit quality may restrict firms’ earnings management behavior. This study uses a Big Four auditor as a proxy for audit quality.

Large audit firms can be assumed to be high-quality auditors due to their level of independence. First, large audit firms may face severe damage and incur significant loss if they do not detect a client’s fraudulent activities. Second, large audit firms may rely less on specific clients economically. Assuming that all auditors have the same level of professionalism, DeAngelo (1981) argued that large auditors have more independence and, therefore, provide higher audit quality. Francis, Stokes, and Anderson (1999) showed that high audit quality from a Big6 auditor leads to lower discretionary accruals from clients audited by a non-Big6 auditor.

However, since managers’ accounting discretion can affect classification shifting in the income statement, auditors must be cautious (Nelson et al., 2003). Graham et al. (2005) argued that managers may prefer and use earnings management methods other than discretionary accruals, which are exposed to external auditors and government agencies. Whether the monitoring effect of a high audit quality decreases classification shifting activity or the substitution effect of other earnings management methods increases classification shifting activity requires empirical research. This study, therefore, develops the following null hypothesis.

Null Hypothesis: The type of auditor does not affect earnings management by classification shifting.

Research Model

Unexpected Operating Income Rate (McVay, 2006)

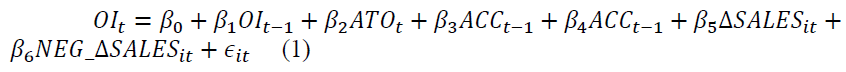

To test the hypothesis, this study first calculates the unexpected operating margin (UEOI) by subtracting the expected operating margin from the actual operating margin following McVay’s (2006) prediction model. The detailed estimation model is

OIt = Operating income before depreciation and amortization: (Sales – Costs of Goods Sold – Selling, General, and Administrative Expenses)/Sales.

ATOt = Asset turnover ratio: Salest / {(Net Operating Assetst-1 + Net Operating Assetst)/2}, where net operating assets is equal to the difference between Operating Assets – Operating Liabilities. Operating Assets is Total Assets less Cash and Short-Term Investments. Operating Liabilities is Total Debt less the Book Value of Common and Preferred Equity.

ACCt = Operating accruals: (Operating Incomet – CFOt) /Salest

ΔSALESt = Percent change in Sales from year t-1 to t: (Salest - Salest-1)/Salest-1

ΔNEG_ = Percent change in sales (ΔSALES); if ΔSALES is negative, and 0 otherwise.

SALESt

t = year

Model 1 aims to predict the expected operating margin. The amount used as the numerator in the dependent variable, OI, is measured by adding depreciation costs and the amortization of intangible assets from the income and manufacturing statements to operating income. This process is necessary because, when there is loss on the disposal of tangible and intangible assets which would be a non-operating expense a decrease in the depreciation and amortization of intangible assets from the disposal of those assets may impact the operating margin.

The independent variables consist of variables that impact the current-period operating margin. According to previous studies, the persistence of operating income is very high (Sloan, 1996). Therefore, in the estimation of Model 1, in which OI is the dependent variable, OIt-1, which is the prior-period operating income, is the most important predictor. The ATO variable is included as an independent variable to control for the phenomenon whereby operating income decreases relative to sales as the operating asset turnover increases. Since accruals have decreasing income persistence, the model includes a variable for prior-period accruals (ACCt-1) to control for the expected phenomenon in which higher prior-period accruals lead to lower current-period operating margins. The fluctuation in accruals is proportionate to extreme management performance. Therefore, to reduce error in the estimation process due to samples showing extreme management performance, it is necessary to include the fluctuation in accruals. However, because the prior-period ACC variable is included in the model, the current-period ACC is used instead of fluctuation in accruals as a control variable. The fluctuation rate of sales, ΔSALES, is a variable to control for the effect whereby an increase in sales leads to a gradual decrease in fixed cost per unit and an increase in operating margin. An increase in selling and administrative expenses due to an increase in sales and a change in operating margin due to a change in sales are asymmetric (Anderson et al., 2003). Therefore, after controlling the explanatory power of ΔSALES for OI, the NEG_ΔSALES variable (decrease rate in sales) is added as a separate control variable. The residuals that these control variables cannot explain in terms of current-period operating income, the dependent variable, are presumed to be the UEOI.

Hypothesis Analysis Model

![]()

UEOIt = Unexpected operating income (UEOIt) is the difference between the actual and predicted operating income, where the predicted values are calculated using Model 1 developed by McVay (2006):

TNOEt = TNOE1t, TNOE2t

TNOE1t = Non-Operating Expenses, exclusive of interest expense and equity method loss

TNOE2t = Non-Operating Expenses, exclusive of interest expense, equity method loss, and loss on the disposal of assets

BIG4t = 1 if the auditor is one of the Big Four, and 0 otherwise

t = year

The dependent variable in Model (2) is the UEOI estimated by Model 1. The experimental variables to test the hypothesis are TNOE, which represents temporary nonoperating expenses relative to sales, and BIG4, which represents large-scale auditors. Temporary non-operating expenses can be measured as two types. The first is TNOE1, which is nonoperating expenses without persistence, and excludes interest expenses and loss on the value of equity-method securities. The second is TNOE2, which excludes loss on asset disposals along with interest expenses and loss on the value of equity-method securities, which is used to enhance robustness. BIG4 is a dummy variable that takes 1 if a company is audited by one of the Big Four accounting firms (Deloitte, Ernst & Young (EY), KPMG, and PricewaterhouseCoopers (PwC)) and 0 otherwise. If a high-quality auditor can monitor shifting activity as well as other earnings management method, then the coefficient of the interaction term of TNOE and BIG4 in Model 2 would be negative. On the contrary, when audited by a Big Four auditor, if a manager opts for classification shifting by shifting operating income upwards rather than earnings management via current-period net income, then the coefficient of the interaction term of TNOE and BIG4 would be positive.

Sample Selection

Since 2009, some South Korean companies have adopted IFRS voluntarily, while all listed companies have been required to adopt IFRS since 2011. The sample period is limited to the period prior to this; thus, the sample for this study is based on firms listed on the Korea Stock Exchange as of December 31, 2009, with the following conditions for sample selection.

1. Company listed on the KOSPI market during 2002–2008.

2. Firms with December year-end, excluding the financial industry.

3. Firms for which financial information can be extracted from DATA GUIDE PRO.

4. Excludes unexpected operating income rate samples.

5. Sample firms that are within the upper 30% level of non-operating expense/sales while the total assets of period t decrease compared to last year.

6. Winsorization of the sample at the upper and lower 1% level based on the dependent and independent variables.

Table 1 summarizes the sample selection process in detail.

| Table 1 Sample Selection | |

| Sample selection process | Num. of firms |

| All firm observations from Korea Stock Exchange (KSE)during the period 2002∼2008 | 4,550 |

| (Less) Financial service | (364) |

| (Less) Non-December Firms | (208) |

| (Less) Firms in industry which has less than 15 firms | (115) |

| (Less) Firms with abnormal high restructuring expenses | (155) |

| (Less) Firms with insufficient financial data | (643) |

| (Less) Firms with insufficient analyst data | (1,420) |

| Final Sample Size Used for Hypothesis | 2,763 |

Empirical Results

Descriptive Statistics and Correlations

Table 2 reports the descriptive statistics for the variables. The mean and median values of UEOIt are 0.002 and –0.002, respectively. The mean and median values of TNOE1, the ratio of non-operating expenses to sales, are 0.046 and 0.012, respectively. BIG4, which indicates whether a firm was audited by a Big Four auditor, shows a mean value of 0.682. This result implies that 68.2% of firm-years are audited by Big Four auditors.

| Table 2 Descriptive Statistics | ||||||

| Variable | N | Mean | Standard deviation |

25% | Median | 75% |

| UEOI | 2,763 | 0.002 | 0.001 | 0.019 | -0.020 | 0.059 |

| TNOE1 | 2,763 | 0.046 | 0.0242 | 0.045 | 0.012 | 0.146 |

| TNOE2 | 2,763 | 0.026 | 0 | 0.019 | 0 | 0.136 |

| BIG4 | 2,763 | 0.682 | 0.465 | 0 | 1 | 1 |

| UEOIt | = Unexpected operating income (UEOIt) is the difference between actual and predicted operating income, where the predicted values are calculated using predicted Model 1 developed by McVay (2006): | |||||

| TNOEt | = TNOE1t, TNOE2t | |||||

| TNOE1t= Non-operating Expenses, exclusive of interest expense and equity method loss | ||||||

| TNOE2t= Non-operating Expenses, exclusive of interest expense, equity method loss, and loss on disposal of assets | ||||||

| BIG4t | = 1 if a firm is audited by Big Four auditors, 0 otherwise | |||||

Table 3 presents the associations among the variables used in the regression. There is a positive association between the unexpected operating income ratio and non-operating expense, implying that operating income increases abnormally due to shifting.

| Table 3 Pearson's Correlation | |||

| TNOE1 | TNOE2 | BIG | |

| UEOI | 0.052 | 0.052 | -0.011 |

| (0.0059) | (0.006) | (0.5791) | |

| TNOE1 | 0.99 | -0.019 | |

| (<.0001) | (0.3213) | ||

| TNOE2 | -0.026 | ||

| (0.1781) | |||

Results

Table 4 presents the empirical analysis of how Big Four auditors affect shifting activity. The key variable is the interaction term of BIG4, a dummy variable for Big Four auditors, and TNOE. The coefficient of TNOE1*BIG4 is 0.047 (t-value=2.85) and is positively significant at the 99% level. For the regression model using TNOE2, which excludes the loss from asset disposal in TNOE1, the coefficient of TNOE2*BIG4 is 0.063 (t-value=4.65), and is positively significant at the 99% level. These results imply that firms audited by one of the Big Four auditors have more incentives to engage in earnings management by classification shifting to increase operating income. These results support the substitution effect wherein managers can use shifting activity as a replacement for other earnings management methods when audit quality is high.

| Table 4 The Effect of the Big4 Auditing Firm on Classification Shifting | |||||

|

|||||

| Variables | Exp. sign | TNOE=TNOE1 | TNOE=TNOE2 | ||

| Coeff. | t Value | Coeff. | t Value | ||

| Intercept | ? | 0.003 | 1.54 | 0.003 | 1.8* |

| TNOE | ? | -0.005 | -0.41 | -0.009 | -0.75 |

| BIG4 | ? | -0.002 | -1.03 | -0.003 | -1.48 |

| TNOEt x + BIG4t | ? | 0.047 | 2.85*** | 0.063 | 4.65*** |

| Year Dummies |

N/A | Included | |||

| Industry Dummies |

N/A | Included | |||

| Model Fit | Adj R2 | 0.07 | Adj R2 | 0.07 | |

| F Value | 2.14*** | F Value | 2.18*** | ||

| Sample Size | 2,763 | ||||

| 1) Refer to <Table 2> for the Variable Definitions. 2) *, **, *** represent significance at the 10, 5, and 1 percent levels, respectively. |

|||||

Conclusion

Classification shifting is an earnings management tool by which managers shift operating income up the income statement by discretionarily classifying operating expenses as nonoperating expenses. Operating income is a more useful tool in measuring company value than current-period net income is. Managers are incentivized to undertake shifting because they can use it to shift operating income upward without changing current-period net income. This study examined the incentives for earnings management via the arbitrary classification of expenses in relation to audit quality. For audit quality, this study used auditing by a Big Four accounting firm as a proxy for a high-quality auditor. When a Big Four auditor conducts an audit, managers are incentivized to opt for classification shifting as an alternative to an earnings management method that increases current-period net income. By contrast, auditors providing a proper high-quality audit in their role of monitoring managers’ earnings management can lead to a decrease in classification shifting. The empirical analysis reveals the following results. Companies audited by a Big Four auditor with high audit quality have a significantly higher rate of classification shifting than companies that are not. This result suggests that, when audited by a Big Four auditing firm, the firm’s managers are likely to choose classification shifting over an earnings management method that adjusts current-period net income. This study offers several practical and academic contributions. Whereas previous studies have tended to focus on accrual-based earnings management, this study empirically provides a new perspective on earnings management methods. The findings of this study suggest that investors should review income statements and make decisions considering companies’ auditors and that accounting auditors should pay attention to operating income while conducting audits.

References

- Anderson, M., Banker, R., & Janakiraman, S. (2003). Are selling, general, and administrative costs “sticky”? Journal of Accounting Research, 41(1), 47–63.

- Becker, C.L., Defond, M.L., Jiambalvo, J., & Subramanyam, K.R. (1998). The effect of audit quality on earnings management. Contemporary Accounting Research, 15, 1-24.

- DeAngelo, L. (1981). Auditor size and auditor quality. Journal of Accounting and Economics, 3, 189-199.

- Fan, Y, Abhijit, B., William, M.C., & Wayne, B.T. (2010). Managing earnings using classification shifting: Evidence from quarterly special items. The Accounting Review, 85, 1303-1323.

- Francis, J.R., Stokes, D., & Anderson. D. (1999). City markets as a unit of analysis in audit research and the re-examination of big 6 market shares. A Journal of Accounting, Finance and Business Studies, 35, 185-206.

- Graham, J.R., Harvey, C.R., & Rajgopal, S. (2005). The economic implications of corporate financial reporting. Journal of Accounting and Economics, 40, 3–73.

- Hayn, C. (1995). The information content of losses. Journal of Accounting and Economics, 20, 125–153.

- Lee, S.C., Cho, J.S., & Cho, M.H. (2008). Earnings management using discretionary classification of expenses. Korean Accounting Review, 33, 141-173.

- McVay, S. (2006). Earnings management using classification shifting: An examination of core earnings and special items. The Accounting Review, 78, 779-799.

- Nah, C.K., & Choi, K. (2003). Accounting accruals and the demand for differential audits. Korean Accounting Review 28, 1-31.

- Nelson, M.W., Elliott, J.A., & Tarpley, R.L. (2013). How are earnings managed? Examples from auditors. Accounting Horizons, 17(supplement), 17-35.

- Sloan, R. (1996). Do stock prices fully reflect information in accruals and cash flows about future earnings? The Accounting Review, 71, 289-315.