Research Article: 2022 Vol: 25 Issue: 2S

The effect of audit committee on financial performance of listed companies in Jordan: The moderating effect of enterprise risk management

Saddam Ali Shatnawi, Universiti Sains Islam Malaysia

Ahmad Marei, Middle East University

Mustafa Mohd Hanefah, Universiti Sains Islam Malaysia

Monther Eldaia, Universiti Sains Islam Malaysia

Saad Alaaraj, Science Gates, Kajang

Citation Information: Shatnawi, S.A., Marei, A., Hanefah, M.M., Eldaia, M., & Alaaraj, S. (2022). The effect of audit committee on financial performance of listed companies in Jordan: The moderating effect of enterprise risk management. Journal of Management Information and Decision Sciences, 25(S2), 1-10.

Keywords

Audit Committee, Enterprise Risk Management, Jordan, ROA, ROE, Tobin’s Q

Abstract

The Audit Committee (AC) is one of the most indispensable mechanisms of CG that impacts corporate performance. In Jordan, there exists a limited separation between the company owners and AC members, where executive managers from family owners make direct decisions and taking risks, consequently limiting the effectiveness of AC. The purpose of this study is to determine the effect of ACE on financial performance (FP) of companies listed on Amman Stock Exchange (ASE). It also aims to examine the moderating effect of enterprise risk management (ERM) between ACE and FP in Jordan. This study uses data from 2009 to 2017 with 92 selected firms cover a period of 9 years of companies listed in ASE in industrial and service sectors. Data was analyzed using STATA. The findings demonstrated that ACE has a significant relationship with ROA, ROE, and Tobin’s Q. Similarly, firm size has a positive relationship with ROA, ROE, and Tobin’s Q, while leverage and firm age have negative relationships with ROA, ROE, and Tobin’s Q. The tested model is statistically significant and can predict 46.7% of the variation in all performance variables. In terms of moderating effect, the findings showed that ERM positively moderated the effect of ACE on ROA and ROE in Jordan. However, it did not support the moderating role between ACE and Tobin’s Q. Decision makers have to enforce the implementation of ERM in Jordanian companies to improve the FP.

Introduction

Audit committee effectiveness (ACE) is an essential player in the firm due to its duties, responsibilities and monitoring job in order to ensure the financial reports quality and enhance corporate accountability (Hasballah & Ilyas, 2019). The audit committee (AC) is an efficient monitoring mechanism that increases the corporate governance (CG) standards. The role of the AC is centered on supervising and monitoring financial reporting integrity, which, as a result, enhances the overall value of the firm (Alqatamin, 2018). A great deal of attention has been directed towards the fact that the role of the AC is to ensure fraud is completely eradicated with the purpose to monitor the financial reporting process of the firm, as well as reviewing its financial reports, the risk management practices, and its internal accounting controls (Erasmus & Coetzee, 2018). Additionally, there is an indication that an active AC has the capability to impact management decisions (Abbott, Brown & Higgs, 2015).

In the wake of the development in global corporate environments, predominantly, as a result of many corporate collapses between 2001 and 2008, there has been increased stress proposing only independent non-executive directors ought to be members of the AC (Al-Hajaya, 2019; Eldaia et al., 2020). In Jordan, ACs are necessary for the listed companies based on Securities Law No. 76 of 2002, which has committed all listed companies to establish an AC. AC is one of the most indispensable mechanisms of CG that impacts corporate performance. Similarly, the Jordanian CG code requires corporates to establish AC, with at least two independent members (Alhababsah, 2016). However, the AC is considered to be a sub-committee of the board of directors (Abdullatif et al., 2015; Mohammed, 2018). Listed firms of Jordanian public service are characterized by dominant strictly held family business (Hammadeh, 2018). There is a limited separation between the owners of companies, AC members, and management, where non-executive managers may be of direct relations with some executive managers, consequently limiting the effectiveness of ACs (Abbott, Brown, and Higgs, 2015). The committee has usually encompassed the bulk of non-executive directors who are anticipated to discuss the affairs of the firm in a practical way (Falatifah & Hermawan, 2019). In Jordan, ACs are more active when there are considerable agency conflicts among minority and majority stakeholders when political costs connected with reporting errors and fraud are larger (Alqatamin, 2018; Daoud et al., 2020; Shatnawi et al., 2020). The demand for effective AC in Jordanian PLCs is considered low and the AC performs their duties within a limited level (Abdullatif et al., 2015).

Enterprise Risk Management (ERM) has been considered as one of the most significant problems bordering corporate management in the contemporary periods. It is promoters consider that incorporating all corporate risks in a single ERM can improve AC and long-term corporate performance (Soliman et al., 2018; Yang et al., 2018, Shatnawi et al., 2019a; Shatnawi et al., 2019b; Marei& Iskandar, 2020). ERM comprises of integrated management threat, operational, financial, and strategic risks along with the orientation of risk management based on corporate policies. The AC as part of corporate management advocates all forms of risk management in a corporate and they monitor both firm internal and external activities to cut down the risks (Dabari & Saidin, 2016). Corporates commonly adopt good ERM tactics to connect ERM with their policies, cost, accounting, guidelines, and long-term projection with aim of regulating assets and interest in an effective manner (Cohen et al., 2017).

According to Abdullah & Shukor (2017), the risk management committee and AC can potentially moderate the relationship between voluntary risk management disclosure and firm performance. Since AC is a supervising division in CG and the major rationale of its existence is to safeguard the interests of stakeholders and to assume its tasks in monitoring internal control, and financial disclosure in a corporate (Marei & Iskandar, 2019). The existing literature revealed that there is no theoretical framework or a model predicting the moderating effect of ERM between AC and corporate performance. In Jordan, such an effect has not been examined in the context of the PLCs. Based on earlier mentioned problems and lack of obtainable study in this area in Jordan, this study aims to examine the effect of ACE on FP and to determine the moderating effect of ERM between ACE and accounting and market performance in Jordan.

Literature Review

This section discusses the theoretical framework include the agency theory and the stakeholder theory.

Theoretical Framework

There is no individual or wide-ranging theory that explains the concerns affecting firm value in the marketplace. The argument is commonly posed that there is a need for a multi-theoretic approach to gaining insight into CG mechanisms (Ruigrok et al., 2006). Each one of these theories complements the other theories (Amran, 2010; Setiawan et al., 2020).

The risks have become the most significant factors influencing the goal of enterprises in the globe (Selamat & Ibrahim, 2018). Marei, et al., (2020) have earlier examined the comparative moderating effect of the risk management committee and audit committee on the association between voluntary risk management disclosure and firm performance. These authors have reaffirmed the used of agency theory in assessing the moderating effect in CG study. The agency theory protects against the misappropriation of the firm’s resources for the egocentric interests of managers and the firm’s employees in general (Setiawan et al., 2020). As a complementary theory, the stakeholder theory supports the CG to identify the significance, the rights, and the needs of the firm’s stakeholders as well as to ensure collaboration among the stakeholders within the firm and direct this towards wealth creation (Al-Matari et al., 2014; Mohammed, 2018). In this study, both theories are deployed to explain the causal effect between ACE and FP as well as the moderating role of ERM.

Conceptual Framework and Hypotheses Development

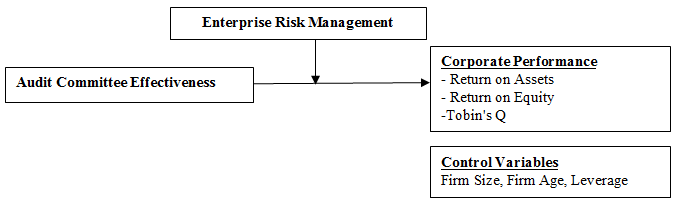

Based on the agency theory and the stakeholder theory, this study proposes that the ACE will affect the accounting and market-based performance. The study also proposed that the ERM will moderate the effect of ACE on FP of industrial and service PLC in Jordan. Based on the literature, firm age, firm size, and leverage are included as control variables. Figure 1 presents the research framework of this study based on the theoretical framework explained above.

ACE and FP

The AC has been in forefront of public attention for decades now since they are the primary decision-making teams with the responsibility to supervise the internal control and financial reporting of firms particularly in Jordan (Al-Daoud et al., 2015). Firms in Jordan are significantly smaller than those found in developed countries, and many Jordanian firms are strictly family-held businesses, which make them more prone to risks due to the nature of decision making (Alqatamin, 2018; Shaqqour, 2019), thus they need better monitoring and control in term of audit committee task. The AC activities may make the boards or managers to take risky mitigating strategies to safeguard the operating effectiveness of the corporate (Al-Ebel, 2013). Thus, ACE in this study is proposed to have a positive direct effect on FP of PLC in Jordan.

H1a: ACE affects the accounting performance (ROA) in the Jordanian industry and service PLC.

H1b: ACE affects the accounting performance (ROE) in the Jordanian industry and service PLC.

H1c: ACE affects the market performance (Tobin’s Q) in the Jordanian industry and service PLC.

ERM as Moderator

ERM has been viewed as one of the most important issues surrounding business management in recent times; its advocates believe that integrating all corporate risks within a single ERM framework will enhance long-term firm performance. Beasley, Clune & Hermanson (2005) examine the factors associated with the stage of ERM implementation in international organizations. The findings of the study were that the stage of ERM implementation was positively related to the presence of a chief risk officer, ERM, board independence, CEO and CFO apparent support for ERM, the presence of a big four auditor, entity size, entities in the banking, education, and insurance industries. This indicated that ERM implementation is associated with AC effectiveness and corporate performance. An effective AC plays a fundamental role in CG as a value creator through guaranteeing financial reporting transparency by structuring and maintaining the confidence of shareholders and the general public as well (Velte, 2017; Falatifah & Hermawan, 2019). Upon these arguments and empirical evidence provided by the prior studies, this study expects that the relationship between the ACE and FP is moderated by ERM in the Jordanian industry and service listed companies. The testable hypothesis is stated as:

H2a: ERM moderates the effect of ACE on accounting performance (ROA) in the Jordanian industry and service PLC.

H2b: ERM moderates the effect of ACE on accounting performance (ROE) in the Jordanian industry and service PLC.

H2c: ERM moderates the effect of ACE on market performance (Tobin’s Q) in the Jordanian industry and service PLC.

Methodology

This study used a quantitative approach. The design is used to test the relationship between ACE on FP and ERM as a moderating variable in the Jordanian industry and service listed companies. The collection of data to accomplish objective are derived through secondary data obtained through published annual reports from ASE website as well as the respective companies’ websites from the years 2009 to 2017. In Jordan, there are three sectors; financial, industrial, and service sectors were divided into 101, 46, and 46 firms, respectively (ASE, 2018). However, this study uses only two sectors industry and sector service. This led to 828 firm-year observations for the whole sample (92 firms multiplied by 9 years). SPSS and STATA (version 14) are used for the data analysis. This study used three control variables: firm size, firm age, and leverage.

Performance Measures

Previous studies have suggested a range of accounting-based measurements such as the ROA and ROE. Tobin’s Q is the most commonly utilized measure for reflecting market-based performance. Tobin's Q shows how investors regard the firm and it is a relevant indicator of company survival. Based on several previous studies (e.g., Arslan, Karan & Eksi, 2010), the variables of this study are measured as follows: ROA is taken as a performance proxy, measured as a percentage of net income to total assets. For ROE, it is measured as a percentage of net income to total equity. Tobin’s Q is measured as the market value of stock plus the book value of the debt divided by the book value of the total assets.

Audit Committee Effectiveness

ACE in this study is measured as a combined measure, where the measurement is calculated by summing the value of the five individual characteristics (i.e., AC Size, AC Meeting, AC Independence, Accounting Expertise in AC, and Muslim directors on the AC) into one score.

Enterprise Risk Management

The ERM is measured in this study by given 1 if the firm is using an ERM and zero if otherwise. This is consistent with previous studies (Hoyt & Liebenberg, 2011).

Panel Data Estimation and Research Model

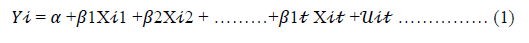

This research applies regression analysis as a statistical technique. Regression analysis forms to estimate the associations between the dependent variable and the independent variables (Hair et al., 2009; Alaaraj et al., 2018). In this study, multiple regression models are used. The general form of a multiple regression model is:

Where: Yi: Dependent variable, ??: Constant, Χ??1, Χ??2, Χ????: Independent variables, ??????: Errors

Regression Analysis for Moderating Effect

The moderating effect or interaction effect occurs when the moderator variable changes the form or the strength of the relationship between two or more variables (Hair et al., 2009). Hartmanna & Moers (2003) pointed out that regression analysis is more suitable for testing a hypothesis that contains moderating variables. The moderating relationship consists of three types of variables: the dependent variable, the independent variable, and the moderator variable. In a moderating relationship, the dependent variable is influenced by the independent variable and a moderating relationship exists when the influence of the independent variable on the dependent variable is different depending on the value of the moderator variable (Aprilcilla, 2019). To investigate the hypothesis of this study regarding the moderating effect of ERM on the relationship between the composite variable ACE on accounting and market-based performance, the study applies the following regression analysis:

FP= ?? + ??1 ACE_SCORE???? + ??2 ERM???? + B1 ACE-SCORE * ERM it + B2FSIZE + B3 FAGE + B4LR + uit (3)

Where (FP ) refers to the financial performance, which represents the dependent variable and measured by ROA, ROE and Tobin's Q. Score for the effectiveness of the audit committee (ACE Score) are the independent variable. Model specification (2-1) refers to the moderating effect of Enterprise Risk Management (ERM), Control variables represented by firm size (FSIZE), Firm Age (FAGE) and Leverage ratio (L).

Results

Descriptive Analysis

Firm size, leverage, and firm age are deployed in this study as a control variable. The descriptive results of these variables are displayed in Table 1. Values are given in Jordanian Dinar (JD). The table shows that the firm size is highly varied with a mean score value of JD 71,709,351.23 while the median is JD 26,215,966.50. The mean score of overall leverage is 32.9919 indicating that the leverage for the sample of this study is almost 33%. Table 1 shows that the mean of firm age is 24.5950 and the median is 20 years. These findings are in agreement with previous studies (Petri & Saadi-Sedik, 2014).

| Table 1 Descriptive Statistics of Control Variables |

||||

|---|---|---|---|---|

| Firm Size | Leverage | Firm Age | ||

| N | Company | 92 | 92 | 92 |

| Time | 9 | 9 | 9 | |

| Observation | 828 | 828 | 828 | |

| Missing | 0 | 0 | 0 | |

| Mean | 71,709,351.23 | 32.9919 | 24.5950 | |

| Median | 26,215,966.50 | 29.2791 | 20.0000 | |

| Std. Deviation | 144,876,279.41 | 21.47343 | 16.68320 | |

| Minimum | 469,848.00 | .02 | 1.00 | |

| Maximum | 994,797,000.00 | 104.24 | 79.00 | |

Effect of ACE on FP

The results of the relationship between the ACE and control variables with the FP are presented in Table 2. The table shows the relationship with ROA, ROE, and Tobin’s Q.

| Table 2 The Relationship With ROA, ROE, and Tobin’s Q |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| ROA | ROE | Tobin’s Q | |||||||

| ROA | Coef. | t | P>t | Coef. | t | P>t | Coef. | t | P>t |

| Constant | .239 | 2.10 | 0.016 | .4704 | -2.00 | 0.045 | .925 | 3.70 | 0.000 |

| ACE | 0.136 | 2.148 | 0.053 | 0.141 | 2.206 | 0.000 | 0.141 | 2.206 | 0.000 |

| Firm Size | .895 | 10.18 | 0.000 | .104 | 1.11 | 0.268 | .391 | 3.91 | 0.000 |

| Leverage | -.081 | -1.85 | 0.064 | .344 | 7.36 | 0.000 | -.172 | -3.47 | 0.001 |

| Firm Age | -.824 | -5.65 | 0.000 | .122 | 0.78 | 0.433 | -.384 | -2.31 | 0.021 |

| F (13, 595) | 18.94 | 16.67 | 14.88 | ||||||

| Prob>F (P-value) | 0.000 | 0.000*** | 0.000 | ||||||

| R-squared | 0.4927 | 0.467 | 0.455 | ||||||

The results revealed that ACE has a significant relationship with ROA (p=0.0536*). Thus, H1a is supported. Firm size as a control variable has a positive relationship with ROA. Leverage and firm age have negative relationships with ROA. For H1b, the results in Table 2 demonstrated that AC effectiveness has a significant positive relationship with ROE. Therefore, H1b is supported. In terms of firm size and firm age, they have an insignificant relationship with ROE, while leverage has a significant positive relationship with ROE. The model is statistically significant and can predict 46.7% of the variation in ROE. For H1c, the results in Table 2 showed that ACE has significant positive relationships with Tobin’s Q.

Moderating Effect

Hieratical regression is deployed to examine the moderating effect of ERM between ACE and FP. The results of the tested hypothesis are displayed in Table 3, 4 and Table 5. Based on the findings in Table 5, the effect of ACE on ROA in Model 1 is significant at the level of 0.05. Similarly, the effect of the control variables is significant. The moderating variable ERM included in model 2 and it has a significant positive relationship with ROA. In Model 3, the interaction effects of the relationship of ACE*ERM with ROA are positive and significant. This indicates that there is a positive interaction effect between ACE and ERM. The positive interaction indicates that the increase in ERM practices and implementation in the context of industrial and services companies in Jordan lead to an increase in the positive relationship between ACE with ROA. Therefore, H2a is supported.

| Table 3 Results of The Moderating Effect of Erm Between ACE and ROA |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | |||||||

| ROA | Coef. | t | P>t | Coef. | t | P>t | Coef. | t | P>t |

| C | 1.17 | 12.4 | 0.000 | 1.06 | 10.7 | 0.000 | .77 | 7.67 | 0.000 |

| ACE | .191 | 2.92 | 0.000 | .141 | 2.12 | 0.034 | 0.064 | 0.97 | 0.331 |

| ERM | .181 | 3.32 | 0.000 | 0.063 | 1.14 | 0.254 | |||

| ACE*ERM | 0.228 | 4.04 | 0.000 | ||||||

| FS | .980 | 10.8 | 0.000 | .926 | 10.1 | 0.000 | .90 | 10.5 | 0.000 |

| LG | -.156 | -3.34 | 0.000 | -.132 | -2.86 | 0.000 | -.11 | -2.51 | 0.012 |

| FA | -1.09 | 12.4 | 0.000 | -.967 | -6.69 | 0.000 | -.957 | -6.97 | 0.000 |

| R-square | .414 | .428 | 0.507 | ||||||

| F statistic | 32.88 | 29.70 | 33.36 | ||||||

ROA: return on assets, C: constant, BDE: Board of director effectiveness, ERM, enterprise risk management, FS: Firm size, LG: Leverage, FA: firm age.

Moreover, the hypothesis is tested with the ROE as a dependent variable. The findings in Table 4 show that the relationship of ACE on ROE is positive and significant in Model 1. The relationship remained significant in Model 2 and Model 3. In terms of the interaction effect (ERM*ACE), the interaction is positive and significant. This supports H2b and indicates that in the context of ROE, ERM moderated the effect of ACE on ROE.

| Table 4 The Result of The Moderating Effect of Erm Between ACE and ROE |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | |||||||

| ROE | Coef. | t | P>t | Coef. | t | P>t | Coef. | t | P>t |

| C | .589 | 5.87 | 0.000 | .368 | 3.59 | 0.000 | .290 | 2.65 | 0.000 |

| ACE | .511 | 7.37 | 0.000 | .409 | 5.94 | 0.000 | .389 | 5.39 | 0.000 |

| ERM | .369 | 6.55 | 0.000 | .339 | 5.59 | 0.000 | |||

| ERM*ACE | .088 | 1.97 | 0.046 | ||||||

| FS | .177 | 1.84 | 0.066 | .117 | 1.26 | 0.209 | .106 | 1.14 | 0.254 |

| LG | .195 | 3.93 | 0.000 | .222 | 4.61 | 0.000 | .230 | 4.75 | 0.000 |

| FA | -.203 | -1.32 | 0.187 | -.175 | -1.18 | 0.240 | -.142 | -0.95 | 0.341 |

| R-square | .393 | .447 | .453 | ||||||

| F statistic | 28.93 | 32.94 | 25.29 | ||||||

For the third dependent variable (Tobin’s Q), the relationship was tested and the results were given in Table 5. The relationship between AC effectiveness and Tobin’s Q is negative and significant as shown in Model 1. The relationships maintained the same direction and level of significance in Model 2 and Model 3. In terms of the interaction effect, the interaction between ERM and ACE is positive but insignificant. Thus, H2c is not supported.

| Table 5 The Result of The Moderating Effect of ERM Between ACE and Tobin’s Q |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | |||||||

| TQ | Coef. | t | P>t | Coef. | t | P>t | Coef. | t | P>t |

| C | -.198 | -1.73 | 0.084 | -.276 | -2.29 | 0.022 | -.303 | -2.35 | 0.019 |

| ACE | -.171 | -2.17 | 0.030 | -.208 | -2.57 | 0.010 | -.236 | -2.78 | 0.000 |

| ERM | .131 | 1.99 | 0.047 | .103 | 1.45 | 0.148 | |||

| ERM*ACE | .077 | 1.07 | 0.284 | ||||||

| FS | .419 | 3.82 | 0.000 | .398 | 3.62 | 0.000 | .394 | 3.59 | 0.000 |

| LG | -.164 | -2.91 | 0.004 | -.155 | -2.73 | 0.006 | -.147 | -2.57 | 0.010 |

| FA | -.290 | -1.66 | 0.098 | -.280 | -1.60 | 0.110 | -.261 | -1.48 | 0.139 |

| R-square | .381 | .366 | .415 | ||||||

| F statistic | 21.3 | 17.5 | 14.75 | ||||||

Discussion

The findings of this study showed that ACE is an effective mechanism in improving the performance of PLC in Jordan. The findings of this study indicated that when the ERM increases, the effect of ACE on ROA and ROE increases as well. This finding could be due to the fact that when the ERM is implemented in the companies, the AC has access to tools that helps them in preparing the financial reports and ensuring the accuracy of the reports, the accounting based performance will improve. Having ERM in the companies enable the AC in these companies to be able to assess the risk more accurately with the ERM tools. These findings are in agreement with previous studies that show ERM is effective in improving the performance of a firm and possess the ability to moderate the effect of ACE on the accounting and market performance (Inaam & Khamoussi, 2016; Abdullah &Shukor, 2017; Al-Hajaya, 2019). For these authors, Abdullah & Shukor (2017) examined the comparative moderating effect of ERM and AC on the association between voluntary risk management disclosure and firm performance. They found that ERM increases the effectiveness of ACE on ROA and ROE. Shad et al. (2019) found that moderating effects of risk management function on determinants of ERM implementation positively affect ACE on ROE and ROA. This is also supported by the findings of Inaam & Khamoussi (2016) who indicated that the increase of ERM enhances the relationship between ACE and corporate performance.

The findings also showed that ERM does not moderate the relationship between ACE on Tobin’s Q. This finding again could be related to the expertise and level of implementing the ERM. Jordanian legal bodies do not mandate companies to implement ERM and the experience level in implementing ERM in the Middle East is still in its infancy (Al-Hajaya, 2019). This could support the findings of no moderating effect of ERM in the relationship between ACE and Tobin’s Q. This finding is supported by the results of studies conducted in Turkey, which found that there is no relationship or moderating effect of ERM on the firm performance or the market performance of Turkish listed companies (Sayilir & Farhan, 2016; ?enol & Karaca, 2017). Likewise, Muslih (2019) also found an insignificant relationship or moderating effect of ERM on firm performance, despite its various benefits.

Altogether, the findings indicated that the hypothesis of this study is supported in term of the moderating effect of ERM between ACE on ROA and ROE but not supported in term of the moderating effect of ERM between ACE and Tobin’s Q. This result can be justified for fact that Amman Stock Exchange (ASE) has not necessitated the Jordanian corporates to implement ERM legally but recommended it, this could have affected the ERM implementation in Jordan. Jordan is still making efforts to meet up with ERM practical challenges in different sectors, thus, this may have caused this insignificant moderating effect of ERM between ACE and Tobin’s Q in Jordan.

Conclusion

The findings showed that ERM positively moderated the effect of ACE on return on assets and return on equity (accounting-based performance) in Jordan. However, it did not support the moderating role between ACE and Tobin’s Q (market-based performance). In addition, the findings showed that ERM has a direct and positive relationship with ROA, ROE, and Tobin’s Q. The ACE and the moderator ERM are able to explain almost half of the variation in the FP of PLC in Jordan. As a limitation of this study, the study focused only on the industrial and service sector. Financial sector was not included. In addition, the study deploys a timeframe of nine years and examine the effect of ACE and ERM. For future work, they are suggested to examine the financial sector in developing countries. Including other variables in the equation such as the board of director, CEO characteristic, and ownership structure could be a direction for future work. Other control variable should be included in future work. The results of the current study will enhance the understanding of the importance of the aforementioned theories in interpreting the moderating role-plays by ERM on the relationship between ACE and FP in the Jordanian context.

Acknowledgements

The authors are grateful to the Middle East University, Amman, Jordan for the financial support granted to cover the publication fee of this article.

References

Abbott, L.J., Brown, V.L., & Higgs, J.L. (2015). The effects of prior manager-auditor affiliation and pcaob inspection reports on audit committee members' auditor recommendations. Behavioral Research in Accounting, 28(1), 1-14.

Abdullatif, M., Ghanayem, H., Amin, R., Al-Shelleh, S., &Sharaiha, L. (2015). The performance of audit committees in jordanian public listed companies. Corporate Ownership and Control, 13(1), 1-21.

Al Qadasi, A., &Abidin, S. (2018). The effectiveness of internal corporate governance and audit quality: the role of ownership concentration–Malaysian evidence. Corporate Governance: The International Journal of Business in Society, 18(2), 233-253.

Al-Daoud, K.A., Ismail, K.N.I.K., & Lode, N.A. (2015). The impact of internal corporate governance on the timeliness of financial reports of Jordanian firms: Evidence using audit and management report lags. Mediterranean Journal of Social Sciences, 6(1), 430.

Alaaraj, S., Mohamed, Z.A., & Ahmad Bustamam, U.S. (2018). External growth strategies and organizational performance in emerging markets: The mediating role of inter-organizational trust. Review of International Business and Strategy, 28(2), 206–222.

Alhababsah, S. (2019). Ownership structure and audit quality: An empirical analysis considering ownership types in Jordan. Journal of International Accounting, Auditing and Taxation, 35, 71-84.

Beasley, M.S., Clune, R., &Hermanson, D.R. (2005). Enterprise Risk Management: An Empirical Analysis of Factors Associated with the Extent of Implementation. Journal of accounting and public policy, 24(6), 521-531.

Cohen, J., Krishnamoorthy, G., & Wright, A. (2017). Enterprise risk management and the financial reporting process: The experiences of audit committee members, CFO s, and external auditors. Contemporary Accounting Research, 34(2), 1178-1209.

Eldaia, M., Hanefah, M.B.M., Marzuki, A.B., & Shatnawi, S. (2020a). Takaful in Malaysia: Emergence, growth, and prospects. In Handbook of Research on Theory and Practice of Global Islamic Finance. 681-702.

Eldaia, M., Hanefah, M.B.M., Marzuki, A.B., Shatnawi, S. (2020b), Moderating role of shariah committee quality on the relationship between audit committee and malaysian takaful performance: A Litera-ture Review, International Journal of Islamic Economics , 2(1), 409-421. .

Hair, J.F., Black, W.C., Babin, B.J., & Anderson, R.E. (2009). Multivariate data analysis (7th ed.). New Jersey: Person Prentic Hall.

Hammadeh, F. (2018). Family business continuity in the middle east & muslim world: Betting against the odds. bookbaby.

Hartmanna, F.G.H., & Moers, F. (2003). "Testing Contingency Hypotheses in Budgetary Research Using Moderated Regression Analysis: A Second Look". Accounting, Organizations and Society. 28, 803-809. .

Hasballah, H.S., &Ilyas, F. (2019). The Substitution Role of Audit Committee Effectiveness and Audit Quality in Explaining Audit Report Lag. Acc. Fin. Review, 4(1), 28-37.

Inaam, Z., &Khamoussi, H. (2016). Audit committee effectiveness, audit quality and earnings management: a meta-analysis. International Journal of Law and Management, 58(2), 179- 196.

Liebenberg, A.P., & Hoyt, R.E. (2003). The determinants of enterprise risk management: Evidence from the appointment of chief risk officers. Risk Management and Insurance Review, 6(1), 37-52. .

Marei, A., & Iskandar, E.D.T.B.M. (2019). The impact of Computer Assisted Auditing Techniques (CAATs) on develop-ment of audit process: an assessment of Performance Expectancy of by the auditors. International Journal of Management and Commerce Innovations. 7(2), 1199-1205.

Marei, A., Daoud, L., Ibrahim, M., & Al-Jabaly, S. Moderating role of top management support in electronic procurement usage of Jordanian firms. Management Science Letters, 11(4), 1121-1132. .

Mohammed, A.M. (2018). The impact of audit committee characteristics on firm performance: Evidence from Jordan. Academy of Accounting and Financial Studies Journal.

Muslih, M. (2019). The Benefit of Enterprise Risk Management (ERM) On Firm Performance. Indonesian Management and Accounting Research (IMAR), 17(2), 171-188.

Petri, M., &Saadi-Sedik, T. (2014). The Jordanian Stock Market: Should You Invest in it for Risk Diversification or Performance? IMF Working Papers, 06(187), 1.

Ruigrok, W., Peck, S., Tacheva, S., Greve, P., & Hu, Y. (2006). The determinants and effects of board nomination committees. Journal of Management and Governance, 10(2), 119-148. .

Sayilir, Ö., &Farhan, M. (2016). Enterprise risk management and its effect on firm value in turkey. Journal of Management Research. .

Selamat, M.H., & Ibrahim, O. (2018). The moderating effect of risk culture in relationship between leadership and enterprise risk management implementation in malaysia. Business Management and Strategy, 9(1), 244-271. .

?enol, Z., &Karaca, S.S. (2017). The effect of enterprise risk management on firm performance: A case study on turkey. financial studies.

Setiawan, R., Cavaliere, L.P.L., Marei, A., Daoud, L., Haleem, A., Laskar, N.H., & Raisal, I. The impact of corporate social responsibility on financial performance. Productivity management, 25(1S), 766-790.

Setiawan, R., Cavaliere, L.P.L., Marei, A., Daoud, L., Haleem, A., Laskar, N.H., & Raisal, I. (2020). The impact of corporate social responsibility on financial performance (Doctoral dissertation, Petra Christian University).

Shad, M.K., Lai, F.W., Fatt, C.L., Klemeš, J.J., &Bokhari, A. (2019). Integrating sustainability reporting into enterprise risk management and its relationship with business performance: A conceptual framework. Journal of cleaner production, 208, 415-425. .

Shaqqour, O.F. (2019). The impact of accounting performance on structure of ownership and accounting conservatism, case of Jordan. Academy of Strategic Management Journal.

Shatnawi, S., Hanefah, M., &Eldaia, M. (2019a). Moderating effect of enterprise risk management on the relationship between board structures and corporate performance. International Journal of Entrepreneurship and Management Practices, 2(6), 01-15. .

Shatnawi, S., Hanefah, M., Adaa, A., &Eldaia, M. (2019b). The moderating effect of enterprise risk management on the relationship between audit committee characteristics and corporate performance: A Conceptual Case of Jordan. International Journal of Academic Research Business and Social Sciences, 9(5), 177–194.

Shatnawi, S., Hanefah, M., Anwar, N., &Eldaia, M. (2020). The factors influencing the enterprise risk management practices and firm performance in Jordan and Malaysia: A comparative review. International Journal of Recent Technology and Engineering (IJRTE), 5(8), 687-702.

Soliman, A., Mukhtar, A., & Shubita, M. (2018). The long-term relationship between enterprise risk management and bank performance: the missing link in Nigeria. Banks and Bank Systems, 13.

Tasmin, R., & Muazu, H.M. (2017). Moderating effects of risk management function on determinants of enterprise risk management implementation in malaysian oil and gas sector: A conceptual framework. Journal of Technology Management and Business, 04(02), 2289–7224.

Velte, P. (2017). The link between audit committees, corporate governance quality, and firm performance: a literature review. Corporate Ownership & Control, 14(1), 15-31.

Yang, S., Ishtiaq, M., & Anwar, M. (2018). Enterprise risk management practices and firm performance, the mediating role of competitive advantage and the moderating role of financial literacy. Journal of Risk and Financial Management, 11(3), 35. .

Received: 08- Dec -2021, Manuscript No. jmids-21-10582; Editor assigned: 11- Dec -2021, PreQC No. jmids-21-10582 (PQ); Reviewed: 20-Dec-2021, QC No. jmids-21-10582; Revised: 27-Dec-2021, Manuscript No. jmids-21-10582 (R); Published: 13-Jan-2022.