Research Article: 2020 Vol: 24 Issue: 4

The Effect of Adoption of IFRS On Financial Reporting Quality in Saudi Nonfinancial Listed Firms

Mohammed Alshetwi, Qassim University

Abstract

In 2017, each Saudi nonfinancial listed firm was required to prepare their reports consistent with International Financial Reporting Standards (IFRS). The current study examined whether the application of IFRS is associated with higher Financial Reporting Quality (FRQ). Based on a sample of 465 nonfinancial listed firms, the current study finds that IFRS adoption is not significantly related to enhanced FRQ. The study suggests that cost considerations might be an important factor contributing to inappropriate application of IFRS and, in turn, reduce the quality of FRQ. Moreover, the incentive of management and enforcement mechanisms might have had a combined effect leading to a ‘symbolic’ application of IFRS. Taking into consideration the situational context of emerging institutions, this study adds insights into global accounting research on the impact of IFRS on FRQ, supporting the view that the relationship between IFRS and FRQ may be confounded by other institutional factors such as cost considerations, enforcement mechanisms, and the development of distinctive legal and accounting systems.

Keywords

IFRS, FRQ, Saudi Nonfinancial Listed Firms, Enforcement Mechanism, Earnings Management.

Introduction

The adoption of International Financial Reporting Standards (IFRS) has received growing attention in recent years due to its positive impact on Financial Reporting Quality (FRQ), and in turn on the efficiency of capital markets. Increased adoption of IFRS around the world reflects the importance of IFRS and its impact on earnings quality. In this context, IFRS works as a function to harmonize accounting practices and enhance the comparability of financial information, and subsequently improve investment decisions (Iatridis, 2010; Zeghal et al., 2012). Indeed, IFRS provides a good indicator of a highly quality report. In this context, prior studies, have documented that the adoption of IFRS enhances the transparency and comparability of financial reporting (Barth et al., 2008; Daske & Gebhardt, 2006; Leuz, 2003; Silva & Nardi, 2017; Zeghal et al., 2010). Specifically, IFRS aims to reduce the accounting alternatives available to management, thereby reducing the opportunities for earnings management (Barth et al., 2008; Pascan, 2015) leading to better FRQ. IFRS also promotes conservatism in practices and requires the full disclosure of information; therefore, it reflects the reality of transactions and helps enhance investment decisions (Christensen et al., 2015).

In the case of Saudi Arabia, the Board of the Saudi Organization of Certified Public Accountants (SOCPA) has approved a plan to adopt IFRS in order to improve FRQ and enhance the efficiency of the capital market. Indeed, SOCPA provides some factors that explain its movement to adopt the IFRS. One of these factors is the need to harmonize accounting practices in order to enhance the comparability of financial reports and reduce information risk, thus promoting local and foreign investment. Second, compared to contemporary local standards, IFRS are more comprehensive, updated, and integrated standards that deal with a range of issues which are not included in local standards (SOCPA,2018). For example, firms should evaluate long term assets based on a fair value approach when using IFRS, which is not required by local standards. Furthermore, IFRS is more valuable for making investment decisions because more information is disclosed than in the provisions included in local standards. In addition, as IFRS is updated in response to changes in user’s needs, it would be more relevant for making decisions (SOCPA, 2018). Looking at these benefits of IFRS, SOCPA hoped that their adoption would improve FRQ of Saudi firms and required all listed firms to implement IFRS starting from 2017.

Although most of the literature indicates that IFRS would contribute to FRQ, some studies have suggested that IFRS might not add value to financial reporting process; rather, it might have an adverse impact on FRQ (Ahmed, Neel, Wang, 2013; Christensen et al., 2015). Some studies argue that the transition to IFRS is mostly accompanied by an increase in cost needed to change to a new system( Bassemir, 2018; Iatridis, 2010); for example, the cost of using a specialized person and the cost of training and buying new programs to deal with the transition to IFRS. Unfortunately, as some firms do not have such resources, inappropriate applications of IFRS are likely to increase, leading to a reduced effectiveness of IFRS and of the FRQ.

Other studies have documented that the effect of IFRS depends on other factors that might confound the relationship between IFRS and FRQ, such as incentives of management, enforcement mechanisms, the economic environment, and ownership structure ( Ahmed et al., 2013; Iatridis, 2010), and the development of legal and political systems (Ball et al., 2003; Pascan, 2015). In the case of weak enforcement mechanisms, present in some lessdeveloped countries, firms might exhibit symbolic conformity with IFRS in order to be legitimated and to avoid sanctions for non-compliance with IFRS. In this situation, they may not obtain any real benefit of IFRS adoption, as they continue to operate their own ‘shadow’ accounting system, leading to reduced quality of their financial reporting.

Moreover, in an environment with an under-developed legal system, such as occurs in Saudi Arabia, earning management practices could increase, thereby resulting in reducing the quality of financial reporting. In addition, compliance problems could increase at the time of adoption of a new system (i.e. IFRS) as a result of a lack of experience and knowledge about how to conform to the new system.

Considering that IFRS is more complicated, more advanced, and was created in industries having strong enforcement mechanisms and developed systems, it is possible that it might not be applied successfully in an environment with different characteristics (such as different needs, weak enforcement mechanisms, less developed systems, and a lack of aspects of quality audit). Therefore, the introduction of IFRS might not produce the same benefits in improving FRQ as those obtained in developed countries, due to differences in the economic model and in the legal and accounting environments.

Building on the above discussion, the current study aims to examine whether the FRQ of Saudi nonfinancial listed firms improved after the adoption of IFRS. In order to test the hypothesis, the current study developed three regression models. FRQ is measured using two metrics: earnings management, and earnings persistence. Meanwhile, income smoothing, and the likelihood of reporting earnings benchmarking are used in this study as indicators of earnings management. Both regression and t- test analysis are used to analyze data. Inferences are made from data taken from the full sample covering the years 2015 to 2018, and data from two subsamples partitioned according to the date when IFRS was required by SOCPA: data taken from the years 2015- 2016 represent a period labeled as the “pre- IFRS period”, while the years 2017- 2018 represent a period labeled as the “post- IFRS period”.

Based on a sample of 465 nonfinancial listed firms, the study finds that IFRS adoption is not significantly related to improved FRQ. This result is consistent with the findings of prior studies (Ahmed et al., 2013; Ball et al., 2003; Christensen et al., 2015) who found that IFRS adoption was not effective in improving the quality of financial reporting.

The current study offers some explanations for this result. The study argues that the lack of strong enforcement could reduce the role of IFRS in improving FRQ as a common factor affecting business models in developing countries. Linked to this, firms with low incentive to comply with IFRS might tend to have a lower level of adherence to IFRS. In other words, firms may exhibit symbolic conformity with the regulations in order avoid being penalized, while maintaining their own practices within the company. The result also might be attributed to a common dilemma associated with adopting any new system; that is, a shortage of qualified staff and technical resources needed to put the new system into operation. Notably, due to cost considerations or the scarcity of suitably qualified personnel in the Saudi business context, some firms might not be able to provide the facilities needed to adopt IFRS. As a result, standards may be applied inappropriately, leading to reduced quality of financial reports (Iatridis, 2010).

With the advantage of current data, this study assesses the initial response to the adoption of IFRS in a less-developed country, Saudi Arabia. From the point of view of the financial reporting context, Saudi Arabia possesses specific characteristics, such as lessdeveloped legal and accounting systems and weak enforcement models (Al-Bassam, Ntim, Opong & Downs, 2018), that differ from those of countries where the introduction of IFRS has shown a positive effect on FRQ. While there is a body of documented evidence on this issue relating to the situation in developed countries such as the US and the EU, there is very little documented evidence about this issue in developing countries. Considering that IFRS is more complicated, more advanced, and was created in industries benefitting from strong enforcement mechanisms and developed systems, this study has demonstrated that IFRS practices function differently in countries which have different institutional models, specifically less-developed legal and accounting systems and weak enforcement mechanisms. The study provides evidence from an emergent situation supporting the view that the impact of IFRS on FRQ may be confounded by these other factors. To our knowledge, this study is the first study to be carried out in Saudi Arabia which investigates the effect of IFRS on FRQ. The results of the study are expected to focus attention not only on the potential role of IFRS in improving FRQ in Saudi Arabia, but can also, perhaps, be generalized to other Gulf Cooperation Council (GCC) countries due to the similarity between Saudi Arabia and other GCC countries in terms of accounting practices and the business environment in general.

From a practical perspective, authoritative bodies in these countries may be welladvised to initiate efforts to overcome any potential problems associated with introducing a new system like IFRS, such as by improving enforcement tools. In this regard, to obtain the full benefit of using IFRS, authoritative bodies need to ensure that IFRS is well understood and applied, and also to review the outcomes. Their role includes providing additional support to firms by, for example, offering training courses and conducting workshops on IFRS practices. At the micro level, the findings of this study show that some firms might apply IFRS inappropriately due to immediate cost-benefit constraints in implementation. However, firms should be encouraged to consider the new standard as a long-term project in which, over time, benefits will exceed costs. Firms may need to invest in improving staff skills in order to better understand and implement the standards, as a path to a better future for the firm.

The remainder of this paper is structured as follows: Section Two explains the literature review hypothesis development; Section Three describes the research design adopted for the study; Section Four sets out the empirical results obtained; Section Five presents the discussion, and Section Six presents conclusions.

Literature Review and Hypothesis Development

The increase in the number of countries applying IFRS reflects its importance in improving a country’s accounting system and, in turn, the efficiency of its capital market. In 2005, all EU listed firms were required to publish their financial reports in compliance with the IFRS. In the case of Saudi Arabia, the Saudi Organization of Certified Public Accountants (SOCPA) required that, starting from 2017, financial reports of publicly listed firms should be prepared consistent with IFRS. According to SOCPA, the IFRS are more comprehensive, up-to-date, and integrated compared to local Saudi standards (SOCPA, 2018).

A number of studies have indicated that IFRS contributes to the FRQ because it ensures enhanced transparency and comparability of financial reports (Barth et al., 2008; Iatridis, 2010; Leuz, 2003; Silva et al., 2017) thereby better meeting the needs of external users of reports. The view that FRQ increases for entities that apply IFRS is based on the argument that IFRS creates fewer opportunities to manage earnings because it offers limited accounting choices for management. In this way, it mitigates the opportunity to exercise earnings management and in turn improves FRQ (Barth et al., 2008; Pascan, 2015 Zeghal et al., 2012). Another argument is that IFRS provides investors with more relevant information that reflects the financial position of entities and meets the investors’ needs (Iatridis, 2010); therefore, it enhances the relevance and usefulness of financial reporting. For example, the use of fair value approaches, as suggested by IFRS, reflects the real value of a long-term asset, so it would be more relevant because it considers the effect of accounting information on users.

Moreover, as IFRS adopts more conservative methods, such as evaluating inventory by the lower of market value or net realizable value, it reduces opportunities to manipulate earnings and improves the FRQ (Bassemir & Farkas, 2018). In line with this view, researchers have argued that IFRS encourages firms to disclose more information either by the main body of reports or by notes accompanied with reports. In this way, information asymmetry that might arise between management and stockholders is reduced (Iatridis, 2010; Leuz, 2003), leading to enhanced informativeness of financial reporting.

Another potential benefit is that the adoption of IFRS could lead to a harmonization of accounting practices among different and more varied systems. Thus, it could enhance the efficiency of a capital market and lead to increased investment on a global basis. This explains the increase in the number of transitions to IFRS by companies around the world which seek to promote investment and gain access to global markets.

According to Bruggmann et al. (2013), after adopting IFRS countries report good indicators in terms of increasing the informativeness of financial reporting and providing quick access to information that improves the decision-making process. In this regard, a study conducted by Zeghal et al., (2012) aimed to examine whether FRQ improved after the mandatory adoption of IFRS in 15 EU countries. This study was based on a comparison of accounting-based attributes between the Pre-IFRS adoption period and the Post- IFRS adoption period. The researchers found that the adoption of IFRS was associated with higher FRQ. Their result provided evidence supporting the view that the transition could lead to harmonized standards among countries and in this way, it would be useful to create a uniform global accounting system.

In a recent study, Silva & Nardi (2017) investigated whether the quality of accounting information increases and the cost of equity capital decreases as a result of adoption of IFRS in Brazilian firms. They used four dimensions to measure the quality of financial reports including: earnings management, conservatism, relevance of the financial statements, and the timeliness of the financial statements. Their results were consistent with the hypothesis that there would be an improvement in earnings quality in the post-IFRS period. In this vein, Daske & Gebhardt (2006) examined the financial reports in three European countries which had switched to IFRS as a result of the EU decision in 2005 (i.e. Austria, Germany, and Switzerland). The study aimed to provide insights particularly into the effect of enforcement mechanisms and management incentives on the relationship between IFRS adoption and FRQ. The finding of this study revealed that FRQ improved after the adoption of IFRS. It is notable that these indicators of improvement in FRQ after adopting IFRS are mostly observed in developing counties that have well- developed legal and accounting systems.

However, there is another view regarding the effect of IFRS on FRQ. Under this view, IFRS provides more flexible standards, in terms of using the considerable discretion that is subject to the control of management. In some case, firms with incentives to exercise earnings management might manipulate their earnings by using the discretion that is embedded in IFRS (Andre et al., 2015) leading to diminished FRQ. In this context, the results of Christensen et al., (2015) suggested that adoption of IFRS might not lead to improved FRQ, specifically for those firms that have no incentive to prepare and present more relevant reports. They provided two interpretations for their findings: First, as IFRS is more flexible, it might be ineffective in reducing the level of earnings management of firms with low incentives to comply. Second, improvement in the FRQ, if any, might be attributed to changes in reporting incentives of these firms around the time of IFRS adoption. Similarly, Ahmed et al., (2013) argued that a situation where managers have incentives to use discretion beyond that needed to respond to the IFRS requirements might explain the weak influence of IFRS on FRQ. This, again, emphasizes the importance of management incentive on the relationship between IFRS and improved FRQ.

Moreover, IFRS might not contribute to enhanced FRQ due to the impact of the economic environment and the stage of development of legal and business systems. According to Zeghal et al. (2012), the effectiveness of IFRS is influenced by other factors, including capital market development, levels of legal enforcement, and the legal system. Related to this issue, ineffective enforcement of IFRS is considered the most plausible factor explaining the weak impact of IFRS on FRQ (Ball et al., 2003). Specifically, the lack of effective enforcement of IFRS, as has been observed in some developing countries, might lead to detachment between what is presented in external reports and what is actually done inside the firms.

However, in the case of less-developed countries, since IFRS is principle-based standard, it might lack sufficient guidance for practices (Ahmed et al., 2013), leading to differences in IFRS practice depending on how managers interpret the standards. In this context, the study of Ahmed et al., (2013) provided evidence that IFRS did not have any significant impact on FRQ. The authors argued that that IFRS is more difficult to enforce because, since its standards are considered principle-based, it would be less precise than those of the local GAAP.

In addition, applying IFRS might not be as effective in less-developed countries because of cost considerations. In other words, when firms are considering converting to a new system (such as IFRS), they may lack the funds required to finance the changes involved, in terms of providing facilities and hiring qualified staff who are familiar with the requirements of IFRS. Such firms may fail to comply to IFRS as fully as needed. In this regard, the result of a survey conducted by KPMG, as cited in Leuz (2003), indicated that the cost of implantation (i.e. the cost of transition from the firm’s existing system to IFRS) is an important factor influencing management’s decision about whether to adopt IFRS.

Overall, then, there are a number of factors that might modify the relationship between the introduction of IFRS into a firm and an enhanced FRQ including: legal and accounting systems, management incentives, enforcement mechanisms, and cost considerations. Thus, the view that IFRS might be effective in improving reporting quality in countries that possess less-developed legal systems just because it is effective in developed countries might not hold true, specifically in the case of the Saudi corporate context. However, the need to investigate the relationship between IFRS and FRQ in Saudi Arabia is more strongly warranted considering the new requirement of SOCPA that all listed firms comply with IFRS as part of its effort to improve FRQ in general. As a response to this need, this study set out to examine whether the FRQ of Saudi nonfinancial listed firms has improved as a result of the transition to IFRS. Hence, to test whether this is, in fact, the case, the current study develops the following hypothesis, presented in alternative forms:

H1 Ceteris paribus, the adoption of IFRS will improve the FRQ of Saudi nonfinancial listed firms.

Research Design

Model

In order to test the hypothesis, the current study adopted methods similar to those used in prior studies (Ahmed et al., 2013; Barth et al., 2008; Christensen et al., 2015; Zeghal et al., 2012). Both regression models for the pooled sample and paired t-tests for the subsamples were used to test the hypothesis. Following prior studies (Ahmed et al., 2013; Barth et al., 2008; Christensen et al., 2015; Francis, Lafond, Olsson & Schipper, 2004; Zeghal et al., 2012), FRQ, the dependent variable, was measured using two proxies for FRQ which are: earnings management, and earnings persistence.

Earnings Management Measurement

The current study used (1) income smoothing and (2) the likelihood of reporting earnings benchmarking as the two dimensions of earnings management. The following briefly describes these two metrics of earnings management.

Earnings Smoothing: This indicates that managers intend to alter earnings in order to smooth out the earnings stream from one period to another. The greater the extent of earnings smoothing, the lower is earnings quality. Two aspects of earnings smoothing were used in this study as indicators of earnings smoothing. First, the variability of change in net income scaled by total assets. Less variability of reported earnings over time indicates a greater likelihood that firms are smoothing their earnings. Hence, small variance indicates more earnings smoothing (Zeghal et al., 2012) and, in turn, lower FRQ. In a regression model, the variable IFRS is included to measure whether FRQ improved in the post-IFRS period due to adopting IFRS, all else being equal. A significant positive coefficient of IFRS indicates that managements have less incentive to smooth earnings, suggesting that the quality of financial reporting is higher in the post-IFRS period. Thus, the model is developed as follows:

Where, ΔNIit is the variability of change in net income scaled by total assets; IFRSit is the dummy variable taking 1 if observations belong to the post-IFRS adoption period for firm i in year t, and zero otherwise; LEVit is the ratio of total liabilities to total assets for firm i in year t; GROWTHit the annual percentage change in sales for firm i in year t; TURNit is the sales divided by end-of-year total assets for firm i in year t; SIZEit is the natural logarithm of end-of- year total assets for firm i in year t; CFOit is the operating cash flow scaled by yearend total assets for firm i in year t; BIG4it is audit firm size, taking 1 if the firm’s auditor belong to Big4, and 0 otherwise for firm i in year t; industry fixed effect is included.

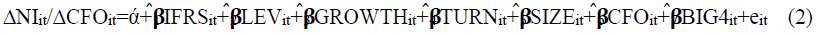

Second, the current study also uses the ratio of the variability of the change in net income to the variability of the change in cash flows from operating to measure income smoothing. This ratio is used by researchers to capture the effect of cash flow from operating on the vitality of earnings (Barth et al., 2008; Zeghal et al., 2012). Under this analysis, earnings smoothing should be lower in the post-IFRS period, indicating that managers have less incentive to smooth earnings as a result of adopting IFRS. The ratio of the variability of the change in net income to the variability of the change in cash flows from operating (ΔNI/ ΔCFO) is used as indicator of income smoothing; meanwhile, the variable of IFRS is used as an independent variable and the remaining variables represent control variables as included in Model 1. Again, a significant positive coefficient of IFRS indicates that managements have less incentive to smooth earnings, suggesting that the quality of financial reporting is higher in the post-IFRS period. The model is developed as follows:

Where, ΔNIit/ΔCFOit is the ratio of the variability of the change in net income to the variability of the change in cash flows from operating for firm i in year t. The remaining variables are as specified above.

The likelihood of reporting earnings benchmarking: This is a second earnings management metric used to measure FRQ. It proposes that managers tend to report small positive earnings rather than reporting negative results in order to avoid losses, through managing earnings to achieve a specific target (Ahmed et al., 2013; Zeghal et al., 2012). A significant negative coefficient of IFRS indicates that managements have less incentive to report small positive earnings, suggesting that the quality of financial reporting is higher in the post-IFRS period. Hence, to test whether management have an incentive to report small positive earnings rather than reporting losses, the current study develops the following logit regression model:

Where, SPOSit is a dummy variable taking 1 if net income scaled by total asset is between 0 and .01, and zero if otherwise; the remaining variables are as specified above.

Earnings Persistence

This is the second proxy adopted in this study to measure FRQ. According to Francis et al., (2004), earnings persistence can be used as an earnings predictor and can provide good indicators for future earnings if the financial reports have high quality earnings numbers. Following the study by Francis et al., (2004), this study develops the following regression model to understand the relationship between IFRS adoption and the FRQ of Saudi nonfinancial listed firms:

EPSit = Q0+ Q1 EPSit-1 +Vit (4)

A value of coefficient of EPSit-1 closer to one indicates higher FRQ, while a value of coefficient of EPSit-1 closer to zero indicates lower FRQ. Under this condition, IFRS has a positive impact on FRQ only if the value of coefficient of EPSit-1 for the post-IFRS period is higher than that of the pre-IFRS period approaching to one. For the purpose of using this model, the sample is divided into two subgroups: the first group is labeled as the pre-IFRS sample, which includes the nonfinancial firms listed in the year of 2015-2016; and the second group is labeled as the post-IFRS sample, which includes the nonfinancial firms listed in the year of 2017-2018.

Sample and Data

For the purpose of using pooled regression, the initial sample consists of all the nonfinancial firms listed in the period covering the years of 2015-2018. Table 1, Panel A, describes the sample selection in detail. In order to ensure homogeneity among all financial data included in the sample, the following exclusions were made from the initial sample: firms with incomplete data; firms delisted during the period of 2015-2018; firms whose fiscal year ends on any date other than December 31. Several outliers were also deleted in order to maintain consistency with normality requirements. Thus, the final sample includes 465 Saudi nonfinancial listed firms.

| Table 1 Panel A. Sample Selection Process | ||||||

| Initial Sample | 512 | |||||

| (-) Firms with incomplete data | 20 | |||||

| (-) Delisted firms | 4 | |||||

| (-) Firms with fiscal year not ending on December 31 | 1 | |||||

| (-) Outliers | 22 | |||||

| Final Sample | 465 | |||||

| Panel B. Descriptive Statistics | ||||||

| Variables | ?NI | LEV | GROWTH | TURN | SIZE | CFO |

| pre-IFRS period | -0.008 | 0.45 | 0.08 | 0.57 | 6.42 | 0.098 |

| post-IFRS period | -0.026 | 0.41 | 0.688 | 0.499 | 6.40 | 0.058 |

On the other hand, for the purpose of t-test analysis, the sample is divided into subgroups, each of which has the same number of observations. Since SOCPA required all listed firms to use IFRS starting from 2017, the period covering the year of 2015-2016 is considered as the pre-IFRS period, while the period covering the year of 2017-2018 is considered as the post- IFRS period. However, the normality test is employed in order to accurately generalize the results of the study. Accordingly, this technique yields a final sample that included 109 firms in each group.

Results

Table 1, panel B, displays the descriptive statistics for the continuous variables used in the analysis. With respect to the change in net income scaled by total assets, the result shows that the change in net income is smaller in the post-IFRS period (-.026), versus (- .008) in the pre- IFRS period), indicating that firms are likely to exhibit a greater level of income smoothing in the post-IFRS period. This result implies that IFRS adoption did not have an impact on FRQ of Saudi nonfinancial listed firms.

With regard to Growth, the result indicates that firms reported lower growth in the pre- IFRS period compared to the post-IFRS period. Size of firms was almost the same in both periods, while asset turnover decreased slightly in the post-IFRS period. However, there was no significant difference between the pre- and post- period in terms of leverage. Finally, cash flow from operating scaled by total assets was lower in the post-IFRS period compared to the pre-IFRS period (0.058, versus 0.098).

Before carrying out multivariate analysis, all continuous variables are tested for normality. The skewness and Kurtosis statistics are used to ensure that normality assumptions are met. Initial testing revealed that some variables did not fulfill the assumption of normality. Thus, a transformation technique was applied to reduce the problem of skewness in non-normal variables through the use of logarithms and square root of values. After transformation, each variable included in the models is normal. Regarding outliers, some outliers were detected and omitted from the sample (as shown in Table 1, Panel A), since they made a significant change in R2 value.

Result of Income Smoothing

As mentioned above, income smoothing is used in this study as the first metric of earnings management. The regression results for income smoothing are summarized in Table 2. Panel A presents the regression result for the variability of the change in net income (Model 1). The coefficient of the IFRS variable is insignificant at the level of 0.05(P= 0.08), indicating that IFRS adoption is not significantly related to improved FRQ in Saudi nonfinancial listed firms.

| Table 2 Panel A: Regression Results for the Variability of the Change in net Income (Model 1) | ||||||||

| ?NI i t= ? +β?1IFRSit+β?2LEVit+β?3GROWTHit+β?4TURNit+β?5 SIZEit+β?6CFOit+β?7BIG4it+eit | ||||||||

| Variables | Β | VIF | t-value | p-value* | ||||

| Intercept | 0.423 | 0.653 | 0.51 | |||||

| IFRS | 0.174 | 1.02 | 1.78 | 0.08 | ||||

| LEV | 0.910 | 1.40 | 3.51 | 0.00 | ||||

| GROWTH | 0.192 | 1.12 | 5.00 | 0.00 | ||||

| TURN | 0.29 | 1.59 | 1.44 | 0.15 | ||||

| SIZE | -0.67 | 1.72 | -7.34 | 0.00 | ||||

| CFO | 0.01 | 1.31 | 0.215 | 0.83 | ||||

| BIG4 | 0.06 | 1.34 | 0.50 | 0.62 | ||||

| R 2 | 0.21 | |||||||

| F-ratio | 15.09 | |||||||

| Panel B: Regression Results for the Ratio of the Variability of Change in Net Income to The Variability of Change in Cash ?ows from Operating (Model 2) | ||||||||

| ?NI i t/?CFOit=?+β?1IFRSit+β?2LEVit+β?3GROWTHit+β?4TURNit+β?5SIZEit+β?6CFOit+β?7BIG4it +eit | ||||||||

| Variables | Β | VIF | t-value | p-value* | ||||

| Intercept | 0.53 | 1.92 | 0.06 | |||||

| IFRS | -0.05 | 1.02 | -1.23 | 0.22 | ||||

| LEV | -0.20 | 1.46 | -1.83 | 0.07 | ||||

| GROWTH | -0.04 | 1.11 | -2.64 | 0.01 | ||||

| TURN | 0.05 | 1.69 | 0.58 | 0.56 | ||||

| SIZE | 0.09 | 1.74 | 2.31 | 0.02 | ||||

| CFO | 0.02 | 1.38 | 0.89 | 0.37 | ||||

| BIG4 | -0.05 | 1.34 | -1.13 | 0.26 | ||||

| R 2 | 0.05 | |||||||

| F-ratio | 0.01 | |||||||

| Panel C: Regression Results for the likelihood of Reporting Earnings Benchmarking (Model 3) | ||||||||

| S POS i t=?+β?1IFRSit+β?2LEVit+β?3GROWTHit+β?4TURNit+β?5SIZEit+β?6CFOit+β?7BIG4it+ e it | ||||||||

| Variables | Intercept | IFRS | LEV | GROWTH | TURN | SIZE | CFO | BIG4 |

| Wald -value | 2.04 | 0.165 | 10.39 | 4.8 | 5.23 | 0.06 | 1.60 | 0.01 |

| p-value* | 0.153 | 0.685 | 0.001 | 0.029 | 0.022 | 0.805 | 0.207 | 0.936 |

The result of the second metric of income smoothing for the pooled sample is presented in Table 2, Panel B. As mentioned above, the variable of ΔNI/ ΔCFO, the ratio of the variability of change in net income to the variability of change in cash flows from operating, is used as an indicator of income smoothing: the variable of IFRS is used as the independent variable and the remaining variables represent control variables, as included in Model 1. The result shows that IFRS is not significantly related to improved FRQ (p=0.22). Thus, the hypothesis that FRQ of Saudi nonfinancial listed firms improved after adopting IFRS is not supported.

Result of the Likelihood of Reporting Earnings Benchmarking

This is the second earnings management metric used to measure FRQ. A logit regression was used to test the relationship between IFRS adoption and FRQ. Table 2, Panel C, summarizes the result of the logit regression. The study finds that IFRS adoption is not significantly related to improved FRQ (p=.685). Thus, the result provides evidence that managers are not less likely to report small positive earnings in the post-IFRS period, indicating a lack of impact of IFRS on FRQ. Therefore, the hypothesis that IFRS is related to improved FRQ of Saudi nonfinancial listed firms is not supported.

Result of the Earnings Persistence

This is used in the study to measure FRQ. The result, as shown in Table 3, Panel A, reveals that earnings persistence is low in the post-IFRS period, approaching zero (Q1= .24); meanwhile, earnings persistence is high, approaching one, in the pre-IFRS period zero (Q1=.82). This result indicates that the FRQ of Saudi nonfinancial listed firms did not improve as a result of adopting IFRS. Thus, the hypothesis of this study is not supported.

| Table 3 Panel A. The Result of Earnings Persistence (Model 4) | |||

| Q1 | t | p-value* | |

| EPSit-1 (pre-IFRS Period) | 0.82 | 23.85 | 0.000 |

| EPSit-1 (Post-IFRS Period) | 0.24 | 3.877 | 0.000 |

| Panel B. Comparison of The Income Smoothing Between Pre-IFRS Adoption Period and Post-IFRS Adoption Period | |||

| Mean | t | Sig. | |

| Pair1: 2015&2017 | -0.398 | -2.715 | 0.008 |

| Pair2: 2016&2018 | -0.05 | -0.355 | 0.723 |

| N | 109 | ||

Additional Analyses

The result is confirmed through the use of paired t-test analysis. As explained above, specific subsamples were extracted from a set of observations representing the pre- and post IFRS periods. The first test, coding as pair 1, was to determine whether the mean value of the change in net income scaled by total asset in the years of 2015 differed significantly from the mean value of the change in net income scaled by total asset in the years of 2017: the second test, coding as pair 2, was to determine whether the mean value of the change in net income scaled by total assets in the year of 2016 differed significantly from the mean value of the change in net income scaled by total assets in the year of 2018. The result, as summarized in Table 3, Panel B, shows that the pair 1 test yielded a small t value of -2.715, significant at 0.01 (p=0.008); while pair 2 test yielded a very small t value of -0.355 insignificant at 0.01 (p=0.723). Taken together, the result is consistent with the previous result, showing that IFRS adoption did not improve the quality of the financial reports of Saudi nonfinancial listed firms.

Discussion

The results of this study reveal that adopting IFRS is not significantly related to any improvement in the FRQ of Saudi nonfinancial listed firms. This result is in line with those of some previous studies (Ahmed et al., 2013; Ball et al., 2003; Christensen et al., 2015). Furthermore, the result is consistent with the view that the adoption of IFRS, in itself, is not sufficient to add value to FRQ. Rather, it can be suggested that the legal enforcement and business environments in which IFRS is introduced are more significant factors shaping the relationship between the adoption of IFRS and improvement of FRQ.

For example, this result might be due to the lack of strong enforcement to ensure that firms are compliant with IFRS (Ahmed et al., 2013; Andre et al., 2015; Christensen et al., 2015). It should be noted that Saudi business environment has specific characteristics such as a weak enforcement and accountability mechanism (Al-Bassam, et.al., 2018). Since the Saudi corporate model is not well developed in terms of enforcement mechanism, some firms might not fully comply with IFRS as they do not regard compliance with IFRS as having any benefit to them. Therefore, firms with low incentive to comply fully to IFRS might institute some level of adherence to IFRS in order to convey symbolic external conformity to the regulations, while at the same time maintaining their own existing system internally.

Another reason for this result might be the problems that usually appear when adopting a new system (i.e. IFRS), especially within a limited timeframe after implementation. The examples of such problems include the lack of adequate resources needed to switch to IFRS, such as the presence of qualified staff who are familiar with IFRS practices, the provision of sufficient training, guides for implementation, technical support, and suitable facilities, including software and hardware. As cited in Leuz (2003), the result of a survey conducted by KPMG indicated that the cost of implantation of IFRS influenced the management decisions about adopting IFRS. Notably, due to cost considerations or the scarcity of qualified personnel in the Saudi business context, some firms might not be able to provide the facilities needed to adopt IFRS. This situation might lead to inappropriate applications of standards which, in turn, could lead to lowering the quality of financial reports (Iatridis, 2010).

The results indicate that a gap still exists between the outcome expected from the adoption of IFRS and what is achieved, and more effort needs to be made to encourage firms to be more fully compliant with IFRS.

Conclusion

In 2017, each Saudi nonfinancial listed firm was required to disseminate their reports in formats consistent with the IFRS. The objective of this requirement was to improve the FRQ of Saudi firms (SOCPA, 2018). The question of the extent to which IFRS can improve FRQ should be of more concern considering the research findings that raise doubts about the impact of IFRS adoption on FRQ. The aim of this study is to test whether IFRS adoption is related to improvements in the FRQ of Saudi nonfinancial listed firms. Using a sample of 465 firms, the study provides evidence that IFRS adoption is not significantly related to any improvement in the FRQ. It is suggested that the result might be due to factors inherent in the Saudi legal and corporate environment: lack of strong enforcement on firms to comply with IFRS as required by SOCPA, resulting in merely symbolic adherence to IFRS, sufficient to avoid sanctions or penalties. It is also suggested that firms lack adequate human and technical resources needed to successfully adopt IFRS so that the quality of financial reporting would increase.

In general, the result of this study is consistent with the views of some other researchers that the effect of adopting IFRS in countries with less-developed corporate environments may not lead to any improvement in FRQ. Instead, other factors, including enforcement mechanisms, cost considerations, may have a greater influence on FRQ.

The present study has some limitations. The first limitation is the FRQ measurements. Prior studies have indicated that using any of the FRQ proxies is not free of bias, thus leading to inconsistent results. Despite such drawbacks, the current study adopted two common proxies of FRQ in order to confirm the result of analysis. Second, previous researchers have argued that IFRS adoption may take more time, beyond the first year in which IFRS was adopted, to be applied fully and effectively. Following this, it could be argued that the first year of implementation (year 2017 in this study) should be omitted. While this practice was recommended by prior studies, assuming that the familiarity with IFRS will increase over time, the current study designated the two years, 2017 and 2018, as the post-IFRS period due to limitations of data availability.

Nevertheless, this study has drawn attention to issues that might be investigated further in future studies. One issue is the possibility of using alternative proxies of FRQ, such as accrual or value relevance. Further, future research might focus on the impact of other factors that modify the relationship between the adoption of IFRS and FRQ, such as cost considerations, management incentives, and enforcement mechanisms. The impact of other factors such as the lack of training courses, implantation guides, technical support, and the effect of time lapse are other possible matters of research concern, possibly through the use of other research methodologies.

References

- Al-Bassam, W.M., Ntim, C.G., Opong, K.K., & Downs, Y. (2018). Corporate boards and ownership structure as antecedents of corporate governance disclosure in Saudi Arabian publicly listed corporations. Business & Society, 57(2), 335 –377.

- Ahmed, A., Neel, M., & Wang, D. (2013). Does mandatory adoption of IFRS improve accounting quality? preliminary evidence. Contemporary Accounting Research, 30(4), 1344–1372.

- Andre, P., Filip. A., & Paugam, L. (2015). The effect of mandatory IFRS adoption on conditional conservatism in Europe. Journal of Business Finance & Accounting, 42(3-4), 482-514.

- Ball, R., Robin, A., & Wu, J.S. (2003). Incentives versus standards: Properties of accounting income in four east asian countries. Journal of Accounting and Economics, 36 (1–3), 235–270.

- Barth, M.E., Landsman, W.R., & Lang, M. (2008). International Accounting Standards and Accounting Quality.

- Journal of Accounting Research, 46 (3): 467–498.

- Bassemir, M. (2018). Why Do Private Firms Adopt IFRS? Accounting and Business Research, 48(3): 237-263.

- Bassemir, M., & Farkas, Z.N. (2018). IFRS adoption, reporting incentives and financial reporting quality in private firms. Journal of Business Finance & Accounting, 45: 759-796.

- Brüggemann, U., Hitz, J.M., & Sellhorn. T. (2013). Intended and unintended consequences of mandatory IFRS adoption: A review of extant evidence and suggestions for future research. European Accounting Review, 22(1), 1–37.

- Christensen, H.B., Lee, E., & Walker, M. (2015). Incentives or standards: What determines accounting quality changes around IFRS adoption? European Accounting Review, 24(1), 31-61.

- Daske, H., & Gebhardt, G. (2006). International financial reporting standards and experts’ perceptions of disclosure quality. Abacus, 42(3–4), 461–498.

- Francis, J., La Fond., R., Olsson., P., & Schipper, K. (2004). Costs of equity and earnings attributes. The Accounting Review, 79(4), 967-1010.

- Iatridis, G. (2010). International financial reporting standards and the quality of financial statement information. International Review of Financial Analysis, 19, 193-204.

- Leuz, C. (2003). IAS versus U.S. GAAP: Information asymmetry-based evidence from germany's new market. Journal of Accounting Research, 41(3), 445–472.

- Pascan, I. (2015). Measuring the effects of IFRS adoption on accounting quality: A review. Procedia Economics and Finance, 32, 580-587.

- Saudi Organization of Certified Public Accountants (SOCPA). (2018). Transition to the International Accounting and Auditing Standards. Retrieved from: https://socpa.org.sa/SOCPA/files/d1/d120821e- 7dbf-4a73-8fed-f82d786ca38b.pdf.

- Silva, R.L.M.D., & Nardi, P.C.C. (2017). Full adoption of IFRSs in Brazil: Earnings quality and the cost of equity capital. Research in International Business and Finance, 42, 1057-1073.

- Zeghal, D., Chtourou, S.M., & Fourati, Y.M. (2012). the effect of mandatory adoption of IFRS on earnings quality: Evidence from the European Union. Journal of International Accounting Research, 11(2), 1- 25.