Research Article: 2021 Vol: 25 Issue: 4S

The Effect of Accounting of Exchange Rate Fluctuations in The Light of Syrian Crisis on the Results of Financial Statements of Private Banks in Syria

Atala Alqtish, Al-Zaytoonah University of Jordan

Mhd Bilal Abdulal, The Elite Home Accounting Consulting Company

Citation Information: Alqtish, A., & Abdulal, M.B. (2021). The effect of accounting of exchange rate fluctuations in the light of syrian crisis on the results of financial statements of private banks in syria. Academy of Accounting and Financial Studies Journal, 25(S4), 1-28.

Abstract

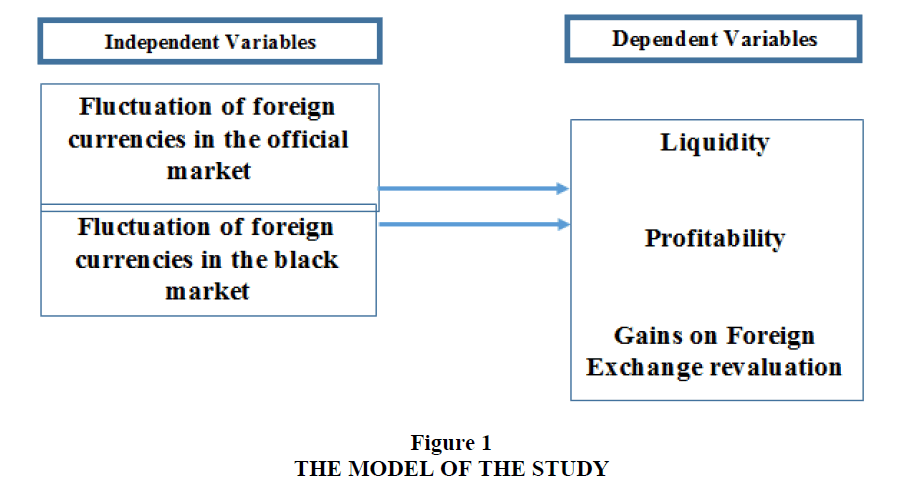

The main objective of this study was to investigate the impact of the exchange rates fluctuation of foreign currencies in the official and black markets on the results of financial statements of the private banks in Syria, through using the ratios of Liquidity and Profitability and the gains on foreign currencies revaluation as independent variables during the period from 2010 to 2017. For the purposes of achieving the objectives of this study, the descriptive research approach was adopted, and the researcher analyzed the financial statements data via E-Views software ninth edition, and the normal distribution was tested through the coefficient of Skewness and a Multicollinearity test, in addition to the Pearson correlation matrix and unit root tests. The conclusions of the study clarified that it was a statistically significant effect of exchange rates fluctuation in the official market on the profitability and the revaluation gains, while it was no effect on the liquidity, and also showed that there was no statistically significant effect of exchange rates fluctuation in the black market on the liquidity and the revaluation gains, while it was an effect on the profitability. The researcher recommends to study other sectors than banks, such as financial brokerage companies and exchange companies, to determine the effect of fluctuations in exchange rates on their performance, and to conduct this study in other countries suffering from conflicts and wars, and extend the study through comparative studies before 2011 and current years.

Keywords

Exchange Rate, Fluctuation, Financial Performance, Banks, Syria.

Introduction

The banking sector plays an important role in the Syrian economy as the lifeblood of the sectors, it mobilizes financial resources from cash surplus units and operates to be used in various aspects of employment in the investment channels to supply various economic sectors to start their activities. This sector plays a leading and strategic role in implementing the objectives and components of the monetary policy of the state with its credit and monetary elements, thus, the Syrian banking sector is engaged in an activity in which it confirms its existence and derives its viability to be one of the most important economic sectors in Syria, which contributes substantially in the enhancing economic and social development (Al Basat, 2001).

The problem of the study is to investigate the accounting effect of exchange rates fluctuation of foreign currencies on the results of financial statements of the private banks in Syria in the light of Syrian crisis during the period from 2010 to 2017, because this fluctuations could be an important source of risk for banking institutions whereas in some cases, the huge amounts which are deposited in the banks while there is no encouraging environment for investment may cause a significant effects on the liquidity of the banks, and in other cases, large foreign exchange losses could lead to bank failures besides causing many problems in banks profitability which is affected by the gain on foreign currencies revaluation (Saif Al Deen, 2014).

Exchange rate movement in Syria has been variable with periods of rapid reduction of the domestic currency, which adversely affects the Syrian economy, and that has been noticed in the exchange rate of SYP against the USD in both; official market and black market making it difficult for the banks to predict the future rate with precision and this has greatly affected the financial performance and consequently the results of financial statements of the private banks as they seek to provide adequate currency to promote international business (Mustafa Eid, 2019).

Therefore, the main problem of the study is to clarify the role which this fluctuation (Official market and Black market) plays in the occurred changes in the Gains on foreign currencies revaluation, in addition to examine the effects of fluctuation on the Liquidity and Profitability of the private banks in Syria. In total, these factors were represented in the title of this study as the results of financial statements and could be considered as a criterion for the financial performance for the banks, therefore the questions of this study will be expressed as follows:

- What is the accounting impact of exchange rates fluctuation of foreign currencies in the official and black markets on the liquidity of the private banks in Syria during the period of crisis from 2010 to 2017?

- What is the accounting impact of exchange rates fluctuation of foreign currencies in the official and black markets on the profitability of the private banks in Syria during the period of crisis from 2010 to 2017?

- How the gains on foreign currencies’ revaluation of the private banks in Syria are affected by the exchange rates fluctuation of foreign currencies in the official and black markets during the period of crisis from 2010 to 2017?

The Significance of the Study

This study provides a general view of the effect of exchange rates fluctuation of foreign currencies on the results of financial statements and consequently on the financial performance of the private banks in Syria during the period from 2010 to 2017 in the light of Syrian crisis, and how this situation should be handled in accordance with International Accounting Standards (IAS) 39 (Financial Instruments: Recognition and Measurement), and (IAS) 21 (The effects of changes in foreign exchange rates).

The main purpose of this study is to explore the potential effects of fluctuation of the exchange rate during the Syrian crisis in the official issues by the government through Central Bank of Syria, and in the black market in Syria, and how this problem has affected on the elements of the financial statements of private banks which were working during the period from 2010 to 2017 and listed in the Damascus Securities Exchange.

The importance of this study comes from understanding the nature of this problem and to give some recommendations to reach to a reasonable interpretation and analyzing of the banks’ financial statements and their elements, in addition to make a realistic comparison of financial statements for the banks between the years prior and during the Syrian crisis by analyzing the elements of these financial statements with focusing on the gains on foreign currencies revaluation and their effects on the banks’ liquidity and profitability, and then to examine the relationships among them, and finally to conclude the proper results and recommendations accordingly (ALHussein & Hamdan, 2016).

Literature Review and Hypotheses Development

The current study will be important to several individuals of bank institution especially who are working in the Credit Facilities and Risk Management departments including the managers of these departments in the private banks in Syria and in other countries which are suffering from the same problem, and it’s expected from the results of this study to provide information to assist these Managements to improve the quality of their financial decisions against the problem of fluctuation in the exchange rate of foreign currencies through taking the necessary actions to enhance the performance of their institutions.

This study contributes in assisting the decision makers in the banks institutions represented by the community of study to identify the actual affecting factors on the financial performance of the private banks, and mainly those factors which are related to the instability of exchange rates and its effects on the liquidity and profitability, and this will highly help in the process of decision making related to the credibility and liability of the information gathered from different departments in the banks, and how exactly to use these information as a basis to reach to the true decision regarding determining the elements of the financial statements which are affected by those decisions.

The Hypotheses of the Study

Main Hypotheses

H01:There is no effect with statistically significance at < 0.05 of exchange rates fluctuation of foreign currencies in the official market on the results of financial statements of the private banks in Syria.

H02:There is no effect with statistically significance at < 0.05 of exchange rates fluctuation of foreign currencies in the black market on the results of financial statements of the private banks in Syria.

Subsidiary Hypotheses

H01:There is no effect with statistically significance at < 0.05 of exchange rates fluctuation of foreign currencies in the official market on the liquidity of the private banks in Syria.

H02:There is no effect with statistically significance at < 0.05 of exchange rates fluctuation of foreign currencies in the official market on the profitability of the private banks in Syria.

H03:There is no effect with statistically significance at < 0.05 of exchange rates fluctuation of foreign currencies in the official market on the gains on foreign currencies revaluation of the banks.

H04:There is no effect with statistically significance at < 0.05 of exchange rates fluctuation of foreign currencies in the black market on the liquidity of the private banks in Syria.

H05:There is no effect with statistically significance at < 0.05 of exchange rates fluctuation of foreign currencies in the black market on the profitability of the private banks in Syria.

H06:There is no effect with statistically significance at < 0.05 of exchange rates fluctuation of foreign currencies in the black market on the gains on foreign currencies revaluation of the private banks in Syria.

The Operational Definitions

A- Fluctuation of foreign currencies in the official market:

It will be measured by calculating the relative difference between the closing exchange rate SYP/USD according to the last issue of Central Bank of Syria (CBOS) for the current year and previous year.

B- Fluctuation of foreign currencies in the Black market:

It will be measured by calculating the relative difference between the closing exchange rate SYP/USD according to the last reading of black market for the current year and previous year.

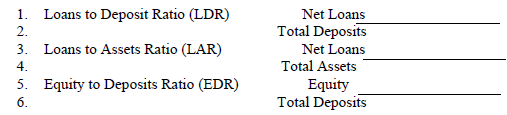

C- The liquidity of the private banks in Syria:

It will be measured by calculating the following ratios using the information published in the financial statements of the banks:

- Loans to Deposit Ratio (LDR)

- Loans to Assets Ratio (LAR)

- Equity to Deposits Ratio (EDR)

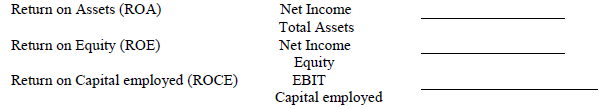

D- The profitability of the private banks in Syria:

It will be measured by calculating the following ratios using the information published in the financial statements of the banks:

- Return on Assets (ROA)

- Return on Equity (ROE)

- Return on Capital employed (ROCE)

E- Gains on foreign currencies revaluation

It will be obtained from the income statements of the banks which it’s declared on annual basis.

Review of Related Literature

Lagat & Nyandema, (2016) “The Influence of Foreign Exchange Rate Fluctuations on the Financial Performance of Commercial Banks Listed at the Nairobi Securities Exchange”. The main goal of this research is to identify the effect of foreign exchange rate volatility on the commercial banks’ financial performance.

And it was concluded that:

- The research results found that foreign exchange rate had a high positive effect on the financial performance of the banks which were working in Kenya during the period of the research.

- It was found that the positive correlation between exchange rate and the financial performance of the banks could reflect how volatility and instable exchange rate may have participated to the profitability’s growth of banks and this may be attributed to the fact that a lot of imports were paid by the locals using the USD and, with the shilling weakening against the USD, the banks are making an arbitrage gains.

Based on the results and conclusion of the research, the researcher recommends that the issues related to foreign exchange trading should always be considered in efforts to improve the transactions of banks which made in foreign exchange and the financial performance of the banks as well.

The research additional recommends that the Government should consider more measures to rise the exports of a country and this will help in enhancing the commercial banks’ performance in Kenya. Al Nahal & Al Shurafa, (2016) “The Impact of Exchange Rates Fluctuations on the Financial Performance of Banks listed in Palestine Securities Exchange”.

The study aimed to:

To assess the reality of exchange rates and their impact on one of the most important sectors of the Palestinian economy, namely the banking sector. Identify the nature and direction of the relationship between the exchange rate fluctuations of major currencies traded and the financial performance of the banks listed on the Palestine Stock Exchange.

Focus on the conditions of banks in Palestine and identify the indicators used to measure their financial performance and analyze their ability to optimize their available resources.

And the conclusions were as follows:

- The performance of the local banks in Palestine has been affected by the political and economic conditions experienced by the Palestinian territories from the state of political division and the Israeli siege of the Gaza Strip and this is evident by analyzing the financial statements of the banks.

- The sample of the study decreased as the credit facilities granted by the banks to different sectors and the credit facilities were oriented towards the safest sectors.

- There is no statistically significant effect at any significant level (<0.05 a) of the exchange rate fluctuations on the return on assets.

- There is no statistically significant effect at any significant level (<0.05 a) of the exchange rate fluctuations on the return on equity.

- There is no statistically significant effect at any significant level (<0.05 a) of the exchange rate fluctuations on the earning per share. Temeraz, (2016) “Impact of Exchange Rate Fluctuations on Performance Financial Institutions of Commercial Banks”.

- The research aimed to identify the relationship between exchange rate fluctuations and the performance of commercial banks.

- Understand the methods of evaluating banks' performance.

And it was concluded that:

- Exchange rate fluctuations are not a phenomenon related to a specific place or time, but rather a global phenomenon that the world has witnessed for two and a half decades of time.

- The fluctuation in exchange rates as we see today is considered harmful and the world is witnessing a large degree of volatility in foreign exchange rates.

- Profitability indicators showed a clear and acceptable increase in the Bank's profitability.

- The profit margin indicator shows the efficiency of the Bank in managing and controlling its costs, with the highest percentage recorded (59.81%).

- The positive relationship between external transaction income and net income for the Bank of Algeria external is a sign that the bank is efficient in managing its assets and has long-term strategies.

- Getachew, (2016) “The Impact of Exchange Rate on the Profitability of Commercial Banks in Ethiopia”.

The main goal of this research is to examine the general effect of exchange rate of foreign currencies on the performance of the commercial banks of which were working in Ethiopia during the period of the study and mainly this research aims to specify those effects on the profitability of the banks.

The explicit objectives of this research are to:

- Assess how the variation between the local currencies of Ethiopia ETB to USD exchange rate affects the profitability of commercial banks in Ethiopia.

- Inspect whether the effect of exchange rate on the profitability of the bank originates from its impact on the growth of bank loan.

The Results from the statistics which have been executed descriptively:

- Within the period enclosed in this research, the commercial banks in Ethiopia have established to be profitable as specified by the average ROE of (23%) on stable basis. This is fairly in extra return that considered to be preferable for the banking sector.

- The portfolio of loans of the commercial banks in Ethiopia had presented a growth rate annually of (26%) for the past fifteen years. But, the average (DLR) deposit to loan ratio of (141%) for the same period as exposed by the statistics indicate that most of the commercial banks which were included in this research had an ability to submit more loans during the period of this research.

- This result quite like the maximum (DLR) for the research period reached (218%).

- Financial analysis of the Balance sheet figure of the commercial banks in Ethiopia included in the research presented that on average, the total of deposit during the research period was ETB (3.67) billion and the total asset detained by the banks was (5.1) billion.

- It was concluded that the total amount of asset had increased on average by (26.3%) annually and this increment which is considered as a growth rate is similar with average growth rate of loan by (26%) stated above and this shows that the growth of loans established the major percentage of the total asset growth of the commercial banks in Ethiopia during the period covered by this research.

- Offiong, et al. (2016) “Foreign Exchange Fluctuations and Commercial Banks Profitability in Nigeria”

- The study aimed to determine the effect volatility of foreign currencies exchange rate on the profitability of working commercial banks in Nigeria during the period of the research.

And the conclusions were as follows:

- The conclusion of the correlation clarified in the attached table No. 1 in the annex of the research showed that the size of bank was greatly correlated with all the foreign currencies.

- The size of the bank had positive relationship of (0.5388) with the Sterling pounds, (0.7060) relationship with the Chinese yen and negative relationship of (0.1289) with the USD.

- The capital of commercial banks capability ratio was noticed to have a positive relationship with Sterling pounds and the Chinese yen, however a negative relationship with the USD.

- The liquidation of the Banks was noticed to have a negative relationship with all the foreign currencies which was selected.

- The Influence of loans which were non-performing was also noticed to have a positive relationship with Sterling pounds and the Chinese yen, however a negative relationship with the USD.

- The findings of the regression analysis for currency volatility on the profitability of the banks in Nigeria which were selected.

- The goal of this specific analysis was to test the independent effect of currency volatility on the profitability of banks without the taking the role of control variables into account.

- The Sterling pounds and USD both have negative important effect on the profitability of the banks but the Chinese yen was noticed to have a positive impact.

- Therefore, a change percentage in USD will meaningfully decrease the profitability of banks by 6% and the Sterling pounds by (11%).

Methodology

This encompasses the research methodology to be used to achieve the research objective, and gives a detailed outline of the procedures which the researchers uses to perform this research, in addition to presenting the research approach, source and type of data, population and sample design and techniques, methods of data collection, methods of data analysis where the model was discussed, data reliability and validity, and the definitions of variables and model specifications.

The approach which was adopted in this research is the descriptive research approach, whereas this approach is described as a systematic and empirical examining where the researchers does not have a direct control of independent variables because their facts have already occurred, or because they cannot be manipulated inherently, and these kinds of studies are concerned with the what, where and how of a phenomenon, hence it will be in better situations to build a clear image on that phenomenon (Zikmund et al., 2013).

The descriptive research approach was more appropriate because the research aimed to build an outline on the accounting effects of exchange rate fluctuations on the results financial statements of private banks in Syria which was represented as financial performance of these banks. As mentioned above, the objective of this study is to examine the effects of exchange rate fluctuations on the financial performance of private banks in Syria, and in order to achieve this objective, the researcher applied the quantitative research methodology and panel data, where the quantitative methods are means for testing objective theories through examining the relationship among variables (Creswell, 2009), and as it was noted by noticeable scholars, the quantitative panel data gives more informative data, more variability, less linearity among variables, more degrees of freedom and more efficiency, thereby all of these factors could minimize the bias that might be resulted when the individuals or firms are aggregated into broad groups.

Research Population and Sample

The study population consists of commercial and Islamic banks which are operating in the Syrian Arab Republic, and the sample were selected from the private banks which are listed in the Damascus Securities Exchange (DSE) including (14) banks, (11) commercial banks and (3) Islamic banks, where their names are shown in chapter two – article (2.1.1_Second) of this research.

Data Collection

The researcher relied in collecting data on two main sources:

Secondary sources:

The general framework of the study (theoretical and applied literature) was addressed through reliance on secondary data sources, which are Arab and foreign books and references related to the topic, magazines and scientific articles, and previous research and studies that dealt with the subject of study and search and reading in various internet sites.

Primary sources:

To address the analytical aspects of the study’s subject, it was relied on:

- Collecting the initial data through personal interviews with a number of high position employees in the banks included in the study, and this was to inquire about some questions and clarify some of the data mentioned in the annual financial reports of the banks.

- Annual published reports of banks listed in the Damascus Stock Exchange (DSE) during the period 2010-2017, by reviewing the financial statements of these banks to obtaining sufficient financial data to analyze the dependent variables of the study (Liquidity, Profitability and Gains on foreign currencies revaluation).

- In order to obtain sufficient data about the independent variables of study (fluctuations of exchange rates in the official market, and in the black market), reliance was placed on the statistics on the Central Bank of Syria (CBOS) website that relate to official exchange rates for the period 2010-2017, while for exchange rates in the black market, it was relied on the available readings about these rates, which were recorded during the period by a private company in Syria and compared with the data available on the Internet sites in order to reach the highest degree of accuracy in the recording.

Method of Data analysis and presentation

First – The Independent Variables

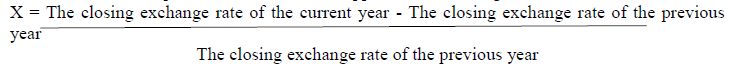

- The variable of exchange rate fluctuations in the official market was measured by comparing the annual closing official exchange rate (SYP/USD) which were issued by (CBOS) from year to the next, using the techniques of horizontal analysis.

- The variable of exchange rate fluctuations in the black market was measured applying the same method that used for the official market, however it was depended on the published rates in the black market.

For both independent variables it was applied the following formula:

Second – The Dependent Variables

A- The liquidity

It will be measured by calculating the following ratios using the information published in the financial statements of the banks:

The profitability:

It will be measured by calculating the following ratios using the information published in the financial statements of the banks (Alqam, 2018):

C - Gains on foreign currencies revaluation:

It will be obtained from the income statements of the banks which it’s declared on annual basis.

Third – The Hypothesis Testing Models

In order to test the hypotheses, the researcher developed the regression equations as follows:

A-The Liquidity

For (LDR):

LDRit = β0 + β1OFit+ ε

LDR it= β0 + β1BFit+ ε

For (LAR):

LARit = β0 + β1OFit+ ε

LAR it= β0 + β1BFit+ ε

For (EDR):

IDRit = β0 + β1OFit+ ε

IDR it= β0 + β1BFit+ ε

B- The profitability:

For (ROA):

ROAit = β0 + β1OFit+ ε

ROA it= β0 + β1BFit+ ε

For (ROE):

ROEit = β0 + β1OFit+ ε

ROE it= β0 + β1BFit+ ε

For (ROCE):

ROCEit = β0 + β1OFit+ ε

ROCE it= β0 + β1BFit+ ε

C- For Gains:

Gains it= β0 + β1OFit+ ε

Gainsit = β0 + β1BFit+ ε

Whereas:

β0: The (unknown) intercept coefficient

β1: The (unknown) slope coefficient

OF: The fluctuations in the official market

BF: The fluctuations in the black market

it: Cross-Section Data

Ε: Random Error

Measurement of Variables

For the purposes of achieving the objectives of this study and testing its hypotheses, the researcher analyzed the financial statements data via E-Views software, the ninth edition, and the following statistical measures and tools were used:

- Descriptive statistics measures, which included the arithmetic average (Mean), Standard deviation, Max value, and Min value.

- Establish the pre-tests such as the normal distribution test and unit root test.

- Finding a Pearson correlation matrix to determine the correlation value between the independent study’s variables.

- Because the study’s data is cross-sectional and across a set of years (2010-2017), which means they represent time series data, with a total of 112 observations, the appropriate regression model is the Simple linear regression model, and the optimum regression method will be used such as; Panel Least Squares, Fixed Effects, or Random Effects, according to Lagrange and Housemann tests.

This deals with the field study of this research as it deals with the most important statistical means for testing the research’s hypotheses and descriptive statistics for the research’s variables, and testing the normal distribution of the research’s sample and Pearson correlation matrix, in addition to the unit root tests and tests for estimating the optimal regression model, in order to determine the impact of exchange rate volatility on the results of financial statements of private banks in Syria.

Descriptive Statistics for the Variables

The descriptive statistics of the independent and dependent variables have been relied based on the annual financial statements of the banks listed in the (DSE) during the period 2010-2017.

The Independent Variables

A- Fluctuation of exchange rates in the official market:

The independent variable may be measured descriptively through several measures, such as mean, standard deviation, Max value and Min value.

The previous table 1 indicates the mean, the standard deviation, the max value and min value for the fluctuation of the exchange rate in the official market, where the mean for this variable was (0.410) and the standard deviation (0.309), and the Max value was (0.823) and this change was in 2013 and Min Value it was (-0.124) and this is the value of the change in 2017.

| Table 1 Descriptive Statistics for the Independent Variables/official Market |

|

| Measure | Fluctuation of exchange rates in the official market |

|---|---|

| Mean | 0.410 |

| Standard Deviation | 0.309 |

| Max Value | 0.823 |

| Min Value | -0.124 |

B- Fluctuation of exchange rates in the Black market:

The independent variable may be measured descriptively through several measures, such as means, standard deviation, Max value and Min value.

The previous table 2 indicates the mean, the standard deviation, the max value and min value for the fluctuation of the exchange rate in the black market, where the mean for this variable was (0.416) and the standard deviation (0.279), and the Max value was (0.866) and this change was in 2015 and Min Value it was (-0.08) and this is the value of the change in 2017.

| Table 2 Descriptive Statistics for the Independent Variables/Black Market |

|

| Measure | Fluctuation of exchange rates in the black market |

|---|---|

| Mean | 0.416 |

| Standard Deviation | 0.279 |

| Max Value | 0.866 |

| Min Value | -0.08 |

The Dependent Variables

A- The Liquidity:

The dependent variable (Liquidity) was measured descriptively by several measures such as the mean, standard deviation, the Max value and the Min value, and it was calculated through the following financial ratios (LDR, LAR, EDR).

Loans to Deposit Ratio (LDR):

The previous table 3 indicates the mean, the standard deviation, the Max value and Min value for the (LDR) variable, where the mean for this variable was (0.450), and the standard deviation was (0.456), and the Max value was (2.93) for the bank (CHB) in 2010, and the Min value was (0.025) for the bank (BSO) in 2016.

| Table 3 Descriptive Statistics for the Dependent Variables/Liquidity/LDR |

|

| Measure | LDR |

|---|---|

| Mean | 0.450 |

| Standard Deviation | 0.456 |

| Max Value | 2.93 |

| Min Value | 0.025 |

Loans to Assets Ratio (LAR):

The previous table 4 indicates the mean, the standard deviation, the Max value and Min value for the (LAR) variable, where the mean for this variable was (0.263), and the standard deviation was (0.151), and the Max value was (0.651) for the bank (CHB) in 2011, and the Min value was (0.019) for the bank (QNBS) in 2015.

| Table 4 Descriptive Statistics for The Dependent Variables/Liquidity/LAR |

|

| Measure | LDR |

|---|---|

| Mean | 0.263 |

| Standard Deviation | 0.151 |

| Max Value | 0.651 |

| Min Value | 0.019 |

Equity to Deposit Ratio (EDR):

The previous table 5 indicates the mean, the standard deviation, the Max value and Min value for the (EDR) variable, where the mean for this variable was (0.457), and the standard deviation was (0.808), and the Max value was (4.43) for the bank (QNBS) in 2015, and the Min value was (0.03) for the bank (SGB) in 2014.

| Table 5 Descriptive Statistics for The Dependent Variables/Liquidity/EDR |

|

| Measure | EDR |

|---|---|

| Mean | 0.457 |

| Standard Deviation | 0.808 |

| Max Value | 4.43 |

| Min Value | 0.03 |

The Profitability:

The dependent variable (Profitability) was measured descriptively by several measures such as the mean, standard deviation, the Max value and the Min value, and it was calculated through the following financial ratios (ROA, ROE, ROCE).

Return on Assets (ROA):

The previous table 6 indicates the mean, the standard deviation, the Max value and Min value for the (ROA) variable, where the mean for this variable was (0.027), and the standard deviation was (1.79), and the Max value was (0.286) for the bank (QNBS) in 2015, and the Min value was (-0.125) for the bank (QNBS) in 2017.

| Table 6 Descriptive Statistics for The Dependent Variables/Profitability/ROA |

|

| Measure | ROA |

|---|---|

| Mean | 0.027 |

| Standard Deviation | 1.79 |

| Max Value | 0.286 |

| Min Value | -0.125 |

Return on Assets (ROE):

The previous table 7 indicates the mean, the standard deviation, the Max value and Min value for the (ROE) variable, where the mean for this variable was (0.113), and the standard deviation was (0.25), and the Max value was (0.557) for the bank (BOJS) in 2015, and the Min value was (-1.35) for the bank (SGB) in 2017.

| Table 7 Descriptive Statistics for The Dependent Variables/Profitability/ROE |

|

| Measure | ROE |

|---|---|

| Mean | 0.113 |

| Standard Deviation | 0.25 |

| Max Value | 0.557 |

| Min Value | -1.35 |

Return on Assets (ROCE):

The previous table 8 indicates the mean, the standard deviation, the Max value and Min value for the (ROCE) variable, where mean for this variable was (0.043), and the standard deviation was (0.06), and the Max value was (0.288) for the bank (QNBS) in 2015, and the Min value was (-0.11) for the bank (QNBS) in 2017.

| Table 8 Descriptive Statistics for The Dependent Variables/Profitability/ROCE |

|

| Measure | ROCE |

|---|---|

| Mean | 0.043 |

| Standard Deviation | 0.06 |

| Max Value | 0.288 |

| Min Value | -0.11 |

The gains on foreign currencies revaluation:

The previous table 9 indicates the mean, the standard deviation, the Max value and Min value for the gains on foreign currencies revaluation, where the mean for this variable was (210396354.804), and the standard deviation was (280000000), and the Max value was (1383938663) for the bank (BBSF) in 2016, and the Min value was (-93888003) for the bank (SGB) in 2014.

| Table 9 Descriptive Statistics for The Dependent Variables/Gains of Revaluation |

|

| Measure | Gains on foreign currencies revaluation |

|---|---|

| Mean | 210396354.804 |

| Standard Deviation | 280000000.000 |

| Max Value | 1383938663.000 |

| Min Value | 93888003-.000 |

Tests of Data Relevance for Statistical Analysis

In these paragraphs, it will be referred to the tests of the relevance of the data for statistical analysis, thereby, the normal distribution will be tested through the coefficient of Skewness and a Multicollinearity test between the independent variable and the dependent variable and the Pearson correlation matrix between the study’s variables, and since the financial statements are a time series of a cross-sectional nature, therefore unit root tests are required.

First – Normal Distribution Test

In this test, the values of coefficient of Skewness were adopted, where the data is distributed normally when the Skewness coefficient values range are from +1 to -1.

The results of the normal distribution test indicate that the variables (fluctuations in the exchange rate in the official market, fluctuations in the exchange rate in the black market, and the natural logarithm of gains on foreign currencies revaluation) follow the natural distribution where the value of the Skewness coefficient of these variables ranged between (-1) and (1), however the variables (liquidity and profitability), the values ??of the Skewness coefficient were greater than (1), but according to the central limit theory, which assumes that the larger the sample size, the more data is distributed normally, and since the number of observations of this study is (112) views, the study’s variables are assumed to follow the distribution because it is more than (30) views in Table 10.

| Table 10 Skewness Coefficient Values |

|

| Variable | Skewness coefficient |

|---|---|

| Exchange rate fluctuations in the official market | -0.285 |

| Exchange rate fluctuations in the Black market | 0.204 |

| LDR | 3.61 |

| LAR | 0.447 |

| EDR | 3.29 |

| ROA | 1.79 |

| ROE | -1.86 |

| ROCE | 1.60 |

| Gains on foreign currencies revaluation / natural logarithm | -0.68 |

Second – Pearson correlation matrix

The Pearson correlation matrix is one of the most important matrices that shows the amount of correlation of each variable with the other, and reveals in another way a high correlation problem between the variables if it is higher than (0.95) and the following table shows the matrix, The previous Pearson correlation matrix indicates the values of the correlation coefficients (Pearson), where the correlations were weak, medium, direct, and inverse, where the largest correlation coefficient between the variables between the ROA and ROCE variables where the value of the Pearson coefficient was (0.968), and this matrix reveals the absence of Multicollinearity problem between Study’s variables.

Unit root test

The stability of time series indicates the stability of each average and the variation of the chain values ??over time, and that the variation between two time periods depends only on the time lag, and not on the real time in which the variation is measured, and the unit root test is applied to ensure whether the study variables Stable or not, and a Levin-Lin-Chu (LLC) test has been performed to test the hypothesis whether the variables contain the unit root and its suitability for cross-sectional data related to the panel data, and if these variables contain the unit root, the differences must be taken to make them static, as many time series are not static but gives high values ??for (t, F, R2) and this leads to wrong interpretation and misleading results, therefore unit root test must be done to check the extent of stability of time series (Greene, 2012).

The hypotheses of this test are as follows:

H0:The series contains a unit root (The series is unstable)

H1:The series doesn’t contain a unit root (The series is stable)

The unit root test results, as in the previous table 11, indicate that all variables had a statistical probability of less than the level of statistical significance (0.05) and therefore it is possible to judge the hypothesis of LLC test by accepting the alternative hypothesis that there is no unit root in the time series and therefore the result is stillness and stability at the level.

| Table 11 The Unit Root Test |

|||

| Variable | value at the level | Sig | Result |

|---|---|---|---|

| official | -4.61 | 0.000 | Stable at the level |

| Black | -1.78 | 0.038 | Stable at the level |

| ROA | -8.23 | 0.000 | Stable at the level |

| ROE | -9.27 | 0.000 | Stable at the level |

| ROCE | -13.124 | 0.000 | Stable at the level |

| LDR | -10.82 | 0.000 | Stable at the level |

| LAR | -6.47 | 0.000 | Stable at the level |

| EDR | -13.06 | 0.000 | Stable at the level |

| Gains | -8.36 | 0.000 | Stable at the level |

Hypotheses Pre-tests

To achieve the objectives of the study, a simple linear regression method was used, and to estimate the optimal model, the researcher conducted the Breusch-Pagan LM Lagrange test and the Hausman test.

A-Breusch-Pagan LM Lagrange test

This test determines the appropriate model for the differentiation between the ordinary model and on the other hand the two models of fixed and random effects.

The hypotheses of this test are as follows:

H0: Ordinary Model is the appropriate

H1: Fixed and random effects Models is the appropriate.

The results of the Breusch-Pagan LM Lagrange test indicate that the dependent variables (ROE and LDR) will be used for the ordinary regression model because the test significance level was greater than the statistical significance level 0.05, and thus accept the null hypothesis that there are no fixed or random effects in the model, and as for the other variables that all values of the test value significance level are less than (0.05) and thus the alternative hypothesis is accepted with either fixed or random effects in table 12.

| Table 12 Breusch-Pagan LM Lagrange Test of official Market on The DV |

|||

| Variable | Test value | Sig | Result |

|---|---|---|---|

| ROA | 18.74 | 0.000 | Fixed and random |

| ROE | 3.47 | 0.06 | Ordinary Model |

| ROCE | 17.52 | 0.000 | Fixed and random |

| LDR | 3.65 | 0.055 | Ordinary Model |

| LAR | 20.53 | 0.000 | Fixed and random |

| EDR | 238.29 | 0.000 | Fixed and random |

| Gains | 35.43 | 0.000 | Fixed and random |

The results of the Breusch-Pagan LM Lagrange test indicate that the dependent variables (ROE and LDR) will be used for the ordinary regression model because the test significance level was greater than the statistical significance level 0.05, and thus accept the null hypothesis that there are no fixed or random effects in the model, and as for the other variables that all values of the test value significance level are less than (0.05), and thus the null hypothesis is refused and the alternative hypothesis is accepted with either fixed or random effects in table 13.

| Table 13 Breusch-Pagan LM Lagrange Test of Black Market on The DV |

|||

| Variable | Test value | Sig | Result |

|---|---|---|---|

| ROA | 13.48 | 0.000 | Fixed and random |

| ROE | 1.99 | 0.157 | Ordinary Model |

| ROCE | 12.88 | 0.000 | Fixed and random |

| LDR | 3.39 | 0.06 | Ordinary Model |

| LAR | 20.06 | 0.000 | Fixed and random |

| EDR | 238.03 | 0.000 | Fixed and random |

| Gains | 33.37 | 0.000 | Fixed and random |

B- Hausman test

The second step of optimal model testing is the Hausman test to determine the optimal model between the fixed or random models.

The hypotheses of this test are as follows:

H1: Fixed Model is the appropriate.

The study of all hypotheses indicated that the Cross-section variance test is invalid (that is, the variance between fixed and random effects is zero) for this test, and therefore the probability value for all study hypotheses was greater than the significance level (0.05), and therefore the best model for these hypotheses is a random effects model in table 14.

| Table 14 Hausman Test of official Market on The DV |

||||

| Variable | Chi-square | DF/Chi-square | Sig | Appropriate model |

|---|---|---|---|---|

| ROA | 0.000 | 1 | 1.000 | Radom |

| ROE | 0.000 | 1 | 1.000 | Radom |

| ROCE | 0.000 | 1 | 1.000 | Radom |

| LDR | 0.000 | 1 | 1.000 | Radom |

| LAR | 0.000 | 1 | 1.000 | Radom |

| EDR | 0.000 | 1 | 1.000 | Radom |

| Gains | 0.000 | 1 | 1.000 | Radom |

The same results of the previous table 15, therefore the best model for these hypotheses is also a random effects model.

| Table 15 Hausman Test of official Black on The DV |

||||

| Variable | Chi-square | DF/Chi-square | Sig | Appropriate model |

|---|---|---|---|---|

| ROA | 0.000 | 1 | 1.000 | Radom |

| ROE | 0.000 | 1 | 1.000 | Radom |

| ROCE | 0.000 | 1 | 1.000 | Radom |

| LDR | 0.000 | 1 | 1.000 | Radom |

| LAR | 0.000 | 1 | 1.000 | Radom |

| EDR | 0.000 | 1 | 1.000 | Radom |

| Gains | 0.000 | 1 | 1.000 | Radom |

Tests of Hypotheses

First – The First Main Hypothesis

H0: There is no effect with statistically significance at < 0.05 of exchange rates fluctuation of foreign currencies in the official market on the results of financial statements of the private banks in Syria.

And from this hypothesis, there are three subsidiary hypotheses are emerged:

A- The first subsidiary hypothesis

H01: There is no effect with statistically significance at < 0.05 of exchange rates fluctuation of foreign currencies in the official market on the liquidity of the private banks in Syria.

To test this hypothesis, the following financial ratios have been tested (LDR, LAR, EDR).

The results of the simple linear regression test indicate that the calculated value of F was (1.46) which is smaller than the tabular value, and that the level of statistical significance of the value of F (0.229) which indicates that the regression model does not mean to explain the change in the dependent variable, and the coefficient of determination was its value (0.015) and that means that the value of (1.5%) of the change in the dependent variable was due to the fluctuations in the exchange rates of foreign currencies in the official market, and the beta value was (-0.143), which means that there is a negative relationship between the fluctuation of the exchange rates of foreign currencies in the official market and (LDR), and the calculated value of T (-1.210) was smaller than the value tabular and the level of statistical significance (0.229) which is greater than the level of statistical significance at the level of significance (0.05), and therefore the judgment on this hypothesis to accept the null hypothesis that there is no statistically significant effect of fluctuating exchange rates of foreign currencies in the official market on the (LDR) in the private Syrian banks in Table 16.

| Table 16 The Test of Fist Subsidiary Hypothesis / official on LDR |

||||

| Dependent Variable LDR |

R2 | F Value | Sig | |

| 0.015 | 1.46 | 0.229 | ||

| Independent Variables | value | Standard Error | T Value | Sig |

| Exchange rate fluctuation in the official market | -0.14 | 0.118 | -1.21 | 0.229 |

| Constant | 0.450 | 0.06 | 7.39 | 0.000 |

The results of the simple linear regression test indicate that the calculated value of F was (1.21) which is smaller than the tabular value, and that the level of statistical significance of the value of F (0.27) which indicates that the regression model does not mean to explain the change in the dependent variable, and the coefficient of determination was its value (0.012) and that means that the value of (1.2%) of the change in the dependent variable was due to the fluctuations in the exchange rates of foreign currencies in the official market, and the beta value was (-0.044), which means that there is a negative relationship between the fluctuation of the exchange rates of foreign currencies in the official market and (LAR), and the calculated value of T (-1.10) was smaller than the value tabular and the level of statistical significance (0.27) which is greater than the level of statistical significance at the level of significance (0.05), and therefore the judgment on this hypothesis to accept the null hypothesis that there is no statistically significant effect of fluctuating exchange rates of foreign currencies in the official market on the (LAR) in the private Syrian banks in Table 17.

| Table 17 The Test of Fist Subsidiary Hypothesis / official on LAR |

||||

| Dependent Variable LAR |

R2 | F Value | Sig | |

| 0.012 | 1.21 | 0.27 | ||

| Independent Variables | value | Standard Error | T Value | Sig |

| Exchange rate fluctuation in the official market | -0.04 | 0.04 | -1.21 | 0.27 |

| Constant | 0.25 | 0.02 | 7.39 | 0.000 |

The results of the simple linear regression test indicate that the calculated value of F was (0.45) which is smaller than the tabular value, and that the level of statistical significance of the value of F (0.50) which indicates that the regression model does not mean to explain the change in the dependent variable, and the coefficient of determination was its value (0.004) and that means that the value of (4%) of the change in the dependent variable was due to the fluctuations in the exchange rates of foreign currencies in the official market, and the beta value was (0.05), which means that there is a positive relationship between the fluctuation of the exchange rates of foreign currencies in the official market and (EDR), and the calculated value of T (0.67) was greater than the value tabular and the level of statistical significance (0.50) which is greater than the level of statistical significance at the level of significance 0.05, and therefore the judgment on this hypothesis to accept the null hypothesis that there is no statistically significant effect of fluctuating exchange rates of foreign currencies in the official market on the (EDR) in the private Syrian banks in Table 18.

| Table 18 The Test of Fist Subsidiary Hypothesis / official on EDR |

||||

| Dependent Variable EDR |

R2 | F Value | Sig | |

| 0.004 | 0.45 | 0.50 | ||

| Independent Variables | value | Standard Error | T Value | Sig |

| Exchange rate fluctuation in the official market | 0.05 | 0.08 | 0.67 | 0.50 |

| Constant | 0.43 | 0.222 | 1.93 | 0.057 |

Consequently, and based on the results of the previous ratios test, it was concluded that there is no statistically significant effect of fluctuating exchange rates of foreign currencies in the official market on the liquidity of Syrian private banks.

B- The Second subsidiary hypothesis

H02: There is no effect with statistically significance at < 0.05 of exchange rates fluctuation of foreign currencies in the official market on the Profitability of the private banks in Syria.

To test this hypothesis, the following financial ratios have been tested (ROA, ROE, ROCE).

The results of the simple linear regression test for fluctuating exchange rates of foreign currencies in the official market on (ROA) indicate that the regression model is significant, where the calculated value of F was (37.6) and the level of statistical significance was (0.000), and the value of the determination coefficient was (0.281) and this means that the independent variable explains what its amount is (28.1%) of the variance in the dependent variable, and the beta value (0.097) is a direct relationship between the two variables, and the calculated value of T was (6.13) and this value is greater than its tabular value and the level of statistical significance (0.000) and this value is less than the level Statistical significance at the level of (0.05), and therefore it can be judged to reject the null hypothesis and accept the alternative hypothesis that there is a statistically significant effect of the volatility of the exchange rates of foreign currencies in the official market on (ROA) in the Syrian private banks in Table 19.

| Table 19 The Test of Second Subsidiary Hypothesis / official on ROA |

||||

| Dependent Variable ROA |

R2 | F Value | Sig | |

| 0.028 | 37.60 | 0.000 | ||

| Independent Variables | value | Standard Error | T Value | Sig |

| Exchange rate fluctuation in the official market | 0.097 | 0.015 | 6.13 | 0.00 |

| Constant | -0.008 | 0.011 | -0.78 | 0.43 |

The results of the simple linear regression test for fluctuating exchange rates of foreign currencies in the official market on (ROE) indicate that the regression model is significant, where the calculated value of F was (43.33) and the level of statistical significance was (0.000), and the value of the determination coefficient was (0.311) and this means that the independent variable explains what its amount is (31.1%) of the variance in the dependent variable, and the beta value (0.477) is a direct relationship between the two variables, and the calculated value of T was (6.58) and this value is greater than its tabular value and the level of statistical significance (0.000) and this value is less than the level Statistical significance at the level of (0.05), and therefore it can be judged to reject the null hypothesis and accept the alternative hypothesis that there is a statistically significant effect of the volatility of the exchange rates of foreign currencies in the official market on (ROE) in the Syrian private banks in table 20.

| Table 20 The Test of Second Subsidiary Hypothesis / official on ROE |

||||

| Dependent Variable ROE |

R2 | F Value | Sig | |

| 0.311 | 43.33 | 0.000 | ||

| Independent Variables | value | Standard Error | T Value | Sig |

| Exchange rate fluctuation in the official market | 0.477 | 0.07 | 6.58 | 0.00 |

| Constant | -0.07 | 0.03 | -1.95 | 0.053 |

The results of the statistical analysis of the simple linear regression test for fluctuating exchange rates of foreign currencies in the official market on the (ROCE) indicates that the regression model is significant, where the calculated value of F was 33.08 and the level of statistical significance was (0.000), and the value of the determination coefficient was (0.256) and this means that the independent variable (25.6%) of the variance of the dependent variable is explained, and the beta value (0.09) is any direct relationship between the two variables, and the calculated value of t was (5.75) and this value is greater than its tabular value and the level of statistical significance (0.000) and this value is less than the level of statistical significance at the level of (0.05), and thus it’s possible to judge to reject the null hypothesis and accept the alternative hypothesis that there is a statistically significant effect of the volatility of the exchange rates of foreign currencies in the official market on (ROCE) in the Syrian private banks in Table 21.

| Table 21 The Test of Second Subsidiary Hypothesis / official on ROCE |

||||

| Dependent Variable ROCE |

R2 | F Value | Sig | |

| 0.256 | 33.08 | 0.000 | ||

| Independent Variables | value | Standard Error | T Value | Sig |

| Exchange rate fluctuation in the official market | 0.09 | 0.016 | 5.75 | 0.000 |

| Constant | 0.008 | 0.011 | 0.76 | 0.44 |

Consequently, and based on the results of the previous ratios test, it was concluded that there is a statistically significant effect of fluctuating exchange rates of foreign currencies in the official market on the profitability of Syrian private banks.

C- The Third subsidiary hypothesis

H03: There is no effect with statistically significance at < 0.05 of exchange rates fluctuation of foreign currencies in the official market on gains on foreign currencies revaluation of the banks.

The results of the simple linear regression test for the fluctuation of the exchange rates of foreign currencies in the official market on the gains resulting from the evaluation of foreign currencies are as follows, that the calculated value of F is (6.74) and the level of significance is (0.01) and this indicates the significance of the model, and the regarding the amount of the variation, the value of the determination coefficient (0.07) has shown that the amount (7%) of the change in the dependent variable is caused by the independent variable, and the beta value (0.88) indicates a strong direct relationship between the two variables, and the calculated value of T was (2.58) at the level of significance (0.01) and this level is less than the level of statistical significance (0.05), and that means the acceptance of the alternative hypothesis and refusal of null hypothesis, thereby, there is a statistically significant effect of the volatility of the exchange rates of foreign currencies in the official market on the gains generated by the revaluation of foreign currency of the Syrian private banks in Table 22.

| Table 22 The Test of Third Subsidiary Hypothesis / official on GAINS |

||||

| Dependent Variable gains on foreign currencies revaluation of the banks |

R2 | F Value | Sig | |

| 0.07 | 6.74 | 0.01 | ||

| Independent Variables | value | Standard Error | T Value | Sig |

| Exchange rate fluctuation in the official market | 0.88 | 0.34 | 2.58 | 0.01 |

| Constant | 18.37 | 0.27 | 65.85 | 0.00 |

Second – The Second Main Hypothesis

H0: There is no effect with statistically significance at < 0.05 of exchange rates fluctuation of foreign currencies in the black market on the results of financial statements of the private banks in Syria.

And from this hypothesis, there are three subsidiary hypotheses are emerged:

A- The first subsidiary hypothesis

H04: There is no effect with statistically significance at < 0.05 of exchange rates fluctuation of foreign currencies in the black market on the liquidity of the private banks in Syria.

To test this hypothesis, the following financial ratios have been tested (LDR, LAR, EDR).

The previous table 23 indicates the results of the simple linear regression test for fluctuating exchange rates of foreign currencies on the black market at (LDR), where the calculated value of F was (0.04) at the level of significance (0.83) and these values ??indicate the insignificance of the model in the interpretation of the dependent variable, and the determination coefficient value was (0.0004), and this amount is very weak, meaning that (0.04%) of the change in the dependent variable is caused by the independent variable, and the beta value was (-0.02), and the calculated T value was (-0.21) which is smaller than the tabular value as for the level of statistical significance it was (0.83) which is greater than the level of statistical significance at the level of significance (0.05), thus, the null hypothesis was accepted as having no statistically significant effect of fluctuating exchange rates of foreign currencies on the black market on the (LDR).

| Table 23 The Test of Fist Subsidiary Hypothesis / Black on LDR |

||||

| Dependent Variable LDR |

R2 | F Value | Sig | |

| 0.0004 | 0.04 | 0.83 | ||

| Independent Variables | value | Standard Error | T Value | Sig |

| Exchange rate fluctuation in the black market | -0.02 | 0.132 | -0.21 | 0.83 |

| Constant | 0.40 | 0.06 | 6.07 | 0.000 |

The previous table 24 shows the results of the simple linear regression test for fluctuating exchange rates of foreign currencies on the black market on the (LAR), where the calculated value of F was (0.26) at the level of significance (0.60) and these values ??indicate the insignificance of the model in the interpretation of the dependent variable, and the determination coefficient has its value at (0.002) and this amount is very weak, meaning that (0.02%) of the change in the dependent variable is caused by the independent variable, and the beta value was (0.02), and the calculated value of T was (10.5) which is smaller than the tabular value, and as for The level of statistical significance was (0.60), which is greater than the level of statistical significance at the level of significance (0.05) and then it was accepted null hypothesis that there is a statistically significant effect of the volatility of the exchange rates of foreign currencies on the black market on (LAR).

| Table 24 The Test of Fist Subsidiary Hypothesis / Black on LAR |

||||

| Dependent Variable LAR |

R2 | F Value | Sig | |

| 0.002 | 0.26 | 0.60 | ||

| Independent Variables | value | Standard Error | T Value | Sig |

| Exchange rate fluctuation in the black market | 0.02 | 0.045 | 0.51 | 0.60 |

| Constant | 0.23 | 0.03 | 7.39 | 0.000 |

The previous table 25 indicates the results of the simple linear regression test for the fluctuation of foreign exchange rates on the black market at (EDR), where the calculated value of F (-0.0003) was at the level of significance (0.995) and these values ??indicate the insignificance of the model in the interpretation of the dependent variable, and the determination coefficient value was (0.000) and this amount is very weak, meaning that (0%) of the change in the dependent variable is caused by the independent variable and this indicates that there is no effect or discrepancy occurring in the dependent variable because of the independent variable, and the beta value was (-0.005 ), and the calculated value of T was (-0.005) which is smaller than the tabular value, and the significance level The statistic has been (0.995) which is greater than the level of statistical significance at the significance level (0.05) and thus, it was accepted that the null hypothesis that there was no statistically significant effect of fluctuating exchange rates of foreign currencies on the black market on the (EDR). Consequently and based on the results of the previous ratios test, it was concluded that there is a partial acceptance of the subsidiary hypothesis, while there is no statistically significant effect of fluctuating exchange rates of foreign currencies in the black market on the liquidity of Syrian private banks.

| Table 25 The Test of Fist Subsidiary Hypothesis / Black on EDR |

||||

| Dependent Variable EDR |

R2 | F Value | Sig | |

| 0.00 | -0.0003 | 0.99 | ||

| Independent Variables | value | Standard Error | T Value | Sig |

| Exchange rate fluctuation in the black market | 0.0005 | 0.09 | -0.005 | 0.99 |

| Constant | 0.45 | 0.223 | 2.03 | 0.044 |

B- The Second subsidiary hypothesis

H05: There is no effect with statistically significance at < 0.05 of exchange rates fluctuation of foreign currencies in the black market on the Profitability of the private banks in Syria.

To test this hypothesis, the following financial ratios have been tested (ROA, ROE, ROCE).

The previous table 26 refers to the simple linear regression test for the volatility of exchange rates for foreign currencies on the black market on the (ROA) where the calculated value of F (21.24) and the level of its significance (0.000) indicate the significance of the model, where the value of the calculated F was greater than the tabular value, and the level of statistical significance is less than the level The statistical significance is at the level of (0.05), and the value of the determination coefficient was (0.181), which means that the independent variable has interpreted an amount of (18.1%) of the change in the dependent variable, and the value of the beta coefficient was (0.08) and this indicates a direct relationship between the two variables, and the calculated value of T was (4.60) which is greater than its tabular value, and its level of statistical significance (0.000) is smaller than the level of statistical significance at the level of significance (0.05), and therefore to be rejected the null hypothesis and accepted the alternative hypothesis that there is a statistically significant effect of the variable volatility of foreign exchange rates in the black market on (ROA).

| Table 26 The Test of Second Subsidiary Hypothesis / Black on ROA |

||||

| Dependent Variable ROA |

R2 | F Value | Sig | |

| 0.181 | 21.24 | 0.000 | ||

| Independent Variables | value | Standard Error | T Value | Sig |

| Exchange rate fluctuation in the black market | 0.08 | 0.01 | 4.6 | 0.00 |

| Constant | -0.008 | 0.011 | -0.78 | 0.43 |

The previous table 27 shows a simple linear regression test for the fluctuation of exchange rates for foreign currencies on the black market on the (ROE) where the calculated value of F (30.00) and the level of its significance (0.000) indicate the significance of the model, where the value of the calculated F was greater than the tabular value and the level of statistical significance is less than the level the statistical significance is at the level of (0.05), and the value of the determination coefficient was (0.238) and this means that the independent variable has interpreted an amount of (23.8%) of the change in the dependent variable, and the value of the beta coefficient was (0.463) and this indicates a direct relationship between the two variables, the calculated value of T was (5.47), which is greater than m tabulated value and the level of statistical (0.000) which is smaller than the significance level of statistical significance at the (0.05) level of significance, and thus, the null hypothesis was reject and the alternative hypothesis was accepted that there is a statistically significant effect of the variable exchange rate fluctuations in foreign currency on the black market on the (ROE).

| Table 27 The Test of Second Subsidiary Hypothesis / Black on ROE |

||||

| Dependent Variable ROE |

R2 | F Value | Sig | |

| 0.238 | 30.00 | 0.000 | ||

| Independent Variables | value | Standard Error | T Value | Sig |

| Exchange rate fluctuation in the black market | 0.463 | 0.08 | 5.47 | 0.00 |

| Constant | -0.06 | 0.04 | -1.65 | 0.1 |

The previous table shows a simple linear regression test for the fluctuation of exchange rates of foreign currencies in the black market on the (ROCE) where the calculated value of F (18.56) and its significance level is (0.000) which indicate the significance of the model, where the calculated value of F was greater than its tabular value, and the level of statistical significance is less than the level of the statistical significance is at the level of (0.05), and the value of the determination coefficient was (0.162) and that means the independent variable has interpreted an amount of (16.2%) of the change in the dependent variable, and the value of the beta coefficient was (0.08) and this indicates a direct relationship between the two variables, and the calculated value of T was (4.30) which is greater than the tabulated value, and the level of statistical (0.000) which is smaller than the significance level of statistical significance at the (0.05) level of significance, and thus, to be rejected the null hypothesis and accepted the alternative hypothesis that there is a statistically significant effect of the variable exchange rate fluctuations in foreign currency on the black market on (ROCE).

| Table 28 The Test of Second Subsidiary Hypothesis / Black on ROCE |

||||

| Dependent Variable ROCE |

R2 | F Value | Sig | |

| 0.162 | 18.56 | 0.000 | ||

| Independent Variables | value | Standard Error | T Value | Sig |

| Exchange rate fluctuation in the black market | 0.08 | 0.019 | 4.30 | 0.000 |

| Constant | 0.012 | 0.012 | 1.01 | 0.31 |

Consequently, and based on the results of the previous ratios test, it was concluded that there is a statistically significant effect of fluctuating exchange rates of foreign currencies in the black market on the profitability of Syrian private banks.

C- The Third subsidiary hypothesis

H03: There is no effect with statistically significance at < 0.05 of exchange rates fluctuation of foreign currencies in the black market on gains on foreign currencies revaluation of the banks.

The third sub-hypothesis test via simple linear regression indicates the lack of significance of the model where the calculated value of F was (3.54) and the level of statistical significance (0.058), and therefore these values ??are not statistically significant at the level of statistical significance at the level of ( 0.05), and the value of the determination coefficient was (0.04) which means that the dependent variable is explained by (4%) by the independent variable, and the beta value was (0.742), and the calculated value of T was (1.91) which is smaller than the tabular value, and the level of statistical significance was (0.058) which is greater than the level of statistical significance at the level of (0.05), and therefore the null hypothesis is accepted which states that there is no statistically significant effect of foreign exchange rates fluctuation in the black market on the gains generated by the revaluation of foreign currency in the Syrian private banks in Table 29.

| Table 29 The Test of Third Subsidiary Hypothesis / Black on GAINS |

||||

| Dependent Variable gains on foreign currencies revaluation of the banks |

R2 | F Value | Sig | |

| 0.04 | 3.71 | 0.057 | ||

| Independent Variables | value | Standard Error | T Value | Sig |

| Exchange rate fluctuation in the black market | 0.742 | 0.38 | 1.91 | 0.058 |

| Constant | 18.43 | 0.28 | 63.92 | 0.00 |

Conclusion

In light of the statistical analysis of the financial data of the study’s variables, the researchers has reached the following conclusions:

- The study confirmed the absence of a statistically significant effect of fluctuating exchange rates of foreign currencies in the official market on the liquidity of the private banks in Syria during the study period, where the results showed that there was no effect of these fluctuations on the ratios through which liquidity was expressed in banks (LDR, LAR, EDR), and in the opinion of the researcher, this result is due to the policy pursued by the (CBOS) by setting restrictions on foreign currency withdrawals, and thus, maintaining a balanced level of foreign exchange in the banks in order to control the amount of foreign exchange offered in the market that would maintain the exchange rate stability in the black market.

- The results of this study showed that there is a statistically significant effect of fluctuating exchange rates of foreign currencies in the official market on the profitability in private banks in Syria during the study period, as there was an effect the profitability ratios covered in the study, which are (ROA , ROE, ROCE), and in the opinion of the researcher, this result is logical, and that because the income that are a component of these ratios have been greatly affected by the gains resulting from the revaluation of foreign currencies, which are an important and major part of the banks’ income.

- The results of this study confirmed that there is a statistically significant effect of fluctuating exchange rates of foreign currencies in the official market on the gains resulting from the revaluation of foreign currencies in private banks in Syria during the study period, and in the opinion of the researcher, as it was mentioned previously, that these gains must be affected by the fluctuation of the exchange rates in the official market because these banks are obligated by the (CBOS) to apply the exchange rates mentioned in the official bulletins that it issues, and therefore all of these banks at the end of the year re-evaluate all the balances deposited with them in the foreign currency by applying the closing price according to the issue of the (CBOS), and then record these amounts in SYP in their financial statements.

- The results of this study indicated that there is no statistically significant effect of fluctuating exchange rates of foreign currencies in the black market on the liquidity of private banks in Syria during the study period, as they did not affect the ratios (LDR, EDR), and in the opinion of the researcher, this result was caused by the control of (CBOS) on the exchange market through direct and indirect intervention, while there was a limited effect one of the liquidity ratio (LAR), which represents the ratio of net loans to total deposits, and this effect was because the borrowing and deposit activities were affected during the Syrian crisis due to the lack of an encouraging environment to make investment that require orientation to take loans, in addition to the feeling of insecurity for depositing money in the banks, that emerged because of the chaos that existed in Syria during the crisis period.

- The results of this study confirmed that there is a statistically significant effect of fluctuating exchange rates of foreign currencies in the black market on the profitability of private banks in Syria during the study period, as there was an effect on the ratios (ROA, ROE, ROCE), and this result, according to the researcher, gives an indication of the power of the black market through its effect on the profits of private banks, despite the fact that these banks do not deal with exchange rates on the black market or rely on them to re-evaluate the amounts deposited with them in foreign currencies, and this matter can be consider as study problem for other researchers.

- The results of this study indicated that there is no statistically significant effect of fluctuating exchange rates of foreign currencies in the black market on the gains resulting from the revaluation of the amounts deposited in foreign currencies in the private banks, and this result confirms, in the researcher's opinion, that Syrian banks are not affected by fluctuations in the exchange rates of foreign currencies in the market Black, as revaluation is only taking place based on official market policies.

The Recommendations

In the light of the previous findings, the researcher has made several recommendations:

- The researcher recommends that a research should be conducted on public banks that the researcher did not address in his study, and then compare the results with the results of the current study.

- Recommendation that it is necessary to study the effect of fluctuations in the exchange rates of foreign currencies on balances deposited in other currencies than the USD, in order to limit the role played by the change in the exchange rate of the USD against SYP.

- The researcher recommends the importance of comparing the results of the statistical analysis of commercial banks with the results of Islamic banks due to the difference in some elements of the financial statements between them, and then studying the effect of fluctuations in exchange rates on Islamic banks individually and determine the extent of their impact by those fluctuations.

- Recommend the necessity of researching the effect of fluctuating exchange rates in the black market on the profitability of private banks in Syria, as it appeared in the results of this study, under the same circumstances, and then determine the possible factors that could contribute to that.

- The researcher recommends studying other sectors other than banks, such as financialbrokerage companies and exchange companies, to know the effect of fluctuations in exchange rates in the official and black market on the performance of these companies.

- The researcher recommends conducting this study in other countries suffering from conflicts and wars such as Iraq, Sudan and Lebanon.

- The researcher recommends the completion of the study through comparative studies before 2011 and current years.

References

- Abou, H.M. (2009). The effectiveness of the performance appraisal system and its impact on the level of employee performance (Arabic), Unpublished Master Thesis, Islamic University, Gaza, Palestine.

- Al Furaigi, H. (2005). The impact of the volatility of the euro exchange risk in banking (Arabic), Iraqi Journal for Economic Science, 10, 87-102.

- Al Haiary, F. (2007). The study of the structure of the Islamic bank and its effect on the profitability ratio (Available). http://www.alhiary.com/?p=1375

- Al Kadi, H., & Hamdan, M. (2008). The International Accounting and its Standards (Arabic). Syria, Damascus: University of Damascus.

- Al kadi, H., & Hashem, M. (2015). The misleading impact of international accounting standard No (21) individually on users of informative at private Syrian banks (Arabic), Tishreen University Journal for Research and Scientific Studies -Economic and Legal Sciences Series, 73, 1.

- Al Khateeb, F., Diab, S., & Abdu, A.A. (2015). Advanced studies in macroeconomic theory (Arabic). Saudi Arabia, Khawarizm.

- Al Mustafa, B. (2010). Information about the private banks in Syria (Available). https://www.alazmenah.com/?page=show_det&id=6008

- Al Nahal, Y., & Al Shurafa, Y. (2016). The impact of exchange rates fluctuations on the financial performance of banks listed in Palestine Securities Exchange” (Arabic), Unpublished Master Thesis, Islamic University, Gaza, Palestine

- ALHussein, B., & Hamdan, M. (2016). Factors affecting the profitability of private banks in Syria (Arabic), Al Baath University, Syria, Homs.

- Ali Bani, H.M. (2011). The Impact of Exchange Rate on the measurement and Accounting Disclosure in Financial Statements in Commercial Banks in Jordan, European Scientific Journal, 7, 26.

- Alqam, M. (2018). Financial Statements Analysis for the purposes of decision making (Arabic). Jordan, Amman: National library.

- Amalendu, B., Sri Somnath, M., & Sri Gautam, R. (2011). Financial Performance Analysis-A Case Study, Current Research Journal of Social Sciences, 3(3), 269-275.

- Bamara, B. (2013). Effect of exchange rate fluctuations on the Performance of banks. (Arabic), Unpublished Master Thesis, University of Kasidy Merbah, Algeria.

- Ben Omar, M. (2010). Study the effect of some financial and economic changes on stock prices (Jordan Stock Exchange case) (Arabic), Unpublished Master Thesis, University of Kasidy Merbah, Algeria.

- Bo Teraa, R., & Bo Rahli, A. (2016). Impact of exchange rate fluctuations on performance Financial institutions of commercial banks (Arabic), Unpublished Master Thesis, University of Al Arabi ben Mhedi, Algeria.

- Bukhari, M. (2010). Foreign exchange policy and its relationship to monetary policy (Arabic). Labanon, Beirut: Dar Al Hasan For printing, publishing and distribution.

- Carnegie Middle East Center (2015). The Syrian Financial Section” (Available). https://carnegie-mec.org/2015/01/07/ar-pub-60301

- Chandra, S., Bhowmik, P.K., Rakibul, I.M., & Abdul, K.M. (2013). Profitability and Liquidity of Conventional Banking and Islamic Banking in Bangladesh: A Comparative Study, ResearchGate

- Creswell, J.W. (2009). Research Design: Qualitative, Quantitative, and Mixed Methods Approaches (3rd ed.). Thousand Oaks, CA: Sage Publications.

- Getachew, T. (2016). The Impact of Exchange Rate on The Profitability of Commercial Banks in Ethiopia, Unpublished Master Thesis, Addis Ababa University, Ethiopia

- Greene, W. (2012). Econometric Analysis. 7th Edition, Prentice Hall, Upper Saddle River

- Hanafi Abd Al, G. (1999). Financial markets and institutions (Arabic). Egypt, Iskandaria: Iskandaria Book center.

- Haqqi, B., & Al Ali, G. (2016). Study the effect of the financing structure on the financial performance of Islamic banks listed on the Damascus Stock Exchange (Arabic), Syrian Virtual University.

- Jaafari, A. (2013). The problem of choosing the appropriate exchange system in light of the recent trend of international exchange systems” (Arabic) Unpublished Master Thesis, Muhammad Khaider University, Algeria.

- Jeffrey, A.F. (2008). Foreign Exchange. The Concise Encyclopedia of Economics, Library of Economics and Liberty.