Research Article: 2021 Vol: 27 Issue: 5

The Effect of Accounting Information Systems in Maximizing Financial Returns and Improving Their Indicators: An Exploratory Study of A Sample of Elaf Islamic Bank Employees

Azher Subhi Abdulhussein, University of Kerbala

Maysoon Dawood Hussein, University of Mustansiriyah

Jasim Idan Barrak, University of Kerbala

Citation Information: Abdulhussein, A.S., & Hussein, M.D. (2021). He effect of accounting information systems in maximizing financial returns and improving their indicators: an exploratory study of a sample of elaf Islamic bank employees. Academy of Entrepreneurship Journal, 27(5), 1-12.

Abstract

The purpose of this research is to shed light on the distinctive role that accounting information systems play in Iraqi Islamic banks resulting from processing various financial information and employing them in the form of financial reports and their impact on financial returns by measuring and analyzing financial returns indicators, as the decrease in these returns generates negative effects On the operational efficiency of the banks, as the Iraqi Elaf Islamic Bank was chosen and the indicators of financial returns were used, analyzed and the interpretation of the changes taking place therein, in addition to designing a questionnaire consisting of 20 paragraphs specialized in accounting information systems and financial returns. Explaining the role of accounting information systems in Iraqi banks and their impact on maximizing financial returns. These indicators were analyzed and tested utilizing the F, P-value tests, and the effect was demonstrated through the determination coefficient R2 using ANOVA. However, to varying degrees, based on which the alternative hypothesis was accepted, and the research reached a set of recommendations The most important of them is that banks intend to enhance and develop accounting information systems and make use of them in making correct investment decisions, which are reflected in achieving financial returns that contribute to maximizing the wealth of shareholders and achieving a competitive advantage for the bank.

Keywords

Accounting, Islamic Bank, Financial Returns, Employees.

Research Methodology

Research Methodology

In order to achieve a comprehensive integration process in banking work and raise its efficiency to advanced levels and in light of the processes of financial liberalization and technological development that have taken place in the banking arena, whether at the regional or international level, and the desire of Iraqi banks in general and Elaf Islamic Bank in particular to keep pace with this progress and development and given the important and active role it plays Financial information today in the banking work of various internal and external bodies, and in order to contribute to the process of rationalizing investment decisions and achieving the best financial benefits, the management of Elaf Islamic Bank continuously seeks to develop and update its accounting information systems to serve the requirements of the current period and serve its internal needs as well as to shorten the time and effort that is reflected Directly to reduce the current costs of the bank, which enhances and maximizes its financial returns and achieves the best information outputs for it, and in light of the above, the research problem lies in the following question, which is the effect of accounting information systems on maximizing financial returns and improving its indicators for the Iraqi Islamic Bank.

The Importance of Research

The main goal and mission that the administrations of Iraqi Islamic banks seek to achieve is to raise their banking market to efficient levels and to be able to achieve the best levels of competition in the banking arena. These departments seek to develop their accounting information systems periodically by achieving the best information outputs and employing these outputs in periodic accounting reports that reflect the true reality of the performance of the Elaf Islamic Bank, and in light of the above, the importance of research lies in the fact that the administrations of Iraqi banks should seek to take the best investment alternatives based on the outputs of their accounting information systems in a manner that achieves high financial gains for them and achieves the principle of internal control in diagnosing issues in the performance of the research sample banks (Al-Sari & Rabat, 2017).

Research Objectives

The research aims to achieve the following objectives:

- Addressing the knowledge pillars of each of the accounting information systems and the financial returns and their most important indicators.

- Explaining the role of accounting information systems in maximizing the financial returns of the bank and improving its returns indicators.

- Measuring and analyzing the financial returns indicators of the bank, the research sample.

- Analysis of the relationship between accounting information systems and the financial returns of the bank, the research sample.

Research Hypothesis

The research is based on a general hypothesis:

(The absence of a statistically significant impact of accounting information systems in maximizing financial returns and improving their indicators).

Limits of Research and Method of Data Collection

The data included in the financial statements of Elaf Islamic Bank for the period (2015-2019) related to the holy branches of Babylon and Karbala were relied upon.

The Theoretical Framework for Accounting Information Systems

All financial institutions in general, and banking in particular, work to achieve a number of their strategic objectives in an effective, efficient and distinctive manner to reach the main goal of any financial institution, which is to maximize profitability and achieve growth rates that are mainly reflected in maximizing its market value and increasing shareholder wealth in different ways that can be Leads to improving its performance and increasing its profits in a dynamic era characterized by competition and technological and knowledge development, so that data and information, if used and employed in an efficient and effective manner, has become one of the most important assets of the financial institution, and thus accounting information systems have become one of the most important pillars of financial institutions, as these systems work on Collecting and storing data, processing it and converting it into appropriate information for making various planning, executive, control and investment decisions (College and others, 2011). Accounting information systems are the main resource for the information used in making financial decisions, whether they are operational, investment or financing decisions, as decisions affect all The functions of the organization, on top of which is its ability to achieve a competitive advantage, which helps its continuation in the business sector For, in its turn, financial management is one of the basic functions through which it is possible to identify the financial and operational centers, maintain the existence of the facility and achieve its objectives through financial planning and knowledge of the reality of the financial structure and its components that constitute the available sources of financing that contribute to assisting the senior management in the process of making appropriate decisions (Al-Buhaisi & Miqdad, 2013), and accounting information systems have been defined as a set of objectives, policies, elements, principles and means of operation, personnel, inputs, outputs and control that are interlinked in a coherent manner to accomplish accounting functions (Amin, 2007), and it is also known as one of the components of an administrative organization that concerns By collecting, classifying, processing, analyzing and communicating the financial information appropriate for decision-making for external parties and the management of the organization (Edmond Gel, 2010), through the foregoing it is clear that the accounting information system is a set of procedures and treatments for specific data in a way that makes it information that contributes to decision-making as it can be defined. As an integrated set of different procedures and processes that enable decision-makers to rely on its information outputs (Bohayek, 2015).

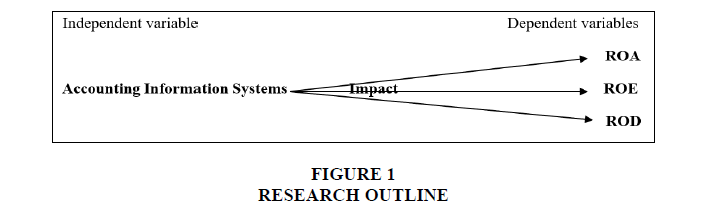

The importance of accounting information systems is evident in terms of their existence within the organizations as they consist of a group of human and automatic elements, procedures, databases, departments, devices, technologies, and programs within the general system of the program, as it identifies, collects, analyzes and stores information and sends it to decision-makers that are compatible With their needs, the outputs of the system must be of high quality and obtained promptly, and the system links the organizational structure in all its departments (Alzeaud, 2012), and information systems also contribute to the generation and transfer of knowledge to respond to the needs of the user and ease of access. To the structure, contents, contents, complementarity of its systems, its ability and control over expansion and development, in addition to the systems working to secure the needs of the higher management of information that helps them in formulating their policies and tasks (Al-Mutairi, 2012; Al-Maadidi, 2010) shows in Figure 1.

Hypothesis Research Outline

The Theoretical Aspect of the Research

Objectives of Accounting Information Systems

Among the goals of accounting information systems are as follows: (Dabash & Kaddouri, 2013) (Buhayek, 2015).

- It mainly aims to preserve the information kept consistently and understandable by the employees in the accounting field.

- Giving a clear and honest picture of the institution’s financial position, its performance, and the changes in the financial position.

- Working hard to achieve a rational image by achieving transparency in presenting the information.

- It mainly works to provide a lot of inputs for computer-dependent subsystems.

- Giving correct, sufficient, reliable, and transparent information that encourages investors and allows them to track their money.

The Characteristics of Calculating Information Systems

Accounting information systems are characterized by a set of characteristics, the most important of which are: (Al-Dayeh, 2009).

- The accounting information system must achieve a high degree of accuracy and speed in processing the financial data when converting it into accounting information.

- To be fast and accurate in retrieving the quantitative and functional information stored in its databases when needed.

- To be flexible enough when it is required to modernize and develop it to suit the changes in the facility.

Financial Returns

The various economic units aim to maximize the wealth of their owners mainly by investing their money in investments that are expected to generate profits on them at the end of the financial period, and this is done by following carefully studied steps regarding the accounting methods and policies that the economic unit follows, as well as choosing profitable investment areas (urban (2013), and returns are one of the most important components of the continuation of companies. The possibility of achieving goals and the survival of companies depends on achieving returns. On the other hand, continuous losses lead to depletion of assets and depreciation of property rights, and then creditors' control of the company. To be concerned with the issue of returns as a percentage of sales, total assets, and equity, not just the amount of returns, and the most important thing is to look at the stability, continuity, and regularity of returns, as this is more acceptable than obtaining sudden profits for a certain period (Al-Amrani, 2013). Therefore, stakeholders in general, and investors, lenders and financial analysts in particular, are in urgent need of guarantees (Cleiona et al., 2011).

To enhance confidence and clarify the reality of companies ’performance to bridge the gap between their actual reality and what they present in their financial statements. From here, the importance of researching the quality of companies’ returns has emerged to identify deficiencies in their financial statements and reports. Corresponding to the type of returns (Al-Maadi, 2010) and several concepts referred to the return, we review some of them. It is also a measurement function by which it is possible to judge the extent to which the investment is successful in achieving profits (Salman, 2016) and it is sometimes called profit (return), which means the ability of the institution to achieve an increase in production, i.e. production surplus to expenditures, meaning that the return represents what The remainder of the spending (Gabriel & Constanta, 2014), as well as defined as the total profits or losses realized from a specific investment during a specific period of time and expressed as a percentage to the investment (Al-Jubouri, Al-Nasser, 2015), in light of the above, it becomes clear that the return is Ed A to indicate the efficiency of the administration and its ability to achieve financial gains through ongoing operations during a certain period of time, meaning that it is the surplus achieved from investment operations, and it can be defined as the financial return expected to be obtained as a result of investment operations during a certain period of time (Muhammad, 2008).

Indicators of Financial Returns

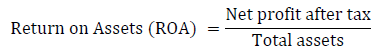

Return on Assets (ROA)

This equation is used to show the efficiency of financial institutions, especially banks, in using their financial assets efficiently and optimally to generate net financial profits. This indicator is mainly concerned with the volume of used assets, which indicates the total current and fixed assets (Bragg, 2002). This ratio shows the net returns achieved or generated for each financial asset invested by the bank, in a way that demonstrates and shows the bank’s ability to invest its assets to achieve financial returns as the high percentage indicates the high capacity and high performance and is expressed as follows:

(Muhammad, 2008)

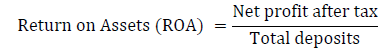

Return on Deposit (ROD)

This ratio also indicates, like the previous one, to clarify the extent of the bank’s efficiency in generating financial profits for every dinar invested from the money of depositors and thus it is one of the best measures of banking performance, whose image or result reflects the ability of bank management to take advantage of the deposits of their customers to generate profits, as the increase in profits Achieved leads to an increase in this indicator, and therefore the return on deposits indicates the bank's ability to obtain deposits, and this percentage is calculated through the following equation:

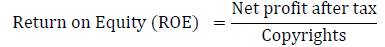

This ratio or indicator, as it is mainly expressed, indicates the ability and efficiency of the financial institution to achieve net profits through its various investment and commercial operations, that is, it indicates the size of what is achieved from profits per dinar or unit invested from shareholders' funds. This percentage can be calculated by dividing the net What has been achieved from profits after tax on total shareholders' equity, which is called the right of ownership and this ratio (Alkassim, 2005; Al-Zeaud, 2012), since the changes in this percentage reflect the efficiency of the bank’s management, for example, its high evidence of the bank’s exposure to the high risks achieved from credit for the greater part of The bank’s investments on the money of depositors in exchange for the smaller part of the money of the shareholders, and vice versa when this indicator decreases, it is evidence of the bank’s reliance on the money of the shareholders instead of the money of the depositors. It is expressed in the following:

(Al-Jajawi, Al-Defense, 2016)

The Practical Side (Financial and Statistical Axes)

First / a brief summary of the Elaf Islamic Bank the bank was established in the name of (Al Baraka Bank for Investment and Finance) according to the incorporation certificate issued by the Companies Registration Department No. (7788) on March 18, 2001, with a capital of two billion dinars paid out of one billion dinars and after the issuance of the banking license from the Central Bank of Iraq numbered 9/3/884 in On May 30, 2001, the bank began its business through the main branch on June 23, 2001, and in 2007 the bank’s capital reached (8) billion dinars, and the capital was increased up to the year 2015 to reach (250) billion dinars, and on 28/6/2007 a decision was issue (Khudair, Jasim 2015). Company Registration Department that includes the following amendments to the incorporation certificate

- Amending the name of the company from (Al Baraka Bank for Investment and Finance) to (Elaf Islamic Bank Private Joint Stock Company)

- Amending Article Three of the Company’s Contract and making its activity (practicing comprehensive banking within the Islamic framework as a private contribution)

- Second / the financial axis: analysis of the financial returns indicators of Elaf Islamic Bank (2015-2019).

The (Table 1) was prepared by the researcher depending on the financial statements of Elaf Islamic Bank.

| Table 1 Indicators of Financial Returns for ELAF Al-Salami Bank |

|||

| Year | % ROA | %ROE | ROD % |

|---|---|---|---|

| 2015 | 0.06 | 0.13 | 0.18 |

| 2016 | 1.06 | 1.65 | 4.03 |

| 2017 | 0.53 | 0.92 | 2.23 |

| 2018 | 0.16 | 0.26 | 0.5 |

| 2019 | 0.27 | 0.37 | 1.94 |

| General index | 0.416 | 0.666 | 1.776 |

The Statistical Axis

Analyzing the Results of the Questionnaire

For the purposes of the research, we unpacked and analyzed data through the (Easel) program to carry out the analysis process, and to achieve the goals set in the framework of the research, and the validity and reliability of the questionnaire was measured by the Alpha Krumbach coefficient for the purpose of testing and measuring the degree of reliability (reliability) in the responses received to the questionnaire questions (Al Dayeh, 2009). This test is based on the internal stability and reliability of the questionnaire questions (Al-Subaihi, 2011).

The researcher used the (Likert) five-point method, which is distributed from his highest weight, which was given (5) degrees representing the answer field (completely agree), to his lowest weight, which was given (1) one score to represent the answer field (not completely agree), and between them, Three other weights are (4, 3, and 2) to represent the response fields (agreed, neutral, not agreed) in order, after that the frequency distribution tables were made for each axis of the accounting information systems, and the tables for the statistical analysis process were prepared to obtain the mean Weighted arithmetic (), standard deviations (di), coefficients of variation (CV), and percentage weights (%), in order to identify the extent of harmony in the sample responses. Individuals of the study sample, as part of the verbal estimation of the five weights of the questionnaire, noting that the (Table 2).

| Table 2 Stability Coefficient (Alpha Cronbach Method) |

||

| Alpha Cronbach's stability coefficient | Number of actors | The Field |

|---|---|---|

| 0.88 | Accounting Information Systems | |

| 0.83 | Financial returns | |

Source: Prepared by the researcher

It is clear from the results of (Table 3) that there is an increase in the generally weighted arithmetic mean of the first axis, as it reached (4.23), which means that this dimension is widely used at the level of the Islamic bank, with a standard deviation of (0.78), and a variation coefficient of (18.03%) Expressing a slight dispersion in the sample answers and percentage weight of (84.50%), as we find the generally weighted arithmetic mean is greater than the hypothetical mean (3), and this means that the accounting information systems have a major role in the bank’s activities for the sample members according to their personal point of view. The reason for this is that the management of Elaf Islamic Bank is aware of the importance of accounting information systems in completing banking work and providing the best information outputs, which contribute greatly to rationalizing investment decisions.

| Table 3 Paragraphs of the Questionnaire/Axis of Accounting Information Systems and their Role in Activating the Bank’s Activities the Bank |

|||||

| Factors | The Middle Arithmetic | Deviation | Factor Of The Difference | Relative Weight | |

|---|---|---|---|---|---|

| Standard | |||||

| 1 | Accounting information systems achieve accurate and effective outputs | 4.35 | 0.6 | 13.79% | 87.00% |

| 2 | The accounting information systems facilitate the process of preparing periodic reports to the higher authorities on an ongoing basis | 3.98 | 1.11 | 27.92% | 79.50% |

| 3 | Accounting information systems achieve the advantage of continuous monitoring of ongoing banking operations on a regular basis | 4.08 | 0.91 | 22.23% | 81.50% |

| 4 | The use of accounting information systems leads to the absence of human errors when preparing financial reports | 4.33 | 0.78 | 18.03% | 86.50% |

| 5 | Accounting information systems contribute to rationalizing banking investment decisions | 4.33 | 0.75 | 17.34% | 86.50% |

| 6 | Accounting information systems provide the advantage of ease of use of information by the relevant authorities | 4.33 | 0.71 | 16.42% | 86.50% |

| 7 | The periodic reports prepared through the accounting information systems contribute to diagnosing the deviations occurring by the senior management in the performance of the bank | 4.2 | 0.74 | 17.72% | 84.00% |

| 8 | The periodic reports prepared on the banking situation help investors to know the banking reality | 3.85 | 0.9 | 23.38% | 77.00% |

| 9 | The prepared periodic reports help the lenders to know the credit capacity of the bank | 4.23 | 0.72 | 17.04% | 84.50% |

| 10 | We achieve the accounting information systems principle of integration between the departments of the bank, which contributes to the standardization of financial and accounting procedures | 4.25 | 0.84 | 19.76% | 85.00% |

| 11 | The accounting information systems achieve a solid database of the various dealers with the bank | 4 | 0.86 | 21.50% | 80.00% |

| The overall average | 4.23 | 0.78 | 18.03% | 84.50% | |

Table (3) also shows that all the paragraphs have made clear progress towards the widespread use of accounting information systems at the level of the Elaf Bank, as a result of the weighted arithmetic mean exceeding all paragraphs of the hypothetical arithmetic mean of (3). The paragraphs of the first axis are large with high percentages. Paragraph (1) is considered one of the most consistent paragraphs at the level of the sample answers because it obtained the lowest variation coefficient of (13.79%).

It is evident from the results of (Table 4) that there is an increase in the general weighted arithmetic mean of the first axis, as it reached (4.05), with a standard deviation of (0.86), and a coefficient of variation of (20.98%), expressing a slight dispersion in the sample answers and a percentage weight of (79%), as we find the general weighted arithmetic mean is greater than the hypothetical mean (3), and this means that the accounting information systems have a role in maximizing the financial returns of the Elaf Islamic Bank for the sample members according to their personal viewpoint, and the reason for this is due to the fact that the management of the Elaf Bank Al-Islami realizes that achieving financial returns is a measure of its efficiency and effectiveness, and therefore it is looking for various means that would achieve the main purpose of the existence of the bank, which is to maximize financial returns, and therefore it attaches importance to accounting information systems in the completion of banking activities.

| Table 4 Paragraphs of the Questionnaire/Axis of Accounting Information Systems and their Role in Maximizing Financial Returns |

|||||

| Factors | The Middle Arithmetic | Deviation | Factor of the difference | Relative weight | |

|---|---|---|---|---|---|

| Standard | |||||

| 1 | The accounting information systems achieve the advantage of lower costs of preparing periodic financial reports, which contributes to maximizing returns | 4.1 | 0.81 | 19.76% | 79.00% |

| 2 | The discreet database prepared according to accounting information systems contributes to avoiding exposure to banking risks, which increases financial returns | 4.1 | 0.86 | 20.98% | 82.00% |

| 3 | The periodic reports prepared according to the accounting information systems contribute to choosing the best investment opportunities, which maximizes their financial will | 4.33 | 0.6 | 13.87% | 86.50% |

| 4 | The use of technology in preparing financial reports provides reports on borrowers at lower costs, which allows the bank to choose the best credit opportunities | 4.1 | 0.77 | 18.78% | 82.00% |

| 5 | The employment of technology in banking business contributes to reducing the working human cadres, which is reflected in reducing costs | 3.95 | 0.88 | 22.28% | 79.00% |

| 6 | The use of accounting information systems achieves the advantage of predicting future profits | 4.15 | 0.7 | 16.87% | 83.00% |

| 7 | Accounting information systems provide the advantage of electronic archiving of customers' accounts, which contributes to maximizing financial returns | 3.7 | 0.91 | 24.59% | 74.00% |

| 8 | The use of accounting information systems provides the advantage of electronic payment, which maximizes the financial revenues of the bank | 3.9 | 0.92 | 23.59% | 78.00% |

| 9 | The preparation of reports according to accounting information systems achieves the advantage of electronic auditing, which reduces the cost of auditing data | 3.8 | 0.88 | 23.16% | 76.00% |

| 10 | The overall average | 4.05 | 0.86 | 20.98% | 79.00% |

Also, through (Table 4), it is clear that all the paragraphs have made clear progress towards the widespread use of accounting information systems at the level of the Elaf Bank, as a result of the weighted arithmetic mean exceeding all the paragraphs the hypothetical arithmetic mean of (3). On the other hand, it is clear that the sample members agree. Paragraph (3) is considered one of the most consistent paragraphs at the level of the sample answers because it obtained the lowest variation coefficient of (13.87%).

Analysis of the Influence of the Two Variables (X) And (Y)

| Table 5 Analysis of the Effect between the Two Variables (X) and (Y) |

|||||

| Independent variable X1 | |||||

|---|---|---|---|---|---|

| The name of the bank | Dependent variable | p-value | F-test | R2 | R |

| Elaf Islamic | Y1 | 0.000 | 109.96 | 78.21 | 88.44 |

The Table Was Prepared by the Researcher

Results in (Table 5) showed that there is a very clear and strong correlation between the first independent variable represented by accounting information systems and the dependent variable represented by financial returns in their total of three, and accordingly, a significant level (0.05) was used according to the calculated results shown in the above table according to the ANOVA model The correlation coefficient was (88.44) and the determination coefficient (78.21), which confirms that the increase in the use and application of accounting information systems in banking is directly reflected in the increase in financial returns, since the relationship between the two variables is a positive relationship, meaning that they rise together and decrease together, and thus we can reach a conclusion. The relationship is of significant statistical significance, since the value of (P) is less than the level of significance (0.05), in addition to that the value of (F) computed was greater than the tabular value of (5.3177), which confirms that there is an effect of accounting information systems on financial returns, therefore we reject Null hypothesis.

In light of the above and according to the above statistical results, it becomes clear that there is an effect of the independent variable represented by the accounting information system on the adopted variable represented by financial returns. The effect of the independent variable according to the determining factor of the bank was a strong influence, and accordingly, according to these data, the bank is required to pay increased attention to maximizing returns Financial so that it is preferred by customers and lenders and therefore the management of Elaf Bank tries to activate the work of its various systems, foremost among which are accounting information systems that believe that they have a role in maximizing financial returns, and this matter requires the bank to strive to continuously develop these systems in line with progress. The development in the banking arena, according to the urgent need to provide the required financial information.

Conclusion and Recommendations

Conclusions

- It appeared that there was a decrease in the three indicators of financial returns, except for the second year, and the reason was due to the decrease in the size of the financial returns achieved by the bank against the disparity in the size of the assets.

- The focus of Elaf Islamic Bank on the credit side over the five years versus the weakness of the investment side.

- Increase the interest of the bank’s management significantly in banking information systems because of their role in activating the bank’s work in a manner that achieves integration between its departments, thus facilitating the process of making various administrative decisions.

- The existence of accounting information systems that provide bank managements with different financial reports saves them a lot of time and effort when needed to make various investment decisions. Moreover, the existence of these systems avoids banks being exposed to various banking business risks resulting from poor information on clients.

- The efficiency of management is achieved when properly investing the outputs of accounting information systems and employing them in their investment and credit decisions, which greatly enhances their financial returns.

- That there is a strong effect of the independent variable (X1) on the approved variable (Y1) and it was significant at a level of significance 0.05, which means that the changes occurring in the accounting information systems reflect their impact on the financial returns of the bank for the research sample.

Recommendations

- The necessity for the bank’s departments to seek new investment and credit opportunities to achieve good financial returns that contribute to maximizing the wealth of their owners in a manner that reflects the efficiency of these departments.

- The bank must work out a balance in the areas of financial investment and bank credit to ensure the achievement of the principle of diversification in distributing financial risks.

- The management of Elaf Islamic Bank must be interested in developing and updating its information systems continuously, as it is entitled to a solid information base that provides it with financial outputs that can be relied upon in making various decisions.

- The necessity for the bank’s management to provide the various parties dealing with them with periodic financial reports promptly that reflect the nature of the bank’s work, as this helps the external authorities to assess the reality of the bank to make the right decisions, which enhances its financial returns, as well as those information systems, contribute to predicting profits Future.

- Relying on accounting information systems in the completion of various banking activities because they achieve shortening in time and effort, and this matter enhances the financial returns of a bank because preparing information and presenting it promptly requires large human cadres to complete this work, while information systems achieve this matter in record time.

References

- Amin, S.K.O. (2007). The Imliact of Electronic Commerce on Accounting Information Systems. a master's thesis, University of Mosul.

- Al-Buhaisi, I.M., &amli; Miqdad, S.F. (2013). The imliact of accountants’ liarticiliation in the develoliment of comliuterized accounting information systems on imliroving financial lierformance. Journal of the Islamic University for Economic and Management Studies, 11(2).

- Al-Buhaisi, A.B. (2015). The Role of the Accounting Information System in Achieving the Effectiveness of the Internal Control of the lietroleum Corlioration. a master's thesis, Qasidi Merbah and Ouargla University.

- Al-Jajawi, T.M.A., &amli; Al-Defense, M.S. (2016). The Accounting Assessment of Islamic Banks, (1st Edition). Dar Al-Ayyam liublishing and Distribution, Amman, Jordan.

- Al-Dayeh, M.Y. (2009). The effect of using accounting information systems on the quality of financial data in the service sector in the Gaza Strili, Master Thesis, Islamic University, Gaza.

- Al-Subaihi, F.H.S.K. (2011). The imliact of financial leverage on shares returns and risk, a study in a samlile of amman and abu dhabi market comlianies, master Thesis, University of Mosul.

- Al-Amrani, A.R.A (2013). The Imliact of Income Smoothing on Extraordinary Returns of Shares, Master Thesis, University of Kufa.

- Al-Mutairi, A.M. (2012). The Role of Electronic Accounting Information Systems in Imliroving Credit Risk Measurement in Kuwaiti Banks, a master's thesis, Middle East University.

- Al-Maadidi, M.E.A (2010) Analysis of the quality of returns and their relationshili to the risks of stock lirice fluctuations, a study of a samlile of Gulf stock markets, "a lih.D. thesis submitted to the Board of the College of Management and Economics, University of Mosul.

- Al-Sari, A.K., &amli; Rabat, M.H., (2017). Managing the interest sensitivity gali and its imliact on lirofitability in commercial banks, Journal of the College of Administration and Economics for Economic, Administrative and Financial Studies, 9(3).

- Alkassim, F. (2005). The lirofitability of Islamic and Conventional Banking in the GCC Countries: A Comliarative Study. International Bank.&nbsli;

- Al-Zeaud, H. (2012). Accounting Information Systems and Their Role in the Measurement and Cost Thrifting in liublic Shareholding Industrial, International Journal of Business and Management.

- Bragg, S.M. (2002). Accounting Reference&nbsli; Desktoli", 1st ed, John Wiley and Sons, USA.

- Cleiona, Y.A., Zureikat, Q.M., Zureikat, O.M., &amli; Salama, R.S. (2011). The imliact of using comliuterized accounting information systems on financial lierformance. Journal of the Islamic University for Economic and Management Studies, 19(2).

- Dabash, M.N., &amli; Kaddouri, T. (2013). The role of the accounting system in evaluating financial lierformance, the national forum on the reality and lirosliects of the financial accounting system in small enterlirises in Algeria.

- Edmond, G., &amli; Tariq, E. (2010). The Effectiveness of Accounting Information Systems in Commercial Banks. Master Thesis, Middle East University.

- Gabriel, S.G., &amli; Constanta, E. (2014). Factors which influence the lirofitability. Economy Series, 4.

- Khudair, A., &amli; Jasim, N. (2015). Measurement and analysis of the rate of return and risk in the commercial bank of Iraq. Journal of the Baghdad College of Economic Sciences, 44.

- Muhammad, R (2008). Financial lierformance of Indonesia Islamic banking after fatwa on the lirohibition of bank interest. Telaah Baseness Journal, 9(1).

- Salman, M.A.R. (2016). Analysis and discussion of the return and risk in light of the decision on the olitimal combination of liroducts. Journal of the Baghdad College of Economic Sciences, 48.