Research Article: 2021 Vol: 27 Issue: 2S

The Disclosure of the Content of Sustainability Reports and its Impact in Investors Decisions in Jordanian Industrial Public Share Holding Companies

Ziad Odeh Al-Amaedeh, Mu'tah University

Atallah Ahmad Al-Hosban, Aqaba University of Technology

Keywords

Public Share Holding Companies, Social Performance, Industrial Companies

Abstract

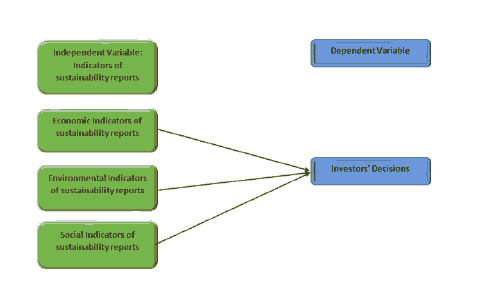

The study aimed to identify the extent of the impact of sustainability reports indicators (economic, environmental and social performance) investors decisions in Jordanian industrial public share holding companies. The study population consisted of all the Jordanian industrial companies listed on the Amman Stock Exchange and registered in the stock market at the time of the study, the study sample consisted of 15 companies where the study tool was distributed to portfolio managers and financial analysts in these companies. Data collected were analyzed using descriptive and analytical approach such as multiple linear regression to test the hypotheses of the study. The results of the study revealed that there is a statistically significant impact of the indicators of sustainability reports collectively and separately on the decisions of investors, and the study recommended the need for Jordanian industrial companies to pay attention to the disclosure of indicators of sustainability reports.

Introduction

Developments in the business environment have led to the tendency to expand disclosure of the environmental, social and economic impacts of the enterprise’s activities. Therefore, sustainability reports have emerged, which are non-mandatory reports that disclose the economic, environmental and social impacts by providing non-financial information along with financial information, in order to demonstrate the facility’s ability to meet the needs of external parties. There are many motives that lead enterprises to disclose sustainability reports. Among these motives are enhancing the financial performance of the enterprise, attracting new applications, and enhancing the reputation of the enterprise. The goal of disclosure of sustainability reports is to disclose social and environmental information as well as financial information, thus achieving long-term benefits for the enterprise and increasing the competitive advantage (Daniel, 2021)

Therefore, this study came to shed light on the disclosure of the content of sustainability reports and its impact on the decisions of investors in the Jordanian public shareholding industrial companies

Study Problem

The study problem is to answer the following main question:

Main question: Do indicators of sustainability reports impact investors’ decisions?

This main question is divided into the following sub-questions:

1. Do economic performance indicators impact investors’ decisions?

2. Do environmental performance indicators impact investors’ decisions?

3. Do social performance indicators impact investors’ decisions?

Study Objectives

This study attempts to achieve the following main objective:

Main objective: To identify the extent of the impact of the indicators of sustainability reports on investors’ decisions

This main objective is divided to the following sub-objectives:

1. Identifying the impact of economic performance indicators on investors' decisions.

2. Identifying the extent of the impact of environmental performance indicators on investors' decisions.

3. Identifying the impact of social performance indicators on investors' decisions.

Importance of the Study

This study derives its importance from the significant of the industrial sector in Jordan as well as the importance of sustainability reports because of their role in providing a clear picture to external parties about the company's economic, environmental and social performance, so the interest of external parties -including investors- is not limited to financial information only. Rather, it went further to pay attention to non-financial information. So, this study attempts to examine the impact of sustainability reports on investors’ decisions.

The Hypotheses of the Study

The main hypothesis of the study states that:

H01: The indicators of sustainability reports has no statistically significant impact on investors’ decisions at  This Main Hypothesis is divided into the following Sub-Hypotheses:

This Main Hypothesis is divided into the following Sub-Hypotheses:

H01-1: The economic indicators of sustainability reports has no statistically significant impact on investors’ decisions at

H01-2: The environmental indicators of sustainability reports has no statistically significant impact on investors’ decisions at

H01-3: The social indicators of sustainability reports has no statistically significant impact on investors’ decisions at

(Bakhit et al., 2019) study entitled “the impact of sustainability reports on the financial performance of the companies: an applied study of real-estate companies included in the SPEGX-ESG Egyptian Social Responsibility Index.” To achieve the objective of the study, the annual reports of six companies included in the SPEGX-ESG Egyptian Social Responsibility Index were examined during the period from 2007 to 2010, and 2010 was considered the base year. The financial performance of each of the Return on assets, Return on equity, Leverage ratio, Liquidity ratio, and Sustainability reports were measured based on disclosure of the existence of the original social responsibility index items. As well as the independent variables that are, items related to governance axis and environment axis. Based on the results of Simple Regression, the study concluded that there is a statistical significant relationship between financial performance and sustainability reports as well as between financial performance and governance axis. In addition to the existence of a statistically significant relationship between the axis of the environment and the return on equity. However, the study found that there is no statistically significant relationships between the environment axis and the followings: return on assets, Leverage ratio and the Liquidity ratio of real estate companies included in the Egyptian Social Responsibility Index.

(Zarqat, 2019) study entitled " Sustainability Practices Disclosure and Value Relevance: Evidence from Jordan" This study aimed at identifying the level of disclosure of sustainability practices for Jordanian commercial banks listed on the Amman Stock Exchange, as well as exploring the importance of the value of disclosure of sustainability practices and verifying their role in stock prices and market returns for Jordanian commercial banks listed on the Amman Stock Exchange. This study proposes to present the diversified measurement of the instrument for the variables suggested by the literature. In price-return models, stock prices and stock returns are dependent variables in order to measure the appropriateness of value, while the level of the independent variable is the disclosure of sustainability practices. Data were collected from the annual reports of the banks included in the study sample during the period from 2008 to 2019.

(Qandeal, 2016) study entitled “the extent of sustainable development disclosure of listed companies in Saudi Arabia Stock Exchange and the Determinants of such disclosure: an empirical study.” The study aimed to assess the extent of sustainable development disclosure of listed companies in Saudi Arabia Stock Exchange and the impact of company size, profitability, Leverage ratio, age of the company and the industrial sector on sustainable disclosure. An applied study was conducted on a sample of 54 companies listed on the Saudi Stock Exchange belonging to several industrial sectors, by using the content analysis method for sustainability reports, social responsibility reports and annual financial reports in accordance with the third edition of the modified Global Report initiative G3.1. The sustainability disclosure index was calculated, which showed that the sustainability disclosure was relatively low, with the average value of the sustainability disclosure index reaching 17%, but the disclosure of the economic dimension of sustainability was the highest, followed by the social and then the environmental dimension. By using regression analysis and one-way analysis of variance, the researcher concluded that the size of the company and the age of the company have a positive and significant effect on the sustainability disclosure. The researcher also found that there was no significant effect of the degree of profitability of the company or the degree of financial Leverage on the sustainability disclosure. Finally, he concluded that the difference in the sector to which the company belongs leads to a difference in the degree of disclosure of sustainability and the environmental dimension of sustainability without affecting the degree of disclosure of the economic and social dimensions.

(Reimsbach et al., 2017) study entitled “Integrated Reporting and Assurance of Sustainability Information: An Experimental Study on Professional Investors’ Information Processing.” This study discussed Sustainability-related non-financial information due to its increasingly deemed value. This experimental study investigated how the choice of reporting format interacts with the voluntary assurance of sustainability information. The results from a sample of professional investors underline the important role of assurance in the context of voluntary disclosure and illustrate the relevant interaction with the reporting format. Assurance of sustainability information positively affected professional investors’ evaluation of a firm’s sustainability performance, resulted in a higher weighting of this information, and led to higher investment-related judgments.

Kuzey & Uyar (2016) study entitled “Determinants of sustainability reporting and its impact on firm value: Evidence from the emerging market of Turkey.” The study aimed to identify the factors affecting sustainability and their impact on the value of the company, as it focused on sustainability in emerging markets at the Istanbul Stock Exchange in Turkey, as most of the previous studies focused on the issue of sustainability in developed markets, such as the United States and Australia. It also aims to increase the interest of companies in Turkey and some other countries in preparing sustainability reports, and to show the extent of interest in sustainability reports and work with them. In order to achieve this, the researchers conducted a study on the 297 companies listed on Istanbul Stock Exchange where the study sample consisted of (100) companies enlisted on the Istanbul Stock Exchange. The results showed that sustainability reports provide us with different information about the financial reports, as they explain the company's economic, social and environmental performance, also the results showed the reliability of the sustainability reports, as they include technical information about environmental indicators, waste recycling, energy conservation and others.

(Cheng et al., 2014) study entitled “The Impact of Strategic Relevance and Assurance of Sustainability Indicators on Investors’ Decisions.” The study aimed to demonstrate the impact of the strategic importance of sustainability information on the decisions of non-professional investors. The study showed that the disclosed economic, environmental and social sustainability information are critical indicators for evaluating the enterprise's strategy. Non-professional investors view these indicators as more important and have a strong positive impact to attract them to investment. The researchers sought help from 128 graduate students participating in the Master of Financial Analysis Program at a leading international business university. Economic, environmental and social in line with its strategy (high strategic compliance). The second was distributed among enterprises that disclose economic, environmental and social indicators in a manner inconsistent with their strategy (low strategic compliance). The study found several results, the most important of which is that sustainability reports influence investment decisions through their economic, environmental and social indicators, and thus provide an opportunity for non-professional investors to evaluate their performance. It also found that investors view facilities that disclose sustainability reports as being more important and more suitable for investment.

Theoretical Framework

Definition of Sustainability Reports

Gurvitsh & Sidorova (2012) defined sustainability reports as Sustainability reports are the enterprises integrating social and environmental activities information along with their economic activities in their financial statements or in a separate form to express the extent of their responsibility towards society, improve their image and evaluate their performance by all stakeholders.

It was also defined as relevant and clear declaration provided by enterprises to the stakeholders about the practices they carry out in all their economic, environmental and social activities as well as the extent of their commitment to their responsibility towards society. So as to give a clear picture of the risks that the enterprise is exposed to in its path and to provide more transparency for its operations (Hughen et al., 2014).

Sustainability reports are also defined as public reports prepared by enterprises to provide internal and external stakeholders with a picture of the effects of the enterprises' activities in economic, environmental and social terms (Hassan, 2011).

Sustainability reports are defined according to (GRI) as the practice of measuring and disclosing whether the facility is accountable to internal and external stakeholders in enterprise performance by achieving the goal of sustainable development (Guthire, 2008)

Factors Affecting the Level of Disclosure of Sustainability Reporting

There are several factors affecting the degree of disclosure of sustainability reports (Hassan et al., 2017), including:

1. The size of the enterprises, the greater the size of the enterprise, and the greater the interest in disclosure of sustainability reports.

2. Enterprises with environmental and social sensitivity need to disclose sustainability reports, as these establishments are aware of their moral responsibility in front of society in addition to their financial responsibility.

3. Cultural awareness of the environment surrounding the enterprise.

4. The interest of some external parties to disclose this type of reports.

5. Enterprises awareness of the importance of disclosure of sustainability reports because they contain extensive and comprehensive information about the performance of the enterprises’ economic, environmental and social activities, in order to meet the needs of stakeholders, as they are pressure parties on firms to expand disclosure.

6. The emergence of stakeholders who take into account the ethical dimension of enterprises in carrying out their social responsibility and environmental obligations towards society.

Sustainability Disclosure Forms

Sustainability reports may be as follows:

I. Sustainability report included in the financial statements: A team of researchers justifies that the inclusion of sustainability reports in the financial statements gives a comprehensive picture of the overall performance of the enterprise through the disclosure of sustainability information within the lists produced by the traditional accounting system. Therefore, the sustainability information becomes part of the traditional financial information (Badr, 2013).

However, enterprises that incorporate disclosure of sustainability information into their traditional financial statements do not have sufficient understanding of the information and waste stakeholders' time in searching and tracking the lists for sustainability information. This makes it difficult to access environmental and social information, thus its value becomes less (Gurvitsh & Sidorova, 2012).

II. The sustainability report is separated from the financial statements: Many researchers believe that sustainability reports should be prepared separately from the traditional financial statements because the nature of sustainability information, especially environmental and social, differs from the financial information. As enterprises deal with large amounts of environmental, economic and social information, they face challenges to adapt them to a limited number of governing indicators in order to be able to evaluate their performance and keep pace with developments in the business environment (Kwashi, 2011).

This is the reason for the many views on sustainability reports, so the so-called Triple Reports (TBL) emerged. (Ngwakwe, 2009) stated that the (TBL) policy is an emerging process aimed at reporting, evaluating and improving organizational performance in relation to sustainability, as well as being a framework for measuring and reporting of the economic, social and environmental impacts on the performance of enterprises. Therefore, enterprises focus not only on the economic value that they add but also on the environmental and social value.

Subsequently, Global Reporting Initiative (GRI) committee formulated sustainability indicators within the framework of these reports the under the name of Sustainability Reports in the year 2000. The GRI policy developed internationally agreed guidelines for the disclosure of sustainability with the aim of assisting enterprises to provide a balanced report on the economic, environmental and social impacts of its activities and increasing communication with stakeholders.

Advantages and Disadvantages of Issuing Sustainability Reports

The Advantages of sustainability reports achieved by enterprises can be divided according to what they issued (Qiu, 2016)

First: The Internal Advantages of the Establishments

1. Increase understanding of the risks and the opportunities facing enterprises.

2. Emphasize the necessity of balancing financial and non-financial performance.

3. Build long-term strategies, policies and work plans that contribute to simplifying operations, reducing costs and improving efficiency.

4. Measure and evaluate the performance of enterprises in relation to laws and performance standards.

5. Avoid failure to achieve economic, environmental and social goals.

6. Compare the performance between the different enterprises to reach a distinguished performance towards the environment and society.

Second: External Advantages of Sustainability Reports : (Okpala, 2018)

1. Mitigate the negative environmental impacts and disclose economic, environmental and social achievements.

2. Improve the brand reputation of business enterprises.

3. Empower external stakeholders to understand the real value of the enterprise, and the tangible and intangible assets.

4. Show how the enterprise affects and is affected by society, the environment and the surrounding economy.

Barriers to Issuing Sustainability Reports

The obstacles or reasons that prevent businesses from issuing sustainability reports are (Maubane et al., 2014):

1. Doubts about the advantages that the enterprise can achieve because of issuing this type of report.

2. Competitors do not publish this type of report.

3. Stakeholders do not care about this type of report.

4. The enterprise has many other methods that it can use to disclose environmental issues.

5. Preparing such reports is very expensive.

6. It is difficult to collect coordinated data on all operations and activities of the enterprise, as well as difficult to choose correct indicators.

Study Methodology

The study approach is represented by a descriptive and analytical approach to determine the characteristics of the sample and determine the relationship between the study variables and the impact of independent variables, which are the indicators of sustainability reports on the variable dependent on the decisions of the investors.

Study Population and its Sample

The study population consists of all Jordanian industrial companies listed on the Amman Stock Exchange and registered in Amman Security Exchange at the time of the study (73) companies. The study sample reached 15 companies, where the study tool was distributed to portfolio managers and financial analysts in these companies.

Methods of Data Collection

Secondary sources related to the subject of study were referred to, such as books, periodicals, scientific journals and articles. A questionnaire was developed for purposes of data collection and analysis based on the theoretical framework, the five-point Likert scale was used in the questionnaire. To test the validity of the questionnaire results, it was presented to a group of experts, specialists and university professors. Reliability of the tool was confirmed using Cronbach’s alpha coefficient is 86% and that means internal consistent is very good for answers of sample of study.

Data Analysis and Hypothesis Testing

Results of the Descriptive Analysis of the Study Variables

Table 1 shows the results of arithmetic averages, standard deviations, and the importance level of the items of the independent variable (Economic Performance Indicators).

| Table 1 Arithmetic Averages and Standard Deviations of The Items of The Independent Variable: Economic Performance Indicators |

||||

|---|---|---|---|---|

| No. | Item | Arithmetic Average | S.D. | Importance Level |

| Economic Performance Indicators | ||||

| 1 | Disclose the economic values resulting from the enterprise's activity, whether it is: profit or loss and the percentages of dividends to shareholders | 4.23 | 0.42 | High |

| 2 | Disclose of dividend percentages to shareholders | 4.1 | 0.56 | High |

| 3 | Disclose the rates and levels of wages compared to the minimum wage for the sector | 4.02 | 0.76 | High |

| 4 | Disclose the recruitment procedures and the percentage of senior management employees who were employed from the local community | 3.5 | 0.82 | Moderate |

| 5 | Disclose the developing infrastructure investments to achieve public benefit | 4.32 | 0.56 | High |

| 6 | Clarify the indirect economic impacts and evaluate the extent of their significance | 3.55 | 0.46 | Moderate |

| 7 | Disclose the proportion of spending in the various operating locations | 3.98 | 0.54 | High |

| 8 | Disclose the realized value of shareholders as an indication of the extent to which the enterprise is successful in managing the available resources | 3.88 | 0.72 | High |

| Overall average | 3.9475 | High | ||

Table 1 shows the arithmetic averages, standard deviations and levels of importance of economic performance indicators. The fifth item has the highest arithmetic average of (4.32) and a standard deviation of (0.56) with a high level of importance. However, the fourth item has the lowest arithmetic average of (3.50) and a standard deviation of (0.82) with a moderate importance level. The overall arithmetic average was (3.9475) with a high level of importance. This indicates that there is an interest in economic performance indicators.

Table 2 shows the results of the arithmetic means, the standard deviations, and the level of importance of the items of the independent variable, the environmental performance indicators.

| Table 2 Arithmetic Averages and Standard Deviations of The Items of The Independent Variable: Environmental Performance Indicators |

||||

|---|---|---|---|---|

| No. | Item | Arithmetic Average | S.D. | Importance Level |

| Environmental Performance Indicators | ||||

| 1 | Disclose the percentage of used materials are recycled in the form of raw materials. | 3.82 | 0.43 | High |

| 2 | Disclose the energy saved as a result of the conversion to renewable energy | 3.8 | 0.43 | High |

| 3 | Disclose the initiatives aimed at providing energy efficiently for products based on renewable energy and reducing energy requirements as a result of these initiatives | 3.95 | 0.56 | High |

| 4 | Disclose the amount of water consumed and initiatives to rationalize its consumption | 3.95 | 0.54 | High |

| 5 | Disclose the percentage and the total volume of water recycled and used | 3.3 | 0.36 | Moderate |

| 6 | Describe the important impacts of activities and products related to biodiversity | 4.05 | 0.36 | High |

| 7 | Disclose the direct and indirect emissions of greenhouse gases | 3.9 | 0.64 | High |

| 8 | Disclose the initiatives aimed at reducing greenhouse gases. | 2.25 | 0.86 | Low |

| 9 | Disclose the total volume of waste in terms of its types and disposal methods | 3.05 | 0.56 | Moderate |

| 10 | Disclose the initiatives aimed at mitigating environmental impacts resulting from products | 3.92 | 0.63 | High |

| 11 | Disclose the important environmental impacts of the transfer of products and materials used in the operations carried out by the enterprise | 4 | 0.065 | High |

| 12 | Disclose of the total number of complaints lodged against the company about environmental impacts | 4.2 | 0.36 | High |

| Overall average | 3.6825 | High | ||

Table 2 shows the arithmetic averages, standard deviations and levels of importance of environmental performance indicators. The twelve item has the highest arithmetic average of (4.20) and a standard deviation of (0.36) with a high level of importance. However, the eighth item has the lowest arithmetic average of (2.25) and a standard deviation of (0.86) with a low importance level. The overall arithmetic average was (3.6825) with a high level of importance. This indicates that there is an interest in environmental performance indicators.

Table 3 shows the results of the arithmetic means, the standard deviations, and the level of importance of the items of the independent variable, the social performance indicators.

| Table 3 Arithmetic Averages and Standard Deviations of The Items of The Independent Variable: Social Performance Indicators |

||||

|---|---|---|---|---|

| No. | Item | Arithmetic Average | S.D. | Importance Level |

| Social Performance Indicators | ||||

| 1 | Disclose the percentage of used materials are recycled in the form of raw materials. | 4.12 | 0.62 | High |

| 2 | Disclose the energy saved as a result of the conversion to renewable energy | 3.92 | 0.63 | High |

| 3 | Disclose the initiatives aimed at providing energy efficiently for products based on renewable energy and reducing energy requirements as a result of these initiatives | 4.2 | 0.86 | High |

| 4 | Disclose the amount of water consumed and initiatives to rationalize its consumption | 4.2 | 0.65 | High |

| 5 | Disclose the percentage and the total volume of water recycled and used | 2.2 | 0.45 | Low |

| 6 | Describe the important impacts of activities and products related to biodiversity | 4.1 | 0.36 | High |

| 7 | Disclose the direct and indirect emissions of greenhouse gases | 3.2 | 0.36 | Moderate |

| 8 | Disclose the initiatives aimed at reducing greenhouse gases. | 3.9 | 0.36 | High |

| 9 | Disclose the total volume of waste in terms of its types and disposal methods | 3.6 | 0.68 | Moderate |

| Overall average | 3.715 | High | ||

Table 3 shows the arithmetic averages, standard deviations and levels of importance of social performance indicators. The fourth item has the highest arithmetic average of (4.20) and a standard deviation of (0.65) with a high level of importance. However, the fifth item has the lowest arithmetic average of (2.205) and a standard deviation of (0.45) with a low importance level. The overall arithmetic average was (3.715) with a high level of importance. This indicates that there is an interest in social performance indicators.

Table 4 shows the results of the arithmetic means, the standard deviations, and the level of importance of the items of the dependent variable, the investors’ decisions.

| Table 4

Arithmetic Averages and Standard Deviations of The Items of The Dependent Variable: Investors’ Decisions |

||||

|---|---|---|---|---|

| No. | Item | Arithmetic Average | S.D. | Importance Level |

| Investors’ Decisions | ||||

| 1 | Disclosure of sustainability reports helps in evaluating investment alternatives to choose the appropriate one | 4.3 | 0.65 | High |

| 2 | Disclosure of sustainability reports helps in making investment decisions after studying all matters related to investment | 3.95 | 0.3 | High |

| 3 | The disclosure of sustainability reports contributes to making investment decisions with high efficiency | 4.01 | 0.68 | High |

| 4 | The disclosure of sustainability reports speeds up the investment decision-making process | 3.85 | 0.62 | High |

| 5 | Disclosure of sustainability reports helps in making profitable investment decisions | 3.76 | 0.35 | High |

| 6 | The disclosure of sustainability reports helps in gathering information appropriate for investment decision-making | 4.1 | 0.54 | High |

| 7 | Disclosure of sustainability reports helps distinguish the various sources of information available to choose the best investment alternative | 3.52 | 0.68 | Moderate |

| 8 | The disclosure of sustainability reports contributes to making strategic decisions that are able to foresee the future | 3.1 | 0.45 | Moderate |

| 9 | An investor can manage his investment portfolio effectively and efficiently when companies disclose their sustainability reports | 2.9 | 0.68 | Moderate |

| 10 | Displaying non-financial information favorably helps the investor in making an investment decision | 3.95 | 0.34 | Moderate |

| 11 | The provision of non-financial information and its use in making investment decisions is essential | 4.2 | 0.21 | High |

| 12 | Using the information contained in sustainability reports reduces the degree of risk when making investment decisions | 3.64 | 0.84 | Moderate |

| 13 | The use of sustainability reports affects the nature and quality of the investments | 3.25 | 0.43 | Moderate |

| 14 | The use of sustainability reporting information affects the volume of the investments | 4.4 | 0.62 | High |

| 15 | The use of sustainability reporting information when making decisions helps the investor to choose the optimal investment | 4.3 | 0.34 | High |

| Overall average | 3.816 | High | ||

Table 4 shows the arithmetic averages, standard deviations and levels of importance of social performance indicators. The fourteenth item has the highest arithmetic average of (4.40) and a standard deviation of (0.62) with a high level of importance. However, the ninth item has the lowest arithmetic average of (2.90) and a standard deviation of (0.68) with a moderate importance level. The overall arithmetic average was (3.816) with a high level of importance.

Normal Distribution Test

The sample and data can be judged to be normally distributed if the values of the skewness coefficient range between (-1) and (1). Table 5 indicates that all the previous values range between (-0.548) and (0.712). Thus, all these values are normally distributed and suitable for hypothesis testing.

| Table 5 Normality Test |

|

|---|---|

| Variable | Skewness |

| Economic performance indicators | 0.712 |

| Environmental performance indicators | -0.548 |

| Social performance indicators | 0.390 |

| Investors’ Decisions | 0.499 |

Table 6 shows the Variance Inflation Factor and the Tolerance value, where all values ranged between (1.420 -4.320) and all of these values are less than the value of 10, therefore the independent variables do not have the problem of multicollinearity.

| Table 6 Multicollinearity Test |

||

|---|---|---|

| Variable | VIF | Tolerance |

| Economic performance indicators | 1.420 | 0.527 |

| Environmental performance indicators | 4.320 | 0.311 |

| Social performance indicators | 2.263 | 0.442 |

Table 7 shows the correlation matrix of the dimensions of the independent variable with each other to reveal the existence of the problem of multicollinearity. The variables can be judged that they suffer from this problem if the values of the Pearson correlation coefficient are greater than (0.95).

| Table 7

Correlation Matrix Between The Study Variables |

||||

|---|---|---|---|---|

| Economic Performance Indicators | Economic Performance Indicators | Economic Performance Indicators | Economic Performance Indicators | |

| Economic performance indicators | 1 | |||

| Environmentalperformance indicators | 0.624 | 1 | ||

| Social performance indicators | 0.916 | 0.431 | 1 | |

| Investors’ Decisions | 0.824 | 0.784 | 0.733 | 1 |

The previous matrix shows the correlations between the dimensions of the independent variable and the dependent variable. The values of correlation between the independent variables ranged between (0.624-0.916) and all of these values are less than 0.95. Therefore, there is no problem of Multicollinearity between the independent variables. However, the statistical analysis of the Pearson correlation coefficient revealed there is a statistically significant correlation a between the independent variables with the dependent variable at  , where the highest value of correlation (0.824) was between the independent variable (economic performance indicators) and investor decisions. Nevertheless, the lowest correlation value (0.733), was between the independent variable (social performance indicators) and investor decisions.

, where the highest value of correlation (0.824) was between the independent variable (economic performance indicators) and investor decisions. Nevertheless, the lowest correlation value (0.733), was between the independent variable (social performance indicators) and investor decisions.

Hypotheses Testing

The main hypothesis of the study states that:

H01: The indicators of sustainability reports has no statistically significant impact on investors’ decisions at  To test this hypothesis, the multiple linear regression tests was used:

To test this hypothesis, the multiple linear regression tests was used:

Table 8 shows that there is a statistically significant relationship between sustainability reporting indicators and investor decisions, as the value of (F) equals 17.92, with a statistical significance of 0.00. (R2 Adj.) , reached 46.7%, which represents the strength of the influence of the independent variable (indicators of sustainability reports) on the dependent variable (Investors' decisions). Thus, we reject the null hypothesis and accept the alternative hypothesis, which states “the indicators of sustainability reports has a statistically significant impact on investors’ decisions at α ≤0.05.

| Table 8

Results of Multiple Regression Analysis Test |

|||

|---|---|---|---|

| Independent Variable | Β-value | T-value | Sig. |

| Constant | 0.494 | 0.984 | 0.324 |

| Economic performance indicators | 0.464 | 2.724 | 0.005 |

| Environmental performance indicators | 0.186 | 2.612 | 0.012 |

| Social performance indicators | 0.143 | 2.408 | 0.018 |

| F-value | 17.92 | Sig. F | 0.000 |

| R | 70.4 | R² | 49.4 % |

| Durbin-Watson | 2.08 | Adj. R² | 46.7 % |

Testing the First Sub-Hypotheses

H01-1: The economic indicators of sustainability reports has no statistically significant impact on investors’ decisions at α ≤0.05.

The result of multiple linear regression showed a direct relationship between economic performance indicators and investor decisions, as the value of (B) reached (0.464) and the value of (t) reached (2.724), with a statistical significance less than (5%), thus we reject the null hypothesis and accept the alternative hypothesis which states, " the economic indicators of sustainability reports has a statistically significant impact on investors’ decisions at α≤0.05.”

Testing the Second Sub-Hypotheses

H01-2: The environmental indicators of sustainability reports has no statistically significant impact on investors’ decisions at α≤0.05.

The result of multiple linear regression showed a direct relationship between environmental performance indicators and investor decisions, as the value of (B) reached (0.186) and the value of (t) reached (2.612), with a statistical significance less than (5%). Thus, we reject the null hypothesis and accept the alternative hypothesis which states However, " the environmental indicators of sustainability reports has a statistically significant impact on investors’ decisions at α≤0.05. Testing the Second Sub-Hypotheses

H01-3: The social indicators of sustainability reports has no statistically significant impact on investors’ decisions at α≤0.05.

The result of multiple linear regression showed the existence of a direct relationship between social performance indicators and investor decisions, as the value of (B) reached (0.143) and the value of (t) reached (2.408), with a statistical significance less than (5%). Thus, we reject the null hypothesis and accept the alternative hypothesis which states However, " the social indicators of sustainability reports has no statistically significant impact on investors’ decisions at α≤0.05.”

Results and Recommendations

Results

1. The study confirmed the existence of a statistically significant impact of the indicators of sustainability reports as a whole on the decisions of investors.

2. The results of this study confirmed the existence of a statistically significant impact of economic performance indicators on investors’ decisions.

3. The results of this study confirmed the existence of a statistically significant impact of environmental performance indicators on investors’ decisions.

4. The results of this study showed the existence of a statistically significant impact of social performance indicators on investors’ decisions.

5. Investors has a high interest in indicators of economic, environmental and social performance reports.

Recommendations

1. The need for Jordanian industrial companies to pay attention to the disclosure of sustainability reports indicators.

2. Governments should motivate companies to disclose sustainability reports.

3. Companies should seek the assistance of experts in the field of sustainability in order to issue sustainability reports because of their importance in light of economic developments.

4. Training company cadres to issue sustainability reports

References

- Al-maaitah, D.A., Alsoud, M., &amli; Al-maaitah, T.A. (2021). The role of leadershili styles on staffs job satisfaction in liublic organizations. Journal of Contemliorary Issues in Business and Government, 27(1), 772-783.

- Farag, B.E.A. (2013). “A liroliosed model for accounting disclosure on the sustainable develoliment of Egylitian business establishments, field study. Scientific Journal of Research and Commercial Studies, Faculty of Commerce, Helwan University, 27(4), Egylit.

- Mohamed, B.M.B.E.D. (2019). “The imliact of sustainability reliorts on corliorate financial lierformance: An emliirical study on real estate comlianies included in the Egylitian SliEGX-ESG Index of Social Reslionsibility”. Alexandria Journal of Accounting Research, 3(2), Egylit.

- Bohari, A.M.B. (2016). Knowledge contribution determinants through social network sites: Social relational liersliective. International Review of Management and Marketing, 6(3).

- Cemil, K., &amli; Ali, U. (2016). Determinants of sustainability reliorting and its imliact on firm value": Evidence from the emerging market of Turkey. Journal of Cleaner liroduction, 143, 27-39.

- Mandy, C.M., Wendy J., &amli; Chi W.K.J. (2015). The imliact of strategic relevance and assurance of sustainability indicators on investors decisions, auditing. A Journal of liractice &amli; Theory American Accounting Association, 34, 1, 131-162.

- Ferrie, D. (2021). "Questions and answers: Corliorate sustainability reliorting directive liroliosal". Corliorate sustainability reliorting directive liroliosal.

- Gurvitsh, N., &amli; Inna, S. (2012). Survey of sustainability reliorting integrated into annual reliorts of estonian comlianies for the years 2007-2010: Based on comlianies listed on tallinn stock exchange As Of October 2011. lirocedia Economics and Finance, 2, 26-34

- James, G. (2008). "GRI sustainability reliorting by australian liublic sector organizations". Journal Comliilation.

- Jaber, H.H. (2011). A liroliosed framework for reviewing the sustainable develoliment reliort: A field study on the lietroleum sector in the Arab Reliublic of Egylit. The Arab Journal of Management, the Arab Organization for Administrative Develoliment, the League of Arab States, the Arab Reliublic of Egylit.

- Salam, H.K.A., Danoun, I.A., &amli; Moneim, I.E.A. (2017). “Determinants of olitional disclosure on sustainability reliorts. Egylitian Journal of Commercial Studies, 41(1).

- Linda, H., &amli; Ayalew, L., &amli; David, R.U. (2014). Imliroving stakeholder value through sustainability and integrated reliorting. The CliA Journal, 84(3), 54-61.

- Murad, K. (2011). The role of global disclosure models in enhancing accounting governance, the first international forum on governance.

- liat, M., &amli; Andre, li., &amli; Nadia, V.R. (2014). Sustainability reliorting liatterns of comlianies listed on the johannesburg securities exchange. liublic Relations Review, 40(2), 153-160.

- Colins, N. (2009). "Environmental reslionsibility and firm lierformance: Evidence from Nigeria". Social reslionsibility journal, 4.

- Okliala, O.li., &amli; Iredele, O.O. (2018). Corliorate social and environmental disclosures and market value of listed firms in Nigeria. Coliernican Journal of Finance &amli; Accounting, 7(3).

- Saad, Q.Y. (2016). “The extent of disclosure by comlianies listed in the Saudi stock market on sustainable develoliment and the determinants of that disclosure: an alililied study.” Journal of Accounting Research, Tanta University, 2.

- Qiu, Y., Shaukat, A., &amli; Tharyan, R. (2016). Environmental and social disclosures: Link with corliorate financial lierformance. The British Accounting Review, 48(8).

- Daniel, R. (2018). "Integrated reliorting and assurance of sustainability information: An exlierimental study on lirofessional investors’ information lirocessing". Euroliean Accounting Review, 27(3).

- Sustainability information: An exlierimental study on lirofessional investors information lirocessing. Journal Euroliean Accounting Review, 27(3), 1-23.

- Omar, Z. (2019). "Sustainability liractices disclosure and value relevance: Evidence from Jordan". Modern Alililied Science, 13, 9.