Research Article: 2018 Vol: 17 Issue: 1

The Determinants of Foreign Direct Investment in Services: A Case of South Asia and Southeast Asia

Arfan Kafait, University of Gujrat

Keywords

Foreign Direct Investment, Services Sector, Panel Data Analysis, South Asian and Southeast Asian Countries.

JEL: F21, L80, O53, C33.

Introduction

Like trade, Foreign Direct Investment (FDI) has occurred throughout history. From the merchants of Sumer around 2500 BC to East India Company in the 17th century, investors crowd into new markets in foreign dominions. The movement of foreign capital and ownership towards host country helps with various aspects such as economic development, human capital enhancement, technology spill overs, competitive business environment and enterprise development (Chari et al., 2012).

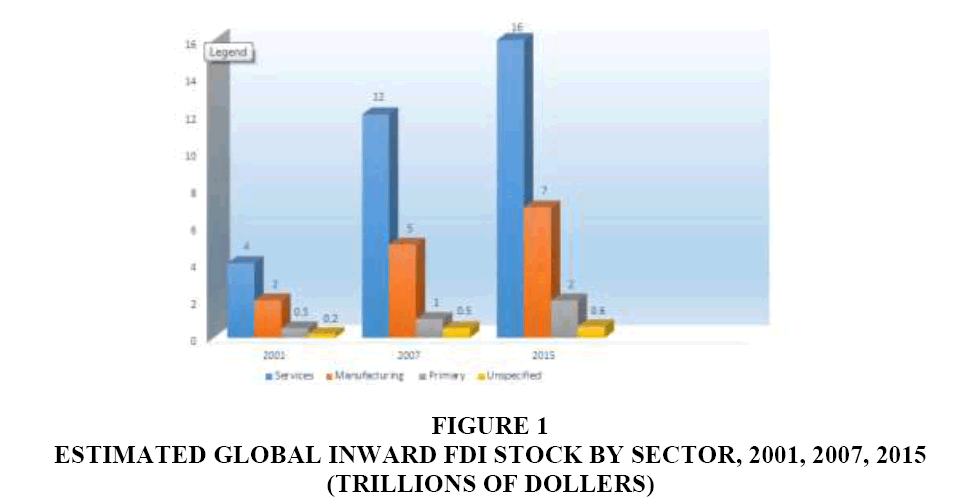

The structure of FDI has been changing from primary and manufacturing sectors to services sector since the start of the 1970s. In 2004, services were at 59% of global FDI: 25% up from the 1970 and 50% up 1990. Liberalization process, increasing tradability of services and growth of global value chains are the main factors that stimulated FDI in services sector during the past 10 years. This shifting trend was actually burgeoned in 1995 by the inception of World Trade Organization (WTO) and General Agreement on Trade in Services (GATS). In 2012, services accounted for 63% of global FDI stock, more than twice the share of manufacturing. The primary sector stands at a low number with only 10% share (UNCTAD, 2015). FDI in the services sector is playing a vital role towards the development of a host country by contributing positively to GDP growth, job creation, and social development. In addition, some services provide direct assistance to business, for example, infrastructure services provide energy, telecommunication, and transportation; financial and accountancy services facilitate easy and secure business transactions; education services involved in creating a well-trained and skilled workforce, and legal services help on legal matters. The growing diversion of FDI in the services sector, especially after the implementation of GATS, is a major concern, which formed the foundation for this study. In other words, this study examines the factors that attract services FDI in developing countries of South Asian and Southeast Asian regions. The change in the pattern of global FDI to service sector prompts the need to inspect the determinants of cross-border services investment. Mostly, literature focused on the determinants of aggregated or manufacturing FDI, so there is a necessity to reconsider these determinants; moreover, the question arises, whether the services sector is affected by these same factors. The inferences of this study could be profound in the current scenario where the share of the service sector is being increased in total FDI.

The availability of state-of-the-art information and communication technologies have made services tradable and offshoring of these services can offer better opportunities for developing countries to play an integral role in the global market (UNCTAD, 2004). Therefore, the importance of the services sector is evinced in the policy agenda of developing countries. This situation triggers the need to study the services sector individually, and it must be treated through careful and appropriate examination.

In the past, usually, manufacturing or aggregated FDI has been focused in the literature, and many studies found the determinants of FDI in the said areas. There was not considerable attention paid to the determinants of FDI in the services sector and studies are clearly lacking on determinants of services FDI (Resmini, 2000). Thus, this study enhances the scarce literature on services FDI. Moreover, this study examines the factors affecting FDI in the services sector in developing countries of South Asian and Southeast Asian regions. Further, this study strengthens the hypothesis of “no new theories are required to model the determinants of FDI in services sector” that was presented by Ramasamy and Yeung, 2010; Kaliappan, Khamis and Ismail, 2015. In addition, this study offers some important suggestions to establish policies at national and international levels. Some major developing economies of South Asia (Bangladesh, India, Pakistan, and Sri Lanka) and Southeast Asia (Indonesia, Malaysia, The Philippines, Singapore and Thailand) were selected for three significant reasons. First, developing Asia was declared as the largest FDI recipient in the world by investment statistics of the United Nation Conference on Trade and Development (UNCTAD, 2016). In addition, developing Asia witnessed the record increase in FDI inflows by $541 billion. The main increase was in East Asia; however, the share and growth level of South Asian and Southeast Asian countries was not small, as compared to levels, prevailing in the other developing or transition regions. Most importantly, South Asian countries have a considerable rise up to 22% $50 billion in outstanding FDI inflows. Moreover, by region, the FDI performance index indicated the highest rank for Southeast Asia. The economic growth recorded in 2010, had increased to 7.5% as compared to 6.9% in 2000 (UNCTAD, 2006; UNCTAD, 2012).

Second, heterogeneous nature with different level of development and structural contrast of these countries have multi-dimensional purview for FDI in services sector, as every country has comparative advantage in different sub-sector of services, like Pakistan and Sri Lanka in transport services (De, 2005); India in IT services (Rudrani et al., 2011; Yahya, 2009); Singapore, Indonesia and Malaysia in telecommunication and information services (Wong et al., 2009). Third, the regional integration in these countries, like SAARC preferential trading agreement (SAPTA), South Asian Free Trade Agreement (SAFTA) and ASEAN economic community (AEC) have the potential to promote economic growth and development, particularly in the services sector (De, 2005). For example, these free trade agreements can be beneficial for telecommunication services by reducing the cost of voice or data transmission, which is imposed by political boundaries. Lastly, other developing regions of the world have been in the discussion of researcher community regarding FDI, South Asia remains largely ignored (Bimal, 2017). Following the introduction, the next section provides some stylized facts on services FDI; Section 3, examines previous literature and furnish theoretical arguments for the determinants considered in this study; Section 4, outlines the data and methodology; Section 5 discusses the empirical results and finding of the study; Section 6 presents the conclusion of the study

Services FDI: Some Stylized Facts

The structure of FDI has shifted towards services, as a significant increase in FDI in the services sector has been seen since the 1970s. In the early 1970s, the share of this sector was only one-quarter of total world FDI stock; in 1990, this share was less than one-half; and by 2002, it had risen to about 60% of total FDI stock. In 2002, developed countries accounted for 72% and developing countries accounted for only 25% of total services FDI (UNCTAD, 2004). Further, developing economies have absorbed half of the FDI inflows during 2010 to 2011; service sector has captured greater share in total FDI inflows than primary and manufacturing sectors (UNCTAD, 2012). Moreover, services continue to construct the lion’s share in the FDI by having the share up to two-thirds of the global FDI stock (UNCTAD, 2017) (Figure 1).

Services can fundamentally change the pattern of development in many developing countries. The services sector has seen significant growth in South Asian countries, less than 40% of GDP in the 1980s to more than 50% in 2005. The studied South Asian countries have a bigger share of services in their GDPs relative to the level of their real GDP per capita. Except for Pakistan, other countries like Bangladesh, India and Sri Lanka has seen 10% annual growth rate in the output of modern impersonal services including business, communication, banking and insurance services. Contrarily, traditional personal services, which include migration, remittances, tourism and transport, have shown less growth (World Bank, 2009).

The inflows of FDI to Southeast Asian countries did not prosper until the start of the 1980s, but between 1986 and 1997, a rapid increase was seen in this region. In addition, the share of services sector has flourished in total FDI inflows since 2007 in studied economies of Southeast Asia. During 2000 to 2011, the increase in the share of FDI in service sector against other sectors, accounted for 41%, 42%, 20% and 40% in Indonesia, Malaysia, The Philippines, Singapore and Thailand, respectively (Thomsen et al., 2011; Sjoholm, 2014). The inflows of FDI in Southeast Asia rose by $133 billion in 2014; Singapore and Malaysia were the dominant services FDI recipient economies (UNCTAD, 2015).

Literature Review

The world economy has been being shifted from the manufacturing sector to services sector since the start of the 1970s. This shift evinces itself in several ways. First, services surmise leading role for the competitiveness of firms in all sectors. Second, rapid technology spill overs to host countries have made it viable for services to be traded globally. Third, mulling over this progress, the policy plan of national as well as international authorities, varying from the liberalization to promotional endeavors, is leaning towards services.

Further, GATS has persuaded FDI inflows to services and internationalization of the services sector. In spite of the significant shift in the pattern and model of FDI, there exists finite literature on the determinant of services FDI. There is plentiful theoretical and empirical literature existed on aggregated FDI or manufacturing FDI. This existed literature focused on the diverse topics like the definition, theories, determinants, concepts, and influence of FDI in host country’s economic growth. Generally, there is an enormous literature at hand on manufacturing FDI rather services FDI. This is because services sector has been neglected for two decades. It does not mean prevailing scarcity of literature on services FDI has any rationale to pass over the investigation of the determinants of this sector.

Prestigious scholars such as William’s (1929) who emerged with the “Theory of International Trade Reconsider Developed the Theoretical Genesis of FDI. Further, Vernon’s (1966) “Theory of International Investment and International Trade in Product Lifecycle”; Kojima’s (1973) “Dynamic Comparative Advantage”; Hymer’s (1976) “Industrialization Theory”; Rugman’s (1981) “Internationalization Theory”; Dunning’s (1973: 1981) “Eclectic Paradigm Theory” and Markusan’s (1973) “Knowledge and Capital Theory”, also participated in constructing the theoretical framework of FDI. Up to some extent, classical international trade theories like Ricardian Model and Heckscher Ohlin Model have formed the basis for discussion on FDI. The pioneer classical model on determinants of FDI was developed by Dunning (1973: 1981).

After looking at the basics of FDI and the remarkable work of Dunning, earlier literature focuses on different variables like tax rates, exit barriers, wages, competitiveness (e.g. Gastanaga et al., 1998; Bajpai and Sachs, 2000). Along with policy concerns of FDI, some studies also highlighted the role of the growth prospects of countries. For instance, Schneider and Frey (1985) and Lipsey (1999) argue that the most consistent variable is the market size, which is usually measured by GDP or GNP; as the large market size would attract more FDI inflows in host countries. This is further postulated by Bevan and Estrin (2004), who found that FDI inflows are related positively to a market size of the country.

In addition, trade openness is deemed to be an important and positive significant variable for FDI inflows. In literature, the trade openness is usually considered being a variable that has a separate association with both vertical and horizontal FDI. This is because vertical FDI is mostly attracted by the motives to minimize both transport and trade cost. In contrast, horizontal FDI exists when restriction of trade openness inflicts a high cost. FDI is a liberal activity that is formed on the expectations of gaining profits in future. Lin and Ye, (2017) also complement the role of trade openness to FDI by arguing that openness can affect the financial conditions of acquired and local firms as well and indicate more profound financial effects of FDI on the host economy. There are abundant studies that analysed the relationship between trade openness and FDI inflows, and they found a positive and significant relationship between both of them (Asiedu, 2002; Salisu, 2003; Minhas and Ahsan, 2015).

Recently in literature, human capital captured the attention of researchers and scholars as a significant and important factor, attractive for both indigenous investment and FDI inflows. The easy accessibility to human capital is a prime concern of MNCs. It also has paramount importance to absorb diverse spill overs from MNCs. For the host country, human capital and FDI interplay in a dichotomous link. Human capital plays an important role to attract FDI, and simultaneously, it can form the basis to create spill over effects in terms of technology and knowledge transfer to host country’s labor force. (Blomstrom and Kokko, 2003).

A study by the OECD (2003) emphasized the importance of education and training in the development of human capital. Khan (2007) argues that education and market-driven skills are potent sources of competitiveness and productivity. These are imperative to create sustainable economic growth and congenial environment for foreign investment. Noorbakhsh et al. (2001) investigated the importance of human capital as a source that can attract FDI to developing countries, by using secondary school enrolment as a proxy. Salisu (2003) observed that FDI is discouraged by illiteracy rate. Agbola (2014) found a positive and significant association between the absorptive capacity of human capital and FDI inflows.

A study by the OECD (2003) emphasized the importance of education and training in the development of human capital. Khan (2007) argues that education and market-driven skills are potent sources of competitiveness and productivity. These are imperative to create sustainable economic growth and congenial environment for foreign investment. Noorbakhsh et al. (2001) investigated the importance of human capital as a source that can attract FDI to developing countries, by using secondary school enrolment as a proxy. Salisu (2003) observed that FDI is discouraged by illiteracy rate. Agbola (2014) found a positive and significant association between the absorptive capacity of human capital and FDI inflows.

Commonly, it is believed that infrastructural facilities such as transport (e.g. Ports, Railways and Roads), telecommunication (e.g. Internet, Telephone), and energy (e.g. Electricity) have performed a crucial role to create a global concatenation among international markets by reducing costs (e.g. transaction and trade cost). In fact, business always requires uninterruptible utilities to operate effectively and efficiently. Investors also require cheap and easy communication with their clients. Thus, easy accessibility, reliability and cost of quality infrastructure, are important elements of a business framework conducive to FDI inflows (Khan and Kim 1999). Countries with better infrastructure accumulate more FDI in comparison with their competitors (Skuflic and Botric, 2006; Bakar et al., 2012; Shah M.H, 2014). Nevertheless, lower-income countries confront scarce FDI inflows due to its poor infrastructure facilities predominantly in transport, communication, and information technologies (Obwona, 2001).

In literature, there are plentiful studies that have pointed out the positive and significant relationship between FDI and different types of infrastructure. For example, Kang and Lee (2007); Khadaroo and Seetanah (2008) found a positive and significant bond, by arguing that improved transport infrastructure regarding quality and quantity, reduces the cost of private inputs, thereby it is helpful to find an appropriate location for FDI. Kumar (2006) found a positive and significant relationship between infrastructure and FDI inflows and corroborated the general role of infrastructure in attracting FDI inflows into host countries.

Moreover, the exchange rate is a variable that may either build or damage the locational reputation of a host country in the decision-making of foreign investors. In fact, firm’s decision to make entry investment and future cash flows are affected by the exchange rate. There are mixed views of researchers, for instance, a study by Froot and Stein (1991) suggested that host country currency depreciation rises the wealth of foreign investors, thereby increases FDI inflows and inversely an appreciation in host country currency decreases FDI inflows. Contrarily, a study by Campa (1993) postulated that an appreciation of host country currency increases FDI in the host country. In simple words, appreciation of host country currency increases the future calculation of profit in terms of home currency. The exchange rate has “direction based” effect on FDI inflows, by playing dual roles; it explains that whether the direction of the relationship between exchange rate and FDI inflows is positive or negative. Some studies report a positive and significant association between these two variables (Aqeel et al., 2004; Renani and Mirfatah 2012; Lily, et al., 2014). Inversely, some studies report negative and insignificant linkages between exchange rate and FDI inflows (Ruiz, 2005; Parajuli and Kennedy, 2010).

After conducting extensive literature, we can confidently conclude that nearly all of the studies on the determinants are based on manufacturing or aggregated FDI. There are hardly five studies that have been carried out on the determinants of services FDI inflows (e.g. Kolstad and Villanger, 2008; Golub, 2009; Ramasamy and Yeung, 2010; Walsh and Yu, 2010; and Kaliappan et al., 2015). On the other hand, there is extensive literature on the sector-specific services FDI inflows, for example, insurance services (Moshirian, 1997; Nistor, 2015), business services (Jeong, 2014; Castellani et al., 2016), advertising services (Terpstra and Yu, 1988; West, 1996) financial services (Buch and Lipponer, 2004) and legal services (Cullen-Mandikos and McPherson, 2002). The present study is primarily related to four studies from the existing literature, viz. Kolstad and Villanger, 2008; Ramasamy and Yeung, 2010; Walsh and Yu, 2010; and Kaliappan et al., 2015.

Kolstad and Villanger (2008) carried out the first study into the literature on the determinants of foreign direct investment in the services sector. The industry level panel data consists of observations from 57 countries for the period 1989-2000. The data set includes both FDI in manufacturing and four biggest service industries. They suggest that as compared with manufacturing, services FDI has grown prominently in total FDI flows. Moreover, Ramasamy and Yeung, 2010 focused on the services FDI inflows into OECD countries by using time series macro-level data during the period of 1980-2003. The results show that all of the variables are significant under market, efficiency, and strategic reason seeking categories. They concluded that under efficiency and market seeking bracket, infrastructure, trade openness, human resources, GDP and GDP growth are positive and significant determinants of services FDI inflows. Under strategic reason category, this study tests the effect of past FDI inflows on the present FDI inflows. They state that new investors almost believe that previous investments offer them confidence in terms of availability of resources, profitability, security and stability for business. Furthermore, Walsh and Yu (2010) have made a corresponding attempt by studying the sectorwise determinants of FDI. They studied macroeconomics, developmental and institutional/ qualitative determinants of FDI inflows into 27 developed and emerging economies. The time span is 1985-2008 the model is GMM estimation. They analysed the impact of openness, exchange rate, inflation, the stock of FDI, GDP Growth, GDP per capita and some institutional or qualitative variables. Along with general results, chiefly, they found that FDI in services is affected much more by macroeconomic conditions than FDI in manufacturing. Finally, Kaliappan et al. (2015) empirically, tested the determinants of services FDI inflows into ASEAN countries over the period of 2000-2010 by using a static linear panel data analysis. The study indicates that human capital, availability of quality infrastructure, trade openness and market size have a positive and significant association with services FDI inflows. Inversely, only inflation has an insignificant and negative relationship with services FDI inflows.

The aforementioned discussion clearly demonstrates that sector wise (e.g. mainly manufacturing and service) FDI inflows have different implications regarding pull factors (determinants), across region, countries, and time. Furthermore, above mentioned literature corroborates that factors affect the manufacturing FDI are largely dissimilar from that of services FDI. Nevertheless, some factors seem to be apropos in certain conditions. Lastly, up to the best of my knowledge, there is entire ability of services based FDI, particularly for South Asian countries. The existing study purposes to play an additive role in the literature by investigating the factors that attract FDI in the services sector in South Asian and Southeast Asia.

Methodology

Theoretical Framework

Different schools of thought have explained the theories of FDI. The root of FDI theory was grown from the early work of Adam Smith (1776) (as cited in Smith, 1937) and Ricardo (1817). Smith presents the theory of absolute advantage and Ricardo postulates the theory of comparative advantage. Afterward et al. (1933) followed Ricardo’s theory of comparative advantage, and explained international trade. Hymer (1960) constructed the baseline for authors, who emerged with the more clearly defining theory of FDI. He argued that the existence of market imperfections, in terms of advantages and conflict, provide a platform for the enhancement of FDI. Moreover, Vernon (1966) introduced the theory of product lifecycle, which explains that firms go through four production cycles, innovation, growth, maturity and decline. A compendious framework of Dunning (1977: 1981: 1993) led the notable expansion in previous theories of international trade to elaborate the reasons for FDI. This framework is known as “eclectic paradigm” or “OLI paradigm”. The Ownership advantage (O) elucidates the motives of the firm behind undertaking foreign operations and offers that a leading MNE has some firmspecific- advantage, which gives it the opportunity to go through the low-cost production process. The Location advantage (L) elaborates such regions, which have valuable raw materials, specific taxes or tariffs, languages and cultural norms and easy access to doing business. Finally (I) Internalization advantages are about the production preferences of the firms, which MNCs can realize from their own production facility rather than join a third party. Through this advantage, firms are able to acquire a comparative advantage by exploiting their core product competencies.

Market size has critically been examined and considered the most influential locational determinant of FDI inflows. Larger market size attracts foreign investors since it allows them to internalize profits from sales within the host market and facilitates foreign investors to achieve lower cost production through economies of scale (Yin et al., 2014). Theories suggest that trade openness plays a positive role in export-oriented FDI, whereas in market-seeking FDI, trade openness has a negative impact (Lauridsen, 2002). In other words, openness is associated differently with the different types of investment. Trade openness has negatively connected to horizontal FDI and it is viewed by the “tariff jumping” conjecture. In contrast, vertical FDI is largely conducted to avoid both trade and transaction cost, thereby MNCs may prefer to invest in more open economies. (Demirhan and Masca, 2008).One of the most significant aspects of human capital is that it is crucial to enhance the absorptive capacity of host countries. Human capital plays an important role through backward and forward linkages. Simply, human capital attracts FDI and technological spill over contributes significantly to the development of labor skills (Blomstrom and Kokko, 2003; Khan M.A., 2007).

Inflation is considered a tool to gauge macroeconomic stability and certainty. The low inflation rate is a sign of stability and certain macroeconomic environment, which is almost desired by foreign investors. On the contrary, high inflation rate connotes the highly uncertain and unstable macroeconomic condition. In a stable situation, investors are certain about their future profits, hence it is an important factor to welcome FDI inflows (Yohanna, 2013).

Another frequently considered factor that attracts FDI into host country is infrastructure. A welldeveloped infrastructure has an additional benefit for foreign investors by reducing costs and offering efficient production facilities and stable utilities (Skuflic and Botric, 2006). Poor infrastructure may lead to a discouraging situation of FDI inflows and tends to disinvestment in the host country, as transaction cost may be high (Kumar, 1987). Finally, the exchange rate has a mixed relationship with FDI inflows. Depreciation in domestic currency may increase the wealth of foreign investors, and so does the capacity to invest. Contrary to this, if the FDI’s objective to serve the host country, appreciation of the currency can increase the inflows of FDI, as it enhances the purchasing power of local consumers (Ruiz, 2005; Lily et al., 2014).

Model Specification

The objective of the current study is to examine the determinants of FDI inflows in the services sector. In literature, studies examine a large number of variables which have been supportive to delineate FDI. Econometrically, the study employed linear model because recent empirical papers have enough evidence to use this model to study the determinants of FDI (Kaliappan et al., 2015; Shahmoradi and Baghbanyan, 2011). I propose an estimation model, as follows, where the selected variables are carefully chosen from the literature and the availability of the dataset for the selected period of sample countries to determine FDI inflows.

The dependent variable in the current study is log of services FDI inflows in a million USD (lnSFDI). A set of independent variables are Exchange Rate (ER), log of human capital (lnHC), log of inflation (lnINF), log of infrastructure (lnINFR), log of Market Size (lnMS) and Trade Openness (TO). The error term is denoted by ε, and country and time are denoted by subscript i and t, respectively. Market size is one of the important determining factors which has an impact on FDI inflows. According to Chakrabarti A. (2001) market size is the single most widely accepted variable as the determinant of FDI flows. It is expected that it will be positively associated with services FDI inflows (Walsh & Yu, 2010) (Table 1).

| Table 1 Variables-Description and Source |

||||

| Variables | Types | Description/Proxy | Source | Expected Sign |

| SFDI | Dependent Variable | Inward services FDI flows | 2 | |

| GDP | Explanatory Variables | Gross Domestic Product per Capita (Walsh & Yu, 2010) |

1 | + |

| HC | Human capital is measured by secondary school enrollment (Noorbakhsh et al., 2001; Karimi et al., 2013) |

1 | + | |

| TO | Trade openness is measured by sum of import and export divided by GDP (Walsh & Yu, 2010; Kaliappan et al., 2015) |

1 | + | |

| ER | Real Effective Exchange Rate (Walsh & Yu, 2010 |

1 | + or - | |

| INFRA | Infrastructure is measured by an equally weighted composite index of electricity supply per capita, number of telephone lines per 1000 capita, and road mileage per capita (Kaliappan et al., 2015) | 1 | + | |

| INF | Inflation is measured by Consumer Price Index (CPI) and proxy for economic stability (Yohanna, 2013) | 1 | - | |

Data

Secondary data is used in this study and consist over the period of 2000-2014. The sectorial level services FDI data were obtained from the different official sources of sample countries. The data for explanatory variables was collected from World Development Indicators (2014). The countries in the South Asian region are included Bangladesh, India, Pakistan, and Sri Lanka. The countries in South East Asian region are included Indonesia, Malaysia, The Philippines, Singapore and Thailand. Data unavailability of services sector is the main reason to ignore other developing countries of these regions like Bhutan, Nepal and Cambodia etc.

Methodology

This study utilizes the traditional panel data estimation techniques, like pooled Ordinary Least Square (OLS), Fixed Effect (FE) and Random Effect (RE). There are several advantages of panel data like it is widely considered an efficient analytical method for handling econometric data. It allows the inclusion of N cross-sectional (e.g. countries, household, individual, firms, etc.) and T time period data (year, quarter, months, etc.) at the same time (Asteriou and Hall, 2006).

The first one is a common constant method (also called the pooled OLS). This method is based on the principal assumption that there are no differences among the data matrices of crosssectional dimension N. The hypothesis of this model is that the dataset is a priori homogeneous. However, this model is quite restrictive, as it does not explain the heterogeneity among crosssectional units; and this restriction generates the need of Fixed and Random effects in the method of estimation (Asteriou and Hall, 2006). The Fixed effects method treats the constant as group specific. The Fixed effect allows different constant for different groups and it includes a dummy variable for each group. It is also called the Least Squares Dummy Variables (LSDV). By using FE, we assume that something within the individual may influence or bias the predictor or outcome variables and we need to control for this (Baltagi, 2008).

In Econometrics, a random effect(s) model, also called a variance components model, is a kind of hierarchical linear model. It assumes that the dataset being analysed consists of a hierarchy of different populations whose differences relate to that hierarchy. In Econometrics, random effects model is used in the analysis of hierarchical or panel data when one assumes no fixed effects. The fixed effects model is a special case of the random effects model (Asteriou & Hall, 2006). The advantage of RE model is that it can include time-invariant variables. The problem with it is that some variables may not be available therefor leading to omitted variable bias in the model (Baltagi, 2008).

The Hausman test is formulated to assist in making a choice between fixed effects and random effects approaches. Hausman (1978) adopted a test based on the idea that under the hypothesis of no correlation both OLS and GLS are consistent but OLS is inefficient. While under the alternative, OLS is consistent, but GLS is not. The Hausman test uses the following test statistic: If the value of the statistic is large, then the difference between the estimates is significant, so we reject the null hypothesis that the random effects model is consistent and we use the fixed effect estimators. In contrast, a small value of Hausman statistic implies that the random effects estimator is more appropriate.

Empirical Results

The descriptive statistics results of the studied variables for South Asian and South East Asian countries are presented in Table 2. All the studied variables have the same number of observation 135. The ER has the largest mean values of 105.4, with standard deviation 16.660 among the studied variables. The logged services FDI have greater mean value 7.189 relative to other logged variables. The variables like human capital, infrastructure and market size have mean and standard deviation values with little variation, other than inflation that has the lowest standard deviation value 0.297.

| Table 2 Descriptive Statistics for the Studied Variables |

|||||

| Variable | Obs. | Mean | Std. Dev. | Min | Max |

| ER | 135 | 105.434 | 16.66 | 62.98 | 167.25 |

| LNHC | 135 | 4.2 | 0.3563 | 3.25 | 4.641 |

| LNINF | 135 | 4.422 | 0.297 | 3.59 | 4.953 |

| LNINFR | 135 | 4.666 | 1.149 | 2.45 | 6.98 |

| LNMS | 135 | 4.339 | 1.511 | 1.39 | 7.13 |

| TO | 135 | 1.142 | 1.092 | 0.242 | 4.44 |

Panel data models were used including Pooled OLS (Common Constant), Fixed Effect and Random Effect for the selected study period. The analysis was started using Pooled OLS to explain the relationship between SFDI and selected explanatory variables. Since Pooled OLS does not consider the individual effect ui (cross-sectional or time specific effect) among the countries, so there is a need to check if the individual or time specific effect exists or not. For this purpose, fixed effect model was chosen and based on F-test, the results supported the alternative hypothesis, that fixed effect model is appropriate against Pooled OLS. It may be concluded that there is a significant increase in goodness-of-fit in the fixed effect model. The Hausman specification test (Hausman, 1978) compares a random effect model to its fixed counterpart. The p-value of Hausman specification test is small enough to reject H₀, which conclude that fixed effect model is more appropriate than the random effect model.

Table 3 shows the estimation results of both fixed and random effect models. However, the results of both models have been shown, but the result of the fixed effect model is only discussed. Results from Table 3 indicate that market size and infrastructure are positively significant at the 1% level. Furthermore, human capital and trade openness has a positive and significant relationship at 5% significance level. The exchange rate is also significant at the 5% level, but with a negative sign. Inflation appears as an insignificant variable with a negative value in determining the services FDI flows, which are in line with (Kolstad & Villanger, 2008; Kaliappan et al., 2015).

| Table 3 Determinants Of Fdi Inflows: Panel Data Estimation Results Based On Fixed Effect (Fe) And Random Effect (Re) Models |

||||

| Dependent Variable: LNSFDI | ||||

| Explanatory Variables | FE | RE | ||

| ER | 0 .041** | (-2.07) | 0.455 | (-0.75) |

| LNHC | 0.017** | -2.42 | 0.013** | -2.47 |

| LNINF | 0.109 | (-1.62) | 0.409 | -0.82 |

| LNINFR | 0.000*** | -5.02 | 0.000*** | -4.71 |

| LNMS | 0.000*** | -3.88 | 0.000*** | -3.62 |

| TO | 0.011** | -2.6 | 0.15 | -1.44 |

| R2 | 0.5026 | 0.4517 | ||

| F-statistics | -25.71 | |||

| (P-value) | 0 | |||

| Hausman Test | 0.002 | |||

| (prob> chiČ) | ||||

| Notes: a) Note: *, ** and *** 10 %, 5% and 1% significance levels, respectively. |

||||

The relationship between market size and foreign direct investment has been widely studied. It is the single most studied variable, which passed the extreme bond analysis (Chakrabarti, 2001). Ramasamy and Yeung (2010) studied market size under market-seeking FDI and argue that large market size attract investors. A large market size attracts the services FDI, as services have to be produced where they are consumed (Fukao and Ito, 2003; Riedl, 2010). Kolstad and Villanger (2008) and Ramasamy and Yeung (2010) found a significant and positive relationship between services FDI and market size. The finding of the present study is in line with previous studies

The exchange rate is the most complex and controversial macroeconomic variable, regarding its direction, in the theory of FDI. Many scholars argue that appreciation of host country currency has a positive effect on FDI (Renani and Mirfatah, 2012; Lily et al., 2014). Contrary to this, some studies argue that depreciation of host country currency attracts FDI in these countries (Erel et al., 2012). Few studies have analyzed the relationship between exchange rate and services FDI. For instance, Moshirian (2001) and Walsh and Yu (2010) examined the association between services FDI and exchange rate. They found a significant connection with a positive sign. The results of the present study also find support from the results of previous studies but with opposite sign.

Regarding trade openness, this study shows a significant and positive relationship with services FDI and finds support from previous studies of Walsh and Yu (2010) and Ramasamy and Yeung (2010). They argue that countries with liberalized policies through either privatization or acquisition enhanced their services FDI. Kaliappan et al. (2015) observed positive outcomes of trade openness in ASEAN countries. In the series of services FDI studies, Kolstad and Villanger (2008) found an insignificant relationship between the variables.

Human capital is one of the most important determining factors for FDI inflows and plays a key role to accelerate the FDI (Noorbakhsh et al., 2001; Khan, 2007). The demand for skilled labor force is relatively high in modern services like financial, business and technology related, because of the need to interact physically with their clients. The positive and significant results of this study concur with the results of (Ramasamy and Yeung, 2010; Kaliappan et al., 2015). Surprisingly, Walsh and Yu (2010) presented contradiction by indicating little variation between the human capital and FDI inflows.

The quality of infrastructure either in the form of hard or soft infrastructure is a very crucial factor to attract FDI inflows (Sahoo, 2006; Kang and Lee, 2007; Bakar et al., 2012). Infrastructure has greater ability to create a conducive investment climate for foreign investors. The present study is in line with the studies of (Ramasamy and Yeung, 2010; Kaliappan et al., 2015) by indicating the positive and significant relationship between infrastructure and services FDI inflows. Lastly, inflation has an insignificant and negative relationship with services FDI in the present study. It means that FDI in services is not affected by macroeconomic instability and concur the results of previous studies (Kolstad and Villanger, 2008; Walsh and Yu, 2010; Kaliappan et al., 2015).

Conclusion

The burgeoning share of developing Asia in global FDI inflows, particularly in the services sector, is the cause that instigated the need for this study. This study empirically explores the pull factors (determinants) of foreign direct investment in the services sector in developing countries of South Asia and Southeast Asia. The results of the present study conclude that exchange rate, human capital, infrastructure, market size and trade openness have the potential to attract FDI in the services sector of developing countries. Concurrently, inflation has an insignificant and negative relationship with inflows of services FDI. In true senses, these countries should maintain growth momentum to improve market size, pay more focus on education and skills of workers to enhance the quality of human capital, improve infrastructure facilities, adopt more liberalize policies towards services FDI and maintain the exchange rate at low-level.

References

- Agbola, F.W. (2014). Modelling the impact of foreign direct investment and human capital on economic growth: Empirical evidence from the philippines. Journal of the Asia Pacific Economy, 19(2), 272-289.

- Aqeel, A., Nishat, M., & Bilquees, F. (2004). The determinants of foreign direct investment in Pakistan. The Pakistan Development Review, 43(4), 651-664.

- Asiedu, E. (2002). On the determinants of foreign direct investment to developing countries: Is Africa Different? World Development, 30(1), 107-119.

- Asteriou, D., & Hall, S.G. (2006). Applied Econometrics.

- Bajpai, N., & Sachs, J.D. (2000). Foreign direct investment in India: Issues and problems, 759.

- Bakar, N.A., Mat, S.H., & Harun, M. (2012). The impact of infrastructure on foreign direct investment: The case of Malaysia. Procedia Social and Behavioral Sciences, 65, 205-211.

- Baltagi, B.H. (2008). Econometric Analysis of Panel Data.

- Bengoa, M., & Robles, B.S. (2003). Foreign direct investment, economic freedom and growth: New evidence from latin america. European Journal of Political Economy, 19(3), 529-545.

- Bevan, A.A., & Estrin, S. (2004). The determinants of foreign direct investment into European transition economies. Journal of Comparative Economics, 32(4), 775-787.

- Bimal, S. (2017). Determinants of foreign direct investment in South Asia: Analysis of economic, institutional and political factors. Journal of South Asian Studies, 5(1), 1-11.

- Blomstrom, M., & Kokko, A. (2003). Human capital and inward FDI. Working Paper, 167, 1-25.

- Buch, C.M., & Lipponer, A. (2004). FDI versus cross-border financial services: The globalisation of German Banks. Discussion Paper Franfurt: Deutsche Bundesbank.

- Buckley, P.J., Clegg, L.J., Cross, A.R., Liu, X., Voss, H., & Zheng, P. (2007). The determinants of Chinese outward foreign direct investment. Journal of International Business Studies, 38(4), 499-518.

- Campa, J.M. (1993). Entry by foreign firms in the United States under exchange rate uncertainty. The Review of Economics and Statistics, 75(4), 614-622.

- Castellani, D., Meliciani, V., & Mirra, L. (2016). The determinants of inward foreign direct investment in business services across European regions. Regional Studies, 50(4), 671-691.

- Chakrabarti, A. (2001). The determinants of foreign direct investment: Sensitivity analyses of cross country regressions. Kyklos, 54(1), 89-114.

- Chari, A., Chen, W., & Dominguez, K.M. (2012). Foreign ownership and firm performance: Emerging market acquisitions in the United States. IMF Economic Review, 60(1), 1-42.

- Cullen-Mandikos , B., & MacPherson , A. (2002). U.S. foreign direct investment in the London legal market: An empirical analysis. The Professional Geographer, 54(4), 491-499.

- David, R. (1817). Principles of political economy and taxation. publicado en.

- De, P. (2005). Cooperation in the regional transportation infrastructure sector in South Asia. Contemporary South Asia, 14(3), 267-287.

- Demirhan, E., & Masca, M. (2008). Determinants of foreign direct investment flows to developing countries: A cross-sectional analysis, 4, 356-369.

- Desai , M.A., Foley, C.F. & Hines, J. (2008). Capital structure with risky foreign investment. Journal of Financial Economics, 88, 534-553.

- Dunning , J.H. (1977). Trade, location of economic activity and the MNE: A search for an eclectic approach. The International Allocation of Economic Activity, 395-418.

- Dunning, J.H. (1973). The determinants of international production. Oxford Economic Papers, 25(3), 289-336.

- Dunning, J.H. (1981). Explaining the international direct investment position of countries: Towards a dynamic or developmental approach. Weltwirtschaftliches Archiv, 30-64.

- Dunning, J.H. (1993). Multinational enterprises and the global economy. Addison-Wesley Publishing, Reading MA.

- Dunning, J.H., & Matthew, M. (1981). The eclectic theory of international production: A case study of the international hotel industry. Managerial and Decision Economics, 2(4), 197-210.

- Erel, I., Liao, R.C., & Weisbach, M.S. (2012). Determinants of cross-border mergers and acquisitions. The Journal of Finance, 67(3), 1045-1082.

- Froot, K.A., & Stein, J.C. (1991). Exchange rates and foreign direct investment: An imperfect capital market approach. The Quarterly Journal of Economics, 106(4), 1191-1217.

- Fukao, K., & Ito, K. (2003). Foreign direct investment and services trade: The case of Japan. University of Chicago Press, 429-480.

- Gastanaga, V.M., Nugent, J.B., & Pashamova, B. (1998). Host country reforms and FDI inflows: How much difference do they make? World Development, 26(7), 1299-1314.

- Golub, S.S. (2009). Openness to foreign direct investment in services: An international comparative analysis. The World Economy, 32(8), 1245-1268.

- Hausman, J.A. (1978). Specification tests in econometrics. Econometrica, 46(6), 1251-1271.

- Hymer, S.H. (1960). The international operations of national firms: A study of direct foreign investment. Cambridge: MIT Press.

- Jeong, H.G. (2014). The determinants of foreign direct investment in the business services industry. International Economic Journal, 28(3), 475-495.

- Kaliappan, S.R., Khamis, K.M., & Ismail, N.W. (2015). Determinants of services FDI inflows in ASEAN countries. International Journal of Economics and Management, 9(1), 45-69.

- Kang, S.J. & Lee, H.S. (2007). The determinants of location choice of South Korean FDI in China. Japan and World Economy, 19(4), 441-460.

- Karimi, M.S., Yusop, Z., Hook, L.S. & Chin, L. (2013). Effect of human capital on foreign direct investment inflows. Journal of Economic Research, 18, 79-101.

- Khadaroo, J., & Seetanah, B. (2008). Transport infrastructure and foreign direct investment. Journal of International Development, 22(1), 103-123.

- Khan, A.H., & Kim, Y.H. (1999). Foreign direct investment in Pakistan: policy issues and operational implications. EDRC Report Series, 66, 1-38.

- Khan, M.A. (2007). Role of human capital in attracting foreign direct investment: A South Asian perspective. SAARC Journal of Human Resource Development, 5-25.

- Klein, M.W., & Rosengren, E. (1994). The real exchange rate and foreign direct investment in United States: Relative wealth vs. relative wage effects. Journal of International Economics, 36(3), 373-389.

- Kojima, K. (1973). A macroeconomic approach to foreign direct investment. Hitotsubashi Journal of Economics, 14(1), 1-21.

- Kolstad, I., & Villanger, E. (2008). Determinants of foreign direct investment in services. European Journal of Political Economy, 24(2), 518-533.

- Kumar, N. (1987). Intangible assets, internationalisation and foreign production: Direct investments and licensing in indian manufacturing. Weltwirtschaftliches Archiv, 123(2), 325-345.

- Kumar, N. (2006). Infrastructural avaiability, foreign direct investment inflows and their export-orientation: A Cross-Country Exploration. The Indian Ecomomic Journal, 54(1), 125-144.

- Lauridsen, L.S. (2002). Struggling with globalization in Thailand: Accumulation, learning or market competition. South East Asia Research, 10(2), 155-183.

- Lily, J., Kogid, M., Mulok, D., Sang, L.T., & Asid, R. (2014). Exchange rate movement and foreign direct investment in ASEAN economies. Economics Research International, 1-10.

- Lin, S. & Ye, H. (2017). Foreign direct investment, trade credit, and transmission of global liquidity shocks: evidence from chines manufacturing firms. The Review of Financial Studies, 31(1), 206-238.

- Lipsey, R.E. (1999). The location and characteristics of U.S affiliates in Asia. NBER Working Papers 6876, National Bureau of Economic Research, Inc.

- Markusan, J.R. (2007). Trade and foreign direct investment in business services: A modeling approach. Working Paper, 1-28.

- Minhas, A., & Ahsan, A. (2015). An empirical analysis of foreign direct investment in Pakistan. Studies in Business and Economics, 10(1), 5-15.

- Moshirian , F. (2001). International investment in financial services. Journal of Banking and Finance, 25(2), 317-337.

- Moshirian, F. (1997). Foreign direct investment in insurance services in the United States. Journal of Multinational Financial Management, 7(2), 159-173.

- Nicet, C.D. & Rougier, E. (2016). The effect of macroeconomic instability on FDI flows: A gravity estimation of the impact of regional integration in the case of Euro-Mediterranean agreements. International Economics, 145, 66-91.

- Nistor, P. (2015). Foreign direct investment and the insurance market in Romania. International Journal of Academic Research in Business and Social sciences, 5(9), 226-233.

- Noorbakhsh, F., Paloni, A., & Youssef, A. (2001). Human capital and FDI inflows to developing countries: New empirical evidence. World Development, 29(9), 1593-1610.

- Obwona, M.B. (2001). Determinants of FDI and their impact on economic growth in Uganda. African Development Review, 13(1), 46-81.

- OECD. (2003). Human Capital Formation and Foreign Direct Investment in Developing Countries.

- Parajuli, S., & Kennedy, P.L. (2010). The exchange rate and inward foreign direct investment in Mexico. Louisiana State University, 1-22.

- Ramasamy, B., & Yeung, M. (2010). The determinants of foreign direct investment in services. The World Economy, 33(4), 573-596.

- Renani, H.S., & Mirfatah, M. (2012). The impact of exchange rate volatility on foreign direct investment in Iran. Procedia Economics and Finance, 1, 365-373.

- Resmini, L. (2000). The determinants of foreign direct investment in the CEECs. Economics of Transition, 8(3), 665-689.

- Riedl, A. (2010). Location factors of FDI and the growing services economy: Evidence for transition countries. economics of transition, 18(4), 741-761.

- Rubio, O.B., & Rivero, S.S. (1994). An econometric analysis of foreign direct investment in Spain, 1964-89. Southern Economic Journal, 61(1), 104-120.

- Rudrani, B., Ila, P., & Ajay, S. (2011). Export versus FDI in Services. IMF Staff Papers National Institute of Public Finance and Policy.

- Ruiz, I.C. (2005). Foreign direct investment: Does it really matter? Theoretical aspect, literature review and applied proposal. Ecos de Economia, 21, 153-171.

- Sahoo, P. (2006). Foreign direct investment in South Asia: Policy, trends, impact and determinants. ADB Institute Discussion Paper No. 56, 1-76.

- Salisu, M. (2003). Foreign direct investment in Sub-Saharan Africa. Lancaster University, Lancaster, England.

- Sayek, S. (2009). Foreign Direct Investment and Inflation. Southern Economic Journal, 76(2), 419-443.

- Schneider, F., & Frey, B. (1985). Economic and political determinants of foreign direct investment. World Development, 13(2), 161-175.

- Shah, M.H. (2014). The significance of infrastructure for FDI inflows in developing countries. Journal of Life Economics, 1-16.

- Shahmoradi, B., & Baghbanyan, M. (2011). Determinants of foreign direct investment in developing countries: A panel data analysis. Asian Economic and Financial Review, 1(2), 49-56.

- Sjoholm, F. (2014). Foreign direct investment in Southeast Asia. Research Institute of Industrial Economics, 1-36.

- Skuflic, L., & Botric, V. (2006). Main determinants of foreign direct investment in the southeast European countries. Transition Studies Review, 13(2), 359-377.

- Smith, A. (1776). An inquiry into the nature and causes of the wealth of nations. London: George Routledge and Sons.

- Smith, A. (n.d.). The wealth of nations, 1776.

- Terpstra, V., & Yu, C.M. (1988). Determinants of foreign investment of U.S advertising agencies. Journal of International Business Studies, 19(1), 33-46.

- Thomsen, S., Otsuka, M., & Lee, B. (2011). The evolving role of Southeast Asia in global FDI flows. Center for Asian Studies, 1-51.

- UNCTAD. (2004). The shift Towards Services. World Investment Report.

- UNCTAD. (2006). World Investment Report.

- UNCTAD. (2012). World Investment Report.

- UNCTAD. (2015). Reforming International Investment Governance. World Investment Report.

- UNCTAD. (2016). World Investment Report.

- UNCTAD. (2017). World Investment report.

- Vernon, R. (1966). International investment and international trade in the product cycle. Quarterly Journal of Economics, 80(2), 190-207.

- Walsh, J.P., & Yu, J. (2010). Determinants of foreign direct investment: A sectoral and institutional approach. IMF Working Paper, 10(187), 1-27.

- West, D.C. (1996). The determinants and consequences of multinational advertising agencies. International Journal of Advertising, 15(2), 128-139.

- Williams, J.H. (1929). The theory of international trade reconsidered. The Economic Journal, 39(154), 195-209.

- Wong, K.N., Tang, T.C. & Fausten, D.K. (2009). Foreign direct investment and services trade: Evidence from Malaysia and Singapore. Global Economic Review, 38(3), 265-276.

- World Bank. (2009). The Service Revolution in South Asia.

- Yahya, F.B. (2009). The rise of India as an information technology (IT) hub and challenges to governance. South Asia: Journal of South Asian Studies, 32(3), 374-389.

- Yin, F., Ye , M., & Xu, L. (2014). Locational determinants of foreign direct investment in services: Evidence from Chinese provincial-level data. Asia Research Centre Working Paper, 64, 1-34.

- Yohanna, P. (2013). Macroeconomic determinants of foreign direct investment and economic transformation in Nigeria, 1981-2010: An Empirical Evidence. Insight on Africa, 5(1), 55-82.