Research Article: 2023 Vol: 24 Issue: 2

The COVID Crisis and the Digital Revolution are making the Blochchain more a necessity than a choice: Investigation in the Tunisian Context

Zaidi Noura, Université De Sfax

Sadraoui Tarek, Université de Monastir

Azouzi Mohamed Ali, université de Monastir

Citation Information: Noura, Z., Tarek, S., & Ali, A., M. (2023).The covid crisis and the digital revolution are making the blochchain more a necessity than a choice: investigation in the tunisian context. Journal of Economics and Economic Education Research, 24(S2), 1-23.

Abstract

Purpose: COVID-19 has become a global challenge with a significant rate of prevalence, and it is likely to have a large impact on bank’s performance. Therefore, a number of studies have already been, or are now being, conducted on the detrimental effects of the virus. In this respect, a question may arise: Is there any possibility to turn the threat of the virus outbreak into an opportunity in some sectors such as the banking industry? In this research, the effects of COVID-19 pandemic as an influential element on the acceptance of digital banking (branchless banking) and blockchain technology has been studied. Branchless banking, digitalization and the introduction of blockchain technology should be the short-term objective of regulators. Design/methodology/approach: In this research, the positive side of the COVID 19 and its effect on the acceptance of digital banking (branchless banking) and blockchain technology has been studied. This by conducting a research questionnaire and interviewing bankers and bank customers. Then the research assumptions and detailed discussions of main results were presented. Findings: Results showed that banking transactions could be maintained by implementing the promoting incentive policies and increasing bank’s investment on digital infrastructure and reducing the number of branches in order to decrease the frequency of customer’s visits. In addition, the COVID 19 has speeds up the bank’s digitalization process. Further, by promoting customers’ acceptance of using digital services, the spread of COVID-19 can be viewed as a positive factor, or even a catalyst, in developing branchless banking in Tunisia. Finally, interviewees shows their high level of trust on blockchain technology, which is highly recommended and not yet introduced. Originality/value: The blockchain technology and a higher level of digitalization (digital infrastructure and qualified workers) are vital as soon as possible for the Tunisian financial system. The COVID crisis has speeds upd willingness and awareness to use digital services, speeds ups the digitalization process and facilitates transactions during the confinement period. The customer visits depends on the number of bank branches, which in turn affects bank costs.

Keywords

COVID19, Digital Transformation, Branchless Banking, Customer Relationship Management, Digital Bank, Blockchain Technology.

Introduction

The bank is a financial institution. Tunisian Bank system is contains 30 banks including 23 resident Banks and 7 non-resident ones. There are only 4 public banks BH, BNA, STB and BTS. This paper will take into account the entire resident banks (18 banks from 23). Generally, when we talk about banks the first thing that comes to mind might be the institutions that have our saving accounts or those which lend us money. However there are at least four types of banks in Tunisia commercial banks (retail banking and wholesale banking), development banks, investment banks and Merchant banks (Zaidi et al., 2021).

In 2019, the world has been shocked by the emergence of new virus. The virus was first reported in Wuhan, China, and was named Coronavirus 2019 or COVID-19. Which then spreads around the world and severely disrupt global economic activities. The disease caused by COVID-I9 is a highly contagious infection, caused by by acute coronavirus respiratory syndrome. (Lupia et al., 2020; Sun et al., 2020; Shereen et al., 2020; Disemadi & shaleh, 2020).

In order to reduce the virus' spread, governments have adopted some mitigation strategies based on social distancing, national quarantines, and shutdown of non-essential businesses. Which in turn have disrupted supply chains and limited international trade, resulting in a reduction in global supply. Global demand has also declined dramatically, mainly due to the rise of unemployment, the decrease in disposable income, and the fear of contamination. As a result, the world GDP dropped sharply from 3.6% in 2018 to -3.5% in 2020. The financial sector, and banks in particular, are expected to play a key role absorbing the shock, by supplying much needed funding. (Acharya & Steffen, 2020; Borio, 2020).

COVID-19 has caused significant instability and turbulence in the global financial market. Although the total impact has not yet been determined, the negative impact is expected to continue due to the impact of the virus.

According to a study made by the Ministry of Health on April 12, 2021, there have been 276,727 cases of infection and 9,480 deaths related to the coronavirus in the country since the beginning of the epidemic. The GDP decreased by 8.8% compared to 2019. In February 2021, the exports and imports of February 2021 decrease respectively by 12.1% and 13.7%. Moreover, the unemployment rate increases to 17.4% in the fourth quarter of 2020. On the other hand, according to a phone survey conducted by the INS in collaboration with the World Bank during the health crisis, companies have increased their use of digital solutions 12.7% of companies have increased their online presence in the fourth quarter of 2020, compared to 9.3% in the third quarter of the same year. This online presence was mainly aimed at facilitating telecommuting and completing administrative tasks. The use of new technologies has increased significantly in the areas of sales, marketing and payment methods.

While credit institutions are required to play an important countercyclical role in supporting the real sector by supplying vital credit to the corporate sector and households, these actions have also had a range of effects on the future resilience of the banking sector. For example, as lenders exhaust their existing cushions, they may also experience a decline in asset quality, threatening the stability of the system. With the crisis expected to continue even after the blockade is lifted and the economy reopens, the ultimate impact of these measures on the banking sector is still unknown (Demirgüç-Kunt et al., 2021).

The crisis has increased the importance of data, the holy grail of simulation, decision and prediction and the important and specific role of finance as a refinancing strategy.

To be more precise, the crisis shows that it is necessary to restore trust between all the stakeholders by promoting and improving their trustworthiness and by ensuring their exchanges and transactions. Blockchain may respond very carefully. The Blockchain platform is a decentralized database, integrated by designing a customizable governance system and sharing a unique and transparent historical record of secure transactions. Blockchain enables verification via a decentralized governance, the data security and the realization of multi-party, inter-organizational and cross-border transactions.

By building trust, which in turn improve cooperation between actors operating in more interdependent markets, blockchain can overcome various governance and technological challenges generated by the ongoing crisis. In addition, Blockchain technology provides governments, businesses, and citizens with a way to ensure the secure operation of important functions, make decision making more reliable and quicker, and make processes and transactions more efficient. This optimization is facilitated by two main general contributions of Blockchain: By ensuring first that information flows are shared, the risks and costs associated with duplicate information are reduced. Secondly, by clearly assign roles and responsibilities to the stakeholders involved in these processes.

“Hannibal Platform” is the first step to introduce Blockchain in Tunisia. “This platform was designed using the blockchain technology, which is considered as one of the most important modern technologies in the field of data storage…. It is a platform that permanently monitors the physical Cross Border Transportation of currency, launched in January 2021…. Hannibal platform is the fruit of the cooperation and collaboration between the LEAs (Ministry of Interior and Customs), Banks, Post Office, Exchange Offices, under the monitoring/oversight and the leadership of the Tunisian FIU ”(CTAF, 2021)

While the Banking sector will be negatively affected by the pandemic, it is also critical for economic recovery. Since this crisis will speeds up the digital trend and new financial service providers, thus intensifying the competitive pressure on banks. Studies have already been, or are now being, conducted on the detrimental effects of the pandemic. In this context, a question may arise: Is there any possibility to turn the threat of the crisis outbreak into an opportunity to introduce the Blockchain technology in some sectors such as the banking industry and to discuss the total digitalization of the bank system (Branchless banking)?.

Covid’s Impact on Bank Performance

Profitability and Credit Management (Cost of Risk)

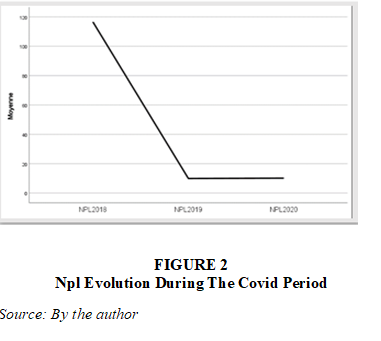

In severely affected sectors, credit defaults have increased because of declining economic activity, reduced collections, increased credit risk, and lower customer ratings. For impairment reasons, the expected decrease in the value of the loan portfolio may affect the ability of banks to meet certain ratios, such as the capital adequacy ratio (CAR), the loan-to-deposit ratio (LDR) as shown in Figure 1, and non-performing loans ratios (NPLs) as shown in Figure 2. Banks can expect a large number of loans to be shifted to the second stage, and the expected credit declines and nonperforming loans resulting from this will increase sharply.

Liquidity Risk

During the COVID-19 crisis the income from credit repayments have decreased, which may negatively affects banks’ liquidity position. Moreover, depositors continuously withdraw their money to cover their needs during the crisis and flight to quality, which is a herd-like behavior of depositors when they begin to shift their funds from banks expected to be significantly impacted by the virus into safer ones (Zaffar et al., 2019).

The bank's function as a financial intermediary is based on obtaining income in the form of interest on loans and other objectives to be achieved when customers repay their loans. Credit management is very important: if it fails, it will have a negative impact on banks and other stakeholders (such as entrepreneurs, who have difficulty to finance their activities) (Suhardi, 2006).Credit management is highly dependent on the creditworthiness of the debtor. Therefore, if debtors fail to meet their credit obligations, the bank's credit management will be greatly disrupted.

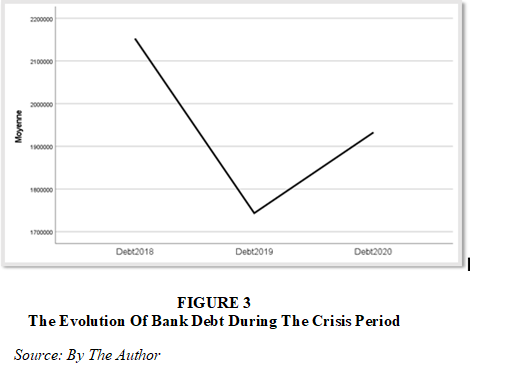

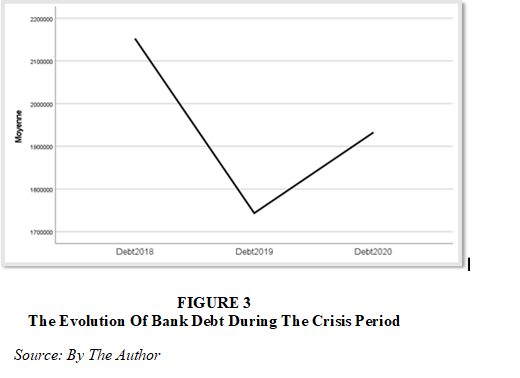

All these factors may deteriorate bank performance by increasing debt ratio as shown in Figure 3 banks are more and more indebted since the beginning of the crisis.

One of the immediate effects of stay-at-home orders on the global real economy is the increase of credit risk for both corporate and retail customers. Moreover, since banks are responsible for financing the real economy in order to support its recovery, they are forced to be more prudent to distinguish between temporary issues, which can be resolved in the short term, and more lasting impacts, which would require strict management and reclassification actions.

First, given the particularity of COVID-19, banks must update potential information, including incorporating new information into the risk parameters, and this information must be carefully analyzed. This situation will not last until there are further downturns due to economic and financial reasons.

Then they should update the "default rate” that should take into account the authorities' exemptions for the temporary phenomenon of expiring financial conditions.

The stay-at-home orders to prevent the spread of Covid-19 has interrupted economic activity in many sectors. Especially those companies, which have direct touchpoints with customers, are being deprived of their sources of income. In addition, the workers of these companies are unemployed. This will have a negative impact on the banks' profitability. Since the crisis is still ahead, the banks can expect further losses, which will lead to the need to make additional provisions, further undermining their profitability and capital position.

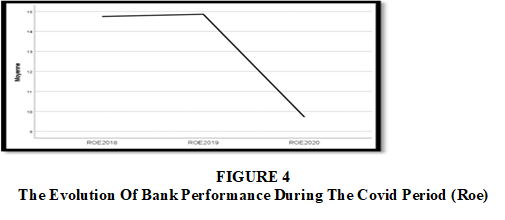

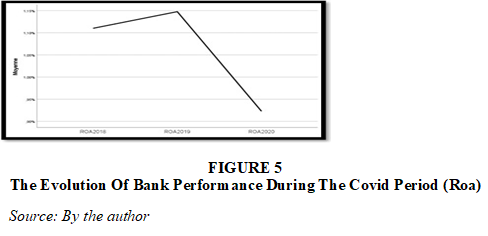

Finally, the foremost necessary is to outline the foremost appropriate timeframes to update the "recovery rates" to be able to take into consideration the positive effects albeit inevitably within the medium term of credit recovery policies that would introduce styles of credit or agreements on longer maturities. Banks were largely affected by the crisis, and as all central banks lowered interest rates, banks began to generate revenues based on commissions and online payment fees. During the crisis, the poverty has increased due to rising unemployment and rising prices, which in turn had a negative impact on credit quality. Thus banks increasing their loan loss reserves. Some Tunisian banks have already recorded significant losses in the fourth quarter of 20 (October to December) in response to the potential increase in non-performing loans. Which in turn deteriorates bank performance as measured by ROE (figure 4) and ROA (figure 5)

Stock Markets Volatility: Depressed Banks' Valuation

The global financial market has been widely affected by the COVID-19 crisis, but the financial sector has always been one of the hardest hit sectors. The valuations of banks in countries around the world have all fallen (the ratio price / net asset value (also known as price / book value). The price to net asset value ratio (representing the net assets that investors are willing to pay) has fallen sharply from 1.00 times to 0, 69 times from December 31, 2019 to April 30, 2020.

The loss in the fair value due to the increase in interest rate spreads and the effect of currency devaluation. This effect is dependent on the bank's net foreign currency position. A net FX asset position would have a positive impact while a net liability position may incur a translation loss.

Banks are negatively affected by the loss of value of bonds and other financial instruments traded, which further increases the losses of banks. To improve their liquidity position banks resort to the sale of bonds and other financial instruments traded, which leads to a fall in the prices of these instruments and has a negative impact on other banks that hold them which may cause a contagion effect.

The Tunindex index recorded in 2020 a drop of 3.33%, compared to a decline of 2.1% in 2019, mainly impacted by the COVID-19 health crisis and despite the exceptional measures taken by the different regulatory authorities of the financial system to contain the impact of the crisis.

Customer Relationship and Accelerating the Digitalization Process

In addition to the recent crisis, a digital overview has been developed and shows that the role of banks in the financial system has largely been changed (Chipeta & Muthinja, 2018), which in turn have changed Customer preferences and needs. Currently, the customer is more willing to use digital operating systems to participate in banking activities (McKinsey & Company, 2016). Innovative financial technology allows banks to provide customers with more exclusive services anytime and anywhere. New banking technologies not only can drive customer engagement they also increase their loyalty (Abualsauod & Othman, 2020). The increase of customer involvement allows banks to perform better (Wang et al., 2019).

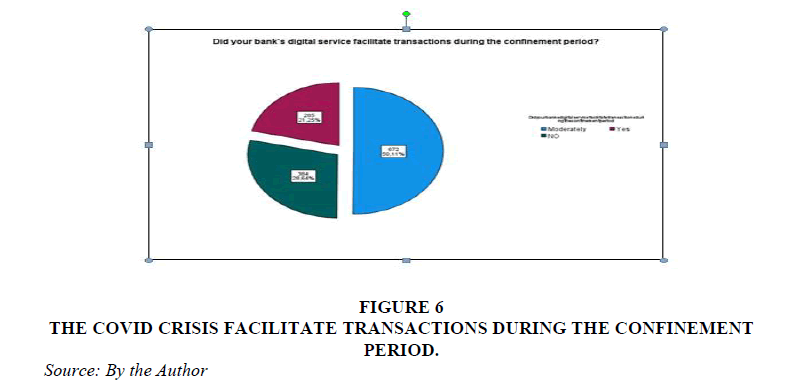

According to a survey on the impact of the COVID-19 pandemic on the private sector in Tunisia. Made by the National Institute of Statistics (INS), in collaboration with the International Finance Corporation (IFC), member of the World Bank Group, Given the health crisis, companies have made greater use of digital solutions 12.7% of companies increased their online presence in Q4, compared to 9.3% in Q3. This online presence was primarily aimed at facilitating telecommuting and completing administrative tasks. The use of new technologies increased significantly in the sales, marketing and payment sectors. These result are confirmed by this research paper , by asking 1400 bank customer; 78% claims that the COVID crisis facilitate transactions during the confinement period (Figure 6).

Figure 6: The Covid Crisis Facilitate Transactions During The Confinement Period.

Source: By the author.

Although health conditions improved after the restrictions were lifted, the health crisis severely disrupted business operations. 86.4% of businesses reported that their liquidity had decreased. 79.5% of businesses reported that demand had decreased and 54.9% of businesses reported that they had encountered difficulties to obtain financial services, while 48.9% had reduced their working hours.

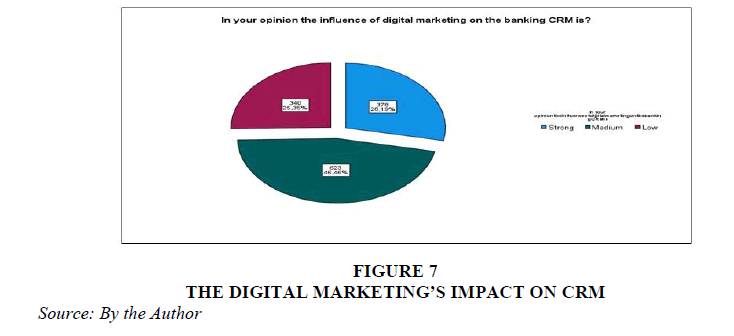

Moreover, there was an increase in customer interaction with digital platforms during the crisis period (Figure 7), which put tremendous pressure on infrastructure and technology resources. It was a real test of capacity, planning and resilience. This increased reliance on digital channels is explained by the consideration of these platforms as the primary option for conducting transactions during the crisis period.

The COVID-19 pandemic crisis will be a challenger for banks to assess their power to adopt digital transformation programs, as digital interactions become the primary option for customers. These digital transformation plans may force banks to reprioritize and try to launch new services / products to maintain their viability. This will allow for real time testing of Omni channel features and functionality, mobile app features and internet banking. Banks must keep offering services and products to stay alive. In order to take advantage of this situation, banks need to remain sensitive to these opportunities and put mechanisms in place to collect, analyze and identify opportunities for improvement due to the growing use of digital banking.

Enhance digital products, deploy dedicated hotlines for key customers, and provide advisory services to customers in key areas. In addition, attracting customers via various communication channels to value the information that their banking service providers are able to withstand shocks.

Although remote banking services can be provided without relying on direct customer contact, as a provider of payment, savings, credit and risk management services, the linkages between banks and the real sector have prolonged the negative impact of the Covid-19 crisis for banks and other financial institutions.

Why Should we Introduce Blockchain in Tunisia?

The spread of COVID-19 encompasses a terribly direct and indirect impact on the debtor's performance and capability. This impact has the potential to gift a stoppage to the performance of banks in Tunisia and disrupt financial set-up stability that ultimately affects Tunisia's economic process. Therefore, so as to be able to encourage the optimization of the banking treated operate, support economic process, and maintain the soundness of the country's financial set-up, an economic stimulant policy is required.

However the combined effects of weak business activity, increased depreciation and potential decline in business operations and fair value may lead to a lower earnings level and a depletion of capital. Because of increased credit exposure, the capital adequacy ratio may fall below the required threshold. Moreover, cyber risks, tele-working conditions, and the adoption of digital channels have widened the area of attack on the banks. Cyber threats are attempting to use new technic attack to exploit potential weaknesses in remote access.

The “Banque Internationale Arabe de Tunisie” (BIAT) is one of the thirty leading institutions in North Africa. In terms of market share, it is the first bank in Tunisia listed on the Tunisian stock exchange, its reference shareholder is the Mabrouk group. It was the victim of a ransomware attack on Thursday, February 18, 2021. By the end of 2020, ransomware attacks have increased by 50%.In Tunisia, the National Agency for Computer Security (ANSI) has warned of the risks posed by ransomware attacks in 2020. In addition, after a large-scale ransomware attack on the network of one of the phones, after an upsurge in attacks on the national network, in March, Ansi raised the national alert level for network security from a very high level to a more severe level.

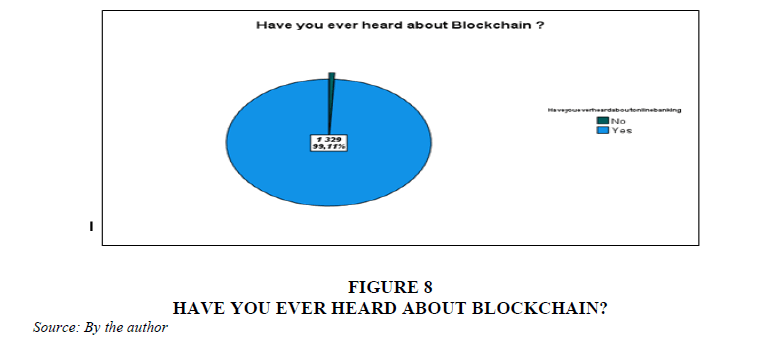

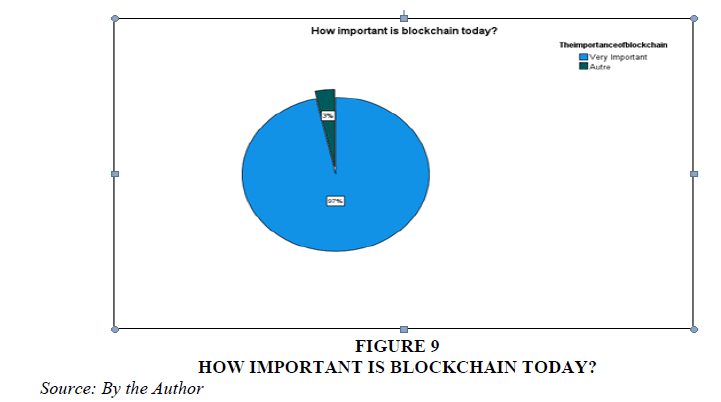

What I mean is that despite the fact that BIAT is the first bank in Tunisia it has been a victim of ransomware. This implies the fragility of the banking system security in Tunisia, which gives more weight to the Blockchain technology that must be integrated into the Tunisian banking system as soon as possible. The blockchain was introduced in 2008, allowing to save and transmit information securely. It is a kind of decentralized and unforgeable record, validating transactions in an immediate central control unit. It is well known in Tunisia (Figure 8) and highly recommended (Figure 9) but not yet introduced in the financial system.

The post office is offering DigiCash, which is a virtual wallet that allows users to send and receive money, pay bills, etc. The service is based on DLT (Distributed Ledger Technology), The central banker also asked Talan1 to create a check verification application that relies on technology. The merchant will simply scan the check and immediately know if it was stolen or if the holder is solvent. A speed and reliability that only the blockchain can guarantee.

This reasoning is also valid outside the border. The Maghreb currency is not convertible. Today's transaction consists in switching to the dollar or the euro, which costs a decline in time, money and sovereignty.

The blockchain has proven that by creating tokens for each country on the blockchain, it is possible to perform financial transactions between Moroccans and Tunisians in a few seconds (instead of 3 days). The virtual currency can be converted and exchanged at the real exchange rate during the transaction. This will promote internal Maghreb trade, which represents less than 6% of regional trade.

However, crypto-currency is one of many applications of blockchain and is still considered suspect in the Maghreb. For example, Algeria and Morocco have passed laws banning the payment method. Tunisia and Egypt do not accept its use, but have not yet passed repressive legislation. Imen Ayari, head of the innovation lab at Talan's local office, said, "In Tunisia, we benefit from the fact that regulators let us conduct experiments."

Methodology and Discussion of Main Results

The concept of branchless banking is an almost new concept, and its implementation is a big step on the way to the digitalizaton. A direct bank is a bank that operates without a branch network and provides online banking services. The reduction of branches is the new benchmark in the banking sector, which is mainly ensured by agents and data processing applications (Shahabi et al., 2020).

Purpose of the Study

This study aims to analyze the role of COVID-19 in the acceleration and development of the digitalization process and the possibility of branchless banking. For this reason, we try to simultaneously study the acceptance and development of e-banking as the main infrastructure of remote banking. Banks should take the necessary measures, including the rapid closure of branches, the development of social banking, the establishment of the required platform for remote banking, and the design and implementation of a central bank service under a single institution to improve the quality of banking services (Tran & Corner, 2016).

Secondly, given that the success of this operation need the increase of the trust level between bank and customers. That is why we test the feasibility of introducing Blockchain in the Tunisian bank system.

Research Question

Before answering the key research question, and as the integration and adoption of digital banking and the development of branchless banking within a country requires that it has already engaged and succeeded in its digital transformation, by implementing a digital infrastructure, through the development of new competencies, skills and responsibilities. The following questions should be asked:

What is the effect of digital marketing implementation on Tunisian banks' performance?

Does the Covid 19 Pandemic speeds up the digitalization of banking process?

Does the digitalization of customer’s relationship management alleviates the COVID’s impact on bank performance?

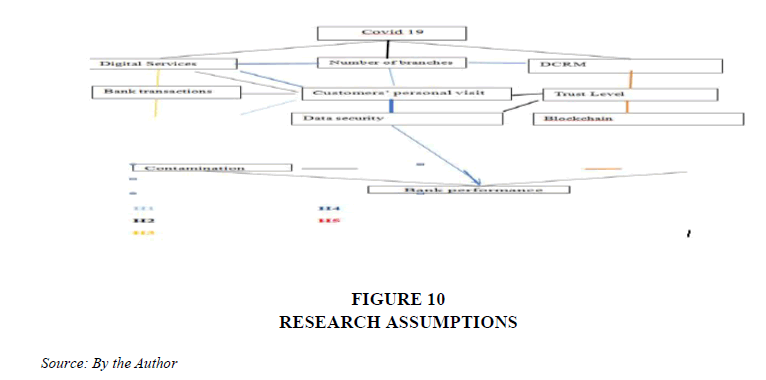

To ensure the continuity of their activities Tunisian banks have to develop their digital process even if it was not their main goal before the Covid 19 pandemic. The success of this process depends on the customers' opinions and their willingness to use the proposed digital services. It is clear that customer-bank trust is the key factor for the success of digital banking. Hence, this study aims to investigate the intention of introducing blockchain technology in the banking system Figure 10.

So our Last Research Questions are the Following

Can the blockchain be the solution to strengthen Bank-customer trust level?

What about the possibility of branchless banking in Tunisia?

Research Assumptions

In this regard, we have made the following assumptions:

H1: The number of branches is directly related to the customers’ personal visit, which increases branch costs. Therefore, reducing the number of branches will lead to less personal visits and significant cost-effectiveness for a bank.

H2: The Stay at home orders speeds up the digitalization process indirectly to help bank services’ continuity in the confinement period which in turn reduce bank losses.

H3: The use of electronic services significantly increases bank transactions and revenues, which in turn leads to the growth of a bank's financial resources. In addition, electronic banking equipment is developed through investment, which improves the quality of the system, customer satisfaction and ensures the sustainability of the bank.

H4: The COVID-19 pandemic may increase awareness and willingness of habitual customers regarding online banking services and reduce personal visits to bank branches, thus reducing the risk of spreading infection.

H5 : Blockchain is the most convenient solution to ensure the trust between the banks and their customers; by introducing blockchain technology we can talk about branchless banking.

Sources of Data

The first data source of this work is the questionnaire while some of data have been manually collected from the annual reports of banks for the period between 2018 and 2020, which were checked via the sites of the banks, central bank of Tunisia BCT and the site of the Tunisian stock exchange BVMT.

Validation of the Questionnaire

The objective of this part of the research is to test the validity of the above-mentioned questionnaire and to see how respondents respond to these items. We tested the validity of the internal consistency of our questionnaire by performing a Cronbach’s Alpha with the 49 items (α = 0,687) which is largely significant.

Population and Sampling Plan

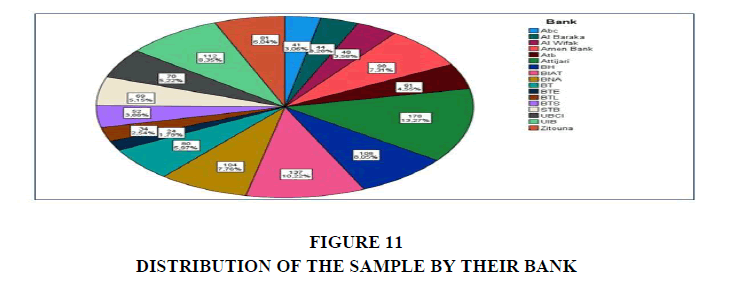

The analysis is based on a sample of 1750 bank customer. Our sample period is from 2018 to 2020. We begin by collecting data via direct research questionnaire and much accounting data are obtained from annual reports sourced from the Tunisian stock exchange site (BVMT) for listed banks and from the annual reports published online for other banks.. From this initial list, we retain only those for which we could collect complete informatios. The questionnaire is addressed to customers and employees of public and private Tunisian bank. Only five banks are eliminated from the sample because they are not listed on the stock exchange and their annual rapports are not published online. As a result, 400 answers are eliminated. Therefore, this paper encompasses 74% of the Tunisian bank system (17 from 23). In order to deepen this study, I conducted a qualitative study, characterized by the method of semi-directive interview with branch managers and client service officers Table 1.

| Table 1 Distribution Of The Sample By Age, Gender And Socio- Professional Category |

||

|---|---|---|

| Socio-professional category | N | Sum |

| Banker | 1342 | 75.24% |

| Employee in another financial organization |

1342 | 8.43% |

| Employee in non-financial organization | 1342 | 10.81% |

| Student | 1342 | 5.52% |

| Gender | ||

| Female | 1342 | 81.22% |

| Male | 1342 | 18.88% |

| Age | ||

The sample used for this study is consisted of 17 different banks (Figure 11). Only 23.5% from the surveyed banks are public. The Tunisian bank system is entirely private. Almost 75.24% of responses were collected from bankers and 24.76% from others (employee in financial and non- financial organizations and students). The bankers are mainly branch managers and client service officer. The choice of account managers in the elaboration of this survey is justified by the insertion of several banking digitalization practices in their missions.

Results

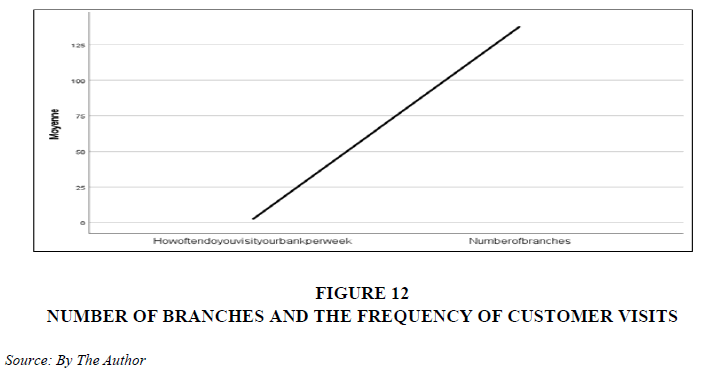

While online banking tools reduce the customer's need to visit branches , the latest innovative tools strive to eliminate any traditional form of branch service. As shown in (Figure 12) there is a positive and significant relationship between number of branches and the frequency of customers’ visits which confirm our first research assumption. However, new banking channels and technologies cannot be developed without the agreement of their customers. Conditions may vary due to environmental and cultural conditions (Hassan & Wood, 2020). Suh & Han (2002) reported that trust is one of the main factors affecting Korean customers' attitudes toward using electronic banking. In Malaysia, people find that self-perceived ability, feasibility, and previous experience of using online banking are the most important factors in accepting online banking (Guriting & Oly Ndubisi, 2006). Tran & Comer (2016) provided evidence that the intention to use the e-banking services and their usefulness and benefits is a priority for New Zealand customers.

Most research in this area focuses on the development and adoption of new technology. While developing a specific technology, regardless of factors that may affect a user's acceptance of the technology, will reduce the capacity of the system and waste most of the organization's and country's resources. Therefore, technology acceptance and development must be considered in a systematic and synchronized manner. It should be noted that to implement telebanking, the

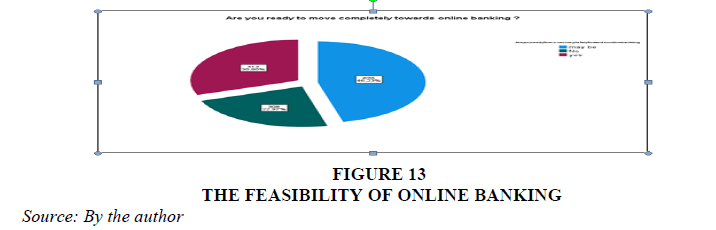

supply chain of banking services must be redesigned as banking services, so that there is no need for personal visits. Electronic banking tools must be developed and accepted by customers. This research studies the role of COVID19 in accelerating the acceptance and development of e-banking services (digital bank services with branchless banking). In this context 1340 bank customer are asked about their opinion to move completely towards digital bank. Only 23% refuse the idea.

Despite the real economic crisis, COVID-19 is still accelerating the digitization of the banking system as shown in (figure 13). Therefore, this can be seen as a positive interruption of digitization, providing an excellent customer experience. The contribution of technological innovation can play an important role in ensuring the continuity of banking activities. Which confirm our second research assumption that the Stay at home orders speeds up the digitalization process indirectly to help bank services’ continuity in the confinement period which in turn reduce bank losses.

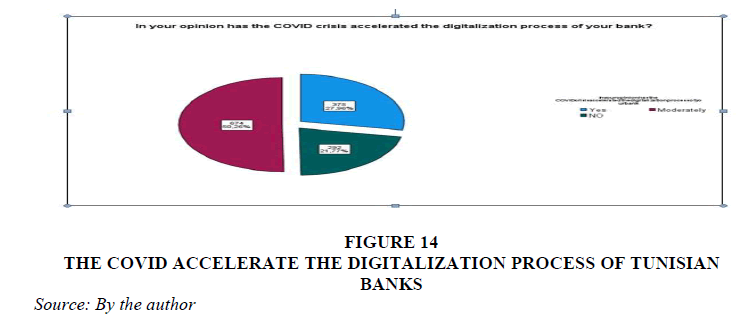

Results show that the more the bank is digitized the more it performs better (figure 14). One of the main challenges of the digital transformation of banks is the transformation of their human resource, to develop and repositioning of skills, behind the closure of branches is the transformation of the customer relationship with new, refocused and diversified professions. This involves speeds upd automation of processes and the development of consulting skills to serve a more qualified and informed customers. All branch networks are accelerating their insurance distribution capacity, while others are thinking about distribution partnerships, particularly with local producers, or sharing offices with start-ups.

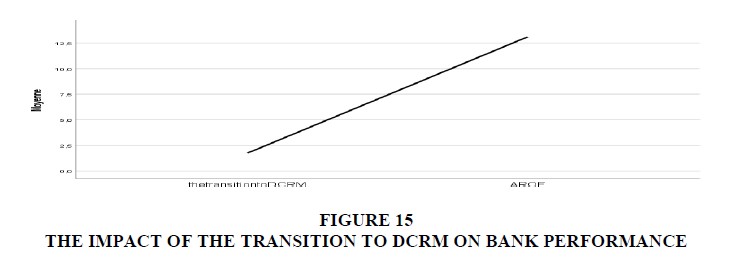

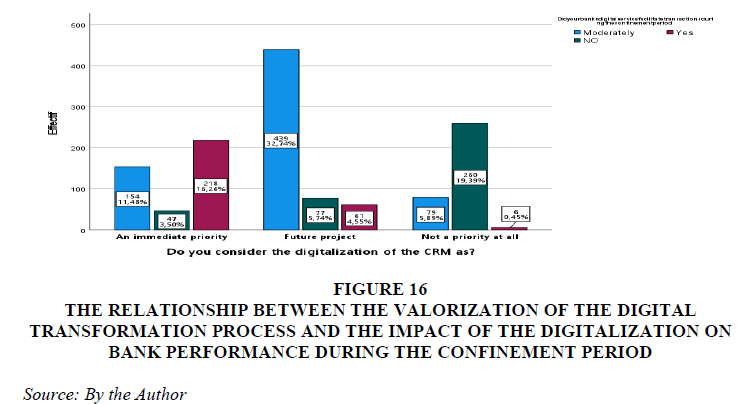

The digital services offered by banks, that have consider the digitalization process as an immediate priority, facilitate significantly the transactions during the confinement period (figure 15). In addition, banks whose consider the DCR as a future project their transactions have been moderately facilitated during the crisis. That is why digitalization now is a real priority. To survive in such a period of crisis banks should have an adequate digital infrastructure and qualified workers. Hence, the use of electronic services significantly increases bank transactions and revenues, which in turn leads to the growth of a bank's financial resources. In addition, electronic banking equipment is developed through investment, which improves the quality of the system, customer satisfaction and ensures the sustainability of the bank which confirm our third research assumption.

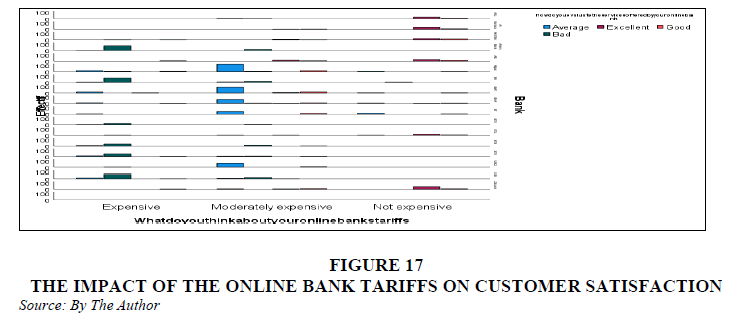

The online bank tariffs is one of the most important driver of customer satisfaction. Results from the graphic (Figure 16) below shows that the more the bank online services are expensive the lower customer satisfaction is. Which confirms the results of the study made by Sanjeepan who argues that there was moderate positive relationship between switching cost and customer satisfaction. However, Selvanathan, 2016 who claims that there is no significant relationship between cost and adoption of online banking, does not share this concern. The results show that there is a positive and significant relationship between online bank tariffs and customer satisfaction.

Figure 16:The Relationship Between The Valorization Of The Digital Transformation Process And The Impact Of The Digitalization On Bank Performance During The Confinement Period.

Source: By the author.

Some banks had a digital mindset even before the COVID crisis and were increasingly involved in digitalization during the crisis. Even the most regional and agent-centric banks are forced to push the use of digitalization, which was never their strategic focus. For them, this step is particularly complicated, and they need to approach this step by demonstrating true proximity to the customer Figure 17.

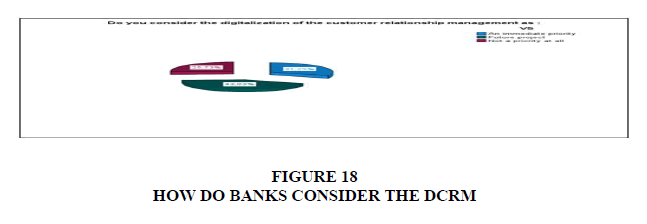

Bankers' clear understanding of their digital delivery gap (more evident than ever in COVID- 19) can make them more willing to speeds up the path to digital transformation Figure 18.

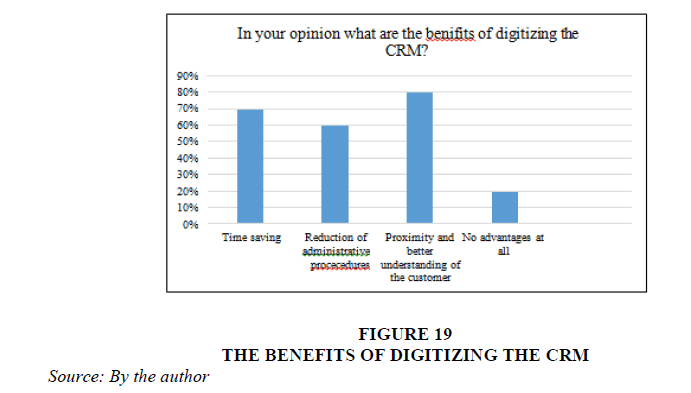

During the implementation of the digital transformation has been a response for imperative of change it has been imposed by customers, who have become more discerning and who want to get a better, more personalized and more transparent customer experience. From now, the adoption of the digital process is no longer a choice but rather a necessity to ensure a sustainable competitive advantage within the bank. Interviewees' answers show that client satisfaction is the most important factor explaining the digital transformation within the bank. . In fact, the majority of bankers interviewed see the digital world as an opportunity to be seized (time saving, reduction of administrative procedures and proximity and better understanding of customers). Which confirm our forth research assumption that COVID-19 pandemic may increase awareness and willingness of habitual customers regarding online banking services and reduce personal visits to bank branches, thus reducing the risk of spreading infection Figure 19.

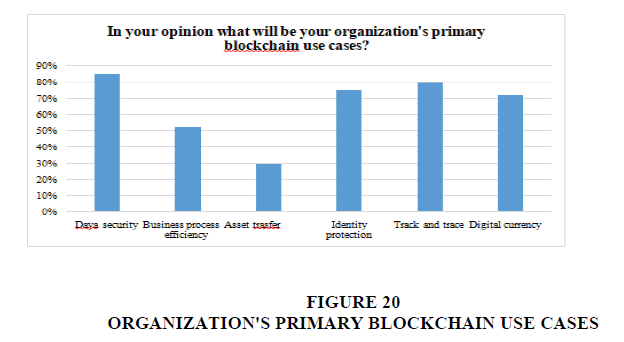

Blockchain technology has received a lot of attention over the last decade, propelling beyond the praise of niche Bitcoin fanatics and into the mainstream conversation of banking experts and investors. The blockchain, on the other hand, makes it possible to move assets in a distributed database. Its system (a network of highly secure nodes that communicate with each other, editor's note), more reliable, produces value without recourse to third parties. And that suggests radical transformations for businesses and society. Blockchain allows asset owners to track and exchange financial items, such as unpaid bills, in a secure, transparent and private "chain" of transactions. The exchange of information or value is direct from person to person (or computer to computer) with a high level of data security and identity protection. Fewer intermediaries means lower costs, greater speed, performance and transparency. Everyone shares the same information in real time and the exchanges are visible to the community. That's why it's distributed. According to the results of my survey, the blockchain’s main use cases are data security, identity protection, track and trace and digital currency. According to this answers security and trust are the most needed factors in the banking system. Therefore, if blockchain will be introduced in the banking industry it will strengthen or replace the traditional bank. Which confirm our fifth research assumption that Blockchain is the most convenient solution to ensure the trust between the banks and their customers; by introducing blockchain technology we can talk about branchless banking Figure 20.

Conclusion

We are dealing with a new concept ‘digital transformation’, which has suddenly emerged from classical concepts and cognition. A transformative technology can completely change the financial world. There are many materials for innovation, but it is an innovation with many risks, so it involves regulatory issues. The role of the central bank is to intervene in this area, especially in our environment.

At the digital level, if we want to improve the quality of service and increase customer satisfaction, the integration of new services and new functions is imperative. At the same time, it is important to ensure that regulatory aspects are respected. The more we open up to technology and information systems, the more it becomes a source of risk in terms of system impact, and we have to be more vigilant.

Overall, organizations are accelerating the adoption of digital transformation as the best way to avoid near-term economic collapse and respond with resilience to the COVID-19 pandemic. Whether this trend continues will depend on how we humans define the role of technology in our work and lives. The following quote from Steve Jobs is instructive:

“Technology is nothing. What is important is that you have a faith in people, that they are basically good and smart, and if you give them tools, they will do wonderful things with them.”

Blockchain technology has received a lot of attention over the last decade, propelling beyond the praise of niche Bitcoin fanatics and into the mainstream conversation of banking experts and investors. It is important to note that according to the World Bank, the banking rate in Tunisia does not exceed 40% because the pre-requisites for opening a bank account are high. Today, the blockchain allows the creation of a digital portfolio in a few clicks on his mobile phone, and guarantees an almost instantaneous exchange of value at a very low price (around 0.02%). Simply reducing financial transaction costs can help support economic growth and financial inclusion. Moreover, the Maghreb currency is not convertible. Therefore, allowing young startups to create their own crypto-currency on the blockchain will open the door to internationalizing their business. It will also solve the problem of obtaining foreign currency, as crypto-currencies are convertible by default, although blockchain financial instruments have considerable advantages.

Blockchain is transforming everything from payments transactions to how money is raised in the private market. Will the traditional banking industry embrace this technology or be replaced by it?

Can't this technology allow the Maghreb region to catch up in financial transactions, and most importantly to ensure that its population still on the bangs of the economic cycle is better integrated?.

Limitation of The Study

The limitations of this study may reduce the quality of the results and follow-up recommendations to some extent. These limitations include thefact that this investigation has been conducted in a single country with only 3 years of sample period. In addition, this study was conducted during the COVID-19 epidemic, and its unknown characteristics may affect the results’ fiabiliy. There are other valid variables and factors that can be included in the proposed model; however, due to the complexity of the model and the lack of accurate information, only the structure of the proposed model is considered. In addition, it is necessary to draw attention to the function of the system dynamics method. This method recommends a modeling process in which a better understanding of the actual structure and behavior of the system can be continuously formed. Since the model developed in this study only makes sense from the above- mentioned point of view, readers should appropriately adjust their expectations regarding the results of the econometric model. In fact, this study is one of the first simulation studies on the impact of the virus in the Tunisian bank sector, and can only be considered as a starting point for further research on branchless banking using blockchain technology. Turning this starting point into a scientific process requires additional research. however, due to the complexity of COVID-19's behavior, some of the views presented in this article may be challenged in the coming months.

References

Abualsauod, E. H., & Othman, A. M. (2020). A study of the effects of online banking quality gaps on customers’ perception in Saudi Arabia. Journal of King Saud University-Engineering Sciences, 32(8), 536-542.

Indexed at, Google Scholar, Cross Ref

Acharya, V.V., & Steffen, S. (2020). The risk of being a fallen angel and the corporate dash for cash in the midst of COVID. The Review of Corporate Finance Studies, 9(3), 430-471.

Indexed at, Google Scholar, Cross Ref

Borio, C. (2020). The prudential response to the Covid-19 crisis. Bank of International Settlements, 4(5), 1-6.

Chipeta, C.& Muthinja, M.M. (2018). Financial innovations and bank performance in Kenya: evidence from branchless banking models, South African J Economic and Management Sciences, 21, 1.

CTAF, 2021. https://ctaf.gov.tn/data/uploads/pdf/6036f145751c40.78125531.pdf

Demirgüç-Kunt, A., Pedraza, A., & Ruiz-Ortega, C. (2021). Banking sector performance during the COVID-19 crisis. Journal of Banking & Finance, 133, 106305.

Indexed at, Google Scholar, Cross Ref

Disemadi, H.S., & Shaleh, A.I. (2020). Banking credit restructuring policy amid COVID-19 pandemic in Indonesia. Jurnal Inovasi Ekonomi, 5(02).

Indexed at, Google Scholar, Cross Ref

Guriting, P., & Oly Ndubisi, N. (2006). Borneo online banking: evaluating customer perceptions and behavioural intention. Management research news, 29(1/2), 6-15.

Indexed at, Google Scholar, Cross Ref

Hassan, H.E., & Wood, V.R. (2020). Does country culture influence consumers' perceptions toward mobile banking? A comparison between egypt and the united states. Telematics and Informatics, 46, 101312.

Indexed at, Google Scholar, Cross Ref

Lupia, T., Scabini, S., Pinna, S.M., Di Perri, G., De Rosa, F.G., & Corcione, S. (2020). 2019 novel coronavirus (2019-nCoV) outbreak: A new challenge. Journal of global antimicrobial resistance, 21, 22-27.

Mckinsey & Company (2016). Cutting through the fintech noise: markers of success,imperatives for banks.

Shahabi, V., Azar, A., Razi, F.F., & Shams, M.F.F. (2020). Simulation of the effect of covid-19 outbreak on the development of branchless banking in iran: case study of resalat qard–al-hasan bank. Review of Behavioral Finance, 13(1), 85-108.

Indexed at, Google Scholar, Cross Ref

Shereen, M.A., Khan, S., Kazmi, A., Bashir, N., & Siddique, R. (2020). COVID-19 infection: Emergence, transmission, and characteristics of human coronaviruses. Journal of advanced research, 24, 91-98.

Indexed at, Google Scholar, Cross Ref

Suh, B., & Han, I. (2002). Effect of trust on customer acceptance of internet banking. Electronic Commerce research and applications, 1(3-4), 247-263.

Indexed at, Google Scholar, Cross Ref

Suhardi, G. (2006). Resiko dalam pemberian kredit perbankan. Jurnal Hukum Pro Justitia, 24(1).

Sun, J., He, W. T., Wang, L., Lai, A., Ji, X., Zhai, X., ... & Su, S. (2020). COVID-19: epidemiology, evolution, and cross-disciplinary perspectives. Trends in molecular medicine, 26(5), 483-495.

Indexed at, Google Scholar, Cross Ref

Tran, H.T.T., & Corner, J. (2016). The impact of communication channels on mobile banking adoption. International Journal of Bank Marketing, 34(1), 78-109.

Indexed at, Google Scholar, Cross Ref

Wang, C., Fan, X., & Yin, Z. (2019). Financing online retailers: bank vs. Electronic business platform, equilibrium, and coordinating strategy. European Journal of Operational Research, 276(1), 343-356.

Indexed at, Google Scholar, Cross Ref

Zaffar, M. A., Kumar, R. L., & Zhao, K. (2019). Using agent-based modelling to investigate diffusion of mobile- based branchless banking services in a developing country. Decision Support Systems, 117, 62-74.

Indexed at, Google Scholar, Cross Ref

Zaidi, N., Azouzi, M. A., & Sadraoui, T. (2021). Ceo financial education and bank performance. Journal of Entrepreneurship Education, 24(2), 1-20.

Received: 18-Apr-2023, Manuscript No. JEEER-23-13506; Editor assigned: 20-Apr-2023, Pre QC No. JEEER-23-13506(PQ); Reviewed: 27- Apr-2023, QC No. JEEER-23-13506; Published: 28-Apr-2023