Research Article: 2022 Vol: 26 Issue: 4S

The Corporate Innovation in Europe

Alberto Costantiello, LUM University

Angelo Leogrande, LUM University

Lucio Laureti, LUM University

Citation Information: Costantiello, A., Leogrande, A., & Laureti, L. (2022). The corporate innovation in Europe. International Journal of Entrepreneurship, 26(S4), 1-10.

Abstract

In this article we investigate the political and industrial determinants of firm investment in Research and Development. We use data from the European Innovation Scoreboard of the European Commission for 36 countries in the period 2000-2019. We found that firm investments in Research and Development are positively associated with “Linkages”, “Innovation Index”, “International Co-publications”, “Medium and high-tech product exports”, “Non-R&D innovation expenditure”, “Turnover share large enterprises”, “Human Resources”, “Intellectual Assets”. Firm investments in Research and Development are negatively associated to “Foreign doctorate students”, “Knowledge-intensive services exports”, “Private co-funding of public R&D expenditures”, “Basic-school entrepreneurial education and training (SD)”, “New doctorate graduates”, “Trademark applications”, “Tertiary education” “Design applications”, “Lifelong Learning”, “Foreign-controlled enterprises – share of value added (SD)”, “Total Entrepreneurial Activity (TEA) (SD)”.

Keywords

Innovation and Invention, Processes and Incentives, Management of Technological Innovation and R&D, Diffusion Processes, Open Innovation

JEL Classification

030, 031, 032, 033, 036

Introduction

The role of innovation has been recognized as an essential tool for economic growth. The Solow growth model (Solow, 1956) considers the human capital as a determinant to improve the degree of technology and improve the degree of efficiency of labor. The endogenous growth theory (Romer, 1994) puts the technology at the center of the economic process considering the technological change as the main force that can improve outputs in the short term with fixed or quasi-fixed inputs. Schumpeterian economics (Schumpeter, 2013) has introduced the idea of the innovation for the process of economic growth either in the complex dynamics of the creative-destruction. In this article we try to understand what the determinants of the corporate investment in innovation in Europe are. We consider data from the European Innovation Scoreboard in the period 2000-2019 for 39 countries (Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finlandia, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Latvia, Lithuania, Luxembourg, Malta, Montenegro, Netherlands, Norway, Poland, Portugal, Romania, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine, UK). We perform panel data econometrics with fixed effects, random effects, pooled OLS, WLS and dynamic panel at 1 stage. We found that the probability of a corporation to invest in innovation in Europe is positively associated to: “Intellectual assets”, “Human resources”, “Non-R&D innovation expenditures”, “Medium and high tech product exports”, “International co-publications”, “Innovation index”, “Linkages”. The probability of European corporations to invest in innovation in Europe is negatively associated to “Foreign doctorate students”, “Knowledge-intensive services exports”, “Private co-funding of public R&D expenditures”, “Basic-school entrepreneurial education and training (SD)”; “New doctorate graduates”, “Trademark applications”, “Tertiary education”, “Design applications”, “Lifelong learning”, “Foreign-controlled enterprises – share of value added (SD)”, “Total Entrepreneurial Activity (TEA)”. The article continues as follows: the second paragraph considers a short analysis of the literature with a focus on R&D intensity; the third paragraph presents the econometric model and the synthesis of the main results, the fourth paragraph contains the conclusions, the fifth paragraph indicates the bibliographical references, the sixth paragraphs is the appendix with the econometric analysis.

Literature Review

Research and Development intensity can be calculated in two methods: directly and indirectly. Direct R&D intensity is defined R&D expenditure divided by output R&D Intensity =

Indirect R&D intensity is the value of knowledge in intermediate goods and services. There is an essential difference between direct R&D intensity and indirect R&D intensity i.e. that while on one side direct R&D intensity can be analyzed using balance sheet data at a firm level on the other side indirect R&D intensity can be calculated with input-output tables

(Ugur, et al., 2016) afford the question of the relationship between R&D intensity and firm survival. The authors analyze 37.930 R&D active firms in the UK in the period 1998-2012. The results are as follows:

- The relationship between Research and Development intensity and firm survival as an inverted U shape pattern;

- Research and Development intensity growths with the degree of concentration of a market;

- Creative destruction has a negative effect on R&D The authors control the results for age, size, and productivity.

(Padgett & Galan, 2010) analyze the impact of Research and Development intensity on Corporate Social Responsibility. The authors focalize on the intangible resources. There is a positive association between Corporate Social Responsibility and Research and Development activity since both created intangible values and empower either stakeholders either communities. The authors analyze either manufacturing industries either non-manufacturing industries and find that Research and Development intensity positively affect Corporate Social Responsibility in manufacturing industries. The positive relationship between Research and Development and Corporate Social Responsibility is absent for the case of non- manufacturing industries.

(Churchill, et al., 2019) question the relationship between Research and Development intensity and CO2 emission per capita in G7 countries. The authors find that R&D activities have a positive effect on reducing CO2 emissions in G7 countries. Results shows that 1% increase in R&D intensity reduces CO2 emissions between 0.13% and 0.16%.

(Falk, 2012) affords the question of the relationship between Research and Development intensity and firm growth activities in Austria in the period 1995-2006. The results show that R&D intensity has a positive effect on employment and sales growth. But the impact of R&D on firm growth decreases over time.

(Mathieu & De La Potterie, 2010) analyze how macro-economic conditions on a country level base can impact aggregate R&D intensity. The authors analyze 21 industrial sectors, 18 countries in 5 years. Results show that there is a positive relationship between national industrial structure and R&D intensity on a country base. The authors find that there are countries in which the macroeconomic environment is particularly favorable to R&D and countries in which the R&D intensity is based on R&D expected returns such as in USA, Sweden, and Japan.

(Savrul & Incekara, 2015) afford the question of the increasing relevance of knowledge and technology in the globalization as instruments to promote economic growth. There are two methodologies by which countries can improve the investment in knowledge and technology: on one hand countries can implement specific policies that improve the degree of technical knowledge or on the other hand firms can spontaneously create and promote a cultural and productive environment oriented to innovation and Research and Development. But if countries need to improve the level of innovation than they should focus on appropriate policies and investments either public either private. But not all investments in innovation can improve innovation performance. The authors conclude that environmental and cultural factors have a relevant role in reducing the gap between innovation investments and innovation performance.

(Gentry & Shen, 2013) afford the question of the relationship between risk averse managers and Research and Development expenditures in firms that are influenced by external evaluations such as that of forecasting analysts. The authors find that managers are oriented to cut R&D expenditures during a crisis or either in the case of missing target. Authors use data from US manufacturing firms during the period 1979-2005.

(Adomako, et al., 2019) analyze the relationship between Research and Development and New Product Performance-NPP. The authors report literature that explains the presence of a positive relationship between Research and Development and New Product Performance. But to better understand the question authors introduce the idea of international R&D i.e., the fact that R&D cannot produce autonomously by single countries, but it is at the contrary based on the presence of international R&D teams. The authors analyze 201 Ghanaian firms and find that there is a positive relationship between R&D and New Product Performance especially for that firms that relate to international R&D team. (Nunes, et al., 2012) afford the impact of R&D intensity either in high tech either in non-high tech small sized enterprise. The results show that R&D intensity has a positive effect for firm growth only for high tech small enterprises. R&D intensity has no effect for low-tech small and medium enterprises. But the authors also find that younger and smaller non-high tech SMEs can benefit from R&D intensity at least better than older, larger non-high tech SMEs.

(Booltink & Saka-Helmhout, 2018) afford the question of the relationship between R&D investment and non-high tech small enterprises. The authors consider that while it is certain that while on one hand R&D intensity is positively associated to the performance of high-tech small enterprises on the other hand R&D intensity is negatively correlated to the performance firm in non-high tech small enterprises. The degree of R&D investment in non-high tech firms is limited. But the investment in R&D for non-high tech SMEs is also important for their performance and survival. The authors find an inverted U-shaped relationship between R&D intensity and non high-tech SMEs performance. Non high-tech SMEs that are oriented to exportations can benefit more from R&D investments.

(Wang, et al., 2018) analyze the relationship between political, managerial, and cognitive bias in respect to R&D. The authors believe that political influences and managerial cognitive biases can reduce the degree of R&D intensity in developing countries. 1.293 Chinese listed firms are analyzed in the period 2010-2014. The authors find the sequent results:

- If manager are subject to political ties than they can reduce the degree of R&D intensity;

- Managers overconfidence improve R&D intensity;

- If managers are either subjects to political ties and either overconfident than R&D intensity tends to growth;

The authors conclude that an appropriate managerial mind-set based on overconfidence can improve R&D investments in emerging countries.

(Dieguez-Soto, et al., 2019) analyze the relationship among Research and evelopment intensity, family management and firm performance. Family management is negatively associated to firm performance. Research and Development intensity is positively associated to firm performance. Research and Development intensity alleviate the negative impact of family management on firm performance. (Purkayastha, et al., 2018) affords the question of the relationship between R&D intensity and the degree of internationalization. The authors show the presence of a positive relationship between R&D intensity and internationalization in Indian firms.

(Min & Smyth, 2016) analyze the relationship among Research and Development intensity, corporate leverage, and growth opportunities. The authors find that generally Research and Development is positively associated to growth opportunities. But for firms that have greater leverage the impact of Research and Development is negatively associated to growth. The authors use a dataset with data of South Korea.

(Yunlu & Murphy, 2012) afford the question of the ability of managers to invest in Research and Development during a recession. Empirical analysis shows that during a recession there is a reduction in R&D spending. But, controlling for the characteristics of the CEOS, the authors find that CEOs with shorter career horizon tend to reduce the investment in Research and Development more that CEOs whit longer career horizon. The authors suggest that the individual incentives of CEOs in connection with their career expectation can have a role in the investment choice in Research and Development during a recession.

(Padgett & Moura-Leite, 2012) afford the question of the relationship between Research and Development intensity and corporate reputation. The authors tested their hypothesis on 257 US firms in the period 2004-2007. The authors try to analyze the relationship between Research and Development intensity and corporate reputation especially for that innovation that can produce social benefits that are valuable for stakeholders. If firms in boosting their expenditure in Research and Development can produce social valuable innovation than the corporate reputation of the firm increases. Managers can improve the corporate reputation of firms investing in Research and Development in connection with corporate social responsibility. The increasing in Corporate Reputation, Corporate Social Responsibility and Research and Development can offer greater probability to improve profits in the long run. (Bordons, et al., 2015) afford the question of the positive relationship between international collaboration and Research and Development. The authors analyzed 9.961 scientific article. The results show that the large part of the bilateral collaboration have been realized among countries with high Research and Development intensity. The presence of a positive relationship between co-publication and countries with an elevated degree of Research and Development intensity is high especially in Social Sciences. Mathematics is the only field in which international collaboration among co-authors is relatively independent from Research and Development intensity at a country level.

(Naik, et al., 2014) afford the question of the relationship between R&D expenditure and market valuation of the firm. The authors use data from 326 R&D Indian firms in the period 2001-2010. Results shows the presence of an inverted U-shaped relationship between R&D intensity and firm value. The relationship between R&D investment and the firm value is rising until the optimal point. After the optimal point, the marginal investment in R&D has decreasing returns.

(Veugelers & Cincera, 2010) analyze the degree of innovation in the European Union. The authors find that the level of innovation in European Union is low especially controlling for the degree of Research and Development in the business sector. In a confrontation with USA the weakness of EU consists in the fact that new firms play a marginal role in the sense of innovation especially for high-tech industries. The authors find that effectively the level of innovative young firms in Europe is lower than the analogous in the US. But the main point of the authors is the fact that young leading innovators in Europe generate lower level of Research and Development in respect to their counterparts. The authors conclude that the R&D gap between EU and USA is not only due to the demography of young tech firms, but it is ascribable to deeper and structural investments.

(Kraiczy, et al., 2015) afford the question of the relationship between CEOs culture and the investment in Research and Development. The authors refer to the “upper echelon theory” i.e., a theory that consider the organizational outcomes as a function of managerial cultures and values. The expenditure in Research and Development can be predicted by the presence of managerial individual characteristics i.e., behaviors, values, personalities, motivations, and executives’ experiences. The authors consider the relationship among firm growth, Research and Development intensity and CEO orientation toward innovation. The study analyzes also if the CEO orientation toward Research and Development change in respect to dimension of the firm and in connection to the economic cycle. The study analyzes 77 German CEOS of SMEs. The result shows the presence of a positive effect between R&D intensity and CEO’s orientation toward innovation. The positive effect between CEO innovation orientation and R&D intensity is greater in firms with low growth.

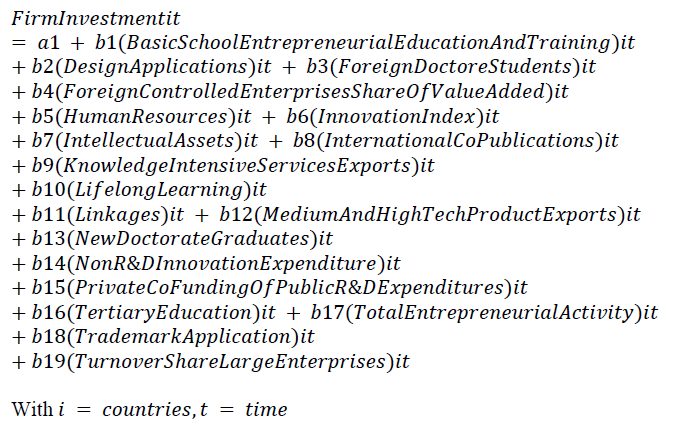

The Model

The sequent model is estimated:

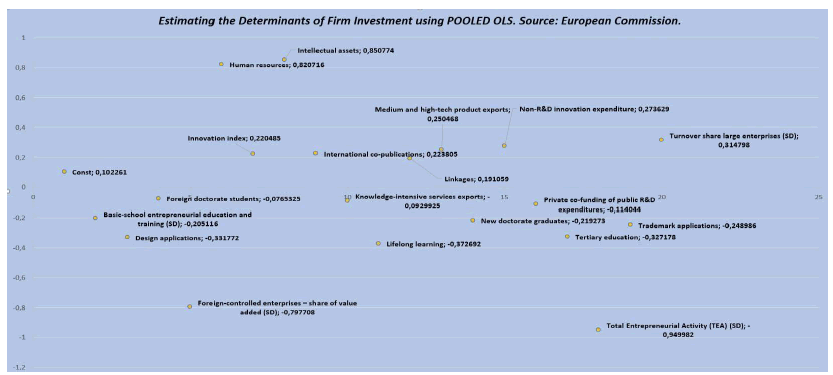

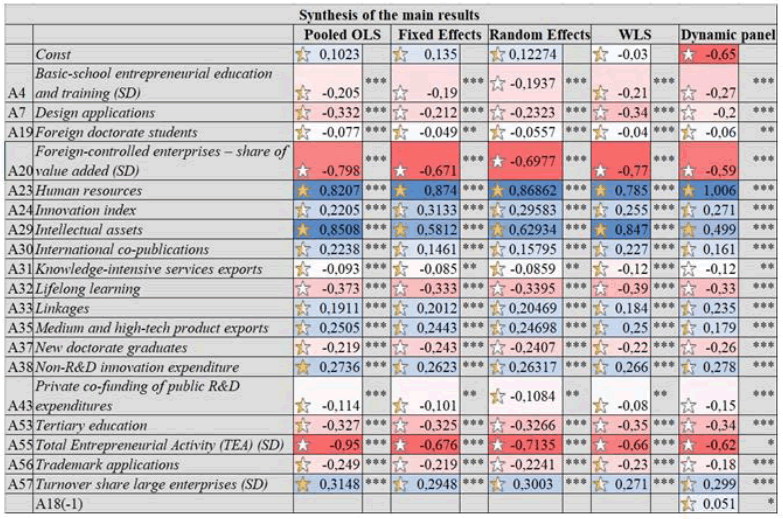

The econometric analysis shows that the degree of firm investment in innovation is positively associated with:

- Intellectual assets: captures different forms of Intellectual Property Rights -IPR generated in the innovation process. This means that the probability of a firm to invest in innovation increases with the diffusion of property rights and patents. Corporations that operate in entrepreneurial environments characterized by the presence of patents can have more opportunities to improve the innovativeness of their business through

- Human resources: is a global measure of the diffusion of scientific and technical knowledge among the workforce population. If a firm can employ workers with a high human capital than there are more probabilities to improve the investment in In effect a qualified human capital has more ability to create innovation either in R&D activities either in non-R&D operations.

- Turnover share large enterprises: this is a measure of a turnover in enterprises with more than 250 There is a positive relationship between turnover in large enterprises and the corporate innovation investment in Europe. Turnover in effect can liberate qualified workforce that can be employed successively in other corporations improving the degree of innovation.

- Non R&D innovation expenditures: is the complex of innovation that can be realized either outside the R&D Non-R&D innovation expenditures give to firms a more innovative approach since all the departments and functions of the firm participate actively in the process of innovation. The net effect is a more innovative orientation of the corporation.

- Medium and high-tech product exports: corporations that operate in economic environment based on a deep orientation toward exportation of medium and high-tech products invest more in innovation. This deep orientation toward innovation can be explained since in the presence of exportations firms can improve their returns on investment associated to

- International co-publications: the presence of international relations among scholars oriented to improve publication can offer a cultural environment favorable to science and technology that can induce corporations to improve their

- Innovation index: is a global measure of the orientation of a country toward innovation not only in the private sector but also in the public sector. If a firm is inserted in a environment positively shaped by a high degree of innovativeness then there are greater probabilities that that firm could improve their investment in

- Linkages: is a measure of the degree of interconnectedness among private sector, public sector and financial sector in the sense of innovation. The greater the interconnectedness among these sectors the greater the probability that a corporation improve the investment in

We found that the degree of firm investment in innovation is negatively associated to:

- Foreign doctorate students: is the share of foreign doctorate students that reflect international mobility. The share of foreign doctorate students can be considered as an essential variable to improve the degree of research in a But the improving share of foreign doctorate student misses the positive relationship with the corporate innovation investment. The negative relationship between foreign doctorate students and the corporate innovation investment can be explained considering that firms seems to be indifferent to the quality of tertiary education.

- Knowledge-intensive services exports: is a measure of the competitiveness of the knowledge intensive service sector. But, contrary to the export of high-tech products, the exportation of knowledge intensive services is negatively associated to corporate innovation This can be since the service sector is more based on intangible assets and require less investment in equipment, machinery, infrastructures, and intermediate goods.

- Private co-funding of public R&D expenditures: is a measure of the cooperation between the public and the private sector to improve the degree of innovativeness of a productive system at a country But there is a negative trade off between the financial resources that a firm can use to boost the public-private partnership and the resources that firm can use to invest in the innovation process.

- Basic-school entrepreneurial education and training: is a measure of the ability of an educational system at a national level to promote business culture. There is a negative relationship between the corporate innovation investment and the educational level in business in the 36 countries of the analyzed dataset for the period 2000-2019.

- New doctorate graduates: is a measure of the supply in tertiary education. This variable is negatively associated to the corporate innovation investment in Even if the general level of human resources is positively associated to corporate innovation investment, the specific increase of the number of doctorate graduate do not improve the innovation investment among corporations.

- Trademark applications: is a relevant variable to boost the economics of the service Since trademark application can guarantee the origin of goods and services and it is a form of communication especially for publicity and advertising. But the choice of a corporation to invest in innovation does not depend on the improving of trademark applications. Corporations are more interested in patents and intellectual property rights that can be used to produce new products and services rather than in trademark applications.

- Tertiary education: this is a measure that consider the supply of advanced skills in the workforce population. But this variable comprehends either scientific either non-scientific skills. Specifically, non-scientific skills are more widespread in the service sector rather than in the manufacturing sector. Firms that invest in innovation are more oriented to product innovation than to process innovation and are more sensible to the presence of a specific workforce that has skills in STEM

- Design applications: is the recognizing of rights that regard the lines, contours, colors, shape, texture, materials, and ornamentation of a product or of a part of a product. The increasing of design application is negatively associated to the decision of a corporation to invest in innovation in Design has in effect more affinity with marketing than with innovation.

- Lifelong learning: is the process of continuous learning either formal either informal of population at a country Lifelong learning activities does not comprehend cultural and sporting activities. Lifelong learning is negatively associated to the decision of a firm to invest in innovation. The negative relationship can be better understood considering that lifelong learning is not necessarily oriented to scientific and technological knowledge and consequently is not necessarily associated to the decision of a corporation to invest in innovation.

- Foreign-controlled enterprises – share of value added: the presence of foreign controlled enterprises is negatively associated to the probability of a corporation to invest in In effect generally foreign controlled enterprises operate in low and medium tech industries that require low or no investments in innovations. The diffusion of low or medium tech corporations depresses the degree of innovation among corporations.

- Total Entrepreneurial Activity (TEA): is the percentage of the population that is an entrepreneur or a owner manager of a business. This variable is negatively associated to the probability of a corporation to invest in When a firm decides to invest in innovation is not interested in the percentage of entrepreneur’s presents among the population but, at the contrary, it is more interested in the quality of innovation and in the orientation of the entire productive system towards high tech industries.

Source: European Innovation Scoreboard-European Commission

Source: European Innovation Scoreboard-European Commission

Conclusion

We investigate the determinants of the corporate investment in innovation in Europe. We report a short literature analysis that consider the role of R&D intensity for firm performance and growth. Finally, we run an econometric analysis to estimate the determinants of firm investment in innovation in Europe for 36 countries in the period 2000-2019. We found that the probability of a corporation to invest in innovation in Europe is positively associated to: “Intellectual assets”, “Human resources”, “Non-R&D innovation expenditures”, “Medium and high-tech product exports”, “International co-publications”, “Innovation index”, “Linkages”. The probability of European corporations to invest in innovation in Europe is negatively associated to “Foreign doctorate students”, “Knowledge-intensive services exports”, “Private co-funding of public R&D expenditures”, “Basic-school entrepreneurial education and training (SD)”; “New doctorate graduates”, “Trademark applications”, “Tertiary education”, “Design applications”, “Lifelong learning”, “Foreign-controlled enterprises – share of value added (SD)”, “Total Entrepreneurial Activity (TEA)”.

References

Adomako, S., Amankwah-Amoah, J., Danso, A., Danquah, J.K., Hussain, Z., Khan, Z. (2019). R&D intensity, knowledge creation process and new product performance:The mediating role of international. R&D teams.

Crossref, GoogleScholar, Indexed at

Booltink, L.W., & Saka-Helmhout, A. (2018). The effects of R&D intensity and internationalization onthe performance of non-high-tech SMEs. International Small Business Journal, 36(1), 81-103.

Crossref, GoogleScholar, Indexed at

Bordons, M., Gonzalez-Albo, B., Aparicio, J., & Moreno, L. (2015). The influence of R&D intensity ofcountries on the impact of international collaborative research: Evidence from Spain. Scientometrics, 102(2), 1385-1400.

Churchill, S.A., Inekwe, J., Smyth, R., & Zhang, X. (2019). R&D intensity and carbon emissions in theG7: 1870?2014. Energy Economics, 80, 30-37.

Crossref, GoogleScholar, Indexed at

Dieguez-Soto, J., Manzaneque, M., Gonzalez-Garcia, V., & Galache-Laza, T. (2019). A study of themoderating influence of R&D intensity on the family management-firm performance relationship:Evidence from Spanish private manufacturing firms. BRQ Business Research Quarterly, 22(2), 105-118.

Crossref, GoogleScholar, Indexed at

Falk, M. (2012). Quantile estimates of the impact of R&D intensity on firm performance. Small BusinessEconomics, 39(1), 19-37.

Gentry, R. J. & Shen, W., 2013. The impacts of performance relative to analyst forecasts and analystcoverage on firm R&D intensity. Strategic Management Journal, 34(1), 121-130.

Crossref, GoogleScholar, Indexed at

Kraiczy, N.D., Hack, A., & Kellermanns, F.W. (2015). CEO innovation orientation and R&D intensityin small and medium-sized firms: the moderating role of firm growth. Journal of Business Economics, 85(8), 851-872.

Mathieu, A., & De La Potterie, B.V.P. (2010). A Note on the Drivers of R&D Intensity. Research inWorld Economy, 1(56).

Min, B.S., & Smyth, R. (2016). How does leverage affect R&D intensity and how does R&D intensityimpact on firm value in South Korea?. Applied Economics, 48(58), 5667-5675.

Crossref, GoogleScholar, Indexed at

Naik, P. K., Narayanan, K. & Padhi, P., 2014. R&D intensity and market valuation of firm: A study ofR&D incurring manufacturing firms in India. Journal of Studies in Dynamics and Change, 1(7), 295-308.

Crossref, GoogleScholar, Indexed at

Nunes, P.M., Serrasqueiro, Z., & Leitao, J. (2012). Is there a linear relationship between R&D intensityand growth? Empirical evidence of non-high-tech vs. high-tech SMEs. Research policy, 41(1), 36-53.

Padgett, R.C., & Galan, J.I. (2010). The effect of R&D intensity on corporate social responsibility. Journal of Business Ethics, 9(3), 407-418.

Crossref, GoogleScholar, Indexed at

Padgett, R.C., & Moura-Leite, R.C. (2012). The impact of R&D intensity on corporate reputation:Interaction effect of innovation with high social benefit. Intangible Capital, 8(2), 216-238.

Crossref, GoogleScholar, Indexed at

Purkayastha, S., Manolova, T.S., & Edelman, L.F. (2018). Business group effects on the R&D intensityinternationalization relationship: Empirical evidence from India. Journal of World Business, 53(2), 104-117.

Romer, P.M. (1994). The origins of endogenous growth. Journal of Economic perspectives, 8(1), 3-22.

Savrul, M., & Incekara, A. (2015). The effect of R&D intensity on innovation performance: A countrylevel evaluation. Procedia?Social and Behavioral Sciences, 210(1), 388-396.

Crossref, GoogleScholar, Indexed at

Schumpeter, J.A. (2013). Capitalism, socialism and democracy. Routledge a cura di s.l.:s.n.

Crossref, GoogleScholar, Indexed at

Solow, R.M. (1956). A contribution to the theory of economic growth. The quarterly journal ofeconomics, 70(1), 65-94.

Ugur, M., Trushin, E., & Solomon, E. (2016). Inverted-U relationship between R&D intensity and survival:Evidence on scale and complementarity effects in UK data. Research Policy, 45(7), 1474-1492.

Crossref, GoogleScholar, Indexed at

Veugelers, R., & Cincera, M. (2010). Young leading innovators and EUs R&D intensity gap. BruegelPolicy Contributions, NA-NA.

Crossref, GoogleScholar, Indexed at

Wang, D. et al., (2018). Exploring the influence of political connections and managerial overconfidence on R&D intensity in China's large-scale private sector firms. Technovation, 69, 40-53.

Crossref, GoogleScholar, Indexed at

Yunlu, D.G., & Murphy, D.D. (2012). R&D intensity and economic recession: Investigating themoderating role of CEO characteristics. Journal of Leadership & Organizational Studies, 19(3), 284-293.

Crossref, GoogleScholar, Indexed at

Received: 20-Feb-2022, Manuscript No. ije-22-10618; Editor assigned: 27-Feb-2022, PreQC No. ije-22-10618 (PQ); Reviewed: 10-Mar2022, QC No. ije-22-10618; Revised: 20-Mar-2022, Manuscript No. ije-22-10618 (R); Published: 07-Apr-2022