Research Article: 2022 Vol: 26 Issue: 1

The Cbdc Retail Money Revolution: How Will It Impact Monetary Policies and Consumer Behavior?

Florie Mazzorana-Kremer, International University Of Monaco, Omnes Education

Citation Information: Mazzorana, F. (2022). The cbdc money revolution and its impacts on monetary policies and consumer behaviours. Academy of Marketing Studies Journal, 26(1), 1-11.

Abstract

A Central Bank Digital Currency (CBDC) is a digital currency issued by a central bank that brings together the characteristics of cryptocurrencies and traditional fiat money. To date, only a few countries have initiated the issuance of this innovative and hybrid medium of exchange (Cambodia, Bahamas, Singapore, China, Uruguay, Caribbean), most of them still at the experimental stage. However, many other central banks are on the way of doing it, such as the Federal Reserve (FED) and the European Central Bank (ECB). Unlike cryptocurrencies, CBDCs are stable units of value, fully backed by central banks. However, like their private crypto counterparts, they enable real-time transactions at no cost. Because they create a direct link between central banks and consumers, they offer new levers for monetary policies. They also facilitate the tracing of transactions and payers, which is likely to generate new business practices. At the same time, they provide governments with a formidable tool for controlling people's money, with the ability to directly withdraw or block funds based on social or discriminatory criteria.

Keywords

CBDC, Cryptocurrency, Blockchain, Digital Money, Monetary Policy, E-Wallet.

Introduction

Thanks to Bitcoin and the emergence of other cryptocurrencies, a new and fully digital way of paying and transferring money has been discovered. Indeed, initially perceived as the means of payment for illegal activities, and reserved for well trained and IT-familiar individuals, cryptocurrencies have gradually aroused the interest of many other people, companies and even institutions because they presented undeniable advantages: contrary to what one might think, most cryptos are very transparent and trace all transactions; they also enable virtually real-time and inexpensive cross-border transactions.

However, even with these advantages, the high volatility of cryptos makes them unreliable for daily use. Even “stablecoins,” that is, cryptos that are backed by fiat money or short-term bills, are limited because they are issued by private companies and come with certain liquidity risks. For this reason, fiat money is still essential, however, cryptos have shown governments how far digitization could go. In doing so, they paved the way for a much more ambitious central bank money, with enhanced capabilities:

1. Real time transfers and payments

2. Reliable and real time settlements

3. Intuitive digital e-wallets, to store and use digital money

4. Payments and transfers at no cost, with no borders

5. Transaction tracing, with associated data processing

Such a shift in our financial landscape has forced countries and central banks to reshape their concept of currencies to stay in the race for the digitalization and internationalization of money. The adoption of bitcoin as an official currency by countries like Japan or El Salvador has reinforced this decision. Major central banks are now planning to issue their own decentralized digital currency before 2025. Such e-money, called Central Bank Digital Currency (CBDC), mixes both the characteristics of cryptocurrencies (with real-time payments and settlement) and the stability of traditional fiat money.

In the following parts of the article, we first discuss the definition of money, explain what technological innovations cryptocurrencies have brought about, and how they could contribute to a new class of central bank digital currencies. We then expand on what CBDC is and the changes in consumption, payments, and state control it could bring in our societies.

The Cryptocurrency Revolution

The definition of money and the place of cryptocurrency

Economists do not all agree on a single definition of money but in the most widely spread definition, money serves three functions: it is a medium of exchange, a store of value and a unit of account.

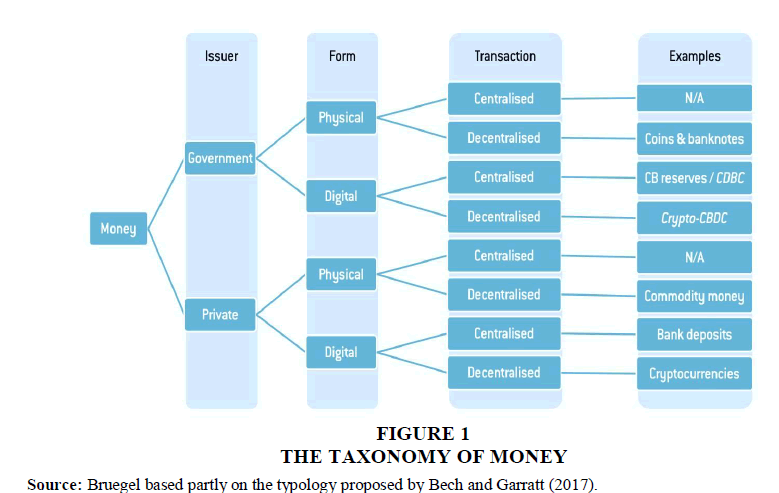

To fulfill these three functions, money can take a variety of forms, including non-perishable goods, non-financial assets, and financial assets (Claeys and al., 2018). Various goods and assets have been used as money. Some have been successful while others have led to monetary instability and thus have been replaced. Therefore, money can vary both in its characteristics and in its relative success in fulfilling its three main functions Figure 1.

Source: Bruegel based partly on the typology proposed by Bech and Garratt (2017).

More precisely, money can take several forms and have several origins: it can be issued by private companies or governments, it can be digital or physical and, be centralized or decentralized (Bech and Garratt, 2017).

Cryptocurrencies are decentralized digital currencies, initiated by private companies or individuals. They represent a form of money that did not exist before, as a special combination in monetary taxonomy.

While cryptocurrencies can practically serve as a medium of exchange, they are still not seen as money because of several of their characteristics. Indeed, if we look at the most famous cryptocurrencies like bitcoin and Ethereum, they have a rigidly inflexible supply which make them wildly fluctuate in demand and price. They thus appear too unstable to be used as a unit of account. However, they have the potential to serve as a store of value, due to their low supply growth, backed by the network’s distributed protocol, and their credible demonstration over time of the absence of any authority able to alter such supply schedule (Ammous, 2018). Even though other cryptocurrencies like Tether USD or USDC are more stable and theoretically backed by real USD dollars or short-term notes, they rely on a centralized and private control, with uncertainty as to the reality of this back support Auer & Boehme (2021).

Despite these limitations, but given the incredible benefits that cryptocurrencies bring, many central banks have started or are planning to issue their CBDCs. To do this, they are inspired by the technological design of cryptocurrencies, which is based on Distribution Ledger technology and Blockchain Auer et al. (2021) Auer, Frost (2021)..

Technical overview of Blockchain and Distributed Ledger technologies (DLT)

Cryptocurrencies work on the principle of blockchains, a sub-category of the distributed ledger technology (DLT). Such technology was invented and disclosed with the very first cryptocurrency called bitcoin.

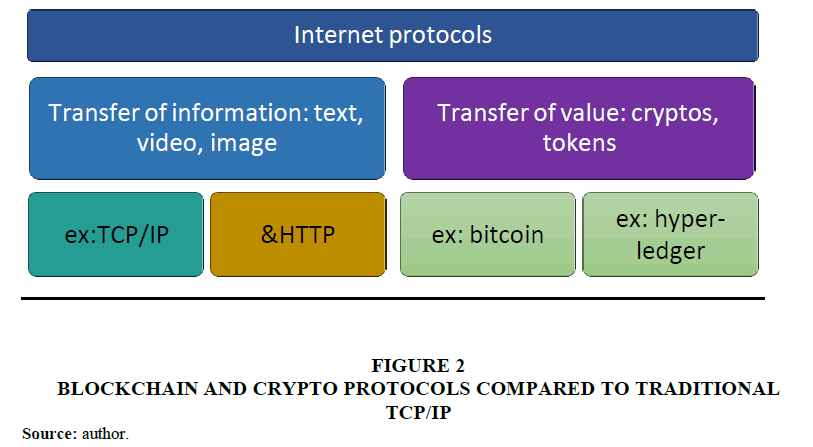

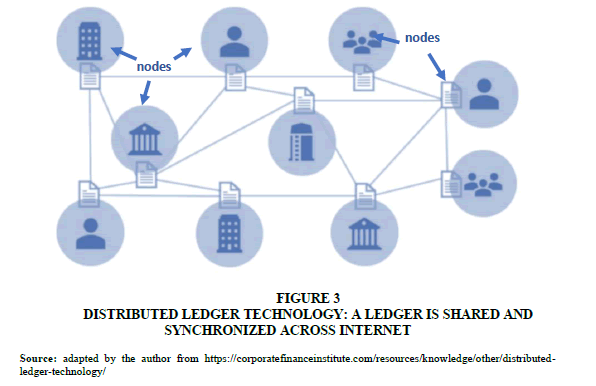

In cryptocurrencies, like bitcoin, a network of participants shares a database called “ledger”, that includes all the “bank accounts” that have owned or currently owns bitcoins. Such database increases in time, at a regular pace, to include the new transactions made. Instead of being centralized like in a bank, the bitcoin database is public and shared across the globe with anyone running the bitcoin protocol and willing to have a copy of this ledger on its computer. This protocol is often called the “value protocol” because it enables the transfer of valuable assets through the internet.

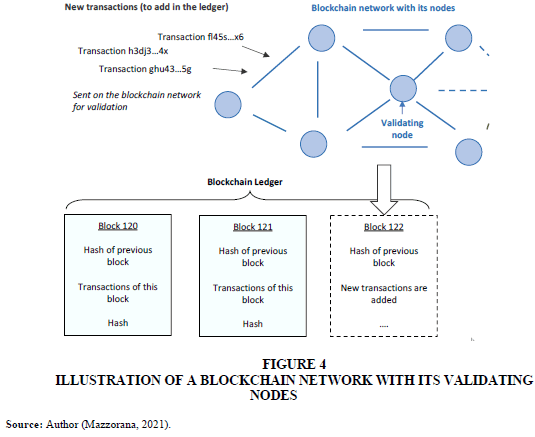

To make the bitcoin system function, all bitcoin network participants – called “nodes” – share the previously described ledger which contains all the history of bitcoin transactions. All the nodes run the same protocol – the bitcoin core – which contains consensus rules according to which a new block with new transactions is added to the ledger every 10 minutes. Because it is built in the form of successive blocks, the ledger is called a “blockchain” in the case of cryptocurrencies. The immutability of a blockchain ledger is both ensured by the high number of network participants that validate the transactions and by a cryptographic fingerprint – called hash (Haber and Scott, 1997) – which is added at the top and bottom end of any new block. This "hash" makes it easy and quick to verify that no past transaction has been changed in the shared ledger.

Source: adapted by the author from https://corporatefinanceinstitute.com/resources/knowledge/other/distributed-ledger-technology/

The advantage of a distributed ledger, compared to a centralized one, is that it exists across several locations and among multiple participants. Because it is decentralized, it eliminates the need for a central authority or intermediary to validate or authenticate transactions. Enterprises use distributed ledger technology to process, validate or authenticate.

A blockchain is thus a particular distributed ledger that takes the form of a sequence of blocks, and in which each additional block does not change the content of the previous ones. It gives more security because it conserves the whole history of past transactions and account balance Figures 2 & 3.

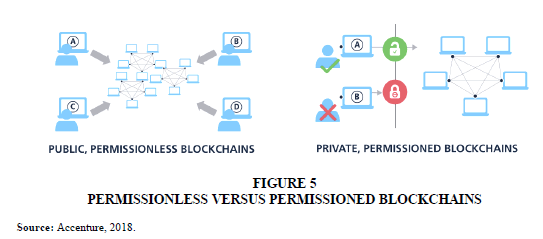

Permissionless Versus Permissioned Blockchains

A permissionless blockchain, like the largest public ones Ethereum and Bitcoin, is a distributed ledger in which anyone can participate in consensus, write new blocks or access data without any control. Consensus mechanisms in permissionless blockchains consist in protocols that make all participants agree on the transactions that must be validated and included in the successive blocks of the blockchain.

Unlike fully public blockchains where anyone can access the ledger and view their transactions, in a permissioned blockchain all members of the system must be authorized. Such types of distributed ledger are more suitable for wholesale CBDCs. They simplify settlement operations, transfers and transactions between a limited number of authorized financial players. Nevertheless, they preserve - at least to the general public - the anonymity of transactions and they limit the possibility to validate transactions to duly regulated and authorized financial institutions Figures 3 & 4.

In the following chapters, we develop what CBDCs are, on which technology they rely, and their possible impact on retail payments and on relations between central banks, governments, and people.

Immersion In the World of Cbdcs

What is CBDC and its relying technology?

Different technical frameworks exist for CBDCs. Some use a decentralized ledger technology (DLT) other do not. However, it is observed that “many central banks are considering the issuance of token-based CBDC on DLT” (Bossu et al., 2020), depending on the economic agent which is using the money.

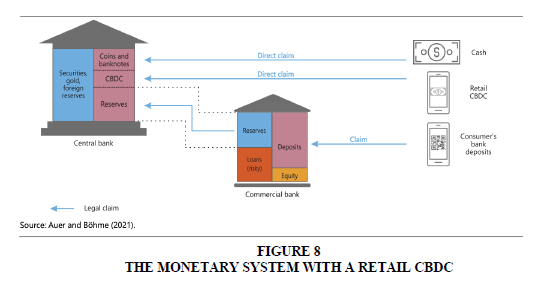

More precisely, while designing their CBDC systems, central banks make a distinction between wholesale CBDC and retail CBDC. Wholesale CBDC is the CBDC used by financial institutions that hold reserve deposits in the central bank. It is used for real time transfers and settlements between banks. Retail CBDC is issued for and used by the general public for the purchase of goods and services, or for instant transfers between individuals.

In most CBDC solutions, the wholesale CBDC rely on a DLT infrastructure connecting all the financial institutions and banks. Depending on the country, retail CBDC use DLT or not. For example, the Reserve Bank of Australia, Singapore and Korea are working with commercial banks on a DLT technology for their CBDC and also explore the DLT feasibility at a retail level (Wang and Gao, 2021). On the other hand, China reported that it will not use blockchain for its CBDC because it doesn’t want to allow the validation of RMB transactions without the need for banks (Alun, 2020). As a result, CBDC can be divided into centralized and decentralized CBDC, in function of their use, or not, of a DLT Figures 4 & 5.

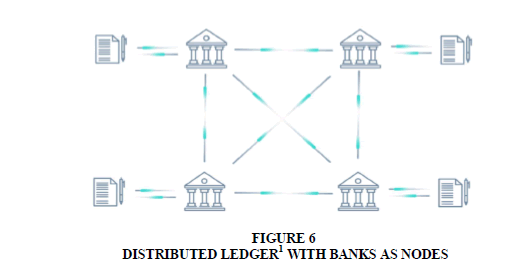

International Settlement through CBDC

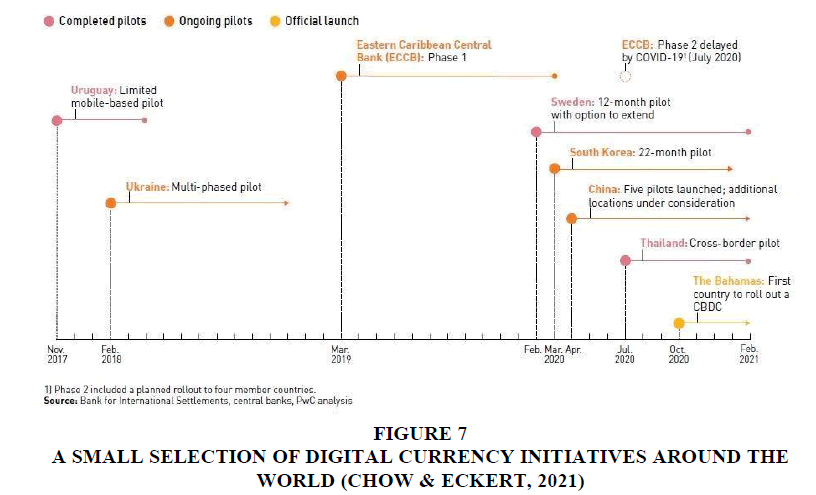

On the top of these national CBDC frameworks, a CBDC network is likely to emerge in the future, with the validating nodes being the economies that issue CBDC (i.e. central banks and large financial institutions). According to the Bank for International Settlements, amid the largest central banks, a majority is considering the international acceptance of CBDCs, which would further develop the CBDC network. Some of these central banks are the Bank of England, the Bank of Japan, the Bank of Canada, the European Central Bank (ECB), the Swiss National Bank, the Federal Reserve System. They are working with the Bank of International Settlements to figure out how such top layer DLT system could work. The solution more likely to emerge is a permissioned blockchain system, where central banks represent a validating node of the ledger Figures 6 & 7.

Figure 6:Distributed Ledger1With Banks As Nodes

Figure 7:A Small Selection Of Digital Currency Initiatives Around The World (Chow & Eckert, 2021).

What Impact can Cbdcs have on Retail Operations and Consumer Behavior?

As mentioned earlier, in central bank digital currencies a distinction is made between wholesale CBDC and retail CBDC. The Wholesale CBDC (w-CBDC) is dedicated to financial institutions that hold reserve deposits at the central bank. As such, w-CBDC will be used to enable nearly real-time payments and settlement with a high level of security, even reducing counterparty liquidity risks.

The Retail CBDC (r-CBDC) is the digital central bank currency issued to the general public. This r-CBDC is relatively popular in emerging economies because it drives financial inclusion and lowers printing and cash processing costs. Indeed, individuals just need an electronic wallet, most of the time linked to a digital identification (Mazzorana, 2021), to receive money directly from the central bank or to carry out retail transactions with other people. Thus, the need for a bank account is bypassed, with all the limiting criteria that are often associated with it for the poorest.

R-CBDC involves the use, on individuals' smartphones, of an e-wallet. In this e-wallet, the CBDC account is identifiable by a QR code. To receive money, one just has to share its QR code. And to transfer money or pay, it only has to scan the recipient's QR code: in doing so, the e-wallet application will send the desired amount of money to the recipient's QR code, after validation by the payer.

The r-CBDC also involves possible changes in monetary policies, payment relationships, and consumer behaviors. Some of these possible changes are listed in the following paragraphs Figures 7 & 8.

Money with Deadlines for Immediate Consumption

First, to support monetary interventions, retail CBDCs can create new monetary policy levers, with currency limited in time or associated with spending conditions (Allen et al., 2020).

Indeed, for illustrative purposes, one of the issues raised by the US helicopter money distributed in 2020 was that most of it was reinvested in the stock markets instead of being used for goods and local consumption. R-CBDC would be a game-changer, allowing central banks to condition the use of distributed digital currency to certain products and services, to fight recession more effectively, and not just to fuel financial bubbles. One consequence is that some businesses and stores will have to adapt to such short-term money and be able to target people with new delays and types of marketing campaigns.

Similarly, CBDC makes monetary policy more efficient. indeed, if well managed, it can facilitate the transmission of interest rate changes from the central bank to the economy.

In particular, when needed, it can allow negative interest rates for cash, to force consumption or investment by individuals. However, in doing so, monetary policies become more and more intrusive in people's lives, almost imposing certain consumer and social behaviors on them.

Easy and Intuitive Payments with No Transaction Cost, Even for A Single Dollar

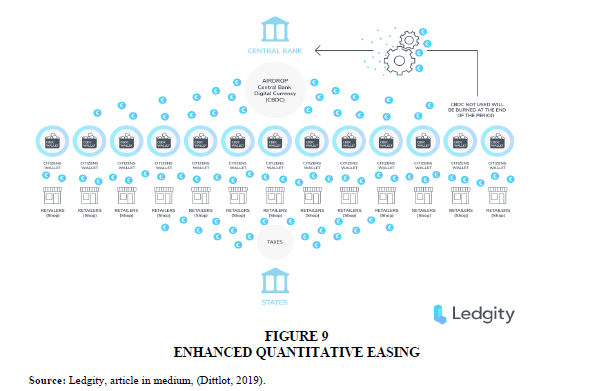

Secondly, digital payment using e-wallet will be possible with no fee, thus facilitating digital payment acceptance in many shops, with no minimal amount Figures 8 & 9.

This fundamental feature of r-CDBC reduces the need for physical cash. It thus may progressively replace the use of cash, with similar anonymity (at least from a retail perspective).

As a result, transactions in virtual currencies, including r-CBDC, are poised to rise quickly because they are intuitive, needing only a finger swipe or mobile phone tap. As the use of such currencies grows, and central banks’ efforts progress, pressures will intensify on companies and shops to offer more digital payment options and better experiences to their customers. Online platforms such as Facebook and Amazon are already anticipating this move, following the objective to make sending money around the world as easy as sending a text message.

On a B2B level, the security, low cost, and ease for tracking payments enabled by digital currencies will increase the attraction for global companies looking to improve supply chain performance (Chow & Huff Eckert, 2021).

Targeted Marketing Feedback and Consumer Understanding

Because the e-wallet used to receive and spend the retail CBDC enable the tracing of transactions by banks and governments, it becomes easier for them to understand consumers’ behaviors. As a result, governments will be able to better target and adapt their economic policies. In addition, many statistics will be available, enabling the financial players to offer more innovative services.

In particular, for tech and fintech companies, there is a great opportunity for developing applications to connect CBDC with artificial intelligence, internet of things, big data, 5G.

At the B-to-C level, it also becomes possible to create loyalty campaigns, with “airdrops” directly targeting customers' e-wallet addresses. Indeed, instead of increasing the number of loyalty cards, merchants will be able to directly target their best clients by identifying their paying address. They will also be able to automatically offer reductions in function of the e-wallets used in their shop. Thus, marketing intelligence and use of big data should enable much more efficient and ambitious fidelity programs.

Social Credit and E-Wallet

From a government perspective, it is also easy to imagine policies that target certain categories of people. Even though for retail stores, the electronic wallet is anonymous and transactions cannot be traced outside said stores, they become fully transparent for banks and governments. As a result, one can easily imagine financial discrimination and immediate fines based on individual behavior. Indeed, with CBDC, a government could directly withdraw money from a personal electronic wallet, particularly if it is linked to a digital ID. By way of illustration, in the event of a pandemic crisis, or in a country with a social credit, the use of the currency can depend on the social score of the individual or on his/her vaccination status.

One could also imagine the loss of citizenship directly associated with the loss of funds, or the suspension of access to the electronic wallet.

Conclusion

CBDCs represent a revolution for our banking systems and economies. They enable real time transactions at no cost and offer new levers for monetary policies. They also facilitate the tracing of transactions and payers, which is likely to generate new business practices. However, and whatever the technical design ultimately adopted, CBDCs create a direct link between central banks and individuals, which makes these types of currencies very particular, with unique political characteristics: indeed, CBDCs give governments and / or central banks the possibility of influencing final consumption at the individual level as well as restricting the use of money. They represent both social progress and possible human regression. For this reason, they require strong regulation and democratic oversight before fully realizing their positive potential. Furthermore, the direction and governance of central banks, in such a CBDC revolution, should ideally be partly managed by representatives of the people, directly elected and revocable through the voting process, in order to ensure maximum control over the use of these powerful tools.

ENDNOTES

1https://www.marcopolonetwork.com/articles/distributed-ledger-technology/

References

Alun, J. (2020). Explainer: How Does China’s Digital Yuan Work. Reuters. Luettavissa: https://www. reuters. com/article/us-china-currency-digital-explainer-idUSKBN27411T. Luettu, 16, 2021.

Ammous, S. (2018). Can cryptocurrencies fulfil the functions of money?. The Quarterly Review of Economics and Finance, 70, 38-51.

Auer, R., & Boehme, R. (2021). Central bank digital currency: the quest for minimally invasive technology (No.948). Bank for International Settlements.

Auer, R., Frost, J., Gambacorta, L., Monnet, C., Rice, T., & Shin, H. S. (2021). Central bank digital currencies: motives, economic implications and the research frontier. Annual Review of Economics, forthcoming.

Bech, M. L., & Garratt, R. (2017). Central bank cryptocurrencies. BIS Quarterly Review September.

Chow, W., & Huff Eckert, V. (2021), “China and the race for the future of money. How digital currency could change the global financial landscape” pwc publication. 1 March 2021.

Dittlot, P.Y. (2019). ‘Central Bank Digital Currency (CBDC): une opportunité pour les Banques Centrales et les Gouvernements’ Medium.

Mazzorana, F. (2022). To be digital or not to be. Academy of marketing studies Journal. 26(S1), 1-13