Research Article: 2023 Vol: 22 Issue: 6

The Buyer's Outlook: Navigating the Impact of Product Differentiation, Innovation, Customer Focus, and Price Strategy upon the Real Estate Business Performance

Manaswini, Panjab University

Monika Aggarwal, Panjab University

Citation Information: Manaswini, & Aggarwal, M. (2023). The buyer's outlook: navigating the impact of product differentiation, innovation, customer focus, and price strategy upon the real estate business performance. Academy of Strategic Management Journal, 22(S6), 1-16.

Abstract

The fierce rivalry in the real estate sector drives the adoption of distinctive product features, ongoing innovation, client focus, and pricing modifications. This study's goal was to determine the major interactions between the real estate developers’ tactics: product differentiation, customer focus, innovation and price approach on business performance from buyers’ lens in the real estate industry. Questionnaire responses were collected from 342 buyers from Tri-City of Chandigarh, Panchkula and Mohali using convenience sampling. Structural Equation Modelling (SEM) was used in this study as a method of verification. The study's findings show that there are important direct implications on market performance, with innovation, customer focus, product differentiation and price approach all having a beneficial impact. The results are consistent with the prediction of direct effects that have a major impact on market performance. This study has important implications for developers because it shows that in order to be successful, they must restructure/ensure that customers have positive experiences with innovation, the best service possible by putting the needs of the customer first, the delivery of distinctive products, and the perception of a fair price. These factors helped real estate firms increase their competitiveness.

Keywords

Foreign Product Differentiation, Innovation, Price, Business Performance, Real Estate Industry.

Introduction

India has the sixth-largest nominal GDP in the world, with the service sector accounting for 53.77 percent of that total. Real estate industry, like residential, commercial, retail and hospitality hold maximum stake in service sector. Five to six percent of the GDP is contributed by the housing industry alone, while nine percent is made up of all real estate activity. Demonetization, RERA, the "Housing for All by 2023" initiative, the "100 Smart Cities Project," and other programmes and policies have all had a big impact on the development of this industry, both favourably and unfavourably. The consumer's purchasing habits, however, did not correspond with the sector's predicted increase. While they have a backlog of unsold inventory, most developers are introducing new projects.

Since the real estate market is a thriving and fiercely competitive sector of the economy, where businesses are always vying for attention, customers, and long-term success. Product differentiation, innovation, customer focus, and price strategy stand out in this context as important elements that have a considerable consequence on the business performance of real estate organisations, especially from the standpoint of buyers.

When separating one real estate property from another, product uniqueness is crucial. Buyers are no longer content with generic options; instead, they look for residences that provide distinctive features, facilities, and benefits. Architectural design, location advantages, ecological features, or creative layouts that accommodate certain consumer preferences are a few examples of these distinctive elements. Effective product differentiation increases potential customers' overall pleasure and perceived value in addition to drawing their attention.

Additionally, innovation has a growing impact on the real estate industry. Real estate companies can improve the buyer's experience by utilising innovative technologies, construction techniques, design ideas, and services. Innovation can provide a company a competitive edge, luring tech-savvy customers and positioning it as a market leader by integrating smart home technologies, energy-saving features, virtual reality tours, or creative financing solutions.

Another crucial element that directly affects the profitability of real estate enterprises is the emphasis on the customer (Puķīte & Geipele, 2017). Personalized interactions, open communication, and top-notch customer service are what buyers need at every stage of the purchasing process. Real estate businesses may develop enduring connections, bring in repeat business, and reap the rewards of favourable word-of-mouth recommendations by putting a priority on customer satisfaction and comprehending their needs (Singh & Gupta, 2020). A customer-focused strategy improves not only the total buying experience but also a real estate brand's credibility and reputation (Sanderson, 2020).

Last but not least, price strategy is a crucial component that profoundly affects consumer choices (Cardella & Seiler, 2016). While accurately pricing a property is essential, it is also critical to match the price to the perceived worth and market demand. Pricing strategies for real estate firms must be carefully considered depending on variables such location, property characteristics, market conditions, and competitive analyses. Businesses may draw customers and increase their sales and profitability by striking the proper balance between value and affordability.

In this investigation into the effects of product differentiation, innovation, customer focus, and pricing strategy on the business performance of the real estate market from the viewpoint of buyers, we delve into the various approaches and tactics that successful real estate businesses use to differentiate themselves from the competition, meet the needs of customers, and achieve sustainable growth. Real estate companies can realise their full potential and succeed in the constantly changing market by comprehending and putting these factors into practise.

Even though there has already been research on the individual effects of product differentiation, price strategy, innovation, and customer focus on the business performance of the real estate market, there is still room for improvement in understanding the interactions between these factors and their combined influence on buyer decision-making, which ultimately has an impact on business performance. The impact of product differentiation, pricing, innovation, and customer focus on consumer preferences and satisfaction in the real estate industry has been carefully examined in several research. However, little research has been done to examine the interactions between these variables and how they affect the choices made by buyers. Real estate companies must comprehend the combined effects of these aspects in order to strategically position their assets and gain a competitive advantage. Researchers and practitioners can learn more about creating holistic strategies that improve customer happiness and propel business performance by investigating how product differentiation, price strategy, innovation, and customer focus jointly affect buyer decision-making.

Due to excessive migration and scarcity of land resource the cost of land in Tier 1 cities is sky rocketing (Lata et al., 2021). The Government is trying to make a shift of people and business undertakings to Tier 2 and Tier 3 cities due to availability of excess resources which have not been yet exploited. Under the SMART City and AMRUT yojna scheme the government is offering planned development (Murugaiah et al., 2018). The Tri-City of Chandigarh, Panchkula and Mohali which comes under the Tier 2 cities has immense potential for the development of real estate industry (Jain 2021; Balasubramanian, 2023). To examine the performance of real estate market, it is important to understand their perception and ultimate experience with the real estate developer’s tactics as it is the buyers for whom developers frame strategies in different forms of conduct.

Based on the objective of the study, the research questions are framed as:

1. Research Question -1 (RQ1): What are the key determinants of Sudan’s economy?

2. Research Question -2 (RQ2): How FDI improves the economy status of Sudan?

Conceptual Framework

Product Differentiation

Kotler (2012) defined product differentiation as the practise of introducing several noteworthy differences to distinguish a firm's offer from that of rivals. Kotler (2012) defined product differentiation as the practise of introducing several noteworthy differences to distinguish a company's offer from that of rivals. Product differentiation strategy strive to gain an advantage over their rivals by setting the firm apart from the competition in areas including firm brand perceptions, feature technological, product and service quality, as well as in terms of network marketing, thereby creating different customer groups (Amar, 2015). Levitt (1980), cited in Ramadani et al., (2023) asserts that product differentiation is a crucial strategic and tactical endeavour that organisations must consistently engage in. The implementation process takes a lot of time and money to put in. However, long-term differentiation plan implementation can boost a firm's performance by enhancing its brand image, expanding its distribution network, and providing superior customer service (Lei & Liping 2012; Porter, 1985). Porter encouraged businesses to pick characteristics for their products that stand out from those of competitive characteristics and are highly regarded by the majority of buyers. The parameters outlined by Kotler (2011), including form, privileges, quality, durability, dependability, repairability, and appearance, can be utilised to guide the execution of product differentiation strategies (Ramadani et al., 2023).

Price Strategy

Price is a crucial strategy as it is a big worry for customers of a particular product. Pricing decisions, according to Suri &Monroe (2003), are among the most significant managerial choices because they affect a firm’s profitability, investment return, and marketability of the company. Consequently, creating and determining prices is a challenging and intricate task because the managers must comprehend how their clients see prices, how to generate value proposition, what are the necessary internal and pertinent costs, as well as taking into account the company's pricing goals and its ability to compete in the market (Hinterhuber & Liozu, 2014; Monroe, 2003).

Innovation

Innovation is a complex process (Therrien et al., 2011; Eggert et al., 2014). An idea, technique, conduct, or product that the adopting unit perceives as novel might be generically referred to as an innovation (Tarafdar & Gordon, 2007). Businesses doing new or current operations in peculiar ways is sometimes referred to as innovation. In other words, innovation entails "carrying out new combinations" (Schumpeter, 1934) and a "change in routine" (Nelson & Winter, 1982). New methods, raw materials, organisational structures, and market opportunities have all been linked to innovation. Innovation in the construction industry is defined by Slaughter (1998) as "real usage of a significant modification and augmentation of a method, item, or system that is original to the establishment creating the progression." According to literature on innovation, one of the most important elements of a successful and long-lasting business is innovation (Jimenez & Sanz-Valle, 2011; Huang et al., 2021; Teng & Chen, 2021; Chaithanapat et al., 2023).

Customer Focus Strategy

Customer focus is a significant strategy which serves as the beginning of any quality drive (Sousa, 2003). Consumers today are more frugal, responsible, and demanding than ever before (Flatters & Willmott, 2009). As a result, in order to improve a company’s performance, companies have turned more of their attention to their customers, as it is considered that in today's highly competitive market, investing in customer orientation offers the best return on investment (Lusch & Webster, 2010). In order to create and capture value more effectively, a firm goal that is "customer-focused" is preferable to one that is "product-focused" (Bowman &Ambrosini, 2000; Lado et al., 2011).

Business Performance

Business Performance may be summed up as a combination of planning and information-gathering techniques that enables an organisation to reach pre-determined goals. The concept of business performance has many definitions in the literature (e.g., short term- or long term, economic or corporate benefits), and it is frequently viewed from two perspective, namely qualitative and quantitative methodologies (Fitriah et al., 2019). Qualitative performance indicators from Venkatraman (1989) were employed in this study as there were no publicly accessible objective data that included the sample firms and it was difficult to collect hard financial data from private enterprises (Priem et al., 1995). The performance metrics put forth by Venkatraman & Ramanujam (1989) gauge perceived performance in comparison to those of the pertinent competitors.

Research Model and Hypotheses Development

Product Differentiation and Business Performance

Using a differentiation strategy, a company seeks to lead the industry by offering superior value to customers (Grifn, 2005). According to Porter, if the value proposition is exceptional, this strategy results in very loyal customers. As a result, if customers perceive a company's services or products to be differentiable, they will adhere to it and be willing to pay more for the same leading to improved business performance. If a business successfully differentiates itself from competitors, it may be able to charge premium price for its products and see an increase in customer loyalty since the distinguishing characteristics may become very significant to customers. However, for an incredibly successful differentiation strategy, the origins of distinctiveness must be prolonged, exorbitant, or arduous to match for rivals (Hackl et al., 2021). The business should therefore be cautious when selecting whether to implement the differentiation strategy. According to a study by Guisado González et al, innovative companies with differentiation strategy reportedly improve R&D participation and innovation alliances. Kharub et al. (2019) further emphasised how the presence of quality increases the impact of a differentiation method. As a result, it is crucial to have a thorough understanding of and a focus on these quality management components in order to maximise profit for a company pursuing differentiation strategy. Many scholars emphasise positive relation between differentiation strategy and business performance (Valipour et al., 2012; Nolega et al., 2015; Islami et al., 2020).

Therefore, the subsequent hypothesis is suggested:

H1: Product differentiation positively and significantly impacts a business performance.

Innovation and Business Performance

Schumpeter's work (1934) is the foundation of the conventional rationale in support of the link between innovation and business performance. He claimed that when inventive new items first enter the market, they face little direct competition, which enables businesses to earn comparatively high profits. Although imitation and rivalry are expected to erode these high earnings over time, businesses that keep offering novel goods and services may be able to maintain high profitability over the long run. Varis and Littunen (2010) asserted, in line with many other academics, that enhancing firm performance and success is the primary motivation for businesses to engage in innovation activities. The meta-analysis by Szymanski et al. (2007) only found a modest to moderate correlation between product innovation and firm performance, but it raised the possibility that other contextual factors might have an impact on this relationship. An association between innovation and company performance was supported by empirical data from several academics. Lai et al. (2014) looked at how innovation and company performance relate to Malaysian SMEs in the service and manufacturing industries. They discovered a strong link between innovation and business performance. Expanding a company's product and service offerings and meeting new market demands through innovation is substantially correlated with performance (Prajogo 2006; Salfore et al., 2023;).

We suggest the following ideas in light of these earlier studies:

H2: Innovation has a positive and significant effect on business performance.

Price Strategy and Firm Performance

Pricing, according to Kotler (2007), is the amount a business charges to recoup its costs associated with generating, disseminating, and promoting the good. Zeithaml (1988) asserted that the price of a product is one of the elements influencing how buyers judge its value. Pricing strategy accounts for the cost of the service or good offered to the consumer while taking their expectations and preferences into consideration (Nitadpakorn et al., 2017). Nagle and Holden (2003) contend that in order to arrive at the ideal pricing, the cognition, perceptivity, and innate traits of the 3C's i.e. Cost, Competition, and Customers must be balanced. Price is an influential factor in competitive performance and business success. According to Hinterhuber (2008), pricing strategies vary widely across industries and market situations and greatly affect a company's profitability. Price and business performance was discovered to be highly associated in the studies of Colpan (2006); Owomoyela et al. (2013); Fitriah et al. (2019).

Therefore, we propose the following research hypothesis:

H3: Price strategy has a positive and significant effect on business performance.

Customer Focus and Business Performance

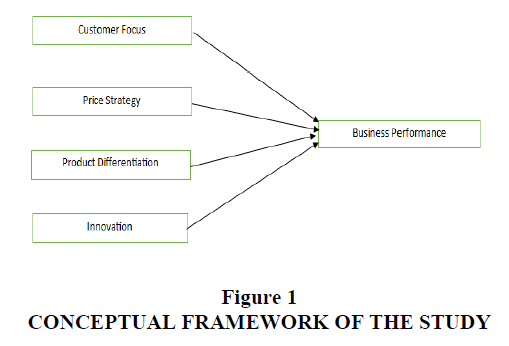

Under the aegis of Total Quality Management, numerous firms have adopted the practise of customer focus (TQM) (Yaacob, 2014). It is one of the many essential components of TQM, along with other essential components like managerial commitment, cooperation, and continual development (Yu et al., 2012). Numerous business sectors, including manufacturing (Mojtahedzadeh and Arumugam, 2011), retail (Tajeddini et al., 2013), service (Alam, 2013), hospitality and tourism, have all attested to the advantages of customer focus practises. Although the goal of this strategy is to satisfy customers, it also appears to have an impact on other business performance indicators, including economic outcomes and satisfaction of employees (Chotekorakul and Nelson, 2013). Customer focus necessitates that businesses closely monitor each step of the supply chain, including identifying reliable suppliers, developing products that satisfy customers' needs, delivering goods on schedule, controlling costs, and offering impactful after-sales support. In other words, in order to become a customer-focused business, the organisation needs to continuously enhance all the relevant processes (Tajeddini et al., 2013). As a result, it has been asserted that a firm's benefits from using this technique may have a direct or indirect impact on a number of performance measures, such as production and quality performance, which results in improved financial performance (Kaynak, 2003; Reed et al., 1996) Figure 1.

Consequently, the following hypothesis is put forth:

H4: Customer Focus has a positive and significant effect on business performance.

Research Methodology

Research Design

In this study, deductive methodology was utilised to assess the hypotheses and confirm the significance of the connection between product differentiation, innovation, price strategy, and customer focus on business performance. Additionally, a cross-sectional research approach has been adopted, with the respondents' information being collected at a single moment in time.

Sampling Technique

The study's objective is to examine the effects of product innovation, price strategy, and customer focus on business performance from buyer’s perspective. For the current study, convenience sampling was employed. Data were gathered from the buyers residing in Tri-City of Chandigarh, Panchkula and Mohali. Out of a total of 400 responses, 347 were deemed relevant for this study, with the remaining responses being disregarded due to their inappropriateness.

Research Measures

The current study was empirical and primarily used five factors, namely product differentiation strategy, customer focus, innovation and price approach, business performance as shown in Figure 1. Items of the product differentiation strategy construct have been adopted from Kibiru (2013) and amended based on real estate literature. Customer focus strategy in-hand items were modified from Xu et al. (2017) and Bouman & wiele (1992). Price approach items developed from Mushagalusa et al., (2018) and Setiawan et al., (2020). Innovation strategy items were adapted from Lai et al., (2015) and Yusof et al., (2014). Business Performance items were adapted from O'Cass & Weerawardena (2009) and Tsai & Yang (2014). The survey included a total of 25 items to assess the degree of consistency between construct items related to company strategy and their results. Likert scale responses were graded, with 1 denoting strongly disagree and 5 denoting highly agree.

Data Analysis

This study is quantitative in nature and is based on the survey approach. Data was processed using Analysis of Moments Structure (AMOS) through the statistical tool IBM AMOS Version 22. The IBM Statistical Package for Social Sciences was used to assess descriptive statistics as well (SPSS-22).

Results

Descriptive Data

Table 1 lists the respondents' demographic details. The majority of participants responded in this study were men (69.7%), between the ages of 31 and 40 (32.5%), with graduate degrees (46.9%), married (79.5%), and employed (38.6%), with an income range of 5 to 10 lakhs (40.9 percent).

| Table 1 Demographic Characteristics | ||

| No. of Respondents | Percentage | |

| Gender | ||

| Male | 242 | 69.7 |

| Female | 105 | 30.2 |

| Age Group (in years) | ||

| 20 or less | 8 | 2.3 |

| 21-30 | 72 | 20.7 |

| 31-40 | 113 | 32.5 |

| 41-50 | 66 | 19 |

| 51-60 | 42 | 12.1 |

| Above 60 | 46 | 13.2 |

| Marital Status | ||

| Married | 276 | 79.5 |

| Unmarried | 71 | 20.5 |

| Education | ||

| Matriculation | 23 | 6.6 |

| Under Graduate | 7 | 2 |

| Graduate | 163 | 46.9 |

| Post Graduate and above | 154 | 44.3 |

| Profession | ||

| Student | 3 | 0.8 |

| Employed | 134 | 38.6 |

| Business | 78 | 22.4 |

| Professional | 62 | 17.8 |

| Retired | 46 | 13.2 |

| Others | 24 | 6.9 |

| Income (In Lakhs) | ||

| Less than | 100 | 28.8 |

| 10-May | 142 | 40.9 |

| Above 10 | 105 | 30.2 |

Reliability Analysis

Cronbach's alpha is shown in Table 2 for each of the model's six components. Value typically ranges from 0 to 1. Greater consistency among the scale's items is indicated by a Cronbach's alpha coefficient that is near to 1. (Gliem & Gliem, 2003). According to George and Mallery (2003) values larger than or equal to 0.8 are a positive indicator of reliability, while values greater than or equal to 0.9 are an excellent indicator, and in this study each value exceeds 0.8, which is an appropriate value.

| Table 2 Reliability Analysis | |

| Factor | Cronbach’s alpha |

| Customer Focus | 0.857 |

| Price Strategy | 0.897 |

| Product Differentiation | 0.91 |

| Innovation | 0.992 |

| Business Performance | 0.907 |

Confirmatory Factor Analysis Model Fit Indices

The model fit indices provide the standards for determining if a model developed for the study conforms to the sample dataset (Hooper et al., 2008). According to Kline (2010), the threshold for RMSEA is 0.08 or less for satisfactory fit and 0.05 or less for outstanding fit and CMIN/df ought to be lower than 3 and to demonstrate a satisfactory model fit, the CFI value must be more than 0.90. The model fit indices for the measurement model are shown in Table 3, and it is clear that the model fits the data well.

| Table 3 Model Fit Indices | ||

| Model Fit Index | Values derived from the model | Acceptable Values |

| CMIN/df | 1.565 | Less than 3 |

| Comparative fit Index (CFI) | 0.952 | > 0.90 |

| RMSEA | 0.048 | < 0.08 is a good fit |

| RMR | 0.043 | 0.05 is a good fit |

Validity of Model: Convergent and Discriminant Validity

Items under one component must significantly correlate with one another in order to achieve convergent validity, according to Brown (2014), while the numerous variables must not converge or correlate in order to achieve discriminant validity (Fornell& Larcker, 1981). The validity statistics are calculated according to the instructions in Table 4 after which the results are shown using Stats tools package in Table 5. Since each factor's AVE and CR are both larger than 0.5 and 0.7, it is clear from Table 5 that discriminant validity has been confirmed to be reached.

| Table 4 Validation Criteria | |

| Convergent Validity | Discriminant Validity |

| CR> 0.7 | AVE>MSV |

| AVE> 0.5 | AVE> ASV |

| CR>AVE | |

| Table 5 Convergent and Discriminant Validity | |||

| CR | AVE | MSV | |

| Customer Focus | 0.834 | 0.71 | 0.446 |

| Price Strategy | 0.873 | 0.761 | 0.312 |

| Product Differentiation | 0.905 | 0.81 | 0.307 |

| Innovation | 0.881 | 0.773 | 0.528 |

| Business Performance | 0.883 | 0.845 | 0.528 |

Hypothesis Testing

Table 6 displays the analysis' findings. Customer focus, Price strategy, Product Differentiation, and Innovation were all identified to be highly important indicators of perceived business performance. The various factors' standardised regression weights (β coefficients) are- customer kindness (0.294, P<0.05), price fairness (0.14, P<0.05), product differentiation (0.292, P<0.05) and innovation (0.12, P<0.05). Customers buying real estate products are more interested with customer kindness while dealing with the real estate developer than with product differentiation, price and innovation. The findings suggest that the most important predictor of real estate buyers' perceptions of business performance is customer focus.

| Table 6 Hypothesis-Testing Results | |||

| Hypothesis | β coefficients | p-value | Result |

| Customer Focus | 0.294 | 0 | Significant |

| Price Strategy | 0.14 | 0 | Significant |

| Product Differentiation | 0.252 | 0.004 | Significant |

| Innovation | 0.12 | 0 | Significant |

Discussion and Conclusions

By illuminating how the factors of product differentiation, customer focus, innovation, and price approach influence the perception of business performance, this paper makes a valuable contribution to the literature in the fields of marketing and strategic management. The current study empirically evaluates earlier academics' hypotheses that putting more emphasis on the customer focus will boost market performance (Bouman and Wiele, 1992). The results of this study, for example, are in line with what we anticipated and support evidence from earlier studies (Bouman & Wiele 1992; Pekovic & Rolland 2016; Xu et al., 2017) showing customer attention has a major impact on business performance. Since a customer-focused approach can be seen as a relationship or human element of service. This study builds on Dhasan and Aryupong's (2019) conclusion that customers will be more likely to associate a brand with high service quality, which improves business performance. Due to the existence of intangible traits observed within service quality, which address affective, interpersonal, and cognitive bases, more customers will be drawn to service quality in the form of customer focus (Hellén & Gummerus 2013). Real estate, which employs many innovative and contemporary designs to the homes, acquires a sizable market share in the industry, improving their performance in the market. The results of this study corroborated those of an earlier study by Alfaraj (2019), which found that having an innovational and distinctive design builds the firm's brand recognition and loyalty and promotes market performance. The company will have a greater competitive advantage if it offers more cutting-edge, technologically assisted, and unique homes. The outcomes of this research were consistent with those of an earlier finding by Kibiru (2013), according to which a company's ability to compete in the market and strengthen its market performance depends on its ability to produce notional products. Pricing approach has a significant influence on firm business performance. A real estate firm's pricing strategy has an impact on factors like affordability, value for money, competitiveness, market perception, negotiation flexibility, and potential for long-term capital growth. Real estate firms can improve their market performance and draw in more customers by being aware of these elements and taking care of the demands and preferences of buyers. In this study, the result is consistent with other studies including Cardella & Michael J. Seiler (2016); Badi (2018) who postulate that price is one of the most efficient determinants for gaining a competitive edge.

Practical Implications

This research analysis is significant for the real estate developers, researchers and policymakers, because it lays forth the crucial aspects of the real estate developer tactics, which strengthens and enhances the real estate market performance in Tri-City of Chandigarh, Panchkula and Mohali. The empirical analysis of our study foreground that product differentiation, price strategy, innovation and customer focus are predictors of improved business performance in real estate sector. The implications of product differentiation, customer focus, innovation, and price approach can be used by real estate developers to guide their strategic decision-making processes. They can use the findings to create and put into practise efficient marketing plans, customer-focused tactics, and pricing procedures that enhance business performance. Real estate developers can allocate resources and make investments in areas that boost competitiveness and customer satisfaction by being aware of the significance of these aspects. In addition, the real estate developer can focus client connections, train people to provide superior service, and use innovation to improve customer experiences and boost their position in the market. When creating regulating frameworks for the real estate business, policymakers might take the implications of these factors into account. A healthy and competitive real estate market can be facilitated by encouraging fair pricing methods, fostering innovation and sustainability, and assuring service quality standards. Researchers can examine the generalizability and applicability of the findings by conducting comparison research across various real estate markets, geographies, or firm sizes.

The consequences of these elements for academics, managers, and policymakers underscore the need for more research, well-informed choices, and regulatory interventions to improve market performance in the real estate sector. Stakeholders may support the growth of a thriving, client-focused, and sustainable real estate market by taking these implications into account.

Limitations of Study

Future studies should still address several shortcomings even if this study produced conclusions that are scientifically valid. First, the study relies on buyer perception, which is arbitrary and sensitive to a variety of influences, including past experiences, expectations, and personal preferences. It may be difficult to reach objective results from the study as a result of these subjective points of view introducing bias. Additionally, by giving socially acceptable replies or modifying their comments to fit expectations, respondents may display response bias.

Second, research on buyer perception tend to be centred on the viewpoint of consumers and may not take into account the perspectives of other parties, such sellers, real estate brokers, or business professionals. The whole complexity of market dynamics and performance may not be adequately represented by this constrained viewpoint.

Third, this research frequently emphasises certain elements like product differentiation, innovation, price approach, and customer focus. However, the study does not expressly take into account other variables, such as location, marketing tactics, and macroeconomic circumstances, which may potentially have an impact on market success. Additionally, the study's findings may not be as generalizable as intended because external factors including socio-cultural trends, market conditions, and economic ups and downs may change over time and have varied effects on consumer opinions.

References

Al Badi, K. S. (2018). The impact of marketing mix on the competitive advantage of the SME sector in the Al Buraimi Governorate in Oman. Sage Open, 8(3), 2158244018800838.

Alam, I. (2013). Customer interaction in service innovation: evidence from India. International Journal of Emerging Markets, 8(1), 41-64.

Indexed at, Google Scholar, Cross Ref

Alfaraj, Q. (2019). Attaining and Sustaining Competitive Advantage in Dubai's Real Estate Industry (Doctoral dissertation, Walden University).

Amar, M. Y. (2015). The influence of product differentiation strategy on operational performance at Small and Medium Enterprises (SMEs) in South Sulawesi, Indonesia. Journal of Economics, Business, & Accountancy Ventura, 18(3), 343-350.

Balasubramanian, R. S. A. H. (2023). Tier 2 cities in India: Will 2023 be the year of real estate boom in these cities?T. Housing.Com.

Bouman, M., & Van der Wiele, T. (1992). Measuring service quality in the car service industry: building and testing an instrument. International Journal of Service Industry Management, 3(4), 0-0.

Bowman, C., & Ambrosini, V. (2000). Value creation versus value capture: towards a coherent definition of value in strategy. British journal of management, 11(1), 1-15.

Brown, T. A. (2015). Confirmatory factor analysis for applied research. Guilford publications.

Indexed at, Google Scholar, Cross Ref

Cardella, E., & Seiler, M. J. (2016). The effect of listing price strategy on real estate negotiations: An experimental study. Journal of Economic Psychology, 52, 71-90.

Chaithanapat, P., Punnakitikashem, P., Oo, N. C. K. K., & Rakthin, S. (2022). Relationships among knowledge-oriented leadership, customer knowledge management, innovation quality and firm performance in SMEs. Journal of Innovation & Knowledge, 7(1), 100162..

Chotekorakul, W., & Nelson, J. (2013). Customer orientation, merchandising competencies, and financial performance of small fashion retailers in Bangkok. Journal of Fashion Marketing and Management: an International Journal, 17(2), 225-242.

Chubaka Mushagalusa, N., Balemba Kanyurhi, E., Bugandwa Mungu Akonkwa, D., & Murhula Cubaka, P. (2022). Measuring price fairness and its impact on consumers’ trust and switching intentions in microfinance institutions. Journal of Financial Services Marketing, 27(2), 111-135.

Colpan, A. M. (2006). Dynamic effects of product diversity, international scope and keiretsu membership on the performance of Japan's textile firms in the 1990s. Asian Business & Management, 5, 419-445.

Dhasan, D., & Aryupong, M. (2019). Effects of product quality, service quality and price fairness on customer engagement and customer loyalty. ABAC journal, 39(2).

Eggert, A., Thiesbrummel, C., & Deutscher, C. (2014). Differential effects of product and service innovations on the financial performance of industrial firms. jbm-Journal of Business Market Management, 7(3), 380-405.

Fitriah, A. W., Rosdi, S. N., Rosli, M. M., Aziz, Z. A., Ibrahim, W. M. Y. W., Radzi, M. S. N. M., & Yaacob, A. A. (2019). The effects of marketing mix on small fish farming business performance. Revista Publicando, 6(19), 1-16.

Flatters, P., & Willmott, M. (2009). Understanding the post-recession consumer. Harvard Business Review, 87(7/8), 106-112.

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of marketing research, 18(1), 39-50.

Hackl, F., Hölzl-Leitner, M., & Pennerstorfer, D. (2021). How to measure product differentiation(No. 2101). Working Paper.

George, D. (2003). SPSS for Windows step by step: A simple guide and reference.

Gliem, J. A., & Gliem, R. R. (2003). Calculating, interpreting, and reporting Cronbach’s alpha reliability coefficient for Likert-type scales. Midwest Research-to-Practice Conference in Adult, Continuing, and Community Education.

DeNisi, A. S., & Griffin, R. W. (2005). Human resource management. Dreamtech Press.

Guisado-González, M., Guisado-Tato, M., & Ferro-Soto, C. (2013). Business strategy and enterprises cooperation agreements in research and development. International Journal of Business Innovation and Research, 7(1), 1-22.

Hellén, K., & Gummerus, J. (2013). Re‐investigating the nature of tangibility/intangibility and its influence on consumer experiences. Journal of Service Management, 24(2), 130-150.

Hinterhuber, A., & Liozu, S. M. (Eds.). (2017). Innovation in pricing: Contemporary theories and best practices. Routledge.

Hooper, D., Coughlan, J., & Mullen, M. (2008, September). Evaluating model fit: a synthesis of the structural equation modelling literature. In 7th European Conference on research methodology for business and management studies (Vol. 2008, pp. 195-200).

Huang, M., Li, M., & Liao, Z. (2021). Do politically connected CEOs promote Chinese listed industrial firms’ green innovation? The mediating role of external governance environments. Journal of Cleaner Production, 278, 123634.

Hui, L., & Liping, O. (2012). Studies on time-lag effect of corporate performance influenced by competitive strategy. Cross-Cultural Communication, 8(6), 79.

Islami, X., Topuzovska Latkovikj, M., Drakulevski, L., & Borota Popovska, M. (2020). Does differentiation strategy model matter? Designation of organizational performance using differentiation strategy instruments–an empirical analysis. Designation of organizational performance using differentiation strategy instruments–an empirical analysis (February 14, 2020). Islami, X., Latkovikj, MT, Drakulevski, L., & Popovska, MB, 158-177.

Jiménez-Jiménez, D., & Sanz-Valle, R. (2011). Innovation, organizational learning, and performance. Journal of business research, 64(4), 408-417.

Kaynak, H. (2003). The relationship between total quality management practices and their effects on firm performance. Journal of operations management, 21(4), 405-435.

Kharub, M., Mor, R. S., & Sharma, R. (2019). The relationship between cost leadership competitive strategy and firm performance: A mediating role of quality management. Journal of Manufacturing Technology Management, 30(6), 920-936.

Kibiru, C. R. (2013). Determinants of competitive advantage in the real estate industry in Kenya: A case of thika greens golf estate in Muranga County (Doctoral dissertation, University of Nairobi).

Kline, R. (2010). Principles and Practice of Structural Equation Modeling, 3rd edn Guilford Press. New York. USA.

Kotler, P. (2011). Philip Kotler's contributions to marketing theory and practice. In Review of Marketing Research: Special Issue–Marketing Legends (pp. 87-120). Emerald Group Publishing Limited.

Lado, A. A., Paulraj, A., & Chen, I. J. (2011). Customer focus, supply‐chain relational capabilities and performance: evidence from US manufacturing industries. The International Journal of Logistics Management, 22(2), 202-221.

Lai, K. S., Yusof, N. A., & Kamal, E. M. (2016). Innovation orientation in architectural firms. Construction innovation, 16(4), 425-445.

Lai, Y. L., Hsu, M. S., Lin, F. J., Chen, Y. M., & Lin, Y. H. (2014). The effects of industry cluster knowledge management on innovation performance. Journal of business research, 67(5), 734-739.

Lata, K., Thapa, K., & Rajput, A. S. (2021). Liveability of Indian Cities and Spread of Covid-19--Case of Tier-1 Cities. Indian Journal of Public Administration, 67(3), 365-382.

Levitt, T. (1980). Marketing success through differentiation-of anything (pp. 83-91). Boston: Graduate School of Business Administration, Harvard University.

Mojtahedzadeh, R., & Arumugam, V. C. (2011). Determinants of TQM in the Iranian automotive industry: A theoretical approach. International Journal for Quality Research, 5(1), 21-32.

Monroe, K. B. (2002). Pricing: Making Profitable Decisions, 3rd (Ed.) New York. NY: McGraw-Hill Book Company.

Murugaiah, V., Shashidhar, R., & Ramakrishna, V. (2018). Smart cities mission and AMRUT scheme: analysis in the context of sustainable development. OIDA International Journal of Sustainable Development, 11(10), 49-60.

Nagle, T., & Holden, R. K. (2003). Strategies and price tactics: a guide for lucrative decisions.

Nelson, R. R., & Winter, S. G. (1982). The Schumpeterian tradeoff revisited. The American economic review, 72(1), 114-132.

Nitadpakorn, S., Farris, K. B., & Kittisopee, T. (2017). Factors affecting pharmacy engagement and pharmacy customer devotion in community pharmacy: A structural equation modeling approach. Pharmacy Practice (Granada), 15(3).

Indexed at, Google Scholar, Cross Ref

Nolega, K. S., Oloko, M., Sakataka, W., & Oteki, E. B. (2015). Effects of Product Differentiation Strategies on Firm Product Performance: A Case of Kenya Seed Company (KSC), Kitale.

O'Cass, A., & Weerawardena, J. (2009). Examining the role of international entrepreneurship, innovation and international market performance in SME internationalisation. European journal of marketing, 43(11/12), 1325-1348.

Owomoyela, S. K., Oyeniyi, K. O., & Ola, O. S. (2013). Investigating the impact of marketing mix elements on consumer loyalty: An empirical study on Nigerian Breweries Plc. Interdisciplinary journal of contemporary research in business, 4(11), 485-496.

Pekovic, S., & Rolland, S. (2016). Customer orientation and firm’s business performance: A moderated mediation model of environmental customer innovation and contextual factors. European Journal of Marketing, 50(12), 2162-2191.

Porter, M. E. (1985). Technology and competitive advantage. Journal of business strategy, 5(3), 60-78 .

Prajogo, D. I. (2006). The relationship between innovation and business performance—a comparative study between manufacturing and service firms. Knowledge and process management, 13(3), 218-225.

Priem, R. L., Rasheed, A. M., & Kotulic, A. G. (1995). Rationality in strategic decision processes, environmental dynamism and firm performance. Journal of management, 21(5), 913-929.

Puķīte, I., & Geipele, S. (2017). Determining customer satisfaction in the real estate management sector in Riga. Baltic Journal of Real Estate Economics and Construction Management, 5(1), 226-237.

Ramadani, S. D., Prayoga, Y., & Elvina, E. (2023). The Influence of Differentiation, Product Quality, Targeting on Interest in Buying Lega Rantauprapat Drinks with Brand Positioning as a Moderating Variable. Quantitative Economics and Management Studies, 4(1), 66-74.

Reed, R., Lemak, D. J., & Montgomery, J. C. (1996). Beyond process: TQM content and firm performance. Academy of management review, 21(1), 173-202.

Salfore, N., Ensermu, M., & Kinde, Z. (2023). Business model innovation and firm performance: Evidence from manufacturing SMEs. Heliyon, 9(6).

Indexed at, Google Scholar, Cross Ref

Sanderson, D. C., & Read, D. C. (2020). Recognizing and realizing the value of customer-focused property management. Property Management, 38(5), 749-764.

Fritsch, M. (2017). The theory of economic development–An inquiry into profits, capital, credit, interest, and the business cycle.

Setiawan, E., Wati, S., Wardana, A., & Ikhsan, R. (2020). Building trust through customer satisfaction in the airline industry in Indonesia: Service quality and price fairness contribution. Management Science Letters, 10(5), 1095-1102.

Sharma, S. K., & Sharma, M. (2019). Examining the role of trust and quality dimensions in the actual usage of mobile banking services: An empirical investigation. International Journal of Information Management, 44, 65-75.

Singh, N., & Gupta, M. (2020).Key factors affecting customer relationship management in real estate sector: a case study of National Capital Region. International Journal of Indian Culture and Business Management, 20(2), 194-209.

Slaughter, E. S. (1998). Models of construction innovation. Journal of Construction Engineering and management, 124(3), 226-231.

Sousa, R. (2003). Linking quality management to manufacturing strategy: an empirical investigation of customer focus practices. Journal of operations management, 21(1), 1-18.

Suri, R., & Monroe, K. B. (2003). The effects of time constraints on consumers' judgments of prices and products. Journal of consumer research, 30(1), 92-104.

Szymanski, D. M., Kroff, M. W., & Troy, L. C. (2007). Innovativeness and new product success: Insights from the cumulative evidence. Journal of the academy of Marketing Science, 35, 35-52.

Tajeddini, K., Elg, U., & Trueman, M. (2013). Efficiency and effectiveness of small retailers: The role of customer and entrepreneurial orientation. Journal of Retailing and Consumer Services, 20(5), 453-462.

Tarafdar, M., & Gordon, S. R. (2007). Understanding the influence of information systems competencies on process innovation: A resource-based view. The Journal of Strategic Information Systems, 16(4), 353-392.

Teng, T., Cao, X., & Chen, H. (2021). The dynamics of inter-firm innovation networks: The case of the photovoltaic industry in China. Energy Strategy Reviews, 33, 100593.

Therrien, P., Doloreux, D., & Chamberlin, T. (2011). Innovation novelty and (commercial) performance in the service sector: A Canadian firm-level analysis. Technovation, 31(12), 655-665.

Tsai, K. H., & Yang, S. Y. (2014). The contingent value of firm innovativeness for business performance under environmental turbulence. International Entrepreneurship and Management Journal, 10, 343-366.

Varis, M., & Littunen, H. (2010). Types of innovation, sources of information and performance in entrepreneurial SMEs. European Journal of Innovation Management, 13(2), 128-154.

Venkatraman, N., & Ramanujam, V. (1986). Measurement of business performance in strategy research: A comparison of approaches. Academy of management review, 11(4), 801-814.

Xu, L. U., Blankson, C., & Prybutok, V. (2017). Relative contributions of product quality and service quality in the automobile industry. Quality Management Journal, 24(1), 21-36.

Yusof, N. A., Mustafa Kamal, E., Kong-Seng, L., & Iranmanesh, M. (2014). Are innovations being created or adopted in the construction industry? Exploring innovation in the construction industry. Sage open, 4(3), 2158244014552424.

Zeithaml, V. A. (1988). Consumer perceptions of price, quality, and value: a means-end model and synthesis of evidence. Journal of marketing, 52(3), 2-22.

Received: 02-Aug-2023, Manuscript No. ASMJ-22-11148; Editor assigned: 04-Aug-2023, PreQC No. ASMJ-22-11148(PQ); Reviewed: 18- Aug-2023, QC No. ASMJ-22-11148; Revised: 22-Aug-2023, Manuscript No. ASMJ-22-11148(R); Published: 29-Aug-2023