Research Article: 2018 Vol: 22 Issue: 5

Testing Phillips Curve to Examine the Inflation Rate regarding Unemployment Rate, Annual Wage Rate and GDP of Philippines: 1950-2017

Md. Rayhanul Islam, Daffodil International University

Nurul Mohammad Zayed, Daffodil International University

K.B.M. Rajibul Hasan, Agrani Bank Limited, Bangladesh

Abstract

This paper investigates whether Phillips curve is identified or not in Philippines during 1950-2017 regarding inflation rate, unemployment rate, annual wage rate and GDP (Gross Domestic Products). An OLS (Ordinary Least Square) model has been developed in accordance with Phillips curve to test the long run relationship among the said variables. ADF (Augmented Dicky-Fuller) unit root test is used to test the stationary state of data. Johansen long run co integration model estimated that there is a long run relationship among the variables. To test the stability of this model, CUSUM (Cumulative Sum) test, CUSUMQ (Cumulative Sum of Squares) test and an ECM (Error Correction Model) have been used. Government of Philippines need to implement policy tools in such a way that GDP and annual wage rate positively influence the unemployment rate and inflation rate of Philippines.

Keywords

Phillips Curve, Inflation Rate, Unemployment Rate, Annual Wage Rate, GDP, Stability.

Introduction

The inverse and stable relationship between unemployment and inflation is known as Phillips curve. This theory states that economic growth must lead to less unemployment. These two variables are the most important macroeconomic variables that affect the daily lives.

The aims of this paper are to explain and clarify the Phillips curve, to explain the objectives of augmented Phillips curve, to identify the influential factors within the Phillips curve, to explain the policies that could eradicate unemployment, to examine the benefits of Phillips curve, to examine the Phillips curve itself, to explain how unemployment could be offset against the level of inflation etc.

The objective of this study is to test Phillips curve in Philippines during 1950-2017 regarding inflation rate, unemployment rate, annual wage rate and GDP. This study seeks the question whether Phillips curve in Philippines is identified or not for the analyzed period.

The rest of the paper has a brief relevant review of literature in section 2. Section 3 shows a theoretical model in accordance with Phillips curve. Section 4 shows the long run relationship among the variables with some econometric estimation. Concluding remarks are shown in section 5.

Literature Review

Puzon (2009) investigated the relationship among unemployment rate, interest rate, exchange rate, supply shock and inflation rate of Philippines, Malaysia, Indonesia and Thailand in accordance with Phillips curve by applying OLS, instrumentals variables and Prais-Winsten method during 1980-2005 and found that exchange rate lag, unemployment and interest rate were significant at 10% level and there were no trade-off between inflation and unemployment. Furuoka (2008) analyzed the relationship between unemployment rate and inflation rate of Philippines in accordance with Phillips curve by applying unit root test, Johansen test; VECM (Vector Error Correction Model) test and Granger-casualty test during 1980-2006 and found that there exists a co integration relationship rather than causal relationship between inflation rate and unemployment rate in the Philippines. Resurreccion (2014) examined inflation, unemployment and economic growth of Philippines in accordance with Okun’s Law and Phillips Curve by applying unit root test, OLS regression technique, White’s test and VIF during 1980-2009 and found that unemployment is inversely related to economic growth and inflation, confirming Phillips Curve and Okun’s Law in the Philippines for the analyzed period. Furoka et al. (2013) examined inflation and unemployment of Philippines in accordance with Phillips curve by applying unit root test, DOLS (Dynamic Ordinary Least Square) regression technique, Johansen test for co integration, VECM test, Granger-casualty test and Hodrick-Prescott during 1980-2010 and found that unemployment is inversely related to inflation and a causal relationship between unemployment and inflation rate, confirming Phillips Curve in the Philippines for the analyzed period. Bagsic (2004) tested inflation and unemployment of Philippines in accordance with Phillips curve by applying regression analysis during 1981-2002 and found that there is a tradeoff between unemployment and inflation for the Philippines for the analyzed period. Paqueo et al. (2016) addressed the influence of higher Legal Minimum Wages (LMWs) on the income level of poor people by using some conflicting hypothesis and found that LMWs could be disadvantageous, could reduce average workers’ work hrs and also could reduce the probability of the employment of young people in Philippines during 2000-2015. Cacnio (2013) analyzed inflation dynamics in short run of Philippines in accordance with Keynesian Phillips curve by using Cobb-Douglas model during 1988-2009 and found that sensitivity of inflation is a declining one because of the flattening Phillips Curve in Philippines for the analyzed period.

Doloriel et al. (2014) examined the volatility of inflation rate of Philippine by using fractal analysis during 1961-2012 and found that inflation rate is stable in Philippines but significantly unstable in fractal dimension for the analyzed period. Phelps (1967) studied aggregate demand in light of optimal fiscal control with the aid of a model of macroeconomics and Phillips Curve and derived the inflation and employment path. It was found that the main ingredient of Phillips curve is the price change rather than wage change and gradually inflation adjusts over time. Lacker & Weinberg (2007) intuited the negative relationship between unemployment and inflation with the aid of Phillips Curve and concluded that lower unemployment is associated with faster inflation which needs to be understood by the policymakers. Ormerod et al. (2009) explored inflation and unemployment of US (United States), Germany and UK (United Kingdom) in accordance with Phillips curve by using the statistical technique of fuzzy clustering during 1871-2009 and identified that the typical rates of unemployment and inflation in the regimes are different and also the trade-off between unemployment and inflation is entirely misplaced that means Phillips Curves was not identified in the short run within the analyzed period. Clark and Laxton (1997) reconsidered nonlinearity issue of Phillips curve and underscored its policymaking importance by using models and empirical estimates of price and wage determination of US. Marfatia (2018) estimated the new Keynesian Phillips curve in UK by applying Kalman filter and found a significant role of the model of unobserved components estimated from expected inflation in explaining the dynamics of inflation. Albuquerque & Baumann (2017) suggested policymakers to forecast inflation in accordance with the Phillips curve by applying Kalman filter during 1992-2015 and found that suddenly inflation which should not be excluded by the policymakers might go up. Marsilli (2017) presented a MIDAS (Mixed-Data Sampling) model of augmented Phillips curve on realtime US inflation and found 2 salient elements; one is oil price hike and another one is the rolling window framework. Both of them are consistent with previous literature. Abdelsalam (2017) criticized regarding forecasting accuracy of Phillips curve by considering open economy, econometric specifications, business cycle, price gap, and some dynamic and static forecasts and found that accurate forecasting is provided by the Phillips curve with Time varying coefficients. Chletsos et al. (2016) explored Phillips curve regarding inflation forecasting of US and Canada during 1960-2013 by using a constant and standard coefficient model of Phillips curve and found that for both of the countries, US and Canada, inflation was instable and hence concluded by suggesting that time variation modeling might help to improve the predictions accuracy for US rather than Canada. Seydl & Spittler (2016) argued about recent flattened trend of Phillips curve using standard econometric specifications and found earning inequalities due to restrained growth of wage in labor and product market and due to the lower rate of commonly estimated full-employment bar of unemployment in US. Ferreira & Palma (2015) proposed a general Phillips curve to estimate inflation of Brazil during 2003-2013 by using DMA (Dynamic Model Averaging) method and Kalman filter estimation and found underscoring forecasting features of inflation along with short and medium term exchange rate which is decreasing during the analyzed period in Brazil. Rusticelli et al. (2015) explained lag process of autoregressive distribution of past inflation and concluded that unemployment gap could be reduced in real-time revisions by the anchored Phillips curve expectations.

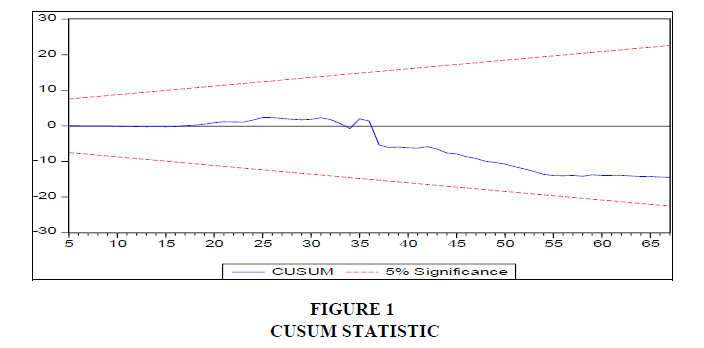

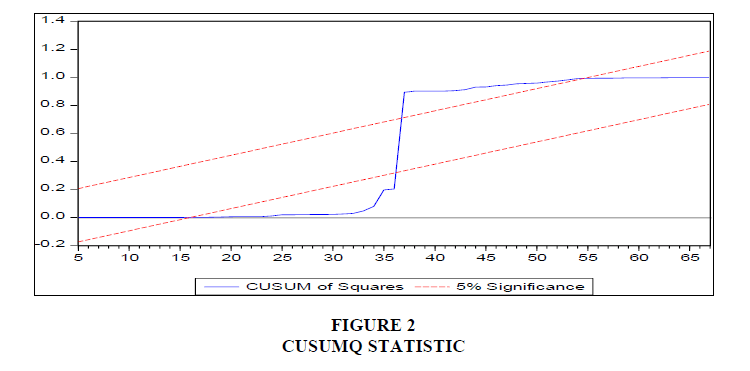

To test Phillips curve, annual wage rate along with unemployment rate and inflation rate must be considered. From the above literature review, it appeared that the researchers ignored annual wage rate which is not justified to the Phillips curve. In this research, annual wage rate has been considered to fill up this gap and also GDP has been taken as a threshold variable. CUSUM test and CUSUMQ test have been applied to test the stability of the model unlike the previous studies.

Objectives

The broad objective of this study is to analyze the inflation rate of Philippines regarding unemployment rate, annual wage rate and GDP during 1950-2017 in accordance with Phillips curve. The specific objectives are to estimate how inflation rate influences unemployment rate, annual wage rate and GDP of Philippines for the analyzed period and also to test whether Phillips curve in Philippines is identified or not.

Methodology

This is a descriptive analysis and the nature of data is quantitative. This research is secondary data based only. Data were collected from different websites, internal database and world development indicator reports. An OLS model has been developed in accordance with Phillips curve to test the long run relationship among the variables such as inflation rate, unemployment rate, annual wage rate and GDP of Philippines during 1950-2017. ADF unit root test has been applied to test the stationary states of data set. Johansen long run co integration technique has been used to test the long run relationship among the variables. CUSUM test, CUSUMQ test and an ECM model have been developed to test the stability of the model.

Theory & Model

To examine macroeconomic policy, Phillips curve has become a significant tool. It depicts the interaction between unemployment and inflation. Though Phillips considered wage inflation, annual wage rate has been separately considered here in this study along with GDP as threshold variable. According to the economic theory, annual wage rate, and GDP is positively correlated with inflation rate but unemployment rate is negatively correlated with inflation rate. In accordance with Phillips curve, an OLS model has been developed under the symmetry condition among inflation rate, unemployment rate, annual wage rate and GDP of Philippines during 1950-2017 and the model is as follows:

πt=α+β0+β1ut+β2wt+β3gt+?t

Where, πt, α, β0, β1, ut, β2, wt, β3, gt and ?t denote inflation rate, alpha coefficient, benchmark recommendations targeting inflation and unemployment, coefficient of unemployment rate, unemployment rate, coefficient of annual wage rate, annual wage rate, coefficient of GDP, GDP and error term respectively. An ECM model has been developed to estimate the short-run dynamics in the relationship among the variables. The ECM model is specified as:

Δlnπt=α0+α1Δlnut-i+α2Δlnwt-i+α3Δlngt-i+Δlnπt-1+α4Ut-1+?t (2)

Where,

Ut-1=lnπ2t–β0–β1lnUt–β2wt–β3gt

Where,  is the error correction term and it is the residual from the co integrating equation,

is the error correction term and it is the residual from the co integrating equation, is the error correction coefficient and

is the error correction coefficient and  are the estimated short-run coefficients (Jammeh, 2012).

are the estimated short-run coefficients (Jammeh, 2012).

Econometric Estimations

Augmented Dicky Fuller (ADF) test has been applied to test the stationary state of the variables. To test Johansen long run co integration test, all the variables should be stationary. From Table 1, it appears that inflation rate, unemployment rate and annual wage rate are stationary at level I (0); on the other hand GDP is stationary at 1st difference, I (1).

| Table 1 Augmented Dicky Fuller (Adf) Unit Root Test |

||||

| Variables | C (constant) and T (trend) in the equation | ADF statistics | Optimum lag | Stationary State |

| π | C & T | -3.651 | 2 | I (0) |

| u | C & T | -5.153 | 0 | I (0) |

| w | C & T | -1.642 | 5 | I (0) |

| g | C & T | -11.114 | 0 | I (1) |

Note: π=Inflation Rate, u=Unemployment Rate, w=Annual Wage Rate & g=GDP.

Johansen test for co integration has been applied to test whether there is any long run relationship among the variables. According to trace statistic and max-Eigen value statistic, there are at least 3 co integration equations (log likelihood 111.4243) among the variables (Table 2).

| Table 2 Johansen Test For Co Integration |

||||||

| Hypothesized No. of CE (s) |

Trace Statistic |

0.05 Critical Value |

Eigen value |

Hypothesized No. of CE (s) |

Max-Eigen Statistic |

Critical Value (0.05) |

| None * | 80.036 | 47.856 | 0.478 | None * | 41.633 | 27.584 |

| At most 1 * | 38.404 | 29.797 | 0.300 | At most 1 * | 22.868 | 21.132 |

| At most 2 * | 15.536 | 15.495 | 0.211 | At most 2 * | 15.160 | 14.265 |

| At most 3 | 0.376 | 3.841 | 0.006 | At most 3 | 0.376 | 3.841 |

Note: *rejection of the hypothesis at the 0.05 level.

There is a long run relationship among inflation rate, unemployment rate, annual wage rate and GDP of Philippines during the analyzed period where except GDP; all other variables are positively correlated to inflation rate (Table 3). From Table 3, it also appears that inflation rate, unemployment rate, annual wage rate and GDP are weekly exogenous. Exogenous coefficients (αs) are measuring the speed of short run dynamics in the model. The retrieved co integration equation has given below:

| Table 3 Normalized Co Integrating Vectors And The Corresponding Adjustment Coefficients |

||||

| Variable | β Coefficients | α Coefficients | Standard error | t-value |

| π | 1.000 | 0.022 | - | - |

| u | 9.778 | -0.007 | 4.416 | 2.214 |

| w | 0.002 | 1.757 | 0.000 | 2.460 |

| g | -8.167 | 0.192 | 1.219 | -6.701 |

| Constant | -1.123 | - | - | - |

πt=1.00+9.78ut+0.002wt–8.17gt–1.12 (3)

From Equation 3, it appears that there are positive associations between inflation rateunemployment rate and inflation rate-annual wage rate and there is negative association between Inflation Rate-GDP where inflation rate is significantly influencing unemployment rate (9.78) and GDP (-8.17).

ECM test has been applied to test the validity of equilibrium relationships among the variables. From Table 4, it appears that F statistic significantly explaining inflation rate at 5% level. Estimated R2 has suggested a relatively good fit of data set. Speed of adjustments among the variables is moderate. According to ECM test, inflation rate-annual wage rate association and Inflation Rate-GDP association are valid but inflation rate-unemployment rate association is not valid and the relationship among inflation rate, unemployment rate, annual wage rate and GDP was not stable during the analyzed period.

| Table 4 Error Correction Representation |

||||||

| Variables | Coefficients | t-values | Standard error | |||

| Constant | 0.019 | 1.170 | 0.016 | |||

| D (π (-1)) | -0.366 | -3.469 | 0.106 | |||

| D (π (-2)) | -0.616 | -6.219 | 0.099 | |||

| D (u (-1)) | -0.529 | -0.778 | 0.679 | |||

| D (u (-2)) | -0.448 | -0.653 | 0.685 | |||

| D (w (-1)) | 0.000 | 0.115 | 0.002 | |||

| D (w (-2)) | -0.003 | -1.156 | 0.002 | |||

| D (g (-1)) | 0.244 | 2.009 | 0.121 | |||

| D (g (-2)) | 0.071 | 0.951 | 0.0747 | |||

| D (π) | D (u) | D (w) | D (g) | |||

| R2 | 0.502 | 0.163 | 0.690 | 0.675 | ||

| Adj. R2 | 0.419 | 0.023 | 0.638 | 0.621 | ||

| Sum sq. resid. | 0.359 | 0.014 | 1161.175 | 1.323 | ||

| S.E. equation | 0.082 | 0.016 | 4.637 | 0.157 | ||

| F-statistic | 6.050 | 1.167 | 13.326 | 12.462 | ||

| Log likelihood | 75.022 | 179.414 | -183.558 | 33.320 | ||

| Akaike AIC | -2.032 | -5.294 | 6.0487 | -0.729 | ||

| Schwarz SC | -1.695 | -4.957 | 6.386 | -0.391 | ||

| Mean dependent | 0.000 | 0.000 | 7.666 | -0.000 | ||

| S.D. dependent | 0.107 | 0.016 | 7.705 | 0.254 | ||

From Figures 1 & 2, it appears that inflation rate function of Philippines was not stable during 1950-2017. CUSUM and CUSUMSQ plots must be under 5% critical bounds if the coefficients of ECM were to be stabled but in this research the plot of CUSUMQ crossed the bounds.

Summary of Findings

According to Johansen long run co integration test, there exists a long run relationship among the variables. Except GDP, the other variables are positively correlated to inflation during the analyzed period of Philippines. Annual wage rate and GDP, justified to economic theory, are positively and negatively correlated to inflation rate respectively. It is quite understandable as annual wage rate increases when inflation rate rises and as unemployment rate also increases, GDP goes down. However, unemployment rate, which is positively correlated with inflation rate, is not consistent with the essence of Phillips curve. According to Phillips curve, there is an inverse relationship between inflation rate and unemployment rate. So, it could be concluded that Phillips curve is not applicable for the economy of Philippines during 1950-2017.

Conclusions & Policy Recommendations

Positive association between inflation and unemployment is a unique challenge for the policy makers. When unemployment decreases, discretionary income rises, demand rises and consequently price increases. On the other hand, when unemployment is high, demand falls and consequently price decreases. During this stagflation period (1950-2017) in Philippines, as it hinders economic growth, currency of Philippines should be removed from gold standard and should left for floatation. Production costs could be cut down to eradicate job lose. Interest rates could be increased to reduce inflation rate. GDP should be forced to regain the job lost. However, as long as inflation rate and unemployment rate both are low, it could be good for the economy while low unemployment rate can trigger global demand of goods which could maintain a lower inflation rate. There is a positive relationship between inflation and annual wage rate but wage growth in relation to inflation is low, which may cause low productivity or per hour output. In such situation, labor productivity or per hour output should be increased to grow the average yearly wage. There exists a negative relationship between inflation rate and GDP, which is consistent with Phillips curve, may be due to real exchange rate movements, tax, government spending, money growth and oil price etc. (Berument et al., 2008).

To implement the policy tools in such a way that GDP and annual wage rate positively influence the unemployment rate and inflation rate of Philippines, the government of Philippines should focus on the salient issues like, leadership styles applied in Philippines’ business sector, extroversion and internationalization of local SMEs in export marketable goods, bilateral agreements among local companies of public or private interest, as well as among multi-national parties and businesses’ along with governmental strategic plans undertaken to support the prosperity of local business and family income. This paper might contribute to resolve the problem of stagflation experienced from high level of inflation and unemployment in the economy not only in Philippines but also in the rest of the world. In the long run there might not be any off set between inflation and unemployment rate. In such situation central banks must not fix unemployment rate below natural rate. The novelty of this research is that unlike the previous studies, annual wage rate has been considered to justify the Phillips curve as well as GDP as the threshold variable. The methodology is also unique in terms of CUSUM and CUSUMQ tests as the stability tests for the model.

References

- Albuquerque, B., & Baumann, U. (2017). Will US inflation awake from the dead? The role of slack and non-linearities in the phillips curve. Journal of Policy Modeling, 39(2), 247-271.

- Abdelsalam, M.A.M. (2017). Improving Phillips curve’s inflation forecasts under misspecification. Romanian Journal of Economic Forecasting, 20(3), 54-76.

- Bagsic, C.B. (2004). The Phillips curve and inflation forecasting: The case of the Philippines, Philippine Management Review, 11, 76-90.

- Berument, H., Inamlik, A., & Olgun, H. (2008). Inflation and growth: Positive or negative relationship? Journal of Applied Sciences, 8, 192-204.

- Cacnio, F.C.Q. (2013). Analysing inflation dynamics in the Philippines using the new Keyensian Phillips curve. The Philippine Review of Economics, 50(2), 53-82.

- Clark, P.B., & Laxton, D. (1997). Phillips curves, Phillips lines and the unemployment costs of overheating. IMF Working Paper.

- Chletsos, M., Drosou, V., & Roupakias, S. (2016). Can Phillips curve explain the recent behavior of inflation? Further evidence from USA and Canada. Journal of Economic Asymmetries, 14, 20-28.

- Doloriel, N.S., Salvaleon, R.G., Ronquillo, A.O., & Estal, B.R. (2014). Fractal analysis of Philippines inflation rate. SDSSU Multidisciplinary Research Journal, 2(1), 179-182.

- Furoka, F., Munir, Q., & Harvey, H. (2013). Does the Phillips curve exist in the Philippines? Economics Bulletin, 33(3), 2001-2016.

- Furuoka, F. (2008). Unemployment and inflation in the Philippines: New evidence from vector error correction model. Philippine Journal of Development, 35(1), 93-106.

- Ferreira, D., & Palma, A.A. (2015). Forecasting inflation with the Phillips curve: A dynamic model averaging approach for Brazil. Revista Brasileria de Economia, 69(4), 451-465.

- Jammeh, K. (2012). Long-and short-run determinants of demand for money and its stability in the Gambia: An empirical investigation. Research paper submitted in fulfilment of the honours requirements for the Bachelor of Science in Economics, University of the Gambia.

- Lacker, J.M., & Weinberg, J.A. (2007). Inflation and unemployment: A layperson’s guide to the Phillips curve. Economic Querterly, 93(3), 201-227.

- Marfatia, H.A. (2018). Estimating the new Keynesian Phillips curve for the UK: Evidence from the inflation-indexed bonds market. Journal of Macroeconomics, 18(1).

- Marsilli, C. (2017). Now casting US inflation using a MIDAS augmented Phillips curve. International Journal of Computational Economics and Econometrics, 7(1-2), 64-77.

- Ormerod, P., Rosewell, B., & Phelps, P. (2009). Inflation/unemployment regimes and the instability of the Phillips curve. Economics.

- Puzon, K.A.M. (2009). The inflation dynamics of the ASEAN-4: A case study of the Phillips curve relationship. Journal of American Science, 5(1), 55-57.

- Paqueo, V.B., Orbeta, A., & Lanzona, L. (2016). The impact of minimum wages on employment, income and poverty incidence in the Philippines. Philippine Institute for Development Studies.

- Phelps, E.S. (1967). Phillips curves, expectations of inflation and optimal unemployment over time. Economica, 34(135), 254-281.

- Phillips, A.W. (1958). The relation between unemployment and the rate of change of money wage rates in the United Kingdom. Economica, 25(100), 283-99.

- Resurreccion, P.F. (2014). Linking unemployment to inflation and economic growth: Toward a better understanding of unemployment in the Philippines. Asian Journal of Economic Modeling, 2(4), 156-168.

- Rusticelli, E., Turner, D., & Cavalleri, M.C. (2015). Incorporating anchored inflation expectations in the Phillips curve and in the derivation of OECD measures of the unemployment gap. OECD Journal: Economic Studies, 1, 299-331.

- Seydl, J., & Spittler, M. (2016). Did globalization flatten the Phillips curve? US consumer price inflation at the sectoral level. Journal of Post Keynesian Economics, 39(3), 387-410.