Research Article: 2019 Vol: 23 Issue: 4

Technological Factors Affecting the Profitability of Commercial Banks in Vietnam

Nga Phan Thi Hang, University of Finance-Marketing (UFM), Vietnam

My-Linh Thi Nguyen, University of Finance-Marketing (UFM), Vietnam

Abstract

The objective of the paper is to analyze how technological factors affect the profitability of commercial banks in Vietnam, and estimate the Pooled Regression Model (Pooled OLS), the Fixed Effects Model (FEM), the Random Effects Model (REM) and the Generalized Method of Moments (GMM). Although technology has been playing a key role in Vietnamese banking operations in recent years, there is no study investigating the impact of technology on efficiency of banks in Vietnam. The results of this study might help banks’ managers using technology effectively. The dependent variable is the return of equity ratio (ROE) and the independent variables are technological factors affecting the profitability of commercial banks in Vietnam. Based on the secondary and primary data collected from 21 banks in the period 2008–2017, the estimation results show that the profitability of commercial banks is influenced by the following factors: using technology in business operations; using technology for automated payment via telephone and computer; technological innovation and the research results also indicate that the profitability of banks is affected by the ratio of equity on total assets; cost management capacity; credit risk; bank size; and inflation. From the research results, the authors propose some policy implications for commercial banks to improve the efficiency of technology use and exploitation during the period of the industrial revolution 4.0.

Keywords

Banks, Profitability, Technology, Industrial Revolution 4.0

Introduction

Bank profitability is not only the result of business operations but it is also essential to the success of banks in the severely competitive period of the credit market. Especially in the digital era of the industrial revolution 4.0, the banking sector is facing many competitors outside the industry. Therefore, the primary goal of bank managers is to achieve profitability as a necessity of any business activity (Bobáková, 2003). At the macro level, a good and efficient banking system is capable of coping with bad fluctuations in business and contributes positively to the stability of the national financial system. Around the world, there are quite a number of theoretical and applied studies on the determinants of bank profitability. Typically, Berger et al. (1987), Berger (1995), Naceur (2003); and Athanasoglou et al. (2005) studied bank profitability in a particular country; meanwhile, Demiguc-Kunt and Huizinga (1999, 2001), Abreu and Mendes (2002), Dietrich & Wanzenried (2014) did research on the determinants of bank profitability in many different countries.

However, there have been a small number of empirical studies on technological factors affecting the profitability of the banking sector is still very few, especially there is no empirical research in Vietnam. Furthermore, in the period of the industrial revolution 4.0, it is essential to examine the impact of technological factors on the profitability of the banking industry, because of the following reason: Currently, commercial banks in Vietnam are implementing the technologization of transactions that arise at banks. In addition, compared to foreign banks, most banks in Vietnam are still carrying out transactions manually. Customers have to go to the bank and fill in many papers to finish a transaction. For example, when a customer deposits his or her savings in the bank, he or she has to go to the bank, then fills in the deposit request form, and waits for the bank teller to process the form. After that, the customer checks and signs a savings deposit contract, transfers cash to the bank teller, and eventually receive the savings book. The duration to finish a deposit transaction is about 15 to 30 minutes. Manual processing will increase transaction costs, decrease productivity and lead to reduced profitability. For this reason, in recent years, Vietnamese commercial banks have invested in technology to automate arising transactions with the average investment cost in the period of 2008-2017 of 617,734.78 USD per year. Compared to the capital scale of Vietnamese banks, this investment cost is quite high; however, it is very necessary to examine the effectiveness of using technology because it helps bank managers evaluate the effectiveness of technology investments during the last time, and identify the changes which need to be made in technology investment and exploitation, especially in the period of the industrial revolution 4.0. Furthermore, if Vietnamese commercial banks apply outdated technology, they will not compete with foreign banks, leading to loss of market share, risk of bankruptcy. Nonetheless, whether investment in technology has a positive impact on bank profitability or not needs to be taken into consideration because Vietnamese people still fear risks when performing automated transactions due to the psychological and cultural characteristics. Stemming from the practical requirements mentioned above, the authors studied "Technological factors affecting the profitability of commercial banks in Vietnam" with the aim of discovering the relationship between technology and profitability, thereby proposing appropriate recommendations for technology investment and exploitation in Vietnamese commercial banks during the period of the industrial revolution 4.0.

Literature Review

As presented above, there have been quite a number of theories and studies on the factors affecting the profitability of commercial banks. These theories and studies can be summarized as follows:

Summary of The Theories About the Factors Affecting Bank Profitability

Theory of representation costs

This theory was introduced to explain the effect of ownership structure on earnings. Accordingly, managers often implement the policies based on their interests rather than optimizing the assets and the interests of owners. An effective way to solve representative conflicts is the ownership of management. This method aims to strengthen the ownership ratio of managers in the company, to help harmonize the interests of managers and companies and force them to act for the interests of shareholders. From this perspective, it seems that banks owned by shareholders will outperform mutual banks, cooperative banks or government banks.

Signaling theory

This theory is about different internal information such as between directors and departments within the company or between parties as investors (Ross, 1977). Accordingly, managers access more important information about the financial situation of the company than outsiders do. Meanwhile, outside investors face a lot of information that may make them misunderstood when evaluating investment opportunities. Therefore, the fluctuations in capital structure will signal to outside parties to capture the performance of the company. More specifically, according to Heid and his research team (2014), sustainable capital structure will transmit positive signals about the bank’s value to the market.

Transaction cost theory

Ronald Coase first mentioned the concept of transaction costs in 1937 in his famous article entitled "The nature of the firm". Transaction costs include the time and costs of negotiating, drafting, and executing transactions or contracts. This theory was later developed by Foss in 1996 with the view that investing in technology would reduce production costs and lead to lower selling prices. Accordingly, for purchasers, reduced transaction costs mean that customers can buy cheap products with unchanged quality. In 2004, Chen also studied technology and performance and found that using technology will increase performance and transaction costs will decrease. For the banking industry, transaction costs will decrease if the bank applies technology to support transactions with customers, instead of having customers go to the bank to request transactions. Customers can perform their transactions that they want everywhere. In addition, the transaction cost theory also reflects the notion that when banks invest in technology, the product quality will change and the customer service efficiency will increase. Technological development can measure how transaction costs change.

Summary of the Research Results on the Factors Affecting Bank Profitability

The relationship between technology use and exploitation and bank profitability

The economies in general and the financial services sector in particular are dramatically affected by the "IT revolution" that has erupted in recent decades. Therefore, IT development is essential for the financial services sector, and the banking sector is certainly driving change by implementing the solutions based on information technology. This change has brought many advantages: the total cost of IT systems has been reduced significantly and sustainably; the customer information on the main channels becomes more consistent; the duration of marketing new and innovative products has decreased considerably. Due to higher levels of automation, the processing capacity has become direct. Therefore, service standards are enhanced and risks are lessend. When faster and efficient systems are being promoted, this will help banks more likely to expand size and reduce costs.

The impact of technology is to help banks increase performance and thereby reduce operating costs leading to the increase in profits and saving labor. However, banks have to invest in IT and IT human resources as well as infrastructure for deployment when technology changes. Consequently, it is necessary to evaluate the effectiveness of technology investment so that bank managers have solutions to improve investment efficiency. Francesco Campanella et al. (2015) studied and conducted an empirical analysis of 3190 banks located in 17 countries during the period of 2008-2011. The results of the empirical research show that (1) There was a negative relationship between financial leverage and technological innovation regarding enterprise resource planning software systems and credit risk management software; That is to say, increasing debts to invest in technology reduces the business performance, showing that the studied banks used technology resources disproportionately compared to the cost. (2) The innovation in enterprise resource planning and the use of credit risk management software had a positive impact on the business performance of banks; That is to say, applying technology to human resource planning and using credit risk management software increased the business performance for the studied banks.

According to Chen's (2004) study, there is the relationship between business performance and technology investment. The study employs DEA method, and the results show that the use of technology in the production process will increase productivity and technology use creates higher efficiency.

The study of Foss (1996) showed the relationship between transaction costs and technology investment in the Danish fruit and vegetable industry. The research results show that technology investment will reduce production costs, contributing to increased profits. In addition, reduced transaction costs mean that customers can buy cheap products with unchanged quality.

The relationship between size and bank profitability

Normally, the bank size is directly proportional to the bank profitability (Zhao & Zhao, 2013; Perera et al., 2013; Pasiouras & Kosmidou, 2007). The reason is that large-sized banks are less likely to encounter risks due to their ability to achieve a larger number of products as well as more diversified loans than small-sized banks. As a result, the capital costs of these banks are significantly reduced, leading to higher profits (Perera et al., 2013). Many researchers argue that large-sized banks benefit from the certain protectionists, which reduces the cost of funds (Demirgüç-Kun & Huizinga, 2012). In contrast, Berger and his team (1987) took the example of 214 state-owned banks to concluded that on the smallest scale, banks achieve economies of scale but on the largest scale, banks do not gain the efficiency of scale. On the other hand, by using the GMM method to assess the determinants of Greek bank profitability in the period from 1985 to 2001, Athanasoglou and his research team (2006) asserted the impact of bank size on profitability is negligible. This group of authors explained that small-sized banks often focus on more rapid development, even using profits. In addition, instead of improving profits, newly established banks usually aim to expand the market share; thus, after only a few years of establishment, these banks will be unprofitable (Athanasoglou et al., 2006). Therefore, many other researchers also believed that there is no relationship between bank size and profitability (Micco et al., 2007). In conclusion, it can be seen that the factor of bank size is mentioned in the majority of studied on bank profitability; however, the relationship between bank size and bank profitability is a trivial topic only.

The relationship between capital ratio and bank profitability

The bank capital structure is calculated by dividing total equity by total assets (Saeed, 2014). Many researchers like Berger (1995); Demirguc-Kunt & Huizinga (1999); Naceur & Omran (2011); Lee & Hsieh (2013) claimed that bank capital ratio is an important determinant of bank profitability. In the study of the relationship between capital ratio and profitability in the banking sector, Berger (1995) pointed out that based on the data on banks in the US in the period 1983-1989, there were positive results from capital to earnings and vice versa. The higher the capital-to-asset ratio, the higher the earnings, thanks to lower interest rates set by uninsured trading funds. This may be explained by the fact that banks with larger capital may reduce the ability of non-insurance debtors to pay bankruptcy costs in the case that the banks make a loss, thereby reducing the interest rate that these creditors set for uninsured debts (Berger, 1995). Other studies by Abreu and Mendes (2001); Naceur and Omran (2011); or by Lee and Hsieh (2013) showed similar results on analyzing the factors affecting bank profitability in different markets. In general, the researchers concluded that there is a positive relationship between capital and bank profitability.

The relationship between credit risk and bank profitability

One of the most important risks in the banking sector is credit risk, stemming from potential failures in the performance of payment obligations of partners (Bessis, 2010). According to Cooper et al. (2003), a bank's loan portfolio is constantly changing, possibly due to the immutability of credit risk. In addition, Duca and McLaughlin (1990) stated that changes in bank profitability are largely due to changes in credit risk. However, measuring bank credit risk remains a controversial issue. Rasaiah (2010) argued that a bank's credit risk level should be assessed by unpaid loans, while Sufian and Chong (2008) and Athanasoglou et al. (2008) claimed that the ratio of loan loss provisions to total outstanding loans is a measure of credit risk. Sufian and Chong (2008) used a linear regression model to test the link between bank profitability and specific determinants. The results from this study show that the higher the the ratio of loan loss provisions to total outstanding loans, the lower the earnings. The reason is that the increase in the risk of loans to the assets of financial institutions leads to the accumulation of bad debts; therefore, credit risk may be inversely proportional to profitability (Miller and Noulas, 1997). On the other hand, despite the choice of different credit risk indicators, Rasiah (2010) still demonstrated that credit risk has no impact on bank profitability.

The relationship between cost management capacity and bank profitability

The bank profitability depends very much on the cost management capacity of bank managers. A bank which is well organized with the systems of quality control and assessment, asset use management, employee performance evaluation to have appropriate remuneration policies will have better cost management capacity. The cost to income ratio (CIR) is often used to assess the bank's cost management capacity. This indicator shows the correlation between cost and income, through which investors get a better view of profitability in the bank's business operations. The smaller this ratio is, the better because then it costs less to create income, or in other words, the bank earns more profits, which means the bank profitability ratio will be higher. The study by Athanasoglou (2008) also emphasizes the important role of cost management capacity on bank profitability.

Interest cost

Interest cost is the amount that the bank has to pay for the mobilized capital through savings deposit and payment of customers. Dietrich & Wanzenried study (2014) showed interest expense has a negative correlation with the bank's ROA and ROE.

The relationship between the growth rate of total assets and bank profitability

A large-sized bank will be capable of leveraging economic resources as well as gain credibility, attract customers to transactions, which leads to the increase in the number of transactions, creating a big revenue not only from lending customers but also from services. Therefore, the growth rate of total assets of commercial banks is an aggregate indicator indicating the financial sustainability and management capacity of a credit institution. In the study of the factors affecting bank profitability in Pakistan, Gul, Irshad and Zaman (2011) found a positive relationship between the rate of return and the growth rate of total assets of banks. line. Alper and Anbar (2011) proclaimed a similar research result proving that the growth rate of total assets has a positive impact on ROA and ROE.

The relationship between inflation rate and bank profitability

Revell (1979) found that inflation can also be a determinant of the fluctuation in bank profitability. It is necessaty to consider the accuracy of the anticipated inflation rate, because banks often rely on this figure to adjust interest rates. Accordingly, the relationship between profitability and inflation rate is unclear because it depends on whether inflation is completely anticipated (Perry, 1992). More specifically, anticipated inflation can lead to interest rates changing faster than inflation costs, thus generating more profits. On the other hand, in the case that inflation is not completely anticipated, bank profitability may increase more slowly than costs due to inappropriately adjusted interest rates. This makes profitability and inflation rate inversely proportional to each other (Sufian and Chong, 2008). Some studies of the effects of inflation on bank profitability concluded that these two factors are directly proportional to each other (Molyneux and Thornton, 1992; Sastrosuwito and Suzuki, 2012). In contrast, Naceur and Kandil (2009) found that inflation rate and bank performance are inversely proportional to each other. It can be explained that the high inflation rate will lead to higher uncertainty, thus reducing credit demand (Naceur and Kandil, 2009).

The relationship between economic growth and bank profitability

Anbar and Alper (2012) argued that banks often benefit more from the economies with higher growth rates by lending more and increasing the quality of bank assets. This result is similar to other researchers such as Hassan and Bashir (2003) with the study on the market of Islamic banks, or Pasiouras and Kosmidou (2007) with the study on the European banking industry. However, the study which was conducted by Athanasoglou et al. (2006) on the Southeast European banking sector disagreed with the above conclusions. According to these studies, the change in GDP per capita did not cause a significant impact on bank profitability, mainly due to the sustainable monetary policy in the observation process that helped to limit bank loans. Therefore, the researchers predicted that economic growth and bank profitability are directly proportional when price stability is achieved (Athanasoglou et al., 2006). In general, the relationship between GDP and bank profitability may vary depending on different market conditions.

Research Methodology

Data Collection

The paper used data from 21 commercial banks out of 31 commercial banks in Vietnam, collected from two sources including primary and secondary data in the period from 2008 to 2017. Specifically, the secondary data were collected from annual reports of banks, the State Bank of Vietnam, Vietnam Bank Statistics, and World Bank. Through the figures on the reports, the authors extracted and calculated the necessary variables in the analysis and regression model to clarify the research objectives. The primary data were collected from the survey that the authors carried out to the above 21 banks to examine the impact of technology on the business performance of banks in the period 2008-2017.

Specifically, for primary data: The researchers carried out the survey of bank managers with over 5 years’ experience in the banking industry, and each questionnaire item is divided into two periods:

1. The period before the industrial revolution 4.0 (From 2008 to 2012)

Select 1 if the bank uses technology and choose 0 if the bank does not use technology.

2. The period of the industrial revolution 4.0 (From 2013 to 2017)

Select 1 if the bank uses technology and choose 0 if the bank does not use technology.

Based on the previous theories and studies, the authors selected the variables in the model as follows Table 1:

| Table 1 Synthesis of Variables | ||||||

| Variable code | Variable name | Variable measurement | Expected sign | Previous studies | ||

| Dependent variables | ||||||

| ROE | Return on equity | Profits after tax /Average equity | ||||

| Independent variables | ||||||

| CN1 | Technology 1 | If the bank uses technology to serve its business operations, it will receive a value of 1; If the bank does not use technology in business operations, it will receive a value of 0. (The period before 2013 and from 2013 to 2018) |

+ | Francesco Campanella et al (2015) | ||

| CN2 | Technology 2 | If the bank uses technology to serve the operations of payment and money transfer, it will receive a value of 1; If the bank does not use technology in the operations of payment and money transfer, it will receive a value of 0. (The period before 2013 and from 2013 to 2018) |

+ | Francesco Campanella et al (2015) | ||

| CN3 | Technology 3 | If the bank uses technology for customers to make automated transactions via phone and computer, it will receive a value of 1; If the bank does not use technology for customers to make automated transactions, it will receive a value of 0. (The period before 2013 and from 2013 to 2018) |

+ | Francesco Campanella et al (2015) | ||

| CN4 | Technology 4 | If the bank uses credit risk management softwares to manage loans, it will receive a value of 1; If the bank does not have credit risk management softwares, it will receive a value of 0. (The period before 2013 and from 2013 to 2018) |

+ | Francesco Campanella et al (2015) | ||

| CN5 | Technology 5 | If the bank invests in technological innovation in the business process, it will receive a value of 1; If the bank does not invest in technological innovation, it will receive a value of 0. (The period before 2013 and from 2013 to 2018) |

+ | Francesco Campanella et al (2015) | ||

| Control variables | ||||||

| Variable code | Variable name | Variable measurement | Expected sign | Previous studies | ||

| TE/TA | Equity ratio | Total equity/ Total assets | + | Berge (1995); Demirguc-Kunt & Huizinga (1999); Abreu &Mendes (2001); Naceur & Omran (2011); Lee & Hsieh (2013); | ||

| CIR | Cost management capacity | Operating cost/Operating income | - | Athanasoglou (2008) | ||

| NPL/TL | Bad debt ratio | Bad debts/Total outstanding loans | - | Duca and McLaughlin (1990); Miller and Noulas, (1997); Sufian and Chong (2008) |

||

| SIZE | Bank size | Ln (total assets) | + | Berger (1987); Pasiouras & Kosmidou (2007); Zhao & Zhao (2013); Perera (2013); | ||

| COST | Interest cost | Interest payment cost/Average mobilized capital | - | Andreas Dietrich & Gabrielle Wanzenried (2014) | ||

| GDP | Economic growth | GDP growth | + | Hassan & Bashir (2003); Athanasoglou et al(2006); Pasiouras & Kosmidou (2007); Anbar & Alper (2012) | ||

| INF | Inflation | Inflation index over the years | +/- | Revell (1979); Molyneux & Thornton, (1992); Sufian & Chong (2008); Naceur & Kandil (2009); Sastrosuwito & Suzuki, (2012). |

||

Research Model

With the static panel data model, the paper uses three regression models: Pooled OLS, fixed effects model, and random effects model.

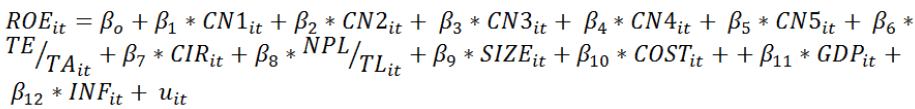

The gross regression model has the following formula:

Where: β0 is intercept, β1-12 is correlation coefficient and uit is correlation error

Research Results

The Current Status of Technology Uses in Vietnamese Commercial Banks

According to the survey results and the data collected from the financial statements of Vietnamese commercial banks, the technologies being used in banks include:

1. Regarding the application of technology for business management: Since 2005, Vietnamese commercial banks have used the software of Corebanking T24 (Core T24) with the version R4 and have upgraded the software gradually over the years and in 2017 the banks used the version R17. Core T24 is a daily data entry and transaction-processing program. All the customers who go to the bank and make transactions are received and processed through Core T24, such as opening a savings account including the activities of depositing, withdrawal, receiving interest, payment, locking temporarily, etc. The risk control department also put data into Core T24 by entering data of loan disbursement information such as real estate mortgage, details of loans and interest per month, etc. Core T24 supports in providing basic reports for statistical purposes and for the tracking purpose of banks.

2. CRM (Customer Relationship Management): This software helps banks manage the activities such as: (1) supporting in sales and marketing strategies; (2) Improving sales management, evaluating existing and potential customers; (3) Improving service management; (4) Improving customer understanding management through CRM 360-degree application, thereby helping to understand customers more smartly, to manage the data and value of customers; (5) Improving the management of distribution channels.

Core Card Portal: This software manages all the information and transaction history of all customer cards and is considered as the core of the card segment. From the input data, Core Card Portal also supports in providing the files of reports and tracking daily sales plans.

3. Regarding the application of technology for payment: Vietnamese commercial banks are using softwares for payment activities such as: QR Pay, QR Cash, Banking Contactless application of contactless payment technology, POS NFC machine, Samsung Pay application, mCard application for quick payment via QR, etc. in order to diversify mobile payment methods, and meet the customers’ demand of non-cash transactions.

4. Regarding the application of technology for customers’ automated transactions (Ebanking): Currently, Vietnamese commercial banks are implementing technologies such as Internet Banking, Mobile Banking App and Mobile Banking Web in order to help customers to carry out their transactions through smart devices without having to go to the bank to request transactions.

5. Regarding the application of technology for credit and credit risk management: The software system to initialize, approve and manage credit granting (LOS - Loan Origination System) provided by Aurionpro - Integro includes three main systems: Initialization of credit records, Limit management, and Collateral management. This system will help banks manage all of the procedures and operations, such as creating customer records, approving loans and implementing decisions; simultaneously, it is easier to manage credit records, collateral assets, and limits as well as control, search, report, manage credit risks, reduce bad debt generation and gradually achieve Basel II standards.

CM Model (Credit Risk Model - CM): (i) Evaluating the risk of business portfolios; thereby planning business strategies, managing credit portfolios, managing portfolio quotas, classifying assets in accordance with risk appetite to balance between risk management and expected profits; (ii) Valuing loans based on risks in terms of the customer segment and the product portfolio, and helping banks to orient towards the development of new products; (iii) Identifying the expected level of risk and loss for the entire business portfolio to determine the amount of capital needed to contribute to the safety of the bank's operations.

The system calculating the expected loss aims to calculate each customer's Probability of Default (PD), to measure specific risks at each loan level (LGD - Loss Given Default) and to estimate debt balance when customers cannot pay debts (EAD - At Default Exposer) according to the basic internal approach of Basel II. From the calculation of PD, LGD, and EAD, the bank is able to value the credit based on the risk that the credit can bring the bank (EL - Expected Loss).

Below are the research results which show the relationship between these technologies and the profitability of commercial banks in Vietnam.

Descriptive Statistics

Research data were collected from 21 commercial banks and macroeconomic indicators in Vietnam in the period 2008-2017, with the variables described in Table 2 follows:

| Table 2 Descriptive Statistics of Variables | ||||

| Variable | Observations | Mean | Min | Max |

| Return on equity (ROE) | 210 | 10.93 | 0.07 | 31.53 |

| Technology 1 (CN1) | 210 | 0.89 | 0 | 1 |

| Technology 2 (CN2) | 210 | 0.76 | 0 | 1 |

| Technology 3 (CN3) | 210 | 0.69 | 0 | 1 |

| Technology 4 (CN4) | 210 | 0.26 | 0 | 1 |

| Technology 5 (CN5) | 210 | 0.15 | 0 | 1 |

| Equity ratio (TE/TA) | 210 | 10.10 | 0.94 | 46.24 |

| Cost management capacity (CIR) | 210 | 50.84 | 21.71 | 92.74 |

| Bad debt ratio (NPL/TL) | 210 | 2.24 | 0 | 8.81 |

| Bank size (SIZE) | 210 | 18.23 | 15.59 | 20.91 |

| Interest cost (COST) | 210 | 3.51 | 0.92 | 11.50 |

| Economic growth (GDP) | 210 | 6 | 5.2 | 6.8 |

| Inflation (INF) | 210 | 8.57 | 0.88 | 23.12 |

The results of descriptive statistical analysis showed that the variables in the model collected enough data with 210 observations. The highest ratio of return on equity (ROE) belongs to Asia Commercial Bank (in 2008), the lowest is Nam Viet Commercial Joint Stock Bank (2012). The highest share of equity (TE/TA) is Lien Viet Post Commercial Joint Stock Bank (in 2008), the lowest is Military Commercial Joint Stock Bank (2017). The highest cost management capacity (CIR) is Nam Viet Commercial Joint Stock Bank (2013), the lowest is Military Commercial Joint Stock Bank (2008). The highest credit risk (NPL/TL) is Saigon Hanoi Commercial Joint Stock Bank (2012), the lowest is Lien Viet Post Commercial Joint Stock Bank (2008). Bank size (SIZE) is the highest value of Vietnam Investment and Development (2017), the lowest is Nam A Commercial Joint Stock Bank (2008). The highest cost of technology investment (COST) is Asia Commercial Joint Stock Bank (2011), the lowest is Vietnam Joint Stock Commercial Bank for Industry and Trade (2009). For technology variables, the factor of using technology to serve business activities (CN1) is applied by most banks (average value is 0.89); the technology innovation factor in the business process (CN5) is applied by few banks (average value is 0.15). For macroeconomic factors: the growth of gross domestic product (GDP) reached the highest value in 2017, the lowest in 2012; the inflation rate (INF) reached the highest value in 2008 and the lowest in 2015.

Regression Result

The paper utilizes regression methods with panel data including: Pooled regression (Pooled OLS), Fixed effects model (FEM) and Random effects model (REM). The regression results of the Random effects model (REM) proved more suitable because the F-test is statistically significant at the significance level of 5% and the Hausman test is not statistically significant in both models. Next, the use of REM results to test LM (Breusch and Pagan Lagrangian multiplier test) shows that the model has the heteroscedasticity at the significance level of 10%. Simultaneously, the Wooldridge test shows that the model has the autocorrelation among errors at the significance level of 1%. The results of the REM research model have the autocorrelation among errors and the heteroscedasticity, which can be controlled by Generalized Method of Moment (GMM) to ensure that the obtained estimates are stable and effective (Blundell & Bond, 1998); moreover, this method also addresses potential endogenous problems (Doytch & Uctum, 2011). Therefore, the researchers use the final results of the GMM model.

The regression results of the models are shown in the Table 3 below.

| Table 3 Regression Results | ||||

| Pooled OLS | FEM | REM | GMM | |

| Constant | 3,4616 | -4,7452 | -0,4454 | 23,2919 |

| CN1 | -0,5120 | 0,1704 | -0,3144 | -3,4912** (0,026) |

| CN2 | -0,8382 | -2,2110** | -1,3052 | -0,9719 (0,319) |

| CN3 | -3,4773*** | -4,3057*** | -3,8031*** | -2,6015*** (0,008) |

| CN4 | 0,1696 | -0,7897 | -0,0610 | -0,3655 (0,709) |

| CN5 | -1,4403 | -0,6689 | -1,1361 | 8,5116* (0,098) |

| TE/TA | -0,3413*** | -0,2907** | -0,3190*** | -0,4674*** (0,008) |

| CIR | -0,2655*** | -0,2237*** | -0,2523*** | -0,2380*** (0,000) |

| NPL/TL | -0,5318* | -0,4912 | -0,5153* | -0,1560 (0,559) |

| SIZE | 1,5996*** | 1,9230* | 1,7821*** | 0,5680 (0,540) |

| COST | 0,1585 | 0,1885 | 0,1706 | 0,1200 (0,663) |

| GDP | -0,3004 | -0,1680 | -0,2897 | -0,6075 (0,550) |

| INF | 0,1570** | 0,1368* | 0,1519** | 0,2257*** (0,004) |

| Significance level | F(12, 197) = 23,36 Prob > F =0,0000*** |

F(12, 177) = 12,17 Prob > F = 0,0000*** |

Wald chi2(12) = 232,42 Prob > chi2 = 0,0000*** |

Wald chi2(11) = 358,10 Prob > chi2 = 0,000*** |

| F test | F(20, 177) = 1,78 Prob > F = 0,0260** |

|||

| Hausman test | chi2(12) = 12,55 Prob>chi2 = 0,4027 |

|||

| Arellano-Bond AR(2) test | Pr > z = 0,930 | |||

| Sargan test | Prob > chi2 = 0,239 | |||

Note: *, **, and *** indicate significance at the 10%, 5% and 1% level respectively.

The result of the research model has the equation as follows:

ROEit =-3,4912 CN1-2,6015 CN3+8,5116 CN5-0,4674 TE/TAit-0,2380 CIRit+0,2257 INFt+uit

The regression results show that the dependent variable of return on equity is affected by the independent variables as follows:

Using Technology In Business Operations (CN1)

The regression results of the GMM model show that the variable of using technology in business operations (CN1) has a negative impact (-3,4912) on ROE at the significance level of 5%. This means that using technology to serve business operations can bring certain effects in banking operations, especially in the periods when the economy as well as the banking sector face many difficulties. However, the investment in technology to serve business operations has not brought positive impacts on the profitability of commercial banks in a short time. Furthermore, from the owner's perspective, the cost of investing in technology can also create negative impacts, which leads to the decrease in the ratio of return on equity.

Using Technology for Automated Payment via Telephone and Computer (CN3)

At the 1% significance level, the variable of using technology for automated payment via phone and computer (CN3) has a negative impact on ROE in the four models. This shows that the investment in technology to serve automated transactions via telephone and computer has not brought positive impacts on the profitability of commercial banks in a short time, which leads to the decline in bank profitability.

Technological Innovation (CN5)

At the significance level of 10%, technological innovation (CN5) has a positive impact (8,5116) on ROE when regressing according to the GMM model. This shows that, from the owner's perspective, the investment in technological innovation in the business process created positive impacts that contribute to improving the ratio of return on equity.

In addition, the paper also finds variables that have an impact on the ratio of return on equity of commercial banks in Vietnam such as:

Equity Ratio (TE/TA)

The ratio of total equity on total assets (TE/TA) has a negative impact on ROE at the 1% significance level GMM models. This shows that the growth rate of profits has not kept pace with the growth of equity. Therefore, although the equity ratio has increased, the ratio of return on equity has not been improved.

Cost Management Capacity (CIR)

At the 1% significance level, cost management capacity (CIR) has a negative impact on ROE. This suggests that if commercial banks are capable of managing costs well, they will limit costs, contributing to increase the rate of return.

Inflation Rate (INF)

The research results show that the inflation rate (INF) has a positive impact on ROE. This indicates that the moderate inflation rate will have positive impacts to help improve the profitability of commercial banks.

Conclusions and Policy Implications

Conclusions

The analysis results from GMM with the data collected from 21 commercial joint stock banks showed that bank profitability is affected by factors including: using technology in business operations, using technology for automated payment via telephone and computer, and technological innovation; in addition, the research also found that the ratio of equity on total assets, cost management capacity, and inflation also affect the profitability of commercial banks in Vietnam.

Policy implications

Based on these results, the research team proposed a number of policy implications to help commercial banks in Vietnam invest and exploit technology effectively in the Industrial Age 4.0.

Technology Investment Must be Accompanied by Exploitation

The regression results show that using technology in business operations and using technology to serve customers with automated payment via smart vehicles have an impact on the ratio of return on equity of commercial banks in Vietnam. However, this impact is currently negative because banks have invested in technology with large costs; nevertheless, the exploitation is not thorough. For example, ATMs have the function of depositing and withdrawing money; nonetheless, customers mainly withdraw money, and do not exploit the function of depositing money because banks have not widely disseminated and instructed customers how to exploit this function. The exploitation of the function of depositing money in ATMS will help customers to save time instead of having to make the transaction at the counter and will help banks to reduce stationery costs and salary costs. Therefore, according to the research team, it is recommended that banks need to fully exploit the functions of technologies to serve the business operations. On the other hand, banks need to instruct customers to use the technologies because currently, Vietnamese people still have the psychology of anxiety when making transactions through technology (fear of risk).

Technological Innovation

The industrial revolution 4.0 will create new steps in changing the way of communication and handling business through interaction and electronic communication such as: Sales channels via Internet, Mobile banking, Tablet Banking, and social networks (Social Media). Digital banking development and paperless transactions will be strong trends. Thanks to the digital conversion application, the bank's products can integrate with many auxiliary products and services to satisfy customers. Based on the research results, it can be seen that the variable of technological innovation has a positive impact on bank profitability. Therefore, banks need to have plans for technological innovation to adapt to the business conditions in the period of the industrial revolution 4.0.

Strengthening Banking System Security

In order for customers to feel assured to make automated transactions through technology, banks need to pay special attention to building data backup centers (Disaster Recovery), upgrading security and confidentiality system at a high level, and ensuring the expansion of operation scope (if any) in a stable, safe and effective way in the long term. Banks should strengthen measures to ensure security and safety for the national payment system; coordinate closely and effectively with functional agencies; strengthen regulations and measures to ensure security, safety, and confidentiality; detect, fight, prevent, prohibit and handle law violations in the areas of card payment, ATM, POS and other high-tech payment methods.

Improving the Quality of Banking Human Resources

Human resources are the key factor, determining the success in the operation and development of a bank. The training and attention to the quality of high-tech human resources should be taken into consideration seriously and invested intensively. The trained professional staff of banks must be qualified to apply information technology and advanced working methods; be capable of proposing and advising on building strategies, orientations, policies, and regimes; and implement the state management of monetary, credit and banking activities, in accordance with the requirements of the economy in the context of international economic integration. Banks need to train and foster IT staff with good professional qualifications and high professionalism, meeting the demand for operation management and mastering modern technological systems. Training to improve qualifications should be combined with considering modern technologies at the national and international levels and implementing remuneration regimes for experts.

In addition, banks also need to manage credit risk well, and increase capital size to ensure the competitiveness of financial capacity with foreign banks. Good governance of operating costs and loan interest payments will contribute to improving the business performance of commercial banks in Vietnam during the period of industrial revolution 4.0.

References

- Abreu, M., & Mendes V. (2002). Commercial bank interest margins and profitability: Evidence from E.U. Countries. University of Porto Working Paper Series, No: 122.

- Athanasoglou, P., Brissimis, S., & Delis, M. (2008). Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of International Financial Markets, Institutions and Money, 18(2), 121-136.

- Athanasoglou, P., Brissimis, S., & Delis, M. (2005). Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Bank of Greece, Working Paper No. 25.

- Athanasoglou, P., Delis, M., & Staikouras, C. (2006). D’eterminants of Bank Profitability in the Southern Eastern European Region. Bank of Greece Working Paper. 47

- Berger, A., & Humphrey, D. (1987). The e?ect of the ?rm’s capital structure on the systematic risk of common stocks. Journal of Finance, 27, 435-452.

- Berger, A. (1995). The relationship between capital and earnings in banking. Journal of Money, Credit and Banking, 27, 404-31.

- Bessis, J. (2010). Risk Management in Banking. John Wiley & Sons Inc., New York.

- Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87, 115-143.

- Bobáková, I.V. (2003). The Federal Reserve Banks, imputed cost of equity capital. Federal Reserve Bank of New York Economic Policy Review, 9, 55-81.

- Campanella, F., Peruta, M.R.D., Giudice, M.D. (2017). The effects of technological innovation on the banking sector. Journal of the Knowledge Economy, 8(1), 356-368.

- Casu, B., Girardone, C., & Molyneux, P. (2006) Introduction to banking. Essex: Pearson.

- Chen. Y., & Joe Zhu (2004). Measuring information technology’s indirect impact on firm performance. Information Technology and Management, 5, 9-22.

- Coase. R.H. (1937). The nature of the firm. Economica, New Series, 4(16), 386-405.

- Cooper, M.J., Jackson, III.W.E., & Patterson, G.A. (2003). Evidence of predictability in the cross-section of bank stock returns. Journal of Banking and Finance. 27(5), 817-850.

- Deger Alper & Adem Anbar. (2011). Bank Specific and Macroeconomic Determinants of Commercial Bank Profitability: Empirical Evidence from Turkey. Business and Economics Research Journal,2(2), 139-152.

- Demiguc-Kunt, A., & Huizinga, H. (2001). The theory and practice of corporate ?nance: Evidence from the ?eld. Journal of Financial Economics, 60, 187-243.

- Demirguc-Kun, A., & Huizinga, H. (1999). Determinants of commercial bank interest margins and profitability: Some international evidence. World Bank Economic Review, 13, 379-408.

- Demirgüç-Kun, A., & Huizinga, H. (2012). Do we need big banks? Evidence on performance, strategy and market discipline. Journal of Financial Intermediation, 22(4), 532-558.

- Dietrich, A., & Wanzenried, G. (2014). The determinants of commercial banking profitability in low-middle-, and high-income countries. The Quarterly Review of Economics and Finance, 18, 1-18.

- Doytch, N., & Uctum, M (2011). Does the worldwide shift of FDI from manufacturing to services accelerate economic growth? A GMM estimation study. Journal of International Money and Finance, 30(3), 410-427.

- Duca, J., & McLaughlin, M. (1990). Developments affecting the profitability of commercial banks. Federal Reserve Bulletin, 477-499

- Foss. Kirsten (1996). Transaction costs and technological development: The case of the Danish fruit and vegetable industry. Research Policy, 25(4), 531-547.

- Gul, S., Irshad, F., & Zaman, K. (2011). Factors affecting bank profitability in Pakistan. Romanian journal of economic forecasting, 14(39), 61-87.

- Hassan, M.K., & Bashir, A.M. (2003). Determinants of islamic banking profitability. In: Economic Research Forum (ERF) 10th Annual Conference: proceeding of a conference. Morocco: Economic Research Forum.

- Heid, F., Porath, D., & Stolz, S. (2004). Does capital regulation matter for bank behaviour? Evidence for German savings banks. Frankfurt am Main: Deutsche Bundesbank.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Lee, C.C., & Hsieh, M.F. (2013). The impact of bank capital on profitability and risk in Asian banking. Journal of International Money and Finance, 32(1), 251-281

- Micco, A., Panizza, U., & Yanez, M. (2007). Bank ownership and performance: Does politics matter? Journal of Banking & Finance, 31, 219-241.

- Miller, S.M., & Noulas, A. (1997). Portfolio mix and large bank profitability in the USA. Applied Economics, 29, 505-512.

- Molyneux, P., & Thornton, J. (1992). Determinants of European bank profitability: A note. Journal of Banking & Finance, 16(6), 1173-1178.

- Naceur, S.B., & Kandil, M. (2009). The impact of capital requirements on banks’ cost of intermediation and performance: The case of Egypt. Journal of Business and Economics. 61(1), 70-89

- Naceur, S.B., & Omran, M. (2011). The effects of bank regulations, competition, and financial reforms on banks' performance. Emerging Markets Review, 12(1), 1-20.

- Naceur, S.B. (2003). The determinants of the Tunisian banking industry profitability: Panel evidence. Universite Libre de Tunis Working Papers. Retrieved from http://www.mafhoum.com/press6/174E11.pdf

- Pasiouras, F., & Kosmidou, K. (2007). Factors influencing the profitability of domestic and foreign commercial banks in the European Union. International Business and Finance, 21, 222-237.

- Pasiouras, F., & Kosmidou, K. (2007). Factors influencing the profitability of domestic and foreign commercial banks in the European Union. Research in International Business and Finance, 21(2), 222-237.

- Perera, S., Skully, M., & Wickramanayake, J. (2007). Cost efficiency in South Asian banking: The impact of bank size, state ownership and stock exchange listings. International Review of Finance,7(1-2), 35-60.

- Perry, P. (1992). Do banks gain or lose from inflation? Journal of Retail Banking, 14, 25-40.

- Rasiah, D. (2010). Theoretical framework of profitability as applied to commercial banks in Malaysia. European Journal of Economics, Finance and Administrative Services, 19, 74-97.

- Revell, J. (1979). Inflation and financial institutions. Financial Times.

- Ross, S.A. (1977). The determination of financial structure: The incentive-signaling approach. The Bell Journal of Economics, 8, 23-40.

- Saeed, M.S. (2014). Bank-related, industry-related and macroeconomic factors affecting bank profitability: A Case of the United Kingdom. Research Journal Finance and Accounting, 5(2), 42-50.

- Sastrosuwito, S., & Suzuki, Y. (2012). The determinant of post-crisis Indonesian banking system profitability. Economics and Financial Reviews, 1(11), 44-55.

- Sufian, F., & Chong, R.R. (2008). Determinants of bank profitability in a developing economy: Empirical evidence from Philippines. Asian Academy of Management Journal of Accounting and Finance, 4(2), 91-112.

- Zhao, S.Y., & Zhao, S.F (2013). States ownership, size and bank profitability: Evidence from chinese commercial banks, 1998-2011. Information Technology Journal, 12(16).