Research Article: 2020 Vol: 24 Issue: 2

Taxation of Non-Profit Religious Organizations in Ukraine

Lyudmyla Chyzhevska, Zhytomyr Polytechnic State University

Svetlana Romanenko, National University of the State Tax Service of Ukraine

Irina Timrienko, National University of the State Tax Service of Ukraine

Tetiana Zatoka, Odessa National University of Economics

Abstract

Non-profit organizations are directed in their operations by widely applied legislative actions as ordinary legal bodies, as well as by specific laws in compliance with the category of non-profit field to which they refer. Religious organizations are vital in building civil society to meet its spiritual needs. The goal of the paper is to identify the characteristics of the taxation of non-profit organizations in Ukraine by highlighting the impact of factors in the development of the accounting. The study showed that, unlike other industries, religious organizations do not have a local document on the methodology of accounting for special transactions (income receiving and writing-off of expenses). The income of non-profit religious organizations is used for non-profit (charitable) activities, respectively, the task of accounting for tax calculations is to provide reliable information about the intended use of such funds. This approach involves the conduct of such analytical accounting, which reflects the characteristics of the non-profit organization in accordance with the constituent documents. The results allow us to draw conclusions about the impact of the tax system on the organization of accounting for such special objects in religious organizations as income, expenses and other types of financing from legal entities and individuals. The findings of the report offer an incentive for donors and other interested parties outside Ukraine to consider the tax characteristics religious organizations. The value of this study is gaining knowledge about the impact of the tax system on the organization of accounting in religious organizations for such objects as expenses, income, taxes. Understanding these features will enable to fund and execute programs undertaken by non-profit organizations in Ukraine more effectively.

Keywords

Tax Base, Income and Expenses, Financial Accounting, Organization of Accounting in Religious Organizations, Taxation.

Introduction

Non-profit organizations are an important element of society. In order to increase the effectiveness of non-profit organizations activities, it is necessary to solve a number of important tasks, in particular: to unify the legislative acts of all levels on taxation issues as well as to develop a unified systematic approach to the bases of organization of activity of non-profit institutions of different kinds; to develop generalized accounting policy components for the main objects of accounting of various types of non-profit organizations; to substantiate the mechanism of taxation of the results of the transactions of non-core statutory activities; to investigate the methodology of administrative actions in the course of implementation of projects of a non-profit organization and to investigate their influence on the organization of accounting; to work out methods for finding financing for projects and to evaluate their effectiveness.

The importance of these issues for the development of non-profit institutions led to the need for a systematic study of tax issues (Popadynets, 2016; Romaniv & Dyda, 2017; Runner et al., 2018; Shytyi, 2016; Wagenmaker, 2018), taking into account international practices and peculiarities of the economic development of the region, which would contribute to the development of society as a whole.

The comparative characteristic given in the article will be useful for those founders of international non-profit organizations, which establish their representative offices in the territory of the post-Soviet countries, because when planning their activity in these territories it is necessary to take into account:

1. Specificity of tax status of non-profit organizations (Wagenmaker, 2018; Alm et al., 2017; Mishchenko, 2016).

2. Identification of taxable transactions which are tax exempt (Freeland, 2015; Blodgett et al., 2017; Cohen, 2017; Fricke, 2015; Heffernan et al., 2016; Runner et al., 2018).

3. Legislative restrictions on registration, taxation and accounting of non-profit organizations (Barragato, 2019; Martin, 2017; Romaniv, 2017).

4. Form of control by the state (Persulessy et al., 2019; Popadynets, 2016)

5. Possibility of receiving state aid from the state budget and income from foreign donors (Freeland, 2015).

6. Restrictions on the membership of founders (Applegate, 2019; Kenneth, 2015; Fricke, 2015; Hofmann, 2017)

7. The procedure for the distribution of property of a non-profit organization in the event of its liquidation (Cohen, 2017; Harris et al., 2019; Runner et al., 2018);

8. The types of taxes levied on the territory of the states and the possibilities of tax optimization (Bogaty`rev, 2017; Heffernan et al., 2016; Newman, 2019; Romaniv, 2017; Shytyi, 2016).

The Role of the State in Developing a Financial Mechanism for Stimulating the Activities of Non-Profit Organizations

Ensuring the human right to freedom of religion implies complicity in this activity, together with state structures, as well as civil society. The involvement of religious organizations by the state helps to achieve mutual understanding in the society, strengthen inter-confessional stability, and prevent conflict exacerbation on a religious basis. One of the main sources of funding for religious organizations is the donation of religious believers, as well as receiving funds from external and internal donors. Local business representatives are internal donors as well. However, in order to promote the business with corporate giving, the state has such an effective financial mechanism as the fiscal system.

The financial mechanism for promoting the activities of non-profit organizations involves legal instruments of tax regulation of operations for financing such organizations. Such a mechanism performs a stimulating function, drawing the attention of the commercial sector to the social problems of society.

Such a mechanism should meet the criteria of:

1. Non-discrimination: Do not discriminate certain types of organizations during the allocation of funds.

2. Transparency: To be transparent at the stage of implementation of such mechanism.

3. legality: To have adequate information support and legal field for implementation of such mechanism.

4. Independence: To maintain the independence of non-profit organizations from donors after using donor funds.

5. Alternative: The possibility of choosing a financial mechanism tool.

6. Accountability: The ability to be monitored and audited for compliance with all funding requirements, including targeted use of funds and non-abuse of preferential tax treatment.

In case these criteria are met, the economic (cost-benefit ratio) and social (meeting the social needs of citizens in the case of religious organizations spiritual) efficiency of the nonprofit organization will be achieved.

Religious organizations included by the STS bodies in the Register compile Tax Report on the use of funds of religious institutions and organizations. The report is submitted by religious organizations, their separate units for each reporting (tax) period. The report is compiled as a growing summary from the beginning of the calendar year. The original report is submitted to the STS body, where a religious organization is registered. In addition, religious organizations together with the Report submit quarterly (small enterprises – annual) financial statements in accordance with the procedure provided for submission of the tax report. The uniqueness of this country is that it tried to apply all three options for tax accounting.

Until 2015, the independent record keeping of two accounting systems was allowed: tax and financial. That is, the accountants kept a record of each transaction twice: in the system of financial accounting and separately in the system of tax accounting, which could be conducted without the use of double entry. After 2015, an adjustment of the financial result for the purpose of taxation on permanent and temporary tax differences was adopted. This is the second method.

The examples of permanent tax differences are:

1. The accrual of travel expenses in an amount greater than mentioned in the Tax Code.

2. Free transfer of assets.

The examples of temporary tax differences are:

1. The expenses on forming a reserve for doubtful debts.

2. Repair of fixed assets.

But religious organizations, which fall under certain criteria, namely annual income does not exceed UAH 20 million (about USD 710 thousand), can use the third method. That is, the tax is to be paid from profit in the financial accounting without adjustments.

Unfortunately, this country has another factor that influence on the accounting system, i.e. military events. Impact of hostilities on the accounting system are as follows:

1. Withholding military levy from the salary (1,5%) this entailed another reason for the non-payment of the official salary, because you need to pay.

2. The increase in charges to the reserve for doubtful debts occurs due to the fact that organizations are forced to Write off bad debts from partners located in uncontrolled territories.

3. Write-off of destroyed assets.

4. Re-registration of organizations from the zone of hostilities in the peaceful zone.

5. Tax benefits for obtaining charitable assistance to participants in hostilities (this benefit relates to the profit tax paid by businesses).

So, in Ukraine, a model of taxation is characterized by the situation that a religious organization initially is not a tax payer. It means that it will only pay this tax if it violates two conditions: 1) it will distribute profits between founders, 2) it will conduct non-statutory activities. The main sources of religious organizations funding include donations from members of the religious community, donations from businesses, charities and philanthropists.

Let's consider the situation.

Situation. Religious organization in September 2017 allowed the misuse of funds in the amount of UAH 200 000. According to the Tax Code, such an organization has lost its religious tax status from the next month, that is, from October 2017. Starting from 2018, the organization has to report as ordinary income tax payers (quarterly). And pay profit tax.

The requirements for staying as a religious organization.

Requirement 1. A religious organization must be formed and registered in accordance with the procedure established by the law regulating the activity of such a religious organization.

Requirement 2. Statutory documents of a religious organization must have a prohibition on the distribution of the received income (profits) or of part among the founders (participants), members of such organization, employees (except for their labor payment, accrual of a single fee), members of the management bodies, other individuals related to listed entities.

Requirement 3. Statutory documents must consider that during the termination of a legal entity (as a result of its liquidation, merger, division, accession or transformation) its assets are transferred to one or more religious organizations of the corresponding type or are included in the budget revenue.

Requirement 4. Religious organizations must be included into the Register of religious institutions and organizations.

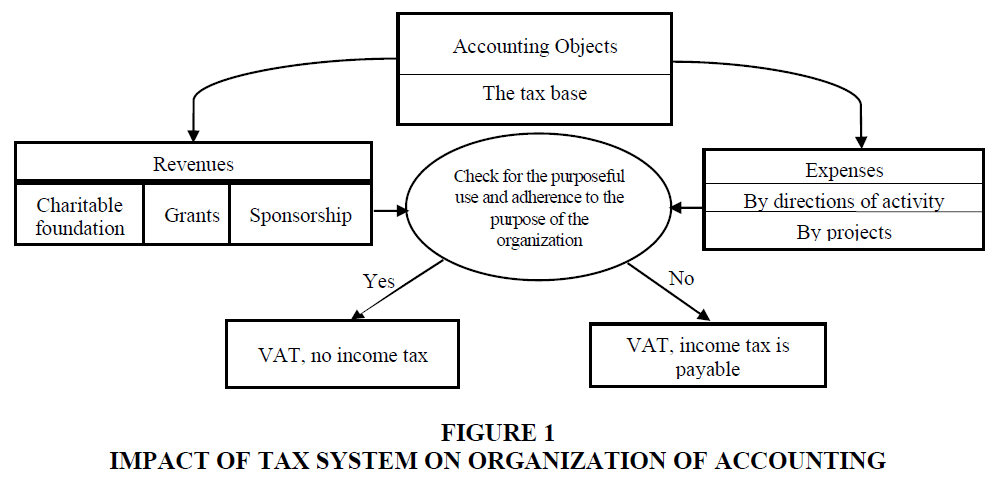

Requirement 5. Unprofitable organization may use its Incomes (profits) exclusively for the financing of expenditures for the maintenance of a religious organization, the realization of aim (goals, tasks) and directions of activity determined by its statutory documents (Figure 1).

Based on the above, the question is raised, would not it be a violation if a part of the received humanitarian assistance is distributed by our religious organization (association) among its members? The answer is as follows: humanitarian assistance is targeted. Thus, the main thing here is to follow the target direction of its use. And if among its recipients, in particular, members of your organization will be, it’s not a big trouble.

Humanitarian assistance in cash or in kind, in the form of carrying out the work or rendering services, is addressed specifically to those in need (Paragraph 3 of Article 1 of Law No. 1192). The recipients of humanitarian assistance are individuals and legal entities who need it and for whom it is directly provided (Paragraph 11 of Article 1 of Law No. 1192).

Therefore, there are no restrictions on the receipt of “humanitarian assistance” by religious members. But such people should be documented as recipients of humanitarian assistance. In particular, they should be specified in terms of distribution of humanitarian assistance among recipients.

This is also indicated by the controllers: entered into the Unified Register of recipients of humanitarian assistance non-profitable organization does not lose unprofitable status, if targeted humanitarian assistance for the intended purpose is distributed between its recipients, in particular if among the recipients there are members of such a religious organization.

Payments made by a religious organization to pay salary for the founders (participants), employees, members of such organization (including sick pay), other payments included in labor costs, as well as compensation expenses for business trips, for professional development of specialized direction are considered expenses within the limits of statutory activity.

Religious organizations should pay attention that Part 7 of Article 17 of the Law of Ukraine No. 987 “On Freedom of Conscience and Religious Organizations” prohibits the use of land pieces for the purpose of business activity, which they were given for permanent use for the construction and maintenance of religious and other buildings.

In its turn, in Part 1.2 of Article 19 of the Law No. 987, religious organizations, in accordance with the procedure established by the current legislation, have the right to establish publishing, printing, industrial, restoration and construction, agricultural and other enterprises, as well as charity institutions (shelters, boarding schools, hospitals, etc.), which have the right of a legal entity. The procedure of their taxation will depend on what kind of activity they are engaged in and how they use their profits.

Religious organization received from the insurance company the amount of funds in the form of insurance compensation for causing material damage to property belonging to the organization. In this case, the question whether the amount of such funds in the income that is a subject of taxation by profit tax is taken into account. Law “On Insurance” states that the insurance compensation is an insurance payment made by the insurer within the limits of the sum insured under the contracts of property insurance and liability insurance upon the occurrence of an insured event.

The amount of losses in the case of damage of the insured property is determined on the basis of its real value. The sum of the insurance compensation shall not exceed the amount of direct loss suffered by the policyholder and shall be determined depending on the size of the insured's own participation in the compensation (franchise), if it is established by the terms of the insurance contract.

Such requirements of tax law require an appropriate accounting organization established in a nonprofit organization, where the Chart of accounts must be constructed in such a way as to provide separate accounting for taxable and non-taxable transactions. Analytical accounting of income and expenses can be constructed in the context of articles of tax legislation and compliance with the criterion of purposeful use of funds.

Types of income received by religious organizations exempt from taxation are stipulated in Article 157 of the Tax Code. In particular, incomes exempted from the taxation by profit tax from the implementation of the main activities of religious organizations, includes passive incomes.

Passive incomes are incomes received in the form of interests, dividends, insurance payments and reimbursements, as well as royalties. Consequently, the amount of the insurance compensation received by the religious organization from the insurance company for the damaged property is not included in the income (irrespective of the religious sign), which is subject of taxation by profit tax.

Conclusions

Public funding of NGOs will be effective if the donor receives tax deductions, including income tax, real estate, VAT. Given the important role of religious organizations in meeting the spiritual needs of citizens, the formation of an economic mechanism for stimulating them becomes an urgent task of the system of management and regulation of the national economy.

An important function of the financial mechanism of stimulating the development of the non-profit sector is to create appropriate conditions for interest of business in supporting religious organizations by creating tax incentives.

In the tax context, religious organizations are legal bodies registered in compliance with the special legislation in regards with their performance.

The lack of sectoral guidelines for accounting in religious organizations has a negative impact on accounting and financial control over such organizations.

Revenues of religious organizations consist mainly of donations received. In turn, the expenses of religious organizations consist mainly of the costs of statutory activities. For taxation, it is essential to adhere to the purpose of such income and expenses.

The study of the peculiarities of the taxation system of religious organizations is the basis for the organization of analytical accounting. Proper detail cuts are the basis for promptly obtaining indicators that will confirm the legality of the selected tax system, target the use of revenues, and confirm compliance with regulatory documents regarding the exemption from mandatory payments.

The comparative analysis will allow to draw conclusions about:

1. Conceptual apparatus in the field of taxation of non-profit organizations (non-profit organization, nonbusiness entity, non-profit status, non-profitability index.

2. Peculiarities of the organizational and legal form of non-profit organizations in the listed countries.

3. Possibilities for choosing the tax system (tax optimization), including analysis of the application of different tax rates.

References

- Alm, J., & Teles, D. (2017). State and federal tax policy toward nonprofit organizations. Tulane Economics Working Paper Series’, New Orleans, no. 1704.

- Barragato, C. (2019). The impact of accounting regulation on non-profit revenue recognition. Journal of Applied Accounting Research, 20(2).

- Blodgett, Z.E., Fish, M.H., & Flash, E.S. (2017). Nonprofit Governance & Tax-exempt Organizations Law Alert. Hancock Estabrook, Hancock.

- Bogaty`rev, S.Y. (2017). Analysis of foreign experience in taxation of non-profit organizations, ‘Audit i finansovy`j analiz’, 1.

- Cohen, C. (2017), Charitable commerce: examining property tax exemptions for community economic development organizations, ‘Columbia Law School’, New York.

- Applegate, D.C.M.A. (2019). Assessing and controlling nonprofit fraud risk. Strategic Finance, 11.

- Erikume, K. (2015), Taxation and Governance – Part 2 (Religious Leadership). PwC Nigeria, Tax and Regulatory Services Unit, Nigeria: PwC Nigeria.

- Freeland, W. (2015), The Effect of State Taxes on Charitable Giving. The State Factor, Virginia: The State Factor.

- Fricke, M. (2015), The case against income tax exemption for nonprofits. St. John's Law Review, 4.

- Harris, E.E., Tate, S.L., & Zimmerman, A.B. (2019). Does hiring a local industry specialist auditor matter to nonprofit organizations? Nonprofit and voluntary sector quarterly. Association for Research on Nonprofit Organizations and Voluntary Action, 3.

- Heffernan, M.J., & Cronin, S.R. (2016). Taxpayer’s guide to local property tax exemptions religious and charitable organizations. Local Property Tax Exemptions for Charitable and Religious Organizations, 11.

- Hofmann, M. (2017). The church and the tax law: Keeping church and state separate. The ATA Journal of Legal Tax Research, 1.

- Martin, J.M. (2017). Should the government be in the business of taxing churches? Regent university law review, 29.

- Mishchenko, L. (2016). In defense of churches: Can the IRS limit tax abuse by “Church” Impostors? The George Washington law review, 5.

- Newman, G.M. (2019). The taxation of religious organizations in America. Harvard Journal of Law and Public Policy, 2.

- Persulessy, G., Pattinama, G.L., Manuputty, G.G., & Tomasila, M. (2019). Application of accounting systems in the church financial management, ‘International Conference on Religion and Public Civilization (ICRPC 2018).

- Picard, R.G., Belair-Gagnon, V., & Ranchordás, S. (2016), The Impact of Charity and Tax Law / Regulation on Not-for-profit News Organizations. The Reuters Institute for the Study of Journalism. University of Oxford Information Society Project, Yale Law School.

- Popadynets, H.O. (2016), Legal status of non-profit organizations in economic activity. Visnyk Natsionalnoho universytetu. 855.

- Romaniv, Y.M., & Dyda, O.V. (2017). Accounting and taxation of non-profit organizations: The peculiarities and conducting procedure in Ukraine. Molodyi vchenyi, 855.

- Runner, S., George, M., Fiona, H., & Jerome, E., (2018). Property Tax Exemptions for Religious Organizations. Property Tax Exemptions, Sacramento, California.

- Shytyi, S.I. (2016). Separate issues of taxation of religious organizations in the legislation of Ukraine and the European Union. Ekonomika i pravo, 31.

- Wagenmaker, R.S. (2018). Why Religious Organizations Shouldn’t Lose Tax-Exempt Status Based on Public Policy, Post-Obergefell, Wagenmaker, New York: SSRN Electronic Journal.