Research Article: 2020 Vol: 24 Issue: 5

Tax Revenue and Financial Development in Emerging Markets

Kunofiwa Tsaurai, University of South Africa

Abstract

Keywords

Tax Revenue, Complementarity, Financial Development, Emerging Markets.

Introduction

Background of the study, research gaps and contribution of the study: Tax revenue is the engine for economic growth, according to Kotlan et al. (2011) and Ali et al. (2018), among others. Although there is still some conflicting message as to the relationship between these two variables, the positive impact of tax revenue on economic growth is no longer a disputable matter in public economics and finance. Other more recent research work that have supported the tax revenue led growth hypothesis were done by Garba (2014), Babatunde et al (2017) and Egbunike et al (2018). What has been overlooked is the channel through which tax revenue influence economic growth, a scenario which led others like Ismail et al (2017) and Volckaert (2016) to investigate the role played by tax revenue in financial sector development, itself a known channel of economic growth.

The nexus between tax revenue and financial development has so far been one sided, that which investigated the impact of financial development on tax revenue. The argument that has been put forward by Okon (2018) is that financial development increases tax revenues by facilitating the tracking and collection of taxes. Empirical studies that explored the impact of financial development on tax revenue were done by Demirtas, 2016; Akram, 2016; Taha et al. 2013; Ilievski, 2015; Nnyanzi et al, 2018; Akcay et al., 2016; Petrescu, 2013; Capasso & Jappeli, 2013; Gnangnon, 2019, among others. The influence of tax revenue on financial development has so far been scantly researched (Volckaert, 2016). Even so, such studies wrongly assumed that there is a linear relationship between tax revenue and financial development. They also ignored the issue od endogeneity and the fact that financial sector development data has got dynamic characteristics, in line with Tsaurai (2018). To the best of the author’s knowledge, no other study exists on the impact of tax revenue on financial development in the context of emerging markets. It is against this backdrop that the current study investigates (1) the role of tax revenue on financial development in emerging markets and (2) the impact of the complementarity between tax revenue and FDI on financial development in emerging markets.

Organization of the paper: Literature review on how tax revenue is related to financial development constitutes Section 2. The discussion on how other factors affect financial development apart from tax revenue is discussed in Section 3. Section 4 is the research methodology, discussion and results interpretation. Section 5 concludes the study.

Literature Review

Three schools of thought are existent in the literature concerning the relationship between tax revenue and financial development, namely (1) The tax revenue led financial development view, (2) financial development led tax revenue perspective and (3) feedback hypothesis.

The tax revenue led financial development view is the most common perspective which states that an increase in tax revenue enhances the development of the financial sector. The hypothesis was supported by Volckaert (2016) and Ismail et al (2017). The financial development led tax revenue hypothesis view which was promoted by Okon (2018) says that financial development increases tax revenues by facilitating the tracking and collection of taxes. Using the Error Correction Model (ECM) model with data ranging from 1993 to 2017, Okon (2018) investigated the impact of financial development on tax revenue. The study observed that financial development enhanced the tax revenue collection capacity in Nigeria during the period under study. Increased depth, access and stability of the financial sector accelerated the collection of tax revenue in Nigeria (Okon. 2018:93). The feedback hypothesis says that both tax revenue and financial development promote one another, and this view was supported by Akram (2016) when using private sector credit as a measure of financial development.

Table 1 summarises the empirical research on the nexus between tax revenue and financial development.

| Table 1 A Summary of Empirical Research on tax Revenue-Financial Development Nexus | |||

| Author | Focal unit of analysis | Methodology | Research findings |

| Okon (2018) | Nigeria | Error Correction Model (ECM) | Financial sector development was found to have had a positive impact on tax revenue collection in Nigeria. |

| Volckaert (2016) | Europe | Mechanisms of mismatches in international taxation and financial sophistication | The study revealed that tax revenue enhanced the development of the financial sector |

| Demirtas (2016) | Turkey | Multivariate panel data framework | Banking and non-banking financial sector development had a direct positive impact on tax revenue in the long run. In the short run, only the banking sector Granger caused tax revenue in Turkey. |

| Akram (2016) | Pakistan | Multivariate time series data analysis | Market capitalization and the number of bank branches had a significant positive impact on tax revenue in the long run. A feedback relationship was detected between financial development and tax revenue when private sector credit was used as a proxy of financial development. The findings apply both in the short and long run. |

| Taha et al (2013) | Malaysia | Multivariate time series data analysis | Stock market development was found to have enhanced tax revenue in Malaysia. |

| Ilievski (2015) | 96 developing countries | Panel data analysis | Higher levels of stock market value traded, and stock market capitalization led to more tax revenue collection during the period under study. |

| Loganathan et al (2017) | Malaysia | Multivariate time series data analysis | Tax revenue was found to have had a significant positive influence on financial development in Malaysia. |

| Nnyanzi et al (2018) | East African countries | System GMM approach | The financial markets depth mattered more when it came to tax revenue enhancement efforts in east African nations studied. Financial markets access had a negligible influence on tax revenue in East Africa. |

| Akcay et al (2016) | Turkey | Vector Error Correction Model (VECM) | Banking sector development enhanced tax revenue collection in Turkey in the short run. |

| Petrescu (2013) | 72 developing countries | Panel data analysis | Financial intermediaries quality enhanced the total revenue collected in these countries. |

| Capasso and Jappeli (2013) | Italy | Multivariate time series data analysis | Financial development was found to have helped to increase tax revenue base in Italy. |

| Gnangnon (2019) | Developing countries | Panel data analysis | Financial development was found to have enhanced collection of taxes from non-resource sectors of the economy. |

From the empirical literature discussion on financial development and tax revenue nexus presented in Table 2, it is quite clear that (1) the tax revenue led financial development, (2) financial development-led tax revenue and (3) the feedback hypotheses are the three perspectives under which the relationship exists. The most dominant one that has so far been investigated is the financial development-led tax revenue hypothesis.

| Table 2 Variables, a Priori Expectation and Theory Intuition | ||

| Variable | Theory intuition | Expected sign |

| FDI | According to Soumare and Tchana (2015), foreign direct investment inflows makes the financial markets more efficient. On the other hand, foreign investors crowd out local investors from the domestic financial markets, for example through excessively borrowing from the domestic financial markets at the expense of the local firms (Harrison and McMillan. 2003). | +/- |

| GROWTH | Higher economic growth enhances the general wealth levels of individuals and their savings and investment capacity in financial assets (Robinson. 1952; Rybcynski (1984). | + |

| INFL | According to Haslag and Koo (1999), higher levels of inflation erodes the value of investment in financial assets hence the people see no need to invest in financial assets. | - |

| SAV | According to Fry (1980), the savings increases the quantity of funds that is eventually invested into either financial assets or into the productive sectors of the economy, a view which supports Romer (1986) and Lucas (1988) who argued that savings increases investment activities in the economy. | + |

| OPEN | Higher degree of trade openness exposes local firms to higher levels of competition in the international arena which can only be managed through making use of robust risk management frameworks and sophisticated financial products (Svaleryd and Vlachos. 2002). In an environment of high levels of trade openness, external shocks in the international financial markets are likely to have a negative consequence on the domestic financial sector. | +/- |

| HCD | According to Kelly (1980), educated individuals have access to information hence they save and invest money in preparation for a possible rainy day. However, De Gregorio (1996) noted that the financial resources that are used to improve human capital development could have been used for on lending and investment in the economy for the good of the financial sector. | +/- |

Other Variables That Affect Development of Financial Sector

Research Methodology

Data

The study used the dynamic GMM approach with panel data (2001-2017) to achieve two objectives. Firstly, to estimate the impact of tax revenue on financial development in emerging markets and secondly, to investigate if the combination of tax revenue and FDI enhanced financial development in the emerging markets. The data which was used was extracted from World Development Indicators, International Monetary Fund (IMF), African Development Bank and the United Nation Development Programme, international sources whose main advantage is that they are reputable (Nnadi & Soobaroyen. 2015). Seventeen emerging markets which were part of the study include Argentina, Brazil, Czech Republic, Greece, Indonesia, India, Mexico, Malaysia, Peru, Philippines, Poland, Portugal, Republic of Korea, Russia, Thailand, Singapore and South Africa, in line with IMF (2015). Emerging countries which were excluded from this study is due to lack of data for the variables being studied.

Empirical and Econometric Model Specification

Based on literature discussed in the preceding sections of this paper, the general model specification can be summarized in the form of equation 1.

FIN =f(TAXREV, FDI, GROWTH, INFL, SAV, OPEN, HCD) [1]

Where FIN, TAXREV, FDI, GROWTH, INFL, SAV, OPEN and HCD stands for financial development, tax revenue, foreign direct investment, economic growth, inflation, savings, trade openness and human capital development respectively.

The following Table 3 shows the proxies of each variable that were used for the purposes of this study.

| Table 3 Proxies of the Variables Used | ||

| Abbreviation | Variables used | Proxy used |

| DCRED | Financial development | Domestic credit by banks to the private sector (% of GDP) |

| DCFIN | Financial development | Domestic private sector credit by financial institutions (% of GDP) |

| TURN | Financial development | Stock turnover ratio |

| VTRADED | Financial development | Value traded ratio |

| MCAP | Financial development | Stock market capitalisation (% of GDP) |

| ODPR | Financial development | Outstanding domestic private debt (% of GDP) |

| ODPUB | Financial development | Outstanding domestic public debt (% of GDP) |

| FDI | Foreign direct investment | Net FDI (% of GDP) |

| GROWTH | Economic growth | GDP per capita |

| INFL | Inflation | Inflation consumer prices (annual %) |

| SAV | Savings | Gross domestic savings (% of GDP) |

| OPEN | Trade openness | Exports +Imports (% of GDP) |

| HCD | Human capital development | Human capital development index |

The selection of the variables and proxies used in the current study were mainly guided by two factors: (1) Earlier related studies such as Okon (2018); Nnyanzi et al (2018); Kimm (2019); Elgin & Uras (2013) and Dumicic (2018) (Table 4).

| Table 4 Equation 2 Signs and Their Interpretations | |

| ?it | Error term |

| i | Country |

| t | Time |

| β0 | Intercept term |

| b1 to b7 | Co-efficient of the independent variables |

| FINit | Financial development in country i at time t |

| TAXREVit | Tax revenue in country i at time t |

| FDIit | Foreign direct investment in country i at time t |

| GROWTHit | Economic growth in country i at time t |

| INFLit | Inflation in country i at time t |

| SAVit | Savings in country i at time t |

| OPENit | Trade openness in country i at time t |

| HCDit | Human capital development in country i at time t |

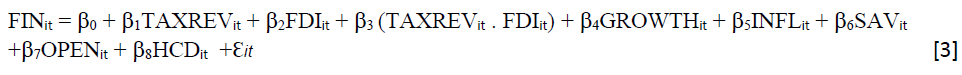

Investigating the impact of tax revenue on financial development in emerging markets is represented by the following econometric equation.

Literature which says that an increase in tax revenue enhances financial development is available (Volckaert. 2016; Ismail et al. 2017). The positive influence of FDI on financial development has also been supported by Soumare and Tchana (2015) whilst research work done by Harrison and McMillan (2003) explained that FDI can have a negative impact on financial development. It naturally follows that a country which is experiencing an increase in tax revenue and FDI inflow is likely to experience higher levels of financial development. It is against this backdrop that the current study investigated the impact of the complementarity between tax revenue and FDI on financial development in emerging markets as captured by equation 3.

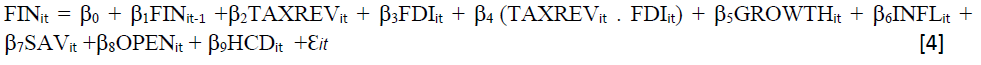

Tsaurai (2018) found out that financial development can be influenced by its lag hence equation 3 is transformed into equation 4 in order to capture the dynamic characteristics of financial development data.

FINit-1is the lag of financial development

Equation 4 is then estimated using Arellano and Bond (1991)’s dynamic panel GMM approach, consistent with Nor et al (2015). In equation 4, a positive and significant sign of β4is proof that the interaction between tax revenue and FDI enhances financial development in emerging markets.

Estimation Diagnostics

The author had to convert all the data sets into natural logarithms before analysing it to avoid spurious results and unsavoury characteristics of the data with a potential of affecting the quality of the outcome.

The results from Table 5 shows that the variables are integrated of order 1. In other words, the variables were found to be stationary at first difference thus paving way for co-integration tests. Using Kao (1999) method, it was established that there is a long run relationship between variables being studied, irrespective of the proxy of financial development used (see results in Table 6).

| Table 5 Panel Root Tests –Individual Intercept | ||||

| Level | ||||

| LLC | IPS | ADF | PP | |

| LTAXREV | -3.0218*** | -1.5953* | 41.7177 | 33.4673 |

| LDCRED | -2.8161*** | -0.3181 | 32.4576 | 27.3967 |

| LDCFIN | -1.3313* | 0.7332 | 24.8859 | 19.6730 |

| LTURN | -4.6174*** | -4.0333*** | 72.4028*** | 110.287*** |

| LVTRADED | -4.8495*** | -4.1419*** | 73.0801*** | 79.9044*** |

| LMCAP | -3.4470*** | -2.3257** | 52.8763** | 92.9452*** |

| LODPR | -1.3099* | 0.9090 | 36.7519 | 30.4467 |

| LODPUB | -2.8708*** | -1.9235** | 48.4053* | 111.566*** |

| LFDI | -4.6874*** | -5.2158*** | 86.4034*** | 148.659*** |

| GROWTH | 0.7953 | 4.1039 | 8.7589 | 7.3819 |

| INFL | -4.2041*** | -4.0871*** | 73.5540*** | 139.519*** |

| SAV | -2.1478** | -2.4945*** | 58.3538*** | 68.4870*** |

| OPEN | -1.1065 | 1.1026 | 21.3951 | 50.3930** |

| HCD | -8.6183*** | -6.6029*** | 105.353*** | 161.555*** |

| First difference | ||||

| LTAXREV | -10.0164*** | -7.8495*** | 124.958*** | 193.120*** |

| LDCRED | -6.5260*** | -6.3373*** | 106.588*** | 145.255*** |

| LDCFIN | -3.5704*** | -5.2756*** | 89.5597*** | 307.375*** |

| LTURN | -11.5891*** | -11.5259*** | 184.905*** | 787.302*** |

| LVTRADED | -9.2372*** | -9.121*** | 145.542*** | 466.054*** |

| LMCAP | -12.0798*** | -12.1578*** | 193.960*** | 431.138*** |

| LODPR | -11.0061*** | -9.1142*** | 156.921*** | 272.912*** |

| LODPUB | -7.7703*** | -6.8315*** | 112.135*** | 141.706*** |

| LFDI | -9.1185*** | -12.694*** | 193.694*** | 1502.23*** |

| GROWTH | -6.0548*** | -5.8778*** | 95.9078*** | 150.334*** |

| INFL | -12.0552*** | -13.6402*** | 218.119*** | 883.312*** |

| SAV | -7.7631*** | -8.9743*** | 143.520*** | 676.903*** |

| OPEN | -7.3727*** | -8.2974*** | 132.334*** | 277.320*** |

| HCD | -15.7504*** | -14.7069*** | 234.909*** | 2544.94*** |

| Table 6 Results of Kao Co-Integration Tests | |

| Series | ADF t-statistic |

| DCRED TAXREV FDI GROWTH INFL SAV OPEN HCD | -4.2317*** |

| DCFIN TAXREV FDI GROWTH INFL SAV OPEN HCD | -3.1724*** |

| TURN TAXREV FDI GROWTH INFL SAV OPEN HCD | -3.2592*** |

| VTRADED TAXREV FDI GROWTH INFL SAV OPEN HCD | -4.1830*** |

| MCAP TAXREV FDI GROWTH INFL SAV OPEN HCD | -6.2482*** |

| ODPR TAXREV FDI GROWTH INFL SAV OPEN HCD | -3.1834* |

| ODPUB TAXREV FDI GROWTH INFL SAV OPEN HCD | -7.2893*** |

Main Data Analysis

The models (1,2,3,4,5,6,7) whose results are shown in Table 6 are described as follows:

Model 1: DCRED =f(TAXREV, FDI, GROWTH, INFL, SAV, OPEN, HCD)

Model 2: DCFIN =f(TAXREV, FDI, GROWTH, INFL, SAV, OPEN, HCD)

Model 3: TURN =f(TAXREV, FDI, GROWTH, INFL, SAV, OPEN, HCD)

Model 4: VTRADED =f(TAXREV, FDI, GROWTH, INFL, SAV, OPEN, HCD)

Model 5: MCAP =f(TAXREV, FDI, GROWTH, INFL, SAV, OPEN, HCD)

Model 6: ODPR =f(TAXREV, FDI, GROWTH, INFL, SAV, OPEN, HCD)

Model 7: ODPUB =f(TAXREV, FDI, GROWTH, INFL, SAV, OPEN, HCD)

Where DCRED, DCFIN, TURN, VTRADED, MCAP, ODPR and ODPUB respectively stands for domestic credit provided by banks to the private sector, domestic private credit provided by the financial sector, stock market turnover, stock market value traded, stock market capitalisation, outstanding domestic private debt securities and outstanding domestic public debt securities.

In line with Tsaurai (2018), financial development was found to have been affected by its own lag in a significant positive manner across all the seven models Table 7. Tax revenue had a nonsignificant positive impact on domestic credit provided by banks to the private sector (model 1), domestic private credit provided by the financial sector (model 2), stock market turnover (model 3) and outstanding domestic private debt securities (model 6) whilst model 4, 5 and 7 shows that tax revenue had a significant positive influence on financial development. These results are backed by Volckaert (2016) and Ismail et al (2017) whose argument is that increased tax revenue boosts economic growth which in turn enhances financial development.

| Table 7 Dynamic Gmm Results for Emerging Markets | |||||||

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | |

| 0.94*** | 0.97*** | 0.89*** | 0.93*** | 0.78*** | 0.96*** | 0.87*** | |

| TAXREV | 0.06 | 0.02 | 0.10 | 0.39*** | 0.47*** | 0.08 | 0.23** |

| FDI | -0.21** | -0.12* | -0.29* | 0.11 | 0.56** | 0.09 | 0.55*** |

| TAXREV. FDI | 0.07** | 0.04 | 0.10 | 0.43*** | 0.21** | 0.03* | 0.20*** |

| GROWTH | 0.07*** | 0.04*** | 0.05 | 0.24* | 0.02** | 0.05 | 0.02 |

| INFL | -0.01 | -0.003 | -0.005 | -0.06** | -0.06** | -0.01 | -0.003 |

| SAV | 0.06** | 0.001 | 0.12 | 0.32*** | 0.30*** | 0.02 | 0.004 |

| OPEN | -0.004 | -0.01 | -0.01 | -0.07 | 0.01 | 0.06 | 0.10** |

| HCD | -0.33*** | -0.16** | -0.28 | 0.74** | 0.01 | 0.57** | 0.09 |

| Adjusted R-squared J-statistic Probability (J-statistic) Durban-Watson statistic |

0.98 | 0.98 | 0.82 | 0.88 | 0.78 | 0.94 | 0.91 |

| 279 | 279 | 279 | 279 | 279 | 279 | 279 | |

| 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| 1.54 | 1.76 | 2.34 | 2.18 | 2.41 | 1.99 | 1.37 | |

Source: Author’s compilation from E-Views

Model 1, 2 and 3 indicates that FDI had a significant negative effect on financial development, a finding which supports Harrison and McMillan (2003)’s view that foreign investors crowd out local investors from the domestic financial markets when they excessively borrow from the domestic financial markets at the expense of the local firms. A non-significant positive relationship running from FDI towards financial development was observed in model 4 and 6 whereas a significant positive impact of FDI on financial development was detected in model 5 and 7, findings which resonate with Soumare and Tchana (2015) whose argument is that foreign direct investment inflows makes the financial markets more efficient.

The complementarity between tax revenue and FDI was found to have had a significant positive effect on financial development in model 1, 4, 5, 6 and 7. Moreover, model 2 and 3 shows a non-significant positive relationship running towards financial development from the complementarity between tax revenue and FDI. These results are in line with literature which predicts that a combination of an increased tax revenue base and foreign investment inflows in the economy enhances financial sector development (Soumare and Tchana. 2015:9).

In model 1,2, 4 and 5, economic growth had a significant positive influence on financial development whilst model 3, 6 and 7 indicates that economic growth affected financial development in a non-significant positive way. These results are in line with Robinson (1952) and Rybcynski (1984) whose studies stated that higher economic growth enhances the general wealth levels of individuals and their savings and investment capacity in financial assets.

A non-significant negative effect of inflation on financial development was detected in model 1,2,3,6 and 7 whereas model 4 and 5 indicates a significant negative relationship running from inflation towards financial development. The results generally resonate with Haslag and Koo (1999) in the sense that higher levels of inflation erodes the value of investment in financial assets hence the people see no need to invest in financial assets.

Savings had a significant positive impact on financial development in model 1, 4 and 5 and a non-significant positive effect on financial development in the remaining models, a finding which in in sync with Romer (1986) and Lucas (1988) that savings increases investment and financial development activities in the economy.

Model 5 and 6 shows a non-significant positive relationship running from trade openness towards financial development yet in model 7, trade openness had a significant positive effect on financial development. The findings support an argument by Svaleryd and Vlachos (2002) whose study is of the view that higher degree of trade openness exposes local firms to higher levels of competition in the international arena which can only be managed through making use of robust risk management frameworks and sophisticated financial products. In models 1 to 4, trade openness was found to have had a non-significant deleterious effect on financial development, results which contradicts literature.

The relationship between human capital development and financial development was found to be quite diverse. Model 4 and 6 shows that human capital development had a significant positive effect on financial development whilst model 5 and 7 indicates that financial development was affected by human capital development in a positive but non-significant manner. These results support Kelly (1980) whose study argued that educated individuals have access to information hence they save and invest money in preparation for a possible rainy day. Model 1 and 2 shows that human capital development had a significant negative impact on financial development whilst a non-significant negative relationship running towards financial development from human capital development was detected in model 3. The results support De Gregorio (1996)’s assertion that the financial resources that are used to improve human capital development could have been used for on lending and investment in the economy for the good of the financial sector.

Conclusion

The paper investigated the impact of tax revenue on financial development and the effect of the complementarity between tax revenue and FDI on financial development in emerging markets. The study used the dynamic GMM approach with panel data ranging from 2001 to 2017. Across all the seven models, it was established that financial development was significantly and positively influenced by its own lag. Moreover, tax revenue was found to have had either a significant or non-significant impact on financial development whilst the impact of FDI on financial development was found to be sensitive to the type of financial development proxy used. The impact of the complementarity of tax revenue and FDI on financial development was found to be significant and positive in emerging markets. Emerging markets are therefore urged to implement policies that are geared towards more tax revenue collection enhancement programmes to deepen financial development. They are also recommended to simultaneously implement these policies alongside FDI inflow attraction programmes if they intend to enhance the development of their financial sector.

References

- Akcay, S. Sagbas, I., & Demirtas, G. (2016). Financial development and tax revenue nexus in Turkey. Journal of Economics and Development Studies, 4(1), 103-108.

- Akram, N. (2016). Financial sector activities affect tax revenue in Pakistan? The Lahore Journal of Economics, 21(2), 153-169.

- Ali, A.A. Ali, A.Y.S., & Dalmar, M.S. (2018). The impact of tax revenues on economic growth: A time series evidence from Kenya. Academic Research International, 9(3), 163-170.

- Arellano, M. and Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58(2), 277-297.

- Babatunde, O.A. Ibukun, A.O., & Oyeyemi, O.G. (2017). Taxation revenue and economic growth in Africa. Journal of Accounting and Taxation, 9(2), 11-22.

- Capasso, S., & Jappeli, T. (2013). Financial development and the underground economy. Journal of Development Economics, 101(3), 167-178.

- De Gregorio, J. (1996). Borrowing constraints, human capital accumulation and growth. Journal of Monetary Economics, 37(1), 49-71.

- Egbunike, F.C. Emudainohwo, O.B., & Gunardi, A. (2018). Tax revenue and economic growth: A study of Nigeria and Ghana. Jurnal IImu Ekonomi, 7(2), 213-220

- Elgin, C., & Uras, B.R. (2013). Is informality a barrier to financial development? SERIEs, 4(2), 309-331.

- Garba, L.S. (2014). Tax revenue and economic growth in Nigeria. Unpublished thesis. Zaria: Ahmadu Bello University.

- Gnangnon, S.K. (2019). Financial development and tax revenue in developing countries: Investigating the international trade and economic growth channels. ECONSTOR Working Paper Number 206626.

- Harrison, A.E., & McMillan, M.S. (2003). Does direct foreign investment affect domestic firms credit constraints? Journal of International Economics, 61(1), 73-100.

- Kao, C. (1999). Spurious regression and residual –based tests for co-integration in panel data. Journal of Econometrics, 90 (1), 1-44.

- Kelly, A. (1980). Interactions of economic and demographic household behavior, in Easterlin, Population and Economic Change in Developing Countries. Chicago, Chicago University Press.

- Kimm, G.S. (2019). Financial development and tax revenue in developing countries: Investigating the international trade and economic growth channels. ECONSTOR Working Paper Number 206628.

- Nnyanzi, J.B., & Sendi, R. (2018). Financial development and tax revenue: How catalytic are political development and corruption? International Journal of Economics and Finance, 10 (8), 92-104

- Okon, E.B. (2018). Financial sector development and tax revenue in Nigeria. International Journal of Economics, Commerce and Management, 6 (6), 93-109.

- Cavusgil, S.T. Ghauri, P.N., & Akcal, A.A. (2013). Doing business in emerging markets. Sage Publications.

- Fry, M.J. (1980). Saving, investment, growth and the cost of financial repression. World Development, 8(4), 317-327.

- Girma, S. Gong, Y., & Gorg, H. (2008). Foreign direct investment, access to finance and innovation activity in Chinese enterprises. The World Bank Economic Review, 22(2), 367-382.

- Haslag, J., & Koo, J. (1999). Financial repression, financial development and economic growth. Federal Reserve Bank of Dallas, Working Paper Number 99-02.

- Ilievski, B. (2015). Stock markets and tax revenue. Journal of Applied Finance and Banking, 5(3), 1-16.

- International Monetary Fund. 2015. World Economic Outlook: Adjusting to Lower Commodity Prices. Washington (October).

- Kotlan, I. Machova, Z., & Janickova, L. (2011). Vliv zdaneni na dlouhodoby ekonomicky rust, Politicka ekonomie, 59(5), 638-658.

- Loganathan, N. Ismail, S. Streimikiene, D. Hassan, A.G. Zavadskas, E.K., & Mardani, A. (2017). Tax reform, inflation, financial development and economic growth in Malaysia. Romanian Journal of Economic Forecasting, 20(4), 152-165.

- Lucas, R., (1988). On the mechanics of economic development. Journal of Monetary Economics, 22(1), 3-42.

- Nor, N.H.H.M Ripain, N., & Ahmad, N.W. (2015). Financial development and FDI-Growth nexus: Panel Analysis. Proceeding of the 2nd International Conference on Management and Muamalah, 435-446.

- Petrescu, I.M. (2013). Financial sector quality and tax revenue: Panel evidence. Mimeo, University of Maryland.

- Robinson, J. (1952). The Generalisation of the General Theory. In the rate of interest and other Essays. London: MacMillan.

- Romer, P. (1986). Increasing returns and long run economic growth. Journal of Political Economy, 94(5), 1002-1037.

- Rybcynski, T.M. (1984). Industrial finance system in Europe, US and Japan. Journal of Economic Behavior and Organization, 5(3-4), 275-286.

- Soumare, I., & Tchana, F.T. (2015). Causality between FDI and financial market development: Evidence from emerging markets. The World Bank Economic Review, 29 (Supplement 1), 1-12.

- Stead, R. (1996). Foundation quantitative methods for business. Prentice Hall. England.

- Svaleryd, H., & Vlachos, J. (2002). Markets for risk and openness to trade: How are they related? Journal of International Economics, 57 (2), 369-395.

- Taha, R. Colombage, S.R. Maslyuk, S., & Loganathan Nanthakumar, L. (2013). Does financial system activity affect tax revenue in Malaysia? Bounds testing and causality approach. Journal of Asian Economics, 24, 147-157.

- Tsaurai, K. (2018). An empirical study of the determinants of banking sector development in the SADC countries. The Journal of Developing Areas, 52(1), 71-84.

- Volckaert, K. (2016). The role of the financial sector in tax planning, TAXE2 Special Committee of the European Parliament.