Short communication: 2022 Vol: 28 Issue: 4

Tax Policy from Colonial America to The Permanent Income Tax Legislation Of 1894: A Case Study

Emmet Fritch, American Public University

Citation Information: Fritch, E. (2022). Tax policy from colonial america to the permanent income tax legislation of 1894: A case study. Journal of the International Academy for Case Studies, 28(S4), 1-8.

Abstract

A case study exploring the evolution of US Tax policy from colonial times to the introduction of the permanent income tax provides insight into US income tax policy. A case study method utilizes inductive research questions, guided by Optimum Income Taxation theory. The case study traces the history of US income tax from the early colonial period until the 1894 permanent tax law. Primary and secondary resources provide historical factors. I searched online library aggregators on tax policy, tax law, opinions on taxation, and other related terms. Seminal articles, government documents, and published articles from government and scholarly articles were analyzed and coded to establish themes. Thematic classification allows readers to see the various types of taxes from colonial times to the US permanent income tax establishment

Keywords

US Income Tax History, US Colonial Tax Regulations, Income and Wealth Tax, Civil War Financing. Permanent Income Tax.

Introduction

The United States tax policy consisted of a series of tax methods and various types of taxes during different historical periods. Taxes in colonial days were generally based on import duties and personal and corporate financial wealth. Among tax, payment policies consisted of coinage or cash payment, donation of assets, especially livestock, and other forms of payment.

The tax policy evolved from colonial and state decentralized fee payment for federal services to a federally controlled mandated permanent tax in 1894.

The theoretical framework, “Optimum Income Taxation,” by Mirrlees (1971) is illustrated in differing viewpoints on United States tax policy. The case study was developed using an archival document review method. Documents from historical records are categorized into significant tax events. The tax policies of the US colonial period, the post-civil war era temporary income tax policy, and the establishment of a permanent income tax are included in the case.

Tax Policy in Colonial America

From America's colonial days to the present, government-imposed taxes create the necessary revenue for the populous' good. Elected and appointed representatives determine the type of tax and the amount paid by citizens. In colonial times, before the "Founding fathers" preparatory efforts to create separation from English rule, taxes first appeared in the form of a "Poll tax" in Virginia. Later, the first general tax law, the Law of 1634, was enacted in Massachusetts. Confusion over terminology and a failure of the government to collect taxes from non-property owners resulted in clarification of the language. Seligman (1911) provided the following clarification of the New Plymouth's revision.

“Seven years later, laws defined ‘ability’ to include something more than mere property. The change in language, however, occurred not in Massachusetts Bay but in the colony of New Plymouth. In 1643 tax assessors rated inhabitants of that colony according to their estates or faculties that is, according to goods lands [improved] faculties and ‘on all abilities.’ This law is noteworthy for a couple of reasons. It is the first to use faculty, distinguishing faculty and personal ability from the visible property. But although it provides for a faculty tax, it does not tell us precisely how to measure this faculty. The more comprehensive law enacted three years later resolved the issue for the Massachusetts Bay Company. The court order of 1646 provides not only for the assessment of personal and real estates, but distinctly mentions ‘laborers, artificers and handicraftsmen’ as subject to taxation, and then goes on to say: And for all such persons as by advantage of their arts and trades are more enabled to help bear the public charges than the common laborers and workers, as butchers, bakers, brewers, victuallers one who provides goods or services, smiths, carpenters, tailors, shoemakers, such are to be rated for returns and gains, proportionable unto other men for the produce of their estates” (Seligman, 1895, 1911).

“At the outset, the faculty tax gave satisfaction but soon became antiquated and unjust. Instead of being a tax on actual profits or gains as a part of a general tax on incomes, the tax was nothing but an arbitrarily levied class tax on certain assumed earnings. It bore minimal relation to the actual income; it became grievous and unequal; and it was, therefore, allowed to fall into disuse. It never was an income tax in the modern sense” (Courtney, 1868; Edgeworth, 1904).

Throughout the colonies, various taxation methods were employed. Land taxes were imposed, and some colonies determined combinations of categories for tax. An example is the combination of taxes divided between land valuation and estates. The colonies' earliest tax policies illustrate a common theme: government spending outpaced citizen wealth and tax transfers to the government.

While the colonies were still under English rule, money to the treasury was a mixture of coins and other valuable items (Adams, 1874). The government-imposed import duties on goods brought overseas to the colonies to produce various goods. Raw goods were transformed into finished products. The transformation process began with essential goods (flour, sugar, tea, and coffee) and other materials required to create finished products. The colonists exported finished products, resulting in a trade balance. Money was scarce in the early days of the colonies. An imbalance of trade, more imports than exports, resulted in payment with fish and peltry for settling accounts with foreign merchants. Money to the treasury was late, and people often paid their taxes late. From 1680 to 1776, government loans, in the form of "Notes" created a medium of exchange. The consequence of transforming from bartering and payment with gold and silver was the creation of devalued notes compared to gold and silver. The government paid with proceeds from notes (the 1st form of paper money), resulting in inflation. The inflation took a toll as the colonies needed more and more money to keep up with government demands for taxes and daily business (Adams, 1886; McKinney,1895; Mill, 1848).

Frank Fenwick McLeod (1898) summarized the pre-revolutionary monetary situation. “The pathway to our current monetary standard is lined with the wrecks of different forms of currency, country pay, debased coinage of the Boston mint, credit bills of the colony of Massachusetts, fiat money of the Providence of Massachusetts Bay, legalized fiat money, inflated currency, land bank bills, silver notes, treasury notes, continental currency. Each form of cash, the product of necessity, relieved from the wants of trade for a time, but periodically the support gave way, and each had been leaning on a reed. Fiat money means degeneration; degeneration precipitates inflation; inflation culminates in repudiation”.

In colonial times, each state determined tax policy. State governments decided tax policy, similar to Medieval and later European models (Dunbar, 1889). The models mainly consisted of taxes on property and were considered "unfair" by citizens, where landowners were taxed based on the "perceived value" of land. In the US, taxation evolved into a system of indirect and direct taxes. Indirect taxes consisted of valuing products (the things landowners produce) and an estimated value of land growing produce. Indirect taxes did not apply to people. Import duties and taxes on services are examples of indirect taxes. Indirect taxes apply a value ratio based on product or service category. Direct taxes are allowed in Article 1, Section 2 of the Constitution. Direct taxes apply to people rather than things. For example, land value was considered a direct tax since people benefited. However, direct taxes require apportionment. Taxes on people required apportionment. The effect of apportionment is that states with higher populations may pay higher amounts than states with fewer people (Dunbar, 1889; Mankiw et al., 2009; Stiglitz, 2015).

The term "Faculty" is introduced and indicates the "Ability” of people to create value in the form of income. The government tax policy is established based on one's ability to offer the government money to obtain government protection. John Stuart Mill (1848) discussed perceptions of unfair taxes based on assessors' estimates on land. Additionally, Mill described the lack of tax applied to income. Seligman described the introduction of direct taxes. In both Mill and Seligman, one sees the attitude of government officials and the public regarding the fairness of taxation. Taxing income a flat percentage presented challenges for wage earners. A graduated income tax was proposed to help the fairness between those with a better means to pay (higher-income people, such as landowners and business owners). If we persist in using the term " income," the first class of taxes may be indirect or partial income taxes.[sic.] The individual's income [sic] is only indirectly reached and only partially assessed; while the new and more general taxes are income taxes in the proper sense of the term, and have the characteristics of a personal tax. (Seligman, 1911; Dingley, 1899) Table 1.

| Table 1 Example of Colony Tax Value | ||||||

| State | Year | Total Taxes collected | Value in 2022 Dollars | Amount from Income Tax | Value in 2022 Dollars | Outcome |

| Pennsylvania | 1843 | $910,000 | $34.1 Mil | $1386 | $52,000 | Disappeared over time |

| Virginia | 1844 | $432000 | $17 Mil. | $16,000 | $593,000 | |

The other states did not fare as well. The revenue raised from income taxes was minimal, and most states gave up on collecting income taxes. Maryland, for example, declared that Maryland received such small amounts of income taxes, reducing debt minimally. Maryland repealed the income tax law. The conclusion for Maryland included concern of prying into the private lives of citizens and the existence of fraud.

Income Tax for Civil War Debt –Temporary?

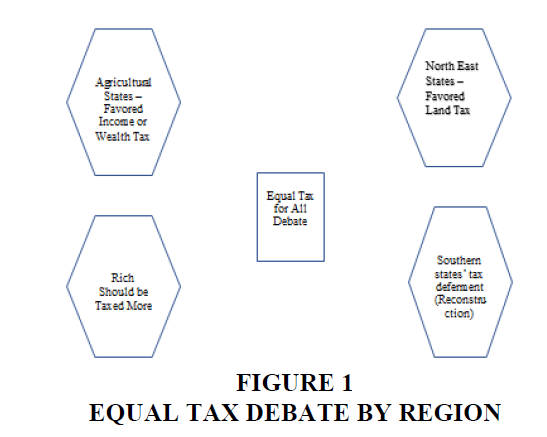

“The Lincoln Administration moved to increase the money flow to the federal treasury. With heavy losses and innumerable deaths even in victory, the Union was depleted of resources. Late in 1861, Secretary Chase, one of the founders of the Republican Party and future Chief Justice of the Supreme Court, sent a request for fifty million dollars to be raised by internal taxation but failed again to offer the creation of a tax on incomes." (Sec. of the Treasury, 1861) Figure 1.

Before the Civil War, federal government revenue for protecting the states against foreign aggression was from various "Non-direct income" taxes. Duties on imports and exports paid for the federal government loans to states created early in the nation's formation. However, as the war effort added debt, government expenses required additional revenue methods. A debate in both the House of Representatives and the Senate polarized the state representatives. On the one hand, merchants and business owners in the North-Eastern states considered income taxes unfair to merchants and businesses (Anonymous,1868; Meitzen & Falkner, 1891; Parton, 1873; Ramsey, 1927).

On the other hand, representatives from agricultural states thought the land tax was discriminatory. In essence, landowners (the lower-income class) would be paying more than a fair share, while the North-Eastern state merchants and business owners paid little or nothing. The tax discrimination included more affluent citizens taking advantage of tax loopholes to reduce their tax burden. In one example, it was brought to the attention of Congress that the wealthier class could distribute income to family members, resulting in less tax, or no tax, if the reported amounts were below the minimum income criteria (Anonymous,1898; Patten, 1889, Shepard, 2010).

“Congress passed the Internal Revenue Act on July 1, 1862, 'to provide Internal Revenue to support the Government and pay Interest on the Public Debt.' Still, the taxes, including the income tax, were not levied until September 1, 1862. Like tax legislation today, the 1862 law was highly complicated. Monthly specific (or fixed) and ad valorem (a percentage of the market value) duties were placed on articles and products ranging from ale to zinc. Monthly taxes were levied on gross receipts of transportation companies; interest paid on bonds; surplus funds accumulated by financial institutions and insurance companies; gross receipts from auction sales; and sales of slaughtered cattle, hogs, and sheep. Annual licenses were required for bankers, auctioneers, wholesale and retail dealers, pawnbrokers, distillers, brewers, brokers, tobacconists, jugglers ('Every person who performs by sleight of hand shall be regarded as a juggler under this act.'), confectioners, horse dealers, livery stable keepers, cattle brokers, tallow-chandlers and soap makers, coal-oil distillers, peddlers, apothecaries, photographers, lawyers, and physicians. Hotels, inns, and taverns were classified according to the annual rent or estimated rent, from a first-class establishment with a yearly rental of $10,000 to an eighth-class hotel with an annual rental of less than $100, and charged license fees from $200 to $5 accordingly. Eating houses paid $10 per year for a license, theaters $100, and circuses $50. [Owners] of bowling alleys and billiard rooms paid according to the number of alleys or tables belonging to or used in the building to be licensed. Stamp duties were imposed on legal and business documents, medicines, playing cards, and cosmetics” (Table 2).

| Table 2 Civil War Income Tax Value | ||||

| Year | Tax Rates | 2022 Equivalent Dollars | Direct and Indirect tax Collected During the Civil War | 2022 Equivalent Dollars |

| 1862 | 3% For $601 to $10,000 5% over $10,000 |

3% For $16,501 to$275,000 5% over $275,001 |

||

| 1864 | 3% For $601 to $5,000 5% over $5,000 |

3% For $16,501 to $5,000 5% over $137,598 |

||

| 1872 | Income Tax Repealed | $55,000,000 | $961,000,000 | |

After the temporary tax period, a condition of “inequality” resulted as some states were not paying their share of the Civil War expenses. The government bought land from people in those states and proceeded to resell the land to obtain treasury funds. Inequality of tax collections became a critical political issue in the post-war period (Cox, 1871).

"To fund the Civil War, an act of August 5, 1861 (12 Stat. 292) levied a direct tax on property and an income tax. The act also provided for a Commissioner of the Revenue and district collectors and assessors. While the Tax Act (12 Stat. 432) of July 1, 1862, repealed these taxes, it also created the basis of the modern internal revenue system, with an income tax and taxes on various commodities, businesses, products, and services. The direct tax commissions were discontinued in 1870, but a collection of unpaid taxes continued (under district internal revenue collectors) until 1888." Civil War Income Tax Repeal (https://www.archives.gov/fort-worth/finding-aids/rg-058-internal-revenue-service).

The debate over continuing, modifying, or abolishing the income tax (part of direct taxes), continued in Congress. An income tax proposal in the 1890s resulted in continued controversy over the constitutionality of direct income taxes. The question was resolved when Congress passed the 16th Amendment clarifying the authority Congress has over the nation's citizens. According to the Amendment, "The Congress shall have the power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states, and without regard to any census or enumeration.”

The Permanent Direct Income Tax

Sewall (1894) summed the public attitude toward the congressional incorporation of taxes on income. He declared the tax imposed by Congress unconstitutional. People previously "gave freely" in taxes to support the country during the formative years and finance the Civil War. However, after the civil war debt payment, there appeared to be sufficient money from indirect tariffs to support the federal government budget. The following direct quote is from Sewall:

“The only answer to the question [of an income tax justification] is to be found in the desires of the leading members of the democratic party in Congress to curry favor with the Populists and throw a sop to the Socialists. It is a measure of purely socialistic tendency. It is the placing of public burdens, not fairly and equally, but unfairly and unequally. It is not a tax on property but a tax on some persons for having over a certain arbitrary amount of productive property or the ability to earn more than an arbitrary sum. The only answer to the question is to be found in the desires of the leading members of the Democratic party in Congress to curry favor with the Populists and throw a sop to the Socialists. It is a measure of purely socialistic tendency. It is the placing of public burdens, not fairly and equally, but unfairly and unequally. It is not a tax on property but a tax on some persons for having over a certain arbitrary amount of productive property or the ability to earn more than an arbitrary sum. It is the first attempt under the Constitution of the United States to interfere with the equal rights of all men, who, by the declaration of independence is said to have been born free and equal. The canons of taxation are violated because some are taxed, but by far, the more significant number is untaxed. The man, who bysuperior industry has an earning power greater than the average man, is taxed on what he earns over the average. It is a deterrent to extra exertion; it gives a prize to the slothful and rewards mediocrity” (Sewall, 1894).

Sewell demonstrates the beginning of an era where a split between government legislators in the significant parties developed. Republications favored the smaller government and minimal taxes on citizens. The Democrat party favored central government control financed by increased taxes on the public. However, the year preceding 1894 was when several factors contributed to the desire for an income tax. Battersby (1894) described the economic issues the US faced in 1893, leading up to the push for an income tax.

Banks, corporations, and individuals suffered from currency policies from multiple countries. The impact on the US was based on European countries and India's suspension of free coinage. For example, India, Great Britain, and Australian bank policies regarding the circulation of coins created unstable economies, resulting in bank failures and lower international trade. The effect on the US was devastating. Cotton prices fell. Crops were priced lower. The Reading Railroad failed. Low prices drove banks to fail. "The possibility of a fall from a gold to a silver standard presented itself to the minds of the people and aroused the desire to hoard, first gold, and then all kinds of money; for they not only began to doubt the Government of the United States and its policy but also to doubt the future solvency of all institutions of the country." (Battersby, 1894).

Belmont (1897) viewed the US tax issue as two opposing views. On the one hand, the socialist view in European nations was the view of states' power over a federally imposed mandate to redistribute income or wealth among all people, as deemed necessary to satisfy the Constitutional "rights to life, liberty, and the pursuit of happiness." The socialist argument was for the federal government to assume control over enterprise competition. The capitalist competitive economic system w breeds economic and political anarchy, according to proponents of socialism.

On the other hand, the argument against the centrally controlled socialist tax policy was the lack of Europeans' experience with individual, political, and industrial freedom. Up to the 1850s, the Europeans had not witnessed the effect of personal, political, or industrial freedom. The English experimented with "Unrestricted" competition. The result was short-lived. The English Liberal party gradually abolished the freedoms of the 1850s.

The Constitution and Income Tax

Until 1913 and the ratification of the 16th Amendment, there was no legal justification for a federal government income tax. The Civil War tax was temporary and lasted only ten years. People challenged the right of the federal government to tax incomes. Congress passed the 16th Amendment as a justification to take money from people generating income. Before the 16th Amendment, decentralized government (see the Articles of Confederation) allowed states to refuse to accept a central federal government. The Articles called for a delegation to the executive branch (federal government). Attempts to receive money from the states to finance war and public expenses failed to generate income for Congress to pay the costs. The US was in a state of bankruptcy. The public treasury was to receive money from the Confederation of States based on the number of people in each state. (Bullock, 1900, Sewell, 1894, Stevens, 1883; Weinzieri, 2008; Wells, 1875; Wilson, 1897).

The “Faculty” clause, popular in the colonies, carried over to the states during and after Constitution's ratification. The faculty clause applied to professions providing services. State legislators assessed services from lawyers, medical doctors, and others as an "estimated" profit for services. A tax was applied. Controversy regarding the apportionment clause for direct taxation ensued. Oliver Wolcott (Secretary of the Treasury, 1796) declared that taxes imposed as faculty taxes were not income taxes as they failed to pass the apportionment requirement in Article 1, section 2. (Seligman, 1911). Wolcott declared the taxes were indirect.

Events in the 1830s and 1840s illustrating the degree states, faced with growing indebtedness, attempted various forms of income tax, were documented by Seligman. The states did not obtain the desired amounts necessary to satisfy debt interest payments. Each state had its peculiar tax policy. Table one summarizes the two states with the most income tax collection.

Conclusion

The information in this case study provides insight into the formation of United States Tax Policy from the colonial period to the establishment of the permanent income tax in 1894. Controversy for consideration in the case include the conflict between capitalistic views and socialist views on the purpose of taxes and the degree state governments or the federal government should create and administer tax policy.

References

Adams, C.F. (1874). The currency debate of 1873-1874. The North American Review, 119(244), 111-165.

Adams, H.C. (1886). American war-financiering. Political Science Quarterly, 1(3), 349-385.

Anonymous. (1868). The finances of the united states. The Alantic Monthly, 22(132), 494-506.

Anonymous. (1898). The capture of government by commercialism the atlantic monhly.

Battersby, T.S.F. (1894). The financial crisis in the United States, 1893-4. Journal of the Statistical and Social Inquiry Society of Ireland, X(34-45).

Belmont, P. (1897). Democracy and socialism. The North American Review, 164(485), 487-502.

Bullock, C. J. (1900). The origin, purpose, and effect of the direct-tax clause of the federal constitution. Political Science Quarterly, 15(2), 217-239.

Indexed at, Google Scholar, Cross ref

Courtney, L. (1868). On the finances of the united states of america. 1861-1867. Royal Statistical Society, 31(2), 164-221.

Cox, J.D. (1871). The civil-service reform. The North American Review, 112(230), 81-113.

Dingley, N. (1899). The sources of national revenue. The North American Review, 168(508), 297-309.

Dunbar, C. (1889). The new income tax. The Quarterly Journal of Economics, 9(1), 26-46.

Edgeworth, F.Y. (1904). The theory of distribution quarterly journal of economics, 18(2), 159-219.

Mankiw, G., Weinzierl, M., & Yagan, D. (2009). Optimal taxation in theory and practice. Journal of Economic Perspectives, 23(4), 147-174.

Indexed at, Google Scholar, Cross ref

McKinney. (1895). Decision of the united states surpreme court in the income-tax cases 1895. Journal of Political Economy, 3(4), 509-527.

McLeod, F.F. (1898). The history of fiat money and currency inflation in new england from 1620 to 1789. The Annals of the American Academy of Political and Social Science, 12(2), 57-77.

Meitzen, A., & Falkner, R.P. (1891). History, theory, and technique of statistics. Part first: History of statistics. The Annals of the American Academy of Political and Social Science, 1(2), 1-100.

Mill, J.S. (1848). Principles of political economy, John W. Parker, West Strand.

Parton, J. (1873). The cabinet of President Washington. The Atlantic Monthly, 31(183), 29-44.

Patten, S.N. (1889). President walker’s theory of distribution. The Quarterly Journal of Economics, 4(1), 34-49.

Indexed at, Google Scholar, Cross ref

Ramsey, F.P. (1927). A contribution to the theory of taxation. The Economic Journal, 37(125), 47-61.

Report of the Secretary of Treasury for the Year 1861 (Washington, DC: 1861), 15.

Seligman, E. (1895). The income tax in the american colonies and states. Political Science Quarterly, 10(5), 21-247.

Indexed at, Google Scholar, Cross ref

Seligman, E. (1911). The income tax: A study of the history, theory, and practice of income taxation at home and abroad. The Macmillan Company

Sewell, R. (1894). The income tax: Is it constitutional?. American Law Review, 28(6), 808-817.

Shepard, C. (2010). The Civil war income tax and the republican party. 1861-1872. Algora Publication.

Stevens, J.A. (1883). Albert Gallatin. Houghton, Mifflin and Company.

Stiglitz, J.E. (2015). In praise of Frank Ramsey’s contribution to the theory of taxation. The Economic Journal, 125, 235-268.

Urban, I. (2013). Contributions of taxes and benefits to vertical and horizontal effects. Springer-Verlag Berlin Heidelberg.

Weinzieri, M.C. (2008). Essays in Optimal Taxation (Publication Number 3312561) [Essays, Harvard University]. Cambridge, Massachusetts.

Wells, D.A. (1875). Taxation without jurisdiction. The Atlantic Monthly. 35(209), 214-322.

Wilson, W. (1897). Mr. Cleveland as President. The Atlantic Monthly, 79(368), 289-300.

Received: 15-Jul-2022, Manuscript No. JIACS-22-12335; Editor assigned: 16-Jul-2022, PreQC No. JIACS-22-12335(PQ); Reviewed: 29- Jul-2022, QC No. JIACS-22-12335; Revised: 05-Aug-2022, Manuscript No. JIACS-22-12335(R); Published: 12-Aug-2022