Research Article: 2023 Vol: 27 Issue: 2S

Systemic analysis of MSME governance research and relevance in the pandemic era

Juhari Sasmito Aji, Universitas Muhammadiyah Yogyakarta

Reza Widhar Pahlevi, Universitas Amikom Yogyakarta

Dian Retnaningdiah, Universitas Aisyiyah Yogyakarta

Citation Information: Juhari Sasmito., Reza Widhar., Dian Retnaningdiah . (2023). Systemic analysis of msme governance research and relevance in the pandemic era. International Journal of Entrepreneurship, 27(S2), 1-13.

Abstract

This study aims to investigate the governance of MSMEs using previously published articles as a guide. A literature review was conducted on the Scopus database from 1995 to 2022 using data acquired with the VOSviewer program for bibliometric analysis. The findings unveiled that MSME governance required government and stakeholder cooperation, support, and commitment to help MSME actors affected by Covid-19. Enhancing the internal environment, including capital, human resources (HR), and information technology adoption, was essential to survive the crisis. In prior studies, questionnaires were the most common data collecting technique; however, in-depth structured interviews were equally dispersed in both emerging and developed countries. The primary topics were divided into corporate governance and MSME governance issues. Good corporate governance improved the success of companies. In contrast, the failure of MSMEs resulted from inadequate corporate governance. Corporate governance was not a panacea for the difficulties encountered by MSMEs, but it was an absolute requirement to achieve business success.

Keywords

Governance, MSMEs, Covid-19 Pandemic and MSME performance.

Introduction

Micro, Small, and Medium-Sized Enterprises (MSMEs) play a crucial role in economic development and growth in both developing countries like Indonesia and developed countries (Resmi et al., 2022). They have contributed to solving the issue of unemployment and economic growth. In the era of global competition, MSMEs are expected to provide more value to their products or services, either qualitatively (better) or quantitatively (more efficiently) than their rivals (Yanez-Araque et al., 2021). It is especially challenging for MSMEs due to inadequate management skills and working capital management (Resmi et al., 2021). The current state of MSMEs, encompassing a fall in sales, barriers to accessing finance, distribution limits, raw material difficulties, lower output, and layoffs, poses a danger to the national economy (Suyatmi & Pahlevi, 2021). As home economic drivers and labor absorbers, MSMEs confront a drop in productivity, resulting in a considerable decline in profitability, particularly during the Covid-19 pandemic (Dewi & Mahendrawathi, 2019).

The Covid-19 pandemic has affected many sectors, notably the economy. It was felt severely by MSMEs since the economic crisis impacted them due to several regulations, including social restrictions, community activities, and efforts to stop the spread of the Coronavirus. The fall in buying power caused by the Covid-19 pandemic has significantly impacted the viability of MSME businesses (Jewalikar & Shelke, 2017). Unwittingly, the economic crises faced by MSMEs might pose a threat to the national economy. Although the government has provided different forms of stimulus aid to MSME business actors to resolve MSME challenges caused by Covid-19, further support is highly required. Government and stakeholder support and commitment are necessary to help MSME actors affected by Covid-19. Therefore, to survive the crisis, it is vital to enhance the internal environment, including capital, human resources (HR), and information technology adoption (Samantha, 2018).

MSMEs are resistant to economic instability. However, Covid-19 has reintroduced the Indonesian economic crisis more sophisticatedly than in 1997-1998 (Dewi & Mahendrawathi, 2019). Digitalization is necessary because, during this period of constraint, MSMEs require assistance with digital technology to continue supporting the growth of their operations (https://aptika.kominfo.go.id). Evidently, one issue arises from the lack of foundational and mental preparation among MSME actors. In reality, most enterprises continue to operate their businesses conventionally and have not adopted good corporate governance principles. In general, good corporate governance policies improve the success of companies; the failure of MSMEs is the result of inadequate corporate governance standards. Governance is fundamental to achieving company success (Vasquez et al., 2021). Corporate governance is not a solution for the difficulties encountered by MSMEs, but it is a prerequisite for achieving business success.

The current corporate climate is dramatically different from that of the past. Intense competition exists in an environment that continually experiences fast changes in a short period (Driss et al., 2021). The rapidity and brevity of environmental change make it challenging for businesses to forecast and prevent failure. In order to survive and advance in such circumstances, businesses must create new resource management tactics. MSMEs typically have inadequate resource management, market research, and strategy planning (Li et al., 2020).

Lack of capital, limited human resources, inadequate business networks, a non-conducive business climate, restricted infrastructure, and limited market access are the weaknesses and obstacles of MSMEs in Indonesia that impede their competitiveness (Imamah et al., 2019). This condition emphasizes the significance of investing in the development of resources, allowing them to align with the implementation of plans for building a competitive advantage and enhancing the performance of the companies.

In response to this intensifying rivalry, MSMEs must enhance their ability to compete globally by designing strategies that quickly adapt to changes. It is consistent with a resource-based view, in which companies can establish competitive advantages by providing value in unique forms and methods that rivals cannot reproduce. A company can gain a competitive edge if it delegates critical responsibilities to management to discover, develop, and deploy its strategic resources to optimize income (Chen & Yu, 2021).

Sustainable competitive advantage in the dynamic and uncertain business climate of the twenty-first century is the objective of all companies. To attain this competitive advantage, companies must utilize a flexible approach to changes and advancements (Vásquez et al., 2021). With limited resources, companies must be able to develop a competitive edge. In addition, the company’s capacity to respond to the dynamics of market shifts and diverse consumer wants is an imperative requirement (Anwer et al., 2021)

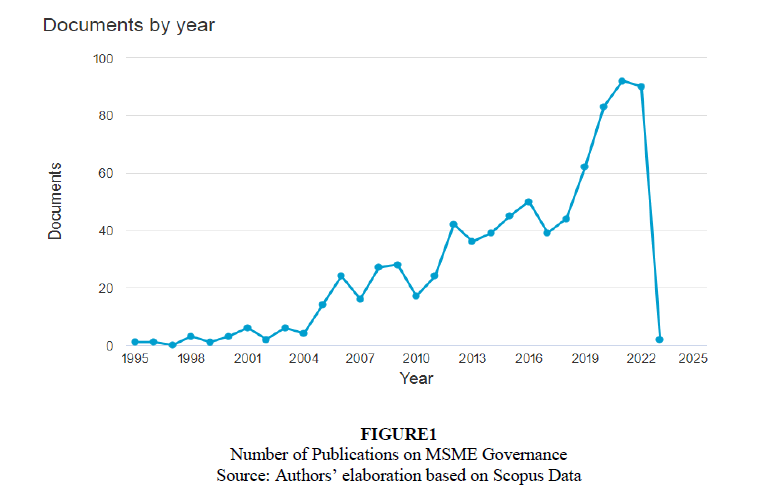

This study examined scientific articles to map worldwide MSME governance research regarding topics, locations, research subjects, and methodologies. Implementing good governance in MSMEs is still a source of contention. Previous studies on MSME governance were conducted in several countries. The issue concerned the appropriateness of governance standards and procedures. In the case of the results of the Indonesian study, good governance in MSMEs was relatively new and received little attention. The governance mechanism would be more successful with a more excellent application of governance concepts of openness, accountability, responsibility, independence, equality, and justice. Therefore, must MSMEs’ actors establish good governance to survive the current pandemic?(Figure 1).

This study examined the distribution of MSME governance research across numerous nations, years, themes, and methodologies and the relationship between the developed themes. Moreover, this study addresses the paucity of prior research on literature reviews. Year after year, research on MSME governance has attracted substantial attention. Increasing MSME governance research has paved the way for developing hitherto unexplored topics. Moreover, the research approach was dominated by surveys. The survey technique was selected because it accommodates the researcher’s objectives and is consistent with the most recent research topics. Regarding the experiment, relatively few studies were conducted on MSME governance. The data obtained revealed a rise in the study on MSME governance with various issues from 1995 to 2022.

The research method of this study covered collecting, translating, processing, and assessing scientific articles. The data processing results were then elaborated upon by examining scientific articles to answer the research questions. The debate concluded with the results of a systematic analysis offering recommendations for further research. This systematic study employed a previously established bibliometric technique. Moreover, 807 scientific articles were utilized for analysis in the final phase. The subsequent phase was to input data or systematic documentation of the 807 scientific articles based on each component: theory, method, setting, and topic. Processing and analyzing scientific articles were the final phase. The researchers utilized VOSviewer to visualize the study data and examine the relationship between each keyword. The findings of the visualization were then presented to address the research questions.

Discussion

This section focuses on article dissemination and the significant components of MSME governance. The distribution of reports was determined by the quantity and frequency of journal articles published annually. An essential component of MSME governance will highlight the most productive components by field of research, author, institution, and country.

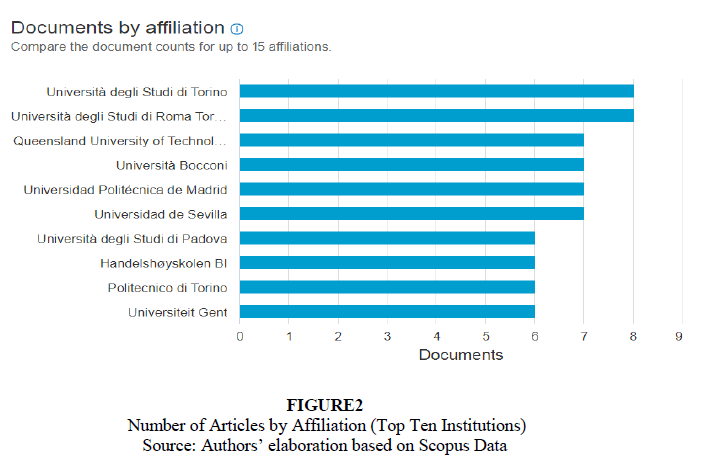

In this part, 807 selected articles answer two research questions on the research setting (topic, subject, and place of research implementation), methodology, and theme clusters. Figure 2 displays the primary sources in the field of MSME governance according to their affiliations. In addition, as indicated in Figure 3, research on MSME governance was primarily conducted in a few countries, including the United States, Britain, Australia, Germany, China, Italy, and Canada. In contrast, emerging countries included India and Indonesia. This conversation’s location underscores the significance of governance in MSMEs.

Regarding study findings in Indonesia, good governance in MSMEs was relatively new and received minimal attention. According to one of the most recent studies, the efficient functioning of the good governance mechanism in MSMEs was characterized by the high application of all good corporate governance principles. MSME governance was not heavily regulated by other parties, such as major corporations, including the rules of law on implementing corporate governance. Hence, this application was a moral obligation and management accountability.

In addition, country co-occurrence mapping illustrates each country’s contribution to the field of research. This study analyzed the search results from the Scopus database to render the picture transparent. Figure 3 depicts a country co-occurrence map (Scopus database) after the node size, label font size, and node position have been adjusted. In Figure 3, the size of each node corresponds to the quantity of literature for that country. The more literature a country has, the greater its node radius. The United Kingdom was the most well-known and influential country, followed by the United States, China, and Italy.

Based on the VOSviewer software, the co-authorship analysis was divided into authors and institutions as units of analysis. The co-author research also revealed the most productive authors, affiliations, and countries, as displayed in Figure 3. However, the analysis of the coauthor was the exclusive emphasis of this study. According to VOSviewer, most of the 149 writers listed in the findings were not yet connected. Only 18 authors had the most significant number of related items. Figure 4 illustrates the relationships between 18 authors.

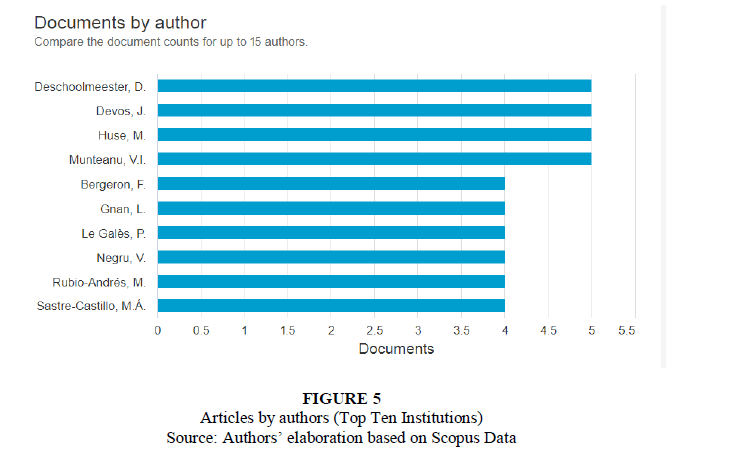

Figure 5 depicts the most prolific authors examining MSME governance. This figure is based only on the number of publications.

Following the criteria mentioned earlier, the final sample consisted of 807 documents (analysis as of 1 September 2022). Analysis was performed using a bibliometric approach on the titles and abstracts of each article, supporting proper research with citations, publisher nation, and main author. In addition, the researchers employed the VOSviewer software to obtain more precise findings. This tool enabled researchers to examine the relationship between keywords, facilitating mapping of the scientific issues under discussion. This stage is essential for providing a planned research agenda for future investigations.

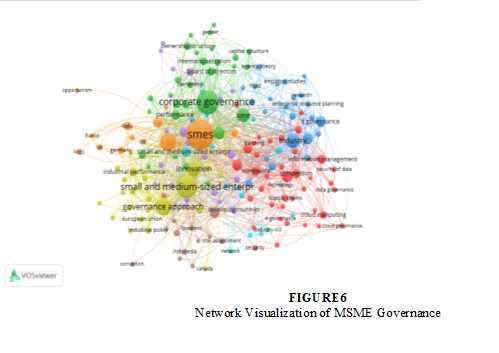

Researchers utilized the VOSviewer program to visualize potential clusters in each keyword of the reviewed article. First, the researchers determined four primary groups (green, purple, blue, and red) based on the color of each issue on the diagram. The color variations represent the interconnected topic of the relationship/analysis. Then, the node indicates how frequently the topic of MSME governance was employed(Figure 6) .

Based on an analysis of 807 articles, this study divided them into four clusters: green, purple, blue, and red. The green cluster encompasses topics on MSMEs, governance, and innovation, whereas the purple cluster’s associated topics include IT governance and enterprise resource planning. The topics on board of directors, ownership structure, and agency theory belong to the blue cluster. Finally, topics associated with cloud governance, technology, information management, and the digital revolution constitute the red cluster.

Foreign countries and Indonesia have conducted significant research on the implementation of GCG in major corporations and companies going public; however, GCG research on MSMEs was highly restricted (Azmi et al., 2019). Within the framework of the sustainability notion, the need to adopt good governance in businesses of all sizes is essential. Moreover, the notion of sustainability provides the foundation for the growth of a company. A well-established company can be founded by one or more entrepreneurs who begin with a small or medium-sized operation. Implementing good governance in MSMEs is still a matter of contention (Chen & Yu, 2021). Several countries have performed previous research. The discussion concerns the appropriateness of governance standards or regulations. Study findings in Indonesia disclosed that good governance in MSMEs was relatively new and received limited attention. One recent study unveiled that the efficient operation of good governance processes in MSMEs was characterized by the widespread implementation of all good corporate governance standards (Erragragui & Revelli, 2016).

This application is a moral obligation and a form of manager responsibility as khalifatullah to protect nature and provide benefits to fellow human beings because MSME governance is not heavily regulated by other parties, such as large corporations or the rules of law relating to the implementation of corporate governance (Imamah et al., 2019). If business operations within Islamic Corporate Governance (ICG) are conducted following the principles of shiddaq, amanah, tabligh, fathanah, istiqamah, and qanaah, the company’s performance and the welfare of all stakeholders will be affected.

The model of implementing GCG in MSMEs with a social entrepreneurship emphasis could enhance MSMEs’ performance and employee welfare. However, problems remain present. However, this model was ineffective for MSMEs employing local raw materials and building good relationships with the surrounding community. It is conceivable since, in the past, it did not prioritize some MSMEs employing a social entrepreneurship model. These circumstances can render the model useless. The model for implementing ICG in MSMEs was developed after testing various dimensions and scenarios of relationships that could effectively improve MSMEs’ performance and employee welfare, thereby enhancing the community’s welfare. The ICG aspects (Shiddiq, Amanah, Fathonah, Tablight, Istiqomah, and Qonaah) stress self-control in its implementation (Jan et al., 2021).

This governance model is anticipated to be successful for managing MSMEs when managers who are also company owners lack external supervision in the form of commissioners or general shareholders’ meetings (Qoyum et al., 2021). In business management, accountability stresses moral and social responsibility. This condition emphasizes the significance of ICG in managing MSMEs. This approach demonstrates its efficiency and success by enhancing the performance of MSMEs (raising sales, profitability, and ROA), the welfare of stakeholders, particularly employees, and the surrounding community (Safiullah, 2021).

In ICG, Shiddiq displays company management behavior based on the values of truth, honesty, value-oriented dedication, and the willingness to be courageous, patient, wise, and sincere. Fairness is another term for honesty and truth, referring to the provision of equal possibilities for each individual to obtain pertinent information from the business (Safiullah et al., 2020). The Shiddiq concept in MSMEs is demonstrated by the managers’ honesty, fairness, and integrity in company management. Amanah denotes dependability; in ICG, dependability is devotion and dedication to the behavior of company management in carrying out its duties and obligations (Srairi, 2019).

For governance to function appropriately following the notion of trust, business actors must have high moral standards; this is a sort of accountability from the bearer of the trust (Kok & Filomeni, 2020). A manager/owner of a company must be able to correctly manage his assets in line with the procedures and aims of the established sharia, not just for profit but also following Allah’s precepts.

Fathanah is a style of ICG that signifies possession of intellectual property, ingenuity, or wisdom. This intelligence is extensive on an intellectual, emotional, and spiritual level and is required for competent business management (Tarazi & Abedifar, 2020). Tabliq is a kind of ICG with a communication and debating significance. Managers of companies/MSMEs with a tabligh nature shall provide information about their obligations and authorities to interested persons correctly and courteously. Every management action is conducted transparently, allowing all interested parties (stakeholders) to comprehend it (Almaqtari et al., 2021).

Istiqamah in ICG is the constant attitude of a professional and moral Muslim, namely the capacity to conduct in a principled manner, to never give up, and to uphold values and commitments; a person who has good self-control and emotional management. This continuous approach has fostered self-assurance, honesty, and the abilitAlmaqtarizy to manage stress while maintaining passion. Istiqamah is a steadfast defense of the truth. This resolve manifests as steadfastness in maintaining commitments and consistency in the agreed-upon truth (Ahmadi et al., 2019). The management of a company with an istiqamah nature will adhere rigorously to the trustee’s commitments (stakeholders). ICG, based on the qana’ah concept, demonstrates that managers attempt to perform the best activities and have faith that Allah would give the best following their company requirements, even though there is less efficiency in management (Alam et al., 2020).

Developing a more complex business environment and various fraud cases in modern businesses encourage business actors to present an excellent company management mechanism and guarantee the implementation of commitments agreed upon by all parties involved in business relationships. This approach is recognized in the worldwide community as corporate governance. Good Corporate Governance (GCG) is more commonly utilized in Indonesia.

Prior to 1997, global research on corporate governance was limited. However, the 1997 crisis that affected the financial markets and economies of Asian nations and the demise of several well-known companies (such as Enron, WorldCom, and Parmalat) occurred within the past two decades, questioning the significance of having GCG standards. As a result, scholars and public policy decision-makers in industrialized and developing nations have taken a keener interest in corporate governance. Corporate governance has evolved dramatically to become an integral aspect of businesses, and its execution is essential to develop the economy of a country.

MSMEs play a crucial role in economic growth and development, not only in developing countries like Indonesia but also in developed countries. As has been discovered, they have participated in solving the unemployment problem and contributing to economic growth (Fatmawati et al., 2020). However, the success of MSMEs during the free trade and the pandemic crisis, for instance, depends on competitiveness, better efficiency, and the strength of business networks. Thus, the issue is how the business governance of the Sharia system for MSMEs is implemented. The objective of MSME operations is inseparable from the financial system due to the interdependent money market and the actual market. Therefore, clients and those requiring financing to build MSMEs will engage in transactions (Chen & Yu, 2021).

The drive to establish Sharia-based MSMEs has noble objectives: (1) serving as an act of submission to Islamic law and (2) developing the nation’s economy, bearing in mind that the global demand for halal products increases annually. Sharia-based MSME governance, such as the application of corporate governance norms or principles, is required for its development (Kok & Filomeni, 2020).

Guidelines for corporate governance are fundamental to the success of any organization or company. Corporate governance is broadly defined as the interactions between management, directors, the board of commissioners, shareholders, and other stakeholders that regulate and direct the operations of the organization (Tarazi & Abedifar, 2020). Every company must guarantee that corporate governance principles are implemented in every element of its operations and at all organizational levels. According to the National Committee on Governance Policy (KNKG), guidelines for corporate governance, encompassing transparency, accountability, responsibility, independence, and fairness or equality, are required to achieve business sustainability by focusing on stakeholders (Dewi & Mahendrawathi, 2019).

Corporate governance from an Islamic perspective must be built on the importance of the concept of justice among all stakeholders. Academically speaking, corporate governance relates to agency theory, describing the interaction between principals (business owners) and agents (company management). Based on agency theory, there is a tug-of-war between the company’s owners and its management, where the management is supposed to do work based on self-interest. Thus, it creates agency issues of knowledge asymmetry that management can use to perpetrate fraud or manipulation, which will hurt the company’s owner, who, in this case, is the shareholder (Ararat et al., 2021). Accordingly, a corporate governance framework is required to control the interaction between the company owner and the management (Ahmadi et al., 2019).

The agency’s approach to formulating and executing corporate governance activities is deemed insufficient since it focuses solely on the connection between the company owner and the management, ignoring other parties with interest within the company. It marks the beginning of implementing the stakeholder theory approach in corporate governance (Kok & Filomeni, 2020). The stakeholder theory perspective attempts to regulate the company’s relationship with all parties that influence and are influenced by the company, both internal and external. Hence, the scope and positive influence of the implementation of corporate governance can be felt by the community more broadly (Srairi, 2019). The application of stakeholder theory to corporate governance is exemplified by the creation of corporate social responsibility and green accounting, which focus on humans and nature and represent a kind of corporate governance development (Tarazi & Abedifar, 2020).

Since the mid-1980s, corporate governance has been a major concern for practitioners, shareholders, investors, the government, and academia and a crucial topic of debate. Corporate governance is not only one of the essential concepts in operating a company to achieve strong performance, but it must also be capable of ensuring that business activities can be monitored and that operational activities can be controlled (Esqueda & O’Connor, 2020). The contemporary multicultural corporate environment necessitates a commitment to create and enforce stricter regulations to adapt to fast change. It suggests that strong corporate governance is an endeavor to avoid unfair behavior following the principles; however, the principles are also employed as a supervisory framework in various business environment settings (Jan et al., 2021). Corporate governance must be a guideline or philosophy, not a regulation (OECD, 2004).

The implementation of corporate governance aims to ensure that the company’s control system is adequate and appropriate in monitoring the company, to prevent individuals from committing fraud and scandals, to regulate the relationship between the company’s management, the board of directors, shareholders, and other stakeholders, and to ensure that the company is managed in the best interest of its shareholders to promote the implementation of transparency and a culture of accountability (Alzahrani, 2019). Therefore, developed countries are beginning to focus on corporate governance to avoid economic problems. A great deal of research has begun to develop corporate governance. In contrast, research on governance and the development of corporate governance models is minimal in most Islamic nations. Obviously, the now-referenced conventional concepts of GCG cannot be applied to Islamic financial companies. Islamic financial organizations must adhere to ICG norms (Tjahjadi et al., 2021).

MSMEs are urged to adopt a complex business growth route to strengthen their competitive edge by keeping up with rapidly accelerating technical advancements (Tsafack & Guo, 2021). The necessity for counseling among MSME actors with poor literacy will significantly assist them. Transformation to the digital age and sustainability are obstacles for MSME actors. Moreover, the advent of digital technology is altering the market environment, presenting MSMEs with new problems and possibilities. Some potential effects of digitization on MSMEs include increased productivity, improved product quality, increased efficiency and effectiveness, enhanced decision-making processes, greater flexibility, a shorter time to market, and the development of new business models. Environmental sustainability is also an essential consideration. MSMEs play a crucial role in economic development and progress, not just in developing countries like Indonesia but also in developed countries.

It has been demonstrated that MSMEs play a crucial role in solving unemployment and contributing to economic growth. However, the success of MSMEs within the free trade and the pandemic crisis depends on competitiveness, better efficiency, and the strength of business networks. In addition, owners or managers of MSMEs must be intimately involved in day-to-day operations due to their lack of managerial competence compared to large organizations (Ararat et al., 2021). The reduction in performance of MSMEs is influenced by limited human resources, such as a lack of financial literacy. Multiple theoretical studies and empirical investigations indicate that a high level of financial literacy promotes the expansion of MSMEs. Better financial literacy can increase demand for financial services, savings, risk management, intermediation, and financial development among MSMEs. Economic development and the expansion of MSMEs are more suitable and productive when training is based on basic financial demands. MSMEs are typically short-sighted when making business choices (Ahmadi et al., 2019).

Conclusion

MSMEs play a crucial role in economic development and progress, both in developing countries like Indonesia and in developed countries. They have taken part in solving unemployment and contributing to economic growth. In the era of global competition, MSMEs are expected to add more value to the products or services they supply, either in terms of quality (better) or efficiency (more efficient). It is especially challenging for MSMEs due to a lack of management skills and inadequate working capital management. Threats to the national economy are posed by the existing state of MSMEs, covering a fall in sales, barriers to accessing finance, distribution difficulties, trouble obtaining raw materials, decreased output, and layoffs. As domestic economic drivers and labor absorbers, MSMEs have been experiencing a reduction in profitability due to a decline in productivity, notably during the Covid-19 pandemic.

References

Ahmadi, A., Kerachian, R., Rahimi, R., & Skardi, M. J. E. (2019). Comparing and combining Social Network Analysis and Stakeholder Analysis for natural resource governance.Environmental Development,32, 100451.

Indexed at , Google Scholar, Cross Ref

Alam, N., Ramachandran, J., & Nahomy, A. H. (2020). The impact of corporate governance and agency effect on earnings management–A test of the dual banking system.Research in International Business and Finance,54, 101242.

Indexed at , Google Scholar, Cross Ref

Almaqtari, F. A., Hashed, A. A., & Shamim, M. (2021). Impact of corporate governance mechanism on IFRS adoption: A comparative study of Saudi Arabia, Oman, and the United Arab Emirates.Heliyon,7(1), e05848.

Indexed at , Google Scholar, Cross Ref

Alzahrani, M. (2019). Islamic corporate finance, financial markets, and institutions: an overview.Journal of Corporate Finance,55, 1-5.

Indexed at , Google Scholar, Cross Ref

Anwer, Z., Azmi, W., & Mohamad, S. (2020). Shariah screening and corporate governance: The case of constituent stocks of Dow Jones US Indices.International Review of Economics & Finance.

Indexed at , Google Scholar, Cross Ref

Ararat, M., Claessens, S., & Yurtoglu, B. B. (2021). Corporate governance in emerging markets: A selective review and an agenda for future research.Emerging Markets Review,48, 100767.

Indexed at , Google Scholar, Cross Ref

Azmi, W., Anwer, Z., Mohamad, S., & Shah, M. E. (2019). The substitution hypothesis of agency conflicts: Evidence on Shariah compliant equities.Global Finance Journal,41, 90-103.

Indexed at , Google Scholar, Cross Ref

Chen, N., & Yu, M. T. (2021). National Governance and Corporate Liquidity in Organization of Islamic Cooperation Countries: Evidence based on a Sharia-compliant Liquidity Measure.Emerging Markets Review,47, 100800.

Indexed at , Google Scholar, Cross Ref

Dewi, F., & Mahendrawathi, E. R. (2019). Business process maturity level of MSMEs in East Java, Indonesia.Procedia Computer Science,161, 1098-1105.

Indexed at , Google Scholar, Cross Ref

Driss, H., Drobetz, W., El Ghoul, S., & Guedhami, O. (2021). Institutional investment horizons, corporate governance, and credit ratings: International evidence.Journal of Corporate Finance,67, 101874.

Indexed at , Google Scholar, Cross Ref

Erragragui, E., & Revelli, C. (2016). Is it costly to be both shariah compliant and socially responsible?.Review of Financial Economics,31, 64-74.

Indexed at , Google Scholar, Cross Ref

Esqueda, O. A., & O’Connor, T. (2020). Corporate governance and life cycles in emerging markets.Research in International Business and Finance,51, 101077.

Indexed at , Google Scholar, Cross Ref

Fatmawati, D., Ariffin, N. M., Abidin, N. H. Z., & Osman, A. Z. (2020). Shariah governance in Islamic banks: Practices, practitioners and praxis.Global Finance Journal, 100555.

Indexed at, Google Scholar, Cross Ref

Imamah, N., Lin, T. J., Handayani, S. R., & Hung, J. H. (2019). Islamic law, corporate governance, growth opportunities and dividend policy in Indonesia stock market.Pacific-Basin Finance Journal,55, 110-126.

Indexed at , Google Scholar, Cross Ref

Jan, A. A., Lai, F. W., & Tahir, M. (2021). Developing an Islamic Corporate Governance framework to examine sustainability performance in Islamic Banks and Financial Institutions.Journal of Cleaner Production,315, 128099.

Indexed at , Google Scholar, Cross Ref

Jewalikar, A. D., & Shelke, A. (2017). Lean integrated management systems in MSME reasons, advantages and barriers on implementation.Materials Today: Proceedings,4(2), 1037-1044.

Indexed at , Google Scholar, Cross Ref

Kluza, K., Ziolo, M., & Spoz, A. (2021). Innovation and environmental, social, and governance factors influencing sustainable business models-Meta-analysis.Journal of Cleaner Production,303, 127015.

Indexed at , Google Scholar, Cross Ref

Kok, S. K., & Filomeni, S. (2021). The holding behavior of Shariah financial assets within the global Islamic financial sector: A macroeconomic and firm-based model.Global Finance Journal,50, 100557.

Indexed at , Google Scholar, Cross Ref

Li, W., Zheng, M., Zhang, Y., & Cui, G. (2020). Green governance structure, ownership characteristics, and corporate financing constraints.Journal of cleaner production,260, 121008.

Indexed at , Google Scholar, Cross Ref

Qoyum, A., Sakti, M. R. P., Thaker, H. M. T., & AlHashfi, R. U. (2022). Does the islamic label indicate good environmental, social, and governance (ESG) performance? Evidence from sharia-compliant firms in Indonesia and Malaysia.Borsa Istanbul Review,22(2), 306-320.

Indexed at , Google Scholar, Cross Ref

RESMI, S., PAHLEVI, R. W., & SAYEKTI, F. (2021). The effect of financial and taxation literation on competitive advantages and business performance: A case study in Indonesia.The Journal of Asian Finance, Economics and Business,8(2), 963-971.

Indexed at , Google Scholar, Cross Ref

Resmi, S., Pahlevi, R. W., & Sayekti, F. IMPROVING ENVIRONMENTAL MANAGEMENT LITERACY AND PERFORMANCE OF MICRO, SMALL AND MEDIUM ENTERPRISES (MSMEs) THROUGH FINANCIAL TRAINING.

Safiullah, M. (2021). Stability efficiency in Islamic banks: Does board governance matter?.Journal of Behavioral and Experimental Finance,29, 100442.

Indexed at , Google Scholar, Cross Ref

Safiullah, M. D., Hassan, M. K., & Kabir, M. N. (2020). Corporate governance and liquidity creation nexus in Islamic banks—Is managerial ability a channel?.Global Finance Journal, 100543.

Indexed at , Google Scholar, Cross Ref

Samantha, G. (2018). The impact of natural disasters on micro, small and medium enterprises (MSMEs): A case study on 2016 flood event in Western Sri Lanka.Procedia engineering,212, 744-751.

Indexed at , Google Scholar, Cross Ref

Srairi, S. (2019). Transparency and bank risk-taking in GCC Islamic banking.Borsa Istanbul Review,19, S64-S74.

Indexed at , Google Scholar, Cross Ref

Suyatmi, R. W. P. (2021). Peran Orientasi Kewirausahaan dan Orientasi Pembelajaran untuk Meningkatkan Kinerja UMKM.

Indexed at , Google Scholar, Cross Ref

Tarazi, A., & Abedifar, P. (2020). Special issue on Islamic banking: Stability and governance.Global Finance Journal.

Indexed at , Google Scholar, Cross Ref

Tjahjadi, B., Soewarno, N., & Mustikaningtiyas, F. (2021). Good corporate governance and corporate sustainability performance in Indonesia: A triple bottom line approach.Heliyon,7(3), e06453.

Indexed at , Google Scholar, Cross Ref

Tsafack, G., & Guo, L. (2021). Foreign shareholding, corporate governance and firm performance: Evidence from Chinese companies.Journal of Behavioral and Experimental Finance,31, 100516.

Indexed at , Google Scholar, Cross Ref

Vásquez, J., Aguirre, S., Puertas, E., Bruno, G., Priarone, P. C., & Settineri, L. (2021). A sustainability maturity model for micro, small and medium-sized enterprises (MSMEs) based on a data analytics evaluation approach.Journal of Cleaner Production,311, 127692.

Indexed at , Google Scholar, Cross Ref

Yanez-Araque, B., Hernández, J. P. S. I., Gutiérrez-Broncano, S., & Jimenez-Estevez, P. (2021). Corporate social responsibility in micro-, small-and medium-sized enterprises: Multigroup analysis of family vs. nonfamily firms.Journal of Business Research,124, 581-592.

Indexed at , Google Scholar, Cross Ref

Received: 30-Nov-2022, Manuscript No. IJE-22-12989; Editor assigned: 03-Dec-2022, PreQC No. IJE-22-12989(PQ); Reviewed: 17-Dec- 2022, QC No. IJE-22-12989; Revised: 20-Dec-2022, Manuscript No. IJE-22-12989(R); Published: 27-Dec-2022