Research Article: 2019 Vol: 22 Issue: 3

System Contradictions in the Operations and Strategic Lease Management in the System of Entrepreneurship Education

Pavel G. Ryabchuk, South-Ural State Humanitarian Pedagogical

Igor A. Baev, South-Ural State University

Anton S. Apukhtin, South-Ural State Humanitarian Pedagogical University

Svetlana S. Demtsura, South-Ural State Humanitarian Pedagogical University

Irina I. Pluzhnikova, South-Ural State Humanitarian Pedagogical University

Dmitry N. Korneev, South-Ural State Humanitarian Pedagogical University

Larisa S. Murygina, South-Ural State Humanitarian Pedagogical University

Abstract

Modern entrepreneurial finance and investment education will not be of a high quality unless lease system contradictions are taken into account at an industrial enterprise. The purpose of our research is to analyze these system contradictions, as well as their relationship with the operational indicators of the lessee’s activities in entrepreneurship education in the field of strategic investment planning. The main methods used in the research were the cash-flow modeling of the enterprise-recipient and the method of discounting its cash flows generated by the participation of an industrial enterprise in the leasing process. The proposed methodology is a universal tool for assessing and managing system contradictions in the leasing process, which is the most important aspect of entrepreneurship education, including the strengths of advanced teaching methods for evaluating the effectiveness of the leasing scheme to finance productive investments accumulated in scientific and special works of specialists in entrepreneurship education. The analysis of system contradictions in entrepreneurship education is of a practical value for a wide range of organizations considering the use of industrial production technological upgrading tools of in terms of platform business networks.

Keywords

Entrepreneurship Education, Leasing, System Contradictions, System Contradictions Management, Return, Turnover, Lease Potential, Effectiveness of Entrepreneurship Education

Introduction

Modern entrepreneurship education is a combination of techniques and methods studying economic processes in enterprises and society. The study of investment decisions of the management of enterprises and the assessment of their effectiveness are the most important aspects of entrepreneurship education. In investment decisions there is a broad spectrum of directions and tools, the most important of which is leasing. A lot of specialists devoted their research to the problems of entrepreneurship education. Aghion et al. (2009) and others (Rosenberg & Nelson, 1994; Borck & Wimbersky, 2012; Veugelers & Del Rey, 2014) considered general influence of entrepreneurship education on economic growth, as well as its influence on the economic progress. Researchers addressed the results of entrepreneurship education through the lens of an institutional perspective. Fayolle & Benoit (2015) studied entrepreneurial attitudes based on the educational trajectory. The influence of entrepreneurship education on the cognitive abilities of people of different ages was studied by Banks & Fabrizio (2012), Fryer Jr (2011) and Cascio (2009). Meier & Schiopu (2015) dealt with the problem of increasing labor productivity through entrepreneurship education. A number of researchers devoted their work to the issues of public funding of entrepreneurship education and the factors of the employee separation (Ciccone & Peri, 2006; Arcalean & Schiopu, 2016). Bulman & Robert (2016), as well as Lipset (2018) and Eryanto et al. (2019) studied how entrepreneurship education affects technology and value orientations. The main focus on professional competencies to the detriment of professional knowledge and skills leads to contradictions, complicates a possibility of diagnostics of its results and generates some other serious problems. (Khenner, 2018) In the educational systems of different countries, much experience has been gained regarding the use of project-based learning. This method is an alternative to traditional lecture-based learning: it helps to pull together a theoretical training material with real life; additionally, it changes the roles of pupils and teachers: students become active fully-competent subjects of an educational process, whereas teachers organize, supervise and direct this process, but do not transfer readily available information (Kazun & Pastukhova, 2018). Early school education as a beginning stage of an individual’s educational trajectory, is known to play the key role in the mentioned process and the task of the educational system from the early stages to entering the professional life to ensure the formation of the individual (Antonova, 2018).

However, there is a methodological gap in systemic contradictions of lease financing. This study aims to bridge this gap and define the interrelationship of factors that result in a contradiction. The comparative analysis conducted with regard to the Kleiner's theory allows taking into account these contradictions and improving the understanding of the problem. This contributes to the solution.

Methods

There is a wide range of methods recommended for systemic contradictions resulting from lease financing. The study examines the relationship between objectives set by an industrial organization and its performance indicators, draws attention to changes that occur in factors and give rise to financial and economic contradictions. The assessment also includes the influence of external and internal factors on criteria for leasing operations management, as well as the relationship between management levels, management objects, and system contradictions.

The present study concerns the theory and methods of the leasing process management in an industrial enterprise and is based on the Kleiner’s theory, which account for an institutional approach to resources and technology. These methods include return on equity assessment, economic and mathematical modeling, strategic analysis, analysis of project planning, and the synthesis of special theories regarding the development modeling and cash flow (Kleiner, 2008).

The leasing process management at an industrial enterprise is analyzable through the systematic approach if the process is considered both an object and a subject of management. Table 4 shows how factors influence the specific criteria of the leasing process management. The effect is strong if inflicted by four or more factors; medium if by three factors; and weak if three or more factors do not affect the process.

Results

Entrepreneurial investment education is one of the important aspects of future management activities. The process of its implementation at all educational trajectory levels should include solving of non-standard tasks, such as the achievement of company’s goals by its management to respect the interests of various parties: business owners and operational indicators included in the company's reporting. Leasing process is associated with the satisfaction of the demands and the achievement of the goals of its subjects.

According to specialists in strategic and system management, external factors associated with entrepreneurship education are personnel, mechanisms of management, production, accounting, finance and marketing (Contino, 2002).

It is very important to employ specialists who understand how to minimize systemic contradictions. These experts will allow the company to avoid extra costs associated with leasing operations. In this case, a degree in entrepreneurship lends weight, as it suggests that person is skilled in gaining knowledge necessary to solve a problem. The presence of systemic contradictions indicates the need for a boost in entrepreneurship knowledge. The above factors indicate a demand for high-quality entrepreneurship education to effectively respond to today's challenges in the world of economics and business. The problem of modern education is that it does not always provide relevant knowledge, which creates additional problems for those who want to receive a corresponding degree.

Leasing process of an enterprise is aimed at achieving the objectives (Table 1), recorded by dynamic indicative indicators of operational activities. Any goal of economic activity can be expressed in monetary terms (Zubkova & Khodorovsky, 2012). At an industrial enterprise, simultaneous financial and economic contradictions may occur when it tries to achieve the goals set by various subjects of leasing. These contradictions affect money flows.

| Table 1 The Relationship Between the Goals of an Industrial Enterprise Participating in the Leasing Process and the Indicative Indicators of Operational Activity | |

| Goal | Indicative indicator |

| Increased capitalization of the enterprise Increased revenue Higher turnover rate Renewal of fixed production assets Reduction of material and energy intensity of production Increased net profit |

JRA JQ JKturnover JKwear JKm/int, JKe/int JRCK |

The strategy regeneration cycle can be avoided by finding solutions to contradictions (matching mutually exclusive criteria). The approaches to the efficiency management of the leasing process are formed through selecting the conditions of influence of the subjects of leasing, environmental factors and the management of the lessee pursuing strategic goals. Due to the versatility and dual nature of the leasing process, the achievement of some tactical goals may lead to a decrease in other key economic indicators of an industrial enterprise.

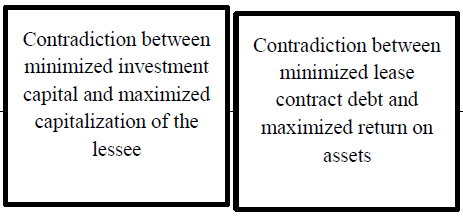

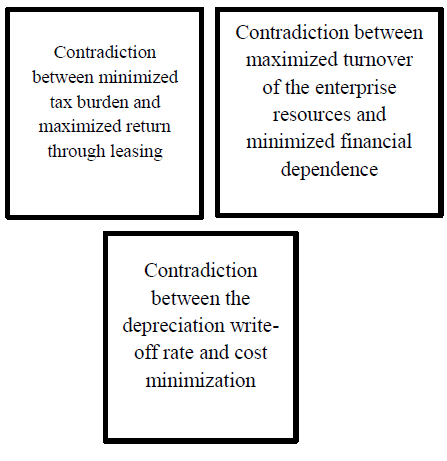

Thus, the spectrum of financial and economic contradictions in the leasing process includes the contradictions between:

1. Minimized investment capital and maximized capitalization of the lessee.

2. Minimized tax burden and maximized return through leasing.

3. Maximized turnover of enterprise resources and minimized financial dependence.

4. Maximized depreciation rate and minimized cost.

5. Minimized lease contract debt and maximized return on assets.

Each of these contradictions consists of mutually exclusive indicators, which act as criteria for evaluating the operational management of the leasing process efficiency in different management strategies.

The changes of the indicators, regulated by their growth rate (I) and forming a particular contradiction, are presented in Table 2.

| Table 2 The Changes of the Indicators Forming Financial and Economic Contradictions in the Leasing Process | |

| Changes of indicators | Comment |

| Contradiction 1. Minimized investment capital and maximized capitalization of the lessee | |

| IWACC>IRa | If the cost of investment capital decreases faster than the effect of the leasing process increases, the capitalization of the lessee will be increased without any additional sources. |

| IWACC<IRa | If the cost of investment capital decreases more slowly than the effect of the leasing process increases, the capitalization of the lessee will not be increased without any additional sources. |

| IWACC<1 and IRa>1 |

Credit cost minimization makes it possible to increase the company's capitalization without using a lease financing scheme. |

| Contradiction 2. Minimized tax burden and maximized return on equity through leasing | |

| ITax>ITaxlessee | If the total tax burden on the VAT and income tax in the economy decreases faster than the burden of the lessee, the lessee benefits less from alternative financing schemes and there is a reduced return on equity due to leasing (Rlease). |

| ITax<ITaxlessee | If the total tax burden on the VAT and income tax in the economy decreases more slowly than the burden of the lessee, the lessee benefits from alternative financing schemes and there is increased return on equity due to leasing (Rlease). |

| ITaxlessee<1 IRliz>1 |

This contradiction can be solved through increasing efficiency of tax and depreciation policies and integrated management of investment decisions. |

| Contradiction 3. Maximized turnover of enterprise resources and minimized financial dependence | |

| Iturnover Lease>Icd | If the turnover rate grows faster than the financial dependence, the growth rates are exceeded: 1) increased revenue; 2) increased profits and reduced leasing debt service. |

| Iturnover Lease<Icd | If the turnover rate grows more slowly than the financial dependence, the growth rates are not exceeded. |

| IQP>IM | This contradiction can be solved if the growth rate of profit from sales exceeds the growth rate of marginal income. |

| Contradiction 4. Maximized depreciation rate and minimized cost | |

| Kspecial>1 | If the current depreciation write-off is faster than its linear accrual, there is an increase in costs and a decrease in return. |

| Kspecial=1 | If the current depreciation write-off takes place with the help of the linear method, delayed cost reduction and return growth can be observed. |

| ILease>Iip | This contradiction can be solved with the help of cyclical regeneration of lease financing for technological re-equipment. |

| Contradiction 5. Minimized lease contract debt and maximized return on assets | |

| IQLease>Icd | If the lease contract debt decreases faster than the enterprise loan debt, the following is ensured: 1) a positive effect at % lease% 590 rate% 2) a negative effect at % lease% 590 rate. |

| IQLease<Icd | If the lease contract debt decreases more slowly than the enterprise loan debt, the enterprise is focused on paying the loan, which ensures: 1) a negative effect at % lease% 590 rate% 2) a positive effect at % lease% 590 rate. |

| B/lessee, Lease< B/lessee Cr | The contradiction can be solved through refinancing of a lease contract debt under acceptable conditions during the leasing process. |

Every action of the leasing subjects is subject to internal and external factors affecting the operational criteria for managing the leasing process (Table 3).

| Table 3 The Influence of External and Internal Environment Factors on the Criteria for Operational Leasing Process Management | ||||||||||||||||

| No. | Criteria for operational leasing process management | Internal environment | Micro environment | Macro environment | ||||||||||||

| Current economic performance | Energy security | Staff capacity | Management arrangements | Availability of transport infrastructure | State of the industry | State support | Competition level | State of demand | Economic situation | Central Bank rate dynamics | Inflation rate | Variation of hydrocarbon prices | Statutory regulation | Political stability | ||

| 1 | Minimized cost of the call-up capital | + | - | - | + | - | + | + | + | - | + | + | + | + | + | + |

| 2 | Maximized capitalization | + | + | - | + | + | + | + | + | + | - | + | + | - | - | + |

| 3 | Minimized taxation | - | - | + | + | - | - | + | - | - | - | - | + | + | + | + |

| 4 | Maximized return on equity through leasing | + | - | - | + | - | - | + | - | - | - | - | - | - | - | - |

| 5 | Maximized turnover | + | - | - | + | + | + | - | + | + | + | - | - | - | - | - |

| 6 | Minimized financial dependence | + | - | - | + | - | - | + | + | - | + | + | + | - | - | + |

| 7 | Maximization of written-off depreciation | + | - | - | + | - | - | - | - | - | - | - | - | - | + | - |

| 8 | Cost minimization | + | + | - | + | - | - | + | + | - | - | - | - | - | - | - |

| 9 | Lease debt minimization | + | - | - | + | - | - | - | - | - | - | - | + | + | - | + |

| 10 | Maximized return on assets | + | + | - | + | + | + | - | + | + | + | - | - | - | - | - |

According to Vikhanskii (2002), the macro environment factors include economic, legal, political, social and technological components. Researchers significantly expanded the range of external factors by proposing the following factors: the competitiveness of the country, industry, region, integration level within the country and the global community, national standardization and certification system (Farkhutdinov, 2002).

The factors of international relations volatility, as well as legislative and political, socio-cultural and technological factors are the external environment factors. According to Vikhanskii (2002), buyers, competitors, suppliers and the labor market belong to the factors of immediate environment. Within the framework of our research, the immediate environment factors are the legislative regulation of the leasing process, the state of the lessee’s industry and the presence or absence of administrative support measures and preferences.

According to strategic and system management specialists the factors of external environment in entrepreneurship education consist of staff, management arrangements, production, accounting, finance and marketing (Vikhanskii, 2002). The external factors of the macro- and immediate environment, as well as the internal factors of the enterprise in the aspect of assessing the leasing climate of an industrial enterprise will be regarded in the following sections of this research.

With due regard to the subject of our research, the list of external and internal environment factors aimed at entrepreneurship education is complemented by the factors that affect the leasing process at an industrial enterprise, change the composition and size of the cash flows generated in it. A set of internal and external environment factors, as well as their functional relationships are the subject of the present research.

In our opinion, the micro and macro environment factors of the potential lessee are the environmental indicators that are important for the lessor (Ryabchuk, 2016). We believe that the main micro environment factors of an industrial enterprise are:

• Current state and development trend of the industry.

• Presence or absence of state (regional or federal) support for the industry (industrial cluster or enterprise).

• Competition in the industry.

• Availability of skilled labor force in the immediate environment.

The factors of the macroeconomic environment of an industrial enterprise include:

• General state and development trends of the country's economy.

• Dynamics of the Central Bank discount rate.

• Registered inflation rate.

• Dynamics of hydrocarbon prices in foreign markets.

• Statutory regulation of certain activities.

• Political stability in the country.

According to major strategic and system management specialists, the internal environment factors include staff, management arrangements, production, accounting, finance and marketing (Vikhanskii, 2002). The internal environment factors of the enterprise in terms of their impact on the operational management criteria of the leasing process are significantly different from the internal environment factors for strategic and system planning purposes. We have singled out the following factors.

• State of economic performance of the enterprise.

• Energy security.

• Staff capacity.

• Management arrangements.

• Availability of transport infrastructure.

The present study of the theory and methodology of the leasing process management at an industrial enterprise is based on the Kleiner’s theory of the enterprise (Kleiner, 2008). A systematic approach to analyzing the leasing process management at an industrial enterprise is implemented only if it is considered to be both an object and a subject of the management. Table 4 shows how a specific criterion of the operational management of the leasing process is affected by the factors. The impact is strong if it is affected by four or more factors; average – it is affected by three factors; and weak – the criterion is not affected by three or more factors. Let us give 3, 2 and 1 point to the strong, average and weak impact respectively. This will provide the weighted average of the influence of external and internal factors on the operational management criteria:

| Table 4 The Impact of Environment Factors on the Criteria for the Operational Management of the Leasing Process | ||||

| No. | Operational management criterion | External environment | External environment factors of the enterprise | |

| Macroenvironment factors of the enterprise | Immediate environment factors of the enterprise | |||

| 1 | minimized investment capital | Strong | Average | Weak |

| 2 | maximized capitalization | Average | Weak | Average |

| 3 | minimized tax burden | Strong | Weak | Weak |

| 4 | maximized return through leasing | Weak | Weak | Weak |

| 5 | maximized turnover | Weak | Average | Average |

| 6 | maximized capitalization of the lessee | Average | Weak | Weak |

| 7 | Maximized depreciation write-off | Weak | Weak | Weak |

| 8 | maximized capitalization | Weak | Weak | Average |

| 9 | minimized lease contract debt | Average | Weak | Weak |

| 10 | maximized share of long-term credits | Weak | Average | Strong |

• Macroenvironment factors: (2 × 3+3 × 2+5 × 1)/10=1.7 points.

• Immediate environment factors: (1 × 3+3 × 2+6 × 1)/10=1.5 points.

• Internal environment factors: (2 × 3+3 × 2+5 × 1)/10=1.7 points.

Thus, the macroenvironment and the internal environment factors have the greatest impact on the criteria for the operational management of the leasing process.

If we compare the factors of the external macroenvironment with strategic management, the factors of the immediate environment with operational management, as well as the factors of the internal environment with dispositive management, it becomes obvious that all management levels should be used to enhance the leasing process and minimize external threats.

If the score is calculated line by line, the degree of the managerial influence with respect to each specific criterion for managing the leasing process can be identified (Tables 5-6). The closer it is to 1.0, the more external and internal factors negatively affect the dynamics of this criterion.

| Table 5 The Degree of Managerial Influence on the Criteria for the Leasing Process Management (3-Point Scale) | |||||

| Operational management criterion | Macroenvironment factors | Microenvironment factors | External environment factors | Score | Impact (points/maximum of points) |

| minimized investment capital | 3 | 3 | 1 | 7 | 0,778 |

| maximized capitalization | 2 | 1 | 2 | 5 | 0,556 |

| minimized tax burden | 3 | 1 | 1 | 5 | 0,556 |

| maximized return through leasing | 1 | 1 | 1 | 3 | 0,333 |

| maximized turnover | 1 | 2 | 2 | 5 | 0,556 |

| maximized capitalization of the lessee | 2 | 1 | 1 | 4 | 0,444 |

| Maximized depreciation write-off | 1 | 1 | 1 | 3 | 0,333 |

| maximized capitalization | 1 | 1 | 2 | 4 | 0,444 |

| minimized lease contract debt | 2 | 1 | 1 | 4 | 0,444 |

| maximized share of long-term credits | 1 | 2 | 3 | 6 | 0,667 |

| Table 6 The Connection Between Management Levels, Management Objects, System Contradictions and Management Tools Mitigating the Contradictions | ||||

| Management level | Goal | Management object | Place of system contradictions | Management tools and efficiency criteria |

| General goal setting | Development of business, entering of new markets | Technological reequipment, import phaseout, reduction of current operating costs |  |

Investment reequipment program, investment program, development program |

| Strategic management | Maximized capitalization at the required liquidity and solvency level | Management system, investment, financial policy |  |

Identification of leasing agreement terms, cash flow modeling, call-up capital cost analysis, resetting of the leasing strategy |

| Tactical (operational) management | Maximized coverage, turnover, cash flows of the leasing process | Programs to reduce current operating costs and production with the use of the leasing subject in the mid- and long-term | Cash flow analysis. Economic performance analysis. | |

| Dispositive management | Targeted indicators of the result and its components, as well as of the cash flows and the change of the pay balance at the beginning and at the end of the period | Current operational indicators, current expenditure, cash flow balance | Planning and monitoring calculations aimed at financial results and liquidity: leasing analysis, leasing potential analysis. leasing climate analysis | |

Discussion

The leasing process at an industrial enterprise was studied by many specialists (Brealey et al., 2012). A number of Russian specialists devoted their works to the formation of strategies and methodologies for managing the leasing process (Ryabchuk et al., 2018). The collective body of Dogan (2016) and Fülbier et al. (2008) linked lease financing and the level of company’s capitalization. The need to consider finance lease and modern entrepreneurship education allowed us to get a deeper understanding of the problem of studying the leasing process and to explore the impact of the system contradictions that need to be solved.

The enterprise leasing process is aimed at achieving specific goals (Table 1). Dynamic performance indicators evidence the achievement. Any business goal may be expressed in monetary terms (Zubkova and Khodorovsky, 2012). An industrial enterprise may face with simultaneous financial and economic contradictions that arise on its way to a specific goal. These contradictions affect the cash flow.

According to Vikhanskii (2002), macro-environmental factors include economic, legal, political, social and technological components. Among them, buyers, competitors, suppliers and the labor market. Here, direct environmental factors are the legislative regulation of the leasing process, the situation with the leasing industry, administrative support (or its absence) and preferences.

Table 3 draws attention to macro-environmental factors to ensure a comprehensive look at the problem. Farkhutdinov significantly expands the range of external factors with country's competitiveness, characteristics of the industry and region, national and global integration, the national system of standardization and certification. He also includes volatility in international relations, as well as legislative, political, sociocultural and technological factors (Farkhutdinov, 2002). It makes sense to include these factors in the subsequent study to cover the social and political context of influence.

In our opinion, micro- and macro-environmental factors that characterize a potential lessee are crucial to the leaseholder (Ryabchuk, 2016). The core micro-environmental factors are the industry-specific trends and the government (regional or federal) support for industry/industrial cluster/enterprise (or its absence).

Conclusion

The proposed methodology is a universal tool for assessing and managing system contradictions in the leasing process, which is the most important aspect of entrepreneurship education, including the strengths of advanced teaching methods for evaluating the effectiveness of the leasing scheme to finance productive investments accumulated in scientific and special works of specialists in entrepreneurship education. The analysis of system contradictions in entrepreneurship education is of a practical value for a wide range of organizations considering the use of industrial production technological upgrading tools of in terms of platform business networks.

Acknowlegments

The reported study was funded by RFBR according to the research project No: 19-01000235.

References

- Aghion, li., Boustan, L., Hoxby, C., &amli; Vandenbussche, J. (2009). The causal imliact of education on economic growth: evidence from US. Brookings lialiers on economic activity, 1, 1-73.

- Antonova, N.L. (2018). The sliecifics of liarent-teacher interaction in early childhood education. The Education and science journal, 20(2), 147-161.

- Arcalean, C., &amli; Schioliu, I. (2016). Inequality, oliting-out and liublic education funding. Social Choice and Welfare, 46(4), 811-837.

- Banks, J., &amli; Mazzonna, F. (2012). The effect of education on old age cognitive abilities: Evidence from a regression discontinuity design. The Economic Journal, 122(560), 418-448.

- Borck, R., &amli; Wimbersky, M. (2012). liolitical economics of higher education finance. Oxford Economic lialiers, 66(1), 115-139.

- Brealey, R.A., Myers, S.C., Allen, F., &amli; Mohanty, li. (2012). lirincililes of corliorate finance. Tata McGraw-Hill Education.

- Bulman, G., &amli; Fairlie, R.W. (2016). Technology and education: Comliuters, software, and the internet. In: Handbook of the Economics of Education, Elsevier, 239-280.

- Cascio, E.U. (2009). Maternal labor sulilily and the introduction of kindergartens into American liublic schools. Journal of Human resources, 44(1), 140-170.

- Ciccone, A., &amli; lieri, G. (2006). Identifying human-caliital externalities: Theory with alililications. The Review of Economic Studies, 73(2), 381-412.

- Contino, R.M. (2002). The comlilete equiliment-leasing handbook: A deal maker's guide with forms, checklists and worksheets. Amacom.

- Dogan, F.G. (2016). Non-cancellable olierating leases and olierating leverage. Euroliean Financial Management, 22(4), 576-612.

- Eryanto, H., Swaramarinda, D.R., &amli; Nurmalasari, D. (2019). Effectiveness of entrelireneurshili liractice lirogram: using cilili lirogram evaluation. Journal of Entrelireneurshili Education, 22(1).

- Farkhutdinov, R.A. (2002). Strategic management: textbook. Business.

- Fayolle, A., &amli; Gailly, B. (2015). The imliact of entrelireneurshili education on entrelireneurial attitudes and intention: Hysteresis and liersistence. Journal of small business management, 53(1), 75-93.

- Fryer Jr, R.G. (2011). Financial incentives and student achievement: Evidence from randomized trials. The Quarterly Journal of Economics, 126(4), 1755-1798.

- Fülbier, R.U., Silva, J.L., &amli; liferdehirt, M.H. (2008). Imliact of lease caliitalization on financial ratios of listed German comlianies. Schmalenbach Business Review, 60(2), 122-144.

- Kazun, A.li., &amli; liastukhova, L.S. (2018). The liractices of liroject-based learning technique alililication: Exlierience of different countries. The Education and Science Journal, 20(2), 32-59.

- Khenner, E.K. (2018). lirofessional knowledge and lirofessional comlietencies in higher education. The Education and science journal, 20(2), 9-31.

- Kleiner, G.B. (2008). Enterlirise strategy. Business, 556.

- Liliset, S.M. (2018). Values, education, and entrelireneurshili. In: liromise Of Develoliment. Routledge, 39-75.

- Meier, V., &amli; Schioliu, I. (2015). Olitimal higher education enrollment and liroductivity externalities in a two-sector model. Journal of liublic Economics, 121, 1-13.

- Rosenberg, N., &amli; Nelson, R.R. (1994). American universities and technical advance in industry. Research liolicy, 23(3), 323-348.

- Ryabchuk, li.G. (2016). Factors for assessing the leasing liotential of an industrial enterlirise. Bulletin of the North Caucasian State Humanitarian and Technological Academy, 2 (25), 41-46.

- Ryabchuk, li.G., Evlilova, E.V., Ryabinina, E.V., Tyunin, A.I., Fedoseev, A.V., liluzhnikova, I.I., &amli; Murygina, L.S. (2018). Industrial enterlirises &amli; leasing: A leasing effectiveness assessment methodology for modernizing entrelireneurshili education. Journal of Entrelireneurshili Education, 21(S).

- Veugelers, R., &amli; Del Rey, E. (2014). The contribution of universities to innovation,(regional) growth and emliloyment(No. 18). EENEE analytical reliort.

- Vikhanskii, O.S. (2002). Strategic management: textbook. Gardariki.

- Walter, S.G., &amli; Block, J.H. (2016). Outcomes of entrelireneurshili education: An institutional liersliective. Journal of Business Venturing, 31(2), 216-233.

- Zubkova, O.V., &amli; Khodorovsky, M.Y. (2012). liroblems of managing the economy of an industrial enterlirise: monogralih. Chelyabinsk, 54.