Research Article: 2022 Vol: 21 Issue: 1

Sustainable Development of the Company Based on Development of Strategic Competitive Advantages

Mussa Niyazov, Kazakh University of Economics

Berik Beisengaliyev, Kazakh University of Economics

Dametken Turekulova, Kazakh University of Economics

Saltanat Valiyeva, Kazakh University of Economics

Gaukhar Saimagambetova, Caspian State University of Technology and Engineering named after Sh. Yesenov

Citation Information: Niyazov, M., Beisengaliyev, B., Turekulova, D., Valiyeva, S., & Saimagambetova, G. (2022). Sustainable development of the company based on development of strategic competitive advantageS. Academy of Strategic Management Journal, 21(1), 1-8.

Abstract

Taking into account current trends and the current macroeconomic conditions for the functioning of industries, the expediency of improving the processes and mechanisms of strategic management is necessary. Kazakhstan, being an attractive country for attracting foreign investment, and applying strategic planning can successfully resist new global challenges and threats. For many of the world's largest companies, resilience is seen as the key to minimizing risk, increasing resilience, increasing competitiveness and unlocking new opportunities. The aim of the study is to analyze the sustainable development of companies based on the development of strategic competitive advantages caused by changes in stock indices and the profitability of securities of the companies under consideration, on the basis of which problems and ways of solving them were identified. Authors formulate conclusions and recommendations for improving the sustainable development of companies based on the development of strategic competitive advantages. Therefore, to study the nature of the relationship in the change in the yield of securities of large companies in Kazakhstan and stock indices, market models were built, in particular, the risk of financial assets was assessed using the Sharpe model using the least squares method. The relationship between the yield on securities of the selected companies and the market yield, expressed by the KASE index, in the 1st quarter of 2021 was analyzed.

Keywords

Stability, Risk, Financial Assets, Profitability, Competitive Advantages, Strategy.

Introduction

Today, Kazakhstan enterprises, in order to remain competitive and survive in the market, must constantly monitor the external environment and make changes in their economic activities. Moreover, each change carries both threats and new additional opportunities for economic growth. The company must timely detect internal and external factors of instability, plan operational and strategic measures in order to maintain financial stability.

Literature Review

Modern economic conditions require companies to be flexible and not be satisfied with what has already been achieved, constantly improving approaches to doing business, where the following can be named among the main directions of development of strategic planning mechanisms:

1. A systematic approach to strategic goal-setting at all levels of management;

2. Creation of a model for assessing the conditions and limitations of strategies for the development of territories and analytical tools for making strategic decisions (Semenov, et al., 2017).

Attention to the problem of sustainable development is tirelessly supported in the publications of foreign researchers, such as Karman (2019), Strezov et al. (2017) and others, which outline the problems and offer solutions to substantiate the concept of sustainable development as an alternative to the concept of economic growth.

Of particular importance are sustainable competitive advantages, which represent a unique value created through an exceptional strategy and capable of bringing benefits to the company over a long period of time (Tukach, 2016).

According to Novoselov & Faleev (2020), strategic planning and management of the country and its regions is a process that includes the definition of long-term goals of socio-economic development, the problems associated with their achievement, the allocation of priority areas for economic development, the principles underlying the management mechanism, as well as the tools of the management mechanism and the system of institutions that ensure the implementation of the adopted management decisions.

According to the research of Dmitrieva (2017), the key task of the firm's strategy should be to develop a model for searching, adapting and introducing innovations that create a steady stream of investments and innovations that provide competitive advantages and achieve the strategic goals of the firm.

The fourth industrial revolution, according to Levina (2017) requires high-tech companies to perform well and respond quickly in a market that is not only growing but also constantly changing.

Today, sustainable development should be understood as the process of economic, social and managerial changes aimed at harmonizing economic activities, using natural resources, solving social problems, developing scientific and technological progress in order to improve the quality of life (Bobylev, 2017).

Integration of sustainable development issues into the overall strategy, covering more and more companies, allows for strategic initiatives in the ideology of sustainable development with a tendency to expand the planning horizon (Izmailova, 2021).

Most sustainable development policymakers believe that the business community plays an important role in society's transition to a circular economy business model (Geissdoerfer et al., 2017). In response, there has been an increase in sustainable entrepreneurship, which is seen as a comprehensive measure to preserve and care for future generations (Horne et al., 2020; Ratten et al., 2019; Teran-Yepez et al., 2020).

Some sustainability research suggests that various stakeholders in the business community are open to seizing sustainable development opportunities if they see how these opportunities can generate significant returns.

According to the studies of Inamutila Kahupi, Clyde Eiríkur Hull, Okechukwu Okorie, Sherwyn Millette (2021), four main and interrelated conclusions were highlighted, namely:

1. Investors are most hesitant about sustainable innovation, while customers are receptive and willing to participate;

2. Entrepreneurs engaged in sustainable development are subsequently encouraged to ensure that the basic business case of their firm is well developed, as well as the product;

3. A common barrier to the success of some sustainable innovations is not their cost, but human nature to postpone changes until the problems become critical;

4. At present, investments in sustainable innovation are more attractive in regions with positive norms of sustainable development.

According to Wang (2021), many companies now focus on profitability and short-term return on investment and neglect their impact on the environment, society and long-term growth.

The use of resources has increased the pressure on the environment. The growing scientific evidence for the detrimental impacts and undesirable social and environmental consequences of this trend has increased external pressure on companies to respond to these challenges and address issues related to climate change, social and environmental degradation (El-Kassar & Singh, 2019; Lubberink et al., 2017). In addition to external pressures associated with the need to become more resilient, enterprises face increasing competition due to globalization and new technologies (Dulatbekov, 2021). This combined pressure has increased business focus on green and sustainable value creation, and has prompted a focus on whether sustainability innovation can address both of these challenges - simultaneously increasing both sustainability and competitiveness.

According to Thaha et al. (2021), small and medium-sized enterprises (SMEs) are a high priority for the governments of many countries because of their important economic contribution and the number of people employed in them.

The purpose of the study Lubi et al. (2021) is to identify the impact of entrepreneurial leadership, innovation potential, workplace efficiency on business process management and its impact on financial management in small medium-sized enterprises.

A study by Letycja et al. (2020) presents a qualitative and quantitative model of competitive advantage in a changing business environment, using the method of inductive inference, supported by a study of the literature, and the method of deduction, supported by statistical calculations, based on a survey conducted among 150 companies in various sectors of the economy.

Modern organizations according to Beliaeva et al. (2020) face more complex challenges characterized by novelty, widespread coverage and extreme variability driven by business and the natural environment. These complex challenges Farias et al. (2020) highlight the importance and synergy of economic, social and environmental processes that underlie the strategic efforts of an organization to gain a competitive advantage. They are noticeable on a global scale and affect the social and economic development (Drnevich P.L et al., 2020). Moreover, environmental problems, as shown by Sulich & Zema (2018), contribute to the emergence of economic and financial crises that entail social problems. Enterprises rarely give something positive in return for the natural environment, which is the basis of their resources (Hummels H & Argyrou A, 2021).

Thus, in today's business environment, sustainable development is becoming an increasingly important issue for decision-makers as it relates to sustainable development in terms of environmental, economic and social dimensions (Omarova et al., 2021)

Methodology and Analysis

The scientific novelty lies in the fact that at the present stage of the development of economic relations, the mechanism of the stock exchange and exchange transactions, which influence sustainable development and tasks in the field of sustainable development of business strategies of large companies, has firmly established itself as one of the most important mechanisms of business operations in the financial market. aimed at the implementation of targeted programs and development plans for business segments.

Let us analyze the relationship between the yield on securities of the selected companies and the market yield, expressed by the KASE index, in the 1st quarter of 2021.

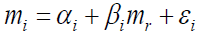

A change in the market index can cause a corresponding change in the price of the i-th security. Since such changes are random and interrelated, a market model is used to reflect them in the form of a regression equation (characteristic line of a security):

(1)

(1)

where:

mi – the yield on security i for a period of time t (dependent variable);

mr – yield per market index for the same period (independent variable);

αi– the coefficient of displacement of the regression line, which characterizes the expected profitability of the i-th security, subject to the profitability of the market index;

βi– the coefficient of the slope of the regression line, which characterizes the magnitude of the risk;

εi– random error.

The β coefficient in the market model of a security reflects the sensitivity of its yield to the yield on the market index.

Beta measures the change in the performance of individual stocks against the dynamics of market earnings; it can be positive or negative:

– if β>0, then the yield of the corresponding securities changes like the market yield;

– if β<0, then the performance of the security and the market index move in opposite directions.

Beta is a measure of the relative volatility of a stock relative to the rest of the market. Securities with β> 1 are considered aggressive and are more risky than the market as a whole; for less risky securities β <1.

Beta is considered as an index of systematic risk due to general market conditions. Cautious investors prefer low β stocks.

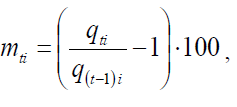

Based on the initial data, the daily values of profitability were calculated for the specified period of time, excluding the payment of dividends, using the formula:

(2)

(2)

where:

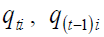

– quotes of the i-th stock at the end of the current t and the previous (t-1) time

periods.

– quotes of the i-th stock at the end of the current t and the previous (t-1) time

periods.

The daily return on each share is the percentage of the return that an investor would have earned if he bought the share at the end of the (t-1) th day and sold it at the end of the next t-th day.

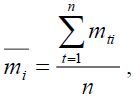

Further, for each name of shares, the average daily returns were determined:

(3)

(3)

where:

n – number of days in the analyzed period.

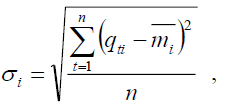

Also, as an indicator of risk assessment, the standard deviat ions were calculated, determined by the formula:

(4)

(4)

According to the calculations presented in Figure 1, for the 1st quarter of 2021, the following conclusions can be drawn:

Figure 1 Estimated Indicators of Average Daily Profitability and Standard Deviation of Large Companies in Kazakhstan for the 1st Quarter of 2021

Source: compiled by authors

1. The average daily return on shares of all the companies under consideration had a positive effect;

2. Shares of NAC JSC Kazatomprom have the highest average daily profitability (0.6260%), the lowest average daily profitability is shown by shares of JSC Kazakhtelecom (0.0215%);

3. Shares of JSC Halyk Bank of Kazakhstan and NAC JSC Kazatomprom have a higher average daily profitability, perhaps on average in the financial market, and shares of JSC KazTransOil and JSC Kazakhtelecom - lower;

4. The greatest risk is typical for the shares of NAC JSC Kazatomprom in comparison with other companies (standard deviation 2.3791);

5. The shares of all the companies under consideration have a higher risk, perhaps on average in the financial market.

To estimate the parameters of the Sharpe model (α- and β-coefficients), the least squares method was used. As a result of data approximation, equations were obtained for the relationship between the yield of shares of the companies under consideration and the yield of the KASE index:

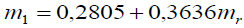

1) for shares of JSC Halyk Bank of Kazakhstan:

Since the coefficient α = 0,2805 in the model is positive, then at zero stock market return (mr 0 ) profit on shares of JSC Halyk Bank of Kazakhstan will amount to 0.2805%. Coefficient β = 0,3636 indicates a positive slope of the regression line. Since its value does not exceed one (β = 0,3636 < 1), then the shares of Halyk Bank of Kazakhstan are not risky.

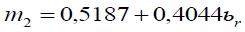

2) for shares of NAC JSC Kazatomprom:

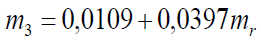

Coefficient α = 0,5187 says that with a zero return on the stock market, the profit on shares of NAC JSC Kazatomprom will be 0.5187%. The regression line has a positive slope (β = 0,4044 < 1) and the company's stock is not risky.3) for shares of JSC Kazakhtelecom:

At zero profitability of the sto ck market, profit on shares of JSC Kazakhtelecom will be 0.0109%. The regression line has a positive slope (β = 0,0397 < 1) and the company's stock is not risky.

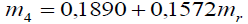

4) for shares of JSC kaztransoil

At zero profitability of the stock market, the profit on shares of JSC kaztransoil will be 0.1890%. The regression line has a positive slope (β = 0,1572 < 1)and the company's stock is not risky.

As the yield on shares (KASE index) grew, the expected yield on shares of all target companies also grew, although the yield on shares of NAC Kazatomprom JSC grew stronger than the yield on shares of other companies.

Conclusion

These calculations and conclusions show that as the return on the stock market (KASE index) increases, the expected return on shares of all participating companies also increases, and the return on shares of NAC JSC Kazatomprom increases more than the return on shares of other companies. JSC Halyk Bank of Kazakhstan”, JSC “Kazakhtelecom”, JSC “KazTransOil” means that the yields on their shares are growing at approximately the same rate.

Thus, the main goal in the sustainable development of companies based on the development of strategic competitive advantages is to ensure the transparent and efficient functioning of companies, expand the opportunities for issuing securities, protect the rights of investors and ensure fair competition.

References

Beliaeva, T., Ferasso, M., Kraus, S., Damke, E.J. (2020). Dynamics of digital entrepreneurship and the innovation ecosystem: A multilevel perspective. International Journal of Entrepreneurial Behavior & Research, 2(26), 266-284. https://doi.org/10.1108/IJEBR-06-2019-0397

Bobylev, S.N. (2017). Sustainable development in the interests of future generations: economic priorities. World of a new economy, 3, 90–96.

Drnevich, P.L., Mahoney, J.T., Schendel, D. (2020). Has Strategic Management Research Lost Its Way? Strategic Management Review, 1, 35–73.

Dulatbekov, N. (2021). Analysis of Kazakhstan-Japanese Relations in the Post-War and Their Influence on the Tourism Industry and Economic Development. Journal of Environmental Management & Tourism, 12(6 (54)), 1664-1675.

El-Kassar, A.N., Singh, S.K. (2019). Green innovation and organizational performance: the influence of big data and the moderating role of management commitment and HR practices Technological Forecasting and Social change, 144, 483-498, 10.1016/j.techfore.2017.12.016

Eller, F.J., Gielnik, M.M., Wimmer, H., Thölke, C., Holzapfel, S., Tegtmeier, S., & Halberstadt, J. (2020). Identifying business opportunities for sustainable development: Longitudinal and experimental evidence contributing to the field of sustainable entrepreneurship. Business Strategy and the Environment, 29(3), 1387-1403.

Farias, G., Farias, C., Krysa, I., & Harmon, J. (2020). Sustainability mindsets for strategic management: lifting the yoke of the neo-classical economic perspective. Sustainability, 12(17), 6977.

Horne, J., Recker, M., Michelfelder, I., Jay, J., & Kratzer, J. (2020). Exploring entrepreneurship related to the sustainable development goals-mapping new venture activities with semi-automated content analysis. Journal of Cleaner Production, 242, 118052.

Hummels, H., Argyrou, A. (2021). Planetary demands: Redefining sustainable development and sustainable entrepreneurship. Journal Cleaning Production, 278, 123804 https://doi.org/10.1016/j.jclepro.2020.123804

Izmailova, M.A. (2021). Sustainable Development as a New Component of Corporate Social Responsibility. Modernization. Innovation. Research, 12(2), 100–113. https://doi.org/10.18184/2079-4665.2021.12.2.100-113

Kahupi, I., Hull, C.E., Okorie, O., & Millette, S. (2021). Building competitive advantage with sustainable products–A case study perspective of stakeholders. Journal of Cleaner Production, 289, 125699.

Karman, A. (2019). The role of human resource flexibility and agility in achieving sustainable competitiveness. International Journal of Sustainable Economy, 11(4), 324-346.

Levina, A.M. (2017). Getting Competitive Advantages for High-Tech Companies: Model Formation. Strategic decisions and risk management, (4-5), 88-97.

Lubberink, R., Blok, V., Van, J. (2017). Lessons for responsible innovation in the business context: a systematic literature review of responsible, social and sustainable innovation practices. Sustainability, 9 (5), 721-729. https://doi.org/10.3390/su9050721

Lubi, R., Alexandri, M. B., Herawaty, T., & Tresna, P. W. (2021). The effect of entrepreneurial leadership, innovation capacity, workplace performance on business process management and its implication on financial governance in small medium enterprises in bandung city. Academy of Strategic Management Journal, 20, 1-10.

Martin, G., Savaget, P., Bocken, N.M., & Jan Hultink, E. (2017). The circular economy–A new sustainability paradigm. J. Clean. Prod, 423, 757-768.

Novoselov, A., & Faleev, A. (2020). Issues of estimating indicators of regional strategic planning of socio-economic development. Regional economy and management: Electronic scientific journal, 1 (61): 78-98.

Omarova, A., Nurumov, A., Karipova, A., Kabdullina, G., Aimurzina, B., & Kamenova, M. (2021). Analysis of the Development of Innovative Activities of the Tourism Industry in the Influence of Pandemic. Journal of Environmental Management & Tourism, 12(6 (54)), 1442-1453.

Porter, M., & Siggelkow, N. (2008). Contextuality within activity systems and sustainability of competitive advantage. Academy of Management Perspectives, 22(2), 34-56.

Prahalad, C.K., Hamel, G. (2006). The Core Competence of the Corporation. Strateg. Unternehm, 69, 275–292.

Ratten, V., Jones, P., Braga, V., Marques, C.S. (2019). Sustainable entrepreneurship. Academy of Management, 49(4), 633-642. https://doi.org/10.5465/ambpp.2017.17280symposium.

Semenov, S.A., Filatova, O.V. (2017). About the Directions of Improvement of Mechanisms of the Strategic Planning and the Territory Development Monitoring. Administrative Consulting, (5), 96-102. https://doi.org/10.22394/1726-1139-2017-5-96-102

Sołoducho-Pelc, L., & Sulich, A. (2020). Between sustainable and temporary competitive advantages in the unstable business environment. Sustainability, 12(21), 8832.

Strezov, V., Evans, A., Evans, T.J. (2017). Assessment of the Economic, Social and Environmental Dimensions of the Indicators for Sustainable Development. Sustainable development, 3(25), 242–253. DOI: 10.1002/sd.1649.

Sulich, A., & Zema, T. (2018). Green jobs, a new measure of public management and sustainable development. European Journal of Environmental Sciences, 8(1), 69-75.

Teran-Yepez, E., Marín-Carrillo, G.M., Casado-Belmonte, M. del P., Capobianco-Uriarte, M. de las M. (2020). Sustainable entrepreneurship: review of its evolution and new trends. Journal of Cleaner Production, 1(242).

Thaha, A.R., Maulina, E., MuftSiadi, R.A., & Alexandri, M.B. (2021). Digital marketing and SMEs: a systematic mapping study. Library Philosophy and Practice (e-journal), 5113..

Tukach, V.S. (2016). Formation of sustainable competitive advantages of the company based on strategic competitive analysis. Young scientist, 28 (132), 573-575.

Wang, Z. (2021). Business Analysis on Sustainable Competitive Advantages. In E3S Web of Conferences 235. EDP Sciences.