Research Article: 2022 Vol: 25 Issue: 6S

Sustainability, Circular Economy, and the Entrepreneurial Value Creation

Suja Pradeep, Khawarizmi International College

Majdi Khaleeli, Khawarizmi International College

Shaista Anwar, Khawarizmi International College

Citation Information: Pradeep, S., Khaleeli, M., & Anwar, S. (2022). Sustainability, Circular Economy, and the Entrepreneurial Value Creation. Journal of Entrepreneurship Education, 25(S6),1-15.

Abstract

This study investigates how the globally emerging macro trends — such as changes in the environment, clean technology, and renewable energy, shifting regulatory landscapes and markets, etc.- are converging and profoundly affecting businesses, causing new value creation and capturing opportunities for entrepreneurs. In this context, the paper explores how sustainable entrepreneurship and circular business models help innovators win the new market dynamics while generating trillions of dollars in value for the global economy by simultaneously decarbonizing and restoring ecosystems. A systematic literature review proposes a conceptual model that serves as a tool for the emerging economies to align their macroeconomic policies and institutional structures to decouple climate change from economic growth. The study fills a research gap by identifying the key macro forces that imapct the synergy between sustainability and profitability. The results of the study pinpoint that transition to a circular economy is to be considered as the focal point of the renewal strategy by the global firms as well as new value creation opportunities for entrepreneurs. The study highlights quantifying the positive and negative synergies across the moderating variables identified in the proposed conceptual model, in the context of emerging and underdeveloped economies, as future areas of research.

Keywords

Sustainability, Entrepreneurship, Climate Crisis, Technological Innovation.

Introduction

The Industrial Revolution ushered in unprecedented levels of development. We became better at obtaining resources and creating value from them as economic and technical development progressed. We progressively established a sophisticated economy with universities, governments, and companies to create jobs, manufacture goods, and provide services that improve our lives. The higher life expectancy, better standard of living, and anything we relish in the form of modern economic growth is the result of this economy which was built on our collective intelligence and powered by technological innovations. However, at the heart of our economy is a linear "take, make, dispose" model that relies on the large-scale use of finite commodities and fossil fuels (Nasir et al., 2017). Any system that relies on constant extraction and consumption will eventually reach its limits (Heshmati, 2016). Today's economy is incredibly wasteful, resulting in significant value losses. Against this backdrop this paper explores why this system requires an overhaul to sustain rapid growth without being overwhelmed by negative environmental and social impacts. Through a systematic literature review and drawing on evidences from real business cases, it aims to establish that market forces and trends are evolving in such a way to help the businesses not only to reconcile the tradeoff between profitability and sustainability that was in existence historically, but also to create new avenues of value creation and capturing. The paper presents a conceptual framework that explains the moderating forces that strengthens the arguments for circular business model and business cases for sustainability. There are many studies in sustainability and circular business models, however the studies that consider the market forces and current macro environmental trends through the lens of entrepreneurship is limited in this area. The proposed conceptual model also serves as a tool for emerging economies, to align their macroeconomic policies and institutional structures to decouple climate change from economic growth.

The section on background information and literature review establishes the connection between topics such as entrepreneurial value creation process and sustainable and circular business models against the backdrop of climate crises. Next it throws lights on the macro trends emerging in the market place with key facts related to food, energy, waste, transportation, demographic shifts and resultant resource pressures, and the much needed shifts in technological and regulatory climate. Finally, it proposes a conceptual framework that would serve as a foundation for future research and roadmap for all stakeholders.

Background Information and Literature review

The linear system is causing a decline in overall quality of life. Poor air quality in cities is having an increasingly negative impact on health, and livelihoods are being challenged by climate change Balogun et al. (2021), which is mostly caused by greenhouse gases released by the use of nonrenewable fossil fuels. This mandates an urgent need for innovative business models (Santa-Maria et al., 2022) that would be remodeling our economy to produce rather than take value, keeping finite technical resources flowing throughout the economy (Murray et al., 2017) and conserving and renewing biological systems.

Recently the number and intensity of natural disasters have increased due to climate change, and as a result, the expenses of climate calamities such as wild fires, lack of rain, hurricanes, and flooding have also increased (Bertini et al., 2021). The year 2020 witnessed $22 billion weather-related calamities in the United States. Since the Industrial Revolution, carbon emissions have been increasing at an exponential rate. Scientists measure that in January 2020, the amount of CO2 emissions in the atmosphere was approximately 413.4 per million pieces but in 1970, that number was 325, whereas at the advent of the Industrial Age, it was only 280. This is causing global warming on an unprecedented scale. Three million years ago in the past sea levels were 15 meters higher possibly due to the presence of the same amount of CO2 we currently have. As a result, to maintain life on Earth, we must limit the release of carbon dioxide and other greenhouse gases so climate action plans has become so demanding and urgent.

Global Warming Implications

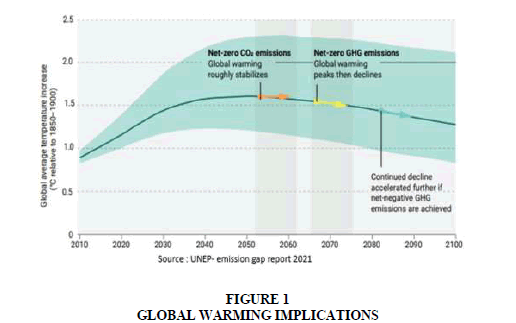

Floods and wildfires such as this year will become even more intense and frequent, crops will be more prone to failure, and ocean levels rise, according to the IPCC study, causing millions of people to leave their homes if global warming is not kept to 1.5°C over pre-industrial levels. Overshooting the upper limit of the safe temperature range of 1.5 degrees Celsius puts us at risk of climate tipping points, such as the thawing of Arctic permafrost and the release of millennia's worth of carbon dioxide emissions On the other hand, there is reason to believe that global warming will not reach catastrophic proportions. Global greenhouse gas emissions must be zero by 2050, with natural carbon sinks such as mangroves and wetlands and innovative technologies such as carbon capture absorbing leftover emissions to reach net-zero emissions.

Nevertheless, the global temperature rise will likely surpass 1.5 °C in the next two decades, and it will be difficult to limit it to 1.5 °C or even 2 °C by the end of this century unless considerable reductions in GHG emissions occur quickly and widely. Forty-nine nations (including the European Union and 50 other parties) have firmly committed to achieving netzero emissions by 2050, according to the Emissions Gap Report 2021, galvanizing credible climate action among cities, regions, companies, and investors. According to the Emissions Gap Report 2021, net-zero CO2 emissions stabilize global warming, but net-zero GHG emissions result in a peak and drop in global warming, as indicated in Figure 1.

The Emissions Gap Report updates the gap between i) estimated future global GHG emissions if countries implement their climate mitigation pledges and ii) global emission levels from least-cost pathways aligned with accomplishing the Paris Agreement objective of limiting global warming to less than 2 °C and pursuing 1.5 °C each year. The gap between where we will likely be and where we need to be is known as the 'emissions gap’. The assessment this year includes the new or modified Nationally Determined Contributions (NDCs), as well as formally declared mitigation promises for 2030, with a deadline of 30 September 2021.

Sustainable Business: Opportunity and Value Creation

It is certain that environmental issues will rise in relevance because of population increases and our dependence on the linear economy. Contaminated air, water, and soil pose an increasing threat to food production, water supply and public health. These issues are of growing concern to both the federal government and the general populace. As environmental and socioeconomic issues deteriorate, public health concerns are expected to drive new laws and novel pollution avoidance strategies, encompassing historically unregulated activities. Everincreasing concerns reflect a corresponding increase in the market power of sustainable business. It is not just a matter of compliance or cost reduction. There are ample opportunities for the entrepreneurially minded, who source ideas from the problems or needs of society. Sustainability innovation Arbib & Seba (2020) offers solutions.

The evolving new models of business sustainability (Geissdoerfer et al., 2018) are favoring economic growth and development by simultaneously preserving and restoring natural systems while enhancing the quality of life for more people, due to scientific research and innovation, political pressure, and public demand. According to (Bertini et al., 2021), those businesses and projects that reflect the sustainability ideal have discovered innovative methods to succeed financially while simultaneously safeguarding and conserving human health, equality, and community vitality. The word "sustainable" in the context of entrepreneurship will be examined in the next section. In the sustainable business sector, there is recognition that sustainability is a new frontier for creativity, innovation, and value creation Larson et al. (2000).

“Resource utilization should not deplete existing capital, that is, resources should not be used at a rate faster than the rate of replenishment, and waste generation should not exceed the carrying capacity of the surrounding ecosystem," says Robert (2000) As noted by Bakshi & Fiksel (2003), when a product or process is self-sustaining, it uses fewer resources and generates less waste while still meeting human requirements while also providing long-term economic benefit to the organization.

Entrepreneurship, Opportunity Recognition and Circular Business Model

Entrepreneurship is vital for the formation and expansion of enterprises as well as the growth and prosperity of regions and nations Rusu & Roman (2017); Lee (2019). Schumpeter is credited with being the first scholar to introduce the world to the concept of entrepreneurship-or, at the very least, the economic relevance (Fagerberg et al., 2012) of it. He coined the term Unternehmergeist, which translates to "entrepreneur-spirit," and claimed that these people were in charge of the economy Schumpeter (1928) since they were in charge of bringing innovation and technological growth Leong (2021). Entrepreneurial acts begin at the intersection of a lucrative opportunity and an innovative individual and can have relatively humble beginnings (Thrane et al., 2016).

According to Sarasvathy (2014); Siegel & Renko (2012), entrepreneurial opportunities are circumstances in which novel products and services, could be introduced and marketed for a price higher than their manufacturing costs. For example, introducing an existing technology product used in one market to create a new market could be an entrepreneurial opportunity. Alternatively, producing a new technology product for an existing market could be an entrepreneurial opportunity Courtney et al. (1997) or creating both a new product/service and a new market Skeete (2018). The idea that an entrepreneurial opportunity represents something novel (Rosado-Cubero et al., 2022) is a reoccurring topic. Such opportunities, however, demand an enterprising person Gieure et al. (2020) or a group of people who are looking for ways to take advantage of these occurrences Suddaby et al. (2015). As a result, entrepreneurship necessitates action, Sastre et al. (2022) for example as the creation of new products/processes or indeed the expansion into new markets Companys & McMullen (2007), which may occur through a newly created organization or within an established organization Wolcott & Lippitz (2007).

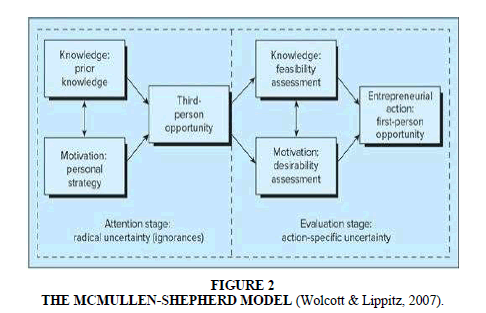

Entrepreneurs take action in response to what they perceive to be an opportunity. As emphasized by McMullen & Shepherd (2006), entrepreneurs must use their judgment to decide whether to act or not to actsince opportunities exist in (or create and/or generate) with considerable uncertainty. As illustrated in Figure 2, two phases of economic ventures are explained by the McMullen-Shepherd model. Some people will detect changes in the surroundings that signal potential possibilities, while others will not. Individuals with market and/or technological knowledge are better able to spot changes in the external environment, and if they are also driven, they will devote more time to processing these data. Others, on the other hand, will be unaware of the prospect. Stage 1 ends with an individual realizing that there is an opportunity for them. After that, the individual must determine whether it is an ideal opportunity for him or her (Phase 2). This entails determining if the opportunity is feasible to exploit given one's knowledge and whether it is desirable given one's interests. To put it another way, does this opportunity for someone else (third-person opportunity belief) indicate a chance for me (firstperson opportunity belief)? This individual may act if he or she overcomes enough doubt to establish (1) the view that the situation represents an opportunity for someone in general and then (2) the belief that the opportunity for someone is an opportunity for him or her individually. To assess the feasibility (Bojovic et al., 2018) of the business opportunity, he needs to engage in the business modeling process.

Figure 2:The Mcmullen-Shepherd Model (wolcott & lippitz, 2007).

A company's value creation, delivery, and monetization processes are encapsulated in its "business model," which is a conceptual framework, Osterwalder et al. (2005). Businesses commonly use three key components to describe their business models Osterwalder et al. (2005): Osterwalder & Pigneur (2011), each of which is linked to the concept of value: There are three components to a value proposition: the product or service being provided; who it is being sold to; and how it is delivered. To put it another way, how does the company make money? Cost structure and revenue streams are the two ways in which value is captured. There is considerable literature on traditional business models Cosenz & Noto (2018); Wilson et al. (2018) that strongly emphasizes capturing economic value in terms of sales and profit Lanzolla & Markides (2021); Teece (2018), but there is also substantial literature on sustainable business models (Nosratabadi et al., 2019); (Comin et al., 2019); (Bocken et al., 2019) that places an emphasis on the capture of environmental and social value as well (Laasch, 2018).

A novel strategy to producing and extracting value in a value network enabled by technological convergence is a business model innovation. A business model innovation made feasible by the convergence of smartphones and the Cloud is ride-hailing (Uber, Lyft, Didi, etc.). Convergence allowed for efficient and cost-effective linkages and matching between passengers and drivers with excess capacity. With its brokerage business model, ride-hailing services make money by taking a cut of every transaction. With the advent of a new business model termed "zero-money-down solar," the solar energy sector in the United States has grown tremendously. Because the solar supplier would fund, install, and even own the solar panels, households may now buy or lease them much like a vehicle, with no or little down payment, but a predetermined monthly installments that will last for many years, unlike in the past when they were required to pay for their solar panels up front.

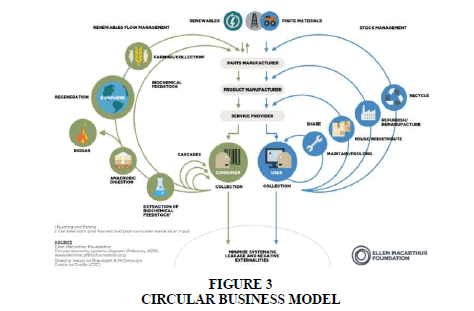

The circular economy concept Jensen (2022); Nubholz (2017) has attracted much traction in recent years, with increased interest from corporations, governments, and academia. It underpins three principles: completely halt the creation of waste and pollution, maintain the best and long term value of goods and resources, and allow the ecosystem to regenerate. A circular economy's economic, environmental, and societal benefits are becoming more apparent. Addressing rising resource-related issues, producing growth and jobs, and minimizing negative environmental impacts such as carbon emissions are among them. Creating value in a circular economy is becoming increasingly disconnected from the consumption of finite resources. It gives small and large enterprises, local and global, commercial and public, the opportunity to build a distributed, diversified, and inclusive economy.

A circular economy strategy Jensen (2022) advocates for designers and manufacturers to extend the life of items by incorporating features such as design for durability, repair, and refurbishment. When this becomes impossible, initiatives to recoup the value of materials are made.

Figure 3 illustrates how a circular business model exhibits two cycles that reflect two fundamentally distinct material flows: one that is biological and one that is technological. In the figure on the left, biological materials are shown as green cycles, and they are materials that may be safely returned to the natural world after one or more usage cycles, where they will biodegrade over time, releasing the nutrients they contain into the environment. On the right, you can observe that technical elements (shown in blue) cannot be reintroduced into the environment. To collect and recover the value of materials such as metals, polymers, and synthetic chemicals, they must be cycled through the system on a constant basis.

Macro Trends Reshaping the Market Forces and Economies

In this section we discuss how the macro trends are reshaping market forces, demand and supply side factors, conducive for sustainable entrepreneurship, in the light of the key facts related to food, energy and transportation, waste, demographic shifts and resultant resource pressures, and the much needed shifts in technological and regulatory landscape.

Key Facts- Energy and Transportation

Several global systems are under severe pressure. Energy consumption was limited to 2,000 kcal per day for middle-class people before the first industrial revolution which was equivalent to the quantity of food they eat; here is an example. In today's world, the average middle-class individual uses approximately 200,000 kcal of energy each day, including gasoline, electricity, and other fossil fuels for transportation, lighting, cooking heating etc. As the world's population grows by a factor of twenty while the demand for energy per person increases by 200,000 times the world’s resources would be dwarfed by a factor of 2000, with respect to what was available at the first industrial revolution. The United Kingdom's GDP per capita doubled over a period of 150 years and the United States doubled in 50 years during the first and second industrial revolutions respectively whereas China took less than 15 years to double its GDP per capita. All of these factors are putting tremendous strain on the world's limited supply of natural resources; in the words of (Heck et al., 2014).

Key-Facts-Food

Agricultural systems are also under a great deal of strain. There is not much opportunity for expansion because a third of the world's arable land is already used to grow crops, and much of the rest is used for grazing animals. It is forecasted that world’s demand for energy will be doubled by the year 2050, and so the demand for water and food. Meanwhile, existing water, energy, and food systems are limited in their ability to supply this expanding need due to competing demands for finite resources. Every year, the world consumes approximately 2.4 trillion gallons of water. For example, by 2050, approximately 60-70 percent more food will be required to feed the global population, whereas the vast majority of industrial scale, extractive agriculture practices will degrade soil quality, resulting in serious doubts about how many harvests are left (along with greenhouse gas emissions). Increased prosperity is frequently accompanied by an increase in animal protein demand. A pound of beef requires fifteen times the amount of water to produce as a pound of rice and it takes one hundred sixty times more energy to produce one calorie of beef than it does one calorie of maize. Animal protein takes approximately six times the amount of land as plant-based proteins, with beef requiring approximately eighteen times the amount of land. Hence, as argued by (Heck et al., 2014) perhaps land, water, and energy productivity will have to grow significantly to supply the protein needs of the emerging middle class or a major change in the diet away from animal proteins, which has never happened in previous income expansions.

Key-Facts- Waste

UNEP estimates that the world consumes one million plastic water bottles each minute. Every year, people consume 5 trillion single-use plastic bags. Most plastic generated is for onetime use and subsequent disposal. The linear economy generates as much plastic garbage as the total weight of the whole human population, 300 million tons. In 2016, the globe generated 45 million tons of electronic garbage (e-waste) worth an estimated EUR 55 billion. Many valuable resources are lost due to an under-recovery of only 20% of waste's potential. A third of the food produced by the world's population is lost or wasted along the production chain and during consumption.

Demographic Shifts

By the end of 2022 or the beginning of 2023, the world's population is expected to officially reach 8 billion people Desjardins (2021). Only a few years ago, we reached the 7 billion mark. There will be 9 billion people on the planet in the next half-century, according to predictions. Carbon emissions are expected to grow as a consequence of the increased demand for fossil fuels. Global population growth is one of four key concerns obstructing our goal of restricting post-industrial global temperature increases to 1.5°C, according to the United Nations' climate council, the Intergovernmental Panel on Climate Change.

According to the World Bank, by 2030 more than 2.5 billion people would have risen out of poverty and urbanize in emerging nations such as India and China. The addition of 2.5 billion individuals to the urban middle class is a once-in-a-generation opportunity for both economic and social advancement. However, one of the biggest tasks ever is to develop the cities to house that 2.5 billion people, to establish the transportation networks to link home and work, and to provide electricity, water, and food to maintain a middle-class lifestyle in the next two decades. The developing nations are striving to achieve the level of economic growth and affluence what the OECD countries took the whole twentieth century to achieve Gates (2021).

Moreover, businesses must be more conscious of the interests and expectations of young consumers when creating offers and promoting their products. Members of Generation Z, in contrast to previous generations, have a radically different outlook, being more ecologically concerned and technologically adept, and preferring companies that can connect with them and enrich their experiences and feelings. Selling items to young consumers may not be plausible without relying on green tactics, either in the manufacturing process or in the marketing of those products based on sustainable principles (Dabija et al., 2019) They place a high priority on finding purpose and meaning in their career and personal life. They want to know about everything they buy, from how does the firm handle its employees to how much of a toll does this have on the environment, including its water and carbon footprints. As Z generations are becoming a more powerful economic force, with radical transparency demanding things from the market and society that preceding generations have not. Their need for sustainability may make it tough to get around it, as stated by Winston (2014).

Convergence of Technological and Ecological Force

Convergence of technological and ecological forces are smoothening the transition to circular business models. To realize the circular economy concept, technological innovations capitalizing on Industry 4 technologies are aiding George et al. (2021). For example, intelligent and connected assets can enable predictive maintenance to extend asset life; block chain can improve supply chain traceability and transparency to decrease waste; and 3D printing of spare parts makes repair easier Kiron & Unruh (2018). Disruptive technologies are causing enormous transformations in the energy, transportation, and agricultural sectors, with far-reaching implications for climate change. The cost of solar power fell from more than $3.30 a kilowatthour in 1970 to less than $0.15 in 2013 and continues to become more accessible and cheaper. In many countries, solar is already one of the cheapest forms of power to build without subsidies. It is more cost-effective than new nuclear, new coal plants, new oil plants, and new gas plants outside the United States (where shale gas has reduced power prices).

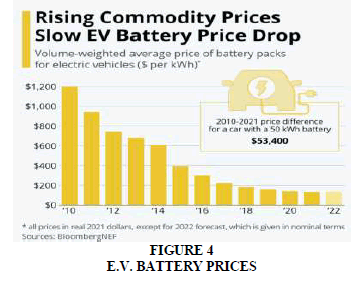

The inflation-adjusted average price of battery packs for cars plummeted from over $1,200 per kWh in 2010 to just $132 this year, as shown in Figure 4. Tesla Model 3's entry-level model has a battery capacity of 50 kWh. This would bring the battery's price down to $6,600 from $60,000 in 2010.

Convergence of Regulatory and Market Forces

Regulatory and market forces are also converging. In mid-2021 the European Commission approved the Fit for 55 package, a collection of legislative recommendations to cut net greenhouse-gas emissions by at least 55% by 2030. Governments are implementing carbon taxes and enacting decarbonization laws. In regards to encouraging the production and purchase of alternative energy vehicles, Europe uses a carrot-and-stick approach. Between 2021 and 2050, investment in infrastructure facilities for energy and land-use systems will amount to $275 trillion, or $9.2 trillion per year on average, an annual growth of up to $3.5 trillion from now.

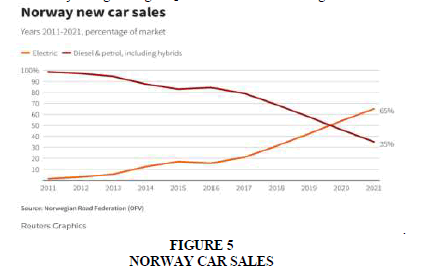

E.V.s now account for 65 percent of all car sales in Norway, Figure 5 (Klesty, 2022). Market pressures and global warming, on the other hand, propel change. Tesla is set to establish a vast new plant near Berlin, and Volkswagen, the world's largest automaker, doubled electric vehicle deliveries last year. Only 8% of new cars sold in Norway last year were powered solely by gasoline or diesel. Electric cars accounted for two-thirds of new automobile sales, with hybrids accounting for the majority of the rest. Norway is propelled by government incentives that make electric vehicles significantly more affordable, including exemptions from parking and toll costs for electric car users. It is reported that Carey (2021) E.V. sales growth in Europe and China has been driven by strengthening CO2 emissions standards and government subsidies.

In this race for net-zero, as highlighted by (Fuchs et al., 2022) mobility, power, and buildings are the three-sector groups that would account for almost 75% of overall investment in physical assets. Around 40% of the budget, with expenditures in electric cars (E.V.s) and charging infrastructure included, would be distributed to mobility. The hare of energy would be 20% of the budget, with investments in renewables such as solar plants and wind farms, transmission and distribution network upgrades, and carbon capture, utilization, and storage (CCUS) technology.

ESG Factors

Investors who control trillions of dollars want to include Environmental, Social, and Governance (ESG) considerations in their portfolio analysis. ESG may boost profits or reduce risk for investors, according to an international poll of 2,000 market players by Kim & Li (2021) find that ESG considerations have a beneficial impact on business profitability, with the effect being more substantial for larger companies. When the IFRS Foundation publicly announced the founding of the International Sustainability Standards Board, or ISSB, which will operate alongside the IFRS Foundation's International Accounting Standards Board, it was the most significant progress in ESG Reporting in a long time Francisco (2021). This represents a huge step toward bringing the currently fragmented reporting landscape together.

Discussion

The financial benefits of sustainability are undeniable (Atasu et al., 2021). A company's ability to effectively manage risk, lower costs, increase brand value and foster innovation is enhanced by operating more sustainably. It is reported that more than 90% of CEOs believe that sustainability concerns are critical to their company's future performance, and 54% believe that sustainability will become a key business strategy for most organizations in the next decade. It is possible for companies to reduce their emissions and energy consumption while generating money since the prices of clean technologies have fallen significantly and other market trends are also getting favorable. Technology, legislation, market disruption, and other variables will have a negative impact on the profitability of firms that refuse to adapt. In addition, the accompanying tension will put strain on everything from operations to hiring and keeping consumers and workers. In contrast, those who are on the right side of this shift will be rewarded by the market forces.

Companies Shifting to Greener Business Models

DONG Energy used to be a coal-heavy utility, but it has transformed into a global leader in green power in less than a generation under its new name. Orsted is the market leader in offshore wind. By scaling up and industrialization, it has pioneered the reduction of offshore wind costs (by -60 percent since 2012) and is currently attempting the same feat with renewable hydrogen Reed (2019). Farmers may utilize Syngenta's tools to enhance and monitor their operations and measure emissions of CO2, as well as the land productivity, water consumption, fertilizer use, and pesticide use to produce sufficient food while simultaneously protecting the environment. The Syngenta Corporation has announced a five-year investment of $2 billion in research and development to assist feed the world's growing population in a sustainable manner. As a consumer, you want to know where your food comes from and how much greenhouse gas (GHG) is created throughout the process. As a consequence, these instruments will play an everincreasing role in the future. As a result of its first-mover advantage, Lenzing has become the world's leading supplier of specialty fibers derived from wood, which are mostly used by sustainable clothing brands Gmt (2022).

Innovators Seizing the Opportunities

Skynrg helps airlines and fuel manufacturers reach agreements to ensure an adequate supply of alternate solutions for aviation fuels. To date, fuels made from used cooking oil, SAF (sustainable aviation fuel), and biofuels have been supplied to Air Canada, Singapore Airlines, KLM/South African Air lines and other airline companies in the region Balch (2021). More than 80% of greenhouse gas emissions have been eliminated. As an alternative to kerosene lamps, MKOPA solar builds rooftop solar systems for consumers. Mobile phones (through M-Pesa money transfers) are used to sell the network to clients, who then own it outright after a year and are able to upgrade to solar-powered gadgets (such as stoves and TVs) and other amenities Faris (2015). Power is now available to more than 700,000 homes thanks to a partnership between the corporation and electronics recycling companies. Solidia teamed with Lafarge Holcim to develop a CO2 cured cement that reduces carbon intensity and acts as a CO2 sink, boosting manufacturing capacity owing to a shorter time to cure. GHG emissions were reduced by 70%.

Conceptual Model of Circular Business Value Creation

The intersection of sustainability imperatives has resulted in some of the most interesting research concepts and business endeavors. Countries and corporations alike face the greatest danger to their existence from climate change, and sustainability is undoubtedly one of the most pressing challenges confronting them currently. This leads to capturing new market dynamics while simultaneously decarbonizing and restoring ecosystems and generating trillions of dollars in value for the global economy.

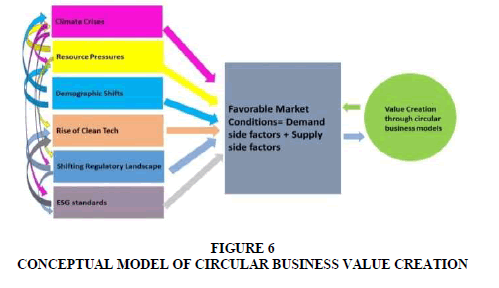

To summarize, we propose a conceptual model of circular business value creation in Figure 6, which presents the 6-forces such as Climate crises, Resource pressures, Demographic shifts, Rise of clean tech, Shifting regulatory landscape and ESG standards, converge and act to create favorable market conditions for innovations and subsequent value creation using circular business models.

This mega opportunity for wealth creation is propelled by the need to sustain the global population with an addition of 2.5 billion to the middle income group, is to embed highproductivity economic growth in the less developed and developing countries. For innovators and entrepreneurs who can unleash productivity that outperforms difficulties and disruptions to drastically enhance living standards and to capture value from these opportunities, a new entrepreneurial action underpinning the principles of circular economy is necessary.

Conclusion

Drawing on examples of real business cases, the researchers highlight that not only businesses can afford the financial consequences of sustainability in their economic value creation process by switching to circular business models, they must consider embedding sustainability into their core strategy and capital allocation processes. Convergence of the above mentioned 6 forces as presented in the conceptual model instead refuting the argument of Milton Friedman that says ‘when valuing a stock, the primary focus should be on the company's financial value, and bottom-line earnings’ still support it, while making his thought ‘socially responsible corporate expenditures as "nonessential expenses" that eat into corporate and shareholder profits’, redundant. However technology is critical to bringing the idea of a circular economy to life on a large scale. Significant productivity gains industrial technology and architecture may be improved by integrating information technology, nanoscale materials science, and biology. This paper aims to observe, analyze, and share findings with the industry and the model's goal is to propose market offerings that improve socioecological outcomes directly, particularly in emerging and developing economies.. The proposed model provides a framework that can serve as a foundation for future research as well as a road map for all stakeholders. The current study is done by reviewing literature available in this filed and most of the facts presented are limited to advanced economies who already have a net zero strategy. Future researchers can further the study by considering country specific and industry specific variables. Quantifying the positve and negative synergies across the moderating varaibles identified in the proposed conceptual model, in the context of emerging and underdeveloped economies, as future areas of research would be of partucluar value for the policy makers. Screening the most significant force among the 6 forces identified could also be a theme for future research.

Disclosure Statement

The authors report there are no competing interests to declare.

References

Arbib, J., & Seba, T. (2020).Rethinking Humanity: Five Foundational Sector Disruptions, the Lifecycle of Civilizations, and the Coming Age of Freedom. RethinkX.

Atasu, A., Dumas, C., & Van Wassenhove, L. N. (2021). The Circular Business Model. Pick a Strategy That Fits Your Resources and Capabilities.Harvard Business Review from the Magazine.

Bakshi, B.R., & Fiksel, J. (2003). The quest for sustainability: Challenges for process systems engineering.AICHE journal,49(6), 1350-1358.

Balch, O. (2021). Sustainable aviation fuel seeks clearance for rapid lift-off. 1–9.

Balogun, A.L., Tella, A., Baloo, L., & Adebisi, N. (2021). A review of the inter-correlation of climate change, air pollution and urban sustainability using novel machine learning algorithms and spatial information science.Urban Climate,40, 100989.

Indexed at, Google Scholar, Cross Ref

Bertini, M., Pineda, J., Petzke, A., & Izaret, J. M. (2021). Can We Afford Sustainable Business?.MIT Sloan Management Review,63(1), 25-33.

Bocken, N., Boons, F., & Baldassarre, B. (2019). Sustainable business model experimentation by understanding ecologies of business models.Journal of Cleaner Production,208, 1498-1512.

Indexed at, Google Scholar, Cross Ref

Bojovic, N., Genet, C., & Sabatier, V. (2018). Learning, signaling, and convincing: The role of experimentation in the business modeling process.Long Range Planning,51(1), 141-157.

Indexed at, Google Scholar, Cross Ref

Carey, B. N. (2021). Global EV sales accelerating, but government help needed – IEA. 1–16.

Comin, L.C., Aguiar, C.C., Sehnem, S., Yusliza, M.Y., Cazella, C.F., & Julkovski, D.J. (2019). Sustainable business models: a literature review.Benchmarking: An International Journal.

Companys, Y.E., & McMullen, J.S. (2007). Strategic entrepreneurs at work: The nature, discovery, and exploitation of entrepreneurial opportunities.Small Business Economics,28(4), 301-322.

Cosenz, F., & Noto, G. (2018). A dynamic business modelling approach to design and experiment new business venture strategies.Long Range Planning,51(1), 127-140.

Indexed at, Google Scholar, Cross Ref

Courtney, H., Kirkland, J., & Viguerie, P. (1997). Strategy under uncertainty.Harvard business review,75(6), 67-79.

Dabija, D.C., Bejan, B.M., & Dinu, V. (2019). How sustainability oriented is Generation Z in retail? A literature review.Transformations in Business & Economics,18(2).

Desjardins, J. (2021). Population Boom: Charting how we got to nearly 8 billion people. 1–10.

Fagerberg, J., Fosaas, M., & Sapprasert, K. (2012). Innovation: Exploring the knowledge base.Research policy,41(7), 1132-1153.

Indexed at, Google Scholar, Cross Ref

Faris, S. (2015). The solar company making a profit on poor Africans.Bloom. Businessweek, 1-11.

Francisco, S.A.N. (2021). Value Reporting Foundation?: IFRS Foundation announces International Sustainability Standards Board , consolidation with CDSB. 1-5.

Fuchs, S., Hatami, H., Huizenga, T., Schmitz C. (2022) Here comes the 21st century’s first big investment wave. Is your capital strategy ready?.

Gates, B. (2021). How to avoid a climate disaster: the solutions we have and the breakthroughs we need. Penguin U.K.

Geissdoerfer, M., & Vladimirova, D. Evans St.,(2018), Sustainable business model innovation: A review.Journal of Cleaner Production,198, 10.

George, G., Merrill, R.K., & Schillebeeckx, S.J. (2021). Digital sustainability and entrepreneurship: How digital innovations are helping tackle climate change and sustainable development.Entrepreneurship Theory and Practice,45(5), 999-1027.

Indexed at, Google Scholar, Cross Ref

Gieure, C., del Mar Benavides-Espinosa, M., & Roig-Dobón, S. (2020). The entrepreneurial process: The link between intentions and behavior.Journal of Business Research,112, 541-548.

Indexed at, Google Scholar, Cross Ref

Gmt, A.M. (2022). EQS-News: Lenzing AG: Lenzing Group with strong operating result in.10–14.

Heck, S., Rogers, M., & Carroll, P. (2014).Resource revolution: how to capture the biggest business opportunity in a century. Houghton Mifflin Harcourt.

Heshmati, A. (2016). A Review of the Circular Economy and its Implementation.

Jensen, H.H. (2022). 5 circular economy business models that offer a competitive advantage, 1–8.

Kim, S., & Li, Z. (2021). Understanding the impact of ESG practices in corporate finance.Sustainability,13(7), 3746.

Indexed at, Google Scholar, Cross Ref

Kiron, D., & Unruh, G. (2018). The convergence of digitalization and sustainability.MIT Sloan Management Review,17.

Klesty, V. (2022). Electric cars hit 65% of Norway sales as Tesla grabs overall pole. Reuters, 1–15.

Laasch, O. (2018). Beyond the purely commercial business model: Organizational value logics and the heterogeneity of sustainability business models.Long Range Planning,51(1), 158-183.

Indexed at, Google Scholar, Cross Ref

Lanzolla, G., & Markides, C. (2021). A business model view of strategy.Journal of Management Studies,58(2), 540-553.

Indexed at, Google Scholar, Cross Ref

Larson, A.L., Teisberg, E.O., & Johnson, R.R. (2000). Sustainable business: opportunity and value creation.Interfaces,30(3), 1-12.

Lee, H.J. (2019). What factors are necessary for sustaining entrepreneurship?.Sustainability,11(11), 3022.

Indexed at, Google Scholar, Cross Ref

Leong, D. (2021). Entrepreneurial Energy in a Far-From-Equilibrium Opportunity Driving Entrepreneurial Actions.Journal of Entrepreneurship, Business and Economics,9(1), 1-31.

Indexed at, Google Scholar, Cross Ref

McMullen, J.S., & Shepherd, D.A. (2006). Entrepreneurial action and the role of uncertainty in the theory of the entrepreneur.Academy of Management review,31(1), 132-152.

Indexed at, Google Scholar, Cross Ref

Murray, A., Skene, K., & Haynes, K. (2017). The circular economy: an interdisciplinary exploration of the concept and application in a global context.Journal of business ethics,140(3), 369-380.

Nasir, M.H.A., Genovese, A., Acquaye, A. A., Koh, S.C.L., & Yamoah, F. (2017). Comparing linear and circular supply chains: A case study from the construction industry.International Journal of Production Economics,183, 443-457.

Indexed at, Google Scholar, Cross Ref

Nosratabadi, S., Mosavi, A., Shamshirband, S., Zavadskas, E. K., Rakotonirainy, A., & Chau, K.W. (2019). Sustainable business models: A review.Sustainability,11(6), 1663.

Indexed at, Google Scholar, Cross Ref

Nubholz, J. L. (2017). Circular business models: Defining a concept and framing an emerging research field.Sustainability,9(10), 1810.

Indexed at, Google Scholar, Cross Ref

Osterwalder, A. Pigneur, Y., & Tucci, CL. (2005). Clarifying Business Models: Origins, Present, and Future of the Concept.Communications of the Association for Information Systems, 16á (1), 1-25.

Osterwalder, A., & Pigneur, Y. (2011). Aligning Profit and Purpose through Business Model Innovation. Responsible Management Practices for the 21st Century, 61–75

Reed, B. S. (2019). Can a Leader in Offshore Wind Power Succeed in the United States?. 12–15.

Robert, K.H. (2000). Tools and concepts for sustainable development, how do they relate to a general framework for sustainable development, and to each other?.Journal of cleaner production,8(3), 243-254.

Indexed at, Google Scholar, Cross Ref

Rosado-Cubero, A., Freire-Rubio, T., & Hernández, A. (2022). Entrepreneurship: What matters most.Journal of Business Research,144, 250-263.

Indexed at, Google Scholar, Cross Ref

Rusu, V.D., & Roman, A. (2017). Entrepreneurial activity in the EU: An empirical evaluation of its determinants.Sustainability,9(10), 1679.

Santa-Maria, T., Vermeulen, W.J., & Baumgartner, R.J. (2022). The Circular Sprint: Circular business model innovation through design thinking.Journal of Cleaner Production, 132323.

Indexed at, Google Scholar, Cross Ref

Sarasvathy, S. (2014). The downside of entrepreneurial opportunities.Management,17(4), 305-315.

Sastre, C.G., del Mar Benavides-Espinosa, M., & Ribeiro-Soriano, D. (2022). When intentions turn into action: pathways to successful firm performance.International Entrepreneurship and Management Journal,18(2), 733-751.

Schumpeter, J. (1928). The instability of capitalism.The economic journal,38(151), 361-386.

Indexed at, Google Scholar, Cross Ref

Siegel, D.S., & Renko, M. (2012). The role of market and technological knowledge in recognizing entrepreneurial opportunities.Management Decision.

Skeete, J.P. (2018). Level 5 autonomy: The new face of disruption in road transport.Technological Forecasting and Social Change,134, 22-34.

Indexed at, Google Scholar, Cross Ref

Suddaby, R., Bruton, G.D., & Si, S.X. (2015). Entrepreneurship through a qualitative lens: Insights on the construction and/or discovery of entrepreneurial opportunity.Journal of Business venturing,30(1), 1-10.

Indexed at, Google Scholar, Cross Ref

Teece, D. J. (2018). Business models and dynamic capabilities.Long range planning,51(1), 40-49.

Indexed at, Google Scholar, Cross Ref

Thrane, C., Blenker, P., Korsgaard, S., & Neergaard, H. (2016). The promise of entrepreneurship education: Reconceptualizing the individual–opportunity nexus as a conceptual framework for entrepreneurship education.International Small Business Journal,34(7), 905-924.

Indexed at, Google Scholar, Cross Ref

Wilson, M., Wnuk, K., Silvander, J., & Gorschek, T. (2018). A literature review on the effectiveness and efficiency of business modeling.E-Informatica Software Engineering Journal,12(1).

Indexed at, Google Scholar, Cross Ref

Winston, A. (2014).The big pivot: Radically practical strategies for a hotter, scarcer, and more open world. Harvard Business Review Press.

Indexed at, Google Scholar, Cross Ref

Wolcott, R.C., & Lippitz, M.J. (2007). The four models of corporate entrepreneurship.MIT Sloan management review,49(1), 75.

Received: 04-Aug-2022, Manuscript No. AJEE-22-12450; Editor assigned: 06-Aug -2022, PreQC No. AJEE-22-12450(PQ); Reviewed: 19-Aug-2022, QC No. AJEE-22-12450; Revised: 22-Aug -2022, Manuscript No. AJEE-22-12450(R); Published: 29-Aug -2022