Review Article: 2024 Vol: 28 Issue: 5

Studying Influence of Social Background on Mobile Wallet Adoption and Consumer Decision Making Through Structural Equational Modelling

Ritu, The NorthCap University, Gurugram

Preeti Chawla, The NorthCap University, Gurugram

Citation Information: Ritu., & Chawla, P. (2024). Studying influence of social background on mobile wallet adoption and consumer decision making through structural equational modelling. Academy of Marketing Studies Journal, 28(5), 1-10.

Abstract

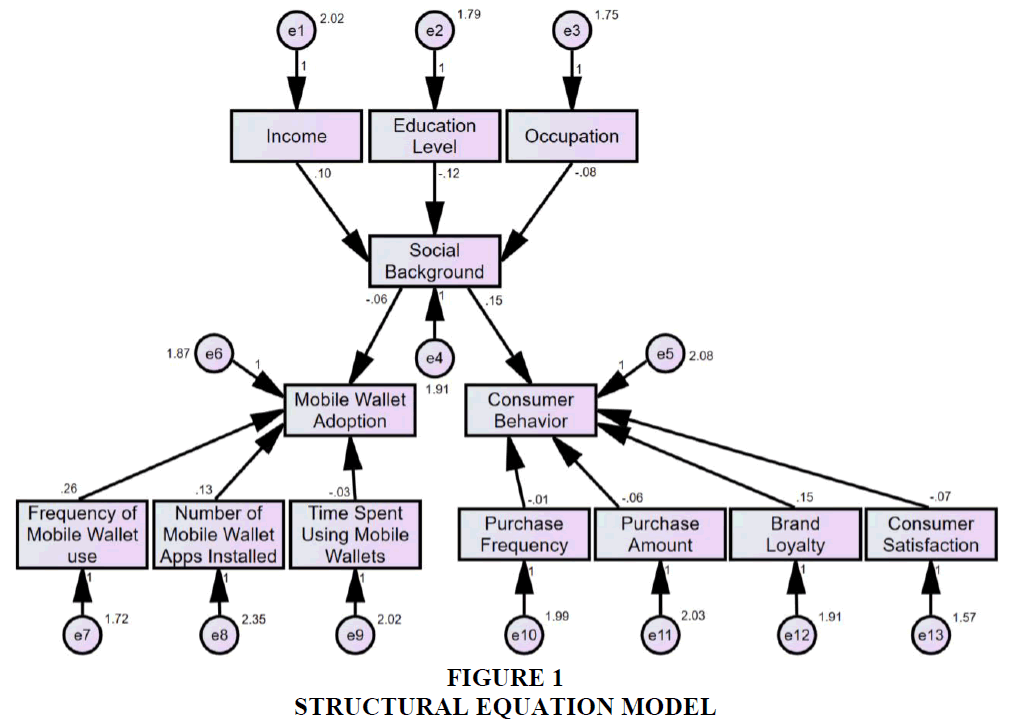

Background: Mobile wallets have become a ubiquitous feature of contemporary financial transactions. Understanding the factors that influence their adoption and their impact on consumer behavior is crucial in today's digital economy. Social background, encompassing income, education, and occupation, plays a pivotal role in shaping individuals' financial choices and consumption patterns. Objective: The major goal of this study is to analyse the complex connections between demographics, mobile wallet use, and customer preferences. Byemploying Structural Equation Modeling (SEM), we aim to shed light on how a person's social background influences their propensity to adopt mobile wallets and consumer behavior. Methodology: This quantitative analysis uses survey data from a varied sample of mobile wallet users. A SEM model with variables for social background, mobile wallet usage, and consumer behavior is created. Income, education, employment, mobile wallet usage, number of applications installed, time spent using mobile wallets, purchase frequency, quantity, brand loyalty, and customer happiness are observed factors. Findings: We found solid evidence that social background affects mobile wallet uptake and customer behavior. Income increases mobile wallet use, education increases app installs, and employment influences use. Mobile wallet use increases purchase frequency, quantity, brand loyalty, and customer pleasure. Importantly, social context indirectly impacts customer behavior via mobile wallet uptake. Conclusion: This research shows that social context strongly influences mobile wallet uptake and customer behavior. It stresses that enterprises and regulators must address socio-demographic characteristics that affect digital financial instrument use.

Keywords

Social background, mobile wallet adoption, consumer behavior, Structural Equation Modeling (SEM), income, education, occupation, digital finance, digital wallets, financial technology.

Introduction

In the ever-evolving landscape of digital finance, the ubiquity of smartphones has catalyzed a significant transformation in the way individuals conduct financial transactions. The rise of mobile wallets, often referred to as digital wallets or e-wallets, has been nothing short of revolutionary. These digital financial tools allow users to store, manage, and transact funds seamlessly through their mobile devices, offering an easy and quick replacement for paper checks and bank wires. As mobile wallets gain traction globally, it becomes increasingly imperative to dissect the intricate dynamics that underlie their adoption and the subsequent impact on consumer behavior.

Apple Pay and other mobile payment systems, Google Pay, and PayPal, have transcended their initial role as a mere payment mechanism. They have evolved into comprehensive platforms, offering users an array of financial services ranging from peer-to-peer (P2P) payments, bill payments, ticket bookings, and even investment opportunities. Consequently, these digital tools have become an integral component of modern financial ecosystems, disrupting conventional banking systems and fostering financial inclusion for the unbanked and underbanked populations.

Given the pervasive nature of mobile wallets, understanding the factors that influence their adoption and the subsequent ramifications on consumer behavior is paramount. The adoption of mobile wallets is not a uniform process; it is influenced by various factors, and one of the most prominent among them is an individual's social background. Social background, which encompasses dimensions like income, education level, and occupation, is a significant determinant of an individual's financial choices and consumption patterns. It shapes the way people perceive and interact with financial technology, including mobile wallets.

This research embarks on an exploration of the complex interplay between social background, mobile wallet adoption, and consumer behavior. By harnessing the power of The purpose of this research is to offer a thorough grasp of the use of Structural Equation Modeling (SEM), a powerful statistical approach that allows for the evaluation of complex interactions between latent and observable variables. How an individual's social background influences their propensity to adopt mobile wallets. Additionally, it seeks to unravel how mobile wallet usage, in turn, shapes consumer behavior.

Background: The Mobile Wallet Phenomenon

The advent of mobile wallets marks a pivotal juncture in the history of financial technology. Mobile wallets, sometimes referred to as mobile money or e-wallets, enable users to store their financial resources digitally, facilitating seamless transactions at the swipe of a smartphone screen. Unlike traditional payment methods that involve physical cards or cash, mobile wallets offer a contactless and cashless mode of conducting financial transactions.

The mobile wallet ecosystem is incredibly diverse, featuring a plethora of providers, each offering unique features and services. Apple Pay, for instance, leverages Near Field Communication (NFC) technology to enable secure contactless payments using an iPhone or Apple Watch. Google Pay, on the other hand, integrates seamlessly with Android devices, offering users a wide range of functionalities beyond payments, such as loyalty card storage and transit ticketing. PayPal, a veteran in the digital payment industry, provides users with a versatile platform for online payments and P2P transfers.

The appeal of mobile wallets extends beyond convenience. They enhance security by replacing sensitive card information with encrypted tokens, reducing the risk of data breaches and fraud. Furthermore, mobile wallets meet the requirements of those who may not be able to use conventional banking services, such as the unbanked and the underbanked. But possess a mobile device. These digital tools facilitate financial inclusion by offering a gateway to formal financial services.

Objective

The major goal of this study is to examine the nexus between socioeconomic status, mobile wallet use, and consumer behavior. In the modern digital age, individuals' financial decisions are increasingly influenced by a myriad of factors, some overt, and others subtle. Among these factors, social background stands out as a fundamental yet often overlooked determinant of financial choices.

Review of Literature

(Kapoor et al., 2013) The research investigates how different characteristics of innovations influence the choices made by consumers and their willingness to use interbank mobile payment services. It bases its indicators on the price and the idea of innovation spread developed by Rogers. Positive correlations were found between the variables of relative advantage, compatibility, complexity, and testability. While behavioral intention and cost significantly influence adoption.

(Thakur & Srivastava, 2014) This paper tests the dependence of Mobile Payments Adoption Readiness, Perceived Risk, and Intention to Use in India. We created a whole model that factors in AR, individual inventiveness, and public relations. Structural equation modelling was used for empirical testing of the model, which revealed substantial variation between users and non-users. The findings provide light on consumer attitudes about new financial technologies and point the way toward avenues for more study.

(Madan & Yadav, 2016 The research delves into the variables that end up swaying customers to use mobile wallets. In a survey of more than 210 mobile phone users, the researchers analyzed the relationships between job satisfaction, job satisfaction expectations, social influence, job satisfaction enabling conditions, job satisfaction risk, job satisfaction value, job satisfaction PRS, and promotion. Advantages were all important predictors. However, the expected value of effort was determined to be non-significant. The results might be useful for developers of mobile wallet apps, financial institutions, and other relevant parties. Develop strategic frameworks to encourage mobile wallet adoption. This is the first study of its kind in India.

(Chakraborty & Mitra, 2018) The research study investigates customer demographics' influence on e-wallet adoption in India, identifying key factors and segmenting the market into different customer groups. The regression model explained 81.7% of adoption intention, revealing three distinct customer segments with distinct criteria, aiding digital wallet companies in understanding Indian consumers' adoption decisions.

(Chawla & Joshi, 2019) The study explores factors influencing consumer attitudes towards mobile wallets in India, using a multidisciplinary model and a nationwide survey. Results indicate that one's perspective has a major role in determining one's attitude. The findings have managerial implications for companies to enhance usage and adoption.

(Shaw & Kesharwani, 2019) The study explores the impact of smartphone dependency on the spread of mobile wallet payment systems in developing countries like India. Using data from a survey taken by 512 young customers, it shows how dependent people are on their smartphones. The results stress the need of communicating clearly and focusing on the correct audience. Base, potentially enhancing internet business opportunities.

(Sinha et al., 2019) This study examines Analysis of Indian customers' interest in using mobile payment services, taking into account their adoption readiness (AR), technical readiness (TR), and privacy concerns (PCs). Based on responses from 600 people, we know that AR favorably mediators the connection between TR and the likelihood that people would start using mobile payment services, whereas personal computers adversely moderate the effect. In a society that is quickly embracing digital technology, this research emphasizes the significance of knowing attitudes about TR among rookie users. Mobile payment technology has the potential to improve India's economy and alleviate some of the country's social problems. but privacy concerns may face greater resistance in the future.

(Sinha & Singh, 2019) Customers' interest in and contentment with using a mobile wallet were evaluated using the UTAUT model. Key factors for adoption were found, including usability, trustworthiness, usefulness, attitude, social norms, perceived risk, and novelty. The research was an attempt to apply the UTAUT paradigm to the situation in India.

(Patil et al., 2020) This study seeks to identify the most significant elements impacting Indian customers' adoption of mobile payment systems; India is the world's second-largest mobile subscriber market. The Consumer Acceptance Modified Technology Acceptance Model was used to analyze consumer behaviour.meta-UTAUT model. Positive predictors of mobile payment use were high performance expectations, desire to use, and access to grievance resolution. The research highlights the significance of mindset in studies of consumer uptake.

(Singh & Sinha, 2020) Factors such as compatibility, usability, awareness, cost, consumer value addition, and trust are examined as they pertain to the acceptance and usage of mobile wallets in the retail sector. Using an empirical model, the study surveyed 315 Indian business owners and found that the perceived value addition to customers had the greatest impact on the businesses' intentions to adopt new technologies. Researchers concluded that mobile payment providers may benefit from knowing what variables influence merchant uptake.

(Singh et al., 2020) This research looks at what makes people want to, like using, and suggest mobile wallets. It analyses 206 answers from an online and manual survey conducted in India using TAM and UTAUT2 versions of the models. According to the findings, users' purpose, happiness, and willingness to suggest are all heavily impacted by how they are risk, usefulness, and attitude. The research establishes a standard for gauging the effects of individual and societal psychological, social, and threat elements on technology adoption.

(Kumar et al., 2021) We investigate how individuals' attitudes about e-wallets change depending on factors such their perceived utility, convenience usage, social impact, favorable environment, lifestyle suitability, and confidence. The data from 501 participants was analyzed using PLS-SEM. Perceived usefulness, ease of use, social impact, lifestyle compatibility, and trust were shown to be significant drivers of e-wallet acceptance. Lifestyle compatibility was regulated by age and gender. The results may be used by managers and policymakers to better encourage e-wallet use in low-income regions.

(Kapoor et al., 2022) The study explores employing a mediated-moderation approach to examine the desire to embrace mobile wallets during the COVID-19 epidemic. Considerations such as relative benefit, factors such as infrastructure, safety, touch lessness, and simplicity of use are analyzed using the stimulus-organism-response hypothesis. Considerations such as perceived value, critical mass, promotional advantages, and user demographics all factor into the model. The findings can help marketers develop strategies to enhance m-wallet adoption.

(Mukhopadhyay & Upadhyay, 2022) This paper examines the effect of platform competition and institutional action on the propensity to adopt and continue using platform-based payment services. Institutional interventions improve people's willingness to utilize mobile payment, leading to the establishment of various platforms, as shown by a single case study of India's high-value banknote demonetization. Competition across platforms also has a favorable effect on users' willingness to stay around. The research shows that user inertia can be lowered and numerous platform-based service providers may be encouraged via well-designed interventions.

(Purohit et al., 2022) This study explores the psychological and behavioral aspects acceptance and continued use of mobile payment systems. The research surveyed 351 users and found that factors including happiness, ease of use, expectations of difficulty, and overall satisfaction all play a role in consumers' likelihood of sticking around. Expectations about future effort and performance also play a role in shaping how likely a person is to stick with an activity. The findings of this study may have significant bearing on the service sector. Creation of novel approaches to enhancing the online experience and retaining customers.

(Chawla & Joshi, 2023) This article investigates user desire to use mobile wallets in India and the moderating function of expectancy fulfilment, confidence, and disposition. TAM and UTAUT are adapted in this research, along with data from 744 participants. Only two of the possible directions had complete mediation, while the others had partial mediation. The study examines implications for future research and adds to the body of knowledge on attitude and intention by exploring the effects of several mediating interactions.

(Gupta & Prusty, 2023) E-payment methods have grown in popularity as a result of advancements in ICT, yet consumers still face difficulties while making purchases online. E-payment uptake was shown to be positively correlated with consumers' levels of digital knowledge, digital competence, and digital engagement, according to research grounded on the philosophy of consumer empowerment. We can learn more about what drives people to utilize electronic payment methods thanks to this study. Systems in emerging economies like India and gives policymakers a road map for facilitating this trend.

(P.H., 2023) The increasing The growing need for mobile payment systems in India calls for research into the elements that affect consumers' willingness to accept and use new forms of financial technology (FinTech). This research looks at how people in India feel about using FinTech, and how it relates to how ready they are to embrace it. The results reveal that the degree of confidence people have in a company has a tiny but substantial effect on their willingness to accept and utilize FinTech. The relevance of customer-friendly service circumstances, including usability and perceived value, is also highlighted. This research extends the technology adoption model (TAM) to account for concerns about cyberattacks and data breaches among Indian banking customers.

Methodology

To achieve the research objective, a robust quantitative research approach is employed, harnessing the capabilities of Modeling using Structural Equations (SEM). SEM is a sophisticated method of statistical analysis. That excels in deciphering complex relationships among variables, particularly in cases where latent constructs are involved. In this study, SEM serves as the analytical framework that connects social background, mobile wallet adoption, and consumer behavior.

The research design involves the collection of survey data from a diverse sample of mobile wallet users. These users are drawn from various socio-demographic backgrounds, ensuring a representative dataset. The model constructed for SEM comprises latent variables representing social background, mobile wallet adoption, and consumer behavior, alongside observed variables that capture specific aspects of these constructs.

Findings: Reliability Analysis

The case processing summary indicates that there was a total of 200 cases included in your analysis, all of which were considered valid and none were excluded. Additionally, the Cronbach's alpha indicates a high degree of confidence in the data at0.901. This statistic suggests that the items or variables you have used in your analysis are internally consistent, indicating a strong level of reliability in your research instrument Tables 1-5.

| Table 1 Case Processing Summary | ||

| N | ||

| Cases | Valid | 200 |

| Excludeda | 0 | |

| Total | 200 | |

| Reliability Statistics | ||

| Cronbach's Alpha | N of Items | |

| 0.901 | 13 | |

| Table 2 Correlations | |||

| Variable | Mobile Wallet Adaption | Consumer Behavior | |

| Social Background | Pearson Correlation | 0.823 | 0.743 |

| Sig. (2-tailed) | 0.033 | 0.011 | |

| Table 3 KMO and Bartlett's Test | ||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | 0.641 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 63.219 |

| df | 78 | |

| Sig. | 0.048 | |

| Table 4 Communalities | ||

| Initial | Extraction | |

| VAR00001 | 1.000 | 0.598 |

| VAR00002 | 1.000 | 0.708 |

| VAR00003 | 1.000 | 0.678 |

| VAR00004 | 1.000 | 0.709 |

| VAR00005 | 1.000 | 0.615 |

| VAR00006 | 1.000 | 0.739 |

| VAR00007 | 1.000 | 0.517 |

| VAR00008 | 1.000 | 0.614 |

| VAR00009 | 1.000 | 0.740 |

| VAR00010 | 1.000 | 0.698 |

| VAR00011 | 1.000 | 0.738 |

| VAR00012 | 1.000 | 0.632 |

| VAR00013 | 1.000 | 0.478 |

| Extraction Method: Principal Component Analysis. | ||

| Table 5 Model Fit Summary | |||

| Measure | Estimate | Threshold | Interpretation |

| CMIN | 120.8 | -- | -- |

| DF | 80 | -- | -- |

| CMIN/DF | 1.51 | Between 1 and 3 | Excellent |

| RMSEA | 0.070 | <0.06 | Acceptable |

| P-Close | 0.078 | >0.05 | Excellent |

Correlation Analysis

The correlation analysis presented reveals the relationships between the variables: "Mobile Wallet Adaption, Consumer Behavior, and Social Background." The Pearson correlation coefficient between "Mobile Wallet Adaption and Consumer Behavior" is 0.823, pointing to the existence of a robust positive relationship between these two factors. This shows that as the use of mobile payment systems grows, consumer behavior becomes more favorable or aligned with the attributes being measured.

Similarly, the correlation between "Social Background and Consumer Behavior" is also positive, with a coefficient of 0.743. This implies that there is a strong inverse correlation between individuals' social backgrounds and their consumer behavior. In other words, people with certain social backgrounds tend to exhibit specific consumer behaviors.

The p-values associated with these correlations are 0.033 for "Mobile Wallet Adaption" and 0.011 for "Social Background." These p-values are below the conventional significance level of 0.05, showing statistically significant associations between thevariables. Therefore, the relationships identified in your data are unlikely to have occurred by chance.

Factor Analysis

Your analysis has a KMO of 0.641, which indicates that your sampling is sufficiently large. The adequacy of your data for factor analysis is evaluated by this statistic. In general, your data will be reasonably if the KMO is more than 0.5, it may be used in a factor analysis.

The Bartlett Sphericity Testoutcomes, which determine whether correlations between variables are statistically significant enough to go on with factor analysis. The associated p-value is 0.048, and the chi-square approximation is 63.219 (with 78 degrees of freedom). If the correlations among the variables are substantially different from zero, as shown by a p-value less than 0.05, then the factor analysis is more likely to be correct.

These values provide a percentage of the total variation for each variable that is retained in the extracted components. In PCA, some variance may be lost during the dimensionality reduction process. The extracted communalities give insight into how much information each variable contributes to the extracted components. Higher communalities suggest that the variable contributes more to the extracted factors. It's important to consider these communalities when interpreting the results of your factor analysis.

Structural Equation Model

The analysis of the SEM model yields intriguing insights into the relationships under scrutiny. Income is found to exert a favorable effect on the regularity with which mobile wallet use, revealing that individuals with higher income levels tend to adopt mobile wallets more enthusiastically. Education level, conversely, demonstrates a significant correlation with the number of mobile wallet apps installed, suggesting that higher educational attainment may result in a greater willingness to explore and utilize various digital wallet services. Occupation emerges as a predictor of the time spent using mobile wallets, indicating that the specifics of one's job affect shaping their mobile wallet usage patterns.

Beyond the realm of mobile wallet adoption, the study underscores the profound impact of digital wallet usage on consumer behavior. Increased mobile wallet usage is associated with higher purchase frequencies, larger purchase amounts, enhanced brand loyalty, and greater consumer satisfaction. This highlights the transformative potential of mobile wallets in shaping not only how individuals make payments but also how they engage with the broader consumer landscape.

Furthermore, the research unearths a crucial insight regarding the indirect influence of social background on consumer behavior. Social background, through its impact on mobile wallet adoption, can indirectly mold consumer behavior. This indirect effect underscores the nuanced relationship between socio-demographic factors and financial choices, emphasizing the intricate pathways through which individuals navigate the digital financial terrain Figure 1.

The table summarizes several fit indices for a structural equation model. These indices are used to evaluate how well a model fits the data. the data. Here's an interpretation of the indices provided:

The CMIN/DF ratio is 1.51. Generally, a CMIN/DF ratio between 1 and 3 is considered excellent. In this case, the value of 1.51 falls within this range, indicating your model's ability to explain the facts well. RMSEA is 0.070. An RMSEA of less than 0.06 is considered acceptable. While RMSEA value is slightly above this threshold, it is still within a reasonable range and suggests a reasonably good fit for your model. The P-Close value is 0.078. P-Close assesses the close model-data compatibility. A value greater than 0.05 is considered excellent, a strong correlation between the model and the data. In your case, the P-Close value of 0.078 meets this criterion.

In summary, based on the fit indices, structural equation model appears to have a reasonably good fit to the data. The CMIN/DF ratio falls within the excellent range, and both RMSEA and P-Close indicate an acceptable to excellent fit.

Conclusion: Navigating the Digital Financial Landscape

In a world where financial technology continues to evolve at an unprecedented pace, mobile wallets have emerged as pivotal agents of change. Their widespread adoption, fueled by the proliferation of smartphones and the quest for convenience, has reshaped the financial landscape. However, their adoption is not uniform, and it is imperative to recognize that social background plays a pivotal role in shaping how individuals embrace this digital revolution.

The findings of this study help shed light on the growing popularity of mobile wallets and its implications for consumer behavior. By elucidating the multifaceted relationships between social background, mobile wallet adoption, and consumer behavior, it equips businesses and policymakers with valuable insights. These insights are vital for crafting effective marketing strategies, tailoring financial products, and formulating policies that promote financial inclusion in a rapidly evolving digital era.

In the pages that follow, we embark on a comprehensive exploration of these relationships, guided by the rigorous principles of Structural Equation Modeling. As we traverse the intricate pathways of mobile wallet adoption and consumer behavior, we endeavor to illuminate the multifaceted world of digital finance and the pivotal role that social background plays within it.

References

Chakraborty, S., & Mitra, D. (2018). A Study on Consumers’ Adoption Intention for Digital Wallets in India. International Journal on Customer Relations, 6(1), 38-57.

Chawla, D., & Joshi, H. (2019). Consumer attitude and intention to adopt mobile wallet in India – An empirical study. International Journal of Bank Marketing, 37(7), 1590–1618.

Indexed at, Google Scholar, Cross Ref

Chawla, D., & Joshi, H. (2023). Role of Mediator in Examining the Influence of Antecedents of Mobile Wallet Adoption on Attitude and Intention. Global Business Review, 24(4), 609–625.

Indexed at, Google Scholar, Cross Ref

Gupta, S., & Prusty, S. (2023). Does consumer empowerment influence e-payment systems adoption? A digital consumer-centric perspective. Journal of Financial Services Marketing.

Indexed at, Google Scholar, Cross Ref

Kapoor, A., Sindwani, R., Goel, M., & Shankar, A. (2022). Mobile wallet adoption intention amid COVID-19 pandemic outbreak: A novel conceptual framework. Computers & Industrial Engineering, 172, 108646.

Indexed at, Google Scholar, Cross Ref

Kapoor, K., Dwivedi, Y.K., & Williams, M.D. (2013). Role of Innovation Attributes in Explaining the Adoption Intention for the Interbank Mobile Payment Service in an Indian Context. In Y. K. Dwivedi, H. Z. Henriksen, D. Wastell, & R. De’ (Eds.), Grand Successes and Failures in IT. Public and Private Sectors (Vol. 402, pp. 203–220). Springer Berlin Heidelberg.

Kumar, V., Nim, N., & Agarwal, A. (2021). Platform-based mobile payments adoption in emerging and developed countries: Role of country-level heterogeneity and network effects. Journal of International Business Studies, 52(8), 1529–1558.

Indexed at, Google Scholar, Cross Ref

Madan, K., & Yadav, R. (2016). Behavioural intention to adopt mobile wallet: A developing country perspective. Journal of Indian Business Research, 8(3), 227–244.

Indexed at, Google Scholar, Cross Ref

Mukhopadhyay, S., & Upadhyay, P. (2022). Institutional intervention in technology innovation: The struggle to increase mobile payment adoption. Digital Policy, Regulation and Governance, 24(1), 74–92.

Indexed at, Google Scholar, Cross Ref

Patil, P., Tamilmani, K., Rana, N. P., & Raghavan, V. (2020). Understanding consumer adoption of mobile payment in India: Extending Meta-UTAUT model with personal innovativeness, anxiety, trust, and grievance redressal. International Journal of Information Management, 54, 102144.

Indexed at, Google Scholar, Cross Ref

Purohit, S., Arora, R., & Paul, J. (2022). The bright side of online consumer behavior: Continuance intention for mobile payments. Journal of Consumer Behaviour, 21(3), 523–542.

Indexed at, Google Scholar, Cross Ref

Shaw, B., & Kesharwani, A. (2019). Moderating Effect of Smartphone Addiction on Mobile Wallet Payment Adoption. Journal of Internet Commerce, 18(3), 291–309.

Indexed at, Google Scholar, Cross Ref

Singh, N., & Sinha, N. (2020). How perceived trust mediates merchant’s intention to use a mobile wallet technology. Journal of Retailing and Consumer Services, 52, 101894.

Singh, N., Sinha, N., & Liébana-Cabanillas, F. J. (2020). Determining factors in the adoption and recommendation of mobile wallet services in India: Analysis of the effect of innovativeness, stress to use and social influence. International Journal of Information Management, 50, 191–205.

Indexed at, Google Scholar, Cross Ref

Sinha, N., & Singh, N. (2019). Understanding technology readiness and user’s perceived satisfaction with mobile wallets services in India. NMIMS Management Review, 37(3), 10-33.

Thakur, R., & Srivastava, M. (2014). Adoption readiness, personal innovativeness, perceived risk and usage intention across customer groups for mobile payment services in India. Internet Research, 24(3), 369–392.

Indexed at, Google Scholar, Cross Ref

Received: 19-Feb-2024, Manuscript No. AMSJ-24-14523; Editor assigned: 20-Feb-2024, PreQC No. AMSJ-24-14523(PQ); Reviewed: 30-Mar-2024, QC No. AMSJ-24-14523; Revised: 29-Apr-2024, Manuscript No. AMSJ-24-14523(R); Published: 03-Jul-2024