Research Article: 2022 Vol: 25 Issue: 2

Study of Methodological Problems of Determining the Customs Value Based on the Real Economic Meaning of the Operations Carried Out in Order to Form a Strategy for the Development of Transnational Companies

A.A. Artemev, Financial University under the Government of the Russian Federation

E.J. Sidorova, Financial University under the Government of the Russian Federation

А.V. Gubin, Law Institute of the Russian University of Transport

O.B. Sokolnikova, Russian Customs Academy

V.N. Ionicheva, Russian Customs Academy

A.Y. Kozhankov, Moscow State Institute of International Relations

Citation Information: Artemev, A.A., Sidorova, E.J., Gubin, А.V., Sokolnikova, O.B., Ionicheva, V.N., & Kozhankov, A.Y. (2022). Study of methodological problems of determining the customs value based on the real economic meaning of the operations carried out in order to form a strategy for the development of transnational companies. Journal of Legal, Ethical and Regulatory Issues, 25(2), 1-9

Abstract

Modern tax systems are characterized with the need for an economically justified and legally correct determination of the tax consequences of operations carried out in the context of the use of complex ambiguous models of contractual relations (business models). Taxation when using such models, as a rule, is accompanied by the need to conduct an analysis aimed at clarifying the essential economically justified reason of either the business model as a whole, or individual elements of the operations carried out, for example, the essence of certain payments made by the taxpayer or in his favor. The results of the preliminary analysis showed that one of the most relevant areas of research in this area is a set of issues related to the methodology for determining the customs value of goods as a basis for calculating customs duties. In some countries, it is one of the components of the tax base for value added tax and excise taxes paid as part of customs payments. At the same time, the study of both Russian and international experience shows the special significance of the scientific development of two directions in this area, namely: formation of methodological approaches to the concept of an actual buyer of goods, the customs value of which is determined; qualification based on the actual economically justified reason of individual payments, including those that are not formally included in the customs value of goods based on the principles formulated by the World Trade Organization. As part of the scientific development of the above questions, the results of which are presented in the article, the following research methods were used: analytical, graphic, generalization and economic modeling.

Keywords

Customs Value of Goods, The Price Actually Paid or Payable for Imported Goods, Royalties, License Payments, Sales Model, Right Holder.

Introduction

When developing a company's tax strategy, especially for multinational associations, foreign economic activity and its taxation play a key role. A special role in this area is played with the customs value of goods, which is the basis for calculating customs payments when moving goods between related companies located in different countries. At the same time, the relations between the group of companies and their counterparties are complex (Shinkevich et al., 2020).

Currently, the formation of methodological approaches to determining the tax consequences in relation to complex models of contractual relations of participants in foreign economic activity (FEA) largely involves conducting a systematic economic analysis aimed at identifying the actual economic meaning of the activities of all companies involved in the model they use. In this regard, the scientific results of typical business situations of both Russian and international experience that have been widely distributed in the last 2-3 years are presented below. The methodological problems of determining the customs value based on the actual economically justified reason of the operations carried out in order to form a strategy for the development of foreign companies are universal in world practice, as all local country acts in this problem are based on a system of regulations developed and adopted by the World Customs Organization. The problems described in the study and the solutions proposed by the authors are universal.

In large TNCs, 80% of the total trade turnover currently falls on foreign trade activities and only 20% on domestic operations. At the same time, the research on this topic examines only the problems of customs value formation without any correlation with the problems of strategic management, for example, Kostyukhin (2016 & 2019); Tolstykh (2018 & 2020); Zhaglovskaya et al. (2019) ; Shinkevich (2020); Ashirov (2019) ; Kabitova (2019) .

Thus, the purpose of the paper is to study the methodological problems of determining the customs value based on the actual economically justified reason of the operations carried out in order to form a strategy for the development of foreign companies.

Materials and Methods

Analytical method for the study of the principles formulated in the documents of the Organization for Economic Co-operation and Development (OECD) in terms of “the priority of essence over form” and “abuse of rights”

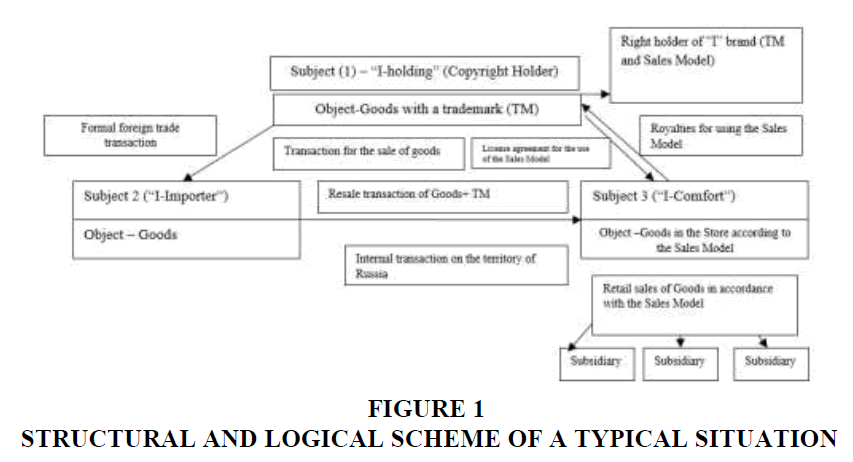

Graphical method for constructing a model of a typical situation (Figure 1-Structural and logical scheme of a typical situation);

The method of generalization for the systematization of scientific knowledge on the qualification of the activities of persons participating in a typical situation for determining the customs value of goods;

Methods of economic modeling on the inclusion in the customs value of goods of royalties paid by a person who is not formally a buyer of goods in a foreign trade transaction (in this article, “I-comfort”) to a franchisor for the use of such a person of the model of sales of goods in the territory of the country of import.

Results

A foreign organization “I-holding”, the owner of the well-known brand of the same name as “I”, creates two or more subsidiaries on the territory of the country (hereinafter as Russia), where the goods are imported and on which the trademark “I” is applied. The first organization (I-Importer) purchases goods with the trademark “I” (hereinafter referred to as the Goods) by entering into foreign trade transactions with foreign manufacturing plants authorized by the company “I-holding” or directly with the company “I-holding”. “I-Importer” further sells Goods to another subsidiary of the I-holding organization “I-comfort”. Such operations of “I-Importer” and “I-comfort” are considered as sales of Goods on the domestic market of Russia. “I-comfort” sells the purchased Goods mainly to retail customers and partly to organizations and entrepreneurs (Shinkevich et al., 2020). All the above-mentioned sales are carried out within the framework of know-how, a special sales model (hereinafter referred to as the Sales Model), and the rights to which belong to a foreign organization “I-holding”.

The features of the Sales Model provide for their retail sale in a specially equipped store (hereinafter referred to as the Store). If the Goods are purchased not by retail buyers, but by enterprises, then such buyers, based on the conditions of the Sales Model, are limited in the possibilities of their further use. In this case, the Goods can be used exclusively for “intra-company purposes” (for example, office decoration) and cannot be further resold. As the trademark “I” is applied to the Goods, the right holder (“I-holding”) considers any further resale of them as a violation of his rights. In Stores operating in accordance with the Sales Model, only products with the trademark “I” can be presented, in respect of which the term “Goods” was proposed in the article.

The license agreement on the use of the Sales Model is concluded between the foreign organization “I-holding” (hereinafter as the Right Holder) and its subsidiary in Russia “I-comfort” (hereinafter as the Licensee).

Structural and Logical Scheme of a Typical Situation is shown in Figure 1

The results of the analysis allowed identifying two systemic issues, the scientific development of which makes it possible to determine methodologically and correctly the customs value of Goods.

Qualification of the Activities of Persons Participating in a Typical Situation for Determining the Customs Value of Goods

The starting point in this case, according to the authors, should be the principles of “The priority of essence over form”, “abuse of rights” and other similar doctrines formulated in the OECD documents (Organisation for Economic Co-operation and Development, 2013 & 2019). Initially, the approach that provides for the possibility of determining tax consequences based on the principle of “the priority of essence over form”, was used in the practice of countries whose experience later formed the basis of the OECD doctrines. The experience of countries (primarily the United States (Gregory, 1935; Helvering & Lazarus, 1939), Commissioner v. Court Holding Co., 324 U.S. 331) and the United Kingdom) that use the system of judicial precedents is particularly interesting. Partington v. Attorney General used this principle in the UK in 1869, and then the House of Lords confirmed it in 1935 in the case of Duke of Westminster v. CIR.

In the Russian Federation, these principles are reflected in Article 54.1 of the Tax Code of the Russian Federation (State Duma of the Federal Assembly of the Russian Federation, 1998) and in Resolution No. 53 of the Resolution of the Plenum of the Russian Federation of 12.10.2006 No. 53 “Estimate of commercial courts validity taxpayer received a tax benefit”. As the customs duty in the Russian Federation does not have the legal status of a federal tax, the provisions of Article 54.1 of the Tax Code of the Russian Federation are not formally applied to the determination of the customs value of goods. Thus, when deciding on the qualification of the activities of persons participating in a typical situation for the purposes of determining the customs value of goods, it is more reasonable to apply the provisions of Resolution No. 53 (Shinkevich et al., 2020).

The business objective in the framework of a typical situation is the sale of goods for export to the customs territory of the Eurasian Economic Union (the EAEU) to “I-comfort”. Therefore, “I-comfort” should be considered as the buyer of goods within the framework of a foreign economic agreement (contract) on purchase and sale with a foreign organization “I-holding” (hereinafter, respectively, the Buyer, the Seller). The activity of “I-Importer” in its actual reason corresponds to the activity of an intermediary (agent) for the sale, which acts in the interests of the Seller. The fact that “I-comfort” is the Buyer within the framework of a foreign economic agreement (contract) on purchase and sale may be evidenced by the circumstances, both given in the description of the Typical Situation, and identified during customs control.

We believe that among the circumstances, the following ones deserve special attention:

1. Lack of the possibility of full implementation of the “I-Importer” rights of the owner, including the possibility of subsequent sale, including retail, of goods to any interested parties without applying the Sales Model provided in the license agreement concluded by the foreign Right Holder with “I-comfort”;

2. Sale of “I-Importer” goods to other interested parties is not carried out or is carried out, but on conditions other than the conditions under which the goods are sold by “I-comfort”;

3. The inability of other interested parties, possible buyers of goods, to exercise full ownership rights with the goods purchased from “I-Importer”, including their implementation without the use of a Sales Model;

4. Goods are shipped from abroad to “I-comfort”.

Taking into account everything stated above, we believe that the customs value of goods can be determined by the method of the transaction value of imported goods (method 1) if other conditions for determining the customs value of goods by method 1 are met, based on the fact that the Buyer of goods when they are sold for export to the customs territory of the EAEU is “I-comfort”. The price actually paid or payable for imported goods (hereinafter referred to as the PAP) should be determined as the total amount of all payments for goods made or payable by the Buyer (in a typical situation I-comfort) directly to the Seller or another person (in a typical situation I-importer) in favor of the Seller (paragraph 3 of Article 39 of the Customs Code of the EAEU, par.5.1 of the Rules for the Application of Method 1, approved by Decision No. 283 of ECE in December 20, 2012, hereinafter, respectively, the Code, Rules).

Therefore, when determining the customs value of goods, the PAP should be based on a higher price of goods i.e., the price paid by a person who is not formally a participant in the foreign trade activity “I-comfort”, but who is the actual buyer of goods in the framework of a foreign trade transaction based on the actual economically justified reason of the operations carried out.

The Issue of Including Royalties in the Customs Value of Goods Paid by I-Comfort to the Right Holder for the use of the Sales Model

In accordance with the provisions of Article 8.1 of Agreement on Implementation of Article VII Of The General Agreement On Tariffs And Trade 1994 (WTO Agreement), when determining the customs value of goods, royalties and royalties related to the goods being valued must be added to the price actually paid or payable for imported goods, which must be paid by the buyer directly or indirectly as a condition of the sale of the goods being valued, to the extent that such royalties and payments are not included in the price actually paid or payable for imported good (World Trade Organization, 1994).In the regulation of the EAEU, the above provisions are stated in subparagraph 7 of paragraph 1 of Article 40 of the Customs Code of the EAEU. Based on these norms, when determining the customs value of imported goods according to method 1, license and other similar payments for the use of intellectual property, including royalties, payments for patents, trademarks, copyrights (hereinafter referred to as royalties), are added to the price actually paid. Imported goods that are directly or indirectly produced or must be made by the buyer as a condition for the sale of imported goods for export to the customs territory of the EAEU, in an amount not included in the price actually paid.

To make a decision on the need to include royalties in the customs value of goods, two conditions must be met simultaneously: the ratio of royalties to imported goods (condition 1); payment of royalties as a condition for the sale of imported goods for export to the customs territory of the EAEU (condition 2).

In the EAEU, in order to develop common approaches to resolving the issue of including royalties in the customs value of goods, that is, to meet two conditions, the Recommendation of the ECE No. 20 of November 15, 2016 was developed and adopted, which approved the Regulation on adding license and other similar payments for the use of intellectual property objects to the price actually paid or payable for imported goods.

In a Typical Situation, a decision that royalties for the use of the Sales Model do not apply to imported goods can be made if the Right Holder does not establish requirements for the purchase and use of imported goods when applying the Sales Model. Therefore, “I-comfort” (the Buyer) should have the right to purchase any goods from any suppliers at its discretion, taking into account the possible requirements of the Right Holder for the quality of the purchased goods.

If the Right Holder has established requirements for the use of goods that go beyond quality requirements, for example, the need to purchase goods from suppliers specified by the Right Holder, the use within the Sales Model of goods with certain trademarks or designations similar to them, etc. Therefore, in this case it must be concluded that condition 1 is satisfied.

Issues related to the fulfillment of condition 2 are described in clause 9 of the Regulation. The consideration of the conditions stated in paragraph 9 of the Regulation in a systematic connection with the conditions for determining the customs value of goods using method 1 (paragraph 1 of Article 39 of the Code, Section II of the Rules) allows noting that the conclusion about the non-fulfillment of condition 2 can be made only if the Buyer, as well as any other interested parties, has the opportunity to purchase these goods on the same terms as the imported goods, but without using the Sales Model and paying royalties. If the possibility of purchasing goods is due to the payment of royalties for the application of the Sales Model, in this case, condition 2 was fulfilled. With regard to the typical situation, taking into account the above conclusion about which person is the actual buyer of goods, we proceed from the fact that although royalties are formally paid by a person who is not a participant in foreign trade, in fact it is this person who purchases goods in the framework of foreign trade activities.

The results showed that both conditions for the inclusion of royalties in the customs value of goods were met: royalties are related to imported goods, stores created in accordance with the Sales Model sell exclusively Goods with the trademark “I”, without using the Sales and Payment Model this royalty purchase of the Goods is not possible. The foreign Seller does not sell the goods to other interested parties.

Discussion

Illustrative Assessment of Tax Consequences, Determination of the Customs Value of Goods

Initial data: The invoice price for Goods sold between “I-holding” and “I-importer” is 100 units (a formal foreign trade transaction).The invoice price for Goods sold between “I-importer” and “I-comfort” is 180 units (a formal internal transaction in the territory of the country of import).A lump sum of royalties accrued in favor of the Right Holder “I-holding” for the use of the Sales Model is 20-unit.

Scenario 1: When determining the customs value, the price of goods set in the invoice within the framework of a formal foreign trade transaction is used as the basis; it is 100 units. Royalties are accrued in favor of the Right Holder by the third party who is not formally a participant in foreign economic activity. “I-importer” considers that the license relationship of the Right Holder to “I-comfort” is not related to the imported goods, and on this basis should not be included in the customs value of the goods. The customs value of the goods=the price on the invoice for the Goods when sold between “I-holding” and “I-importer”=100 units.

Scenario 2: Based on the actual economically justified reason of the operations carried out, when determining the customs value, the price of goods established in the invoice within the framework of the transaction with the actual buyer of foreign trade goods “I-comfort” is used as a basis. 180 Royalties accrued in favor of the Right Holder, “I-comfort”, must be included in the customs value of the goods, taking into account the fulfillment of condition 1 and condition 2.Customs value of goods=invoice price for Goods when sold between “I-importer” and “I-comfort”+royalties=180 units+20 units=200 units.

The possibility of the two scenarios noted above, accompanied with different tax consequences, makes it advisable to highlight an alternative point of view. Thus, some experts note that among the problems that are considered in the framework of scientific discussions, the issues of legal certainty of the current regulation regarding the conditions under which license, interest and dividend payments may not be included in the customs value of goods are raised (Zaripov, 2021). In their opinion, the possible lack of legal certainty in the regulation may have not only practical, but also constitutional significance (Zaripov, 2021).

However, in our opinion, the current norms of the Customs Code of the EAEU in the Russian Federation concerning the rules for including royalties in the customs value of goods fully comply with the above provisions of the WTO Agreement.

When dispute situations arise the search for a solution often occurs against the background of a lack of understanding of the economic essence of the conditions established by the WTO Agreement and the Customs Code of the EAEU (condition 1 and condition 2).

Taking into account the above, we believe that the assumption expressed in the "alternative" points of view about the existing uncertainty of the rules for including royalties in the customs value of goods and the associated risks of violating the theoretical and constitutional principles of taxation is debatable. Thus, the company should take into account the possibility of a second option for assessing the customs value of the goods with the resulting consequences for economic efficiency.

Conclusion

The analysis of the Typical Situation allows stating the advantages of the approach to determining the tax consequences based on the study of the actual economically justified reason of the operations carried out. It is advisable to form a methodologically correct solution to the problems of determining tax consequences in the context of using complex models of contractual relations based on the real economically justified reason of the situation under consideration. Although the set of typical situations is diverse, we believe that the gradual consideration and analysis of the most interesting of them in the scientific literature will help form their methodologically grounded understanding. As a result, it may become possible to make the sphere of tax and customs relations less conflicting, as well as more transparent and accessible for strategic analysis.

References

Helvering, F., & Lazaru, R. (1939). Justia US Supreme Court: 308 U.S. 252. Retrieved November 25, 2020, from https://supreme.justia.com/cases/federal/us/308/252/

Kabitova, E.V., Yudina, S.V., & Ashirova, S.A. (2019). The causality of deviation from the optimal parameters of a regional demographic system. International Journal of Engineering and Advanced Technology, 9(1), 5559-5564.

Kostyukhin, Y. (2019). Conceptual provisions of sustainable development of socio-economic systems (on the example of an industrial enterprise). International Multidisciplinary Scientific GeoConference: SGEM, 19(5), 131-138.

Organisation for Economic Co-operation and Development. (2013). Action plan on base erosion and profit shifting. Retrieved from https://www.oecd.org/ctp/BEPSActionPlan.pdf

Organisation for Economic Co-operation and Development. (2019). Model tax convention on income and on capital 2017. Retrieved from https://read.oecd-ilibrary.org/taxation/model-tax-convention-on-income-and-on-capital-2017-full-version_g2g972ee-en#page1

Shinkevich, A. (2020). Sustainable development of territories in the zone of industrial facilities. IOP Conference Series: Materials Science and Engineering, 890(1), 12-19.

Shinkevich, A.I. (2020). Modelling the efficiency of using digital technologies of energy and resource saving technologies at petrochemical enterprises. International Journal of Energy Economics and Policy, 10(5), 1-6.

Shinkevich, A.I., Kudryavtseva, S.S., & Ershova, I.G. (2020). Modelling of energy efficiency factors of petrochemical industry. International Journal of Energy Economics and Policy, 10(3), 465-479.

State Duma of the Federal Assembly of the Russian Federation. (1998). Tax code of the Russian Federation of July 31, 1998 No. 146-FZ. Collection of legislation of the RF 03.08.1998, No. 31, Item 3824.

Tolstykh, T., Shkarupeta, E., Kostuhin, Y., & Zhaglovskaya, A. (2018). Key factors of manufacturing enterprises development in the context of industry 4.0. In Innovation Management and Education Excellence through Vision 2020.

Tolstykh, T.O., Shkarupeta, E.V., Kostuhin, Y.Y., Zhaglovskaya, A.V., & Garin, A.P. (2020). Scenarios for the development of industrial complexes in the digital economy. In Growth Poles of the Global Economy: Emergence, Changes and Future Perspectives.

World Trade Organization. (1994). Agreement on implementation of Article VII of the general agreement on tariffs and trade 1994. Retrieved https://www.wto.org/english/docs_e/legal_e/20-val_01_e.html

Zaripov, V.M. (2021). Inclusion of license payments in the customs value: Is liability possible in the conditions of legal uncertainty? Modern practice of customs regulation and foreign trade. Eurasian Tax Week. Financial University under the Government of the Russian Federation. Department of Taxes and Tax Administration.

Zhaglovskaya, A.V., Kostyukhin, Y.Y., Savon D.Y., & Safronov A.E. (2019). Improvement of industrial safety control in the coal sector. Mining Informational and Analytical Bulletin, 6(1), 184-192.

Gregory, H. (1935). Justia US Supreme Court. Retrieved November 25, 2020, from https://supreme.justia.com/cases/federal/us/293/465/